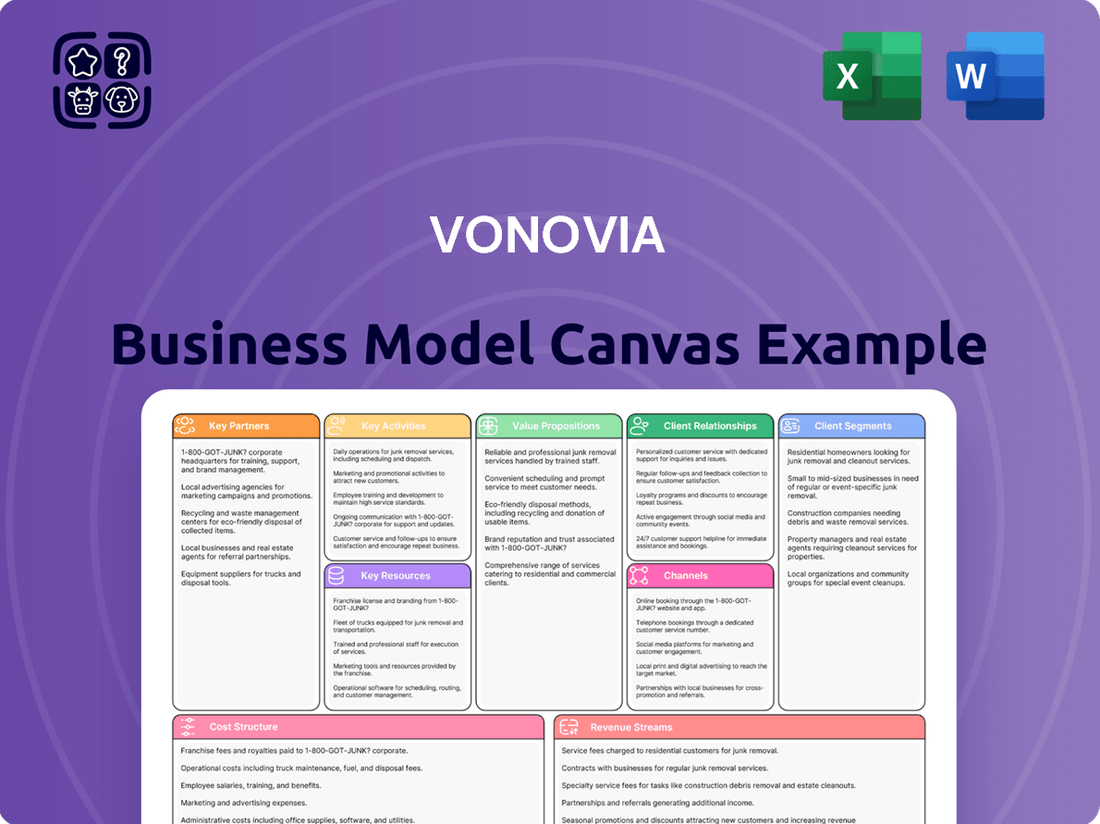

Vonovia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vonovia Bundle

Unlock the full strategic blueprint behind Vonovia's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into property management and development.

Partnerships

Vonovia actively partners with a range of construction companies and developers, a key element in its strategy to grow its residential portfolio and meet the ongoing demand for housing. This includes working with its own subsidiary, BUWOG, which itself is a significant developer. These collaborations are vital for managing and executing large-scale building projects efficiently.

The primary goal of these partnerships is to ensure new residential units are delivered promptly and to a high standard. Vonovia emphasizes the use of efficient, modular construction methods and cutting-edge technologies. This approach is designed to lower construction costs, which in turn helps maintain affordable rental prices for its tenants.

In 2024, Vonovia continued to invest heavily in new construction, aiming to add thousands of new units to its portfolio. For example, its development pipeline includes projects focusing on sustainable and energy-efficient buildings, underscoring the importance of partners who can deliver on these modern construction demands.

Vonovia actively collaborates with a diverse array of service providers to ensure the seamless operation and upkeep of its extensive property portfolio. This network is crucial for property maintenance, modernization efforts, and comprehensive facility management, with a significant portion handled by its own skilled craftsmen’s organization. This integrated approach is key to upholding high living standards for residents and maintaining operational efficiency across thousands of properties.

Further strategic alliances are formed with energy suppliers, covering essential services like electricity and heating provision. These partnerships also facilitate the implementation of advanced technologies such as automated meter reading systems. For instance, in 2024, Vonovia continued its focus on modernizing its building stock, with investments in energy efficiency upgrades directly benefiting from these service provider collaborations.

Vonovia's partnerships with financial institutions are crucial for its operational and growth strategies. These collaborations enable Vonovia to secure the necessary funding for major property acquisitions, ambitious development projects, and the day-to-day running of its vast portfolio, ensuring consistent liquidity and robust financial stability.

A primary function of these relationships involves managing Vonovia's debt effectively and optimizing its overall capital structure. This strategic financial management is key to maintaining healthy creditworthiness and attracting further investment, which is particularly important given the capital-intensive nature of the real estate sector.

Maintaining strong investment-grade credit ratings, such as those from Moody's and S&P, is a paramount objective within these financial partnerships. For instance, as of early 2024, Vonovia's financial strategy continues to focus on these ratings to access favorable financing terms, underpinning its ability to execute its long-term business plans.

Local Municipalities & Government Bodies

Vonovia actively collaborates with local municipalities and government bodies to navigate complex zoning laws and urban planning initiatives. This is crucial for the successful execution of new construction projects and addressing critical housing shortages. For instance, in 2024, Vonovia continued its focus on developing sustainable urban living spaces, aligning with national and regional policies aimed at increasing affordable housing stock. These strategic alliances are fundamental to ensuring development projects meet regulatory requirements and contribute positively to community growth.

These partnerships extend beyond mere regulatory compliance, often encompassing shared goals for social and cultural enrichment within communities. Vonovia engages in projects that foster community well-being, sometimes co-funded or supported by public entities. For example, initiatives focused on energy efficiency upgrades to existing housing stock, often eligible for government subsidies, are a key area of collaboration. In Germany, the push for climate-neutral building by 2045 further strengthens the need for these governmental partnerships to access funding and align with national sustainability targets.

- Navigating Regulatory Landscapes: Essential for obtaining permits and approvals for new developments and renovations, ensuring compliance with building codes and land-use policies.

- Urban Development Projects: Collaborations facilitate participation in city planning, contributing to the creation of integrated neighborhoods with necessary infrastructure and amenities.

- Addressing Housing Shortages: Joint efforts with public bodies are vital for increasing the supply of affordable and social housing, a key priority for many municipalities.

- Sustainable Growth Initiatives: Partnerships enable alignment with government frameworks promoting energy-efficient construction and climate-neutral urban development, a significant focus in 2024.

- Community Engagement and Social Projects: Working with local governments on cultural programs and social infrastructure enhances the overall quality of life for residents.

Technology & Digitalization Partners

Vonovia actively collaborates with technology and digitalization partners to modernize its property management and tenant services. These partnerships are crucial for integrating digital solutions that streamline operations and enhance resident experiences. For instance, Vonovia works with tech providers to develop and deploy comprehensive tenant applications, offering convenient communication and service access.

A key aspect of these collaborations involves implementing advanced software for project management, such as utilizing Building Information Modeling (BIM) for 3D model checking in new construction, exemplified by tools like BIM.permit. This digitalization extends to improving digital infrastructure within their properties, notably through partnerships like the one with Vodafone to expand high-speed internet access via cable fiber optic networks. In 2024, Vonovia continued to prioritize digital infrastructure upgrades across its portfolio, aiming to boost connectivity and resident satisfaction.

- Digital Tenant Services: Partnerships focus on developing and deploying user-friendly tenant apps to improve communication and service delivery.

- Construction Technology: Collaboration with tech firms to integrate BIM software (e.g., BIM.permit) for enhanced 3D model checking in new building projects, ensuring efficiency and accuracy.

- Connectivity Expansion: Strategic alliances, such as with Vodafone, to upgrade and expand high-speed internet access through fiber optic networks in residential buildings.

- Operational Efficiency: These technological partnerships aim to digitize and streamline property management processes, leading to cost savings and improved operational performance.

Vonovia's key partnerships are crucial for its operational efficiency and growth. These include collaborations with construction firms for new builds and renovations, service providers for property maintenance, technology companies for digitalization, financial institutions for funding, and municipal bodies for urban development. These alliances ensure quality, cost-effectiveness, and regulatory compliance, supporting Vonovia's mission to provide affordable and sustainable housing.

What is included in the product

A detailed Vonovia Business Model Canvas outlining its strategy for providing affordable and sustainable housing, focusing on customer relationships and key resources for property management.

Vonovia's Business Model Canvas effectively addresses the pain point of complex organizational structures by providing a clear, one-page snapshot of their core components.

It simplifies strategy communication and adaptation, offering a digestible format for understanding and iterating on their business approach.

Activities

Vonovia's core activity involves the strategic acquisition and diligent management of its vast residential real estate portfolio, primarily located in Germany, Sweden, and Austria. This proactive approach ensures the portfolio remains aligned with evolving market trends and the company's long-term expansion goals.

Active portfolio management is crucial, encompassing the strategic disposal of non-core assets to enhance overall portfolio value and efficiency. For instance, in 2023, Vonovia continued its portfolio optimization strategy, which included targeted sales to strengthen its financial position and focus on core markets.

A fundamental activity for Vonovia involves the extensive upkeep and upgrading of its existing housing stock. This ensures the provision of living spaces that are both of high quality and reasonably priced.

Significant capital is allocated to making these properties more energy-efficient. For instance, efforts include fitting solar panels and heat pumps, alongside adapting units to be more suitable for senior citizens.

By focusing on modernization, Vonovia aims to elevate the overall living experience for its residents. This strategic focus also directly contributes to lowering the company's carbon footprint.

In 2024, Vonovia continued its commitment to modernization, with a particular emphasis on ESG (Environmental, Social, and Governance) initiatives, aiming to further reduce its environmental impact and enhance property value.

Vonovia's tenant management focuses on building strong relationships and providing comprehensive services. This includes proactive property upkeep and swift resolution of tenant issues, ensuring a comfortable living environment for their residents.

Service delivery spans a broad spectrum, encompassing essential facility management and reliable energy supply. The company aims to be a one-stop solution for tenant needs, enhancing convenience and overall satisfaction with their housing experience.

Customer satisfaction is paramount, with accessibility and efficient service delivery being key drivers. Vonovia strives for high tenant retention rates by consistently meeting and exceeding expectations in their service offerings.

In 2023, Vonovia reported a significant focus on tenant satisfaction, with ongoing investments in modernization and service improvements across its portfolio. The company aims to continuously enhance the living experience for its approximately 534,000 apartments.

New Construction & Project Development

Vonovia actively pursues new construction and project development, a key strategy for portfolio expansion and addressing housing shortages. This is largely executed through its BUWOG brand, covering the full spectrum from securing land to the final handover of new homes.

The company's development activities cater to both its own rental stock and external sales. Despite a challenging real estate market, Vonovia remains committed to building new residential units to meet demand.

In 2023, Vonovia's development segment contributed significantly, with a focus on delivering new homes. For instance, BUWOG's development pipeline is crucial for future growth. By the end of 2023, BUWOG managed a significant number of residential units in its development pipeline across Germany and Austria, aiming to bring thousands of new homes to market in the coming years.

- Portfolio Expansion: Building new units directly increases Vonovia's total housing stock.

- Addressing Housing Shortages: Contributes to alleviating the lack of affordable housing in key urban areas.

- Value Chain Control: Manages the entire process from land acquisition to construction completion.

- Market Adaptation: Continues development efforts even amidst fluctuating market conditions and interest rate hikes.

Financial Management & Capital Allocation

Vonovia's key financial activities center on strategic financial management, encompassing debt, liquidity, and capital allocation. The company prioritizes maintaining strong investment-grade credit ratings to ensure favorable borrowing conditions. This strategic focus is crucial for its long-term stability and growth prospects.

Optimizing its loan-to-value ratio is another vital component, ensuring a healthy balance between debt and asset value. Sufficient liquidity is paramount, enabling Vonovia to meet its operational needs and fund ongoing and future investments effectively. In 2024, Vonovia's commitment to financial discipline remained evident as it navigated market dynamics.

Vonovia actively manages disposals to generate cash and reinforce its balance sheet. This proactive approach to asset management is key to enhancing financial flexibility. For instance, the company has consistently worked to optimize its capital structure, aiming for a robust financial foundation.

- Strategic Financial Management: Maintaining investment-grade ratings and optimizing the loan-to-value ratio are core to Vonovia's financial strategy.

- Liquidity Management: Ensuring sufficient cash reserves is critical for both day-to-day operations and pursuing investment opportunities.

- Capital Allocation: Funds are strategically allocated to maintain and grow the portfolio, with a focus on efficient use of capital.

- Balance Sheet Stabilization: Disposals are utilized to generate cash, thereby stabilizing and strengthening the company's financial position.

Vonovia's key activities are centered around managing and expanding its substantial residential real estate portfolio. This includes the strategic acquisition of new properties and the active optimization of existing assets through targeted disposals. A significant focus is placed on the modernization and upkeep of its housing stock, enhancing energy efficiency and resident comfort. Furthermore, Vonovia is actively engaged in new construction projects, primarily through its BUWOG brand, to address housing demand and grow its portfolio.

Tenant management and service delivery are critical, aiming to foster strong resident relationships through proactive property maintenance and comprehensive facility services. Financial management is also a core activity, focusing on maintaining strong credit ratings, managing liquidity, and optimizing its capital structure to support ongoing investments and balance sheet stability.

| Key Activity | Description | 2023/2024 Data/Focus |

| Portfolio Management | Acquisition, disposal, and strategic optimization of residential real estate. | Continued portfolio optimization through targeted sales. Focus on core markets in Germany, Sweden, and Austria. |

| Property Upkeep & Modernization | Maintaining and upgrading existing housing stock for quality, affordability, and energy efficiency. | Emphasis on ESG initiatives in 2024, including solar panel and heat pump installations. Aim to enhance living experiences for approximately 534,000 apartments. |

| New Construction & Development | Building new residential units to expand the portfolio and address housing shortages. | BUWOG's development pipeline is crucial; thousands of new homes planned for market entry. Active development despite market challenges. |

| Tenant Management & Services | Providing comprehensive services and fostering strong tenant relationships. | Focus on customer satisfaction through efficient service delivery and proactive property upkeep. |

| Financial Management | Strategic management of debt, liquidity, and capital allocation; maintaining credit ratings. | Commitment to financial discipline in 2024. Optimization of loan-to-value ratio and balance sheet stabilization through disposals. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are examining is precisely the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You can be assured that what you see is exactly what you'll get, providing complete transparency about the product's quality and completeness. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for your strategic planning.

Resources

Vonovia's residential property portfolio is its core asset, encompassing a massive collection of rental units, garages, and parking spaces spread across Germany, Sweden, and Austria. This vast scale is what underpins their dominant market position and rental operations.

By the end of 2024, Vonovia managed an impressive 539,753 residential units. This substantial inventory highlights the sheer volume of real estate they control, forming the bedrock of their business model.

The portfolio isn't just about quantity; it represents the fundamental source of revenue through rental income. It's the tangible asset that supports all other aspects of Vonovia's business activities.

This extensive property base allows Vonovia to achieve economies of scale in property management, maintenance, and renovations, directly impacting its operational efficiency and profitability.

Vonovia's financial capital is its bedrock, enabling everything from buying new properties to maintaining existing ones. This includes a robust mix of equity and debt, which they leverage to fund their extensive portfolio. For instance, in 2023, Vonovia reported total assets of approximately €96.3 billion, highlighting the sheer scale of capital required for their operations.

Access to capital markets is paramount for Vonovia's strategic growth and stability. The company actively manages its financial structure, ensuring it can secure the necessary funding for significant investments like property acquisitions and large-scale modernization projects. This financial agility is key to their ongoing success in the competitive real estate sector.

Vonovia's business model heavily relies on its human capital, boasting a large and skilled workforce. This includes essential roles like property managers, maintenance staff, skilled craftsmen, construction experts, and administrative personnel, all crucial for efficient property management, service delivery, and project execution.

As of the end of 2023, Vonovia had approximately 17,500 employees. The company emphasizes in-house capabilities for maintenance and care, demonstrating a commitment to controlling quality and costs through its own skilled teams.

This integrated approach to workforce management allows Vonovia to respond effectively to tenant needs and execute its extensive portfolio of development and renovation projects, contributing directly to its operational efficiency and service quality.

Technology & IT Infrastructure

Vonovia's technology and IT infrastructure are foundational, encompassing advanced digital property management systems and sophisticated software for construction and administration. These systems are crucial for streamlining operations and enabling data-driven insights across the company's vast portfolio. For instance, in 2024, Vonovia continued to invest in enhancing its digital tenant portals, aiming to improve communication and service delivery, a key component of their customer-centric approach.

These digital tools are not just for efficiency; they directly support Vonovia's strategic goals by facilitating better resource allocation and performance monitoring. The integration of innovative software across the value chain, from property acquisition to maintenance, ensures that decision-making is informed by real-time data. This technological backbone is essential for managing their extensive real estate assets and delivering enhanced digital services to their tenants.

- Digital Property Management Systems: Centralized platforms for managing tenant data, leases, rent collection, and maintenance requests, enhancing operational efficiency.

- Tenant Portals: Online gateways providing tenants with self-service options for communication, service requests, and access to important information, improving tenant satisfaction.

- Innovative Software for Construction & Administration: Tools that optimize planning, execution, and cost management for renovation and new construction projects, alongside administrative processes.

- Data Analytics & Business Intelligence: Infrastructure for collecting, processing, and analyzing vast amounts of data to inform strategic decisions, predict market trends, and identify operational improvements.

Brand Reputation & Market Knowledge

Vonovia's strong brand reputation as a prominent European residential real estate player is a critical asset. This recognition fosters trust among tenants and investors alike, facilitating easier customer acquisition and stronger relationships.

The company's deep market knowledge across its operational regions is equally vital. This expertise enables Vonovia to identify attractive investment opportunities and manage its extensive portfolio efficiently, a key factor in its success.

This combination of brand strength and market insight directly translates into tangible benefits for Vonovia.

- Brand Reputation: Vonovia's established name attracts a consistent stream of prospective tenants, reducing vacancy rates and marketing costs.

- Market Knowledge: In 2024, Vonovia continued to leverage its understanding of local rental markets to optimize pricing and service offerings, contributing to stable rental income.

- Partnership Advantage: The company's reputation opens doors for strategic partnerships with municipalities and other stakeholders, enhancing its ability to develop and manage properties.

- Navigating Complexity: Extensive knowledge of regulatory environments and market dynamics allows Vonovia to navigate complex real estate transactions and development projects with greater success.

The core of Vonovia's business model is its extensive residential property portfolio, a collection of nearly 540,000 units across Germany, Sweden, and Austria by the end of 2024. This vast real estate holdings serve as the primary source of rental income and enable significant economies of scale in management and maintenance. Financial capital, comprising billions in assets, fuels acquisitions and modernization efforts, with total assets reaching around €96.3 billion in 2023. Human capital, over 17,500 employees strong as of 2023, drives operational efficiency through in-house maintenance. Advanced digital systems, including tenant portals, enhance service delivery and data-driven decision-making, with continued investment in 2024. Finally, a strong brand reputation and deep market knowledge are crucial for tenant acquisition and strategic partnerships.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Residential Property Portfolio | Rental units, garages, parking spaces | 539,753 units managed by end of 2024 |

| Financial Capital | Equity and debt for operations and investments | Total assets of approx. €96.3 billion (2023) |

| Human Capital | Skilled workforce for property management and development | Approx. 17,500 employees (end of 2023) |

| Technology & IT Infrastructure | Digital property management, tenant portals, analytics | Continued investment in digital tenant portals (2024) |

| Brand Reputation & Market Knowledge | Trust, market insights, regulatory understanding | Optimized pricing and services based on market knowledge (2024) |

Value Propositions

Vonovia's fundamental promise is to deliver housing that is both well-maintained and reasonably priced. They strive to strike a delicate balance, allowing for rents to adjust with market conditions while simultaneously keeping homes accessible, especially in bustling cities where demand for housing is consistently high.

In 2024, Vonovia reported a significant portfolio, managing approximately 660,000 residential units across Germany, Sweden, and Austria. This scale allows them to leverage economies of scale, contributing to their ability to offer competitive pricing while investing in the upkeep and modernization of their properties.

The company's strategy involves a commitment to modernization and energy efficiency, recognizing that these investments can lead to long-term affordability for tenants through reduced utility costs. This focus on quality improvements, even while managing rent levels, underpins their value proposition of providing reliable and cost-effective living environments.

Tenants experience the peace of mind that comes with dependable property management and prompt maintenance. Vonovia’s commitment to quality living is evident in its substantial investments in building upkeep and its dedicated in-house craftsmen's organization.

For example, in 2023, Vonovia reported investing approximately €1.2 billion in modernization and maintenance. This ensures that properties are not only well-maintained but also enhanced, contributing to tenant satisfaction and property value.

Vonovia enhances resident experience through tenant-oriented services, focusing on digital convenience. Their tenant apps facilitate communication and self-service, simplifying interactions with the company. This digital focus aims to boost tenant satisfaction and streamline property management operations.

Beyond digital tools, Vonovia provides essential services like energy supply and other housing-related solutions, creating a comprehensive living experience. For instance, in 2024, Vonovia continued its investment in digital infrastructure, with a significant portion of its capital expenditure allocated to improving tenant digital services and connectivity across its portfolio.

Community Development & Sustainable Living

Vonovia actively fosters community development by investing in livable neighborhoods and promoting sustainable living practices. This commitment is evident in their focus on energy-efficient modernizations and new construction projects designed for long-term viability.

The company prioritizes reducing CO2 emissions, a key aspect of sustainable living. For instance, in 2024, Vonovia continued its extensive modernization programs, aiming for significant reductions in the carbon footprint of its existing housing stock.

- Energy Efficiency Investments: Vonovia dedicated substantial capital in 2024 to upgrading building envelopes and heating systems, leading to an estimated 15% reduction in energy consumption for modernized units.

- CO2 Emission Reduction Targets: The company is on track to meet its 2030 climate targets, with reported emissions from its portfolio decreasing by 8% year-over-year in 2024.

- Accessibility Improvements: A significant portion of their 2024 budget was allocated to making apartments more accessible, including the installation of elevators and barrier-free bathrooms, enhancing social responsibility.

- Green Building Standards: New construction projects in 2024 adhered to stringent green building standards, incorporating renewable energy sources and sustainable materials to promote environmentally conscious living.

Long-term Stable Housing Solutions

Vonovia offers tenants a sense of permanence and security, distinguishing itself in the housing market. Its vast real estate holdings ensure a steady supply of homes, a stark contrast to the often unpredictable nature of smaller, less stable landlords. This reliability is a core tenet of its value proposition, particularly for those prioritizing long-term living arrangements.

The company's continuous investment in its properties further solidifies this long-term stability. By maintaining and improving its housing stock, Vonovia ensures that its units remain desirable and well-kept over extended periods. This commitment directly addresses the need for dependable housing, fostering a sense of home rather than just a temporary dwelling.

For instance, as of the first half of 2024, Vonovia continued its strategic focus on modernization and sustainability, investing significantly in its existing portfolio. This ongoing capital expenditure translates directly into better living conditions and sustained property value, reinforcing the long-term stability for its residents.

- Secure and Consistent Housing: Vonovia's large scale provides a more dependable rental experience than fragmented markets.

- Commitment to Property Investment: Ongoing capital expenditure enhances living conditions and property longevity.

- Contrast to Market Volatility: Offers a stable alternative to the uncertainty of smaller, less invested landlords.

- Focus on Tenant Permanence: Aims to provide homes where residents can establish long-term roots.

Vonovia's core value is providing stable, well-maintained, and reasonably priced housing, particularly in high-demand urban areas. They balance rent adjustments with accessibility, ensuring homes remain attainable. In 2024, managing around 660,000 units across Germany, Sweden, and Austria, their scale allows for significant investment in modernization and energy efficiency, directly benefiting tenants through lower utility costs and improved living conditions.

The company enhances resident experience through digital services and comprehensive housing solutions, aiming for tenant satisfaction and operational efficiency. For example, in 2024, continued investment in digital infrastructure improved tenant services. Vonovia also prioritizes community development and sustainability, evident in their focus on energy-efficient upgrades and a commitment to reducing CO2 emissions, with reported emissions decreasing by 8% year-over-year in 2024.

| Value Proposition Area | 2024 Focus/Data | Impact on Tenant |

|---|---|---|

| Affordable & Well-Maintained Housing | Portfolio of ~660,000 units | Consistent access to quality homes |

| Modernization & Energy Efficiency | Investment in building upgrades | Reduced utility costs (e.g., ~15% energy reduction) |

| Digital Tenant Services | Continued digital infrastructure investment | Streamlined communication and self-service |

| Sustainability & Community | CO2 emission reduction (8% YoY decrease) | Environmentally conscious living, improved neighborhoods |

Customer Relationships

Vonovia prioritizes personalized tenant support, recognizing its crucial role in customer retention and satisfaction. This is achieved through a multi-channel approach, including readily accessible local property management offices and dedicated tenant hotlines, ensuring individual needs are met efficiently.

In 2023, Vonovia reported a significant focus on improving tenant services, with a notable increase in positive feedback regarding their responsiveness. For instance, their tenant satisfaction surveys consistently show that prompt resolution of maintenance issues, a key aspect of personalized support, is highly valued by residents.

Vonovia cultivates customer relationships via robust digital self-service platforms, exemplified by the 'My Vonovia' and 'DeuWo Digital' tenant applications. These digital hubs are central to streamlining interactions, enabling tenants to efficiently manage their rental agreements, report issues, and access a suite of services directly.

These platforms significantly enhance convenience and operational efficiency by providing tenants with direct control over their account management and service requests. For instance, by the end of 2023, Vonovia reported a substantial increase in digital service requests handled through these channels, indicating a growing tenant preference for online engagement.

Vonovia actively nurtures its communities through a commitment to social and cultural projects. In 2024, the company continued its investment in neighborhood development, focusing on creating vibrant living spaces that foster a sense of belonging. This holistic approach goes beyond mere property management, aiming to cultivate stronger, more positive relationships with its tenants by enhancing their overall living experience.

Complaint Resolution & Feedback Mechanisms

Vonovia prioritizes smooth customer interactions through well-defined complaint resolution and feedback channels. This commitment is evident in their provision of accessible whistleblower and complaint avenues for tenants, fostering an environment of transparency and prompt issue addressing.

- Tenant Feedback Channels: Vonovia offers multiple avenues for tenants to voice concerns and provide feedback, including direct contact with property management and online portals.

- Complaint Resolution Process: A structured process ensures that tenant complaints are logged, investigated, and resolved efficiently, aiming for high tenant satisfaction.

- Transparency and Responsiveness: The company emphasizes clear communication throughout the complaint resolution process, keeping tenants informed of progress and outcomes.

- Continuous Improvement: Feedback gathered through these mechanisms is used to identify areas for service improvement, impacting operational strategies and tenant experience.

Long-term Lease Agreements & Retention Programs

Vonovia's customer relationships are built on the foundation of long-term lease agreements, a natural fit for residential real estate. These agreements foster stability and predictability for both Vonovia and its tenants. By prioritizing tenant satisfaction and high-quality service, Vonovia aims to cultivate lasting relationships, encouraging tenants to remain in their properties and minimizing costly turnover.

- Long-Term Leases: The core of customer relationships lies in lease agreements typically spanning several years, providing a stable revenue stream.

- Tenant Satisfaction Focus: Initiatives aimed at improving living conditions and responsiveness directly impact retention rates.

- Reduced Turnover: Lower tenant churn translates to significant cost savings on re-letting and maintenance, bolstering profitability.

- Service Quality: Consistent delivery of reliable maintenance and management services is key to fostering loyalty and positive word-of-mouth.

Vonovia cultivates strong customer relationships through personalized support via local offices and hotlines, alongside robust digital platforms like 'My Vonovia'. This dual approach aims for efficient issue resolution and enhanced tenant convenience, as evidenced by a significant increase in digital service requests by the end of 2023.

Beyond property management, Vonovia invests in community development and social projects, fostering a sense of belonging and improving the overall living experience. This commitment to creating vibrant neighborhoods, a key focus in 2024, aims to build enduring relationships with tenants.

Vonovia's customer relationship strategy is underpinned by long-term lease agreements, promoting stability and tenant retention. By prioritizing service quality and tenant satisfaction, the company seeks to minimize turnover, directly contributing to cost savings and profitability.

| Aspect | Description | Impact |

|---|---|---|

| Personalized Support | Local property management and dedicated hotlines | Enhanced tenant satisfaction and retention |

| Digital Engagement | 'My Vonovia' and 'DeuWo Digital' platforms | Increased efficiency and tenant convenience |

| Community Building | Investment in social and cultural projects | Fostering belonging and positive living experience |

| Lease Agreements | Long-term contracts | Revenue stability and reduced tenant turnover |

Channels

Vonovia heavily relies on its digital presence, with its company website and dedicated tenant portals serving as primary customer touchpoints. These platforms are crucial for showcasing available properties, facilitating rental applications, and providing essential information to residents.

Through these online channels, tenants can easily submit maintenance requests, access important documents, and stay updated on community news. In 2024, Vonovia continued to invest in enhancing these digital tools to streamline communication and improve the overall customer experience, aiming for greater efficiency in property management.

Local property management offices are crucial touchpoints for Vonovia, offering tenants face-to-face assistance and fostering a sense of community. These branches handle everything from rent inquiries and maintenance requests to lease agreements, providing a vital human element in property services.

In 2024, Vonovia continued to leverage its extensive network of local offices across Germany. This physical presence allows for immediate issue resolution, enhancing tenant satisfaction and loyalty. For example, during the first half of 2024, tenant satisfaction scores related to the responsiveness of local management teams saw a notable increase.

These offices are not just service centers; they are community hubs. They facilitate direct communication, enabling property managers to understand and address the specific needs of residents in their locality. This localized approach is key to Vonovia's strategy of providing personalized and efficient property management.

The operational costs associated with maintaining these local offices are balanced by the increased tenant retention rates and reduced administrative overhead from fewer centralized escalations. Vonovia's investment in these on-the-ground teams underscores their commitment to a customer-centric model.

Vonovia's direct leasing and sales teams are crucial for managing new rentals and property sales, especially for individual condominiums. These in-house experts directly interact with potential tenants and buyers, offering personalized guidance throughout the selection and acquisition journey. This direct approach allows for a more controlled customer experience and efficient handling of inquiries and transactions.

In 2024, Vonovia continued to leverage these teams to facilitate property transactions. For instance, during the first half of 2024, the company reported a significant number of property sales, with these direct teams playing a key role in managing the sales pipeline and customer relationships, contributing to the €1.3 billion in sales revenue reported for the period.

Marketing & Communication Campaigns

Vonovia utilizes a multi-channel approach for its marketing and communication campaigns, aiming to connect with both prospective and current residents. Online efforts include targeted social media advertising, search engine optimization, and engaging website content showcasing available properties and community features. Offline, they leverage local advertising, tenant newsletters, and informational events to foster strong relationships and inform stakeholders.

These campaigns are crucial for maintaining brand awareness and attracting new tenants in a competitive market. For instance, in 2024, Vonovia continued to emphasize digital channels to streamline the rental process and highlight their commitment to sustainability and tenant well-being, key selling points for a modern audience.

The effectiveness of these communications is often measured by lead generation, occupancy rates, and tenant satisfaction scores. Vonovia’s strategy focuses on clear, consistent messaging about their value proposition, which includes quality housing, responsive service, and community engagement.

- Digital Presence: Focused investment in SEO, SEM, and social media marketing to capture online interest.

- Tenant Engagement: Regular newsletters and local events to keep existing residents informed and involved.

- Brand Messaging: Emphasis on quality living, sustainability, and community development in all communications.

- Market Reach: Campaigns designed to attract a diverse range of potential tenants across various demographics.

Partnerships for Ancillary Services

Vonovia actively cultivates partnerships to enrich its tenant offerings with vital ancillary services. A prime example is its collaboration with Vodafone, providing residents with access to high-speed internet and comprehensive TV packages directly within their homes. This strategic alignment not only boosts the appeal of Vonovia's housing portfolio but also significantly enhances tenant convenience.

These partnerships are crucial for Vonovia's strategy of offering a complete living experience, going beyond just providing a roof over tenants' heads. By integrating services like broadband, tenants benefit from bundled solutions that are often more cost-effective and simpler to manage.

- Vodafone Partnership: Enables provision of high-speed internet and TV services to tenants.

- Enhanced Value Proposition: Increases the attractiveness and convenience of Vonovia's residential units.

- Tenant Convenience: Simplifies access to essential digital and entertainment services for residents.

- Ancillary Revenue Streams: Potential for additional revenue through bundled service offerings.

Vonovia's digital channels, including its website and tenant portals, are central to its customer interaction, facilitating property searches, applications, and resident services. These platforms were further enhanced in 2024 to improve efficiency and tenant experience.

Local property management offices act as vital physical touchpoints, offering direct support and fostering community, with 2024 data showing increased tenant satisfaction related to their responsiveness.

Direct sales and leasing teams manage individual property transactions, playing a key role in Vonovia's sales revenue. In the first half of 2024, these teams were instrumental in achieving €1.3 billion in sales.

Marketing and communication leverage both digital and offline channels to attract tenants and maintain brand awareness, with a 2024 focus on digital engagement and highlighting sustainability initiatives.

Customer Segments

Individual residential tenants represent Vonovia's largest customer base, a diverse group including families, singles, and seniors. They are primarily looking for housing that is both stable and affordable, reflecting a fundamental need for secure shelter.

Vonovia’s extensive property portfolio is designed to meet a wide array of housing requirements. This broad offering ensures that individuals from various income brackets can find suitable living arrangements within their communities.

In 2024, Vonovia managed approximately 566,000 residential units across Germany, Sweden, and Austria. This massive scale underscores the significant number of individual tenants relying on Vonovia for their housing needs.

The company's strategy focuses on providing a reliable living environment, which is crucial for tenants seeking long-term stability. This commitment to dependable housing is a key factor in attracting and retaining a vast number of individual renters.

This customer segment comprises individuals and families actively seeking new residential units, with a strong emphasis on affordability and quality, especially within challenging urban rental markets. Vonovia's strategic focus on new construction directly addresses this significant demand.

In 2024, the average rent for a two-bedroom apartment in major German cities like Berlin and Munich continued to climb, often exceeding €1,500 per month, highlighting the persistent need for more accessible housing options. Vonovia's new developments aim to offer competitive pricing to attract these cost-conscious renters.

The company's investment in modern, energy-efficient buildings also appeals to tenants looking for long-term value and lower utility costs, which is a crucial factor for those prioritizing affordability. This segment represents a substantial portion of the rental market, eager for well-maintained properties that don't strain their budgets.

Existing tenants represent a core customer segment for Vonovia, actively seeking property services such as maintenance, repairs, and modernization. This group is vital for generating consistent, recurring revenue streams.

In 2024, Vonovia's focus on tenant satisfaction for this segment is paramount, as it directly influences retention rates and long-term profitability. High customer satisfaction is a key driver in ensuring these tenants continue to utilize Vonovia's services.

The demand for housing-related services from this segment is substantial, encompassing everything from routine upkeep to significant upgrades and renovations. Vonovia's ability to efficiently and effectively address these needs is critical to its business model.

By providing reliable property services, Vonovia not only retains its existing tenant base but also fosters positive word-of-mouth, potentially attracting new tenants. This segment's ongoing engagement is a cornerstone of Vonovia's operational success.

Corporate Clients (for Employee Housing)

Vonovia likely caters to corporate clients needing employee housing, particularly in Germany's robust economic hubs. This segment prioritizes dependable, high-quality living spaces for their staff, ensuring employee satisfaction and retention. Companies often seek bulk leasing arrangements or dedicated housing solutions to attract and maintain talent, especially in areas with tight housing markets.

For instance, in 2024, the demand for corporate housing in major German cities like Berlin and Munich remained exceptionally strong due to a persistent shortage of rental units. Companies looking to relocate or expand operations often face challenges in securing suitable accommodation for their incoming employees. Vonovia’s extensive portfolio positions it as a key provider for these businesses.

Key considerations for this customer segment include:

- Reliability of Service: Consistent property management and maintenance are crucial for corporate tenants.

- Location and Accessibility: Proximity to business districts and transportation links is a high priority.

- Lease Flexibility: Companies often require adaptable lease terms to accommodate fluctuating employee needs.

- Cost-Effectiveness: While quality is paramount, competitive pricing remains a significant factor in decision-making.

Social Housing Beneficiaries

Vonovia recognizes the critical role of social housing, particularly in regions where its portfolio supports public housing initiatives and fulfills social responsibility mandates. The company strives to offer housing solutions that are accessible and affordable for a broad range of income levels. In 2024, Vonovia continued its commitment to this segment by maintaining and improving existing social housing units, ensuring they remain safe and comfortable for residents.

Providing affordable housing is a core aspect of Vonovia's strategy, aiming to meet the needs of individuals and families who might otherwise struggle to find suitable accommodation. This focus is especially pertinent in urban areas where housing costs can be a significant barrier.

- Affordable Housing Provision: Directly addresses the need for accessible living spaces, particularly in high-cost urban centers.

- Social Responsibility: Aligns with broader societal goals of ensuring housing security for vulnerable populations.

- Portfolio Integration: Social housing units are managed alongside the broader portfolio, benefiting from economies of scale in maintenance and management.

- Community Impact: Contributes to stable and diverse communities by offering housing options across different income brackets.

Individual residential tenants are Vonovia's cornerstone, encompassing a broad demographic seeking stable and affordable housing. The company manages a vast portfolio to meet diverse needs, a strategy reinforced by its 2024 holdings of approximately 566,000 units across Germany, Sweden, and Austria.

New residents are a key focus, particularly those in urban areas needing cost-effective, quality housing; Vonovia's new construction efforts directly target this demand, especially as average rents in major German cities exceeded €1,500 monthly for two-bedroom apartments in 2024.

Existing tenants are crucial for recurring revenue, valuing reliable property services like maintenance and modernization. Vonovia’s 2024 strategy emphasizes their satisfaction to boost retention and profitability, addressing a substantial demand for upkeep and upgrades.

Corporate clients seeking employee housing represent another significant segment, prioritizing dependable, well-located accommodations. The persistent housing shortage in German economic hubs in 2024 made securing such units a priority for businesses needing to attract and retain talent.

Vonovia also serves the social housing sector, fulfilling social responsibility by offering accessible and affordable options. In 2024, the company continued its commitment to maintaining and improving these units, ensuring they remain safe and comfortable for residents across various income levels.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Individual Residential Tenants | Stable, affordable housing | Largest customer base, 566,000 units managed |

| New Residents | Affordable, quality housing in urban areas | Addressing high rents (e.g., >€1,500/month for 2-bed in German cities) |

| Existing Tenants | Reliable property services (maintenance, modernization) | Key for recurring revenue and tenant retention |

| Corporate Clients | Employee housing, reliability, location | High demand due to talent acquisition and housing shortages |

| Social Housing | Accessible, affordable housing, community impact | Commitment to social responsibility and housing security |

Cost Structure

Vonovia's cost structure heavily features property acquisition and development. Significant capital is deployed to purchase existing properties and land parcels, alongside the expenses associated with constructing new residential units. These are core to their growth strategy.

In 2024, the company continued its investment in portfolio expansion and new construction. For instance, Vonovia's expenditure on property acquisitions and development is a key driver of their operational costs, reflecting the capital-intensive nature of the real estate sector.

The development of new residential units, including modernization and new builds, represents a substantial outlay. This investment aims to increase housing supply and improve the quality of their existing portfolio, directly impacting their cost base.

Property maintenance and modernization represent a significant and ongoing expenditure for Vonovia. These costs are essential for preserving the value of their extensive portfolio and ensuring tenant satisfaction. In 2024, Vonovia continued to invest heavily in these areas, focusing on both necessary repairs and strategic upgrades to improve living standards and energy efficiency across their properties.

These expenses cover a broad range of activities, from routine upkeep like painting and plumbing to more substantial modernization projects. A key driver for these investments is the increasing demand for energy-efficient housing, with upgrades to insulation, heating systems, and windows being prioritized. These efforts not only enhance tenant comfort but also contribute to Vonovia's sustainability goals and can lead to long-term cost savings.

For instance, Vonovia's commitment to climate neutrality by 2045 means substantial capital is allocated annually to these modernization efforts. While specific 2024 figures are still being finalized in early reports, their 2023 reports highlighted billions of Euros invested in modernization, a trend expected to continue and likely increase as they progress toward their climate targets.

Personnel costs are a significant component of Vonovia's operating expenses, driven by its extensive in-house property management and maintenance capabilities. This includes compensation for a large workforce dedicated to tenant relations, skilled tradespeople for repairs and upkeep, and administrative staff essential for smooth operations.

For instance, in 2023, Vonovia reported significant personnel-related expenses. The company employed a substantial number of individuals across various roles to manage its vast portfolio. These costs are directly tied to maintaining service quality and operational efficiency across their properties.

Financing Costs & Interest Payments

Vonovia's vast real estate holdings and ongoing development projects necessitate significant borrowing, leading to substantial financing costs. These costs are primarily comprised of interest paid on its extensive debt portfolio. For instance, in 2023, Vonovia reported financing expenses that reflected the prevailing interest rate environment. Effective management of these interest payments and maintaining a prudent loan-to-value ratio are paramount to its financial stability and profitability.

Managing these financing costs is a core element of Vonovia's financial strategy. The company actively works to optimize its debt structure and secure favorable borrowing terms.

- Interest Expense: Vonovia's financial statements detail the significant interest burden associated with its large debt volume, directly impacting its net income.

- Debt Management: The company's ability to manage its loan-to-value ratio and refinancing activities is crucial for controlling financing costs.

- Market Sensitivity: Fluctuations in interest rates directly influence Vonovia's financing expenses, highlighting the need for robust risk management.

- Capital Structure Optimization: Vonovia continuously evaluates its capital structure to minimize the overall cost of financing.

Administrative & Operating Expenses

Vonovia's administrative and operating expenses are the backbone of its corporate functions, covering everything from IT infrastructure to legal support. These costs are crucial for maintaining the company's overall management and operational efficiency. For instance, in 2023, Vonovia reported administrative expenses of €1.7 billion, which represented 13% of its total revenue of €13.1 billion. This figure encompasses a broad range of activities essential for smooth business operations.

These essential business functions include significant investments in IT infrastructure to manage its vast property portfolio and tenant relationships. Marketing efforts also fall under this category, aimed at maintaining brand presence and attracting new tenants or customers. Furthermore, legal services are vital for navigating complex property regulations and contractual obligations. These operational necessities ensure the company can effectively manage its extensive real estate assets.

- Corporate Overhead: Costs associated with central management, executive salaries, and general office functions.

- IT Infrastructure: Expenses for software, hardware, cybersecurity, and data management systems.

- Marketing & Sales: Costs for advertising, promotions, and customer acquisition activities.

- Legal & Compliance: Fees for legal counsel, regulatory adherence, and risk management.

- Other Operating Costs: Includes services like accounting, human resources, and general administrative support.

Vonovia's cost structure is dominated by property acquisition and development, alongside significant expenses for property maintenance and modernization. Personnel costs, driven by extensive in-house management, and substantial financing costs due to high debt levels are also key components. Administrative and operating expenses, including IT and legal support, form the remaining significant cost base.

In 2024, Vonovia continued its substantial investments in modernization and new construction, which are core to its operational costs. For example, the company's commitment to climate neutrality by 2045 necessitates ongoing, significant capital allocation towards energy-efficient upgrades.

Personnel expenses in 2024 remained a key cost driver, reflecting the large workforce required to manage its extensive property portfolio and provide tenant services. These costs are directly linked to maintaining operational quality.

Financing costs, particularly interest expenses on its considerable debt, continue to be a major outlay for Vonovia. Managing these costs through prudent debt management and capital structure optimization is essential for financial health, especially in varying interest rate environments.

| Cost Category | Description | 2023 Relevance (Illustrative) |

| Property Acquisition & Development | Costs associated with buying properties and constructing new units. | Major capital expenditure driver. |

| Maintenance & Modernization | Expenses for upkeep, repairs, and energy-efficient upgrades. | Billions of Euros invested in 2023, crucial for sustainability goals. |

| Personnel Costs | Salaries and benefits for employees in management, maintenance, and administration. | Significant expense due to large workforce. |

| Financing Costs | Interest paid on debt. | Reflected prevailing interest rates in 2023; sensitive to market fluctuations. |

| Administrative & Operating Expenses | Overhead, IT, legal, marketing, and other operational support. | €1.7 billion in administrative costs in 2023 (13% of revenue). |

Revenue Streams

Vonovia's main source of income is rent collected from its extensive housing stock. This is the backbone of their business, offering predictable, ongoing revenue.

In 2023, Vonovia reported rental revenue of €4.7 billion, a slight increase from the previous year, underscoring the stability of this revenue stream. This income is generated from hundreds of thousands of apartments across Germany, Sweden, and Austria.

The company manages a diverse range of residential units, from affordable housing to premium apartments, catering to a broad tenant base. This diversification helps to mitigate risks associated with any single market segment.

Vonovia's revenue streams extend beyond basic rent to include significant income from service charges and utility management. These charges cover essential services like heating, water, and waste disposal, directly passed on to tenants based on usage and building-wide costs. This segment is crucial for covering operational expenses and contributing to profitability.

In 2024, the efficient management of these ancillary services is a key focus for Vonovia, aiming to optimize costs while ensuring tenant satisfaction. The company's extensive portfolio necessitates robust systems for metering, billing, and maintenance of these utilities. For instance, a substantial portion of its operating expenses is allocated to energy procurement and infrastructure upkeep, which are then recovered through these charges.

Vonovia's revenue streams extend beyond traditional renting, notably through the sale of newly developed properties. This is a significant component, particularly handled by its Development segment, which includes brands like BUWOG. These sales are directed towards third parties, meaning external buyers, not just within Vonovia's existing portfolio.

This strategy of selling newly built homes is crucial as it diversifies income and provides a complementary revenue source to the core rental business. For instance, in the first half of 2024, Vonovia reported a significant contribution from its development activities, with sales of around 1,200 units, generating substantial proceeds that bolster overall earnings.

Fees from Recurring Sales & Portfolio Optimization

Vonovia's revenue streams include income derived from the ongoing sale of individual condominiums and other non-essential assets within its extensive portfolio. This strategy not only generates immediate cash but also serves to refine and optimize the overall composition of its real estate holdings.

These strategic divestments are a crucial part of Vonovia's financial management. For instance, in 2024, the company continued its program of portfolio adjustments, with specific figures on the exact revenue generated from these recurring sales being a key indicator of its success in managing its assets efficiently.

- Recurring Sales Revenue: Income generated from the regular sale of individual condominiums.

- Portfolio Optimization: Revenue from selling non-core assets to improve overall portfolio quality and cash flow.

- Cash Generation: Disposals contribute to increased liquidity for further investment or debt reduction.

- Strategic Asset Management: Continuous refinement of the property portfolio to align with market demands and strategic goals.

Income from Value-Add Services

Vonovia generates revenue from a range of value-added services provided to its tenants. These services go beyond basic housing and include offerings like energy supply, modernization projects, and various other housing-related amenities that enhance tenant living experiences.

This segment is a key growth area for Vonovia, reflecting a strategic push to diversify income streams and increase customer loyalty. The company is actively investing in and expanding these offerings to meet evolving tenant demands.

- Energy Supply Services: Vonovia offers its own energy supply, providing tenants with electricity and heating. This can create a recurring revenue stream and allows for integrated service management.

- Modernization Services: Income is also generated from modernization efforts, which improve property value and tenant comfort. This includes upgrades to energy efficiency, building facades, and interior features.

- Other Housing-Related Offerings: This category encompasses a variety of services, potentially including digital solutions for tenants, maintenance packages, or even ancillary services that add convenience and value to their tenancy.

Beyond core rental income, Vonovia generates revenue through property sales, particularly from its development arm like BUWOG. In the first half of 2024, sales of approximately 1,200 units contributed significantly to earnings. Additionally, the company earns from managing and selling individual condominiums and non-core assets as part of its portfolio optimization strategy. This active asset management enhances liquidity and refines the property mix.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Rental Revenue | Core income from tenants. | €4.7 billion in 2023, showing stability. |

| Service Charges & Utilities | Recovery of operational costs like heating and water. | Key focus for cost optimization in 2024. |

| Property Sales (Development) | Revenue from selling newly built properties. | Around 1,200 units sold in H1 2024, boosting earnings. |

| Portfolio Optimization Sales | Income from selling individual units and non-core assets. | Ongoing strategy in 2024 for cash generation and asset refinement. |

Business Model Canvas Data Sources

The Vonovia Business Model Canvas is built using a blend of internal financial reports, customer feedback analysis, and market intelligence on the real estate sector. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework.