Vonovia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vonovia Bundle

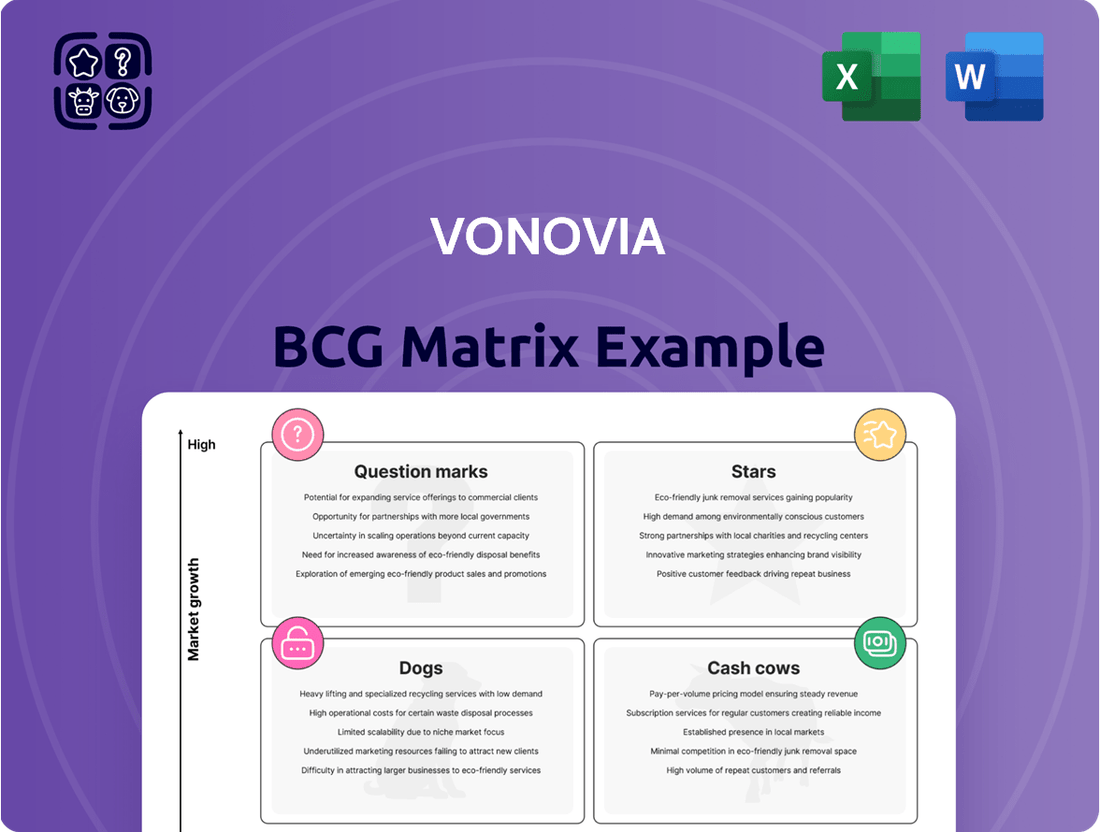

Curious about Vonovia's strategic positioning? Our BCG Matrix analysis offers a compelling glimpse into their portfolio, categorizing their ventures as potential Stars, Cash Cows, Dogs, or Question Marks. Understanding these dynamics is crucial for any investor or competitor looking to navigate the real estate landscape.

This preview highlights the foundational insights, but the real power lies in the full report. Gain a comprehensive understanding of each business unit's market share and growth rate, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable strategies and detailed quadrant placements that await. Purchase the complete Vonovia BCG Matrix to unlock a clear roadmap for optimizing their real estate assets and maximizing profitability.

Stars

Vonovia is heavily investing in modernizing its existing portfolio with energy-efficient solutions. This includes installing solar panels and heat pumps, a key move towards their goal of a nearly climate-neutral building stock by 2045.

These upgrades are more than just about sustainability; they directly boost property value and tenant happiness, which translates to better rental income and fewer empty units. For example, in 2023, Vonovia reported that modernization measures contributed positively to rental growth.

The company anticipates a substantial rise in capital expenditures dedicated to these modernization efforts. This signals a high-growth potential market, especially as the demand for environmentally friendly housing solutions continues to climb, making it a strategic focus for Vonovia.

Vonovia is significantly investing in new construction, especially in sought-after German cities. The company plans to deliver approximately 3,000 new residential units by 2025. This strategic focus on urban development is designed to meet the persistent housing deficit in metropolitan regions.

Despite rising construction expenses, Vonovia sees new builds as crucial for its long-term expansion strategy. Their ambition is to develop 70,000 apartments on existing land holdings.

These developments are strategically located in areas with strong demand, which typically translates to high occupancy rates and robust rental income potential. This approach positions Vonovia to capitalize on the ongoing housing shortage in key urban centers.

Vonovia is strategically focusing on enhancing its value-add services and expanding recurring sales, aiming for these segments to contribute 20-25% to Adjusted EBITDA by 2028, a significant jump from their 9% share in 2024. This growth will be driven by an increased offering of maintenance services, the efficient deployment of modular new builds, and a more aggressive approach to selling individual condominiums.

These initiatives are designed to tap into Vonovia's substantial expertise and extensive property portfolio, moving beyond conventional rental income. By commercializing these capabilities, Vonovia expects to unlock scalable business models and introduce innovative technologies to a broader market.

Digitalization of Tenant Services and Operations

Vonovia is making significant strides in digitalizing tenant services, aiming for greater efficiency and tenant satisfaction. This focus is evident in their Q1 2025 Customer Satisfaction Index, which hit an all-time high, underscoring the positive impact of these digital initiatives.

The company is investing in digital tenant platforms, incorporating AI and intelligent infrastructure to streamline maintenance and communication. This strategic move is designed not only to improve operational workflows but also to elevate the overall customer experience, positioning Vonovia at the forefront of tech-enabled urban living solutions.

- Digital Tenant Platforms: Enhancing communication and service delivery.

- AI Integration: Optimizing maintenance scheduling and response times.

- Intelligent Infrastructure: Improving building management and resource efficiency.

- Tenant Satisfaction: Achieved an all-time high in Q1 2025 due to these digital efforts.

Strategic Acquisitions in Growth Markets

While Vonovia has been actively divesting non-core assets, the company is strategically positioning itself for targeted acquisitions in high-potential growth markets. This dual approach allows them to refine their portfolio and invest in properties that align with their long-term vision of enhancing energy efficiency and expanding in desirable urban centers. For instance, in 2024, Vonovia continued its focus on upgrading its existing housing stock, with significant investments earmarked for sustainability improvements across its German portfolio.

This selective acquisition strategy is particularly potent in Germany, a market characterized by persistent high housing demand. By acquiring properties that fit their upgrade criteria and are located in attractive urban areas, Vonovia aims to solidify its market leadership. This allows them to leverage favorable market trends and capitalize on opportunities to enhance their offering to residents. The company's ability to secure prime assets in these competitive markets demonstrates its strategic foresight and financial capacity.

- Continued focus on energy efficiency upgrades: Vonovia allocated a substantial portion of its capital expenditure in 2024 towards modernizing its properties to meet higher energy efficiency standards, reflecting a commitment to sustainability and long-term value creation.

- Targeted acquisitions in growth markets: The company actively seeks opportunities to acquire residential properties in urban locations with strong demand, aiming to expand its footprint in key German cities.

- Portfolio optimization through divestments: Alongside acquisitions, Vonovia continues to divest non-core assets to streamline its operations and enhance financial flexibility, supporting its strategic growth initiatives.

Vonovia's modernized existing portfolio, focusing on energy efficiency, represents a significant Star in its BCG Matrix. Investments in solar panels and heat pumps are enhancing property values and tenant satisfaction, directly contributing to rental growth as seen in 2023. This segment is poised for continued expansion driven by increasing demand for sustainable housing.

New construction, particularly in high-demand German cities, also falls into the Star category. Vonovia's plan to deliver 3,000 new units by 2025 and its ambition to develop 70,000 apartments on existing land highlight this segment's growth potential. These projects are strategically located to capitalize on the persistent housing deficit.

The expansion of value-add services and recurring sales, targeting 20-25% of Adjusted EBITDA by 2028, marks another Star. This diversification leverages Vonovia's expertise and portfolio to create scalable business models beyond traditional rental income.

Digitalization efforts, including AI integration and intelligent infrastructure, are driving tenant satisfaction and operational efficiency. The Q1 2025 Customer Satisfaction Index reaching an all-time high validates these investments as a key growth area.

| Business Segment | BCG Category | Key Growth Drivers | 2024/2025 Data Points |

| Modernized Existing Portfolio (Energy Efficiency) | Star | Tenant demand for sustainability, increased property value, rental growth | Positive contribution to rental growth in 2023. Significant capital expenditure in 2024 for upgrades. |

| New Construction (Urban Development) | Star | Housing deficit in metropolitan areas, strong demand in key cities | Plan to deliver ~3,000 units by 2025. Ambition to develop 70,000 apartments on existing land. |

| Value-Add Services & Recurring Sales | Star | Leveraging expertise, expanding service offerings, commercializing capabilities | Targeting 20-25% of Adjusted EBITDA by 2028 (from 9% in 2024). |

| Digitalization of Tenant Services | Star | Enhanced tenant satisfaction, operational efficiency, AI integration | All-time high Customer Satisfaction Index in Q1 2025. |

What is included in the product

The Vonovia BCG Matrix offers a strategic framework for analyzing its diverse portfolio, guiding investment decisions.

It categorizes Vonovia's business units into Stars, Cash Cows, Question Marks, and Dogs, highlighting growth potential and market share.

The Vonovia BCG Matrix provides a clear, visual snapshot of portfolio performance, alleviating the pain of complex data analysis for strategic decision-making.

Cash Cows

Vonovia's extensive portfolio of residential properties in core German cities is its undisputed cash cow. This segment boasts a dominant market share and delivers highly stable, recurring rental income, forming the bedrock of the company's financial strength.

As of December 2024, Vonovia managed over 479,000 residential units in Germany, maintaining an impressive occupancy rate of 98%. This high demand translates into consistent and substantial Adjusted EBITDA generation for the company.

The enduring demand for rental apartments across Germany ensures a predictable and robust cash flow stream for this business unit. Crucially, these established assets require minimal promotional investment to maintain their strong performance.

Vonovia's established property management services act as a classic cash cow within its portfolio. These in-house operations are crucial for maintaining its extensive housing stock, generating a steady and reliable income stream that bolsters the company's overall financial stability. For instance, in 2023, Vonovia continued to focus on optimizing its property management, a core element that underpins its rental income.

The efficiency of these management services directly impacts Vonovia's bottom line by ensuring properties are well-maintained and tenant retention remains high. This focus on tenant satisfaction and minimizing vacancies is key to the consistent performance of its rental business, solidifying its position as a dependable cash generator for the company.

Vonovia's existing multi-family homes portfolio forms the bedrock of its operations, representing mature assets within a stable rental market. These properties are designed to generate consistent and predictable rental income, a hallmark of a cash cow business. The sustained demand for housing in urban centers is a key driver, contributing to an observed organic rental growth of approximately 4.1% in 2024, demonstrating the portfolio's resilience and ability to expand revenue streams even in a less dynamic market.

The relatively low growth environment for these established multi-family units translates into reduced marketing expenditures. This efficiency directly bolsters profit margins, as less capital is required to acquire and retain tenants. The resulting strong and stable cash flow from these assets provides Vonovia with the financial flexibility needed to invest in other areas of its business or to return capital to shareholders, solidifying their position as a core cash-generating segment.

Recurring Rental Income from Long-Term Leases

Vonovia's recurring rental income from long-term leases is a significant cash cow. These agreements ensure a predictable and stable revenue flow, crucial for financial stability. With a remarkably low vacancy rate, averaging approximately 2.0% across its portfolio, the company maximizes rental income generation.

This consistent income stream is the foundation upon which Vonovia can reliably pay dividends and invest in future growth strategies. The residential leasing market, especially in desirable locations, demonstrates strong tenant retention, solidifying these leases as dependable cash-generating assets.

- Predictable Revenue: Long-term leases provide a stable and consistent income stream.

- Low Vacancy: A vacancy rate around 2.0% ensures high occupancy and rental income.

- Financial Stability: This reliable income supports dividend payments and strategic investments.

- Tenant Stickiness: Residential leases in high-demand areas offer strong tenant retention.

Operational Efficiency and Cost Discipline

Vonovia's emphasis on operational efficiency and cost discipline is a cornerstone of its strategy for its mature real estate portfolio, directly contributing to its status as a cash cow. This focus allows the company to maintain robust profit margins and optimize cash flow generation from its stable rental income streams.

By effectively managing its vast asset base through scale and operational expertise, Vonovia minimizes unnecessary costs. This disciplined approach ensures that its core rental business generates strong and reliable cash flows, a key characteristic of a cash cow in the BCG matrix.

- Operational Efficiency: Vonovia leverages its scale to streamline operations and reduce per-unit management costs.

- Cost Discipline: Strict adherence to cost control measures across its portfolio enhances profitability.

- High Profit Margins: The combination of efficient operations and cost control leads to superior profit margins on rental income.

- Cash Flow Generation: These factors result in consistent and substantial cash flow from its mature assets, typically seen in cash cow business units.

Vonovia's established rental portfolio in prime German locations acts as its primary cash cow. These assets generate consistent, predictable rental income with minimal need for aggressive marketing or growth investment. As of the close of 2024, the company's German residential portfolio, comprising nearly 480,000 units, maintained an exceptional occupancy rate of 98%, underscoring its stable demand and reliable cash generation capabilities.

| Metric | Value (2024 Data) | Significance for Cash Cow Status |

| German Residential Units Managed | ~479,000 | Scale of operations providing market dominance |

| Occupancy Rate (Germany) | 98% | High utilization ensures maximum rental income |

| Organic Rental Growth (Portfolio) | ~4.1% | Steady, modest growth without high investment |

| Vacancy Rate (Portfolio Average) | ~2.0% | Minimizes lost revenue, maximizes cash flow |

What You See Is What You Get

Vonovia BCG Matrix

The Vonovia BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis tool, designed by industry experts, provides a clear framework for understanding Vonovia's portfolio. Upon completion of your purchase, you will gain full access to this professionally formatted report, enabling you to make informed decisions about resource allocation and future investments. Rest assured, no demo content or limitations are present; you are seeing the complete, actionable strategic resource.

Dogs

Vonovia has strategically decided to shed non-core assets as part of its larger business plan. This involves selling off properties that don't directly contribute to its main growth objectives or have shown weaker performance. The goal is to simplify the company's structure and improve its financial health by lowering debt levels.

In 2024 alone, Vonovia completed property sales totaling €3.7 billion. A significant portion of this was a €1 billion deal involving a portfolio of properties located in northern Germany, acquired by Apollo Global Management. This move is indicative of Vonovia's commitment to actively managing its real estate holdings.

Looking ahead, Vonovia has ambitious plans to divest approximately 66,000 apartments by the year 2028. The estimated value of these apartments is around €13 billion. These assets are categorized as divestments because they are seen as having lower potential for future growth or are no longer strategically vital to the company's core operations.

By divesting these less critical assets, Vonovia aims to unlock capital that can then be reinvested in more promising areas or used to strengthen its balance sheet. This strategic sharpening of its portfolio is a key component of its ongoing operational streamlining efforts.

Properties situated in economically stagnant or declining regions, particularly those needing substantial upkeep with minimal rental income growth prospects, can be categorized as Dogs. These assets often yield low returns and immobilize capital without substantial appreciation potential.

While Vonovia doesn't explicitly label them as Dogs, their strategic emphasis on high-demand metropolitan areas for their primary operations and divestment plans suggests an intention to offload properties in less desirable locales. This approach aims to optimize capital allocation and focus resources on more profitable ventures.

By 2024, Vonovia has been actively managing its portfolio, seeking to divest approximately 14.7 billion euros worth of assets, a move that would likely include properties in such less attractive regions. This portfolio optimization is crucial for improving overall financial performance and concentrating on core, growth-oriented markets.

Legacy IT systems and inefficient processes at Vonovia would likely fall into the Dogs category of the BCG matrix. These older systems, often fragmented and lacking integration, hinder the adoption of modern, data-driven management practices. For instance, in 2023, Vonovia reported significant investments in IT modernization, aiming to streamline operations and improve data analytics capabilities, indicating a recognition of the drag these legacy systems impose.

Such outdated infrastructure consumes valuable resources and personnel time without offering a clear path to growth or a competitive edge. While not a direct product, their existence represents an internal inefficiency that detracts from overall performance. The company's strategic focus on digitalization and innovation, evident in their 2024 plans for further cloud migration and AI implementation, directly targets the obsolescence of these legacy elements.

Underperforming Commercial Units

Vonovia's extensive real estate portfolio includes commercial units, though these represent a smaller portion compared to its residential holdings. As of December 2024, Vonovia managed 8,331 commercial units. Some of these assets might be situated in commercial real estate segments experiencing limited growth.

When commercial properties within Vonovia's portfolio exhibit low returns or struggle with occupancy, they would be classified as Question Marks or Dogs in a BCG matrix context. These underperforming units necessitate a thorough strategic evaluation.

- Low Returns: Commercial units that consistently fail to meet profitability targets.

- Poor Occupancy: Properties with significant vacancy rates, indicating weak demand.

- Market Stagnation: Assets located in commercial segments with minimal growth prospects.

- Strategic Review: These units require focused attention for potential turnaround or divestment to improve overall portfolio efficiency.

Unsuccessful Large-Scale Development Projects

Vonovia appears to be stepping back from extensive, sprawling development projects. Instead, the company is concentrating on smaller, more focused initiatives, particularly in urban areas where demand for housing is robust. This strategic adjustment implies that prior large-scale endeavors likely encountered substantial obstacles, such as escalating construction expenses or complex regulatory environments.

These challenges may have rendered those projects unprofitable, characterized by meager returns on investment and significant capital outlay. For instance, in 2024, the German construction sector experienced a notable increase in material costs, with prices for wood rising by an estimated 15% and steel by 10% compared to 2023, impacting the viability of large projects.

The company's shift signals an acknowledgment of past inefficiencies in managing and executing these larger developments. This pivot is a strategic move to optimize resource allocation and improve profitability by concentrating on more manageable and potentially lucrative ventures.

- Strategic Shift: Vonovia is moving away from large-scale developments towards smaller, targeted urban projects.

- Reasons for Shift: High construction costs (e.g., 10-15% material cost increases in 2024) and regulatory hurdles likely made previous large projects less profitable.

- Recognition of Inefficiencies: The company's pivot indicates a learning from past challenges in large-scale project execution.

- Focus on Demand: New strategy prioritizes projects in high-demand urban areas for better return potential.

Properties in economically weak regions with low rental income growth and high maintenance needs are considered Dogs. These assets typically generate minimal returns and tie up capital without significant appreciation potential.

Vonovia's divestment strategy, which includes offloading around 66,000 apartments by 2028 valued at €13 billion, suggests a move away from such underperforming assets. This focus on shedding less critical holdings aims to optimize capital and concentrate on more lucrative markets.

The company's strategic shift away from large, potentially unprofitable development projects towards smaller, urban-focused initiatives also reflects an effort to avoid assets that might become Dogs due to escalating costs or regulatory challenges.

By prioritizing high-demand metropolitan areas and divesting properties in less attractive locales, Vonovia aims to improve its overall portfolio efficiency and financial performance.

Question Marks

Vonovia's strategic consideration of new European markets beyond Germany, Sweden, and Austria positions it for potential growth, but also presents significant challenges. While the overall European residential real estate market is expected to see continued expansion, Vonovia would likely enter these new territories with a very small market share.

This low initial penetration necessitates substantial capital investment to build brand recognition, acquire properties, and establish operational infrastructure. For instance, entering a market like Poland or the Netherlands would require a deliberate strategy to overcome established local players and understand diverse regulatory environments.

Success in these ventures hinges critically on meticulous market selection, identifying geographies with favorable demographic trends and economic stability, and executing expansion plans with precision. Vonovia's ability to adapt its business model to local nuances will be paramount in capturing emerging opportunities and achieving a meaningful market presence.

The development and implementation of advanced high-tech solutions, such as AI-based energy management systems, digital twins, and smart home features for tenants, represent a significant investment in future differentiation for Vonovia. These innovations require substantial capital for research and development, as well as pilot projects. For instance, the global smart home market was valued at approximately USD 100 billion in 2023 and is projected to grow considerably, indicating a strong underlying demand for such technologies.

While these high-tech, smart home, and AI-driven tenant solutions offer high growth potential and a unique selling proposition in the long term, their market adoption and ultimate profitability are currently unproven. This places them in a high-risk, high-reward category within the BCG matrix. Vonovia’s commitment to these areas in 2024, as evidenced by increased R&D spending on digital transformation initiatives, underscores their strategic bet on future value creation, even with the inherent uncertainties.

Vonovia's strategic move to offer its advanced, digitalized property management platform to external clients positions it as a Question Mark within its business portfolio. This initiative leverages Vonovia's proven operational efficiency and technological infrastructure, aiming to expand its reach and generate new revenue streams by serving a broader market.

The success of this venture hinges on Vonovia's ability to effectively market its services and differentiate itself in a competitive landscape. While the potential for scale is significant, the initial investment in customer acquisition and platform adaptation carries inherent risks, leading to uncertain early returns.

In 2023, the German property management market saw continued growth, with a trend towards digitalization accelerating. Companies like Vonovia, with established digital platforms, are well-positioned to capture market share, but the cost of acquiring and retaining third-party clients remains a substantial hurdle.

Vonovia's platform offers features like digital tenant communication, automated maintenance requests, and data-driven portfolio analysis, which are increasingly in demand. However, competing against established property management firms and convincing new clients to switch requires a robust value proposition and significant marketing outlay, making its long-term market position a question mark.

Modular Construction Techniques for Rapid Development

Vonovia's investment in modular construction techniques is a classic Question Mark. This strategy aims to significantly cut construction costs and speed up the delivery of new apartments, directly addressing the urgent housing needs. For instance, in 2024, Vonovia continued to explore and implement modular building solutions, with a target to increase the proportion of prefabricated elements in their projects. The potential for high growth is evident, as this method can streamline the building process, reduce waste, and offer greater predictability in timelines and budgets.

However, this promising approach carries inherent risks. The substantial upfront capital required for advanced manufacturing facilities, specialized training, and process integration is a major hurdle. Furthermore, the long-term cost-effectiveness and scalability of modular construction are still being proven across the industry. Vonovia's success will depend on its ability to optimize these investments and overcome the challenges of widespread adoption.

- Cost Reduction Potential: Modular construction can lower building costs by up to 20-30% through factory-controlled environments and reduced on-site labor.

- Accelerated Delivery: Projects can be completed up to 50% faster compared to traditional methods, crucial for addressing housing shortages rapidly.

- Upfront Investment: Significant capital is needed for specialized factories, technology, and supply chain development.

- Scalability Risks: Achieving consistent quality and cost-efficiency at a large scale remains a developing challenge in the industry.

Development of Niche Housing Concepts (e.g., specific co-living or senior living innovations)

While Vonovia has divested its senior care facilities, the development of niche housing concepts presents a strategic avenue for growth. Innovative co-living spaces and new models for age-appropriate senior living cater directly to evolving demographic demands and hold significant high-growth potential.

These segments, though promising, necessitate thorough market validation and substantial investment in pilot projects. Initial market share can be uncertain due to potential regulatory hurdles and the need for social acceptance of novel housing arrangements.

Consider these points for niche housing development:

- Market Trends: The global co-living market was projected to reach $10.8 billion by 2025, indicating strong demand for communal living solutions. Similarly, the senior living market continues to expand, driven by an aging global population. For instance, in 2023, the number of individuals aged 65 and over in Germany exceeded 17 million, highlighting the demographic imperative for specialized housing.

- Investment & Risk: Pilot projects for new concepts require significant upfront capital. For example, establishing a technologically advanced co-living space could involve millions in development and fit-out costs. The risk lies in the unproven nature of some concepts and the time required to achieve profitability.

- Regulatory & Social Factors: Zoning laws, building codes, and local community acceptance can impact the speed and feasibility of launching new housing models. Gaining approval for co-living units or innovative senior independent living facilities might involve navigating complex bureaucratic processes.

- Potential for Differentiation: Successful niche concepts can create strong brand loyalty and command premium pricing. Vonovia could explore partnerships with technology providers for smart home features in co-living or with healthcare providers for integrated services in senior living, differentiating its offerings.

Vonovia's expansion into new European markets represents a classic Question Mark. While the overall European residential market is growing, Vonovia would likely enter these territories with minimal market share, requiring significant investment to build brand presence and acquire properties. For example, in 2024, the company continued to assess opportunities in markets beyond its core Germany, Sweden, and Austria, aiming for strategic expansion despite the inherent risks of low initial penetration.

These ventures require substantial capital for market entry, brand building, and operational setup, facing competition from established local players and diverse regulatory landscapes. Success hinges on careful market selection, focusing on geographies with favorable demographics and economic stability, alongside precise execution of expansion plans. Vonovia's ability to adapt its business model to local conditions will be crucial for capturing opportunities and establishing a meaningful presence.

The firm's investment in advanced digital solutions like AI for energy management and smart home features for tenants also falls into the Question Mark category. These innovations, while offering high long-term growth potential, require substantial R&D and pilot project funding, with market adoption and profitability yet to be fully proven. Vonovia's increased R&D spending in 2024 on digital transformation highlights this strategic bet on future differentiation.

Offering its digitalized property management platform to external clients is another Question Mark. This leverages existing infrastructure to generate new revenue streams but faces challenges in marketing and differentiation within a competitive landscape. While the potential for scale is significant, initial customer acquisition costs and platform adaptation risks lead to uncertain early returns, despite the growing demand for digital property management solutions observed in markets like Germany in 2023.

Modular construction is a key Question Mark for Vonovia, aiming to cut costs and speed up housing delivery. The company continued to explore and implement these solutions in 2024, targeting increased use of prefabricated elements. While this method offers high growth potential through streamlined processes, it demands significant upfront capital for specialized facilities and training, with long-term cost-effectiveness and scalability still under industry-wide validation.

The development of niche housing concepts like co-living and age-appropriate senior living also represents a Question Mark. These segments cater to evolving demographic demands and offer high growth potential, but require thorough market validation and substantial pilot project investment. Initial market share is uncertain due to potential regulatory hurdles and the need for social acceptance of novel housing arrangements, although trends like the growing global co-living market and Germany's aging population, exceeding 17 million individuals aged 65+ in 2023, underscore the demographic imperative.

| Strategic Initiative | BCG Category | Key Considerations | Relevant Data/Facts (2023-2024) |

| New European Market Expansion | Question Mark | Low initial market share, high capital investment needed for brand building and property acquisition, competition from local players, regulatory diversity. | Continued assessment of opportunities beyond Germany, Sweden, Austria in 2024. |

| High-Tech Tenant Solutions (AI, Smart Home) | Question Mark | High R&D and pilot project costs, unproven market adoption and profitability, potential for long-term differentiation. | Global smart home market valued approx. USD 100 billion in 2023. Increased R&D spending on digital transformation in 2024. |

| External Property Management Platform Offering | Question Mark | Marketing and differentiation challenges, customer acquisition costs, uncertain early returns, competitive landscape. | German property management market saw accelerated digitalization in 2023. |

| Modular Construction Techniques | Question Mark | Significant upfront capital for facilities and training, unproven long-term cost-effectiveness and scalability, potential for cost reduction and accelerated delivery. | Target to increase prefabricated elements in projects in 2024. Potential cost reduction of 20-30%, project completion up to 50% faster. |

| Niche Housing Concepts (Co-living, Senior Living) | Question Mark | Market validation and pilot project investment required, uncertain initial market share, regulatory and social acceptance hurdles. | Global co-living market projected at $10.8 billion by 2025. German population aged 65+ exceeded 17 million in 2023. |

BCG Matrix Data Sources

Our Vonovia BCG Matrix is built upon a foundation of extensive market data, incorporating financial reports, real estate industry analysis, and economic forecasts to provide strategic clarity.