Vital Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vital Energy Bundle

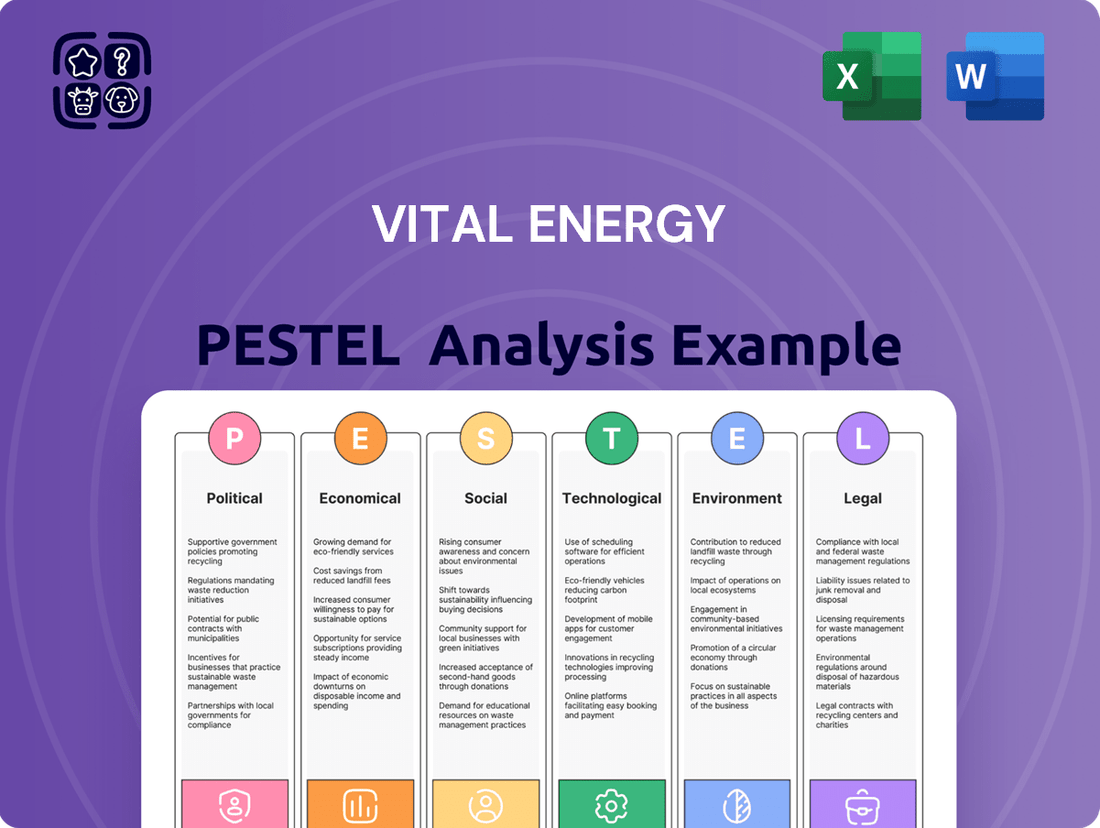

Navigate the complex external forces shaping Vital Energy's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental landscapes that directly impact its operations and strategic direction. This expertly crafted report provides the critical intelligence you need to anticipate challenges, identify opportunities, and make informed decisions. Don't be caught off guard by evolving market dynamics – download the full PESTLE analysis now for actionable insights.

Political factors

Government policies, particularly those enacted by a new administration, can dramatically reshape the energy sector. For instance, the Trump administration's focus on deregulation and boosting domestic production, including measures to speed up drilling and pipeline projects, directly influences companies like Vital Energy. This regulatory shift, however, frequently encounters legal hurdles, introducing an element of unpredictability.

Global geopolitical shifts and the increasing importance placed on energy security profoundly impact oil and natural gas demand and pricing. International conflicts, such as those in Eastern Europe and the Middle East, have underscored the need for stable energy supplies, driving up prices. In 2023, global energy demand was projected to grow by 2% according to the IEA, highlighting the ongoing reliance on fossil fuels despite energy transition efforts.

The United States is actively pursuing a strategy to maintain its position as a leading oil and gas producer. This focus on national energy independence is particularly pronounced in response to international instability, leading to policies that often encourage higher domestic production levels. US crude oil production reached an all-time high of approximately 13.2 million barrels per day in 2023, a testament to this policy direction.

As an operator in the Permian Basin, Vital Energy is well-positioned to capitalize on this emphasis on national energy independence. The Permian Basin is a prolific oil-producing region, and its output is crucial for meeting domestic demand and bolstering US energy security. Vital Energy's operations within this key area allow it to benefit directly from policies that favor increased American oil and gas output.

International trade policies and export regulations are critical for Vital Energy, especially concerning its liquefied natural gas (LNG) operations. Agreements and rules governing oil and gas exports directly influence market access and, consequently, profitability. The U.S. is projected to see significant growth in its LNG export capacity, with new projects expected to come online. However, this expansion occurs against a backdrop of anticipated global market oversupply by 2026, a situation that requires strategic policy interventions to ensure continued competitiveness for U.S. exporters like Vital Energy.

Shifts in global trade relations, including tariffs or sanctions, can materially impact Vital Energy's ability to sell its energy products on the international stage. For instance, a change in trade policy between major importing nations and the U.S. could alter demand patterns or introduce new cost barriers. As of early 2024, the U.S. remains a leading global LNG exporter, but geopolitical dynamics and evolving energy security concerns among importing countries could lead to policy adjustments that affect Vital Energy's sales volumes and pricing power.

State-Level Regulations and Local Governance

Vital Energy's operations are significantly shaped by state-level regulations, particularly in Texas, its primary operating area. The Texas Railroad Commission (TRRC) oversees oil and gas activities, aiming to balance regulatory responsibilities with promoting a conducive business climate. The TRRC has been implementing technological upgrades, such as the launch of its new online permitting system in 2023, to improve efficiency and transparency in filings.

Despite efforts to streamline processes, state-specific environmental regulations present ongoing compliance hurdles for Vital Energy. For example, recent updates to waste disposal rules and pit permitting requirements, implemented in late 2023, necessitate careful adherence to ensure environmental protection and avoid penalties. These evolving state mandates directly impact operational costs and strategic planning.

- Texas Railroad Commission Oversight: The TRRC's approach influences operational flexibility and investment decisions for Vital Energy.

- Technological Advancements in Permitting: Initiatives like the TRRC's online system aim to reduce processing times for new projects.

- Environmental Compliance Challenges: New waste and pit permitting rules, effective from January 1, 2024, require updated operational procedures and increased monitoring.

- Impact on Operational Costs: Adherence to these state-specific environmental standards can lead to higher capital expenditures and ongoing operational expenses.

Political and Public Opinion Shifts

The political landscape surrounding energy is in constant flux, with public opinion playing a significant role in shaping long-term policy. The ongoing debate about whether to increase fossil fuel production or accelerate the transition to renewable energy sources directly impacts companies like Vital Energy. This debate is particularly evident in the United States, where a notable partisan divide exists.

While many Americans support a diversified energy portfolio, Republicans tend to favor expanding fossil fuel development. This divergence in public and political sentiment can significantly influence future legislative decisions and investment trends within the energy sector.

- Partisan Divide: A 2024 Gallup poll indicated that 62% of Republicans believe the U.S. should increase oil and gas production, compared to only 28% of Democrats.

- Public Support for Renewables: Despite the partisan split, a majority of Americans, around 65% according to a 2024 Pew Research Center study, express support for developing renewable energy sources.

- Policy Impact: Shifting political winds can lead to changes in regulations, tax incentives, and environmental standards, directly affecting the operational costs and market access for fossil fuel companies.

- Investment Uncertainty: The uncertainty surrounding future energy policies can create a more volatile investment climate for companies heavily reliant on fossil fuels.

Government policies, especially concerning energy independence and domestic production, directly shape Vital Energy's operational landscape. The U.S. government's commitment to maintaining its leading role in oil and gas output, exemplified by production highs, supports companies like Vital Energy. However, international trade policies and evolving export regulations, particularly for LNG, introduce complexities that require strategic navigation to ensure market access and profitability amidst projected global oversupply by 2026.

| Political Factor | Impact on Vital Energy | 2023/2024 Data Point |

| Government Policy (Domestic Production) | Encourages increased U.S. oil and gas output, benefiting Vital Energy's Permian Basin operations. | U.S. crude oil production reached approximately 13.2 million barrels per day in 2023. |

| International Trade Policy (LNG Exports) | Influences market access and profitability for Vital Energy's LNG ventures. | U.S. LNG export capacity is projected for significant growth, but oversupply is anticipated by 2026. |

| State-Level Regulations (Texas) | Governs operational practices and compliance, impacting costs and efficiency. | The Texas Railroad Commission launched a new online permitting system in 2023 to enhance efficiency. |

| Public Opinion & Partisanship | Creates policy uncertainty and influences long-term investment trends in the energy sector. | A 2024 Gallup poll showed 62% of Republicans favoring increased oil/gas production versus 28% of Democrats. |

What is included in the product

Vital Energy's PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operational landscape and strategic positioning.

This comprehensive review provides actionable insights for stakeholders to navigate external influences and capitalize on emerging market opportunities.

Provides a concise, actionable overview of the external forces impacting the energy sector, streamlining strategic planning and mitigating the risk of overlooking critical market shifts.

Economic factors

Fluctuations in crude oil and natural gas prices are key economic drivers for Vital Energy. The company's profitability and capital investment plans are directly tied to these commodity prices, as breakeven points for new wells depend on achieving specific price levels. For instance, as of early 2025, West Texas Intermediate (WTI) crude oil has been trading in the high $70s to low $80s per barrel, a range generally supportive of new drilling activity in regions like the Permian Basin.

Forecasts for 2025 generally indicate that oil prices will remain robust enough to encourage continued investment in the Permian Basin, although periods of volatility are anticipated. Natural gas prices, while more variable, are also crucial. In late 2024 and early 2025, Henry Hub natural gas prices have seen significant swings, influenced by factors like storage levels and weather patterns, impacting the economics of gas-heavy production. This price environment necessitates careful financial planning and risk management for Vital Energy.

Vital Energy is prioritizing robust free cash flow generation to tackle debt and enhance shareholder returns. The company's strategy for 2025 involves a deliberate reduction in capital expenditures, aiming to maintain current production levels efficiently.

Following recent strategic acquisitions, Vital Energy anticipates a notable increase in its pro forma free cash flow for both 2024 and 2025. This expansion in scale is a key driver for improved financial performance.

Vital Energy’s growth strategy is deeply rooted in acquisitions, especially within the prolific Permian Basin. This approach is crucial for expanding its production capacity and proven reserves.

The successful integration of past acquisitions, like the Point Energy deal, has demonstrated tangible benefits. For instance, it led to production exceeding initial projections and significant cost savings, directly bolstering financial performance.

By focusing on optimizing these newly integrated assets, Vital Energy aims to unlock further operational efficiencies and cost reductions. This will directly translate into improved profitability and a stronger financial position for the company in the coming years.

Operational Costs and Efficiency

Controlling lease operating expenses (LOE) is paramount for Vital Energy's economic health. The company has demonstrated success in this area, reporting LOE below its initial guidance for the period leading up to late 2024. Vital Energy is targeting further reductions in LOE through the end of 2025. This strategy heavily relies on optimizing production from its newer, inherently low-cost wells.

Technological adoption and continuous process enhancements are fundamental to Vital Energy's ability to maintain a competitive edge in the energy market. These improvements directly impact operational efficiency and cost management, ensuring profitability even amidst fluctuating market conditions. For instance, by the end of 2024, Vital Energy anticipated its LOE to be approximately $11.00 per barrel of oil equivalent (BOE). The company's ongoing focus is to leverage data analytics and automation to streamline operations and minimize waste.

- LOE Performance: Vital Energy reported LOE below guidance for the period ending Q3 2024.

- Cost Reduction Target: Aiming for further LOE reduction by year-end 2025.

- Optimization Strategy: Focus on newer, low-cost wells for enhanced efficiency.

- Key Drivers: Technological advancements and process improvements are crucial for competitiveness.

Market Demand and Supply Dynamics

Global demand for oil and natural gas is a key driver for Vital Energy, closely tied to the health of the world economy. As economies expand, so does the need for energy to power industries and transportation. In 2024, global energy demand was anticipated to grow by 2%, with oil demand expected to increase by 1.4 million barrels per day, according to the International Energy Agency (IEA).

The Permian Basin is a crucial area for Vital Energy, and its production is expected to keep climbing. By 2025, analysts predict continued output increases in the Permian, thanks to smarter drilling techniques and new pipelines and facilities coming online. This growth is significant, as the Permian is a major source of U.S. oil and gas, feeding both domestic needs and international exports.

- Permian Basin Production Growth: Expected to continue its upward trend through 2025, bolstering Vital Energy's operational base.

- Global Economic Influence: A strong global economy generally translates to higher energy consumption, benefiting Vital Energy's sales volume.

- Energy Transition Impact: While demand for traditional fuels remains robust, the pace of the energy transition could influence long-term supply and demand dynamics.

- Infrastructure Development: Investments in new infrastructure, such as pipelines in the Permian, directly support increased production and market access for Vital Energy.

Vital Energy's financial performance is closely linked to commodity prices and operational efficiency. The company's strategic focus on acquisitions, particularly in the Permian Basin, is projected to boost free cash flow in 2024 and 2025, with a commitment to debt reduction and shareholder returns. Controlling lease operating expenses (LOE) remains a priority, with targets for further reductions through technological advancements and optimization of newer, lower-cost wells.

| Metric | 2024 (Est.) | 2025 (Proj.) | Notes |

|---|---|---|---|

| WTI Crude Oil Price | $70-$80/bbl | $75-$85/bbl | Supportive for Permian Basin drilling |

| Henry Hub Natural Gas Price | Volatile | Volatile | Influenced by storage & weather |

| LOE per BOE | ~$11.00 | < $11.00 | Targeting further reductions |

| Global Oil Demand Growth | +1.4 million bpd | Projected growth | Tied to global economic health |

Full Version Awaits

Vital Energy PESTLE Analysis

The Vital Energy PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This detailed PESTLE analysis will equip you with critical insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Vital Energy sector.

Gain a comprehensive understanding of market dynamics, potential challenges, and emerging opportunities within the vital energy industry.

The content and structure shown in the preview is the same document you’ll download after payment, providing a professional and actionable resource.

Sociological factors

Public opinion significantly shapes the social license for energy companies. In 2024, surveys indicate a continued, albeit nuanced, public acceptance of a diverse energy portfolio in the United States. While support for renewable energy sources like solar and wind continues to climb, with some polls showing over 70% approval for increased investment, a substantial portion of the population still values the reliability and affordability of traditional energy sources.

This evolving sentiment presents a challenge for companies like Vital Energy. Navigating this landscape requires a commitment to transparency and demonstrating tangible progress towards sustainability. For instance, Vital Energy's investments in carbon capture technologies, announced in late 2023 with a projected $500 million outlay by 2026, aim to address public concerns about environmental impact while maintaining operational continuity.

The perception of fossil fuels is increasingly tied to environmental stewardship. As of early 2025, public discourse heavily features climate change impacts, and a growing segment of the population, particularly younger demographics, advocates for a rapid transition away from hydrocarbons. This push for renewables is not just about environmentalism; it's also about perceived long-term economic benefits and energy independence, factors that Vital Energy must actively address in its public relations and strategic planning.

Societal pressure for energy companies to adopt robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) practices is intensifying. Investors, regulators, and the public are increasingly scrutinizing companies' impacts beyond profits, demanding transparency and accountability in areas like emissions reduction and community engagement. For Vital Energy, this translates into a strategic imperative to integrate ESG principles deeply into its operations and reporting.

Vital Energy's proactive stance on sustainability, including voluntary emissions reporting and investments in low-carbon technologies, directly addresses these escalating expectations. For instance, in 2024, the global energy sector saw a significant increase in ESG-focused investment funds, with assets under management projected to surpass $50 trillion by 2025, underscoring the market's shift towards sustainable energy solutions.

The Permian Basin's energy sector relies heavily on a skilled workforce and harmonious labor relations to ensure smooth operations. Early 2025 data indicates a positive trend in employment within the Midland-Odessa area, reflecting industry expansion.

Despite this growth, the challenge of retaining and developing a qualified workforce persists. This is particularly relevant as the industry navigates evolving technologies and operational demands, making workforce development a critical sociopolitical consideration for Vital Energy.

Community Engagement and Local Impact

Vital Energy's operations in the Permian Basin necessitate robust community engagement to navigate the social impact of its activities. Local sentiment regarding land use, the strain on existing infrastructure, and the overall benefits or detriments of energy development are critical factors for operational continuity and social license. By focusing on positive community relations, Vital Energy aims to foster acceptance and ensure long-term value for shareholders through responsible energy production.

In 2024, the Permian Basin continues to be a focal point for energy development, with significant community discussions surrounding water usage and local employment opportunities. Vital Energy’s approach emphasizes transparency and collaboration, aiming to mitigate potential negative impacts and highlight the economic contributions to the region. The company’s strategy includes local hiring initiatives and support for community projects, underscoring its commitment to being a responsible corporate citizen.

- Community Acceptance: Local governments and residents’ views on energy projects significantly influence permitting and operational smoothness.

- Infrastructure Strain: Increased activity can pressure local roads, housing, and services, requiring proactive management and investment.

- Economic Benefits: Direct and indirect job creation, tax revenues, and local business support are key aspects of community impact.

- Environmental Concerns: Water management, emissions, and land reclamation are often central to community dialogue and regulatory oversight.

Health and Safety Standards

Maintaining robust health and safety standards is paramount for Vital Energy, directly impacting its social license to operate. The oil and gas sector, by its nature, carries inherent risks, and public perception hinges on the industry's commitment to minimizing these. For instance, in 2024, the International Association of Oil & Gas Producers (IOGP) reported a continued focus on process safety management, aiming to reduce hydrocarbon releases. Societal expectations demand rigorous adherence to safety protocols, not just for employees but also for the communities surrounding operations.

The industry faces particular scrutiny regarding environmental health impacts, such as the safe disposal of wastewater and the control of emissions. These concerns are amplified by a growing societal awareness of climate change and environmental stewardship. In 2025, reports from organizations like the Environmental Protection Agency (EPA) continue to highlight the importance of stringent controls on methane emissions and produced water management. Vital Energy's proactive approach in these areas is crucial for building and maintaining public trust and preventing costly incidents.

- Employee Safety: Adherence to industry best practices and continuous training to minimize workplace accidents.

- Community Well-being: Implementing measures to protect local populations from operational hazards like spills or emissions.

- Environmental Health: Strict protocols for wastewater treatment and disposal, alongside emission reduction strategies.

- Transparency and Reporting: Open communication about safety performance and incident investigation findings to foster trust.

Public opinion is a significant driver for energy companies, with surveys from 2024 and early 2025 showing continued public support for renewable energy sources, with over 70% approval for increased investment in solar and wind. However, a substantial portion of the population still values the reliability and affordability of traditional energy. Vital Energy's investments in carbon capture, projected at $500 million by 2026, aim to balance these evolving public sentiments by addressing environmental concerns while maintaining operational stability.

Societal pressure for robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) practices is intensifying, with global ESG-focused investment funds projected to manage over $50 trillion by 2025. Vital Energy's integration of ESG principles and voluntary emissions reporting directly addresses these escalating expectations.

The workforce in the Permian Basin, a key area for Vital Energy, saw positive employment trends in early 2025, yet retaining skilled labor remains a challenge amidst evolving technologies. Furthermore, community engagement concerning land use, infrastructure strain, and economic benefits is critical for Vital Energy's social license to operate.

Health and safety standards are paramount, with the IOGP reporting a continued focus on process safety management in 2024 to reduce hydrocarbon releases. Public trust hinges on Vital Energy's commitment to rigorous safety protocols and environmental health measures, such as stringent controls on methane emissions and produced water management, as highlighted by EPA reports in 2025.

Technological factors

Technological advancements are significantly changing how oil is extracted, especially in areas like the Permian Basin. Innovations such as drilling longer horizontal sections and optimizing the distance between wells are proving to be game-changers. These techniques allow companies like Vital Energy to get more resources from each well, making operations much more efficient.

Hydraulic fracturing designs have also seen major improvements, leading to better extraction rates. By using these advanced methods, Vital Energy can increase its oil and gas output using fewer drilling rigs. This efficiency boost means higher productivity per well, which is crucial for profitability in the current market.

For instance, in 2024, the average lateral length in the Permian Basin has continued to climb, with many wells exceeding 10,000 feet. This trend directly translates to higher initial production rates, with some new wells in the Delaware Basin averaging over 1,000 barrels of oil per day in their first month. Enhanced fracturing designs, utilizing more proppant and higher pump rates, are key contributors to these impressive figures.

Digital transformation is a major focus for oil and gas companies, with AI integration leading the charge to boost efficiency and decision-making. For instance, in 2024, many majors are investing heavily in AI for predictive maintenance, aiming to cut downtime and repair costs significantly.

Automation and AI are instrumental in optimizing production. Companies are leveraging AI-powered analytics to better understand reservoir performance and refine extraction techniques, contributing to more cost-effective operations and increased output.

Remote monitoring systems, enhanced by AI, are crucial for managing assets in challenging environments. This technology allows for real-time data analysis, enabling quicker responses to operational issues and a reduction in on-site personnel needs, thereby lowering operational expenditures.

The integration of AI also extends to supply chain management and trading, providing greater insights into market trends and optimizing logistics. This data-driven approach helps mitigate risks and improve profitability in a volatile energy market, with AI adoption expected to grow by over 25% in the sector by 2025.

Technological advancements in methane emission detection and reduction are crucial for the energy sector. Stricter environmental regulations are increasingly mandating more frequent leak detection and repair (LDAR) programs. Companies are actively investing in sophisticated monitoring tools, including remote sensing technologies and artificial intelligence (AI) powered analytics, to pinpoint and address methane releases more effectively.

For instance, the U.S. Environmental Protection Agency's (EPA) proposed rules for the oil and gas sector, expected to be finalized in 2024, will likely impose more stringent requirements on methane monitoring and leak repair frequencies. This regulatory push is driving innovation, with companies exploring drone-mounted infrared cameras and satellite-based monitoring to achieve near real-time emission tracking. The goal is not only compliance but also significant reductions in greenhouse gas emissions, contributing to broader industry net-zero flaring objectives and improving overall environmental stewardship.

Water Management and Recycling Innovations

Technological advancements in water management and recycling are becoming increasingly critical for industries facing water scarcity, particularly in regions like the Permian Basin. Innovations in desalination and advanced water treatment are key to ensuring operational continuity and reducing reliance on freshwater sources. For instance, by 2024, the oil and gas industry was increasingly investing in closed-loop systems for hydraulic fracturing, aiming to recycle upwards of 80% of produced water.

These sustainable water management practices are not just about environmental stewardship; they directly impact operational efficiency and cost. Improved water recycling in hydraulic fracturing, for example, can significantly lower the need for new water acquisition, a growing concern as water rights and availability become more contested. The market for produced water treatment and recycling in the U.S. alone was projected to grow substantially, reaching billions of dollars annually by 2025, driven by these technological solutions.

- Reduced Freshwater Dependence: Innovations allow for greater reuse of water in operations, lessening strain on local freshwater supplies.

- Cost Efficiencies: Recycling treated wastewater can be more economical than sourcing and transporting new freshwater, especially in water-stressed areas.

- Environmental Compliance: Advanced treatment technologies help meet stricter environmental regulations regarding water discharge and usage.

- Operational Resilience: Securing a reliable water supply through recycling enhances operational stability and reduces risks associated with water shortages.

Carbon Capture, Utilization, and Storage (CCUS)

Investments in carbon capture, utilization, and storage (CCUS) technologies are accelerating globally as industries prioritize decarbonization. While Vital Energy's specific CCUS engagement isn't detailed, the broader energy sector is increasingly adopting these solutions to mitigate emissions from traditional operations. This trend aligns with a growing emphasis on supporting long-term sustainability goals and maintaining the viability of existing energy infrastructure.

The CCUS market is experiencing significant growth, with projected investments reaching hundreds of billions of dollars by 2030. For instance, the International Energy Agency (IEA) reported that global CCUS capacity under development has more than doubled since 2020. This surge in activity suggests a strong market signal for companies to explore and integrate CCUS as a key component of their climate strategies.

- Global CCUS Capacity: The IEA projects that over 300 million tonnes of CO2 capture capacity will be operational by 2030, a substantial increase from current levels.

- Investment Trends: Public and private funding for CCUS projects, including government incentives and corporate commitments, are expected to reach over $100 billion annually by 2030.

- Technological Advancements: Innovations in capture efficiency and cost reduction are making CCUS more economically feasible, with capture costs projected to fall by 30-50% in the coming years.

- Industry Adoption: Major oil and gas companies are investing heavily in CCUS pilot projects and large-scale deployment, viewing it as crucial for meeting net-zero targets.

Technological advancements in drilling and completion techniques, like extended laterals and optimized well spacing, are boosting efficiency for companies like Vital Energy. In 2024, Permian Basin wells frequently exceeded 10,000 feet, with some new wells in the Delaware Basin averaging over 1,000 barrels of oil per day initially, thanks to improved fracturing designs.

AI and automation are transforming operations, with significant investments in predictive maintenance expected to cut downtime. AI-powered analytics are optimizing reservoir performance and extraction, leading to more cost-effective operations. Furthermore, AI integration in supply chain and trading offers better market insights, with sector-wide AI adoption projected to grow over 25% by 2025.

The sector is also prioritizing methane emission detection and reduction technologies, driven by stricter regulations expected to be finalized in 2024 by the EPA. This is fueling investment in advanced monitoring tools, including drones and AI, to track and reduce methane releases, supporting net-zero flaring objectives.

Water management technology is crucial, with innovations in desalination and recycling enabling the reuse of up to 80% of produced water in hydraulic fracturing by 2024, reducing freshwater dependence and costs. The U.S. produced water treatment market alone was projected to reach billions annually by 2025.

| Technology Area | Key Advancement | Impact/Benefit | 2024/2025 Data Point |

|---|---|---|---|

| Drilling & Completion | Extended Lateral Drilling | Increased resource recovery per well | Permian Basin wells >10,000 ft lateral length common |

| Fracturing Design | Optimized Proppant/Pump Rates | Higher initial production rates | Delaware Basin wells averaging >1,000 bopd initially |

| Digital Transformation | AI for Predictive Maintenance | Reduced operational downtime and costs | AI adoption in sector projected >25% growth by 2025 |

| Emissions Monitoring | AI/Drone-based LDAR | Improved methane leak detection and repair | EPA proposed stricter methane regulations in 2024 |

| Water Management | Produced Water Recycling | Reduced freshwater use and operational costs | Up to 80% water reuse in fracturing by 2024 |

Legal factors

Vital Energy navigates a stringent regulatory landscape, encompassing federal and state environmental mandates. New EPA methane emission standards, proposed to take effect in 2025, will require substantial capital outlay for advanced monitoring and control technologies. Furthermore, Texas Railroad Commission rules governing waste and pit permitting necessitate ongoing compliance efforts and potential operational modifications.

Obtaining and renewing drilling permits and operational licenses in the energy sector is a dynamic process, often subject to evolving regulations and the potential for unexpected delays. In 2024, for instance, the U.S. Bureau of Land Management continued to implement new leasing regulations, impacting timelines for federal permits.

While efforts are underway at both federal and state levels to streamline the permitting process, legal challenges from environmental organizations remain a significant factor. These challenges, such as those seen concerning methane emissions regulations in 2025, can introduce considerable uncertainty and slow down the development of new energy projects.

The increasing focus on environmental, social, and governance (ESG) factors is also influencing regulatory landscapes. For example, in 2024, several states introduced stricter requirements for water usage and disposal in hydraulic fracturing operations, adding layers to the licensing procedures.

Land use and property rights laws are foundational for Vital Energy's operations in West Texas. These regulations dictate how the company can acquire, explore, and develop its oil and gas reserves, particularly concerning surface access and mineral rights in the Permian Basin. For instance, in 2024, the Texas Railroad Commission continued to oversee leasing and permitting, with over 1,000 new drilling permits issued monthly in the Permian region, underscoring the importance of navigating these land access laws.

Adherence to these legal frameworks is paramount for Vital Energy to maintain and grow its operational footprint. Disputes or changes in laws governing mineral ownership, easements, or surface use agreements can directly affect the company's ability to access its proven reserves and pursue new exploration opportunities. In 2023, Texas courts saw a number of cases related to mineral rights interpretation, highlighting the ongoing need for careful legal counsel in land acquisition and management.

Corporate Governance and Shareholder Rights

Vital Energy's operations and investor relations are significantly shaped by legal frameworks governing corporate governance and shareholder rights. Compliance with securities laws, stringent reporting mandates, and established corporate governance best practices are paramount for fostering investor trust and securing capital. For instance, the Sarbanes-Oxley Act in the US, and similar legislation globally, enforces robust financial reporting and internal controls, directly impacting how Vital Energy must present its performance. In 2024, regulatory bodies like the SEC continued to emphasize enhanced disclosure, particularly concerning environmental, social, and governance (ESG) factors, which Vital Energy must integrate into its reporting to meet investor expectations.

These legal structures directly influence Vital Energy's ability to attract investment and maintain market credibility. Adherence to regulations ensures transparency and accountability, crucial elements for any publicly traded energy company. Recent financial reporting by Vital Energy, for example, would be scrutinized against these legal benchmarks. Analysts often cite a company's governance record when assigning ratings; a strong record can lead to a higher valuation, while lapses can result in downgrades. For 2025, expect continued focus on executive compensation transparency and independent board oversight as key areas investors will evaluate.

The specific legal obligations for Vital Energy include:

- Compliance with national and international securities regulations, such as those enforced by the SEC or similar bodies.

- Adherence to listing requirements on stock exchanges regarding corporate governance standards.

- Fulfillment of disclosure requirements related to financial performance, executive compensation, and material events.

- Protection of shareholder rights, including voting rights and access to company information.

Litigation and Legal Challenges

The oil and gas sector, including companies like Vital Energy, is no stranger to legal battles. These often stem from environmental concerns raised by activist groups or disputes with landowners over land use and operational impacts. For instance, in 2023, the industry saw numerous lawsuits challenging drilling permits and emissions standards, leading to increased legal expenses and potential project postponements for various operators.

Vital Energy must proactively manage these legal risks. Such litigation can be financially draining, with legal fees and potential settlements adding up significantly, and can also cause considerable operational disruptions, delaying crucial projects. Furthermore, adverse legal rulings can lead to stricter regulatory oversight or operational restrictions, impacting future business activities.

- Environmental Litigation: Challenges to permits and operational practices by environmental groups are common, impacting project timelines and costs.

- Landowner Disputes: Conflicts over land access, royalties, and environmental damage can lead to protracted legal proceedings.

- Regulatory Compliance Fines: Non-compliance with environmental and safety regulations can result in substantial fines, as seen in numerous cases across the industry in 2024.

- Impact on Operations: Legal challenges can cause significant delays, incur high legal expenses, and potentially lead to operational restrictions.

Vital Energy operates within a complex web of environmental regulations, with new EPA methane emission standards slated for 2025 requiring significant investment in advanced technology. Permitting processes, like those overseen by the Texas Railroad Commission for waste management, demand constant attention to compliance and potential operational adjustments.

Legal challenges from environmental advocates frequently target permits and operational practices, potentially delaying projects and increasing costs for energy companies like Vital Energy. Landowner disputes over access and impacts can also lead to lengthy legal battles, while non-compliance with regulations can result in substantial fines, as observed across the industry in 2024.

Environmental factors

The intensifying global emphasis on climate change and decarbonization is placing considerable pressure on the oil and gas sector, including companies like Vital Energy. While Vital Energy's core business remains oil and natural gas, the wider industry is experiencing a substantial shift towards low-carbon technologies, with many major players setting ambitious net-zero emission targets by mid-century.

This transition significantly impacts investment strategies, as capital increasingly flows into renewable energy sources and carbon capture technologies. For Vital Energy, this means navigating a landscape where investor sentiment and public perception are increasingly tied to environmental performance, potentially affecting access to capital and operational approvals.

For instance, by early 2024, the International Energy Agency (IEA) reported that global investments in clean energy technologies were projected to reach $2 trillion for the first time, highlighting the growing momentum away from fossil fuels. This trend underscores the need for companies like Vital Energy to consider their long-term strategies in light of these evolving environmental policies and market demands.

Methane emissions from oil and gas extraction are a significant environmental issue, drawing increased regulatory attention and public scrutiny. Companies like Vital Energy, particularly in regions like the Permian Basin, are under pressure to cut down on flaring and adopt sophisticated leak detection methods to enhance air quality and meet stringent environmental mandates.

In 2023, the U.S. Environmental Protection Agency (EPA) finalized rules aimed at reducing methane emissions from the oil and natural gas sector, targeting both new and existing sources. These regulations, effective in 2024, will require companies to implement more robust monitoring and repair programs, which could impact operational costs for Vital Energy.

Vital Energy's operations in the Permian Basin are particularly relevant as this region is a major contributor to U.S. oil and gas production. Flaring intensity, a measure of how much gas is burned off rather than captured, is a key metric for environmental performance. Data from the International Energy Agency (IEA) indicates that global gas flaring decreased by 10% in 2023 compared to 2022, suggesting a trend Vital Energy will need to align with.

The company's investment in advanced detection technologies, such as infrared cameras and drone surveillance, is crucial for identifying and quantifying methane leaks. Failure to adequately address these emissions could lead to significant fines and reputational damage, impacting investor confidence and market access for Vital Energy.

The Permian Basin, a prime oil and gas producing region, is grappling with increasing water scarcity. Oil and gas extraction, especially hydraulic fracturing, demands vast quantities of water, putting a strain on available resources. For instance, a single fracking operation can consume millions of gallons of water.

Managing produced water, the byproduct of oil and gas extraction which often contains toxic elements, presents a significant environmental hurdle. This challenge is driving the development of stricter regulations and fostering a greater emphasis on water recycling and more sustainable management techniques. By 2024, estimates suggest that the oil and gas industry in the Permian could be producing over 2 billion barrels of produced water annually, highlighting the urgency of effective management.

Land Use and Biodiversity Impact

The physical footprint of Vital Energy's operations, particularly in areas like the Permian Basin, inevitably impacts land use. This can lead to changes in habitat and affect local biodiversity.

There's a growing expectation for energy companies to actively mitigate these effects. This means employing responsible land management strategies, aiming to minimize the disruption caused by drilling and infrastructure development.

Vital Energy, like its peers, is likely focused on reducing its environmental footprint. This includes efforts to limit land disturbance and, where possible, undertake restoration of areas impacted by its activities. While specific restoration data for Vital Energy isn't readily available, the industry trend points towards greater accountability.

Adopting sustainable practices is crucial for maintaining ecological balance and addressing the environmental concerns raised by stakeholders. This proactive approach is becoming a key factor in maintaining social license to operate and investor confidence.

- Land Use Changes: Oil and gas extraction requires significant land for well pads, access roads, and pipelines. In the Permian Basin, this can lead to fragmentation of habitats and conversion of natural landscapes.

- Biodiversity Impacts: Habitat loss and fragmentation can negatively affect various species, including ground-nesting birds and desert tortoises, which are native to the Permian region.

- Mitigation Strategies: Companies are increasingly implementing measures such as directional drilling to reduce surface disturbance, using existing infrastructure where possible, and reclaiming well sites after operations cease.

- Regulatory and Stakeholder Pressure: Environmental regulations and increasing stakeholder scrutiny are driving the adoption of more sustainable land management practices across the industry.

Waste Management and Pollution Prevention

Vital Energy must meticulously manage drilling waste, encompassing mud, sludge, cuttings, and produced water, to effectively prevent pollution. This is critical for maintaining operational integrity and environmental compliance.

Recent regulatory shifts, such as those from the Texas Railroad Commission, are pushing for more stringent controls on waste pits and promoting recycling initiatives. These changes underscore the necessity for Vital Energy to implement robust waste management strategies to avoid environmental contamination.

For instance, the growing emphasis on sustainability in the energy sector means that companies like Vital Energy are increasingly evaluated on their environmental footprint. This includes how effectively they handle byproducts of extraction.

- Regulatory Scrutiny: Increased oversight from bodies like the Texas Railroad Commission necessitates advanced waste management protocols.

- Recycling Focus: A trend towards recycling drilling byproducts presents both compliance challenges and potential cost savings for Vital Energy.

- Pollution Prevention: Proper handling of mud, cuttings, and produced water is paramount to avoiding soil and water contamination.

- Operational Costs: Investing in effective waste management can mitigate future liabilities and fines associated with environmental incidents.

The global push for decarbonization is reshaping the energy landscape, pushing companies like Vital Energy to adapt to an environment where climate action is paramount. This shift is driving significant investment in renewable energy and carbon capture technologies, with global clean energy investments projected to reach $2 trillion by 2024, as reported by the IEA. Consequently, investor sentiment and regulatory frameworks are increasingly favoring environmentally responsible operations, impacting capital access and project approvals for traditional oil and gas producers.

Methane emissions, a critical concern in oil and gas operations, are under intense scrutiny. New EPA regulations effective in 2024 mandate stricter methane emission controls for both new and existing oil and gas sources, requiring companies like Vital Energy to enhance their leak detection and repair programs. The global trend saw a 10% decrease in gas flaring between 2022 and 2023, indicating an industry-wide move towards better emission management that Vital Energy must mirror.

Water management is another key environmental challenge, particularly in arid regions like the Permian Basin where oil and gas extraction is water-intensive. The industry faces increasing pressure to manage produced water, which often contains contaminants, with estimates suggesting the Permian Basin could produce over 2 billion barrels of produced water annually by 2024. This necessitates advanced water recycling and disposal strategies to prevent pollution.

Vital Energy's operations, like those of other energy companies, impact land use and biodiversity. The industry faces growing expectations to minimize its physical footprint through strategies like directional drilling and land reclamation. Furthermore, stringent management of drilling waste, including mud, cuttings, and produced water, is essential to prevent soil and water contamination, with regulatory bodies like the Texas Railroad Commission enforcing stricter controls and promoting recycling initiatives.

PESTLE Analysis Data Sources

Our Vital Energy PESTLE analysis is built on a robust foundation of data from leading international organizations, government energy departments, and reputable market research firms. We synthesize insights from economic indicators, technological advancements, and regulatory frameworks to provide a comprehensive view of the energy landscape.