Vital Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vital Energy Bundle

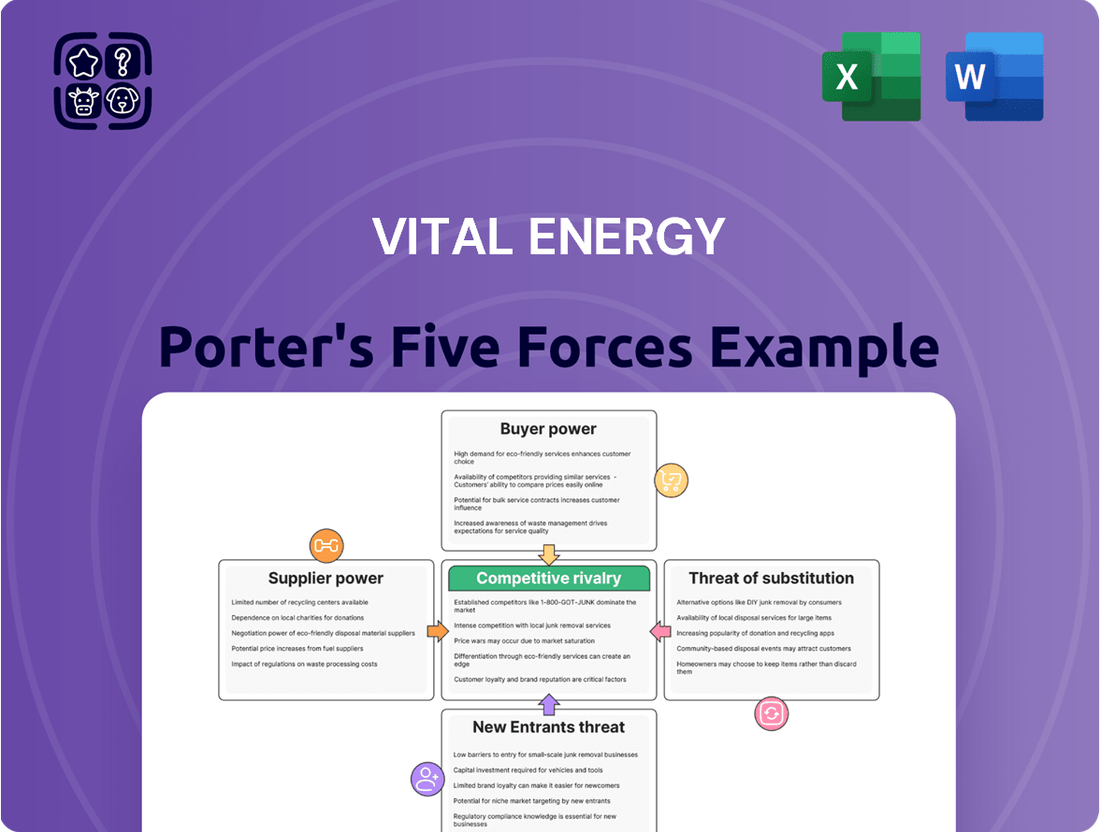

Vital Energy operates within a dynamic energy sector, significantly shaped by Porter's Five Forces. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning. This analysis delves into how these forces impact Vital Energy's profitability and market position.

The complete report reveals the real forces shaping Vital Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and gas sector, including companies like Vital Energy, depends significantly on specialized services such as drilling, hydraulic fracturing, and well completion. A market dominated by a few major oilfield service providers can grant them considerable leverage. This concentration means Vital Energy might face increased costs for essential operational activities.

When a small number of firms control these vital services, Vital Energy's ability to solicit competitive bids is restricted. This can directly inflate operational expenditures, impacting the company's profitability. For instance, in 2024, the North American oilfield services market has seen consolidation, with major players like Schlumberger, Halliburton, and Baker Hughes holding substantial market shares, potentially increasing their pricing power.

Suppliers of specialized equipment and advanced technology, such as sophisticated drilling rigs and proprietary completion fluids, hold considerable sway. For Vital Energy, which operates in the demanding Permian Basin, access to these cutting-edge tools is crucial for maintaining operational efficiency and maximizing extraction yields.

The market for such high-tech, specialized oilfield equipment is often concentrated, meaning a small number of suppliers control the supply chain. This limited competition allows these suppliers to influence pricing and contract terms, directly impacting Vital Energy's capital expenditure budgets and the cost-effectiveness of its extraction processes. For instance, the cost of a modern drilling rig can easily exceed $20 million, and securing access to the most advanced models can involve premium pricing.

The availability of skilled labor, such as engineers, geologists, and seasoned field staff, is paramount for Vital Energy's success. A competitive labor market, where demand outstrips supply for these specialized roles, directly translates to higher wage pressures and potential delays in project schedules.

This scarcity empowers skilled workers, giving them significant bargaining power. This can lead to increased operational expenses for Vital Energy and complicate the efficient execution of its projects, directly impacting profitability.

In 2024, the U.S. oil and gas industry faced a notable shortage of experienced petroleum engineers, with some reports indicating a demand-to-supply ratio of over 3:1 for certain specialized roles. This trend suggests that labor costs for Vital Energy could continue to rise as they compete for a limited pool of qualified professionals.

Supplier Switching Costs

Supplier switching costs are a significant factor for Vital Energy, impacting its operational flexibility and cost structure. When Vital Energy needs to change oilfield service providers or equipment suppliers, these transitions often incur substantial expenses. These costs can include breaking existing contracts, which may involve termination fees, and the expense of re-tooling equipment or retraining personnel to work with new suppliers' systems and products.

These high switching costs effectively lock Vital Energy into its current supplier relationships. This situation inherently strengthens the bargaining power of existing suppliers. They are aware that Vital Energy faces considerable hurdles in switching to a competitor, which can allow suppliers to maintain higher prices or less favorable contract terms, knowing that a change is costly and disruptive.

- High Switching Costs: For Vital Energy, switching oilfield service providers or equipment suppliers can involve substantial financial outlays, including contract termination fees and the costs associated with re-tooling or retraining.

- Reduced Flexibility: These elevated switching costs limit Vital Energy's ability to readily change suppliers, thereby reducing its operational flexibility and increasing its dependence on existing partners.

- Increased Supplier Bargaining Power: Entrenched suppliers leverage these high switching costs as a deterrent against Vital Energy seeking alternative providers, allowing them to negotiate from a position of strength.

Impact of Commodity Prices on Supplier Viability

Fluctuations in crude oil and natural gas prices significantly affect the financial health of Vital Energy's suppliers. For instance, during the first quarter of 2024, West Texas Intermediate (WTI) crude oil prices averaged around $78 per barrel, while European Brent crude averaged approximately $83 per barrel. These price levels directly influence the profitability of companies that supply equipment, services, and materials to the energy sector.

When commodity prices drop, many suppliers experience reduced revenues and tighter profit margins. This can lead to financial strain, potentially forcing smaller or less efficient suppliers out of the market. This consolidation can, in turn, strengthen the bargaining power of the remaining suppliers when market conditions improve and prices rise again. For example, a downturn in oil prices in late 2023 saw several smaller oilfield service providers facing solvency issues, leading to mergers and acquisitions.

Conversely, periods of high commodity prices can boost supplier profitability, but also empower them to demand higher prices for their goods and services from Vital Energy. High prices can also attract new entrants into the supply market, increasing overall supply. However, the capital expenditure required for new entrants and the lead times for bringing new capacity online mean that existing suppliers often maintain significant leverage, especially for specialized or critical components.

- Supplier Financial Health: Direct correlation between crude oil and natural gas prices and supplier profitability and solvency.

- Market Consolidation: Low commodity prices can lead to supplier consolidation, reducing competition and increasing the bargaining power of remaining players.

- Price Leverage: High commodity prices empower existing suppliers to increase their prices, while also potentially attracting new market entrants.

- 2024 Price Benchmarks: Q1 2024 saw WTI averaging around $78/barrel and Brent around $83/barrel, impacting supplier economics.

Vital Energy faces significant bargaining power from its suppliers due to market concentration in essential oilfield services. A limited number of major service providers, such as Schlumberger and Halliburton, control critical operations, allowing them to dictate terms and potentially increase costs for Vital Energy. This concentration was evident in 2024, where these key players held substantial market shares, giving them considerable pricing leverage for drilling and completion services.

The reliance on specialized equipment and advanced technology further amplifies supplier power. Suppliers of cutting-edge drilling rigs and proprietary extraction technologies operate in concentrated markets, enabling them to influence pricing and contract terms. Securing access to these vital, high-tech assets, some costing upwards of $20 million, means Vital Energy must often accept premium pricing, directly impacting its capital expenditure budgets.

The scarcity of skilled labor, particularly experienced petroleum engineers, also empowers suppliers of human capital. In 2024, the U.S. oil and gas sector experienced a shortage of these professionals, with demand-to-supply ratios exceeding 3:1 for certain roles. This imbalance forces Vital Energy into a competitive bidding war for talent, driving up labor costs and potentially delaying project timelines.

| Factor | Impact on Vital Energy | Supplier Leverage | 2024 Data/Context |

| Market Concentration (Services) | Increased operational costs, reduced negotiation flexibility | Ability to set higher prices and terms | Major players like Schlumberger, Halliburton dominate, holding significant market share. |

| Specialized Equipment & Technology | Higher capital expenditure, potential operational inefficiencies if access is limited | Control over pricing and availability of critical assets | Advanced drilling rigs can cost over $20 million; access to latest tech commands premium. |

| Skilled Labor Shortage | Elevated wage pressures, project delays | Increased bargaining power for skilled workers and staffing agencies | Over 3:1 demand-to-supply ratio for experienced petroleum engineers in the U.S. |

What is included in the product

Vital Energy's Porter's Five Forces Analysis comprehensively assesses the competitive intensity within its industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Quickly identify and mitigate competitive threats with a streamlined analysis of industry forces, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Vital Energy's customer base is concentrated, primarily consisting of a few large refiners, midstream operators, and major industrial users. This limited number of significant buyers means they possess considerable leverage in negotiations. For instance, in 2024, the top five refining companies in North America accounted for over 60% of total refining capacity, giving them substantial bargaining power.

When a few buyers dominate the market, they can effectively dictate terms, pushing for lower prices for Vital Energy's crude oil and natural gas. This is particularly true during periods of oversupply, where buyers can easily find alternative suppliers, further strengthening their position to demand concessions that directly impact Vital Energy's revenue streams.

Customers making large volume purchases, like major refiners or pipeline operators, naturally possess increased negotiating power. Vital Energy's dependence on a limited number of significant buyers for its Permian Basin output gives these high-volume purchasers leverage to seek discounts or more favorable contract conditions. This directly impacts Vital Energy's per-barrel profitability.

Vital Energy's customers are increasingly exploring alternatives to traditional hydrocarbons, driven by environmental concerns and evolving market demands. This shift, though not always a direct substitution, grants buyers more negotiating power as they can envision reducing their dependence on fossil fuels over time.

The rising availability and competitive cost of renewable energy sources like solar and wind directly impact customer leverage. For instance, by mid-2024, the levelized cost of electricity from utility-scale solar PV had fallen significantly, making it a more attractive option for many consumers and businesses, thereby pressuring traditional energy providers.

Customer Switching Costs and Supply Chain Integration

For Vital Energy's customers, the cost of switching suppliers for crude oil or natural gas can involve navigating logistical hurdles, fulfilling existing pipeline contracts, or reconfiguring refining processes. These factors introduce a degree of switching cost, which would normally limit customer bargaining power.

However, if customers possess highly integrated supply chains or can readily access a variety of transportation methods, their capacity to shift between suppliers with minimal disruption is enhanced. This flexibility directly amplifies their bargaining power against Vital Energy.

In 2024, the global energy market saw increased volatility, with spot prices for Brent crude oil fluctuating significantly. For instance, prices ranged from approximately $77 per barrel in early 2024 to over $90 per barrel by mid-year, presenting opportunities for buyers with agile procurement strategies to leverage competitive pricing. This market dynamic underscores the importance of flexible supply chain management for customers.

- Logistical Hurdles: Customers may face costs associated with changing delivery routes or storage facilities when switching oil or gas suppliers.

- Contractual Obligations: Existing long-term contracts for pipeline access or supply can create penalties or complexities for early termination, increasing switching costs.

- Refining Adaptability: Different crude oil grades require specific refining processes; switching suppliers might necessitate adjustments or investments in refining equipment.

- Supply Chain Integration: Customers with integrated operations, from extraction to refining, can absorb switching costs more readily due to internal efficiencies.

Global Commodity Price Influence

The bargaining power of customers for Vital Energy is significantly influenced by global commodity prices, particularly for crude oil and natural gas. These prices are primarily dictated by broad supply and demand forces on a worldwide scale, which customers closely track. For instance, in early 2024, Brent crude oil prices fluctuated around the $80-$85 per barrel range, reflecting these global dynamics.

Vital Energy, like many in the industry, functions as a price-taker. This means its ability to unilaterally influence the market price for its products is very limited. The company must accept the prevailing global market rates, which are set by larger forces beyond its control. This position inherently strengthens the customer's hand.

Customers can effectively use their awareness of global price trends as leverage to negotiate more favorable purchase agreements. In scenarios where the global market is oversupplied, leading to lower commodity prices, customers are in a stronger position to demand reduced rates from Vital Energy. For example, if global natural gas inventories are high, leading to spot prices dropping, a large industrial buyer could use this information to push for a lower contracted price.

- Global Price Dependency: Vital Energy's revenue is directly tied to global crude oil and natural gas prices, which are subject to international supply and demand.

- Price-Taker Status: The company has minimal individual impact on these global prices, making it vulnerable to market fluctuations.

- Customer Leverage: Customers can use their knowledge of global price trends to negotiate lower prices, especially when the market is well-supplied.

- Market Volatility: In 2024, oil prices experienced volatility, with factors like geopolitical events and OPEC+ decisions influencing them, providing customers with points of negotiation.

Vital Energy's customers, particularly large refiners and industrial users, wield significant bargaining power due to market concentration. In 2024, the top five North American refiners controlled over 60% of refining capacity, enabling them to negotiate lower prices for Vital Energy's products. This dominance allows buyers to dictate terms, especially during oversupply periods, directly impacting Vital Energy's revenue and profitability.

Customers' ability to switch suppliers is a key factor. While logistical challenges and existing contracts present some switching costs, customers with integrated supply chains or flexible transportation options can more easily shift, amplifying their leverage. For example, the global energy market in 2024, with Brent crude fluctuating between $77 and $90 per barrel, rewarded agile customers who could capitalize on price swings.

Vital Energy operates as a price-taker, meaning its individual sales have minimal impact on global commodity prices. Customers leverage this reality, using their knowledge of worldwide supply and demand dynamics, such as high natural gas inventories in early 2024 that pushed prices down, to secure more favorable purchase agreements.

| Factor | Impact on Customer Bargaining Power | 2024 Context Example |

|---|---|---|

| Customer Concentration | High | Top 5 North American refiners controlled >60% refining capacity in 2024. |

| Switching Costs | Moderate (can be low for integrated players) | Flexible logistics in a volatile market (e.g., Brent crude $77-$90/bbl in 2024) reduce barriers. |

| Price Sensitivity | High (as price-takers) | Customers use global price trends (e.g., falling natural gas prices due to high inventories) to negotiate lower rates. |

Same Document Delivered

Vital Energy Porter's Five Forces Analysis

You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, offering a comprehensive breakdown of Vital Energy's competitive landscape through Porter's Five Forces. This analysis meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry, providing actionable insights for strategic decision-making. The document you see here is exactly what you’ll be able to download after payment, ensuring you receive a complete and professionally formatted analysis ready for immediate application.

Rivalry Among Competitors

The Permian Basin is a hotbed for oil and natural gas production, making it incredibly competitive. Vital Energy operates within this dynamic landscape, facing off against a multitude of independent and major exploration and production (E&P) companies. This sheer volume of players all seeking valuable acreage and aiming to boost their output creates a fiercely contested market.

While the Permian Basin is projected to maintain its growth trajectory into 2025, a broader slowdown in the overall oil and gas industry can significantly heighten competitive rivalry. When industry expansion falters, companies often engage in more aggressive pricing or intensified marketing campaigns to capture market share, leading to a more cutthroat environment. For instance, in 2024, the EIA reported that while Permian production was robust, capital expenditure by major players in the region remained focused on efficiency rather than broad capacity expansion, signaling a strategic response to potential market headwinds.

Crude oil and natural gas, the core products for companies like Vital Energy, are largely undifferentiated commodities. This means that for many buyers, Vital Energy's product is virtually indistinguishable from what competitors offer, creating a level playing field where price becomes the most significant deciding factor.

This product homogeneity naturally fuels intense price competition within the energy sector. Buyers, having little reason to prefer one supplier over another based on the product itself, will almost always opt for the lowest available price. This dynamic puts significant pressure on all players to be extremely cost-conscious.

For Vital Energy, this necessitates a relentless focus on cost efficiency and operational excellence. Achieving and maintaining profitability in such an environment hinges on minimizing extraction, processing, and transportation costs. For instance, in 2024, the average cost of producing a barrel of oil globally remained a critical metric, and any company unable to keep these costs competitive faced significant challenges.

High Exit Barriers for Oil and Gas Producers

High exit barriers significantly influence competitive rivalry within the oil and gas sector, impacting companies like Vital Energy. The substantial capital outlay required for drilling infrastructure, coupled with long-term leases and extensive environmental liabilities, makes it exceedingly difficult and costly for producers to exit the market. This stickiness means companies often remain operational even during periods of low oil prices, contributing to persistent oversupply. Consequently, existing players face intensified competition as they vie for market share, driving down profitability.

These high exit barriers manifest in several ways:

- Capital Intensity: The upfront investment in exploration, drilling equipment, and processing facilities represents a massive sunk cost, discouraging new entrants and trapping existing players. For instance, the average cost to drill an oil well can range from $2 million to $8 million, depending on complexity and location.

- Long-Term Commitments: Oil and gas companies often operate under long-term exploration and production (E&P) leases, which bind them to specific regions and projects for many years, limiting their flexibility to withdraw.

- Environmental and Decommissioning Costs: Companies are responsible for environmental remediation and the eventual decommissioning of wells and facilities, adding significant liabilities that must be accounted for, even if operations cease. These costs can run into millions of dollars per site.

- Operational Interdependence: The infrastructure developed for oil and gas production, such as pipelines and processing plants, is often shared or interconnected, making it challenging for individual firms to cease operations without impacting others, further reinforcing the difficulty of exit.

Strategic Acquisitions and Consolidation Activity

The Permian Basin, a key operational area for Vital Energy, has experienced significant merger and acquisition (M&A) activity. Vital Energy itself has been an active participant, completing strategic acquisitions to bolster its position. For instance, in 2023, Vital Energy finalized the acquisition of assets from Waskom Gas Processing Company for approximately $100 million, which expanded its footprint in the Delaware Basin.

This ongoing consolidation trend, while potentially reducing the sheer number of competing entities, concurrently cultivates larger, more formidable rivals. These consolidated entities often benefit from enhanced economies of scale and operational efficiencies, which can then translate into intensified competition for remaining prime acreage and resources.

The impact of these strategic moves is multifaceted. On one hand, fewer, larger players might lead to more stable market dynamics. However, it also means that Vital Energy faces competition from well-capitalized entities with substantial market power, capable of outbidding for desirable assets or leveraging their scale to achieve lower production costs. This dynamic is evident as major players like ExxonMobil and Chevron continue to expand their Permian holdings, acquiring smaller independent producers throughout 2023 and into early 2024.

Key M&A trends impacting competitive rivalry in the Permian Basin include:

- Increased Scale of Competitors: Major acquisitions by large energy companies create rivals with greater financial muscle and operational capacity.

- Focus on Efficiency: Consolidated entities often drive for greater cost efficiencies, putting pressure on less efficient operators.

- Competition for Talent and Resources: Larger companies can more easily attract skilled labor and secure essential drilling and completion services.

- Shifting Market Power: Consolidation can alter the bargaining power of producers in relation to midstream providers and downstream purchasers.

The intense rivalry among the numerous oil and gas producers in the Permian Basin, where Vital Energy operates, is a defining characteristic of the sector. This crowded marketplace means companies are constantly vying for prime acreage, resources, and market share, creating a highly competitive environment where efficiency and cost management are paramount. The undifferentiated nature of crude oil and natural gas further amplifies this rivalry, as price often becomes the primary differentiator for buyers.

Vital Energy faces formidable competition from both independent producers and major integrated energy companies, many of whom are engaged in strategic acquisitions to enhance their scale and efficiency. For example, throughout 2023 and into early 2024, major players like ExxonMobil and Chevron continued to expand their Permian holdings by acquiring smaller independent producers. This consolidation trend, while potentially streamlining the market, creates larger, more powerful rivals that can exert greater influence on pricing and resource allocation.

| Competitor Type | Key Characteristics | Impact on Rivalry |

|---|---|---|

| Independent E&P Companies | Agile, focused on specific plays, often privately held or smaller public entities. | Contribute to a fragmented market, driving competition for leases and services. |

| Major Integrated Energy Companies | Large scale, diversified operations, significant capital resources, e.g., ExxonMobil, Chevron. | Can outbid for assets, achieve lower production costs through economies of scale, and influence market dynamics. |

| Private Equity-backed Producers | Well-capitalized, often aggressive in acquisitions, focus on operational improvements. | Increase competition for attractive acreage and drive efficiency benchmarks. |

SSubstitutes Threaten

The accelerating global transition to renewable energy represents a significant substitute threat to Vital Energy's core business. As solar and wind power become increasingly competitive, their adoption is projected to continue its upward trajectory through 2024 and beyond, directly impacting the demand for traditional fossil fuels.

By the end of 2023, renewable energy sources accounted for over 30% of global electricity generation, a figure expected to climb. This expanding market share for clean alternatives means less reliance on oil and natural gas, potentially eroding Vital Energy's customer base and revenue streams.

The cost-effectiveness of renewables is a major driver of this substitution. For instance, the levelized cost of electricity for solar photovoltaic (PV) projects has fallen dramatically, making it an attractive alternative for many industrial and commercial consumers.

The accelerating shift towards electric vehicles (EVs) presents a substantial threat of substitution for Vital Energy's traditional fuel offerings. By 2024, global EV sales are projected to exceed 15 million units, a significant jump from previous years. This growing adoption directly diminishes demand for gasoline and diesel, impacting Vital Energy's core revenue streams.

Furthermore, the industrial sector's increasing adoption of electricity over fossil fuels for processes like heating and machinery operation also substitutes for Vital Energy's natural gas products. Many industries are investing in electrification infrastructure, driven by both environmental regulations and the pursuit of operational efficiencies. This trend represents a long-term erosion of demand for conventional energy sources.

Advancements in energy efficiency are a significant threat. For instance, in 2024, the International Energy Agency reported that global energy efficiency improvements slowed to 1.7% in 2023, down from 2.1% in 2022, indicating a potential for increased consumption if these trends reverse. As more homes and businesses adopt technologies like smart thermostats and improved insulation, or transition to more efficient industrial processes, the demand for traditional energy sources like oil and natural gas, which Vital Energy supplies, could decrease. This trend directly impacts Vital Energy's market share and revenue potential.

Government Policies and Environmental Regulations

Government policies significantly bolster the threat of substitutes for traditional energy sources like those Vital Energy might rely on. Measures such as carbon pricing, which in the European Union saw the Emissions Trading System (ETS) allowance price average around €65 per tonne in 2023, directly increase the cost of fossil fuels. This makes cleaner alternatives more economically viable.

Subsidies for renewable energy further tilt the playing field. For instance, the US Inflation Reduction Act of 2022 provides substantial tax credits for solar and wind power, driving investment and deployment. Stricter environmental regulations on fossil fuel extraction, like enhanced methane emission controls, also raise operational costs for incumbent energy producers, thereby improving the competitive position of substitutes.

These policy interventions are accelerating the shift away from hydrocarbons. By 2024, global renewable energy capacity additions are projected to exceed 500 gigawatts, a substantial increase driven by supportive government frameworks. This policy-driven growth in renewables directly erodes the market share and attractiveness of traditional energy sources.

- Carbon Pricing Impact: Policies like the EU ETS, with average 2023 prices around €65/tonne, penalize carbon-intensive energy, boosting substitute competitiveness.

- Renewable Subsidies: US tax credits under the Inflation Reduction Act are a prime example, stimulating significant investment in solar and wind.

- Regulatory Pressure: Stricter environmental rules on fossil fuel operations increase costs, making alternatives more appealing.

- Accelerated Transition: Global renewable capacity growth, projected to surpass 500 GW in 2024, is a direct consequence of these supportive government policies.

Price Competitiveness of Alternative Fuels

The price competitiveness of alternative fuels is a significant threat to Vital Energy. While historically more expensive, the costs associated with renewable energy generation, particularly solar and wind, have plummeted. For instance, the global average Levelized Cost of Energy (LCOE) for utility-scale solar PV fell by approximately 89% between 2010 and 2022, according to IRENA. Similarly, battery storage costs have seen dramatic reductions, making hybrid solutions more economically viable.

This declining cost trend directly impacts Vital Energy's customer base. As the economic advantage shifts towards renewables and other cleaner alternatives, the incentive for customers to switch away from traditional fossil fuels grows. By mid-2024, many industrial and commercial sectors are finding that the total cost of ownership for renewable energy systems, including upfront investment and ongoing operational expenses, is becoming comparable to, or even lower than, the cost of relying solely on fossil fuels. This price parity, or even a price advantage for substitutes, intensifies competitive pressure.

- Declining Renewable Energy Costs: Global LCOE for solar PV dropped by nearly 90% from 2010 to 2022, making it increasingly competitive.

- Advancements in Battery Storage: Significant cost reductions in battery technology enhance the viability of renewable energy solutions.

- Narrowing Cost Gap: The economic gap between fossil fuels and cleaner alternatives is shrinking, increasing the incentive to switch.

- Total Cost of Ownership: For many customers, the comprehensive cost of renewable energy systems now rivals or undercuts fossil fuel reliance by mid-2024.

The increasing affordability and efficiency of renewable energy sources represent a significant substitute threat to Vital Energy. By 2024, the global average Levelized Cost of Energy (LCOE) for solar PV has fallen dramatically, making it a compelling alternative to traditional fossil fuels for many consumers. This trend is further amplified by advancements in battery storage technology, which enhance the reliability and economic viability of intermittent renewable sources. As a result, the total cost of ownership for clean energy solutions is increasingly competitive with, or even lower than, fossil fuel reliance.

| Substitute Technology | Cost Reduction (2010-2022) | 2024 Outlook |

|---|---|---|

| Solar PV (Utility-Scale) | ~89% (LCOE) | Continued cost declines, increasing competitiveness |

| Battery Storage | Significant reductions | Enhanced grid integration and reliability for renewables |

| Wind Power | Declining LCOE | Growing capacity additions globally |

Entrants Threaten

The sheer cost of entry into oil and gas exploration and production acts as a significant barrier. For instance, securing leases and commencing drilling operations in a prime location like the Permian Basin can easily run into hundreds of millions, if not billions, of dollars. These high capital requirements for exploration, drilling, and essential infrastructure development effectively deter most smaller or less capitalized players from even attempting to enter the market.

New entrants in the energy sector encounter a formidable array of environmental regulations, stringent permitting processes, and rigorous safety standards. These requirements necessitate substantial investment in compliance, technology, and expertise, creating a high cost of entry.

For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and the Clean Water Act, impacting emissions and water discharge for energy facilities, adding complexity and cost to new project development.

The ever-changing nature of these environmental and safety mandates, including evolving carbon capture requirements and renewable energy integration standards, further complicates market entry by demanding continuous adaptation and significant upfront investment in compliance infrastructure.

This intricate and dynamic regulatory landscape acts as a powerful deterrent, significantly raising the barrier for new companies seeking to establish a foothold in the energy market, particularly in established or heavily regulated regions.

Established companies like Vital Energy already hold vast amounts of desirable acreage with proven reserves in the Permian Basin. For instance, as of the end of 2023, Vital Energy reported proved reserves of approximately 154 million barrels of oil equivalent, primarily concentrated in this highly productive region. This existing infrastructure and resource base present a significant barrier.

New entrants would struggle to acquire comparable high-quality, economic drilling locations, or would have to pay a premium, making it difficult to compete effectively. The cost of acquiring prime acreage in the Permian has been substantial, with some lease sales in 2024 seeing per-acre prices reaching tens of thousands of dollars, especially for undeveloped but prospective land.

Economies of Scale and Operational Expertise of Incumbents

Existing energy giants benefit from massive economies of scale, significantly reducing their per-unit costs in drilling, production, and transportation. This scale advantage, honed over decades, is a formidable barrier. For instance, major oil and gas companies often operate integrated value chains, from exploration to refining, which allows for greater efficiency and cost optimization that smaller, newer players struggle to replicate. Their established operational expertise and intricate supply chain networks are also difficult and time-consuming for newcomers to build.

New entrants face a steep uphill battle in matching the cost-competitiveness of established players. They typically lack the leverage in procurement, the optimized logistics, and the deep technical knowledge that incumbents have cultivated. This disparity in operational efficiency and cost structure makes it challenging for new companies to gain market share without substantial capital investment or a highly differentiated offering.

- Economies of Scale: Major energy companies leverage vast production volumes to achieve lower per-barrel costs in exploration and extraction.

- Operational Expertise: Decades of experience allow incumbents to optimize extraction techniques and minimize downtime, reducing operating expenses.

- Supply Chain Integration: Established players often control transportation and distribution networks, providing cost advantages over new entrants who must secure these services.

- Capital Intensity: The high capital requirements for infrastructure and technology create a significant hurdle for new entrants aiming for cost parity with established firms.

Volatility of Commodity Prices and Investment Risk

The extreme price swings in crude oil and natural gas present a formidable barrier for newcomers. These fluctuations directly impact profitability, and without robust financial buffers or sophisticated hedging mechanisms, new entrants face amplified investment risk.

For instance, crude oil prices in 2024 have shown considerable volatility, swinging between lows in the $70s and highs approaching $90 per barrel at various points, influenced by geopolitical events and supply-demand dynamics. This unpredictability makes it challenging for new companies to secure financing and forecast returns, as their revenue streams can be drastically altered by market conditions.

- Price Volatility Impact: Crude oil prices in 2024 demonstrated significant swings, impacting revenue predictability for new entrants.

- Hedging Disadvantage: New companies often lack the established hedging strategies of larger, incumbent players to mitigate price risk.

- Investment Risk Amplified: The inherent uncertainty in commodity prices deters new capital investment in the sector.

- Financial Resilience Gap: Smaller, newer firms are less equipped to withstand prolonged periods of low commodity prices compared to established entities.

The threat of new entrants into the energy sector, particularly for companies like Vital Energy, is significantly mitigated by the immense capital requirements and regulatory hurdles. For example, the cost of acquiring land, drilling, and building infrastructure can easily reach hundreds of millions, deterring smaller players. Furthermore, stringent environmental regulations, like those enforced by the EPA in 2024 regarding emissions and water discharge, add substantial compliance costs and complexity.

Established players, such as Vital Energy with its substantial reserves in the Permian Basin, benefit from existing infrastructure and resource bases, making it difficult for newcomers to compete on cost and access. Economies of scale achieved by larger companies also create a significant cost advantage that new entrants struggle to match. The inherent price volatility of oil and gas further amplifies the risk for new companies, which often lack the financial resilience and hedging strategies of established firms.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | High upfront investment for exploration, drilling, and infrastructure. | Deters smaller, less capitalized firms. | Permian Basin lease costs can reach tens of thousands per acre. |

| Regulatory Compliance | Meeting environmental, safety, and permitting standards. | Increases operating costs and project timelines. | EPA regulations on emissions and water discharge require continuous investment. |

| Economies of Scale | Lower per-unit costs due to high production volumes and integrated operations. | Makes it difficult for new entrants to achieve cost parity. | Major integrated energy companies optimize extraction and logistics. |

| Commodity Price Volatility | Fluctuations in oil and gas prices create revenue uncertainty. | Amplifies investment risk and hinders financing for new ventures. | Crude oil prices in 2024 ranged from $70s to $90s per barrel. |

Porter's Five Forces Analysis Data Sources

Our Vital Energy Porter's Five Forces analysis is built upon a foundation of reliable data, including company annual reports, industry-specific market research, and regulatory filings. This ensures a comprehensive understanding of the competitive landscape.