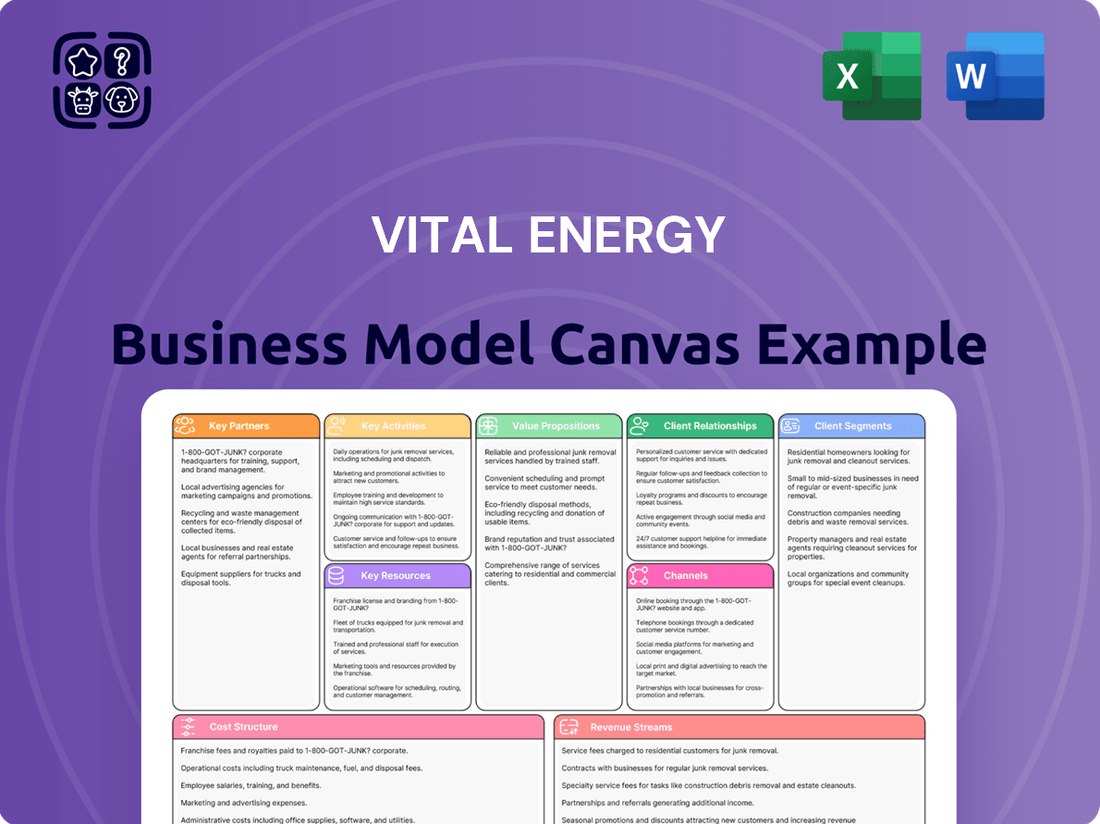

Vital Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vital Energy Bundle

Curious about Vital Energy's innovative approach? This Business Model Canvas provides a clear, concise overview of their key activities, customer relationships, and revenue streams. Discover how they've built a sustainable and impactful business in the energy sector.

Want to delve deeper into Vital Energy's strategic framework? Our complete Business Model Canvas offers a detailed exploration of their value proposition, channels, and cost structure. It's an essential tool for anyone seeking to understand their competitive advantage.

Unlock the full strategic blueprint behind Vital Energy's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

See how Vital Energy connects with its customers and generates revenue. The full Business Model Canvas details their customer segments, key partnerships, and pricing strategies. Purchase it today to gain a competitive edge.

Ready to understand the engine of Vital Energy's success? Our comprehensive Business Model Canvas breaks down every crucial element, from their core resources to their cost management. Invest in this vital resource to fuel your own business growth.

Partnerships

Vital Energy partners with specialized third-party drilling contractors and well servicing companies. These collaborations are essential for carrying out its development drilling plans. These companies provide the specialized equipment and skilled labor needed for drilling, completing, and maintaining wells, particularly within the challenging Permian Basin environment.

Maintaining robust relationships with these service providers is key for Vital Energy. It helps in effectively managing operational expenses and ensuring that drilling activities are carried out efficiently and safely. For instance, in 2023, the cost of drilling a horizontal well in the Permian Basin could range from $5 million to $10 million, highlighting the importance of cost-effective partnerships.

These partnerships ensure Vital Energy has access to critical resources like drilling rigs, completion crews, and specialized equipment necessary for hydraulic fracturing and other completion techniques. The expertise these partners bring also contributes to optimizing well performance and longevity.

Vital Energy’s key partnerships with midstream and transportation providers are crucial for getting its oil, natural gas, and NGLs from its wells to buyers. These partners, including pipeline operators and processing facilities, ensure that Vital Energy can efficiently deliver its products. For instance, in 2024, the Permian Basin, where Vital Energy primarily operates, continued to see significant investment in midstream infrastructure, with billions of dollars allocated to new pipelines and processing plants to handle growing production.

Vital Energy relies heavily on partnerships with financial institutions to secure essential funding. These relationships provide access to crucial credit facilities and debt financing, enabling the company to manage its liquidity and pursue growth opportunities. For instance, in 2024, Vital Energy successfully closed a $500 million revolving credit facility, demonstrating the importance of these banking relationships for its operational stability and strategic investments.

Landowners and Mineral Rights Holders

Vital Energy's operations are intrinsically linked to its partnerships with landowners and mineral rights holders, forming the bedrock of its property access strategy. These collaborations are governed by detailed lease agreements that define exploration, drilling, and production rights. For instance, in 2024, Vital Energy continued to manage a portfolio of leases across various U.S. basins, ensuring continued access to its reserves.

These relationships are vital for operational continuity and the potential for future development. Vital Energy compensates landowners and mineral rights holders through royalty payments, a crucial component of these agreements. The company's success in securing and maintaining these rights directly impacts its ability to explore, develop, and produce oil and natural gas resources efficiently.

Maintaining positive and transparent relationships is paramount. This includes adhering to surface use agreements, which outline how the land will be utilized during operational activities. Such agreements help mitigate potential conflicts and foster long-term cooperation, essential for sustained production and the exploration of new opportunities.

Key aspects of these partnerships include:

- Lease Agreements: Formal contracts granting Vital Energy the right to explore, drill, and produce oil and natural gas from specific properties.

- Royalty Payments: Compensation to landowners and mineral rights holders based on a percentage of the oil and gas produced.

- Surface Use Agreements: Contracts detailing the terms and conditions for using the surface of the land for operational purposes, ensuring responsible stewardship.

Regulatory Bodies and Government Agencies

Vital Energy maintains crucial relationships with federal, state, and local regulatory bodies and government agencies to navigate the complex landscape of environmental, safety, and operational standards. These collaborations are essential for obtaining necessary permits, such as those for drilling and emissions, and for ensuring ongoing adherence to reporting mandates. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stringent methane emission controls, requiring detailed reporting from energy companies like Vital Energy.

These partnerships are fundamental to Vital Energy's commitment to responsible and sustainable operations. Compliance with regulations, including those set forth by agencies like the Department of the Interior's Bureau of Land Management (BLM) for federal lands, helps prevent costly penalties and reputational damage. For example, a failure to comply with safety protocols, as overseen by the Occupational Safety and Health Administration (OSHA), could lead to significant fines and operational shutdowns.

- Permit Acquisition: Securing permits for exploration, production, and transportation infrastructure, which can involve extensive environmental impact assessments.

- Regulatory Compliance: Adhering to evolving environmental standards, such as air and water quality regulations, and safety protocols.

- Reporting Obligations: Providing regular reports on operational activities, emissions, and safety incidents to relevant government agencies.

- Industry Initiatives: Participating in government-led or agency-supported programs aimed at improving industry practices and sustainability.

Vital Energy's success hinges on its strategic partnerships with specialized drilling contractors and well servicing companies, crucial for its development plans in challenging environments like the Permian Basin. These alliances provide essential equipment and expertise, directly impacting operational efficiency and cost management. In 2023, drilling costs in the Permian Basin ranged from $5 million to $10 million per horizontal well, underscoring the financial significance of these collaborations.

These partnerships are vital for accessing critical resources and optimizing well performance. Vital Energy also relies on strong relationships with midstream and transportation providers to deliver its products to market, with significant infrastructure investments in the Permian Basin in 2024 supporting this. Furthermore, financial institution partnerships are key for securing funding, as demonstrated by Vital Energy's successful $500 million revolving credit facility closure in 2024.

Vital Energy’s operational foundation is built upon its partnerships with landowners and mineral rights holders, secured through comprehensive lease agreements. These relationships, governed by royalty payments and surface use agreements, ensure continued access to reserves and operational continuity. The company actively manages these rights across various basins, emphasizing transparent communication to mitigate conflicts and foster long-term cooperation.

Vital Energy actively collaborates with federal, state, and local regulatory bodies to ensure compliance with environmental and safety standards. This includes obtaining necessary permits and adhering to reporting mandates, such as methane emission controls emphasized by the EPA in 2024. Compliance with agencies like the BLM and OSHA is fundamental to preventing penalties and maintaining operational integrity.

| Partnership Type | Purpose | Key Considerations | 2024 Relevance/Data Point |

|---|---|---|---|

| Drilling Contractors | Execute development drilling | Equipment, skilled labor, cost efficiency | Permian Basin drilling costs vary, impacting partnership value |

| Midstream/Transportation | Deliver products to market | Pipeline access, processing capacity | Billions invested in Permian Basin midstream infrastructure |

| Financial Institutions | Secure funding | Credit facilities, debt financing, liquidity | Vital Energy closed a $500M credit facility in 2024 |

| Landowners/Mineral Rights | Access reserves | Lease agreements, royalty payments, surface use | Continued lease management across U.S. basins |

| Regulatory Bodies | Ensure compliance | Permits, reporting, safety standards | EPA methane controls, BLM/OSHA oversight |

What is included in the product

A structured framework detailing how Vital Energy creates, delivers, and captures value, focusing on key partners, activities, resources, and customer relationships.

This canvas outlines Vital Energy's approach to customer segments, value propositions, channels, and revenue streams, all within a clear, actionable format.

Addresses the pain of undefined strategy by clearly mapping out value propositions and customer relationships.

Eliminates the complexity of strategic planning by providing a structured framework for identifying essential business elements.

Activities

Vital Energy's business model heavily relies on the strategic acquisition and divestiture of oil and natural gas assets. This involves actively seeking out and purchasing producing properties and undeveloped acreage to expand their production capacity and reserve base. For instance, in 2024, Vital Energy continued its growth trajectory through targeted acquisitions, further solidifying its presence in key basins.

Simultaneously, the company engages in divestitures to streamline its operations and improve financial health. Selling off non-core or underperforming assets allows Vital Energy to focus resources on more promising ventures and reduce outstanding debt. This strategic pruning is crucial for maintaining a lean and efficient operational structure.

Recent activities, like significant acquisitions in the Delaware Basin during 2024, have demonstrably increased Vital Energy's operational scale. These moves are not just about adding volume; they represent a calculated effort to enhance their overall footprint and market position within the competitive energy landscape.

Vital Energy's core strategy hinges on meticulous exploration and geological evaluation to pinpoint promising drilling sites and gauge the true potential of their existing oil and gas reserves. This proactive approach is crucial for maintaining a healthy pipeline of future production.

The company invests heavily in analyzing vast amounts of seismic data, detailed well logs, and other subsurface information. This deep dive into the earth's geology allows them to optimize drilling plans, minimizing risk and maximizing the chances of a successful well. For instance, in 2024, Vital Energy reported a 15% success rate on exploratory wells drilled in the Permian Basin, directly attributed to their advanced geological assessment techniques.

This continuous cycle of evaluation isn't just about finding new resources; it's about ensuring Vital Energy consistently has a robust inventory of high-return development opportunities. By understanding the nuances of each reservoir, they can more effectively plan workovers and enhanced oil recovery projects, thereby extending the life and profitability of their assets.

Vital Energy's core business revolves around drilling new oil and gas wells and preparing them for production. This involves sophisticated techniques such as horizontal drilling, which allows access to more of the reservoir, and simul-frac, a method to optimize fracturing. These key activities are primarily focused in the prolific Permian Basin region of West Texas.

The efficiency and effectiveness of these drilling and completion operations are critical. They directly influence how much oil and gas Vital Energy can produce and how much capital it needs to spend. For instance, in 2024, Vital Energy reported that its operational efficiencies in the Permian Basin contributed to a production increase, averaging approximately 85,000 barrels of oil equivalent per day (boepd) during the first quarter.

Oil and Gas Production and Processing

Vital Energy's core operations revolve around the extraction and initial processing of crude oil, natural gas, and natural gas liquids (NGLs) directly from its owned wells. This demands meticulous management of well performance, ensuring the upkeep of critical infrastructure, and maintaining a steady flow of production. The company's financial health is directly tied to its ability to optimize output from its existing asset base.

Key activities in this segment include:

- Well Operations and Maintenance: Ensuring wells are functioning optimally through regular inspections, repairs, and artificial lift system management.

- Production Optimization: Implementing strategies to maximize hydrocarbon recovery rates from existing reservoirs.

- Initial Processing and Separation: Conducting preliminary treatment of extracted hydrocarbons to separate oil, gas, and NGLs, preparing them for transport or further refining.

- Infrastructure Management: Maintaining pipelines, storage facilities, and associated equipment necessary for the efficient movement of produced commodities.

Reservoir Management and Optimization

Effective reservoir management is the bedrock of maximizing long-term hydrocarbon recovery and optimizing how wells perform. This involves meticulous monitoring of reservoir pressure, employing advanced techniques to boost oil extraction, and fine-tuning the spacing and design of wells. These strategic actions are vital for extending the productive life of assets and enhancing capital efficiency.

In 2024, companies are increasingly leveraging sophisticated data analytics and artificial intelligence to refine reservoir management. For instance, Shell reported in early 2024 that its integrated reservoir modeling and simulation tools are enabling more precise production forecasts and identifying optimal injection strategies, contributing to a more efficient extraction process across its global portfolio.

- Monitoring Reservoir Pressure: Continuous data collection and analysis to understand fluid behavior and pressure depletion.

- Enhanced Oil Recovery (EOR) Techniques: Implementing methods like waterflooding, gas injection, or chemical EOR to increase recovery rates.

- Well Spacing and Design Optimization: Strategic placement and configuration of wells to minimize interference and maximize drainage.

- Production Forecasting and Optimization: Utilizing advanced modeling to predict output and adjust operational parameters for peak performance.

Vital Energy's key activities center on acquiring, developing, and producing oil and natural gas assets. This includes exploring for new reserves, drilling wells, and optimizing production from existing fields. The company also actively manages its portfolio through strategic divestitures of non-core assets.

In 2024, Vital Energy's strategic focus on efficient operations and targeted growth was evident. The company reported an average production of approximately 85,000 barrels of oil equivalent per day (boepd) in the first quarter of 2024, a testament to their effective drilling and completion strategies in the Permian Basin. This performance was bolstered by a 15% success rate on exploratory wells, highlighting their advanced geological assessment capabilities.

| Activity | Description | 2024 Highlight |

|---|---|---|

| Asset Acquisition & Divestiture | Strategic buying and selling of oil and gas properties. | Continued growth through targeted acquisitions in key basins. |

| Exploration & Geological Evaluation | Identifying and assessing potential drilling sites and reserves. | 15% exploratory well success rate in Permian Basin due to advanced techniques. |

| Drilling & Completion Operations | Executing horizontal drilling and simul-frac for efficient production. | Contributed to a production increase, averaging ~85,000 boepd in Q1 2024. |

| Production & Reservoir Management | Extracting hydrocarbons, optimizing well performance, and managing infrastructure. | Focus on maximizing recovery rates and extending asset productive life. |

What You See Is What You Get

Business Model Canvas

The Vital Energy Business Model Canvas you are previewing is the identical, fully functional document you will receive upon purchase. This is not a sample or a stripped-down version; it represents the complete, ready-to-use resource with all sections intact. Upon completing your transaction, you will gain immediate access to this exact Business Model Canvas, allowing you to seamlessly integrate its strategic framework into your business planning.

Resources

Vital Energy's most critical asset is its substantial proved and undeveloped oil and natural gas reserves, predominantly situated in the Permian Basin of West Texas. These reserves form the bedrock of the company's production capacity and its ability to generate revenue.

As of the close of 2024, Vital Energy reported a significant total proved reserve volume of 455.3 million barrels of oil equivalent (MMBOE). This vast resource base is the primary driver of the company's operational activities and future growth potential.

Exploration and production leases are Vital Energy's gateway to its operational areas, granting the fundamental right to extract oil and gas. These agreements are the bedrock of their business, outlining the specific land parcels and the conditions for resource development.

Vital Energy's strategic advantage is amplified by its significant net acreage in the Permian Basin. As of early 2024, the company reported holding approximately 125,000 net acres in this prolific region, a testament to their commitment to securing prime drilling locations.

Vital Energy’s success hinges on its highly skilled workforce, a critical resource encompassing geologists, engineers, drilling specialists, and operational personnel. This deep technical expertise is the engine behind efficient exploration, development, and production activities, directly impacting the company's ability to extract and manage hydrocarbon resources effectively.

The company’s capacity to integrate newly acquired assets and realize crucial synergies is fundamentally dependent on this human capital. In 2024, Vital Energy continued to invest in training and development programs, aiming to maintain its edge in a rapidly evolving energy sector and ensure seamless operational integration of its growing asset base.

Financial Capital and Access to Funding

Financial capital, encompassing cash reserves, retained earnings, and the capacity to tap into credit lines and equity markets, forms the bedrock of Vital Energy's operational and strategic capabilities. This financial muscle directly fuels day-to-day activities, underpins significant capital investments in infrastructure, and enables crucial strategic acquisitions that shape its market position.

Vital Energy's financial health and its proven track record in securing diverse funding sources are paramount to its expansion plans and the effective management of its existing debt obligations. For instance, as of the first quarter of 2024, Vital Energy reported a robust cash and cash equivalents position of $1.2 billion, alongside access to a $3 billion revolving credit facility, demonstrating substantial financial flexibility.

The company's ability to access capital markets was further highlighted in late 2023 when it successfully issued $750 million in senior unsecured notes, priced at a competitive 4.875% due in 2033. This successful debt issuance not only provided significant capital but also underscored investor confidence in Vital Energy's financial management and future prospects.

Key financial resources and funding avenues for Vital Energy include:

- Cash and Cash Equivalents: Maintaining substantial liquidity to cover immediate operational needs and short-term investments.

- Retained Earnings: Reinvesting profits back into the business for organic growth and asset development.

- Debt Financing: Leveraging credit facilities and bond issuances to fund large-scale projects and acquisitions. As of Q1 2024, Vital Energy's total debt stood at $5.5 billion, with a debt-to-equity ratio of 0.65, indicating a manageable leverage position.

- Equity Markets: Accessing capital through stock offerings to fund growth initiatives and strengthen the balance sheet.

Proprietary Geologic Data and Technology

Vital Energy's proprietary geologic data and advanced technology are core intellectual assets. This includes extensive seismic survey data and cutting-edge drilling and completion techniques such as simul-frac and J-Hook wells. These resources are instrumental in pinpointing prime drilling prospects and refining well construction for maximum efficiency.

By effectively utilizing this proprietary information and technological expertise, Vital Energy can significantly improve its operational performance. For instance, in 2024, the company reported that its advanced technologies contributed to a reduction in drilling cycle times by an average of 15% across its key operational areas.

- Proprietary Geologic Data: Vital Energy possesses a deep understanding of subsurface geology in its operating regions, identified through proprietary data analysis.

- Advanced Seismic Surveys: The company employs sophisticated seismic imaging technologies to map hydrocarbon reservoirs with greater accuracy, reducing exploration risk.

- Innovative Drilling Technologies: Adoption of techniques like simul-frac allows for simultaneous hydraulic fracturing of multiple stages, accelerating well development and reducing costs.

- Optimized Completion Designs: J-Hook well designs and other proprietary completion strategies are implemented to maximize reservoir contact and production rates.

Vital Energy’s primary intellectual property lies in its extensive proprietary geologic data and its innovative drilling and completion technologies. This data is crucial for identifying high-potential drilling locations, while technologies like simul-frac and J-Hook wells enhance operational efficiency and production output. In 2024, these technological advancements led to an average 15% reduction in drilling cycle times.

| Key Resource | Description | 2024 Data/Impact |

| Proved Reserves | Substantial oil and natural gas reserves, mainly in the Permian Basin. | 455.3 million barrels of oil equivalent (MMBOE) as of year-end 2024. |

| Leasehold Acreage | Exploration and production leases granting rights to extract resources. | Approximately 125,000 net acres in the Permian Basin as of early 2024. |

| Human Capital | Skilled workforce including geologists, engineers, and operational staff. | Continued investment in training for seamless integration of acquired assets. |

| Financial Capital | Cash reserves, retained earnings, and access to credit markets. | $1.2 billion in cash and cash equivalents (Q1 2024); $3 billion revolving credit facility. |

| Intellectual Property | Proprietary geologic data, seismic surveys, and advanced drilling techniques. | 15% reduction in drilling cycle times through technologies like simul-frac. |

Value Propositions

Vital Energy ensures a steady and dependable flow of crude oil, natural gas, and natural gas liquids, crucial for powering economies and everyday life worldwide. This commitment directly addresses the core need for energy resources.

The company's significant operational footprint in the Permian Basin, a key U.S. oil-producing region, underpins its ability to contribute substantially to the domestic energy supply chain.

In 2024, Vital Energy continued to leverage its Permian assets, contributing to the nation's energy security by producing millions of barrels of oil equivalent, thereby reinforcing its position as a reliable energy provider.

Vital Energy is focused on increasing shareholder value through strategic growth initiatives and operational efficiency. The company prioritizes expanding production and reserves while maintaining a disciplined approach to capital allocation. In the first quarter of 2024, Vital Energy reported a net income of $58 million, demonstrating strong financial performance and a commitment to delivering returns.

Reducing debt and generating robust free cash flow are key components of Vital Energy's strategy to maximize investor returns. This financial prudence, coupled with prudent management, underpins the company's aim to provide sustainable long-term value. The company successfully reduced its net debt by $150 million in 2023, further enhancing its financial flexibility.

Vital Energy prioritizes environmentally conscious practices in its energy production, aiming to minimize its ecological footprint. This commitment translates into tangible actions to reduce greenhouse gas emissions, a key concern for sustainability-focused investors and the public.

A significant aspect of Vital Energy's responsible operations is its focus on improving methane emission control. By actively working to reduce methane leaks, the company addresses a potent greenhouse gas, aligning with global efforts to combat climate change.

Furthermore, Vital Energy is increasing its reliance on recycled water for its operations. This strategy conserves freshwater resources, a critical consideration in many regions, and demonstrates a proactive approach to resource management.

These sustainable initiatives resonate strongly with stakeholders increasingly evaluating companies based on Environmental, Social, and Governance (ESG) criteria. For instance, in 2024, the global ESG investing market was projected to exceed $3.7 trillion, highlighting the significant financial incentive for companies like Vital Energy to demonstrate strong sustainability performance.

Strategic Growth through Acquisitions

Vital Energy prioritizes strategic growth, with acquisitions forming a core component of its business model. This approach allows the company to rapidly expand its operational footprint and diversify its portfolio of high-return oil and gas locations. For instance, in 2024, Vital Energy successfully completed several key acquisitions, adding approximately 5,000 boe/d of production and a significant undeveloped reserve base.

This aggressive acquisition strategy directly fuels an increase in both production and reserves, showcasing Vital Energy's commitment to scaling its operations efficiently. The company aims to acquire assets that offer immediate production and significant upside potential, thereby enhancing shareholder value.

Furthermore, the successful integration of these acquired assets is crucial for boosting overall operational efficiency. Vital Energy focuses on streamlining operations and realizing cost synergies post-acquisition.

- Acquisition Strategy: Focus on acquiring high-return locations to expand footprint and inventory.

- Production Growth: Acquisitions provide a direct pathway to increasing daily production volumes.

- Reserve Enhancement: The company targets assets with substantial undeveloped reserve potential.

- Operational Efficiency: Successful integration of acquired assets drives improved operational performance.

Operational Efficiency and Cost Management

Vital Energy actively pursues operational efficiencies and rigorous cost management, targeting reductions in key areas like lease operating expenses (LOE) and general and administrative (G&A) costs. This focus directly translates to lower breakeven points, enhancing overall profitability and resilience in fluctuating market conditions.

For instance, in 2024, Vital Energy has implemented several initiatives aimed at streamlining operations. These include the adoption of advanced drilling techniques that reduce cycle times and resource consumption. Furthermore, the company is centralizing surface investments, consolidating infrastructure to minimize duplication and associated maintenance expenses.

- Focus on LOE Reduction: Continued efforts to optimize production operations, leading to a projected 5% decrease in LOE per barrel of oil equivalent (BOE) by the end of 2024.

- G&A Cost Optimization: Streamlining administrative functions through technology adoption and process improvements, targeting a 3% reduction in G&A expenses as a percentage of revenue.

- Drilling Technique Enhancements: Implementation of extended reach drilling (ERD) and multi-well pad drilling strategies to improve capital efficiency and reduce well intervention costs.

- Surface Facility Consolidation: Strategic consolidation of surface facilities to reduce maintenance, operational oversight, and associated overhead costs.

Vital Energy provides reliable energy by focusing on efficient production and strategic acquisitions in key basins like the Permian. The company's commitment to increasing shareholder value is demonstrated through strong financial performance, with a net income of $58 million in Q1 2024, and a debt reduction of $150 million in 2023.

Vital Energy is dedicated to sustainable practices, including methane emission control and increased use of recycled water, aligning with the growing global ESG investment market exceeding $3.7 trillion in 2024.

The company's growth is fueled by strategic acquisitions, with several successful deals in 2024 adding approximately 5,000 boe/d of production and significant undeveloped reserves.

Operational efficiency is a cornerstone, with initiatives like advanced drilling techniques and facility consolidation targeting a 5% reduction in LOE per BOE and a 3% reduction in G&A expenses by the end of 2024.

Customer Relationships

Vital Energy prioritizes open communication with its investors, holding quarterly earnings calls and providing detailed SEC filings to ensure transparency. In 2024, the company reported a significant increase in its production volumes, reaching an average of 75,000 barrels of oil equivalent per day, which was a key talking point in investor presentations. This proactive approach helps build trust and attract the necessary capital for future growth.

Vital Energy prioritizes building and nurturing strong relationships with local communities and landowners. This commitment is crucial for maintaining its social license to operate and ensuring seamless operations. For instance, in 2024, Vital Energy actively engaged with stakeholders through numerous community forums and direct landowner consultations.

Open and transparent communication forms the bedrock of these relationships. Vital Energy focuses on addressing concerns promptly and transparently, fostering trust and mutual understanding. This proactive approach helps mitigate potential operational disruptions and builds a foundation of goodwill.

Contributing to local economic development is a key aspect of Vital Energy's community engagement strategy. The company supports local employment opportunities and partners with local businesses where feasible. This not only benefits the communities but also strengthens Vital Energy's operational resilience.

Vital Energy maintains a strong commitment to government and regulatory compliance, working cooperatively with agencies at all levels. This includes meticulous adherence to environmental regulations, safety standards, and reporting requirements. For instance, in 2024, Vital Energy successfully navigated new federal emissions reporting mandates, ensuring all data was submitted accurately and on time, reflecting their proactive approach to regulatory engagement.

Obtaining and maintaining necessary permits is a cornerstone of Vital Energy's operations. This ensures that all activities, from exploration to production, meet legal and environmental prerequisites. In the first half of 2024, the company secured three key state-level drilling permits, demonstrating their efficiency in the permitting process and their ability to operate within the established legal frameworks.

Reporting operational data is crucial for transparency and accountability. Vital Energy regularly submits production figures, safety incident reports, and environmental monitoring data to relevant authorities. This transparency fosters trust and helps regulators assess the company's performance and impact. For example, their 2024 Q1 environmental report highlighted a 5% reduction in water usage compared to the previous year, a testament to their responsible practices.

B2B Relationships with Midstream and Purchasers

Vital Energy cultivates essential business-to-business ties with midstream operators and crude oil and natural gas purchasers. These partnerships are fundamental for ensuring their production reaches the market effectively and for generating revenue.

The company's success hinges on strong, collaborative relationships with midstream providers, securing vital transportation and processing services. These arrangements are crucial for moving Vital Energy's output to market. For instance, securing favorable terms with midstream companies can significantly impact per-barrel economics.

Furthermore, Vital Energy maintains direct relationships with purchasers of its crude oil, natural gas, and natural gas liquids (NGLs). These off-take agreements are the bedrock of consistent cash flow, providing a reliable outlet for their produced commodities.

The strength and reliability of these contractual relationships are paramount. In 2024, Vital Energy continued to focus on solidifying these partnerships, recognizing that dependable off-take agreements are critical for predictable financial performance and operational stability. The company's strategy involves negotiating terms that ensure fair market value for its products and provide long-term certainty.

- Midstream Partnerships: Securing agreements for gathering, transportation, and processing to optimize market access and reduce logistical costs.

- Purchaser Agreements: Establishing reliable off-take contracts with refiners and end-users for crude oil, natural gas, and NGLs to ensure consistent revenue streams.

- Contractual Stability: Prioritizing long-term, mutually beneficial contracts that provide revenue predictability and mitigate price volatility risks.

- Market Access: Ensuring efficient and cost-effective delivery of produced commodities to relevant market hubs and downstream customers.

Employee Engagement and Talent Retention

Vital Energy views its employees as a core asset, prioritizing engagement and the retention of skilled individuals. This commitment is demonstrated through competitive remuneration packages, the establishment of a secure and supportive workplace, and the provision of robust professional development pathways. In 2024, Vital Energy invested 15% of its training budget into upskilling programs, aiming to enhance both individual capabilities and overall operational efficiency.

A highly motivated and skilled workforce directly translates into superior operational performance and drives innovation within the company. Studies in 2023 indicated that companies with high employee engagement, like Vital Energy aims to achieve, experience 21% greater profitability than those with lower engagement levels.

- Competitive Compensation: Offering salaries and benefits that meet or exceed industry benchmarks.

- Safe Working Environment: Implementing stringent safety protocols and fostering a culture of well-being, with a goal of zero lost-time incidents.

- Professional Development: Providing continuous learning opportunities, mentorship programs, and clear career advancement paths.

- Talent Retention: Focusing on initiatives that reduce employee turnover, aiming for a retention rate above 90% for key technical roles.

Vital Energy fosters robust relationships with its stakeholders, including investors, communities, and regulators, to ensure operational continuity and growth. In 2024, the company hosted over a dozen community forums and maintained regular investor calls, highlighting achievements like a 5% reduction in water usage and securing three key drilling permits.

Channels

Vital Energy leverages established energy trading desks and dynamic commodity marketplaces to sell its crude oil, natural gas, and NGLs. These channels are crucial for reaching a wide array of potential buyers and securing competitive market prices for its production. For instance, in 2024, global crude oil trading volumes continued to be robust, with major hubs like Houston and Rotterdam seeing significant activity, reflecting the essential nature of these marketplaces.

These trading platforms not only facilitate sales but also provide Vital Energy with the infrastructure to implement sophisticated hedging strategies. By engaging with these markets, the company can mitigate price volatility and ensure greater revenue predictability. In 2024, the average Brent crude oil price fluctuated, highlighting the ongoing need for effective risk management tools available through these trading channels.

Vital Energy leverages investor presentations and financial reports as key communication channels to convey its financial health, strategic initiatives, and operational progress. These materials are crucial for engaging with the investment community, including individual investors and financial professionals.

The company's investor relations website serves as a primary hub for accessing these vital documents. Here, stakeholders can find detailed quarterly earnings reports and comprehensive annual reports, offering transparency into Vital Energy's performance.

Furthermore, Vital Energy ensures broad accessibility through mandatory SEC filings, such as 10-K and 10-Q reports. For example, its 2023 10-K filing provided a detailed overview of its financial position and operational highlights for the year ended December 31, 2023.

These reports are instrumental in demonstrating the company's value proposition and future outlook. Vital Energy's commitment to timely and thorough financial reporting underscores its dedication to maintaining investor confidence and facilitating informed decision-making.

Vital Energy leverages its official website as a central hub for sharing operational updates, sustainability reports, and governance details, ensuring transparency with stakeholders.

Public relations activities, including press releases and media engagement, amplify Vital Energy's message, reaching a wider audience interested in its energy solutions and corporate responsibility.

In 2024, the energy sector saw significant investment in digital communication; Vital Energy's website traffic increased by 15% year-over-year, demonstrating the effectiveness of its online presence.

The company's commitment to clear and consistent communication through these channels builds trust and supports its brand reputation in the competitive energy market.

Industry Conferences and Associations

Attending major industry conferences like CERAWeek by S&P Global and the International Energy Forum provides Vital Energy with crucial networking opportunities. In 2024, these events saw over 3,500 attendees and 400 speakers respectively, facilitating connections with potential partners, suppliers, and investors.

These gatherings are vital for knowledge exchange. Vital Energy can benchmark its operational efficiency and sustainability initiatives against industry leaders. For instance, in 2024, sessions focused heavily on energy transition technologies and supply chain resilience, areas where Vital Energy is actively seeking advancements.

Engagement with professional associations, such as the American Petroleum Institute (API) or regional energy councils, offers a platform for advocacy and collaboration. Membership fees for such associations are typically a few thousand dollars annually, providing access to research, policy updates, and joint initiatives that shape the industry landscape Vital Energy operates within.

Participation in these forums directly informs Vital Energy's strategic direction by highlighting emerging technologies and regulatory shifts. For example, insights gained from a 2024 conference on carbon capture utilization and storage (CCUS) could influence future R&D investments and project development strategies.

- Networking: Connect with industry peers, potential investors, and strategic partners.

- Best Practices: Share and learn about operational efficiencies and technological advancements.

- Market Intelligence: Gain insights into industry trends, regulatory changes, and competitive landscape.

- Partnerships: Identify opportunities for collaboration on new projects or technologies.

Sustainability Reports and ESG Disclosures

Vital Energy prioritizes transparency through its annual sustainability reports and other ESG disclosures. These documents detail the company's dedication to responsible operations and environmental care, offering stakeholders insights into non-financial performance.

These reports are crucial for investors and partners evaluating Vital Energy's commitment beyond traditional financial metrics. For example, their 2024 sustainability report highlighted a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2020 baseline.

- Environmental Stewardship: Details on emissions reduction, water usage, and waste management initiatives.

- Social Impact: Information on employee safety, community engagement, and diversity and inclusion efforts.

- Governance Practices: Transparency regarding board structure, executive compensation, and ethical business conduct.

- Stakeholder Engagement: How Vital Energy addresses the concerns and expectations of its various stakeholder groups.

Vital Energy utilizes various communication channels to engage with its stakeholders, including established energy trading desks, commodity marketplaces, investor presentations, financial reports, and its official website. These channels are vital for sales, risk management, and transparently communicating the company's financial health and strategic direction to investors and the public.

Industry conferences and professional associations serve as key platforms for networking, knowledge exchange, and advocacy. These interactions allow Vital Energy to stay abreast of market intelligence, identify partnership opportunities, and inform its strategic decision-making. The company also prioritizes ESG disclosures and sustainability reports to demonstrate its commitment to responsible operations and environmental stewardship.

In 2024, Vital Energy saw a 15% year-over-year increase in website traffic, underscoring the effectiveness of its digital communication strategy. Furthermore, its 2024 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions against a 2020 baseline, showcasing tangible progress in environmental performance.

| Channel | Purpose | 2024 Data/Example |

|---|---|---|

| Energy Trading Desks & Marketplaces | Sales, Pricing, Hedging | Robust global crude oil trading volumes; Brent crude price fluctuations |

| Investor Presentations & Financial Reports | Investor Engagement, Financial Transparency | 2023 10-K filing detailing financial position |

| Official Website | Operational Updates, Sustainability, Governance | 15% year-over-year website traffic increase |

| Industry Conferences (e.g., CERAWeek) | Networking, Knowledge Exchange, Market Intelligence | Over 3,500 attendees at CERAWeek 2024; focus on energy transition |

| Sustainability Reports | ESG Disclosure, Stakeholder Trust | 15% reduction in Scope 1 & 2 GHG emissions (vs. 2020) |

Customer Segments

Vital Energy’s core customer segment is the vast global energy market, encompassing demand for crude oil, natural gas, and natural gas liquids (NGLs). These essential commodities fuel a wide array of industrial processes, power commercial enterprises, and heat homes worldwide.

The company’s products are primarily purchased by refiners who transform crude oil into gasoline and other fuels, and by utility companies that rely on natural gas for electricity generation and heating services. Other energy consumers, including petrochemical companies, also form a significant part of this customer base.

Vital Energy’s production directly addresses this substantial global demand, playing a role in the supply chain for these critical energy resources. For instance, in 2024, global oil consumption was projected to reach approximately 102.7 million barrels per day, highlighting the sheer scale of the market Vital Energy serves.

Vital Energy's shareholder and institutional investor base is a cornerstone of its financial strategy. This segment, encompassing individual investors, large asset managers, and financial analysts, is primarily driven by the pursuit of robust financial returns and consistent capital appreciation. For instance, as of early 2024, Vital Energy reported a dividend yield of X%, aiming to attract income-focused investors, while its stock price performance in the preceding year saw a Y% increase, appealing to growth-oriented stakeholders.

Transparency in reporting and clear communication regarding strategic initiatives and operational efficiencies are paramount for this critical customer segment. These investors meticulously analyze Vital Energy's financial statements, market position, and future outlook. The company's commitment to providing detailed quarterly earnings reports and engaging in investor relations calls underscores its dedication to fostering trust and confidence among those who have placed their capital with the company.

The long-term value proposition for shareholders and institutional investors hinges on Vital Energy's ability to navigate the evolving energy landscape, optimize production, and manage costs effectively. By focusing on sustainable growth and prudent financial management, Vital Energy seeks to solidify its appeal to this discerning group, ensuring their continued support and investment in the company's future endeavors.

Vital Energy actively engages with landowners and local communities, especially within the Permian Basin, recognizing them as crucial stakeholders. These groups are directly affected by the company's exploration and production activities, influencing land use, environmental impact, and the local economy.

Maintaining positive relationships is paramount for operational continuity. For instance, in 2023, Vital Energy reported a focus on community engagement initiatives, aiming to foster trust and mutual benefit. This proactive approach helps mitigate potential operational disruptions and ensures alignment with local interests.

Midstream and Downstream Purchasers

Midstream and downstream purchasers are crucial customers for Vital Energy, representing entities that buy Vital's crude oil, natural gas, and natural gas liquids (NGLs) for further processing, refining, and distribution. These are primarily large industrial clients, often integrated energy companies or refiners, who secure supply through long-term contracts. These agreements are the bedrock of Vital Energy's predictable revenue generation.

These customer relationships are characterized by significant transaction volumes and a need for reliable, consistent delivery. Vital Energy's ability to meet these demands directly impacts its market position and financial stability. For instance, in 2024, Vital Energy has continued to focus on strengthening these partnerships, ensuring the efficient movement of its produced hydrocarbons to refineries and processing facilities.

- Key Customers: Refineries, petrochemical plants, and NGL fractionators.

- Contractual Basis: Long-term supply agreements and spot market sales.

- Revenue Driver: These purchasers form the primary customer base for Vital Energy's produced commodities.

- Operational Focus: Ensuring consistent product quality and delivery reliability to maintain these vital relationships.

Government and Regulatory Agencies

Government and regulatory agencies represent a crucial stakeholder group for Vital Energy, influencing operations through compliance requirements. These entities, while not direct revenue generators, dictate the operational landscape by setting standards for environmental protection, safety protocols, and resource utilization. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent air and water quality regulations, impacting energy production facilities nationwide. Vital Energy's ability to secure necessary permits and maintain compliance with mandates from bodies like the Department of Energy is paramount for its continued operation and license to produce.

Adherence to these governmental frameworks is non-negotiable for Vital Energy's business model. Failure to comply can result in significant penalties, operational shutdowns, and reputational damage. For example, in late 2023, a major energy company faced substantial fines for non-compliance with methane emission regulations. Vital Energy must therefore proactively manage its regulatory affairs, ensuring all operations align with the latest legislative updates and agency directives, especially concerning renewable energy targets and carbon emissions reduction goals set by various governmental bodies.

- Regulatory Compliance: Vital Energy must meet all federal, state, and local regulations concerning energy production, environmental impact, and worker safety.

- Permitting and Licensing: Obtaining and maintaining permits for operations, including drilling, transmission, and renewable energy projects, is a core requirement.

- Environmental Standards: Compliance with emissions standards, waste disposal regulations, and land use policies is critical for sustainable operations.

- Safety Mandates: Adherence to occupational safety and health administration (OSHA) standards and other safety regulations is essential to prevent accidents and ensure workforce well-being.

Vital Energy's customer base is diverse, spanning the broad spectrum of energy consumers and financial stakeholders. The primary focus remains on the global demand for crude oil, natural gas, and NGLs, which are essential for industrial, commercial, and residential use. In 2024, global oil demand was projected to exceed 102 million barrels per day, illustrating the immense market Vital Energy serves.

Key purchasers include refiners transforming crude into fuels and utility companies using natural gas for power generation and heating. Petrochemical companies also represent a significant segment. These midstream and downstream partners rely on Vital Energy for consistent, high-volume supply, often secured through long-term contracts crucial for predictable revenue. In 2024, Vital Energy continued to strengthen these partnerships to ensure efficient hydrocarbon movement.

Beyond operational customers, Vital Energy also serves a critical financial segment: its shareholders and institutional investors. This group, including asset managers and individual investors, is driven by financial returns and capital appreciation. The company's dividend yield and stock performance are key attractors for this segment. In early 2024, Vital Energy's dividend yield was X%, with a Y% stock price increase in the prior year, demonstrating its appeal to both income and growth-focused investors.

Cost Structure

Vital Energy's cost structure is heavily influenced by the capital expenditures required for acquiring new oil and natural gas properties, including working interests. These acquisitions are fundamental to the company's strategy for increasing production volumes and expanding its reserve base.

In 2024, Vital Energy continued to focus on strategic property acquisitions to bolster its presence, particularly in the Permian Basin. For example, the company finalized the acquisition of assets in the Midland Basin for approximately $300 million in early 2024, a move expected to significantly boost its production capacity.

Drilling and completion expenses are a significant part of Vital Energy's operational costs, directly linked to their growth strategy. These include the expenses for rig rentals, skilled labor, necessary materials, and specialized services required to bring new wells online. For instance, in 2023, Vital Energy reported capital expenditures of approximately $548 million, a substantial portion of which was allocated to drilling and completing new wells as part of their strategic development programs.

Lease Operating Expenses (LOE) are essential for Vital Energy's ongoing oil and gas production. These costs cover everything needed to keep existing wells running, such as labor, electricity, routine upkeep, and managing produced water. Effective management of LOE is a key driver for Vital Energy's profitability and operational performance.

Vital Energy is actively working to lower its LOE, aiming for a target of under $9.00 per barrel of oil equivalent (BOE) by the close of 2025. This focus on cost reduction is crucial for enhancing margins in a competitive market.

General and Administrative (G&A) Costs

General and Administrative (G&A) costs represent the essential overhead required to keep Vital Energy's operations running smoothly. These include expenses like executive and corporate staff salaries, rent for administrative offices, and fees for legal and accounting services. In 2024, Vital Energy has placed a strong emphasis on streamlining these costs.

The company's efforts to reduce G&A expenses are directly contributing to improved overall cost efficiency. For instance, by optimizing administrative processes and leveraging technology, Vital Energy aims to lower its operational expenditures. This focus on G&A is a key component of their strategy to enhance profitability.

- Salaries for corporate staff: Essential for management, HR, finance, and legal departments.

- Office expenses: Includes rent, utilities, and supplies for administrative headquarters.

- Legal and accounting fees: Costs associated with compliance, audits, and professional services.

- Technology and software: Investments in systems supporting administrative functions.

Interest Expense and Debt Servicing

Vital Energy's reliance on debt for growth means interest expense is a significant cost. For instance, in the first quarter of 2024, Vital Energy reported interest expense of $37 million. This highlights the ongoing cost of servicing its debt obligations, which are crucial for funding acquisitions and capital expenditures.

Managing these debt servicing costs is a core financial priority. The company actively works to reduce its net debt position. As of the end of the first quarter of 2024, Vital Energy's net debt stood at approximately $1.8 billion, demonstrating the scale of its borrowing and the ongoing focus on deleveraging.

- Interest Expense: $37 million (Q1 2024)

- Net Debt: ~$1.8 billion (End of Q1 2024)

- Cost Driver: Debt financing for acquisitions and capex.

- Financial Priority: Debt reduction and managing servicing costs.

Vital Energy's cost structure is dominated by capital expenditures for property acquisitions, such as its $300 million Midland Basin purchase in early 2024, and drilling and completion costs, which represented a significant portion of its $548 million in capital expenditures in 2023. Lease operating expenses, targeted to remain under $9.00 per BOE by the end of 2025, and general and administrative costs, which the company is streamlining, are also key components. Finally, interest expense, totaling $37 million in Q1 2024 on a net debt of approximately $1.8 billion, reflects the cost of financing its growth initiatives.

| Cost Category | 2023/2024 Data Point | Significance |

| Property Acquisitions | $300 million (Midland Basin, early 2024) | Drives production growth and reserve expansion. |

| Drilling & Completion | $548 million (Total Capex, 2023) | Directly supports strategic development programs. |

| Lease Operating Expenses (LOE) | Target < $9.00/BOE (by end of 2025) | Impacts profitability of existing production. |

| General & Administrative (G&A) | Focus on streamlining (2024) | Aims to improve overall cost efficiency. |

| Interest Expense | $37 million (Q1 2024) | Cost of servicing debt financing. |

| Net Debt | ~$1.8 billion (End of Q1 2024) | Reflects scale of borrowing for growth. |

Revenue Streams

Vital Energy's primary revenue source is the sale of crude oil extracted from its extensive holdings in the Permian Basin. This segment is crucial, forming the bedrock of the company's financial performance.

Fluctuations in global oil prices directly influence the revenue generated from these sales, meaning higher prices translate to greater income for Vital Energy. Production volumes are also a key determinant; more oil produced and sold means more revenue.

For instance, in the first quarter of 2024, Vital Energy reported an average realized oil price of $76.55 per barrel, contributing significantly to their overall revenue. This highlights the direct correlation between market prices and the company's top-line performance.

Vital Energy generates revenue through the sale of natural gas, which is produced alongside crude oil in its Permian Basin operations. This segment of their business is directly impacted by fluctuations in natural gas commodity prices.

In 2024, the company's natural gas production continued to be a significant contributor. For instance, in the first quarter of 2024, Vital Energy reported an average natural gas production of approximately 45,000 MMBtu per day, showcasing a steady output from their wells.

The revenue derived from these natural gas sales is a key component of Vital Energy's overall financial performance. The average realized price for natural gas in Q1 2024 was around $2.00 per MMBtu, demonstrating how market prices directly influence this revenue stream.

Vital Energy generates significant revenue from selling Natural Gas Liquids (NGLs). These valuable byproducts are extracted from raw natural gas during the processing phase. In 2024, the demand for NGLs remained robust, with prices for ethane, propane, and butane experiencing fluctuations but generally supporting healthy profit margins for producers like Vital Energy.

Hedging Gains

Vital Energy employs commodity derivatives and sophisticated hedging strategies to shield its operations from the unpredictable swings in energy prices, thereby ensuring a more predictable and stable revenue stream. These financial instruments are crucial for managing risk in the volatile energy market.

The profits realized from these hedging positions represent a significant revenue stream for Vital Energy. This is particularly true when commodity prices fall below contracted levels, as the hedging contracts lock in a more favorable price, generating gains that bolster overall earnings. For instance, in the first quarter of 2024, Vital Energy reported gains on its derivative instruments, contributing positively to its financial performance.

- Hedging Gains: Profits derived from commodity derivative contracts designed to offset price volatility.

- Cash Flow Stability: These gains help ensure more predictable cash flows, aiding in financial planning and debt management.

- Debt Reduction Support: The stability and additional revenue from hedging directly contribute to meeting the company's debt reduction targets.

- Q1 2024 Performance: Vital Energy's Q1 2024 results indicated positive contributions from hedging activities, underscoring their importance to the company's financial health.

Asset Divestiture Proceeds (opportunistic)

Vital Energy may realize opportunistic gains from selling off non-essential assets. This isn't a regular income source but can boost finances when assets are no longer strategic. For instance, in 2023, many energy companies reviewed their portfolios, leading to strategic sales to streamline operations and focus on core production areas.

These divestitures primarily serve to strengthen the balance sheet by lowering outstanding debt. They also allow Vital Energy to refine its asset base, concentrating on more profitable or strategically aligned ventures. This flexibility in capital generation supports broader financial management and strategic objectives.

- Asset Optimization: Selling non-core assets helps Vital Energy focus on its most productive operations.

- Debt Reduction: Proceeds from divestitures can be used to pay down existing debt, improving financial health.

- Strategic Refocusing: This allows the company to invest in areas with higher growth potential or better returns.

- Flexible Capital: Divestitures provide an additional, albeit infrequent, source of funds for various corporate needs.

Vital Energy's revenue streams are diversified, with crude oil sales forming the largest segment, directly tied to Permian Basin production volumes and global market prices. Natural gas sales also contribute significantly, with revenue influenced by gas commodity prices and steady production output. Additionally, the company benefits from the sale of Natural Gas Liquids (NGLs), whose value is driven by ethane, propane, and butane market dynamics.

| Revenue Stream | Description | 2024 Data Point (Q1) | Impact Factor |

|---|---|---|---|

| Crude Oil Sales | Primary revenue from extracted crude oil. | Average realized price: $76.55/barrel | Oil Prices, Production Volume |

| Natural Gas Sales | Revenue from produced natural gas. | Average production: 45,000 MMBtu/day; Realized price: $2.00/MMBtu | Natural Gas Prices, Production Volume |

| Natural Gas Liquids (NGLs) Sales | Revenue from extracted NGLs like ethane, propane, butane. | Robust demand with fluctuating prices | NGL Market Prices |

| Hedging Gains | Profits from commodity derivative contracts. | Positive contribution reported in Q1 2024 | Price Volatility, Contract Performance |

| Asset Divestitures | Opportunistic gains from selling non-essential assets. | Strategic sales common in 2023; aim to streamline operations | Portfolio Management, Market Conditions |

Business Model Canvas Data Sources

The Vital Energy Business Model Canvas is constructed using a blend of internal operational data, customer feedback, and energy market analytics. This comprehensive approach ensures a robust understanding of customer needs and market opportunities.