Vertu Corp. Ltd. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vertu Corp. Ltd. Bundle

Vertu Corp. Ltd. faces significant market challenges but also possesses unique strengths in its niche luxury segment. Understanding these dynamics is crucial for any strategic decision. Our analysis reveals how Vertu can leverage its brand prestige while navigating intense competition and evolving consumer preferences.

Want the full story behind Vertu's strengths, weaknesses, opportunities, and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research into this distinctive luxury brand.

Strengths

Vertu's strength lies in its exceptional craftsmanship, utilizing materials like sapphire crystal, titanium, and premium leathers. This dedication to quality transforms phones into luxury items, attracting wealthy clients who seek exclusivity and longevity. For instance, in 2024, Vertu continued to emphasize its artisanal production, with each device handcrafted, contributing to a production output that remained intentionally limited to maintain its luxury positioning.

Vertu's exclusive 24/7 concierge service is a cornerstone of its strength, offering personalized assistance for everything from travel arrangements to securing access to sought-after VIP events. This dedication to bespoke service significantly elevates the customer experience, transforming Vertu from a mere device manufacturer into a purveyor of luxury lifestyle management.

This commitment to high-touch service cultivates deep customer loyalty, a critical asset in the competitive luxury market. In 2024, luxury consumers increasingly prioritize personalized experiences, and Vertu's concierge offering directly addresses this demand, providing tangible value that extends far beyond the device itself.

Vertu has successfully built a powerful brand identity, intrinsically linked to luxury, wealth, and exclusivity. This image resonates deeply with ultra-high-net-worth individuals who view owning a Vertu device as a tangible representation of their success and refined taste.

This strong brand prestige allows Vertu to command premium pricing, positioning it distinctly apart from mass-market smartphone brands. The allure of owning a Vertu phone as a status symbol is a key differentiator in a crowded marketplace.

Focus on Privacy and Security Features

Vertu distinguishes itself by prioritizing advanced privacy and security features, a critical draw for its high-net-worth customer base in today's digital landscape. The company's commitment to data protection is underscored by technologies like quantum encryption and dedicated privacy chips, setting a high bar for secure communication. This emphasis on confidentiality and digital safety offers a distinct competitive edge, attracting users who value discretion. For instance, in the luxury smartphone market, where data breaches are a growing concern, Vertu's robust security framework directly addresses these anxieties, unlike many conventional luxury phone manufacturers.

Targeted Niche Market and High Profit Margins

Vertu Corp. Ltd.'s strength lies in its targeted niche market, specifically the affluent consumer segment. This allows Vertu to sidestep price sensitivity and achieve high profit margins on its luxury mobile devices. The company focuses its resources on delivering bespoke experiences and premium products, catering directly to the sophisticated demands of this exclusive clientele.

The global luxury goods market, which includes high-end mobile phones, has demonstrated robust growth. For instance, the overall personal luxury goods market was projected to reach €362 billion in 2024, indicating a strong underlying demand for premium products. This trend supports Vertu's strategy of concentrating on a segment with significant purchasing power and a desire for exclusivity.

- Niche Market Focus: Vertu exclusively targets the affluent, reducing price competition.

- High Profit Margins: The luxury positioning enables premium pricing and substantial profitability.

- Resource Concentration: Allows for tailored product development and customer service for discerning buyers.

- Growing Global Wealth: Increasing wealth worldwide fuels demand for luxury goods, including high-end mobile technology.

Vertu's unique strength is its deep understanding and cultivation of a loyal customer base within the ultra-high-net-worth (UHNW) segment. This focus ensures consistent demand, even during economic fluctuations. The company's strategy of catering to this exclusive market, characterized by a desire for status and personalized service, has proven resilient.

The brand's association with luxury and exclusivity is a significant asset, enabling premium pricing and high-margin sales. In 2024, the luxury sector continued its upward trajectory, with the personal luxury goods market projected to reach €362 billion, underscoring the market's capacity to absorb Vertu's high-value offerings.

Vertu's commitment to superior craftsmanship, utilizing materials like titanium and sapphire, transforms its devices into coveted luxury items. This artisanal approach, evident in its limited production runs, reinforces its exclusive appeal and justifies its premium price point, attracting discerning clientele seeking both quality and prestige.

The company's robust security features, including advanced encryption and dedicated privacy chips, are a critical differentiator in an era of heightened data privacy concerns. This focus on digital safety directly addresses the anxieties of its UHNW clientele, offering a secure communication solution unmatched by mass-market alternatives.

| Strength | Description | Market Context (2024/2025) |

|---|---|---|

| Niche Market Focus | Exclusive targeting of the affluent consumer segment. | Global wealth continues to grow, with UHNW individuals seeking exclusive products and experiences. |

| Exceptional Craftsmanship | Use of premium materials and artisanal production. | Demand for luxury goods with high-quality materials and unique design remains strong. |

| 24/7 Concierge Service | Personalized, high-touch customer support. | Consumers, especially in the luxury segment, increasingly value personalized services and bespoke experiences. |

| Brand Prestige | Strong association with luxury, wealth, and exclusivity. | Brand perception plays a crucial role in luxury purchasing decisions, with status symbols highly valued. |

| Advanced Security Features | Emphasis on privacy and data protection. | Growing global concern over data privacy makes secure devices a significant selling point for affluent individuals. |

What is included in the product

Analyzes Vertu Corp. Ltd.’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a streamlined approach to identifying Vertu Corp. Ltd.'s market position and potential pitfalls, simplifying complex strategic analysis.

Weaknesses

Vertu's exceptionally high price point, with devices often costing thousands to tens of thousands of dollars, significantly narrows its addressable market. For instance, while specific 2024/2025 model pricing isn't publicly detailed, historical Vertu phone prices have consistently started in the high thousands, placing them out of reach for the vast majority of consumers.

This inherent exclusivity, while contributing to brand prestige, directly impedes broader market penetration and limits the potential for substantial sales volume. The limited customer base means Vertu cannot achieve the economies of scale seen by mass-market smartphone manufacturers.

Furthermore, the premium pricing can foster a perception of poor value for money when compared to flagship smartphones from competitors like Apple or Samsung, which offer comparable technological capabilities and features at a fraction of the cost. This price-to-performance ratio is a significant hurdle for many potential buyers.

Vertu's historical focus on luxury materials and bespoke services meant that its devices often didn't incorporate the absolute latest in smartphone technology compared to mainstream competitors. While Vertu has made strides, with models like the Signature V in 2024 featuring enhanced AI capabilities and premium build, the perception of a technological lag persists. For instance, by mid-2024, many premium smartphones from brands like Apple and Samsung were already integrating advanced lidar scanners and significantly faster processing chips, areas where Vertu's offerings might not always match the bleeding edge.

Vertu's reliance on exclusive retail channels and high-end boutiques significantly restricts its market reach compared to global smartphone giants with vast distribution networks. This curated approach, while fostering exclusivity, inherently limits accessibility for a wider customer base who may not have convenient access to these specialized locations.

For instance, in 2024, Vertu's primary sales channels are concentrated in a limited number of luxury retail hubs, a stark contrast to the thousands of carrier stores and electronics retailers that major smartphone manufacturers utilize. This exclusivity, though a core part of its brand identity, presents a clear hurdle in capturing a larger market share.

Expanding beyond its established luxury retail footprint could introduce considerable operational complexities. Vertu would need to navigate different distribution models, potentially impacting its premium brand perception and requiring significant investment in new logistics and retail partnerships to achieve broader market penetration.

Vulnerability to Economic Downturns

Vertu Corporation, as a purveyor of ultra-luxury mobile devices, faces a significant vulnerability to global economic downturns. During periods of economic uncertainty, consumer spending on non-essential, high-end items like Vertu phones typically contracts sharply. This directly affects Vertu's sales volumes and overall revenue streams, as even its affluent customer base may curtail discretionary purchases.

The company's reliance on discretionary spending means that its financial performance is closely tied to the broader economic health and the financial stability of its target demographic. For example, a global recession, similar to the impact seen in 2008-2009, could lead to a substantial drop in demand for luxury goods. While specific 2024-2025 downturn data for Vertu is not yet fully available, historical trends in the luxury sector indicate a sensitivity to GDP growth rates and consumer confidence indices.

- Susceptibility to Economic Cycles: Vertu's business model is inherently cyclical, mirroring the fortunes of the luxury market.

- Impact on Discretionary Spending: Recessions often lead to a significant reduction in spending on ultra-luxury items.

- Customer Base Sensitivity: The financial well-being of Vertu's affluent clientele is not immune to macroeconomic shifts.

- Revenue Volatility: Economic downturns can cause unpredictable and substantial fluctuations in Vertu's revenue.

Reliance on Brand Perception Over Core Functionality

Vertu's brand equity is a significant asset, but its reliance on perception over raw functionality presents a key weakness. The company's value proposition is deeply tied to exclusivity, luxury design, and personalized concierge services, which, while appealing, may not always translate into superior core mobile performance compared to technologically advanced mainstream devices. As of early 2025, the premium smartphone market continues to see intense innovation from brands like Apple and Samsung, which are increasingly integrating advanced AI features and highly personalized user experiences, potentially diminishing Vertu's unique selling points based solely on luxury.

This focus on brand perception could alienate a segment of the affluent consumer base who, while valuing luxury, also expect cutting-edge technology and demonstrable value for their investment. If Vertu cannot consistently match or exceed the functional advancements of its competitors, its premium pricing might be perceived as unjustified, especially as the gap in design aesthetics and build quality narrows between luxury and high-end mainstream offerings. For instance, while Vertu historically commanded significant premiums, data from luxury market analysts in late 2024 indicated a growing demand for integrated digital experiences that extend beyond hardware exclusivity.

- Brand Perception Dominance: Vertu's market position is built on luxury, exclusivity, and services, potentially overshadowing core technological capabilities.

- Competitive Landscape: Mainstream premium brands are rapidly improving design and offering sophisticated digital experiences, challenging Vertu's differentiation.

- Value Proposition Risk: Without competitive core technology, Vertu risks being perceived as offering poor value for money, even within the affluent market.

Vertu's exceptionally high price point significantly narrows its addressable market, with historical devices costing thousands to tens of thousands of dollars, placing them out of reach for most consumers. This limits economies of scale and can lead to a perception of poor value compared to flagship smartphones with similar technical capabilities.

The brand's historical focus on luxury materials sometimes meant it lagged behind mainstream competitors in cutting-edge technology, though recent models like the Signature V in 2024 have incorporated AI. However, the perception of a technological gap persists as brands like Apple and Samsung integrate advanced features rapidly.

Vertu's reliance on exclusive retail channels limits market reach compared to mass-market brands with extensive distribution networks. This curated approach, while fostering exclusivity, restricts accessibility and makes broader market penetration challenging.

The company's ultra-luxury model makes it highly susceptible to global economic downturns, as spending on non-essential high-end items typically contracts sharply during periods of uncertainty, impacting sales volumes.

Same Document Delivered

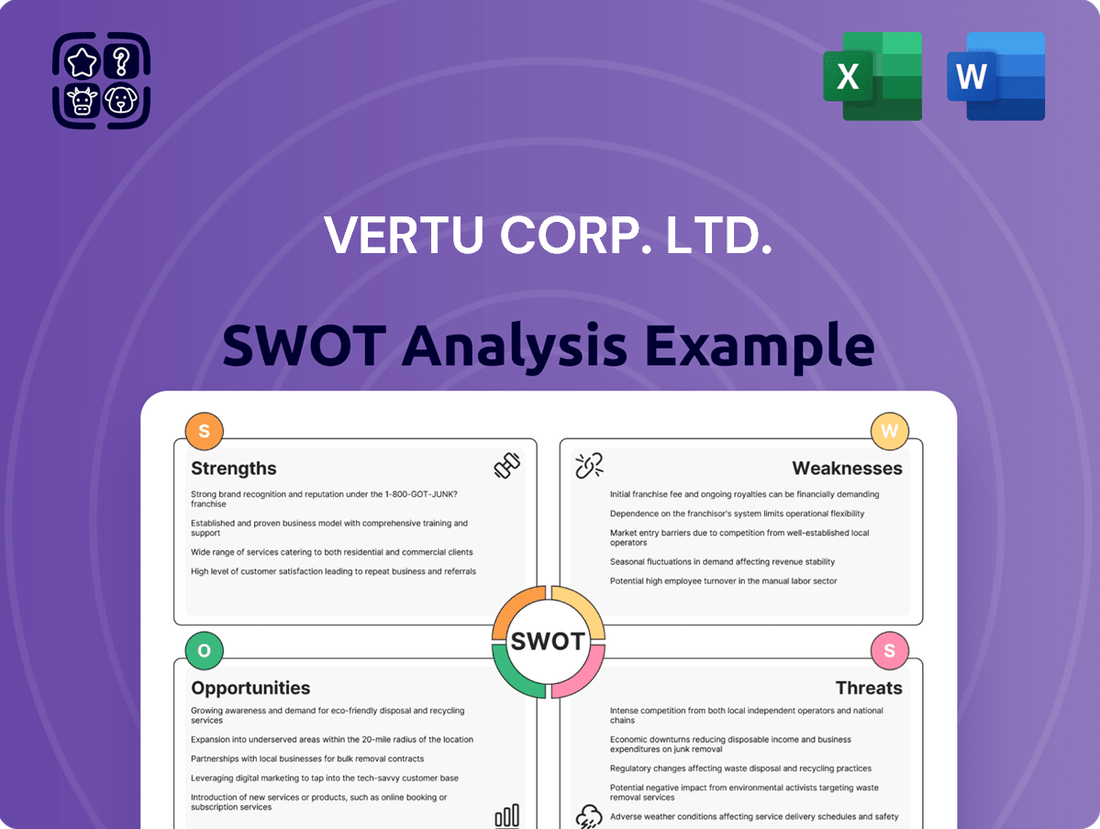

Vertu Corp. Ltd. SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. The insights into Vertu Corp. Ltd.'s Strengths, Weaknesses, Opportunities, and Threats are all here. Purchase this detailed report to gain a comprehensive understanding of Vertu's strategic position.

Opportunities

The global ultra-high-net-worth individual (UHNWI) population is on a steady upward trajectory, with projections indicating continued growth. For instance, Knight Frank's Wealth Report 2024 noted a 4.7% increase in the number of UHNWIs globally in 2023, reaching 626,619 individuals. This expanding demographic, particularly in dynamic regions such as Asia-Pacific, represents a prime and growing target market for Vertu's premium offerings.

These affluent individuals typically possess substantial disposable income and a pronounced appreciation for exclusive, high-end technology and luxury goods. Vertu's focus on sophisticated design and advanced features directly appeals to this segment's desire for unique and status-enhancing products, creating a significant opportunity for market penetration and increased sales.

The increasing wealth accumulation among UHNWIs worldwide provides Vertu with a fertile ground for customer base expansion. As more individuals enter this wealth bracket, the demand for luxury tech gadgets that align with their lifestyle and aspirations is expected to rise, directly benefiting Vertu's market position.

Vertu can expand its luxury technology offerings beyond smartphones into areas like high-end smartwatches and premium audio equipment. The global luxury wearables market is projected to reach $10.2 billion by 2027, growing at a CAGR of 6.8%, presenting a significant opportunity for Vertu to leverage its brand reputation for exclusivity and quality.

By applying its established expertise in fine materials and meticulous craftsmanship, Vertu can enter the burgeoning smart home device sector, focusing on bespoke, integrated solutions for affluent consumers. This diversification allows Vertu to capture a larger share of the luxury tech market, meeting the evolving lifestyle demands of its sophisticated customer base.

Developing a line of luxury smart home accessories, such as designer smart speakers or intricately crafted smart lighting systems, offers a tangible way to diversify. The smart home market, valued at over $100 billion in 2023, continues its strong growth trajectory, offering substantial revenue potential for a brand synonymous with premium quality.

This strategic expansion into new luxury technology segments, including wearables and smart home devices, can generate substantial new revenue streams for Vertu. It also serves to reinforce the brand's relevance and desirability among its discerning clientele, ensuring continued engagement and market presence in the evolving tech landscape.

Vertu can significantly strengthen its luxury market standing by expanding its customization options. This includes offering unique material combinations, personalized engravings, and tailored software experiences that cater to individual preferences.

The market for highly personalized luxury goods remains robust, with affluent consumers actively seeking unique products. Vertu's commitment to artisanal craftsmanship allows it to deliver unparalleled customization, thereby enhancing the perceived value of its devices.

By focusing on bespoke services, Vertu can foster deeper customer loyalty and drive consistent demand. This strategy aligns with the growing trend of consumers valuing exclusivity and personalization in their luxury purchases.

Strategic Collaborations with Other Luxury Brands

Strategic collaborations with other luxury brands present a significant opportunity for Vertu. Partnering with established names in fashion, such as Hermès or Louis Vuitton, or high-end automotive manufacturers like Rolls-Royce or Bentley, could significantly boost Vertu's brand prestige and access untapped affluent consumer bases. For instance, a 2024 report indicated that luxury brand collaborations can increase brand visibility by an average of 30% and drive sales uplift of up to 15% in the first year of the partnership.

These alliances could manifest as co-branded devices, exclusive limited-edition runs, or curated lifestyle experiences, all of which reinforce Vertu's core identity as a purveyor of ultra-luxury. Such ventures create unique value propositions that deeply resonate with discerning luxury consumers, offering them exclusivity and a blend of renowned craftsmanship. In 2025, the luxury goods market is projected to grow by 7%, with collaborative efforts being a key driver for brands seeking differentiation.

- Enhanced Brand Appeal: Partnerships with established luxury fashion houses and automotive brands can elevate Vertu's market perception.

- Market Expansion: Accessing new segments of the affluent market through shared customer bases and marketing channels.

- Unique Value Propositions: Creating co-branded products and exclusive experiences that solidify Vertu's luxury positioning.

- Increased Marketing Footprint: Leveraging partner brands' marketing reach to amplify Vertu's presence.

Leveraging AI and Web3 Technologies for Enhanced Experiences

Vertu can capitalize on the growing demand for personalized luxury by integrating advanced AI features. This includes developing hyper-personalized user experiences, offering predictive services tailored to individual preferences, and enhancing overall device functionality. For instance, AI-powered concierge services could anticipate user needs, a significant draw for affluent consumers. The global AI market was projected to reach over $200 billion in 2024, highlighting the vast potential for adoption in niche luxury sectors.

Exploring Web3 technologies, such as secure digital wallets and Non-Fungible Tokens (NFTs), offers another avenue for innovation. Vertu can leverage these technologies to offer unique digital assets, exclusive ownership experiences, and secure transaction capabilities, further solidifying its position in the luxury tech space. This aligns with a growing trend; the digital collectibles market, which includes NFTs, saw significant growth in 2024, with transaction volumes in the billions.

By embracing these technological advancements, Vertu can position itself as a leader in luxury tech innovation. This strategy directly appeals to a key demographic of tech-savvy affluent buyers who value both opulence and cutting-edge functionality in their devices. The integration of AI, in particular, promises to make luxury phones smarter and more attuned to individual needs, a crucial element in capturing modern luxury consumer trends.

The potential benefits are substantial:

- Hyper-personalization: AI can tailor user interfaces, app recommendations, and even communication styles to individual users.

- Predictive Services: Anticipating user needs, such as scheduling or travel arrangements, can elevate the luxury experience.

- Web3 Integration: Secure digital wallets and NFTs can offer exclusive ownership benefits and unique digital collectibles.

- Market Differentiation: Positioning Vertu at the forefront of tech innovation will attract a discerning, affluent customer base.

Vertu can significantly expand its market by tapping into the growing global ultra-high-net-worth individual (UHNWI) population, which saw a 4.7% increase in 2023 according to Knight Frank's Wealth Report 2024. The company can also diversify its product line into lucrative segments like luxury wearables, with the global market projected to reach $10.2 billion by 2027. Furthermore, strategic collaborations with established luxury brands can elevate Vertu's brand prestige and access new affluent consumer bases, with such partnerships potentially increasing brand visibility by 30%.

Threats

Major tech players like Apple and Samsung are intensifying competition by releasing ultra-premium versions of their flagship phones. These devices, featuring high-end materials and advanced tech, are increasingly appealing to affluent consumers, even if they lack Vertu's extreme exclusivity. For instance, the Samsung Galaxy S24 Ultra and the iPhone 15 Pro Max represent significant technological advancements at price points considerably lower than traditional Vertu offerings.

This trend means that while Vertu targets the pinnacle of luxury, mainstream brands are encroaching on the premium segment with compelling technology and design. Consumers seeking a blend of advanced features and a prestigious brand may find these alternatives more attractive, especially given the significant price difference. Apple's reported profit margin on iPhones, often exceeding 40%, allows for substantial investment in premium materials and features that directly compete with the luxury market.

The vast research and development budgets of these tech giants present a persistent threat. Their ability to rapidly innovate and integrate cutting-edge technology, such as advanced camera systems and faster processors, means Vertu must constantly strive to differentiate itself beyond material luxury. The continuous innovation cycle in the smartphone industry, where flagship models are updated annually, puts pressure on any player in the premium space.

Global economic instability poses a significant threat to Vertu Corp. Ltd. Should a global recession occur, or if consumer spending habits shift dramatically, demand for ultra-luxury smartphones could decline. For instance, a move towards minimalist luxury or sustainable consumption, rather than ostentatious displays of wealth, could reduce the appeal of Vertu's high-priced devices.

Changing generational values also present a challenge. As younger generations, like Gen Z and Millennials, increasingly prioritize experiences and environmental consciousness, the allure of purely status-driven luxury goods might wane. Vertu's reliance on overt luxury could be undermined if these demographic shifts gain momentum.

Furthermore, growing consumer awareness of environmental impact could affect purchasing decisions. If Vertu is perceived as not aligning with sustainable practices, it could alienate a segment of the market, particularly younger, affluent consumers who are more environmentally aware. For example, reports from 2024 indicate a growing consumer preference for brands demonstrating strong ESG (Environmental, Social, and Governance) credentials, a factor that could impact even the luxury sector.

The allure of Vertu's luxury smartphones unfortunately makes them a prime target for counterfeiters. These fake products, often of lower quality, can significantly damage Vertu's premium image and erode the trust consumers place in the brand's authenticity. Reports from 2023 indicated a rise in sophisticated counterfeits across luxury goods markets, a trend that directly impacts high-value electronics like Vertu.

The increasing sophistication of these counterfeit offerings makes them harder to distinguish from genuine Vertu devices, posing a substantial threat to the brand's exclusivity and perceived value. This proliferation directly dilutes the brand's carefully cultivated image of unparalleled craftsmanship and cutting-edge technology.

Combating this threat requires a robust strategy focused on protecting Vertu's intellectual property rights and implementing stringent controls over its distribution networks. This includes active monitoring of online marketplaces and collaborating with law enforcement to seize illicit products, a costly but necessary endeavor to preserve brand integrity.

Rapid Technological Obsolescence

The mobile industry's relentless pace of innovation poses a significant threat. Even premium specifications can become outdated rapidly, impacting Vertu's appeal to consumers who value cutting-edge technology. A delay in integrating advancements like next-generation processors or enhanced camera systems could alienate a segment of its target market, irrespective of the device's luxury materials.

To counter this, Vertu must maintain substantial research and development investments. For context, the global smartphone market saw shipments reach approximately 285 million units in Q1 2024, highlighting the speed of product cycles. Failing to keep pace with key technological shifts, such as widespread 5G adoption or new display technologies, risks making Vertu devices feel dated despite their premium build.

- Technological Lag: A failure to quickly integrate new processors, camera tech, and connectivity standards like 5G.

- Consumer Perception: Tech-savvy luxury buyers may overlook high-end materials if devices lack the latest performance features.

- R&D Necessity: Continuous investment is crucial to remain competitive in a rapidly evolving market.

- Market Dynamics: The average smartphone upgrade cycle is around 2-3 years, compressing the window for relevance.

Limited Market for Niche Ultra-Luxury Devices

The market for ultra-luxury mobile devices, where prices can reach tens of thousands of dollars, is exceptionally small and caters to a very specific clientele. This inherently limited demand means Vertu's sales figures are sensitive to even modest economic fluctuations or changes in the preferences of its high-net-worth customer base. For example, while specific sales figures for Vertu in recent years are not publicly disclosed, the broader luxury goods market, which includes high-end electronics, experienced a slowdown in some segments during 2023, with reports indicating cautious spending among some affluent consumers.

This restricted market size poses a significant risk, as any downturn in the global economy or a shift in luxury spending habits can disproportionately affect Vertu's revenue and profitability. For instance, the ultra-luxury segment of the smartphone market is estimated to be a fraction of the overall smartphone market, potentially in the tens of thousands of units globally per year, rather than millions.

Furthermore, Vertu faces the considerable challenge of expanding its reach without compromising the exclusivity and prestige that define its brand. Attempting to attract a broader customer base could dilute the very essence of what makes Vertu desirable to its core demographic, potentially alienating existing customers.

Key considerations regarding this limited market include:

- Highly specialized customer base: Vertu's target demographic is extremely niche, making it vulnerable to shifts in their spending power and preferences.

- Disproportionate impact of market changes: Even small economic downturns or competitive pressures can significantly affect sales volumes in such a confined market.

- Brand dilution risk: Efforts to broaden appeal could undermine the exclusivity that justifies the devices' high price points.

- Limited scalability: The inherent nature of the ultra-luxury market restricts the potential for significant sales volume growth.

Major tech players like Apple and Samsung are intensifying competition by releasing ultra-premium versions of their flagship phones, encroaching on Vertu's luxury niche. These devices, offering advanced technology at lower price points, appeal to affluent consumers. For instance, the Samsung Galaxy S24 Ultra and iPhone 15 Pro Max showcase significant tech advancements, making Vertu's extreme exclusivity a harder sell, especially with Apple's high profit margins enabling premium feature integration.

The rapid pace of innovation in the mobile industry presents a constant threat, as even premium specifications can quickly become outdated. Vertu must invest heavily in R&D to integrate new processors, camera tech, and connectivity standards like 5G to remain relevant. The average smartphone upgrade cycle of 2-3 years means Vertu's devices risk feeling dated if they don't keep pace with technological shifts, despite their luxury materials.

Global economic instability and changing generational values pose significant risks to Vertu. Economic downturns could reduce demand for ultra-luxury items, while younger generations prioritizing experiences and environmental consciousness may find overt luxury less appealing. Growing awareness of environmental impact could also affect purchasing decisions if Vertu is perceived as not sustainable, a factor increasingly important to affluent consumers.

The market for ultra-luxury mobile devices is exceptionally small and highly specialized, making Vertu vulnerable to economic fluctuations and shifts in high-net-worth consumer preferences. This limited demand restricts scalability and increases the risk of brand dilution if Vertu attempts to broaden its appeal, potentially alienating its core customer base.

SWOT Analysis Data Sources

The data sources for this Vertu Corp. Ltd. SWOT analysis include their latest financial reports, comprehensive market research on the luxury mobile sector, and expert opinions from industry analysts to provide a well-rounded view.