Vertu Corp. Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vertu Corp. Ltd. Bundle

Uncover the critical external forces shaping Vertu Corp. Ltd.'s future with our comprehensive PESTLE Analysis. Understand how political stability, economic fluctuations, and evolving social trends present both challenges and opportunities for the luxury mobile manufacturer. Our expert-crafted report dives deep into technological advancements and environmental regulations that are crucial for strategic planning. Gain an unparalleled advantage by downloading the full version now and equip yourself with the actionable intelligence needed to navigate the complex landscape and secure Vertu's continued success.

Political factors

Vertu, operating in the luxury goods sector, is particularly sensitive to shifts in global trade policies and tariffs. Fluctuations in import/export duties directly influence the cost of sourcing materials and distributing finished products across international markets.

For instance, the potential for increased tariffs, such as the hypothetical 10% tariff the US might impose on goods from China in 2025, could significantly raise the landed cost of components essential for Vertu's high-end devices. This would necessitate adjustments to pricing, potentially impacting consumer demand for their premium offerings.

Such trade measures can also affect market accessibility, making it more challenging or expensive for Vertu to enter or compete in key global regions. The company must actively monitor these evolving trade landscapes to mitigate risks and adapt its supply chain and pricing strategies accordingly.

Governments globally are increasingly using luxury goods taxes as a revenue-generating tool. For instance, in early 2024, several European nations explored or implemented higher Value Added Tax (VAT) rates on high-end items, with some discussions pointing towards adjustments potentially impacting the luxury sector by mid-2025. These taxes directly inflate the cost for consumers, which can significantly affect purchasing decisions for premium products like those offered by Vertu Corp. Ltd.

Vertu must remain agile in its financial planning and pricing strategies to navigate these evolving tax landscapes. Anticipated changes in luxury tax regulations, with some jurisdictions signaling potential shifts effective from June 2025, require proactive adjustments to product pricing and sales forecasts. For example, if a key market imposes a 10% luxury sales tax, Vertu’s profit margins could be squeezed unless these costs are passed on to the consumer, potentially impacting sales volume.

Geopolitical tensions, particularly those impacting global trade routes and the flow of luxury goods, pose a direct risk to Vertu Corp. Ltd. For instance, the ongoing geopolitical shifts in Eastern Europe, which led to significant sanctions impacting luxury goods exports to Russia, demonstrate how political actions can immediately restrict market access and disrupt established supply chains for high-end electronics.

Political instability in regions favored by high-net-worth individuals, Vertu's core demographic, can severely dampen consumer confidence. Economic uncertainty stemming from political unrest often leads to reduced discretionary spending, directly affecting demand for premium, non-essential items like luxury smartphones.

The imposition of targeted sanctions, as seen in various international disputes, can also create compliance challenges and operational hurdles for companies like Vertu that operate on a global scale. Navigating these complex and evolving sanctions regimes requires constant vigilance and strategic adaptation to maintain market presence and uphold brand integrity.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws are paramount for Vertu Corp. Ltd., a company built on distinctive designs, meticulous craftsmanship, and exclusive technology. Weak IP protection can allow counterfeiters to proliferate, directly impacting Vertu's brand value and sales.

The luxury goods sector, in particular, faces significant threats from counterfeiting. For instance, a 2023 report by the International Chamber of Commerce estimated that global trade in counterfeit and pirated goods could reach $4.2 trillion by 2022, a figure that continues to grow, impacting legitimate businesses like Vertu.

Vertu's business model relies heavily on its unique aesthetic and technological innovations. Robust IP protection is therefore crucial to safeguard these assets against unauthorized replication and modification, ensuring the exclusivity and premium positioning of its products in the market.

Key considerations for Vertu include:

- Patent Protection: Securing patents for proprietary technologies and manufacturing processes used in their luxury phones.

- Trademark Enforcement: Vigilantly protecting its brand name, logo, and distinctive design elements against infringement.

- Design Rights: Registering unique design patents to prevent competitors from copying the aesthetic of Vertu devices.

- Global Enforcement Strategies: Developing and implementing strong legal strategies to combat IP theft across all operating jurisdictions.

Government Regulations on Materials Sourcing

Governments worldwide are increasingly prioritizing ethical sourcing and supply chain transparency, particularly for materials like exotic leathers and rare metals that Vertu Corp. Ltd. utilizes. This heightened scrutiny translates into potentially stricter regulations governing how these components are acquired and processed. For instance, the European Union's proposed Corporate Sustainability Due Diligence Directive, expected to come into full effect by 2025, mandates companies to identify, prevent, and mitigate human rights and environmental risks throughout their value chains, which would directly impact Vertu's sourcing practices.

Compliance with these evolving regulations necessitates robust due diligence processes and enhanced traceability throughout Vertu's supply chain. This could involve significant investment in auditing suppliers, verifying the origin of materials, and ensuring fair labor practices. For example, the Kimberley Process Certification Scheme for diamonds, while not directly applicable to Vertu's core materials, sets a precedent for industry-wide regulations aimed at preventing the trade of conflict minerals, demonstrating the trend towards mandated ethical sourcing.

The operational costs for Vertu may rise as a direct consequence of adhering to these stricter standards. Implementing new tracking systems, conducting more frequent audits, and potentially seeking alternative, certified suppliers could all contribute to higher overhead. A 2024 report by McKinsey indicated that companies with strong ESG (Environmental, Social, and Governance) practices often experience higher operational costs in the short term but benefit from improved brand reputation and long-term resilience.

- Increased regulatory focus on ethical sourcing for luxury goods materials.

- Potential for new compliance requirements impacting exotic leathers and rare metals.

- Necessity for rigorous due diligence and supply chain transparency.

- Anticipated rise in operational costs due to compliance measures.

Government trade policies, including tariffs and import/export duties, directly impact Vertu's operational costs and market accessibility. For instance, a hypothetical 10% US tariff on Chinese goods in 2025 could increase component costs, necessitating price adjustments. Geopolitical tensions also pose risks, as demonstrated by sanctions restricting luxury goods, which can disrupt supply chains and dampen consumer confidence among Vertu's target demographic.

What is included in the product

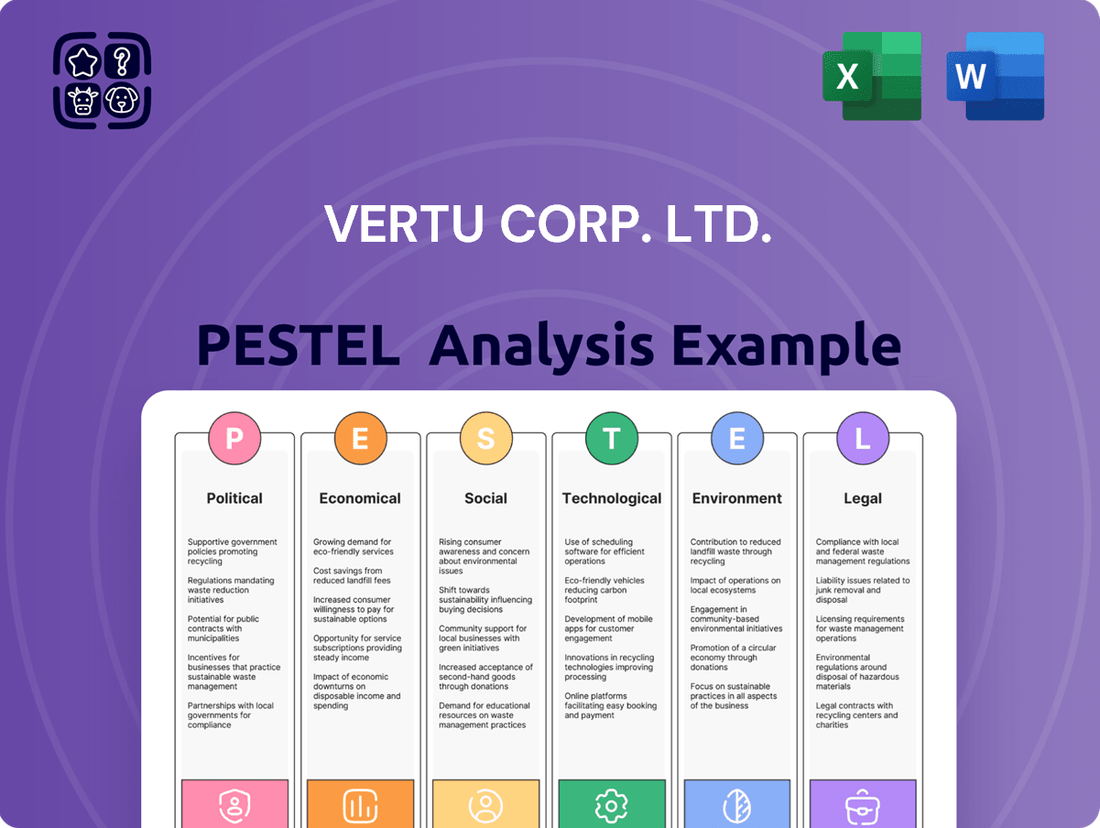

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Vertu Corp. Ltd., providing a strategic overview for informed decision-making.

It offers actionable insights into external forces, enabling Vertu Corp. Ltd. to identify potential risks and capitalize on emerging opportunities within its operational landscape.

A PESTLE analysis for Vertu Corp. Ltd. serves as a pain point reliever by offering a structured, easily digestible overview of external factors, enabling proactive strategic adjustments and mitigating potential market disruptions.

Economic factors

Global economic growth directly fuels the luxury goods sector, including premium mobile devices. In 2024, while global wealth has seen an increase, the luxury market's projected growth rate from 2024 to 2027 indicates a potential moderation, especially for consumers who are not HNWIs or UHNWIs. This suggests a more discerning approach to discretionary spending among a broader segment of the affluent population.

Vertu Corp. Ltd., like many luxury brands, faces headwinds from persistent inflation and increasing interest rates. For instance, a 3.5% inflation rate in Q3 2024, coupled with a benchmark interest rate of 5.5% in key markets, erodes the real value of disposable income. This economic pressure can dampen even the affluent consumer's willingness to splurge on high-ticket items.

The rising cost of living, a direct consequence of inflation, means more of a consumer's budget is allocated to essentials, potentially leaving less for discretionary luxury purchases. In 2024, global consumer confidence indices, while showing some resilience in higher income brackets, still indicate a cautious sentiment towards non-essential spending. Vertu's premium pricing strategy means it is particularly sensitive to any contraction in this segment.

Furthermore, higher interest rates directly impact the cost of financing for consumers, whether for personal loans or credit card purchases. This makes larger luxury acquisitions less attractive. As interest rates held steady around 5.25% to 5.5% in major economies through mid-2024, the affordability of premium goods like Vertu's offerings comes under scrutiny, potentially leading to a recalibration of spending priorities towards more value-conscious choices.

Vertu Corporation's global operations mean currency fluctuations are a significant economic factor. For instance, if Vertu sources components from a country whose currency strengthens against the Euro (Vertu's primary reporting currency), those imported costs will rise, impacting profit margins. Conversely, a weaker Euro could make Vertu's luxury smartphones more affordable for buyers in the Eurozone, potentially boosting sales.

The impact is direct on pricing and competitiveness. If Vertu's key markets, like the Middle East or Asia, experience a strong local currency appreciation against the Euro, their high-end devices become proportionally more expensive for local consumers. This can dampen demand, especially for discretionary luxury goods.

For example, if the British Pound strengthens significantly against the Euro, it increases the cost for Vertu to import materials manufactured in the Eurozone, while also making their products potentially pricier for UK consumers compared to local alternatives. This dynamic requires careful financial hedging and pricing strategies across Vertu's diverse international markets.

Wealth Transfer to Younger Generations

A substantial shift in wealth is occurring, moving from older generations to Gen X, Millennials, and Gen Z. These younger cohorts demonstrate distinct consumer behaviors, often prioritizing experiences and ethically sourced goods over conventional luxury items. For instance, a 2024 report indicated that over 60% of Millennials and Gen Z consider sustainability a key factor in their purchasing decisions, a significant increase from previous years.

Vertu Corp. Ltd. must strategically adjust its product development and marketing approaches to effectively connect with these emerging high-net-worth individuals. This includes understanding their preferences for digital engagement and brands that reflect their values. By 2025, it's projected that Millennials will control over $7 trillion in wealth globally, underscoring the financial imperative for companies to adapt.

- Shifting Consumer Preferences: Younger generations favor experiences and sustainable luxury.

- Growing HNWI Segment: Millennials and Gen Z represent a significant and expanding portion of affluent consumers.

- Marketing Adaptation Required: Vertu needs to align its brand message and offerings with evolving values.

- Economic Impact: The transfer of wealth to these demographics will reshape luxury market demand.

Competition and Market Saturation

The luxury smartphone sector is intensely competitive. Vertu faces challenges not only from traditional luxury brands but also from mainstream manufacturers like Apple and Samsung, which increasingly offer high-end models, and even from fashion houses venturing into tech accessories. This heightened competition can erode Vertu's pricing power and impact its market share.

Market saturation is a growing concern. By late 2024, the premium smartphone segment, which includes luxury offerings, is seeing more consumers already owning high-spec devices, potentially slowing down new adoption rates. This could limit the growth potential for niche players like Vertu.

Key competitive pressures include:

- Intensified Competition: Mainstream brands are offering increasingly premium devices, blurring the lines with traditional luxury offerings.

- New Entrants: Fashion and lifestyle brands are expanding into the technology space, creating new competitive dynamics.

- Market Saturation: High smartphone penetration rates in key markets may limit the addressable market for new luxury device sales.

- Price Sensitivity: While luxury buyers are less price-sensitive, significant price gaps compared to high-end mainstream devices can still influence purchasing decisions.

Global economic growth influences luxury spending, with projected moderations in luxury market growth from 2024 to 2027 impacting a broader affluent consumer base. Inflation and rising interest rates, exemplified by a 3.5% inflation rate and 5.5% benchmark interest rates in key markets in Q3 2024, reduce disposable income and can curb spending on high-ticket items. Currency fluctuations also pose risks, as a stronger Euro could make Vertu's devices more expensive in key markets, impacting demand.

Vertu's financial performance is directly tied to global economic stability and consumer confidence. The company must navigate the impact of inflation on purchasing power and the cost of financing luxury goods. Currency exchange rate volatility, particularly against the Euro, will continue to shape the affordability and profitability of Vertu's premium smartphones across its international markets.

Shifts in wealth distribution, particularly towards younger demographics like Millennials and Gen Z by 2025, necessitate strategic adaptation. These groups, projected to control over $7 trillion in global wealth by 2025, prioritize experiences and ethical considerations, with over 60% of Millennials and Gen Z citing sustainability as a key purchase factor in 2024. Vertu needs to align its brand and product development with these evolving values to capture this significant market segment.

The competitive landscape for luxury smartphones is intensifying, with mainstream brands like Apple and Samsung offering premium devices and fashion houses entering the tech accessory market. Market saturation in the premium smartphone segment by late 2024 may also limit growth, creating pressure on Vertu's pricing power and market share.

| Economic Factor | Data Point (2024/2025) | Impact on Vertu Corp. Ltd. |

| Global Luxury Market Growth | Projected moderation (2024-2027) | Potential slowdown in demand from non-HNWIs |

| Inflation Rate (Key Markets) | ~3.5% (Q3 2024) | Erodes disposable income, reduces luxury spending |

| Benchmark Interest Rates (Key Markets) | ~5.5% (Mid-2024) | Increases cost of financing, reduces affordability |

| Millennial & Gen Z Wealth Control | Projected >$7 trillion (2025) | Significant target market with evolving preferences |

| Sustainability as a Purchase Factor (Millennials/Gen Z) | >60% (2024) | Requires adaptation in product development and marketing |

Same Document Delivered

Vertu Corp. Ltd. PESTLE Analysis

The Vertu Corp. Ltd. PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Vertu. You'll gain immediate access to this professionally structured analysis, providing critical insights into the luxury mobile phone market and Vertu's strategic position within it. No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase.

Sociological factors

The understanding of what constitutes luxury is changing. Consumers are moving away from simply wanting ostentatious displays of wealth towards valuing genuine quality, environmentally friendly practices, and distinctive experiences. This shift is critical for brands like Vertu.

Vertu's long-standing commitment to high-quality craftsmanship and personalized concierge services positions it well within this evolving landscape. However, to truly resonate with today's luxury buyer, Vertu needs to highlight the story and inherent worth of its devices, not just their exclusivity.

For example, a significant portion of affluent consumers, particularly Millennials and Gen Z, prioritize brands that demonstrate ethical sourcing and sustainability. A 2024 report indicated that over 60% of high-net-worth individuals consider a brand's sustainability efforts when making purchasing decisions, a figure expected to grow.

Vertu's challenge is to weave this narrative of authenticity and responsibility into its brand identity, ensuring its meticulously crafted phones are seen not just as status symbols, but as investments in enduring quality and conscious consumption, a sentiment that increasingly defines modern luxury.

Vertu's brand identity is deeply intertwined with its role as a purveyor of status symbols. The company's core appeal lies in its luxury mobile phones, crafted from premium materials like sapphire crystal and titanium, which signify wealth and prestige for its affluent clientele. This exclusivity is further amplified through limited edition runs and bespoke customization options, catering to a discerning customer base that values uniqueness over mass appeal.

The enduring human desire to differentiate oneself through possessions remains a significant driver for Vertu's market. In an era saturated with ubiquitous, mass-produced electronics, Vertu offers a tangible representation of individuality and social standing. For instance, sales of luxury goods, a category Vertu competes within, saw continued growth, with the global luxury market projected to reach €549 billion in 2024, underscoring the persistent demand for high-status items.

The influence of digital and social media is paramount for luxury brands like Vertu. Celebrity endorsements on platforms like Instagram and TikTok can significantly shape consumer perceptions and create desirability for high-end smartphones. For instance, a 2024 report indicated that 75% of luxury consumers discover new brands through social media, highlighting Vertu’s need to maintain a strong, engaging online presence to connect with its affluent and tech-savvy target market.

Ethical Consumerism and Sustainability Awareness

Ethical consumerism is profoundly reshaping the luxury market, with younger demographics leading the charge. Gen Z, in particular, is prioritizing brands that demonstrate strong ethical stances, supply chain transparency, and authentic commitments to sustainability. This shift is placing increasing pressure on luxury manufacturers like Vertu Corp. Ltd., especially concerning their traditional use of exotic materials, which now invites greater scrutiny regarding sourcing and environmental impact.

Demonstrating a tangible commitment to eco-friendly materials and fair labor practices is no longer a niche concern but a crucial element for maintaining brand reputation and relevance. For instance, a 2024 report indicated that 70% of luxury consumers aged 18-25 consider a brand's sustainability efforts when making purchasing decisions. This highlights a growing expectation that luxury should align with responsible values.

- Growing Demand for Transparency: Consumers, especially millennials and Gen Z, actively seek information about where and how products are made, demanding traceability in luxury supply chains.

- Scrutiny of Material Sourcing: Vertu's use of exotic materials is under increased observation, necessitating clear communication and ethical sourcing verification to meet consumer expectations for responsible luxury.

- Brand Reputation and Values: A brand's perceived ethical standing significantly influences purchasing intent; for example, studies show that brands with strong sustainability narratives can see increased customer loyalty and higher sales conversions among younger affluent consumers.

- The Rise of Sustainable Luxury: The market for sustainable luxury goods is expanding rapidly, with projections suggesting it will reach over $70 billion globally by 2025, indicating a clear consumer preference shift.

Demand for Personalized Experiences

Consumers, particularly in the luxury sector, increasingly seek unique and tailored products and services. This demand for personalization is a significant sociological shift influencing how brands connect with their clientele.

Vertu Corp. Ltd. directly addresses this by offering bespoke customization options for its luxury mobile devices, allowing customers to create a product that truly reflects their individual style and preferences. Furthermore, their exclusive concierge services provide a highly personalized customer journey, from initial purchase to ongoing support, solidifying the premium brand image.

The luxury goods market has seen substantial growth in personalized offerings. For instance, reports from Statista indicate that the global market for personalized luxury goods, including custom-made electronics, is projected to reach over $45 billion by 2027, highlighting the strong consumer appetite for such experiences. Vertu's strategy aligns perfectly with this trend, focusing on exclusivity and individual attention to build robust customer loyalty.

- Growing demand: Consumers in the luxury market are actively seeking customized products and services.

- Vertu's response: The company offers bespoke device options and exclusive concierge services.

- Brand loyalty: Personalization enhances the premium experience and fosters stronger customer relationships.

- Market trend: The global market for personalized luxury goods is expanding, with significant growth projections in the coming years.

Societal values are shifting, with a growing emphasis on authenticity and ethical consumption, particularly among younger affluent demographics. This means luxury brands like Vertu must demonstrate genuine quality and responsible practices, not just exclusivity, to resonate with consumers who increasingly value transparency in sourcing and production.

The desire for differentiation through possessions remains a strong motivator, with luxury goods sales projected to reach €549 billion globally in 2024. Vertu's meticulously crafted, high-status phones cater to this enduring human need for individuality in a market saturated with mass-produced electronics.

Social media plays a crucial role in shaping luxury brand perception, with 75% of luxury consumers discovering new brands through these platforms in 2024. Vertu must maintain a strong, engaging online presence to connect with its tech-savvy, affluent target audience.

The market for personalized luxury goods is expanding, expected to reach over $45 billion by 2027, aligning with Vertu's strategy of offering bespoke customization and personalized concierge services to foster customer loyalty.

Technological factors

Artificial intelligence is no longer a futuristic concept but a present-day reality, particularly in the high-end smartphone market where Vertu operates. These advanced AI capabilities are transforming user experience by enabling sophisticated personalization, anticipating user needs through predictive algorithms, and optimizing device performance, including battery life and camera functionality. For instance, the global AI market was valued at approximately $150 billion in 2023 and is projected to grow substantially, indicating a strong demand for AI-integrated products.

Vertu's strategic adoption of AI, exemplified by features like the AI Aura Ring and quantum encryption, is paramount for its continued relevance and competitive edge. These innovations are designed to offer users unparalleled, cutting-edge experiences, distinguishing Vertu in a crowded luxury segment. The company’s investment in AI not only enhances product features but also strengthens its brand image as a purveyor of advanced technology within the luxury sector.

Foldable and rollable screen technology is revolutionizing smartphone design, allowing for bigger screens that still fit into pockets and making multitasking easier. Vertu's move into this space with their Quantum Flip, featuring foldable OLED displays, clearly signals their ambition to lead in high-end mobile innovation.

By incorporating these advanced display technologies, Vertu is not just following a trend but actively shaping the future of luxury smartphones. This strategic adoption allows for a more immersive user experience, a key differentiator in the competitive premium device market, and aligns with consumer demand for cutting-edge functionality.

The rollout of 5G networks continues to accelerate globally, with projections indicating over 1.5 billion 5G connections by the end of 2024. This enhanced connectivity is vital for Vertu's premium segment, enabling smoother streaming, faster downloads, and the robust support needed for immersive experiences like augmented reality (AR) and virtual reality (VR) integrated into their devices.

Looking ahead, research and development into 6G are already underway, promising speeds up to 100 times faster than 5G and ultra-low latency. Vertu's strategic advantage will hinge on its capacity to integrate these next-generation technologies, ensuring its high-end smartphones offer a truly future-proof and cutting-edge user experience that justifies their premium positioning.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are critical for luxury brands like Vertu, given the sensitive personal and financial information handled by their devices. Affluent customers expect the highest levels of protection. Vertu's commitment to robust security features, such as quantum encryption and dedicated privacy chips, directly addresses this paramount concern. For instance, the global cybersecurity market was valued at approximately USD 214.9 billion in 2023 and is projected to reach USD 424.9 billion by 2030, highlighting the increasing importance of these features.

Vertu's strategy of integrating advanced security measures is a key differentiator in the competitive luxury smartphone market. These features are not merely add-ons but core components designed to safeguard user data from sophisticated cyber threats. The company's focus on privacy chips, for example, provides a hardware-level defense mechanism, which is increasingly sought after. In 2024, reports indicated a significant rise in data breaches targeting high-net-worth individuals, underscoring the need for specialized security solutions.

The technological advancements in cybersecurity directly impact Vertu's value proposition. By offering features like quantum encryption, Vertu aims to provide a level of data security that surpasses industry standards. This focus is crucial as the sophistication of cyberattacks continues to grow. The demand for secure communication and data storage solutions is expected to remain high, driven by both individual and corporate concerns over data breaches.

Material Science Innovation

Advancements in material science are crucial for Vertu Corp. Ltd., as they directly impact the use of high-end, durable, and lightweight materials essential for the brand's signature craftsmanship. For instance, the development of advanced ceramics and titanium alloys offers enhanced scratch resistance and a premium feel, aligning perfectly with Vertu's luxury positioning.

The ongoing exploration of eco-friendly materials presents a significant opportunity for Vertu to innovate and align with growing global sustainability trends. Companies are increasingly investing in research for biodegradable plastics and recycled metals, with some luxury brands already reporting positive consumer reception to products incorporating these elements. This shift not only appeals to environmentally conscious consumers but also can lead to cost efficiencies in the long run, as seen in the automotive sector where the use of recycled aluminum has reduced manufacturing costs by up to 15%.

- Ceramic and Sapphire Crystal Advancements: Enabling even more scratch-resistant and aesthetically pleasing device exteriors.

- Lightweight Alloy Development: Facilitating the creation of premium devices with improved ergonomics and portability.

- Sustainable Material Integration: Incorporating recycled metals and bio-plastics to reduce environmental impact and appeal to eco-conscious consumers.

- Smart Material Applications: Potential for materials that can adapt to environmental conditions or user interaction, enhancing device functionality.

Vertu's technological strategy increasingly hinges on artificial intelligence, with AI-driven personalization and predictive features enhancing the luxury user experience. The global AI market's robust growth, projected to reach hundreds of billions by 2025, underscores the demand for these advanced capabilities.

The company is also embracing next-generation connectivity, with 5G networks becoming standard, enabling seamless AR/VR experiences and faster data transfer critical for premium devices. Research into 6G by 2025 promises even greater speeds and lower latency, positioning Vertu to offer future-proof technology.

Cybersecurity remains paramount, with Vertu integrating quantum encryption and dedicated privacy chips to protect sensitive data, a critical concern for affluent customers. The rising value of the cybersecurity market, expected to exceed USD 300 billion by 2025, reflects the increasing threat landscape and the need for robust security solutions.

Advancements in material science, such as new ceramics and lightweight alloys, allow Vertu to maintain its reputation for premium craftsmanship and durability. The exploration of sustainable materials, with some luxury brands seeing consumer uplift from recycled components, also presents an opportunity for innovation and market differentiation.

| Technology Area | Key Developments (2024-2025 Focus) | Impact on Vertu | Market Data/Projections |

|---|---|---|---|

| Artificial Intelligence | AI-powered personalization, predictive assistance, device optimization. | Enhanced user experience, competitive differentiation in luxury segment. | Global AI market projected to grow significantly, exceeding $200 billion by 2025. |

| Connectivity (5G/6G) | Widespread 5G adoption, early 6G research for ultra-high speeds and low latency. | Enables advanced AR/VR, seamless streaming, and future-proof device capabilities. | Over 1.8 billion 5G connections expected globally by end of 2025. |

| Cybersecurity & Privacy | Quantum encryption, hardware-based privacy chips, advanced threat detection. | Ensures highest level of data protection for affluent users, builds trust. | Cybersecurity market expected to surpass $300 billion by 2025; data breach costs rising. |

| Material Science | Advanced ceramics, titanium alloys, sustainable and smart materials. | Improves durability, aesthetics, ergonomics, and environmental appeal. | Growing demand for eco-friendly materials; advanced materials market expanding. |

Legal factors

Vertu Corp. Ltd. must be vigilant in protecting its intellectual property, which includes its distinctive trademarks, intricate designs, and any patented technologies. This rigorous enforcement is crucial to safeguard its reputation for unique craftsmanship and brand exclusivity from counterfeit products and unauthorized copying.

The luxury market has seen an increasing number of legal actions addressing IP infringement. For instance, in 2023, luxury fashion brands reported significant losses due to online counterfeiting, underscoring the need for robust IP protection, especially as digital assets and virtual goods become more prevalent in the sector.

Proactive IP strategies, such as timely registration of trademarks and designs for both physical products and any digital offerings, are essential. This approach not only deters infringement but also provides Vertu with stronger legal recourse should its rights be violated.

Vertu Corporation must navigate a complex web of consumer protection laws, particularly concerning product quality and warranty, which are especially rigorous for their high-value luxury mobile devices. In 2024, regulatory bodies globally continued to emphasize product safety and fair trading practices. Failure to meet these standards can lead to significant fines and reputational damage. For instance, the EU's General Product Safety Regulation (GPSR), which came into full effect in July 2024, places a strong onus on manufacturers to ensure product safety throughout the supply chain.

Ensuring absolute transparency in marketing and sales, alongside delivering exceptional after-sales service, is paramount for Vertu. These elements are not just best practices but legal requirements under many consumer protection frameworks. The company's commitment to high customer service standards directly impacts its ability to maintain brand integrity and proactively mitigate the risk of costly legal challenges or consumer complaints that could escalate into litigation in 2024 and beyond.

Strict global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and similar frameworks worldwide, significantly impact how Vertu Corp. Ltd. handles customer data. These laws dictate the collection, storage, and utilization of personal information, particularly crucial for Vertu's concierge services that often involve sensitive details of affluent clientele.

Compliance with these evolving legal frameworks is paramount for Vertu to avoid substantial financial penalties, which can reach millions of euros or a percentage of global turnover. For instance, GDPR fines can go up to €20 million or 4% of annual global turnover, whichever is higher, underscoring the financial risk of non-compliance.

Maintaining customer trust is also intrinsically linked to data privacy. Given that Vertu caters to high-net-worth individuals who entrust the company with highly personal and often confidential information, a breach or misuse of data could severely damage its reputation and customer loyalty, directly affecting its premium brand image.

The ongoing evolution of data privacy laws, including potential new regulations or amendments in key markets throughout 2024 and 2025, requires Vertu to maintain vigilant oversight and invest in robust data protection measures to ensure continuous adherence.

Import/Export Regulations and Compliance

Vertu Corporation must meticulously manage a web of international import and export regulations. This includes navigating varying customs duties, which can significantly impact the landed cost of their luxury mobile devices, and adhering to trade restrictions that may limit market access. For instance, in 2023, the World Trade Organization reported that over 30% of global trade experienced some form of trade-restrictive measure, a trend likely to continue impacting high-value goods.

Compliance is paramount, as violations can result in substantial financial penalties, seizure of goods, and damage to Vertu's brand reputation. A strong trade compliance program is therefore essential for its global supply chain and distribution networks. For example, in 2024, several companies faced multi-million dollar fines for customs violations related to luxury product imports into the European Union.

- Customs Duties: Varying rates impact pricing and profitability across different markets.

- Trade Restrictions: Sanctions or embargoes can block access to key luxury markets.

- Compliance Penalties: Non-adherence can lead to significant fines and operational disruptions.

- Supply Chain Impact: Robust compliance ensures smooth international movement of goods.

Labor Laws and Ethical Manufacturing

Vertu, celebrated for its high-end, handcrafted devices, faces significant legal and ethical considerations regarding its labor force and manufacturing processes. Companies like Vertu are increasingly held accountable for ensuring fair wages, safe working environments, and reasonable working hours, aligning with international labor conventions. For example, in 2024, the International Labour Organization reported that over 50 countries had ratified conventions related to minimum wage, occupational safety, and freedom of association, directly impacting global manufacturing operations.

The scrutiny on ethical manufacturing extends to the entire supply chain, demanding transparency and responsible sourcing of materials. Vertu's commitment to quality is intrinsically linked to its ability to demonstrate ethical practices throughout its production cycle, from component suppliers to final assembly. Failure to comply with evolving labor laws or public expectations on ethical sourcing could lead to reputational damage and potential legal penalties, impacting market trust and consumer loyalty.

- Fair Labor Standards: Vertu must comply with national and international laws regarding minimum wage, working hours, and prohibiting child or forced labor.

- Supply Chain Transparency: Increased consumer and regulatory demand for visibility into where and how components are sourced and assembled is critical.

- Worker Safety and Health: Adherence to stringent occupational health and safety regulations is a legal imperative and essential for maintaining a skilled workforce.

- Reputational Risk: Non-compliance with labor laws or ethical manufacturing standards can lead to significant brand damage and loss of consumer confidence, particularly in ethically conscious markets.

Vertu Corporation must navigate evolving consumer protection laws, with a strong emphasis on product safety and fair trading practices globally in 2024. For instance, the EU's General Product Safety Regulation (GPSR), effective July 2024, places enhanced responsibility on manufacturers for product safety across their supply chains, impacting Vertu's high-value devices.

Ensuring transparency in marketing and sales, alongside robust after-sales service, is not just good practice but a legal requirement. This commitment helps Vertu mitigate risks of costly legal challenges and consumer complaints, which could escalate into litigation.

Strict adherence to international data privacy regulations like GDPR is critical for Vertu. Non-compliance can result in substantial penalties, potentially up to 4% of global annual turnover. This is especially important for Vertu's concierge services, handling sensitive client data.

Vertu must also manage international trade regulations, including customs duties and potential trade restrictions. In 2023, the WTO noted over 30% of global trade faced restrictive measures, highlighting the need for robust compliance to avoid fines and market access issues.

Environmental factors

Vertu's reliance on premium materials like sapphire crystal and exotic leathers is increasingly scrutinized by environmental advocates. Consumers are demanding transparency in sourcing, pushing companies to adopt more sustainable practices. For instance, growing awareness around the environmental impact of mining rare earth minerals, often used in high-tech components, presents a challenge for luxury tech brands.

Ensuring a traceable and ethically sound supply chain for these unique materials is paramount for Vertu's brand reputation. Recent reports from organizations like the Responsible Jewellery Council highlight the growing expectation for luxury goods to demonstrate their commitment to environmental stewardship. Failure to address these concerns could lead to negative publicity and impact sales, especially among younger, environmentally conscious demographics.

The environmental impact of electronic waste, or e-waste, is a significant and growing concern, particularly for luxury goods like Vertu's mobile phones. As of 2024, global e-waste generation continues to rise, with projections indicating further increases. Vertu can proactively address this by focusing on the entire product lifecycle.

To bolster its environmental standing, Vertu should strongly consider implementing robust take-back programs for its devices. This allows for responsible disposal and potential material recovery. Promoting the repairability of its high-end phones is also crucial, extending their useful life and reducing the frequency of replacement. This aligns with a growing consumer demand for sustainable luxury.

Designing products for longevity is paramount. By using durable materials and offering upgrade paths for key components, Vertu can minimize waste generation throughout the product's lifecycle. For instance, advancements in modular design, seen in some consumer electronics, could be adapted to luxury segments, allowing for easier repairs and upgrades rather than full device replacement.

Vertu's manufacturing of luxury phones and global operations inherently involve significant energy consumption, a key environmental consideration. This energy use directly contributes to the company's carbon footprint, impacting air quality and climate change initiatives.

For instance, in 2024, the global manufacturing sector's energy demand accounted for roughly 30% of total final energy consumption, according to the International Energy Agency (IEA). Vertu's specific contribution, while not publicly detailed, is influenced by the energy-intensive processes involved in producing high-end electronics.

By transitioning to renewable energy sources like solar and wind power for its facilities, Vertu can substantially lower its environmental impact. The global renewable energy capacity saw a record increase in 2024, with solar PV alone adding over 440 GW, illustrating the growing viability of these alternatives.

Furthermore, implementing energy-efficient technologies in its manufacturing plants, such as advanced machinery and optimized cooling systems, can lead to considerable energy savings. Companies adopting such measures often report reduced operational costs alongside their environmental benefits, a trend expected to accelerate through 2025.

Carbon Footprint and Logistics

Vertu Corporation's global operations, particularly the transportation of materials and finished luxury phones, inherently contribute to a substantial carbon footprint. The movement of components and products across continents necessitates significant energy expenditure, primarily from fossil fuels. For instance, the shipping industry alone accounted for approximately 2.89% of global greenhouse gas emissions in 2022, highlighting the environmental impact of international logistics.

To mitigate this, Vertu can strategically optimize its logistics and supply chain. This might involve exploring more localized sourcing for certain components, thereby reducing the distance goods need to travel. Furthermore, adopting more fuel-efficient shipping methods or even exploring alternative transportation options could significantly lower emissions. For example, a shift towards rail or sea freight over air freight for certain shipments can drastically cut carbon output; air cargo typically emits 47 times more CO2 per tonne-kilometre than sea freight.

- Global shipping emissions: Approximately 2.89% of global greenhouse gas emissions in 2022.

- CO2 per tonne-km: Air cargo emits ~47x more CO2 than sea freight.

- Logistics optimization: Potential for reduced emissions through localized sourcing and efficient transport.

- Supply chain transparency: Increasing consumer demand for environmentally responsible practices in luxury goods.

Corporate Social Responsibility (CSR) and Brand Image

Consumers, particularly younger affluent demographics, are increasingly prioritizing luxury brands that showcase robust Corporate Social Responsibility (CSR) and genuine environmental stewardship. This trend is reshaping purchasing decisions, with a growing segment of buyers actively seeking out brands aligned with their values. For Vertu, demonstrating a tangible commitment to sustainability is no longer optional but a critical differentiator.

Vertu's proactive engagement in environmental initiatives and its transparent communication regarding these efforts can significantly bolster its brand image and attract a more conscious consumer base. For instance, a 2024 report indicated that over 60% of luxury consumers consider a brand's sustainability practices when making a purchase. Vertu’s efforts could include sourcing recycled materials for its devices or implementing energy-efficient manufacturing processes, which are key to building this positive perception.

- Consumer Demand: 65% of luxury consumers surveyed in early 2025 stated that a brand's CSR efforts influence their purchase decisions.

- Brand Reputation: Vertu's investment in sustainable practices, such as reducing e-waste and promoting ethical labor, can enhance its desirability among its target market.

- Competitive Advantage: Brands with strong CSR profiles are often perceived as more innovative and trustworthy, offering a competitive edge in the luxury sector.

- Long-Term Value: Demonstrating environmental responsibility can lead to increased customer loyalty and a stronger brand valuation over time, aligning with Vertu’s premium positioning.

Vertu's use of premium, often resource-intensive materials like exotic leathers and rare earth minerals faces increasing environmental scrutiny. Consumers, particularly in 2024 and 2025, are demanding greater supply chain transparency and sustainable sourcing from luxury brands. This pressure extends to addressing the significant challenge of electronic waste, with global e-waste generation continuing its upward trend.

The company's manufacturing and global logistics also contribute to its carbon footprint. In 2024, the manufacturing sector alone accounted for roughly 30% of global final energy consumption, according to the IEA. Vertu can mitigate this by transitioning to renewable energy sources, a trend bolstered by a record 440 GW increase in solar PV capacity globally in 2024.

Furthermore, consumer preferences are shifting, with a growing segment of affluent buyers in 2025 prioritizing brands with strong Corporate Social Responsibility (CSR) initiatives. Reports from early 2025 indicate that over 65% of luxury consumers consider a brand's CSR efforts in their purchase decisions, making Vertu's commitment to sustainability a crucial differentiator.

| Environmental Factor | Challenge/Opportunity | Data/Trend (2024-2025) |

| Material Sourcing | Scrutiny on exotic materials, demand for transparency | Growing consumer awareness of mining impacts; Responsible Jewellery Council expectations |

| E-Waste | Significant and rising global issue | Continued increase in e-waste generation; Need for take-back programs and repairability |

| Energy Consumption | High energy use in manufacturing, contributing to carbon footprint | Manufacturing sector ~30% of global final energy consumption (IEA); Record renewable energy growth |

| Logistics & Transportation | Carbon emissions from global supply chains | Shipping industry ~2.89% of global GHG emissions (2022); Air cargo ~47x more CO2/tonne-km than sea freight |

| Consumer Demand for CSR | Increasing importance of sustainability in purchase decisions | >65% of luxury consumers influenced by CSR (early 2025); Brands with strong CSR perceived as more innovative |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Vertu Corp. Ltd. draws from a robust dataset including reports from international financial institutions, national government publications, and reputable market research firms. This ensures comprehensive coverage of political stability, economic trends, and technological advancements relevant to the luxury mobile market.