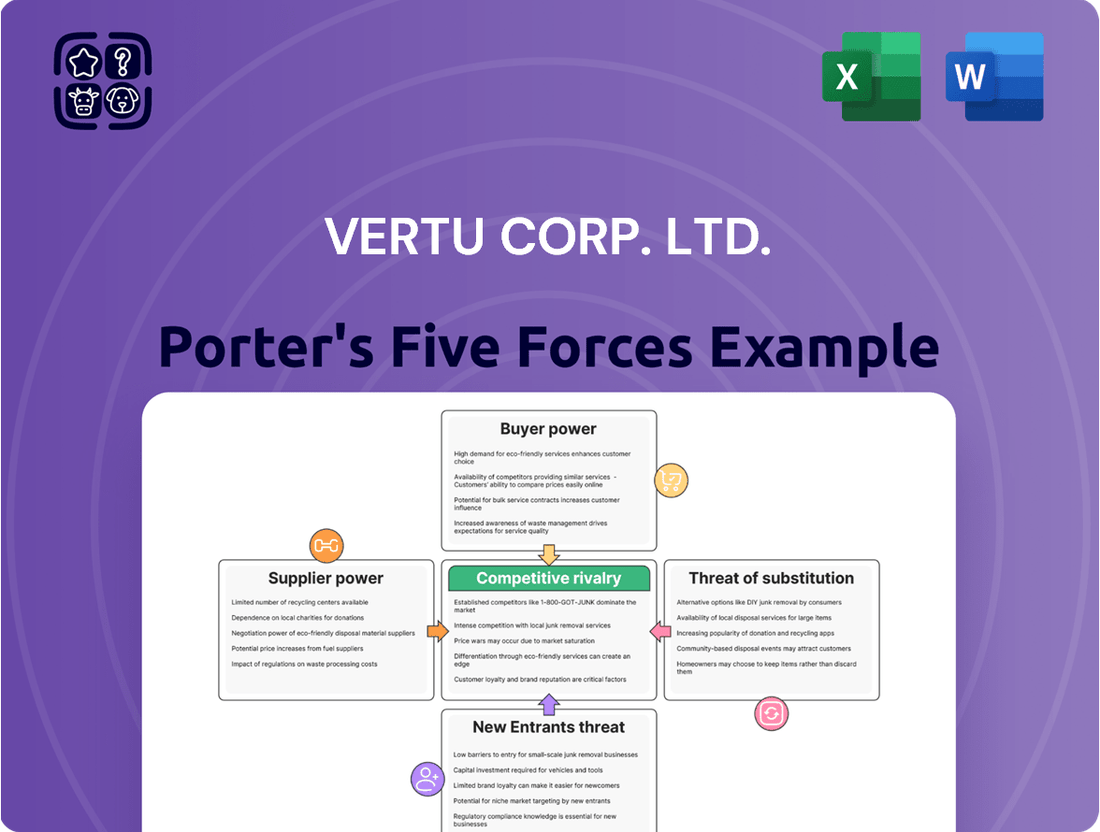

Vertu Corp. Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vertu Corp. Ltd. Bundle

Vertu Corp. Ltd. operates in a market characterized by moderate to high bargaining power of buyers, given the luxury nature of its products and the availability of alternatives. The threat of new entrants is relatively low due to high capital requirements and established brand loyalty. However, the threat of substitutes, particularly high-end smartphones from established tech giants, poses a significant challenge.

The competitive rivalry within the luxury mobile phone sector is intense, with established players vying for market share. Supplier power is also a consideration, as Vertu relies on specialized components and craftsmanship. Understanding these forces is crucial for Vertu's strategic positioning and long-term success.

The complete report reveals the real forces shaping Vertu Corp. Ltd.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Vertu's reliance on specialized materials like sapphire crystal, titanium, and exotic leathers means suppliers of these unique components hold significant bargaining power. The limited availability and stringent quality requirements for such premium resources concentrate power with a select few providers.

The global sapphire glass market, for example, is projected for robust growth. In 2024, it's estimated to reach over $1 billion, driven by demand from luxury watches and high-end electronics, suggesting that Vertu's suppliers of this material are in a strong position due to broader market demand.

Vertu Corp. Ltd.'s commitment to meticulous craftsmanship signals a dependence on highly skilled artisans and specialized manufacturing techniques. This reliance on unique expertise, particularly in areas like fine watchmaking or bespoke electronics, means these skilled labor pools can exert significant bargaining power, demanding premium wages and favorable terms. For instance, in 2024, the average hourly wage for specialized craftspeople in luxury goods manufacturing saw an increase, reflecting the scarcity and demand for such talent.

Vertu Corp. Ltd., despite its emphasis on luxury, relies on advanced mobile technology, meaning suppliers of proprietary components hold significant bargaining power. If Vertu sources critical elements like custom chipsets or unique display technologies from a select few specialized tech firms, these suppliers can dictate terms, impacting Vertu's costs and product development timelines. The rapid evolution of the high-end smartphone sector, particularly with AI and 5G integration, often necessitates proprietary components, further amplifying supplier leverage. For instance, the global semiconductor market, crucial for chipsets, saw revenues reach an estimated $600 billion in 2023, with specialized suppliers often commanding premium pricing.

Concierge Service Partnerships

Vertu Corp. Ltd.'s exclusive concierge services rely on partnerships with premium providers. If these partners offer unique or highly specialized support, their leverage over Vertu increases significantly. The luxury concierge market is experiencing robust growth, attracting high-net-worth individuals, further strengthening these suppliers' positions.

Consider the impact of exclusive access to certain luxury travel or event management services. For instance, if a single, highly reputable global concierge firm holds exclusive contracts for VIP access to major international sporting events, Vertu's dependence on them would be considerable. This exclusivity translates directly into higher costs or less favorable terms for Vertu. The global luxury travel market, a key segment for high-end concierge services, was projected to reach over $1.5 trillion by 2023, indicating substantial supplier power in this niche.

- Supplier Concentration: A limited number of elite concierge partners could exert significant pricing power.

- Uniqueness of Service: Highly specialized or exclusive offerings from partners make them difficult to replace.

- Reputation and Brand Association: Partnerships with well-regarded luxury brands lend credibility but also increase supplier leverage.

- Switching Costs: Vertu may incur substantial costs in finding and integrating new, equally capable concierge partners.

Brand Reputation of Suppliers

The brand reputation of suppliers significantly bolsters their bargaining power for Vertu Corp. Ltd. Luxury material providers often cultivate strong brand recognition within high-end markets. Vertu may depend on these suppliers not only for superior components but also for the inherent prestige their brand name confers, amplifying the supplier's leverage. This is particularly true in the luxury sector where the provenance and quality of materials are critical selling points, directly impacting consumer perception and willingness to pay a premium.

For instance, a supplier of ethically sourced, rare gemstones or uniquely crafted metal alloys might command higher prices due to their established luxury brand association. Vertu's ability to highlight these prestigious origins in its marketing can be a key differentiator, making it difficult to substitute such suppliers without diminishing the product's perceived value. In 2024, the demand for traceable and ethically sourced luxury materials continued to rise, further empowering reputable suppliers in this niche.

- Supplier Brand Prestige: Vertu's reliance on suppliers with established luxury brand reputations increases supplier bargaining power.

- Association with Quality: Strong supplier brands lend an aura of quality and exclusivity to Vertu's products.

- Limited Substitutability: The unique prestige of certain luxury materials makes finding comparable alternatives challenging for Vertu.

- Market Trends: The growing consumer demand for ethically sourced and traceable luxury goods in 2024 enhanced the leverage of reputable suppliers in this segment.

Vertu Corp. Ltd. faces significant bargaining power from its suppliers due to the specialized and often proprietary nature of the materials and components used in its luxury devices. This concentration of power is amplified by the limited number of manufacturers capable of meeting Vertu's stringent quality and exclusivity standards.

The reliance on unique materials like custom-engineered ceramics or specific precious metals means that suppliers of these niche inputs can dictate terms. For example, the global market for advanced ceramics used in high-end applications saw significant growth, with specialized producers holding considerable sway. In 2024, the demand for high-purity technical ceramics was projected to exceed $12 billion globally, underscoring the value and leverage of these specialized suppliers.

Furthermore, the advanced technological components, such as bespoke processors or advanced camera modules, are often sourced from a small pool of tech innovators. These suppliers, critical for Vertu's performance and differentiation, can command premium pricing and influence product roadmaps, impacting Vertu's cost structure and innovation cycle. The increasing complexity of mobile technology, particularly in areas like AI and advanced connectivity, further consolidates power with these key technology providers. The global market for AI chips, for instance, was estimated to reach over $70 billion in 2024, highlighting the substantial influence of chip manufacturers.

| Factor | Impact on Vertu | Supplier Leverage | Supporting Data (2024 Estimates/Projections) |

| Material Uniqueness | High dependence on specialized luxury materials | Strong | Global advanced ceramics market expected to exceed $12 billion |

| Technological Complexity | Reliance on proprietary tech components | Strong | AI chip market projected to exceed $70 billion |

| Supplier Concentration | Limited number of high-quality providers | High | Niche luxury material markets often dominated by few key players |

| Brand Association | Need for suppliers with luxury brand prestige | Moderate to Strong | Luxury goods market continues to grow, valuing supplier reputation |

What is included in the product

Tailored exclusively for Vertu Corp. Ltd., analyzing its position within its competitive landscape by examining the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes.

Effortlessly identify and neutralize competitive threats by visualizing the intensity of each of Porter's Five Forces, providing actionable insights for Vertu Corp. Ltd.

Gain immediate clarity on the strategic landscape by seeing how supplier power, buyer bargaining, and the threat of substitutes impact Vertu Corp. Ltd.'s profitability.

Customers Bargaining Power

Vertu's strategy of targeting affluent customers in a niche market segment grants this group significant bargaining power. These discerning consumers prioritize unparalleled quality, exclusivity, and bespoke service over price, enabling them to dictate specific value propositions to Vertu.

While this niche customer base may be less price-sensitive, their demand for a premium mobile experience means they hold considerable sway. They expect nothing less than perfection and are willing to vocalize their needs, influencing product development and service delivery.

The luxury cell phone market, where Vertu operates, is experiencing robust growth. Projections indicate a substantial increase, fueled by rising disposable incomes among high-net-worth individuals globally, further solidifying the bargaining power of Vertu's affluent clientele.

Affluent customers buying luxury items like Vertu phones have very high expectations for uniqueness and top-notch service. They anticipate personalized attention, exclusive content, and services like a personal concierge.

Their readiness to pay a premium directly links to these elevated expectations. This means they can push Vertu to consistently offer superior value and tailor-made experiences, making it difficult for Vertu to lower prices without risking customer dissatisfaction.

In 2024, the luxury goods market saw continued growth, with demand for personalized experiences rising. For instance, reports indicated that over 60% of high-net-worth individuals prioritize unique experiences and personalized services when making luxury purchases, directly impacting brands like Vertu.

Even with Vertu's exclusive luxury focus, affluent consumers possess significant leverage due to the robust availability of high-end mainstream smartphone alternatives. Devices like the latest Apple iPhone Pro Max or Samsung Galaxy Ultra series offer advanced technology and premium features that directly compete for the attention of wealthy buyers.

In 2024, flagship smartphone models from major brands consistently push the boundaries of innovation, offering sophisticated cameras, powerful processors, and premium build materials. This intense competition in the mainstream luxury segment means customers can find devices that are technologically comparable to Vertu's offerings, often at a substantially lower price point, thereby increasing their bargaining power.

Low Switching Costs (Functional)

From a purely functional standpoint, switching from a Vertu device to another high-end smartphone is straightforward. The monetary costs associated with changing brands are negligible, as most premium smartphones operate on widely adopted operating systems like iOS or Android. This ease of transition means Vertu has limited leverage to retain customers based solely on the device's inherent functionality.

Consider the smartphone market in 2024. Over 85% of the global smartphone market share is dominated by Android and iOS devices, highlighting the widespread compatibility and user familiarity with these platforms. This broad ecosystem makes it simple for users to move between brands without significant technical hurdles or financial penalties, directly impacting Vertu's bargaining power of customers.

- Minimal Monetary Switching Costs: Users can switch between premium smartphone brands without incurring substantial financial penalties.

- Dominant Operating Systems: The prevalence of iOS and Android, used by over 85% of the global smartphone market in 2024, ensures ease of transition.

- Limited Functional Lock-in: Vertu's exclusive features do not create significant functional barriers that prevent customers from adopting alternative devices.

- Psychological vs. Functional Costs: While Vertu may have some psychological switching costs related to its brand prestige, these are outweighed by the low functional barriers to entry for competitors.

Information and Market Transparency

The affluent consumer segment, a core demographic for luxury brands like Vertu Corp. Ltd., demonstrates significant bargaining power due to enhanced information accessibility. These consumers are typically well-versed in luxury market offerings, pricing structures, and the array of alternatives available. This increased market transparency, fueled by readily available online information and reviews, allows them to meticulously compare Vertu's value proposition against other high-end technology and luxury goods.

This heightened awareness empowers affluent customers to negotiate more effectively or seek out better deals. For instance, a consumer researching a new luxury smartphone can easily access comparative pricing, feature breakdowns, and independent reviews from multiple sources. In 2024, the luxury goods market saw continued digital penetration, with a significant portion of high-net-worth individuals making purchasing decisions based on online research and peer recommendations, directly impacting brands' pricing flexibility.

- Informed Decision-Making: Affluent consumers in 2024 are digitally savvy and actively research luxury products, comparing specifications, materials, and brand prestige across various platforms.

- Price Sensitivity Despite Affluence: While less price-sensitive than mass-market consumers, affluent buyers still seek value and are aware of competitive pricing within the ultra-luxury segment.

- Access to Alternatives: The proliferation of luxury tech and high-end lifestyle brands means consumers have more choices, intensifying the need for Vertu to differentiate and justify its premium pricing.

- Impact on Vertu's Pricing Strategy: The transparency and availability of information grant customers leverage, compelling Vertu to maintain a clear and compelling justification for its pricing, potentially influencing promotional strategies or exclusive offers.

Vertu's affluent customer base, characterized by high expectations for exclusivity and service, wields significant bargaining power. Their discerning nature means they can influence product development and service delivery, as they demand perfection and readily voice their needs.

In 2024, the luxury market saw over 60% of high-net-worth individuals prioritize unique experiences and personalized services, directly impacting brands like Vertu by granting customers greater leverage.

The ease of switching between high-end smartphones, coupled with the dominance of iOS and Android (over 85% market share in 2024), minimizes functional lock-in for Vertu customers, further enhancing their bargaining power.

Affluent consumers, empowered by readily available online information and reviews in 2024, meticulously compare Vertu's offerings against competitors, compelling the brand to justify its premium pricing.

| Factor | Impact on Vertu | Evidence (2024 Data) |

|---|---|---|

| Customer Expectations | High demand for exclusivity, bespoke service | Over 60% of HNWIs prioritize unique experiences in luxury purchases |

| Switching Costs | Minimal monetary and functional barriers | iOS/Android dominate over 85% of global smartphone market |

| Information Accessibility | Increased market transparency and comparison | Digital penetration in luxury market drives research-based decisions |

Same Document Delivered

Vertu Corp. Ltd. Porter's Five Forces Analysis

This preview showcases the full Porter's Five Forces analysis for Vertu Corp. Ltd., presenting the exact document you'll receive immediately after purchase, with no placeholders or omitted sections. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the luxury mobile phone market. This detailed report is professionally formatted and ready for your immediate use, offering actionable insights into Vertu's strategic positioning. What you see is precisely what you get—a complete and valuable competitive analysis.

Rivalry Among Competitors

The ultra-luxury mobile phone market, characterized by premium materials and bespoke services, exhibits limited direct competition. Vertu, a prominent player, operates in a niche where brands like Mobiado and Gresso also compete, but the overall number of direct rivals is small. This scarcity of direct competitors within this specific segment means that intense head-to-head battles are less frequent compared to mass-market segments.

Vertu's most significant indirect competition arises from premium smartphone brands such as Apple, Samsung, and Huawei. These giants consistently push the boundaries of technology, offering cutting-edge features and sleek designs that appeal to affluent consumers. For instance, in 2024, Apple's iPhone 15 Pro Max and Samsung's Galaxy S24 Ultra set new benchmarks for performance and camera capabilities, drawing in customers who value innovation and a seamless user experience, often at a fraction of Vertu's price point.

Vertu’s competitive rivalry extends far beyond direct smartphone competitors. The company vies for the disposable income of wealthy consumers against a wide array of luxury goods. This includes prestigious brands in haute horlogerie, the automotive sector, designer apparel, and premium travel services.

For instance, the global luxury watch market was valued at approximately $40 billion in 2023 and is projected to grow at a CAGR of around 5% through 2030, indicating significant consumer allocation towards high-end timepieces. Similarly, the luxury car market, a direct competitor for discretionary spending, saw global sales exceed 3 million units in 2023.

This broad competitive set means Vertu must differentiate itself not just on features, but on the overall lifestyle and status it represents. Affluent customers often have diverse luxury portfolios, making their spending decisions multifaceted.

Brand and Exclusivity as Key Differentiators

Competitive rivalry in the ultra-luxury mobile phone sector is intensely focused on brand prestige and the perception of exclusivity. Vertu, historically, has capitalized on this by offering unique craftsmanship and bespoke concierge services, positioning itself as a lifestyle statement rather than just a communication device. This strategy is vital for maintaining its competitive edge against other high-end brands that also leverage similar differentiators.

The market sees a constant interplay of brands vying for the attention of affluent consumers who seek status and unique experiences. Vertu's ability to consistently deliver on its promise of unparalleled luxury and personalized service directly impacts its standing against competitors. For instance, while specific 2024 market share data for niche ultra-luxury phone segments like Vertu's is not readily available, the broader luxury goods market, which heavily influences consumer perception, saw significant growth. In 2023, the global personal luxury goods market reached €362 billion, indicating a strong appetite for high-value, exclusive items.

- Brand Prestige: Vertu's competitive advantage hinges on its established reputation for luxury and superior build quality.

- Exclusivity: Limited production runs and premium pricing contribute to a sense of exclusivity, a key motivator for its target demographic.

- Concierge Services: The inclusion of personalized 24/7 concierge services provides a tangible, high-value differentiator.

- Lifestyle Association: Vertu phones are marketed as symbols of success and discerning taste, aligning with a high-net-worth lifestyle.

Innovation Pace vs. Craftsmanship Focus

Mainstream smartphone rivals like Apple and Samsung are locked in a fierce race for technological supremacy, constantly pushing boundaries with AI integration and foldable screen technology. For instance, in 2024, Samsung unveiled its Galaxy Z Fold 6 and Z Flip 6, showcasing advancements in display durability and hinge design, while Apple’s iPhone 16 lineup is anticipated to feature significant AI enhancements. This rapid innovation cycle puts pressure on luxury brands like Vertu to not only maintain their heritage of exquisite craftsmanship and premium materials but also to incorporate cutting-edge technology to stay relevant in a discerning market.

Vertu's strategy of emphasizing timeless design and meticulous craftsmanship presents a unique challenge in an industry defined by accelerating technological obsolescence. While Vertu's target demographic values exclusivity and enduring quality, the pace of innovation in the broader smartphone market, with companies like Qualcomm releasing new flagship processors annually, means that even luxury devices must offer compelling technological upgrades to avoid appearing outdated. Balancing the meticulous, multi-week assembly process for a Vertu phone against the rapid development cycles of mass-market competitors necessitates a strategic approach to technology adoption.

- Technological Advancements: Competitors like Apple and Samsung are investing billions in R&D, with Apple’s R&D spending in fiscal year 2023 reaching $22.18 billion, and Samsung consistently investing heavily in areas like AI and display technology.

- Product Cycles: Major smartphone manufacturers typically release flagship models annually, creating a constant stream of new features and performance improvements that Vertu must consider in its own product development.

- Consumer Expectations: Even luxury buyers expect a certain level of technological parity in core functionalities like camera performance, processing power, and connectivity, which are rapidly evolving in the mainstream market.

- Craftsmanship vs. Technology: Vertu's commitment to hand-assembled components and rare materials, a process that can take weeks, contrasts sharply with the mass-production efficiency of its high-tech rivals.

Competitive rivalry for Vertu is characterized by its unique position in the ultra-luxury mobile phone market, facing both direct niche competitors and significant indirect pressure from mainstream premium brands. While direct rivals are few, the constant innovation by giants like Apple and Samsung, evidenced by their substantial R&D investments in 2023—Apple's $22.18 billion—forces Vertu to balance its heritage of craftsmanship with technological relevance. This dynamic means Vertu must differentiate through brand prestige, exclusivity, and exceptional concierge services to capture the attention of affluent consumers whose spending priorities also extend to other luxury sectors like haute horlogerie and automotive, further intensifying the competitive landscape.

| Competitor Type | Key Players | Differentiation Strategy | 2023/2024 Data Point |

|---|---|---|---|

| Direct Luxury Mobile | Mobiado, Gresso | Exclusivity, premium materials | Niche market with limited players |

| Premium Mainstream Smartphones | Apple, Samsung | Technological innovation, AI, design | Apple R&D: $22.18B (FY23); Samsung Galaxy S24 Ultra (2024) |

| Broader Luxury Goods | Luxury Watches, Luxury Cars | Status, lifestyle, heritage | Global luxury watch market: ~$40B (2023); Luxury car sales: >3M units (2023) |

SSubstitutes Threaten

The primary threat of substitutes for Vertu comes from high-end smartphones offered by mainstream brands. Consider Apple's iPhone 17 Pro Max or Samsung's Galaxy Z Fold6 Ultra as prime examples. These devices deliver exceptional performance, cutting-edge camera technology, vast app selections, and premium aesthetics, effectively meeting the fundamental communication and computational demands of wealthy consumers at a considerably lower cost than Vertu.

For affluent consumers, high-end smartwatches and premium wearables present a significant threat of substitution for luxury phones. These devices, often featuring sophisticated materials and advanced functionalities like health monitoring and seamless connectivity, cater to a desire for exclusive, on-the-go technology. For instance, sales of luxury smartwatches like the Apple Watch Hermès collection continue to grow, with the overall smartwatch market projected to reach over 200 million units by 2024, indicating a strong consumer appetite for premium wearable alternatives.

Affluent consumers, those with significant disposable income, have a wide array of luxury goods and experiences to choose from, which directly impacts the demand for luxury mobile phones. For instance, a substantial portion of the global luxury goods market, valued at over $300 billion in 2024, is allocated to items like high-end watches, exotic cars, and haute couture fashion. These alternatives offer comparable social signaling and a sense of exclusivity that a luxury smartphone aims to provide.

The allure of a Patek Philippe watch or a Ferrari sports car can be as potent, if not more so, than owning a Vertu phone. In 2024, the luxury automotive sector saw continued strong demand, with sales of premium vehicles remaining robust. Similarly, the market for designer apparel and accessories consistently attracts significant spending from the wealthy, indicating that a luxury phone competes for a share of a broader luxury consumption budget.

Exclusive travel, such as private jet charters or luxury resort stays, also represents a significant alternative expenditure for affluent individuals seeking status and unique experiences. These services, often commanding five-figure price tags for a single trip, compete directly for discretionary luxury spending. The ability to signal wealth and taste through experiences rather than possessions is a growing trend, posing a threat to traditional luxury goods, including high-end mobile devices.

Basic Smartphone Paired with Separate Luxury Item

The threat of substitutes for Vertu’s luxury smartphones is amplified by a practical alternative: pairing a high-performing standard smartphone with a separate, non-tech luxury item. This approach caters to consumers seeking both functionality and status. For instance, a user might opt for a flagship device from Apple or Samsung for everyday tasks and communications, while satisfying their desire for exclusivity and craftsmanship through items like a Montblanc pen, Tiffany & Co. jewelry, or a Louis Vuitton handbag. This segmentation allows for cost optimization without sacrificing the aspiration for luxury.

This strategy directly challenges Vertu’s value proposition by offering a more flexible and potentially less expensive way to achieve a similar outcome. In 2024, the global luxury goods market was projected to reach over $370 billion, indicating a strong consumer appetite for status-affirming products. Consumers can allocate a significant portion of this spending towards high-quality, functional smartphones and still have ample budget for distinct luxury accessories, thus mitigating the need for an integrated, all-encompassing luxury device.

- Consumer Preference Shift: A growing segment of affluent consumers prioritizes utility from their primary communication device and seeks luxury in artisanal, non-technological goods.

- Cost-Effectiveness: A premium standard smartphone (e.g., iPhone 15 Pro at around $1,000-$1,200) combined with a luxury accessory can be substantially more affordable than a Vertu device, which often retails for several thousand dollars.

- Brand Diversification: Consumers can mix and match luxury brands across different categories, curating a personal style that a single brand like Vertu might not fully encompass.

- Technological Obsolescence: The rapid pace of smartphone innovation makes high-priced, integrated luxury devices more vulnerable to becoming outdated compared to modular luxury purchases.

Specialized Secure Communication Devices

While Vertu phones are known for luxury and craftsmanship, specialized secure communication devices present a threat of substitution, particularly for a niche segment of high-net-worth individuals prioritizing robust security and privacy. These devices focus on advanced encryption and secure operating systems, offering a functional alternative for those whose primary concern is safeguarding sensitive information rather than brand prestige or opulent design. For instance, companies like Silent Circle or organizations developing government-grade secure communication tools cater to this demand. The market for cybersecurity solutions, which includes these specialized devices, saw significant growth, with global spending on information security expected to reach over $200 billion in 2024. This indicates a growing segment of consumers willing to invest in security features that surpass typical smartphone offerings.

The threat of substitutes for Vertu is amplified by the increasing sophistication and availability of communication technologies that offer enhanced security.

- Focus on Functionality: Specialized devices prioritize military-grade encryption and secure communication protocols, a core feature that Vertu's luxury focus may not fully address.

- Target Audience: High-net-worth individuals and those in sensitive professions are the primary adopters of these secure alternatives, valuing data protection above all else.

- Market Growth: The global cybersecurity market is projected for continued expansion, indicating a strong and growing demand for secure communication solutions, potentially diverting customers from luxury-focused devices.

- Technological Advancements: Ongoing innovation in encryption and secure mobile operating systems by specialized tech firms creates increasingly viable substitutes.

The threat of substitutes for Vertu is significant, primarily stemming from high-end smartphones offered by mainstream brands like Apple and Samsung. These devices provide comparable performance, advanced features, and extensive app ecosystems at a much lower price point than Vertu phones. Additionally, luxury smartwatches and other premium wearables are increasingly capturing the attention of affluent consumers seeking exclusive, on-the-go technology, further diluting the necessity of a dedicated luxury mobile device.

The broader luxury market also poses a substantial threat, as consumers can allocate their considerable disposable income to alternatives like high-end watches, luxury cars, designer fashion, or exclusive travel experiences. These options offer similar social signaling and exclusivity, often at price points comparable to or even exceeding Vertu devices. For instance, the global luxury goods market was valued at over $370 billion in 2024, indicating a vast landscape of competing luxury purchases.

Furthermore, a growing trend involves affluent individuals opting for a high-performing standard smartphone paired with distinct luxury accessories, a strategy that offers both functionality and curated status. This approach allows consumers to enjoy cutting-edge technology from leading smartphone manufacturers while still indulging in the craftsmanship and prestige of brands like Montblanc or Louis Vuitton, often at a more manageable overall cost than a single, integrated luxury device.

| Substitute Category | Examples | Key Value Proposition | Threat Level to Vertu |

|---|---|---|---|

| High-End Mainstream Smartphones | Apple iPhone 17 Pro Max, Samsung Galaxy Z Fold6 Ultra | Advanced features, performance, app ecosystem, premium design | High |

| Luxury Wearables | Apple Watch Hermès, Tag Heuer Connected | Exclusive materials, advanced health tracking, seamless connectivity | Medium |

| Broader Luxury Goods & Experiences | Patek Philippe watches, Ferrari cars, Haute Couture, Luxury Travel | Status signaling, exclusivity, craftsmanship, unique experiences | High |

| Modular Luxury Strategy | Flagship smartphone + luxury accessories (e.g., Montblanc pen, Louis Vuitton handbag) | Flexibility, cost-effectiveness, curated personal style, dual functionality | High |

Entrants Threaten

The luxury mobile phone sector presents a formidable barrier to entry due to the substantial capital required for manufacturing and materials. Sourcing rare and high-end components, such as sapphire crystal for screens and exotic leathers for casings, demands significant upfront investment. Vertu Corp. Ltd., for example, relies on these premium materials, driving up production costs.

Establishing specialized manufacturing facilities equipped for intricate craftsmanship also necessitates a large capital outlay. The production of sapphire glass alone involves considerable costs, contributing to the high barrier to entry for potential new competitors aiming to replicate Vertu's product quality and appeal.

Building brand prestige and trust in the luxury sector is an arduous, multi-decade endeavor. New entrants would find it incredibly difficult to replicate the decades of consistent quality and meticulous marketing that established brands like Vertu have cultivated, a sentiment echoed across the luxury goods market where heritage and exclusivity are paramount.

For instance, while the overall luxury goods market saw a robust growth of 8% in 2024, reaching an estimated €362 billion, newcomers often struggle to gain traction against established players with deep-rooted customer loyalty and recognized prestige.

Vertu's exclusive access to specialized supply chains for exotic materials and highly skilled artisans presents a formidable barrier to new entrants. These suppliers and craftspeople are often scarce and have deep-rooted relationships with established luxury players, making it incredibly difficult for newcomers to replicate Vertu's unique product offerings.

Development of Exclusive Concierge Services and Networks

The development of exclusive concierge services and curated content represents a significant barrier to entry for potential competitors. Establishing the extensive networks and partnerships necessary for such offerings is both complex and costly, requiring substantial upfront investment and considerable time.

New entrants would face the daunting task of replicating Vertu's established global concierge infrastructure. This includes building a comparable service offering and cultivating the deep relationships with luxury providers and discerning clientele that Vertu has nurtured over time. The luxury concierge market, a growing segment, demands a high degree of trust and proven delivery.

Consider the sheer scale of investment required. For example, building a global network similar to Vertu's could easily run into hundreds of millions of dollars. In 2024, the global luxury market itself was valued at over $1.5 trillion, with the luxury services sector a significant and growing component of that. Replicating Vertu's specific, high-touch service model in this environment is a formidable challenge.

- High Capital Investment: Replicating Vertu's global concierge infrastructure demands significant capital.

- Network Complexity: Building and managing exclusive networks and partnerships is inherently complex and time-consuming.

- Time to Market: New entrants would require years to establish a comparable service offering and reputation.

- Market Growth: The growing luxury concierge market makes the barriers to entry even more pronounced due to established player advantages.

Intense Competition from Established Mainstream and Luxury Players

The threat of new entrants for Vertu Corp. Ltd. is significantly shaped by the formidable competition already present. While the direct luxury phone market might appear niche, any new player would immediately confront established giants in the premium smartphone sector. These companies, such as Apple and Samsung, possess enormous financial resources, extensive distribution networks, and powerful brand recognition, making it incredibly difficult for a newcomer to gain traction.

Furthermore, indirect competition from other luxury goods manufacturers entering the tech space also poses a challenge. These established luxury brands can leverage their existing customer loyalty and premium positioning to potentially offer alternative high-end technology products. For instance, brands like Louis Vuitton or Gucci have explored connected accessories, demonstrating how luxury players can expand into adjacent technology markets.

The barrier to entry is therefore elevated not just by the capital required for R&D and manufacturing, but also by the sheer marketing muscle and established customer base of existing players. In 2024, the premium smartphone segment saw continued dominance by these large corporations, with Apple alone holding a significant share of the global market in the over $800 price bracket.

Consider these factors impacting new entrants:

- Established Brand Loyalty: Major smartphone brands have cultivated deep customer loyalty, making switching difficult.

- Economies of Scale: Large players benefit from massive production volumes, reducing per-unit costs.

- Marketing and Distribution Prowess: Competitors have extensive marketing budgets and global distribution channels.

- Technological Advancement: Significant investment in R&D by leading firms creates a high bar for technological innovation.

The threat of new entrants for Vertu Corp. Ltd. is significantly mitigated by the immense capital investment required for both manufacturing and material sourcing. High-end components, like sapphire crystal and exotic leathers, alongside specialized production facilities, demand substantial upfront costs. This financial hurdle, combined with the decades required to build brand prestige and cultivate deep customer loyalty, presents a formidable barrier for any new player aiming to compete in the luxury mobile phone sector.

New entrants face the challenge of replicating Vertu's exclusive access to specialized supply chains and highly skilled artisans, resources that are scarce and deeply integrated with established luxury brands. Furthermore, the complex and costly development of exclusive concierge services and curated content, requiring extensive networks and partnerships, adds another significant layer of difficulty.

The existing competitive landscape, dominated by premium smartphone giants like Apple and Samsung with their vast financial resources, extensive distribution networks, and powerful brand recognition, further elevates the barrier to entry. Even indirect competition from other luxury goods manufacturers expanding into technology, leveraging existing customer loyalty, poses a challenge.

Consider these key factors for new entrants:

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for manufacturing, rare materials, and R&D. | Extremely high; requires substantial funding. |

| Brand Prestige & Loyalty | Decades of building trust and exclusivity. | Very difficult and time-consuming to replicate. |

| Supply Chain & Artisans | Exclusive access to scarce resources and skilled labor. | Challenging to secure comparable quality and uniqueness. |

| Concierge Services & Networks | Complex and costly development of high-touch services. | Requires significant time, investment, and relationship building. |

| Established Competition | Dominance of large tech and luxury brands. | Intense competition from players with significant market share and resources. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Vertu Corp. Ltd. is built on a foundation of publicly available company filings, industry association reports, and reputable market research databases. This ensures a comprehensive understanding of competitive dynamics, supplier power, buyer bargaining, and the threat of new entrants and substitutes.