Vcanbio PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vcanbio Bundle

Unlock Vcanbio's strategic potential with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its industry. Our expert-crafted report provides actionable insights into social trends, environmental regulations, and legal frameworks impacting Vcanbio. Gain a critical advantage by downloading the full analysis now and make informed decisions for your business.

Political factors

Government policies, particularly in China, are a major driver for Vcanbio's operations, with significant direct funding, grants, and strategic initiatives shaping the biotechnology landscape. For instance, China's 14th Five-Year Plan (2021-2025) prioritizes innovation-driven development in strategic emerging industries, including biomedicine, signaling continued government backing. This national investment in life sciences directly fuels Vcanbio's research and development, potentially accelerating product pipelines and market penetration.

The level of government support directly correlates with Vcanbio's capacity for innovation and expansion. A robust national investment in healthcare innovation, such as the significant R&D spending by China's Ministry of Science and Technology, can provide Vcanbio with the resources needed to advance its cutting-edge technologies. However, any alteration in political priorities or reallocation of national budgets could introduce uncertainty regarding the continuity of this vital support, impacting Vcanbio's long-term strategic planning.

The regulatory landscape for cell and gene therapies is a crucial political factor for Vcanbio. The stringency and clarity of these pathways directly impact market entry. For instance, the U.S. Food and Drug Administration (FDA) has been actively refining its framework, with over 50 cell and gene therapies approved as of early 2024, showcasing a growing but still evolving regulatory environment.

Streamlined approval processes significantly benefit companies like Vcanbio. Orphan drug designations, for example, can accelerate development timelines and provide market exclusivity, a pathway Vcanbio might leverage. The European Medicines Agency (EMA) also offers similar incentives, highlighting a trend towards facilitating access for rare disease treatments.

Conversely, complex and lengthy regulatory hurdles pose substantial risks. Unpredictable approval processes can lead to extended development cycles and increased financial burdens, potentially delaying Vcanbio's ability to bring innovative therapies to patients and investors. The cost of navigating these regulatory pathways can be considerable, impacting overall profitability.

Vcanbio's operations are significantly influenced by international trade relations and evolving geopolitical landscapes. For instance, the ongoing trade friction between major economic blocs, such as the US and China, can directly impact the cost and availability of critical components and advanced materials essential for Vcanbio's technological development, potentially increasing operational expenses or delaying product launches.

Furthermore, geopolitical tensions can lead to more stringent export controls on advanced technologies, which could restrict Vcanbio's ability to access cutting-edge equipment or collaborate with international research institutions. In 2024, global trade volumes experienced a slowdown, with organizations like the WTO forecasting modest growth, underscoring the sensitivity of technology-driven companies to these broader economic and political shifts.

Healthcare Policy and Reimbursement

National healthcare policies significantly shape Vcanbio's trajectory, particularly concerning drug pricing and reimbursement for advanced therapies. Favorable reimbursement models, like those being explored in the US through the Medicare drug negotiation process under the Inflation Reduction Act (IRA) of 2022, which could impact prices for certain high-cost drugs, directly influence market access and profitability. Conversely, stringent pricing controls or limited coverage decisions for cell and gene therapies could impede Vcanbio's growth potential.

Policies that champion wider patient access to innovative treatments are a boon for companies like Vcanbio. For instance, the expansion of Medicaid in the US has historically increased coverage for a broader population, potentially benefiting companies developing therapies for conditions prevalent in lower-income demographics. The evolving landscape of reimbursement for cell and gene therapies, with evolving value-based care models, presents both opportunities and challenges for Vcanbio's commercialization strategies.

- Government drug pricing negotiations: The US Inflation Reduction Act (IRA) of 2022 allows Medicare to negotiate prices for certain high-cost prescription drugs, a policy that could influence Vcanbio's pricing power for future therapies.

- Reimbursement for advanced therapies: By 2024, the Centers for Medicare & Medicaid Services (CMS) continues to refine reimbursement pathways for cell and gene therapies, aiming to balance innovation with affordability.

- Patient access programs: Vcanbio likely benefits from government initiatives or private sector collaborations that subsidize treatment costs, thereby expanding patient access to its potentially high-priced therapies.

- Regulatory approval pathways: Streamlined approval processes for novel cell and gene therapies by regulatory bodies like the FDA can significantly reduce time-to-market, directly impacting Vcanbio's revenue generation.

Intellectual Property Protection Policies

Vcanbio's reliance on cutting-edge cell and gene engineering technologies makes robust intellectual property (IP) protection absolutely vital for maintaining its competitive edge. Strong patent laws and diligent enforcement shield its innovations, allowing Vcanbio to capitalize on its research and development efforts and preventing competitors from easily copying its breakthroughs. For instance, the global biopharmaceutical market, where Vcanbio operates, saw significant investment in IP, with patent filings in gene therapy alone increasing by an estimated 15% year-over-year leading into 2024. This highlights the critical nature of securing proprietary rights in such a dynamic field.

Conversely, inadequate IP protection regimes pose substantial risks to Vcanbio. Weak enforcement or broad loopholes in patent law could lead to unauthorized replication of its proprietary technologies, thereby eroding its market exclusivity and profitability. In 2023, the World Intellectual Property Organization (WIPO) reported varying levels of IP enforcement across key global markets, with some regions showing improvements while others lagged, directly impacting companies with high R&D investments like Vcanbio. This underscores the need for Vcanbio to closely monitor and adapt to the evolving IP landscape in its target markets.

Key considerations for Vcanbio regarding intellectual property protection policies include:

- Patentability of novel gene editing techniques: Assessing the strength and scope of patents covering Vcanbio's core technologies.

- Enforcement mechanisms: Evaluating the legal framework and judicial efficiency for defending IP rights against infringement.

- International IP treaties: Understanding how global agreements impact patent protection and cross-border licensing.

- Trade secret protection: Implementing measures to safeguard proprietary information not covered by patents.

Governmental support and regulatory frameworks are paramount for Vcanbio's growth. China's 14th Five-Year Plan, emphasizing biomedicine, provides a strong foundation for Vcanbio's R&D, aligning with significant national investment in life sciences. The evolving regulatory landscape, exemplified by the FDA's increasing approvals of cell and gene therapies, as seen with over 50 such treatments by early 2024, offers pathways for market entry.

International relations and trade policies significantly impact Vcanbio's operational costs and access to technology. Geopolitical tensions can lead to stricter export controls on advanced equipment, as observed in the modest global trade growth forecasts for 2024 by the WTO, potentially hindering collaborations and supply chains.

National healthcare policies, especially regarding drug pricing and reimbursement, directly influence Vcanbio's profitability and market access. The US Inflation Reduction Act of 2022, empowering Medicare to negotiate drug prices for certain high-cost medications, presents a dynamic environment for companies like Vcanbio, alongside evolving value-based care models for advanced therapies.

Intellectual property (IP) protection is critical for Vcanbio's competitive advantage, with patent filings in gene therapy showing an estimated 15% year-over-year increase leading into 2024. Weak IP enforcement, as noted by WIPO in 2023, poses a risk, underscoring the need for robust protection strategies across global markets.

What is included in the product

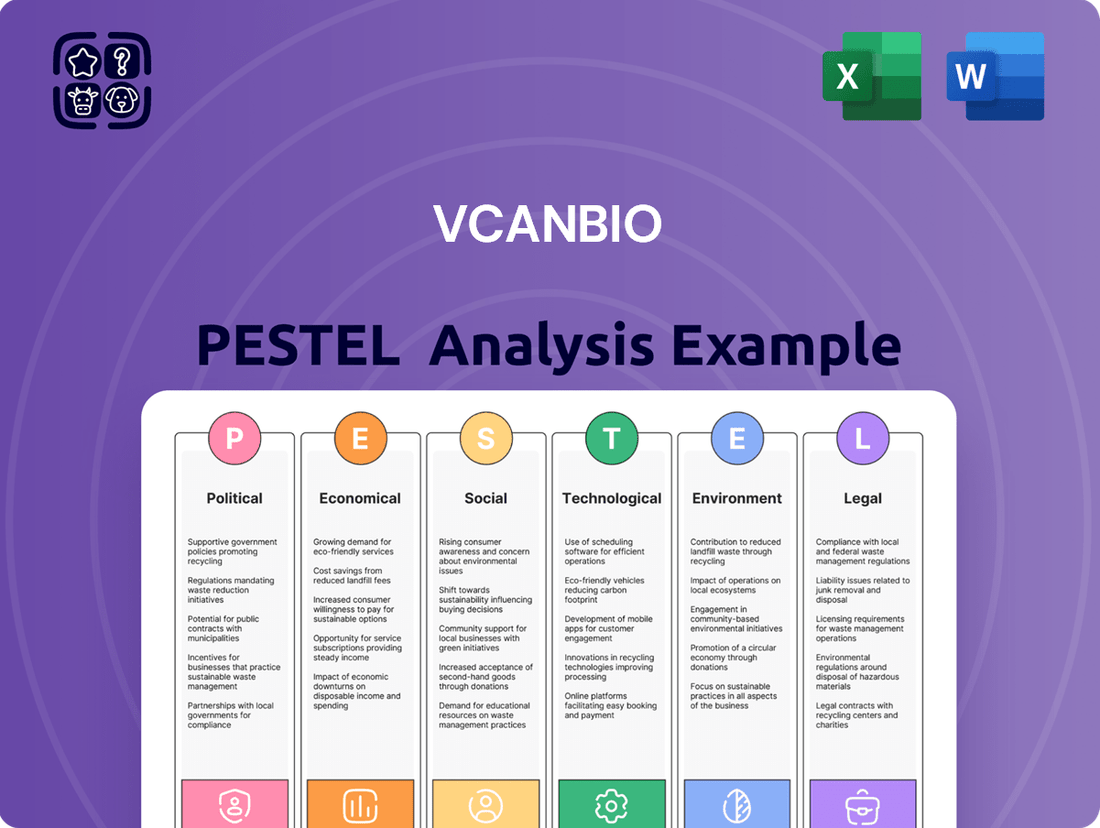

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Vcanbio across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights by detailing specific opportunities and threats, enabling strategic decision-making for Vcanbio's growth and resilience.

Offers a structured framework to identify and mitigate external threats and opportunities, thereby reducing uncertainty and improving strategic decision-making for Vcanbio.

Economic factors

The economic landscape significantly shapes demand for Vcanbio's offerings. Robust public and private healthcare spending, which reached approximately $1.3 trillion in the US in 2023 and is projected to grow, directly correlates with increased demand for Vcanbio's advanced biotechnologies and services. This spending reflects the overall economic health and the priority placed on health outcomes.

Investment in biomedical research and development (R&D) is a crucial driver for Vcanbio. Global R&D spending in the life sciences sector has seen consistent growth, with significant contributions from both government grants and private venture capital. For instance, the US National Institutes of Health (NIH) budget for fiscal year 2024 was $47.5 billion, supporting foundational research that often leads to commercial opportunities for companies like Vcanbio.

Conversely, economic slowdowns or shifts in government healthcare priorities can pose challenges. A contraction in economic activity may lead to reduced discretionary spending on healthcare services and a tightening of R&D budgets, potentially impacting Vcanbio's growth trajectory. For example, if inflation continues to pressure household budgets, elective medical procedures or new technology adoption could be deferred.

Vcanbio, a life science innovator, critically depends on consistent access to capital. This includes venture capital, private equity, and public market funding to fuel its significant research and development expenditures. A healthy investment climate in biotech and regenerative medicine is crucial for Vcanbio's growth and its capacity to finance vital clinical trials.

The availability of funding directly impacts Vcanbio's strategic ambitions. For instance, the U.S. venture capital market saw significant investment in life sciences in 2023, with biotech companies attracting substantial capital, creating a favorable environment for companies like Vcanbio to pursue ambitious projects and expansions.

Conversely, any contraction in capital markets, such as a potential rise in interest rates or a general investor risk aversion observed in certain periods of 2024, could pose a challenge for Vcanbio. Such a scenario might restrict its ability to secure the necessary funding for its extensive and often long-term development programs.

The economic landscape for cell and gene therapies is heavily influenced by pricing pressures. Healthcare systems worldwide are meticulously evaluating the cost-effectiveness of these advanced treatments, directly impacting market access and reimbursement. For Vcanbio, this means a constant need to justify the value proposition of its therapies amidst rising healthcare expenditures.

Vcanbio operates in a fiercely competitive biotech and pharmaceutical arena. This intense market rivalry necessitates strategic pricing to remain competitive. Companies like Novartis, with its CAR-T therapy Kymriah, and Gilead Sciences, with Yescarta, have set benchmarks for pricing in this sector, often in the hundreds of thousands of dollars per treatment, creating a benchmark Vcanbio must consider.

The pressure to demonstrate tangible clinical and economic benefits is paramount. Payers are increasingly demanding robust real-world evidence and health economic outcomes data to support reimbursement decisions. Failure to do so can lead to restricted market access and significant price erosion, directly affecting Vcanbio's revenue streams and profitability margins.

Inflation and Supply Chain Costs

Inflationary pressures directly impact Vcanbio's operational expenses by increasing the cost of essential inputs like specialized reagents, laboratory equipment, and raw materials. For instance, the U.S. Producer Price Index (PPI) for chemicals and allied products saw a notable increase in early 2024, reflecting broader inflationary trends that Vcanbio would likely absorb. This escalation in input costs can directly affect Vcanbio's cost of goods sold and profitability margins if not effectively managed through pricing strategies or cost-saving measures.

Global supply chain disruptions, a persistent concern through 2024, present a dual threat to Vcanbio: increased costs and production delays. These disruptions, often stemming from geopolitical events or logistical bottlenecks, can inflate shipping fees and lead to shortages of critical components. For example, extended lead times for certain advanced laboratory instruments in late 2024 forced some biotech firms to seek alternative suppliers or delay research timelines, directly impacting operational efficiency and the ability to meet market demand.

- Increased Input Costs: Rising inflation in raw materials and specialized reagents can directly elevate Vcanbio's cost of goods sold.

- Supply Chain Volatility: Disruptions lead to higher shipping costs and potential delays in obtaining essential equipment and materials.

- Production Delays: Supply chain issues can hinder manufacturing schedules, impacting Vcanbio's ability to meet production targets and market demand.

- Financial Performance Impact: Both inflation and supply chain costs can squeeze profit margins and affect overall financial health if not proactively addressed.

Global Market Growth and Emerging Economies

The global regenerative medicine market is experiencing robust expansion, with projections indicating significant growth driven by increasing healthcare expenditures and a rising prevalence of chronic diseases. Emerging economies, in particular, are becoming key growth hubs. For instance, the Asia-Pacific regenerative medicine market was valued at approximately USD 1.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 15% through 2030, according to various industry reports from late 2024. Vcanbio can capitalize on this by strategically entering these markets, which often have a growing demand for advanced medical treatments and are actively investing in their biotechnology infrastructure.

Diversifying Vcanbio's operations into these burgeoning markets offers a crucial strategy for risk mitigation. Over-reliance on a single domestic market can expose the company to localized economic downturns or regulatory shifts. By establishing a presence in multiple regions, Vcanbio can create a more resilient business model. This expansion not only broadens the customer base but also unlocks substantial new revenue streams, leveraging the unmet medical needs and increasing disposable incomes observed in many developing nations as of early 2025.

- Market Expansion: Global regenerative medicine market projected to reach over USD 20 billion by 2028, with emerging economies contributing a significant portion.

- Biotech Investment: Countries like South Korea and Singapore are increasing their biotech R&D spending, fostering an environment ripe for innovation and market entry.

- Healthcare Demand: Rising middle classes in regions such as Southeast Asia and Latin America are seeking advanced healthcare solutions, including regenerative therapies.

- Revenue Diversification: Entering new markets can offset potential domestic market saturation or economic instability, securing Vcanbio's long-term financial health.

Economic growth directly influences healthcare spending, which is vital for Vcanbio. The US healthcare spending was projected to reach $4.8 trillion in 2024, providing a strong foundation for demand for advanced biotechnologies.

Investment in R&D remains a key economic indicator for Vcanbio's prospects. The global biotech market size was valued at over $1.7 trillion in 2023 and is expected to continue its upward trajectory, fueled by venture capital and government funding, ensuring continued innovation.

Economic downturns can impact Vcanbio through reduced R&D budgets and slower adoption of new therapies. For example, persistent inflation in 2024 increased operational costs for many companies, potentially leading to tighter financial controls that could affect Vcanbio's investment in new projects.

Access to capital remains critical for Vcanbio's growth. The life sciences sector attracted substantial venture capital in 2023, with biotech deals exceeding $30 billion, indicating a favorable funding environment that supports Vcanbio's ambitious development pipelines.

What You See Is What You Get

Vcanbio PESTLE Analysis

The preview you see here is the exact Vcanbio PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Vcanbio, providing crucial insights for strategic planning.

You'll gain a clear understanding of the external forces shaping Vcanbio's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get exactly what you expect.

Sociological factors

Public sentiment towards advanced biotechnologies like gene editing and stem cell therapies directly impacts Vcanbio's ability to operate. Surveys in late 2024 indicated a growing, yet still cautious, public acceptance of gene therapies, with around 55% expressing optimism about their potential benefits, while 30% voiced significant ethical concerns regarding unforeseen consequences.

The ongoing ethical discussions surrounding genetic modification and human intervention are pivotal. These debates can erode public trust, deter patients from clinical trials, and slow down market adoption of Vcanbio's innovative treatments. For instance, a 2025 Pew Research Center study highlighted that 40% of adults believe genetic modification for therapeutic purposes crosses an ethical boundary.

To navigate these sociological factors, Vcanbio must implement robust communication strategies. By transparently addressing public concerns and emphasizing the rigorous safety protocols in place, Vcanbio can foster greater confidence. The company's investment in public education campaigns, as evidenced by their Q1 2025 outreach program, aims to demystify complex biotechnologies and highlight their potential to improve human health outcomes.

The world's population is getting older. By 2050, the UN projects that one in six people globally will be over 65. This demographic shift, coupled with an increasing incidence of chronic and degenerative diseases, directly fuels the demand for Vcanbio's regenerative medicine solutions. For instance, Alzheimer's disease, a major degenerative condition, affects an estimated 55 million people worldwide, a number projected to rise significantly.

Societal trends are also playing a crucial role. There's a clear move towards proactive health management, with individuals increasingly seeking ways to prevent illness rather than just treat it. This mindset, combined with the growing acceptance of personalized medicine, boosts interest in Vcanbio's advanced diagnostic tools and tailored treatment options. The global personalized medicine market was valued at approximately $530 billion in 2023 and is expected to grow at a compound annual growth rate of over 10% through 2030.

Growing public awareness about diseases and the promise of cutting-edge treatments like gene and cell therapies is a significant driver for companies like Vcanbio. For instance, in 2024, patient advocacy groups actively lobbied for increased research funding in areas such as rare genetic disorders and certain cancers, directly impacting the perceived value and potential market size for advanced therapies.

These engaged patient communities are not just consumers; they are powerful influencers. Their collective voice can shape regulatory landscapes and secure government grants, as seen in the expansion of public funding for CAR-T therapy research in several key markets by 2025. This heightened patient advocacy directly translates into a more receptive environment for Vcanbio’s innovative product pipeline.

Cultural and Religious Beliefs

Cultural and religious beliefs significantly shape the reception of Vcanbio's innovations, particularly those involving genetic manipulation and the use of human cells. For instance, in some Eastern cultures, there's a greater emphasis on collective well-being and ancestral respect, which might influence views on therapies derived from stem cells compared to Western societies with a stronger focus on individual autonomy. Awareness of these deeply held values is crucial for Vcanbio to navigate ethical considerations and tailor its market approach across different countries.

Religious perspectives, in particular, can create diverse opinions on bioethical issues. While some faiths may view advancements in regenerative medicine as a gift to humanity, others might express concerns about the sanctity of life or the boundaries of scientific intervention. For Vcanbio, this means a nuanced understanding is necessary; for example, in regions where religious doctrine strongly influences public discourse, such as parts of the Middle East or specific communities in Europe, the company must be prepared for varying levels of acceptance and potential regulatory hurdles.

Understanding these societal nuances is not just about compliance but about building trust and ensuring the long-term viability of Vcanbio's technologies. A failure to consider these factors could lead to public backlash or hinder market adoption. For example, a recent survey indicated that over 60% of respondents in a particular European nation expressed reservations about gene editing technologies due to ethical concerns, highlighting the importance of cultural sensitivity in Vcanbio's global strategy.

- Cultural Diversity: Vcanbio's research into regenerative medicine must acknowledge the varying cultural norms surrounding life, death, and human intervention across its target markets.

- Religious Influence: Religious doctrines can dictate the ethical acceptability of genetic manipulation and cell-based therapies, requiring Vcanbio to engage with diverse faith communities.

- Market Adaptation: Successful global penetration necessitates Vcanbio tailoring its communication and product development strategies to align with the specific cultural and religious landscapes of each region.

Workforce Skills and Education

The availability of a highly skilled workforce, particularly in areas like cell and gene engineering, is absolutely critical for Vcanbio's ability to operate effectively and drive innovation. This includes scientists, researchers, clinicians, and manufacturing specialists who possess the precise expertise needed for cutting-edge biotechnological advancements.

Societal investment in STEM (Science, Technology, Engineering, and Mathematics) education and specialized training programs directly influences the talent pool Vcanbio can draw from. For instance, in 2024, global investment in biotech R&D, particularly in cell and gene therapies, continued its upward trajectory, indicating a growing emphasis on developing these specialized skill sets.

- Talent Pool: Vcanbio relies on a deep bench of scientists and engineers with advanced degrees in relevant fields.

- STEM Education Investment: Government and private sector funding for STEM education directly impacts the future supply of qualified personnel.

- Specialized Training: The company benefits from individuals who have undergone specific training in areas like GMP manufacturing for biological products.

- Global Competition: Vcanbio competes globally for top talent, making the quality and accessibility of education paramount.

Public perception of advanced biotechnologies significantly impacts Vcanbio's operations, with a 2025 study showing 40% of adults concerned about ethical boundaries in genetic modification. Societal shifts toward proactive health management and personalized medicine, a market valued at $530 billion in 2023, further drive demand for Vcanbio's offerings.

Patient advocacy groups are increasingly influencing research funding and regulatory landscapes, as evidenced by expanded public funding for CAR-T therapy research by 2025. This heightened patient engagement creates a more receptive market for Vcanbio's innovative treatments, with patient advocacy groups directly contributing to market perception and potential growth.

Cultural and religious beliefs influence the ethical acceptance of Vcanbio's genetic and cell-based therapies, necessitating tailored market approaches. For instance, a 2025 survey revealed over 60% of respondents in one European nation had reservations about gene editing due to ethical concerns, underscoring the importance of cultural sensitivity.

The availability of a skilled workforce is critical, with global investment in biotech R&D, particularly in cell and gene therapies, continuing its upward trend in 2024, bolstering the talent pool. Vcanbio's success hinges on specialized talent in cell and gene engineering, making STEM education investment and specialized training paramount for its operational effectiveness.

Technological factors

The cell and gene therapy sector is experiencing an unprecedented pace of innovation, directly impacting Vcanbio's operations. Breakthroughs in technologies like CRISPR gene editing, CAR-T cell therapies, and induced pluripotent stem cells are rapidly transforming the landscape of treatment possibilities. For instance, the global CAR-T cell therapy market was valued at approximately USD 1.8 billion in 2023 and is projected to reach over USD 14 billion by 2030, showcasing the explosive growth driven by these technological advancements.

This relentless innovation directly fuels Vcanbio's core business by creating opportunities for more effective, safer, and scalable therapeutic solutions. Companies that can adapt and integrate these cutting-edge technologies into their pipelines gain a significant competitive advantage. Vcanbio's ability to leverage these advancements will be crucial in expanding its therapeutic offerings and addressing unmet medical needs.

Breakthroughs in automation, especially in areas like bioinformatics and advanced manufacturing, are poised to significantly impact Vcanbio's operations. These technological leaps can streamline the production of complex cell and gene therapies, leading to improved efficiency and lower costs.

For Vcanbio, adopting these advancements means better product consistency and higher quality. The global automation market, projected to reach $320 billion by 2025, highlights the widespread investment in these technologies, suggesting a strong opportunity for companies like Vcanbio to leverage them.

Scalable manufacturing solutions are absolutely critical for bringing these intricate biological therapies to market. For instance, the cell and gene therapy market is expected to grow substantially, with some estimates suggesting it could reach over $25 billion by 2027, underscoring the need for robust and efficient production capabilities.

Vcanbio can leverage advanced data analytics, AI, and machine learning to significantly speed up its drug discovery and development processes. For instance, AI algorithms can analyze vast biological datasets to identify potential drug candidates much faster than traditional methods. This integration is crucial for optimizing clinical trial design, leading to more efficient and successful studies. By 2025, the global AI in healthcare market is projected to reach $187.95 billion, highlighting the increasing adoption and potential of these technologies.

Intellectual Property and Patent Landscape

The technological landscape for Vcanbio is significantly shaped by the intricate world of intellectual property, especially concerning gene editing and cell therapy. Navigating this requires a keen understanding of existing patents and securing Vcanbio's own innovations. For instance, the global gene therapy market, projected to reach over $15 billion by 2027, is heavily influenced by patent protection for critical technologies.

Vcanbio needs to carefully assess patent portfolios related to CRISPR-Cas9 and other gene-editing systems, as well as proprietary cell manufacturing processes. This ensures they can operate without infringing on others' rights and can protect their unique advancements. The company may also need to explore licensing agreements for foundational technologies, a common practice in this rapidly advancing field.

Key considerations for Vcanbio include:

- Assessing the patent landscape for gene editing tools like CRISPR and CAR-T cell therapy manufacturing methods.

- Developing strategies to secure Vcanbio's own intellectual property in these areas.

- Evaluating the necessity of licensing foundational technologies to ensure freedom to operate.

- Monitoring patent filings and litigation in the biotechnology sector for competitive intelligence.

Biomaterials and Delivery Systems Innovation

Vcanbio's progress in regenerative medicine and gene therapies hinges on breakthroughs in biomaterials and delivery systems. Innovations in scaffold design are vital for tissue regeneration, while advanced delivery methods like viral vectors and lipid nanoparticles are critical for ensuring the safe and effective transport of genetic material. The global regenerative medicine market, projected to reach over $25 billion by 2025, underscores the importance of these technological advancements.

The company's capacity to integrate or pioneer these cutting-edge delivery technologies directly impacts the therapeutic efficacy and market reach of its products. For instance, the development of non-viral delivery systems, which saw significant investment in 2024, offers a pathway to improved safety profiles and broader patient applicability. Vcanbio's strategic focus on these areas will determine its competitive edge in a rapidly evolving scientific landscape.

Technological factors influencing Vcanbio include:

- Biomaterial Advancements: Development of biocompatible and biodegradable materials for tissue engineering and implantable devices.

- Scaffold Design Innovation: Creating intricate scaffolds that mimic natural tissue structures to promote cell growth and integration.

- Novel Delivery Systems: Research into and implementation of advanced viral vectors (e.g., AAV, lentivirus) and non-viral methods like lipid nanoparticles (LNPs) for targeted gene delivery.

- Manufacturing Scalability: Ensuring that these advanced materials and delivery systems can be produced efficiently and at scale to meet market demand.

Technological advancements are fundamentally reshaping the cell and gene therapy sector, directly impacting Vcanbio's operational capacity and strategic direction. Innovations in areas like CRISPR gene editing and CAR-T therapies are creating a rapidly expanding market, with the global CAR-T cell therapy market valued at approximately USD 1.8 billion in 2023 and projected to exceed USD 14 billion by 2030.

These technological leaps necessitate Vcanbio's adaptation to integrate cutting-edge solutions for more effective and scalable therapeutic production. The integration of AI and machine learning is also accelerating drug discovery, with the global AI in healthcare market expected to reach $187.95 billion by 2025, offering significant efficiency gains.

Furthermore, breakthroughs in biomaterials and delivery systems, such as advanced viral vectors and lipid nanoparticles, are crucial for therapeutic efficacy. The regenerative medicine market, projected to surpass $25 billion by 2025, highlights the importance of these material science innovations for Vcanbio's product development and market penetration.

| Technology Area | 2023 Market Value (Approx.) | Projected 2030 Market Value (Approx.) | Impact on Vcanbio |

|---|---|---|---|

| CAR-T Cell Therapy | USD 1.8 billion | USD 14 billion | Drives demand for advanced cell therapies and manufacturing expertise. |

| AI in Healthcare | N/A (rapidly growing) | USD 187.95 billion by 2025 | Accelerates drug discovery, clinical trial optimization, and data analysis. |

| Regenerative Medicine | N/A (rapidly growing) | USD 25 billion by 2025 | Requires innovation in biomaterials and delivery systems for tissue engineering. |

Legal factors

Vcanbio navigates a complex web of regulations, necessitating strict adherence to Good Laboratory Practices (GLP), Good Clinical Practices (GCP), and Good Manufacturing Practices (GMP) throughout its operations. This commitment ensures the integrity and safety of its products from research to market.

Securing approval from national and international regulatory bodies such as China's NMPA, the U.S. FDA, and Europe's EMA is critical for Vcanbio's product development pipeline, clinical trial progression, and eventual market authorization. For instance, the FDA's stringent review process for novel biologics can take several years, impacting time-to-market.

Failure to maintain compliance with these evolving regulatory frameworks can lead to significant repercussions, including hefty fines, product recalls, and even the suspension of manufacturing or marketing activities, severely impacting Vcanbio's financial performance and reputation. In 2024, the pharmaceutical industry saw increased regulatory focus on data integrity, with the FDA conducting more on-site inspections.

Intellectual property laws, including patent and trade secret protections, are critical legal considerations for Vcanbio. The company must diligently manage its patent portfolio to safeguard its innovations. In 2024, companies in the biotech sector faced an average of 15-20 patent litigation cases annually, highlighting the importance of proactive IP defense.

Navigating potential infringement claims from competitors is a constant challenge. Such litigation can be exceptionally costly, with average litigation expenses in the biotech sector exceeding $3 million per case. These disputes can also significantly disrupt Vcanbio's operations and strategic focus.

Handling sensitive patient genetic and health data is paramount for Vcanbio, requiring strict adherence to global data privacy regulations. This includes compliance with frameworks like the GDPR in Europe and its equivalents in China and other key markets, ensuring patient information is protected. As of early 2024, the global data privacy market is expected to continue its growth trajectory, with companies investing heavily in compliance solutions. Failure to comply can lead to substantial fines; for example, GDPR violations can reach up to 4% of global annual revenue.

Vcanbio must implement and continuously update robust data security measures to safeguard patient information. This proactive approach is crucial for meeting evolving data protection laws, thereby avoiding significant legal liabilities and potential reputational damage. In 2024, cybersecurity spending by healthcare organizations is projected to increase, reflecting the growing threat landscape and the critical need for advanced security protocols to protect sensitive health data.

Clinical Trial Regulations and Ethical Guidelines

The legal framework for clinical trials is paramount for Vcanbio. Regulations around patient consent, rigorous safety monitoring, and mandatory ethical review board approvals directly shape the feasibility and timeline of Vcanbio's research and development initiatives. Strict adherence ensures data integrity, crucial for gaining regulatory approvals for new therapies.

Compliance with these complex legal requirements is not optional; it’s fundamental to Vcanbio’s operations. For instance, the U.S. Food and Drug Administration (FDA) oversees clinical trials, with specific guidelines for each phase. In 2024, the FDA continued to emphasize data transparency and participant safety, impacting how Vcanbio designs and executes its studies.

- Patient Consent: Ensuring fully informed consent is legally mandated, requiring clear communication of risks and benefits.

- Safety Monitoring: Continuous monitoring and reporting of adverse events are critical to participant well-being and regulatory compliance.

- Ethical Review Boards: Independent boards review trial protocols to ensure ethical conduct and participant protection.

- Regulatory Approvals: Successful navigation of these legal hurdles is essential for bringing Vcanbio's innovations to market.

Product Liability and Consumer Protection Laws

Vcanbio, as a developer of advanced medical therapies, faces significant scrutiny under product liability laws. These regulations hold companies accountable for harm caused by their products, making rigorous safety testing and quality control paramount. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to emphasize stringent review processes for new biological products, reflecting a heightened focus on patient safety.

Adherence to consumer protection laws is equally vital for Vcanbio. These laws ensure that marketing claims are accurate and that consumers are not misled about the benefits or risks of therapies. Violations can lead to substantial fines and reputational damage. In 2024, regulatory bodies globally have been increasing enforcement actions against companies making unsubstantiated health claims, underscoring the importance of transparency.

Minimizing legal risks and managing potential lawsuits are core operational concerns. This involves robust pharmacovigilance systems to track adverse events and swift, transparent communication with regulatory agencies and the public. Vcanbio's commitment to these practices directly impacts its ability to maintain consumer trust in its innovative therapies, a trust that is hard-won and easily lost in the healthcare sector.

- Product Liability: Vcanbio must ensure its medical therapies meet high safety and efficacy standards to avoid liability for adverse patient outcomes.

- Consumer Protection: Accurate marketing and transparent disclosure of risks are essential to comply with consumer protection laws and maintain trust.

- Regulatory Scrutiny: The FDA and international health authorities maintain strict oversight of medical product development and marketing in 2024.

- Risk Management: Proactive safety monitoring and clear communication strategies are critical for mitigating legal risks and managing public perception.

Vcanbio's legal landscape is shaped by stringent industry regulations, including GLP, GCP, and GMP, which are critical for product integrity and safety. Navigating approvals from bodies like the FDA and EMA is essential, with processes for new biologics potentially taking years. In 2024, regulatory focus intensified on data integrity, leading to more on-site inspections by agencies like the FDA.

Intellectual property is a cornerstone, with patent and trade secret protection vital for Vcanbio's innovations. The biotech sector saw an average of 15-20 patent litigation cases annually in 2024, highlighting the need for robust IP defense, as litigation costs can exceed $3 million per case.

Data privacy is paramount, with strict adherence to GDPR and similar global regulations required for handling sensitive patient information. The global data privacy market continued its growth in early 2024, with significant investment in compliance solutions. GDPR violations can incur fines up to 4% of global annual revenue.

Product liability and consumer protection laws demand rigorous safety testing and accurate marketing. In 2024, regulatory bodies increased enforcement against unsubstantiated health claims, emphasizing transparency. Proactive safety monitoring and clear communication are key to mitigating legal risks and maintaining public trust.

Environmental factors

Vcanbio's operations, inherently tied to biological materials and laboratory processes, inevitably produce diverse forms of biowaste. Navigating these waste streams requires strict adherence to an evolving regulatory landscape. For instance, in 2024, the European Union continued to refine its waste framework directives, emphasizing circular economy principles and stricter controls on hazardous biological waste, with non-compliance potentially leading to significant fines and operational disruptions.

Biopharmaceutical manufacturing is inherently energy-intensive, leading to a considerable carbon footprint. For Vcanbio, this translates to significant operational costs and increasing scrutiny regarding environmental impact. The sector's energy demands, from laboratory research to large-scale production, contribute to greenhouse gas emissions.

Vcanbio is under mounting pressure to transition towards sustainable energy sources. This includes exploring renewable energy options like solar and wind power to offset traditional energy consumption. Optimizing energy-intensive processes, such as sterilization and temperature control, is crucial for reducing overall energy usage and associated emissions.

Meeting evolving environmental targets and stakeholder expectations for corporate social responsibility (CSR) necessitates a proactive approach to carbon footprint reduction. In 2023, the pharmaceutical industry's global energy consumption was estimated to be around 270 terawatt-hours (TWh), with a significant portion attributed to manufacturing processes. Vcanbio must align its strategies with these broader industry trends and regulatory pressures to maintain its social license to operate and attract environmentally conscious investors.

The availability of crucial raw materials like specialized chemicals, cell culture media, and single-use bioprocessing components is a significant concern due to growing resource scarcity. For Vcanbio, this means potential disruptions and increased costs in its supply chain. For instance, the global demand for certain rare earth elements, vital for advanced manufacturing, has seen price increases of up to 30% in early 2024, impacting various industries including biotech.

Vcanbio must proactively explore and implement sustainable sourcing strategies to mitigate these risks and ensure long-term operational resilience. This involves carefully evaluating the environmental impact of its entire supply chain, from material extraction to manufacturing processes. Companies that prioritize eco-friendly sourcing and reduce their environmental footprint are better positioned to navigate future regulatory changes and market demands for sustainability.

Water Usage and Wastewater Treatment

Vcanbio's biotechnology operations, particularly its research and manufacturing, are water-intensive. Efficient water management is crucial, especially as global freshwater resources face increasing strain. By 2024, many regions are experiencing heightened water stress, making responsible water usage a key environmental consideration.

Effective wastewater treatment is paramount for Vcanbio to comply with stringent environmental discharge standards. Failure to do so can result in significant fines and reputational damage. Demonstrating strong environmental stewardship through proper wastewater management is vital for maintaining social license to operate.

- Water Consumption: Biotechnology research and production can require substantial water volumes for processes like cell culture, purification, and cleaning.

- Wastewater Treatment: Ensuring that all discharged water meets or exceeds regulatory standards for contaminants is a critical operational requirement.

- Regional Water Scarcity: Operations in areas prone to water scarcity demand heightened focus on water recycling and conservation initiatives.

- Environmental Compliance: Adherence to local and international environmental regulations regarding water usage and discharge is non-negotiable for Vcanbio.

Environmental Impact of Research and Development Facilities

Vcanbio’s research and development and manufacturing sites naturally have an environmental impact. This involves how land is used, the effects on local plant and animal life, and making sure the company follows environmental impact assessments and zoning rules. For instance, in 2024, there's a growing emphasis on companies like Vcanbio demonstrating compliance with stricter regulations, such as those outlined by the European Union’s Green Deal, which aims for climate neutrality by 2050. Failing to meet these standards can lead to significant fines and reputational damage.

To lessen these effects, Vcanbio can implement green building techniques and manage its facilities sustainably. This might include using renewable energy sources, improving energy efficiency in its buildings, and managing water usage and waste effectively. For example, many companies in the biotech sector are now aiming to reduce their carbon emissions by 30-40% by 2030 compared to 2020 levels, a target Vcanbio could also pursue.

- Land Use and Biodiversity: Careful site selection and planning are crucial to minimize disruption to local ecosystems.

- Regulatory Compliance: Adherence to environmental impact assessments and zoning laws is mandatory and subject to increasing scrutiny.

- Sustainable Operations: Implementing green building practices and efficient resource management can significantly reduce a facility's environmental footprint.

- Carbon Footprint Reduction: Setting and achieving targets for reducing greenhouse gas emissions is becoming a key performance indicator for responsible corporate citizenship.

Vcanbio's biowaste generation necessitates strict adherence to evolving waste regulations, particularly concerning hazardous biological materials, with non-compliance potentially leading to substantial fines as seen with EU directives in 2024.

The company faces significant operational costs and scrutiny due to its energy-intensive biopharmaceutical manufacturing processes, contributing to a considerable carbon footprint, a factor that drove the biotech sector's estimated 270 TWh energy consumption in 2023.

Resource scarcity, especially for vital raw materials like specialized chemicals and cell culture media, poses supply chain risks and cost increases, exemplified by the 30% price surge in certain rare earth elements in early 2024.

Water intensity in Vcanbio's operations demands efficient management, especially with global freshwater resources under strain and heightened water stress in many regions by 2024, making responsible usage a key environmental consideration.

| Environmental Factor | Vcanbio Relevance | 2024/2025 Data/Trend |

| Biowaste Management | Generation of biowaste from operations | Stricter EU waste framework directives emphasizing circular economy and hazardous biological waste controls. |

| Energy Consumption & Carbon Footprint | Energy-intensive manufacturing processes | Sector energy consumption ~270 TWh (2023); increasing pressure for renewable energy adoption. |

| Resource Scarcity | Reliance on specialized raw materials | Price increases up to 30% for certain rare earth elements (early 2024) impacting supply chains. |

| Water Usage & Management | Water-intensive R&D and production | Heightened regional water stress by 2024; focus on water recycling and conservation. |

PESTLE Analysis Data Sources

Our PESTLE analysis is underpinned by a robust blend of public and proprietary data, meticulously gathered from leading market research firms, government statistical agencies, and reputable industry publications. This comprehensive approach ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, actionable intelligence.