Vcanbio Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vcanbio Bundle

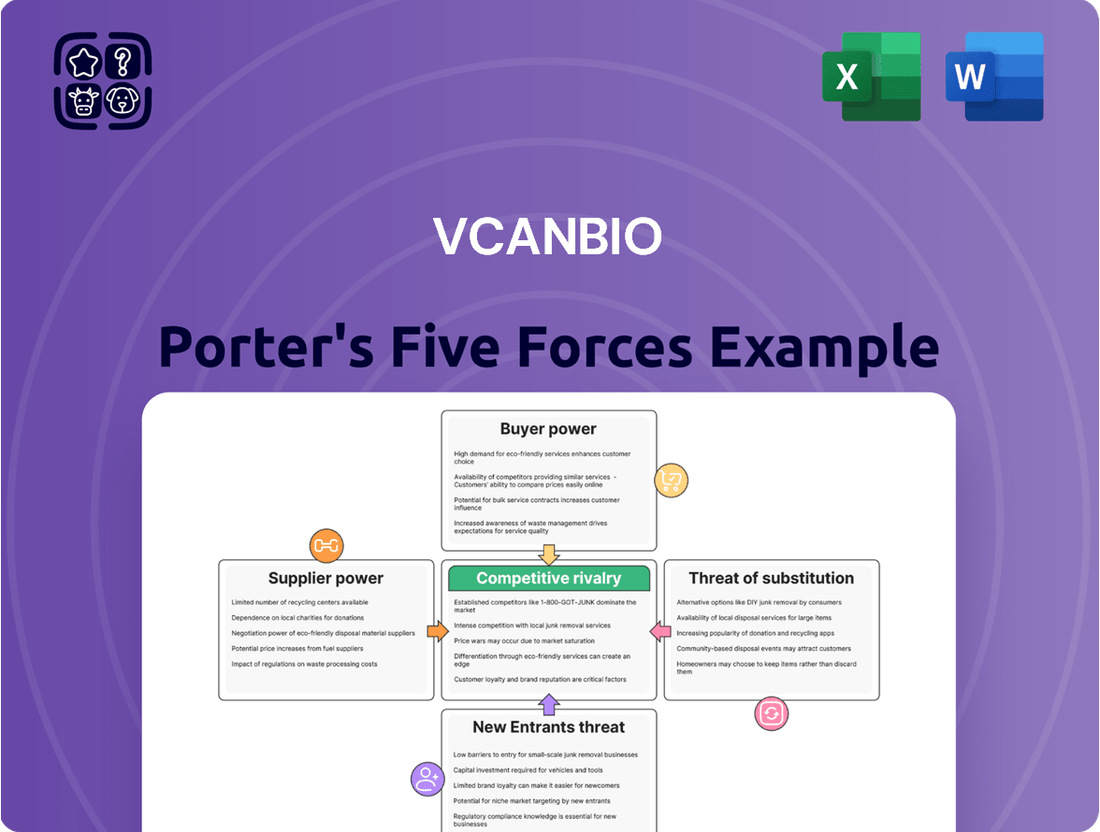

A Porter's Five Forces analysis of Vcanbio reveals a dynamic industry landscape. Understanding the bargaining power of buyers and suppliers is crucial, as is assessing the threat of new entrants and the intensity of rivalry among existing competitors. The presence of substitutes also plays a significant role in shaping Vcanbio's strategic options.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Vcanbio’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Vcanbio's reliance on specialized biological reagents, cell culture media, and unique genetic materials for its cell and gene engineering technologies places it at the mercy of its suppliers. The scarcity or proprietary nature of these critical inputs can empower a select few suppliers, potentially driving up costs and creating vulnerabilities in Vcanbio's supply chain.

For instance, critical enzymes for gene editing or specialized growth factors essential for stem cell expansion might be sourced from only a handful of manufacturers globally. In 2024, the global market for cell culture media alone was valued at approximately $4.5 billion, with a significant portion attributed to highly specialized and proprietary formulations, highlighting the concentrated power of key suppliers in this niche.

Suppliers that possess patents or exclusive rights to crucial technologies, like advanced gene editing tools or unique cell isolation methods, wield considerable bargaining power. For Vcanbio, this means they might struggle to replicate these innovations internally or find other providers without incurring hefty licensing costs or undertaking substantial research and development. This reliance can restrict Vcanbio's operational agility and inflate its expenses. For instance, in 2024, the global market for gene therapy manufacturing equipment saw a significant portion of its value tied to patented, specialized components, highlighting supplier leverage in critical supply chains.

Switching suppliers in the life sciences sector, particularly for specialized biological materials used by companies like Vcanbio, is a significant undertaking. The process often involves rigorous validation protocols, obtaining necessary regulatory approvals, and re-optimizing existing research or production workflows. These complexities translate directly into high switching costs for Vcanbio.

These substantial switching costs diminish Vcanbio's leverage in negotiating favorable terms with its current suppliers. The potential disruption to critical research timelines, ongoing clinical trials, and established manufacturing processes if a supplier were changed presents a substantial risk that outweighs the benefits of seeking alternative, potentially cheaper, sources.

Vcanbio's investment in deeply integrating a specific supplier's unique materials and processes into its proprietary workflows further cements this dependency. This deep integration makes a simple transition to a new supplier not just costly, but often technically prohibitive without significant time and resource allocation.

Supplier Concentration

When the market for crucial raw materials or components is dominated by a small number of large suppliers, their bargaining power significantly rises. For Vcanbio, if a key ingredient for its biotech products comes from only a few major global producers, these suppliers have little reason to offer Vcanbio the best prices or most flexible terms. This situation is particularly potent when Vcanbio represents a substantial portion of a supplier's customer base, creating a dependency that can be leveraged.

This supplier concentration can directly impact Vcanbio’s cost structure and operational flexibility. For instance, if the global supply of a specific growth factor essential for Vcanbio's cell culture media is controlled by just two or three companies, those companies can dictate higher prices. In 2024, reports indicated that for certain specialized biochemicals, the top three global manufacturers controlled over 70% of the market, leading to price increases of up to 15% for buyers with less purchasing leverage.

- Supplier Concentration: A market dominated by a few large suppliers increases their leverage.

- Reduced Price Competition: Concentrated suppliers have less incentive to compete on price or offer favorable terms.

- Stricter Contractual Terms: Vcanbio may face more rigid contracts and less negotiation room.

- Impact on Costs: Higher input costs can directly affect Vcanbio's profit margins and product pricing.

Forward Integration Threat

The threat of suppliers engaging in forward integration, essentially moving into Vcanbio's core business of cell and gene therapies, can significantly impact bargaining power. While not a widespread concern for basic material providers, specialized technology or platform suppliers could potentially evolve into direct competitors. This shift would diminish Vcanbio's market opportunities and strengthen the supplier's position.

This dynamic encourages Vcanbio to cultivate robust supplier relationships and consider strategic backward integration for critical components. For instance, if a key supplier of viral vectors also began developing its own therapeutic candidates, Vcanbio would face increased competition and potentially higher input costs. Companies in the biotech sector, like Vcanbio, often assess the integration strategies of their key partners to mitigate such risks.

- Forward Integration Risk: Suppliers developing their own cell or gene therapies directly challenge Vcanbio's market.

- Specialized Competitors: Technology providers, rather than raw material suppliers, are the primary concern for forward integration.

- Market Opportunity Reduction: Competitors emerging from the supply chain can limit Vcanbio's growth potential.

- Strategic Response: Maintaining strong supplier relationships and exploring backward integration are key mitigation strategies.

Vcanbio's reliance on specialized biological reagents and proprietary genetic materials grants significant leverage to its suppliers, particularly those holding patents on critical technologies like advanced gene editing tools. The high switching costs, stemming from rigorous validation and workflow re-optimization, further diminish Vcanbio's negotiation power. Supplier concentration in niche markets, where a few companies control a large market share, also allows suppliers to dictate terms and potentially increase prices, impacting Vcanbio's profitability.

| Factor | Description | Impact on Vcanbio | 2024 Data Point |

|---|---|---|---|

| Supplier Concentration | Market dominated by few large suppliers | Increased supplier leverage, less price competition | Top 3 biochemical manufacturers controlled >70% of certain specialized markets |

| Switching Costs | High costs associated with changing suppliers | Reduced Vcanbio's negotiation power, risk of disruption | Significant investment in validation and workflow integration |

| Proprietary Inputs | Scarcity or exclusive rights to critical materials | Empowers suppliers, drives up costs | Global cell culture media market valued at ~$4.5 billion, with specialized formulations |

What is included in the product

This analysis unpacks the competitive intensity and strategic positioning of Vcanbio by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and address competitive threats with a visual breakdown of all five forces, empowering swift strategic adjustments.

Customers Bargaining Power

In the cell and gene therapy sector, customers like hospitals, research facilities, and patients seeking services such as stem cell storage place paramount importance on treatment effectiveness and safety. The inherently life-saving or life-altering nature of Vcanbio's offerings means clients expect exceptional results, granting them leverage to insist on stringent quality controls and documented successes.

This high demand for successful outcomes significantly influences Vcanbio's market position. For instance, the success rates in CAR-T therapy, a key area in gene therapy, are crucial. In 2024, while advancements continue, reported complete remission rates in certain B-cell malignancies treated with CAR-T therapies can range from 40% to over 80% depending on the specific therapy and patient population, highlighting the critical nature of these outcomes for customer satisfaction and Vcanbio's brand reputation.

The availability of alternative treatments significantly impacts Vcanbio's customer bargaining power. While Vcanbio focuses on specialized regenerative medicine, patients and healthcare providers have other options. These can range from established pharmaceutical treatments to different regenerative medicine companies or even less intensive care approaches. For instance, a patient seeking cartilage repair might consider traditional surgery alongside Vcanbio's offerings.

This competitive landscape allows customers to exert pressure on Vcanbio. If Vcanbio's therapies are perceived as too expensive, less effective, or difficult to access compared to alternatives, customers can leverage this. In 2024, the regenerative medicine market continued to see innovation, with a growing number of cell and gene therapies entering or nearing clinical trials, potentially increasing the substitutability of Vcanbio's services.

Customer price sensitivity is a significant factor for Vcanbio, particularly given the high cost of advanced cell and gene therapies. For instance, the average cost of a CAR T-cell therapy in 2023 could range from $373,000 to over $500,000, making affordability a major concern.

Healthcare systems and private insurers, as key customers, are constantly evaluating cost-effectiveness. This forces Vcanbio to demonstrate the value proposition of its therapies to justify pricing, potentially leading to negotiations for more competitive rates or bundled payment models.

Reimbursement hurdles in various markets can amplify this price sensitivity. In 2024, navigating complex reimbursement landscapes, especially for novel treatments, remains a challenge, directly impacting a customer's ability to absorb high therapy costs.

Customer Concentration (for certain services)

For specialized B2B offerings, like extensive stem cell banking for research institutions or collaborative ventures in clinical trials, Vcanbio may encounter a concentrated customer demographic. A handful of major institutional clients, by virtue of the substantial business volume they generate, can exert considerable influence. These key clients might leverage their position to negotiate for bespoke service packages, more favorable pricing structures, or more rigorous service level agreements, directly impacting Vcanbio's operational flexibility and profitability.

This customer concentration can translate into tangible demands that Vcanbio must address.

- Negotiating Power: Large clients can demand customized solutions and preferential pricing due to their significant contribution to Vcanbio's revenue.

- Service Level Agreements (SLAs): The volume of business from these clients may lead to stricter SLAs, requiring Vcanbio to maintain higher operational standards.

- Market Impact: A few dominant clients in specific niches could dictate terms, potentially limiting Vcanbio's ability to standardize services or explore broader market segments.

Transparency and Information Availability

As the cell and gene therapy market matures, increased transparency regarding treatment options, success rates, and pricing among competitors can empower customers. Access to information, often through patient advocacy groups, clinical trial databases, or comparative studies, allows customers to make more informed decisions, enhancing their ability to compare and negotiate with Vcanbio. For instance, by mid-2024, the number of publicly available clinical trials for cell and gene therapies had surpassed 1,000 globally, providing a rich source of data for patients and payers. This accessibility directly impacts customer bargaining power by enabling them to identify potentially more cost-effective or clinically superior alternatives, putting pressure on Vcanbio to offer competitive terms and demonstrate clear value propositions.

Customers in the cell and gene therapy sector, including hospitals and research institutions, possess significant bargaining power due to the critical nature of Vcanbio's life-altering treatments. Their ability to demand stringent quality controls and documented successes is high, especially considering the high costs involved; for example, CAR T-cell therapy costs could exceed $500,000 in 2023. This price sensitivity is further amplified by reimbursement challenges prevalent in 2024, forcing Vcanbio to justify its value proposition and potentially negotiate pricing.

The availability of alternative treatments, which is growing with over 1,000 global cell and gene therapy clinical trials by mid-2024, empowers customers to exert pressure on Vcanbio. If Vcanbio's offerings are perceived as less effective or accessible, clients can leverage this to seek more competitive terms. Furthermore, concentration among key institutional clients can lead to demands for customized solutions and stricter service level agreements, directly impacting Vcanbio's operational flexibility and profitability.

Same Document Delivered

Vcanbio Porter's Five Forces Analysis

This preview showcases the complete Vcanbio Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry.

The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring transparency and no hidden surprises.

You're looking at the final version of the Vcanbio Porter's Five Forces Analysis; once you complete your purchase, you’ll get instant access to this precise document, ready for your strategic planning.

No mockups, no samples. The comprehensive Vcanbio Porter's Five Forces Analysis you see here is exactly what you’ll be able to download and utilize after payment.

Rivalry Among Competitors

The cell and gene engineering sector thrives on a fierce rivalry fueled by substantial research and development spending. Companies are locked in a continuous innovation race, pushing the boundaries of what's possible with new therapies and technologies.

Vcanbio, like its competitors, must commit significant financial and intellectual resources to remain competitive. This intense investment environment means that staying at the forefront requires a relentless pursuit of novel solutions and a rapid pace of development.

For instance, the global cell and gene therapy market was valued at approximately USD 13.5 billion in 2023 and is projected to reach over USD 30 billion by 2028, highlighting the immense investment and growth potential, and thus, the competitive pressure to capture market share through innovation.

Vcanbio operates in a highly competitive arena, facing pressure from both established giants and nimble newcomers. Major pharmaceutical and biotech firms, with their significant financial resources and broad research portfolios, represent a constant challenge. For instance, in the broader biotech sector, companies like Moderna and BioNTech have demonstrated the power of rapid innovation and market penetration, setting a high bar for others.

Simultaneously, Vcanbio must contend with a multitude of emerging biotechs. These specialized firms, often focusing on niche areas like gene editing or advanced cell therapies, can quickly disrupt markets with novel technologies. Players such as Vertex Pharmaceuticals, though not directly in stem cell banking, showcase the rapid growth potential within specialized biotech segments, often achieving significant market capitalization in short periods.

In the specific realm of stem cell banking, Vcanbio sees direct competition from companies like Cordlife and LifeCell, which have a strong market presence. The diagnostics and reagents sector, crucial for many biotech operations, is dominated by giants such as Agilent Technologies and Thermo Fisher Scientific, whose extensive product lines and established distribution networks create significant barriers to entry and require constant innovation from competitors.

This multifaceted competitive environment, characterized by deep-pocketed incumbents and agile innovators across various related fields, underscores the critical need for Vcanbio to maintain a strong competitive advantage through clear differentiation and continuous technological advancement.

The regenerative medicine and stem cell banking sectors are experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 6% for stem cell storage from 2025 through 2033. This expansion, while presenting significant opportunities, also acts as a magnet for new entrants and spurs existing players to broaden their service portfolios. Consequently, Vcanbio finds itself in a dynamic market where the very growth that fuels opportunity simultaneously escalates the competition for market dominance and customer acquisition.

Product Differentiation and IP Protection

Vcanbio's competitive rivalry is heavily influenced by product differentiation and the robust protection of its intellectual property (IP). In the fast-paced biotech sector, having unique technologies and proprietary cell lines is paramount, yet achieving and maintaining this distinctiveness presents significant hurdles.

Vcanbio's strategic focus on safeguarding its innovations via patents and trade secrets directly bolsters its competitive edge. This strong IP portfolio acts as a shield, deterring competitors from easily replicating or developing comparable solutions. For instance, as of early 2024, Vcanbio has actively pursued patent filings for its novel CAR-T cell therapy platforms, aiming to secure exclusive market positions.

- Vcanbio's IP Strategy: Focus on patents and trade secrets for CAR-T and other cell therapies.

- Market Impact: Strong IP limits rivals' ability to copy innovative solutions.

- Competitive Landscape: Rapid advancements necessitate continuous innovation and protection.

- Financial Implications: IP protection can lead to premium pricing and market share dominance.

Regulatory Hurdles and Clinical Trial Success

The competitive landscape for Vcanbio is intensely shaped by regulatory hurdles and the critical need for successful clinical trials. Companies in this sector are locked in a continuous race to secure approvals from bodies like the FDA and EMA, a process that can take years and cost hundreds of millions of dollars. Vcanbio's success hinges on its capacity to navigate these complex pathways efficiently, bringing innovative and safe therapies to market ahead of competitors.

Achieving positive clinical trial outcomes is paramount. For instance, in 2024, the success rates for Phase III oncology trials, a key area for many biotech firms, continued to be challenging, with many candidates failing to demonstrate sufficient efficacy or safety. Vcanbio's ability to consistently achieve positive data readouts directly impacts its market position and its capacity to attract further investment and partnerships. Competitors are actively engaged in similar pursuits, making timely and successful clinical development a significant differentiator.

- Navigating Regulatory Pathways: The path to market is arduous, requiring meticulous adherence to stringent guidelines set by health authorities.

- Clinical Trial Efficacy: Demonstrating clear therapeutic benefits and safety profiles in human trials is non-negotiable for approval.

- Speed to Market: Companies that can expedite the approval process by presenting robust data often gain a significant first-mover advantage.

- Competitive Approvals: The industry sees constant jockeying for regulatory nods, with rivals often developing similar treatment modalities.

The competitive rivalry within Vcanbio's sector is characterized by high R&D spending and a relentless pursuit of innovation. Companies must invest heavily to develop new therapies, facing pressure from both large pharmaceutical companies and agile biotech startups. For example, the global cell and gene therapy market, valued at USD 13.5 billion in 2023, is expected to exceed USD 30 billion by 2028, indicating intense competition for market share.

Vcanbio's competitive edge is also heavily influenced by its intellectual property (IP) strategy, focusing on patents and trade secrets for its CAR-T and other cell therapies. This strong IP protection is crucial for deterring competitors from replicating its innovations. As of early 2024, Vcanbio has been actively filing patents for its novel CAR-T cell therapy platforms to secure exclusive market positions.

Regulatory hurdles and the success of clinical trials are significant factors in Vcanbio's competitive landscape. Navigating complex approval processes with bodies like the FDA and EMA is time-consuming and costly. In 2024, oncology Phase III trials, a key area for biotech, continued to show challenging success rates, making positive clinical trial outcomes a critical differentiator for companies like Vcanbio.

| Key Competitor Aspect | Vcanbio's Position/Strategy | Market Impact | 2024 Data/Trend |

| R&D Intensity | High investment in novel therapies | Drives innovation race | Cell & gene therapy market growth: USD 13.5B (2023) to >USD 30B (2028) |

| Intellectual Property | Focus on patents for CAR-T therapies | Deters replication, secures market | Active patent filings in early 2024 |

| Regulatory & Clinical Success | Navigating FDA/EMA, achieving trial success | Key to market entry and differentiation | Challenging Phase III oncology trial success rates in 2024 |

SSubstitutes Threaten

For many conditions Vcanbio targets, traditional pharmaceutical drugs remain significant substitutes. These include small molecule drugs and biologics that have long been the standard of care. While Vcanbio's therapies aim for curative potential, the established efficacy and lower cost of conventional treatments make them a persistent alternative, particularly in resource-constrained markets or for less aggressive conditions.

The market for chronic conditions like diabetes or certain autoimmune diseases, where Vcanbio might seek to innovate, is dominated by established pharmaceutical players with extensive pipelines and market penetration. For instance, the global diabetes drug market alone was valued at over $60 billion in 2023, highlighting the sheer scale and entrenched nature of these substitutes.

Despite the promise of cell and gene therapies, their current high price points and complex administration protocols present a barrier to widespread adoption compared to readily available oral or injectable medications. This cost differential, coupled with the established safety profiles of many traditional drugs, ensures their continued viability as a substitute, especially when considering patient out-of-pocket expenses and healthcare system reimbursement policies.

Lifestyle changes and preventative measures present a significant threat of substitutes for Vcanbio's precision medicine services. Individuals focused on maintaining health through diet, exercise, and avoiding harmful habits might see less immediate need for genetic testing or early detection tools. For instance, a growing awareness of the benefits of a Mediterranean diet, which has been linked to reduced risk of chronic diseases, can be seen as a low-cost alternative to sophisticated diagnostic services. In 2024, the global wellness market continued its expansion, with a significant portion dedicated to fitness and healthy eating, underscoring the consumer inclination towards these lifestyle-based preventative strategies.

For certain medical conditions, traditional surgical interventions or other well-established procedures can act as substitutes for Vcanbio's innovative regenerative medicine solutions. For example, a patient with severe joint degeneration might consider a joint replacement surgery instead of pursuing a stem cell-based cartilage regeneration therapy. The global joint replacement market was valued at approximately $16.5 billion in 2023 and is projected to reach $25 billion by 2030, indicating a significant existing alternative.

Similarly, organ transplantation represents a substitute for advanced regenerative medicine approaches aimed at repairing or replacing damaged organs. The demand for organ transplants remains high, with over 100,000 people on the waiting list in the United States alone in 2024. This highlights the established nature and significant patient base for these traditional alternatives.

Evolving Research and New Therapeutic Modalities

The threat of substitutes for Vcanbio's cell and gene therapy offerings is significantly influenced by the rapid evolution of scientific research. Breakthroughs in areas such as RNA interference (RNAi) and antisense oligonucleotides (ASOs) present alternative mechanisms for treating diseases. For instance, the global RNA therapeutics market was valued at approximately USD 7.6 billion in 2023 and is projected to grow substantially, indicating a rising adoption of these modalities.

Entirely new bio-engineered solutions could also emerge as viable substitutes, offering different pathways to achieve therapeutic outcomes. The increasing investment in biotechnology research and development underscores this potential. In 2023, global biotech R&D spending reached an estimated USD 180 billion, fueling innovation across various platforms.

These emerging therapeutic modalities can potentially address the same patient populations and disease indications currently targeted by Vcanbio's cell and gene therapies. This creates a competitive pressure, as patients and healthcare providers may opt for more advanced or cost-effective alternatives as they become available and validated.

The ongoing development of novel drug delivery systems and precision medicine approaches further broadens the landscape of potential substitutes. Companies are exploring innovative ways to deliver therapies more effectively and target specific disease pathways, which could challenge existing treatment paradigms.

Non-Medical or Complementary Therapies

The threat of substitutes for Vcanbio's advanced medical treatments comes from non-medical or complementary therapies. For certain health management needs or chronic conditions, patients may opt for these alternatives. While not direct replacements for Vcanbio's sophisticated offerings, these therapies can sway patient decisions, potentially delaying or preventing the uptake of advanced medical interventions. This is especially true if these complementary options are perceived as less invasive or more cost-effective.

For example, in the realm of chronic pain management, patients might explore options like acupuncture, chiropractic care, or specialized physical therapy programs. While Vcanbio might offer cutting-edge regenerative medicine or advanced pharmaceutical solutions, the lower perceived risk and potentially lower out-of-pocket costs of these complementary approaches can represent a significant substitute. In 2024, the global complementary and alternative medicine market was valued at approximately USD 90 billion, indicating substantial patient interest and expenditure in these areas.

The influence of these substitutes is amplified when patients prioritize holistic wellness or seek to avoid the potential side effects or procedural complexities associated with advanced medical treatments. This can lead to a scenario where Vcanbio's treatments are considered only after other avenues have been exhausted, or in some cases, not at all, impacting market penetration and revenue potential.

- Influence on Patient Choice: Non-medical therapies can divert patients from advanced medical treatments by offering perceived benefits like being less invasive or more affordable.

- Market Impact: The growing complementary and alternative medicine market, valued around USD 90 billion in 2024, highlights a significant segment of healthcare spending that could be redirected from advanced medical solutions.

- Substitution Mechanism: Patients may choose these alternatives to manage chronic conditions or for general health, potentially delaying or preventing the adoption of Vcanbio's advanced therapies.

- Perception of Value: If complementary therapies are seen as offering comparable or sufficient results with fewer drawbacks, they pose a credible threat to Vcanbio's market share.

The threat of substitutes for Vcanbio's offerings is multifaceted, ranging from established pharmaceutical drugs and traditional medical procedures to emerging biotechnologies and even lifestyle interventions. While Vcanbio targets innovative therapeutic areas, the existence of proven, often more affordable, alternatives exerts significant pressure.

For instance, traditional small molecule drugs and biologics remain strong substitutes, especially in markets where cost is a primary consideration or for less severe conditions. The sheer scale of the established pharmaceutical market, with the global diabetes drug market alone exceeding $60 billion in 2023, underscores the entrenched nature of these alternatives.

Furthermore, emerging biotechnologies like RNA interference (RNAi) and antisense oligonucleotides (ASOs) represent a growing threat. The global RNA therapeutics market, valued at approximately $7.6 billion in 2023, signals a shift towards alternative therapeutic mechanisms that could compete with Vcanbio's cell and gene therapies.

| Substitute Category | Examples | Market Data (Approximate) | Implication for Vcanbio |

|---|---|---|---|

| Traditional Pharmaceuticals | Small molecule drugs, Biologics | Global diabetes drug market: >$60B (2023) | Established efficacy, lower cost, significant market penetration |

| Emerging Biotechnologies | RNAi, ASOs | Global RNA therapeutics market: ~$7.6B (2023) | Alternative therapeutic mechanisms, growing adoption |

| Lifestyle & Preventative Measures | Diet, Exercise, Wellness Programs | Global wellness market: Expanding rapidly (2024) | Reduces perceived need for advanced diagnostics/therapies |

| Established Medical Procedures | Joint Replacement Surgery, Organ Transplantation | Joint replacement market: ~$16.5B (2023) | Proven alternatives for specific conditions, significant patient bases |

Entrants Threaten

Entering the cell and gene engineering sector demands significant capital. Companies need vast sums for cutting-edge research and development, building advanced manufacturing plants, and conducting lengthy, costly clinical trials. For instance, in 2024, the average cost to bring a new gene therapy to market is estimated to be in the hundreds of millions of dollars, with some exceeding a billion.

These substantial upfront investments create a formidable barrier, deterring many potential new competitors from entering the market. Established players like Vcanbio, with their existing infrastructure and financial reserves, are better positioned to absorb these costs, thereby limiting the number of viable new entrants capable of challenging their market position.

The biotech industry, including companies like Vcanbio, faces a formidable threat from new entrants due to its complex and constantly shifting regulatory landscape. Agencies such as China's NMPA and the global FDA impose rigorous approval processes that demand extensive evidence of safety and efficacy.

Successfully navigating these intricate approval pathways, which involve multiple phases of clinical trials and stringent manufacturing compliance, presents a significant barrier to entry. For instance, bringing a new biologic drug to market can cost upwards of $2 billion and take over a decade, deterring many potential new players.

The intellectual property and patent landscape for Vcanbio presents a significant barrier to new entrants. The company's operations, particularly in advanced cell therapies and gene editing, are built upon a foundation of proprietary technologies and extensive patent protections. These patents cover critical aspects like specific cell lines, novel gene editing mechanisms, therapeutic applications of these technologies, and sophisticated manufacturing processes.

For any new player looking to enter this space, the options are limited and challenging. They would either need to negotiate expensive licensing agreements for existing, Vcanbio-protected intellectual property, which can be a substantial financial hurdle. Alternatively, they must invest heavily in research and development to create entirely new, non-infringing technologies. This approach is not only incredibly resource-intensive, requiring significant capital and skilled personnel, but also carries a high risk of failure, as developing truly novel and viable alternatives is a complex scientific and commercial undertaking.

Need for Specialized Expertise and Talent

The cell and gene therapy sector, including companies like Vcanbio, requires a highly specialized workforce. This includes experts in advanced scientific research, intricate clinical trial management, and complex Good Manufacturing Practice (GMP) production. The scarcity of individuals possessing this blend of skills presents a substantial hurdle for new entrants. For instance, in 2024, the demand for bioengineers and geneticists with experience in therapeutic development significantly outpaced the available talent pool, driving up recruitment costs.

Building a team capable of navigating the regulatory landscape and executing cutting-edge research and development is both time-consuming and capital-intensive. New companies must invest heavily in attracting and retaining top-tier scientists and manufacturing professionals. This talent acquisition challenge is exacerbated by the competitive nature of the biotechnology industry, where established players often offer attractive compensation and career advancement opportunities, making it difficult for startups to compete for essential human capital.

This specialized expertise requirement acts as a significant barrier to entry:

- High demand for specialized skills: The industry requires a niche skillset, creating a talent gap.

- Cost of talent acquisition: Attracting and retaining skilled professionals is expensive, impacting new entrants' budgets.

- Limited talent pool: The number of qualified individuals is finite, increasing competition for talent.

- Long lead times for team building: Establishing a competent team can take considerable time, delaying market entry.

Brand Reputation and Trust

In the advanced therapy sector, particularly for Vcanbio, brand reputation and patient trust are absolutely critical. Vcanbio, with its established track record in research and development and demonstrated clinical advancements, has cultivated significant trust over time. New companies entering this space would find it incredibly difficult to build the necessary credibility and earn the confidence of patients, healthcare providers, and investors, which is a substantial barrier.

The challenge for new entrants is amplified by the stringent regulatory environment and the long, costly development cycles inherent in advanced therapies. For instance, the average cost to bring a new drug to market is estimated to be over $2 billion, and this figure can be even higher for complex biological treatments. A strong brand reputation, built on a history of successful clinical trials and positive patient outcomes, directly translates into a higher likelihood of securing funding and navigating these hurdles.

- Established Trust: Vcanbio's history of R&D and clinical progress has built a strong foundation of trust with patients and healthcare professionals.

- Credibility Gap: New entrants must overcome a significant hurdle in establishing credibility and gaining the confidence of key stakeholders in the healthcare ecosystem.

- Regulatory and Development Costs: The high costs and lengthy timelines associated with advanced therapy development make it difficult for unproven entities to compete.

- Investor Confidence: A reputable brand is crucial for attracting the substantial investment required to operate in this capital-intensive industry.

The threat of new entrants into Vcanbio's cell and gene engineering sector is moderate to low, primarily due to extremely high capital requirements and complex regulatory hurdles. Bringing a new gene therapy to market in 2024 can cost hundreds of millions, sometimes exceeding a billion dollars, a significant deterrent for potential competitors.

Furthermore, the industry's stringent regulatory landscape, overseen by bodies like the FDA and NMPA, demands extensive evidence of safety and efficacy, adding years and substantial costs to product development, often exceeding $2 billion per drug. This creates a formidable barrier, limiting the number of entities capable of entering and competing effectively.

The need for highly specialized talent, including bioengineers and geneticists with specific therapeutic development experience, further constrains new entrants. In 2024, the demand for these professionals significantly outstripped supply, driving up recruitment costs and making it challenging for new companies to assemble the necessary expertise.

| Barrier to Entry | Description | Impact on New Entrants | 2024 Data/Example |

|---|---|---|---|

| Capital Requirements | Significant investment needed for R&D, manufacturing, and clinical trials. | High barrier, favors established players with financial reserves. | Gene therapy development costs: $100s of millions to over $1 billion. |

| Regulatory Complexity | Rigorous approval processes by health authorities. | Lengthy, costly, and uncertain path to market. | Drug development cost: >$2 billion; timeline: >10 years. |

| Specialized Talent | Scarcity of highly skilled professionals in bioengineering and genetics. | Increased recruitment costs and time to build a competent team. | High demand for bioengineers, outstripping supply. |

| Intellectual Property | Extensive patent protection on proprietary technologies. | Requires expensive licensing or costly development of non-infringing alternatives. | Vcanbio's patents on cell lines and manufacturing processes. |

| Brand Reputation & Trust | Established credibility with patients and healthcare providers. | Difficult for new entrants to gain essential market confidence. | Vcanbio's track record in clinical advancements. |

Porter's Five Forces Analysis Data Sources

Our Vcanbio Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, industry-specific market research, and competitor disclosures to provide a comprehensive view of the competitive landscape.