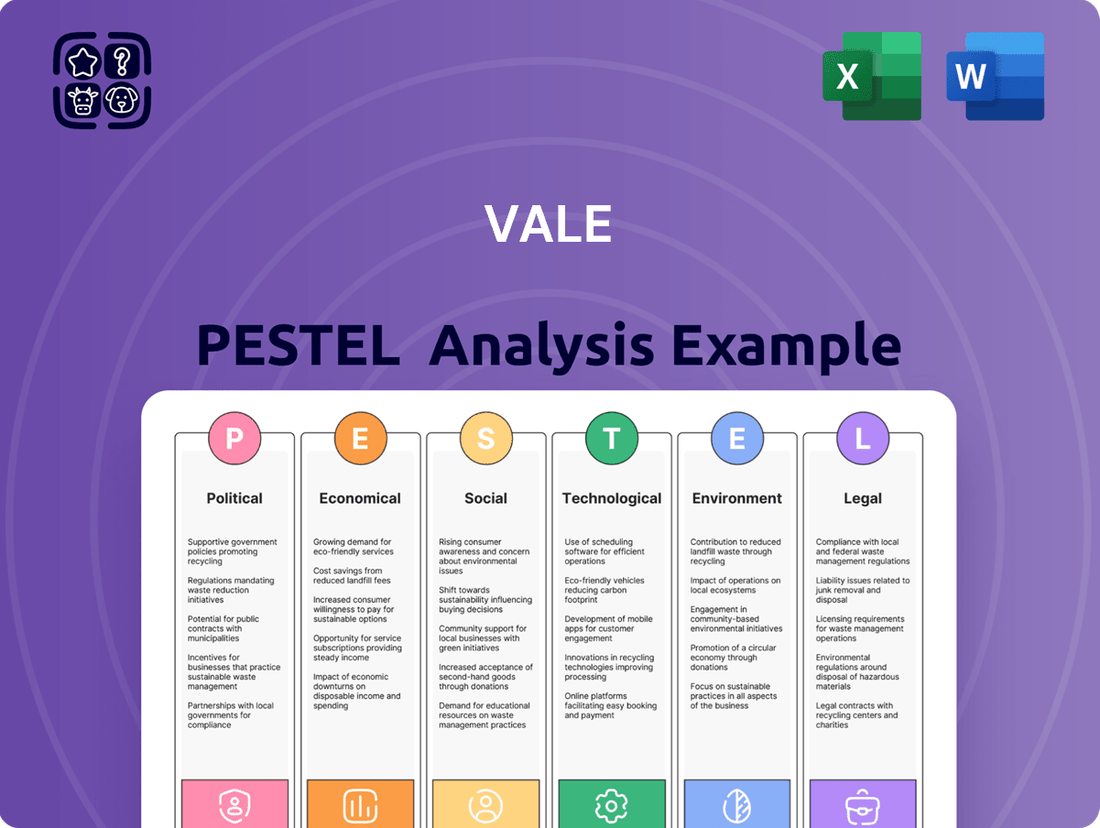

Vale PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vale Bundle

Uncover the critical external forces shaping Vale's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are impacting this global mining giant. Gain a strategic advantage by anticipating challenges and identifying opportunities that directly influence Vale's operations and market position. Equip yourself with expert-level insights to refine your investment strategies or business plans. Download the full PESTLE analysis now for actionable intelligence at your fingertips and stay ahead of the curve.

Political factors

The Brazilian government's policies and political stability significantly influence Vale's operations. As of 2024, the government maintains substantial control over mining regulations, including royalties and environmental licensing, impacting profitability. Potential political instability and shifts in regulatory frameworks, such as discussions around increased mining royalties, introduce considerable uncertainty for strategic planning. While increased government oversight remains a market concern, some analysts project Vale's robust financial position allows it to manage these pressures effectively through 2025.

Geopolitical tensions significantly impact Vale's global operations, particularly concerning international trade relations. Trade restrictions and tariffs, especially between major economies like China and Europe, can directly affect demand for iron ore, Vale's primary commodity, potentially impacting sales volumes which were 321.2 Mt in 2023. Disruptions in key shipping routes due to geopolitical events, such as those seen in the Red Sea in early 2024, lead to increased logistics costs and extended delivery times. Furthermore, instability in regions where Vale maintains operational assets or supply chain partners can disrupt production and create unforeseen operational challenges. These factors necessitate continuous monitoring of global political landscapes to mitigate risks to Vale's 2024-2025 revenue projections.

Vale's operations are subject to strict governmental oversight, with mining royalties, such as Brazil's CFEM on iron ore at 2% of gross revenue, directly impacting profitability. The National Mining Agency (ANM) in Brazil regulates the sector. The ANM's 2025-2026 agenda includes reviewing financial guarantees and insurance requirements. Simplifying grant processes is also a focus. Changes in these regulations can directly affect Vale's operational costs and overall profitability.

International Agreements

Brazil's active engagement in international agreements significantly impacts Vale. A potential critical minerals agreement with the United States, for instance, could position Vale to benefit from initiatives like the Inflation Reduction Act (IRA), which earmarks substantial funding for clean energy, including an estimated $270 billion in tax credits and investments by 2031. Such accords enhance Vale's access to new markets for essential battery minerals, crucial for the global energy transition. Furthermore, Brazil's leadership in global climate negotiations, evidenced by its commitment to reduce greenhouse gas emissions by 50% by 2030, fosters an environment conducive to sustainable mining practices.

- IRA benefits: Potential for Vale to leverage US clean energy incentives for critical minerals.

- Market access: New agreements open pathways for Vale's battery minerals in key global markets.

- Energy transition: Brazil's role strengthens Vale's position in supplying essential materials.

- Sustainable mining: National climate targets align with and promote greener operational standards for Vale.

Host Government Relations

Maintaining positive relationships with host governments is crucial for Vale's long-term success, especially given its extensive operations in Brazil, Canada, and Indonesia. The company's ability to navigate local political landscapes and secure necessary operational permits, like those for its iron ore expansion projects, directly impacts production continuity. Contributing to local economies, as demonstrated by its 2024 investments in community development programs totaling over $150 million globally, reinforces its social license to operate. Any deterioration in these relationships, such as increased regulatory scrutiny or tax disputes, could lead to significant operational disruptions and increased business risks, impacting its 2025 financial outlook.

- Vale's 2024 iron ore production targets rely heavily on stable government relations for license renewals.

- Brazilian regulatory changes in Q1 2025 regarding environmental licensing could impact Vale's future project timelines.

- The company anticipates over $200 million in community investments by mid-2025 across its operational regions.

- Potential 2025 tax policy shifts in key jurisdictions like Canada could influence Vale's profitability.

Vale's operational stability relies heavily on managing government regulations in Brazil, including mining royalties and environmental licensing impacting 2024 profitability. Geopolitical tensions and international trade policies, like those affecting iron ore demand in China, significantly influence market access and revenue projections through 2025. Maintaining positive relationships with host governments across its global footprint, particularly for securing permits and navigating tax policies, remains crucial for its long-term success. Brazil's active role in climate agreements also guides Vale's sustainable mining practices.

| Factor | Impact on Vale | 2024/2025 Data Point |

|---|---|---|

| Brazilian Mining Royalties | Directly impacts profitability | CFEM on iron ore at 2% of gross revenue |

| US Inflation Reduction Act (IRA) | Potential for critical minerals market access | Estimated $270B in tax credits/investments by 2031 |

| Community Investments | Strengthens social license to operate | Over $150M globally in 2024; >$200M projected by mid-2025 |

What is included in the product

This Vale PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic planning.

It provides actionable insights into external forces shaping Vale's industry, helping stakeholders identify opportunities and mitigate risks.

Provides a clear, actionable summary of external factors, helping teams prioritize strategic responses and mitigate potential risks.

Economic factors

Vale's revenues are highly sensitive to global iron ore and nickel prices. These prices fluctuate due to factors like China's steel industry demand and global economic growth, directly impacting profitability. In the first quarter of 2025, Vale's average realized iron ore price stood at $98.5 per dry metric ton, a notable decrease from $110.2 in Q1 2024. This volatility poses a significant challenge to the company's financial stability and earnings forecasts.

Global economic health, particularly in major markets like China, significantly impacts demand for Vale's iron ore. A projected slowdown in global GDP growth to 2.9% in 2024, down from 3.1% in 2023, suggests potential headwinds for industrial production and construction. This deceleration could reduce global steel output, subsequently lowering demand for iron ore, a primary Vale product. Conversely, robust infrastructure spending, such as potential increases in public investment in key developing economies through 2025, could stimulate demand, offsetting some of the broader economic slowdown effects.

Vale, as a Brazilian multinational, is highly exposed to currency exchange rate fluctuations, notably between the Brazilian Real (BRL) and the US Dollar (USD). A weaker BRL, observed in early 2025 with the exchange rate hovering around R$5.20 to the USD, can reduce Vale's production costs when translated into dollar terms, enhancing competitiveness. However, this depreciation simultaneously increases the BRL value of its USD-denominated debt and impacts financial instruments. Such volatility directly influences Vale's profitability and financial leverage.

Inflation and Production Costs

Inflationary pressures directly impact Vale's operating expenses, increasing costs for labor, energy, and equipment. To mitigate these effects, Vale prioritizes robust cost efficiency across its global operations. In early 2025, specifically Q1, the company's focus on operational discipline led to lower unit iron ore costs. This strategic cost reduction was crucial in offsetting the impact of lower realized iron ore prices during the period, demonstrating effective cost management.

- Vale's Q1 2025 iron ore C1 cash cost, excluding freight, was approximately $21.5 per dry metric ton, reflecting a focus on cost control.

- Despite a 12% decline in average realized iron ore fines prices in Q1 2025 compared to Q4 2024, cost efficiencies helped maintain margins.

Capital Markets and Investment

Vale's ability to secure financing for its significant capital projects, such as the US$2.5 billion investments planned for 2024, heavily relies on the health of global capital markets. Investor sentiment, often swayed by the volatile outlook for iron ore and copper prices, directly impacts the company's access to capital and its share valuation.

The company's consistent dividend policy, with a 2023 dividend yield around 7.5%, alongside its share buyback programs, remains a critical consideration for attracting and retaining investors in 2024 and 2025.

- Global interest rates and liquidity directly affect Vale's cost of borrowing for new ventures.

- Commodity price forecasts for iron ore (e.g., around $100-$120/tonne for 2024) influence investor confidence.

- Vale's dividend payout strategy aims to return significant capital to shareholders.

- Share buybacks, like the ongoing program through 2025, signal financial strength and enhance shareholder value.

Vale's profitability is highly susceptible to volatile global iron ore prices, with Q1 2025 average realized prices at $98.5/dmt, a decrease from Q1 2024. Global economic slowdowns, reflected in a projected 2.9% GDP growth for 2024, directly temper demand for its products. Currency fluctuations, like the BRL/USD rate around R$5.20 in early 2025, significantly impact costs and debt. Despite these headwinds, Vale's Q1 2025 C1 cash cost of $21.5/dmt demonstrates effective cost control.

| Metric | Q1 2025 | Q1 2024 | ||

|---|---|---|---|---|

| Avg Iron Ore Price | $98.5/dmt | $110.2/dmt | ||

| Iron Ore C1 Cash Cost | $21.5/dmt | N/A | ||

| BRL/USD Exchange Rate (early) | ~R$5.20 | N/A |

Full Version Awaits

Vale PESTLE Analysis

The preview shown here is the exact Vale PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use. You can confidently assess the political, economic, social, technological, legal, and environmental factors impacting Vale based on this comprehensive preview. Every section, from the introduction to the conclusion, is presented accurately. Rest assured, what you see is precisely what you'll get to inform your strategic decisions.

Sociological factors

Maintaining strong community relations is crucial for Vale to secure its social license to operate, especially near its global mining sites. The company actively implements comprehensive community engagement plans and invests in social development initiatives. These programs span vital areas like education, health, and local infrastructure improvements, directly benefiting surrounding populations. For 2024, Vale prioritized hundreds of community engagement plans, with a significant focus on generating local employment opportunities and boosting income-related initiatives to foster economic resilience.

Effective management of labor relations is crucial for Vale, particularly given its vast global workforce. Maintaining positive relationships with labor unions helps prevent operational disruptions like strikes, which can significantly impact production and financial performance. As of late 2023, Vale directly employed over 67,000 individuals worldwide, making workforce demographics and a strong commitment to diversity and inclusion vital social considerations. Ensuring fair labor practices and fostering an inclusive environment are key to stable operations and meeting societal expectations.

Public perception of Vale, particularly within the mining sector, is heavily shaped by its environmental and safety track record. Catastrophic events like the Brumadinho dam failure in 2019 severely damaged the company's reputation, leading to significant societal and financial repercussions, including a 2024 agreement for R$37.7 billion in reparations. Vale is actively working to rebuild trust and enhance safety protocols, targeting a new benchmark for sustainable mining practices by 2025. This commitment aims to restore its standing as a leader in responsible resource extraction and value creation.

Corporate Social Responsibility (CSR)

Vale invests substantially in Corporate Social Responsibility initiatives, contributing significantly to the development of regions where it operates. In 2023, the company allocated over $200 million towards social development programs and community projects globally, demonstrating its commitment beyond mining operations. These ongoing initiatives for 2024 and 2025 are strategically aligned with global ambitions, including the United Nations Sustainable Development Goals (SDGs), focusing on areas like education, health, and local economic empowerment. This sustained investment helps foster positive community relations and mitigate operational risks.

- 2023 CSR Investment: Over $200 million allocated to community development.

- Strategic Alignment: Programs linked to UN Sustainable Development Goals (SDGs).

- Focus Areas: Education, health, and local economic empowerment in host communities.

- Impact: Strengthens social license to operate and reduces community-related risks.

Human Rights

Vale, as a major global mining entity, faces significant scrutiny regarding its human rights practices across its operations and supply chain. The company is expected to uphold international principles, like the UN Guiding Principles on Business and Human Rights, to prevent and address any adverse impacts. Communities affected by past incidents, such as the Brumadinho dam collapse in 2019, continue to voice concerns about ongoing issues, including resettlement and reparations, which are still in various stages of resolution in 2024.

- Vale's 2023 Human Rights Report outlined engagement with over 100 communities.

- In early 2024, discussions continued regarding compensation for approximately 140,000 claimants related to the Brumadinho event.

- The company aims to achieve 100% resolution of priority human rights grievances by Q4 2025.

Vale's social license to operate relies heavily on strong community and labor relations, crucial for stable global operations in 2024. The company prioritizes extensive CSR investments and human rights adherence, allocating over $200 million in 2023 for community development. Public perception, influenced by past events like Brumadinho, necessitates ongoing efforts to rebuild trust and enhance safety protocols by 2025. Addressing over 140,000 Brumadinho claimants in 2024 remains a key social and financial commitment.

| Factor | 2024/2025 Focus | Data Point |

|---|---|---|

| Community Relations | Engagement Plans | Hundreds of plans |

| CSR Investment | Social Development | >$200M (2023) |

| Reputation | Brumadinho Reparations | R$37.7B (2024) |

Technological factors

Vale is significantly advancing its digital transformation initiatives, targeting enhanced operational efficiency, cost reduction, and safety improvements across its global operations. The company has notably expanded its autonomous haul truck fleet, with projections to reach over 200 autonomous vehicles by late 2024, contributing to safer sites and optimized material handling. Furthermore, Vale is implementing digital twin technology for critical infrastructure, such as its iron ore processing plants, to enable real-time monitoring and predictive maintenance. These technological adoptions are central to creating more intelligent and reliable mining operations, aligning with its 2025 strategic goals for productivity gains.

Vale is aggressively leveraging artificial intelligence and machine learning to optimize its mining operations, improving ore management and predicting equipment failures. The company's 2024 capital expenditure plan, projected at around $6.5 billion, includes significant investments in digital transformation and innovation, aiming to enhance efficiency. Collaborations with technology firms are identifying new drilling targets and minimizing exploration risks, crucial for maintaining a competitive edge. These technological advancements are a core pillar of Vale's strategy, contributing to projected operational cost reductions and safety improvements by 2025.

Vale is actively investing in advanced decarbonization technologies, aiming to significantly reduce its operational carbon footprint and support the steel industry's green transition.

A key focus is the development of innovative iron ore briquettes, projected to cut blast furnace emissions by up to 10%.

Through its venture capital arm, Vale has allocated over $100 million to date, backing startups focused on carbon capture, green hydrogen, and other sustainable solutions.

These strategic investments align with Vale's 2024-2025 sustainability goals, targeting a 15% reduction in Scope 1 and 2 emissions by 2030.

Logistics and Supply Chain Technology

Vale leverages advanced logistics and supply chain technology across its vast network of railroads and ports, significantly boosting operational efficiency. The deployment of 4G networks along its major rail lines, like the Carajás Railway, facilitates the automation of operations and supports autonomous vehicle integration, enhancing safety. This technological push aims to reduce operational costs and improve the flow of iron ore, with expected efficiency gains of 15% by late 2025 for key corridors.

- Vale's 4G network expansion covers over 900 kilometers of rail lines.

- Autonomous train operations are projected to increase by 20% by 2025.

- Digital twin technology is being implemented for port optimization, aiming for a 10% reduction in vessel waiting times.

- Real-time data analytics improve predictive maintenance, reducing unplanned downtime by 12% in 2024.

Workforce Digital Inclusion

As Vale increasingly integrates advanced technologies, ensuring its workforce possesses essential digital skills is paramount. The company actively invests in comprehensive training and digital inclusion initiatives, aiming to prepare its employees for the evolving demands of modern mining operations.

This strategic focus, with over 150,000 training hours dedicated to digital literacy in 2024, aims to cultivate a digitally empowered workforce, enhancing operational efficiency and safety across its global sites.

- Vale projects a 20% increase in digital training modules by mid-2025, focusing on AI and automation.

- Over 70% of Vale's operational employees are expected to complete foundational digital literacy courses by late 2024.

Vale is aggressively adopting digital transformation, aiming for operational efficiency and safety, evidenced by over 200 autonomous haul trucks by late 2024 and a 2024 capital expenditure of around $6.5 billion in innovation. The company leverages AI/ML for optimizing ore management and predictive maintenance, while investing in decarbonization technologies like iron ore briquettes to cut emissions by up to 10%. Furthermore, Vale's 4G network expansion across over 900 kilometers of rail lines supports autonomous train operations, projected to increase by 20% by 2025. Workforce digital upskilling, with 150,000 training hours in 2024, is crucial for these advancements.

| Technological Initiative | 2024/2025 Target/Status | Impact |

|---|---|---|

| Autonomous Haul Trucks | Over 200 by late 2024 | Enhanced safety, optimized material handling |

| 2024 Capex for Innovation | ~$6.5 billion | Drives digital transformation and efficiency |

| Iron Ore Briquettes | Up to 10% blast furnace emission cut | Supports decarbonization and green steel |

| 4G Rail Network Coverage | Over 900 kilometers | Enables autonomous train operations |

| Workforce Digital Training | 150,000+ hours in 2024 | Cultivates digitally empowered workforce |

Legal factors

Vale faces strict environmental regulations across its global operations, particularly concerning environmental licensing, waste management, and mine closure. Brazil's evolving environmental permitting framework remains a critical focus for the mining giant, impacting project timelines and operational costs. For instance, new federal environmental licensing requirements expected by early 2025 could further influence Vale's project approvals and compliance outlays. In 2024, Vale's provisions for decommissioning and environmental remediation reflect substantial commitments to these regulatory demands, totaling billions of USD globally.

Vale's operational scope, including its extensive iron ore and nickel activities, is directly governed by strict mining laws and concessions granted by various governments. The Brazilian Mining Code, specifically Decree-Law 227/1967, establishes the foundational legal framework for all mining activities within Brazil, where Vale has significant operations. The National Mining Agency (ANM) serves as the primary regulator, diligently overseeing compliance with these complex regulations. Notably, the ANM is currently updating its regulatory agenda for the 2025-2026 biennium, potentially introducing new compliance requirements for major players like Vale.

Following past dam failures, Brazil has significantly increased regulations and oversight concerning tailings dam safety, directly impacting Vale.

The company is subject to the stringent National Dam Safety Policy and has committed substantial capital, with an estimated R$16.5 billion (approximately USD 3.2 billion) allocated by early 2024 for its dam decharacterization program.

Vale faces severe legal consequences, including hefty fines and potential criminal charges, for not meeting critical decommissioning deadlines set by authorities like Brazil's National Mining Agency (ANM).

This heightened legal scrutiny ensures ongoing compliance efforts and significant operational adjustments for the mining giant into 2025.

Litigation and Legal Disputes

Vale continues to navigate extensive legal challenges stemming from past environmental incidents, notably the Brumadinho and Mariana dam collapses. These ongoing lawsuits involve significant financial claims for damages and reparations, impacting the company's financial outlook through 2025. For instance, negotiations related to the Mariana disaster, involving Samarco, BHP, and Vale, were still progressing in early 2024, targeting a potential settlement exceeding R$100 billion. The company also faces legal scrutiny from regulatory bodies, including proceedings initiated by the Brazilian Securities and Exchange Commission (CVM).

- Brumadinho litigation continued into 2024, with victim compensation programs ongoing.

- Mariana dam collapse settlement talks, involving a potential R$100 billion plus agreement, were active in Q1 2024.

- Vale’s provisions for these legal matters significantly impact its balance sheet and cash flow projections for 2024-2025.

Tax Legislation

Changes in tax laws at federal, state, and municipal levels directly impact Vale's financial performance, especially given Brazil's complex tax system. Brazil's significant tax reform, approved in late 2023, is still being implemented through 2024 and 2025, introducing new consumption taxes and potentially altering corporate tax structures. Vale's tax obligations are a substantial component of its operating costs, with corporate income tax (IRPJ) and social contribution on net profit (CSLL) being key considerations. The ongoing transition requires Vale to continuously adapt its financial planning and compliance strategies.

- Brazil's tax reform aims to consolidate five federal taxes into a dual-VAT system by 2033, with initial phases beginning in 2024.

- Vale's effective tax rate is influenced by its global operations, navigating diverse international tax regimes.

- The complexity of tax legislation in Brazil often leads to significant compliance costs for large corporations like Vale.

Vale navigates complex legal frameworks, including evolving environmental regulations and updated ANM mining rules for 2025-2026. Ongoing litigation from past dam failures, like the Mariana disaster with R$100 billion settlement talks in Q1 2024, heavily impacts its financial outlook. Brazil's 2023 tax reform, phasing in through 2025, also necessitates continuous adaptation of Vale's financial planning. The company committed R$16.5 billion by early 2024 to dam decharacterization.

| Legal Factor | Key Impact | 2024/2025 Data |

|---|---|---|

| Environmental Licensing | Project timelines, operational costs | New federal requirements expected by early 2025 |

| Dam Decharacterization | Safety compliance, capital expenditure | R$16.5 billion allocated by early 2024 |

| Mariana Litigation | Financial claims, reparations | R$100 billion+ settlement talks in Q1 2024 |

| Tax Reform | Corporate tax structure, compliance | Phased implementation through 2025 |

Environmental factors

Vale is actively addressing climate change by targeting significant reductions in its greenhouse gas emissions. The company aims for a 30% reduction in Scope 1 and 2 emissions by 2030, based on 2017 levels, and a long-term goal of achieving net-zero emissions by 2050. Vale has committed approximately $2 billion towards decarbonization initiatives through 2030, including investments in renewable energy and green steel technologies. These efforts, crucial for meeting investor and societal expectations, are transparently reported in line with international frameworks, underscoring its sustainability strategy.

The safe management and decommissioning of its tailings dams remains Vale's paramount environmental and safety commitment. The company has actively progressed its plan to eliminate all upstream tailings dams, aiming for completion by 2035, with 13 of 30 such structures already de-characterized by early 2024. This initiative, reinforced by a 2024 investment of approximately $180 million in dam safety, is crucial following the catastrophic failures in Mariana and Brumadinho. Vale has also significantly reduced the number of dams under emergency protocols, reflecting ongoing risk mitigation efforts.

As a major industrial water user, Vale is intensely focused on responsible water management. The company targets a 10% reduction in fresh water consumption by 2030 from its 2017 baseline, actively investing in technologies like dry processing to achieve this. By early 2025, over 70% of iron ore production is expected to use dry processing, significantly cutting water demand. Vale also rigorously manages the quality of water discharged from its operations to minimize environmental impact and comply with evolving regulations.

Biodiversity and Land Rehabilitation

Vale SA's mining operations significantly impact land and ecosystems, necessitating robust environmental stewardship. The company commits to protecting and restoring vast habitats, with a goal of rehabilitating 6,700 hectares of degraded areas by 2030. In 2024, Vale continued investing in biodiversity conservation projects, dedicating approximately $100 million annually to environmental programs, including restoring native vegetation in the Amazon. Their efforts include comprehensive land rehabilitation post-mining and supporting local biodiversity initiatives, crucial for maintaining ecological balance.

- Vale aims to rehabilitate 6,700 hectares of degraded land by 2030, demonstrating long-term environmental commitment.

- Annual investments in environmental programs, including biodiversity, are projected to be around $100 million for 2024-2025.

- Significant focus on restoring native vegetation in biomes like the Amazon, crucial for carbon sequestration and biodiversity.

Waste Management

The generation and management of mining waste pose a significant environmental challenge for Vale. The company must implement comprehensive plans for waste management, including the safe storage of tailings and other mining byproducts. This is a crucial element of its environmental impact assessments and operational planning, especially following incidents such as the Brumadinho dam collapse in 2019. Vale has invested significantly in decommissioning upstream tailings dams, aiming to eliminate all such structures by 2035, with 40% already eliminated by late 2023.

- Vale aims to eliminate all upstream tailings dams by 2035.

- By late 2023, approximately 40% of these structures had been decommissioned.

- Ongoing investments in waste management and dam safety measures are critical for 2024-2025 operations.

Vale aims to cut Scope 1 and 2 emissions by 30% by 2030, investing $2 billion in decarbonization through 2030. A key priority is eliminating all 30 upstream tailings dams by 2035, with 13 de-characterized by early 2024.

The company targets a 10% reduction in fresh water consumption by 2030; over 70% of iron ore production will use dry processing by early 2025. Vale also plans to rehabilitate 6,700 hectares of degraded land by 2030, allocating $100 million annually for environmental programs in 2024-2025.

| Metric | Target/Status (2024/2025) | Investment (2024/2025) |

|---|---|---|

| Scope 1&2 Emissions Reduction | 30% by 2030 (from 2017) | $2B (by 2030) |

| Upstream Tailings Dams Elimination | 13 of 30 de-characterized (early 2024) | $180M (2024) |

| Dry Processing Use (Iron Ore) | >70% (early 2025) | N/A |

PESTLE Analysis Data Sources

Our PESTLE analysis is built upon a robust foundation of data, drawing from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.