Vale Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vale Bundle

Vale's position in the global mining industry is shaped by powerful forces. Understanding the intensity of rivalry among major players, the bargaining power of suppliers, and the influence of buyers is crucial for strategic planning. Furthermore, the threat of new entrants and the availability of substitute products significantly impact Vale's profitability and market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Vale’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of essential heavy machinery, such as Caterpillar and Komatsu, hold some power due to the technological sophistication and specialized nature of their equipment. However, Vale's status as a major global purchaser provides significant negotiating leverage through bulk orders and long-term contracts. This scale helps balance the power dynamic, securing favorable terms for its extensive operations. Vale's projected 2024 capital expenditures, estimated around $6.5 billion, underscore its substantial purchasing volume. This enables the company to maintain a strong position in supplier negotiations for critical assets.

Vale's extensive mining operations are highly energy-intensive, making it significantly dependent on suppliers of diesel and electricity. Global energy markets, particularly throughout 2024, have shown considerable volatility, directly impacting fuel and electricity prices. This grants energy providers substantial bargaining power over Vale's operational costs. To counter this, Vale actively hedges fuel prices and is accelerating investments in renewable energy sources, aiming to reduce its reliance on fossil fuels and stabilize energy expenditures.

A highly skilled workforce and strong labor unions significantly empower suppliers for Vale, particularly in critical mining operations. Labor negotiations, like those seen in 2024 with various unions impacting the global mining sector, pose a direct threat of strikes, which can severely disrupt Vale's iron ore and nickel production. Ensuring competitive compensation, such as Vale's reported average annual total compensation of over R$160,000 per employee in 2023 (latest available data for 2024 context), and fostering positive labor relations are paramount for Vale to maintain operational stability and avoid costly disruptions that impact profitability.

Logistics and Infrastructure

Vale relies heavily on external logistics and infrastructure providers for global ore transport, despite owning significant portions of its supply chain, such as its extensive Brazilian rail network including the Carajás Railroad. While Vale's ownership mitigates some risk, third-party maritime shippers and rail operators in other regions hold considerable bargaining power, especially where infrastructure alternatives are limited. For instance, in Q1 2024, shipping costs remained a significant operational expense, reflecting this dependence. This reliance on a concentrated group of specialized carriers can lead to higher costs or service disruptions if favorable terms are not secured.

- Vale operates over 2,000 km of railways in Brazil, but global shipping relies on external providers.

- Maritime freight rates, influenced by global demand and vessel availability, directly impact Vale's profitability.

- Limited port access or specialized vessel requirements can empower a few key shipping companies.

- Logistics expenses represent a notable portion of Vale's overall cost structure in 2024.

Technical Services and Consumables

Suppliers of critical consumables like explosives and specialized technical services exert significant bargaining power over Vale. The reliability and consistent quality of these inputs are paramount for uninterrupted operational efficiency and safety across Vale's global mining sites, which saw iron ore production reach 70.8 million tonnes in Q1 2024. To mitigate this supplier leverage, Vale strategically qualifies multiple suppliers for key materials, fostering competition and ensuring supply chain resilience. Additionally, the company maintains robust strategic stockpiles of essential materials, safeguarding against potential disruptions and price volatility in 2024.

- Critical inputs: Explosives, chemicals, and specialized technical services.

- Operational impact: Direct link to production efficiency and safety.

- Mitigation: Multi-supplier qualification and strategic stockpiles.

- 2024 context: Vale's Q1 2024 iron ore output was 70.8 million tonnes, underscoring input criticality.

Vale experiences significant supplier power from energy providers due to 2024 market volatility and from skilled labor unions, impacting costs and operational stability. While heavy machinery and critical consumables suppliers hold leverage, Vale's substantial purchasing volume and multi-supplier strategies mitigate this. Logistics providers, particularly for global maritime transport, exert power due to specialized needs, influencing Q1 2024 shipping costs.

| Supplier Group | Bargaining Power | 2024 Impact/Metric |

|---|---|---|

| Energy Providers | High | Global energy volatility |

| Labor Unions | High | Potential strike actions |

| Logistics | Moderate-High | Significant Q1 2024 shipping costs |

| Machinery/Consumables | Moderate | ~$6.5B 2024 capex leverage |

What is included in the product

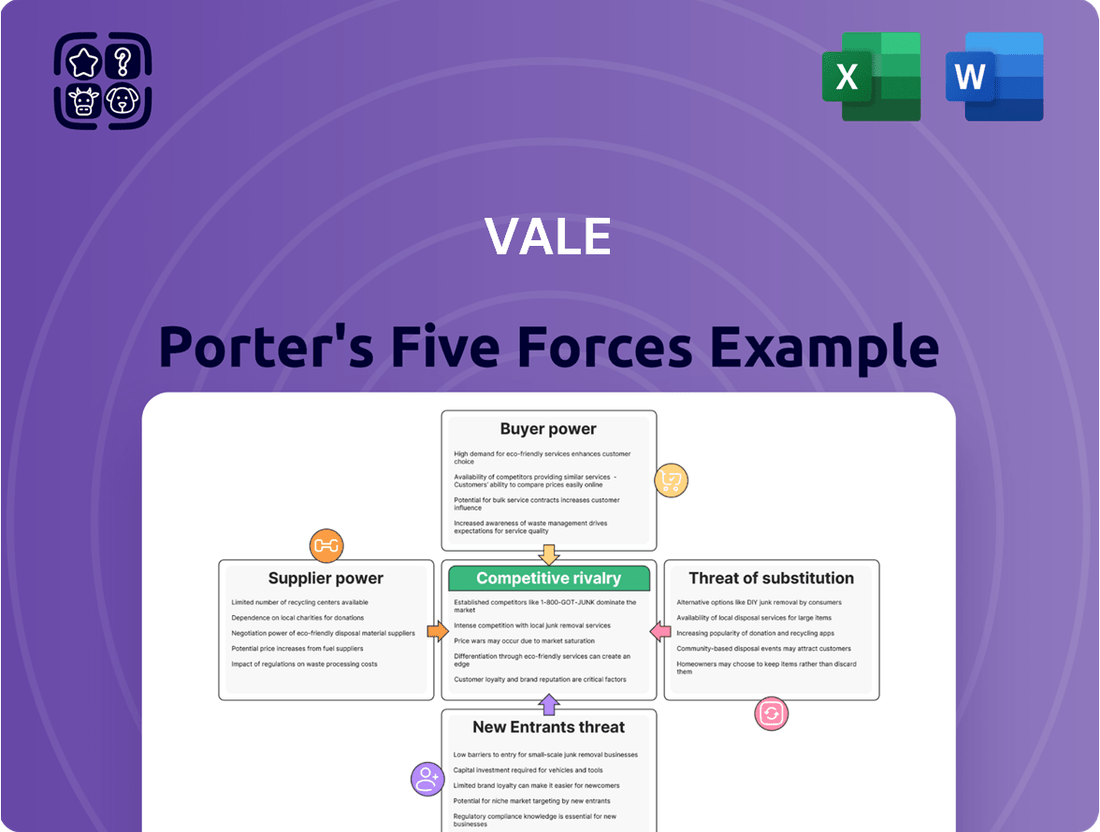

Examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitutes impacting Vale's industry.

Quickly identify and neutralize competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Vale faces significant customer bargaining power due to a highly concentrated global steel industry, its primary customer base. A few large steelmakers, particularly in China, account for a substantial portion of global demand; China alone produced over 1.019 billion tonnes of crude steel in 2023. This concentration allows major customers to negotiate aggressively on prices and contract terms for iron ore. Consequently, Vale's revenue is highly sensitive to the purchasing decisions and production levels of these key players, impacting its financial performance.

Iron ore, as a global commodity and Vale's primary product, is subject to market-based pricing. Prices are largely determined by supply and demand on benchmark indices, such as the Platts IODEX 62% Fe CFR China, which saw averages around $110-120 per dry metric ton in early 2024. This mechanism significantly limits any single customer's ability to dictate prices below prevailing market rates. However, large buyers can influence overall market sentiment and futures prices through their substantial purchasing patterns. Their collective demand shifts, for instance, can impact the forward curve, even if individual spot price negotiation power remains low.

Vale is renowned for its high-grade iron ore from the Carajás mine, which significantly boosts productivity and lowers emissions for steelmakers globally. This premium quality creates substantial switching costs for customers whose mills are specifically optimized for this superior ore type. As of 2024, the demand for high-quality iron ore remains robust, bolstering Vale's position. This strong differentiation empowers Vale with a notable degree of pricing power over alternatives that offer lower-grade ore.

Long-Term Supply Agreements

Vale establishes long-term supply agreements with major customers like steel producers, ensuring stable demand and predictable supply volumes. While these agreements provide significant volume security for Vale, pricing mechanisms are typically linked to prevailing market indices, such as the Platts IODEX for iron ore, which was around $115 per dry metric ton in early 2024, preserving exposure to price volatility. These contracts foster deep strategic relationships, yet they still reflect the nuanced balance of power between Vale as a key supplier and its large, consolidated customer base. The ability of customers to negotiate favorable terms depends heavily on global commodity supply and demand dynamics.

- Long-term contracts provide volume stability.

- Pricing is often tied to market indices like Platts IODEX.

- Market prices for iron ore fluctuated around $115/dmt in early 2024.

- Agreements balance strategic relationships with market power.

Threat from Steel Recycling

The increasing reliance on scrap steel in electric arc furnaces significantly enhances the bargaining power of steel manufacturers, posing a direct threat to virgin iron ore demand. As of 2024, EAFs are responsible for over 30% of global crude steel production, primarily utilizing recycled materials. This expanding use of scrap provides a viable alternative to newly mined iron ore, acting as a natural cap on price increases for producers like Vale. The growing efficiency and widespread adoption of steel recycling temper long-term demand growth for iron ore, limiting Vale’s ability to dictate pricing.

- EAFs use over 30% of global crude steel production as of 2024.

- Recycled steel provides a key alternative to virgin iron ore.

- This trend caps long-term demand growth for iron ore.

- It limits the pricing power of major producers like Vale.

The concentrated global steel industry, with China producing over 1.019 billion tonnes of crude steel in 2023, grants customers significant bargaining power. While high-grade ore provides some pricing leverage for Vale, commodity pricing linked to indices like Platts IODEX, around $115 per dry metric ton in early 2024, limits individual customer influence. However, the increasing use of scrap steel in EAFs, accounting for over 30% of global crude steel production in 2024, presents a viable alternative, capping iron ore prices.

| Factor | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | High bargaining leverage | China crude steel: 1.019B tonnes (2023) |

| Commodity Pricing | Market-driven prices | Platts IODEX: ~$115/dmt (early 2024) |

| Scrap Steel Alternative | Caps iron ore demand/price | EAFs: >30% global crude steel production |

Preview the Actual Deliverable

Vale Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our Vale Porter's Five Forces Analysis meticulously breaks down the competitive landscape of the iron ore industry. It thoroughly examines the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This comprehensive report provides actionable insights to understand Vale's strategic positioning and future outlook.

Rivalry Among Competitors

The seaborne iron ore market is a significant oligopoly, dominated by major players like Vale, Rio Tinto, and BHP, with Fortescue Metals Group also holding a substantial share. This structure fosters intense rivalry, primarily focused on achieving superior operational efficiency and cost leadership to gain market share. For example, in 2024, these key producers collectively accounted for over 70% of global seaborne iron ore shipments. Any strategic decision by one, such as changes in production volumes or expansion plans, immediately impacts the competitive landscape and profitability of all rivals.

High exit barriers significantly intensify competitive rivalry in the mining sector. Mining companies face immense, illiquid investments in mine development and infrastructure, often totaling billions of dollars for new projects. For instance, environmental reclamation bonds alone can demand hundreds of millions, compelling continued operation even during low profitability periods. This forces firms to aggressively compete for market share and survival, especially when commodity prices experience volatility, as observed in early 2024. The sheer sunk costs mean companies cannot easily leave, exacerbating industry competition.

Competitive rivalry in the iron ore market is intensely focused on cost leadership, as the product is largely a commodity with little differentiation beyond grade. Companies that achieve lower cash costs for extraction, processing, and transportation gain a sustainable competitive advantage. Vale benefits from its high-grade deposits, like those in Carajás, which naturally provide a cost edge due to higher iron content. However, continuous operational excellence is crucial; for instance, Vale reported C1 cash costs of $19.3 per ton for its Northern System in Q1 2024, highlighting ongoing efforts to maintain its cost position against global competitors.

Competition for Future Resources

Competition for Vale extends beyond current output to securing future mineral assets. Major mining companies fiercely vie for new, high-quality, and economically viable deposits, crucial for long-term growth and maintaining market share. Securing these future growth projects, like critical mineral exploration, is essential for sustained profitability and competitive positioning.

- Global exploration spending in 2024 is projected to remain robust, particularly for critical minerals like copper and nickel.

- Major players allocate significant capital expenditure towards exploration; for instance, BHP's exploration budget for 2024 is substantial.

- Acquisition of exploration tenements and advanced projects remains a key strategy for securing future resource pipelines.

- The race for new discoveries impacts valuations and long-term strategic planning in the mining sector.

Logistics and Infrastructure Control

Control over dedicated and efficient logistics infrastructure, including extensive railways and deep-water ports, serves as a major competitive differentiator for Vale. The company's integrated northern and southeastern systems in Brazil significantly reduce costs and enhance reliability. This strategic advantage, especially with its Carajás railway, minimizes reliance on expensive third-party infrastructure, which is crucial for iron ore exports.

In 2024, Vale's control over its logistics network, which handles over 300 million tons of iron ore annually, remains a key battleground for market share against competitors. This integrated system allows for optimized supply chain efficiency and better control over delivery schedules.

- Vale's railway network spans over 10,000 kilometers in Brazil, a critical asset.

- Deep-water ports like Ponta da Madeira offer capacity for large Valemax vessels.

- Logistics efficiency directly impacts Vale's cost of goods sold, providing a competitive edge.

- Competitors often face higher freight costs due to reliance on shared or less efficient infrastructure.

Competitive rivalry in the oligopolistic seaborne iron ore market remains intense, driven by major players like Vale, Rio Tinto, and BHP. Firms fiercely pursue cost leadership, as seen with Vale's Q1 2024 C1 cash cost of $19.3 per ton for its Northern System. High exit barriers, due to massive sunk investments, further compel aggressive competition for market share and future high-quality deposits. Control over integrated logistics, such as Vale's 10,000 km railway network, provides a crucial competitive advantage in 2024.

| Company | 2024 Market Share (Est.) | 2024 Key Metric |

|---|---|---|

| Vale | ~15-18% | Q1 2024 C1 Cash Cost: $19.3/ton |

| Rio Tinto | ~18-20% | Q1 2024 Pilbara Shipments: 77.9 Mt |

| BHP | ~12-14% | FY2024 Iron Ore Production Guidance: 254-264 Mt |

SSubstitutes Threaten

The most significant substitute for Vale's virgin iron ore is recycled scrap steel, predominantly used in electric arc furnaces (EAFs).

As global decarbonization efforts accelerate, EAF steelmaking, which relies heavily on scrap, is expected to expand, potentially moderating long-term growth in iron ore demand.

In 2024, EAFs continue to gain traction, with their share of global crude steel production projected to rise as steelmakers aim for lower emissions. The availability and fluctuating price of high-quality scrap steel remain critical factors influencing this substitution threat.

This shift could impact Vale's market position, given the push towards more circular economies and reduced reliance on primary raw materials.

Direct Reduced Iron (DRI), produced using natural gas or increasingly hydrogen, presents a growing substitute threat to Vale's traditional iron ore products, especially for electric arc furnaces. While DRI currently constitutes a smaller segment of global steel production, the push towards 'green steel' utilizing hydrogen-based DRI is a significant long-term technological shift. Industry analysts project hydrogen-based steel production to reach over 100 million tonnes annually by 2030, reflecting this trend. Vale itself is actively investing in DRI technologies and low-carbon steel solutions, recognizing this evolving market dynamic and adapting its strategy.

The primary threat to Vale's nickel business stems from alternative battery chemistries, notably Lithium Iron Phosphate (LFP). While high-performance electric vehicle applications still favor nickel-based cathodes, LFP's market share in EVs grew significantly, reaching over 60% in China by early 2024. The rapid evolution of battery technology poses a substantial risk, as further advancements could reduce nickel demand. The pace of innovation in the EV sector directly determines the severity of this substitution threat.

Manganese and Copper Substitutes

The threat of substitutes for Vale's copper and manganese products presents a nuanced challenge. Aluminum can substitute copper in certain electrical applications, particularly power transmission lines, where its lighter weight and lower cost per unit volume are advantages, despite its approximately 60% lower conductivity compared to copper. For manganese, essential in steel production to enhance strength and hardness, other elements like nickel or molybdenum can sometimes be used, but manganese remains the most cost-effective and widely adopted deoxidizer and desulfurizer. In 2024, the global steel industry's reliance on manganese remains robust, limiting widespread substitution. This makes the overall threat of substitutes for manganese relatively low due to its unique combination of properties and cost-efficiency.

- Aluminum's 2024 price per ton generally remains lower than copper, driving substitution in bulk electrical uses.

- Copper's superior conductivity (around 1.7 times that of aluminum) maintains its dominance in high-performance electrical components.

- Manganese is crucial, with roughly 90% of its demand tied to steel production.

- No other element offers manganese's cost-benefit ratio for steel's key properties.

Limited Direct Substitutes for Iron in Steel

There are virtually no direct, large-scale, and economically viable elemental substitutes for iron in the production of steel. Steel's unique blend of strength, workability, and cost-effectiveness solidifies its position as the world's most vital construction and engineering material. This fundamental reality ensures a consistent baseline demand for iron ore, making the overall threat of substitution moderate for companies like Vale. For instance, global crude steel production is projected to remain robust, with an estimated output of over 1.9 billion tonnes in 2024, emphasizing iron's irreplaceable role.

- No viable elemental substitute for iron in steel production.

- Steel's strength, workability, and low cost are unmatched.

- Global crude steel output projected over 1.9 billion tonnes in 2024.

- Ensures sustained demand for iron ore.

The threat of substitutes for Vale's products varies; recycled scrap steel and Direct Reduced Iron increasingly challenge iron ore, particularly with EAF steelmaking expanding in 2024.

LFP batteries pose a significant threat to nickel demand, capturing over 60% of the Chinese EV market by early 2024.

While aluminum can substitute copper in some electrical applications, manganese faces a low threat due to its irreplaceable and cost-effective role in steel production.

Crucially, there is no viable elemental substitute for iron in steel, ensuring persistent demand, with global crude steel output projected over 1.9 billion tonnes in 2024.

| Resource | Primary Substitute | 2024 Impact |

|---|---|---|

| Iron Ore | Recycled Scrap Steel, DRI | EAF expansion, Hydrogen-DRI growth |

| Nickel | Lithium Iron Phosphate (LFP) | 60%+ China EV market share for LFP |

| Copper | Aluminum | Limited substitution in bulk electrical |

| Manganese | (Minor Alternatives) | Low threat, critical for 90% of steel |

Entrants Threaten

Entering the large-scale mining industry faces a major hurdle due to exceptionally high capital requirements, often running into tens of billions of dollars. For instance, developing a new copper mine can easily exceed $5 billion, with some projects like the Simandou iron ore project in Guinea estimated to cost over $15 billion for infrastructure alone in 2024. These massive funds are essential for extensive exploration, mine development, sophisticated processing facilities, and dedicated infrastructure such as railways and ports. This colossal financial barrier effectively makes it nearly impossible for new companies to enter the market at a scale that could challenge established global players.

Existing giants like Vale, a leading global iron ore producer, benefit immensely from enormous economies of scale across their operations, including production, procurement, and logistics. For instance, Vale’s 2024 iron ore production targets highlight their immense operational footprint, enabling a significantly lower cost per ton. A new entrant, lacking such scale, would operate at a much higher cost, making it uncompetitive against established producers. This cost disadvantage creates a formidable barrier to entry, especially in the highly price-sensitive commodity market.

The threat of new entrants for Vale is significantly mitigated by the limited access to viable ore deposits. The most accessible, high-grade, and economically attractive mineral deposits globally are already controlled by established major mining companies. This forces potential new entrants to explore in more remote, geopolitically risky, or geologically challenging locations, which drastically increases their initial capital expenditure and operational costs. For instance, developing a new iron ore project in 2024 can cost several billions of US dollars, making market entry prohibitive without access to prime resources.

Stringent Regulatory and Environmental Hurdles

New entrants face substantial barriers in the mining sector due to stringent regulatory and environmental hurdles. The industry navigates a complex web of government regulations, including detailed environmental impact assessments and community engagement requirements. Obtaining necessary permits alone can often span more than a decade, demanding significant expertise and financial resources.

This extensive regulatory landscape, further amplified by the increasing focus on Environmental, Social, and Governance (ESG) standards, creates a formidable administrative barrier for new companies. For instance, in 2024, the average permitting time for a new mine in North America remained over 7 years, reflecting the persistent challenges.

- Permitting processes often exceed a decade, requiring extensive due diligence.

- High costs associated with regulatory compliance deter smaller players.

- ESG standards are raising the bar for operational and social licenses.

- Expertise in environmental law and community relations is critical.

Control over Logistics and Infrastructure

New entrants face a significant hurdle due to incumbent control over logistics and infrastructure. Companies like Vale possess extensive rail networks, ports, and shipping fleets essential for transporting massive volumes of iron ore from mines to global markets. A new competitor would need to invest billions in building similar infrastructure or pay high access fees to existing players, creating a substantial financial barrier. This capital-intensive requirement effectively deters new market participants, solidifying Vale's position.

- Vale's established infrastructure includes dedicated rail lines and port terminals.

- New entrants would incur prohibitive costs for comparable logistics.

- Accessing incumbent networks often comes with significant fees.

- This control creates a high barrier to entry in key iron ore markets.

The threat of new entrants to Vale is exceptionally low, primarily due to the colossal capital required, often billions for new projects in 2024, alongside established economies of scale. Limited access to prime ore deposits and protracted permitting, averaging over seven years in 2024, further deter new market participants. Incumbent control over critical logistics infrastructure also creates an insurmountable barrier.

| Barrier | Description | 2024 Impact |

|---|---|---|

| Capital | New mine development | >$5B per project |

| Permitting | Regulatory approval time | >7 years average |

| Infrastructure | Logistics control | Billions to replicate |

Porter's Five Forces Analysis Data Sources

Our Vale Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research reports. We also leverage publicly available financial data and news articles to capture competitor strategies and market trends.