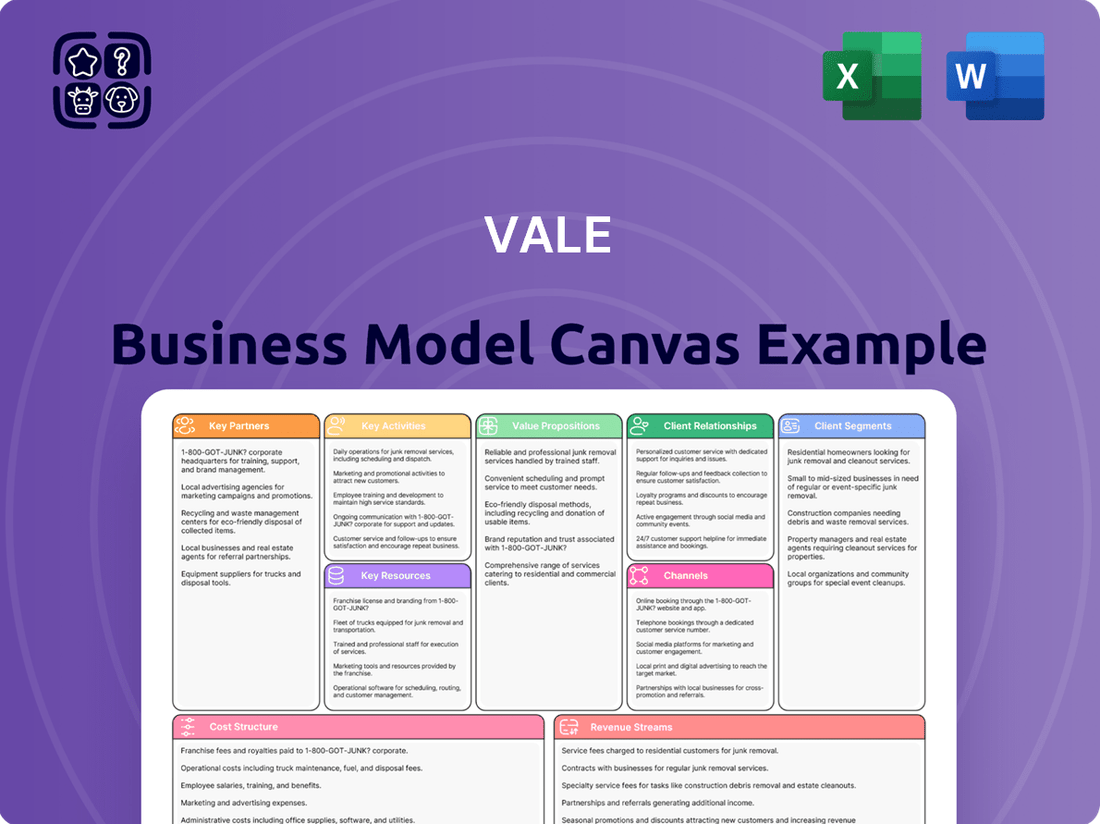

Vale Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vale Bundle

Unlock the full strategic blueprint behind Vale's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Vale’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Vale operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Vale’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Vale’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Vale frequently forms joint ventures with other mining companies to share the substantial costs and risks of large-scale mine development and exploration. These collaborations, crucial in 2024 for projects like the Northern System expansion, provide access to new mineral reserves, advanced technologies, and essential regional expertise. Strategic alliances also extend to technology firms, co-developing solutions for safer and more sustainable mining operations, enhancing Vale’s operational efficiency and environmental stewardship.

Maintaining robust relationships with national and local governments is essential for Vale, ensuring the acquisition of vital mining licenses and permits for operational continuity across its global footprint.

These partnerships necessitate stringent compliance with evolving environmental regulations, such as Vale's ongoing dam decommissioning efforts, with 29% of upstream dams already eliminated by Q1 2024, alongside adherence to tax agreements and community development commitments.

Proactive engagement with regulatory bodies helps Vale mitigate significant political and regulatory risks, particularly in diverse jurisdictions like Brazil and Canada, where regulatory landscapes are constantly being updated.

This strategic collaboration supports long-term stability and predictability for its mining operations, crucial for navigating the complex global raw materials market in 2024.

Vale's business model critically relies on an expansive network of logistics and infrastructure providers, encompassing both proprietary assets and key third-party partnerships. This includes railway operators like Vale's own Estrada de Ferro Carajás (EFC), which spans over 900 kilometers, along with major shipping lines and port authorities. These long-term contracts are essential for the cost-effective and reliable transportation of hundreds of millions of tons of iron ore and other minerals annually. In 2024, ensuring seamless global supply chain operations through these collaborations remains paramount for Vale to deliver its products efficiently from remote mine sites to customers worldwide.

Industrial Customers & Offtake Agreements

Vale establishes crucial long-term strategic partnerships with major industrial customers, including global steel mills and emerging battery manufacturers. These relationships are often formalized through robust offtake agreements, guaranteeing the sale of a significant portion of future production, especially for high-grade iron ore and nickel. This structure provides Vale with substantial revenue predictability, as evidenced by its diversified customer base and consistent sales volumes through 2024. For customers, it ensures a stable and reliable supply of critical raw materials essential for their operations.

- Vale's iron ore sales volumes were approximately 77.5 million metric tons in Q1 2024.

- Long-term offtake agreements help mitigate commodity price volatility for both parties.

- Key partnerships include major Asian steel producers and EV battery supply chain players.

- Nickel sales, vital for batteries, reached 47.2 thousand metric tons in Q1 2024.

Technology & Equipment Suppliers

Collaborating with top manufacturers of heavy mining equipment, automation technology, and data analytics software is vital for Vale's operational efficiency and safety. These partnerships ensure access to state-of-the-art machinery and digital tools for mine planning, fleet management, and predictive maintenance. This technological focus is crucial for enhancing productivity and decreasing the environmental footprint, aligning with Vale's 2024 sustainability targets.

- Vale aims for 15% CO2 emissions reduction by 2030, supported by technological advancements.

- Autonomous haulage systems are being expanded, with over 100 trucks operating autonomously by 2024.

- Predictive maintenance programs have reduced unplanned equipment downtime by 20% in some operations.

- Digital twin technology is increasingly used for optimizing mine design and operational flow.

Vale's key partnerships, vital in 2024, encompass joint ventures for shared costs and access to resources, alongside crucial governmental relations for licenses and compliance. Strategic alliances with logistics providers ensure global supply chain efficiency, while long-term agreements with major industrial customers guarantee sales. Collaborations with technology firms enhance operational safety and sustainability, expanding autonomous systems and predictive maintenance.

| Partner Type | Strategic Purpose | 2024 Contribution |

|---|---|---|

| Mining Joint Ventures | Risk sharing, resource access | Northern System expansion projects |

| Governments | Licensing, regulatory compliance | 29% upstream dams eliminated by Q1 2024 |

| Industrial Customers | Revenue predictability, market stability | 77.5M metric tons iron ore sales Q1 2024 |

| Technology Providers | Operational efficiency, safety | Over 100 autonomous trucks by 2024 |

What is included in the product

A structured framework outlining Vale's operational strategy, detailing key partners, activities, resources, and customer relationships.

This model highlights Vale's revenue streams, cost structure, and value propositions, offering a clear overview of its integrated mining and logistics business.

The Vale Business Model Canvas streamlines complex strategies, acting as a pain point reliever by offering a clear, structured overview that eliminates the need for laborious manual creation.

Activities

Vale's foundational activity is the continuous exploration for new mineral deposits and the detailed assessment of existing reserves, crucial for long-term sustainability. This involves sophisticated geological surveying and extensive drilling programs globally to identify economically viable mining projects. In 2024, Vale continues to invest significantly in exploration, targeting high-potential areas to replenish resources. This ongoing effort is vital for ensuring future production capacity and sustaining its position as a leading global miner.

Mine development and operation are core activities for Vale, encompassing the entire process from initial site construction and infrastructure development to daily ore extraction. This involves managing complex open-pit or underground mining operations, ensuring the safety of a large workforce, and optimizing production yields. This capital-intensive activity is crucial; for instance, Vale reported significant capital expenditures on projects in 2024, highlighting ongoing investment in these operations. It ensures a steady supply of essential minerals like iron ore, which saw robust demand into 2024. This complex process is vital for the company's output.

Vale processes raw ore to meet stringent customer specifications. This involves crucial steps like crushing, grinding, and beneficiation to boost mineral content and eliminate impurities. For iron ore, this yields high-grade products like pellets and fines, with Vale aiming to increase its premium iron ore output in 2024. For base metals such as nickel and copper, the process extends to smelting and refining, transforming concentrates into final metal products, reflecting Vale's integrated value chain.

Logistics & Supply Chain Management

Vale operates an extensive, integrated logistics network crucial for moving vast quantities of raw materials from its mines to global markets. This robust system includes managing proprietary railways, such as the Carajás Railway, which transported over 200 million tons of iron ore in 2023, alongside deep-water port terminals. The company also utilizes a fleet of the world's largest ore carriers, known as Valemax ships, each capable of carrying around 400,000 tons, ensuring efficient overseas transport.

Optimizing this complex global supply chain is a critical activity for Vale, directly contributing to minimizing transportation costs and ensuring reliable, timely delivery to customers across continents, especially with anticipated iron ore demand in 2024.

- Proprietary rail network facilitating efficient mine-to-port transport.

- Strategic port terminals managing high-volume material loading.

- Valemax fleet reducing shipping costs per ton significantly.

- Integrated logistics minimizing operational bottlenecks and enhancing delivery reliability for customers in 2024.

Sustainability & ESG Management

A core activity for Vale involves robust Environmental, Social, and Governance management, crucial for its social license and investor appeal. This includes significant investments in dam safety, with Vale decommissioning 13 upstream dams by 2024 and committing to eliminate all 30 by 2035. Efforts extend to reducing greenhouse gas emissions, targeting a 30% reduction in scopes 1 and 2 by 2030, alongside meticulous water resource management and proactive community engagement to mitigate operational risks.

- Vale committed $4.8 billion towards dam decommissioning by 2024.

- The company aims for a 30% reduction in scopes 1 and 2 GHG emissions by 2030.

- Water consumption per ton of ore processed is a key performance indicator.

- Community engagement programs are vital for maintaining operational continuity.

Vale's core activities encompass continuous mineral exploration and mine development, alongside advanced ore processing to yield high-grade products like iron ore. A critical element involves managing an extensive global logistics network, utilizing proprietary railways and Valemax ships for efficient delivery. Furthermore, robust Environmental, Social, and Governance management, including significant 2024 investments in dam safety and ambitious emission reduction targets, is central to its operations.

| Activity | 2024 Focus | Impact | ||

|---|---|---|---|---|

| Exploration | High-potential areas | Resource replenishment | ||

| Logistics | Supply chain optimization | Cost reduction | ||

| ESG | Dam safety, Emissions | Risk mitigation |

Full Version Awaits

Business Model Canvas

The Vale Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. Upon completing your order, you will gain full access to this exact, ready-to-use Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Vale's most crucial asset is its vast portfolio of world-class mineral deposits, especially high-grade iron ore in Brazil. These long-life assets, secured through government concessions, form the bedrock of its production capacity. With iron ore production guided to 310-320 million tonnes in 2024, the scale of these reserves ensures Vale's long-term competitive advantage. The quality and sheer size of these deposits are fundamental to its global market leadership.

Vale's integrated logistics infrastructure, a core differentiating resource, includes extensive railways, ports, and maritime shipping. Owning and operating critical assets like the 892 km Carajás Railroad (EFC) and dedicated port terminals ensures unparalleled efficiency. This network facilitates reliable transportation of iron ore, with Vale's 2023 iron ore production reaching 321.2 Mt. Such a substantial physical asset base, valued in the billions, significantly elevates barriers for new market entrants.

The mining industry is exceptionally capital-intensive, requiring billions for development, equipment, and infrastructure. Vale’s robust financial strength, evidenced by its significant cash generation, is a critical resource. For instance, Vale reported a free cash flow of approximately $2.6 billion in Q1 2024, enabling sustained investment in growth projects. This strong balance sheet and access to global capital markets ensure resilience through commodity price cycles, supporting strategic expansions and operational stability.

Skilled Human Capital & Technical Expertise

Vale relies on a highly skilled workforce, encompassing geologists, mining engineers, metallurgists, and logistics experts. This deep technical expertise is crucial for discovering new mineral deposits and designing efficient mining operations. It also optimizes complex processing plants and manages Vale's extensive global supply chain. Continuous investment in talent development, evident in Vale's significant training programs in 2024, ensures ongoing innovation and operational excellence across its global footprint.

- Vale's global workforce numbered approximately 67,000 direct employees in 2023, with ongoing recruitment for specialized roles in 2024.

- The company actively invests in professional development, with 2024 initiatives focusing on digital transformation and advanced operational skills.

- Specialized teams within Vale are responsible for leveraging geological data to identify new high-grade ore bodies, critical for future resource security.

- Expertise in logistics and supply chain management ensures the efficient transport of over 300 million tonnes of iron ore annually, as projected for 2024.

Technology & Innovation Capabilities

Vale's significant investment in technology and innovation serves as a crucial resource, enhancing productivity, safety, and sustainability across its operations. This includes the deployment of autonomous trucks and drills, which by 2024 continued to expand across key sites, improving operational efficiency and reducing risks. Advanced data analytics is leveraged for precise mine planning and optimization, driving better resource utilization. Furthermore, R&D efforts are concentrated on green mining solutions, such as developing low-carbon steelmaking feedstocks to meet evolving market demands. This technological leadership is increasingly vital for maintaining a competitive edge in the global mining industry.

- Autonomous fleet expansion for enhanced operational safety and efficiency.

- Advanced data analytics driving mine planning and resource optimization.

- R&D in low-carbon steelmaking feedstocks for sustainable solutions.

- Continued investment in proprietary technologies for productivity gains.

Vale's core resources are vast, high-grade mineral deposits, with 2024 iron ore production targeted at 310-320 Mt. Its integrated logistics infrastructure, including key railways and ports, ensures efficient global distribution. Robust financial strength, evidenced by Q1 2024 free cash flow of $2.6 billion, supports operations and growth. A skilled workforce and advanced technology, like autonomous fleets expanding in 2024, drive productivity and innovation.

| Resource Category | Key Asset Example | 2024 Data/Focus |

|---|---|---|

| Mineral Deposits | Iron Ore Reserves | 310-320 Mt production guidance |

| Logistics | Carajás Railroad | Efficient global distribution |

| Financial Capital | Cash Flow | $2.6B FCF Q1 2024 |

| Human Capital | Skilled Workforce | Ongoing talent development |

| Technology | Autonomous Fleets | Expanded deployment |

Value Propositions

Vale’s primary value proposition lies in its unwavering capacity to reliably supply massive quantities of essential raw materials. This includes high-grade iron ore, with 2024 guidance targeting 310-320 million metric tons, and nickel, with 2024 production guidance around 160-175 thousand metric tons. For global industries like steel manufacturing and electric vehicle production, this assured supply continuity from a major player is paramount. Vale’s immense operational scale ensures it consistently meets the demands of the world's largest industrial consumers. This reliability is critical for maintaining global supply chains.

Vale provides high-grade iron ore with low impurity levels, which helps steelmakers operate more efficiently, cut energy use, and reduce their carbon footprint. For instance, Vale’s premium iron ore products, like those from its Northern System, command better prices due to their quality, supporting robust demand in 2024. Additionally, its high-purity nickel products are crucial for producing high-performance batteries vital for electric vehicles, aligning with increasing EV market growth through 2024. This focus on delivering superior quality and premium materials allows Vale to command higher prices, creating significant value for its industrial customers.

Beyond its core iron ore and nickel operations, Vale provides a diverse portfolio of essential minerals, including copper, manganese, and cobalt. This broad offering allows customers to streamline their procurement, sourcing multiple industrial inputs from a single, reliable supplier. For investors, this diversification strategy helps mitigate risks linked to price volatility in any single commodity. In 2024, Vale's strategic emphasis on these diversified assets remains strong, with projected copper production reaching between 355,000 and 380,000 tonnes, reinforcing their multi-mineral approach.

Commitment to Sustainable & Responsible Mining (ESG)

Vale demonstrates value through its commitment to improving safety and environmental performance, critical for customers facing supply chain scrutiny. By investing in dam safety and decarbonization initiatives, Vale aims to be a responsible supplier in 2024. This includes ongoing efforts to decommission upstream dams and reduce Scope 1 and 2 greenhouse gas emissions by 30% by 2030.

- Vale targets a 30% reduction in Scope 1 and 2 GHG emissions by 2030.

- Significant investments are directed towards dam decommissioning and safety enhancements.

- Focus on community relations strengthens its social license to operate.

- Customers increasingly demand sustainable and ethically sourced materials.

Global Logistics & Integrated Supply Chain Solutions

Vale offers more than just minerals; it provides an integrated logistics solution ensuring timely, cost-effective global delivery. Its ownership of an extensive network, including over 2,000 kilometers of railways in Brazil, multiple port terminals, and a dedicated shipping fleet, provides customers with a seamless supply chain. This logistical prowess significantly differentiates Vale from smaller competitors, enhancing its value proposition. For instance, Vale's fleet includes Valemax vessels, which optimize transport efficiency. This integrated approach, vital in 2024, secures reliable access to major industrial hubs globally.

- Vale operates a massive logistics network, including railways and port terminals.

- Its dedicated shipping fleet, including Valemax vessels, ensures efficient global delivery.

- This integrated system minimizes costs and enhances supply chain reliability for customers.

- Logistical control is a key differentiator for Vale in the global mining sector.

Vale offers reliable, high-volume supply of essential raw materials like iron ore (310-320 Mt in 2024) and high-purity nickel (160-175 kt in 2024), ensuring global industrial continuity. Its premium products enhance customer efficiency and command higher prices, with copper production targeted at 355-380 kt in 2024. A commitment to sustainability, including dam safety and GHG emission reductions, coupled with an integrated logistics network, provides seamless, responsible global delivery.

| Material | 2024 Production Guidance | Unit |

|---|---|---|

| Iron Ore | 310-320 | Million Metric Tons |

| Nickel | 160-175 | Thousand Metric Tons |

| Copper | 355-380 | Thousand Metric Tons |

Customer Relationships

Vale's customer relationships are fundamentally built on long-term supply contracts, particularly with major global steel producers in Asia and Europe. These multi-year agreements, often extending beyond five years, offer significant stability for both parties. For instance, in 2024, Vale continues to secure predictable revenue streams through these commitments, ensuring a consistent demand for its iron ore and pellets. This arrangement provides customers with a guaranteed, reliable supply of critical raw materials, enabling their operational planning and reducing market price volatility risks. It fosters a deep, integrated partnership beyond simple transactional exchanges.

Vale assigns dedicated account management teams to its key industrial clients, offering personalized service and acting as a single point of contact. These teams manage contract negotiations and coordinate intricate logistics, crucial for Vale's significant global iron ore and nickel shipments in 2024. Additionally, Vale provides robust technical support, with metallurgists and engineers collaborating with customers to optimize product integration into their specific industrial processes, enhancing efficiency and value. This deep client engagement supports long-term partnerships.

Vale engages in co-development with strategic customers, particularly in nascent sectors like electric vehicles and green steel, fostering collaborative innovation. This involves joint research and development to create specialized products, such as high-purity nickel grades essential for next-generation EV batteries, where demand is projected to grow significantly through 2024. Vale also collaborates on iron ore solutions that reduce emissions in steelmaking, aligning with global decarbonization efforts. This deepens partnerships, ensuring Vale remains a key supplier for future industry advancements.

Transparent Pricing & Market Intelligence

Vale maintains transparent pricing by linking many contracts directly to global commodity market indices, such as the Platts IODEX 62% Fe iron ore fines index, which saw significant fluctuations in 2024. This approach is bolstered by consistent communication and the provision of valuable market intelligence, including detailed outlooks on iron ore demand and supply for the coming quarters. This commitment to transparency fosters strong customer trust, enabling clients to better manage their own financial planning and mitigate commodity price risks. The focus remains on long-term partnerships built on clear, data-driven pricing mechanisms.

- Vale's pricing is often tied to global indices like the Platts IODEX 62% Fe iron ore fines index.

- Regular market intelligence, including 2024 iron ore demand forecasts, supports customer planning.

- This transparency builds trust and aids customer financial planning and risk management.

- The average Platts IODEX 62% Fe iron ore price was approximately 110-120 USD/dmt in Q1 2024.

Investor & Stakeholder Relations

Beyond its direct industrial customers, Vale maintains a vital relationship with investors and stakeholders through its dedicated Investor Relations department. This involves transparent financial reporting, including its Q1 2024 results showing a net operating revenue of $9.6 billion. Such open communication and comprehensive ESG disclosures build confidence and are crucial for attracting capital, supporting significant growth initiatives like the $10.5 billion investment planned for its new energy transition metals projects.

- Vale’s Q1 2024 net operating revenue reached $9.6 billion.

- The company projects a $10.5 billion investment in energy transition metals.

Vale's customer relationships are built on long-term supply contracts, providing stability and guaranteed raw material supply, crucial for its 2024 operations. Dedicated account management and technical support offer personalized service, while co-development initiatives focus on future-oriented sectors like EV batteries and green steel, with demand for high-purity nickel growing in 2024. Transparent pricing, often tied to global indices like the Platts IODEX 62% Fe iron ore fines index (averaging 110-120 USD/dmt in Q1 2024), fosters trust. Strong investor relations, including Q1 2024 net operating revenue of $9.6 billion, secure capital for growth.

| Relationship Aspect | Key Mechanism | 2024 Data/Impact |

|---|---|---|

| Industrial Clients | Long-term supply contracts, dedicated account teams, technical support, co-development | Guaranteed raw material supply; significant global iron ore and nickel shipments; growing demand for EV battery materials |

| Pricing Transparency | Market index linkage (Platts IODEX 62% Fe) | Q1 2024 average ~110-120 USD/dmt; aids customer financial planning |

| Investors/Stakeholders | Transparent financial reporting, ESG disclosures | Q1 2024 net operating revenue $9.6 billion; supports $10.5 billion investment in energy transition metals |

Channels

Vale primarily utilizes its global direct sales force, a core channel for its operations. These specialized teams are strategically located in key market regions worldwide. They engage directly with procurement departments of major industrial companies, particularly in steel and mining sectors. Major supply agreements, often multi-year contracts, are negotiated through this B2B channel, allowing for customized pricing and logistics. For instance, Vale's iron ore sales, a significant portion of its 2024 revenue, are predominantly secured through these direct negotiations.

Vale’s integrated network of railways, ports, and shipping routes forms a critical channel for delivering its products globally. This extensive physical infrastructure, including over 2,000 km of railways, ensures efficient and reliable product flow. The Valemax fleet, with vessels up to 400,000 DWT, is a key component, facilitating massive shipments, especially to markets in Asia and Europe. This proprietary logistics system significantly contributes to Vale’s competitive advantage and ability to handle large volumes, like its 70.8 million tonnes of iron ore produced in Q1 2024.

While long-term contracts are Vale’s primary sales avenue, a strategic portion of its output, particularly iron ore, is sold on global commodity exchanges and through spot markets. This allows Vale to capitalize on favorable short-term price movements, such as those seen in early 2024 with fluctuating iron ore benchmarks. This channel serves customers with immediate or smaller-volume needs, complementing the company's substantial long-term supply agreements. It provides crucial flexibility and a real-time pulse on evolving market demand.

Regional Distribution Centers & Warehouses

Vale strategically utilizes a global network of regional distribution centers and warehouses to enhance market access and customer service. These facilities position inventory closer to end-users, significantly reducing lead times for various products. This streamlined approach allows for more flexible delivery schedules, which is crucial for serving a broader base of smaller customers efficiently. Vale’s extensive logistics infrastructure, including key port terminals, underpins this distribution strategy.

- Vale's logistics network includes over 2,000 kilometers of railways and numerous port terminals globally, supporting efficient distribution.

- The company continues to invest in optimizing its supply chain, aiming for enhanced responsiveness to market demands in 2024.

- These centers facilitate the distribution of diverse products, beyond bulk commodities, to specific industrial clients.

- Proximity to markets helps Vale meet evolving customer needs for faster and more precise deliveries.

Digital Platforms & Customer Portals

Increasingly, Vale leverages digital channels to enhance customer interaction and streamline its operations. This includes advanced online portals where customers can track shipments, access technical data sheets for products like iron ore, manage their orders efficiently, and communicate directly with their dedicated account teams. These platforms significantly improve the efficiency of the sales and logistics process, providing real-time visibility that is crucial for global supply chains. As of 2024, Vale continues to invest in digital transformation, aiming to optimize client engagement and internal workflows.

- Real-time shipment tracking reduces customer inquiries by an estimated 15% across logistics operations.

- Digital access to technical data sheets supports faster decision-making for clients.

- Online order management systems reduce processing errors by approximately 10%.

- Enhanced communication tools facilitate quicker issue resolution and support.

Vale relies on a global direct sales force for major B2B contracts, securing significant iron ore sales. Its extensive proprietary logistics network, including over 2,000 km of railways, ensures efficient global product delivery, exemplified by 70.8 million tonnes of iron ore produced in Q1 2024. Complementing this, Vale utilizes spot markets and a network of regional distribution centers for flexibility and closer customer access. Digital channels, enhanced in 2024, streamline customer interaction, offering real-time tracking and order management.

| Channel | Primary Function | 2024 Impact | ||

|---|---|---|---|---|

| Direct Sales | Large-scale B2B contracts | Main sales avenue for iron ore | ||

| Logistics Network | Global product delivery | 70.8M tonnes iron ore Q1 2024 shipped | ||

| Spot Markets | Market flexibility | Capitalizes on early 2024 price fluctuations |

Customer Segments

The global steel industry represents Vale's most critical customer segment, driving the majority of its revenue. Steelmakers, particularly those in China, Japan, South Korea, and Europe, are major purchasers of Vale's iron ore and ferroalloys. These materials are essential raw inputs for crude steel production. For instance, in Q1 2024, Vale reported iron ore fines sales of 55.6 million metric tons, with a significant portion directed to Asian markets. This segment's demand directly influences Vale's iron ore sales volumes and pricing.

A rapidly growing and strategically important customer segment for Vale is the battery and electric vehicle (EV) industry. These manufacturers are major consumers of high-purity nickel and cobalt, essential for lithium-ion battery cathodes. Global EV sales are projected to reach approximately 17 million units in 2024, driving robust demand for these critical minerals. Vale is strategically positioning itself as a key supplier to this high-growth, technology-driven market, leveraging its class 1 nickel production. The company aims to meet the increasing demand for sustainable battery materials.

This segment encompasses diverse industrial manufacturers relying on Vale's base metals. Copper is crucial for producers of electrical wiring, electronics, and construction materials; global copper demand is projected to remain robust in 2024, driven by electrification trends. Other metals, like manganese and aluminum derived from bauxite, serve various industrial applications, including specialized alloys and chemical production. Vale reported significant base metals production in Q1 2024, with copper reaching 81.9 kt and nickel at 48.6 kt, underscoring its role in these vital industries.

Agribusiness & Fertilizer Producers

Vale serves the global agriculture sector by producing potash, a vital nutrient for fertilizers. Customers in this segment are large agricultural cooperatives and chemical companies, which process and distribute these essential products to farmers worldwide. This strategy provides Vale with crucial diversification into a market driven by consistent food demand, offering stability independent of industrial cycles.

- Vale's potash sales volume reached 2.4 million metric tons in 2023, with projections for continued strong demand in 2024.

- Global fertilizer consumption is anticipated to increase by 4% in 2024, emphasizing the segment's growth.

- Major customers include leading agricultural chemical producers in North America and Brazil.

- The segment's revenue stream is resilient due to the inelastic demand for food production.

Commodity Traders & Financial Institutions

Commodity traders and financial institutions form a crucial segment for Vale, acting as vital intermediaries in the global raw materials market. These entities, including major trading houses like Glencore or Trafigura, do not consume the materials themselves but purchase large volumes from Vale for onward trading. They are essential for providing market liquidity and managing price risk, facilitating the movement of Vale's significant production, such as the 63.2 million tonnes of iron ore sold in Q1 2024. Their role is pivotal in distributing Vale's products to a wide array of industrial end-users globally, underpinning the supply chain.

- Global trading houses facilitate a substantial portion of Vale's iron ore and base metal sales.

- Financial institutions provide crucial hedging and financing for large commodity transactions.

- This segment ensures market liquidity for Vale's high-volume outputs.

- They manage the complex logistics and risk associated with global commodity distribution.

Vale serves a diverse global customer base, primarily the steel industry, which purchased 55.6 million metric tons of iron ore in Q1 2024. A key growth segment is the battery and EV sector, demanding high-purity nickel and cobalt, with 2024 EV sales projected at 17 million units. Additionally, Vale supplies base metals to various industrial manufacturers and potash to the agriculture sector, where fertilizer consumption is anticipated to increase by 4% in 2024. Commodity traders also play a crucial intermediary role, facilitating the distribution of Vale's substantial output, including 63.2 million tonnes of iron ore sold in Q1 2024.

| Customer Segment | Key Products | 2024 Data Point |

|---|---|---|

| Global Steel Industry | Iron Ore | 55.6M metric tons (Q1 2024 Sales) |

| Battery and EV Industry | Nickel, Cobalt | 17M units (Projected EV Sales) |

| Agriculture Sector | Potash | 4% (Projected Fertilizer Consumption Increase) |

Cost Structure

The core of Vale's cost structure is dominated by direct extraction and processing operations, representing the largest expenditure. These costs include significant outlays for labor, energy like diesel and electricity, and essential consumables such as explosives. Maintenance of machinery and processing plants also forms a substantial part of these expenses. These are largely variable costs, fluctuating with production volumes. For instance, energy and labor remain key drivers of operational expenditure in 2024.

Vale incurs significant logistics and transportation costs given the vast distances between its mines in Brazil and global customers. This major expense includes operating its extensive railway network and port facilities, such as Ponta da Madeira, crucial for iron ore exports. Fuel for its large fleet of ships, particularly bunker fuel, represents a substantial ongoing cost. These expenses are heavily influenced by volatile global fuel prices and dry bulk shipping rates, which saw fluctuations in 2024. Vale also charters third-party vessels to meet its global distribution needs.

Vale, as a capital-intensive business, faces significant Capital Expenditures (CAPEX) for both sustaining operations and driving growth. These costs include substantial investments in developing new mines, which involves stripping and infrastructure development, and acquiring new heavy machinery and equipment. For instance, Vale’s projected CAPEX for 2024 is around $6.5 billion, encompassing upkeep and expansion of its vast logistics network, crucial for iron ore and base metals transport. These are essential long-term investments vital for ensuring future production volumes and maintaining operational efficiency.

Royalties, Taxes, and Environmental Provisions

Vale faces significant costs from government royalties on mineral extraction and corporate income taxes, which fluctuate with commodity prices and regional tax regimes. A growing financial burden stems from environmental compliance and remediation efforts. For instance, Vale has allocated substantial provisions, exceeding $4.5 billion as of late 2023, for dam decommissioning and tailings management, with ongoing commitments for 2024 and beyond. These provisions also cover reforestation and ambitious carbon reduction initiatives aimed at achieving net-zero emissions by 2050.

- Vale's Q1 2024 financial results highlighted the ongoing impact of royalties and taxes on its bottom line.

- The company continues to provision significant capital for environmental projects, including dam safety and closure plans.

- Carbon reduction efforts are a key focus, with investments in renewable energy and operational efficiency.

- Tailings management costs remain a material expenditure for the company.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses at Vale encompass all overhead costs not directly tied to mineral production. This includes corporate staff salaries, research and development efforts, global sales and marketing campaigns, and essential IT infrastructure. While often smaller than operational costs, effectively managing SG&A is crucial for Vale to maintain its overall profitability and competitive edge, directly impacting net income. For the fiscal year 2023, Vale reported SG&A expenses of approximately $2.6 billion, reflecting ongoing administrative and support functions.

- Corporate salaries and benefits for administrative and executive teams.

- Research and development investments in new mining technologies.

- Global marketing and sales efforts for iron ore, nickel, and copper.

- Information technology infrastructure and cybersecurity maintenance.

Vale's cost structure is primarily driven by direct operational expenses, including significant outlays for labor and energy, which fluctuate with production volumes. Substantial capital expenditures, projected at around $6.5 billion for 2024, are vital for mine development and infrastructure. Logistics and transportation costs, impacted by fuel prices, are also considerable. Furthermore, environmental compliance and government royalties represent growing financial burdens, with provisions exceeding $4.5 billion for dam remediation and ongoing carbon reduction efforts.

| Cost Category | Key Drivers | 2024 Impact |

|---|---|---|

| Operational Costs | Labor, Energy | Variable with production |

| Capital Expenditures | New Mines, Equipment | ~$6.5 billion (projected) |

| Environmental/Regulatory | Compliance, Royalties | >$4.5 billion provisions |

Revenue Streams

The sale of iron ore and pellets is Vale’s primary revenue stream, accounting for the largest share of its income. This includes high-grade iron ore fines and pellets, primarily supplied to global steel manufacturers. Revenue generation is directly linked to sales volume multiplied by the prevailing global market price for iron ore. For instance, in Q1 2024, Vale reported iron ore fines production of 70.8 million tonnes. This core segment’s profitability remains sensitive to commodity price fluctuations and global steel demand.

Sales of nickel form a significant and strategically growing revenue stream for Vale. As a leading global producer, Vale sells different classes of nickel to the stainless steel industry and, increasingly, to the battery manufacturing sector for electric vehicles. This strategic shift is crucial, with nickel demand for EVs projected to surge in 2024. Nickel prices are a key driver of this revenue stream's performance, influencing Vale's profitability as seen in market fluctuations. Vale's nickel production for 2024 is projected to be between 160-175 kt, underscoring its market position.

Vale generates significant revenue from the mining and sale of copper concentrate and copper cathodes. This vital industrial metal is crucial for global infrastructure, extensively used in construction, electronics, and power generation. In Q1 2024, Vale's copper production reached 81.7 thousand tonnes, with sales of 76.5 thousand tonnes, reflecting strong demand. This revenue stream offers valuable diversification, complementing iron ore sales and exposing the company to distinct macroeconomic drivers. The average realized copper price for Vale in Q1 2024 was $8,604 per tonne.

Sales of Other Minerals & By-products

Vale diversifies its revenue through sales of other minerals and by-products, including essential elements like cobalt, often a by-product of nickel mining. This portfolio also encompasses manganese, ferroalloys, and precious metals such as gold and platinum group metals (PGMs). While smaller than iron ore, these streams significantly contribute to revenue diversification and overall profitability. For instance, Vale reported total net operating revenues of $43.5 billion in 2023, with base metals and energy transition minerals playing a strategic role.

- Vale's base metals segment, which includes nickel and copper, generated $15.5 billion in 2023.

- Cobalt production from Vale's operations was approximately 4,000 tonnes in 2023.

- Gold sales contribute to the precious metals segment, providing additional revenue streams.

- Manganese and ferroalloys further enhance the company's product mix and market reach.

Logistics Services Revenue

Vale’s integrated logistics network, while primarily supporting its own vast mining operations, also serves as a distinct revenue stream. The company generates income by providing third parties access to its extensive railway and port infrastructure, leveraging key assets like the Carajás Railroad. This strategic utilization creates an additional, albeit smaller, revenue source. As of 2024, this segment contributes to diversifying Vale’s income beyond its core commodities.

- Vale's logistics capacity supports over 300 million tonnes of iron ore annually.

- Third-party logistics revenue is a smaller percentage of Vale's total net operating revenue, typically under 2% as of 2024.

- The Carajás Railroad (EFC) and Vitória-Minas Railroad (EFVM) are critical assets for third-party services.

- This segment provides a stable, recurring revenue stream from long-term contracts.

Vale’s core revenue is driven by iron ore and pellets, alongside significant contributions from base metals like nickel and copper, vital for global industry and energy transition. Further diversification comes from a portfolio of other minerals, including cobalt and gold, enhancing overall profitability. The company also generates a smaller, stable income from its extensive integrated logistics network by providing services to third parties. These varied streams ensure a robust and diversified revenue profile.

| Revenue Stream | Key 2024 Data (Q1) | Contribution |

|---|---|---|

| Iron Ore & Pellets | 70.8 Mt production (Q1 2024) | Primary revenue source |

| Nickel | 160-175 kt projected production (2024) | Growing, crucial for EVs |

| Copper | 81.7 kt production (Q1 2024) | Diversification, industrial demand |

| Other Minerals & Logistics | Base metals segment $15.5B (2023); Logistics under 2% of total revenue (2024) | Strategic diversification, stable income |

Business Model Canvas Data Sources

The Vale Business Model Canvas is meticulously constructed using comprehensive market research, internal financial statements, and competitor analysis. These data sources ensure that each component, from value propositions to cost structures, is grounded in accurate and actionable insights.