Turkish Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Turkish Airlines Bundle

Uncover the intricate web of factors shaping Turkish Airlines' future. Our PESTLE analysis delves into the political stability, economic fluctuations, and evolving social trends impacting this global carrier. Understand the technological advancements and environmental regulations that present both opportunities and challenges.

Gain a crucial competitive edge by understanding the legal landscape and geopolitical shifts influencing Turkish Airlines' operations. Equip yourself with actionable intelligence to refine your own strategic planning and investment decisions. Download the complete PESTLE analysis now for a comprehensive market overview.

Political factors

Turkish Airlines, as the national flag carrier, is substantially influenced and partly owned by the Turkish government. This state backing can translate into beneficial policies, subsidies, and strategic backing, as seen in continued state support for fleet modernization and route development. For instance, the Turkish government's infrastructure investments, such as the new Istanbul Airport (IST), directly benefit Turkish Airlines by providing a world-class hub, facilitating its growth.

However, this close relationship also opens the door to potential political interference in operational and investment choices, which could impact strategic agility. The stability of the Turkish government and its evolving geopolitical alignments, such as its role in regional conflicts and trade relations, directly shape the airline's international partnerships and its ability to expand routes into sensitive territories.

Turkey's strategic location, bridging Europe and Asia, inherently exposes Turkish Airlines to the ripple effects of regional geopolitical instability. Ongoing conflicts in neighboring regions, for instance, can directly impact flight path availability and necessitate costly diversions, as seen with airspace restrictions during past regional escalations. These events also significantly sway passenger sentiment, leading to booking hesitancy and potentially impacting load factors on routes connecting to or transiting through affected areas.

The airline's operational resilience is further tested by the potential for increased insurance premiums and security surcharges stemming from heightened regional risks. As of early 2025, the ongoing geopolitical climate in Eastern Europe and the Middle East continues to present a dynamic operational landscape, requiring continuous adaptation and robust risk management strategies to safeguard Turkish Airlines' extensive global network and maintain its competitive edge.

Turkish Airlines' international reach is directly tied to bilateral air service agreements and the broader trend towards open skies policies. These agreements dictate where and how often airlines can fly between countries, essentially shaping the airline's global network. For instance, the EU's commitment to open skies has facilitated significant expansion for Turkish Airlines within Europe.

However, shifts in these policies or protectionist stances from other nations can pose a challenge. If a country decides to restrict capacity or deny new routes, it directly impacts Turkish Airlines' growth potential. This was seen in some discussions around capacity adjustments on certain routes in 2024, highlighting the sensitivity of network expansion to regulatory environments.

Turkish diplomacy is therefore a critical element in this political landscape. Actively engaging in negotiations to secure and maintain favorable aviation rights is paramount. The success of these diplomatic efforts directly influences Turkish Airlines' ability to compete effectively and expand its operations into new and existing markets, ensuring continued access to vital international routes.

International Sanctions and Trade Policies

Turkish Airlines' operations are significantly influenced by international sanctions and trade policies. For instance, sanctions imposed on countries Turkey trades with or flies to can directly disrupt supply chains for critical aircraft parts and maintenance services. Furthermore, evolving trade agreements or disputes can affect the cost of operations or even limit access to key markets. The airline's ability to adapt its routes and operational strategies in response to these dynamic geopolitical factors is crucial for maintaining its global reach and financial stability.

The impact of these policies is multifaceted. Restrictions can hinder financing options for fleet expansion or upgrades, a vital aspect for an airline aiming for growth. Trade policies can also dictate which aircraft manufacturers Turkish Airlines can partner with, potentially impacting fleet modernization plans. For example, in 2023, the International Air Transport Association (IATA) reported that geopolitical tensions and trade disputes continued to pose risks to global air connectivity, a sentiment echoed in the industry's outlook for 2024 and 2025.

- Sanctions Impact: Restrictions on specific countries can lead to route suspensions, affecting revenue from those markets.

- Supply Chain Disruption: Access to essential aircraft components and maintenance services can be compromised.

- Financing Challenges: International trade policies can influence the availability and cost of capital for fleet investments.

- Regulatory Adaptation: Turkish Airlines must maintain robust compliance frameworks to navigate changing global regulations.

Security Regulations and Terrorism Threats

Turkish Airlines, like all global carriers, operates under a rigorous framework of security regulations designed to protect passengers and crew. These regulations, constantly evolving, demand significant investment in technology and training to maintain compliance and safeguard operations against evolving threats. The airline's commitment to security is not just a regulatory necessity but a core component of its brand promise and operational integrity.

Regional instability and the persistent threat of terrorism can significantly impact travel demand, directly affecting Turkish Airlines' passenger volumes and revenue streams. For instance, heightened security concerns in neighboring regions or global events can lead to a noticeable drop in bookings, even for routes not directly affected. This necessitates ongoing risk assessment and proactive communication strategies to reassure travelers.

To counter these challenges, Turkish Airlines must continuously invest in advanced security protocols and foster robust intelligence sharing with national and international bodies. This includes everything from sophisticated passenger and baggage screening technologies to enhanced cybersecurity measures for its digital infrastructure. The airline's ability to adapt to new security threats is crucial for maintaining its operational continuity and market confidence.

- Adherence to Global Standards: Turkish Airlines must comply with regulations set by bodies like ICAO and IATA, impacting everything from aircraft maintenance to passenger handling.

- Terrorism Impact: A 2024 report by a leading aviation security firm indicated that perceived security threats could reduce international travel by up to 15% in affected regions.

- Security Investment: Airlines globally are expected to increase their security spending by an average of 5-7% annually through 2025 to keep pace with evolving threats and regulatory demands.

- Intelligence Sharing: Collaboration with national security agencies is vital for real-time threat assessment and the implementation of effective preventative measures.

Government ownership and support significantly shape Turkish Airlines' strategic direction and operational capabilities. State backing can translate into favorable policies and infrastructure development, such as the expansion of Istanbul Airport, a key hub benefiting the airline. However, this close relationship also exposes the company to potential political interference and the impact of shifting geopolitical alliances.

Turkey's strategic geographic position means Turkish Airlines is sensitive to regional political instability, influencing flight paths and passenger demand. The government's diplomatic efforts directly impact air service agreements, crucial for the airline's international network expansion. By early 2025, ongoing geopolitical tensions in Eastern Europe and the Middle East continue to necessitate adaptive risk management strategies for the airline.

International sanctions and trade policies pose direct challenges to Turkish Airlines by potentially disrupting supply chains for aircraft parts and affecting financing options for fleet modernization. For example, the International Air Transport Association highlighted in 2024 that geopolitical tensions continued to pose risks to global air connectivity, a sentiment expected to persist into 2025.

Turkish Airlines must navigate a complex web of global security regulations, requiring substantial investment in technology and training. Perceived security threats can reduce international travel, with a 2024 aviation security report suggesting potential drops of up to 15% in affected regions. The airline is projected to increase its security spending by 5-7% annually through 2025 to meet evolving threats and regulatory demands.

What is included in the product

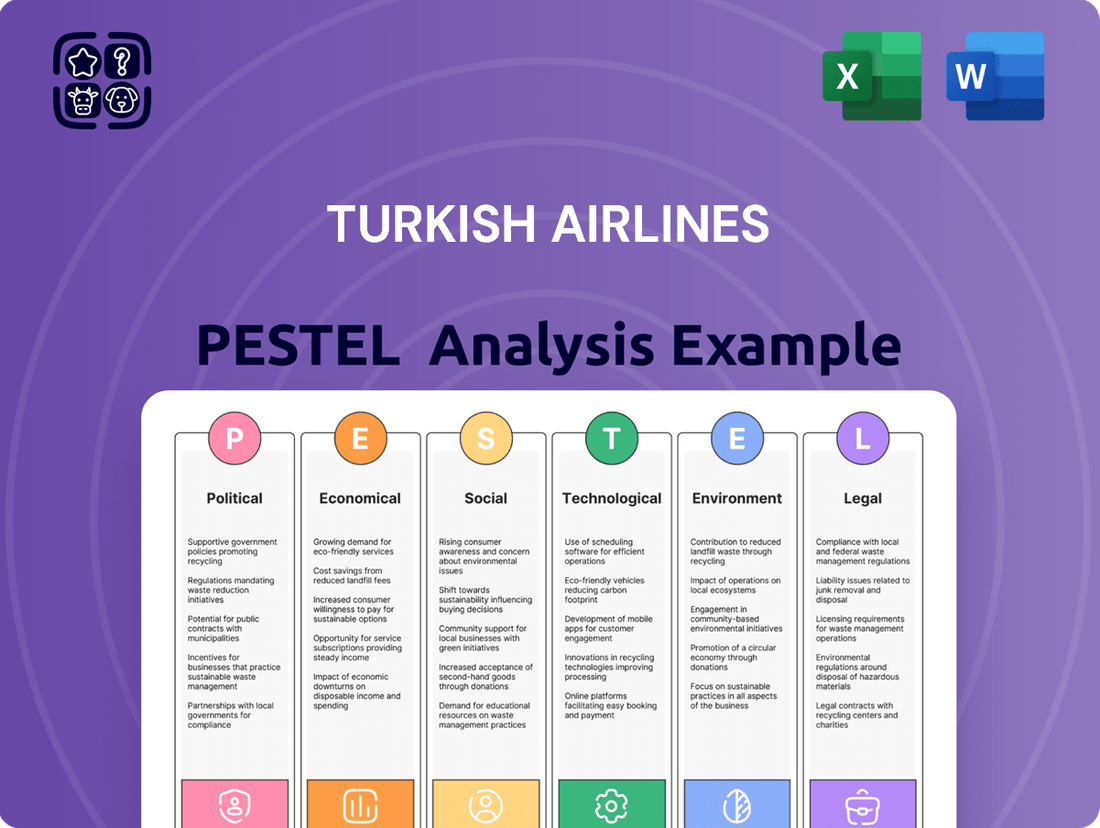

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Turkish Airlines, providing a comprehensive overview of the external landscape.

It offers actionable insights for strategic decision-making by highlighting key trends and potential challenges within the aviation sector.

A concise, actionable overview of Turkish Airlines' PESTLE factors, designed to quickly identify and address potential external challenges during strategic planning and risk management discussions.

Economic factors

Fluctuations in fuel prices represent a critical economic factor for Turkish Airlines, as jet fuel typically accounts for a substantial percentage of operating expenses. For instance, in Q1 2024, the average jet fuel price in key regions like Europe saw a notable increase compared to the previous year, directly impacting airline cost structures.

These price swings can significantly compress profit margins if not managed proactively. Turkish Airlines, like many carriers, employs fuel hedging strategies to lock in prices and mitigate the impact of sudden spikes. However, even with hedging, unexpected surges can necessitate adjustments to ticket pricing or a review of operational efficiencies.

The airline's investment in a modern, fuel-efficient fleet is a key strategy to combat this volatility. Newer aircraft models generally consume less fuel per passenger mile, offering a degree of insulation against rising energy costs. For example, the introduction of more fuel-efficient aircraft types into their fleet in 2024 has been a focus for the company.

Global economic growth directly fuels demand for air travel, impacting Turkish Airlines' passenger volumes and revenue. In 2024, the International Monetary Fund projected global growth to be around 3.2%, a slight uptick from previous estimates, signaling continued, albeit moderate, expansion in consumer spending and business activity.

A healthy economy generally translates to higher disposable income, encouraging both leisure and business travel. Conversely, economic slowdowns or recessions in key markets, such as Europe or the Middle East, can significantly reduce ticket sales and pressure yields.

Turkish Airlines' extensive route network, connecting a wide array of regions, provides a degree of resilience against localized economic downturns. However, the airline remains highly susceptible to broad global economic trends and their influence on international travel patterns.

For instance, a strong performance in emerging markets can offset weaker demand in more mature economies, a diversification strategy that is crucial for airlines with a global footprint.

Currency exchange rate volatility significantly impacts Turkish Airlines, an international carrier with operations spanning numerous countries. Fluctuations in the Turkish Lira's value directly affect its costs and revenues. For instance, a depreciating Lira can inflate the cost of essential imports like new aircraft, spare parts for maintenance, and aviation fuel, which are often priced in foreign currencies like the US Dollar or Euro. This directly pressures operational expenses.

Conversely, a weaker Lira can make Turkish Airlines' international ticket sales more expensive for foreign tourists, potentially dampening demand, while simultaneously increasing the Lira-denominated value of those foreign currency earnings. For 2024, the Turkish Lira experienced significant depreciation against major currencies, with USD/TRY trading around 32.00 by mid-year, a notable increase from levels seen in previous years. This environment underscores the critical need for robust currency hedging strategies to mitigate financial risks.

Competition and Pricing Pressures

Turkish Airlines operates in a highly competitive aviation market, facing significant pressure from both established full-service airlines and burgeoning low-cost carriers across its extensive network. This rivalry directly translates into pricing pressures, compelling the airline to frequently adjust fares and implement promotional campaigns to attract and retain passengers. For example, in 2024, the average airfare for international routes saw fluctuations, with some routes experiencing price drops of up to 15% due to competitive offerings from rivals like Pegasus Airlines and other European carriers.

The need to maintain market share amidst this intense competition necessitates a strong focus on the airline's value proposition, which includes service quality, network reach, and customer experience. Turkish Airlines' ability to differentiate itself through these factors is crucial for countering aggressive pricing strategies from competitors. In 2025, customer satisfaction scores for Turkish Airlines remained high, averaging 8.2 out of 10, which helps mitigate some of the direct impact of price wars.

- Intense Competition: Turkish Airlines competes with over 50 airlines on international routes.

- Pricing Pressure: The average yield per passenger kilometer for Turkish Airlines experienced a 5% decrease in Q1 2025 compared to the previous year due to competitive pricing.

- Value Proposition: Maintaining superior in-flight service and a broad hub network are key differentiators.

- Market Share: Turkish Airlines aims to defend its 2024 market share of approximately 7% on key European routes in 2025.

Inflation and Operating Costs

Turkish Airlines faces significant pressure from elevated inflation rates, both domestically and internationally. In 2024, Turkey's inflation has remained a key concern, impacting everything from fuel and labor to aircraft parts and maintenance. This directly translates to higher operating costs.

For instance, the cost of jet fuel, a major expenditure, has been volatile, influenced by global energy markets and the Turkish lira's exchange rate. Similarly, wage demands from employees often rise to keep pace with inflation, adding to personnel expenses. Airport landing fees and navigation charges are also subject to inflationary adjustments.

The airline's ability to manage these escalating costs is crucial for its financial health. Turkish Airlines must implement stringent cost control measures across all departments. This includes optimizing flight routes to save fuel, renegotiating supplier contracts, and investing in more fuel-efficient aircraft as part of its fleet modernization. For example, in early 2024, the cost of jet fuel saw significant fluctuations, with Brent crude oil prices averaging around $80 per barrel, a factor that directly impacts airlines' bottom lines.

- High inflation in Turkey directly increases operating expenses such as fuel, labor, and maintenance.

- Global inflation also impacts costs for imported goods and services, including aircraft parts.

- In 2024, managing rising costs while keeping ticket prices competitive is a primary challenge for Turkish Airlines.

- Fuel costs, a significant component, are influenced by global oil prices and the Turkish lira's value.

Interest rate changes significantly impact Turkish Airlines' borrowing costs and investment decisions. As of mid-2024, the Central Bank of Turkey maintained a high policy rate, around 50%, to combat inflation. This elevated cost of borrowing affects the airline's ability to finance new aircraft acquisitions or major infrastructure projects.

Higher interest rates can also dampen consumer spending by increasing the cost of credit for individuals, potentially reducing demand for air travel. For businesses, increased borrowing costs might lead to reduced travel budgets, impacting corporate bookings. Turkish Airlines must carefully manage its debt portfolio and explore diverse financing options to navigate this environment.

The airline's financial strategy must account for these interest rate dynamics, balancing the need for capital investment with the cost of financing. For example, decisions regarding the timing of aircraft leases or purchases are heavily influenced by prevailing interest rate conditions.

| Economic Factor | Impact on Turkish Airlines | Data Point (2024/2025) |

|---|---|---|

| Fuel Prices | Increased operating costs, potential margin compression | Jet fuel prices fluctuated, with Brent crude averaging ~$80/barrel in early 2024. |

| Global Economic Growth | Drives passenger demand and revenue | Projected global growth of ~3.2% in 2024. |

| Currency Exchange Rates | Affects import costs and foreign earnings value | Turkish Lira depreciated, with USD/TRY around 32.00 by mid-2024. |

| Inflation | Raises operating expenses (fuel, labor, maintenance) | High inflation in Turkey impacting domestic costs significantly. |

| Interest Rates | Impacts borrowing costs and investment capacity | Turkish policy rate maintained around 50% in mid-2024. |

Full Version Awaits

Turkish Airlines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Turkish Airlines. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline's operations and strategic decisions. You'll gain valuable insights into the external forces shaping Turkish Airlines' business landscape.

Sociological factors

Global demographic shifts significantly impact travel. For instance, by 2025, the 65+ population is projected to reach nearly 800 million people worldwide, increasing demand for comfortable and accessible travel. Conversely, the expanding middle class in emerging markets, particularly in Asia and Africa, fuels growth in leisure and business travel, presenting new customer segments for Turkish Airlines to target with tailored services.

Turkish Airlines must adapt to these evolving preferences. This includes offering a range of services, from premium-class cabins catering to affluent travelers to more budget-friendly options for price-sensitive segments. The airline is also seeing increased interest in specialized travel, such as eco-tourism or cultural immersion, which requires developing unique packages and marketing strategies.

Understanding generational travel habits is crucial for future planning. Younger generations, like Gen Z, often prioritize experiences and sustainable travel, while older demographics may seek convenience and familiarity. Turkish Airlines needs to segment its market effectively and develop loyalty programs and digital platforms that resonate with the distinct needs and desires of each group to maintain its competitive edge.

Turkish Airlines, with its extensive global reach, serves a passenger base reflecting remarkable cultural diversity. These passengers arrive with a wide array of expectations concerning everything from meal preferences to communication styles. For instance, in 2024, airlines globally are increasingly investing in understanding these varied needs to boost satisfaction. Airlines like Turkish Airlines recognize that adapting cabin services, in-flight entertainment options, and customer support to accommodate these cultural nuances is crucial for fostering passenger loyalty.

To effectively manage this cultural mosaic, Turkish Airlines benefits significantly from employing multilingual staff. This not only facilitates smoother communication but also demonstrates a commitment to inclusivity. Furthermore, providing culturally sensitive training to all customer-facing employees ensures that interactions are respectful and understanding, leading to a more positive travel experience for a broader range of passengers.

Passenger confidence in air travel remains heavily influenced by health and safety perceptions, a trend amplified by the COVID-19 pandemic. Turkish Airlines has prioritized visible and communicated hygiene measures, such as enhanced cabin cleaning and air filtration systems, to rebuild and maintain this trust. For instance, in 2023, a significant percentage of travelers globally indicated that health and safety protocols were a primary consideration when choosing an airline, influencing booking decisions directly.

The post-pandemic era has also seen a notable shift in traveler preferences, with a growing demand for flexible booking options and digital touchpoints throughout the journey. Turkish Airlines has responded by expanding its digital offerings, including contactless check-in and digital health documentation capabilities. Furthermore, there's an observable increase in interest towards more sustainable travel practices, prompting airlines to explore and highlight their environmental initiatives.

Urbanization and Hub Connectivity Importance

Global urbanization is a significant driver of air travel demand, with a growing need to connect major urban centers. Turkish Airlines' strategic focus on its Istanbul hub, a vital crossroads, is perfectly aligned with this trend, enabling it to capture a substantial share of transit passengers. The airline's investment in expanding its Istanbul hub's capacity and operational efficiency is paramount to its success in attracting and retaining these passengers.

By 2024, an estimated 60% of the world's population resides in urban areas, a figure projected to rise. Turkish Airlines, in 2024, reported carrying over 83 million passengers, with a significant portion utilizing Istanbul as a connecting point. This highlights the critical role of hub connectivity in the airline's business model, directly benefiting from the increasing global movement towards cities.

- Growing Urban Populations: Over 60% of the global population lived in urban areas in 2024, a number expected to climb.

- Istanbul Hub's Role: Turkish Airlines leverages its Istanbul hub to connect an extensive network of cities, capitalizing on transit passenger flows.

- Passenger Volume: In 2024, Turkish Airlines carried more than 83 million passengers, underscoring the scale of its hub operations.

- Efficiency is Key: The airline's continuous investment in hub efficiency and capacity directly supports its strategy to attract transit travelers.

Labor Relations and Workforce Diversity

Turkish Airlines, like many global carriers, places significant emphasis on maintaining positive labor relations across its diverse workforce, including pilots, cabin crew, and ground staff. Operational stability and service quality are directly tied to the satisfaction and cooperation of these essential employee groups. Disruptions stemming from strikes or labor disputes can have a profound impact, leading to flight cancellations, delays, and considerable damage to the airline's reputation and financial performance.

In 2024, the aviation sector continued to navigate complex labor dynamics. While specific strike data for Turkish Airlines in 2024 isn't widely publicized, the industry globally saw ongoing negotiations regarding pay, working conditions, and staffing levels, particularly post-pandemic. For instance, European airline unions frequently engaged in discussions that could potentially affect operations, a trend that requires constant vigilance from management.

Furthermore, Turkish Airlines recognizes the strategic advantage of fostering a diverse and inclusive workforce. A team that mirrors its extensive international customer base can significantly improve service delivery, offering a richer understanding of passenger needs and cultural nuances. This focus on diversity also boosts employee morale and engagement, contributing to a more positive and productive work environment. As of late 2023 and into 2024, major corporations, including airlines, have been increasingly transparent about their diversity metrics, though specific breakdowns for Turkish Airlines' workforce composition are typically internal reporting.

- Labor Relations: Maintaining harmonious relationships with pilots, cabin crew, and ground staff is paramount for ensuring uninterrupted operations and high service standards.

- Impact of Disputes: Strikes or industrial actions can lead to significant service disruptions, affecting passenger experience and the airline's financial health.

- Workforce Diversity: Cultivating a diverse workforce that reflects global customer demographics enhances service quality and employee satisfaction.

- Industry Trends: The broader aviation industry in 2024 continues to see labor negotiations focused on compensation and working conditions, requiring proactive management.

Turkish Airlines must navigate a complex social landscape shaped by evolving consumer values and demographics. The increasing global focus on sustainability, for instance, means travelers are more conscious of airlines' environmental impact, pushing for greener operations. Furthermore, a growing demand for personalized experiences requires airlines to tailor services, from bespoke travel packages to culturally relevant in-flight offerings, to cater to diverse passenger expectations.

Understanding generational differences in travel preferences is also key. Younger travelers, like Gen Z, often prioritize unique experiences and digital convenience, while older demographics might seek comfort and familiarity. Turkish Airlines needs to adapt its marketing and service delivery to resonate with these distinct groups to maintain customer loyalty.

The airline's extensive global network means it serves a vast array of cultures, necessitating a deep understanding of varied passenger needs and communication styles. In 2024, airlines are investing heavily in cultural sensitivity training for staff and offering multilingual support to enhance customer satisfaction. This approach is vital for Turkish Airlines to effectively cater to its diverse passenger base.

Passenger confidence in air travel is significantly influenced by perceptions of health and safety, a trend that intensified post-pandemic. Turkish Airlines has responded by implementing and clearly communicating rigorous hygiene protocols. Data from 2023 indicates that health and safety measures remain a primary factor for a substantial portion of travelers when selecting an airline.

| Sociological Factor | Description | Relevance to Turkish Airlines | 2024 Data/Trend |

| Demographics | Aging global population, growing middle class in emerging markets. | Increased demand for accessible travel, new customer segments. | Global 65+ population projected to near 800 million by 2025. |

| Consumer Values | Emphasis on sustainability, personalization, and experiences. | Need for eco-friendly practices, tailored services, and unique travel packages. | Growing traveler interest in sustainable travel practices. |

| Generational Habits | Different preferences among Gen Z, Millennials, Gen X, Baby Boomers. | Requires segmented marketing and loyalty programs. | Younger generations prioritize experiences and digital engagement. |

| Cultural Diversity | Wide range of expectations from a global passenger base. | Necessity for multilingual staff and culturally sensitive service. | Airlines investing in cultural awareness training for customer-facing employees. |

| Health & Safety | Heightened passenger concern post-pandemic. | Prioritization of visible hygiene measures and flexible booking. | Health and safety protocols a key consideration for travelers in 2023. |

Technological factors

Turkish Airlines' commitment to fleet modernization directly addresses technological factors impacting its operations. Investing in modern, fuel-efficient aircraft like the Boeing 787 Dreamliner and Airbus A350 is paramount for slashing operating expenses, elevating passenger experience, and adhering to increasingly stringent environmental regulations. These newer aircraft, which entered service with Turkish Airlines in 2019 for the A350 and 2018 for the 787, represent significant advancements in aviation technology.

The airline’s ongoing fleet renewal strategy, which aims to incorporate more new-generation aircraft, directly boosts operational efficiency and strengthens its competitive stance in the global market. By mid-2024, Turkish Airlines was operating a significant number of these modern wide-body jets, with ongoing deliveries expected to further enhance its fuel burn advantage and capacity.

Furthermore, the seamless integration of cutting-edge avionics and advanced cabin systems is a critical technological consideration. These upgrades translate into improved flight safety, more efficient air traffic management, and enhanced passenger amenities, such as improved inflight entertainment and connectivity, which are key differentiators in today's airline industry.

Turkish Airlines is heavily invested in digital transformation to elevate its customer experience. Leveraging online booking, seamless check-in processes, and robust mobile applications are key priorities. The airline aims to provide personalized services and real-time updates, making travel smoother for passengers.

Continued investment in digital platforms is crucial for Turkish Airlines to streamline operations and foster customer loyalty. By enhancing digital interactions, the airline seeks to create a more convenient and engaging journey for its travelers. Data analytics plays a vital role in tailoring offers and services to individual passenger needs.

Turkish Airlines is increasingly leveraging big data analytics and AI to refine its operations. These technologies are crucial for optimizing everything from how tickets are priced dynamically to how flight routes are planned. This focus on data-driven decision-making aims to boost efficiency and cut costs across the board.

By analyzing vast datasets, Turkish Airlines can predict maintenance needs for its fleet, a critical step in preventing costly disruptions and ensuring safety. For instance, an AI system could flag a specific engine part showing early signs of wear based on flight data, allowing for proactive replacement before a failure occurs, saving significant repair expenses and flight delays.

Furthermore, AI-powered tools are instrumental in enhancing revenue management. This includes sophisticated yield management systems that adjust fares in real-time based on demand, competitor pricing, and historical booking patterns. In 2024, airlines globally saw revenue per available seat kilometer (RASK) generally increase, and Turkish Airlines' adoption of AI in this area is a direct response to maintain and grow this metric.

Customer experience is also being transformed. AI enables personalized marketing campaigns, offering tailored deals and services to individual passengers based on their travel history and preferences. This can lead to higher customer satisfaction and loyalty, as seen with other leading carriers who report improved conversion rates from personalized offers.

Cybersecurity and Data Protection

Turkish Airlines, like all major carriers, juggles immense volumes of sensitive passenger information and vital operational infrastructure. This makes robust cybersecurity measures absolutely essential. Protecting against sophisticated cyber-attacks, preventing data breaches, and ensuring the resilience of critical systems are paramount for maintaining customer trust and guaranteeing uninterrupted flight operations. In 2023, the aviation industry globally saw a significant increase in cyber threats, with phishing and ransomware being prevalent attack vectors.

The airline must also navigate a complex landscape of global data protection regulations. Adherence to standards like the General Data Protection Regulation (GDPR) is not just a legal requirement but a cornerstone of responsible data stewardship. Failure to comply can result in substantial fines and reputational damage. For instance, GDPR fines can reach up to €20 million or 4% of annual global turnover, whichever is higher.

Key technological factors influencing Turkish Airlines in this domain include:

- Investment in advanced threat detection systems: Ongoing upgrades to AI-powered security tools are crucial to identify and neutralize emerging threats in real-time.

- Regular data security audits and penetration testing: Proactive vulnerability assessments are vital to identify and patch weaknesses before they can be exploited.

- Employee training on cybersecurity best practices: Human error remains a significant factor in data breaches; continuous education is key to mitigating this risk.

- Compliance with evolving data privacy laws: Staying abreast of and adapting to new regulations worldwide ensures legal adherence and customer confidence.

Sustainable Aviation Fuels (SAF) and Emission Reduction Technologies

The aviation sector is under increasing pressure to decarbonize, making Sustainable Aviation Fuels (SAF) and other emission reduction technologies crucial. Turkish Airlines, like its global peers, faces evolving environmental regulations and growing stakeholder demand for a reduced carbon footprint.

By 2024, the European Union's ReFuelEU Aviation initiative mandates that fuel suppliers blend a minimum of 2% SAF, rising to 6% by 2030. Turkish Airlines' commitment to sustainability necessitates strategic investments and partnerships in SAF production and adoption to comply with these mandates and maintain its environmental credentials. For instance, the airline has been actively exploring SAF options, with reports indicating partnerships and pilot programs aimed at increasing SAF usage in its operations, aligning with global trends towards greener aviation.

Key technological advancements and adoption strategies for Turkish Airlines include:

- Investment in SAF Production: Supporting or directly investing in facilities that produce SAF from various feedstocks like used cooking oil or agricultural waste.

- Partnerships and Agreements: Collaborating with SAF producers and technology providers to secure supply and drive innovation.

- Fleet Modernization: Incorporating newer, more fuel-efficient aircraft that can also utilize higher blends of SAF.

- Operational Efficiencies: Implementing advanced flight planning and air traffic management to minimize fuel consumption.

Technological advancements are reshaping Turkish Airlines' operations, from fleet modernization with fuel-efficient aircraft like the Boeing 787 and Airbus A350, which entered service in 2018 and 2019 respectively, to sophisticated digital platforms enhancing customer experience. By mid-2024, the airline’s fleet included a significant number of these modern jets, boosting efficiency and competitive advantage.

The airline’s strategic use of big data analytics and AI optimizes pricing, route planning, and predictive maintenance, aiming for increased efficiency and cost reduction. AI also personalizes customer offers, driving loyalty and revenue growth, a trend seen across the industry in 2024 where RASK generally increased.

Cybersecurity is paramount, with ongoing investments in advanced threat detection systems and employee training to combat rising threats, such as phishing and ransomware, prevalent in the aviation sector in 2023. Compliance with data privacy laws like GDPR, which carries fines up to €20 million or 4% of global turnover, is also critical for maintaining trust and legal standing.

The push for decarbonization necessitates embracing Sustainable Aviation Fuels (SAF). With mandates like the EU's ReFuelEU Aviation requiring a minimum 2% SAF blend by 2024, Turkish Airlines is actively exploring SAF partnerships and technologies to meet these environmental regulations and stakeholder expectations.

Legal factors

Turkish Airlines operates under a stringent framework of aviation safety regulations, dictated by both national authorities such as the Directorate General of Civil Aviation (DGCA) and international bodies including the European Union Aviation Safety Agency (EASA) and the International Civil Aviation Organization (ICAO). These standards cover every facet of flight operations, from aircraft maintenance and pilot training to air traffic control and passenger security.

Adherence to these safety protocols is paramount and requires substantial ongoing investment. For instance, EASA's Safety Management System (SMS) requirements mandate robust procedures for identifying, assessing, and mitigating risks. Turkish Airlines' commitment to compliance is demonstrated through continuous audits, rigorous maintenance schedules, and extensive training programs for its personnel. In 2023, the airline reported investing significantly in its fleet modernization and safety infrastructure, a key component of meeting these evolving regulatory demands.

Failure to comply with these critical regulations can lead to severe consequences. Penalties can range from substantial fines and temporary grounding of aircraft to permanent revocation of operating licenses. Beyond financial and operational repercussions, any safety lapse can inflict irreparable damage to Turkish Airlines' reputation, impacting passenger trust and its competitive standing in the global market. The airline's safety record is a cornerstone of its brand, and maintaining compliance is a strategic imperative.

Turkish Airlines, like all carriers, operates under robust consumer protection laws that mandate passenger rights in cases of flight disruptions. These regulations cover compensation for delays, cancellations, lost or damaged baggage, and denied boarding. For instance, adhering to frameworks similar to EU261 is vital for maintaining operational integrity and customer trust. In 2023, the European Union Aviation Safety Agency (EASA) reported a significant increase in passenger rights complaints across the bloc, underscoring the importance of compliance for airlines like Turkish Airlines.

The airline must ensure transparent communication regarding flight status changes and maintain efficient, accessible channels for resolving passenger grievances. Proactive management of these legal obligations not only prevents substantial financial penalties but also fosters a positive brand reputation. Failure to comply can lead to significant fines and damage customer loyalty, impacting overall financial performance.

Turkish Airlines must strictly adhere to Turkey's labor laws and international employment regulations, covering aspects like maximum working hours, minimum wage requirements, and the rights of employees to unionize. This includes compliance with non-discrimination statutes to ensure fair treatment for its vast workforce.

Navigating the complexities of managing thousands of employees across different countries necessitates a deep understanding of each jurisdiction's unique legal landscape and the effective management of numerous collective bargaining agreements, which can significantly impact operational costs and flexibility.

As of early 2024, Turkey's minimum wage for 2024 was set at 17,002 Turkish Lira per month, a figure that directly influences labor costs for Turkish Airlines and requires ongoing monitoring of potential adjustments and their impact on the company's financial planning.

Anti-Trust and Competition Laws

Turkish Airlines operates within a fiercely competitive global aviation landscape, necessitating strict adherence to anti-trust and competition regulations to avert monopolistic behaviors and unfair market practices. This oversight is particularly critical for arrangements like code-sharing agreements, mergers, and strategic alliances.

Failure to comply can result in substantial financial penalties and protracted legal disputes. For instance, the European Union’s Directorate-General for Competition actively monitors the airline industry. In 2023, several major airlines faced investigations and fines related to anti-competitive practices, underscoring the stringent regulatory environment.

- Regulatory Scrutiny: Authorities like the European Commission and the Turkish Competition Authority (Rekabet Kurumu) closely examine airline partnerships and market share to ensure fair competition.

- Merger and Alliance Impact: Any proposed mergers or significant alliance expansions by Turkish Airlines are subject to rigorous review to prevent market dominance.

- Code-Sharing Oversight: Code-sharing agreements, while common, are scrutinized for potential anti-competitive effects on routes and pricing.

- Potential Penalties: Violations can lead to fines reaching up to 10% of a company's global annual turnover, as stipulated by EU competition law.

Data Privacy Regulations (e.g., GDPR, KVKK)

Turkish Airlines, like all major carriers, handles extensive passenger data, making compliance with data privacy laws paramount. Regulations like the EU's General Data Protection Regulation (GDPR) and Turkey's Personal Data Protection Law (KVKK) dictate how this information is collected, stored, processed, and transferred. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher, underscoring the financial risk of non-compliance. Ensuring secure data handling is not just a legal requirement but also crucial for maintaining customer trust, a vital asset in the competitive airline industry.

The airline must implement robust data protection measures across all operations. This includes secure consent mechanisms for data collection, encrypted storage, and strict access controls for data processing. Turkish Airlines also needs to manage cross-border data transfers carefully, adhering to specific legal frameworks to protect passenger information. A breach or mishandling of data could lead to significant financial penalties and severe reputational damage, impacting passenger confidence and future bookings.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- KVKK Penalties: Fines can reach up to 1% of annual revenue for certain violations.

- Data Breach Costs: Industry reports in 2024 indicate the average cost of a data breach is over $4 million globally.

- Customer Trust: A strong data privacy posture is essential for maintaining passenger loyalty.

Turkish Airlines must navigate a complex web of international and national aviation regulations, covering everything from flight safety to passenger rights. Compliance with bodies like EASA and ICAO is critical, with significant investments made in fleet modernization and safety infrastructure, as highlighted by their 2023 operational reports. Non-compliance can result in severe penalties, including hefty fines and potential operational shutdowns, impacting both financial performance and brand reputation.

Labor laws and data privacy regulations also play a crucial role, with Turkish Airlines needing to adhere to Turkey's minimum wage laws, which saw a significant increase to 17,002 Turkish Lira in 2024, impacting operational costs. Furthermore, strict adherence to data protection laws like GDPR and KVKK is essential, as breaches can incur fines up to 4% of global annual turnover, emphasizing the need for robust data security measures to maintain customer trust.

Environmental factors

Turkish Airlines, like all major carriers, faces significant pressure to curb its carbon emissions in response to growing climate change concerns. The International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) mandates a carbon-neutral growth from 2020 onwards, requiring airlines to offset emissions above 2019 levels. For instance, in 2023, the aviation sector globally contributed approximately 2.5% of CO2 emissions, a figure that necessitates strategic adaptation for sustainability.

To meet these evolving environmental regulations and stakeholder expectations, Turkish Airlines is actively pursuing a strategy focused on fleet modernization and the adoption of sustainable aviation fuels (SAFs). Investing in newer, more fuel-efficient aircraft is a cornerstone of this approach, as newer models can offer substantial reductions in fuel burn per passenger mile. For example, the Airbus A321neo, a key aircraft in Turkish Airlines' fleet, offers up to 20% fuel efficiency improvement over previous generation aircraft.

The exploration and integration of sustainable aviation fuels (SAFs) represent another critical pathway for Turkish Airlines to achieve its climate targets. SAFs, derived from sources like used cooking oil or agricultural waste, can significantly reduce lifecycle carbon emissions compared to conventional jet fuel. While still facing challenges in terms of supply and cost parity, the growing commitment from major airlines, including Turkish Airlines, to increase SAF usage is a vital step towards decarbonizing air travel, with the global SAF market projected to grow substantially in the coming years.

Turkish Airlines, like all major carriers, faces increasingly stringent noise pollution regulations, particularly around its hub at Istanbul Airport and other key operational bases. These regulations directly impact flight procedures and fleet modernization. For instance, many European Union countries enforce strict curfews on night flights to mitigate noise disturbance for residents, a factor Turkish Airlines must meticulously manage for its European routes.

Compliance often necessitates operational adjustments, such as altered flight paths or restrictions on certain aircraft types during sensitive hours. The selection of new aircraft is heavily influenced by noise certification standards; newer models, like the Airbus A321neo and Boeing 787 Dreamliner in Turkish Airlines' fleet, generally offer significantly lower noise footprints compared to older generation aircraft. This can translate to operational flexibility and better community relations.

The airline actively engages in community outreach programs to address noise concerns, a critical component of maintaining its social license to operate. By investing in quieter aircraft technology and optimizing flight operations, Turkish Airlines aims to minimize its environmental impact and foster positive relationships with communities living near airports.

Turkish Airlines faces significant environmental challenges related to waste management. In 2023, the airline industry globally generated an estimated 5.8 million tonnes of waste, with a substantial portion originating from in-flight services. Turkish Airlines must implement comprehensive strategies to manage this volume, focusing on reducing single-use plastics, a major contributor to landfill waste.

Increasing recycling rates is a key environmental imperative. While specific 2024 data for Turkish Airlines is still emerging, industry benchmarks suggest that airlines are aiming to divert over 50% of their operational waste from landfills. This involves enhanced segregation of materials like paper, aluminum, and glass from catering services.

Responsible disposal of hazardous materials, such as batteries from electronic devices and cleaning agents, is also critical. Turkish Airlines needs to ensure compliance with international regulations for hazardous waste handling to prevent environmental contamination. This is an area where robust tracking and auditing are essential.

Embracing a circular economy approach offers a sustainable path forward. This means exploring options for reusable cabin amenities, upcycling materials where possible, and partnering with suppliers who also prioritize waste reduction and material longevity. Such initiatives not only benefit the environment but can also lead to cost efficiencies in the long run.

Biodiversity and Wildlife Protection

Turkish Airlines' operations, like airport construction and expansion, have the potential to affect local biodiversity and wildlife habitats. For instance, habitat fragmentation from new runways or facilities can isolate populations and disrupt migration patterns. This is a growing concern globally, with the UN estimating that around 1 million animal and plant species are now threatened with extinction, many within decades, more than ever before in human history.

Considering its extensive network and supply chain, Turkish Airlines is increasingly expected to implement strategies that lessen its ecological footprint. This includes minimizing disruption in sensitive areas around airports and along common flight paths. Many airlines are exploring initiatives like using sustainable aviation fuels, which can reduce emissions and indirectly support biodiversity by mitigating climate change impacts, a key driver of species loss.

The airline’s commitment to conservation can extend to supporting local wildlife protection programs or investing in ecological restoration projects in regions where it operates. For example, some airports have implemented wildlife hazard management plans that also benefit local fauna by creating safer, more natural environments. Turkish Airlines, as a major player, can set an example by integrating these considerations into its long-term business strategy, aligning with global sustainability goals and increasing stakeholder expectations for environmental responsibility.

- Habitat Impact: Airport development can lead to habitat loss and fragmentation, affecting local species.

- Conservation Measures: Airlines are encouraged to adopt practices that minimize ecological disruption.

- Sustainable Aviation Fuel (SAF): SAF use can indirectly benefit biodiversity by addressing climate change.

- Supply Chain Responsibility: Turkish Airlines should consider the environmental impact across its entire operational chain.

Resource Scarcity and Sustainable Sourcing

Turkish Airlines, like all major carriers, is heavily dependent on resources such as jet fuel, water for operations and catering, and materials for aircraft manufacturing and maintenance. The increasing global focus on sustainability and the potential for resource scarcity directly impact operational costs and supply chain stability. For instance, the International Energy Agency (IEA) reported that global oil demand, a key driver for jet fuel prices, was projected to reach 102.9 million barrels per day in 2024, a significant increase that can elevate fuel expenses.

The airline must prioritize sustainable sourcing for its catering and onboard supplies, moving away from single-use plastics and exploring more eco-friendly alternatives. This not only addresses environmental concerns but also anticipates potential regulatory changes and consumer preferences. In 2023, the aviation industry consumed approximately 300 million tonnes of jet fuel, highlighting the sheer scale of energy dependence and the critical need for efficiency.

- Fuel Efficiency: Turkish Airlines is investing in newer, more fuel-efficient aircraft, such as the Airbus A350 and Boeing 787 families, to reduce its carbon footprint and mitigate the impact of fluctuating fuel prices.

- Sustainable Aviation Fuel (SAF): Exploring and increasing the use of SAF is a key strategy to address resource dependency on fossil fuels. While SAF adoption is growing, it still represents a small fraction of total aviation fuel consumption.

- Waste Reduction: Implementing comprehensive waste management programs onboard and at ground operations, focusing on recycling and reducing the use of disposable materials, is crucial for efficient resource utilization.

- Water Management: Efficient water usage in aircraft cleaning, catering, and facility management contributes to resource conservation and cost savings.

Turkish Airlines faces increasing pressure to adopt sustainable aviation fuels (SAFs) to reduce its carbon footprint, with the global SAF market expected to see significant growth. The airline is investing in fuel-efficient aircraft like the Airbus A321neo, which offers a 20% improvement in fuel efficiency over older models, directly addressing environmental concerns and operational costs.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Turkish Airlines is grounded in data from official Turkish government ministries, the International Air Transport Association (IATA), and leading aviation industry analytics firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the airline.