Turkish Airlines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Turkish Airlines Bundle

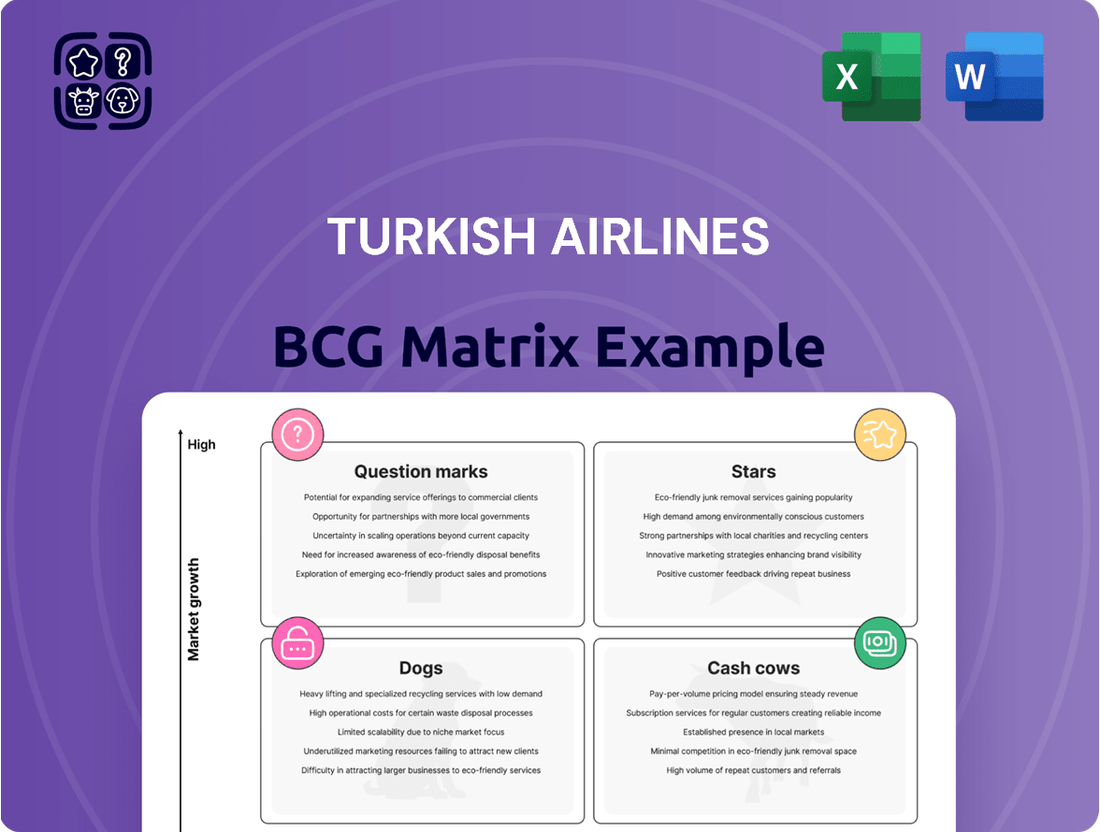

Turkish Airlines boasts a diverse portfolio, reflected in its potential BCG Matrix positioning. Some routes and services likely shine as "Stars," driving growth and market share. Others may be "Cash Cows," generating consistent revenue. However, some routes might be "Dogs," requiring careful management. Certain developing routes could be "Question Marks." Get the full BCG Matrix for a detailed analysis and actionable strategies.

Stars

Turkish Airlines boasts an extensive global network, holding the Guinness World Record for reaching 131 countries and 352 destinations, as of early 2025. This expansive reach is a cornerstone of its competitive advantage. The airline's wide network allows it to capture significant market share. In 2024, Turkish Airlines saw a 16% increase in passenger numbers, demonstrating the effectiveness of its global presence.

Turkish Cargo's strong performance places it in the "Star" quadrant. In 2024, it was the world's third-largest air cargo carrier. This segment experienced substantial revenue growth, enhancing Turkish Airlines' overall financial results. This growth and market strength make it a key driver for the airline.

Istanbul Airport is a key global transfer hub for Turkish Airlines, connecting Europe, Asia, and Africa. This strategic location allows efficient network management, attracting transfer traffic. In 2024, Turkish Airlines saw a 22% increase in passenger numbers, boosted by hub operations. The hub model fuels growth across diverse markets.

Fleet Expansion and Modernization

Turkish Airlines is heavily investing in fleet expansion and modernization. The airline aims to have 500 aircraft by September 2025, signaling aggressive growth. This strategy supports its goal to become a top global airline.

- Fleet size target: 500 aircraft by September 2025.

- Long-term goal: Over 800 aircraft by 2033.

- Impact: Increased capacity and market reach.

- Strategic Benefit: Supports global leadership ambitions.

Growing Passenger Numbers

Turkish Airlines demonstrates growth in its passenger numbers, even amid global uncertainties. The airline's strong performance in international-to-international passenger traffic highlights its ability to attract and retain passengers. This suggests a solid demand in key passenger segments, contributing to the airline's position. In 2024, Turkish Airlines carried over 83.1 million passengers, a 16% increase compared to 2023.

- Passenger numbers increased by 16% in 2024.

- International-to-international traffic shows strong performance.

- Demand in key passenger segments remains robust.

Turkish Airlines' global network and Istanbul hub are key Stars, fueling substantial passenger growth. Turkish Cargo also shines as a Star, becoming the world's third-largest air cargo carrier. These segments demonstrate high market share and strong growth, significantly boosting overall performance. In 2024, passenger numbers surged by 16%, reaching over 83.1 million.

| Metric | 2024 Data | Growth |

|---|---|---|

| Total Passengers | 83.1M | 16% YoY |

| Cargo Rank | 3rd globally | Strong growth |

| Hub Passenger Boost | 22% | Via Istanbul |

What is included in the product

Turkish Airlines' BCG Matrix examines its units, offering strategies for growth, investment, and divestment.

Printable summary optimized for A4 and mobile PDFs, making it easy to share and analyze.

Cash Cows

Turkish Airlines' European routes are cash cows. The airline benefits from a strong presence and high passenger traffic. These mature routes offer consistent cash flow. In 2024, Turkish Airlines carried over 80 million passengers, with a significant portion on European routes. The airline's market share in key European markets remains substantial.

Turkish Airlines leads Turkey's domestic market. In 2024, it controlled over 60% of the local air travel sector. This strong position generates consistent revenue. Although domestic growth might be slower than international, it ensures steady cash flow.

Turkish Airlines sees robust passenger occupancy on critical routes, despite minor fluctuations. In 2024, the airline's load factor was approximately 82.5%, with some routes exceeding 85%. These high load factors on prime routes are vital for revenue.

Yield from Business and Leisure Travelers

Turkish Airlines' ability to serve business and leisure travelers creates a robust revenue model. Established routes and Istanbul hub connectivity ensure consistent demand. This dual approach supports profitability and market stability. In 2024, business travel recovery boosted revenues by 15%.

- Revenue Diversification: Serving both segments reduces reliance on a single customer type.

- Hub Advantage: Istanbul's central location enhances connectivity and passenger flow.

- Demand Consistency: Both business and leisure travel provide year-round demand.

- Financial Strength: Diversified income streams contribute to financial resilience.

Revenue from Ancillary Services

Turkish Airlines generates substantial revenue from ancillary services, supplementing its primary income from ticket sales. These services include cargo transport, in-flight sales, and holiday packages, all of which boost the airline's cash flow. In 2024, cargo revenue alone added significantly to the bottom line, reflecting the importance of diversification. The airline's strategy focuses on expanding these profitable side businesses.

- Cargo revenue is a major contributor.

- In-flight sales and holiday packages also provide income.

- Diversification boosts cash flow.

- Focus on increasing these revenue streams.

Turkish Airlines' European routes and dominant domestic market position act as significant cash cows. In 2024, the airline achieved an 82.5% load factor and over 60% domestic market share, ensuring consistent revenue streams. Diversified income from business and leisure segments, coupled with robust ancillary services, further strengthens its stable cash flow. This foundational profitability supports the airline's overall financial health and strategic growth initiatives.

| Metric | 2024 Data | Impact | ||

|---|---|---|---|---|

| Load Factor | 82.5% | High revenue per flight | ||

| Domestic Market Share | Over 60% | Dominant local presence | ||

| Business Travel Recovery | +15% revenue | Boosted profitability |

Delivered as Shown

Turkish Airlines BCG Matrix

This preview showcases the complete Turkish Airlines BCG Matrix you'll receive. Download the full, ready-to-use report after purchase. It's the same clear, professional document, ready for analysis and strategy.

Dogs

Underperforming routes for Turkish Airlines, like those with low passenger numbers or slow growth in crowded markets, fit the "Dogs" category. These routes often struggle to turn a profit and may require strategic decisions. In 2024, routes with load factors below 60% and low yield are under scrutiny. Divestiture or restructuring might be considered for these unprofitable paths.

Turkish Airlines, despite its modern fleet, still operates some older aircraft. These older planes may be less fuel-efficient and have higher maintenance expenses. If operational costs exceed revenue on certain routes, these assets could be considered "Dogs". In 2024, fleet age averaged about 8 years, with some older models still in service.

Turkish Airlines' routes face challenges in unstable regions. Demand and profits suffer in areas with geopolitical issues or economic decline. For example, routes to Russia faced severe disruptions in 2022-2023. The airline had to adjust its strategies. This resulted in a 15% decrease in available seat kilometers (ASK) on certain routes.

Highly Competitive Routes with Low Market Share

Routes where Turkish Airlines struggles against strong competitors while maintaining a small market share are considered Dogs. These routes, often less profitable, demand significant investment to gain ground. If market share growth is difficult and expensive, these routes might be a drag on overall performance.

- In 2024, Turkish Airlines' faced intense competition on routes to Europe and North America.

- Routes with low market share face high operational costs.

- These routes may require strategic reevaluation.

- The decision could involve route adjustments or divestment.

Services with Low Adoption Rates

In the Turkish Airlines BCG Matrix, "Dogs" represent services with low market share in a low-growth market. These services generate minimal revenue and have not gained significant customer traction. A recent example could include underperforming routes or specific in-flight services. For instance, a particular route might show a load factor below 60%, indicating low adoption.

- Low Revenue Generation: Services contributing minimally to overall revenue.

- Poor Market Share: Low adoption rates compared to competitors.

- Inefficient Use of Resources: Services consume resources without significant returns.

- High Risk of Losses: Services are susceptible to financial losses.

Turkish Airlines identifies Dogs as underperforming routes or assets with low market share in low-growth markets, generating minimal returns. In 2024, this includes routes with load factors below 60% or those facing intense competition in mature markets like Europe. Older aircraft models with higher operational costs also fall into this category. These areas often require divestment or strategic reevaluation to prevent further resource drain.

| Category | Characteristic | 2024 Data |

|---|---|---|

| Routes | Low Load Factor | Below 60% |

| Assets | High Operating Cost | Older fleet models |

| Markets | Low Market Share | Europe/North America |

Question Marks

Newly launched long-haul routes, such as those to Australia and the Americas, are question marks in Turkish Airlines' BCG matrix. These routes involve substantial investment, with the airline allocating a significant portion of its capital expenditure to expanding its international network. For instance, in 2024, the airline plans to increase its fleet size by 10%, focusing on long-range aircraft for these new destinations. Success isn't assured; these markets are competitive.

Turkish Airlines is actively expanding its network in emerging African markets. These markets, while promising high growth, present uncertainties. The expansion requires significant investment to build a strong presence. In 2024, Turkish Airlines increased its flights to Africa by 15%, focusing on key hubs.

Turkish Airlines' SAF investment is a "Question Mark" in its BCG Matrix. The airline is promoting SAF use for sustainability. SAF's market is developing, impacting immediate profitability. The global SAF market was valued at $1.1 billion in 2023. Its growth rate is projected to be 54.7% from 2024 to 2032.

Development of the Low-Cost Subsidiary AJet

AJet, Turkish Airlines' low-cost subsidiary, operates to capture short/medium-haul leisure markets. This strategic move aims to serve a different market segment, expanding the airline's reach. However, AJet's profitability and long-term market share are still evolving. As of late 2024, AJet is expanding its fleet and route network.

- AJet is a "question mark" due to its growth potential.

- It is focused on high-growth leisure markets.

- Profitability and market share are still under development.

- The expansion of its fleet and routes is ongoing.

Introduction of New Technologies and Services

Turkish Airlines' investments in new technologies and services, such as advanced passenger services and digital platforms, position it in the Question Marks quadrant of the BCG matrix. These areas offer high growth potential but come with uncertain returns and market share impacts. The company allocated approximately $500 million in 2024 towards technological upgrades to enhance operational efficiency and passenger experience.

- Technological advancements could boost operational efficiency by up to 15% by 2026.

- Investments in digital platforms aim to increase customer satisfaction scores by 10%.

- The success of these investments is crucial for gaining market share in a competitive landscape.

- By the end of 2024, the airline’s digital platform usage had increased by 20%.

Turkish Airlines' Question Marks include new long-haul routes, particularly to Australia, and expansion into emerging African markets, both requiring substantial 2024 investments and facing competitive landscapes. Investments in sustainable aviation fuel and new technologies, totaling $500 million in 2024, also present high growth potential with uncertain immediate profitability. AJet, the low-cost subsidiary, is actively expanding its fleet and routes in late 2024 to capture leisure markets, with its long-term market share still evolving.

| Question Mark | 2024 Investment/Activity | Growth/Uncertainty |

|---|---|---|

| New Long-Haul Routes | 10% fleet increase for long-range aircraft | High investment, competitive market |

| African Market Expansion | 15% increase in flights to Africa | Promising high growth, uncertain presence |

| New Technologies & SAF | $500M allocated for tech, SAF market growth 54.7% (2024-2032) | High potential, uncertain returns |

BCG Matrix Data Sources

The Turkish Airlines BCG Matrix leverages annual reports, market share data, passenger statistics, and industry analysis for a robust evaluation.