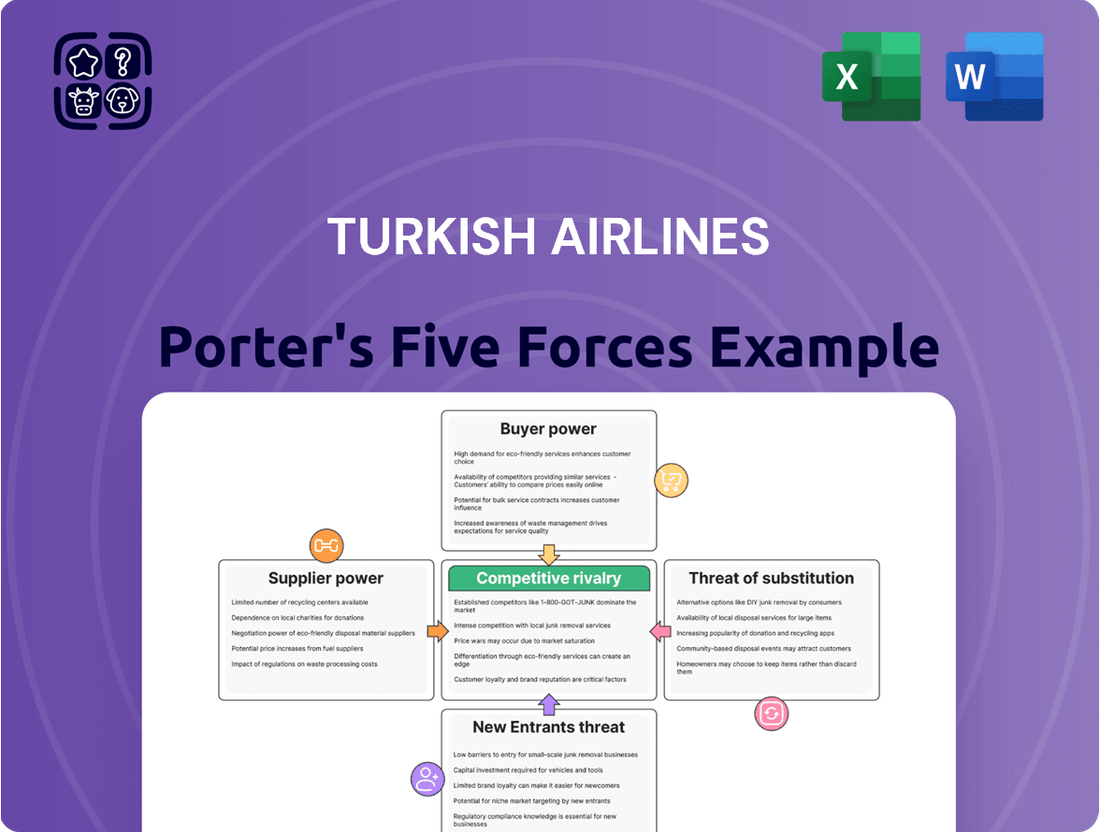

Turkish Airlines Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Turkish Airlines Bundle

Turkish Airlines operates in a fiercely competitive global aviation market, where the threat of new entrants is moderate due to high capital requirements, yet low-cost carriers continuously challenge established players. The bargaining power of buyers is significant, as passengers can easily switch between airlines based on price and convenience, forcing Turkish Airlines to offer competitive fares.

Suppliers, particularly aircraft manufacturers and fuel providers, wield considerable power, impacting Turkish Airlines' operational costs and fleet expansion plans. The threat of substitutes, such as high-speed rail for shorter routes, presents a growing challenge, requiring Turkish Airlines to differentiate its services and network reach.

Rivalry among existing competitors is intense, with global airlines constantly vying for market share through alliances, route expansion, and service innovations, directly influencing Turkish Airlines' profitability and strategic decisions.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Turkish Airlines’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of aircraft manufacturers like Boeing and Airbus is substantial for Turkish Airlines. This is due to the industry's highly concentrated nature, with only these two major players dominating global commercial aircraft production.

Ongoing production challenges and delivery delays in 2024 further amplify this power. Airlines worldwide, including Turkish Airlines, face extended lead times for new aircraft, forcing them to rely more heavily on existing fleets or accept less favorable terms from manufacturers.

For instance, Boeing faced significant production issues in early 2024, impacting delivery schedules. This situation limits airlines' options and strengthens the manufacturers' negotiating position on pricing, customization, and payment terms.

Turkish Airlines, like other carriers, must contend with these supply-side constraints, which translate into higher acquisition costs and potential operational disruptions, underscoring the significant bargaining power held by these aircraft giants.

Engine manufacturers such as General Electric, Rolls-Royce, and Pratt & Whitney exert significant bargaining power over Turkish Airlines. These specialized firms are few in number and possess proprietary technology, making it difficult for airlines to switch suppliers easily. For instance, the widespread issues with Pratt & Whitney's Geared Turbofan (GTF) engines in 2023 and early 2024 led to significant flight disruptions and capacity reductions for many airlines, including Turkish Airlines, underscoring their reliance on these critical components and the supplier's leverage.

Fuel is a significant expense for Turkish Airlines, directly impacting profitability. The airline's reliance on external fuel suppliers means it's exposed to global oil market volatility. In 2024, while fuel prices saw some moderation compared to previous years, the underlying vulnerability remains.

Geopolitical events continue to be a major factor influencing oil supply and, consequently, prices. This creates a degree of bargaining power for fuel suppliers, as disruptions can rapidly escalate costs for airlines like Turkish Airlines. For instance, heightened tensions in oil-producing regions can lead to immediate price spikes, forcing airlines to absorb these increases or pass them on to consumers.

Maintenance, Repair, and Overhaul (MRO) Providers

Maintenance, Repair, and Overhaul (MRO) providers hold significant bargaining power over Turkish Airlines. The specialized nature of aircraft MRO services and critical spare parts means that airlines often have limited alternatives for essential maintenance. Supply chain disruptions, a growing concern in recent years, further amplify this power; delays in receiving necessary parts can lead to aircraft being grounded, directly impacting operational efficiency and revenue. This reliance makes airlines more susceptible to price increases and less flexible in negotiating terms with MRO suppliers.

The bargaining power of MRO providers is evident in their ability to command premium pricing for specialized services and genuine parts. For instance, in 2024, the global aviation MRO market was valued at approximately $80 billion, with a significant portion attributed to engine and component MRO, areas requiring deep technical expertise and proprietary tooling. Turkish Technic, Turkish Airlines' own MRO subsidiary, competes with a range of international MRO providers, but the need for OEM-certified parts and specialized knowledge often limits the airline's ability to switch suppliers easily. This dependency can translate into higher operational costs for Turkish Airlines if MRO providers leverage their unique capabilities and market position effectively.

- Specialized Expertise: MRO providers possess unique technical skills and certifications essential for maintaining complex aircraft systems, limiting Turkish Airlines' options.

- Critical Spare Parts: Access to original equipment manufacturer (OEM) certified spare parts is vital, and suppliers of these parts can exert considerable influence.

- Impact of Disruptions: In 2023 and continuing into 2024, global supply chain issues have led to longer lead times for aircraft parts, increasing the bargaining power of MRO suppliers who can deliver these essential components.

- Grounding Costs: Aircraft downtime due to maintenance delays can cost airlines millions of dollars per day, making timely and reliable MRO services a necessity, even at higher prices.

Airport Operators and Air Navigation Services

Airport operators and air navigation service providers hold substantial bargaining power over airlines like Turkish Airlines. Airlines depend on these entities for essential services such as landing and takeoff slots, gate assignments, and crucial ground handling operations. The ability to access these services is non-negotiable for flight operations.

Furthermore, air navigation services are critical for the safe and efficient transit of aircraft through airspace. These providers, often operating as natural monopolies or heavily regulated bodies, dictate the terms and pricing for their services. This inherent market structure allows them to exert significant influence over airlines, compelling them to accept established fees and contract conditions.

For instance, in 2024, major international airports often charge airlines substantial fees for landing, parking, and passenger services. These fees can represent a significant portion of an airline's operating expenses. Similarly, air traffic control fees are standardized and often non-negotiable, directly impacting an airline's cost structure.

- High Dependence: Airlines cannot operate without access to airport facilities and air traffic control.

- Monopolistic/Regulated Nature: Many airport operators and air navigation services function as monopolies or are subject to government regulation, limiting competition.

- Fee Setting Power: These providers have the authority to set fees for essential services, which airlines must absorb.

- Limited Negotiation Scope: The bargaining power of airlines in negotiating these fees is often restricted due to the essential nature of the services.

The bargaining power of suppliers for Turkish Airlines is considerable, primarily driven by the concentrated nature of key industries and critical component dependencies. Aircraft manufacturers like Boeing and Airbus, along with engine producers such as GE and Rolls-Royce, hold significant sway due to their limited number and proprietary technologies. This is further exacerbated by ongoing production challenges and delivery delays seen in 2024, which amplify lead times and strengthen supplier negotiating positions on pricing and terms.

Fuel suppliers also wield influence due to global oil market volatility and geopolitical risks, meaning airlines like Turkish Airlines are susceptible to price spikes. Similarly, Maintenance, Repair, and Overhaul (MRO) providers, particularly those supplying OEM-certified parts and specialized technical expertise, command strong leverage. This is intensified by supply chain disruptions that have lengthened lead times for critical components in recent years, making timely MRO a costly necessity.

Airport operators and air navigation service providers represent another crucial area of supplier power. Airlines are entirely dependent on these entities for essential operational services, which are often provided by natural monopolies or heavily regulated bodies. This inherent lack of alternatives allows them to dictate fees for landing, gate access, and air traffic control, significantly impacting an airline's cost structure. For example, major international airport fees in 2024 can represent a substantial portion of an airline's operating expenses.

The limited number of key suppliers across these essential areas, coupled with the critical nature of their products and services, means Turkish Airlines faces substantial supplier bargaining power. This necessitates careful management of supplier relationships and strategic planning to mitigate the impact of these powerful external forces on operational costs and efficiency.

| Supplier Category | Key Players | Factors Influencing Bargaining Power | Impact on Turkish Airlines |

|---|---|---|---|

| Aircraft Manufacturers | Boeing, Airbus | Industry concentration, proprietary technology, production challenges (2024) | Higher acquisition costs, less favorable terms, delivery delays |

| Engine Manufacturers | GE, Rolls-Royce, Pratt & Whitney | Limited number of specialized providers, critical technology, reliance on specific engines (e.g., GTF issues 2023-2024) | Dependency on maintenance and parts, potential for operational disruptions and increased costs |

| Fuel Suppliers | Global Oil Markets | Global oil price volatility, geopolitical events | Exposure to price spikes, impact on operating expenses |

| MRO Providers | Specialized MROs, OEM Parts Suppliers | Unique technical skills, OEM certification, supply chain disruptions (2023-2024) | Premium pricing for services and parts, potential for aircraft grounding due to delays |

| Airport Operators & Air Navigation | Airport Authorities, Air Traffic Control | Monopolistic/regulated nature, essential services, fee-setting authority | Significant operating costs from landing/service fees, non-negotiable charges |

What is included in the product

This Porter's Five Forces analysis for Turkish Airlines meticulously dissects the airline industry's competitive intensity, buyer and supplier power, threat of new entrants, and the influence of substitute products to reveal strategic opportunities and challenges.

Understand the competitive landscape for Turkish Airlines with a clear, one-sheet Porter's Five Forces analysis, simplifying complex market pressures for agile strategic adjustments.

Customers Bargaining Power

Airline passengers, particularly those traveling for leisure, demonstrate significant price sensitivity. The widespread availability of online travel agencies and comparison websites means customers can easily shop around for the best deals. For instance, in early 2024, numerous reports highlighted how travelers were actively seeking out the cheapest available flights, often switching between airlines based on minor price differences. This transparency directly empowers consumers, allowing them to quickly identify and switch to competitors, thereby increasing their bargaining leverage.

Turkish Airlines faces significant customer bargaining power due to the sheer number of alternative airlines and routes available. In 2024, the global airline industry remains highly competitive, with both established carriers and the continued rise of low-cost options providing passengers with ample choices for their travel needs.

Customers can easily compare fares and schedules across a multitude of carriers, especially when considering travel between major international hubs. For instance, routes served by carriers from the Gulf region, known for aggressive pricing strategies, directly challenge Turkish Airlines' customer loyalty. This ease of switching empowers consumers to demand lower prices and better service, directly impacting Turkish Airlines' revenue and profitability.

Customers today have high expectations for personalized service and a smooth journey, covering everything from booking to the flight itself. Turkish Airlines, like many in the industry, faces this as a significant factor in their competitive landscape. The demand for tailored experiences, including customized entertainment and comfort options, directly influences customer loyalty and their willingness to choose one airline over another.

In 2024, passenger satisfaction scores are heavily weighted by these experiential elements. Airlines that don't deliver on personalized offerings, such as preferred seating arrangements or tailored meal options, are vulnerable. For instance, a customer's positive experience with in-flight Wi-Fi and connectivity, coupled with responsive customer service, can be a deciding factor when booking future flights, directly impacting Turkish Airlines' market share.

Low Switching Costs for Passengers

For passengers, the cost of switching from one airline to another is remarkably low. This ease of switching means customers can easily move between carriers with minimal effort, often just a few clicks online. This low switching cost directly impacts airline loyalty, compelling companies like Turkish Airlines to constantly compete on price and service quality to retain passengers.

This dynamic is clearly reflected in the market. For instance, in 2024, the average price of a domestic round-trip flight in Turkey saw fluctuations, driven by this very competition. Airlines must offer compelling fares and appealing services to prevent passengers from simply opting for a competitor's cheaper or more convenient option.

- Low Switching Costs: Passengers can change airlines with minimal effort and expense.

- Price Sensitivity: Customers are highly responsive to price differences, driving competition.

- Service Competition: Airlines must differentiate through service quality to combat price wars.

- Customer Loyalty: Limited loyalty means airlines must continuously earn passenger business.

Impact of Business Travel Trends

The bargaining power of customers is significantly shaped by shifting business travel trends. While leisure travel demand has shown resilience, business travelers are adapting their habits. Some anticipate an increase in business trips, but a notable trend is the growing adoption of virtual meeting technologies for specific business needs. This evolution impacts how airlines must cater to this segment.

Turkish Airlines, like other carriers, faces customers demanding greater flexibility and efficiency in their travel arrangements. The preference for hybrid work models and the cost-effectiveness of virtual collaboration tools mean that business travel may not return to pre-pandemic levels uniformly across all sectors. Airlines need to respond with tailored services and pricing to retain this crucial customer base.

- Business Travel Evolution: A portion of business travelers expect to increase their travel frequency, but virtual meeting technology adoption is rising for certain business purposes.

- Customer Demands: Key customer demands from the business travel segment include enhanced flexibility and greater operational efficiency.

- Impact on Airlines: Turkish Airlines must adapt its offerings to meet these evolving customer needs to maintain competitiveness.

The bargaining power of customers for Turkish Airlines is substantial, driven by low switching costs and high price sensitivity. In 2024, the ease with which passengers can compare fares across numerous airlines, particularly with the prevalence of online travel agencies, empowers them to seek the best deals. This intense competition means airlines must constantly innovate on price and service to retain customers.

| Factor | Impact on Turkish Airlines | 2024 Data/Observation |

|---|---|---|

| Switching Costs | Low | Minimal effort and cost for passengers to switch between airlines. |

| Price Sensitivity | High | Customers actively seek cheapest flights, influencing fare strategies. |

| Information Availability | High | Online comparison sites provide extensive fare and schedule data. |

| Service Expectations | Increasing | Demand for personalized experiences impacts loyalty and choice. |

Preview Before You Purchase

Turkish Airlines Porter's Five Forces Analysis

The document you see here is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for Turkish Airlines meticulously breaks down the competitive landscape, examining the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry within the airline industry. You are previewing the final version—precisely the same document that will be available to you instantly after buying, offering actionable insights into the strategic positioning of Turkish Airlines.

Rivalry Among Competitors

Turkish Airlines faces fierce competition from other major international network carriers. Airlines like Emirates, Qatar Airways, and Lufthansa, operating from competing global transfer hubs, significantly challenge Turkish Airlines' market share and passenger revenue. This intense rivalry necessitates continuous innovation and strategic pricing to maintain a competitive edge.

The competitive landscape for Turkish Airlines is significantly shaped by the ascent of Low-Cost Carriers (LCCs). Pegasus Airlines, a prominent LCC in Turkey, has notably expanded its reach, particularly on short-to-medium haul routes, directly challenging Turkish Airlines for price-sensitive travelers. In 2023, LCCs captured a substantial portion of international seats operating to and from Turkey, a trend that continued to grow throughout early 2024, intensifying price competition and forcing legacy carriers to adapt their strategies.

The airline industry, including Turkish Airlines, often grapples with overcapacity. Despite demand fluctuations, airlines frequently add more aircraft, leading to more available seats than passengers. This excess capacity can ignite intense price wars, as carriers try to fill those seats, even at lower fares.

For instance, in 2024, the International Air Transport Association (IATA) projected that passenger yields, a key indicator of airline profitability, were expected to decline. This downward pressure on yields directly results from carriers resorting to price competition to maintain load factors in an environment with more supply than demand on many routes.

Product Differentiation and Service Quality

Turkish Airlines faces intense rivalry, as airlines compete on more than just ticket prices. Service quality, the extent of their flight network, and the overall customer experience are crucial battlegrounds. This means Turkish Airlines must constantly innovate and excel in these areas to stand out.

Turkish Airlines strategically utilizes its expansive global network, originating from its central Istanbul hub, as a primary differentiator. This broad reach, combined with a commitment to high-quality service, allows them to attract and retain passengers who value convenience and comfort.

In 2024, Turkish Airlines continued to solidify its position by offering a superior passenger experience. For instance, they were recognized for their onboard catering and entertainment systems, key aspects of service quality that set them apart. Their network expansion also saw them adding new destinations, further enhancing their competitive edge against rivals who may have more limited reach.

- Network Breadth: Turkish Airlines served over 340 destinations in 2024, providing a significant advantage over many competitors.

- Service Quality Recognition: The airline consistently receives awards for its in-flight service, including meals and cabin crew attentiveness.

- Customer Experience Focus: Investments in airport lounges and digital services aim to enhance the end-to-end travel experience.

Geopolitical Factors and Route Limitations

Geopolitical instability significantly impacts Turkish Airlines' competitive landscape by restricting operational flexibility and creating new challenges. For instance, ongoing regional conflicts can lead to airspace closures, forcing costly rerouting and impacting flight schedules. This directly affects the airline's ability to serve key markets efficiently. In 2024, many airlines, including Turkish Airlines, continued to navigate airspace limitations stemming from conflicts in Eastern Europe and the Middle East, leading to extended flight times and increased fuel consumption on certain routes.

These external pressures can rapidly alter competitive advantages. An airline that previously enjoyed direct access to a lucrative market might find its routes curtailed, while a competitor with more adaptable network strategies could gain an edge. Turkish Airlines, with its strategic hub in Istanbul, is particularly susceptible to shifts in regional stability. The airline must continuously monitor and adjust its network to mitigate the impact of these geopolitical events on its operational efficiency and market share.

- Airspace Restrictions: Geopolitical tensions in 2024 led to several key airspace closures affecting major international carriers, including Turkish Airlines, forcing flight path alterations and increasing operational costs.

- Route Adaptation: Airlines are investing in advanced network planning tools to swiftly adapt to changing geopolitical landscapes, a necessity highlighted by the extended flight times experienced on routes over conflict zones.

- Competitive Shifts: The ability to quickly reroute and maintain service levels during periods of geopolitical stress can create significant competitive advantages, impacting passenger choice and market share.

- Economic Impact: For Turkish Airlines, disruptions due to geopolitical factors in 2024 contributed to higher operating expenses, directly influencing profitability and the competitive pricing of its services.

Turkish Airlines faces intense rivalry not only from global legacy carriers but also from aggressive low-cost carriers (LCCs) like Pegasus Airlines, especially on short to medium-haul routes. This competition intensifies during periods of overcapacity, which in 2024 saw projected declines in passenger yields as airlines engaged in price wars to fill seats. The airline industry's competitive nature extends beyond price, encompassing network breadth, service quality, and customer experience, areas where Turkish Airlines strives to differentiate itself.

In 2024, Turkish Airlines' competitive edge was bolstered by its extensive network serving over 340 destinations and its consistent recognition for superior in-flight service, including catering and entertainment. However, geopolitical instability, particularly airspace closures in 2024 due to regional conflicts, forced costly rerouting and impacted operational efficiency, creating new competitive challenges and potentially shifting market advantages for airlines adept at adapting their networks.

SSubstitutes Threaten

High-speed rail presents a significant threat to Turkish Airlines, particularly for shorter routes where it offers a compelling alternative. For instance, within Europe, the expanding high-speed rail networks provide a more convenient and eco-friendly option for travelers. In 2023, European rail passenger numbers saw a notable increase, with many routes now competing directly with short-haul flights for business and leisure travelers.

For domestic and regional routes, particularly within Turkey and to nearby countries, personal cars and intercity buses represent significant substitutes for air travel. These alternatives offer greater flexibility, especially for shorter distances or when traveling in groups, allowing passengers to depart and arrive on their own schedules without the constraints of airport procedures. In 2023, Turkey's bus network remained robust, carrying millions of passengers annually, with many opting for bus travel over flights for cost savings on journeys under 500 kilometers.

Virtual communication tools like Zoom and Microsoft Teams remain a viable substitute for business travel, potentially curbing the need for some face-to-face meetings. These platforms allow for efficient collaboration and information exchange, thereby reducing the frequency of certain corporate trips.

While virtual meetings cannot fully replicate the benefits of in-person interaction for all business purposes, their increasing sophistication and widespread adoption, especially following 2020, continue to exert pressure. A 2024 Statista report indicated that 60% of businesses surveyed planned to maintain hybrid work models, suggesting a continued reliance on virtual communication for internal and external meetings.

Environmental Concerns Driving Substitute Adoption

Growing environmental awareness is a significant threat of substitutes for Turkish Airlines. As global concern for climate change intensifies, some travelers, particularly for shorter routes, may opt for more eco-friendly transportation. For instance, the European Union has been investing heavily in high-speed rail networks, presenting a viable alternative for many journeys previously dominated by air travel.

This shift is not merely theoretical. Studies in 2024 indicated a rising preference among certain demographics for overland travel due to its lower carbon footprint. While air travel remains a necessity for long-haul and time-sensitive trips, the appeal of alternatives like trains and even increasingly sophisticated bus services for regional travel poses a tangible threat.

- Increased investment in high-speed rail infrastructure across Europe is making train travel a more competitive substitute for short to medium-haul flights.

- Consumer surveys from 2024 show a growing segment of travelers prioritizing sustainability, potentially diverting demand from airlines.

- For leisure travel, particularly within continents, the appeal of scenic train journeys or even cruise options for specific routes is gaining traction as an alternative to flying.

Limited Substitutes for Long-Haul International Travel

For Turkish Airlines' core long-haul international routes, direct substitutes are scarce. The vast geographical distances and inherent time limitations make alternative transport modes impractical for most travelers. While options like cargo ships or extensive train journeys exist, they often take weeks rather than hours, rendering them unviable for the typical business or leisure traveler seeking efficiency.

The convenience and speed of air travel remain paramount for journeys exceeding several thousand kilometers. For instance, a flight from Istanbul to New York takes approximately 11-12 hours. Consider the alternative: a sea voyage could take upwards of 15-20 days. This significant time difference heavily favors air travel, thereby substantially limiting the threat of substitutes in this crucial segment of Turkish Airlines' operations. In 2024, the vast majority of long-haul international travel relies on air transport.

- Limited Viability of Alternatives: For routes like Istanbul to Tokyo (around 12 hours by air), overland or sea travel would involve multiple transfers and days, if not weeks, of transit.

- Dominance of Air Travel: The speed advantage of air travel is critical for business travelers and tourists alike, making it the default choice for long distances.

- Cost-Effectiveness for Speed: While not always the cheapest, air travel often presents the best value when time is factored into the overall cost of a journey.

- Geographical Necessity: Many intercontinental routes served by Turkish Airlines have no practical land-based alternatives.

For Turkish Airlines, the threat of substitutes is most pronounced on short to medium-haul routes where alternatives like high-speed rail and efficient bus networks offer viable competition. Growing environmental consciousness also pushes some travelers towards these less carbon-intensive options, particularly within Europe. However, for long-haul international travel, the speed and necessity of air transport render most substitutes impractical.

| Substitute Type | Route Relevance | 2023/2024 Trend | Impact on Turkish Airlines |

| High-Speed Rail | Short-to-medium haul (especially in Europe) | Increasing investment and passenger numbers | Direct competition, potential demand diversion |

| Buses/Cars | Domestic/Regional (within Turkey and nearby) | Robust network, cost-effective for shorter distances | Competition on price and flexibility for shorter trips |

| Virtual Meetings | Business travel (non-essential meetings) | Continued hybrid work models, advanced platforms | Reduced frequency of some business trips |

| Sea/Land Travel | Long-haul international | Impractical due to time | Minimal threat; air travel dominant |

Entrants Threaten

The airline industry is notoriously capital-intensive, demanding substantial upfront investment in aircraft acquisition, sophisticated maintenance facilities, and extensive operational infrastructure. For instance, Turkish Airlines aims to grow its fleet to over 500 aircraft by September 2025, underscoring the immense financial commitment required to even enter the market. This high barrier to entry naturally discourages potential new competitors from challenging established players like Turkish Airlines.

New airlines looking to enter the Turkish aviation market face significant challenges due to strict regulatory hurdles and licensing requirements. Obtaining necessary certifications, air operator certificates, and adhering to rigorous safety standards, as mandated by the Directorate General of Civil Aviation (SHGM), creates a substantial barrier. These processes are not only complex and time-consuming but also require substantial financial investment, effectively deterring many potential new entrants.

New airlines face significant hurdles in obtaining desirable airport slots, particularly at major international gateways like Istanbul Airport. Turkish Airlines, leveraging its established position, has secured critical landing and takeoff slots, forming a cornerstone of its efficient hub-and-spoke network. For instance, in 2023, Istanbul Airport handled over 80 million passengers, indicating the high demand and limited availability of prime operational times.

Established carriers like Turkish Airlines often possess long-standing relationships and agreements that grant them preferential access to these valuable airport resources. This can make it exceedingly difficult and expensive for new entrants to acquire the necessary slots to operate competitive routes. The sheer volume of traffic and the strategic importance of these slots create a substantial barrier to entry, effectively limiting the competitive landscape.

Brand Loyalty and Established Networks

Brand loyalty and established networks represent a significant barrier for new entrants aiming to compete with legacy carriers like Turkish Airlines. Decades of operation have allowed Turkish Airlines to cultivate a strong brand reputation and customer loyalty through its Miles&Smiles program, which boasted over 10 million members globally as of early 2024. This ingrained trust and habit are difficult and costly for newcomers to replicate.

Furthermore, Turkish Airlines' extensive global network, connecting 120 countries and over 300 destinations as of mid-2024, provides a competitive advantage that new airlines find challenging to match. This vast network facilitates seamless travel and attracts passengers seeking convenience and a wide range of options. Developing comparable flight routes and partnerships requires substantial investment and time, presenting a formidable obstacle.

- Brand Recognition: Turkish Airlines enjoys high brand recognition built over many years.

- Customer Loyalty: Programs like Miles&Smiles foster repeat business.

- Global Network: Extensive flight routes offer superior connectivity.

- Partnerships: Established alliances with other airlines enhance travel options.

Economies of Scale and Cost Advantages

Turkish Airlines, like other major carriers, benefits immensely from economies of scale. In 2024, the airline's substantial fleet size and passenger volume allow for bulk purchasing of vital resources such as fuel and aircraft, leading to lower per-unit costs. This cost advantage is further amplified through efficient operational strategies and widespread distribution networks, making it challenging for newcomers to match pricing.

New entrants face a steep uphill battle due to these inherent cost disadvantages.

- Economies of Scale: Turkish Airlines' massive operational scale provides significant cost reductions in procurement of fuel, aircraft, and services.

- Purchasing Power: Bulk buying allows for better negotiation on prices for aircraft leases, maintenance, and spare parts.

- Marketing and Distribution: Established networks and brand recognition reduce per-passenger marketing and sales costs compared to a new airline.

- Cost Disadvantage for New Entrants: Start-ups lack the volume to achieve similar cost efficiencies, hindering their ability to compete on price.

The threat of new entrants for Turkish Airlines is considerably low due to immense capital requirements and stringent regulatory frameworks, making market entry exceedingly difficult. For instance, launching a new airline demands hundreds of millions, if not billions, of dollars for aircraft acquisition, operational setup, and regulatory compliance. The complexity and cost associated with obtaining necessary certifications from authorities like Turkey's Directorate General of Civil Aviation (SHGM) act as a significant deterrent.

Furthermore, securing prime airport slots, especially at hubs like Istanbul Airport which saw over 80 million passengers in 2023, is a major hurdle. Turkish Airlines, as an established player, benefits from existing relationships and secured slots, which are scarce and highly valuable. This scarcity makes it challenging for newcomers to establish a competitive flight schedule and network.

Established brand loyalty, exemplified by Turkish Airlines' Miles&Smiles program with over 10 million members as of early 2024, and its extensive global network connecting over 300 destinations, create substantial barriers. New entrants struggle to replicate this brand recognition and route comprehensiveness, which require decades of investment and strategic development to build.

Economies of scale also significantly reduce the threat of new entrants. Turkish Airlines' large fleet and passenger volume in 2024 enable cost advantages through bulk purchasing of fuel and services. This cost efficiency is difficult for smaller, new operations to match, impacting their ability to compete on price and profitability from the outset.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of aircraft, infrastructure, and operations. | Deters new entrants due to prohibitive initial investment. |

| Regulatory Hurdles | Complex licensing and safety certifications. | Time-consuming and costly processes that new firms must navigate. |

| Airport Slot Access | Limited availability of desirable landing and takeoff times. | Established carriers like Turkish Airlines hold key slots, hindering new operations. |

| Brand Loyalty & Network | Strong brand recognition and extensive route network. | Difficult and expensive for new entrants to build comparable customer base and connectivity. |

| Economies of Scale | Cost advantages from large-scale operations. | New entrants face higher per-unit costs, making price competition challenging. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Turkish Airlines is built upon a foundation of publicly available company filings, including annual reports and investor presentations. We also leverage industry-specific market research reports and aviation sector data from reputable sources to provide a comprehensive competitive landscape.