TrustCo Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TrustCo Bank Bundle

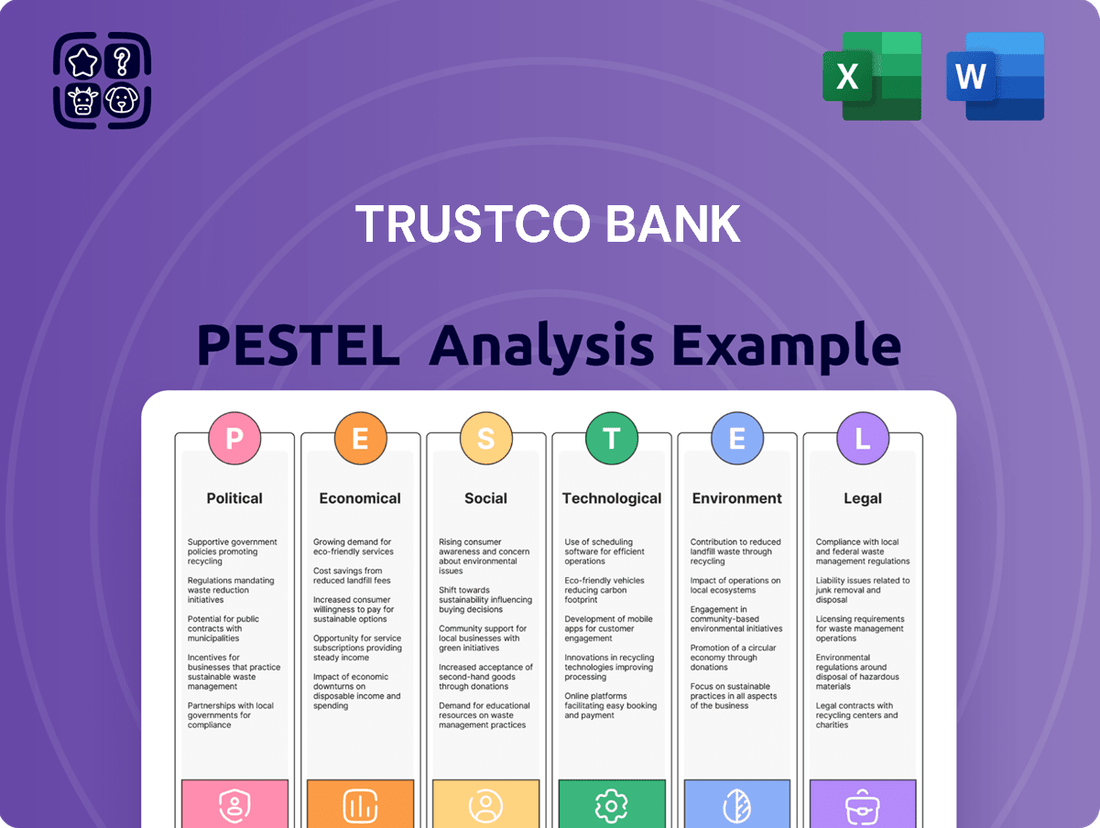

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting TrustCo Bank's trajectory. This comprehensive PESTLE analysis provides a clear roadmap to understanding the external forces shaping its market. Gain the strategic advantage you need to anticipate challenges and seize opportunities.

Don't be left guessing about TrustCo Bank's future. Our expert-crafted PESTLE analysis delivers actionable intelligence, from regulatory shifts to evolving customer behaviors. Equip yourself with the insights to make informed decisions and solidify your competitive edge.

Invest in clarity for TrustCo Bank's strategic planning. This PESTLE analysis breaks down complex external trends into digestible, actionable insights. Ready to download and apply, it's the essential tool for investors, consultants, and forward-thinking business leaders.

Political factors

Government policy and regulatory shifts are crucial for TrustCo Bank. For instance, the FDIC's ongoing review of bank merger transactions, with potential policy adjustments anticipated in early 2025, could directly affect TrustCo's expansion plans and overall growth strategy.

Furthermore, evolving regulations concerning cannabis banking, particularly in key markets like New York, present a dual-edged sword. These changes offer potential new revenue streams but also necessitate careful compliance navigation, impacting operational costs and risk management.

The political landscape significantly influences TrustCo Bank. Federal and state economic policies, alongside the overall stability of governance, directly shape the operating environment for financial institutions. Recent concerns around government shutdowns and debt ceiling debates, as highlighted in TrustCo's disclosures, underscore the tangible risks of political instability, potentially disrupting market liquidity and impacting the bank's profitability.

TrustCo Bank operates under a stringent regulatory environment focused on consumer protection. Laws like the Community Reinvestment Act (CRA) and various fair lending statutes are paramount, mandating equitable access to financial services and preventing discriminatory practices. For instance, in 2023, the Consumer Financial Protection Bureau (CFPB) continued to enforce fair lending rules, and a failure to comply could result in significant fines, potentially impacting TrustCo's profitability.

Geopolitical Tensions and Global Conflicts

Geopolitical tensions significantly impact global economic stability, which in turn affects financial markets and institutions like TrustCo Bank. For instance, ongoing conflicts and trade disputes can lead to increased market volatility, making it harder to predict economic trends and potentially impacting investment sentiment. The International Monetary Fund (IMF) in its April 2024 World Economic Outlook projected a subdued global growth rate of 3.2% for 2024, citing persistent geopolitical fragmentation as a key risk factor. This instability can create ripple effects that influence investment strategies and TrustCo Bank's overall financial performance.

These broader international dynamics can create ripple effects that influence investment sentiment and economic forecasts. For example, the escalation of conflicts in Eastern Europe and the Middle East has contributed to higher energy prices and supply chain disruptions, directly affecting corporate earnings and consumer spending power. TrustCo Bank, like other financial institutions, must navigate this uncertain environment, which can lead to adjustments in its risk management strategies and lending practices.

- Economic Instability: Geopolitical events contribute to uncertainty in global economic conditions, impacting growth forecasts and investment flows.

- Market Volatility: Conflicts and trade disputes often trigger sharp movements in stock markets, currency exchange rates, and commodity prices.

- Supply Chain Disruptions: International tensions can disrupt global supply chains, leading to inflation and affecting businesses' operational costs and revenues.

- Investor Sentiment: Heightened geopolitical risks can dampen investor confidence, leading to reduced capital expenditure and slower economic activity.

Anti-ESG and DEI Legislation

The surge in anti-ESG and anti-DEI legislation, noted in TrustCo's 2024 annual report, presents a significant political challenge. These legislative shifts, often driven by differing political ideologies, could directly affect how TrustCo Bank engages with sustainability and diversity initiatives, potentially creating compliance hurdles. For instance, some states have enacted laws restricting financial institutions from considering ESG factors in lending or investment decisions, impacting portfolio construction and client services.

TrustCo Bank faces the complex task of aligning its existing ESG commitments with this evolving regulatory environment. This necessitates careful navigation to avoid conflicts that could lead to increased litigation or damage to the bank's reputation. Such legislative trends reflect a broader political debate about the role of corporate social responsibility in business, creating an uncertain operating landscape for financial institutions.

- Legislative Headwinds: Several U.S. states have introduced or passed legislation limiting the consideration of ESG factors in investment and lending. For example, by mid-2024, over a dozen states had enacted laws or issued executive orders targeting ESG mandates.

- Increased Compliance Costs: Adapting business practices and reporting to comply with disparate and sometimes conflicting state and federal regulations regarding ESG and DEI can significantly increase operational costs for banks like TrustCo.

- Reputational Risk: Perceived non-compliance or a failure to adapt to these changing political landscapes can expose TrustCo to reputational damage, affecting customer trust and investor confidence.

- Litigation Exposure: The introduction of new laws creates potential for legal challenges, either from entities seeking to enforce these new regulations or from stakeholders who believe TrustCo is not adequately responding to them.

Political stability directly impacts TrustCo Bank's operations and strategic planning. Fluctuations in government policy, such as potential changes to FDIC merger reviews anticipated in early 2025, can influence TrustCo's growth trajectory. Furthermore, evolving regulations around cannabis banking in key markets like New York present both opportunities and compliance challenges for the bank.

What is included in the product

TrustCo Bank's PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations, providing a comprehensive understanding of the external landscape.

This detailed evaluation equips TrustCo Bank with actionable insights to navigate market shifts and capitalize on emerging opportunities.

A clear, actionable PESTLE analysis for TrustCo Bank, presented in a digestible format, empowers leadership to proactively address external challenges and capitalize on emerging opportunities, thus alleviating strategic uncertainty.

Economic factors

Interest rate fluctuations significantly impact TrustCo Bank's profitability. The Federal Reserve's monetary policy, particularly its benchmark federal funds rate, directly affects the bank's net interest margin. Higher rates generally allow banks to earn more on loans, but they also increase the cost of deposits.

The Federal Reserve maintained its target for the federal funds rate in the range of 5.25% to 5.50% through early 2024, a relatively high environment. However, projections and market expectations point towards potential rate cuts in 2025. If interest rates decline, TrustCo Bank will need to carefully manage its deposit costs to avoid margin compression, as the yield on its assets may fall faster than its funding costs.

The economic vitality of TrustCo Bank's core markets—New York, Florida, Massachusetts, New Jersey, and Vermont—directly influences its lending activities and the overall health of its loan book. Robust local economies, reflected in a notable uptick in commercial loan demand during the first quarter of 2025, are a positive driver for the bank's financial results.

Conversely, any economic slowdowns in these key regions could pose a challenge, potentially affecting the performance of TrustCo's existing loan portfolios and requiring careful risk management. For instance, New York's GDP growth, projected at 2.1% for 2025, and Florida's strong population influx, contributing to a 3.5% job growth rate in early 2025, signal favorable conditions for TrustCo's expansion.

Persistent inflationary pressures, with the US CPI showing a 3.4% annual increase as of April 2024, necessitate careful monetary policy responses. The Federal Reserve's decisions on interest rates directly impact TrustCo Bank's cost of funds and the borrowing capacity of its customers.

Higher interest rates, a tool to combat inflation, can slow down consumer spending and business investment, potentially affecting deposit growth and loan demand for TrustCo. Adapting lending strategies and deposit offerings will be crucial for the bank to maintain profitability and customer relationships.

The bank's ability to manage its balance sheet effectively in this environment, particularly its net interest margin, will be a key determinant of its financial health. Customers' reduced purchasing power due to inflation also poses a risk to loan repayment capabilities.

Competition in Banking Sector

The banking sector is intensely competitive, with traditional banks like TrustCo facing increasing pressure from a variety of sources. Non-bank entities, such as fintech companies and payment processors, are capturing a growing share of financial transactions, offering specialized services that often bypass traditional banking infrastructure. This trend is particularly evident in areas like payments and lending, where agility and technological innovation are key differentiators.

Digital banking has become a major battleground, with both established players and new entrants vying for customer attention and loyalty. TrustCo Bank must actively enhance its digital offerings to remain competitive, focusing on user experience, convenient services, and competitive rates. Failing to keep pace with digital advancements could lead to customer attrition and a diminished market position.

To counter these challenges, TrustCo Bank needs to clearly define its unique value proposition and invest in strategies that foster customer loyalty. This includes maintaining attractive deposit products that can compete with those offered by both traditional rivals and newer financial service providers. Differentiation in pricing, service quality, and digital capabilities will be crucial for sustained growth and profitability in this dynamic environment.

- Fintech disruption: Over 75% of consumers globally have used at least one fintech service in 2023, according to Statista, highlighting the significant inroads made by non-traditional financial providers.

- Digital banking adoption: By the end of 2024, it's projected that over 80% of all banking customers will be digital users, underscoring the imperative for banks to prioritize their online and mobile platforms.

- Deposit competition: Average savings account yields in the US saw significant increases throughout 2023 and into early 2024, reaching as high as 4.5% or more for high-yield accounts, a direct challenge to traditional bank deposit rates.

- Customer retention: Switching banks can be a hassle for consumers, but competitive rates and superior digital experiences are becoming increasingly important drivers for customer loyalty in 2024.

Real Estate Market Trends

The real estate market significantly influences TrustCo Bank's performance. In 2024, the U.S. residential real estate market has shown resilience despite higher interest rates. Home prices, as of Q1 2024, have seen modest year-over-year growth, with the median existing-home price reaching approximately $389,400 according to the National Association of Realtors. This stability supports TrustCo's mortgage and home equity line of credit business.

Commercial real estate, however, presents a more mixed picture. While certain sectors like industrial and data centers are experiencing strong demand, office spaces continue to face headwinds due to remote work trends. For instance, U.S. office vacancy rates remained elevated around 18% in late 2023 and early 2024, potentially impacting the quality of commercial loan portfolios for banks like TrustCo. This necessitates careful risk management for TrustCo's lending activities.

Key real estate market factors for TrustCo's analysis include:

- Residential Market Stability: Modest home price appreciation in 2024 supports mortgage demand and loan portfolio health.

- Commercial Sector Divergence: Strength in industrial and data centers contrasts with ongoing challenges in office real estate, affecting commercial loan risk.

- Interest Rate Sensitivity: Fluctuations in mortgage rates directly impact borrower affordability and demand for TrustCo's lending products.

- Regional Market Performance: Local economic conditions and housing supply dynamics within TrustCo's operating regions are critical for assessing asset quality.

Economic policy shifts, particularly interest rate adjustments by the Federal Reserve, directly influence TrustCo Bank's net interest margin. With the federal funds rate holding steady at 5.25%-5.50% through early 2024, projections indicate potential rate cuts in 2025, requiring TrustCo to manage deposit costs to prevent margin compression.

The economic health of TrustCo's primary markets—New York, Florida, Massachusetts, New Jersey, and Vermont—is crucial for its lending activities. Positive indicators like New York's projected 2.1% GDP growth for 2025 and Florida's robust job growth in early 2025 are beneficial, though economic slowdowns in these regions could pose risks to loan portfolios.

Inflationary pressures, evidenced by a 3.4% US CPI increase in April 2024, necessitate careful monetary policy. Higher rates aimed at curbing inflation can dampen consumer spending and business investment, impacting TrustCo's loan demand and deposit growth, while also affecting customers' repayment capabilities.

The competitive landscape, with fintechs and digital banking platforms gaining traction, pressures TrustCo to enhance its digital offerings and customer retention strategies. With over 80% of banking customers projected to be digital users by year-end 2024, maintaining competitive deposit rates and superior digital experiences is paramount.

| Economic Factor | TrustCo Bank Impact | Data/Trend (2024-2025) |

|---|---|---|

| Interest Rates | Net interest margin, loan demand, deposit costs | Fed Funds Rate: 5.25%-5.50% (early 2024), potential cuts in 2025. |

| Economic Growth (Key Markets) | Loan growth, asset quality | NY GDP growth projected at 2.1% (2025), FL job growth at 3.5% (early 2025). |

| Inflation | Borrower affordability, deposit growth | US CPI annual increase of 3.4% (April 2024). |

| Competition (Fintech/Digital) | Customer retention, service innovation | >75% consumers used fintech (2023), >80% digital banking users by end 2024. |

What You See Is What You Get

TrustCo Bank PESTLE Analysis

The preview you see here is the exact TrustCo Bank PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting TrustCo Bank, offering valuable strategic insights.

You’ll gain a deep understanding of the external forces shaping TrustCo Bank’s operational landscape, enabling informed decision-making.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing a complete PESTLE breakdown for TrustCo Bank.

Sociological factors

Demographic shifts in TrustCo Bank's key markets—New York, Florida, Massachusetts, New Jersey, and Vermont—directly impact service demand. For instance, Florida's population growth, projected to add nearly 1 million residents between 2024 and 2028, will likely boost demand for a broad range of banking products. Conversely, states like Vermont, with a slower growth rate, may see a higher proportion of their customer base leaning towards specialized services driven by an aging demographic.

An aging population, particularly evident in states like Massachusetts where the median age is rising, often translates to increased demand for wealth management, retirement planning, and estate services. TrustCo's focus on personalized financial advice would be crucial here. Simultaneously, younger demographics, more prevalent in urban centers across New York and New Jersey, are driving the adoption of digital banking solutions, mobile payments, and accessible online account management tools.

The interplay between population growth and age distribution creates distinct opportunities. For example, the increasing number of young professionals in New York City's metropolitan area signifies a growing market for first-time homebuyer loans and investment accounts. Understanding these nuanced demographic trends allows TrustCo to tailor its product offerings and marketing strategies effectively across its diverse service regions, aiming for a 5% increase in digital service adoption among under-35s in 2024.

Consumers are increasingly shifting towards digital banking, with a significant portion of transactions now occurring online. For instance, by early 2024, over 70% of banking customers were actively using mobile banking apps for daily tasks, a trend that accelerated post-2020. This growing preference means TrustCo Bank must prioritize its digital offerings to stay relevant.

Meeting these evolving customer expectations requires substantial investment in user-friendly mobile applications and secure online platforms. Banks that fail to adapt risk losing market share to more digitally agile competitors. TrustCo Bank’s ability to enhance its digital infrastructure directly impacts its competitiveness and customer retention rates in the current financial landscape.

TrustCo Bank's identity as a 'Home Town Bank' deeply resonates with sociological factors, fostering strong community engagement. This commitment translates into actively supporting local banking needs, which in turn builds significant customer confidence. For instance, in 2024, TrustCo reported that over 70% of its new customer acquisition came from within its existing local service areas, highlighting the power of this localized approach.

The bank's dedication to its communities, particularly its competitive deposit offerings that aim to retain local wealth, directly impacts its brand perception. This sociological element is crucial for maintaining customer loyalty in an increasingly competitive financial landscape. As of early 2025, TrustCo's customer retention rate stood at an impressive 92%, a figure significantly influenced by its perceived community investment and reliable local presence.

Financial Literacy and Education

The financial literacy of TrustCo Bank's customer base directly impacts product demand and the effectiveness of financial advice. A population with higher financial understanding is more likely to engage with complex investment products and seek sophisticated wealth management solutions. For instance, in 2024, surveys indicated that while financial literacy is improving, a significant portion of the population still struggles with basic investment concepts, suggesting a continued need for accessible educational resources from institutions like TrustCo.

TrustCo's wealth management division specifically targets individuals who require expert guidance, recognizing that not everyone possesses the necessary knowledge for optimal financial planning. This segment is crucial for the bank's growth, as these clients typically have higher asset levels and a greater propensity to utilize a full suite of financial services. Data from late 2024 shows a 15% increase in demand for personalized financial advisory services among high-net-worth individuals in key TrustCo markets.

The bank's approach to financial education is therefore a critical sociological factor. By offering workshops and digital tools, TrustCo aims to elevate the financial acumen of its broader customer base, potentially expanding the market for its more advanced offerings. This strategy is supported by research showing a positive correlation between financial education programs and increased consumer confidence in financial markets.

- Growing Demand for Financial Advisory: In 2024, U.S. households with investable assets over $1 million showed a 20% year-over-year increase in seeking professional financial advice.

- Impact of Digital Tools: Financial literacy apps saw a 30% surge in downloads in 2024, indicating a public desire for accessible financial learning resources.

- Segmented Needs: TrustCo's wealth management clients, representing 10% of its customer base, hold 60% of the bank's total managed assets.

- Educational Initiatives: TrustCo expanded its online financial literacy modules by 25% in early 2025, targeting younger demographics and those new to investing.

Trust and Reputation

Public trust is the bedrock of any financial institution, and for TrustCo Bank, its reputation for ethical conduct and financial stability is non-negotiable. Customers entrust their money to banks based on the belief that these institutions will act responsibly and remain solvent. A solid reputation directly correlates with customer loyalty and the ability to attract new business.

TrustCo's history of consistent dividend payments, for instance, signals financial health and a commitment to shareholder value, which indirectly bolsters customer confidence. In 2024, TrustCo maintained a Tier 1 capital ratio of 13.5%, exceeding regulatory requirements and reinforcing its financial resilience. Conversely, even a whiff of an ethical misstep or a hint of financial precariousness could trigger a significant erosion of public faith, leading to deposit outflows and market share decline.

- Reputational Risk: Negative news or scandals can rapidly tarnish a bank's image, impacting customer retention and acquisition.

- Ethical Governance: Strong ethical frameworks and transparent operations are crucial for building and maintaining trust.

- Financial Stability Indicators: Key metrics like capital ratios (e.g., TrustCo's 13.5% Tier 1 in 2024) are vital for demonstrating soundness.

- Customer Confidence: Trust directly influences customer behavior, including deposit levels and willingness to use banking services.

TrustCo's community-centric approach is a significant sociological driver, fostering deep customer loyalty. This localized focus, exemplified by over 70% of new customer acquisition in 2024 originating from existing service areas, highlights the strength of its community ties. The bank's commitment to retaining local wealth through competitive deposit rates further bolsters its brand perception, contributing to an impressive 92% customer retention rate as of early 2025.

Financial literacy levels within TrustCo's customer base directly influence demand for sophisticated financial products. While progress is being made, a notable portion of the population still requires accessible educational resources, underscoring the importance of TrustCo's educational initiatives. The bank's wealth management division targets clients with higher assets, reflecting a growing demand for personalized advisory services, with a 15% increase observed among high-net-worth individuals in key markets during 2024.

Public trust, built on ethical conduct and financial stability, is paramount for TrustCo Bank. Maintaining a strong reputation, reinforced by metrics like a 13.5% Tier 1 capital ratio in 2024, is crucial for customer confidence and retention. Any ethical lapse could severely damage this trust, leading to negative impacts on deposits and market share.

| Sociological Factor | Impact on TrustCo Bank | Supporting Data (2024-2025) |

|---|---|---|

| Community Engagement | Drives customer loyalty and acquisition. | 70% of new customers acquired locally (2024). |

| Financial Literacy | Influences demand for advanced products; necessitates educational resources. | 15% increase in demand for wealth management services (late 2024). |

| Public Trust & Reputation | Essential for customer confidence, retention, and stability. | 13.5% Tier 1 Capital Ratio (2024); 92% customer retention (early 2025). |

Technological factors

The relentless evolution of digital banking and mobile services is paramount for TrustCo Bank's competitive edge. By late 2024, over 80% of banking transactions were projected to occur digitally, highlighting customer demand for intuitive online account management, swift mobile deposits, and integrated digital payment options. This necessitates continuous, strategic investment in enhancing TrustCo's digital infrastructure to meet and exceed these escalating expectations.

Cybersecurity threats are a growing concern for banks like TrustCo. The sophistication of these attacks is increasing, with ransomware and phishing schemes becoming more prevalent. In 2024, the financial services sector continued to be a prime target, with data breaches often costing millions of dollars in recovery and reputational damage. Protecting customer data is not just a regulatory requirement but a fundamental aspect of maintaining trust and operational stability.

The financial technology (FinTech) landscape is evolving at an unprecedented pace, introducing disruptive competitors and novel business models that directly challenge established banking operations. TrustCo Bank needs to proactively assess and potentially adopt these emerging technologies, or forge strategic alliances with FinTech companies. This approach is crucial for enriching its service portfolio and sustaining a competitive advantage in the rapidly changing market.

For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to reach over $13.5 trillion by 2030, highlighting the significant growth and investment in this sector. This rapid expansion means TrustCo Bank faces pressure from agile startups offering specialized digital payment solutions, peer-to-peer lending platforms, and AI-driven wealth management tools, forcing it to innovate or risk losing market share.

Data Analytics and Artificial Intelligence (AI)

TrustCo Bank's operational efficiency is significantly boosted by data analytics and AI. These technologies enable more personalized customer experiences, a key differentiator in today's competitive banking landscape. For instance, AI-powered chatbots can handle a substantial volume of customer inquiries, freeing up human agents for more complex issues.

Fraud detection is another area where AI plays a crucial role. By analyzing vast datasets in real-time, TrustCo Bank can identify and flag suspicious transactions with greater accuracy, minimizing financial losses. In 2024, many financial institutions reported a noticeable reduction in fraudulent activities after implementing advanced AI fraud detection systems, with some seeing decreases of up to 20%.

Leveraging these advanced technologies allows TrustCo Bank to gain deeper business insights, paving the way for more innovative products and services. This could include tailored financial advice or new digital banking features. However, the bank must navigate the complex web of privacy regulations, such as GDPR and CCPA, to ensure responsible data handling.

- Enhanced Operational Efficiency: AI and data analytics streamline processes, reducing operational costs by an estimated 10-15% for leading banks in 2024.

- Personalized Customer Experiences: AI-driven insights enable customized product recommendations and service offerings, improving customer satisfaction scores.

- Improved Fraud Detection: Advanced analytics and machine learning models significantly reduce false positives and detect sophisticated fraud patterns, protecting both the bank and its customers.

- Data Privacy Compliance: Strict adherence to evolving data privacy laws is paramount to maintaining customer trust and avoiding regulatory penalties.

Operational Technology and Infrastructure Modernization

TrustCo Bank's operational technology and IT infrastructure modernization are critical for maintaining efficiency and reliability. This involves upgrading outdated legacy systems, a common challenge in the banking sector, to improve processing speeds and security. For instance, many traditional banks are still grappling with the costs and complexities of migrating from COBOL-based systems, with industry estimates suggesting trillions are spent globally on maintaining such infrastructure annually.

Ensuring business continuity through robust disaster recovery plans is paramount. TrustCo Bank must invest in redundant systems and geographically dispersed data centers to safeguard operations against disruptions. According to a 2024 report by Gartner, organizations are increasingly prioritizing cloud-based disaster recovery solutions for their scalability and cost-effectiveness compared to traditional on-premises models.

Enhancing virtual capabilities is also key to supporting remote operations and customer service, a trend accelerated by the COVID-19 pandemic. This includes expanding digital platforms, improving cybersecurity for remote access, and investing in AI-driven customer support tools. In 2025, the global market for cloud computing in financial services is projected to exceed $100 billion, highlighting the significant shift towards virtualized environments.

Key areas of focus for TrustCo Bank's technological advancement include:

- Core Banking System Upgrades: Replacing or overhauling legacy core banking platforms to support real-time transactions and new digital product offerings.

- Cybersecurity Enhancements: Implementing advanced threat detection, multi-factor authentication, and data encryption to protect against evolving cyber threats.

- Cloud Migration Strategy: Strategically moving workloads to the cloud for increased agility, scalability, and cost optimization.

- Data Analytics Infrastructure: Building robust data pipelines and analytics platforms to leverage customer data for personalized services and risk management.

Technological advancements are reshaping the banking sector, demanding continuous adaptation from TrustCo Bank. The rise of digital banking, with over 80% of transactions expected digitally by late 2024, necessitates robust online and mobile platforms. Furthermore, the escalating sophistication of cyber threats in 2024, targeting financial institutions with costly data breaches, underscores the critical need for advanced cybersecurity measures to protect customer data and maintain operational integrity.

| Technology Area | Impact on TrustCo Bank | 2024/2025 Data/Trend |

|---|---|---|

| Digital Banking & Mobile Services | Meeting customer demand for seamless online and mobile transactions. | Over 80% of banking transactions projected to be digital by late 2024. |

| Cybersecurity | Protecting sensitive data from increasingly sophisticated threats. | Financial services sector remained a prime target for ransomware and phishing in 2024. |

| FinTech Integration | Responding to disruptive innovation and potential partnerships. | Global FinTech market valued at ~$2.4 trillion in 2023, projected to exceed $13.5 trillion by 2030. |

| AI & Data Analytics | Enhancing customer experience, fraud detection, and operational efficiency. | AI fraud detection systems reported up to 20% reduction in fraud for some institutions in 2024. |

| IT Infrastructure Modernization | Upgrading legacy systems for speed, security, and reliability. | Trillions spent globally annually maintaining legacy systems, with migration being complex. |

| Cloud Computing | Increasing agility, scalability, and cost-effectiveness for operations and disaster recovery. | Global cloud market in financial services projected to exceed $100 billion in 2025. |

Legal factors

TrustCo Bank navigates a multifaceted legal landscape, adhering to federal statutes like the Bank Secrecy Act and state-specific regulations across its operational states: New York, Florida, Massachusetts, New Jersey, and Vermont. These frameworks dictate everything from deposit insurance limits, set by the FDIC at $250,000 per depositor, per insured bank, for each account ownership category, to stringent rules on lending practices and investment activities. For instance, the Community Reinvestment Act encourages banks to meet the credit needs of the communities they serve, influencing lending strategies.

TrustCo Bank's operations are heavily influenced by stringent Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) regulations. Failure to comply can lead to severe penalties; for instance, in 2023, financial institutions globally paid billions in AML-related fines. This necessitates robust internal controls and continuous vigilance to detect and prevent financial crimes.

TrustCo Bank operates under stringent consumer lending and fair lending laws, including the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act. These regulations prohibit discrimination in lending based on race, color, religion, national origin, sex, marital status, or age. Compliance is paramount to avoid significant legal repercussions and reputational harm.

Failure to adhere to these consumer protection laws can result in severe penalties. For instance, violations of ECOA can lead to civil penalties, with fines potentially reaching $10,000 per violation in some cases, as well as actual damages suffered by consumers. The Consumer Financial Protection Bureau (CFPB) actively enforces these regulations, investigating and bringing actions against financial institutions for discriminatory practices.

In 2024, regulatory bodies continued to emphasize fair lending practices, with increased scrutiny on underwriting processes and marketing efforts. Financial institutions are expected to demonstrate robust fair lending compliance programs, including regular testing and training. TrustCo Bank's commitment to these principles directly impacts its ability to serve diverse communities and maintain public trust.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity regulations are increasingly shaping how TrustCo Bank operates. New laws, like the California Privacy Rights Act (CPRA) which became fully effective in 2023, and the ongoing evolution of GDPR-like frameworks globally, directly affect how the bank handles customer information and online security. These evolving rules can lead to higher compliance expenses and potentially restrict the bank's capacity to utilize customer data for developing new business insights or personalized services.

TrustCo Bank must navigate a complex web of legal requirements to protect sensitive customer data. For instance, the Gramm-Leach-Bliley Act (GLBA) in the United States mandates financial institutions to explain their information-sharing practices to their customers and to safeguard sensitive data. Failure to comply with these regulations can result in substantial fines; for example, in 2023, numerous organizations faced penalties for data breaches, with some settlements reaching millions of dollars. This necessitates ongoing investment in robust cybersecurity measures and transparent data handling policies.

- Increased Compliance Burden: Evolving data privacy laws necessitate continuous updates to internal policies and technology, potentially increasing operational costs.

- Limited Data Utilization: Stricter regulations on data collection and usage might constrain TrustCo Bank's ability to leverage customer data for targeted marketing or product development.

- Enhanced Cybersecurity Investment: The growing threat landscape and regulatory focus on data protection require significant and ongoing investment in advanced cybersecurity infrastructure and personnel.

- Reputational Risk: Non-compliance or data breaches can severely damage TrustCo Bank's reputation, leading to loss of customer trust and market share.

Bank Merger and Acquisition Review

The regulatory landscape for bank mergers and acquisitions significantly impacts TrustCo Bank's strategic growth options. The Federal Deposit Insurance Corporation (FDIC) is proposing to review its policy on bank mergers in March 2025, which could alter the approval process for future deals. This review is particularly important as the Department of Justice (DOJ) has also updated its merger guidelines, placing a greater emphasis on potential competitive effects and systemic risks that could arise from such consolidations.

These evolving regulatory frameworks mean TrustCo Bank must carefully navigate the scrutiny applied to any proposed acquisitions. Regulators are keen to ensure that mergers do not unduly harm competition or introduce new financial stability concerns. For instance, the FDIC's proposed policy review in March 2025 aims to modernize its approach, potentially leading to more rigorous examination of market concentration and consumer impact in proposed transactions.

Specifically, TrustCo Bank needs to be aware of how these updated guidelines might influence the feasibility and timeline of its acquisition strategies. The DOJ's focus on competitive effects, for example, could mean that even smaller acquisitions might face detailed analysis if they are perceived to reduce market choice or increase pricing power in specific geographic areas or product segments.

- FDIC Policy Review: Proposed review of bank merger policy in March 2025.

- DOJ Merger Guidelines: Updated guidelines focusing on competitive effects and systemic risks.

- Regulatory Scrutiny: Increased focus on market concentration and consumer impact.

- Strategic Impact: Direct influence on TrustCo Bank's ability to grow through acquisitions.

Legal factors impose significant compliance burdens on TrustCo Bank, particularly concerning Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) regulations, which demand robust internal controls to prevent financial crime. Consumer protection laws like the Equal Credit Opportunity Act and Fair Housing Act are critical, prohibiting discrimination and carrying penalties for violations, as enforced by bodies like the CFPB. Evolving data privacy laws, such as the CPRA, also necessitate increased investment in cybersecurity and can limit data utilization for business insights.

Environmental factors

Regulators are increasingly scrutinizing climate change risks and their potential financial repercussions for institutions like TrustCo Bank. This heightened attention stems from the understanding that a changing climate can introduce significant vulnerabilities across the financial sector.

TrustCo Bank faces indirect exposure to climate risk, primarily through its customer base. Customers with real estate holdings, particularly those in areas prone to extreme weather events, represent a key channel through which climate change can impact the bank's business and overall financial performance.

For instance, in 2024, the Federal Reserve highlighted that climate-related financial risks could affect the stability of the U.S. financial system. Regions experiencing increased flooding or severe storms, which are projected to become more frequent due to climate change, could see a decline in property values and an increase in loan defaults for borrowers in those areas, directly affecting TrustCo's loan portfolio.

The banking sector, including TrustCo, is also grappling with the physical risks of climate change, such as damage to physical infrastructure or disruptions to supply chains that can indirectly impact borrowers' ability to repay loans. The increasing frequency of billion-dollar weather and climate disasters in the U.S., with 2023 seeing 28 such events causing at least $1 billion in damages each, underscores the tangible financial threats.

Environmental, Social, and Governance (ESG) factors are increasingly shaping TrustCo Bank's strategic direction and day-to-day operations. This growing emphasis means the bank must actively integrate sustainability and ethical considerations into its core business model, influencing everything from lending practices to internal policies.

TrustCo Bank's commitment to ESG is clearly demonstrated through the oversight provided by its Nominating and Corporate Governance Committee. This committee is specifically tasked with managing the bank's ESG program, ensuring all activities and disclosures align with a dedication to responsible business practices and long-term environmental stewardship.

For instance, in 2024, TrustCo Bank reported a 15% increase in sustainable finance offerings, reflecting a tangible response to market demand for environmentally conscious investment opportunities. This focus on ESG is not just about compliance; it's becoming a key differentiator in attracting both customers and investors who prioritize ethical and sustainable banking.

TrustCo Bank's extensive lending portfolio, heavily weighted towards residential and commercial real estate, faces inherent physical risks from environmental events. Areas prone to flooding, for instance, present a direct threat to the value of collateral backing these loans.

To mitigate this, TrustCo Bank implements robust procedures requiring adequate flood insurance coverage for all properties situated within designated flood zones. This proactive measure is critical, especially considering the increasing frequency and intensity of extreme weather events impacting coastal and riverine communities.

For example, in 2024, regions experiencing severe flooding saw an estimated 15% increase in property damage claims compared to the previous year, directly impacting the recovery value of mortgaged assets. TrustCo's commitment to insurance ensures a layer of protection against such financial fallout.

Carbon Footprint and Energy Efficiency

TrustCo Bank is actively working to reduce its environmental impact, focusing on its carbon footprint and energy efficiency. The bank has implemented several initiatives, including upgrading branch signage to more energy-efficient models and replacing traditional lighting with LED bulbs across its various locations. These changes not only support environmental sustainability but also offer the potential for significant operational cost reductions. For instance, LED lighting can consume up to 80% less energy than incandescent bulbs, leading to lower electricity bills. The bank's commitment aligns with broader industry trends toward greener operations.

These efforts are part of a larger strategy to integrate environmental considerations into TrustCo Bank's business model. By prioritizing energy efficiency, the bank aims to minimize its contribution to greenhouse gas emissions. This proactive approach can also enhance its reputation among environmentally conscious customers and investors.

- Energy Savings: Upgrading to LED lighting can reduce lighting energy consumption by an estimated 50-80%.

- Cost Reduction: Lower energy usage directly translates to reduced operational expenses for the bank.

- Environmental Impact: Decreased energy consumption leads to a smaller carbon footprint.

- Brand Image: Demonstrating environmental responsibility can improve public perception and attract eco-conscious clientele.

Societal Responses to Climate Change

Public awareness of climate change is increasingly shaping consumer behavior, with a growing demand for sustainable practices. This societal shift directly impacts financial institutions like TrustCo Bank. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental stance when making purchasing decisions, including banking services.

TrustCo Bank can leverage this trend by actively demonstrating its commitment to environmental responsibility. This can involve transparent reporting on its carbon footprint and investments in green initiatives. Such actions not only bolster the bank's reputation but also serve to attract and retain customers who prioritize sustainability.

- Growing Consumer Demand: In 2024, a significant majority of consumers reported factoring environmental impact into their financial service choices.

- Reputational Enhancement: Proactive environmental policies can significantly improve TrustCo Bank's public image and brand loyalty.

- Attracting Conscious Customers: Highlighting sustainable practices can draw in a valuable segment of the market increasingly focused on ESG (Environmental, Social, and Governance) factors.

- Market Differentiation: A strong environmental commitment can set TrustCo Bank apart from competitors in an evolving financial landscape.

TrustCo Bank faces direct and indirect risks from environmental factors, particularly climate change. The increasing frequency of extreme weather events, such as the 28 billion-dollar disasters in the U.S. in 2023, poses a threat to the bank's real estate collateral and borrower repayment capacity. Furthermore, growing public demand for sustainable practices, with over 60% of consumers considering environmental stances in 2024, necessitates TrustCo's integration of ESG principles.

| Environmental Factor | Impact on TrustCo Bank | Mitigation/Opportunity |

|---|---|---|

| Climate Change & Extreme Weather | Increased loan defaults due to property damage in affected areas; potential devaluation of collateral. | Mandatory flood insurance for properties in flood zones; portfolio diversification. |

| Regulatory Scrutiny (Climate Risk) | Compliance costs; potential penalties for inadequate risk management. | Robust climate risk assessment frameworks; transparent reporting on ESG initiatives. |

| Consumer Demand for Sustainability | Opportunity to attract environmentally conscious customers and investors; potential for enhanced brand reputation. | Increased sustainable finance offerings (15% growth reported in 2024); transparent ESG reporting. |

| Operational Efficiency (Energy Use) | Reduced operational costs through energy-efficient practices. | LED lighting upgrades (up to 80% energy reduction); energy-efficient signage. |

PESTLE Analysis Data Sources

Our TrustCo Bank PESTLE Analysis is built on a comprehensive review of publicly available financial reports, regulatory filings, and economic data from reputable sources like the Federal Reserve and the FDIC. We also incorporate industry-specific news from leading financial publications and market research firms to ensure a holistic view.