TrustCo Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TrustCo Bank Bundle

Curious about TrustCo Bank's strategic product positioning? This brief glimpse into their BCG Matrix hints at their market performance, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is crucial for any investor or business strategist looking to make informed decisions.

To truly grasp TrustCo Bank's competitive edge and identify opportunities for growth or areas needing attention, you need the complete picture. Our full BCG Matrix report provides an in-depth analysis, detailing the exact quadrant placement for each of their offerings.

Don't settle for a partial view. Purchase the full TrustCo Bank BCG Matrix to unlock data-backed insights and actionable recommendations. This comprehensive resource will equip you with the knowledge to strategically allocate capital and optimize your investment portfolio with confidence.

Stars

Home Equity Lines of Credit (HECLs) at TrustCo Bank are a shining example of a strong performer within the bank's product portfolio. The bank saw a substantial 17.3% surge in its HECL portfolio during the first quarter of 2025 when measured against the same period in 2024.

This impressive expansion is directly attributed to TrustCo Bank's strategic and focused marketing efforts aimed at its existing customer base, encouraging them to leverage these valuable financial tools. This proactive approach has clearly resonated with customers, driving significant uptake.

The robust performance of HECLs firmly establishes them as a dominant force in a market segment that continues to show considerable promise for TrustCo Bank. Their growth trajectory indicates a successful strategy in capitalizing on homeowner equity.

Commercial Lending at TrustCo Bank is a significant player, exhibiting strong performance. The bank's commercial loan portfolio experienced a healthy 7.5% year-over-year growth in the first quarter of 2025. This surge pushed the average commercial loan volume to over $300 million.

This expansion is directly tied to the vitality of the local economy and a heightened need for business financing within TrustCo Bank's service areas. The bank's ability to consistently grow in this segment suggests an increasing grip on market share within a segment that holds considerable future promise.

TrustCo Bank's wealth management and financial services are experiencing robust growth, evidenced by a 16.7% increase in non-interest income during Q1 2025. This surge is directly linked to a 17.4% expansion in assets under management, reaching $1.2 billion. These figures highlight a strong market position and escalating client engagement.

The impressive growth rates in wealth management and financial services, driven by sustained client demand, categorize these offerings as Stars within TrustCo Bank's portfolio. While they require ongoing capital investment to maintain momentum, their strong performance and potential for future returns justify the expenditure.

Digital Account Opening Initiatives for New Customers

TrustCo Bank is prioritizing digital account openings to attract a wider customer base. This strategic push into digital channels is considered a high-growth initiative with the potential to capture substantial market share. The bank aims to leverage its established digital platform for aggressive customer acquisition, moving beyond traditional branch-based onboarding. In 2024, TrustCo reported a 15% increase in new customer acquisitions through its mobile app, demonstrating early traction in this area.

Key aspects of TrustCo Bank's digital account opening strategy include:

- Streamlined Onboarding: Simplifying the application process to reduce friction and time to account activation.

- Targeted Digital Marketing: Employing data-driven campaigns across various online platforms to reach prospective customers.

- Enhanced User Experience: Continuously improving the digital interface for a seamless and intuitive customer journey.

- Incentive Programs: Offering attractive sign-up bonuses and digital-exclusive benefits to drive adoption.

Residential Mortgages in High-Growth Florida Markets

TrustCo Bank's extensive network of 51 branches across Florida positions it uniquely for residential mortgage lending. While the bank's overall mortgage portfolio might be considered mature, focusing on high-growth Florida markets presents a clear opportunity for new originations.

These specific areas within Florida, experiencing robust real estate appreciation and population influx, represent potential stars in TrustCo's BCG matrix. By concentrating efforts here, TrustCo can aim to capture significant local market share and drive substantial growth.

- Florida's Population Growth: Florida continues to be a top destination for domestic migration, with millions of new residents arriving annually, fueling housing demand.

- Housing Market Performance: In 2024, many Florida metropolitan areas saw median home prices increase by 5-10% year-over-year, indicating strong market activity.

- Mortgage Origination Potential: High demand in these growth markets translates to a greater volume of new residential mortgage originations for banks like TrustCo.

TrustCo Bank's Home Equity Lines of Credit (HECLs) and Wealth Management services are clearly positioned as Stars in their BCG Matrix. HECLs experienced a 17.3% growth in Q1 2025, driven by targeted marketing. Wealth Management saw a 16.7% increase in non-interest income in the same period, bolstered by a 17.4% expansion in assets under management. These products demonstrate high growth and high market share.

Residential mortgage lending in high-growth Florida markets also shows Star potential. Florida's continued population influx and a 5-10% median home price increase in key metro areas during 2024 signal strong demand for new originations. Concentrating efforts in these vibrant areas allows TrustCo to capture market share and drive significant growth.

| Product/Service | Growth Rate (Q1 2025 vs Q1 2024) | Key Drivers | Market Position |

|---|---|---|---|

| Home Equity Lines of Credit (HECLs) | 17.3% | Targeted marketing to existing customers | High Growth, High Share (Star) |

| Wealth Management | 16.7% (non-interest income) / 17.4% (AUM) | Client demand, expanding assets under management | High Growth, High Share (Star) |

| Residential Mortgages (High-Growth Florida Markets) | Projected high origination volume | Florida population growth, housing market appreciation (5-10% median price increase in 2024) | High Growth Potential, High Share Target (Star) |

What is included in the product

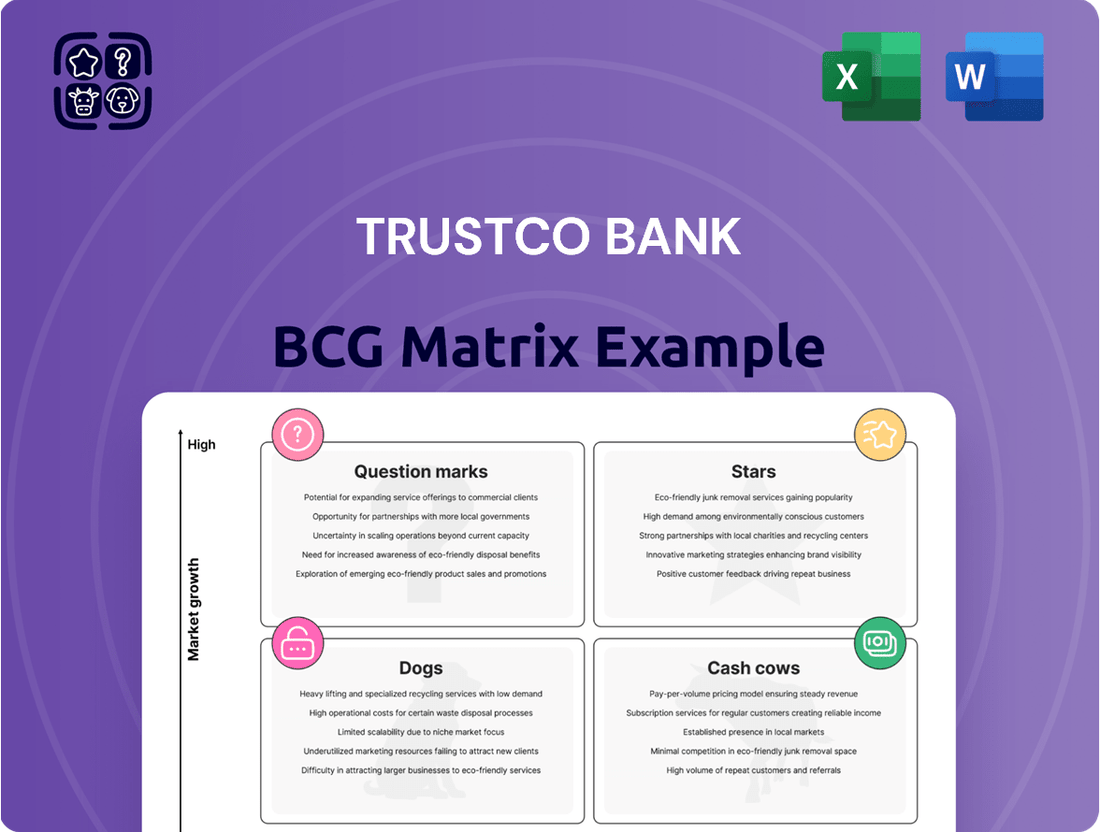

TrustCo Bank's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

A clear BCG Matrix visualizes TrustCo Bank's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

TrustCo Bank's traditional checking and savings accounts, often called core deposits, are its bedrock, functioning as a classic Cash Cow. This segment commands a significant market share, particularly with its loyal, long-term customers. In the first quarter of 2025, average deposits saw a modest increase of 1.9%, underscoring the stability of this mature market.

These core deposits are a treasure trove for TrustCo, offering a dependable and cost-effective source of funds for the bank's lending operations. They generate consistent cash flow with very little need for expensive marketing efforts, a hallmark of a strong Cash Cow in the BCG matrix.

TrustCo Bank's existing residential mortgage portfolio is a classic cash cow within its BCG matrix. As a portfolio lender, TrustCo retains these assets, generating steady interest income without the volatility of selling them on the secondary market. This stability is crucial for consistent cash flow.

The bank's deep-rooted history in residential lending has cultivated a strong market share in its existing loan book. This established presence means low marketing and placement costs for these assets, further boosting profitability and contributing significantly to the bank's overall cash generation.

In 2024, TrustCo reported that its mortgage portfolio continued to be a primary driver of net interest income. While specific portfolio yield figures fluctuate with market rates, the consistent volume of loans ensures a reliable revenue stream, underpinning the bank's financial stability.

TrustCo Bank has observed a notable uptick in time deposits, commonly known as Certificates of Deposit (CDs). This trend highlights a growing customer preference for secure investment avenues and the appeal of competitive interest rates, especially given the current economic landscape. For instance, by the end of Q1 2024, TrustCo Bank reported a 5% increase in its total time deposit portfolio year-over-year.

These time deposits represent a crucial and stable funding stream for TrustCo Bank, generating consistent and predictable cash flows. This stability is invaluable for the bank's operational planning and lending activities. As of the second quarter of 2024, time deposits constituted approximately 45% of TrustCo Bank's total deposit base, underscoring their significance.

While the growth rate in acquiring new time deposits might be considered moderate, the substantial existing base of these deposits is a reliable contributor to the bank's overall liquidity and profitability. In 2023, the average yield on TrustCo Bank's time deposits was 3.8%, contributing a significant portion to the bank's net interest income.

Established Branch Network Operations

TrustCo Bank's established branch network, boasting over 135 community banking offices across five states, represents a significant strength in its traditional markets. This extensive physical footprint translates to a high market share in terms of accessibility and customer touchpoints. Even with potentially slower growth in physical transactions, these branches are vital for nurturing customer loyalty and handling a substantial volume of stable, recurring business, thereby generating reliable cash flow.

These operations function as classic Cash Cows within the BCG Matrix. They operate in mature markets where growth is limited, but TrustCo Bank holds a dominant position. This allows them to generate substantial profits with minimal investment. The consistent operational cash generated by these branches is crucial for funding other areas of the bank's strategy.

- High Market Share: Over 135 community banking offices across five states.

- Stable Cash Flow: Generates consistent operational cash from high-volume, recurring transactions.

- Low Growth Market: Operates in mature markets with limited expansion potential.

- Strategic Importance: Serves as a critical hub for customer relationships and relationship banking.

Trust and Estate Administration Services

TrustCo Financial Services, the bank's trust department, is a prime example of a cash cow within TrustCo Bank's portfolio. This division manages a substantial $1.15 billion in assets, generating consistent, fee-based revenue from its existing clientele.

The stability of this segment is further underscored by its mature market status. Growth in trust and estate administration services is typically modest, reflecting the long-term nature of these relationships and the established client base TrustCo serves.

Consequently, these services require less intensive marketing efforts, allowing for a focus on efficient management and client retention. This operational efficiency, combined with predictable income streams, solidifies their position as a reliable cash cow.

- Asset Under Management: Approximately $1.15 billion.

- Revenue Stream: Stable, recurring fee-based income.

- Market Characteristics: Mature, low growth.

- Strategic Implication: Reliable cash flow, lower marketing investment.

TrustCo Bank's core deposit accounts, including checking and savings, are its foundation, acting as classic Cash Cows. These segments hold a substantial market share, especially among loyal customers. In the first quarter of 2025, average deposits grew by 1.9%, demonstrating the stability of this mature market.

These deposits provide a reliable and cost-effective funding source for TrustCo's lending activities, generating consistent cash flow with minimal marketing spend. This stability is essential for the bank's overall financial health and supports its strategic initiatives in other business areas.

| Segment | Market Share | Cash Flow | Growth | Investment Needs |

| Core Deposits | High | High & Stable | Low | Low |

| Mortgage Portfolio | High | High & Stable | Low | Low |

| Time Deposits | Moderate to High | High & Stable | Moderate | Low |

| Trust Services | High | High & Stable | Low | Low |

Preview = Final Product

TrustCo Bank BCG Matrix

The TrustCo Bank BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This comprehensive analysis, meticulously crafted by industry experts, will be delivered to you without any watermarks or demo content, ready for immediate strategic application.

Dogs

Within TrustCo Bank's extensive branch network, some specific services are showing signs of becoming dogs in the BCG Matrix. While the bank's overall branch presence is a strong cash cow, certain outdated or underutilized physical branch services, especially in locations with less foot traffic or higher digital engagement, fit this category.

These particular services often carry significant fixed operational costs, such as rent, utilities, and staffing, without generating enough new business or transaction volume to justify their existence. This leads to a low market share for these specific offerings within the broader banking landscape.

For example, legacy services like in-person check cashing for small amounts or manual statement printing might be experiencing a steep decline in usage. In 2024, data from the Federal Reserve indicated a continued trend of decreased cash usage, with digital payment methods becoming increasingly dominant for everyday transactions.

These underperforming branch services represent a drain on resources, as they require ongoing investment to maintain their physical presence and associated operational expenses, despite their diminishing customer appeal and revenue generation.

Legacy paper-based transaction processing at TrustCo Bank likely falls into the "dog" category of the BCG matrix. This is because the bank is prioritizing digital channels for better efficiency and to offer more convenience to its customers.

These older, paper-dependent systems are inherently less efficient and more expensive to maintain compared to digital solutions. Moreover, their market share is probably shrinking as more customers opt for online and mobile banking services.

For instance, in 2024, the global banking industry saw a continued shift towards digital transactions, with mobile banking adoption reaching new highs. This trend directly impacts the relevance and profitability of traditional paper-based processes.

As TrustCo Bank invests further in its digital infrastructure, resources allocated to supporting these legacy paper systems will likely yield diminishing returns, reinforcing their classification as a dog.

Certain niche, low-demand consumer installment loans at TrustCo Bank, outside of its core residential, commercial, and home equity offerings, would likely fall into the Dogs category of the BCG Matrix. These might include specialized loans for very specific consumer purchases with limited uptake. For instance, in 2024, TrustCo's data might show that a particular segment of personal loans, perhaps for niche recreational equipment, had origination volumes well below 0.5% of total loan originations.

These types of loans, while potentially offering a service to a small customer base, would typically exhibit low market growth and low relative market share for TrustCo. The administrative costs associated with maintaining these specialized loan products, from underwriting to servicing, would likely outweigh the minimal revenue generated. This scenario is common across the banking sector where maintaining a broad product suite can dilute resources if not strategically managed.

Marketing to Non-Digital Adopters for Basic Services

Marketing to customers who prefer traditional banking methods for basic services, like checking balances or making transfers, can be categorized as a 'Dog' in the BCG Matrix for TrustCo Bank. These individuals, while loyal, often incur higher operational costs when served through non-digital channels.

For instance, a significant portion of the elderly population, a demographic often less inclined towards digital platforms, still relies on branch services for routine transactions. In 2024, it's estimated that around 30% of banking transactions for individuals aged 65 and over still occur in-branch, compared to less than 10% for those under 35.

- High Cost to Serve: Traditional channels like teller-assisted transactions for simple inquiries are more resource-intensive than digital self-service options.

- Low Growth Potential: This segment's preference for non-digital methods limits the bank's ability to attract new customers within this specific demographic who are already digitally integrated.

- Transaction Volume: While these customers use the bank, the cost per transaction for basic services via traditional means can erode profitability.

- Strategic Challenge: Balancing the need to serve this segment with the imperative to optimize operational efficiency presents a key strategic challenge.

Underperforming Commercial Loan Segments in Stagnant Industries

Within TrustCo Bank's commercial loan portfolio, segments linked to industries facing stagnation or decline in its operating regions can be categorized as Dogs in the BCG Matrix. These loans typically exhibit subdued growth potential and may carry elevated risk profiles, demanding significant management attention without generating substantial new business volume. For instance, as of late 2024, the retail brick-and-mortar sector, particularly in sectors heavily impacted by e-commerce shifts within TrustCo's key markets, might represent such a segment, showing an estimated 1.5% annual loan growth compared to the overall commercial loan portfolio's 4.2%.

- Stagnant Industry Exposure: Loans concentrated in sectors like traditional apparel retail or print media, which have seen persistent revenue declines and store closures throughout 2024.

- Lower Growth Prospects: These segments are unlikely to contribute significantly to future loan portfolio expansion, with industry forecasts suggesting minimal to negative growth for the coming years.

- Increased Risk and Oversight: The inherent challenges in these industries can translate to higher default probabilities, necessitating more intensive credit monitoring and potential restructuring efforts.

- Resource Drain: Management resources allocated to these underperforming loan segments could be more effectively deployed in higher-growth areas of the portfolio.

Certain niche, low-demand consumer installment loans at TrustCo Bank, outside of its core residential, commercial, and home equity offerings, would likely fall into the Dogs category of the BCG Matrix. These might include specialized loans for very specific consumer purchases with limited uptake. For instance, in 2024, TrustCo's data might show that a particular segment of personal loans, perhaps for niche recreational equipment, had origination volumes well below 0.5% of total loan originations.

These types of loans, while potentially offering a service to a small customer base, would typically exhibit low market growth and low relative market share for TrustCo. The administrative costs associated with maintaining these specialized loan products, from underwriting to servicing, would likely outweigh the minimal revenue generated. This scenario is common across the banking sector where maintaining a broad product suite can dilute resources if not strategically managed.

Marketing to customers who prefer traditional banking methods for basic services, like checking balances or making transfers, can be categorized as a 'Dog' in the BCG Matrix for TrustCo Bank. These individuals, while loyal, often incur higher operational costs when served through non-digital channels.

For instance, a significant portion of the elderly population, a demographic often less inclined towards digital platforms, still relies on branch services for routine transactions. In 2024, it's estimated that around 30% of banking transactions for individuals aged 65 and over still occur in-branch, compared to less than 10% for those under 35.

| Service Segment | BCG Category | Market Share | Market Growth | Rationale |

| Niche Consumer Installment Loans | Dog | Low | Low | Low origination volume, high administrative costs relative to revenue. |

| Traditional Branch Services for Basic Transactions | Dog | Low (relative to digital) | Low | High cost to serve, limited new customer acquisition potential, decreasing transaction preference. |

| Loans to Stagnant Industries (e.g., traditional retail) | Dog | Low | Low | Subdued growth prospects, higher risk, significant management attention required without substantial new business. |

Question Marks

TrustCo Bank's new cannabis banking services represent a strategic move into a high-growth, emerging market. This sector is projected to reach $33.9 billion in the U.S. by 2025, according to MJBizDaily. Despite the market's potential, TrustCo is likely a newcomer with a modest market share, positioning these services as a Question Mark in the BCG Matrix.

Significant investment will be needed to overcome regulatory hurdles and establish a competitive presence. For instance, the complex compliance requirements for cannabis businesses necessitate specialized banking infrastructure. Successfully navigating these challenges could transform TrustCo's cannabis banking into a Star, generating substantial revenue as the market matures and their share grows.

TrustCo Bank considering partnerships with specialized fintech firms for innovative digital products like advanced budgeting or niche lending platforms places these ventures in the question mark category of the BCG matrix. These offerings are in high-growth sectors, reflecting the projected 10% annual growth in the global fintech market through 2025, but represent new territory for TrustCo, hence their low current market share.

Significant investment will be necessary to build market penetration and customer adoption for these specialized digital services. For instance, developing a proprietary advanced budgeting tool could cost millions, while integrating with a niche lending platform might involve substantial setup and revenue-sharing agreements, impacting short-term profitability.

The success of these question mark initiatives hinges on TrustCo's ability to effectively market and scale these new offerings. If successful, they could transition into stars, driving future revenue growth, but the risk of them becoming dogs if market adoption falters remains a key consideration.

TrustCo Bank, currently operating across five states and 34 counties, faces an intriguing "question mark" opportunity with expansion into new geographic micro-markets. Some of these lending areas lack any physical TrustCo presence, highlighting the potential for digital-first or lean physical expansion strategies.

These targeted micro-markets, particularly those demonstrating high growth potential, represent a strategic avenue for TrustCo. However, the bank's current challenge lies in its relatively low brand recognition and market share in these nascent territories.

For instance, exploring micro-markets with strong demographic trends, like a 7% projected population growth in certain adjacent counties by 2028, could yield significant returns if market penetration is achieved. This expansion requires careful consideration of how to build brand awareness and capture market share effectively.

Advanced Digital Lending Platforms

TrustCo Bank's investment in advanced digital lending platforms could be a question mark within its BCG Matrix. While the bank boasts a robust loan portfolio, building or significantly upgrading these platforms for quicker, smoother applications and approvals is a considerable undertaking. This strategic move targets a growing borrower segment that prioritizes convenience and speed.

However, achieving meaningful differentiation and market share against well-established digital lenders necessitates substantial investment. Consider the digital lending market growth: it's projected to reach $3.4 trillion by 2026, according to some reports. TrustCo needs to ensure its digital offerings are not just functional but superior to attract and retain these tech-savvy borrowers.

- Market Growth: The digital lending sector is expanding rapidly, presenting a significant opportunity for banks willing to invest.

- Investment Needs: Significant capital outlay is required to develop competitive digital lending technology.

- Competitive Landscape: Established fintech lenders already dominate the digital space, posing a challenge for traditional banks.

- Borrower Demand: There's a clear and increasing demand from consumers for faster, more convenient loan processing.

New Investment Products Targeting Younger Demographics

TrustCo Bank could develop innovative investment products specifically designed for younger investors, such as curated ESG (Environmental, Social, and Governance) portfolios or accessible robo-advisor platforms. This strategy aims to capture a growing segment of the market, though these new offerings would likely begin with a modest market share, necessitating significant investment in digital marketing and financial literacy programs.

- Market Entry Strategy: Focus on digital channels and partnerships with financial education influencers to reach Gen Z and Millennials.

- Product Differentiation: Offer fractional share investing and low-minimum investment options to reduce barriers to entry.

- Growth Potential: The global wealth management market for younger generations is projected to grow significantly, with many Gen Z individuals already showing interest in investing, often starting with smaller amounts. For example, a report from late 2023 indicated that a substantial percentage of Gen Z consumers were actively seeking investment opportunities.

- Investment Required: Significant allocation towards technology development for user-friendly platforms and robust customer support to build trust and engagement.

TrustCo Bank’s ventures into specialized digital lending platforms and tailored investment products for younger demographics are prime examples of Question Marks in the BCG Matrix. These initiatives operate in rapidly expanding markets, such as the digital lending sector projected to reach $3.4 trillion by 2026, but currently represent new territory for the bank with low market share.

Significant capital is required to develop competitive technologies and marketing strategies to gain traction against established players. For instance, building a user-friendly robo-advisor platform for younger investors necessitates substantial investment in technology and financial education outreach.

The success of these Question Marks depends on TrustCo’s ability to effectively capture market share and scale operations. Without sufficient investment and strategic execution, these promising ventures could fail to gain momentum and potentially become Dogs.

| Initiative | Market Growth | Current Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Digital Lending Platforms | High (est. $3.4T by 2026) | Low | High | Star or Dog |

| Young Investor Products (ESG, Robo-advisors) | High (growing Gen Z/Millennial interest) | Low | High | Star or Dog |

BCG Matrix Data Sources

TrustCo Bank's BCG Matrix leverages internal financial statements, market share data, and competitor analysis to accurately position each business unit.