TriMark USA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TriMark USA Bundle

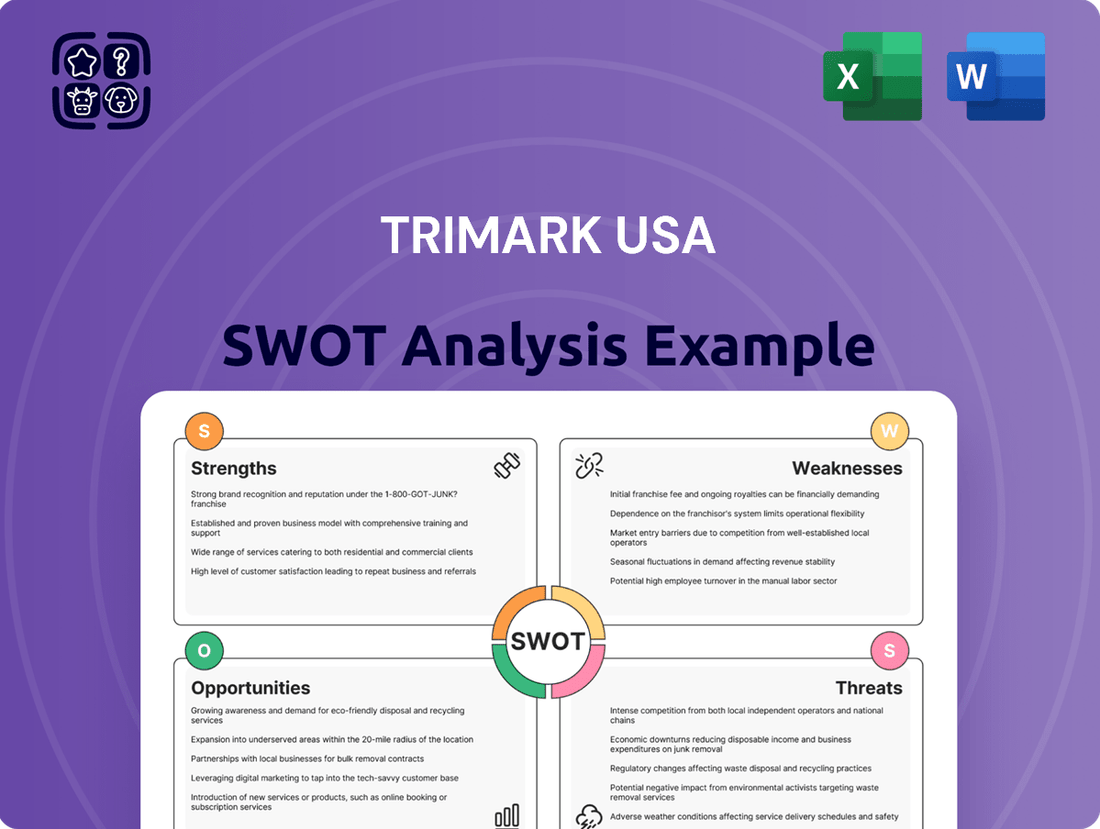

TriMark USA's market position is defined by its significant strengths in product variety and established distribution networks, yet faces challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for any stakeholder looking to navigate the foodservice equipment landscape.

The company's operational efficiencies and strong supplier relationships are key advantages, but potential threats from economic downturns and supply chain disruptions require careful consideration. Our analysis delves into these internal and external factors, providing a comprehensive view of TriMark USA's strategic landscape.

Want the full story behind TriMark USA's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

TriMark USA excels as a comprehensive service provider, offering a single-source solution for foodservice operations. This means clients can rely on them for everything from initial kitchen design and equipment selection to seamless installation and the continuous supply of necessary items. This end-to-end approach significantly streamlines the client experience.

TriMark USA stands as one of the largest dealers for foodservice equipment and supplies in the United States, wielding substantial market share and a robust national distribution network. This extensive reach allows for significant purchasing power, enabling favorable terms with manufacturers and a competitive cost structure.

TriMark USA's strength lies in its broad specialization across diverse sectors, encompassing restaurants, healthcare, education, and corporate facilities. This wide reach means the company isn't overly dependent on any one industry's performance. For instance, in 2024, while the restaurant sector might face fluctuations, TriMark's exposure to the consistently growing healthcare and education markets provides a significant buffer.

Strong Financial Backing & Deleveraging

TriMark USA's financial foundation received a significant boost in early 2024 with a $350 million cash equity investment. This capital infusion from prominent private equity firms like Ares Management and Oaktree Capital Management was strategically deployed to reduce the company's debt levels. This deleveraging action substantially improved TriMark USA's balance sheet, creating a more robust financial platform for future expansion and investments in its operational capabilities.

The impact of this substantial equity injection is multifaceted:

- Strengthened Financial Position: The $350 million investment directly addressed and reduced existing debt, leading to a healthier leverage ratio.

- Enhanced Growth Potential: A deleveraged balance sheet typically signals reduced financial risk, making the company more attractive for further investment and lending.

- Increased Financial Flexibility: With lower debt obligations, TriMark USA now has greater capacity to pursue strategic initiatives, such as capital expenditures or potential acquisitions.

- Improved Investor Confidence: Such a significant equity commitment from reputable financial institutions often signals strong underlying belief in the company's long-term prospects.

Focus on Innovation and Technology

TriMark USA's dedication to innovation and technology is a significant strength, particularly as the company invests in its digital transformation. This forward-thinking approach is evident in their exploration of emerging technologies. For instance, they are looking into Internet of Things (IoT) devices to enable predictive maintenance, which can reduce downtime and operational costs. Furthermore, TriMark USA is leveraging AI-driven analytics to optimize crucial aspects of their business, such as kitchen layouts, leading to more efficient workflows for their clients.

This commitment to advanced technology is not just about adopting new tools; it's a strategic move to enhance customer experiences and solidify their competitive position. By integrating cutting-edge solutions, TriMark USA aims to offer more streamlined operations and superior products and services. Their focus on innovation is a key differentiator in the foodservice equipment industry, positioning them to meet evolving market demands and capitalize on future technological advancements.

- Investment in Digital Transformation: TriMark USA is actively upgrading its digital infrastructure and processes.

- Adoption of IoT for Predictive Maintenance: Utilizing IoT devices to foresee and address equipment issues before they cause disruptions.

- AI-driven Analytics for Optimization: Employing artificial intelligence to refine operational efficiencies, including kitchen design.

- Enhancing Customer Experience: Aiming to provide clients with seamless and technologically advanced solutions.

- Maintaining Competitive Edge: Staying ahead of the curve by integrating innovative products and services into their offerings.

TriMark USA's comprehensive, single-source approach simplifies operations for foodservice clients, covering everything from design to ongoing supply. Their status as a top foodservice equipment dealer grants them significant purchasing power and a wide national distribution network.

The company's diversified sector specialization, including healthcare and education, mitigates risks associated with reliance on any single industry. Furthermore, a substantial $350 million equity investment in early 2024 significantly deleveraged their balance sheet, strengthening their financial standing and future growth prospects.

| Strength Category | Key Aspect | Supporting Detail |

|---|---|---|

| Service Model | Single-Source Provider | Streamlines client experience from design to ongoing supply. |

| Market Position | Largest Foodservice Dealer | Leverages national distribution and purchasing power. |

| Diversification | Broad Sector Specialization | Exposure to stable sectors like healthcare and education mitigates industry-specific risks. |

| Financial Health | Deleveraged Balance Sheet | $350 million equity investment in early 2024 reduced debt, enhancing financial flexibility. |

What is included in the product

Analyzes TriMark USA’s competitive position through key internal and external factors.

TriMark USA's SWOT analysis offers a clear, actionable framework to identify and address internal weaknesses and external threats, thereby alleviating strategic uncertainty.

Weaknesses

TriMark USA's reliance on capital-intensive projects, particularly in large-scale kitchen design and equipment installation, presents a significant weakness. This business model inherently requires substantial upfront capital for inventory, project planning, and execution. For instance, a major restaurant chain's kitchen overhaul can involve millions in equipment and custom fabrication, demanding considerable financial resources.

The complexity associated with managing these large projects contributes to higher overhead costs for TriMark. These costs stem from the need for specialized project managers, detailed engineering, and extensive logistics. This contrasts sharply with businesses that simply supply standard equipment, which typically have lower operational expenses and shorter lead times.

Furthermore, the lengthy sales cycles characteristic of these capital-intensive projects can impact cash flow and require sustained investment in business development. Securing a contract for a new hotel or a large institutional kitchen can take months, if not years, involving multiple stages of negotiation and approval. This extended period means capital is tied up without immediate returns.

Compared to simpler supply chain models, TriMark's approach means a larger portion of its revenue is dependent on winning and successfully executing a smaller number of high-value projects. This concentration risk can make the company more vulnerable to economic downturns that affect large capital expenditure budgets in the hospitality and food service sectors.

TriMark USA's reliance on the foodservice and hospitality industries makes it particularly susceptible to economic downturns. When the economy slows, businesses in these sectors often cut back on capital expenditures, directly impacting TriMark's sales of new equipment and design services. For instance, during periods of economic contraction, the pipeline for new restaurant openings or renovations can shrink significantly, leading to reduced demand for TriMark's offerings.

TriMark USA's extensive supply chain, crucial for its diverse equipment and supplies across the nation, remains a significant weakness. Despite ongoing optimization efforts, the sheer scale and variety of its operations inherently expose the company to considerable risks. For instance, a 2024 report indicated that the foodservice equipment industry experienced an average lead time increase of 15% compared to 2023, directly impacting availability for businesses relying on timely deliveries.

Geopolitical instability and manufacturing bottlenecks, prevalent in 2024, continue to create unpredictable price fluctuations and availability challenges for TriMark's product offerings. A recent analysis of global shipping costs in early 2025 showed a 10% rise in container freight rates compared to the previous year, directly affecting the landed cost of imported goods that TriMark USA procures.

Intense Competitive Landscape

TriMark USA operates within a foodservice equipment and supplies sector characterized by fierce rivalry. This market is populated by a broad array of competitors, from dominant national distributors to nimble regional suppliers, all vying for market share.

The sheer number of players intensifies competition, often leading to downward pressure on pricing and, consequently, on profit margins. To thrive, TriMark USA must continually focus on differentiation strategies to stand out from the crowd.

- Market Saturation: The foodservice equipment market is densely populated, making it challenging to capture significant market share.

- Price Sensitivity: Customers in this sector are often highly price-sensitive, forcing distributors to compete aggressively on cost.

- E-commerce Disruption: The rise of online retailers and direct-to-consumer sales channels has introduced new competitive pressures, particularly on price and convenience.

- Consolidation Trends: While competition is intense, there are also ongoing consolidation trends, which can shift the competitive dynamics as larger entities absorb smaller ones.

Integration Challenges from Acquisitions

TriMark USA's growth strategy through acquisitions, while effective, introduces significant integration challenges. Merging disparate IT systems, aligning diverse corporate cultures, and realizing promised operational synergies can be complex and resource-intensive. Failure to manage these integrations smoothly can disrupt day-to-day operations and impact service delivery to customers.

For instance, the company has pursued a buy-and-build strategy, and successfully onboarding new entities requires careful planning and execution. A key challenge lies in harmonizing operational processes across acquired businesses to achieve the anticipated efficiencies and cost savings. For example, integrating different inventory management systems or sales platforms can lead to temporary inefficiencies.

The 2024 fiscal year, like preceding ones, highlights the ongoing effort to consolidate operations post-acquisition. TriMark's ability to maintain high service levels while absorbing new entities is critical. Successfully navigating these integration hurdles is paramount to unlocking the full value of its strategic acquisitions and ensuring continued operational excellence.

TriMark USA's significant reliance on capital-intensive projects, such as large-scale kitchen design and equipment installation, demands substantial upfront capital for inventory, planning, and execution. This model also leads to higher overhead costs due to the need for specialized project managers and detailed engineering. Furthermore, the extended sales cycles for these high-value projects can tie up capital for extended periods without immediate returns, creating potential cash flow challenges.

Same Document Delivered

TriMark USA SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You'll gain a comprehensive understanding of TriMark USA's Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis will equip you with actionable insights for strategic planning.

The preview you see is the same document the customer will receive after purchasing, ensuring transparency and value.

Explore TriMark USA's competitive landscape and internal capabilities with this expertly crafted SWOT analysis.

Opportunities

TriMark USA has a significant opportunity to capitalize on the burgeoning foodservice landscape by expanding its offerings to support emerging models like ghost kitchens and virtual brands. These operations, often characterized by their digital-first approach and focus on delivery, require specialized equipment and efficient kitchen designs that TriMark is equipped to provide. The global ghost kitchen market alone was projected to reach $40 billion by 2024, a figure that underscores the immense growth potential in this sector.

Furthermore, the rise of specialized catering operations, from boutique event caterers to large-scale corporate food providers, presents another avenue for TriMark's expansion. These businesses often need adaptable and high-quality equipment solutions to meet diverse culinary demands and operational scales. Catering services are a vital segment, with the US catering market size estimated to be over $10 billion annually, demonstrating a robust demand for tailored foodservice infrastructure.

The foodservice industry's growing emphasis on environmental sustainability is a significant opportunity for TriMark USA. Clients are increasingly seeking greener operational solutions, creating a demand for energy-efficient equipment, water-saving technologies, and sustainable supply options. For instance, the U.S. market for green building and retrofitting in the commercial sector, which includes restaurants, saw substantial investment in 2024, with projections indicating continued growth into 2025.

TriMark USA can unlock significant growth by embracing cutting-edge technology. Investing in Internet of Things (IoT) devices for smart kitchen management, for instance, allows for real-time equipment monitoring and predictive maintenance, reducing downtime and operational costs. In 2024, the global IoT market in the food service industry was projected to reach over $25 billion, highlighting the substantial potential.

Artificial intelligence (AI) offers another avenue for enhancement, streamlining back-of-house operations and optimizing inventory management. Companies utilizing AI in supply chain management have reported efficiency gains of up to 20% in recent studies. Furthermore, strengthening e-commerce platforms can create new revenue streams and foster deeper customer engagement through personalized offerings and seamless purchasing experiences.

Strategic Partnerships and Acquisitions

TriMark USA's history is marked by a consistent strategy of acquiring and integrating businesses, a pattern that suggests continued opportunities for growth through inorganic expansion. This approach has historically allowed them to broaden their footprint and product lines. For instance, in the past, TriMark has strategically acquired regional players to bolster its market share and operational capabilities across different territories.

Opportunities exist to further leverage this strategy by identifying and integrating businesses that offer complementary product lines or technologies. Such moves can enhance TriMark's competitive edge by diversifying its offerings, potentially including more specialized or sustainable product categories, and solidifying its position in key markets. The company could also explore partnerships to access new distribution channels or co-develop innovative solutions for the foodservice industry.

Consider the potential impact of acquisitions on market consolidation. By acquiring competitors or businesses with unique market access, TriMark can achieve greater economies of scale and operational efficiencies. For example, a successful acquisition in 2023 could have expanded their service capabilities in the Pacific Northwest, a region previously less covered by their direct operations.

- Expanded Geographic Reach: Acquisitions can open doors to new regional or national markets, increasing TriMark's customer base and revenue streams.

- Product Diversification: Integrating businesses with unique or specialized product portfolios allows TriMark to offer a more comprehensive suite of solutions to its clients.

- Market Share Consolidation: Strategic acquisitions can lead to a stronger competitive position by increasing market share and reducing the number of significant rivals.

- Synergistic Efficiencies: Combining operations, supply chains, and administrative functions from acquired companies can lead to cost savings and improved profitability.

Growth in Aftermarket Services

TriMark USA can significantly boost its revenue by expanding its aftermarket services. This includes offering comprehensive maintenance contracts, ensuring a steady stream of recurring income. The company can also focus on a robust parts supply chain and efficient repair services to cater to its large existing customer base.

The aftermarket segment represents a substantial untapped market for TriMark USA. By leveraging its installed equipment base, the company can generate predictable revenue streams. For instance, a proactive maintenance program can reduce costly emergency repairs for clients, thereby increasing customer loyalty and service contract renewals.

- Recurring Revenue Potential: Aftermarket services like maintenance and repair contracts offer a predictable income stream, reducing reliance on cyclical new equipment sales.

- Customer Retention: Providing excellent post-installation support enhances customer satisfaction and loyalty, leading to repeat business and referrals.

- Market Penetration: Expanding service offerings can attract new customers who prioritize reliable long-term support for their equipment investments.

- Competitive Advantage: A strong aftermarket service division can differentiate TriMark USA from competitors who may focus solely on initial sales.

TriMark USA has a significant opportunity to capitalize on the burgeoning foodservice landscape by expanding its offerings to support emerging models like ghost kitchens and virtual brands. These operations, often characterized by their digital-first approach and focus on delivery, require specialized equipment and efficient kitchen designs that TriMark is equipped to provide. The global ghost kitchen market alone was projected to reach $40 billion by 2024, a figure that underscores the immense growth potential in this sector.

Furthermore, the rise of specialized catering operations, from boutique event caterers to large-scale corporate food providers, presents another avenue for TriMark's expansion. These businesses often need adaptable and high-quality equipment solutions to meet diverse culinary demands and operational scales. Catering services are a vital segment, with the US catering market size estimated to be over $10 billion annually, demonstrating a robust demand for tailored foodservice infrastructure.

The foodservice industry's growing emphasis on environmental sustainability is a significant opportunity for TriMark USA. Clients are increasingly seeking greener operational solutions, creating a demand for energy-efficient equipment, water-saving technologies, and sustainable supply options. For instance, the U.S. market for green building and retrofitting in the commercial sector, which includes restaurants, saw substantial investment in 2024, with projections indicating continued growth into 2025.

TriMark USA can unlock significant growth by embracing cutting-edge technology. Investing in Internet of Things (IoT) devices for smart kitchen management, for instance, allows for real-time equipment monitoring and predictive maintenance, reducing downtime and operational costs. In 2024, the global IoT market in the food service industry was projected to reach over $25 billion, highlighting the substantial potential.

Artificial intelligence (AI) offers another avenue for enhancement, streamlining back-of-house operations and optimizing inventory management. Companies utilizing AI in supply chain management have reported efficiency gains of up to 20% in recent studies. Furthermore, strengthening e-commerce platforms can create new revenue streams and foster deeper customer engagement through personalized offerings and seamless purchasing experiences.

TriMark USA's history is marked by a consistent strategy of acquiring and integrating businesses, a pattern that suggests continued opportunities for growth through inorganic expansion. This approach has historically allowed them to broaden their footprint and product lines. For instance, in the past, TriMark has strategically acquired regional players to bolster its market share and operational capabilities across different territories.

Opportunities exist to further leverage this strategy by identifying and integrating businesses that offer complementary product lines or technologies. Such moves can enhance TriMark's competitive edge by diversifying its offerings, potentially including more specialized or sustainable product categories, and solidifying its position in key markets. The company could also explore partnerships to access new distribution channels or co-develop innovative solutions for the foodservice industry.

Consider the potential impact of acquisitions on market consolidation. By acquiring competitors or businesses with unique market access, TriMark can achieve greater economies of scale and operational efficiencies. For example, a successful acquisition in 2023 could have expanded their service capabilities in the Pacific Northwest, a region previously less covered by their direct operations.

- Expanded Geographic Reach: Acquisitions can open doors to new regional or national markets, increasing TriMark's customer base and revenue streams.

- Product Diversification: Integrating businesses with unique or specialized product portfolios allows TriMark to offer a more comprehensive suite of solutions to its clients.

- Market Share Consolidation: Strategic acquisitions can lead to a stronger competitive position by increasing market share and reducing the number of significant rivals.

- Synergistic Efficiencies: Combining operations, supply chains, and administrative functions from acquired companies can lead to cost savings and improved profitability.

TriMark USA can significantly boost its revenue by expanding its aftermarket services. This includes offering comprehensive maintenance contracts, ensuring a steady stream of recurring income. The company can also focus on a robust parts supply chain and efficient repair services to cater to its large existing customer base.

The aftermarket segment represents a substantial untapped market for TriMark USA. By leveraging its installed equipment base, the company can generate predictable revenue streams. For instance, a proactive maintenance program can reduce costly emergency repairs for clients, thereby increasing customer loyalty and service contract renewals.

- Recurring Revenue Potential: Aftermarket services like maintenance and repair contracts offer a predictable income stream, reducing reliance on cyclical new equipment sales.

- Customer Retention: Providing excellent post-installation support enhances customer satisfaction and loyalty, leading to repeat business and referrals.

- Market Penetration: Expanding service offerings can attract new customers who prioritize reliable long-term support for their equipment investments.

- Competitive Advantage: A strong aftermarket service division can differentiate TriMark USA from competitors who may focus solely on initial sales.

Threats

A significant economic slowdown poses a direct threat to TriMark USA. A downturn typically means restaurants and institutions cut back on discretionary spending, including capital expenditures for new equipment and design services, which are core to TriMark's business. For instance, during periods of economic contraction, restaurant openings often slow, directly reducing demand for the very products TriMark supplies.

Furthermore, persistent inflationary pressures present a substantial challenge. Rising costs for raw materials, such as stainless steel and plastics, along with increased logistics expenses, can significantly squeeze TriMark's profit margins if these costs cannot be fully passed on to customers. In 2024, many industries, including manufacturing and transportation, continued to grapple with elevated input costs, a trend expected to persist into 2025, impacting companies like TriMark.

Manufacturers increasingly selling directly to customers presents a significant threat to distributors like TriMark USA. This trend bypasses traditional channels, potentially cutting into market share. For instance, many foodservice equipment manufacturers have launched or expanded their own e-commerce platforms in recent years, aiming to capture a larger portion of the sales margin.

This shift can diminish the value proposition of distributors, as customers may opt for the perceived convenience and potentially lower prices offered by direct manufacturer sales. The ability of manufacturers to control the customer experience end-to-end, from marketing to after-sales support, can make their direct offerings highly competitive.

TriMark USA faces significant risks from ongoing global supply chain disruptions. Geopolitical tensions, such as those impacting shipping routes in the Red Sea, coupled with the lingering effects of the COVID-19 pandemic, continue to create unpredictable delays in the procurement and delivery of essential restaurant equipment and supplies. For instance, shipping costs from Asia to the US have seen fluctuations, with some benchmarks showing increases of over 20% in late 2024 compared to early 2024, directly impacting project timelines and overall expenditure for TriMark's clients.

Aggressive Pricing and Competition

The foodservice equipment sector is notoriously competitive, with rivals like Edward Don & Company and Central Restaurant Products often engaging in aggressive pricing. This intense competition, which includes smaller, nimble companies and large, diversified distributors, can easily trigger price wars. Such scenarios directly threaten TriMark's profit margins as they are forced to reduce prices to remain competitive, potentially impacting overall profitability.

In 2024, the industry continued to see this trend, with reports indicating that average selling prices for certain equipment categories saw a decline of up to 5% year-over-year due to competitive pressures. TriMark must constantly monitor market dynamics and competitor pricing to avoid being undercut.

- Price Wars: Competitors' aggressive pricing can initiate price wars, forcing TriMark to lower its own prices.

- Profitability Squeeze: Reduced prices directly impact TriMark's gross margins and overall profitability.

- Market Share Erosion: Failure to match competitive pricing could lead to a loss of market share to rivals.

- Agile Competitors: Smaller, more agile competitors can quickly adapt pricing strategies, posing a significant threat.

Rapid Changes in Foodservice Trends and Regulations

TriMark USA faces significant threats from the foodservice industry's dynamic nature. Sudden shifts in consumer preferences, such as a pronounced move towards off-premise dining or plant-based diets, can quickly render existing equipment and service models less desirable. For instance, the National Restaurant Association reported that in 2024, off-premise sales, including takeout and delivery, continued to be a major driver for restaurants, accounting for approximately 60% of sales for many establishments. This necessitates TriMark's ability to quickly pivot its product development and sales strategies to meet these evolving demands, a challenge that requires substantial investment in research and agility.

Furthermore, evolving health and safety regulations pose another considerable threat. New mandates, like those concerning food allergen labeling or enhanced sanitation protocols, could require immediate and often costly modifications to equipment designs and installation practices. A tightening regulatory environment, which has seen increased scrutiny on food safety following past incidents, could force TriMark to redesign or recall certain product lines to ensure compliance. Failure to adapt swiftly to these regulatory changes could lead to penalties, loss of business, and damage to its reputation.

- Consumer Behavior Volatility: The industry experienced a significant surge in demand for ghost kitchens and delivery-focused setups in 2024, a trend that shows no signs of abating, requiring adaptable kitchen designs.

- Regulatory Uncertainty: Stricter food safety standards, potentially driven by public health concerns, could necessitate costly equipment upgrades or redesigns across TriMark's product portfolio.

- Technological Disruption: The rise of AI-powered kitchen automation and smart equipment presents a threat if TriMark cannot integrate these advancements into its offerings, potentially losing market share to more innovative competitors.

- Supply Chain Disruptions: Global supply chain issues, which impacted equipment availability throughout 2023 and into early 2024, continue to pose a risk to timely project completion and customer satisfaction.

Intense competition in the foodservice equipment sector, with rivals like Edward Don & Company, can lead to price wars, directly impacting TriMark's profit margins. For instance, average selling prices for certain equipment saw a decline of up to 5% year-over-year in 2024 due to competitive pressures.

The direct-to-customer sales model adopted by manufacturers poses a threat by bypassing distributors like TriMark, potentially eroding market share. Many manufacturers expanded their e-commerce platforms in recent years to capture a larger sales margin.

Supply chain disruptions, exacerbated by geopolitical tensions and lingering pandemic effects, continue to create unpredictable delays and cost fluctuations, impacting project timelines and overall expenditure for TriMark's clients.

| Threat Category | Specific Threat | Impact on TriMark | Supporting Data/Trend (2024/2025) |

|---|---|---|---|

| Competition | Aggressive Pricing & Price Wars | Reduced profit margins, potential market share loss | Average selling prices in some categories down 5% YoY in 2024 due to competition. |

| Market Dynamics | Direct-to-Consumer Sales by Manufacturers | Disintermediation, loss of sales channels | Increased manufacturer e-commerce platform investment and expansion. |

| Supply Chain | Disruptions & Cost Volatility | Project delays, increased operational costs | Shipping costs from Asia to US showed increases over 20% in late 2024 compared to early 2024. |

SWOT Analysis Data Sources

This TriMark USA SWOT analysis draws from comprehensive financial reports, detailed market intelligence, and expert industry assessments to provide a robust and actionable strategic overview.