TriMark USA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TriMark USA Bundle

Curious about TriMark USA's product portfolio performance? Our BCG Matrix preview offers a glimpse into whether their offerings are market-leading Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks. Understanding this positioning is crucial for strategic resource allocation and future growth.

Don't let this limited view hold you back from unlocking TriMark USA's full strategic potential. Purchase the complete BCG Matrix to gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing their product lineup.

This isn't just about classification; it's about informed decision-making. The full report provides the data-backed recommendations you need to identify growth opportunities and mitigate risks within TriMark USA's diverse product offerings.

Equip yourself with the ultimate tool for competitive analysis. Buy the full BCG Matrix to receive a comprehensive Word report alongside a high-level Excel summary, empowering you to evaluate, present, and strategize with absolute confidence.

Stop guessing and start strategizing. Get instant access to the full BCG Matrix and discover exactly where TriMark USA's products stand, allowing you to make smarter investment decisions and drive business success.

Stars

TriMark USA is strategically positioned to capitalize on the burgeoning smart kitchen technology market. The foodservice equipment sector is experiencing robust expansion, largely driven by the increasing adoption of IoT-enabled and intelligent kitchen appliances. For instance, the global smart kitchen market was valued at approximately USD 20.4 billion in 2023 and is projected to reach USD 60.5 billion by 2030, exhibiting a compound annual growth rate of over 16.8% during this period.

TriMark's commitment to integrating advanced solutions, both through internal development and key alliances, directly addresses this high-growth trajectory. This approach allows them to effectively secure a substantial portion of this expanding market. By focusing on automation and smart appliances, TriMark is aligning its offerings with a clear market demand for efficiency and innovation in commercial kitchens.

The market for sustainable foodservice equipment is booming, driven by consumer demand for eco-friendly options and stricter environmental laws. In 2024, this segment is projected to see continued expansion, with many businesses prioritizing energy efficiency.

TriMark USA is well-positioned to capitalize on this trend, actively growing its portfolio of sustainable equipment. This strategic focus allows TriMark to capture a significant market share as the foodservice industry increasingly adopts greener solutions.

The move towards energy-efficient appliances is a major force propelling the entire foodservice equipment market forward. With its commitment to this area, TriMark is set to shine as a leader, offering solutions that meet both operational needs and environmental goals.

The foodservice industry is rapidly evolving with the surge of ghost kitchens, virtual brands, and adaptable kitchen setups. This dynamic shift creates a significant growth avenue for companies that can cater to these innovative models. TriMark USA is strategically positioned to capitalize on this trend, offering extensive design and build expertise tailored for these emerging concepts.

The demand for flexible and efficient kitchen solutions is undeniable. For instance, the modular commercial kitchen market is expected to expand significantly, with a projected Compound Annual Growth Rate (CAGR) of 7.3% between 2025 and 2033. This robust growth signals a substantial opportunity for TriMark USA to secure a leading market share by outfitting these forward-thinking foodservice operations.

Specialized Solutions for High-Growth Healthcare Foodservice

The hospital foodservice equipment market is projected to see robust expansion, with a compound annual growth rate (CAGR) of approximately 5.5% anticipated between 2024 and 2029. This growth is fueled by rising healthcare spending and a heightened focus on patient well-being through improved nutrition.

TriMark USA's expertise in providing specialized equipment and comprehensive design solutions for healthcare settings, including advanced medical-grade refrigeration and infection control-compliant serving systems, firmly establishes it as a star performer. The company's ability to cater to the unique demands of hospitals, such as those requiring energy-efficient cooking equipment and specialized warewashing systems, is a key differentiator.

- Market Growth: The global healthcare foodservice market was valued at an estimated $24.5 billion in 2023 and is expected to reach over $34 billion by 2028.

- Specialized Needs: Hospitals increasingly require equipment that meets stringent hygiene standards and enhances operational efficiency in patient meal preparation and delivery.

- TriMark's Position: TriMark's comprehensive product portfolio and design services are well-aligned with the growing demand for compliant and technologically advanced foodservice solutions in healthcare.

- Regulatory Compliance: The emphasis on food safety and adherence to regulations like HACCP is driving demand for equipment with built-in monitoring and traceability features, areas where TriMark excels.

Comprehensive Project Management for Large-Scale New Builds

TriMark USA's extensive network and single-source capabilities position it strongly for large-scale new builds, particularly in sectors like hospitality and education. While overall commercial construction growth may show moderate increases, the demand for integrated design, equipment, and supply solutions remains robust, allowing TriMark to secure a significant market share in this vital segment.

The company's ability to manage complex, multi-phase projects from concept to completion is a key differentiator. This comprehensive approach is crucial for new construction where coordination across multiple vendors is often challenging and costly. TriMark's national distribution footprint ensures timely delivery and consistent quality, vital for keeping large projects on schedule and within budget.

- Market Position: TriMark USA operates in a segment of commercial construction characterized by consistent, albeit sometimes fluctuating, demand for integrated solutions.

- Sector Focus: Key growth areas for TriMark's large-scale new build projects include the hospitality and education sectors, which increasingly favor single-source providers.

- Competitive Advantage: The company leverages its national distribution network and comprehensive service offerings to manage the complexities of large-scale projects efficiently.

- Growth Outlook: Despite potentially modest overall commercial construction growth, the demand for complete project management solutions provides a stable revenue stream and market share for TriMark.

TriMark USA's strong performance in the hospital foodservice equipment market firmly places it in the Stars category of the BCG matrix. This segment benefits from consistent growth, driven by healthcare spending and a focus on patient nutrition. For example, the hospital foodservice market saw an estimated value of $24.5 billion in 2023 and is projected to exceed $34 billion by 2028, demonstrating a substantial growth trajectory.

TriMark's ability to meet specialized needs, such as stringent hygiene standards and energy-efficient appliances, differentiates it. Their comprehensive product lines and design expertise are highly sought after by healthcare facilities, ensuring they capture a significant share of this expanding market. This strategic alignment with healthcare demands positions TriMark as a leader in this high-growth, high-share quadrant.

What is included in the product

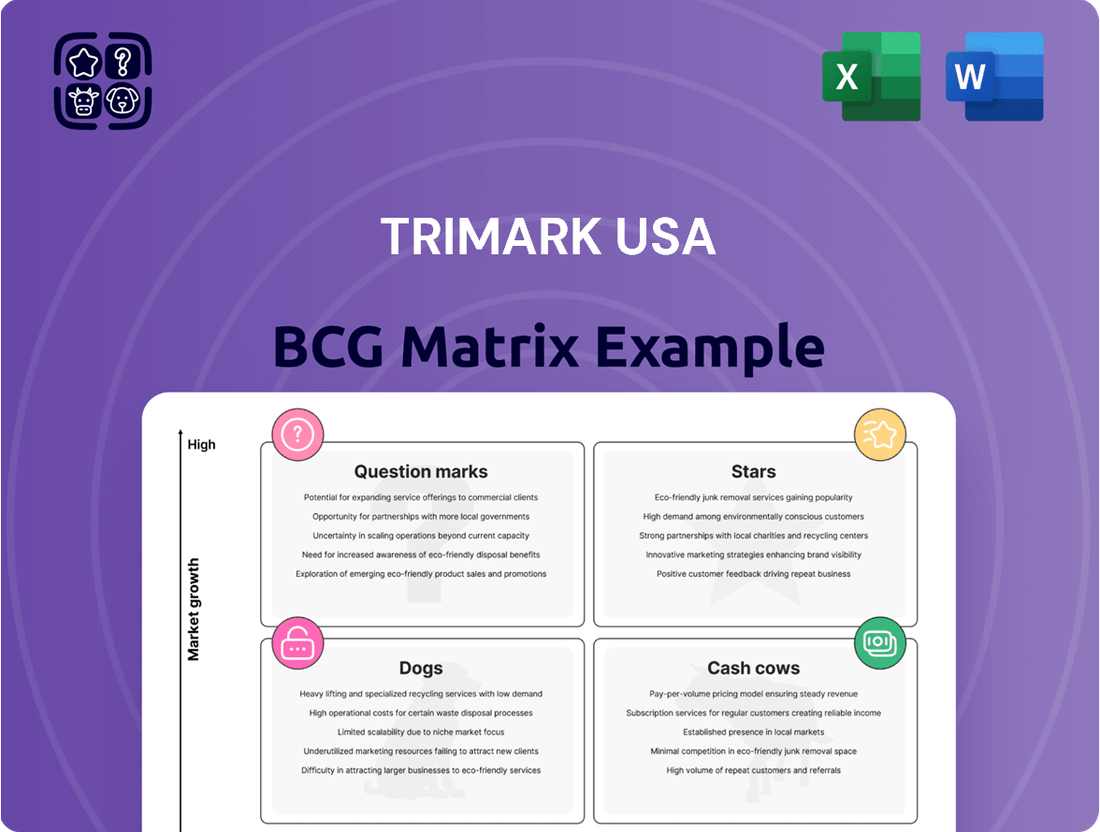

TriMark USA's BCG Matrix offers clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within their product portfolio.

A visual representation of TriMark USA's portfolio, simplifying complex business unit performance into actionable insights.

Cash Cows

Standard commercial kitchen equipment sales represent a significant revenue generator for TriMark USA. This category, encompassing ovens, refrigerators, and dishwashers, forms the bedrock of most foodservice businesses. The market for these essential items is established, yet TriMark's robust market share and widespread distribution channels consistently drive high sales volumes and dependable cash flow.

While the foodservice equipment market exhibits steady growth, with projections indicating continued expansion in the coming years, TriMark's core kitchen equipment offerings are well-positioned. For instance, the global commercial kitchen equipment market was valued at approximately $39.5 billion in 2023 and is anticipated to reach over $55 billion by 2030, demonstrating a healthy compound annual growth rate. This stable, mature segment acts as a reliable cash cow for the company.

Routine supply and smallwares distribution are indeed a cash cow for TriMark USA. These products, like cutlery, cookware, and disposables, are the backbone of many foodservice operations, ensuring consistent, albeit low-growth, demand.

In 2024, the foodservice smallwares market continued to show resilience. Reports indicate that the global foodservice disposables market alone was projected to reach over $120 billion, with a steady compound annual growth rate of around 4-5% through 2028, underscoring the stable nature of this segment.

TriMark's strategy of being a comprehensive partner leverages these recurring needs. They secure contracts for essential items, creating predictable revenue streams that support the business, much like a classic cash cow in the BCG matrix.

TriMark USA's established design and build services for traditional restaurants represent a classic Cash Cow within their portfolio. This segment leverages decades of experience in a mature market, ensuring a consistent and predictable revenue stream. For example, in 2024, the commercial kitchen equipment market, which directly impacts this segment, was valued at approximately $45 billion globally, showing its enduring stability.

The steady demand from both new restaurant openings and necessary renovations in the traditional dining sector provides TriMark with a reliable base of projects. Despite potentially slower growth compared to emerging trends, TriMark's strong market presence and brand recognition allow them to command healthy profit margins from these operations. This stability is crucial for funding other, more growth-oriented ventures within the company.

Maintenance and Service Contracts for Legacy Installations

Maintenance and service contracts for TriMark USA's legacy installations are a prime example of a cash cow within the BCG matrix. These contracts typically represent a high market share in a low-growth segment, providing a stable and predictable revenue stream.

The critical nature of kitchen equipment uptime ensures high customer retention for these service agreements. TriMark's focus on nurturing long-term customer relationships and delivering comprehensive support further solidifies this position.

- Predictable Revenue: Service contracts generate consistent income, buffering against market fluctuations.

- High Customer Retention: Essential equipment uptime makes switching providers costly for clients.

- Established Market Share: TriMark's history with installations translates to a dominant position in servicing this installed base.

- Low Growth Segment: The market for servicing older, established equipment is typically mature with limited expansion opportunities.

Long-term Partnerships with Large Institutional Clients

TriMark USA's strong long-term partnerships with large institutional clients in sectors like healthcare, education, and corporate facilities are prime examples of their cash cows. These relationships translate into stable, high-volume contracts that provide dependable revenue streams.

The consistent demand for equipment and supplies within these institutional sectors ensures a predictable, albeit low-growth, revenue base for TriMark. The company's high market share in these areas is a testament to its established presence and capacity to manage large-scale operational needs.

- Healthcare Sector: Consistent demand for medical equipment and supplies.

- Education Sector: Ongoing needs for classroom and administrative furnishings.

- Corporate Facilities: Stable requirements for office furniture and operational equipment.

- High Market Share: TriMark leverages long-standing relationships and large-scale service capabilities.

TriMark USA's comprehensive distribution of essential foodservice smallwares, from cutlery to disposables, firmly anchors it as a cash cow. This segment benefits from consistent demand across a mature market, with the global foodservice disposables market alone projected to exceed $120 billion in value, showcasing its stability.

The company’s established design and build services for traditional restaurants also represent a significant cash cow. Even in 2024, the commercial kitchen equipment market, a direct indicator for this segment, held a global valuation around $45 billion, highlighting its enduring robustness.

Maintenance and service contracts for existing installations further solidify TriMark's cash cow status. These agreements capitalize on high customer retention due to the critical need for equipment uptime in a low-growth, mature market segment.

Finally, TriMark's long-standing partnerships with large institutional clients in healthcare and education contribute substantially to its cash cow portfolio. These relationships ensure stable, high-volume contracts, leveraging TriMark's high market share in these consistent, low-growth sectors.

Delivered as Shown

TriMark USA BCG Matrix

The TriMark USA BCG Matrix preview you are currently viewing is the exact, final document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted report ready for your strategic analysis.

Rest assured, the BCG Matrix document you see here is the identical, unedited file that will be delivered to you after completing your purchase. It’s designed for immediate application in your business planning and competitive strategy discussions.

This preview accurately represents the TriMark USA BCG Matrix you will download once your purchase is confirmed. You can expect the same high-quality, analysis-ready content that’s perfect for informing critical business decisions.

Dogs

Certain highly specialized or technologically superseded kitchen equipment lines, like antique immersion circulators or outdated blast chillers, could be classified as Dogs within TriMark USA's portfolio. These items likely possess a low market share, with demand shrinking as newer, more efficient alternatives emerge. For instance, sales of manual can openers might be negligible compared to electric models, reflecting a declining niche.

TriMark might retain these Dog products to provide a comprehensive selection for a very specific customer base, or simply due to existing inventory. However, these items would represent a drain on resources, requiring storage, maintenance, and potentially marketing, without generating substantial revenue. Consider the market for manual tilt skillets; while some restaurants might still use them, the vast majority have transitioned to electric or gas-powered units, limiting sales potential.

The market growth for such equipment is likely stagnant or even declining. For example, the global market for traditional ice cream makers, as opposed to modern batch freezers, has seen minimal growth in recent years, with many consumers opting for simpler, more convenient solutions. This low growth, coupled with low market share, firmly places these specialty items in the Dog quadrant.

Highly commoditized, low-margin basic supplies represent a segment where TriMark USA likely holds a low market share in a low-growth environment. These are fundamental, undifferentiated products that many suppliers offer, leading to intense price competition.

The intense competition in this basic supplies category significantly pressures profit margins. This makes it challenging for TriMark USA to generate substantial revenue or profit from these items, potentially acting more as a necessary but low-contributing part of their broader catalog rather than a growth engine.

For instance, in 2024, the restaurant supply industry, which includes basic supplies, saw average gross profit margins for general merchandise hover around 20-25%. This is considerably lower than specialized or branded equipment, highlighting the challenge of profitability in commoditized segments.

In stagnant or declining local markets where TriMark USA may not hold a dominant share, its services could be categorized as Dogs within the BCG Matrix. This means these offerings face low growth prospects and a low market share. For instance, if a specific regional market saw a 5% decline in foodservice establishments in 2024, and TriMark's presence there remained minimal, those localized services would fit this profile.

Consider a scenario where a particular city experienced a 10% closure rate among independent restaurants in the past year. If TriMark’s service penetration in that specific locale remains below 5%, these services would represent a Dog. The challenge here is that resources might be better allocated to more promising segments of the business.

Legacy Equipment Lines with Limited Compatibility

Legacy equipment lines that struggle with modern kitchen system compatibility or adhere to outdated industry standards often represent a significant challenge for TriMark USA. These products, potentially requiring expensive proprietary parts, face diminished market appeal and limited growth prospects, especially in 2024 where integration and efficiency are paramount. For instance, if a significant portion of TriMark’s legacy equipment sales come from older refrigeration units that cannot be easily integrated with newer smart kitchen management software, it directly impacts their ability to capture market share in a rapidly evolving sector.

The financial implications of maintaining such lines are considerable. Capital tied up in inventory and support for these products could be better allocated to areas with higher growth potential. In 2024, the foodservice industry is heavily focused on technological advancements and sustainability; therefore, products that don’t align with these trends, such as inefficient older ovens that consume more energy, become a drag on resources. This scenario positions these legacy lines as potential ‘Dogs’ within the BCG matrix, requiring careful strategic consideration.

- Limited Growth Potential: Equipment lines lacking compatibility with modern kitchen technology or industry standards exhibit low market growth. For example, older dishwashers that do not meet current energy efficiency standards (e.g., Energy Star requirements) may see declining demand.

- High Maintenance Costs: Supporting legacy equipment, especially those with proprietary parts, incurs significant inventory and service expenses. This can divert resources from more profitable ventures, impacting overall profitability.

- Reduced Market Appeal: As the foodservice industry embraces smart technology and integrated systems, outdated equipment becomes less attractive to new customers seeking seamless operations.

- Capital Inefficiency: Maintaining stock and providing support for low-demand legacy products ties up working capital that could be invested in developing or acquiring more competitive offerings.

Underperforming Small Client Accounts Requiring High Overhead

Underperforming small client accounts that demand significant overhead, like extensive administrative support or frequent sales outreach, can be categorized as Dogs within the TriMark USA BCG Matrix. These accounts, while potentially numerous, offer little in terms of revenue or profit margin, instead consuming valuable resources. For instance, managing 100 small accounts, each requiring an average of 2 hours of administrative time per month, translates to 200 hours monthly that could be allocated to larger, more profitable clients. This inefficiency directly impacts overall profitability, especially when considering that the average overhead cost per client can significantly outweigh the revenue generated by these smaller relationships.

These problematic accounts can become resource drains, hindering growth and innovation. The focus on maintaining these low-yield relationships diverts attention and capital from strategic initiatives. In 2024, many businesses found that clients representing less than 5% of their total revenue consumed over 20% of their customer service and support budget. This highlights the disproportionate cost associated with servicing a large volume of small accounts.

- Resource Drain: Small accounts with high overhead consume disproportionate administrative, sales, and logistical resources relative to their revenue contribution.

- Low Profitability: These accounts typically generate minimal profit, potentially operating at a loss when all associated costs are factored in.

- Opportunity Cost: Time and money spent on underperforming small accounts could be invested in high-growth or high-margin opportunities.

- Strategic Impact: Managing a large base of low-yield clients can dilute focus and hinder the company's ability to scale effectively.

Certain highly specialized or technologically superseded kitchen equipment lines, like antique immersion circulators or outdated blast chillers, could be classified as Dogs within TriMark USA's portfolio. These items likely possess a low market share, with demand shrinking as newer, more efficient alternatives emerge. For instance, sales of manual can openers might be negligible compared to electric models, reflecting a declining niche.

TriMark might retain these Dog products to provide a comprehensive selection for a very specific customer base, or simply due to existing inventory. However, these items would represent a drain on resources, requiring storage, maintenance, and potentially marketing, without generating substantial revenue. Consider the market for manual tilt skillets; while some restaurants might still use them, the vast majority have transitioned to electric or gas-powered units, limiting sales potential.

The market growth for such equipment is likely stagnant or even declining. For example, the global market for traditional ice cream makers, as opposed to modern batch freezers, has seen minimal growth in recent years, with many consumers opting for simpler, more convenient solutions. This low growth, coupled with low market share, firmly places these specialty items in the Dog quadrant.

Highly commoditized, low-margin basic supplies represent a segment where TriMark USA likely holds a low market share in a low-growth environment. These are fundamental, undifferentiated products that many suppliers offer, leading to intense price competition.

The intense competition in this basic supplies category significantly pressures profit margins. This makes it challenging for TriMark USA to generate substantial revenue or profit from these items, potentially acting more as a necessary but low-contributing part of their broader catalog rather than a growth engine. For instance, in 2024, the restaurant supply industry, which includes basic supplies, saw average gross profit margins for general merchandise hover around 20-25%. This is considerably lower than specialized or branded equipment, highlighting the challenge of profitability in commoditized segments.

In stagnant or declining local markets where TriMark USA may not hold a dominant share, its services could be categorized as Dogs within the BCG Matrix. This means these offerings face low growth prospects and a low market share. For instance, if a specific regional market saw a 5% decline in foodservice establishments in 2024, and TriMark's presence there remained minimal, those localized services would fit this profile.

Consider a scenario where a particular city experienced a 10% closure rate among independent restaurants in the past year. If TriMark’s service penetration in that specific locale remains below 5%, these services would represent a Dog. The challenge here is that resources might be better allocated to more promising segments of the business.

Legacy equipment lines that struggle with modern kitchen system compatibility or adhere to outdated industry standards often represent a significant challenge for TriMark USA. These products, potentially requiring expensive proprietary parts, face diminished market appeal and limited growth prospects, especially in 2024 where integration and efficiency are paramount. For instance, if a significant portion of TriMark’s legacy equipment sales come from older refrigeration units that cannot be easily integrated with newer smart kitchen management software, it directly impacts their ability to capture market share in a rapidly evolving sector.

The financial implications of maintaining such lines are considerable. Capital tied up in inventory and support for these products could be better allocated to areas with higher growth potential. In 2024, the foodservice industry is heavily focused on technological advancements and sustainability; therefore, products that don’t align with these trends, such as inefficient older ovens that consume more energy, become a drag on resources. This scenario positions these legacy lines as potential ‘Dogs’ within the BCG matrix, requiring careful strategic consideration.

- Limited Growth Potential: Equipment lines lacking compatibility with modern kitchen technology or industry standards exhibit low market growth. For example, older dishwashers that do not meet current energy efficiency standards (e.g., Energy Star requirements) may see declining demand.

- High Maintenance Costs: Supporting legacy equipment, especially those with proprietary parts, incurs significant inventory and service expenses. This can divert resources from more profitable ventures, impacting overall profitability.

- Reduced Market Appeal: As the foodservice industry embraces smart technology and integrated systems, outdated equipment becomes less attractive to new customers seeking seamless operations.

- Capital Inefficiency: Maintaining stock and providing support for low-demand legacy products ties up working capital that could be invested in developing or acquiring more competitive offerings.

Underperforming small client accounts that demand significant overhead, like extensive administrative support or frequent sales outreach, can be categorized as Dogs within the TriMark USA BCG Matrix. These accounts, while potentially numerous, offer little in terms of revenue or profit margin, instead consuming valuable resources. For instance, managing 100 small accounts, each requiring an average of 2 hours of administrative time per month, translates to 200 hours monthly that could be allocated to larger, more profitable clients. This inefficiency directly impacts overall profitability, especially when considering that the average overhead cost per client can significantly outweigh the revenue generated by these smaller relationships.

These problematic accounts can become resource drains, hindering growth and innovation. The focus on maintaining these low-yield relationships diverts attention and capital from strategic initiatives. In 2024, many businesses found that clients representing less than 5% of their total revenue consumed over 20% of their customer service and support budget. This highlights the disproportionate cost associated with servicing a large volume of small accounts.

- Resource Drain: Small accounts with high overhead consume disproportionate administrative, sales, and logistical resources relative to their revenue contribution.

- Low Profitability: These accounts typically generate minimal profit, potentially operating at a loss when all associated costs are factored in.

- Opportunity Cost: Time and money spent on underperforming small accounts could be invested in high-growth or high-margin opportunities.

- Strategic Impact: Managing a large base of low-yield clients can dilute focus and hinder the company's ability to scale effectively.

Question Marks

The market for AI-driven kitchen analytics and optimization is experiencing rapid expansion, with projections suggesting continued strong growth through 2024 and beyond. This surge is fueled by the increasing demand for smart kitchen management systems that enhance efficiency and reduce waste. Adoption of AI for personalized customer experiences within food service is also a key driver, promising to reshape operational strategies.

While TriMark USA operates in a high-growth sector with advanced data analytics and AI for kitchen optimization, its market share in this specialized software and service integration is likely still developing. This is an emerging area for traditional equipment providers, meaning significant strategic investment is necessary to capture a leading position. By 2024, early adopters of these technologies were already seeing substantial improvements in operational costs and customer satisfaction.

Expanding into niche international markets, like specialized food service equipment sectors in emerging economies, could position TriMark USA as a Question Mark. These markets often exhibit rapid growth, with potential for high returns, but also carry significant risk due to unfamiliar competitive landscapes and regulatory hurdles. For instance, the global food service equipment market, projected to reach over $70 billion by 2027, presents opportunities in regions like Southeast Asia, where demand for modern kitchen solutions is rising.

TriMark would likely enter these markets with a low initial market share, requiring substantial investment in distribution networks, localized marketing, and potentially adapting product offerings to meet regional needs. The key challenge is achieving a strong competitive foothold against established local providers and navigating diverse consumer preferences. For example, in 2024, the growth rate of the food service industry in India and Vietnam has been notably high, indicating a potential area for TriMark to explore, albeit with significant upfront capital requirements.

The foodservice industry is increasingly favoring subscription-based equipment leasing over traditional outright purchases. This represents a potential high-growth area, aligning with the broader shift towards service-based business models. For TriMark USA, this emerging trend might position their subscription leasing offerings as a question mark within the BCG matrix, given their historical strength in direct sales and design.

While TriMark USA's current market share in these newer leasing models may be relatively low, the strategic investment in developing and promoting these services could prove highly beneficial. Such a focus could unlock significant future growth, especially as operators seek flexible, pay-as-you-go solutions for essential kitchen equipment.

Specialized Consulting for Food Waste Reduction Technologies

Specialized consulting for food waste reduction technologies represents a burgeoning market, driven by heightened global sustainability concerns. TriMark USA could strategically enter this high-growth niche by expanding its service portfolio.

However, TriMark's current market share in this specialized area is likely minimal, necessitating substantial investment in developing expertise and acquiring cutting-edge reduction solutions. For instance, the global food waste market was valued at approximately $1 trillion in 2023 and is projected to grow significantly. Expanding into this sector would position TriMark to capitalize on this trend.

- Market Growth: The global market for food waste reduction technologies is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 5% through 2030.

- Investment Needs: Significant upfront investment would be required for TriMark to build the necessary technical knowledge and implement effective waste reduction solutions.

- Competitive Landscape: Entering this niche means competing with established sustainability consultants and technology providers, demanding a strong value proposition.

- Potential Returns: Successful penetration into this market could yield substantial returns, aligning with increasing corporate and governmental mandates for waste reduction.

Development of Proprietary Smart Kitchen Software Platforms

Developing proprietary smart kitchen software platforms represents a high-risk, high-reward opportunity for TriMark USA. While the market for integrated kitchen management solutions is expanding, TriMark's current market share in this specialized tech sector is likely modest compared to established software providers.

To establish a strong presence, TriMark would need substantial investment in research, development, and marketing. This venture could potentially become a Star in the BCG matrix if it gains significant traction and market share, but the initial investment and competitive landscape pose considerable risks.

- Market Opportunity: The global smart kitchen appliances market was valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating substantial potential for software integration.

- Competitive Landscape: TriMark would face competition from pure-play software companies with established platforms and extensive R&D budgets, requiring a differentiated offering.

- Investment Needs: Significant capital would be required for software development, cloud infrastructure, cybersecurity, and ongoing updates to maintain a competitive edge.

- Potential for Growth: Successful development and adoption of a proprietary platform could lead to recurring revenue streams and a stronger competitive moat in the foodservice equipment sector.

Question Marks in TriMark USA's BCG Matrix likely represent emerging technologies or market segments where the company has a low market share but operates in a high-growth environment. These ventures require significant investment to gain traction and could either become Stars or Dogs.

Expanding into niche international markets for specialized food service equipment, for example, presents a classic Question Mark scenario. While these markets, like Southeast Asia, show strong growth potential, TriMark's current penetration is minimal, demanding substantial investment in distribution and localized strategies.

Similarly, TriMark's development of proprietary smart kitchen software platforms falls into the Question Mark category. The market is expanding rapidly, with the global smart kitchen appliances market projected to reach over $3.5 billion by 2023 and grow at a CAGR of over 15% through 2030, but TriMark faces stiff competition from established tech firms, necessitating significant R&D investment.

The burgeoning market for food waste reduction consulting also positions TriMark as a Question Mark. This sector, valued at approximately $1 trillion in 2023, offers high growth due to sustainability mandates, but TriMark requires substantial investment to build expertise and offer cutting-edge solutions in a competitive landscape.

| Business Area | Market Growth | TriMark Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Niche International Markets | High | Low | High (Distribution, Localization) | Star or Dog |

| Proprietary Smart Kitchen Software | Very High | Low | Very High (R&D, Marketing) | Star or Dog |

| Food Waste Reduction Consulting | High | Low | High (Expertise, Technology) | Star or Dog |

BCG Matrix Data Sources

TriMark USA's BCG Matrix leverages financial disclosures, market share data, and industry growth forecasts to accurately position each business unit.