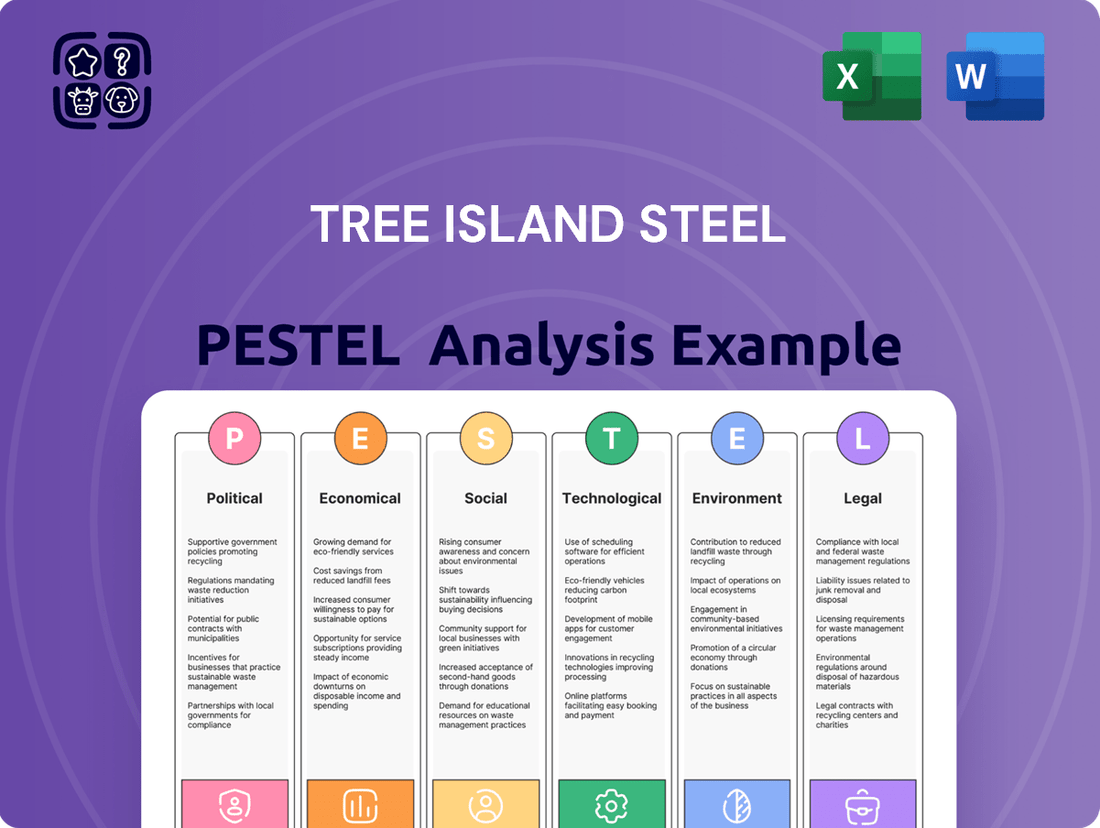

Tree Island Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tree Island Steel Bundle

Political shifts, economic volatility, and emerging social trends all significantly impact Tree Island Steel's operational landscape. Understand the technological advancements and environmental regulations that are redefining the steel industry. Our comprehensive PESTLE analysis unpacks these critical external forces, providing you with actionable intelligence. Equip yourself with the foresight needed to navigate these complexities and secure Tree Island Steel's future success. Download the full analysis now and gain a decisive market advantage.

Political factors

The U.S. imposition of tariffs on Canadian steel products, and Canada's subsequent retaliatory measures, directly affect Tree Island Steel's cross-border business and financial health. These tariffs inflate the cost of essential imported raw materials and diminish the competitiveness of Canadian steel exports to the United States, impacting sales, particularly in sectors like residential construction. For example, U.S. tariffs on Canadian steel have fluctuated, with some initial rates around 25% impacting import costs significantly.

The ongoing trade discussions between the U.S. and Canada, which may lead to modifications in these tariff structures, introduce considerable unpredictability for Tree Island Steel's strategic planning and its ability to access key markets. This uncertainty can hinder long-term investment decisions and supply chain management, as the company navigates potential shifts in market access and cost structures. The steel trade relationship between the two nations remains a critical variable influencing Tree Island Steel's market positioning and revenue streams.

Government infrastructure spending represents a significant tailwind for Tree Island Steel. In 2024, Canada's federal budget allocated over CAD 100 billion towards infrastructure, with a strong emphasis on public transit, clean energy, and social infrastructure. Similarly, the United States' Infrastructure Investment and Jobs Act, enacted in 2021 and continuing its impact through 2025, is injecting hundreds of billions of dollars into roads, bridges, water systems, and broadband expansion.

These public sector investments translate directly into increased demand for steel products. Projects like new highway construction, bridge repairs, and upgrades to water and sewer systems all require substantial quantities of wire, rebar, and fabricated steel components. Tree Island Steel is well-positioned to capitalize on these opportunities, particularly in public works and institutional construction, which are less susceptible to the cyclical downturns seen in residential or commercial building.

The growth in government-backed civil engineering projects is particularly beneficial, providing a stable demand base that can help mitigate volatility in other market segments. For instance, the push for renewable energy infrastructure, such as wind farms and solar installations, also necessitates steel for foundations and support structures, further diversifying Tree Island Steel's revenue streams.

The stability of the regulatory environment is a key political factor for Tree Island Steel, particularly concerning manufacturing and trade policies. Uncertainty in these areas, such as shifts in tariffs or environmental standards, can force expensive operational changes and hinder long-term strategic planning. For instance, if new emission regulations were introduced in 2024 without adequate lead time, Tree Island Steel might face unexpected capital expenditures for compliance.

Political Instability and Elections

Upcoming elections in both Canada and the United States, anticipated in late 2024 and 2025 respectively, introduce a degree of political uncertainty. This instability can impact trade agreements, such as those affecting steel tariffs, and influence government infrastructure spending, a key driver for the construction sector. For instance, a shift in U.S. trade policy could directly affect the cost of imported materials or the competitiveness of exported steel products for Tree Island Steel.

The outcomes of these elections can significantly shape economic sentiment and consumer confidence. A change in government or policy direction might lead to altered fiscal policies, impacting interest rates and overall investment in construction projects. Tree Island Steel must remain agile, ready to adapt its strategies in response to potential shifts in market demand and regulatory environments stemming from these political developments.

- Anticipated Federal Elections: Canada's next federal election is due by October 2025, while the U.S. presidential election is scheduled for November 2024.

- Potential Policy Shifts: Changes in government could lead to revised trade policies, influencing steel import/export dynamics and pricing.

- Infrastructure Spending Impact: Government decisions on large-scale infrastructure projects, often influenced by political priorities, directly affect demand for steel products.

- Economic Sentiment Volatility: Election periods can create market volatility, impacting business investment and consumer spending on construction.

Support for Domestic Manufacturing

Government initiatives focused on bolstering domestic manufacturing can significantly influence Tree Island Steel's market position. Policies like Buy American or Buy Canadian directives are designed to favor domestically produced goods, which directly benefits companies with substantial North American operations like Tree Island Steel. These policies can translate into increased demand for its steel and wire products by creating preferential access to government contracts and projects. For instance, a renewed emphasis on infrastructure spending in the US, often coupled with domestic sourcing requirements, could provide a substantial boost.

The actual impact of these policies hinges on their specific details and how rigorously they are enforced. Tree Island Steel's ability to capitalize on such measures will depend on its competitive pricing, product quality, and capacity to meet any stipulated local content requirements. As of early 2024, many North American governments continue to explore and implement such trade-protective measures, signaling a supportive environment for domestic producers. For example, Canada's federal government has been actively promoting its Buyandsell.gc.ca platform, encouraging procurement from Canadian businesses.

- Government Procurement Policies: 'Buy American' and 'Buy Canadian' initiatives can steer government contracts towards domestic suppliers, benefiting Tree Island Steel.

- Economic Incentives: Tax credits or subsidies for using domestically manufactured steel could lower Tree Island Steel's production costs or increase its competitiveness.

- Infrastructure Investment: Large-scale government infrastructure projects, particularly those with domestic content mandates, directly drive demand for steel products.

- Trade Agreements: While supporting domestic production, governments also balance this with trade agreements, which can affect the competitive landscape for imported steel.

Upcoming elections in Canada (by October 2025) and the U.S. (November 2024) introduce political uncertainty, potentially altering trade policies like steel tariffs and impacting infrastructure spending. These shifts can directly influence Tree Island Steel's operational costs and market access. For instance, a change in U.S. administration could lead to revised Section 232 tariffs on steel imports, affecting raw material costs.

Government infrastructure spending continues to be a significant driver, with Canada's federal budget in 2024 allocating over CAD 100 billion and the U.S. Infrastructure Investment and Jobs Act continuing to inject substantial funds into projects through 2025. These initiatives, favoring domestic procurement, directly boost demand for steel products used in construction and renewable energy projects.

Domestic manufacturing support policies, such as 'Buy American' or 'Buy Canadian', are crucial for Tree Island Steel. These directives can create preferential access to government contracts, increasing demand for its products. The effectiveness of these policies depends on enforcement and local content requirements, with many North American governments exploring such measures in early 2024.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Tree Island Steel, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential threats and opportunities within its operating landscape.

This PESTLE analysis for Tree Island Steel offers a sharp, actionable summary that directly addresses common strategic planning pain points, providing clarity on external factors impacting the business.

It serves as a crucial tool for Tree Island Steel by distilling complex external forces into easily digestible insights, thereby alleviating the burden of lengthy research and analysis for strategic decision-making.

Economic factors

The health of the construction market in North America is a critical factor for Tree Island Steel. In the U.S., while single-family housing starts saw a dip in late 2023 and early 2024 due to higher interest rates, multi-family and non-residential construction, especially for infrastructure and industrial projects, are showing resilience and some growth. For example, U.S. housing starts were projected to be around 1.4 million units in 2024, a slight decrease from 2023 levels, but non-residential construction spending has been robust.

Canada's construction sector presents a more varied picture. While some regions experience slowdowns in residential building, others see increased activity in commercial and infrastructure development. National housing starts in Canada were around 220,000 units annually in early 2024, with significant regional differences. This mixed performance across North America directly impacts the demand for Tree Island Steel's products, affecting sales volumes and revenue.

Tree Island Steel is highly sensitive to the unpredictable swings in raw material prices, especially steel and other metals. These fluctuations directly affect the company's cost of producing goods and, consequently, its profit margins.

In recent periods, the company has experienced squeezed margins, a situation exacerbated by intense competition and the volatile nature of its key input costs. For instance, global steel prices, a primary driver for Tree Island Steel, saw significant volatility throughout 2023 and early 2024, with some benchmarks experiencing double-digit percentage changes within months.

Effectively managing these input cost pressures is not just important; it's absolutely crucial for Tree Island Steel to stay profitable in today's highly competitive market landscape. The ability to forecast and mitigate these cost increases will be a key determinant of its financial performance going forward.

Monetary policy decisions from central banks, like the Bank of Canada and the U.S. Federal Reserve, directly impact borrowing costs. Anticipated interest rate cuts in 2024/2025 could potentially lower financing expenses for Tree Island Steel's clients undertaking construction projects, thereby stimulating economic activity.

However, current elevated mortgage rates, a lingering effect from recent tightening, continue to suppress residential construction demand. This dampening effect on new housing starts directly translates to reduced demand for wire products used in these projects.

The interplay between potential rate reductions and existing high rates creates a nuanced lending environment. While lower rates could encourage investment, the sustained impact of higher borrowing costs on consumer spending and business investment remains a key consideration for the construction sector's outlook.

Competitive Market Pressures

Tree Island Steel navigates a fiercely competitive landscape, where aggressive import pricing significantly impacts its market position. This pressure is particularly acute in residential and industrial sectors, leading to a constant battle for market share and profitability.

These competitive forces translate directly into lower average selling prices for Tree Island Steel's products. For instance, in 2024, the global steel market experienced fluctuations where some regions saw steel prices dip due to oversupply, directly affecting Tree Island Steel's revenue potential.

The consequence of such intense competition is a squeeze on gross profit margins. Tree Island Steel must therefore prioritize strategic cost management initiatives and diligently optimize its product lines to maintain financial health.

Key competitive pressures include:

- Aggressive Import Pricing: Competitors from regions with lower production costs often flood the market, driving down prices.

- General Pricing Pressures: Demand and supply dynamics across various steel applications, from construction to manufacturing, create ongoing pricing challenges.

- Product Differentiation: The need to stand out in a crowded market necessitates investment in product quality and innovation to command better pricing.

- Capacity Utilization: Competitors' production levels and their ability to absorb fixed costs can also influence market pricing strategies.

North American Economic Growth

North American economic growth is a crucial driver for Tree Island Steel. The overall economic expansion rates in both Canada and the United States directly influence the demand for steel and wire products. These products are essential across many sectors, such as construction, agriculture, and various industrial uses. For instance, a robust construction sector, fueled by economic prosperity, translates into higher demand for steel rebar and other structural components.

Economic headwinds can significantly impact Tree Island Steel's performance. A slowdown in GDP growth, which some projections indicated for parts of 2024 and early 2025, can dampen consumer confidence and corporate investment. This reduced spending power directly affects industries that rely on steel products, consequently leading to lower sales volumes and potentially impacting Tree Island Steel's revenue and profit margins. For example, a dip in housing starts or a decrease in capital expenditure by manufacturers would directly reduce the need for Tree Island Steel's offerings.

- Canada's GDP growth was projected to be around 1.6% for 2024, moderating from previous years.

- The United States' GDP growth forecast for 2024 was around 2.1%, showing resilience but potentially slowing from earlier peaks.

- Construction spending in North America is a key indicator; a decline in residential or non-residential construction directly correlates with reduced steel demand.

- Consumer sentiment indices, such as the Conference Board Consumer Confidence Index, often precede changes in spending on durable goods and housing, impacting steel demand.

Interest rate policies significantly influence Tree Island Steel's market. Anticipated interest rate cuts in 2024/2025 could lower financing costs for construction clients, potentially boosting demand. However, current elevated mortgage rates continue to dampen residential construction, directly reducing the need for steel products.

The economic growth trajectory in North America is vital for Tree Island Steel. Projected GDP growth of around 1.6% for Canada and 2.1% for the US in 2024 indicates a moderating but still expanding economy. This overall economic health directly correlates with demand for steel in sectors like construction and manufacturing.

Global steel price volatility remains a key economic factor for Tree Island Steel. Fluctuations in raw material costs, particularly steel, directly impact production expenses and profit margins. For instance, steel prices experienced double-digit percentage shifts within months during 2023 and early 2024, creating margin pressure.

The competitive landscape, characterized by aggressive import pricing, exerts downward pressure on Tree Island Steel's average selling prices. In 2024, oversupply in certain global steel markets led to price dips, affecting potential revenues and squeezing gross profit margins for domestic producers.

Preview Before You Purchase

Tree Island Steel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Tree Island Steel PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape. It's a detailed examination designed to inform your business decisions.

Sociological factors

The availability of skilled labor in North America's manufacturing and construction industries significantly impacts Tree Island Steel. Persistent worker shortages in construction, a key market for steel products, could slow project timelines and increase material demand, while also potentially driving up labor costs.

In Canada's manufacturing sector, job losses have been reported, which could affect the pool of experienced workers available for steel production. This situation may lead to increased operational costs for Tree Island Steel due to higher wages or the need for more extensive training to fill skill gaps.

Tree Island Steel has already taken steps to manage operational costs by reducing its headcount, a move that directly reflects the company's adaptation to evolving labor market conditions and potentially fluctuating demand for its products. This strategic adjustment underscores the sensitivity of the business to workforce availability and cost factors within the broader economy.

Consumer preferences are evolving, with a growing emphasis on sustainability and specific housing types. For instance, the demand for multi-family dwellings has seen a steady rise in many urban centers, potentially impacting the need for certain construction materials compared to single-family home construction.

Tree Island Steel's strategic move to exit unprofitable residential product lines directly reflects an adaptation to these shifting demands. This proactive adjustment aims to align their offerings with current market needs, such as focusing on more in-demand construction segments.

The construction industry, in general, is seeing increased consumer interest in energy-efficient homes and materials with a lower environmental footprint. This trend suggests that manufacturers like Tree Island Steel need to continuously assess and potentially pivot their product development to meet these evolving eco-conscious expectations.

Urbanization and population growth in North America are significant drivers for the construction sector, directly impacting demand for steel products like those offered by Tree Island Steel. As more people move to cities and the overall population expands, there's a consistent need for new homes, offices, and public infrastructure. This trend suggests a robust long-term outlook for construction materials.

While the pace of construction can fluctuate, the underlying demographic shifts are positive for sustained demand. For instance, in 2024, projections indicated continued population increases across major North American urban centers, reinforcing the fundamental need for building materials. This ongoing demand, even with short-term market variations, underpins the strategic importance of urbanization for companies like Tree Island Steel.

Safety Standards and Worker Welfare

Societal expectations and regulatory scrutiny on worker safety are intensifying across the manufacturing sector. Tree Island Steel's commitment to robust safety standards and worker welfare directly impacts its brand reputation and ability to attract and retain talent. For instance, in 2024, the Canadian manufacturing sector saw a lost-time injury frequency rate of approximately 2.8 per 100 full-time workers, highlighting the industry's ongoing focus on safety improvements.

Adherence to stringent safety protocols is not just a matter of compliance but a strategic imperative for Tree Island Steel. It helps mitigate the risk of costly penalties and operational disruptions, while also fostering a more productive and engaged workforce. The financial implications are significant, encompassing investments in advanced safety equipment, comprehensive training programs, and ongoing safety audits.

- Reputational Impact: Strong safety records enhance public perception and stakeholder trust.

- Regulatory Compliance: Meeting or exceeding safety regulations avoids fines and legal challenges.

- Workforce Productivity: A safe work environment reduces absenteeism and boosts employee morale.

- Operational Costs: Investment in safety measures can lead to long-term cost savings through reduced accidents and insurance premiums.

Community Relations and Local Impact

Tree Island Steel’s ability to maintain strong community relations is a cornerstone of its social license to operate. This involves proactively addressing local concerns regarding environmental stewardship, such as emissions and waste management, and ensuring fair employment practices that benefit the surrounding areas. For instance, in 2024, companies in the steel sector faced increased scrutiny over their carbon footprints, making transparent communication about mitigation efforts crucial for community acceptance.

Positive engagement builds trust and can translate into tangible operational advantages. When communities feel valued and involved, they are more likely to support the company's activities, potentially streamlining permitting processes and reducing the risk of operational disruptions. This also aids in attracting and retaining a skilled local workforce, a critical factor for sustainable growth.

- Environmental Stewardship: Addressing community concerns about air and water quality is paramount, especially as regulatory bodies in Canada and the U.S. continue to tighten environmental standards throughout 2024 and into 2025.

- Local Employment: Prioritizing local hiring and providing training opportunities directly contributes to community well-being and strengthens the company's local ties.

- Community Investment: Supporting local initiatives, sponsorships, and educational programs can significantly enhance brand reputation and foster goodwill.

- Transparency: Open communication channels regarding operational impacts and future plans are essential for building and maintaining trust with stakeholders.

Societal expectations regarding worker safety are a significant factor for Tree Island Steel, directly influencing operational costs and brand reputation. In 2024, the Canadian manufacturing sector reported a lost-time injury frequency rate of approximately 2.8 per 100 full-time workers, highlighting the industry's ongoing emphasis on safety improvements.

Tree Island Steel's focus on strong community relations is vital for its social license to operate, particularly concerning environmental stewardship and fair employment. As of 2024, steel sector companies faced heightened scrutiny over their carbon footprints, making transparent communication about mitigation efforts essential for community acceptance and regulatory compliance.

The evolving consumer preference for sustainability and specific housing types, such as multi-family dwellings, impacts Tree Island Steel's product demand. The company's strategic exit from unprofitable residential product lines in response to these shifts demonstrates adaptability to market needs and a focus on more in-demand construction segments.

Technological factors

Automation and digitalization are transforming steel production, and Tree Island Steel is poised to benefit. By adopting advanced technologies, the company can significantly boost efficiency and product quality in its wire manufacturing. For instance, in 2024, the global industrial automation market was valued at approximately $239.4 billion, with a projected compound annual growth rate (CAGR) of 7.7% through 2030, indicating a strong trend towards greater adoption.

Implementing enhanced wire coating processes, coupled with greater automation, can streamline operations and reduce waste, leading to lower costs. Tree Island Steel can leverage these advancements to optimize its production lines, potentially increasing output by 10-15% while simultaneously improving the consistency and durability of its wire products. This competitive edge is crucial in today's market.

Technological advancements are continuously reshaping the steel wire industry. Tree Island Steel, like its competitors, faces opportunities and challenges from ongoing innovation in steel wire production. For instance, the development of high-strength, lighter steel wires is crucial for sectors like automotive and construction, where weight reduction and enhanced durability are paramount. This trend is evident in the growing demand for advanced high-strength steels (AHSS) in vehicles, contributing to fuel efficiency and safety.

Investing in research and development to differentiate products is a vital strategy for maintaining a competitive edge. Companies that can offer specialized wire products with unique properties, such as improved corrosion resistance or specific tensile strengths, can command premium pricing and capture new market niches. For example, the global market for specialty steel is projected to grow, indicating a strong appetite for innovative steel wire solutions.

Innovation also extends to production processes. Automation, advanced manufacturing techniques, and the use of new material compositions can lead to more efficient production, reduced waste, and improved product quality. Companies that embrace these technological shifts are better positioned to meet evolving customer demands and regulatory requirements, particularly concerning sustainability and environmental impact in their manufacturing operations.

The shift towards energy-efficient manufacturing, particularly in steel production, presents a significant technological factor for Tree Island Steel. Embracing technologies like electric arc furnaces (EAFs) or exploring oven alternatives powered by green hydrogen is vital for both cutting operational expenses and lowering carbon emissions. For instance, North America's steel industry, with its substantial adoption of EAFs, demonstrates the potential for these advancements to enhance environmental performance and cost efficiency.

These technological upgrades directly impact a company's environmental footprint and financial health. By adopting more efficient processes, Tree Island Steel can expect to see a reduction in energy consumption, which directly translates to lower utility bills. The integration of green hydrogen as a fuel source, for example, could position the company favorably as regulatory pressures and market demand for sustainable products intensify.

Recycling and Circular Economy Technologies

Technological leaps in recycling and the circular economy are reshaping the steel sector, pushing companies like Tree Island Steel towards greater sustainability. Innovations in scrap steel processing, such as advanced sorting and purification techniques, allow for higher quality recycled content. This directly impacts Tree Island Steel by enabling a reduced dependence on primary raw materials, potentially lowering operational expenditures. For instance, the global steel recycling rate reached approximately 85% in 2023, a testament to these technological advancements and their economic viability.

These advancements are crucial for Tree Island Steel to meet evolving environmental regulations and consumer demands for greener products. By adopting cutting-edge recycling technologies, the company can enhance its environmental, social, and governance (ESG) profile, a critical factor for investors and stakeholders. The potential cost savings are significant; utilizing scrap steel is generally less energy-intensive than producing steel from iron ore. For example, electric arc furnaces (EAFs), which predominantly use scrap, consume up to 75% less energy compared to blast furnaces.

- Advanced Sorting Technologies: AI-powered optical sorters and magnetic separators improve scrap purity, increasing the yield of usable steel.

- Improved Melting and Refining: New furnace designs and slag conditioning techniques enhance energy efficiency and reduce emissions during the recycling process.

- Circular Economy Integration: Technologies facilitating the reuse of by-products and waste streams from steel production create closed-loop systems.

- Digitalization of Supply Chains: Blockchain and IoT platforms are being used to track and manage scrap materials, ensuring quality and transparency.

Data Analytics and Supply Chain Optimization

Data analytics is a game-changer for optimizing supply chains, from where raw materials are found all the way to getting finished products to customers. By analyzing vast amounts of data, companies like Tree Island Steel can pinpoint inefficiencies and cut costs. For instance, the global supply chain management market was valued at approximately USD 23.3 billion in 2023 and is projected to grow significantly, highlighting the widespread adoption of these technologies.

Leveraging real-time data and predictive analytics allows Tree Island Steel to react swiftly to market shifts and manage inventory more effectively. This capability is crucial for maintaining operational resilience, especially in an industry prone to price fluctuations and demand changes. The use of AI in supply chain management alone is expected to reach USD 20.1 billion by 2028, demonstrating its growing importance in predicting and mitigating disruptions.

- Enhanced Efficiency: Data analytics enables precise tracking and forecasting across the supply chain, leading to smoother operations.

- Cost Reduction: Identifying and eliminating waste through data-driven insights directly impacts the bottom line.

- Market Responsiveness: Real-time data allows for agile adjustments to production and distribution in response to market volatility.

- Inventory Management: Predictive analytics helps maintain optimal stock levels, reducing carrying costs and preventing stockouts.

Technological advancements in automation and digitalization are revolutionizing steel production, offering Tree Island Steel significant opportunities for efficiency gains and quality improvements in its wire manufacturing. The global industrial automation market, valued at approximately $239.4 billion in 2024, is expected to grow at a 7.7% CAGR through 2030, underscoring the widespread adoption of these transformative technologies.

Investing in advanced manufacturing techniques, including automation and new material compositions, allows Tree Island Steel to enhance production efficiency, reduce waste, and improve product quality. For example, the development of high-strength, lightweight steel wires is critical for industries like automotive and construction, driven by demand for improved fuel efficiency and structural integrity.

Tree Island Steel can leverage technological innovation to differentiate its product offerings, such as specialized wires with superior corrosion resistance or specific tensile strengths, enabling premium pricing and access to new market segments. The growing global market for specialty steel reflects a strong demand for such innovative solutions.

The adoption of energy-efficient manufacturing technologies, such as electric arc furnaces (EAFs) and the potential use of green hydrogen, is crucial for reducing operational costs and carbon emissions. North America's steel industry, with its high EAF utilization, exemplifies the benefits of these advancements for both environmental performance and cost-effectiveness.

| Technology Area | Impact on Tree Island Steel | Market Data/Trend |

|---|---|---|

| Automation & Digitalization | Increased production efficiency, improved product quality, streamlined operations | Global industrial automation market: $239.4B (2024), 7.7% CAGR (to 2030) |

| Advanced Materials | Development of high-strength, lightweight wires; new market opportunities | Growing demand for advanced high-strength steels (AHSS) in automotive |

| Energy Efficiency | Reduced operational costs, lower carbon emissions | High EAF adoption in North America indicates cost and environmental benefits |

| Data Analytics & Supply Chain | Optimized supply chains, reduced costs, enhanced market responsiveness | Global supply chain management market: $23.3B (2023), AI in supply chain: $20.1B (by 2028) |

Legal factors

International trade agreements and tariffs significantly shape Tree Island Steel's operational environment. Agreements like the United States-Mexico-Canada Agreement (USMCA) facilitate trade among member nations, potentially lowering costs and expanding market access for Tree Island Steel's products. However, ongoing disputes, such as the U.S. tariffs on Canadian steel and aluminum, introduce considerable uncertainty and increased costs for cross-border transactions.

Canada's recent implementation of tariff rate quotas on steel imports from countries not party to free trade agreements adds another layer of complexity. These measures, designed to protect domestic industries, can alter competitive dynamics and influence the sourcing of raw materials or the sale of finished goods. For Tree Island Steel, navigating these varying tariff structures directly impacts their ability to price competitively and secure market share in different regions.

The U.S. tariffs on Canadian steel, which were subject to review and potential adjustments throughout 2024, directly affected Tree Island Steel's export potential and cost of goods sold. For instance, in 2023, the U.S. maintained a 25% tariff on certain steel imports, impacting Canadian producers. The ongoing negotiations and potential retaliatory measures create a dynamic and challenging legal landscape for any steel producer involved in North American trade.

Tree Island Steel operates under strict environmental mandates in both Canada and the United States, covering air emissions, waste handling, and water pollution.

The U.S. Environmental Protection Agency (EPA) recently updated National Emission Standards for Hazardous Air Pollutants for steel manufacturing, impacting compliance timelines and requiring ongoing capital for upgrades.

For instance, in 2024, companies in this sector are facing increased pressure to adopt advanced pollution control technologies to meet evolving standards, potentially adding significant operational costs.

Non-compliance can result in substantial fines and operational disruptions, underscoring the critical nature of environmental stewardship for Tree Island Steel's long-term viability and reputation.

Tree Island Steel must navigate complex labor laws and employment regulations in both Canada and the United States, covering areas like minimum wage, overtime, and workplace safety. For instance, in 2024, Canada’s federal minimum wage stands at $17.30 per hour, with provincial variations. Failure to comply with these standards, such as those outlined in Canada’s Labour Code or the U.S. Fair Labor Standards Act, can lead to significant fines and legal challenges.

Changes in employment standards, such as new parental leave entitlements or modifications to overtime calculations, directly affect operational costs and human resource strategies. Increased enforcement or new regulatory requirements from bodies like Employment and Social Development Canada or the U.S. Department of Labor can necessitate adjustments to payroll, benefits, and training programs, potentially impacting Tree Island Steel's profitability.

The company's recent workforce adjustments, including any headcount reductions, must strictly adhere to all applicable labor laws. This includes proper notice periods, severance pay considerations, and consultation requirements, particularly under Canadian provincial employment standards and U.S. WARN Act provisions if applicable. Non-compliance in these sensitive areas can result in costly litigation and damage to the company's reputation.

Product Standards and Certifications

Tree Island Steel must adhere to stringent national and international product standards and certifications, a legal imperative for its wire and steel products. These standards, covering quality, safety, and performance, are crucial for market acceptance across sectors like construction, agriculture, and industrial manufacturing. For instance, many jurisdictions require steel products used in construction to meet specific tensile strength and composition requirements, often verified through certifications like ASTM or EN standards. Failure to comply not only risks market exclusion but also significant legal liabilities and reputational damage, impacting Tree Island Steel's ability to operate and sell its goods.

Compliance with these regulations is a key market differentiator. For 2024 and into 2025, the emphasis on sustainable and high-performance materials in infrastructure projects is likely to increase demand for certified products. For example, new building codes or updated environmental regulations in key markets could necessitate specific certifications for steel products, influencing Tree Island Steel's product development and market access strategies. This legal framework directly shapes the company's operational requirements and competitive positioning.

Corporate Governance and Reporting Requirements

As a publicly traded entity on the Toronto Stock Exchange (TSX), Tree Island Steel is bound by rigorous corporate governance and financial reporting mandates. This necessitates the punctual release of financial performance updates, such as its Q1 2025 and Full Year 2024 results, ensuring adherence to all applicable securities regulations. Such legal frameworks are crucial for fostering transparency and bolstering investor trust in the company's operations and financial health.

Compliance with these legal factors directly impacts Tree Island Steel's operational integrity and market perception. The company's adherence to these rules is a testament to its commitment to accountability.

- Timely Financial Disclosures: Tree Island Steel must provide regular and accurate financial reports, including its Q1 2025 and Full Year 2024 financial statements, to the market.

- Securities Regulations Compliance: Adherence to TSX and relevant securities commission rules ensures fair trading practices and investor protection.

- Corporate Governance Standards: Implementing robust governance structures, including board oversight and ethical conduct policies, is a legal requirement.

- Transparency and Investor Confidence: Fulfilling these legal obligations builds confidence among shareholders and potential investors, contributing to a stable stock valuation.

Tree Island Steel's operations are significantly influenced by trade agreements and tariffs. For instance, the USMCA facilitates trade but U.S. tariffs on Canadian steel, subject to review in 2024, create cost uncertainty. Canada's tariff rate quotas on steel imports from non-free trade agreement countries also reshape competitive landscapes.

Environmental regulations are stringent, with the U.S. EPA's updated National Emission Standards for Hazardous Air Pollutants for steel manufacturing requiring ongoing capital investment for compliance. In 2024, meeting these evolving standards necessitates advanced pollution control technologies, potentially increasing operational costs.

Labor laws in Canada and the U.S. dictate wages, overtime, and safety. Canada's federal minimum wage in 2024 was $17.30 per hour, with provincial variations, and non-compliance with labor codes can lead to fines. Workforce adjustments must also adhere to legal notice and severance requirements.

The company must meet national and international product standards, such as ASTM or EN certifications for construction steel, which are critical for market access. In 2024-2025, increasing demand for certified, sustainable materials could influence product development and market strategies.

As a TSX-listed company, Tree Island Steel is bound by corporate governance and financial reporting mandates, requiring timely disclosures like its Q1 2025 and Full Year 2024 results to maintain investor trust.

Environmental factors

Tree Island Steel operates within an industry that is a substantial source of global carbon emissions, intensifying pressure to transition towards more sustainable, low-carbon steelmaking processes. North American steel production is increasingly emphasizing electric arc furnace (EAF) technology, which is significantly less carbon-intensive than traditional blast furnace methods, and actively exploring hydrogen-based production pathways as a means to further reduce its environmental footprint. By 2024, North American steelmakers are projected to have a significant portion of their output derived from EAFs, reflecting this technological shift.

The growing market demand for 'green steel,' coupled with supportive government policies and incentives aimed at decarbonization, is compelling significant investments in new technologies and operational changes. This trend is expected to accelerate, requiring companies like Tree Island Steel to allocate capital towards R&D and infrastructure upgrades to meet evolving environmental standards and customer expectations by 2025.

Effective waste management and enhanced recycling of steel scrap are paramount environmental considerations for Tree Island Steel. The global steel industry is increasingly adopting circular economy principles, with recycling practices contributing to a significant volume of recovered steel annually. For instance, in 2023, the steel industry globally recycled approximately 630 million tonnes of steel scrap, a testament to the growing emphasis on resource efficiency.

Implementing robust recycling initiatives not only minimizes Tree Island Steel's environmental footprint but also presents an opportunity to reduce raw material costs. By integrating more recycled content, the company can potentially lower its reliance on virgin iron ore, a commodity subject to price volatility and environmental extraction impacts. This strategic approach aligns with sustainability goals and can improve cost competitiveness in the 2024-2025 period.

The availability and sustainable sourcing of key raw materials like iron ore and various metals pose a significant environmental hurdle for Tree Island Steel. As global awareness of resource limitations grows, the company faces potential cost increases and stricter environmental regulations impacting its supply chain. For instance, the World Steel Association reported that iron ore prices saw fluctuations throughout 2023 and into early 2024, influenced by both demand and supply-side environmental concerns.

Tree Island Steel's operational reliance on these finite resources means that escalating resource scarcity directly translates to higher input costs or increased compliance burdens. This environmental factor necessitates proactive strategies to mitigate these risks. The company's commitment to environmental sustainability hinges on its ability to manage these challenges effectively.

To address these environmental pressures, diversifying raw material sourcing is a crucial strategy. Simultaneously, maximizing resource efficiency throughout its production processes is paramount. By implementing advanced recycling technologies and optimizing material usage, Tree Island Steel can reduce its dependence on virgin resources and lessen its environmental footprint, a critical aspect of its long-term viability.

Water Usage and Pollution Control

Steel production is a thirsty business, and Tree Island Steel, like others in the industry, relies heavily on water for cooling and processing. In 2024, global water scarcity is a growing concern, impacting industries that are significant water consumers. Effective wastewater management is crucial, not just for environmental stewardship but also to meet stringent regulatory requirements concerning discharge quality.

Tree Island Steel must navigate a landscape of evolving environmental regulations. For instance, the European Union's Water Framework Directive sets ambitious goals for water quality, which directly influence industrial operations. Implementing advanced water treatment technologies and focusing on water conservation initiatives are therefore paramount for maintaining operational licenses and minimizing environmental impact.

- Water Intensity: Steel manufacturing can consume thousands of gallons of water per ton of steel produced.

- Wastewater Discharge: Treated wastewater must meet strict pollutant limits before release, often involving complex filtration and chemical treatment.

- Regulatory Compliance: Fines for non-compliance with water discharge permits can be substantial, impacting profitability.

- Conservation Technologies: Investments in closed-loop water systems and recycling technologies can significantly reduce overall water consumption.

Energy Consumption and Renewable Energy Adoption

The energy intensity of steel production is a significant environmental consideration for Tree Island Steel. In 2023, the global steel industry accounted for approximately 7% of global CO2 emissions, highlighting the sector's substantial energy footprint. Tree Island Steel, like its peers, faces increasing stakeholder pressure to reduce its overall energy consumption and actively adopt renewable energy sources.

Transitioning to cleaner energy is crucial for mitigating environmental impact and enhancing sustainability credentials. Tree Island Steel's strategic focus on investing in energy-efficient technologies, such as advanced furnace designs and waste heat recovery systems, directly addresses this challenge. For example, by 2025, many steel manufacturers aim to achieve a 15-20% reduction in energy intensity compared to 2020 levels through such upgrades.

Exploring alternative energy sources, including green hydrogen, presents a long-term opportunity to decarbonize operations. The global market for green hydrogen in industry is projected to grow substantially, with estimates suggesting it could supply up to 24% of global energy demand by 2050. Tree Island Steel's commitment to evaluating and potentially integrating these innovative solutions will be key to its future environmental performance and competitive positioning.

- Energy Intensity: Steel production is inherently energy-intensive, with the sector being a major contributor to global carbon emissions.

- Renewable Adoption Pressure: Stakeholders, including investors and regulators, are increasingly urging steel companies like Tree Island Steel to reduce their reliance on fossil fuels and integrate renewable energy.

- Investment in Efficiency: Tree Island Steel is investing in technologies that improve energy efficiency within its production processes, aiming to lower its overall energy footprint.

- Green Hydrogen Potential: The company is exploring the use of green hydrogen as a cleaner fuel alternative, a move aligned with broader industry trends towards decarbonization.

Tree Island Steel faces growing pressure to adopt sustainable steelmaking processes due to the industry's significant carbon emissions, with North American producers increasingly favoring electric arc furnace (EAF) technology. By 2024, EAFs are projected to account for a substantial portion of North American steel output, a trend driven by market demand for green steel and supportive government policies for decarbonization.

PESTLE Analysis Data Sources

Our Tree Island Steel PESTLE Analysis is informed by a comprehensive review of economic indicators from organizations like Statistics Canada and the Bank of Canada, alongside policy updates from governmental bodies and industry-specific publications.