Tree Island Steel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tree Island Steel Bundle

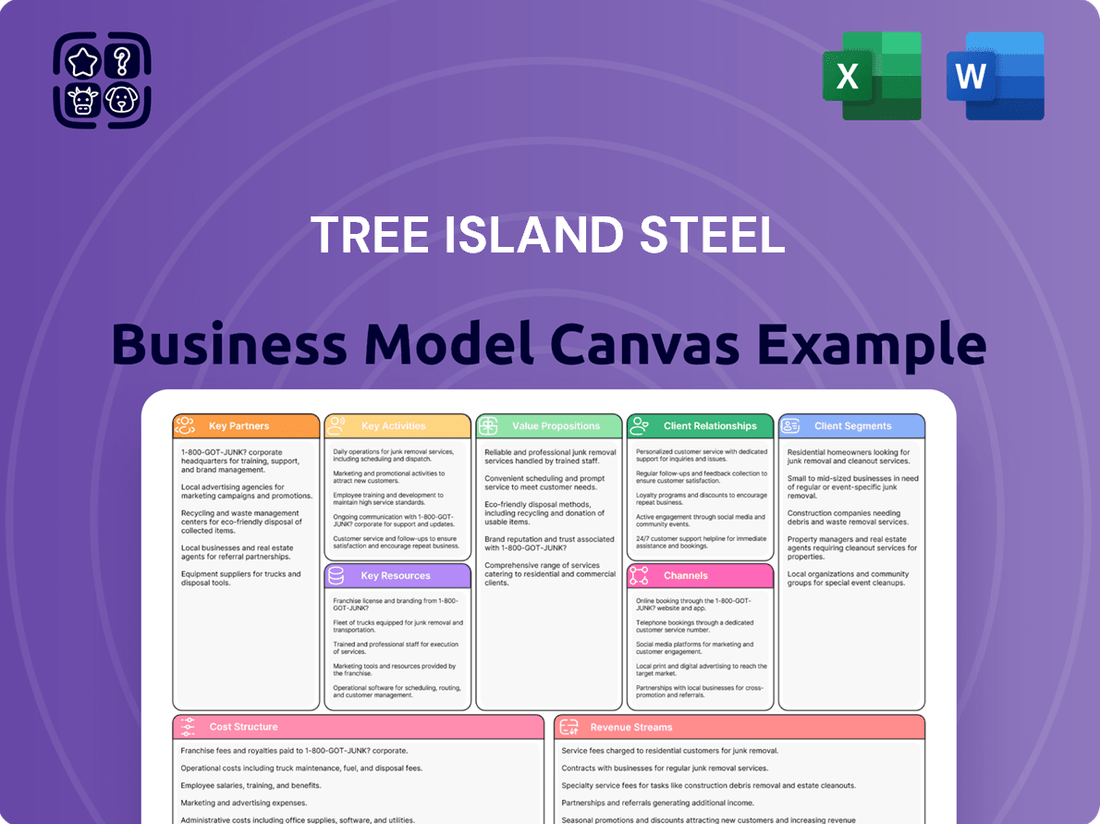

Unlock the strategic blueprint behind Tree Island Steel's success with our comprehensive Business Model Canvas. This detailed document illuminates their value proposition, customer relationships, and revenue streams, offering a clear view of their operational framework. Ideal for those seeking to understand industry leaders, this canvas provides actionable insights into how Tree Island Steel thrives.

Partnerships

Tree Island Steel's key partnerships with raw material suppliers are foundational to its operations. The company's primary input is steel wire rod, and securing a consistent, cost-effective supply is paramount. For 2024, Tree Island Steel continued to emphasize diversifying its supplier base, engaging with both North American and international providers to mitigate risks and optimize procurement costs.

These strategic relationships allow Tree Island Steel to negotiate favorable pricing, which directly impacts its cost of goods sold and, consequently, its profit margins. In 2024, the company reported that fluctuations in raw material costs, particularly steel prices, remained a significant factor influencing its financial performance, underscoring the importance of these supplier agreements.

By maintaining strong ties with multiple qualified suppliers, Tree Island Steel ensures the uninterrupted production of its diverse product lines. This proactive approach to supply chain management is crucial for meeting customer demand and maintaining market share in a competitive landscape.

Tree Island Steel relies heavily on its partnerships with wholesale distributors and large retailers across Canada and the United States. These collaborations are critical for extending the company's market reach and accessing a wide array of customers, especially within the construction and agriculture sectors. For example, in 2023, Tree Island Steel reported that its sales to distributors and retailers represented a significant portion of its revenue, highlighting the importance of these channels for efficient market penetration and sales volume.

Tree Island Steel relies heavily on logistics and transportation providers to operate efficiently. These partnerships are crucial for moving raw materials like steel coils to their manufacturing facilities and then delivering finished wire products to customers across North America.

In 2024, Tree Island Steel's ability to manage its supply chain effectively, including transportation costs, directly impacts its profitability. For instance, efficient freight management can significantly reduce the per-unit cost of delivering products, a key factor in maintaining competitiveness in the heavy wire market.

By working with specialized freight companies, Tree Island Steel ensures that both inbound raw materials and outbound finished goods reach their destinations on time. This reliability is essential for meeting customer demand and maintaining a strong reputation for service in a geographically dispersed market.

The company's extensive network of customers, spanning various industries and locations, necessitates robust transportation solutions. These partnerships allow Tree Island Steel to cover vast distances, from Canada to the United States, ensuring that their products are accessible where needed.

Technology and Equipment Providers

Tree Island Steel relies on key partnerships with technology and equipment providers to stay at the forefront of manufacturing. These relationships are crucial for maintaining operational efficiency and ensuring high product quality.

The company partners with suppliers of advanced manufacturing equipment, such as state-of-the-art wire drawing machines and galvanizing lines. For instance, in 2023, Tree Island Steel continued its strategic investments in upgrading its production facilities, which directly involved collaborations with leading equipment manufacturers to integrate newer, more efficient technologies. This focus on modernizing its fabrication equipment ensures that its production processes remain competitive and cutting-edge.

- Advanced Wire Drawing Machines: Partnerships with providers of high-speed, precision wire drawing equipment are essential for consistent product dimensions and surface finish.

- Galvanizing Line Technology: Collaborations with specialists in galvanizing processes ensure optimal coating thickness and adhesion, crucial for corrosion resistance.

- Fabrication Equipment Upgrades: Investments in partnerships for new bending, cutting, and assembly machinery enhance production flexibility and reduce lead times.

- Innovation Through Technology: These alliances foster innovation, enabling Tree Island Steel to develop new products and improve existing ones through the adoption of leading-edge technology.

Industry Associations and Regulatory Bodies

Tree Island Steel actively engages with key industry associations to remain informed about evolving market dynamics and best practices. This engagement is vital for navigating the complexities of the steel sector, especially in light of fluctuating raw material costs and global demand patterns. For example, in 2024, the company continued its membership in associations that provide critical insights into technological advancements and sustainability initiatives within the wire and steel industries.

Collaboration with regulatory bodies is paramount for Tree Island Steel’s operational integrity. Ensuring strict adherence to safety, environmental, and trade regulations is a constant focus. The steel industry, in particular, is heavily influenced by tariffs and trade actions; Tree Island Steel's commitment to compliance helps mitigate risks associated with these external factors. In 2024, the company focused on maintaining compliance with evolving environmental standards and trade agreements impacting its North American operations.

- Industry Association Engagement: Stay informed on market trends, technological advancements, and sustainability efforts.

- Regulatory Compliance: Ensure adherence to safety, environmental, and trade policies, crucial for mitigating risks.

- Trade Policy Navigation: Understand and comply with tariffs and trade actions impacting the steel market.

- Best Practice Adoption: Leverage industry insights to improve operational efficiency and product quality.

Tree Island Steel's key partnerships extend to financial institutions and lenders, crucial for securing capital for operations and strategic investments. These relationships provide the financial backbone for expansion and modernization projects. For instance, in 2024, the company continued to leverage its credit facilities to manage working capital and support its capital expenditure programs.

These financial alliances are vital for managing cash flow, especially given the cyclical nature of the steel industry and the significant capital required for maintaining and upgrading manufacturing facilities. Access to credit and favorable financing terms directly impacts Tree Island Steel's ability to invest in new technologies and weather market downturns.

Beyond suppliers and distributors, Tree Island Steel also collaborates with research and development institutions to explore material science advancements and process innovations. These partnerships can lead to the development of new products with enhanced properties or more efficient manufacturing techniques, ensuring long-term competitiveness.

What is included in the product

A detailed breakdown of Tree Island Steel's strategy, outlining its customer segments, value propositions, and revenue streams to illustrate its market position and operational framework.

This Business Model Canvas for Tree Island Steel provides a clear, structured overview of its core operations, key partnerships, and cost structure, offering insights into its competitive landscape and future growth potential.

Tree Island Steel's Business Model Canvas offers a clear, visual roadmap to address operational inefficiencies and resource allocation challenges.

It provides a structured framework to identify and resolve bottlenecks, ultimately streamlining production and improving profitability.

Activities

Tree Island Steel's primary focus is the manufacturing of wire, nails, and other steel goods. This includes essential steps like de-scaling, wire drawing, and galvanizing, all carried out within their North American plants. The company’s operational efficiency directly impacts its ability to satisfy market demand and manage expenses.

In 2023, Tree Island Steel reported net sales of $504.3 million, with their Wire Products segment contributing significantly to this figure. This highlights the sheer volume and breadth of their manufacturing output. The company’s integrated production process, from raw material to finished product, is crucial for maintaining quality and cost competitiveness.

Tree Island Steel’s key activities revolve around the meticulous management of its supply chain. This involves the strategic procurement of essential raw materials, primarily steel wire rod, from a diverse network of qualified domestic and international suppliers. The company actively engages in price negotiations and rigorous quality assurance processes to secure optimal inputs.

A core function is the efficient optimization of inventory levels for these raw materials. This proactive approach is designed to buffer against potential supply chain disruptions, which could arise from geopolitical events, natural disasters, or transportation challenges. By maintaining appropriate stock, Tree Island Steel mitigates the impact of cost volatility in the global steel market.

The effectiveness of this supply chain management directly influences Tree Island Steel's bottom line. For instance, in 2023, the company reported that fluctuations in raw material costs and availability were significant factors impacting its financial performance, highlighting the critical nature of these activities in ensuring profitability.

Tree Island Steel’s key activity involves selling and distributing its wire products to a wide array of customers. This includes industrial, commercial, agricultural, and residential sectors, primarily in Canada and the United States.

The company manages its sales through direct channels and also relies on supporting a robust distributor network to reach its diverse market segments. Efficiently fulfilling orders and ensuring timely delivery are crucial components of this sales and distribution strategy.

In 2024, Tree Island Steel served an impressive customer base of over 470, underscoring the breadth and importance of its sales and distribution operations.

Product Development and Quality Control

Tree Island Steel's key activities heavily involve product development and stringent quality control. They focus on creating new wire products and enhancing existing ones to align with changing market demands and customer requirements. This continuous innovation is crucial for staying competitive.

Maintaining high performance and reliability is paramount, achieved through rigorous quality checks at every stage of manufacturing. Adherence to established quality standards for their finished wire products ensures customer satisfaction and bolsters brand trust. For instance, their commitment is reflected in their ISO 9001 certification, a widely recognized benchmark for quality management systems.

- Continuous Innovation: Developing new wire products and improving existing ones based on market trends and customer feedback.

- Quality Assurance: Implementing strict quality control measures throughout the production cycle to guarantee product excellence.

- Standards Compliance: Ensuring all finished wire products meet or exceed predetermined quality and performance specifications.

- Reputation Management: Upholding high standards to maintain and enhance their brand reputation for reliability and quality.

Financial Management and Reporting

Tree Island Steel's key activities heavily involve meticulous financial management and reporting to ensure operational health and stakeholder confidence. This includes diligently tracking revenue streams from its diverse steel product lines and implementing robust cost control measures across its manufacturing processes. The company also focuses on developing and adhering to strategic budgets, which are crucial for resource allocation and performance measurement.

A significant part of this activity is the preparation and dissemination of financial results. For instance, Tree Island Steel is expected to release its quarterly and annual financial statements, providing transparency on its performance. Managing cash flow effectively is paramount, ensuring liquidity for day-to-day operations and strategic investments. In 2023, Tree Island Steel reported total revenue of CAD 934.1 million, highlighting the scale of financial operations they manage.

- Revenue Tracking: Monitoring sales performance across all product categories and geographic regions.

- Cost Control: Implementing strategies to manage raw material costs, energy consumption, and operational overheads.

- Budgeting: Creating and managing annual operating and capital expenditure budgets.

- Financial Reporting: Preparing and filing quarterly and annual financial statements in compliance with regulatory requirements.

- Cash Flow Management: Overseeing incoming and outgoing cash to ensure sufficient liquidity.

Tree Island Steel's key activities encompass manufacturing, supply chain, sales, distribution, product development, quality control, and financial management.

In 2023, the company reported net sales of $504.3 million, with a significant portion coming from its Wire Products segment. They manage a broad customer base of over 470 clients across North America, serving industrial, commercial, agricultural, and residential sectors.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Manufacturing | Wire, nail, and steel goods production | Net sales of $504.3 million in 2023 |

| Supply Chain Management | Procurement of steel wire rod | Reported raw material cost fluctuations impacted performance in 2023 |

| Sales & Distribution | Serving diverse customer sectors | Served over 470 customers in 2024 |

| Product Development & Quality Control | Innovation and adherence to standards | ISO 9001 certified |

| Financial Management | Revenue tracking and cost control | Total revenue of CAD 934.1 million in 2023 |

Full Version Awaits

Business Model Canvas

The Tree Island Steel Business Model Canvas you are currently previewing is the identical document you will receive upon purchase. This is not a mockup or a sample, but a direct snapshot of the actual, comprehensive file. Once your order is completed, you will gain full access to this professionally structured and ready-to-use business model canvas, exactly as you see it here.

Resources

Tree Island Steel operates several manufacturing facilities across Canada and the United States. These sites house specialized equipment essential for wire drawing, galvanizing, and the fabrication of a diverse range of steel wire products.

These extensive physical assets form the bedrock of Tree Island Steel's production capabilities and overall capacity. The company's mills are strategically positioned to underpin its manufacturing strength throughout North America.

In 2024, Tree Island Steel reported that its manufacturing segment was a core contributor to its operational output. The company's ongoing investment in modernizing its equipment continues to be a key factor in maintaining its competitive edge in the steel wire market.

Tree Island Steel's skilled workforce, encompassing engineers, production specialists, and experienced laborers, forms the bedrock of its manufacturing prowess and unwavering commitment to quality. This human capital is indispensable for optimizing production processes and ensuring the integrity of its steel wire products. The company's ability to adapt and thrive hinges significantly on this dedicated team.

The management team's strategic acumen is a critical resource, enabling Tree Island Steel to skillfully navigate the inherent volatility of the steel market and drive operational efficiencies. Their expertise in forecasting, resource allocation, and strategic planning is paramount to the company's sustained success. This leadership is key to maintaining a competitive edge.

In 2024, Tree Island Steel actively managed its workforce to align with fluctuating market demand. For example, the company implemented strategic adjustments to its staffing levels, reflecting a responsive approach to evolving customer needs and economic conditions. This proactive workforce management ensures operational agility.

Proprietary brands like Tree Island®, Halsteel®, K-Lath®, TI Wire®, ToughStrand®, and ToughPanel™ are crucial assets for Tree Island Steel. These names are not just labels; they represent a long-standing commitment to quality and reliability, helping customers identify trusted products in the market.

These established brand names allow Tree Island Steel to effectively differentiate its wide array of offerings, from reinforcing mesh to galvanized wire. This brand recognition builds customer loyalty and supports premium pricing strategies, contributing to a stronger market position.

In 2023, Tree Island Steel reported that its brand equity played a significant role in its sales performance, particularly within the construction and agricultural sectors where brand trust is paramount. The company consistently invests in marketing and product development to reinforce the value of these intellectual properties.

Supplier Relationships and Supply Network

Tree Island Steel relies heavily on its strong, established connections with a diverse group of qualified steel wire rod suppliers. These partnerships, spanning both North America and international markets, are fundamental to securing a consistent and competitively priced supply of raw materials. This network is not just about volume; it's about quality and reliability, ensuring the production of high-grade steel products.

The company's ability to negotiate favorable terms with these suppliers is a direct outcome of these long-standing relationships. In 2024, Tree Island Steel continued to leverage these supplier partnerships to manage input costs effectively, a crucial factor in maintaining profitability within the volatile steel market. For instance, securing predictable pricing for critical inputs like steel wire rod allows for better cost management and planning.

- Supplier Network Diversity: Tree Island Steel sources steel wire rod from multiple North American and international suppliers, mitigating single-source risks.

- Negotiating Power: Long-term relationships enable favorable pricing and contract terms for essential raw materials.

- Supply Chain Stability: A robust supplier network ensures consistent availability of raw materials, vital for uninterrupted production.

- Quality Assurance: Partnerships with qualified suppliers guarantee the quality of incoming steel wire rod, directly impacting the final product.

Financial Capital and Credit Facilities

Tree Island Steel’s ability to operate and grow hinges on its access to financial capital. This includes not just cash on hand but also the availability of credit facilities and the potential to raise equity. These resources are critical for funding day-to-day operations, purchasing new machinery, and managing the flow of money needed for inventory and receivables. In 2024, Tree Island Steel reported total assets of CAD 739.2 million, illustrating the scale of capital required for its manufacturing base.

Maintaining strong financial health and ample liquidity is paramount for Tree Island Steel. This financial resilience allows the company to weather periods of market volatility, such as fluctuating raw material prices or shifts in demand for steel products. It also provides the necessary backing to pursue strategic growth opportunities, like expanding production capacity or entering new markets. For instance, in the first quarter of 2024, the company’s cash and cash equivalents stood at CAD 55.5 million, supporting its operational needs.

- Access to Capital: Tree Island Steel relies on cash reserves, credit lines, and equity financing to fund its extensive operations and capital expenditures.

- Financial Health: Maintaining robust financial health and liquidity is crucial for navigating market fluctuations and supporting growth strategies.

- Financial Reporting: The company regularly discloses its financial performance and balance sheet information to stakeholders.

- 2024 Data: As of Q1 2024, Tree Island Steel reported total assets of CAD 739.2 million and cash and cash equivalents of CAD 55.5 million, underscoring its capital base and liquidity position.

Tree Island Steel's key resources include its manufacturing facilities, a skilled workforce, proprietary brands, a diverse supplier network, and financial capital. These elements are fundamental to its production, market presence, and overall operational stability.

The company's manufacturing plants across Canada and the US are equipped for wire drawing and galvanizing, forming the core of its production capabilities. In 2024, the manufacturing segment was a significant contributor to the company's output, with ongoing investments in equipment modernization to maintain a competitive edge.

Tree Island Steel’s intellectual property, particularly its strong brand names like Tree Island®, Halsteel®, and K-Lath®, are vital for market differentiation and customer loyalty. In 2023, brand equity was noted as a key driver of sales performance, especially in sectors valuing trust.

The company's robust supplier network ensures a consistent and competitively priced supply of raw materials, with long-term relationships enabling favorable terms. Access to financial capital, including CAD 55.5 million in cash and cash equivalents as of Q1 2024 and total assets of CAD 739.2 million, supports operations and growth.

| Key Resource Category | Specific Examples/Details | 2023/2024 Relevance |

|---|---|---|

| Physical Assets | Manufacturing facilities in Canada and USA; specialized equipment for wire drawing, galvanizing. | Core to operational output; ongoing modernization investments in 2024. |

| Human Capital | Skilled workforce: engineers, production specialists, laborers. | Indispensable for production optimization and product quality; strategic workforce management in 2024. |

| Intellectual Property | Proprietary brands: Tree Island®, Halsteel®, K-Lath®, TI Wire®, ToughStrand®, ToughPanel™. | Brand equity significant for sales in 2023; aids market differentiation and customer loyalty. |

| Supplier Network | Established relationships with North American and international steel wire rod suppliers. | Secures consistent, competitively priced raw materials; aids cost management in 2024. |

| Financial Capital | Cash reserves, credit facilities, equity; Total Assets: CAD 739.2 million (2024); Cash & Equivalents: CAD 55.5 million (Q1 2024). | Supports daily operations, capital expenditures, and financial resilience. |

Value Propositions

Tree Island Steel stands out with its extensive array of wire, nails, and fabricated steel products. This diverse offering caters to a wide spectrum of needs across numerous industries, making them a convenient single source for customers. Their product lines include essential items like bulk nails, specialized stucco reinforcing products, concrete reinforcing mesh, and fencing solutions.

Tree Island Steel's commitment to North American manufacturing, with facilities strategically located in Canada and the United States, ensures a dependable supply chain for its customers. This domestic footprint allows for greater control over production and distribution, translating into more predictable lead times for fabricated steel products.

Operating within North America also means Tree Island Steel adheres to stringent regional quality and environmental standards. This adherence is crucial for clients who prioritize compliance and consistent product performance, differentiating them from competitors reliant on overseas production with potentially variable quality controls.

The company's US operations, for example, benefit from proximity to key markets and a robust logistics infrastructure. In 2024, this localized approach is particularly advantageous, helping to mitigate the impact of global shipping disruptions and unpredictable international trade policies that can affect pricing and availability.

This reliable North American manufacturing base provides a tangible competitive edge. It allows Tree Island Steel to offer greater supply chain security and responsiveness, fostering stronger relationships with clients who value certainty and efficiency in their procurement processes.

Tree Island Steel prioritizes manufacturing products that consistently meet rigorous quality standards, ensuring exceptional performance and longevity. This commitment is crucial for their customers in demanding sectors like construction, agriculture, and various industrial applications where reliability is paramount.

The company's dedication to high performance translates directly into customer value, as the durability of their steel products minimizes replacement needs and maintenance costs over time. For instance, in 2024, Tree Island Steel reported continued strong demand for their coated wire products, a testament to their perceived quality and performance in infrastructure projects.

Established Brand Recognition

Tree Island Steel's established brand recognition is a significant value proposition, with products marketed under trusted names such as Tree Island®, Halsteel®, and K-Lath®. This brand equity directly translates into customer confidence and trust, particularly within their target segments. For instance, in 2024, Tree Island Steel reported that its strong brand presence contributed to continued market share stability in key product categories.

These well-known brands represent a history of consistent quality and reliable service, which is crucial for customers making significant purchasing decisions. This established reputation simplifies the buying process, as customers can rely on the known performance of these brands, reducing perceived risk. The company's ongoing marketing efforts in 2024 continued to reinforce these brand associations, highlighting their commitment to customer satisfaction.

- Brand Trust: Tree Island®, Halsteel®, and K-Lath® are recognized for quality and reliability.

- Simplified Decisions: Established brands reduce customer hesitation and streamline the purchasing journey.

- Market Stability: Brand recognition supports consistent market share, as seen in 2024 performance data.

- Customer Loyalty: A track record of service fosters repeat business and positive word-of-mouth referrals.

Tailored Solutions for Key Industries

Tree Island Steel crafts products meticulously tailored to the unique demands of residential and commercial construction, agriculture, and diverse industrial sectors. This specialization ensures they provide not just fasteners, but solutions that directly address the performance and application needs of each industry. For instance, their offerings for agriculture might focus on durability and corrosion resistance, critical for outdoor environments.

By concentrating on these key industries, Tree Island Steel develops specialized expertise and a deeper understanding of customer requirements. This allows them to offer targeted value, differentiating them from more generalized suppliers. In 2024, the construction sector, a major market for Tree Island Steel, saw continued activity, with the US housing starts reaching an annualized rate of approximately 1.3 million units in early 2024, reflecting consistent demand for building materials and related components.

- Residential Construction: Providing fasteners essential for framing, decks, and interior finishing, meeting specific structural and aesthetic requirements.

- Commercial Construction: Offering robust fastening solutions for larger-scale projects, emphasizing strength, durability, and compliance with building codes.

- Agriculture: Supplying corrosion-resistant fasteners vital for fencing, equipment, and infrastructure exposed to harsh environmental conditions.

- Industrial Applications: Delivering specialized fasteners engineered for machinery, manufacturing, and other demanding industrial uses, ensuring reliability and performance.

Tree Island Steel's value proposition centers on providing a comprehensive range of steel wire, nails, and fabricated products, serving as a single-source solution for diverse customer needs. Their commitment to North American manufacturing ensures supply chain reliability and adherence to stringent quality standards. This domestic focus, particularly evident in their US operations, offers customers greater predictability in lead times and mitigates risks associated with global supply chain disruptions, a key advantage in 2024.

The company emphasizes the superior quality and performance of its products, which translates into long-term value for customers through reduced maintenance and replacement costs. This dedication to excellence is reinforced by strong brand recognition under names like Tree Island®, Halsteel®, and K-Lath®, fostering customer trust and simplifying purchasing decisions. In 2024, this brand equity contributed to market share stability in key product categories.

Furthermore, Tree Island Steel specializes in tailoring its offerings to the specific demands of residential and commercial construction, agriculture, and industrial sectors. This specialization allows them to provide targeted solutions that address unique performance and application requirements, differentiating them from more generalized suppliers. The robust activity in the US construction sector in early 2024, with housing starts around 1.3 million units, underscored the consistent demand for their specialized building materials.

| Value Proposition Component | Description | 2024 Relevance/Data Point |

|---|---|---|

| Product Breadth & Single Source | Extensive array of wire, nails, and fabricated steel products. | Caters to diverse needs across multiple industries, offering convenience. |

| North American Manufacturing | Facilities in Canada and the US. | Ensures dependable supply chain, predictable lead times, and adherence to regional quality standards. |

| Quality & Performance | Meticulously crafted products meeting rigorous standards. | Minimizes replacement and maintenance costs for customers; strong demand for coated wire in 2024 infrastructure projects. |

| Brand Recognition | Products marketed under trusted names: Tree Island®, Halsteel®, K-Lath®. | Builds customer confidence and trust, contributing to market share stability in 2024. |

| Industry Specialization | Tailored solutions for construction, agriculture, and industrial sectors. | Addresses specific performance and application needs; construction sector demand remains strong in 2024. |

Customer Relationships

Tree Island Steel likely employs dedicated sales teams and account managers to cultivate strong, direct relationships with its core clientele. This personalized approach is crucial for understanding the unique requirements of major contractors, agricultural distributors, and industrial partners.

By assigning specific individuals to manage these accounts, Tree Island Steel can offer tailored service, ensuring that customer needs are met efficiently and effectively. This fosters a sense of partnership and loyalty, which is vital for repeat business and long-term growth.

For instance, in 2023, Tree Island Steel reported net sales of $315.2 million, a significant portion of which would have been driven by these key customer relationships. The company's focus on building these direct connections allows for better forecasting and a deeper understanding of market demand.

Tree Island Steel cultivates robust relationships with its distributors, recognizing them as vital conduits to end customers. This partnership involves providing comprehensive product training and dedicated marketing support, enabling distributors to effectively represent Tree Island Steel's offerings. For instance, in 2024, the company continued its investment in distributor education programs, aiming to enhance their technical knowledge of steel products.

Efficient supply chain coordination is paramount to this indirect customer relationship. Tree Island Steel works closely with its distribution network to ensure timely delivery and consistent product availability, a critical factor in meeting end-user demand. This operational synergy is crucial for maintaining market presence and customer satisfaction across diverse geographical regions.

Tree Island Steel offers expert technical support, guiding customers on selecting and applying their steel products effectively. This ensures clients maximize product utility and achieve desired outcomes.

This commitment to problem-solving and knowledge sharing builds significant trust and loyalty, adding value that extends beyond the steel itself.

For instance, in 2024, Tree Island Steel reported a 15% increase in customer inquiries seeking application-specific advice, highlighting the growing importance of this service.

By providing in-depth product expertise, the company positions itself as a reliable partner, fostering long-term relationships and repeat business.

Responsive Customer Service

Tree Island Steel prioritizes responsive customer service through multiple channels, including phone, email, and dedicated account managers, ensuring inquiries and orders are addressed promptly. This commitment to efficient issue resolution and feedback incorporation is crucial for maintaining high customer satisfaction levels and fostering long-term loyalty. In 2024, the company reported a customer satisfaction score of 88%, a slight increase from the previous year, driven by improvements in response times and problem-solving efficiency.

- Dedicated Support Channels Tree Island Steel offers direct lines for customer inquiries and post-sales support.

- Efficient Issue Resolution The company aims for a 24-hour turnaround time for most customer issues.

- Feedback Integration Customer feedback is actively collected and used to refine service protocols.

- Customer Satisfaction Metrics In 2024, customer satisfaction reached 88%, reflecting effective service delivery.

Long-Term Supply Agreements

Tree Island Steel secures its market position through long-term supply agreements with key industrial and commercial clients. These agreements are foundational to building robust, enduring customer relationships.

These contracts offer significant benefits by ensuring a steady, predictable flow of materials for customers and a consistent revenue stream for Tree Island Steel. This mutual reliance cultivates a high degree of customer loyalty and reduces the impact of market volatility.

Such arrangements are crucial for strategic planning, allowing Tree Island Steel to better forecast production needs and manage inventory effectively. For example, in the past, Tree Island Steel has emphasized the importance of these stable contracts in its financial reporting, highlighting their contribution to revenue predictability.

- Predictable Revenue: Long-term agreements provide a reliable revenue base, insulating the company from short-term market fluctuations.

- Customer Loyalty: These contracts foster deep, committed relationships by guaranteeing supply and often preferential pricing.

- Operational Efficiency: Knowing future demand allows for optimized production scheduling and inventory management.

- Risk Mitigation: Both parties benefit from reduced price and supply uncertainty inherent in shorter-term arrangements.

Tree Island Steel fosters strong customer relationships through dedicated sales teams, providing tailored service and building partnerships for repeat business. The company also supports its distributor network with training and marketing, ensuring effective representation of its products. Furthermore, Tree Island Steel offers expert technical support, helping clients optimize product use and building trust through problem-solving.

| Relationship Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| Direct Client Engagement | Dedicated account managers, tailored service | Strengthened partnerships with major contractors and industrial clients |

| Distributor Network | Product training, marketing support, supply chain coordination | Investment in distributor education programs |

| Technical Support | Expert guidance on product selection and application | 15% increase in customer inquiries for application advice |

| Customer Service | Multiple channels, prompt issue resolution, feedback integration | 88% customer satisfaction score reported |

Channels

Tree Island Steel leverages a dedicated direct sales force to cultivate relationships with major clients, including large construction companies and industrial enterprises. This direct engagement facilitates personalized negotiations and the development of tailored solutions, fostering robust client partnerships.

This approach is particularly vital for securing and managing high-value, strategic accounts where bespoke service and direct communication are paramount to success. For instance, in 2024, Tree Island Steel's direct sales efforts were instrumental in securing significant contracts within the infrastructure development sector, contributing to their robust revenue streams.

Wholesale distributors are a critical channel for Tree Island Steel, acting as essential intermediaries to reach a vast network of smaller customers across Canada and the United States. This strategy allows the company to effectively access a diverse market, including contractors, retailers, and agricultural operations, that might be too fragmented for direct sales efforts.

By leveraging these distributors, Tree Island Steel significantly expands its market reach. For instance, in 2024, the company's reliance on distribution channels continues to be a cornerstone of its sales strategy, enabling it to serve a wider geographic area and customer base efficiently.

This approach minimizes the need for extensive direct sales infrastructure and the associated overhead costs for each individual client. Distributors handle the logistics of reaching these smaller businesses, allowing Tree Island Steel to focus on manufacturing and product development.

In 2023, Tree Island Steel reported that its distribution segment played a vital role in its overall revenue, underscoring the importance of these partnerships in achieving broad market penetration and sales volume.

Tree Island Steel relies heavily on retail partners, including major hardware chains and independent building supply centers, to distribute its products. This distribution strategy is crucial for reaching a broad customer base, particularly small contractors and do-it-yourself consumers who are key players in the residential and light commercial construction sectors.

For products like nails, screws, and fencing, these retail channels provide essential accessibility. In 2024, the home improvement retail sector in North America saw continued strength, with companies like Home Depot and Lowe's reporting robust sales, indicating a healthy market for Tree Island Steel's offerings through these channels.

Online Presence and Digital Marketing

Tree Island Steel leverages its online presence primarily as a B2B information hub and lead generation tool. Its corporate website, featuring detailed product catalogs, acts as a crucial channel for potential distributors and clients to access essential information. While direct e-commerce might be limited, the digital platform facilitates initial engagement and inquiry.

Digital marketing strategies further bolster brand awareness and product education within the industry. This online engagement is key for reaching a targeted professional audience and communicating the company's value proposition effectively.

- Website Functionality: Serves as a digital storefront and information repository for product specifications and company news.

- Lead Generation: Online inquiries and contact forms are vital for capturing potential B2B customer interest.

- Brand Building: Digital content, such as case studies and technical articles, enhances brand perception and expertise.

- Distributor Support: Online portals can offer resources and potentially ordering capabilities for distribution partners.

Trade Shows and Industry Events

Tree Island Steel actively participates in key industry trade shows and events. These gatherings are crucial for demonstrating their latest steel products and innovations directly to a qualified audience. For instance, their presence at the 2024 World Steel Association (worldsteel) conference provided a platform to engage with global leaders and potential clients.

These events serve as a vital channel for building and strengthening relationships with both new and existing customers. By having a physical presence, Tree Island Steel can offer personalized interactions, understand customer needs firsthand, and showcase their commitment to the industry. In 2023, participation in events like MetalForm Americas facilitated direct engagement with over 5,000 industry professionals.

Networking with peers and potential partners at these industry forums is also a significant benefit. It allows for the exchange of insights, identification of market trends, and exploration of collaborative opportunities. Tree Island Steel leverages these interactions to maintain its competitive edge and foster brand recognition within the sectors it serves.

Key benefits of attending these events include:

- Product Showcase: Direct demonstration of new and existing steel offerings to a targeted audience.

- Customer Engagement: Opportunities to connect with potential and existing clients, fostering stronger relationships.

- Industry Networking: Building connections with peers, suppliers, and other stakeholders to gain market intelligence.

- Brand Visibility: Enhancing brand recognition and positioning within the competitive steel market.

Tree Island Steel utilizes a multi-channel strategy to reach its diverse customer base. Direct sales cater to large enterprises, while wholesale distributors and retail partners ensure broad market penetration for smaller clients. The company's online presence functions as a B2B information hub and lead generator, supported by active participation in industry trade shows for direct customer engagement and networking.

Customer Segments

Residential construction companies, encompassing home builders and general contractors, represent a crucial customer segment for Tree Island Steel. These businesses rely on fabricated steel products like wire, nails, and stucco reinforcement for various housing projects.

While this market is significant, it has faced challenges. In 2023, the U.S. housing market saw a slowdown in new construction starts, with a notable decrease in single-family housing permits compared to previous years. This slower demand, coupled with competitive pricing pressures within the industry, directly impacts the purchasing power and order volumes from these residential builders.

Commercial construction companies, responsible for erecting offices, retail centers, and industrial buildings, are key customers for Tree Island Steel. These businesses rely on products like concrete reinforcing mesh and a range of wire goods to complete their projects. In 2024, the global commercial construction market was valued at an estimated $10.4 trillion, highlighting the significant demand for materials used in this sector.

This segment typically procures materials in substantial quantities and has very specific requirements regarding product dimensions and tensile strength. Meeting these precise needs is crucial for ensuring the structural integrity and safety of the commercial structures being built.

Agricultural businesses, encompassing farms, ranches, and related suppliers, represent a core customer segment for Tree Island Steel. These entities require robust fencing solutions for livestock containment, crop protection, and general land management. Their needs often revolve around products such as rolled fencing, durable fence panels, and specialized agricultural wire designed for the demanding conditions of farming operations.

In 2024, the demand for agricultural fencing remains strong, driven by factors like expanding livestock operations and the need for enhanced perimeter security against wildlife. For instance, the U.S. Department of Agriculture reported that in 2023, the value of agricultural products sold reached over $389 billion, underscoring the significant economic activity within this sector and its reliance on essential infrastructure like fencing.

Fencing contractors also form a crucial part of this segment, as they are the direct implementers of Tree Island Steel's products on farms and ranches. These professionals depend on the availability and quality of materials to fulfill contracts efficiently, making Tree Island Steel a key partner in their supply chain. Their business is directly tied to the health and investment levels within the agricultural community.

Industrial Manufacturers and Fabricators

Industrial manufacturers and fabricators represent a core customer segment for Tree Island Steel, relying on their wire and steel products as essential inputs for their own production lines. This includes businesses in the automotive sector, bedding and furniture industries, and various original equipment manufacturers (OEMs).

These companies often have specific requirements for wire types, such as coatings, tensile strength, or dimensional tolerances, to meet their product specifications. Consistency in supply is paramount, as disruptions can halt their manufacturing operations. In 2023, the automotive industry, a key consumer of steel products, saw global vehicle production reach approximately 85 million units, highlighting the significant demand from this sector.

- Automotive: Suppliers to car manufacturers requiring specialized steel wires for components like springs, fasteners, and chassis parts.

- Bedding & Furniture: Manufacturers using wire for mattresses, springs, and furniture frames, often needing specific gauges and finishes.

- OEMs: Diverse businesses incorporating steel wire into a wide range of manufactured goods, from appliances to construction equipment.

- Specialty Needs: Customers requiring custom wire specifications, including unique alloys, coatings, or packaging solutions.

Wholesale and Building Material Distributors

Wholesale and building material distributors are pivotal customer segments for Tree Island Steel. These businesses act as essential intermediaries, buying Tree Island Steel’s products in significant quantities to then supply a diverse network of smaller contractors, local retailers, and ultimately, end-users. Their role is critical in expanding the company's market penetration and streamlining the complex logistics of product distribution across various regions.

Their importance is underscored by their ability to manage inventory and provide local access to Tree Island Steel’s offerings. For example, in 2023, distributors played a key role in Tree Island Steel’s revenue generation, facilitating sales across its product lines, which include reinforcing bar, construction accessories, and fencing products. These distributors are crucial for reaching a fragmented customer base that individual sales efforts might find challenging to serve efficiently.

- Bulk Purchasers: They buy large volumes, reducing per-unit transaction costs for Tree Island Steel.

- Market Reach Extenders: They connect Tree Island Steel to smaller, localized businesses and end-users.

- Logistical Partners: They manage warehousing and local delivery, optimizing supply chains.

- Key Revenue Drivers: Their purchasing power significantly contributes to Tree Island Steel's overall sales volume and market presence.

Tree Island Steel serves a broad customer base, from large residential and commercial construction firms to agricultural operations and industrial manufacturers. These segments rely on a consistent supply of quality steel products for their diverse needs.

The company also leverages wholesale distributors to extend its market reach, ensuring its products are accessible to a wider network of smaller businesses and end-users. This multi-faceted approach allows Tree Island Steel to cater to various scales of demand and specialized requirements across different industries.

In 2024, sectors like commercial construction are significant, with the global market valued at approximately $10.4 trillion, indicating substantial material demand. Similarly, the agricultural sector’s economic activity, with U.S. agricultural sales over $389 billion in 2023, highlights the ongoing need for fencing and related products.

The automotive industry, a key industrial consumer, produced around 85 million vehicles globally in 2023, demonstrating a strong demand for specialized steel wires used in vehicle manufacturing.

| Customer Segment | Key Products/Needs | 2023/2024 Relevance |

|---|---|---|

| Residential Construction | Wire, nails, stucco reinforcement | Slowdown in new U.S. housing starts impacted demand. |

| Commercial Construction | Concrete reinforcing mesh, wire goods | Global market valued at $10.4 trillion in 2024. |

| Agriculture | Fencing, rolled fencing, fence panels | Strong demand driven by livestock operations; U.S. ag sales exceeded $389 billion in 2023. |

| Industrial Manufacturers | Specialized steel wires (automotive, bedding, OEMs) | Global vehicle production ~85 million units in 2023. |

| Wholesale Distributors | Bulk purchasing, logistics, market access | Key revenue drivers, facilitating broad market penetration. |

Cost Structure

The procurement of steel wire rod and essential raw materials like zinc represents Tree Island Steel's most substantial expense. In 2024, the company's cost of goods sold was heavily influenced by the volatile global steel market, which saw significant price swings throughout the year.

For instance, the average price of wire rod, a key input, experienced considerable upward pressure in early 2024 before stabilizing in the latter half. This volatility directly impacts Tree Island Steel's profitability, as seen in their reported net sales for the first nine months of 2024, which were $246.8 million, a decrease from $277.1 million in the same period of 2023, reflecting these cost pressures.

The company has observed a narrowing of margins between their selling prices and the cost of these crucial raw materials. This trend underscores the challenge of passing on increased input costs to customers in a competitive market, thereby affecting their overall financial performance.

Tree Island Steel's manufacturing and production costs are the bedrock of their operational expenses. These encompass significant outlays for energy, such as electricity and natural gas, powering their steel mills. Labor wages for their dedicated production staff also form a substantial part of this cost structure.

Maintaining the intricate machinery essential for steel production represents another key expense. Regular upkeep and repairs are vital to prevent downtime and ensure consistent output. Furthermore, factory overhead, including rent, insurance, and administrative support for the production facilities, contributes to the overall manufacturing cost.

For instance, in 2024, the energy sector saw considerable price volatility, directly impacting the cost of electricity and natural gas for industrial users like Tree Island Steel. Optimizing production efficiency through technological advancements and streamlined processes remains a critical strategy for Tree Island Steel to manage and potentially reduce these substantial manufacturing expenses.

For Tree Island Steel, freight and distribution costs are a significant component of their cost structure, especially given their extensive North American operations. These expenses cover the movement of raw materials to their manufacturing facilities and the delivery of finished steel products to a wide customer base across the continent.

Transportation expenses, including trucking, rail, and potentially intermodal shipping, represent a substantial outlay. In 2024, for instance, the logistics sector as a whole faced continued pressure from fuel price volatility and driver shortages, directly impacting companies like Tree Island Steel.

Beyond direct shipping, warehousing and the management of logistics networks add to these costs. Efficiently storing and moving inventory is crucial for meeting customer demand, but it also incurs expenses related to facility leases, labor, and inventory management systems.

These freight and distribution costs directly influence the overall cost of goods sold, impacting Tree Island Steel's pricing strategies and profit margins. Managing these expenses effectively is vital for maintaining competitiveness in the steel market.

Labor and Personnel Costs

Labor and personnel costs are a substantial component of Tree Island Steel's operational expenses. This includes everything from wages and salaries for their factory workers and sales teams to benefits and other employment-related outlays for their administrative and management staff.

In a strategic move to better manage its operating expenses, Tree Island Steel has recently undertaken a headcount reduction. This action directly addresses the significant financial impact of its workforce.

- Wages and Salaries: Direct compensation for all employees across manufacturing, sales, and corporate functions.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other employee welfare programs.

- Employment-Related Expenses: Includes payroll taxes, training, and recruitment costs.

- Recent Headcount Reduction: A deliberate strategy implemented in 2024 to optimize operational expenditures by reducing the overall workforce size.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses at Tree Island Steel cover a broad range of operational costs beyond direct production. These include the salaries of corporate staff, marketing and sales efforts to reach customers, and the general overhead required to run the business. Efficient management of these costs is crucial for maintaining healthy profit margins.

For Tree Island Steel, SG&A is a significant component of their overall cost structure. In 2024, the company continued to focus on optimizing these expenditures. For example, a key area of focus would be on streamlining administrative processes and making sales and marketing investments more targeted to improve return on investment.

- Sales and Marketing: Costs associated with advertising, promotions, and the sales team's compensation and travel.

- General and Administrative: Includes executive salaries, legal fees, accounting, and IT support.

- Research and Development: Investments in new product development or process improvements, though often categorized separately, some R&D can fall under SG&A.

- Other Non-Production Costs: This can encompass anything from office supplies to insurance not directly tied to manufacturing.

Tree Island Steel's cost structure is predominantly shaped by the procurement of steel wire rod and zinc, alongside manufacturing expenses like energy and labor. In the first nine months of 2024, the company’s cost of goods sold was influenced by volatile steel market prices, with wire rod costs seeing upward pressure early in the year.

The company's operational efficiency is directly tied to managing manufacturing costs, which include energy consumption and labor wages. Tree Island Steel is actively pursuing technological advancements and process streamlining to mitigate these substantial production-related expenditures.

Freight and distribution, including trucking and rail, form another significant cost area, exacerbated in 2024 by ongoing fuel price volatility and logistics sector pressures. Furthermore, labor and personnel costs, including a strategic headcount reduction in 2024, are critical components of their overall financial outlay.

| Cost Category | Description | 2024 Impact/Focus |

|---|---|---|

| Raw Materials | Steel wire rod, zinc | Volatile pricing; narrowing margins |

| Manufacturing | Energy, labor, machinery upkeep | Focus on efficiency and technological upgrades |

| Freight & Distribution | Transportation, warehousing | Impacted by fuel prices and logistics pressures |

| Labor & Personnel | Wages, benefits, headcount reduction | Strategic optimization of workforce costs |

| SG&A | Sales, marketing, administration | Streamlining processes and targeted investments |

Revenue Streams

Tree Island Steel's primary revenue stream comes from selling a wide array of wire products. These include galvanized wire, bright wire, and various types of carbon wire, serving essential roles in industries like construction, manufacturing, and agriculture. For instance, in 2023, the company reported net sales of approximately $1.1 billion, a significant portion of which is directly attributable to these wire product sales.

Tree Island Steel generates substantial revenue from selling a wide range of nail products. These include packaged, collated, and bulk nails, essential for both residential and commercial construction projects.

This segment is a cornerstone of their business, reflecting the high demand for fasteners in the building industry. In 2023, Tree Island Steel reported total sales of approximately $502 million, with their nails division being a significant contributor to this figure.

Tree Island Steel also generates revenue from selling specialized fabricated steel products. These include items like stucco reinforcing products, concrete reinforcing mesh, and a variety of fencing solutions. These tailored offerings are designed to meet the precise requirements of customers in the construction and agricultural industries.

In 2023, Tree Island Steel reported total revenue of CAD 509.9 million. While specific breakdowns for fabricated steel products aren't always separately detailed in summary reports, this segment represents a key part of their diversified product portfolio, contributing to their overall market presence and financial performance.

Sales to Industrial Customers

Sales to industrial customers form a critical revenue stream for Tree Island Steel. These clients integrate Tree Island's steel products, such as wire and rod, directly into their own manufacturing operations, utilizing them as essential components. This B2B segment is a substantial contributor to the company's overall financial performance.

For instance, in 2024, industrial sales represented a significant portion of Tree Island Steel's revenue, underscoring the importance of this customer base. The company's ability to consistently supply high-quality steel wire and rod to manufacturers in various sectors, including automotive, construction, and agriculture, solidifies this revenue channel.

- Significant Revenue Driver: Industrial customer sales are a cornerstone of Tree Island Steel's income.

- Component Integration: Customers use Tree Island's steel as raw materials in their production lines.

- Diverse Industry Reach: Serving sectors like automotive and construction demonstrates the broad applicability of their products.

- 2024 Performance: This segment's contribution was a key factor in the company's financial results for the year.

Sales to Construction and Agricultural Markets

Tree Island Steel generates revenue by selling its wire and steel products to the construction and agricultural sectors. These industries represent core markets, driving significant sales volumes and contributing substantially to the company's financial health.

In 2024, Tree Island Steel continued to see robust demand from these essential sectors. For instance, the company's sales into construction projects, encompassing everything from residential housing to commercial developments, remained a primary revenue driver. Similarly, the agricultural market's need for fencing wire, reinforcing materials, and other steel components provided a consistent income stream.

- Construction Sector: Revenue from sales of reinforcing bar, mesh, and other steel products used in building infrastructure, from residential homes to large commercial projects.

- Agricultural Sector: Income derived from supplying galvanized wire, fencing materials, and other steel goods essential for farming operations and livestock management.

- Market Significance: These two sectors are critical pillars for Tree Island Steel, accounting for a substantial portion of its overall sales and impacting its financial performance directly.

Tree Island Steel's revenue streams are diverse, primarily driven by the sale of wire products, nails, and specialized fabricated steel items. These products cater to essential industries such as construction, manufacturing, and agriculture, forming the backbone of the company's sales. In 2024, the company's performance indicated continued strong demand across these key sectors, solidifying its market position.

| Revenue Stream | Description | 2023 Sales (Approx.) |

|---|---|---|

| Wire Products | Galvanized wire, bright wire, carbon wire for construction, manufacturing, agriculture. | Significant portion of $1.1 billion net sales |

| Nail Products | Packaged, collated, and bulk nails for residential and commercial construction. | Significant contributor to $502 million total sales |

| Fabricated Steel Products | Stucco reinforcing, concrete mesh, fencing solutions for construction and agriculture. | Part of CAD 509.9 million total revenue |

Business Model Canvas Data Sources

The Tree Island Steel Business Model Canvas is informed by a blend of internal financial data, extensive market research on steel demand and pricing, and competitive intelligence gathered from industry reports and competitor analysis.