Tree Island Steel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tree Island Steel Bundle

Tree Island Steel operates in a challenging environment, facing significant bargaining power from its buyers due to industry consolidation and the availability of alternatives. The threat of new entrants, while moderate, requires continuous innovation and cost management. Understanding these dynamics is crucial for any stakeholder.

The intensity of rivalry among existing competitors is a key factor, with price sensitivity and product differentiation playing vital roles in Tree Island Steel's market. The threat of substitute products also adds pressure, forcing the company to maintain a competitive edge through efficiency and customer service.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Tree Island Steel’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Tree Island Steel is significantly influenced by the volatility of its primary raw material: steel wire rod. The price of steel wire rod in North America has seen notable swings. For instance, after a period of increases, late 2024 and early 2025 experienced a downward price trend. This was attributed to an oversupply in the market coupled with weaker demand.

This price fluctuation directly impacts Tree Island Steel's cost structure and profitability. When suppliers can command higher prices due to sudden market shifts or supply constraints, their bargaining power increases. Conversely, periods of oversupply can temporarily weaken supplier power, offering Tree Island Steel a potential cost advantage if they can secure favorable terms.

Supplier concentration for Tree Island Steel's key inputs, such as steel wire rod, can be a significant factor. If the market is dominated by a few large suppliers, especially for specialized grades of steel, these suppliers can wield considerable power. This concentration means Tree Island Steel may face fewer alternatives, potentially leading to higher prices or less favorable payment terms.

For instance, if only a handful of companies produce the specific high-quality steel wire rod required for certain applications, they can dictate terms more effectively. This situation was observed in some segments of the steel market in 2024, where supply chain disruptions and increased demand for specific alloys led to price hikes from concentrated supplier bases.

While Tree Island Steel may have strategies to mitigate this, such as diversifying its supplier base globally or entering into long-term contracts, the underlying market structure remains crucial. A high degree of supplier concentration inherently tips the scales in favor of the suppliers, reducing Tree Island Steel's bargaining leverage and potentially impacting its cost of goods sold.

Tree Island Steel faces moderate switching costs when changing raw material suppliers. These costs can include the expense and time associated with qualifying new vendors, retooling or adjusting existing manufacturing processes to accommodate different material specifications, and establishing new logistics and supply chain arrangements. For example, a change in steel alloy composition could necessitate recalibration of furnace temperatures and rolling speeds, impacting production efficiency during the transition.

Uniqueness of Input

While steel wire rod is generally considered a commodity, certain specialized grades or custom wire products can necessitate unique inputs or manufacturing processes from suppliers. If a supplier can provide a highly specialized or proprietary input that Tree Island Steel cannot easily source elsewhere, their bargaining power naturally increases. This is because the lack of readily available alternatives limits Tree Island Steel's ability to switch suppliers without incurring significant costs or production disruptions.

The uniqueness of inputs can be a critical factor in the bargaining power of suppliers to Tree Island Steel. Consider, for instance, suppliers of specialized alloys or chemicals required for high-strength or corrosion-resistant wire. In 2024, the global market for specialty steel alloys saw continued demand, with pricing influenced by the proprietary nature of certain formulations. For Tree Island Steel, reliance on such specialized suppliers means these entities hold more leverage.

- Specialized Steel Grades: Suppliers of unique alloy compositions or specific metallurgical properties for wire rod can command higher prices.

- Proprietary Manufacturing Processes: Suppliers utilizing patented or highly guarded techniques for producing key inputs gain a pricing advantage.

- Limited Alternative Sources: If only a few suppliers can meet the exact specifications for a critical input, their bargaining power is amplified.

- Impact on Production Costs: Dependence on unique inputs can directly affect Tree Island Steel's cost of goods sold, particularly if supplier pricing increases.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a key consideration in analyzing the bargaining power of suppliers for companies like Tree Island Steel. Generally, suppliers of primary steel wire rod face significant hurdles in moving into the fabricated wire products market. This is largely due to the differing operational complexities and distinct customer segments involved.

While less common for raw material suppliers, large, integrated steel producers could potentially venture into specific downstream fabricated products. This would represent a more significant threat, as these entities already possess substantial manufacturing capabilities and established market presence.

- Operational Divergence: Fabricating wire products requires different machinery, processes, and often a more customized approach compared to bulk wire rod production.

- Customer Base Differences: Steel wire rod suppliers typically serve large industrial clients, while fabricated wire product manufacturers cater to a broader, often more fragmented customer base with diverse needs.

- Market Fragmentation: The fabricated wire products market is often highly fragmented, making it less attractive for large-scale forward integration by major raw material suppliers.

- Potential for Niche Product Integration: However, integrated steel producers might target specific, high-margin niche fabricated products where their existing infrastructure offers a competitive advantage.

Tree Island Steel's suppliers, particularly those providing steel wire rod, exert moderate bargaining power. This is influenced by the commodity nature of the input and the presence of multiple North American producers, though specialized grades can increase supplier leverage. The company's reliance on these suppliers for crucial raw materials means that price fluctuations and supply conditions directly impact its cost of goods sold and overall profitability.

The bargaining power of suppliers is also shaped by the relative importance of the input to the buyer and the buyer's ability to switch suppliers. For Tree Island Steel, steel wire rod is a significant cost component. While switching costs are generally moderate for standard wire rod, the uniqueness of certain specialty grades can elevate supplier power, as finding direct alternatives becomes more challenging and costly.

Supplier concentration, especially for specialized steel wire rod, can amplify their bargaining power. If only a few entities can supply specific alloys or meet stringent quality requirements, they can dictate terms more effectively. This was evident in 2024, where supply chain dynamics and demand for niche steel types led to increased leverage for select suppliers in the market.

The threat of forward integration by suppliers is minimal for Tree Island Steel's primary raw material providers. The significant differences in operational complexity, capital investment, and customer bases between bulk steel wire rod production and fabricated wire product manufacturing make this integration unlikely for most suppliers.

| Factor | Impact on Tree Island Steel | Supplier Power Level |

|---|---|---|

| Steel Wire Rod Price Volatility (late 2024/early 2025 trend) | Affects cost of goods sold; periods of oversupply can reduce supplier power. | Moderate |

| Supplier Concentration (for specialized grades) | Limits alternatives, potentially increasing prices and reducing negotiation leverage. | Moderate to High (for specialized inputs) |

| Switching Costs (for standard vs. specialized grades) | Moderate for standard; higher for unique alloys requiring process adjustments. | Moderate |

| Uniqueness of Inputs (specialty alloys, proprietary processes) | Increases supplier leverage due to lack of easy substitutes. | Moderate to High |

| Threat of Forward Integration | Low due to operational and market divergence. | Low |

What is included in the product

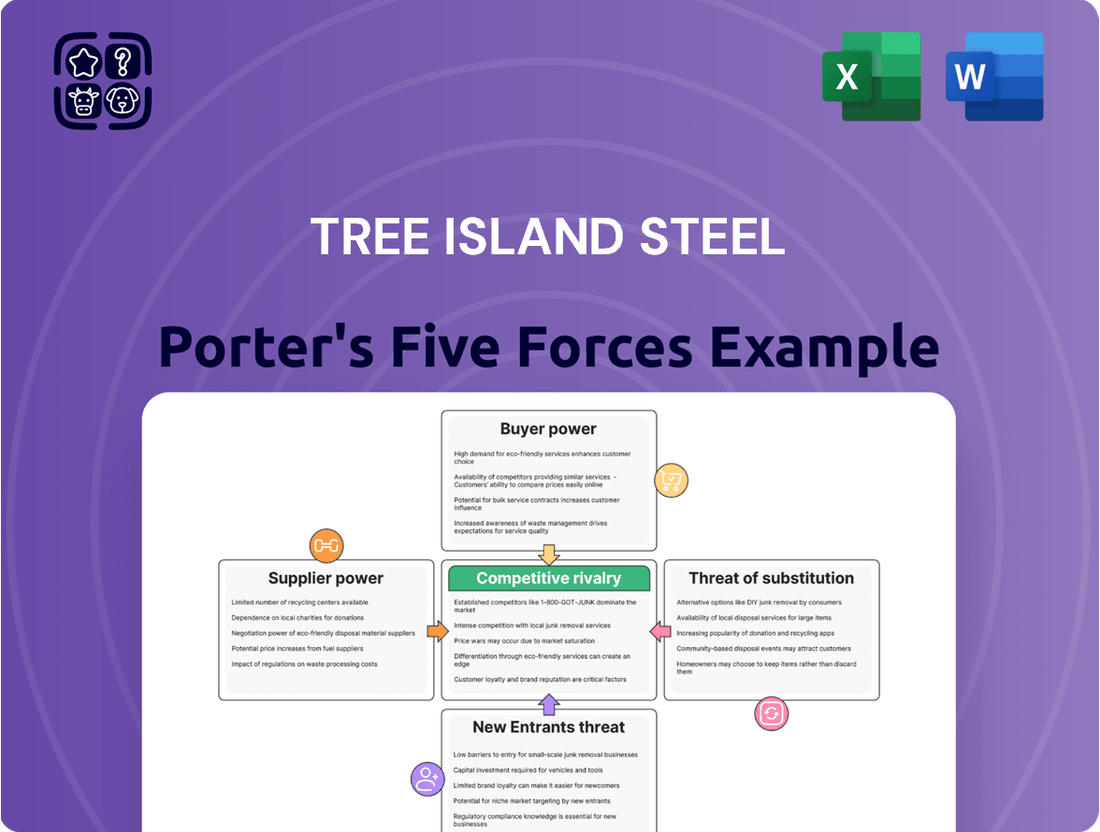

This Porter's Five Forces analysis unpacks the competitive intensity, buyer and supplier power, threat of new entrants, and availability of substitutes specifically for Tree Island Steel.

Effortlessly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis that pinpoints where Tree Island Steel faces the most significant pressure.

Customers Bargaining Power

Tree Island Steel's customer base is spread across crucial sectors like construction, agriculture, and industrial uses throughout Canada and the United States. While the customer base is diverse, significant purchasing power can emerge from large construction companies or major distributors who buy in substantial volumes. These high-volume buyers can leverage their commitment to secure more favorable pricing and contract terms, particularly when the market offers multiple suppliers.

For standard wire and fabricated steel products, customers face very low switching costs. This means they can easily move from one supplier to another without incurring significant expenses or disruption. For instance, in 2024, many buyers of basic construction steel simply compare prices from multiple suppliers, making it easy to change if a better deal arises.

This ease of switching directly translates into increased bargaining power for customers. They can leverage the availability of alternative suppliers to negotiate better prices and terms. The commoditized nature of many steel products further amplifies this, as differentiation between manufacturers becomes less about unique features and more about competitive pricing and efficient delivery.

Customers in construction and agriculture, especially for basic items like nails and wire, are very sensitive to price. This means they will likely choose the cheapest option available.

With steel prices generally falling and a lot of companies competing, Tree Island Steel faces significant pressure. Customers will use price as their main reason for buying, which can squeeze the company's profits.

For instance, in 2023, the average selling price for many steel products saw a decline compared to the previous year, forcing manufacturers to operate on tighter margins. This trend is expected to continue into 2024, amplifying customer bargaining power.

Customer Information and Transparency

The bargaining power of customers for Tree Island Steel is significantly influenced by increasing market transparency and readily available information. Buyers can now effortlessly compare prices, product features, and supplier reputations online, which naturally fuels more assertive negotiation tactics, particularly for commodity steel products where differentiation is minimal.

This enhanced access to data empowers customers to leverage competitive pricing, often pushing for lower costs and better terms. For instance, in 2024, the global steel market saw continued price volatility, making it easier for large industrial buyers to secure favorable deals by playing suppliers against each other. This dynamic directly impacts Tree Island Steel’s ability to maintain premium pricing and margins.

- Information Accessibility: Customers can easily access price lists, product specifications, and performance reviews from multiple steel manufacturers.

- Price Comparison: With readily available data, buyers can swiftly compare offers, leading to increased price sensitivity.

- Negotiating Leverage: For standardized steel products, this transparency allows customers to negotiate more aggressively on price and contract terms.

- Supplier Switching Costs: Low switching costs for customers in the commodity steel sector further amplify their bargaining power.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Tree Island Steel is generally low. While theoretically possible for very large distributors or construction firms with substantial volume, the significant capital investment and specialized expertise required for wire and steel fabrication make this an unlikely strategy for most. For instance, the sheer scale of setting up a steel mill or wire production facility, involving billions in upfront costs, deters most potential integrators.

However, in specific scenarios, a major customer might explore this if supplier margins appear exceptionally high and their own purchasing volumes are consistently large enough to justify the investment. For example, a consortium of major infrastructure project developers could potentially pool resources. Despite this, the complexity and ongoing operational demands mean this remains a limited concern for Tree Island Steel.

- Low Likelihood: The immense capital expenditure and technical know-how needed for steel and wire production act as significant barriers to entry for customers seeking backward integration.

- Potential for Large Conglomerates: Extremely large distributors or construction firms with massive, consistent order volumes might consider backward integration if supplier profitability is particularly attractive.

- High Capital Intensity: Establishing a steel fabrication plant can cost hundreds of millions, if not billions, of dollars, making it an impractical move for most.

- Limited Impact: Due to these barriers, the direct threat of significant customer backward integration is minimal for companies like Tree Island Steel.

Tree Island Steel faces substantial customer bargaining power due to low switching costs and price sensitivity, particularly for standardized steel products. In 2024, the market's transparency and the availability of comparable pricing online empower buyers to negotiate aggressively, forcing suppliers like Tree Island Steel to operate on tighter margins. For example, the average selling price for many steel products saw a decline in 2023, a trend expected to persist into 2024, directly impacting Tree Island Steel's pricing flexibility and profitability.

| Factor | Impact on Tree Island Steel | 2024 Context |

|---|---|---|

| Switching Costs | Low | Customers can easily shift suppliers for commodity steel products. |

| Price Sensitivity | High | Buyers prioritize cost, especially in construction and agriculture sectors. |

| Information Accessibility | High | Online price comparison and product reviews empower buyers. |

| Supplier Concentration | Moderate | While diverse, large buyers wield significant influence. |

Preview Before You Purchase

Tree Island Steel Porter's Five Forces Analysis

This preview showcases the complete Tree Island Steel Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. You're viewing the exact document you'll receive immediately after purchase, ensuring no surprises or placeholder content. This professionally formatted analysis delves into the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. What you see here is the final, ready-to-use file, providing actionable insights into Tree Island Steel's strategic position.

Rivalry Among Competitors

The North American steel and fabricated wire products market is quite crowded, featuring a large number of companies, both big and small, from here and abroad. This fragmentation means intense competition for Tree Island Steel.

Key players like Bekaert, Nucor, and ArcelorMittal are significant global entities, but they operate alongside many smaller, regional manufacturers. This diverse competitive landscape directly fuels the rivalry within the industry.

For instance, in 2024, the global steel industry saw production from over 70 countries, with major players like China, India, and the United States leading the charge. This broad global participation underscores the fragmented nature of the market Tree Island Steel navigates.

The presence of numerous competitors, each vying for market share, puts constant pressure on pricing and innovation, making it challenging for any single company to dominate without significant strategic effort.

The North American wire and cable market is expected to see moderate growth, driven by significant infrastructure spending and ongoing construction projects. This expansion is a key factor influencing competitive dynamics.

Despite the overall market outlook, Tree Island Steel faced a revenue decline in 2024 and the first quarter of 2025. This downturn was attributed to softer demand and increased pricing pressures.

The combination of a generally expanding market and Tree Island Steel's specific challenges suggests a competitive landscape where companies are vying for market share amidst fluctuating demand and pricing.

This environment intensifies rivalry as companies work to secure business and manage profitability in a market that, while growing, presents headwinds for individual players like Tree Island Steel.

Competitive rivalry at Tree Island Steel is influenced by the largely commodity nature of its products, like basic wire and nails. This inherent lack of differentiation makes it difficult to stand out. While Tree Island Steel does promote its brands, such as Halsteel® and K-Lath®, and a commitment to quality, establishing deep brand loyalty in such a price-sensitive market remains a significant hurdle.

Exit Barriers

Tree Island Steel faces considerable competitive rivalry, partly due to high exit barriers. The steel industry, by its nature, demands substantial capital outlays for manufacturing plants and specialized machinery. For instance, a modern steel mill can cost hundreds of millions, even billions, of dollars to construct and equip.

These high fixed costs and the often-specialized nature of steel production assets mean that exiting the market is not a simple decision. Companies are often reluctant to abandon such significant investments, even when facing unprofitable periods. This reluctance to exit means that even during economic slowdowns or periods of overcapacity, firms tend to remain in the market and continue competing, which naturally intensifies the rivalry among existing players.

- Capital Intensity: The steel industry requires massive upfront investment in plant, property, and equipment, often running into hundreds of millions of dollars per facility.

- Specialized Assets: Steel production equipment is highly specialized and has limited alternative uses, making it difficult to repurpose or sell at a favorable price if a company decides to exit.

- High Fixed Costs: Once operational, steel mills have substantial fixed costs associated with maintenance, depreciation, and labor, incentivizing companies to continue production to cover these costs, even at lower operating rates.

- Intensified Rivalry: The presence of significant exit barriers encourages firms to stay and fight for market share, leading to more aggressive pricing and operational strategies among competitors, especially during challenging economic conditions.

Diversity of Competitors and Strategic Goals

Tree Island Steel faces a highly competitive environment with rivals varying significantly in scale and strategic orientation. These competitors include massive, integrated steel producers and smaller, specialized manufacturers focused on wire products.

Foreign competitors often target high-volume commodity steel, engaging in aggressive price-based competition. For instance, in 2024, the global steel market saw continued pressure from producers in regions with lower production costs, impacting pricing benchmarks for items like rebar and wire rod.

- Diverse Competitor Landscape: Includes large integrated steelmakers and specialized wire product manufacturers.

- Foreign Competition: Often driven by price on high-volume commodity steel products.

- Strategic Goal Variation: Competitors pursue different objectives, from market share dominance to niche product leadership.

- Dynamic Market: The mix of competitor types creates a constantly shifting competitive arena.

Competitive rivalry for Tree Island Steel is intense due to the fragmented nature of the North American steel and fabricated wire products market. Many companies, from large global players like Nucor to smaller regional ones, vie for market share. This crowded field means constant pressure on pricing and innovation. For example, in 2024, over 70 countries produced steel, highlighting the broad global competition. Tree Island Steel's revenue decline in 2024 and early 2025 further illustrates the challenging competitive environment, marked by softer demand and increased pricing pressures.

SSubstitutes Threaten

For construction, alternative materials like wood, plastics, and advanced ceramics pose a threat to steel wire products. These substitutes can be favored when weight savings, superior corrosion resistance, or specific aesthetic qualities are paramount. For instance, the growing trend of modular construction, emphasizing prefabrication and lighter components, could further drive the adoption of these alternatives in certain building applications.

Alternative fastening methods pose a potential threat by offering different solutions for joining materials. For instance, advanced adhesives and interlocking systems are increasingly sophisticated and can replace traditional nails and wire fasteners in specific applications, particularly in construction and manufacturing. While the global industrial adhesives market was valued at approximately USD 65 billion in 2023 and is projected to grow, this indicates a growing acceptance of these alternatives.

Innovations in materials science are a significant threat, potentially introducing high-performance substitutes that could challenge steel wire in specific applications. For instance, advancements in composite materials or advanced polymers might offer superior strength-to-weight ratios or unique properties, making them attractive alternatives for certain industrial uses. While the broad market for basic steel wire remains robust, these emerging materials could erode market share in specialized sectors.

Cost-Performance Trade-offs

The threat of substitutes for Tree Island Steel hinges significantly on the cost-performance trade-offs presented by alternative materials. If competing materials, such as advanced plastics or composites, offer similar structural integrity and durability at a lower price point, they can erode Tree Island Steel's market share. Conversely, if these substitutes provide enhanced performance characteristics, like increased corrosion resistance or lighter weight, even at a slightly higher cost, they become a more potent threat if the added benefits justify the premium.

- Cost-Performance Balance: The attractiveness of substitutes is directly tied to their ability to meet performance needs more economically than steel.

- Material Innovation: Advancements in non-steel materials that improve their cost-effectiveness or performance capabilities increase the threat.

- Application Specificity: The threat varies by end-use; for instance, lightweight aluminum in automotive might be a stronger substitute than in heavy construction.

- Economic Sensitivity: During periods of high steel prices or economic downturns, the pressure from lower-cost substitutes intensifies.

Technological Advancements in Other Materials

Ongoing research and development in alternative materials present a significant threat to Tree Island Steel. Innovations in polymers and advanced composites, for instance, are creating lightweight yet strong substitutes for steel wire products. These materials are increasingly finding applications in industries like automotive and construction, directly impacting the demand for traditional steel components.

For example, the automotive sector is actively exploring composites to reduce vehicle weight, thereby improving fuel efficiency. By 2024, the global composites market was projected to reach over $100 billion, indicating substantial investment and growth in these alternative material technologies. This trend directly challenges steel's market share in applications where weight reduction is a key performance metric.

The threat is amplified by the continuous innovation pipeline in these sectors. Companies are investing heavily in R&D to enhance the properties of non-steel materials, making them more competitive on cost, durability, and performance. This necessitates that Tree Island Steel monitor these advancements closely.

- Material Innovation: Polymers and carbon fiber advancements offer lightweight, high-strength alternatives to steel wire.

- Industry Adoption: Sectors like automotive and construction are increasingly integrating these substitutes.

- Market Growth: The global composites market's projected growth signifies a significant shift towards alternative materials.

- Competitive Pressure: Continuous R&D in substitute materials intensifies competitive pressure on steel products.

The threat of substitutes for Tree Island Steel is significant, driven by advancements in alternative materials and fastening methods. These substitutes often compete on cost-performance trade-offs, offering advantages like weight savings, corrosion resistance, or unique aesthetic qualities. For instance, the increasing adoption of advanced adhesives and interlocking systems in construction and manufacturing can replace traditional wire fasteners.

| Substitute Material/Method | Key Advantages | Threat Level for Steel Wire |

|---|---|---|

| Advanced Polymers & Composites | Lightweight, high strength-to-weight ratio, corrosion resistance | High (especially in automotive, aerospace, and certain construction applications) |

| Advanced Adhesives | Strong bonding, potential for weight reduction, design flexibility | Medium to High (in specific fastening applications) |

| Wood & Advanced Ceramics | Aesthetics, insulation, specific environmental resistance | Low to Medium (application-specific) |

The automotive industry's push for lighter vehicles to improve fuel efficiency exemplifies this threat, with composites market growth projected to exceed $100 billion by 2024. This trend highlights how innovations in competing materials can directly impact demand for steel wire in weight-sensitive applications.

Entrants Threaten

The wire and fabricated steel product manufacturing sector demands significant upfront investment. Companies need to acquire specialized machinery, construct or lease mill facilities, and establish robust infrastructure, often running into tens or even hundreds of millions of dollars. For instance, a new greenfield steel mill project can easily cost upwards of $1 billion, a figure that immediately deters many aspiring players.

This substantial capital requirement serves as a formidable barrier, effectively limiting the number of new companies that can realistically enter the market. Tree Island Steel, like its competitors, operates within this landscape where the sheer cost of entry makes it difficult for new players to establish a foothold and compete on scale.

Established players like Tree Island Steel leverage significant economies of scale in their operations. For instance, their large-scale production allows for lower per-unit manufacturing costs, and their substantial purchasing power for raw materials like steel billets translates into better pricing compared to smaller competitors. In 2023, Tree Island Steel reported net sales of CAD 635.9 million, indicating a substantial operational footprint that underpins these cost advantages.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the same production volume, they cannot negotiate favorable terms with suppliers or spread fixed costs across as many units. This disparity makes it challenging for newcomers to compete on price, a critical factor in the steel industry, especially for commodity products.

The capital investment required to achieve comparable economies of scale is immense, acting as a strong deterrent. Building new, large-scale steel production facilities demands billions in upfront investment, a barrier that many potential entrants find insurmountable. This financial commitment, coupled with the need to quickly ramp up production to realize scale benefits, deters many from entering the market.

Tree Island Steel has cultivated robust distribution networks throughout Canada and the United States, effectively reaching a broad spectrum of customer segments. This established presence makes it difficult for new players to replicate the same reach and customer access.

For any new entrant, the primary hurdle would be the significant investment and time required to build out comparable distribution channels. This includes securing warehousing, logistics, and sales force capabilities that match Tree Island Steel's existing infrastructure.

Gaining access to key customers who are already loyal to Tree Island Steel's established supply chains presents another formidable obstacle. Building trust and securing initial orders in a market with entrenched players is a substantial challenge.

In 2023, Tree Island Steel reported revenue of CAD 435.3 million, underscoring the scale of their operations and the established customer base that new entrants would need to penetrate.

Brand Recognition and Customer Loyalty

Tree Island Steel benefits from strong brand recognition and customer loyalty, cultivated over decades since its founding in 1964. This established reputation for quality and reliable service presents a significant hurdle for potential new entrants.

New competitors would face substantial costs associated with marketing and brand development to challenge Tree Island Steel's entrenched market position and win over customer trust. For instance, in 2024, the global steel industry saw continued consolidation, with larger players leveraging existing brand equity to maintain market share.

- Established Brand Equity: Tree Island Steel's brand names are recognized in the market, signifying a history of dependable products.

- Customer Loyalty: Decades of consistent quality and service have fostered strong relationships with existing customers, making them less likely to switch to unproven brands.

- High Entry Barriers: New entrants must overcome the significant investment required for marketing and brand building to compete effectively.

- Industry Trends: In 2024, the steel sector emphasized resilience and supply chain reliability, further solidifying the advantage of established, trusted suppliers like Tree Island Steel.

Regulatory and Trade Barriers

The steel industry faces significant regulatory hurdles that can act as a strong deterrent to new entrants. For instance, stringent environmental standards, which vary by region, require substantial investment in compliance technologies and processes, making it difficult for newcomers to compete with established players who have already made these investments.

Trade barriers, such as the U.S. Section 232 tariffs implemented in 2018, directly impact the cost-effectiveness of importing steel. These tariffs, which remain a consideration in international trade discussions, increase the price of foreign steel, thereby protecting domestic producers and raising the barrier to entry for companies relying on imported materials or seeking to export finished products.

These combined regulatory and trade complexities create a challenging landscape for potential new steel manufacturers.

- Environmental Compliance Costs: New entrants must invest heavily to meet evolving environmental regulations, such as those related to emissions and waste management.

- Trade Tariffs and Quotas: Protectionist measures like Section 232 tariffs on steel imports directly increase the cost of entry for foreign competitors or those sourcing materials internationally.

- Navigating Complex Regulations: Understanding and adhering to a web of international and national regulations adds significant operational complexity and expense for new market participants.

The threat of new entrants for Tree Island Steel is considerably low due to significant capital requirements for establishing production facilities, which can easily exceed $1 billion for a new greenfield steel mill. This immense financial hurdle, coupled with the need for specialized machinery and infrastructure, deters most potential competitors from entering the market. The sheer cost of entry makes it impractical for new companies to compete on scale and efficiency from the outset.

Established players like Tree Island Steel benefit from substantial economies of scale, which translate into lower per-unit costs and better raw material pricing. For example, Tree Island Steel's 2023 net sales of CAD 635.9 million highlight their operational footprint and purchasing power, making it difficult for newcomers to match their cost efficiencies. Without comparable production volumes, new entrants struggle to negotiate favorable terms with suppliers or spread fixed costs, impacting their ability to compete on price.

Tree Island Steel's established distribution networks and strong brand recognition, built since 1964, present further barriers. Building comparable logistics and securing customer trust requires significant investment and time, especially in a market where customer loyalty to established brands is high. In 2024, the steel sector's focus on supply chain reliability further solidifies the advantage of trusted suppliers like Tree Island Steel.

Regulatory and trade barriers also limit new entrants. Stringent environmental standards demand considerable investment in compliance technologies, while trade tariffs, like the U.S. Section 232 tariffs, increase the cost of imported steel, protecting domestic producers. Navigating these complex regulations adds operational expense and complexity for potential market participants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Tree Island Steel leverages financial statements, investor relations materials, and industry-specific market research reports to assess competitive intensity.

We integrate data from steel industry trade publications, economic indicators, and competitor announcements to provide a comprehensive understanding of Tree Island Steel's operating environment.