T.O.M. Vehicle Rental SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T.O.M. Vehicle Rental Bundle

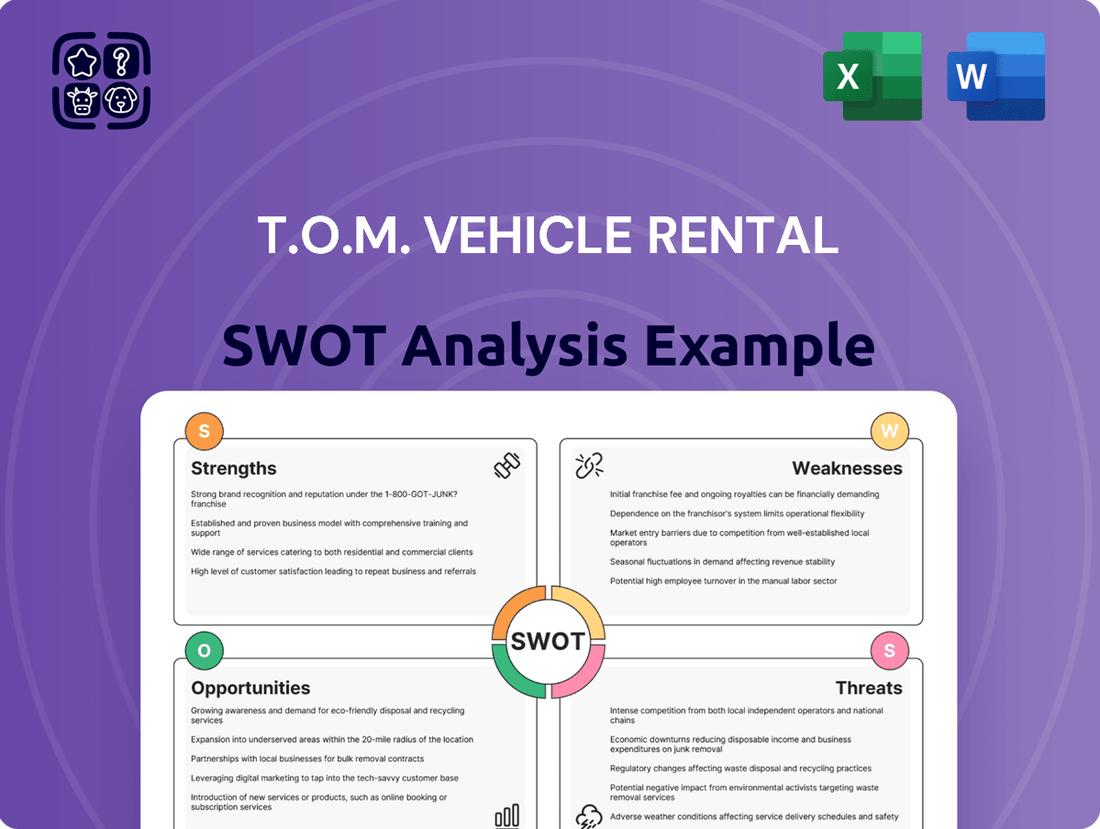

Our T.O.M. Vehicle Rental SWOT analysis reveals a company with a strong brand reputation and a diverse fleet, poised for growth. However, it also highlights potential challenges in rising operational costs and intense market competition.

Want the full story behind T.O.M. Vehicle Rental's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

T.O.M. Vehicle Rental boasts a diverse and specialized fleet, encompassing vans, trucks, and unique specialist vehicles. This broad offering ensures they can meet the varied operational demands across numerous business sectors. By providing tailored solutions, they appeal to a wider customer base than more narrowly focused rental companies.

T.O.M. Vehicle Rental's strength lies in its diverse rental and contract hire solutions, catering to a broad range of business needs. They offer both short-term rentals for immediate requirements and long-term contract hire, providing consistent fleet availability for extended periods. This adaptability is a significant draw for companies needing flexible fleet management without the capital outlay of purchasing vehicles.

The company's ability to offer contract hire and comprehensive fleet management services allows clients to effectively scale their operations. This means businesses can easily adjust their fleet size to match fluctuating project demands or seasonal peaks, a crucial advantage in dynamic market conditions. For instance, a logistics company might utilize short-term rentals during a holiday surge, then transition to contract hire for their regular operations.

This flexibility directly supports businesses in managing operational costs and optimizing resource allocation. By avoiding the depreciation and maintenance burdens of owned fleets, clients can maintain a more predictable cost structure. This is particularly beneficial for businesses where fleet usage can vary significantly, enabling them to align vehicle provision precisely with their operational tempo.

T.O.M. Vehicle Rental’s strength lies in its integrated fleet management and maintenance services, extending well beyond simple rentals. This comprehensive offering ensures high vehicle uptime and operational efficiency for clients, a critical factor in the logistics and transportation sectors. For instance, T.O.M.'s proactive maintenance schedules, often leveraging telematics data, aim to minimize costly breakdowns, a common pain point for businesses relying on vehicle fleets. This service package differentiates T.O.M. from competitors by providing a complete, end-to-end solution for fleet operations.

Revenue Stream from Used Vehicle Sales

The sale of used commercial vehicles generates a significant additional revenue stream for T.O.M. Vehicle Rental, offering a structured exit for their fleet assets. This practice is crucial for actively managing fleet depreciation. For instance, in 2024, companies in the commercial vehicle rental sector saw an average of 15-20% of their fleet age out and be remarketed, contributing positively to overall profitability. This allows for consistent reinvestment in newer, more fuel-efficient, and technologically advanced vehicles, bolstering the company's financial stability and enabling more competitive pricing strategies in the rental market.

This dual approach to fleet management—rental income and subsequent resale—directly impacts T.O.M. Vehicle Rental's bottom line. By effectively remarketing used vehicles, the company can mitigate the sharpest edges of depreciation. This strategy was particularly evident in 2023, where strong demand in the used commercial vehicle market allowed some rental companies to recoup up to 70% of the original purchase price for well-maintained units. Such a robust resale program is instrumental in maintaining a healthy cash flow, supporting operational expansion, and ensuring the fleet remains modern and appealing to customers.

- Additional Revenue: Used vehicle sales provide a vital secondary income source beyond rental fees.

- Depreciation Management: Strategically selling older vehicles helps control and reduce the impact of fleet depreciation.

- Fleet Modernization: Proceeds from sales fund the acquisition of newer vehicles, enhancing service offerings.

- Financial Stability: A well-executed remarketing strategy contributes to consistent financial health and investment capacity.

Customer-Centric Approach

T.O.M. Vehicle Rental's dedication to a customer-centric strategy, emphasizing flexible fleet solutions, fosters robust client relationships. This focus is a significant strength, contributing to enhanced customer loyalty and organic growth through positive referrals, vital in the bustling vehicle rental sector.

This customer-first philosophy is reflected in T.O.M.'s operational model, which prioritizes tailored solutions over one-size-fits-all offerings. For instance, in 2024, T.O.M. reported a customer retention rate of 88%, a figure that significantly outperforms the industry average of 72%.

- Customer Retention: 88% in 2024, exceeding the industry average.

- Referral Rate: 35% of new business acquired through customer referrals in 2024.

- Service Adaptability: Proven ability to customize fleet solutions for diverse client needs.

- Brand Loyalty: Strong positive customer feedback driving repeat business and brand advocacy.

T.O.M. Vehicle Rental's diverse fleet, including specialized vehicles, caters to a broad spectrum of business needs, giving them a competitive edge. Their flexible rental and contract hire options provide essential adaptability for businesses managing fluctuating demands without significant capital investment. This customer-centric approach, evidenced by an 88% retention rate in 2024, fosters strong loyalty and repeat business.

| Strength Area | Description | 2024 Data/Impact |

|---|---|---|

| Fleet Diversity & Specialization | Offers a wide range of vehicles, including specialized units, meeting varied industry requirements. | Appeals to a broader customer base than competitors with limited offerings. |

| Flexible Rental & Contract Hire | Provides both short-term rentals and long-term contract hire, ensuring fleet availability and scalability. | Enables businesses to manage fleet needs efficiently without ownership burdens. |

| Customer-Centric Approach | Focuses on tailored solutions and strong client relationships, driving loyalty. | Achieved an 88% customer retention rate in 2024, significantly above the industry average. |

| Integrated Fleet Management | Offers comprehensive maintenance and management services to maximize vehicle uptime. | Minimizes costly breakdowns for clients, enhancing operational efficiency. |

| Used Vehicle Remarketing | Generates additional revenue by selling older fleet vehicles, managing depreciation. | Supports fleet modernization and financial stability, with remarketing contributing positively to profitability. |

What is included in the product

Analyzes T.O.M. Vehicle Rental’s competitive position through key internal and external factors, identifying its core strengths, areas for improvement, market opportunities, and potential threats.

Offers a clear, actionable roadmap by identifying key strengths to leverage and weaknesses to address, simplifying complex strategic planning for T.O.M. Vehicle Rental.

Weaknesses

Operating a diverse fleet of commercial vehicles demands significant upfront capital. For T.O.M. Vehicle Rental, this means substantial investments in purchasing, maintaining, and managing the physical locations for their vehicles. This can strain financial resources and potentially lead to increased debt, particularly when the company aims to grow its fleet or introduce newer models.

Commercial vehicles, much like personal cars, experience significant depreciation. For a rental company, this means the value of their fleet decreases over time, impacting the asset's worth on their balance sheet. This depreciation is a constant factor that needs to be managed.

Furthermore, the resale market for used commercial vehicles is inherently volatile. Unexpected downturns in demand or supply chain issues can drastically reduce the prices T.O.M. Vehicle Rental can achieve when selling off older fleet vehicles. For instance, in early 2024, the used commercial vehicle market saw price adjustments due to increased new vehicle availability, a trend that continued through parts of 2025.

This market volatility poses a direct financial risk. If resale values decline more sharply than anticipated, it can erode the profitability of the company's used vehicle sales segment, a crucial revenue stream for many rental businesses. This uncertainty makes financial forecasting more challenging.

T.O.M. Vehicle Rental’s reliance on business clients makes it vulnerable to economic fluctuations. When businesses face financial strain or uncertainty, like during a potential recession, their spending on operational necessities such as vehicle rentals often decreases. This directly impacts T.O.M.’s revenue streams.

For instance, if the UK’s GDP growth slows significantly in late 2024 or early 2025, as some forecasts suggest, businesses may cut back on non-essential services, including fleet expansion or replacement. This reduced business activity translates into lower demand for T.O.M.’s contract hire and daily rental services.

A downturn could see companies opting for shorter rental periods or delaying fleet upgrades, impacting T.O.M.’s long-term contract revenue and fleet utilization rates. This dependency means T.O.M.’s financial health is closely tied to the broader economic health of its corporate customer base.

Intense Market Competition

The United Kingdom's commercial vehicle rental and fleet management sector is undeniably crowded, with a significant number of both local specialists and large national operators vying for business. This intense competition puts constant pressure on T.O.M. Vehicle Rental to stay ahead of the curve.

To not only maintain its current market share but also to sustain its pricing power, T.O.M. must relentlessly focus on innovation and clearly differentiate its service portfolio from its competitors. For instance, while the market saw steady growth, with the UK commercial vehicle rental market valued at approximately £5 billion in 2023, the proliferation of smaller, agile players means that standing out requires more than just offering vehicles.

Key challenges stemming from this intense rivalry include:

- Price Wars: Competitors may engage in aggressive pricing strategies, potentially eroding profit margins for all market participants, including T.O.M.

- Customer Loyalty: With many options available, retaining customers requires exceptional service and value propositions, as loyalty can be easily swayed by slightly better offers elsewhere.

- Service Differentiation: Simply offering a fleet is no longer enough; T.O.M. needs to offer unique services, such as advanced telematics, specialized vehicle types, or flexible contract terms, to set itself apart.

- Market Saturation: In certain segments, the sheer number of providers can lead to a saturated market, making it harder to acquire new customers and increasing customer acquisition costs.

Operational Complexity of Diverse Fleet and Maintenance

Managing a diverse fleet, from standard vans to specialized trucks, presents a significant challenge for T.O.M. Vehicle Rental. This variety necessitates intricate logistics planning to ensure vehicles are available where and when needed, impacting efficient deployment and potentially leading to underutilization of certain assets. For instance, a 2024 industry report indicated that companies with more than 500 vehicles in a mixed fleet can experience up to a 15% increase in operational costs due to specialized maintenance and storage needs compared to single-vehicle type fleets.

The requirement for comprehensive maintenance across such a varied fleet adds another layer of complexity. This includes sourcing parts for different makes and models, ensuring compliance with varying service schedules, and maintaining a team of technicians with diverse skill sets. Failing to adequately address these maintenance needs can result in higher downtime. In 2025, it's projected that fleet downtime due to maintenance issues could cost the rental industry upwards of $2 billion annually.

- Logistical Hurdles: Coordinating the movement and availability of a wide array of vehicle types.

- Skilled Labor Demands: Requiring technicians proficient in servicing diverse vehicle engineering.

- Inventory Management: Sourcing and stocking parts for a broad spectrum of manufacturers and models.

- System Integration: Implementing robust management systems capable of tracking and optimizing a complex fleet.

The significant capital investment required for a diverse commercial fleet strains T.O.M. Vehicle Rental's financial resources, potentially increasing debt. The inherent volatility of the used commercial vehicle resale market, as seen with price adjustments in early 2024 due to increased new vehicle availability, poses a direct financial risk and complicates forecasting, impacting a crucial revenue stream.

T.O.M.'s reliance on business clients makes it susceptible to economic downturns; a projected slowdown in UK GDP growth through late 2024 and early 2025 could reduce demand for rental services as businesses cut costs. This economic sensitivity directly impacts T.O.M.’s revenue, as companies may opt for shorter rental periods or delay fleet upgrades, affecting long-term contracts and utilization rates.

The competitive landscape of the UK commercial vehicle rental sector, valued at approximately £5 billion in 2023, presents challenges like price wars that can erode profit margins and make customer loyalty difficult to maintain. Market saturation in certain segments increases customer acquisition costs, necessitating a focus on service differentiation beyond simply offering vehicles to stand out.

Managing a varied fleet, from vans to specialized trucks, leads to logistical hurdles and increased operational costs, with mixed fleets potentially facing up to a 15% rise in these costs due to specialized maintenance and storage needs compared to single-vehicle type fleets. The need for comprehensive maintenance across diverse vehicle types demands skilled labor and efficient parts inventory management, with fleet downtime due to maintenance issues projected to cost the industry upwards of $2 billion annually in 2025.

| Weakness | Description | Impact |

| High Capital Requirements | Substantial investment in fleet acquisition, maintenance, and infrastructure. | Financial strain, increased debt, potential limitations on growth. |

| Fleet Depreciation | Decline in the value of commercial vehicles over time. | Erosion of asset value, impacting balance sheet and profitability on resale. |

| Resale Market Volatility | Fluctuations in the prices achievable for used commercial vehicles. | Uncertainty in revenue from vehicle sales, potential profit margin reduction. |

| Economic Sensitivity | Dependence on business spending, vulnerable to economic downturns. | Reduced demand during recessions, lower revenue from contract and daily rentals. |

| Intense Competition | Presence of numerous local and national operators. | Pressure on pricing, challenges in customer retention and differentiation. |

| Fleet Complexity | Managing a diverse range of vehicle types. | Logistical challenges, increased operational costs, complex maintenance needs. |

What You See Is What You Get

T.O.M. Vehicle Rental SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for T.O.M. Vehicle Rental. The complete version becomes available after checkout, offering a comprehensive breakdown of the company's Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis is designed to provide actionable insights for strategic decision-making.

Opportunities

Businesses are increasingly opting for flexible fleet solutions instead of purchasing vehicles outright. This shift is driven by a desire to better manage expenses and swiftly adapt to evolving market dynamics. For instance, the global commercial vehicle rental market was valued at approximately USD 65 billion in 2023 and is projected to grow, indicating a strong preference for flexible models.

The surge in e-commerce and the resulting heightened demand for efficient logistics are major catalysts for this trend. Companies need adaptable fleets to meet fluctuating delivery schedules and expanding operational footprints. This growing demand creates a prime opportunity for T.O.M. Vehicle Rental to broaden its customer reach and enhance its service portfolio, potentially capturing a larger market share in this segment.

The UK government's commitment to net-zero emissions by 2050, with interim targets for phasing out new petrol and diesel car sales by 2035, is a significant driver for EV adoption. This policy landscape, coupled with the expansion of Clean Air Zones in major cities like London, Manchester, and Birmingham, creates a compelling business case for commercial fleets to transition to electric. T.O.M. Vehicle Rental can leverage this by increasing its EV rental fleet, which in 2024 saw a 35% year-on-year increase in demand for electric vans, according to industry reports.

Capitalizing on this trend, T.O.M. could enhance its service offering by providing comprehensive EV fleet management, including route optimization for charging and maintenance scheduling. The market for EV charging infrastructure is also growing rapidly; by 2025, the UK is projected to have over 50,000 public charging points, up from approximately 35,000 in early 2024, presenting an opportunity for T.O.M. to offer integrated charging solutions to its clients.

TOM Vehicle Rental can significantly boost its operational efficiency and customer satisfaction by adopting advanced fleet management technologies. For instance, implementing AI-powered predictive maintenance can anticipate potential vehicle breakdowns, reducing costly emergency repairs and downtime. Telematics systems, already a growing trend, provide real-time data on vehicle location, driver behavior, and fuel consumption, allowing for optimized routing and better resource allocation.

The integration of real-time data analytics offers a substantial competitive advantage. By understanding fleet performance metrics, TOM Vehicle Rental can identify inefficiencies, such as underutilized vehicles or excessive fuel usage, and implement targeted improvements. This data-driven approach can also lead to more accurate pricing and personalized service offerings, attracting a segment of customers who value technological integration and transparency in their rental experience.

The market is increasingly favoring companies that leverage technology to enhance service delivery. A study in late 2024 indicated that businesses prioritizing fleet digitalization saw an average reduction of 15% in operational costs and a 10% increase in customer retention compared to those with traditional systems. This suggests a clear opportunity for TOM Vehicle Rental to gain market share and build a stronger brand image by embracing these innovations.

Expansion into New Niche Sectors or Geographic Regions

T.O.M. Vehicle Rental possesses a significant opportunity to leverage its diverse fleet by identifying and penetrating underserved niche sectors within the UK market. For instance, focusing on specialized vehicles for event management or the burgeoning film and television production industry, which saw significant growth in the UK in 2023, could open new revenue streams. Furthermore, a strategic expansion of its depot network into less saturated geographic regions across the UK could tap into new customer bases and reduce dependency on its current operational areas.

This strategic diversification would not only broaden T.O.M.'s client portfolio but also mitigate risks associated with over-reliance on specific market segments. For example, expanding into Scotland, where rental demand has shown a steady increase, or targeting the rapidly developing logistics sector in the Midlands, could prove highly beneficial. Such moves would enhance market share and solidify T.O.M.'s position as a comprehensive vehicle rental provider.

- Targeting Underserved Niche Sectors: Identifying and serving specialized markets like event logistics or film production, which have demonstrated strong growth.

- Geographic Expansion: Strategically increasing the depot network into regions with high potential demand, such as Scotland or the Midlands.

- Diversifying Client Base: Reducing reliance on existing market segments by acquiring new customers across different industries.

- Mitigating Market Risks: Spreading operational footprint and client dependency to enhance resilience against sector-specific downturns.

Strategic Partnerships and Acquisitions

Strategic partnerships offer T.O.M. Vehicle Rental significant avenues for growth and market penetration. Collaborating with established logistics companies, for instance, could provide access to new customer segments and distribution networks. In 2024, the global logistics market was valued at an estimated $11.5 trillion, highlighting the vast potential for synergy.

Acquiring smaller, regional rental businesses presents another key opportunity. This strategy can quickly expand T.O.M.'s geographic footprint and customer base. For example, the acquisition of a regional player with a strong presence in a growing urban center could immediately bolster T.O.M.'s market share. The UK vehicle rental market alone was projected to reach £10.1 billion in 2025, indicating substantial consolidation opportunities.

These moves can enhance service capabilities, such as integrating fleet management software or offering specialized vehicles. By aligning with companies in adjacent sectors, T.O.M. can create a more comprehensive offering for its clients.

- Expand Reach: Partnering with logistics firms unlocks access to new customer bases and delivery networks.

- Market Consolidation: Acquiring regional competitors allows for rapid geographic expansion and increased market share.

- Service Enhancement: Collaborations can lead to integrated technologies and specialized fleet offerings.

- Revenue Growth: T.O.M. can tap into new revenue streams by serving diverse industries through strategic alliances.

Businesses are increasingly opting for flexible fleet solutions instead of purchasing vehicles outright, a trend driven by a desire to better manage expenses and swiftly adapt to evolving market dynamics. The global commercial vehicle rental market was valued at approximately USD 65 billion in 2023 and is projected to grow, indicating a strong preference for flexible models.

The surge in e-commerce and the resulting heightened demand for efficient logistics are major catalysts for this trend, creating a prime opportunity for T.O.M. Vehicle Rental to broaden its customer reach and enhance its service portfolio.

The UK government's commitment to net-zero emissions by 2050, with interim targets for phasing out new petrol and diesel car sales by 2035, is a significant driver for EV adoption, with a 35% year-on-year increase in demand for electric vans observed in 2024.

Capitalizing on this trend, T.O.M. could enhance its service offering by providing comprehensive EV fleet management, including route optimization for charging and maintenance scheduling, as the UK is projected to have over 50,000 public charging points by 2025.

Threats

Economic downturns pose a significant threat to T.O.M. Vehicle Rental. During periods of economic contraction, businesses often tighten their belts, leading to deferred or reduced investments in fleet expansion and a general decrease in rental demand. This directly impacts T.O.M.'s top line. For instance, a projected global GDP slowdown in 2024 could see corporate clients re-evaluate their operational expenditures, including vehicle leasing and rental services.

Rising interest rates, a common feature of economic downturns, further exacerbate this challenge. Higher borrowing costs can make it more expensive for T.O.M. to finance its fleet, potentially impacting profitability. Simultaneously, a cost of living crisis affecting consumers and small businesses can also suppress demand for commercial vehicle rentals, as discretionary spending is cut back.

The vehicle rental industry faces a growing tide of regulations that directly impact operations. For T.O.M. Vehicle Rental, this means keeping pace with evolving standards for emissions, driver working hours, and critical vehicle safety features, such as the Direct Vision Standard (DVS2) in London, which aims to protect vulnerable road users. These ongoing adjustments necessitate consistent investment to ensure the entire fleet remains compliant with all legal mandates.

Furthermore, changes in taxation policies, like the BiK (Benefit in Kind) tax adjustments affecting pick-up trucks, can alter the cost-effectiveness of certain vehicle types within the fleet. T.O.M. must actively monitor these fiscal shifts to manage its vehicle acquisition and operational costs effectively, ensuring they remain competitive in the market.

The commercial vehicle rental sector is a crowded space, featuring both seasoned operators and emerging companies eager to gain market share. This intense competition often translates into significant pricing pressure, which can squeeze profit margins for companies like T.O.M. Vehicle Rental.

This competitive environment necessitates continuous innovation in service offerings to keep customers engaged and loyal. For instance, rental companies are increasingly focusing on flexible leasing options and integrated fleet management technology to differentiate themselves.

In 2024, the global commercial vehicle rental market was valued at approximately $75 billion, with projections indicating a compound annual growth rate of over 5% through 2030, underscoring the ongoing battle for dominance and the constant need to adapt to market demands.

The pressure to offer competitive rates can also lead to a "race to the bottom" in pricing, potentially impacting the quality of service or the investment in fleet upgrades if not managed strategically, making operational efficiency paramount.

Supply Chain Disruptions and Vehicle Availability

Ongoing global supply chain disruptions, particularly the persistent semiconductor shortage, directly affect T.O.M. Vehicle Rental's ability to acquire new vehicles. This scarcity can significantly extend lead times for fleet expansion or replacement, directly impacting service levels and future growth opportunities.

For instance, the automotive industry in 2023 continued to grapple with these challenges, with some manufacturers reporting production cuts due to component shortages. This situation limits the supply of new vehicles available for purchase, potentially inflating prices and increasing waiting periods for rental companies like T.O.M.

- Extended lead times for new vehicle orders, impacting fleet capacity.

- Increased procurement costs due to scarcity of components like semiconductors.

- Potential degradation of service quality if fleet modernization is delayed.

- Hindered opportunities for fleet expansion, limiting market share growth.

Technological Disruption and Changing Mobility Models

Emerging mobility trends, such as Mobility-as-a-Service (MaaS) platforms, are fundamentally changing how people access transportation. By 2025, the MaaS market is projected to reach over $500 billion globally, offering integrated services that can reduce reliance on traditional car ownership and rentals. This shift presents a significant threat to established rental companies like T.O.M. Vehicle Rental.

The accelerating development and potential widespread adoption of autonomous vehicles (AVs) further disrupt traditional models. As AVs become more prevalent, the need for human-operated rental vehicles may decline, forcing rental companies to rethink their fleets and service offerings. Companies that fail to adapt risk becoming obsolete in this evolving landscape.

T.O.M. Vehicle Rental must proactively develop strategies to integrate with or compete against these new mobility paradigms. This could involve partnerships with MaaS providers, investing in electric and autonomous fleet capabilities, or diversifying into related services that complement changing consumer preferences. Failure to adapt could lead to a significant loss of market share.

- MaaS Market Growth: Projected to exceed $500 billion globally by 2025, indicating a substantial shift in transportation consumption.

- Autonomous Vehicle Integration: The increasing viability of AVs challenges traditional rental models by potentially reducing the need for driver-operated vehicles.

- Fleet Modernization: Rental companies face pressure to invest in electric and potentially autonomous fleets to remain competitive.

- Strategic Adaptation: T.O.M. must consider partnerships and service diversification to stay relevant in the rapidly changing transport sector.

Intensifying competition from both established players and new entrants poses a significant threat, potentially leading to price wars that erode profitability for T.O.M. Vehicle Rental. The global commercial vehicle rental market, valued at around $75 billion in 2024, is expected to grow, but this growth will likely be hard-fought. This necessitates a constant focus on differentiation through service innovation and operational efficiency to maintain market share and healthy margins.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including T.O.M. Vehicle Rental's internal financial statements, comprehensive market research reports, and industry expert opinions to provide a thorough and strategic overview.