T.O.M. Vehicle Rental PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T.O.M. Vehicle Rental Bundle

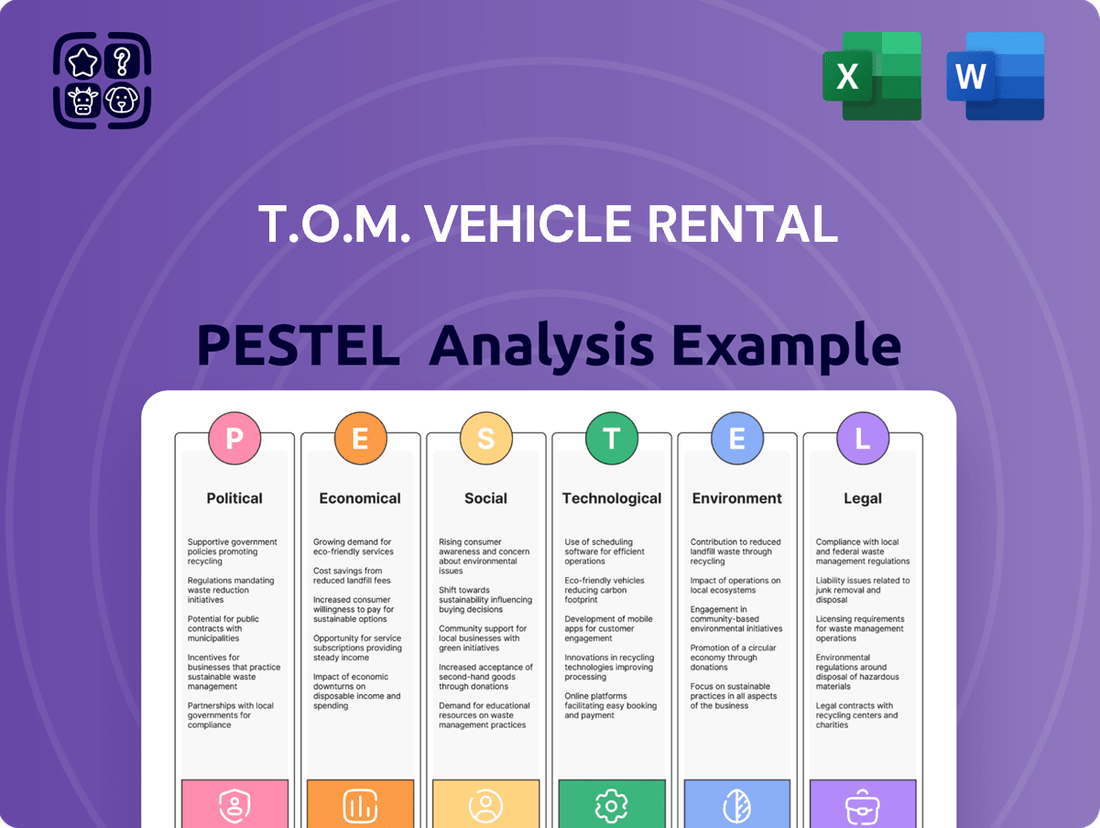

Gain a critical advantage with our comprehensive PESTLE Analysis of T.O.M. Vehicle Rental. We've meticulously examined the political, economic, social, technological, legal, and environmental factors that are profoundly shaping the company's operational landscape and future growth trajectory. Understand the subtle shifts in consumer behavior, the impact of emerging technologies on fleet management, and the evolving regulatory environment that T.O.M. Vehicle Rental must navigate. Equip yourself with this vital intelligence to identify both emerging threats and untapped opportunities within the vehicle rental sector. Download the full PESTLE analysis now to unlock actionable insights and refine your strategic planning for T.O.M. Vehicle Rental.

Political factors

The UK government's Zero Emission Vehicle (ZEV) mandate is a significant political factor for T.O.M. Vehicle Rental. This mandate requires a progressively higher proportion of new car and van sales to be zero-emission, starting in 2024.

Specifically for vans, the initial target is 10% zero-emission sales in 2024. This figure is set to increase sharply to 28% in 2025, signaling a rapid shift away from internal combustion engine vehicles. Ultimately, the government aims to ban the sale of new petrol and diesel vans entirely by 2035.

This policy directly influences T.O.M. Vehicle Rental's fleet procurement. The company must adapt its acquisition strategy to meet these evolving regulations and the increasing demand for electric vehicles from its business clients. Failure to do so could result in a fleet that is increasingly unmarketable and non-compliant.

Starting April 1, 2025, electric vehicles will no longer be exempt from Vehicle Excise Duty (VED). New EVs will face a first-year rate, followed by an annual standard rate, impacting the total cost of ownership for T.O.M. Vehicle Rental's electric fleet.

This taxation change, coupled with the extension of the Plug-in Van Grant, directly influences T.O.M.'s fleet acquisition costs and subsequent customer pricing strategies for their electric rental options.

Ongoing updates to road transport legislation, like London's stricter Direct Vision Standard (DVS2) for HGVs from October 2024, and the anticipated Euro 7 standard in 2025, demand constant fleet compliance. T.O.M. Vehicle Rental needs to ensure its vehicles adhere to these evolving safety and emission requirements to prevent penalties and maintain legal operations.

Failure to comply with these regulations can lead to significant fines. For instance, a DVS star rating below the required threshold in London can result in a £550 penalty. The introduction of Euro 7 is expected to increase vehicle manufacturing costs, potentially impacting rental fleet acquisition prices.

Impact of UK-EU Trade and Cooperation Agreement

The UK-EU Trade and Cooperation Agreement continues to shape post-Brexit regulatory landscapes. New amendments to international passenger services and goods vehicle operator licenses are set to take effect from April 1, 2025, directly impacting cross-border logistics. While T.O.M. Vehicle Rental's core business is domestic, these changes can indirectly affect clients engaged in international transport, potentially altering their vehicle rental requirements. For instance, a UK-based logistics firm that frequently transports goods to the EU might need different vehicle specifications or documentation to comply with updated regulations, influencing their fleet choices and rental duration. This regulatory evolution underscores the need for T.O.M. to stay abreast of international transport rules to better serve its diverse clientele.

The implementation of these new regulations from April 2025 could lead to increased administrative burdens and compliance costs for businesses operating across the UK and EU. For T.O.M.'s clients involved in international rentals, this might translate to higher operational expenses, potentially affecting their demand for rental vehicles or the types of vehicles they require. For example, a company previously using standard UK-registered vans for short trips into the EU might now need specialized vehicles or permits, impacting their rental budget. The Office for National Statistics reported that in Q4 2024, UK trade in goods with the EU saw a 3% increase compared to the previous year, indicating continued economic activity that is sensitive to such regulatory shifts.

- Regulatory Changes: Amendments to international passenger services and goods vehicle operator licenses from April 1, 2025, will impact cross-border operations.

- Client Impact: Clients involved in international transport may face new requirements influencing their rental needs and vehicle choices.

- Operational Adjustments: Businesses may need different vehicle specifications or documentation for cross-border compliance, affecting rental budgets.

- Economic Context: Continued UK-EU trade activity highlights the sensitivity of the rental market to these regulatory adjustments.

Government Investment in Transport Infrastructure

The UK government's extensive infrastructure strategy, with a strong focus on electric vehicle (EV) charging and data-driven mobility solutions, directly impacts the operational feasibility and growth potential for T.O.M. Vehicle Rental's electric commercial vehicle fleet. Significant government investment, such as the more than £2 billion committed to EV charging infrastructure by 2030, aims to create a robust charging network, which is crucial for T.O.M. to expand its EV offerings. The emphasis on green refuelling hubs and the expansion of charging infrastructure directly supports the transition to electric vehicles, presenting a strategic opportunity for T.O.M. to align its fleet development with national policy.

Key government initiatives that T.O.M. can leverage include:

- Funding for EV charging points: The ZEV mandate and associated grants encourage the deployment of public and private charging infrastructure.

- Investment in smart grid technology: This will support the increased demand from commercial EV fleets.

- Support for hydrogen refuelling infrastructure: This could present future opportunities for alternative fuel vehicle rentals.

- Data-led mobility initiatives: These could provide T.O.M. with insights to optimize fleet management and charging schedules.

The UK's Zero Emission Vehicle (ZEV) mandate, starting with 10% zero-emission van sales in 2024 and rising to 28% in 2025, directly compels T.O.M. Vehicle Rental to shift its fleet acquisition towards electric vehicles. From April 1, 2025, electric vehicles will incur Vehicle Excise Duty, impacting the total cost of ownership and rental pricing for T.O.M.'s EV fleet. Furthermore, stricter road transport legislation like London's Direct Vision Standard (DVS2) from October 2024 and the anticipated Euro 7 emissions standard in 2025 necessitate continuous fleet compliance to avoid penalties.

| Regulation | Effective Date | Impact on T.O.M. Vehicle Rental |

|---|---|---|

| ZEV Mandate (Vans) | 2024 (10% ZEV), 2025 (28% ZEV) | Fleet procurement must prioritize EVs; potential for higher upfront costs. |

| VED for EVs | April 1, 2025 | Increased operating costs for EV fleet, influencing rental pricing. |

| London DVS2 (HGVs) | October 2024 | Fleet must meet minimum safety standards for operation in London. |

| Euro 7 Emissions Standard | Anticipated 2025 | Potential for increased vehicle manufacturing costs, affecting fleet acquisition. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing T.O.M. Vehicle Rental across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify both opportunities and threats within the industry.

This PESTLE analysis for T.O.M. Vehicle Rental acts as a pain point reliever by offering a clear, summarized overview of external factors, enabling swift identification of potential operational hurdles and strategic opportunities for proactive mitigation and growth.

Economic factors

The broader UK economic outlook, particularly trends in business investment, significantly influences the demand for commercial vehicle rental services. Businesses often scale their fleet needs in line with their investment plans and overall economic confidence.

In the first quarter of 2025, UK business investment demonstrated a positive uptick, rising by 2.1%. This suggests a growing willingness among companies to expand operations and capital expenditure, which can translate to increased demand for flexible fleet solutions as businesses look to optimize their spending rather than commit to outright purchases.

Inflationary pressures are a significant concern for T.O.M. Vehicle Rental, directly impacting the cost of acquiring new vehicles, essential maintenance, fuel, and labor. For instance, the average price of a new car in the US saw an increase of approximately 10% in 2024 compared to the previous year, a trend expected to continue into 2025, impacting T.O.M.'s fleet acquisition costs.

The outlook for the vehicle rental sector in 2025 is certainly challenged by these escalating operational costs. T.O.M. will need to carefully navigate pricing strategies and enhance operational efficiencies to safeguard its profit margins amidst this rising cost environment.

Elevated interest rates, such as the Bank of England's base rate holding steady at 5.25% through early 2024, directly impact vehicle financing costs. This makes acquiring new vehicles, especially the often higher-priced electric models, more expensive for fleet managers.

The increased burden of financing can deter businesses from outright purchases or long-term leases. This situation creates a more appealing environment for flexible rental and contract hire solutions, which T.O.M. Vehicle Rental specializes in providing.

For instance, a business looking to add 50 new vehicles to its fleet in 2024 might face significantly higher monthly payments due to interest rate hikes compared to a year prior, potentially shifting their budget priorities.

Consequently, T.O.M.'s adaptable rental agreements offer a predictable cost structure, shielding businesses from the volatility and higher upfront capital requirements associated with interest-sensitive vehicle acquisition.

Commercial Vehicle Market Trends

The UK commercial vehicle market faces a projected decline in registrations over the next five years. This downturn is already being felt, with a notable slump in production observed in May 2024, largely due to ongoing supply chain challenges. These disruptions directly impact vehicle availability and can lead to increased pricing for T.O.M. Vehicle Rental, affecting their fleet expansion and replacement strategies.

Specific data from the Society of Motor Manufacturers and Traders (SMMT) indicates a significant year-on-year drop in commercial vehicle production in May 2024. For instance, light commercial vehicle production saw a substantial percentage decrease compared to the previous year, a trend that is expected to persist. This scarcity can translate into longer lead times and higher capital expenditure for T.O.M. when acquiring new vehicles for its rental fleet.

The economic headwinds affecting the broader automotive sector, including inflation and rising interest rates, also contribute to this subdued outlook for commercial vehicles. Businesses may postpone fleet upgrades or reduce their overall vehicle requirements in response to economic uncertainty. This market contraction presents a challenge for T.O.M. in securing competitive pricing and timely delivery of vehicles necessary to maintain and grow its rental operations.

- Projected Registration Decline: The UK commercial vehicle market is forecast to see fewer new registrations over the next five years.

- Production Slump: May 2024 witnessed a significant drop in commercial vehicle production, exacerbating supply issues.

- Supply Chain Impact: Ongoing supply chain disruptions are a primary driver of reduced production and availability.

- Cost Implications: Reduced availability and increased demand for remaining stock are likely to drive up vehicle acquisition costs for T.O.M.

Demand for Flexible Fleet Solutions

The UK's vehicle rental market is set for significant expansion, with projections indicating robust growth up to 2035. This upward trajectory is largely fueled by a continuing consumer preference for flexible and shared mobility options, a trend perfectly aligned with T.O.M. Vehicle Rental's established business model.

This growing demand for agility in transportation solutions plays directly into T.O.M.'s strengths. The company's focus on both short-term rentals and longer-term contract hire caters precisely to this evolving market dynamic. For instance, the Association of Fleet Professionals (AFP) reported in early 2024 that over 60% of their members were actively exploring flexible fleet solutions to manage costs and operational efficiency.

- Growing Mobility as a Service (MaaS) Adoption: Consumers are increasingly viewing mobility not as ownership but as a service, driving demand for rental and sharing platforms.

- Economic Uncertainty Favoring Flexibility: In uncertain economic climates, businesses and individuals often prefer rental over outright purchase to maintain capital flexibility.

- Corporate Fleet Optimization: Companies are seeking to reduce fixed assets and improve fleet adaptability, making rental solutions attractive for managing fluctuations in demand.

- Environmental Considerations: The rental model can also support the adoption of newer, more fuel-efficient, or electric vehicles, aligning with sustainability goals.

The UK economy's performance directly impacts T.O.M. Vehicle Rental. While business investment showed a positive 2.1% increase in Q1 2025, signaling potential demand for fleet services, persistent inflation continues to drive up acquisition and operational costs for rental companies. Elevated interest rates, with the Bank of England's rate at 5.25% in early 2024, increase financing expenses, potentially making rental solutions more attractive than outright purchases for businesses seeking cost predictability.

Despite a projected decline in UK commercial vehicle registrations and production challenges, the broader vehicle rental market is expected to expand significantly by 2035. This growth is driven by a consumer shift towards mobility as a service and a corporate preference for flexible fleet solutions to manage economic uncertainty and optimize capital. For T.O.M. Vehicle Rental, this presents an opportunity to capitalize on the demand for adaptable, cost-effective transportation.

| Economic Indicator | Value/Trend | Impact on T.O.M. Vehicle Rental |

|---|---|---|

| UK Business Investment (Q1 2025) | +2.1% increase | Potentially increased demand for commercial fleet rental. |

| UK Inflation (Ongoing) | Elevated | Higher vehicle acquisition, maintenance, and operational costs. |

| Bank of England Base Rate (Early 2024) | 5.25% | Increased financing costs for vehicle acquisition. |

| UK Commercial Vehicle Registrations | Projected decline over 5 years | Challenges in fleet expansion and higher per-unit costs for new vehicles. |

| UK Vehicle Rental Market Growth (to 2035) | Projected robust expansion | Opportunity for increased rental and contract hire demand. |

What You See Is What You Get

T.O.M. Vehicle Rental PESTLE Analysis

The preview you see here is the exact T.O.M. Vehicle Rental PESTLE Analysis document you’ll receive after purchase. It's fully formatted and professionally structured, offering a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the business. This detailed report is ready to use immediately, providing valuable insights for strategic planning. You can be confident that what you're previewing is precisely what you'll be downloading.

Sociological factors

The shift towards remote and hybrid work models is fundamentally altering how businesses approach fleet management. For instance, a 2024 survey indicated that 60% of companies now offer hybrid work options, a significant increase from pre-pandemic levels. This evolution means some organizations might downsize their permanent vehicle fleets, viewing them as less essential for daily operations.

However, this doesn't necessarily mean a decline in commercial vehicle demand. Instead, it can translate to a greater need for flexible, on-demand rental solutions. Businesses are increasingly turning to rental services like T.O.M. Vehicle Rental for project-specific needs or to cover temporary surges in demand, providing adaptability without the long-term commitment of ownership. In 2024, the commercial vehicle rental market saw a 7% growth, largely driven by this flexible usage trend.

Furthermore, increased employee mobility, even in hybrid setups, can spur rental demand. Employees might require vehicles for client visits, site inspections, or inter-office travel that isn't covered by their daily commute. T.O.M.'s ability to provide a diverse range of vehicles on short-term and flexible leases directly addresses these evolving mobility requirements.

The ongoing shortage of qualified commercial vehicle drivers, a persistent issue throughout 2024 and projected into 2025, significantly impacts fleet operations. In the UK, for instance, estimates from industry bodies suggest a deficit of over 50,000 HGV drivers, a figure that directly affects rental companies like T.O.M. by limiting the pool of available drivers for their clients’ needs.

Demographic shifts, with an aging driver population and fewer younger individuals entering the profession, exacerbate this driver shortage. This trend means T.O.M.'s clients might face increased operational costs and potential delays, thereby boosting demand for their fully managed fleet solutions that include driver provision or management.

Furthermore, regulatory requirements such as the Driver Certificate of Professional Competence (Driver CPC) mandate continuous training for drivers. This adds to the operational burden for businesses, making T.O.M.'s service offerings, which often encompass compliance and training management, more attractive as a way to mitigate these complexities.

Societal and business focus on Environmental, Social, and Governance (ESG) standards is intensifying, leading customers to prioritize eco-friendly fleet options. In 2024, a significant portion of consumers, estimated at over 70%, indicated a preference for businesses demonstrating strong sustainability commitments.

T.O.M. Vehicle Rental can capitalize on this trend by broadening its range of electric and low-emission vehicles. For instance, the global electric vehicle market is projected to reach $803 billion by 2027, highlighting a substantial growth opportunity.

Furthermore, offering clear and transparent sustainability reports for its fleet operations will build trust and appeal to environmentally conscious clients. By 2025, companies with robust ESG reporting are expected to see a 15% higher valuation compared to their peers.

Preference for Flexible Consumption Models

There's a noticeable societal move away from owning things outright and towards using services on a flexible, as-needed basis. This is particularly true in the automotive sector, with car rental companies seeing increased demand for flexible usage options.

Businesses are also embracing this shift, preferring rental or contract hire for their fleets instead of committing to long-term ownership. This preference for flexibility directly benefits companies like T.O.M. Vehicle Rental, as it aligns with their core service offering.

Consider these points:

- Subscription Growth: The global subscription e-commerce market, encompassing various services including mobility, was projected to reach over $1.5 trillion by 2025.

- On-Demand Economy: The rise of the on-demand economy has normalized paying for access rather than ownership across many industries.

- Fleet Flexibility: Businesses are increasingly looking for agile fleet solutions to manage costs and adapt to fluctuating operational needs.

- Contract Hire Demand: Contract hire agreements offer predictable monthly costs and often include maintenance, appealing to companies seeking budget certainty.

Safety and Wellbeing of Drivers

Societal expectations are increasingly prioritizing the safety and wellbeing of drivers, influencing fleet management practices. This shift is fueled by evolving regulations and a heightened sense of corporate responsibility. For T.O.M. Vehicle Rental, this translates into a strategic opportunity to integrate cutting-edge safety technologies and robust driver support programs.

By incorporating advanced driver-assistance systems (ADAS) and proactive driver monitoring, T.O.M. can significantly reduce accident risks and improve overall operational efficiency. For instance, advancements in telematics can provide real-time data on driver behavior, enabling targeted training interventions. This focus on safety not only protects drivers but also enhances T.O.M.'s reputation and service offering, making it a more attractive option for clients who value responsible fleet operations.

- Driver Safety Technologies: Adoption of ADAS features like automatic emergency braking and lane departure warnings is on the rise. In 2024, many new commercial vehicles are equipped with these systems as standard, reflecting industry trends.

- Wellbeing Initiatives: Companies are investing more in driver wellness programs, addressing issues like fatigue management and mental health support. This trend is expected to continue through 2025.

- Regulatory Push: Stricter regulations, such as those focusing on driver hours and vehicle maintenance, are compelling fleet operators to enhance their safety protocols.

- Corporate Responsibility: Brands are increasingly judged on their commitment to safety, impacting customer acquisition and retention. T.O.M.'s investment in safety directly supports its ESG (Environmental, Social, and Governance) commitments.

Societal shifts towards flexible consumption models are significantly impacting vehicle rental preferences. The "access over ownership" mentality, bolstered by the growth of the on-demand economy, means more businesses and individuals prefer renting for specific needs rather than outright purchase. This trend, projected to continue through 2025, supports T.O.M. Vehicle Rental's agile service offerings.

Increased emphasis on driver safety and well-being is reshaping fleet management. Companies are prioritizing vehicles equipped with advanced driver-assistance systems (ADAS), with many 2024 commercial vehicle models featuring these as standard. This focus on safety, coupled with growing corporate responsibility, makes T.O.M.'s commitment to safe fleet solutions a key differentiator.

The growing demand for subscription-based services, extending into mobility, is a key sociological factor. With the global subscription e-commerce market expected to exceed $1.5 trillion by 2025, consumers and businesses are increasingly comfortable with recurring payment models for access to goods and services, aligning perfectly with T.O.M.'s rental and contract hire structures.

| Societal Factor | Impact on T.O.M. Vehicle Rental | Supporting Data (2024/2025 Projection) |

| Access over Ownership | Increased demand for flexible rental and contract hire. | Growth in subscription services projected to exceed $1.5 trillion by 2025. |

| Driver Safety & Well-being | Demand for fleets with advanced safety features and driver support. | Widespread adoption of ADAS in new commercial vehicles in 2024; continued focus on driver wellness through 2025. |

| Environmental Consciousness | Preference for eco-friendly vehicle options. | Over 70% of consumers prefer businesses with strong sustainability commitments (2024 data). |

Technological factors

The automotive sector's rapid embrace of advanced telematics, AI, and 5G is fundamentally reshaping fleet operations. By 2024, over 90% of new commercial vehicles are projected to be equipped with telematics systems, providing a constant stream of data. T.O.M. Vehicle Rental can harness this for predictive maintenance, reducing downtime, and optimizing routes, with AI-powered analytics potentially cutting fuel costs by up to 15%.

This technological integration allows for granular insights into vehicle performance and driver behavior. For instance, AI can analyze driving patterns to identify areas for improvement, leading to safer operations and reduced accident rates, a critical factor in the rental industry. Furthermore, real-time diagnostics enabled by telematics can anticipate mechanical failures, preventing costly breakdowns and enhancing customer satisfaction.

The UK is witnessing a swift surge in electric commercial vehicle (EV) uptake, fueled by stringent environmental goals and the compelling long-term cost savings EVs offer. This trend means T.O.M. Vehicle Rental faces a dual imperative: capitalize on growing customer demand for electric options while navigating the complexities of managing a specialized fleet.

To stay competitive, T.O.M. must commit to ongoing investment in a varied electric fleet, encompassing vans and trucks. By 2024, for instance, the Society of Motor Manufacturers and Traders (SMMT) reported a significant increase in new zero-emission van registrations, indicating a clear market shift.

Meeting this evolving customer demand requires T.O.M. to not only expand its electric vehicle inventory but also to ensure robust charging infrastructure and maintenance support are in place. Failure to adapt could mean missing out on a substantial segment of the rental market, which is increasingly prioritizing sustainability.

Technology is rapidly transforming how rental services operate, making the entire experience smoother for customers. Think about it: booking a car can now be done entirely online, often with contactless options and even keyless entry systems. Many companies are also offering app-based access to vehicles, simplifying pick-up and drop-off.

T.O.M. Vehicle Rental can really leverage these technological advancements to stand out. By integrating digital check-ins and robust online booking systems, they can create a much more convenient customer journey. Imagine using AI-powered platforms to offer personalized deals and services, tailoring recommendations based on past rentals and preferences. This digital shift is not just about convenience; it’s about building stronger customer relationships. For instance, in 2023, the global car rental market saw a significant increase in app usage for bookings, with many leading companies reporting over 60% of their reservations originating from mobile platforms.

Development of Charging Infrastructure

The ongoing expansion of the UK's electric vehicle (EV) charging network is a key technological factor for T.O.M. Vehicle Rental. By the end of 2024, the government aimed for over 100,000 public charging points, a significant increase that eases range anxiety for EV users. This growth directly impacts T.O.M.'s ability to operate and offer electric fleet solutions, necessitating strategic planning for both in-house charging facilities and guidance for clients utilizing public infrastructure.

The development of green refuelling hubs, integrating renewable energy sources with charging capabilities, presents a further technological advancement. These hubs will be crucial for larger fleet operators like T.O.M. to ensure efficient and sustainable charging operations. By late 2025, projections indicate a substantial rise in the availability of high-speed charging options, making EV adoption more practical for commercial vehicle rentals.

- Network Expansion: The UK government's target of 100,000+ public charge points by end-2024 is a critical enabler.

- Green Refuelling Hubs: Integration of renewables with charging offers sustainable solutions for fleets.

- High-Speed Charging: Increasing availability of rapid charging by late 2025 will improve operational efficiency.

- Client Support: T.O.M. must assist clients in navigating and utilising this evolving charging landscape.

Cybersecurity and Data Protection in Fleet Management

The increasing reliance on telematics and digital platforms for fleet management means T.O.M. Vehicle Rental faces significant cybersecurity risks. In 2024, the global fleet management market, valued at approximately $24.6 billion, is heavily digitized, making data protection a critical concern. Protecting sensitive vehicle performance data and driver information from breaches is essential for maintaining customer trust and operational integrity.

T.O.M. must prioritize robust cybersecurity measures to safeguard its operations. This includes implementing advanced encryption for all data transmitted and stored, along with secure data handling protocols that align with regulations like GDPR. Non-compliance can lead to substantial penalties; for example, GDPR fines can reach up to €20 million or 4% of annual global turnover. By investing in strong cybersecurity, T.O.M. can mitigate risks and ensure compliance.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million globally, a significant increase that underscores the financial impact of inadequate security.

- GDPR Fines: Over 1,300 organizations faced GDPR fines totaling more than €300 million by early 2024, highlighting the regulatory imperative for data protection.

- Cybersecurity Investment: Companies are increasing cybersecurity budgets, with many projecting a 10-15% rise in spending for 2024 to address evolving threats.

- Telematics Data Volume: Modern fleets generate terabytes of data annually, necessitating scalable and secure data management solutions.

The evolution of vehicle technology, particularly in telematics and AI, is transforming fleet management for T.O.M. Vehicle Rental. By 2024, over 90% of new commercial vehicles are expected to have telematics, enabling predictive maintenance and route optimization, with AI potentially cutting fuel costs by up to 15%.

The increasing adoption of electric vehicles (EVs) in the UK, driven by environmental goals and cost savings, presents both opportunities and challenges. T.O.M. must expand its EV fleet and ensure adequate charging infrastructure to meet growing customer demand for sustainable options.

Technological advancements are also streamlining the customer experience, with app-based bookings and contactless entry becoming more common. In 2023, over 60% of car rental bookings originated from mobile platforms, highlighting the importance of digital integration for T.O.M. to enhance customer convenience and loyalty.

The expansion of the UK's EV charging network, aiming for over 100,000 public charge points by the end of 2024, is crucial for T.O.M.'s electric fleet strategy. Strategic planning for charging facilities and client support in navigating this network will be key.

The increasing reliance on digital platforms for fleet management exposes T.O.M. to significant cybersecurity risks. With the global fleet management market valued at approximately $24.6 billion in 2024 and heavily digitized, robust data protection is paramount to maintain customer trust and operational integrity.

Legal factors

The Zero Emission Vehicle (ZEV) mandate, effective January 1, 2024, requires manufacturers to meet specific targets for zero-emission vehicle sales. For T.O.M. Vehicle Rental, this regulation indirectly boosts the availability of electric and other ZEVs in the market. This increased supply is crucial for T.O.M. to meet its own sustainability goals and adapt its fleet acquisition strategies to align with the growing regulatory push for cleaner transportation options.

The Driver and Vehicle Standards Agency (DVSA) mandates stringent roadworthiness standards for all vehicles, directly impacting T.O.M. Vehicle Rental. This includes regular MOT testing, which verifies essential safety components like brakes, tires, and emissions control systems. For instance, in the UK, the pass rate for the Class 4 MOT test, which covers most cars, was around 85% in 2023, highlighting the rigorous nature of these inspections.

To maintain compliance and operational integrity, T.O.M. must adhere to these DVSA regulations by implementing robust maintenance schedules and frequent internal checks across its entire fleet. Failure to meet these standards can result in significant penalties, including fines and the grounding of vehicles, which directly affect revenue and customer satisfaction. Recent DVSA enforcement actions in 2024 have shown an increased focus on tire wear and brake performance, areas critical for rental fleets.

Regulations around driver licensing, particularly for commercial vehicles, are paramount for T.O.M. Vehicle Rental. This includes ensuring clients understand and adhere to requirements for specific licenses, such as those needed for larger trucks or specialized equipment. In 2024, continued scrutiny on driver qualifications means clients must verify their drivers hold the correct permits.

The Certificate of Professional Competence (CPC) is another vital legal factor, especially for drivers operating commercially in many European countries. T.O.M. must guide its clients to ensure their drivers possess valid CPCs, as non-compliance can lead to significant penalties. The EU’s ongoing enforcement of CPC requirements remains a key consideration for cross-border rentals.

Working time limits for commercial drivers are strictly regulated to ensure road safety. T.O.M. needs to educate clients on these limits, which often involve daily and weekly driving hour restrictions, as well as mandatory rest periods. The introduction of more sophisticated tachograph technology, including smart tachographs mandated for new vehicles from August 2023, aids in monitoring compliance, and T.O.M. can leverage this by offering vehicles equipped with such systems for international operations.

Clean Air Zones (CAZ) and Ultra Low Emission Zones (ULEZ)

The increasing number of Clean Air Zones (CAZs) and Ultra Low Emission Zones (ULEZs) in major UK cities, such as London, Birmingham, and Oxford, directly impacts T.O.M. Vehicle Rental's operational costs and fleet strategy. To avoid daily charges, which can be substantial, T.O.M. must ensure its fleet is compliant with stringent emission standards, typically Euro 6 or higher for diesel vehicles, and zero-emission for electric vehicles.

This regulatory push is a significant driver for fleet modernization. For instance, by late 2024, London's ULEZ expanded to cover all boroughs, increasing the number of vehicles requiring compliance. This trend means T.O.M. is incentivized to invest in newer, more fuel-efficient, and potentially electric vehicles, which command higher upfront costs but reduce ongoing charges and potential fines. The government’s commitment to net-zero targets by 2050 further accelerates this shift, influencing long-term fleet planning and acquisition strategies.

- Regulatory Compliance Costs: Failure to meet Euro 6 standards can result in daily charges for vehicles entering CAZs/ULEZs, impacting profitability. For example, the London ULEZ charge is £12.50 per day for non-compliant cars and smaller vans.

- Fleet Modernization Demand: There's a growing market demand for rental vehicles that meet these emission standards, creating opportunities for T.O.M. if its fleet is compliant.

- Investment in Electric Vehicles (EVs): The government's support for EV adoption, including grants and charging infrastructure development, encourages T.O.M. to consider expanding its electric fleet.

- Operational Efficiency: Investing in compliant vehicles can lead to operational savings by avoiding penalty charges and potentially benefiting from lower running costs associated with newer technologies.

Data Protection Regulations (GDPR)

The General Data Protection Regulation (GDPR) significantly impacts T.O.M. Vehicle Rental's operations by dictating how personal data, including that from vehicle tracking and telematics, can be handled. Compliance requires meticulous attention to data collection, storage, and usage protocols. For instance, T.O.M. must be transparent with customers and drivers about what data is collected and why, ensuring clear consent is obtained, especially for telematics data that can monitor driver behavior.

Failure to adhere to GDPR can result in substantial penalties. In 2023, fines under GDPR continued to be a significant concern for businesses across the EU, with some companies facing multi-million euro penalties for data breaches or non-compliance. T.O.M. must implement robust security measures to protect this sensitive information.

- GDPR mandates explicit consent for data collection, particularly for telematics data.

- Data minimization is key; T.O.M. should only collect data essential for its services.

- Robust security protocols are necessary to prevent data breaches and unauthorized access.

- Transparency in data usage builds trust with drivers and customers.

The evolving landscape of emissions regulations, particularly Clean Air Zones (CAZs) and Ultra Low Emission Zones (ULEZs), directly influences T.O.M. Vehicle Rental's fleet composition and operational costs. Cities like London have expanded their ULEZ zones in 2024, making compliance with stricter emission standards, such as Euro 6 for diesel, a necessity to avoid significant daily charges. This regulatory pressure compels T.O.M. to accelerate its investment in newer, compliant vehicles, including electric options, to mitigate penalties and meet growing customer demand for environmentally friendly rentals.

Adherence to General Data Protection Regulation (GDPR) is critical for T.O.M. Vehicle Rental, especially concerning the data collected through telematics and booking systems. Non-compliance, as evidenced by significant fines issued in 2023 across the EU for data breaches, necessitates robust data protection measures and transparent consent processes for customer and driver information. This legal framework shapes how T.O.M. manages client data, emphasizing security and privacy.

The Zero Emission Vehicle (ZEV) mandate, implemented from January 1, 2024, is reshaping the automotive market by requiring manufacturers to increase their ZEV sales. This indirectly benefits T.O.M. Vehicle Rental by increasing the availability of electric and other ZEVs, facilitating the company's transition towards a more sustainable fleet. Aligning with these mandates is essential for T.O.M. to meet its own sustainability targets and adapt its fleet acquisition strategies.

| Regulation | Impact on T.O.M. Vehicle Rental | Key Compliance Aspects | Example Data Point |

|---|---|---|---|

| ZEV Mandate (2024) | Increases availability of electric vehicles, supporting fleet modernization. | Fleet acquisition strategy alignment with ZEV targets. | Manufacturers must meet specific ZEV sales percentages. |

| CAZ/ULEZ Regulations | Drives investment in compliant vehicles to avoid charges. | Fleet must meet Euro 6 (diesel) or zero-emission standards. | London ULEZ charge: £12.50 per day for non-compliant vehicles. |

| GDPR | Requires stringent data protection and transparent consent. | Secure handling of customer and telematics data. | Significant GDPR fines issued in 2023 for data breaches. |

Environmental factors

The UK government's legally binding commitment to achieve net-zero greenhouse gas emissions by 2050, with interim targets like the 68% reduction by 2030 compared to 1990 levels, directly pressures the transport sector. This translates to a significant push for the decarbonization of commercial vehicle fleets, influencing rental companies like T.O.M. Vehicle Rental.

To comply and remain competitive, T.O.M. must strategically invest in electric vehicles (EVs) and other low-emission alternatives, such as hydrogen fuel cell vehicles. For instance, by the end of 2023, the UK had over 1 million electric cars on the road, a figure that is rapidly growing and signaling a shift in infrastructure and availability for commercial operations.

Furthermore, T.O.M. will need to adopt and promote sustainable fleet management practices. This includes optimizing routes to reduce mileage, implementing efficient driving training for renters, and exploring vehicle-to-grid technology to support the wider energy transition, aligning operational efficiency with environmental mandates.

The number of electric commercial vehicles (ECVs) on UK roads saw a significant 31% increase between 2023 and 2024, underscoring a powerful shift toward sustainable logistics. This rapid adoption means T.O.M. Vehicle Rental needs to bolster its fleet with more electric vans and trucks to cater to evolving customer needs.

Stricter emissions standards like Euro 6 are already in place, with Euro 7 anticipated to further tighten limits on pollutants. Many European cities, including London with its Ultra Low Emission Zone (ULEZ), are expanding or implementing clean air zones, restricting older, more polluting vehicles. T.O.M. Vehicle Rental needs to ensure its fleet meets these evolving requirements to avoid client penalties and maintain access to key urban markets, reflecting the growing demand for greener transportation solutions.

Sustainability in Fleet Management Practices

Sustainability in fleet management is expanding beyond just reducing tailpipe emissions. There's a growing emphasis on aspects like ensuring fleets are the right size for the job, maximizing vehicle utilization, and planning routes for maximum efficiency. This shift means fleet managers are looking at their operations holistically to minimize their environmental footprint.

T.O.M. Vehicle Rental is well-positioned to assist clients in this evolving landscape. By offering expert advice and practical solutions, T.O.M. can help businesses reduce their overall environmental impact. This not only aligns with corporate social responsibility goals but also adds tangible value to T.O.M.'s service offerings, potentially attracting environmentally conscious clients.

For instance, the UK's Department for Transport reported that in 2023, road transport accounted for 27% of all greenhouse gas emissions. Optimizing fleet size and usage directly addresses this, with studies suggesting that improved route planning alone can reduce fuel consumption by up to 15%. T.O.M.'s ability to provide these services can be a significant differentiator.

- Fleet Right-Sizing: Reducing the number of vehicles to match actual operational needs, cutting down on idle time and associated emissions.

- Optimized Utilization: Ensuring vehicles are used as much as possible, avoiding underutilized assets that contribute to unnecessary environmental strain.

- Efficient Route Planning: Utilizing advanced software to create the most direct and fuel-efficient routes, minimizing mileage and fuel consumption.

- Data-Driven Insights: Providing clients with analytics on their fleet's environmental performance to identify areas for further improvement.

Development of Green Energy and Charging Infrastructure

The expansion of electric vehicle (EV) rentals by companies like T.O.M. Vehicle Rental is significantly influenced by the availability and accessibility of green energy sources and charging infrastructure. While T.O.M. doesn't directly build this infrastructure, its business model relies heavily on these external developments. For instance, by the end of 2023, the UK had over 50,000 public charging points, a number projected to grow, but the distribution and reliability of these points, especially for commercial fleet needs, remain critical. This dependency means T.O.M. must stay informed and potentially forge strategic alliances to ensure its EV rental fleet can be efficiently powered and maintained.

The growth trajectory of EV adoption in the commercial sector, which directly impacts T.O.M.'s rental market, is intrinsically linked to the robustness of the charging ecosystem. Government incentives and private investment are driving installations, with projections indicating a substantial increase in charging station availability by 2025.

- Increased EV Charging Points: As of early 2024, the UK government aims to have at least 300,000 public charging devices by 2030.

- Green Energy Integration: A growing percentage of new charging installations are powered by renewable energy sources, aligning with sustainability goals.

- Fleet Charging Solutions: Investments are being made in dedicated charging hubs for commercial fleets, addressing range anxiety and downtime concerns.

- Grid Capacity Concerns: While infrastructure is expanding, ensuring sufficient grid capacity to handle the surge in EV charging, particularly for large fleets, remains an ongoing challenge.

The UK's commitment to net-zero by 2050, with a 68% emissions reduction target by 2030, significantly impacts T.O.M. Vehicle Rental by driving demand for low-emission commercial vehicles. The rapid growth of electric cars, exceeding 1 million by late 2023, signals a strong market shift, necessitating T.O.M.'s investment in EVs and sustainable fleet practices to meet evolving client needs and regulatory pressures.

The increasing number of electric commercial vehicles (ECVs) on UK roads, showing a 31% rise between 2023 and 2024, directly influences T.O.M.'s fleet strategy. Furthermore, stricter emission standards like Euro 7 and expanding clean air zones, such as London's ULEZ, require T.O.M. to maintain a compliant fleet to ensure client access to urban markets and avoid penalties.

Environmental factors also highlight opportunities for T.O.M. to offer value-added services like fleet right-sizing and optimized route planning, which can reduce client emissions and operational costs. For instance, road transport accounted for 27% of UK greenhouse gas emissions in 2023, and improved route planning can cut fuel consumption by up to 15%.

The availability of charging infrastructure is a critical environmental consideration for T.O.M.'s EV rental growth. While the UK had over 50,000 public charging points by late 2023, with aims for 300,000 by 2030, the distribution and reliability for commercial fleets remain key. Investments in fleet-specific charging hubs and green energy integration are crucial for supporting wider EV adoption.

| Environmental Factor | Impact on T.O.M. Vehicle Rental | Key Data/Trend (2023-2025) |

|---|---|---|

| Net-Zero Targets (UK Gov) | Drives demand for low-emission vehicles; necessitates fleet decarbonization. | 68% emissions reduction target by 2030. |

| EV Adoption | Opportunity to expand EV rental fleet; need to adapt to growing market. | 31% increase in ECVs (2023-2024); >1 million EVs on UK roads (late 2023). |

| Emissions Standards & Clean Air Zones | Requires fleet compliance; potential market access restrictions for older vehicles. | Euro 7 standards anticipated; ULEZ expansion in London. |

| Charging Infrastructure | Essential for EV rental viability; reliance on external development. | >50,000 public charging points (late 2023); aim for 300,000 by 2030. |

PESTLE Analysis Data Sources

Our T.O.M. Vehicle Rental PESTLE Analysis is built on a robust foundation of data from government agencies, industry associations, and reputable market research firms. We incorporate regulatory updates, economic indicators, technological advancements, and socio-cultural trends to provide a comprehensive view.