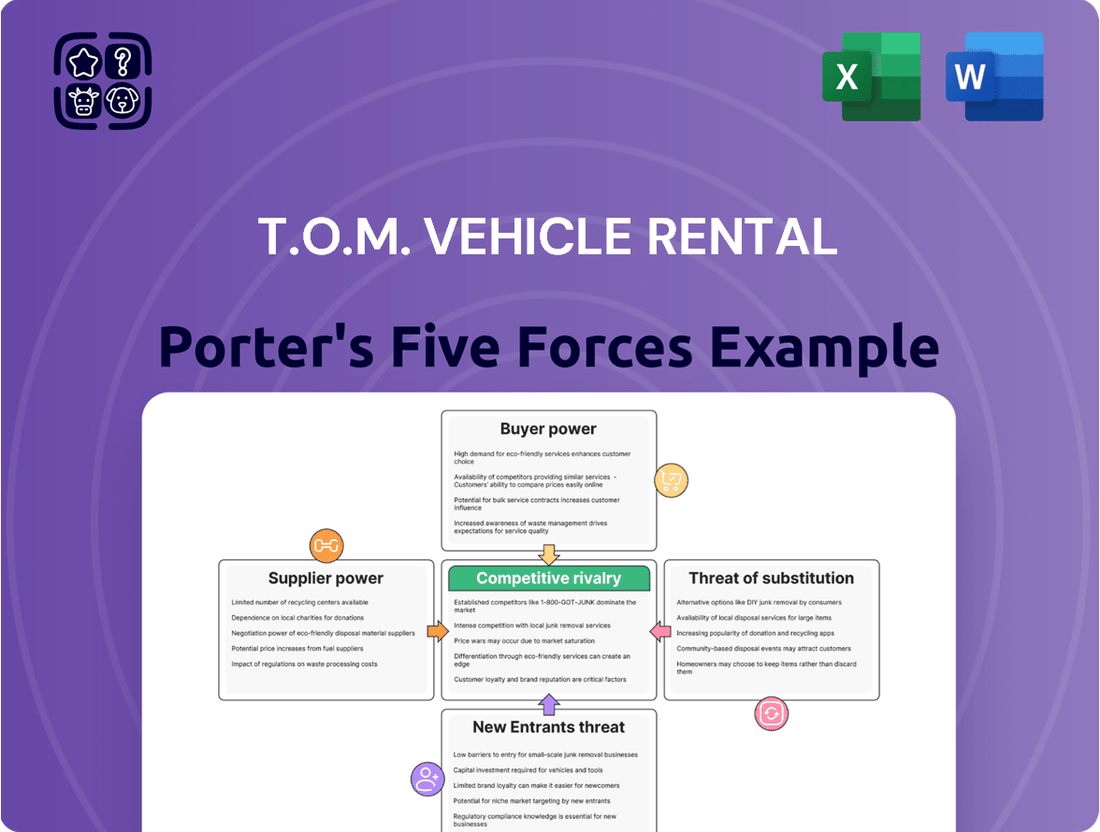

T.O.M. Vehicle Rental Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

T.O.M. Vehicle Rental Bundle

T.O.M. Vehicle Rental operates in a dynamic market, facing distinct pressures from buyers, suppliers, rivals, new entrants, and substitutes. Understanding these forces is crucial for strategic positioning and long-term success. This brief snapshot only scratches the surface of these critical competitive dynamics. Unlock the full Porter's Five Forces Analysis to explore T.O.M. Vehicle Rental’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The UK commercial vehicle market's consolidation, with manufacturers like DAF, Ford, Vauxhall, and Renault holding substantial sway, directly empowers suppliers. This limited choice for rental firms like T.O.M. Vehicle Rental grants these manufacturers considerable bargaining power, influencing prices and terms.

With fewer sourcing options, T.O.M. faces the reality of potentially higher acquisition costs for its fleet. The concentration of manufacturers means that these key players can dictate terms, especially for high-demand vehicles or the latest electric models, impacting T.O.M.'s operational costs and fleet expansion capabilities.

In 2024, the UK commercial vehicle market saw continued demand, particularly for electric vans, with registrations of battery electric vans increasing by approximately 15% year-on-year according to SMMT data. This growing demand for newer, greener technologies further strengthens the hand of manufacturers who can control the supply of these sought-after vehicles.

Suppliers of specialized vehicle parts and maintenance services wield significant power, particularly for a company like T.O.M. Vehicle Rental, which operates a diverse fleet encompassing vans, trucks, and more specialized vehicles. This power stems from the unique nature and specialized technical expertise demanded for maintaining such commercial fleets. T.O.M.'s dependence on specific suppliers for genuine parts and qualified technicians to service its complex vehicle range inherently limits its bargaining options and can lead to higher operational costs.

Recent years have highlighted the impact of supply chain disruptions on the automotive sector, affecting the availability of essential parts. For instance, the global semiconductor shortage, which significantly impacted vehicle production and parts availability through 2022 and into 2023, demonstrated how such disruptions can amplify supplier leverage. This situation directly affects T.O.M.'s capacity to efficiently maintain its fleet, potentially leading to increased downtime and repair expenses, thereby bolstering the bargaining power of those suppliers who can ensure consistent part availability.

While the traditional fuel market for diesel and petrol vehicles is typically competitive, the accelerating shift towards electric vehicles (EVs) is reshaping this landscape. T.O.M. Vehicle Rental's increasing reliance on EV fleets means its bargaining power with traditional fuel suppliers may diminish, while its dependence on energy providers and charging infrastructure companies will grow. This transition could see utility companies and charging network developers gain leverage as T.O.M. seeks consistent and affordable energy sources.

The global average price of electricity for businesses saw a notable increase in 2024, with some regions experiencing double-digit percentage hikes. For instance, data from the International Energy Agency (IEA) indicated that industrial electricity prices in the European Union rose by approximately 15% in the first half of 2024 compared to the previous year. This volatility in energy prices directly impacts T.O.M.'s operating expenses, potentially forcing the company to adjust rental rates for its EV fleet to maintain profitability.

Vehicle Financing and Insurance Providers

Vehicle financing and insurance providers, such as banks and specialist asset finance firms, wield considerable influence. T.O.M. Vehicle Rental depends on these suppliers to acquire and maintain its extensive fleet without immobilizing substantial capital.

The conditions, interest rates, and insurance premiums set by these financial institutions directly impact T.O.M.'s bottom line and its capacity for growth or fleet modernization. For instance, in 2024, the average interest rate for commercial vehicle loans saw fluctuations, potentially increasing T.O.M.'s financing costs.

- Financing Costs: Higher interest rates on vehicle loans increase T.O.M.'s operational expenses.

- Insurance Premiums: Rising insurance costs for commercial fleets directly reduce profit margins.

- Access to Capital: The willingness of lenders to finance fleet expansion is crucial for T.O.M.'s growth strategy.

- Terms and Conditions: Favorable financing terms can significantly improve T.O.M.'s cash flow and investment capacity.

Technology and Software Providers for Fleet Management

The bargaining power of technology and software providers for fleet management is significant and growing, particularly for T.O.M. Vehicle Rental. As the industry increasingly relies on sophisticated digital tools, companies like T.O.M. are dependent on suppliers offering telematics, AI for predictive maintenance, and advanced route optimization. This reliance translates into greater leverage for these technology vendors.

The specialized nature of these software solutions means that switching providers can be costly and disruptive. Proprietary technologies or systems that are deeply integrated into T.O.M.'s operations create substantial switching costs. For instance, the global fleet management software market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, indicating strong demand and supplier influence.

- Increased Reliance on Advanced Software: T.O.M. needs cutting-edge telematics and AI to maintain operational efficiency and competitive edge.

- High Switching Costs: Integrating new software systems is complex and expensive, locking T.O.M. into existing vendor relationships.

- Vendor Lock-in: Proprietary software and data integration can make it difficult and costly for T.O.M. to change suppliers.

- Market Growth and Specialization: The expanding fleet management technology market empowers specialized providers who offer unique, in-demand solutions.

The bargaining power of suppliers for T.O.M. Vehicle Rental is amplified by market consolidation among vehicle manufacturers, leading to fewer sourcing options and potentially higher acquisition costs. This is further intensified by the growing demand for specialized vehicles, such as electric vans, where manufacturers like DAF and Ford, holding significant market share in the UK, can dictate terms. For instance, the UK's battery electric van registrations saw around a 15% year-on-year increase in 2024, a trend that strengthens manufacturers' leverage in supplying these in-demand models.

Specialized parts and maintenance suppliers also exert considerable power due to the complex nature of commercial fleets, demanding unique technical expertise and genuine parts. Furthermore, the shift to electric vehicles increases T.O.M.'s reliance on energy providers and charging infrastructure companies, whose pricing directly impacts operational expenses, with business electricity prices seeing an approximate 15% rise in the EU during early 2024.

The bargaining power of suppliers for T.O.M. Vehicle Rental is notably shaped by the automotive industry's dynamics. Key factors include market concentration among vehicle manufacturers, the increasing demand for specialized vehicles like electric vans, and the critical role of specialized parts and maintenance providers. Additionally, the transition to electric mobility shifts leverage towards energy providers and charging infrastructure companies.

| Supplier Category | Key Factors Amplifying Bargaining Power | Impact on T.O.M. Vehicle Rental | Relevant 2024 Data/Trends |

|---|---|---|---|

| Vehicle Manufacturers | Market consolidation, limited alternative sourcing options | Higher vehicle acquisition costs, restricted choice of models | UK commercial vehicle market concentration; ~15% YoY increase in battery electric van registrations (SMMT) |

| Parts & Maintenance Specialists | Specialized technical expertise, proprietary parts, supply chain disruptions | Increased repair costs, potential for fleet downtime | Lingering effects of semiconductor shortages impacting parts availability |

| Energy & Charging Infrastructure Providers | Growing reliance on EVs, volatility in energy prices | Increased operating expenses for EV fleet, potential for higher rental rates | ~15% increase in European business electricity prices (IEA) in H1 2024 |

| Technology & Software Providers | High switching costs, proprietary systems, increasing dependence on advanced fleet management tools | Vendor lock-in, potential for higher software licensing fees | Global fleet management software market valued at ~$2.5 billion in 2023, indicating strong vendor influence |

What is included in the product

This analysis specifically examines the competitive forces impacting T.O.M. Vehicle Rental, detailing the intensity of rivalry, the bargaining power of customers and suppliers, and the threats from new entrants and substitutes.

T.O.M. Vehicle Rental's Porter's Five Forces Analysis provides a visual, actionable roadmap to navigate competitive threats, transforming complex market dynamics into clear strategic opportunities.

Customers Bargaining Power

T.O.M. Vehicle Rental serves a diverse business clientele, from small startups to large corporations. Customers requiring substantial fleet services, such as extensive contract hire or comprehensive fleet management, wield significant bargaining power. This is directly linked to the sheer volume of business they represent, allowing them to negotiate for better pricing and customized service agreements, impacting T.O.M.'s per-vehicle revenue. For instance, a large corporate client might represent 10% or more of T.O.M.'s annual revenue, giving them considerable leverage.

Businesses, especially those in logistics and commercial sectors, are acutely aware of their expenses, making vehicle rental costs a significant consideration. This heightened price sensitivity, fueled by economic conditions and the drive to manage operational budgets efficiently, empowers customers to push T.O.M. Vehicle Rental for more competitive pricing.

For instance, a study in early 2024 indicated that over 60% of small to medium-sized businesses in the transport sector regularly compare at least three rental providers before making a decision, directly impacting T.O.M.'s pricing strategies.

The ease with which customers can switch between rental providers due to a competitive market landscape further amplifies their ability to negotiate favorable terms, forcing T.O.M. to remain vigilant about its rate structure to retain market share.

The UK commercial vehicle rental market is robust, offering businesses a wealth of choices. Major players like Hertz, Ryder, Penske, and Europcar compete alongside numerous smaller providers, creating a highly competitive landscape. This abundance of alternatives directly amplifies customer bargaining power, allowing businesses to easily shift to a different rental company if T.O.M. Vehicle Rental’s pricing or service doesn't meet their expectations. For instance, in 2024, the UK commercial vehicle rental sector saw significant growth, with total revenues projected to reach billions, indicating a market ripe for customer choice.

Low Switching Costs for Customers

For many businesses, switching commercial vehicle rental or fleet management providers involves relatively low costs, especially for short-term engagements. While long-term contracts might require some administrative setup, the lack of significant penalties or complex integration processes makes it straightforward for clients to explore other options. This ease of transition directly impacts T.O.M. Vehicle Rental, as it allows customers to readily seek out better pricing or service levels from competitors, thereby increasing the bargaining power of the customer.

The competitive landscape in commercial vehicle rental further amplifies this. In 2024, the global commercial vehicle rental market was valued at approximately $75 billion, indicating a highly competitive environment where customer retention is paramount. This means T.O.M. must continually offer compelling value propositions to prevent customers from easily migrating. The absence of substantial exit barriers means customers can, and often do, shop around for the best available terms.

- Low Switching Costs: Minimal financial or operational hurdles exist for clients moving between rental providers.

- Competitive Market Pressure: A large market value of around $75 billion in 2024 means many alternatives are readily available.

- Customer Leverage: The ease of switching empowers customers to negotiate favorable terms and pricing.

Customer Knowledge and Information Access

Sophisticated business clients at T.O.M. Vehicle Rental possess a deep understanding of prevailing market rates, service options, and what competitors offer. This informed position allows them to negotiate terms more assertively.

The widespread availability of information online and through industry channels means customers are highly knowledgeable. This transparency directly impacts T.O.M.'s pricing power, making it harder to charge premium rates unless superior value is clearly demonstrated.

- Informed Negotiation: Business clients can leverage real-time market data to secure better rental agreements, potentially reducing T.O.M.'s profit margins on corporate accounts.

- Price Sensitivity: Increased customer awareness of competitor pricing makes T.O.M. more susceptible to price wars, especially for standard rental services.

- Demand for Value-Added Services: Customers are more likely to pay higher prices if T.O.M. can clearly articulate and deliver unique benefits beyond basic vehicle provision.

Customers at T.O.M. Vehicle Rental possess significant bargaining power due to the competitive nature of the commercial vehicle rental market. With a global market valued at approximately $75 billion in 2024, businesses have numerous alternatives, allowing them to easily switch providers if T.O.M.'s offerings are not competitive. This ease of switching, coupled with informed clients who actively compare rates and services, compels T.O.M. to maintain aggressive pricing and deliver superior value to retain its customer base.

| Factor | Impact on T.O.M. Vehicle Rental | Example/Data (2024) |

| Market Size & Competition | Amplifies customer power due to abundant alternatives. | Global commercial vehicle rental market valued at ~$75 billion. |

| Switching Costs | Low switching costs empower customers to negotiate better terms. | Minimal financial or operational hurdles for clients changing providers. |

| Customer Information | Informed clients negotiate more assertively, impacting pricing. | Over 60% of SMBs in transport compare 3+ providers before deciding. |

| Price Sensitivity | Makes T.O.M. susceptible to price wars for standard services. | Businesses actively manage operational budgets, seeking cost efficiencies. |

Preview Before You Purchase

T.O.M. Vehicle Rental Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Five Forces analysis for T.O.M. Vehicle Rental details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors, all presented in a professionally formatted and actionable format.

Rivalry Among Competitors

The UK commercial vehicle rental and fleet management sector is a dynamic landscape featuring both major national companies and numerous smaller, localized businesses. T.O.M. operates within this environment, contending with established rental behemoths and niche fleet management specialists. This diverse competitive set, with some players holding substantial market sway and considerable financial backing, naturally fuels intense rivalry as everyone targets the same commercial clientele.

The UK truck rental market is poised for significant expansion, with forecasts indicating a compound annual growth rate of approximately 7.15% between 2025 and 2030. This growth is largely propelled by the escalating demands of e-commerce and the broader logistics sector.

While a growing market can naturally temper some competitive intensity, it doesn't eliminate it. Companies are actively investing and expanding to secure their positions, leading to robust rivalry as they vie for market share in this expanding but competitive landscape.

The increasing need for efficient logistics and transportation services is a primary driver behind the heightened competition. Businesses are looking for reliable and flexible truck rental solutions to meet fluctuating demands, intensifying the race among providers.

T.O.M. seeks to carve out its niche through a customer-focused approach, providing a wide array of vehicles, comprehensive maintenance, and even options for purchasing pre-owned fleet vehicles. This multifaceted service model aims to offer a complete solution for clients.

Despite these efforts, the competitive landscape is fierce, with many rivals offering comparable services, making it difficult to truly stand apart from the pack solely on service features. Price often becomes a primary differentiator when core offerings are similar.

The key to gaining a competitive edge for T.O.M. lies in offering distinct value propositions. This could include implementing cutting-edge telematics for better fleet management, prioritizing environmentally friendly vehicle options, or delivering an exceptional level of customer service that goes above and beyond the standard.

In 2024, the UK vehicle rental market saw continued emphasis on fleet modernization and sustainability, with a growing demand for electric vehicles. Companies that successfully integrated these aspects into their value proposition, alongside competitive pricing, were better positioned to attract and retain customers, indicating the importance of moving beyond basic rental services.

High Fixed Costs and Exit Barriers

The commercial vehicle rental sector is inherently capital-intensive. Companies must make substantial investments in acquiring diverse vehicle fleets, establishing and maintaining depots, and building essential maintenance infrastructure. For instance, in 2024, the average cost of a new medium-duty truck could range from $60,000 to $100,000, with heavy-duty vehicles exceeding $150,000.

These high fixed costs, coupled with the specialized nature of these assets, erect significant barriers to exiting the market. Once a company has invested heavily in its fleet and infrastructure, it becomes difficult and costly to divest these specialized assets. This often compels competitors to remain active, even during periods of low demand, to try and recoup their investments.

Consequently, the industry often experiences sustained competitive pressure. To maintain fleet utilization rates, which directly impact profitability given the high fixed costs, companies may engage in aggressive pricing strategies. This can lead to price wars, especially when multiple players are vying for market share and trying to cover their operational expenses.

- Capital Intensity: Significant upfront investment in vehicle fleets, depots, and maintenance facilities.

- Exit Barriers: Specialized assets and high sunk costs make exiting the market difficult and expensive.

- Competitive Pressure: Competitors tend to stay in the market, leading to ongoing rivalry.

- Price Wars: The need to maintain utilization rates can trigger price competition to cover fixed costs.

Strategic Objectives of Competitors

Competitors in the vehicle rental market exhibit a range of strategic aims. Some prioritize expanding their footprint and gaining market share, potentially through aggressive pricing strategies. Others focus on achieving robust profitability by optimizing fleet utilization and operational efficiency. A notable trend, observed as of mid-2024, is a significant push towards fleet electrification, with major players like Hertz and Avis Budget Group announcing substantial investments in electric vehicles (EVs) and related charging infrastructure. For instance, Hertz committed to acquiring 100,000 Teslas by the end of 2024, and Avis Budget Group partnered with BP Pulse for EV charging solutions.

These varied objectives can translate into unpredictable competitive actions. Companies aiming for market dominance might engage in price wars, making it challenging for T.O.M. to maintain margins without a similar commitment to scale or cost reduction. Conversely, a focus on niche markets, such as specialized commercial vehicle rentals or premium electric vehicle offerings, can lead to intense competition within those specific segments. The adoption of advanced technologies, including artificial intelligence for dynamic pricing and the Internet of Things (IoT) for fleet management, is also a key differentiator, requiring continuous investment to remain competitive.

- Market Share Maximization: Leading rental companies are actively pursuing growth, aiming to capture a larger portion of the overall rental market.

- Profitability Focus: Some competitors concentrate on operational efficiencies and premium service offerings to drive higher profit margins.

- Fleet Electrification: A significant strategic objective across the industry is the transition to electric vehicle fleets, with substantial capital being allocated to EV acquisition and charging infrastructure development.

- Technological Integration: Competitors are investing in AI and IoT to enhance customer experience, optimize fleet management, and improve pricing strategies.

Competitive rivalry in the UK commercial vehicle rental sector is intense, fueled by a mix of large national players and smaller regional businesses all vying for the same commercial clients. This is particularly evident as the market anticipates significant growth, projected at a 7.15% CAGR from 2025 to 2030, driven by e-commerce logistics. Companies are actively investing in fleet expansion and modernization, including a notable shift towards electric vehicles, to secure market share.

The capital-intensive nature of the industry, with substantial investments in fleets and infrastructure, creates high exit barriers. This compels existing players to remain competitive, often leading to price wars as they strive to maintain fleet utilization and cover significant fixed costs. For instance, in 2024, acquiring new medium-duty trucks could cost between $60,000 and $100,000, underscoring the financial commitment required.

Competitors pursue varied strategies, from aggressive market share expansion, sometimes through price undercutting, to optimizing profitability via operational efficiency and niche offerings. The drive towards fleet electrification is a major trend; Hertz planned to acquire 100,000 Teslas by the end of 2024, and Avis Budget Group partnered with BP Pulse for EV charging. These diverse strategic aims, coupled with investments in AI and IoT for enhanced fleet management, create a dynamic and challenging competitive environment.

| Company | 2024 EV Investment/Strategy | Key Competitor Focus |

|---|---|---|

| Hertz | Acquire 100,000 Teslas by end of 2024 | Fleet electrification, expanding EV options |

| Avis Budget Group | Partnered with BP Pulse for EV charging | Charging infrastructure, sustainability initiatives |

| Major UK Players (e.g., Enterprise, Europcar) | Increasing EV fleet availability, sustainable fleet management | Customer service, operational efficiency, technology integration |

| Smaller Regional Operators | Focus on specialized vehicle types, competitive pricing | Niche market penetration, local customer relationships |

SSubstitutes Threaten

Businesses can bypass T.O.M. by investing in their own commercial vehicle fleets. This direct ownership is a potent substitute, particularly for large corporations with stable, long-term operational requirements and the financial capacity for initial outlays. For instance, a logistics company might find owning its trucks more cost-effective over a decade than consistently renting, especially when factoring in customization and branding opportunities.

While T.O.M. Vehicle Rental primarily serves the commercial sector, certain business needs, like employee shuttles or small package deliveries, might consider public transportation or ride-sharing as indirect substitutes. For instance, in urban centers with robust transit networks, companies might opt for bus passes or subsidized ride-sharing for non-specialized employee commutes, potentially impacting demand for light commercial vehicle rentals for such purposes.

However, the viability of these substitutes is highly context-dependent. For operations demanding specific vehicle configurations, such as refrigerated vans for food transport or heavy-duty trucks for construction, public transport and ride-sharing simply cannot fulfill the requirements. This limits their threat significantly for T.O.M.'s core business, where specialized fleet capabilities are paramount.

The actual threat posed by these substitutes hinges directly on the precise use case of T.O.M.'s clientele. If a business's need is a basic passenger van for a team outing, ride-sharing might be considered. But if the need is a flatbed truck for equipment transport, the threat of substitutes like buses or taxis becomes negligible, as they are entirely unsuited for the task.

The burgeoning e-commerce landscape and innovations in last-mile delivery are creating compelling alternatives to traditional vehicle rental. Companies are increasingly exploring drone and autonomous vehicle delivery, alongside urban micro-fulfillment centers and integrated logistics platforms. These advancements offer a more streamlined and potentially cost-effective approach to goods movement.

While these substitute models are still developing, particularly for larger commercial needs, their potential to disrupt the market is significant. They could lessen the reliance on rented vehicles by optimizing how existing fleets are utilized or by completely bypassing conventional delivery methods. For instance, the global drone delivery market was valued at approximately $2.4 billion in 2023 and is projected for substantial growth, indicating a clear shift in delivery paradigms.

Businesses may find themselves prioritizing integrated logistics solutions that encompass more than just vehicle provision. This means a rental company that only offers vehicles might face reduced demand if clients can access comprehensive delivery networks that manage the entire process, from warehousing to final mile. The rise of platforms connecting shippers with carriers, often leveraging technology for efficiency, further strengthens this competitive pressure.

Short-term Ridesharing/On-demand Services for Goods

The rise of short-term ridesharing and on-demand services for goods presents a growing threat to traditional vehicle rental, particularly for very specific, short-duration needs. Businesses might opt for these flexible courier services, utilizing smaller vehicles or existing logistical networks, instead of renting a van or truck from T.O.M. Vehicle Rental. This trend, fueled by the demand for immediate solutions in logistics, could chip away at the demand for T.O.M.'s shorter rental periods and smaller vehicle segments.

For instance, the global last-mile delivery market, a key area where these services thrive, was valued at approximately $150 billion in 2023 and is projected to grow significantly. This growth indicates a strong preference for agile, on-demand logistics. Specifically, in 2024, many businesses are exploring partnerships with gig economy platforms for delivery needs, reducing their reliance on owned or rented fleets for sporadic tasks.

- On-Demand Logistics Growth: The market for on-demand delivery services, particularly for goods, is expanding rapidly, driven by consumer and business expectations for speed and convenience.

- Shift in Business Needs: Some businesses may find it more cost-effective and operationally simpler to use specialized on-demand services for small, infrequent deliveries rather than managing their own vehicle rentals.

- Impact on Shorter Rentals: This trend is most likely to affect T.O.M.'s shorter rental periods and smaller vehicle categories, as these are the services most easily replicated by on-demand couriers.

- Competitive Landscape: While not a direct substitute for T.O.M.'s core contract hire or longer-term rentals, these services introduce a new layer of competition for specific, short-term transportation requirements.

Intermodal Transport Solutions

The threat of substitutes for T.O.M. Vehicle Rental, particularly in long-haul logistics, is growing as intermodal transport solutions gain traction. These solutions blend road, rail, and sea freight, diminishing the exclusive dependence on road-based trucking.

For instance, the global intermodal freight market was valued at approximately USD 29.7 billion in 2023 and is projected to reach USD 44.9 billion by 2030, demonstrating a compound annual growth rate of 6.1% according to industry analyses. This indicates a significant trend towards integrating different transport modes.

While T.O.M. specializes in road transport vehicles, a broader adoption of intermodal strategies by large-scale logistics operators could lead to a reduced overall demand for long-term truck rentals. This is because goods would spend less time exclusively on the road, shifting the need towards a mix of transportation assets and services.

- Intermodal Growth: The intermodal freight market is expanding, indicating a shift away from single-mode transportation.

- Cost Efficiency: Businesses often adopt intermodal transport for cost savings and improved transit times for longer distances.

- Environmental Benefits: Rail and sea transport generally have a lower carbon footprint per ton-mile compared to trucking, appealing to sustainability goals.

- Supply Chain Diversification: Intermodal solutions offer greater flexibility and resilience in supply chains, reducing reliance on any single transport method.

The threat of substitutes for T.O.M. Vehicle Rental is amplified by the increasing adoption of intermodal transportation, which combines road, rail, and sea freight. This trend reduces the exclusive reliance on road-based trucking for long-haul logistics.

The global intermodal freight market was valued at approximately USD 29.7 billion in 2023, with projections indicating growth to USD 44.9 billion by 2030. This expansion highlights a significant shift towards integrating various transport modes for greater efficiency and cost savings.

As large logistics operators increasingly leverage intermodal strategies, the demand for long-term truck rentals from companies like T.O.M. may decrease. This is because goods will spend less time solely on the road, necessitating a broader mix of transportation assets and services rather than just road vehicles.

| Substitute Type | Key Benefit | Impact on T.O.M. | Market Data (2023) |

| Intermodal Transport | Cost-efficiency, reduced transit times for long distances | Reduced demand for long-haul truck rentals | Global intermodal freight market valued at USD 29.7 billion |

| On-Demand Logistics | Speed, convenience for small deliveries | Impacts shorter rentals and smaller vehicle segments | Last-mile delivery market valued at USD 150 billion |

| Owned Fleets | Customization, long-term cost control | Alternative for large corporations with stable needs | N/A (depends on individual company investment) |

| Public Transport/Ride-Sharing | Cost-effectiveness for non-specialized commutes | Negligible for specialized commercial needs | N/A (indirect impact on niche segments) |

Entrants Threaten

The commercial vehicle rental sector demands significant upfront capital. New players must invest heavily in acquiring or leasing a varied fleet, setting up maintenance facilities, and securing prime depot locations. For instance, a fleet of 100 commercial vans could easily cost millions in initial purchase or leasing agreements.

This substantial financial barrier limits competition to companies with robust financial backing, effectively deterring smaller or less capitalized entrants. The necessity to offer a broad spectrum of vehicle types, from light commercial vans to heavy-duty trucks, amplifies this capital requirement, making market entry particularly challenging.

Established players like T.O.M. Vehicle Rental leverage significant economies of scale, particularly in vehicle procurement and maintenance. Their substantial fleet size allows for bulk purchasing discounts and optimized servicing schedules, creating a cost advantage that new entrants would find challenging to surmount. For instance, a large rental company might secure a 15% discount on new vehicle acquisitions compared to a startup purchasing a fraction of that volume.

Furthermore, T.O.M. benefits from accumulated experience in operational efficiency. Managing a diverse fleet, from small vans to heavy-duty trucks, and navigating the complexities of maintenance, logistics, and customer service requires considerable know-how. This operational expertise, honed over years, translates into lower operating costs and higher service quality, presenting a substantial barrier to entry for newcomers who lack this ingrained knowledge base.

TOM Vehicle Rental’s established relationships with a wide array of UK businesses present a significant barrier to new entrants. Building a comparable customer base and earning the trust necessary for long-term contract hire and fleet management requires substantial time and investment.

The company’s reputation for flexible, customer-centric solutions means that new players must offer demonstrably superior value or niche offerings to attract away existing clients. For instance, in 2024, the UK’s vehicle rental market saw continued demand for flexible fleet solutions, with businesses prioritizing reliability and tailored service packages, areas where TOM has a proven track record.

Existing contractual obligations and the inherent need for personalized service in fleet management create substantial hurdles for market penetration. New entrants will find it difficult to replicate the depth of understanding and established rapport that TOM has cultivated with its client base, a critical factor in retaining business in this competitive sector.

Regulatory Hurdles and Compliance

The commercial vehicle rental industry faces significant regulatory barriers for new players. Compliance with stringent vehicle standards, emission controls, driver hour regulations, and safety protocols demands substantial upfront investment and ongoing operational adjustments. For instance, the UK's commitment to phasing out new petrol and diesel cars by 2035, alongside the expansion of clean air zones in cities like London and Birmingham, necessitates that new entrants invest heavily in zero-emission or ultra-low emission vehicles from the outset. This regulatory landscape, coupled with the need for various operational licenses and certifications, creates a formidable entry cost and complexity that deters many potential competitors.

- Stringent Vehicle Standards: New entrants must ensure their fleet meets evolving safety and environmental regulations.

- Emission Controls and ZEV Mandates: Compliance with targets like the UK's ZEV mandate requires investment in greener fleets, adding to initial costs.

- Licensing and Certification: Obtaining necessary operating licenses and certifications involves time and financial commitment.

- Driver Hour Regulations: Adhering to strict rules on driver working hours adds operational complexity and cost.

Brand Loyalty and Reputation

For companies that depend on commercial vehicles to keep their operations running smoothly, things like reliability, consistent service, and a good reputation are incredibly important. T.O.M. Vehicle Rental has been in business since 1991, meaning they’ve had many years to build up their brand recognition and earn customer loyalty. New companies entering this market would need a significant amount of time and financial resources to establish a similar level of trust and overcome the established reputation that companies like T.O.M. already enjoy, particularly for essential fleet management services.

Building this kind of trust isn't quick. Consider that in 2023, customer retention rates in the commercial vehicle rental sector often exceeded 80% for established players, reflecting the difficulty for new entrants to sway these loyal customers. Newcomers face the challenge of demonstrating a proven track record, which T.O.M. has, having served clients for over three decades.

- Established Trust: Decades of operation foster significant customer trust, making it hard for new entrants to gain traction.

- Brand Recognition: T.O.M.s long history since 1991 has built strong brand awareness in the commercial rental market.

- Customer Loyalty: Repeat business is crucial, and loyalty built over years presents a high barrier to new competitors.

- Service Reputation: A consistent, reliable service record is a key differentiator that new entrants must replicate.

The threat of new entrants in the commercial vehicle rental market is moderate to high, primarily due to substantial capital requirements for fleet acquisition and infrastructure. Regulatory hurdles, including evolving emission standards and licensing, further complicate market entry. Established players like T.O.M. Vehicle Rental benefit from significant economies of scale and strong customer loyalty built over decades, making it difficult for newcomers to compete on price and service. For instance, the UK's transition towards zero-emission vehicles by 2035 necessitates significant upfront investment in electric or hydrogen fleets for any new entrant.

| Factor | Impact on New Entrants | T.O.M. Vehicle Rental Advantage |

| Capital Requirements | High (Fleet, Depots, Maintenance) | Economies of scale in procurement, established infrastructure |

| Regulatory Compliance | Costly (Emissions, Licensing, Safety) | Existing compliance framework, operational expertise |

| Brand Reputation & Loyalty | Low (Needs time to build) | Decades of trust, established client relationships (e.g., 80%+ retention in 2023) |

| Operational Expertise | Steep learning curve (Logistics, Maintenance) | Honed efficiency, lower operating costs from experience |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for T.O.M. Vehicle Rental is built upon data from company annual reports, industry-specific market research from firms like IBISWorld, and consumer behavior surveys to understand buyer power and threat of substitutes.

We've leveraged publicly available financial data from T.O.M. Vehicle Rental's filings and competitor disclosures, alongside industry news and regulatory updates, to assess bargaining power of suppliers and the intensity of rivalry.