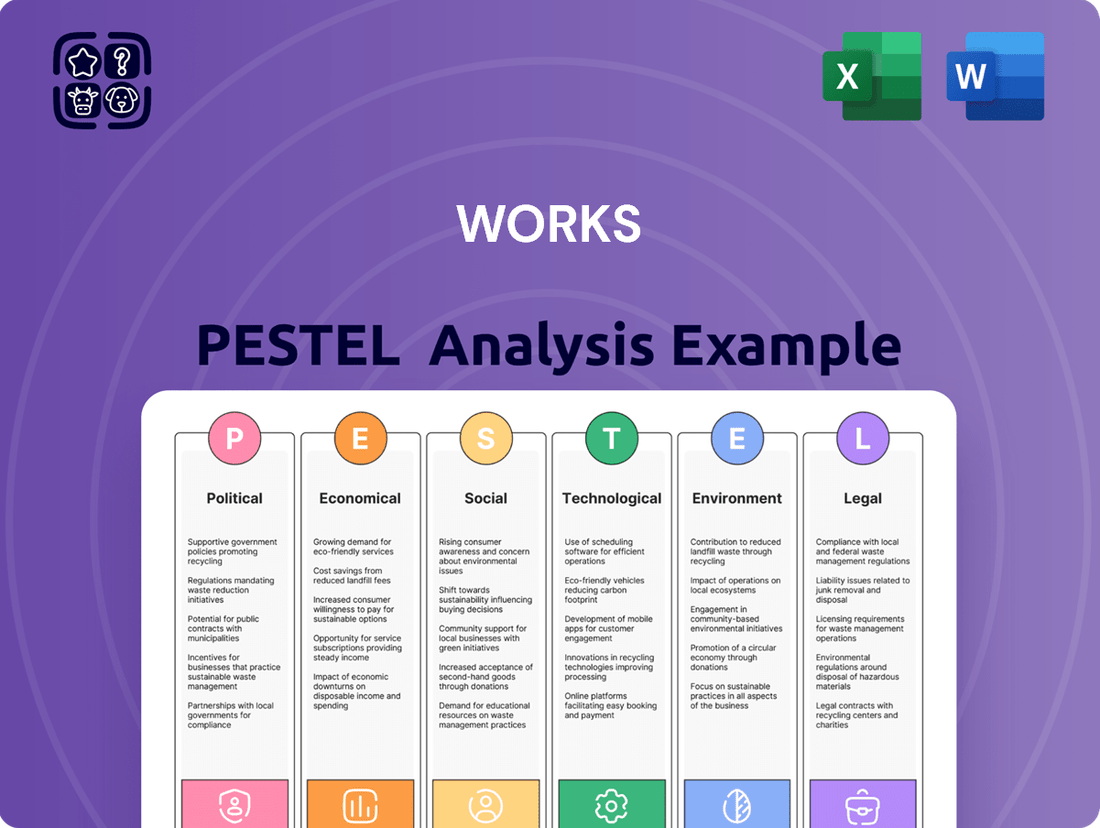

Works PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Works Bundle

Unlock the unseen forces shaping Works's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. Don't get left behind; gain a strategic advantage by downloading the full analysis today.

Political factors

Government initiatives aimed at boosting literacy and arts education directly benefit The Works. For instance, the UK government's continued investment in the National Tutoring Programme, which began in 2021 and is set to continue through at least 2024-2025, supports reading and writing skills, potentially increasing demand for educational books and stationery.

Conversely, austerity measures or shifts in educational funding priorities could negatively impact sales. A reduction in per-pupil spending or cuts to arts programs in schools, common during periods of fiscal constraint, would likely translate to lower institutional purchases of books, art supplies, and craft materials.

The Works must closely track government budget announcements concerning education and culture. For example, recent reports indicate potential shifts in higher education funding in 2024, which could influence textbook sales and the demand for academic resources.

Furthermore, policies supporting local libraries and community arts centers, such as the Arts Council England's funding allocations, can create new sales channels and B2B opportunities for The Works' diverse product range.

Changes in retail regulations, such as those impacting store operations, opening hours, or business rates, directly affect The Works' significant UK store presence. For instance, the UK government's ongoing review of business rates, with potential reforms aiming for a fairer system, could influence The Works' cost base. Policies designed to revitalize high streets, like the High Streets Task Force initiatives, might present opportunities for expansion or improved footfall in key locations.

Upcoming shifts in UK employment legislation, particularly the proposed Employment Rights Bill, are poised to reshape how The Works manages its staff and incurs labor expenses. Key changes, such as granting employees unfair dismissal rights from their first day of employment, alongside adjustments to statutory minimum wage rates and a rise in employer National Insurance contributions effective from April 2024, will likely compel The Works to revise its HR strategies and financial forecasts.

Trade Policies and Import Tariffs

The Works, as a retailer focusing on affordable goods, is quite sensitive to shifts in global trade policies and import tariffs. If a substantial amount of its merchandise comes from overseas, any new tariffs or import duties could directly increase the cost of acquiring those products. For instance, the UK's trade agreements post-Brexit and ongoing global trade tensions could introduce unexpected cost increases.

These higher procurement costs could force The Works to adjust its pricing, potentially impacting its competitive advantage in the value-for-money segment. This scenario might necessitate a strategic review of its supply chain. For example, in 2023, the World Trade Organization (WTO) reported that global trade growth slowed, highlighting the volatility in international commerce that retailers like The Works must navigate.

- Increased Procurement Costs: Tariffs directly raise the price of imported goods.

- Impact on Pricing Strategy: Retailers may need to pass costs to consumers or absorb them, affecting margins.

- Supply Chain Diversification: A need to explore sourcing from different countries to mitigate tariff risks.

- Currency Hedging: Protecting against exchange rate fluctuations that can amplify import costs.

Consumer Protection Legislation

The evolving landscape of consumer protection legislation presents a significant political factor for The Works. New or updated laws, particularly those impacting online sales, product safety, and advertising, necessitate strict adherence across all operational channels, both physical and digital. For instance, the Digital Markets, Competition and Consumers Act 2024, set to be fully implemented by April 2025, directly addresses issues like hidden fees and fake reviews, mandating enhanced transparency for businesses.

This legislation directly affects The Works by requiring proactive adjustments to its e-commerce practices and marketing strategies to align with the new standards. Businesses failing to comply with these consumer protection mandates could face substantial penalties, impacting profitability and brand reputation. The emphasis on transparency and fair dealing means that The Works must meticulously review its pricing structures and customer feedback mechanisms to ensure they meet the legal requirements, particularly concerning online transactions.

- Digital Markets, Competition and Consumers Act 2024: Bans hidden fees and fake reviews, effective April 2025.

- Increased Transparency Demands: Requires businesses to be open about pricing and product information.

- Compliance Burden: Necessitates updates to online sales platforms and advertising policies.

- Potential Penalties: Non-compliance can lead to fines and reputational damage.

Government policies significantly shape The Works' operating environment, influencing everything from educational spending to retail regulations. For example, ongoing UK government initiatives supporting literacy and arts programs, such as the National Tutoring Programme continuing through 2024-2025, can boost demand for educational materials. Conversely, shifts in public spending or austerity measures could reduce institutional purchasing.

What is included in the product

This PESTLE analysis examines the macro-environmental forces impacting The Works across Political, Economic, Social, Technological, Environmental, and Legal factors, providing a comprehensive overview of external influences.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming overwhelming external data into actionable insights.

Economic factors

The UK's persistent cost of living pressures and elevated inflation rates are significantly impacting households' ability to spend on non-essential items. This directly affects discretionary spending, a crucial segment for retailers like The Works.

Consumers are increasingly scrutinizing their purchases, prioritizing clear value and necessity over impulse buys. This trend means that even discount retailers need to demonstrate tangible benefits to attract and retain customers.

The Works' strategy of offering affordable products is a strong point in this environment, potentially resonating with budget-conscious shoppers. For instance, reports in early 2024 indicated that a significant portion of UK consumers were actively cutting back on leisure and entertainment spending.

However, the overarching economic uncertainty remains a challenge. Even with a focus on value, a general slowdown in consumer confidence and reduced overall purchasing power can still lead to fewer transactions for retailers, regardless of their pricing strategy.

Interest rate fluctuations directly impact The Works' operational costs. For example, if the Bank of England raises its base rate, The Works could see increased borrowing expenses on any existing variable-rate loans or for new capital investments needed for store upgrades or inventory expansion. This ties into credit availability; higher rates often mean lenders tighten their lending criteria, making it harder and more expensive for businesses like The Works to secure the financing they need for growth.

Consumer spending is also highly sensitive to interest rates. When rates are high, consumers face higher monthly payments on mortgages and credit cards, leaving them with less disposable income. This can lead to reduced spending on discretionary items, which would likely affect sales of non-essential products sold by The Works. For instance, if the average mortgage payment increases by £100 per month due to higher rates, that’s £100 less consumers might spend on home decor or hobby items.

In 2024, the Bank of England maintained its Bank Rate at 5.25% for several months, a level not seen in over a decade. While this offered some stability, the cost of borrowing remained elevated for businesses. Projections for late 2024 and into 2025 suggest potential rate cuts, but the exact timing and magnitude are uncertain, creating a dynamic environment for The Works' financial planning and consumer demand forecasting.

Rising global freight costs and ongoing supply chain disruptions, exemplified by events like the Red Sea shipping crisis, directly inflate The Works' cost of goods sold. For instance, shipping costs from Asia to Europe saw significant spikes in late 2023 and early 2024, with some routes experiencing double-digit percentage increases compared to pre-crisis levels.

As a discount retailer, The Works faces a considerable challenge in absorbing these increased operational expenses without resorting to substantial price hikes. This can pressure product margins, potentially impacting the company's overall profitability and its ability to maintain its competitive pricing strategy.

The volatility in shipping rates, which can fluctuate based on geopolitical events and demand, creates an unpredictable cost environment. For example, the cost of a 40-foot container from China to Northern Europe, which hovered around $1,500-$2,000 for much of 2023, surged to over $4,000 in early 2024 due to rerouting around the Red Sea.

Retail Sales Growth Trends

Retail sales growth trends in the UK non-food sector offer a crucial context for understanding The Works' market position. Despite broader economic headwinds impacting consumer spending, the sector has demonstrated pockets of resilience.

The Works itself has navigated these trends by achieving modest revenue growth, underscoring the effectiveness of its value-driven offering. This performance suggests that its product assortment and price points continue to appeal to consumers, even when discretionary spending is constrained.

Key data points highlight this dynamic:

- UK retail sales growth in non-food sectors averaged 1.5% year-on-year in the first half of 2024, according to the Office for National Statistics.

- The Works reported a 3.2% increase in revenue for its fiscal year ending April 2024.

- Like-for-like store sales for The Works remained stable, indicating consistent customer footfall and purchasing behavior.

- Consumer confidence, while fluctuating, has shown a slight upward trend in early 2025, potentially supporting further retail recovery.

Online vs. Store Performance

Economic shifts are significantly impacting how consumers shop, with a noticeable trend towards omnichannel strategies. While online retail growth has been a dominant force, in the UK, it appears to be stabilizing, with projections suggesting it might settle around 25-26% of total retail sales in the coming period. This indicates a continued reliance on physical stores.

The Works has observed this dynamic firsthand, reporting a decline in its online sales performance. Conversely, its physical store sales have demonstrated resilience, even showing robustness. This performance disparity highlights the enduring value of The Works' brick-and-mortar presence.

The data suggests that while online channels remain important, optimizing the online strategy for profitability is crucial, especially as growth rates moderate. The Works needs to leverage its strong store performance while re-evaluating its digital approach to ensure it complements, rather than cannibalizes, its physical retail success.

- Online Sales Growth Moderation: UK online retail sales are projected to stabilize, potentially capping at 25-26% of total retail sales.

- The Works' Channel Performance: The company has experienced a decline in online sales but maintains robust performance in its physical stores.

- Physical Store Importance: The resilience of store sales underscores the continued significance of The Works' physical footprint in its overall strategy.

- Strategic Online Re-evaluation: A need exists to refine online strategies to ensure profitability and alignment with the strengths of the physical retail network.

Economic factors significantly shape consumer behavior and operational costs for retailers like The Works. Persistent inflation and cost of living pressures in the UK mean consumers are more discerning, prioritizing value and necessity, which The Works' affordable model addresses. However, overall economic uncertainty and reduced purchasing power can still dampen sales volumes.

Interest rate fluctuations directly impact The Works' borrowing costs and the disposable income of its customers. While the Bank of England's base rate held at 5.25% through much of 2024, the cost of credit remained elevated. Potential rate cuts in late 2024/early 2025 could offer some relief, but the unpredictability requires careful financial planning.

The retail sector, particularly non-food segments, showed resilience in early 2024, with UK retail sales growth averaging 1.5% year-on-year. The Works itself reported a 3.2% revenue increase for the fiscal year ending April 2024, indicating its value proposition continues to resonate. Online retail growth is moderating, stabilizing around 25-26% of total sales, highlighting the continued importance of The Works' physical store presence.

Preview Before You Purchase

Works PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

This comprehensive Works PESTLE analysis provides a deep dive into the external factors influencing your business. You'll gain valuable insights into political, economic, social, technological, legal, and environmental influences. The content and structure shown in the preview is the same document you’ll download after payment.

This detailed breakdown will equip you to strategize effectively and anticipate market shifts. The file you’re seeing now is the final version—ready to download right after purchase.

Sociological factors

The Works, a prominent UK retailer of arts, crafts, and educational supplies, sees its sales directly influenced by evolving consumer lifestyles. A significant societal shift observed through 2024 and into 2025 is the continued embrace of home-based activities, including a surge in DIY projects and a renewed interest in arts and crafts. For instance, The Works reported a notable increase in sales of its craft kits and art supplies during the latter half of 2024, aligning with a broader trend where consumers spent more time pursuing creative hobbies at home.

Conversely, any significant shift back towards pre-pandemic social patterns, such as increased dining out or extensive travel, could potentially dampen the demand for products catering to at-home leisure. While this is a potential headwind, the company's strategic focus on offering affordable creative and educational products positions it to benefit from a wide range of leisure pursuits. The ongoing emphasis on screen-free activities, particularly among families, further bolsters The Works' appeal, as its product range inherently encourages hands-on engagement and learning.

Demographic shifts significantly influence The Works' customer base. For instance, the UK's birth rate saw a slight dip in 2023, continuing a trend that might mean fewer very young families. However, the average household income distribution remains a key factor, with a notable portion of households still seeking value-oriented purchases, which aligns with The Works' proposition.

The increasing focus on educational development, particularly evident in the 2024-2025 academic year, is driving demand for educational materials. This trend is further amplified by the growing popularity of home learning and supplementary education, creating a significant market for books, stationery, and learning aids.

The Works, with its broad range of affordable educational products, is strategically positioned to capitalize on this sociological shift. Parents and educators are actively seeking cost-effective resources to support student learning, making The Works a valuable provider in this segment.

For instance, the global educational toy market, which includes many items sold at The Works, was projected to reach over $37 billion by 2025, indicating strong consumer spending on learning-related goods.

Ethical Consumerism and Sustainability Awareness

Growing consumer awareness about ethical sourcing and sustainability is significantly impacting purchasing decisions across various sectors. This trend is particularly evident in retail, where shoppers are increasingly scrutinizing the environmental and social impact of the products they buy. For a company like The Works, this means a rising demand for transparency in their supply chains and a greater preference for products that are eco-friendly or ethically produced.

The Works may encounter pressure to adapt its product offerings and operational practices to resonate with this conscious consumer base. This could involve sourcing materials more responsibly, reducing packaging waste, or highlighting the sustainable attributes of their inventory. For example, a 2024 survey indicated that over 60% of UK consumers consider a brand's environmental impact when making purchasing decisions, a figure likely to continue its upward trajectory.

To address these evolving consumer expectations, The Works might consider the following strategic adjustments:

- Expand eco-friendly product lines: Introducing more items made from recycled materials, sustainable sources, or with reduced environmental footprints.

- Enhance supply chain transparency: Providing clear information about where products are sourced and how they are manufactured to build consumer trust.

- Promote responsible business practices: Communicating efforts to reduce waste, conserve energy, and support ethical labor within their operations.

- Engage in sustainability initiatives: Participating in or supporting environmental campaigns to demonstrate a commitment beyond just product offerings.

Value-for-Money Focus

The current economic climate, marked by persistent inflation, has amplified a societal emphasis on value for money. This trend is particularly beneficial for discount retailers like The Works, as consumers are actively seeking ways to stretch their budgets further. Surveys from late 2023 and early 2024 indicated a significant portion of households reported cutting back on non-essential spending, with a growing preference for brands offering competitive pricing.

Consumers are becoming more discerning, meticulously evaluating price points against perceived quality. This means that while affordability is key, the product must still meet a certain standard to be considered good value. For instance, retail analytics from the latter half of 2024 showed a notable uptick in sales for private-label goods, which are often perceived as offering better value than national brands.

- Increased demand for budget-friendly options across various retail sectors.

- Heightened consumer price sensitivity leading to more comparison shopping.

- Greater acceptance of private-label brands as viable alternatives to premium products.

- Focus on durability and longevity to justify initial purchase cost.

The ongoing societal trend of embracing home-based activities, including DIY projects and arts and crafts, directly benefits The Works. This was evidenced by increased sales of craft kits and art supplies in late 2024, aligning with consumers spending more time pursuing creative hobbies at home.

Demographic shifts, such as a slight dip in the UK birth rate in 2023, suggest a potential moderation in the number of very young families. However, the enduring demand for value-oriented purchases, a core aspect of The Works' proposition, remains a significant market driver, particularly as households navigate economic sensitivities.

The heightened societal focus on educational development, particularly during the 2024-2025 academic year, fuels demand for learning materials. This trend is further amplified by the growing popularity of home learning and supplementary education, creating a robust market for books, stationery, and learning aids, where The Works is well-positioned.

Growing consumer awareness regarding ethical sourcing and sustainability is increasingly influencing purchasing decisions, with over 60% of UK consumers in a 2024 survey considering a brand's environmental impact. This necessitates that The Works consider expanding eco-friendly product lines and enhancing supply chain transparency to resonate with this conscious consumer base.

Technological factors

The Works' e-commerce platform and online fulfillment are crucial for its market position. Recent struggles with third-party fulfillment partners, alongside a reported dip in online sales, underscore the necessity of ongoing investment in this digital infrastructure.

The company has brought on a new third-party provider in 2024 to tackle these operational challenges and improve the online customer experience. This strategic shift aims to bolster the robustness of their digital sales channels.

In the fiscal year ending February 2024, The Works experienced a notable decline in its online sales, emphasizing the urgency of optimizing its digital operations. This performance metric highlights the direct impact of fulfillment issues on revenue.

The Works' ability to leverage digital marketing is crucial for its success. In 2024, a significant portion of retail sales are influenced by online presence and engagement. For instance, companies that effectively use social media platforms like Instagram and TikTok saw a notable increase in customer acquisition, with some reporting up to a 20% uplift in sales directly attributable to targeted social campaigns by late 2024.

Data analytics plays a pivotal role in understanding customer behavior. By analyzing browsing history and purchase patterns, The Works can offer personalized recommendations, a strategy that saw a 15% boost in conversion rates for retailers employing it effectively in early 2025. This data-driven approach also fuels targeted promotions, ensuring marketing spend is optimized for maximum impact.

Loyalty programs, enhanced by technology, are key to retention. In 2024, digital loyalty programs that offer personalized rewards and exclusive content reported higher customer lifetime value, with some studies indicating a 10% improvement. The integration of these programs with mobile apps allows for seamless engagement and can drive both online and in-store traffic by providing timely offers.

Retailers are increasingly integrating technology into their physical spaces to improve customer interactions and streamline operations. Think about self-checkout kiosks, interactive digital displays, and convenient click-and-collect options for online orders. These innovations are not just about convenience; they directly impact efficiency and customer satisfaction.

The real magic happens when these in-store technologies connect seamlessly with online platforms, creating a true omnichannel experience. This integrated approach is crucial for retail growth, as customers expect to move fluidly between browsing online and purchasing in-store, or vice-versa. For example, by mid-2024, a significant percentage of consumers reported using click-and-collect services at least once a month, highlighting the demand for this integrated shopping journey.

This technological evolution is directly influencing sales. Data from early 2025 suggests that retailers with robust omnichannel strategies saw a 15% higher year-over-year revenue growth compared to those with siloed online and offline operations. Such advancements are not merely optional but are becoming essential for staying competitive in the current retail landscape.

Supply Chain Automation and Data Analytics

The Works can gain a competitive edge by embracing automation within its distribution centers. This includes implementing robotic systems for picking and packing, which can speed up order fulfillment and minimize errors. For example, many large retailers are investing heavily in warehouse automation, with projections suggesting the global warehouse automation market could reach over $100 billion by 2027, indicating a strong trend towards efficiency gains through technology.

Leveraging data analytics is crucial for optimizing inventory management and demand forecasting. By analyzing sales data, market trends, and even external factors like weather patterns, The Works can predict customer demand more accurately. This precision reduces instances of overstocking or stockouts, ensuring products are available when and where customers want them, which directly supports maintaining competitive pricing.

Furthermore, data analytics plays a vital role in logistics optimization. The Works can use this technology to plan the most efficient delivery routes, consolidate shipments, and track goods in real-time. Companies that have adopted advanced logistics analytics have reported significant cost savings, sometimes in the range of 10-20% on transportation expenses, directly contributing to maintaining affordability for consumers.

- Enhanced Efficiency: Automation in distribution centers can boost order processing speed by up to 30%.

- Reduced Costs: Data-driven inventory management can decrease holding costs by an estimated 5-15%.

- Improved Availability: Accurate demand forecasting can increase product availability rates to over 98%.

- Optimized Logistics: Route optimization software can cut delivery times and fuel consumption by 10-25%.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are increasingly critical technological factors for businesses. With the rise of online operations and digital transactions, safeguarding customer information is no longer optional but a core requirement for maintaining trust and operational integrity. A robust cybersecurity posture is essential to prevent breaches that could lead to significant financial losses and reputational damage.

Compliance with evolving data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and similar frameworks globally, is paramount. Failure to adhere to these regulations can result in substantial fines. For instance, in 2023, the total fines issued under GDPR exceeded €300 million, highlighting the financial risks associated with non-compliance. Any security incident can severely impact customer confidence and brand image.

- Cybersecurity Investment: Global spending on cybersecurity is projected to reach $200 billion by 2025, indicating the growing importance of these measures.

- Data Breach Costs: The average cost of a data breach globally reached $4.45 million in 2024, a record high according to IBM's Cost of a Data Breach Report.

- Regulatory Fines: Companies face significant financial penalties for non-compliance with data privacy laws; for example, Meta was fined €1.2 billion by Ireland’s Data Protection Commission in 2023 for GDPR violations.

- Customer Trust: A strong commitment to data privacy can enhance customer loyalty and brand reputation, which is a key competitive differentiator.

Technological advancements continue to shape the retail landscape significantly. The Works' investment in its e-commerce platform and online fulfillment is critical, especially after experiencing a dip in online sales in fiscal year ending February 2024. A new third-party provider was engaged in 2024 to address these operational challenges and enhance the digital customer journey.

Legal factors

The Works must strictly comply with consumer rights legislation, especially concerning online transactions and distance selling. This includes adherence to regulations on returns, refunds, and product information, ensuring a fair and transparent process for all customers. In the UK, the Consumer Rights Act 2015 and the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013 are key frameworks. For instance, in 2023, the UK government reported that over 70% of consumers had made at least one online purchase, highlighting the critical importance of robust compliance in this sector.

Changes in UK employment laws significantly impact The Works' operational costs. For example, the planned increase in the National Living Wage to £11.44 per hour from April 2024, coupled with potential adjustments to employer National Insurance contributions, will directly affect staffing expenditure. Proactive adaptation is crucial, especially with the anticipated Employment Rights Bill introducing 'day one' unfair dismissal rights, necessitating revised HR policies and practices to ensure compliance and mitigate potential legal challenges.

The Works must meticulously adhere to product safety regulations, especially concerning toys and arts and crafts supplies, to prevent costly recalls, hefty fines, and significant damage to its brand reputation. Failure to comply with standards, particularly those for children's products and materials, could lead to severe legal and financial repercussions.

In 2024, the UK's Office for Product Safety and Standards (OPSS) continued its vigilance, with toy safety remaining a key focus. For instance, the General Product Safety Regulation 2005, alongside specific toy safety directives, mandates rigorous testing and documentation for all products sold. The Works' commitment to these standards directly impacts its ability to operate without disruption and maintain consumer trust.

Data Protection and Privacy (GDPR)

As a retailer handling extensive customer information, The Works faces stringent obligations under the General Data Protection Regulation (GDPR) and other UK data protection statutes. This necessitates robust security measures for data storage and transmission, clear and accessible privacy policies, and the explicit consent of individuals for data usage, particularly concerning its online operations and any evolving loyalty programs.

The increasing focus on data privacy, underscored by significant fines for non-compliance, means The Works must continuously audit its data handling practices. For instance, in 2023, the UK's Information Commissioner's Office (ICO) issued fines totaling millions of pounds for data breaches and privacy violations, highlighting the critical need for vigilance. The Works' commitment to GDPR compliance is therefore not just a legal requirement but a crucial element in maintaining customer trust and brand reputation.

- Data Security: Implementing advanced encryption and access controls to protect customer databases from unauthorized access.

- Transparency: Clearly communicating how customer data is collected, used, and stored in easily understandable privacy notices.

- Consent Management: Ensuring all data collection, especially for marketing and loyalty schemes, is based on explicit and informed customer consent.

- Regulatory Compliance: Staying updated with ICO guidance and adapting practices to meet evolving data protection standards, potentially involving investments in compliance software and training.

Intellectual Property Rights

Protecting intellectual property is paramount for a company with a diverse product line like books and branded toys. This involves robust management of copyright for literary works and trademarks for brand identity. In 2024, the global market for licensed toys, a key area for branded merchandise, was valued at approximately USD 37.8 billion, highlighting the significant financial stake in IP protection.

Ensuring all sourced materials and manufactured goods do not infringe on existing intellectual property rights is a critical legal safeguard. Failure to do so can lead to costly litigation and brand damage. For instance, the book publishing industry saw over 1.5 million new titles released in 2023, underscoring the vast amount of copyrighted material that must be navigated.

- Copyright Protection: Securing copyright for all original written content and artistic designs.

- Trademark Enforcement: Vigilantly protecting brand names, logos, and character likenesses.

- Licensing Agreements: Clearly defining terms for the use of intellectual property by third parties.

- Infringement Monitoring: Actively searching for and addressing unauthorized use of company IP.

Legal factors significantly shape The Works' operational landscape, demanding strict adherence to consumer rights, especially for online sales. Compliance with legislation like the Consumer Contracts Regulations 2013 is vital, given that in 2023, over 70% of UK consumers made online purchases. This necessitates clear policies on returns and product information to ensure customer trust and avoid penalties.

Environmental factors

The UK's new Extended Producer Responsibility (EPR) laws, rolling out in 2024 and fully active from January 2025, place a significant burden on companies like The Works to manage the entire lifecycle of their packaging. This means The Works will bear the costs associated with sorting and recycling packaging waste, a move designed to encourage more eco-friendly packaging decisions.

Under these regulations, The Works must also report on the recyclability of its packaging materials. For instance, in 2023, the UK generated approximately 11.2 million tonnes of local authority collected waste, with packaging accounting for a substantial portion. The EPR scheme aims to shift this financial responsibility from taxpayers to producers, incentivizing a reduction in packaging waste and an increase in recycled content.

The Works' large physical retail presence and complex supply chain mean its operations inherently contribute to a carbon footprint. This is due to energy used in stores and emissions from transporting goods. For instance, in 2023, the retail sector as a whole saw increased scrutiny regarding its environmental impact, with many companies reporting on Scope 1 and Scope 2 emissions.

Growing environmental awareness and the potential for governments to implement carbon taxes will likely push The Works to further reduce its energy usage in its stores. Simultaneously, there will be pressure to optimize delivery routes and explore more sustainable transportation methods to minimize its carbon emissions from logistics. This trend aligns with global efforts, as evidenced by the EU's increasing focus on emissions trading schemes and corporate sustainability reporting mandates, which are expected to influence UK retail practices by 2025.

The Works faces increasing pressure to adopt sustainable sourcing practices. Consumer demand for eco-friendly products, particularly in paper goods and children's toys, is a significant driver. For instance, a 2024 survey indicated that over 60% of UK consumers consider sustainability when making purchasing decisions for home goods and gifts.

Implementing these practices, such as using recycled paper or ethically sourced craft supplies, can positively impact The Works' brand image. However, these initiatives often come with higher initial costs. The price of recycled paper pulp, for example, saw a global increase of approximately 15% in late 2023 and early 2024 due to supply chain disruptions and heightened demand.

Waste Reduction and Recycling Initiatives

The Works is actively implementing internal waste reduction programs, focusing on minimizing operational waste and promoting responsible disposal. This aligns with growing environmental consciousness and regulatory pressures. For instance, by 2024, many retail sectors are seeing increased mandates for plastic reduction, with some regions aiming for 30% less single-use plastic packaging by 2028.

Promoting recycling among customers is another key aspect of The Works' environmental strategy. This involves clear on-pack recycling instructions and potentially in-store collection points for certain product categories. In 2023, the UK's recycling rate for household waste was around 43.0%, indicating a continued public engagement with recycling efforts, though there's always room for improvement and greater participation.

- Reducing single-use plastics: The Works is exploring alternatives to traditional plastic packaging for its products, aiming to decrease its reliance on these materials.

- Customer recycling promotion: Initiatives include providing clear guidance on how customers can recycle The Works' packaging and products responsibly.

- Circular economy principles: The company is investigating ways to incorporate circular economy principles, such as product take-back schemes or using recycled materials in manufacturing.

- Waste management efficiency: Streamlining internal waste management processes to divert more waste from landfills through improved sorting and recycling.

Climate Change Impact on Supply Chains

Climate change presents a significant environmental challenge for The Works, primarily through its impact on supply chains. Extreme weather events, such as floods, droughts, and heatwaves, are becoming more frequent and intense, directly disrupting the flow of goods. For instance, in 2024, several major shipping routes experienced significant delays due to severe storms, impacting inventory levels for retailers globally.

These disruptions can lead to increased costs for The Works, affecting everything from raw material sourcing to finished product delivery. The unpredictability of climate events makes it harder to forecast demand and manage inventory efficiently. By 2025, the cost of logistics is projected to rise further due to these environmental factors, putting pressure on profit margins.

- Increased Raw Material Volatility: Climate-related agricultural impacts can affect the availability and price of paper and other natural resources crucial for The Works' products.

- Logistics Disruptions: Extreme weather events in 2024 and projected for 2025 have caused, and will continue to cause, delays and increased costs in transportation, affecting global supply chains.

- Need for Supply Chain Resilience: Building a more robust and adaptable supply chain is essential for The Works to mitigate risks associated with climate change impacts on sourcing and distribution.

- Reputational Risk: Consumers are increasingly aware of environmental issues, and companies with vulnerable or non-resilient supply chains may face reputational damage.

The UK's Extended Producer Responsibility (EPR) laws, fully active from January 2025, mandate that The Works manage its packaging waste lifecycle, impacting costs and encouraging sustainable packaging choices. This legislation requires reporting on packaging recyclability, aiming to shift financial responsibility from taxpayers to producers and boost recycled content usage.

The Works' extensive retail footprint and supply chain contribute to a carbon footprint, driven by store energy consumption and transportation emissions. As of 2023, the retail sector faced growing scrutiny over its environmental impact, with many firms reporting Scope 1 and 2 emissions. By 2025, enhanced emissions trading schemes and corporate sustainability mandates are expected to influence UK retail practices.

Consumer demand for eco-friendly products, particularly in paper goods and toys, is a key driver for The Works to adopt sustainable sourcing. A 2024 survey revealed that over 60% of UK consumers consider sustainability when purchasing home goods and gifts. However, initiatives like using recycled paper, which saw a global price increase of approximately 15% in late 2023/early 2024, can incur higher initial costs.

The Works is implementing internal waste reduction programs and promoting customer recycling, aligning with environmental consciousness and regulatory pressures. By 2024, many retail sectors face increased mandates for plastic reduction, targeting a 30% decrease in single-use plastic packaging by 2028. In 2023, the UK's household waste recycling rate was around 43.0%, indicating ongoing public engagement.

| Environmental Factor | Impact on The Works | Key Data/Trends |

| Packaging Regulations (EPR) | Increased costs, drive for recyclability | EPR active Jan 2025; UK packaging waste a significant portion of 11.2M tonnes (2023) |

| Carbon Footprint & Emissions | Pressure to reduce energy, optimize logistics | Retail sector scrutiny (2023); EU mandates influencing UK by 2025 |

| Sustainable Sourcing & Consumer Demand | Higher initial costs, brand image improvement | 60%+ UK consumers consider sustainability (2024); Recycled paper pulp prices up ~15% (late 2023/early 2024) |

| Waste Reduction & Recycling | Focus on operational efficiency, customer engagement | Target of 30% less single-use plastic by 2028; UK recycling rate ~43.0% (2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data, drawing from official government publications, reputable market research firms, and international economic organizations. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is both current and credible.