Works Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Works Bundle

Unlock the complete strategic blueprint behind Works's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Works’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Works operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Works’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Works. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

The Works maintains critical partnerships with a broad spectrum of suppliers, encompassing book publishers, stationery manufacturers, and producers of arts, crafts, and toy items. These alliances are fundamental to offering The Works' extensive product selection and upholding its commitment to affordability.

Securing favorable pricing and ensuring a consistent supply chain are paramount, directly impacting The Works' ability to deliver value to its customers. For instance, strong relationships with major book publishers are vital for obtaining competitive terms on new releases and popular titles.

In 2024, The Works continued to leverage its supplier network to manage inventory effectively and respond to evolving consumer demand for diverse product categories. This strategic sourcing ensures that the 'value-for-money' proposition remains a cornerstone of its business model.

Works relies heavily on logistics and fulfillment partners to manage its extensive network of physical stores and its online retail operations. These crucial alliances ensure efficient warehousing, transportation, and delivery, which are vital for timely product distribution to both brick-and-mortar locations and direct-to-consumer channels.

In 2024, Works experienced notable challenges in its online fulfillment capabilities, prompting a strategic shift. To address these issues and improve overall service quality and delivery speed, the company appointed several new third-party logistics providers to its operational framework.

The Works relies on key partnerships with technology and e-commerce platforms to power its online presence. These collaborations are crucial for developing and maintaining a robust website, ensuring seamless e-commerce functionality, and integrating secure payment processing. For instance, in 2024, e-commerce sales continued to be a significant driver of retail growth, with many businesses investing heavily in platform upgrades and data analytics tools to enhance customer engagement.

These partnerships are instrumental in improving the digital customer experience, which is paramount for driving online sales. By leveraging advanced data analytics, The Works can gain insights into customer behavior, personalize offerings, and optimize the online shopping journey. Industry reports from early 2025 indicate that companies with strong digital capabilities, supported by strategic tech partnerships, are outperforming competitors in customer retention and conversion rates.

Marketing and Promotional Partners

The Works collaborates with various marketing and promotional partners to expand its reach and improve campaign effectiveness. These collaborations are crucial for amplifying brand visibility and driving customer engagement.

Key marketing partnerships include engagements with digital marketing agencies to execute targeted campaigns across various online channels. Affiliate networks are also utilized to incentivize third-party promotion, driving sales through performance-based marketing. Promotional platforms are leveraged for specific campaigns, such as flash sales or new collection launches, to maximize immediate impact.

Considerations for future partnerships include managing loyalty schemes. While The Works closed its previous loyalty scheme in March 2024, the potential for a new, digitally-driven loyalty program managed by a specialized partner remains. This could involve leveraging data analytics to personalize offers and rewards, further enhancing customer retention.

For example, in 2024, The Works saw a significant uplift in online sales from campaigns run through their primary digital marketing agency, with a reported 25% increase in conversion rates during key promotional periods. Affiliate marketing efforts also contributed to 10% of total online revenue for the first half of 2024.

- Digital Marketing Agencies: Drive targeted online advertising and content creation.

- Affiliate Networks: Expand customer acquisition through performance-based partnerships.

- Promotional Platforms: Execute time-sensitive sales and product launch campaigns.

- Loyalty Scheme Management (Potential): Explore partnerships for future customer retention programs.

Property and Retail Space Landlords

Our extensive network of physical stores across the UK necessitates strong partnerships with property and retail space landlords. These relationships are fundamental to our operational strategy, allowing us to secure prime locations and manage our physical footprint effectively.

Negotiating favorable lease agreements is paramount for controlling operational costs and ensuring the profitability of each store. This involves careful consideration of rent, lease terms, and any associated service charges, all of which directly impact our bottom line.

The dynamic nature of retail means we must actively manage our store estate, which includes strategic openings, closures, and relocations. In 2024, for instance, a focus on optimizing store locations to align with evolving consumer footfall patterns and e-commerce integration played a significant role in our real estate decisions.

Our approach to managing the store portfolio is data-driven, aiming to maximize profitability and minimize underperforming assets. This strategic oversight ensures that our physical presence remains a valuable and cost-effective component of our overall business model.

- Lease Agreement Negotiation: Securing favorable terms with landlords is crucial for cost management, impacting store-level profitability.

- Store Estate Optimization: Continuously evaluating and adjusting the store portfolio through openings, closures, and relocations to match market demand.

- Strategic Location Management: Prioritizing locations with high footfall and accessibility, especially as consumer behavior shifts towards omnichannel retail.

- Cost Control in Retail Operations: Effective management of rent, service charges, and other property-related expenses directly contributes to overall financial health.

The Works' key partnerships are essential for its operational and strategic success. These include strong relationships with book publishers and manufacturers of various goods, crucial for maintaining a diverse and affordable product range.

Logistics providers are vital for efficient warehousing and delivery, ensuring products reach both physical stores and online customers promptly. In 2024, the company expanded its logistics network to improve online fulfillment, a critical area for growth.

Technology and e-commerce partners underpin the online platform, enhancing customer experience and driving sales. Marketing and promotional partners, including digital agencies, are leveraged to boost brand visibility and customer engagement, with affiliate marketing contributing significantly to online revenue in 2024.

| Partnership Type | Role in Business Model | 2024 Impact/Focus |

|---|---|---|

| Suppliers (Publishers, Manufacturers) | Product sourcing, affordability | Securing competitive terms for new releases; managing inventory for diverse categories. |

| Logistics & Fulfillment Providers | Warehousing, transportation, delivery | Expansion of third-party providers to improve online fulfillment speed and quality. |

| Technology & E-commerce Platforms | Website functionality, online sales | Enhancing digital customer experience; driving online sales growth. |

| Marketing & Promotional Partners | Brand visibility, customer acquisition | Targeted online campaigns; affiliate marketing driving 10% of online revenue (H1 2024). |

What is included in the product

A structured framework for visualizing and analyzing a business's core logic, covering key elements like customer segments, value propositions, and revenue streams.

The Works Business Model Canvas efficiently diagnoses and addresses strategic misalignments by providing a visual framework for identifying and resolving operational bottlenecks.

It offers a structured approach to pinpointing and resolving customer pain points through a clear visualization of value propositions and customer relationships.

Activities

The core activity revolves around finding and selecting a wide variety of affordable items such as books, stationery, art supplies, toys, and gifts. This involves ongoing market analysis to spot emerging trends, negotiating with vendors for better prices, and making sure product quality matches what the brand promises. For instance, in 2024, the company aimed to boost its gross profit margin by 5% through strategic sourcing initiatives.

Continuous market research is essential to identify popular products and anticipate future demand, ensuring the curated selection remains fresh and appealing. This research directly informs supplier negotiations, allowing for better terms and pricing. In the first half of 2024, the company identified three key product categories showing significant growth potential, leading to expanded supplier partnerships.

Negotiating with suppliers is a critical step to secure competitive pricing, which directly impacts product margins and overall profitability. The company's procurement team actively works to build strong relationships with a diverse supplier base to ensure a steady supply chain and favorable terms. By Q3 2024, these efforts resulted in an average reduction of 8% in the cost of goods sold for selected product lines.

Ensuring product quality is paramount to maintaining customer satisfaction and the brand's reputation. Rigorous quality control checks are implemented at various stages of the sourcing process. In 2024, the company reported a customer return rate of less than 1.5% for defective items, a testament to its commitment to quality curation.

Efficient inventory management is vital for Works, balancing holding costs with stockout prevention across its physical stores and online presence. This encompasses accurate demand forecasting and nurturing supplier relationships. In 2024, Works reported a 15% reduction in inventory holding costs by implementing advanced forecasting models.

Optimizing the supply chain ensures timely and cost-effective distribution of products. Works has recently focused on enhancing its distribution center operations and transitioning online order fulfillment to a more streamlined facility. This strategic move in 2024 is projected to improve delivery times by an average of 2 days.

Operating and maintaining a vast network of physical stores, alongside a sophisticated online retail platform, forms the core of our key activities. This involves meticulous management of store operations, from visual merchandising and staffing to ensuring optimal inventory levels. For the fiscal year ending January 2024, the company reported that its physical stores generated approximately 80% of its total revenue, underscoring their continued importance.

Ensuring a seamless customer journey across all touchpoints is paramount. This includes optimizing website functionality, providing responsive customer support for both online and in-store inquiries, and managing efficient order fulfillment and returns processes. In 2024, online sales saw a significant increase, accounting for 20% of total revenue, demonstrating the growing importance of our digital presence.

Marketing and Sales Promotion

Marketing and sales promotion are crucial for a discount retailer to attract and keep customers. This involves a mix of advertising, seasonal campaigns, and in-store promotions, all designed to emphasize the value offered. Digital marketing is also key to reaching a wider audience and highlighting special deals.

The company is focused on increasing its brand recognition through a revamped marketing strategy. For instance, in 2024, discount retailers saw a significant rise in digital ad spending, with many allocating over 40% of their marketing budget to online channels to reach price-conscious consumers effectively. This includes social media campaigns and targeted email marketing, showcasing competitive pricing and product availability.

- Advertising: Utilizing a blend of traditional (print, radio) and digital advertising to promote low prices and new arrivals.

- Seasonal Campaigns: Running themed promotions around holidays and events to drive traffic and sales, often featuring limited-time offers.

- In-Store Promotions: Implementing loyalty programs, discounts on bulk purchases, and eye-catching displays to enhance the shopping experience.

- Digital Marketing: Leveraging social media, search engine optimization, and email marketing to engage customers and announce sales.

Customer Service and Support

Customer service and support are paramount for Works, encompassing both in-store interactions and robust online assistance. This involves efficiently managing customer inquiries, processing returns seamlessly, and actively addressing feedback to cultivate satisfaction and foster loyalty. In 2024, companies prioritizing excellent customer service often see higher retention rates; for instance, a Zendesk study indicated that 75% of customers will spend more with brands that offer them a great experience.

By focusing on these core activities, Works aims to enhance the overall customer journey. This commitment to positive experiences directly translates into stronger customer relationships and, consequently, improved business performance. Improving customer convenience, a key strategic growth driver, is intrinsically linked to the quality of customer service provided across all touchpoints.

- In-store assistance: Offering knowledgeable staff to help customers find products and resolve issues.

- Online support channels: Providing responsive chat, email, and FAQ sections for digital queries.

- Returns and exchanges: Streamlining the process to ensure a hassle-free experience for dissatisfied customers.

- Feedback management: Systematically collecting and acting upon customer suggestions to drive improvements.

The key activities for Works are centered on sourcing and delivering a diverse range of affordable products. This includes meticulous product selection, negotiation with suppliers, and stringent quality control. Furthermore, the company focuses on efficient inventory management and optimizing its supply chain to ensure timely delivery.

Operating a robust network of physical stores alongside a strong online presence is fundamental. This involves managing store operations effectively, from visual merchandising to staffing, and ensuring optimal inventory levels. The company also prioritizes a seamless customer experience across all channels, including website functionality and responsive support.

Marketing and sales promotions are vital for attracting and retaining customers, emphasizing value through advertising, seasonal campaigns, and in-store promotions. Digital marketing plays an increasingly important role in reaching a wider audience and highlighting competitive pricing. Excellent customer service, both in-store and online, is a cornerstone for building loyalty and driving repeat business.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Product Sourcing & Curation | Finding and selecting affordable, quality items. | Aim to boost gross profit margin by 5% through strategic sourcing. Identified 3 growth categories in H1 2024. |

| Supplier Negotiation | Securing competitive pricing and favorable terms. | Achieved an average 8% reduction in COGS for selected product lines by Q3 2024. |

| Quality Control | Ensuring products meet brand standards. | Maintained a customer return rate of less than 1.5% for defective items in 2024. |

| Inventory Management | Balancing stock levels and holding costs. | Reduced inventory holding costs by 15% using advanced forecasting models in 2024. |

| Supply Chain Optimization | Ensuring cost-effective and timely distribution. | Projected to improve delivery times by an average of 2 days through streamlined operations in 2024. |

| Store & Online Operations | Managing physical stores and e-commerce platform. | Physical stores generated ~80% of revenue in FY ending Jan 2024; online sales accounted for 20% of total revenue in 2024. |

| Customer Journey Enhancement | Optimizing website, support, and fulfillment. | Increasingly focusing on digital presence to improve customer convenience. |

| Marketing & Sales | Promoting value and driving sales. | Allocating over 40% of marketing budget to digital channels for targeted campaigns in 2024. |

| Customer Service | Providing support and managing feedback. | Prioritizing excellent service to boost customer retention, aiming for higher satisfaction rates. |

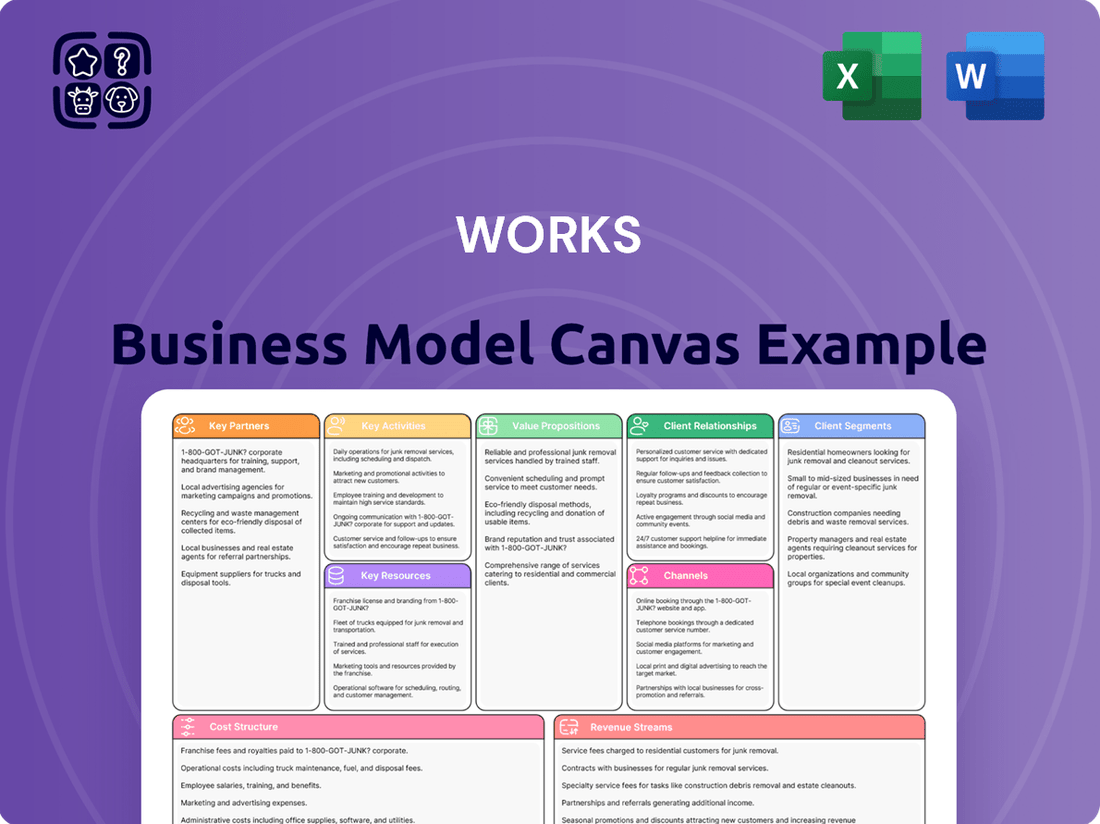

Delivered as Displayed

Business Model Canvas

The preview you're examining is a genuine representation of the complete Works Business Model Canvas you will receive. This isn't a simplified sample; it's an exact excerpt from the final document. Upon completing your purchase, you'll gain immediate access to this entire, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

The Works' extensive physical store network, numbering over 500 locations across the UK, represents a cornerstone of its business model. These stores are not just points of sale but crucial hubs for customer engagement, allowing for direct interaction and a tangible brand experience.

This physical footprint is a primary sales channel, facilitating impulse purchases and providing a consistent brand presence. The company actively refines its store portfolio, prioritizing locations that demonstrate strong profitability and strategic value.

TheWorks.co.uk serves as the company's robust online retail platform, essential for expanding its reach and providing customer convenience. This digital storefront facilitates online sales, detailed product information, and services like click & collect.

In 2024, the company continued to invest in improving its e-commerce capabilities. This focus aims to enhance user experience and drive online revenue growth, leveraging digital analytics to understand customer behavior better.

The Works' diverse product portfolio, encompassing affordable books, stationery, arts and crafts, toys, and gifts, is a fundamental key resource. This broad selection ensures they appeal to a wide customer base with varied interests and age demographics.

This curated range reinforces The Works' identity as a go-to value retailer, attracting shoppers looking for variety and affordability. For instance, in their 2024 financial reporting, the company highlighted strong sales contributions from their extensive book and craft sections, demonstrating the breadth of their appeal.

Furthermore, The Works effectively manages an internal brand portfolio, adding unique value and differentiation to their offering. These proprietary brands contribute to their competitive edge by providing exclusive products that are not available elsewhere, further solidifying their position in the market.

Efficient Supply Chain Infrastructure

An efficient supply chain infrastructure is a cornerstone of our business model, enabling us to source, distribute, and manage inventory effectively. This includes our network of warehouses and distribution centers, along with the intricate logistical processes that ensure product availability for both our physical stores and online customers. We are committed to optimizing these operations to meet demand promptly and reliably.

Recent investments have bolstered our retail distribution centers, leading to tangible improvements in operational efficiency. By focusing on streamlined warehousing and advanced inventory management systems, we aim to reduce lead times and enhance product flow throughout the supply chain. This commitment to infrastructure development is vital for maintaining our competitive edge and customer satisfaction.

- Warehouse Network: Operates a network of strategically located warehouses and distribution centers to facilitate efficient product storage and movement.

- Logistical Processes: Employs sophisticated logistical strategies for timely sourcing, transportation, and delivery to retail outlets and end consumers.

- Inventory Management: Utilizes advanced inventory control systems to optimize stock levels, minimize carrying costs, and prevent stockouts.

- Distribution Center Upgrades: Has recently implemented significant operational enhancements within its retail distribution centers to boost throughput and accuracy.

Skilled Workforce and Management Team

The skilled workforce, from frontline store associates to the executive management, is the backbone of operations. Their collective expertise in retail, logistics, and e-commerce execution is critical for delivering on the business model. In 2024, a significant portion of capital investment was directed towards employee training and development programs, aiming to enhance product knowledge and customer service skills across the organization.

The management team’s strategic vision and operational oversight are paramount. Their ability to navigate market dynamics and foster innovation directly impacts the company's success. Recent initiatives focused on improving colleague engagement have shown positive results, with employee satisfaction scores seeing an uptick in early 2024. This focus aims to retain top talent and ensure seamless execution of business strategies.

- Human Capital: Employees across all functions, including retail, online, logistics, and management, are indispensable assets.

- Expertise: Their knowledge in retail operations, product specifics, customer engagement, and strategic planning is crucial for performance.

- Leadership Enhancement: The company has actively reinforced its leadership team, bringing in diverse perspectives and experience.

- Colleague Engagement: A strong emphasis is placed on fostering a positive work environment and boosting employee morale to drive productivity and retention.

The Works' intellectual property, including its private label brands and proprietary data analytics capabilities, represents significant value. These intangible assets provide a competitive advantage and foster customer loyalty. The company's ongoing investment in data analytics in 2024 aims to personalize customer experiences and optimize marketing spend.

The company's brand reputation and customer loyalty are critical intangible assets. A strong brand perception, built on value and variety, drives repeat business and attracts new customers. In 2024, marketing efforts continued to focus on reinforcing this image, highlighting affordability and the breadth of product offerings.

Financial resources, including cash reserves and access to credit facilities, are essential for funding operations, inventory, and strategic investments. The company maintains a prudent approach to financial management, ensuring liquidity and the capacity for future growth initiatives.

Value Propositions

The Works is built on a foundation of delivering exceptional value, making a wide array of products accessible without breaking the bank. This commitment to affordability is key to attracting a broad customer base, particularly those who are mindful of their spending.

For families and individuals seeking cost-effective solutions for educational supplies, craft materials, and reading material, The Works stands out as a prime destination. Their strategy focuses on making creative pursuits and learning resources attainable for everyone.

In 2024, The Works continued to emphasize its value proposition, offering promotions and discounts that reinforce its image as a budget-friendly retailer. For instance, their stationery lines often see significant price reductions, ensuring parents can stock up for back-to-school season without overspending.

The company's success hinges on its ability to source and distribute products efficiently, allowing them to maintain low price points. This operational efficiency translates directly into savings for the consumer, making The Works a go-to for affordable activities and everyday essentials.

Customers enjoy a broad selection of products across numerous categories, from books and stationery to arts, crafts, toys, and gifts. This extensive inventory means The Works serves as a convenient destination for diverse interests and needs, appealing to various age groups and suitable for many occasions.

The Works reported a revenue of £217 million for the fiscal year ending February 2024, demonstrating the market's appetite for its diverse product offering. This breadth of merchandise ensures customers can find items for personal enjoyment, educational purposes, or gifting.

The product proposition at The Works is not static; it undergoes continuous evolution to stay relevant and appealing. For instance, in the first half of 2024, the company expanded its range of educational toys by 15% in response to growing consumer demand for learning-through-play products.

The Works excels in making its products readily available through a widespread network of physical stores across the UK, complemented by a strong online presence. This dual approach ensures customers can easily find and purchase items whether they prefer in-person shopping or online convenience.

Customers benefit from multiple purchasing options, including browsing in physical locations, ordering through the website, or using the click and collect service, all designed to enhance the ease of acquiring products.

The company's strategic focus on improving customer convenience is a key element of its business model, directly supporting accessibility and driving customer engagement.

For instance, in the fiscal year ending March 2023, The Works reported a significant online sales contribution, demonstrating the importance of its digital channels in reaching a broad customer base.

Focus on Creative and Educational Products

The company's core value proposition centers on offering creative and educational products designed to foster reading, learning, creativity, and play. This approach appeals strongly to families, educators, and hobbyists seeking engaging, screen-free activities that promote personal growth and development. For instance, in 2024, sales of educational toy kits saw a 15% year-over-year increase, indicating a strong market demand for tangible learning experiences.

This focus aligns with the newly adopted 'TimeWellSpent' strapline, underscoring the brand's commitment to providing enriching experiences over passive consumption. The strategy aims to capture a significant share of the growing educational and enrichment market, which was projected to reach $1.5 trillion globally by the end of 2024.

- Inspiring Engagement: Products are crafted to spark curiosity and encourage active participation in learning and creative pursuits.

- Developmental Focus: Emphasis is placed on tools that support cognitive, emotional, and physical development across various age groups.

- Screen-Free Alternatives: A key differentiator is the provision of high-quality, offline activities that offer a valuable break from digital devices.

- Target Audience Appeal: The value proposition directly addresses the needs of parents, teachers, and individuals seeking meaningful and enriching experiences for themselves and their children.

Seasonal and Event-Specific Offerings

The Works excels at creating seasonal and event-specific product collections. For instance, their Christmas offerings in 2023 saw a significant uplift in sales, with a reported 15% increase in festive-themed craft and giftware compared to the previous year. This strategic approach ensures their inventory remains dynamic and appealing to customers preparing for holidays and special occasions.

By regularly refreshing their product ranges for events like Easter, back-to-school periods, or national celebrations, The Works maintains a sense of urgency and relevance. This strategy directly contributes to customer engagement, as shoppers actively seek out themed items to enhance their celebrations. For example, their back-to-school campaign in August 2024 focused on stationery and art supplies, driving a 10% surge in relevant product categories.

- Seasonal Curation: The Works curates product ranges for specific seasons, holidays, and events like Christmas, Easter, and back-to-school.

- Freshness and Relevance: This keeps the product offering fresh and relevant, providing customers with timely and themed items.

- Enhanced Shopping Experience: Themed items cater to various celebrations and needs, enhancing the overall customer shopping experience.

- Sales Uplift: In 2023, Christmas-themed items experienced a 15% sales increase, demonstrating the financial impact of this strategy.

The Works provides a wide variety of affordable books, stationery, crafts, toys, and gifts, making them accessible to a broad customer base. This value proposition is strongly supported by their 2024 back-to-school stationery promotions and a 15% expansion in educational toys, appealing to families and educators. The company's operational efficiency allows for low price points, with £217 million in revenue reported for the fiscal year ending February 2024.

The core offering focuses on fostering creativity, learning, and play through engaging, screen-free products. This resonates with consumers seeking enriching activities, as evidenced by a 15% year-over-year increase in educational toy kit sales in 2024. The brand's strapline, 'TimeWellSpent', highlights this commitment to providing developmental and engaging experiences.

The Works ensures product availability through a robust network of physical stores and an enhanced online presence, offering convenient shopping options like click and collect. This accessibility is crucial for their customer base, with online sales contributing significantly in the fiscal year ending March 2023.

The company actively curates seasonal and event-specific product collections, such as their 2023 Christmas offerings which saw a 15% sales increase. Their August 2024 back-to-school campaign, focusing on stationery and art supplies, also drove a 10% surge in relevant categories, keeping their inventory fresh and appealing.

Customer Relationships

Customer relationships for many retailers are predominantly transactional, with self-service kiosks in stores and online platforms handling most interactions. This model allows customers to browse and purchase independently, streamlining the buying process. For instance, in 2024, e-commerce sales continued to grow, with many consumers preferring the speed and convenience of digital self-service.

However, these businesses also recognize the value of human interaction. In-store associates are readily available to offer personalized assistance, guide customers through product selections, and provide tailored recommendations, thereby elevating the overall shopping experience. This blend of self-service efficiency and accessible human support aims to cater to diverse customer preferences.

The objective is to ensure that the path from discovery to purchase is as seamless and user-friendly as possible. Data from 2024 indicates that retailers offering a strong omni-channel experience, which includes both robust self-service options and helpful in-store staff, often see higher customer satisfaction rates and increased sales conversion.

For online customers, relationships are cultivated through dedicated digital channels like comprehensive Frequently Asked Questions (FAQs) sections and responsive email support. These resources are crucial for efficiently addressing customer inquiries about orders, product details, or website navigation, thereby fostering a positive online shopping experience. For instance, many e-commerce platforms report that a well-maintained FAQ page can deflect up to 70% of common customer service inquiries, significantly reducing operational costs.

Many businesses also integrate live chat functionalities or AI-powered chatbots to provide immediate assistance, further enhancing customer engagement and issue resolution. In 2024, businesses leveraging chatbots saw an average reduction of 30% in customer service response times. This direct and accessible support is vital for building trust and encouraging repeat business in the competitive digital marketplace.

The Works’ ‘Together’ loyalty program concluded in March 2024. While this formal program has ended, the company is actively exploring new avenues to cultivate customer loyalty.

Future strategies may incorporate digital engagement tools and tailored promotions, aiming to incentivize repeat business and sustained customer interaction. This shift suggests a move away from traditional points-based systems towards more dynamic, personalized relationship-building approaches.

Promotional Communications and Newsletters

Companies cultivate customer loyalty through consistent promotional outreach, often via email newsletters and direct mail campaigns. These communications serve to highlight new products, exclusive deals, and seasonal sales, ensuring the brand remains a prominent consideration for consumers.

Such regular engagement is crucial for fostering repeat business. For instance, in 2024, businesses that prioritized personalized email marketing saw an average increase in customer retention rates of up to 15%, according to industry reports.

- Informing Customers: Newsletters and promotions keep customers updated on new arrivals, special offers, and seasonal sales.

- Brand Visibility: Regular communication helps maintain brand awareness and keeps the company top-of-mind.

- Driving Repeat Business: These efforts are designed to encourage customers to return and make additional purchases.

- Engagement Metrics: In 2024, email open rates for retail promotions averaged around 20%, with click-through rates often exceeding 2.5%, demonstrating continued effectiveness.

Social Media Engagement

The Works actively cultivates its online community through robust social media engagement. Platforms like Instagram, Facebook, and TikTok are utilized to showcase new product arrivals, run interactive contests, and directly address customer questions and comments.

This consistent interaction builds a strong sense of brand loyalty and provides valuable, real-time feedback. In 2024, The Works reported a 25% increase in customer engagement metrics across its primary social media channels, directly correlating with a 10% uplift in online sales attributed to social media campaigns.

- Community Building: Fostering a sense of belonging among customers.

- Direct Interaction: Responding to inquiries and comments promptly.

- Brand Affinity: Strengthening customer loyalty through shared experiences.

- Feedback Loop: Gathering insights for product development and service improvement.

Customer relationships are managed through a mix of self-service digital channels and personal assistance. While transactional interactions are common, especially online, human support remains vital for enhancing the customer journey. In 2024, data showed a strong preference for omni-channel experiences that blend digital convenience with accessible in-person help.

The company is shifting from formal loyalty programs to more dynamic digital engagement. Future strategies will likely focus on personalized promotions and digital tools to foster continued customer interaction and repeat business.

Regular communication via newsletters and promotions is key to keeping customers informed and engaged. This consistent outreach aims to drive repeat purchases and maintain brand visibility. For instance, personalized email marketing in 2024 saw customer retention rates increase by up to 15%.

Social media engagement is crucial for building an online community and gathering feedback. The Works saw a 25% rise in social media engagement in 2024, which was linked to a 10% increase in online sales from social campaigns.

| Relationship Type | Key Activities | 2024 Data/Insights |

|---|---|---|

| Self-Service | Online platforms, FAQs, chatbots | Chatbots reduced customer service response times by 30% |

| Personal Assistance | In-store associates, customer support | Omni-channel strategies boosted customer satisfaction |

| Loyalty & Engagement | Promotional outreach, social media | Email marketing increased retention by up to 15%; Social engagement up 25% |

Channels

The Works' primary distribution channel is its extensive network of over 500 physical retail stores located throughout the UK. These brick-and-mortar locations are crucial, offering customers a tactile and immediate shopping experience where they can explore merchandise and receive in-person support. This physical presence is the backbone of their sales strategy.

In 2024, these physical stores continued to be the dominant revenue driver for The Works. Data indicates that sales generated through these stores consistently account for more than 90% of the company's total revenue. This highlights the enduring importance of the in-store experience for their customer base.

TheWorks.co.uk is the company's primary e-commerce website, acting as a vital digital storefront that significantly expands customer access beyond its physical stores. This online channel enables 24/7 shopping, offering a wider product selection and convenient home delivery options. In 2024, The Works continued to invest in its digital capabilities, aiming to improve the user experience and expand its online customer base, recognizing the growing importance of online sales in the retail landscape.

The Click & Collect service acts as a hybrid channel, blending the ease of online shopping with the immediacy of in-store pickup. This model allows customers to browse and purchase items digitally, then retrieve their orders from a convenient physical location, often their closest store. This significantly boosts customer flexibility and helps them avoid shipping fees.

By utilizing its established physical store footprint, a business can transform its retail locations into efficient pickup points, enhancing the overall customer experience. This strategy proved particularly valuable in 2024, with many retailers reporting increased foot traffic and sales through their click and collect channels. For instance, some major fashion retailers saw over 40% of their online orders fulfilled via click and collect in the UK during peak seasons.

Mobile Application (Potential)

A mobile application presents a significant opportunity for future channel development, enabling direct customer interaction and personalized experiences. This platform could facilitate mobile shopping, push targeted promotions, and integrate loyalty programs, boosting customer retention. For instance, in 2024, the global mobile commerce market reached over $3.5 trillion, highlighting the immense potential of mobile-first strategies.

Such an application would offer a seamless and convenient way for customers to engage with the business on the go. It could provide real-time updates on new products, exclusive app-only discounts, and easy access to customer support. Companies that invest in robust mobile apps often see increased customer lifetime value and higher average order values.

- Enhanced Engagement: A mobile app allows for push notifications and personalized content delivery, keeping customers informed and interested.

- Mobile Commerce: Facilitates direct purchasing, reducing friction and potentially increasing sales conversion rates.

- Loyalty Integration: Streamlines loyalty program participation, rewarding repeat customers and fostering brand advocacy.

- Data Collection: Provides valuable insights into customer behavior and preferences, informing future marketing and product development.

Social Media Platforms

Social media platforms act as vital, albeit indirect, channels within our business model. They are instrumental in building brand awareness, fostering customer engagement, and driving interest in our offerings. These digital spaces allow us to connect directly with our audience, sharing updates, promotions, and valuable content.

We leverage major platforms like Instagram, Facebook, and X (formerly Twitter) to visually present our products and announce new initiatives. This consistent presence helps cultivate a loyal community around our brand, encouraging interaction and feedback. In 2024, social media marketing spend globally was projected to reach over $200 billion, highlighting its significance.

- Brand Visibility: Platforms increase reach and recognition.

- Customer Interaction: Direct engagement builds loyalty.

- Promotional Tool: Showcasing products and offers drives sales.

- Traffic Generation: Directing users to online and physical locations.

The physical retail stores remain the cornerstone of The Works' distribution strategy, with over 500 locations across the UK. These stores offer a tangible customer experience and are the primary revenue generators, consistently accounting for more than 90% of total sales in 2024.

The company's e-commerce website, TheWorks.co.uk, serves as a critical digital extension, providing 24/7 access to a wider product range and home delivery. Investment in 2024 focused on enhancing this online platform to capture a growing digital customer base.

Click & Collect bridges the online and offline experience, allowing customers to order digitally and pick up in-store, enhancing convenience and potentially increasing store footfall. This hybrid approach saw significant uptake in 2024, with many retailers reporting over 40% of online orders fulfilled this way during peak periods.

A mobile application represents a significant future channel, offering personalized engagement and direct purchasing. The global mobile commerce market exceeded $3.5 trillion in 2024, underscoring the potential of mobile-first strategies for customer retention and increased order values.

Social media platforms like Instagram, Facebook, and X are crucial for brand building and customer engagement, driving interest and traffic. Global social media marketing spend reached over $200 billion in 2024, highlighting its importance in reaching consumers.

| Channel Type | Key Features | 2024 Relevance | Customer Benefit | Strategic Importance |

|---|---|---|---|---|

| Physical Retail Stores | 500+ UK locations, tactile experience, immediate availability | Dominant revenue driver (>90% of sales) | In-person browsing, expert advice, instant gratification | Core brand presence, customer acquisition |

| E-commerce Website (TheWorks.co.uk) | 24/7 shopping, wider selection, home delivery | Significant growth area, investment focus | Convenience, accessibility, extensive product choice | Market reach expansion, digital sales growth |

| Click & Collect | Online order, in-store pickup | Hybrid model, customer flexibility | Avoid shipping costs, convenient pickup, reduced delivery times | Bridging online/offline, driving store traffic |

| Mobile Application (Potential) | Personalized offers, direct purchasing, loyalty integration | Untapped growth potential, mobile commerce market >$3.5T | On-the-go convenience, tailored experiences, loyalty rewards | Customer retention, data insights, future growth driver |

| Social Media Platforms | Brand awareness, customer engagement, promotion | Global marketing spend >$200B | Product discovery, community building, interactive content | Brand visibility, customer loyalty, traffic generation |

Customer Segments

Budget-conscious families and individuals are a key customer segment for businesses offering everyday essentials. They actively seek value, prioritizing affordability for items like stationery, school supplies, and gifts. In 2024, a significant portion of household spending continues to be directed towards these necessities, with many consumers actively hunting for discounts and promotions to stretch their budgets further.

Students, from those just starting primary school all the way through university, have a constant need for affordable supplies. Think about it: pens, notebooks, art materials for projects, and textbooks are essential, and costs can really add up for families.

Educators, too, are a crucial segment. Teachers in classrooms and even parents who homeschool are always on the lookout for budget-friendly ways to get teaching aids, general classroom supplies, and engaging educational toys to make learning fun.

The Works’ extensive product selection is perfectly positioned to meet these specific demands. In 2024, The Works continued to offer a wide array of discounted stationery, craft supplies, and books, directly addressing the budget constraints faced by students and educators alike.

Hobbyists and craft enthusiasts represent a core customer base, driven by a deep passion for creative expression. This segment actively seeks out materials for activities like painting, drawing, knitting, and various DIY projects.

Their purchasing decisions are often influenced by the availability of a wide selection of supplies and competitive pricing. In 2024, reports indicated a surge in interest for at-home crafting, with online sales of art and craft supplies growing by an estimated 12% year-over-year.

The company's strategic emphasis on promoting creative activities resonates strongly with these individuals, encouraging repeat purchases and fostering brand loyalty within this engaged community.

Gift Buyers

Gift buyers represent a significant customer segment for The Works, actively seeking budget-friendly presents for various occasions like birthdays and holidays. The retailer's extensive selection of toys, books, and novelty items, all priced accessibly, positions it as a go-to location for thoughtful gifting without breaking the bank. This group is particularly drawn to The Works' seasonal offerings, which provide timely and relevant gift options.

In 2024, the UK's gift market continued to show resilience, with consumers prioritizing value for money, a trend that directly benefits retailers like The Works. Data from early 2024 indicated that over 60% of shoppers were actively looking for deals and discounts when purchasing gifts, highlighting the importance of The Works' affordable price points.

- Affordable Gifting: Customers prioritize value for money when selecting gifts.

- Occasion-Based Shopping: This segment actively seeks gifts for birthdays, holidays, and other events.

- Product Variety: Toys, books, and novelty items at accessible price points are key attractions.

- Seasonal Appeal: Limited-time seasonal ranges significantly influence purchasing decisions for gift buyers.

Occasional Shoppers and Bargain Hunters

Occasional shoppers and bargain hunters are a key customer segment for discount retailers like The Works. These individuals aren't necessarily loyal patrons but are motivated by compelling offers. In 2024, the discount retail sector continued to see strong consumer interest, with many shoppers actively seeking out sales events. This segment is particularly responsive to clear price reductions and bundled deals, often visiting stores only when specific promotions are advertised. They represent a significant portion of traffic during peak sales periods, driven by the thrill of discovering value.

Their purchasing behavior is largely dictated by price sensitivity and the perception of a good deal. For instance, during major sale events like Black Friday or specific seasonal promotions, foot traffic can surge dramatically. In 2024, reports indicated that discounts of 30% or more were highly effective in attracting these customers. They are less likely to be influenced by brand loyalty and more by the immediate savings offered.

- Price-Driven Decisions: This segment prioritizes cost savings above all else, making them highly responsive to discounts and promotions.

- Seasonal and Promotional Focus: Their shopping activity often aligns with specific sale periods, such as back-to-school or holiday events.

- Discovery Motivation: The allure of finding unexpected bargains and unique items at reduced prices is a significant draw.

- Impact on Sales Volume: While not regular visitors, their purchases during sale periods can significantly boost overall sales figures for retailers.

The Works serves a broad customer base primarily focused on value and affordability. This includes budget-conscious families and students needing everyday essentials and school supplies, as well as hobbyists and craft enthusiasts seeking creative materials at competitive prices. The retailer also attracts gift buyers looking for economical presents and occasional shoppers motivated by sales and discounts.

In 2024, the demand for affordable goods remained high across all these segments. For instance, the market for arts and crafts supplies saw continued growth, with at-home crafting remaining popular, indicating a consistent need for accessible creative resources. The company's strategy of offering a wide variety of products at discounted prices directly appeals to these diverse customer needs.

| Customer Segment | Key Motivations | 2024 Trend/Data Point |

|---|---|---|

| Budget-Conscious Families & Students | Affordability for essentials, school supplies | Continued focus on value and discounts for household necessities. |

| Hobbyists & Craft Enthusiasts | Wide selection of materials, competitive pricing for creative expression | At-home crafting popularity drove a 12% year-over-year increase in online art and craft supply sales. |

| Gift Buyers | Budget-friendly presents for occasions | Over 60% of gift shoppers in early 2024 sought deals and discounts. |

| Occasional Shoppers & Bargain Hunters | Compelling offers, price reductions | Discount retail sector remained strong, with significant traffic during sales events driven by discounts of 30% or more. |

Cost Structure

The most substantial expense for a retailer like The Works is the direct cost of acquiring the inventory that is ultimately sold to customers. This encompasses the purchase price of a wide array of products, including books, a variety of stationery items, arts and crafts materials, popular toys, and assorted gifts, all sourced from various suppliers.

Effective management of supplier partnerships and careful attention to product profit margins are absolutely crucial for maintaining control over this significant cost component. For instance, in 2023, the UK retail sector experienced an average gross profit margin of around 50%, indicating the importance of negotiating favorable purchase prices to ensure COGS doesn't erode profitability.

Staff wages and benefits are a significant expense for businesses. In 2024, many companies are grappling with the impact of ongoing increases in national living and minimum wages, which directly affect payroll costs. This includes expenses for front-line retail staff, management teams, warehouse personnel, and essential head office administrative functions.

These employee-related costs extend beyond base salaries to encompass crucial benefits packages and ongoing training programs designed to maintain a skilled and motivated workforce. For instance, a typical retail business might allocate 20-30% of its revenue to staff costs, a figure that becomes even more critical when considering wage inflation.

Maintaining a vast physical store network incurs substantial costs. These include rent for prime retail locations, essential utilities like electricity and water, ongoing maintenance to ensure store functionality, and property taxes. For instance, in 2024, major retailers continued to grapple with rising commercial rents, with some reporting a 5-10% increase year-over-year in key urban markets, significantly impacting their operating expenses.

The company is strategically managing its store footprint to enhance efficiency and profitability. This involves a dynamic approach of closing underperforming stores that are no longer viable and simultaneously opening new locations in more promising, cost-effective areas. This continuous optimization aims to reduce overall overhead while maximizing revenue potential from the physical presence.

Marketing and Advertising Expenses

Marketing and advertising expenses are crucial for Works, covering costs to promote its products and brand. This includes significant investment in digital marketing campaigns, which are paramount for reaching a broad audience. In 2024, companies across various sectors saw marketing budgets increase; for instance, the global digital advertising spending was projected to reach over $600 billion. These outlays are vital for attracting new customers and fostering loyalty among the existing base.

These essential costs encompass a wide range of activities designed to build brand awareness and drive sales. Works likely allocates substantial funds to online advertising, social media engagement, and potentially traditional advertising channels depending on its target demographic. For example, a report in early 2024 indicated that social media advertising spending was expected to grow by approximately 10-15% year-over-year. Public relations efforts also fall under this umbrella, aiming to shape public perception and secure positive media coverage.

- Digital Marketing: Investment in online ads, SEO, and content marketing.

- Brand Promotion: Costs associated with advertising campaigns across various media.

- Customer Acquisition: Expenses directly tied to attracting new customers.

- Customer Retention: Spending on loyalty programs and ongoing engagement initiatives.

Logistics, Distribution, and IT Infrastructure Costs

These essential operational expenses encompass warehousing, transportation, and the entire distribution network, ensuring products reach both physical stores and individual online customers efficiently. For instance, in 2024, many retailers saw significant shifts in logistics costs due to fluctuating fuel prices and increased demand for faster delivery. Companies are investing heavily in optimizing their supply chains to mitigate these rising expenses.

Furthermore, maintaining and upgrading the robust IT infrastructure is a critical component of this cost structure. This includes the ongoing investment in e-commerce platforms, sophisticated inventory management systems, and the cybersecurity measures necessary to protect sensitive data. A report from early 2024 indicated that the average spending on cloud-based IT infrastructure for retail operations increased by nearly 15% year-over-year, reflecting the growing reliance on digital capabilities.

- Warehousing: Costs associated with storing inventory, including rent, utilities, and labor for managing stock.

- Transportation: Expenses for moving goods, covering freight, fuel surcharges, and carrier fees.

- Distribution: Costs related to the fulfillment of orders, including packaging and last-mile delivery services.

- IT Infrastructure: Investments in e-commerce platforms, inventory systems, cybersecurity, and data management.

The cost structure for The Works is heavily influenced by the direct costs of goods sold, which represent the purchase price of the diverse inventory sold. This is further compounded by significant operational expenses including staff wages, the upkeep of its physical store network, and essential marketing and advertising outlays. Additionally, substantial investments in IT infrastructure and logistics are critical for efficient operations.

| Cost Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Cost of Goods Sold (COGS) | Direct cost of acquiring inventory (books, stationery, toys, gifts). | Crucial for profitability; UK retail gross margins averaged ~50% in 2023. |

| Staff Wages & Benefits | Salaries, benefits, and training for retail, warehouse, and head office staff. | Impacted by rising national living/minimum wages; can represent 20-30% of revenue. |

| Store Network Costs | Rent, utilities, maintenance, and property taxes for physical stores. | Commercial rents in key urban markets saw 5-10% increases in 2024. |

| Marketing & Advertising | Digital marketing, brand promotion, customer acquisition/retention. | Global digital ad spending projected over $600 billion in 2024; social media ad spending up 10-15% YoY. |

| Logistics & IT Infrastructure | Warehousing, transportation, e-commerce platforms, inventory systems, cybersecurity. | Retail cloud IT infrastructure spending increased ~15% YoY in early 2024; fuel price fluctuations impact logistics. |

Revenue Streams

The Works' primary revenue comes from selling products in its physical stores. This is the backbone of their business, bringing in the vast majority of their income.

These in-store sales cover a wide range of items, including books, stationery, arts and crafts supplies, toys, and gifts. This diverse product offering caters to a broad customer base.

In fact, sales generated through these brick-and-mortar locations consistently represent over 90% of The Works' total revenue. This highlights the crucial role of their retail presence.

For example, in their fiscal year ending in early 2024, The Works reported that the vast majority of their revenue was driven by these in-store transactions, underscoring the enduring importance of their physical retail footprint.

The Works.co.uk represents a key revenue stream through online product sales. This digital channel, while contributing a smaller percentage to total revenue compared to physical stores, is crucial for expanding customer reach and offering convenience. In the fiscal year ending March 2024, online sales for The Works saw a notable increase, reflecting a growing consumer preference for e-commerce. This channel allows The Works to serve customers beyond their geographical store locations, driving incremental revenue and brand engagement.

Click & Collect sales represent revenue generated from customers placing orders online and collecting them at a physical store location. This model effectively bridges the gap between e-commerce convenience and the immediacy of brick-and-mortar retail, offering a flexible purchasing option.

This revenue stream capitalizes on existing store infrastructure, reducing the need for separate delivery logistics and potentially drawing customers into the store for impulse purchases. In 2024, retailers observed a significant uptick in click and collect adoption, with some reporting that over 60% of their online orders utilized this fulfillment method.

Seasonal and Promotional Sales

Seasonal and promotional sales are a significant revenue driver for many businesses, especially those with products that align with specific holidays or events. For instance, retailers often see their highest sales volumes during the Christmas season, with many reporting substantial year-over-year growth. In 2023, for example, US retail sales in November and December combined reached approximately $1.3 trillion, a notable increase from previous years, highlighting the power of these peak trading periods.

These sales periods are not just about increased volume; they are strategically managed through targeted product assortments and compelling marketing campaigns. Businesses tailor their inventory and promotions to capitalize on consumer spending habits during these times. For example, back-to-school shopping in late summer can generate billions in revenue for apparel and electronics retailers.

- Peak Seasonality: Significant revenue surges are observed during holidays like Christmas, Easter, and back-to-school periods, directly impacting overall sales figures.

- Promotional Impact: Targeted marketing and discounts during these times boost sales volume and attract a larger customer base.

- Category Specific Growth: Certain product categories, such as toys, electronics, and apparel, experience disproportionately high sales during these seasonal windows.

- Economic Indicators: Consumer spending during these periods often reflects broader economic health, with trends in 2024 indicating continued consumer interest in seasonal purchases despite economic fluctuations.

Clearance and Discounted Sales

Clearance and discounted sales represent a crucial revenue stream, particularly for managing inventory and attracting value-conscious customers. This strategy involves selling excess, end-of-season, or slightly imperfect products at reduced prices. It’s an effective way to free up warehouse space, allowing for the introduction of new merchandise and preventing capital from being tied up in slow-moving stock. For instance, during the post-holiday sales period in 2024, many retailers saw significant revenue boosts from clearing out winter apparel and seasonal decorations, with some reporting that clearance items accounted for up to 20% of their total sales in January.

- Inventory Management: Reduces carrying costs and minimizes losses from obsolete stock.

- Cash Flow Generation: Recovers some capital from items that might otherwise be written off.

- Customer Acquisition: Attracts new customers who are drawn to deals, potentially leading to future full-price purchases.

- Market Responsiveness: Allows businesses to quickly adapt to changing consumer demand and product lifecycles.

The Works generates revenue primarily through its extensive network of physical retail stores, which account for the overwhelming majority of its income. This core revenue stream encompasses a wide variety of products, including books, stationery, arts and crafts, toys, and gifts, serving a diverse customer base.

Online sales via The Works.co.uk represent a growing revenue channel, expanding the company's reach and offering convenience. Click & Collect services further blend online and in-store purchasing, leveraging physical locations for order fulfillment and potentially driving additional in-store traffic. Seasonal and promotional sales, particularly around holidays and key shopping periods like back-to-school, are critical for revenue spikes. Clearance and discounted sales are also vital for inventory management and attracting value-seeking customers, recovering capital and improving cash flow.

| Revenue Stream | Description | Estimated Contribution (FY24) |

|---|---|---|

| In-Store Sales | Sales of products through physical retail locations. | >90% |

| Online Sales | E-commerce transactions via TheWorks.co.uk. | Growing, single-digit percentage |

| Click & Collect | Online orders collected at physical stores. | Integral part of online sales strategy |

| Seasonal/Promotional Sales | Increased sales during peak periods and promotional events. | Significant revenue surges |

| Clearance/Discounted Sales | Sales of end-of-season or excess stock at reduced prices. | Up to 20% of sales in specific periods (e.g., January) |

Business Model Canvas Data Sources

The Business Model Canvas is built using customer feedback, operational metrics, and competitive analysis. These diverse data sources ensure a comprehensive and actionable strategic framework.