Textron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Textron Bundle

Navigate the complex external landscape impacting Textron. Our PESTLE analysis delves into political stability, economic fluctuations, societal shifts, technological advancements, environmental regulations, and legal frameworks. Understand the forces shaping Textron's operational environment and strategic direction. Gain actionable intelligence to inform your own business decisions and identify potential opportunities and threats. Invest in comprehensive market understanding today.

Political factors

Textron's defense divisions, Bell and Textron Systems, are heavily influenced by the U.S. government's defense spending. These segments are crucial to Textron's overall performance, directly benefiting from shifts in military budgets and modernization initiatives.

The geopolitical landscape in 2024 has spurred increased global defense outlays, a trend anticipated to persist into 2025. This environment bolsters demand for Textron's key products, including military helicopters, advanced unmanned aerial systems, and specialized ground vehicles.

For Textron, U.S. government contracts represented a significant portion of its revenue stream, accounting for roughly 25% in 2024. This reliance underscores the direct correlation between government defense spending and Textron's financial results.

Textron's global footprint means it's significantly influenced by international trade policies and sanctions. For instance, shifts in trade agreements, like potential renegotiations of existing pacts or the introduction of new ones, can directly impact Textron's ability to export its Bell helicopters and Textron Aviation aircraft, as well as influence the cost of components sourced internationally.

The imposition of sanctions on specific countries or regions can create substantial hurdles. If a key market for business jets or defense systems faces sanctions, Textron could see a sharp decline in sales and face challenges in maintaining its supply chain. For example, in 2023, ongoing geopolitical tensions continued to affect trade flows, impacting various industries reliant on global commerce.

Moreover, geopolitical instability can alter demand patterns for private aviation. Areas experiencing political unrest or economic sanctions might see a reduced need for business jet travel, directly affecting Textron Aviation's sales and service operations in those locations.

The evolving landscape of international trade, including tariffs and trade barriers, necessitates constant adaptation in Textron's strategic planning and operational execution to mitigate risks and capitalize on opportunities in diverse global markets.

The aviation sector operates under a dense web of regulations, requiring Textron Aviation, Bell, and Textron eAviation to adhere to strict national and international mandates from bodies like the FAA and EASA. These regulations, encompassing safety certifications, emissions targets, and the approval process for novel aircraft like eVTOLs, significantly shape product timelines, development expenses, and the ability to enter new markets. For example, the FAA's 2024 exemption for the Pipistrel Velis Electro to be used for flight training highlights a pathway for new electric aircraft technologies.

Political Stability in Key Markets

Political stability in regions where Textron operates is a significant consideration. For instance, geopolitical tensions in Eastern Europe, which saw some escalation in early 2024, could indirectly affect global supply chains or defense spending priorities, impacting Textron's various business segments. Similarly, elections in major markets, such as potential shifts in government policy following the 2024 US presidential election, could influence defense contracts and commercial aviation demand.

Textron's diversified global footprint, with manufacturing and sales across North America, Europe, and Asia, helps to buffer against localized political instability. However, a significant downturn or widespread unrest in a major market, like a substantial disruption in the Middle East affecting oil prices and subsequent commercial aviation demand, could still present considerable challenges. The company's ability to navigate these political landscapes effectively directly impacts its revenue streams and operational continuity.

- Geopolitical Risk Mitigation: Textron's presence in over 30 countries provides a natural hedge against single-market political instability.

- Defense Spending Sensitivity: Changes in defense budgets in key countries like the United States, which accounted for a significant portion of Textron's defense sales in 2023, are directly tied to political decisions.

- Commercial Market Volatility: Economic impacts stemming from political events can affect consumer and business confidence, influencing demand for Textron's commercial aircraft and industrial products.

Government Support for Sustainable Aviation

Governments globally are intensifying their focus on sustainable aviation, presenting both avenues for growth and potential regulatory hurdles for Textron. For instance, the EU's 'Fit for 55' package aims for a 55% emissions reduction by 2030, which includes mandates for Sustainable Aviation Fuel (SAF) blending. This policy landscape encourages investment in eco-friendly technologies, aligning with Textron Aviation's SustainableAdvantage program and Pipistrel's advancements in electric aircraft development.

These initiatives can stimulate demand for Textron's innovative solutions. The U.S. government, through programs like the Inflation Reduction Act, also offers incentives for clean energy and manufacturing, potentially benefiting Textron's sustainable aviation efforts. Such governmental backing supports research and development, creating a more favorable market for aircraft designed with reduced environmental impact.

Key government support mechanisms include:

- Tax credits and grants for SAF production and adoption.

- Investment in electric and hybrid-electric propulsion research.

- Support for carbon offsetting and emissions trading schemes in aviation.

- Regulatory frameworks encouraging the development of new, sustainable aircraft designs.

Governmental policies directly influence Textron's defense business, with U.S. defense spending representing approximately 25% of its revenue in 2024. International trade policies and sanctions also significantly impact Textron's global operations, affecting exports of its aviation products and supply chain costs. Geopolitical stability in operating regions, alongside election outcomes in key markets like the U.S., can alter demand for both defense systems and commercial aircraft.

The push for sustainable aviation by governments globally, such as the EU's 'Fit for 55' initiative, creates opportunities for Textron's eco-friendly technologies, like those developed by Pipistrel. Incentives from programs like the U.S. Inflation Reduction Act further support Textron's sustainable aviation research and development, fostering a market for environmentally conscious aircraft designs.

Textron's diverse geographical presence, spanning over 30 countries, serves as a natural hedge against localized political instability. However, significant geopolitical events or economic disruptions in major markets can still pose challenges to revenue streams and operational continuity.

What is included in the product

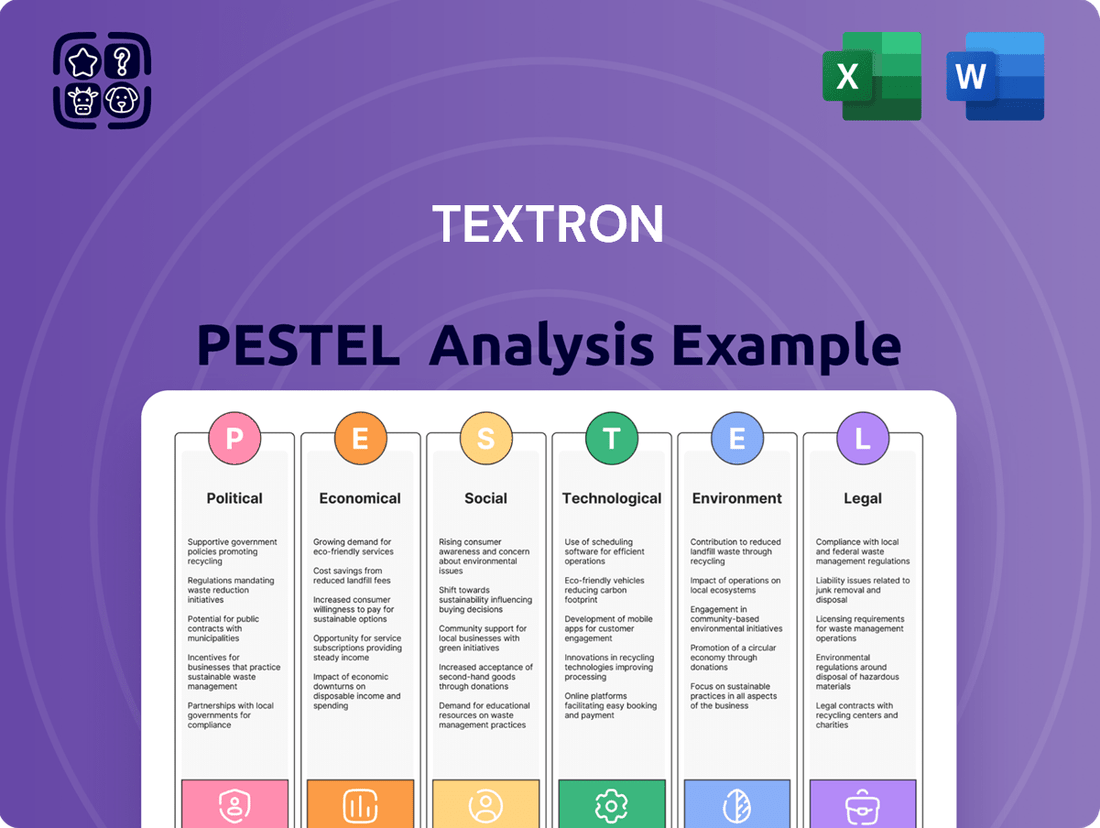

This comprehensive PESTLE analysis of Textron examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic direction.

Offers a streamlined understanding of Textron's external environment, simplifying complex market dynamics for strategic decision-making.

Economic factors

Textron's commercial businesses, especially Textron Aviation and its Industrial segment, are quite attuned to how the global economy is doing. When economies are strong, people and businesses tend to spend more, which means more demand for things like business jets and specialized vehicles. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% for 2024, with a slight moderation expected into 2025. This steady growth generally supports Textron's markets.

Conversely, a slowdown or a recession can hit Textron hard. During tough economic times, companies often cut back on discretionary spending, leading to fewer orders for new aircraft and equipment. This directly impacts Textron's sales and can put a squeeze on their profits. The risk of recession, while debated, remains a factor, especially with ongoing geopolitical uncertainties and inflation concerns that could dampen consumer and business confidence throughout 2025.

Textron's operations are sensitive to inflation and interest rates. High inflation, evidenced by the U.S. Consumer Price Index (CPI) reaching 4.0% year-over-year in May 2024, directly increases the cost of raw materials, components, and labor across its diverse manufacturing segments. This rising cost environment pressures Textron's profitability if it cannot fully pass these increases onto its customers.

Rising interest rates, with the Federal Funds Rate hovering around 5.25%-5.50% in mid-2024, significantly impact Textron's cost of capital for expansion and operations. More critically, for its Finance segment and customers purchasing large assets like aircraft, higher borrowing costs can stifle demand. For instance, in the helicopter market, increased financing expenses can depress aircraft values and make leasing less attractive, directly affecting sales pipelines for Textron Aviation.

Corporate buyers of Textron's business jets, for example, face higher financing costs, potentially delaying or canceling significant capital expenditures. This trend was observed with a tightening of credit conditions in late 2023 and early 2024, impacting discretionary spending on high-value assets. Consequently, Textron must navigate these macroeconomic headwinds by managing its own costs and offering competitive financing solutions to maintain sales momentum.

Ongoing global supply chain issues, including parts shortages and logistics challenges, continue to affect Textron's production capabilities, particularly within its aviation division. These disruptions contribute to factory inefficiencies and delayed deliveries, ultimately impacting revenue recognition and overall financial performance.

The persistent nature of these supply chain headwinds was acknowledged by Textron's CEO in July 2024, who stated that the issues were still problematic. Such challenges translate directly into increased operational costs for the company as it navigates a complex and often unpredictable sourcing environment.

Defense Budget Allocations

Defense budget allocations represent a critical economic factor for Textron. While global defense spending continues its upward trajectory, specific governmental funding priorities can significantly influence the success of particular Textron programs. The U.S. Department of Defense's fiscal 2025 budget request, for instance, emphasizes investments in advanced technologies such as unmanned systems. This focus could directly benefit Textron Systems' product development and sales in this high-growth area.

Furthermore, Textron's Bell segment has been actively engaged in significant military aviation projects. A notable example is the progress made on the Future Long-Range Assault Aircraft (FLRAA) program, which is a key initiative that could lead to substantial future revenue streams for Textron if successful.

- U.S. Defense Budget Trends: The U.S. Department of Defense requested $886 billion for fiscal year 2025, signaling continued robust investment in national security.

- Prioritization of Unmanned Systems: Key elements of the 2025 request include increased funding for autonomous and unmanned platforms, aligning with Textron Systems' strategic focus.

- Bell's FLRAA Program: Textron's Bell division is a contender for the FLRAA program, a major modernization effort aimed at replacing aging helicopters in the U.S. Army.

Currency Fluctuations

As a multinational corporation, Textron is significantly exposed to currency fluctuations. Changes in exchange rates directly impact the reported value of its international sales, operational costs, and overall profitability. For instance, a stronger US dollar can make Textron's products more expensive for foreign buyers, potentially hurting sales volume in those markets. Conversely, a weaker dollar can boost the translated value of profits earned in foreign currencies.

These shifts are a constant consideration for Textron’s finance and international sales teams. For example, in early 2024, the US dollar showed strength against several major currencies, which could have a dampening effect on earnings from regions like Europe and Asia when repatriated. Textron's hedging strategies are crucial in mitigating these risks, but volatile currency markets present an ongoing challenge to maintaining consistent financial performance across its global operations.

- Impact on Sales: A stronger USD can increase the price of Textron's products in international markets, potentially reducing demand.

- Profitability: Fluctuations affect the translated value of foreign earnings, impacting overall reported profits.

- Competitive Edge: Exchange rates can alter the price competitiveness of Textron's offerings against local manufacturers abroad.

- Financial Management: Textron actively manages currency exposure through hedging and operational adjustments.

Global economic growth directly influences Textron's commercial segments, with the IMF forecasting around 3.2% growth for 2024. Strong economies boost demand for business jets and industrial equipment. Conversely, economic downturns or recessions can significantly reduce orders and profitability for Textron.

Inflation and rising interest rates pose challenges, increasing operational costs and potentially dampening demand for high-value assets like aircraft. For example, the U.S. CPI was 4.0% year-over-year in May 2024, and the Federal Funds Rate remained around 5.25%-5.50% in mid-2024.

Supply chain disruptions continue to impact Textron's production, leading to inefficiencies and delivery delays, as acknowledged by the company's CEO in July 2024. Defense budget allocations, such as the U.S. FY2025 request of $886 billion, are critical for Textron Systems, especially its focus on unmanned systems.

Currency fluctuations also affect Textron's multinational operations, impacting international sales and reported profits. A stronger USD, observed in early 2024, can make Textron's products more expensive abroad, necessitating robust hedging strategies.

| Economic Factor | Impact on Textron | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Global Economic Growth | Drives demand for commercial aircraft and industrial products. | IMF global growth forecast: ~3.2% for 2024. |

| Inflation | Increases raw material, labor, and component costs. | U.S. CPI: 4.0% YoY (May 2024). |

| Interest Rates | Raises cost of capital; affects financing for customers. | Federal Funds Rate: 5.25%-5.50% (Mid-2024). |

| Supply Chain Issues | Causes production inefficiencies and delivery delays. | Ongoing challenges acknowledged by CEO (July 2024). |

| Defense Spending | Critical for Textron Systems; drives military program success. | U.S. FY2025 Defense Budget Request: $886 billion. |

| Currency Exchange Rates | Affects international sales value and foreign earnings translation. | Strong USD observed in early 2024 impacting international pricing. |

Full Version Awaits

Textron PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This Textron PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the aerospace and defense giant. It provides a comprehensive overview of the external forces shaping Textron's strategic landscape.

You'll gain insights into key market trends, regulatory changes, and societal shifts relevant to Textron's operations and future growth. The document is designed for immediate application in your business planning and strategic decision-making.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a deep dive into Textron's external operating environment.

Sociological factors

Textron's ability to secure and keep a skilled workforce, especially in engineering and manufacturing, is paramount to its success. Labor market dynamics, such as the scarcity of specialized talent and ongoing union negotiations, directly influence production capabilities and operational expenses. For instance, a strike at Textron Aviation in late 2024 highlighted these potential disruptions.

The company boasts a diverse workforce, reflecting a commitment to varied representation. However, this diversity presents ongoing challenges in specific departments and roles where underrepresentation persists, requiring targeted recruitment and retention strategies to ensure equitable opportunities and a broader talent pool.

Sociological shifts are notably influencing the aviation sector, particularly Textron's business jet segment. There's a clear evolution in how people prefer to travel, with a growing interest in private aviation solutions. This isn't just about traditional jet ownership anymore; it's about flexibility and personalization.

The rise of jet-sharing and fractional ownership models is a prime example of this changing preference. These options offer access to private travel without the full commitment of owning an aircraft, making it more accessible to a wider audience. This trend directly impacts the demand for business jets and how Textron Aviation might structure its offerings.

For instance, the market for private jet rental services is experiencing robust growth. Industry projections indicate a significant expansion in this area, with some analyses suggesting the global private jet charter market could reach over $20 billion by 2028, up from an estimated $9 billion in 2023. This highlights a substantial opportunity for Textron to adapt its services and cater to this expanding client base seeking tailored travel experiences.

Societal and investor demands for corporate social responsibility are on the rise, pushing companies like Textron to prioritize ethical conduct, diversity, and community involvement. These expectations significantly shape Textron's brand image and how it manages relationships with everyone involved, from customers to shareholders.

Textron's dedication to sustainability and its Environmental, Social, and Governance (ESG) efforts are increasingly vital for attracting both top talent and crucial investment capital. For instance, Textron Aviation's participation in the Business Aviation Commitment on Climate Change highlights a tangible step towards environmental stewardship.

Public Perception of Defense and Aviation Industries

Public sentiment significantly shapes how Textron is perceived and its operational freedom. Negative views on defense spending or the environmental footprint of aviation can create headwinds.

Growing concerns regarding the ethical implications of defense contracts and the societal role of private aviation are becoming more prominent. These issues can influence regulatory frameworks, investor confidence, and overall public acceptance of Textron's offerings.

The defense and aviation sectors are actively working to mitigate environmental impacts. For instance, the International Air Transport Association (IATA) aims for net-zero carbon emissions from aviation by 2050, a target that will require substantial technological advancements and operational changes across the industry, impacting companies like Textron.

- Defense Industry Perception: Public scrutiny over defense spending and the ethical sourcing of military equipment can affect government contracts and corporate reputation.

- Aviation's Environmental Concerns: Rising awareness of aviation's carbon emissions drives demand for more sustainable aircraft and operational practices.

- Societal Role of Private Jets: Discussions about wealth inequality and the environmental impact of private aviation can lead to calls for stricter regulations or taxes.

- Industry Sustainability Initiatives: Efforts like IATA's net-zero by 2050 goal demonstrate a commitment to addressing environmental challenges, which is crucial for public acceptance.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with projections indicating that 68% of the world's population will live in urban areas by 2050, according to UN data. This trend directly fuels demand for Textron's specialized vehicles, essential for construction, logistics, and public services within these expanding urban centers. Furthermore, advancements in infrastructure development, particularly in rapidly growing regions like Asia-Pacific, are creating significant market opportunities for Textron's diverse product portfolio.

The Asia-Pacific region is a key growth engine, expected to see continued investment in infrastructure projects throughout 2024 and 2025. This expansion in areas like transportation networks and urban development will likely boost sales of Textron Specialized Vehicles, which are designed for demanding operational environments. The global specialty vehicle market itself is poised for steady growth, with some estimates placing its compound annual growth rate in the mid-single digits for the coming years, driven by these overarching urbanization and infrastructure trends.

- Urban Population Growth: Global urban population projected to reach 68% by 2050.

- Regional Focus: Asia-Pacific leading infrastructure development, benefiting Textron.

- Market Expansion: Specialty vehicle market growth anticipated due to urbanization.

- Demand Drivers: Increased need for construction, logistics, and emergency vehicles.

Societal expectations around corporate responsibility significantly influence Textron's operations and brand perception. Growing demands for ethical business practices, diversity, and community engagement are paramount. Textron's commitment to sustainability and ESG initiatives, such as its participation in the Business Aviation Commitment on Climate Change, is crucial for attracting talent and investment.

Public sentiment, particularly regarding defense spending and the environmental impact of aviation, presents both challenges and opportunities. Concerns about ethical defense contracts and the societal role of private jets can shape regulatory landscapes and investor confidence. The industry's collective goal of net-zero carbon emissions by 2050, as championed by organizations like IATA, underscores the need for Textron to innovate towards more sustainable aviation solutions.

The increasing global urbanization, with 68% of the world population expected to live in urban areas by 2050, directly boosts demand for Textron's specialized vehicles used in construction, logistics, and public services. Asia-Pacific's infrastructure development, projected to continue through 2024-2025, offers significant market opportunities for these vehicles, supporting the anticipated mid-single-digit growth of the global specialty vehicle market.

| Sociological Factor | Impact on Textron | Supporting Data/Trend |

| Demand for Private Aviation | Increased interest in fractional ownership and jet-sharing models. | Global private jet charter market projected to exceed $20 billion by 2028. |

| Corporate Social Responsibility (CSR) | Emphasis on ethical conduct, diversity, and community involvement. | ESG efforts crucial for talent acquisition and investment. |

| Environmental Concerns | Pressure for sustainable aircraft and operations. | IATA's goal for net-zero carbon emissions from aviation by 2050. |

| Urbanization | Growth in demand for specialized vehicles in construction and logistics. | 68% of global population expected in urban areas by 2050; Asia-Pacific infrastructure growth. |

Technological factors

Textron's competitive edge hinges on continuous innovation in aerospace and defense, particularly in areas like artificial intelligence, advanced materials, and unmanned systems. These technological leaps are crucial for staying ahead in a rapidly evolving market.

The company demonstrates its commitment through significant investments in new product development. Examples include the Citation Ascend business jet and Bell's involvement in the Future Long-Range Assault Aircraft (FLRAA) program, showcasing a focus on next-generation capabilities.

Furthermore, Textron actively explores emerging technologies such as electric vertical takeoff and landing (eVTOL) aircraft and fully electric aviation. This forward-looking approach aims to secure future market leadership and address evolving customer needs and environmental considerations.

The aviation sector is undergoing a significant shift towards sustainability, driven by the development and adoption of sustainable aviation fuels (SAF) and advanced propulsion systems like hybrid-electric and electric. These technological advancements are not just about environmental compliance but are increasingly becoming a competitive differentiator and a response to growing market expectations. For Textron, this presents both opportunities and challenges as it navigates the transition.

Textron's commitment to these emerging technologies is evident through its subsidiaries. Textron eAviation is spearheading efforts in electric and hybrid-electric aircraft development, while Textron Aviation is actively supporting the integration of SAF into existing operations. Pipistrel, a Textron eAviation company, already has the Velis Electro, a fully electric aircraft, certified, demonstrating tangible progress in this domain. By 2024, the global SAF market was projected to reach over $15 billion, highlighting the significant economic potential and the strategic imperative for Textron to be at the forefront of this evolution.

The increasing adoption of automation and digital manufacturing, including advancements like 3D printing and digital twins, is a significant technological factor for Textron. These innovations are poised to boost Textron's operational efficiency and cut expenses, while also speeding up the development cycle for new products. For instance, in 2024, the aerospace sector saw a 15% increase in the use of additive manufacturing for prototyping and component production, a trend Textron is actively integrating across its business units.

These digital tools are becoming crucial for navigating supply chain disruptions and strengthening overall manufacturing capabilities within Textron's varied segments, from aviation to industrial products. The aerospace and defense industry, in particular, is heavily investing in digital technologies to create more resilient and agile production systems. By 2025, it's projected that over 60% of major aerospace manufacturers will have implemented digital twin technology for at least one critical production line, directly impacting Textron's competitive landscape.

Cybersecurity and Data Protection

As technology rapidly evolves, Textron faces escalating cybersecurity threats. The increasing interconnectedness of its systems, particularly those supporting complex defense contracts and advanced manufacturing, amplifies the risk to its intellectual property and operational continuity. Protecting sensitive data is paramount, not just for compliance but to maintain the trust of critical government and commercial partners.

The financial implications of a breach can be substantial. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, a figure that underscores the economic imperative of robust cybersecurity. Textron's investment in advanced security protocols and continuous monitoring is therefore crucial to safeguard its operations and reputation.

Key considerations for Textron include:

- Data Breach Costs: The average cost of a data breach in the aerospace and defense sector can be exceptionally high, impacting recovery efforts and client confidence.

- Intellectual Property Theft: Advanced technologies developed by Textron are prime targets for industrial espionage, necessitating sophisticated defenses.

- Regulatory Compliance: Stringent regulations, particularly for defense contractors, mandate specific cybersecurity standards that Textron must adhere to.

- Supply Chain Vulnerabilities: Ensuring the cybersecurity posture of suppliers is also critical, as a compromise anywhere in the chain can impact Textron's own security.

Advanced Air Mobility (AAM) Development

The emergence of Advanced Air Mobility (AAM), particularly electric vertical takeoff and landing (eVTOL) aircraft and unmanned aerial systems (UAS), signals a transformative technological frontier for Textron. Bell, a Textron business, is actively engaged in eVTOL development, aiming to capture a share of this nascent market. The company's existing expertise in rotorcraft and unmanned systems positions it well to capitalize on these advancements.

Textron Systems continues to be a leader in advanced unmanned aircraft systems, a segment that is rapidly evolving with increasing autonomy and mission capabilities. This technological trajectory presents substantial long-term growth potential for Textron. For instance, the global AAM market is projected to reach tens of billions of dollars by the late 2030s, with eVTOLs expected to play a significant role.

- Market Growth: The AAM market is anticipated to grow significantly, with some forecasts suggesting it could reach over $700 billion by 2040.

- Bell's Involvement: Bell has showcased concepts like the Nexus, an eVTOL air taxi, indicating direct investment in this area.

- Textron Systems' Expertise: Textron Systems' Unmanned Systems division consistently delivers advanced UAS solutions, with a strong backlog and ongoing development programs.

- Challenges: Despite the promise, AAM development faces hurdles, including significant upfront investment, evolving certification standards, and infrastructure requirements, which could impact near-term profitability.

Textron is deeply invested in technological advancements, particularly in aerospace and defense, focusing on areas like AI and advanced materials. These innovations are critical for maintaining its competitive edge in a fast-paced market.

The company's commitment is underscored by substantial investments in new products, such as the Citation Ascend jet and Bell's participation in the FLRAA program, highlighting a drive towards next-generation capabilities.

Textron is also actively exploring emerging technologies like eVTOL aircraft and fully electric aviation to secure future market leadership and address evolving customer demands and environmental concerns.

| Technology Area | Textron Involvement | Market Projection (2024/2025 Data) |

|---|---|---|

| Sustainable Aviation Fuels (SAF) | Textron Aviation supporting integration; Textron eAviation developing electric/hybrid-electric aircraft. | Global SAF market projected over $15 billion in 2024. |

| Additive Manufacturing (3D Printing) | Integration across business units for prototyping and component production. | Aerospace sector saw a 15% increase in additive manufacturing use in 2024. |

| Digital Twins | Implementing for production lines to enhance efficiency and product development. | Over 60% of major aerospace manufacturers projected to use digital twins by 2025. |

| Advanced Air Mobility (AAM) / eVTOL | Bell developing eVTOL concepts; Textron Systems leading in advanced UAS. | AAM market projected to reach tens of billions by late 2030s. |

Legal factors

Textron's reliance on U.S. government contracts, which accounted for roughly 25% of its 2024 consolidated revenues, exposes it to a stringent web of regulations. These rules govern everything from cost disclosure and what costs are permissible to the intricate clauses surrounding contract termination.

Navigating these complex legal frameworks is crucial for maintaining profitability. Failure to comply with these government contract regulations can lead to significant cost increases, penalties, or even the disruption of key revenue streams.

Furthermore, any shifts in U.S. procurement policies could directly impact Textron's operational costs and overall financial performance, requiring constant vigilance and adaptation to ensure continued compliance and mitigate potential financial risks.

Textron's global operations necessitate careful navigation of international trade laws and stringent export controls, particularly for its defense and aerospace segments. In 2024, the complexity of these regulations continues to grow, directly impacting the ability to move sensitive technologies across borders. Failure to comply can result in significant financial penalties and loss of market access. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, affecting companies' ability to export U.S.-origin goods and technology, with revisions occurring throughout 2024 that could impact Textron's supply chain and customer base.

Geopolitical tensions in 2024 and into 2025 are increasingly leading to new or tightened export restrictions, forcing companies like Textron to constantly adapt their compliance strategies. These shifts can impact everything from component sourcing to the final sale of aircraft and defense systems. For example, ongoing international relations dynamics are prompting re-evaluations of export licenses for certain advanced technologies, requiring robust due diligence and proactive engagement with regulatory bodies to ensure continued market participation.

Textron’s manufacturing of aircraft, defense systems, and specialized vehicles places it under intense scrutiny regarding product liability and safety. Adherence to rigorous standards set by bodies like the FAA for aviation is not just a regulatory requirement but a critical business imperative. Failure to meet these standards can result in severe consequences, including substantial fines and legal settlements.

In 2023, the aviation industry, a key sector for Textron, saw a notable increase in the value of product liability claims, with some estimates pointing to billions in potential payouts for major manufacturers facing product recalls or safety incidents. This highlights the immense financial exposure Textron faces. The company’s commitment to ongoing certification and robust quality control is therefore essential to mitigate these risks and maintain its operational license.

Environmental Regulations and Emissions Standards

Textron navigates a complex web of environmental regulations governing its manufacturing, waste disposal, and product emissions. The intensifying global commitment to climate action translates into increasingly stringent emissions standards, especially within the aviation sector, a key market for Textron. This regulatory landscape compels significant investment in developing and adopting cleaner technologies and more sustainable operational practices to ensure compliance and maintain market competitiveness.

In response to these pressures, Textron has set ambitious enterprise-wide targets. Specifically, the company aims to achieve a 20% reduction in greenhouse gas emissions by the year 2025. This commitment reflects a proactive approach to environmental stewardship and a recognition of the financial and reputational implications of failing to meet evolving environmental expectations.

- Regulatory Compliance: Textron must adhere to numerous environmental laws affecting manufacturing, waste, and emissions.

- Climate Change Impact: Growing global concern over climate change drives stricter emissions standards, particularly for aviation.

- Investment in Sustainability: The company needs to invest in cleaner technologies and sustainable operations to meet these standards.

- Emissions Reduction Goal: Textron has a stated goal to reduce greenhouse gas emissions by 20% by 2025.

Intellectual Property Rights Protection

Protecting its intellectual property, such as patents for innovative aircraft designs and advanced manufacturing processes, is fundamental to Textron's sustained competitive edge. This includes safeguarding proprietary technologies in areas like turboprop engines and defense systems.

Navigating the complexities of varying global intellectual property laws is crucial for Textron. The company must proactively manage and vigorously enforce its rights across different jurisdictions to deter and address any potential infringement on its valuable innovations.

Textron's commitment to IP protection is evident in its substantial investments in research and development. For instance, in 2023, Textron invested $957 million in R&D, a significant portion of which is dedicated to securing and defending patents for its cutting-edge products and processes.

The company actively monitors the marketplace for potential violations of its intellectual property. This vigilance is essential in sectors like aerospace and defense where technological advancements quickly become market differentiators.

Textron's legal landscape is shaped by its significant reliance on government contracts, requiring strict adherence to regulations concerning cost disclosure and contract termination, which formed about 25% of its 2024 revenue. Global operations also demand careful navigation of international trade laws and export controls, especially for defense and aerospace products, with ongoing geopolitical shifts in 2024 and 2025 impacting these restrictions. Furthermore, product liability and safety standards, particularly within the aviation sector, present substantial financial exposure, as evidenced by a notable increase in claims in 2023.

| Legal Factor | Description | 2024/2025 Relevance |

| Government Contract Compliance | Adherence to regulations on cost, termination, and procurement policies. | 25% of 2024 revenue derived from U.S. government contracts. |

| International Trade & Export Controls | Navigating global trade laws and restrictions on sensitive technologies. | Increasingly stringent due to geopolitical shifts in 2024-2025. |

| Product Liability & Safety | Meeting rigorous standards for aircraft, defense systems, and vehicles. | Significant financial exposure, with increased claims in the aviation sector in 2023. |

| Intellectual Property Protection | Safeguarding patents for designs, engines, and manufacturing processes. | Essential for competitive edge; $957 million invested in R&D in 2023 for IP. |

Environmental factors

Textron is actively addressing climate change by focusing on reducing its carbon footprint throughout its operations and product lifecycles. This commitment is becoming increasingly critical as global awareness and regulatory pressures around environmental sustainability grow.

The company has established ambitious enterprise-wide goals, aiming for a 20% reduction in greenhouse gas emissions by the end of 2025. Furthermore, Textron has made a significant commitment to achieve net-zero carbon emissions within its aviation segment by 2050, demonstrating a long-term strategic vision.

To achieve these targets, Textron is implementing various initiatives, including the adoption of renewable energy sources across its facilities and the development of carbon offset programs. These actions reflect a proactive approach to environmental stewardship and are crucial for navigating the evolving regulatory and market landscape.

The push for Sustainable Aviation Fuel (SAF) is a major environmental factor shaping the aviation sector, and Textron is actively participating. By offering SAF for new aircraft and at their service centers, Textron Aviation is helping customers reduce their carbon footprint. This commitment aligns with the industry's broader environmental targets.

While the aviation industry is increasingly embracing SAF, challenges persist. Regulatory frameworks are still evolving, and the cost of SAF compared to traditional jet fuel remains a significant barrier to widespread adoption. These factors will influence the pace of SAF integration for companies like Textron.

Growing concerns about resource scarcity, particularly for critical raw materials like rare earth elements used in advanced manufacturing, pose a significant risk to Textron's supply chain stability and overall costs. The company's reliance on global suppliers for components in its Bell helicopters and Cessna aircraft means that disruptions due to availability or environmental events, such as droughts affecting key manufacturing regions, could directly impact production and delivery timelines. Textron itself has acknowledged that supply chain issues have been problematic, indicating a tangible impact on their operations as they navigate these environmental challenges.

Waste Management and Pollution Control

Textron's manufacturing operations inherently produce waste and emissions, making effective waste management and pollution control crucial for regulatory compliance and environmental stewardship. The company has set an ambitious target to reduce its overall waste generation by 10% by the year 2025, reflecting a commitment to sustainability. This focus on sustainable manufacturing practices is becoming increasingly vital in today's market.

Textron's efforts in this area are supported by specific initiatives:

- Waste Reduction Targets: Aiming for a 10% reduction in waste by 2025.

- Regulatory Adherence: Ensuring compliance with stringent environmental laws governing emissions and waste disposal.

- Sustainable Practices: Integrating environmentally friendly processes into manufacturing to minimize ecological footprint.

- Pollution Control Investment: Allocating resources to technologies and systems that mitigate air and water pollution.

Impact of Extreme Weather Events

The increasing frequency and intensity of extreme weather events, driven by climate change, pose a significant threat to Textron's operational continuity. These disruptions can manifest as delays in production schedules, damage to manufacturing facilities, and interruptions in global supply chains, impacting various business segments.

For instance, severe flooding or hurricanes can halt production at Textron's Bell or Textron Aviation facilities, leading to revenue losses. Similarly, disruptions to transportation networks can impede the delivery of finished goods or the receipt of critical components, affecting overall efficiency and profitability.

While extreme weather can negatively impact demand for some products, it also creates opportunities. Governments worldwide are stepping up investments in emergency response and disaster preparedness equipment. This includes a notable increase in spending on specialized vehicles, such as firefighting apparatus and heavy-duty transport, which could benefit Textron's Industrial segment, particularly its businesses like E-Z-GO and Jacobsen that produce utility vehicles.

The U.S. government, for example, allocated substantial funds in its 2024 budget towards climate resilience and disaster management initiatives. This trend is expected to continue, potentially driving demand for Textron's specialized vehicles designed for rugged terrain and emergency deployment.

- Increased Frequency of Wildfires: Leading to higher demand for firefighting vehicles.

- Severe Storms: Causing potential damage to infrastructure and supply chain disruptions for Textron's manufacturing plants.

- Government Investments: Growing public sector spending on disaster relief and preparedness equipment in 2024 and projected for 2025.

- Supply Chain Vulnerability: Textron's reliance on global suppliers makes it susceptible to weather-related disruptions in component availability.

Textron is actively working to reduce its environmental impact, setting a goal for a 20% decrease in greenhouse gas emissions by the end of 2025 and aiming for net-zero emissions in aviation by 2050. The company is incorporating renewable energy and developing carbon offset programs to meet these targets.

The push for Sustainable Aviation Fuel (SAF) is a significant environmental trend, and Textron Aviation is supporting this by offering SAF for new aircraft and at service centers, helping customers lower their carbon footprint. However, evolving regulations and the higher cost of SAF compared to traditional jet fuel present ongoing challenges for widespread adoption.

Textron faces risks from resource scarcity, particularly for rare earth elements crucial for advanced manufacturing, which could impact its supply chain for Bell helicopters and Cessna aircraft. The company is also focused on waste reduction, targeting a 10% decrease in waste generation by 2025, and investing in pollution control to ensure regulatory compliance and minimize its ecological footprint.

Extreme weather events, amplified by climate change, pose a threat to Textron's operations through potential production delays and supply chain disruptions. Conversely, these events can also spur demand for Textron's specialized vehicles used in disaster response and preparedness, with governments increasing investments in these areas, as seen in the U.S. 2024 budget.

| Environmental Factor | Textron's Response/Impact | Data/Target (2024/2025) |

|---|---|---|

| Greenhouse Gas Emissions | Reduction efforts, net-zero aviation goal | 20% reduction goal by end of 2025 |

| Sustainable Aviation Fuel (SAF) | Offering SAF, supporting customer carbon reduction | Industry-wide adoption challenges persist |

| Waste Reduction | Focus on sustainable manufacturing | 10% waste reduction target by 2025 |

| Extreme Weather Events | Operational risks and potential demand increase for specialized vehicles | Increased government spending on disaster preparedness (e.g., U.S. 2024 budget) |

PESTLE Analysis Data Sources

Our Textron PESTLE Analysis draws on a robust mix of data from government publications, financial reports from leading economic institutions, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Textron.