Textron Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Textron Bundle

Textron's competitive landscape is shaped by significant forces, from the bargaining power of its diverse customer base to the intense rivalry among aerospace and defense manufacturers. Understanding the threat of new entrants and the availability of substitutes is crucial for navigating this dynamic industry. The influence of suppliers, particularly for specialized components, also plays a vital role in Textron's operational costs and strategic flexibility.

The complete report reveals the real forces shaping Textron’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Textron’s reliance on a limited pool of specialized suppliers, especially in its aerospace and defense divisions, significantly amplifies supplier bargaining power. These suppliers often hold unique technological capabilities and intellectual property, making it difficult for Textron to find viable alternatives for critical components such as advanced engines or sophisticated avionics systems.

For example, in the commercial aviation sector, major engine manufacturers like GE Aviation and Rolls-Royce, or avionics providers such as Honeywell Aerospace, dictate terms due to their specialized expertise and the high barriers to entry for new competitors. This concentration of specialized suppliers means Textron has fewer choices, thereby strengthening the suppliers’ negotiating leverage over pricing and contract terms.

High switching costs significantly bolster supplier bargaining power for Textron. For specialized aerospace and defense components, changing suppliers isn't a simple matter of finding a new vendor. It often necessitates costly redesigns, rigorous re-certification processes, and extensive testing, potentially costing millions for each aircraft system.

These substantial financial and operational barriers make it incredibly difficult and expensive for Textron to shift to alternative suppliers. Consequently, existing suppliers can leverage this situation, demanding higher prices or more favorable terms, knowing that Textron faces significant disruption and expense if it attempts to switch.

The aerospace and defense sector, including companies like Textron, grappled with persistent supply chain vulnerabilities in 2024. Shortages of critical inputs such as semiconductors and specialized raw materials significantly hampered production schedules. This fragility directly translates to increased bargaining power for suppliers, as they can dictate terms and prices due to high demand and limited availability.

A notable event impacting Textron in 2024 was a strike at Textron Aviation. Such labor actions further strain supply chains, leading to production delays and increased costs. These disruptions empower suppliers by creating a less competitive environment, allowing them to command higher prices for their goods and services, thereby strengthening their position against manufacturers like Textron.

Long-Term Supplier Relationships

Textron often cultivates long-term strategic partnerships with its specialized suppliers. This approach fosters stability and reliability within its supply chain, which is crucial for complex manufacturing operations. These enduring alliances can result in more predictable pricing and consistent access to critical components, mitigating some of the inherent supplier power.

However, these deep-rooted relationships can also solidify a supplier's position, potentially limiting Textron's ability to drive down costs through aggressive negotiation. The commitment to these partnerships might mean accepting less favorable terms to maintain the established supply flow, especially when switching suppliers is costly or disruptive.

Consider the semiconductor industry, where lead times for specialized chips can extend for months. Textron’s long-term agreements, possibly cemented in 2023 or early 2024, would secure necessary components for its aviation and defense segments. For instance, a significant long-term contract for avionics components, potentially valued in the tens of millions of dollars, would demonstrate this strategy.

- Strategic Alliances: Textron's focus on long-term partnerships with key suppliers aims to ensure supply chain continuity and quality.

- Supplier Entrenchment: While beneficial for stability, these relationships can reduce Textron's leverage in price negotiations.

- Component Dependency: For specialized parts, Textron's reliance on a few established suppliers highlights the ongoing bargaining power they hold.

- Cost Implications: The trade-off for supply chain stability can be higher component costs than might be achievable through more transactional supplier relationships.

Labor Shortages in Supplier Base

The aerospace and defense industry, including Textron's suppliers, continues to grapple with significant labor shortages, especially for critical skilled roles like machinists and experienced engineers. For instance, as of early 2024, the U.S. manufacturing sector, broadly, reported millions of unfilled positions, with specialized manufacturing roles being particularly acute.

This persistent talent scarcity directly translates into higher labor costs for suppliers. As companies compete for a limited pool of qualified workers, wages and benefits often increase. These elevated operating expenses within the supply chain are frequently passed on to their customers, including Textron, thereby increasing Textron's own cost of goods sold and impacting its profitability.

- Skilled Labor Gap: Shortages persist for machinists, welders, and engineers.

- Wage Inflation: Increased competition for talent drives up labor costs for suppliers.

- Cost Pass-Through: Suppliers are likely to pass these higher costs onto Textron.

- Impact on Margins: This can reduce Textron's profit margins if not effectively managed.

Textron's bargaining power with its suppliers is notably constrained by the specialized nature of many components, particularly in its aerospace and defense segments. The limited number of qualified providers for critical items like advanced avionics or specialized engine parts means these suppliers hold considerable sway. This situation was evident in 2024, as supply chain disruptions, including semiconductor shortages, amplified the leverage of original equipment manufacturers (OEMs) and their component suppliers.

High switching costs further entrench supplier power. For Textron, changing a supplier for a certified aerospace component can involve extensive re-engineering, testing, and regulatory approval, often costing millions. This makes suppliers with established relationships and proven track records difficult to replace, allowing them to maintain pricing power.

The persistent skilled labor shortage across the manufacturing sector in 2024 also strengthened supplier positions. With fewer qualified machinists and engineers available, suppliers faced increased labor costs, which they frequently passed on to clients like Textron. This dynamic directly impacts Textron's cost of goods sold.

For example, Textron's reliance on a few key avionics suppliers means these companies can command higher prices due to limited alternatives and the deep integration of their systems into Textron's aircraft. This dependence was underscored by industry-wide delays in component delivery throughout 2024, allowing suppliers to dictate terms more readily.

| Factor | Impact on Textron | 2024 Context |

|---|---|---|

| Supplier Specialization | Limited alternatives increase supplier leverage. | Critical components for aerospace remain concentrated among few providers. |

| Switching Costs | High costs for redesign and re-certification deter supplier changes. | Significant financial and time investment required for component integration. |

| Labor Shortages | Increased supplier labor costs are passed on. | Skilled manufacturing roles saw wage inflation due to talent scarcity. |

| Supply Chain Disruptions | Shortages grant suppliers pricing power. | Semiconductor and raw material scarcity in 2024 exacerbated this trend. |

What is included in the product

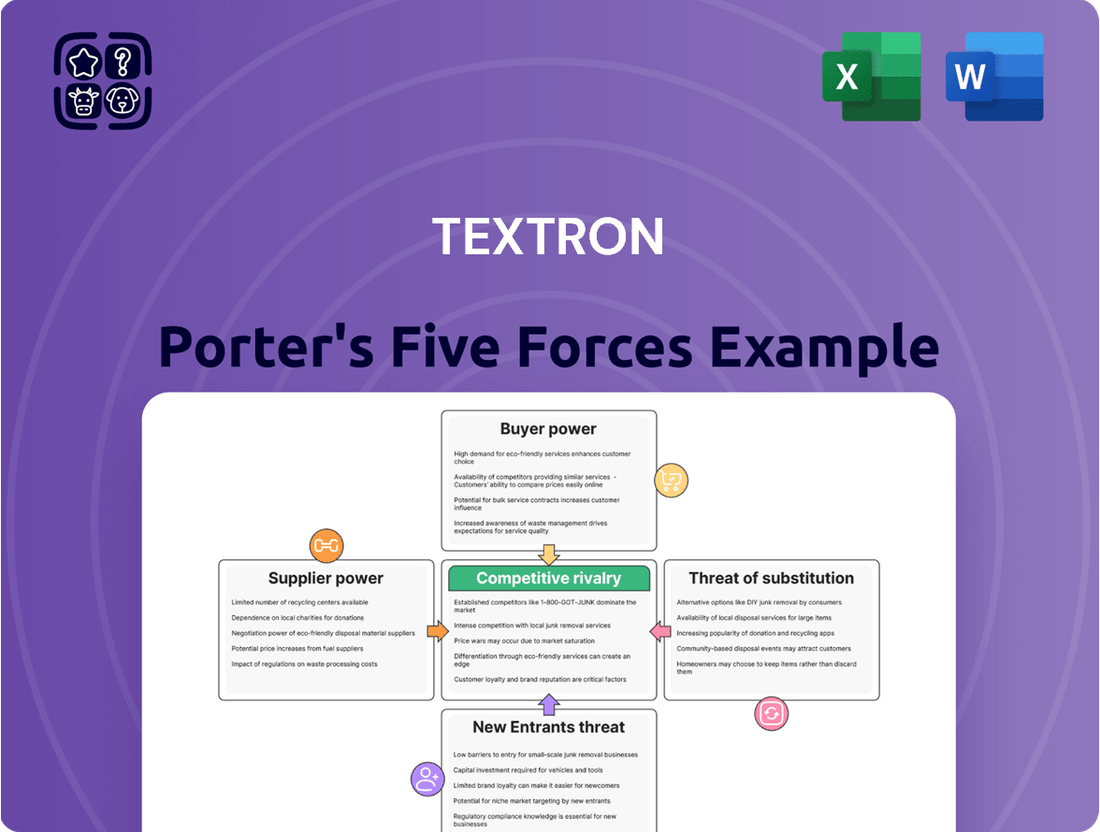

This analysis dissects the competitive landscape for Textron by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each Porter's Five Forces, empowering proactive strategy development.

Customers Bargaining Power

Textron’s diverse customer base, ranging from governments procuring defense systems to individuals purchasing recreational vehicles, presents a complex landscape for customer bargaining power. Government entities, particularly for substantial defense contracts like the Future Long-Range Assault Aircraft (FLRAA) program for Bell, wield considerable leverage due to the sheer volume and strategic nature of these orders, often dictating terms and specifications.

Corporate clients, such as those purchasing Textron Aviation’s business jets, also possess significant bargaining power, especially when acquiring multiple aircraft or engaging in long-term fleet management. Their ability to compare offerings across various manufacturers and negotiate pricing on large-scale purchases directly impacts Textron’s margins.

Conversely, individual buyers of Textron’s recreational products, like snowmobiles or ATVs from its Powersports division, generally exert less individual bargaining power. However, collective demand and the availability of competitive alternatives in the consumer market can still influence pricing and product development decisions.

Customers in the business jet market, including buyers of Textron Aviation's Cessna and Beechcraft aircraft, are typically highly knowledgeable. They possess detailed information on aircraft specifications, performance metrics, and pricing structures from various manufacturers, enabling them to make informed comparisons.

This access to comprehensive data empowers these sophisticated buyers to negotiate effectively for better terms and pricing. For instance, in 2024, the business jet market saw robust demand, with manufacturers like Textron delivering a significant number of aircraft, underscoring the competitive environment where buyer leverage is substantial.

For Textron's commercial products, particularly business jets, customer purchasing decisions can be discretionary. This means that buyers aren't forced to buy and can delay or forgo purchases if conditions aren't favorable, directly increasing their bargaining power.

The presence of a strong pre-owned market for business jets significantly bolsters customer bargaining power. In 2024, the pre-owned business jet market continued to offer a substantial volume of aircraft, providing buyers with viable alternatives to new models. This availability allows customers to negotiate more aggressively on price and terms for new aircraft, knowing they have other options readily accessible.

Aftermarket Services as a Revenue Driver

Textron's aftermarket services, encompassing maintenance, repair, and support, are a crucial and consistent revenue generator, often exhibiting different customer bargaining power compared to new equipment sales. This segment benefits from the installed base of Textron's diverse products, creating a sticky customer relationship.

For instance, Textron Aviation reported a substantial aftermarket segment, contributing significantly to its overall financial performance. This highlights the loyalty and ongoing need for specialized support from existing aircraft owners. Similarly, Bell's aftermarket operations demonstrate a robust demand for services that maintain the operational readiness and value of their helicopter fleets.

- Aftermarket revenue provides a stable income stream for Textron.

- Customer loyalty in aftermarket services can reduce price sensitivity.

- Textron Aviation and Bell both show strong growth in their aftermarket segments.

- The need for specialized maintenance gives Textron leverage with customers.

Customer Consolidation and Collective Pooling

While Textron serves a broad customer base, the consolidation of buyers, especially in sectors like fractional jet ownership or large fleet operators, can amplify their collective bargaining influence. For example, a significant portion of business jet sales can be concentrated among a few large companies or ownership groups, giving them more leverage in negotiations.

The inherent need for highly customized aircraft configurations in the business jet market acts as a counterbalancing force. This customization requirement means that buyers often work closely with manufacturers like Textron, reducing their ability to simply switch suppliers, thereby tempering their overall bargaining power.

- Buyer Consolidation: Fractional ownership programs and large corporate flight departments can represent significant consolidated demand.

- Customization as a Mitigant: The bespoke nature of business jet production limits the ease with which buyers can switch manufacturers.

- Fleet Purchases: A single large order from a fleet operator can represent a substantial portion of a specific aircraft model's annual production.

- Information Asymmetry Reduction: As customers become more sophisticated, they gather more information on production costs and competitor offerings, potentially increasing their bargaining power.

Customers, particularly large government entities and corporate clients, possess considerable bargaining power due to the significant value of their purchases and their ability to compare Textron's offerings with competitors. This leverage is amplified by the availability of pre-owned aircraft and the discretionary nature of some purchases, especially in the business jet market where sophisticated buyers are well-informed.

In 2024, Textron Aviation saw strong demand in its business jet segment, with deliveries contributing to robust revenue. This competitive environment, coupled with the availability of pre-owned jets, empowered buyers to negotiate favorable terms, underscoring their substantial influence.

While individual consumers of recreational products have less individual power, the collective market demand and availability of alternatives can still shape pricing. Conversely, Textron's aftermarket services benefit from customer loyalty and the specialized nature of maintenance, which tends to reduce price sensitivity and enhance Textron's position.

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

| Government (Defense Contracts) | High | Volume of orders, strategic importance, contract terms |

| Corporate (Business Jets) | High | Fleet size, knowledge of market, pre-owned availability, customization needs |

| Individual (Recreational Products) | Moderate | Collective demand, availability of alternatives, brand loyalty |

| Aftermarket Services | Moderate to Low (for Textron) | Installed base, specialized knowledge, customer loyalty, switching costs |

What You See Is What You Get

Textron Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Textron Porter's Five Forces Analysis meticulously examines the competitive landscape, evaluating the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. You will receive this exact, professionally formatted analysis immediately after purchase, providing you with actionable insights into Textron's strategic position.

Rivalry Among Competitors

Textron operates within the highly competitive aerospace and defense sectors, facing formidable rivals such as Boeing, Airbus, Lockheed Martin, and Bombardier. This intense rivalry is fueled by the constant pursuit of product innovation, cutting-edge technology, and securing lucrative government contracts. For instance, the global aerospace market was valued at approximately $885 billion in 2023, with defense spending also remaining a significant driver.

The aerospace and defense sector, where Textron operates, faces intense rivalry driven by substantial fixed costs. Companies invest heavily in research and development, advanced manufacturing plants, and specialized machinery. For instance, the development of a new commercial aircraft can cost billions of dollars, creating a significant barrier to entry and increasing pressure on existing players.

These high upfront investments compel manufacturers to achieve high capacity utilization to spread their fixed costs over more units. This pursuit of volume often results in aggressive competition for contracts, whether from government defense budgets or commercial airline orders. In 2023, the global commercial aircraft manufacturing market saw intense competition as manufacturers like Boeing and Airbus vied for airline orders amidst ongoing supply chain challenges.

Competitive rivalry within Textron's industries, particularly aerospace and defense, is intensely shaped by ongoing product development and innovation. This drive is evident in Textron Aviation's investment in its Gen3 platform, enhancing existing aircraft, and Bell's advancement in crucial military programs like the Future Long-Range Assault Aircraft (FLRAA). Companies in these sectors pour substantial resources into research and development, often exceeding 5% of revenue, to maintain or achieve a competitive advantage and satisfy increasingly sophisticated customer requirements. This relentless pursuit of technological superiority fuels aggressive competition.

Geopolitical Landscape and Defense Spending

Heightened global geopolitical tensions are directly fueling increased national defense budgets, creating a fiercely competitive environment for companies like Textron. This competition centers on securing lucrative government contracts and expanding market share within the defense sector. These dynamics mean that companies must continuously innovate and demonstrate value to win business.

Textron Systems, for instance, has recently secured significant contract awards from the U.S. Navy. One notable award in early 2024 involved sustainment services for the Navy's fleet of unmanned maritime vehicles, underscoring the demand for advanced capabilities. Another contract awarded in late 2023 focused on the production of unmanned systems, signaling Textron's active participation in this competitive landscape.

- Increased Defense Spending: Global defense spending is projected to reach approximately $2.4 trillion in 2024, a notable increase driven by geopolitical instability.

- Contract Opportunities: The U.S. Department of Defense awarded over $600 billion in prime contract obligations in fiscal year 2023, presenting substantial opportunities for defense contractors.

- Textron's Wins: Textron Systems' recent contract awards, including those for unmanned maritime systems, highlight its competitive positioning and ability to secure significant government business.

- Technological Advancement: Companies are compelled to invest heavily in research and development to maintain a competitive edge in advanced defense technologies.

Market Share and Backlog Dynamics

Textron's competitive rivalry is significantly shaped by its market share and the health of its order backlog. A strong backlog signals robust demand and provides a degree of revenue predictability. For instance, Textron reported a total backlog of $7.8 billion at the end of the first quarter of 2024, underscoring sustained customer interest across its segments. This backlog is a key indicator of its competitive standing, suggesting that customers continue to place significant value on Textron's offerings, particularly within its aerospace and defense sectors. Despite operational hurdles, such as the 2024 strike impacting Textron Aviation, the overall backlog figure highlights the company's ability to secure future business and maintain its market presence.

The dynamics of Textron's backlog are directly tied to its competitive intensity. A growing backlog generally reflects a stronger competitive position, as it indicates that Textron is winning orders against rivals. Conversely, a shrinking backlog could signal increased competitive pressure or a slowdown in demand. The company's ability to consistently manage and grow this backlog is therefore a critical element in its ongoing competitive rivalry.

- Market Share Indicator: A substantial backlog directly supports Textron's market share by ensuring future sales and revenue streams.

- Revenue Visibility: The backlog provides crucial visibility into future financial performance, aiding strategic planning and investor confidence.

- Competitive Stability: A consistently healthy backlog helps Textron maintain stability and fend off competitors by demonstrating ongoing product desirability.

- Impact of Operational Issues: Events like the 2024 strike at Textron Aviation can temporarily affect backlog fulfillment and market perception, highlighting the importance of operational efficiency in maintaining competitive advantage.

Textron faces intense competition from established players like Boeing, Lockheed Martin, and Bombardier, driven by high R&D costs and the need for technological superiority. This rivalry is exacerbated by significant government defense spending, projected to reach approximately $2.4 trillion globally in 2024, creating a competitive race for lucrative contracts. Textron's ability to secure these contracts, as evidenced by recent awards to Textron Systems from the U.S. Navy for unmanned systems, is crucial for maintaining its market position.

| Competitor | Key Areas of Competition | 2024 Market Dynamics Context |

|---|---|---|

| Boeing | Commercial Aircraft, Defense Systems | Navigating supply chain issues and intense demand for new aircraft. |

| Lockheed Martin | Defense Systems, Aerospace | Benefiting from increased global defense budgets, focusing on advanced military platforms. |

| Bombardier | Business and Regional Aircraft | Competing in the business jet market with a focus on new aircraft development. |

| Airbus | Commercial Aircraft, Defense Systems | Strong presence in commercial aviation, facing similar supply chain pressures as Boeing. |

SSubstitutes Threaten

For Textron Aviation's business jet division, the threat of substitutes is a significant consideration. Commercial airline travel often presents a more budget-friendly option for certain routes, directly competing for business travelers. In 2024, the average domestic business trip cost via commercial airlines, including flights and incidentals, remained considerably lower than chartering or owning a business jet for many destinations.

Furthermore, advancements in communication technology, particularly widespread adoption of high-definition video conferencing and virtual collaboration platforms, are increasingly substituting the need for some physical business travel. For instance, many companies found in 2024 that a substantial portion of their internal meetings and even some client consultations could be effectively conducted remotely, reducing the overall demand for travel, and by extension, business jet utilization.

While business jets offer unparalleled flexibility, time savings, and privacy, these advantages are weighed against the cost and the growing viability of alternatives. The perceived value proposition of a business jet is directly challenged when commercial flights are efficient for a specific journey or when virtual meetings adequately serve their purpose, thereby impacting Textron's market share in the business aviation segment.

For Textron's industrial vehicles, particularly in niches like golf carts and utility vehicles, the threat of substitutes is present. While not a direct replacement for heavy-duty industrial tasks, public transportation or ride-sharing services could substitute for smaller-scale, personnel-moving applications within industrial settings. Textron's decision to pause certain powersports production in 2024 signals a strategic response to evolving market dynamics, potentially including the impact of these alternative mobility solutions in some segments.

The threat of substitutes for Textron's defense segment, particularly its unmanned systems, arises from shifts in military strategy and the emergence of entirely new technological paradigms. For instance, advancements in cyber warfare or directed energy weapons could potentially reduce reliance on traditional aerial or ground platforms, though Textron is also investing in these areas.

Cost-Benefit Analysis by Customers

Customers across Textron's diverse segments consistently evaluate the cost-benefit of its specialized offerings against available substitutes. This analysis hinges on factors like performance, reliability, and the total cost of ownership. For example, in the aviation sector, the substantial investment and specialized training required to operate and maintain Textron’s business jets often make switching to a competitor’s aircraft a significant undertaking, thus dampening the threat of substitutes.

The cost of switching from Textron's products is a critical determinant of the threat of substitutes. In 2024, for many of Textron’s advanced industrial equipment lines, the integration costs, including new machinery, employee retraining, and potential downtime, can easily run into hundreds of thousands or even millions of dollars, making it economically unviable for many customers to consider alternatives unless Textron’s pricing or product performance becomes significantly uncompetitive.

- High Switching Costs in Aviation: Textron's aviation segment, including Cessna and Beechcraft, faces customers who weigh the significant costs of pilot training, maintenance infrastructure, and regulatory compliance against the benefits of new aircraft, thereby limiting the immediate threat of substitutes.

- Industrial Equipment Integration: For Textron's industrial segments like Jacobsen (turf care equipment) or Kautex (automotive fuel systems), customers must factor in the expense of integrating new machinery, which can include modifications to existing production lines or new operational protocols, making substitution less appealing.

- Performance vs. Price Trade-off: Customers perform a detailed cost-benefit analysis, comparing Textron’s specialized product performance, such as fuel efficiency in aircraft or precision in industrial machinery, against the potentially lower price but also lower performance or higher maintenance costs of substitute offerings.

- Long-Term Value Consideration: Many Textron customers focus on the total cost of ownership and long-term reliability rather than just the initial purchase price, which often favors Textron's durable and technologically advanced products over cheaper, less reliable substitutes.

Emergence of Advanced Air Mobility (AAM)

The nascent Advanced Air Mobility (AAM) market, featuring electric vertical takeoff and landing (eVTOL) aircraft, poses a potential long-term threat by offering alternative transportation for certain helicopter and short-range business jet uses. Though still in its early stages, AAM technology promises quicker, more environmentally friendly, and potentially more economical travel solutions down the line.

By 2024, significant investment has flowed into AAM, with companies like Joby Aviation and Archer Aviation actively pursuing certification and early operations. This emerging sector could eventually challenge traditional aviation by providing point-to-point urban and regional transport, impacting Textron's existing customer base for smaller aircraft.

- Market Penetration: While AAM is not yet a widespread substitute, early-stage commercial operations are anticipated by the mid-to-late 2020s.

- Technological Advancements: eVTOL aircraft aim for reduced noise pollution and lower operating costs compared to conventional helicopters.

- Investment Trends: Venture capital funding in the AAM sector reached billions of dollars by early 2024, signaling strong industry belief in its future viability.

- Potential Impact: For specific short-haul routes, AAM could offer a speed and convenience advantage, indirectly substituting demand for some Textron Aviation products.

The threat of substitutes for Textron's diverse portfolio is managed by high switching costs and a focus on long-term value. For aviation customers, the expense of pilot training and maintenance infrastructure significantly deters switching. Similarly, industrial clients face substantial integration costs for new machinery, making Textron's offerings more appealing due to their reliability and performance. By 2024, the total cost of ownership remained a primary consideration for many, often favoring Textron's durable products over cheaper alternatives.

| Segment | Key Substitute Considerations | Examples of Switching Costs | 2024 Market Indicator |

| Aviation | Commercial airlines, fractional ownership, charter services | Pilot training, maintenance infrastructure, regulatory compliance | Business jet utilization rates remained strong for critical travel needs. |

| Industrial | Competitor machinery, rental services, alternative process technologies | Integration, employee retraining, potential downtime | Industrial equipment upgrades often prioritize efficiency and reliability, justifying initial investment. |

| Defense | Emerging technologies (cyber, directed energy), alternative defense contractors | R&D investment, platform integration, operational strategy shifts | Defense spending priorities continue to evolve, influencing platform choices. |

Entrants Threaten

The aerospace and defense sectors, where Textron has a strong presence, demand enormous upfront investments. Companies need to fund extensive research and development, build sophisticated manufacturing plants, and navigate complex, costly certification procedures. For instance, developing a new aircraft can easily cost billions of dollars, a figure that significantly deters smaller players from entering the market.

New entrants in the aviation and defense sectors, where Textron operates, confront formidable regulatory and certification hurdles. These processes are not merely bureaucratic; they are designed to ensure safety and reliability, demanding substantial upfront capital and extended timelines for compliance. For instance, obtaining Federal Aviation Administration (FAA) certifications for new aircraft models can take years and cost millions, effectively creating a high barrier to entry.

These stringent standards, set by bodies like the FAA and international aviation authorities, cover every facet of design, manufacturing, and operational safety. Companies must demonstrate rigorous adherence to these benchmarks, a process that requires extensive testing, documentation, and validation. This complexity significantly deters potential new competitors who may lack the financial resources and technical expertise to navigate such demanding requirements.

Textron benefits from substantial brand loyalty and a strong reputation built over decades in sectors like aviation with Bell, Cessna, and Beechcraft. This ingrained trust makes it difficult for newcomers to attract customers. For instance, Textron's aviation segment alone generated approximately $7.3 billion in revenue in 2023, showcasing the scale of its established market presence. New entrants face the daunting task of replicating this deep-seated customer affinity and perceived reliability, requiring significant time and investment to even approach Textron's standing.

Technological Expertise and Intellectual Property

The specialized nature of Textron's diverse product lines, encompassing everything from sophisticated helicopters and business jets to advanced unmanned aerial vehicles and specialized defense systems, necessitates significant technological expertise. This deep knowledge base, coupled with substantial investments in research and development, creates a high barrier to entry. Potential new entrants would face immense challenges in replicating Textron's established technological capabilities and proprietary intellectual property. For instance, Textron Aviation's Cessna Citation series, a leader in business jets, requires decades of accumulated aerodynamic engineering and manufacturing know-how.

Developing and securing the necessary patents and trade secrets for these complex systems is a costly and time-consuming endeavor. Textron's commitment to innovation is reflected in its consistent R&D spending; in 2023, the company reported approximately $1.1 billion in R&D expenses. This investment fuels the development of next-generation technologies, further solidifying its competitive advantage and making it exceptionally difficult for new players to compete on technological merit alone. The stringent regulatory approvals required for aerospace and defense products also add to the entry barriers, demanding proven reliability and safety standards that new companies would struggle to meet quickly.

- High R&D Investment: Textron's 2023 R&D expenditure of around $1.1 billion underscores the significant financial commitment required to maintain technological leadership.

- Intellectual Property Portfolio: The company holds a vast portfolio of patents and proprietary technologies across its various business segments, protecting its innovations.

- Specialized Manufacturing Processes: Advanced manufacturing techniques and specialized tooling for producing complex components like aircraft engines and composite structures are difficult to replicate.

- Skilled Workforce: Textron relies on a highly skilled workforce with expertise in aerospace engineering, software development, and advanced materials science, a talent pool that is not easily accessible to new entrants.

Access to Distribution Channels and Supply Chains

New entrants in the aerospace and defense sector face significant hurdles in accessing established global distribution channels and securing reliable supply chains. These are critical for delivering complex products like those manufactured by Textron.

Existing companies, including Textron, have cultivated deep, long-standing relationships with suppliers and distributors, creating integrated and highly efficient supply chains that new players struggle to replicate. For instance, in 2024, major aerospace manufacturers continued to report extended lead times for critical components, highlighting the robustness and exclusivity of existing supplier networks.

- Established Relationships: New entrants find it difficult to break into exclusive supplier agreements and distribution networks that major players like Textron have built over decades.

- Supply Chain Complexity: The aerospace industry relies on highly specialized and often proprietary components, making it challenging for newcomers to find and vet reliable suppliers capable of meeting stringent quality and volume demands.

- Cost of Integration: Building a comparable supply chain and distribution network from scratch requires substantial capital investment and time, often proving prohibitive for emerging companies.

- Market Access: Securing contracts with major airlines, defense ministries, or other large customers necessitates proven track records and established logistical capabilities, which new entrants typically lack.

The threat of new entrants for Textron is significantly mitigated by the immense capital requirements and specialized knowledge needed in its core aerospace and defense markets. These industries demand billions in upfront investment for research, development, and manufacturing, alongside navigating stringent regulatory approvals that can take years and millions in costs. Furthermore, Textron's established brand reputation, deep technological expertise, and robust supply chain relationships create formidable barriers for any potential newcomers attempting to gain a foothold.

| Barrier Type | Description | Impact on New Entrants | Example for Textron |

|---|---|---|---|

| Capital Requirements | Extensive R&D, sophisticated manufacturing, and certification processes require billions in investment. | Prohibitive for most potential competitors. | Developing a new business jet can cost over $1 billion. |

| Regulatory Hurdles | Rigorous safety and performance certifications (e.g., FAA) are time-consuming and costly. | Significantly lengthens time-to-market and increases initial expenses. | FAA certification for a new aircraft model can take 3-5 years. |

| Brand Loyalty & Reputation | Decades of building trust and a strong brand image make customer acquisition difficult for newcomers. | New entrants struggle to attract customers away from established, trusted brands. | Textron Aviation's strong market share in business jets (e.g., Cessna Citation). |

| Technological Expertise | Deep knowledge in complex systems, proprietary IP, and skilled workforce are hard to replicate. | New entrants lack the necessary technical capabilities and innovation capacity. | Textron's advanced composite materials and propulsion systems expertise. |

| Supply Chain & Distribution | Established relationships with suppliers and distributors create integrated, efficient networks. | New entrants face difficulties accessing critical components and reaching customers. | Textron's long-standing supplier agreements for aerospace components. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Textron is built upon a foundation of diverse data, including publicly available financial reports, industry-specific market research, and insights from aviation trade publications. We also leverage data from regulatory filings and economic indicators to provide a comprehensive view of the competitive landscape.