Textron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Textron Bundle

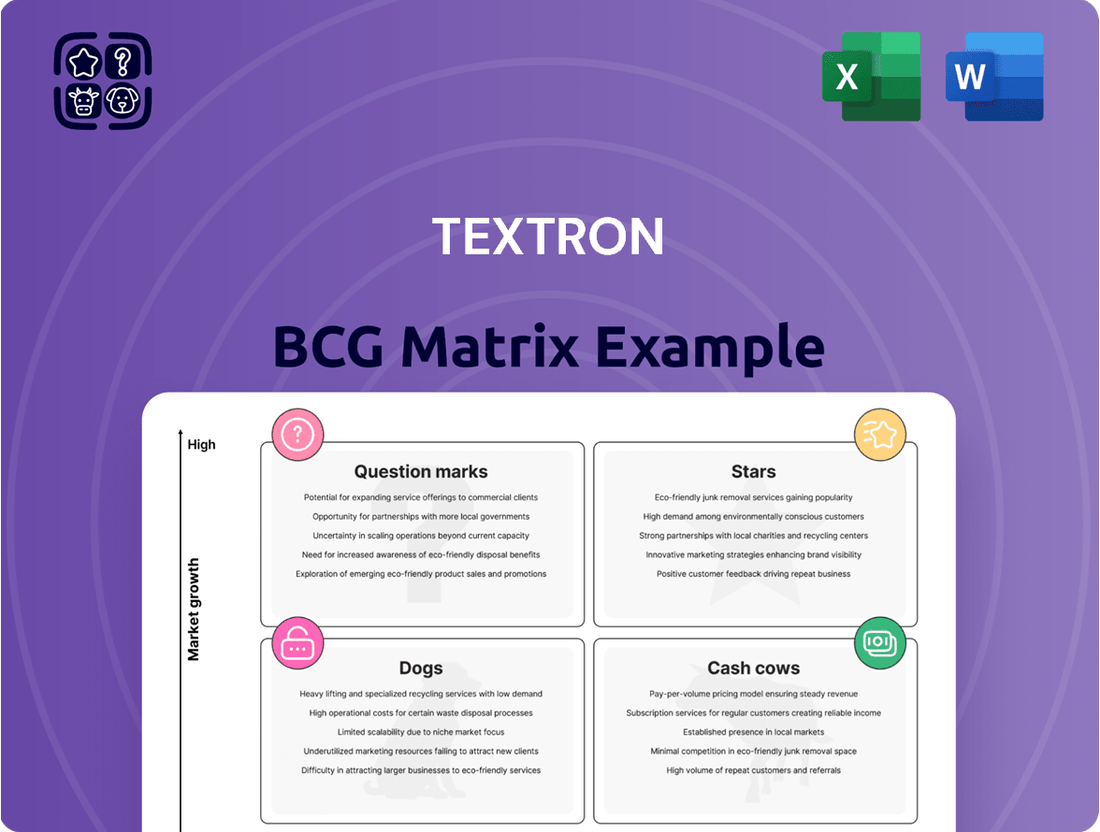

Curious about Textron's product portfolio? Our preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Understand their current market standing and identify opportunities for growth and resource optimization.

This initial view is just the tip of the iceberg. To truly unlock Textron's strategic potential, invest in the full BCG Matrix report. It provides a comprehensive quadrant-by-quadrant analysis, complete with data-driven recommendations and actionable insights for your business decisions.

Don't get left behind in a dynamic market. The complete Textron BCG Matrix will equip you with the clarity needed to navigate competitive landscapes. Gain quadrant-specific insights and strategic takeaways to sharpen your competitive edge.

Ready to make informed investment decisions? Purchase the full BCG Matrix now for immediate access to identify market leaders, resource drains, and optimal capital allocation strategies.

This isn't just theoretical analysis; the full report includes tailored strategic moves based on Textron's specific market positioning. Plan smarter, faster, and more effectively with this powerful tool.

Stars

Bell's Future Long-Range Assault Aircraft (FLRAA) program, featuring the V-280 Valor tiltrotor, represents a substantial growth opportunity for Textron. This initiative secured a critical U.S. Army contract in December 2022, worth around $7.1 billion, aimed at replacing the iconic UH-60 Black Hawk fleet.

The program is actively advancing, with Bell showcasing a virtual prototype in May 2025, signaling robust progress. Initial deliveries are slated for late 2028 or early 2029, pointing towards significant future market penetration and expansion within the defense sector.

The Cessna Citation Longitude is a prime example of a Star in Textron's portfolio. Despite a minor overall dip in Textron Aviation deliveries in Q1 2025, the Longitude maintains a significant market share within the robust super-midsize jet segment. This strong position, combined with consistent aftermarket support and high fleet utilization, solidifies its Star status.

Bell Commercial Helicopters is a shining Star in Textron's BCG Matrix. In the first quarter of 2025, their commercial helicopter segment saw impressive growth, with revenues jumping thanks to increased sales volume and a favorable product mix. Bell delivered a notable 29 commercial helicopters during this period, a significant increase from the 18 delivered in Q1 2024.

This surge in deliveries points to Bell's strong market position within the expanding commercial helicopter sector. The segment's profitability also experienced a healthy rise, reinforcing its status as a top performer within Textron's portfolio. Bell's robust performance here suggests continued investment and focus are warranted.

Textron Aviation Aftermarket Parts and Services

Textron Aviation's aftermarket parts and services represent a strong contender in the BCG matrix, showcasing robust revenue expansion. This segment saw a notable increase of $27 million in the first quarter of 2025, underscoring its significant contribution to the company's financial performance.

The business holds a dominant position within the crucial maintenance and support sector for its extensive fleet of Cessna and Beechcraft aircraft. This high market share ensures consistent demand for its offerings.

The sustained and increasing need for these aftermarket services generates a dependable and profitable revenue stream. This financial characteristic aligns with a business unit that is a Star, poised to transition into a Cash Cow.

- Revenue Growth: Q1 2025 saw a $27 million increase in aftermarket parts and services revenue.

- Market Dominance: High market share in the essential maintenance and support for Cessna and Beechcraft aircraft.

- Financial Profile: Provides a stable, high-margin revenue stream, indicative of a Star product.

Textron Systems' Robotic Combat Vehicle (RCV) Program (Ripsaw M3)

Textron Systems' Ripsaw M3 Robotic Combat Vehicle (RCV) is positioned as a Star in the BCG matrix due to its strong market potential. The U.S. Army's selection of the Ripsaw M3 for its RCV program indicates a significant future revenue stream. This development is crucial for Textron Systems in the burgeoning autonomous defense systems market.

- Market Leadership Potential: Winning the U.S. Army's RCV competition suggests Textron Systems is a frontrunner in a key defense technology segment.

- Growth Phase: Prototype deliveries in late 2024 and design finalization in 2025 signal a high-growth trajectory for the Ripsaw M3 program.

- Future Revenue: The program represents a substantial opportunity for significant future defense contracts and market expansion.

- Industry Trend: The RCV program aligns with the broader defense industry trend towards increased automation and robotic capabilities.

Bell Commercial Helicopters is a clear Star, with Q1 2025 revenues up due to higher sales volume and a better product mix. They delivered 29 commercial helicopters in Q1 2025, a significant jump from 18 in Q1 2024, indicating strong market traction.

Textron Aviation's aftermarket services also shine as a Star, generating $27 million more revenue in Q1 2025. Their dominant position in servicing Cessna and Beechcraft aircraft ensures consistent demand, creating a predictable and profitable income stream.

The Cessna Citation Longitude, a super-midsize jet, maintains a strong market share despite minor overall delivery dips in Q1 2025. Consistent aftermarket support and high fleet utilization solidify its Star status.

Textron Systems' Ripsaw M3 Robotic Combat Vehicle is a Star, poised for significant future revenue from the U.S. Army's RCV program. Prototype deliveries in late 2024 and design finalization in 2025 highlight its high-growth trajectory in the autonomous defense market.

| Business Unit | BCG Category | Key Growth Drivers | Q1 2025 Performance Indicators |

|---|---|---|---|

| Bell Commercial Helicopters | Star | Increased sales volume, favorable product mix | 29 deliveries (vs. 18 in Q1 2024), revenue growth |

| Textron Aviation Aftermarket | Star | Dominant market share in aircraft support, consistent demand | +$27 million revenue growth |

| Cessna Citation Longitude | Star | Strong segment market share, aftermarket support | Maintained strong position in super-midsize jet segment |

| Textron Systems Ripsaw M3 | Star | U.S. Army RCV program, autonomous defense market growth | Prototype deliveries (late 2024), design finalization (2025) |

What is included in the product

Strategic guidance on managing Textron's business units based on market share and growth.

Highlights which Textron units to invest in, hold, or divest for optimal portfolio performance.

Clear visualization of Textron's portfolio, simplifying complex strategic decisions.

Cash Cows

The Beechcraft King Air turboprop line continues to be a stalwart performer within Textron Aviation's portfolio. Its reputation for durability and adaptability across a wide range of operational needs solidifies its dominance in the turboprop segment.

Despite the turboprop market being relatively mature, the King Air enjoys a substantial and enduring market share. This is reflected in consistent demand, with Textron Aviation reporting a notable uptick in King Air deliveries during the first quarter of 2025, underscoring its stable revenue-generating capacity.

With its established market leadership and predictable sales, the King Air series fits the profile of a classic Cash Cow. It reliably contributes significant, steady cash flow to Textron, supporting other ventures within the company.

The Cessna Citation XLS Gen2 remains a dominant force in the light-to-midsize business jet market, demonstrating sustained demand with consistent deliveries throughout the first quarter of 2025. This enduring popularity, fueled by a dedicated customer base and a mature market, translates into robust profit margins with comparatively modest reinvestment needs.

Its established leadership within its segment consistently generates significant cash flow, firmly positioning the XLS Gen2 as a prime example of a Cash Cow within Textron's portfolio.

Textron's Finance segment acts as a crucial enabler for its product sales, consistently generating stable revenue and profit. In the first quarter of 2025, this segment reported revenues of $16 million and a profit of $10 million, highlighting its reliable financial contribution. Its primary function is to facilitate the financing of Textron's diverse product portfolio, ensuring smooth transactions and supporting the company's overall sales efforts.

Bell Military Sustainment Programs

Bell's military sustainment programs are a prime example of a Cash Cow within Textron's portfolio. These programs focus on providing ongoing support, maintenance, and services for the extensive fleet of Bell helicopters and tiltrotors already in operation with military forces worldwide. This segment benefits from a substantial installed base, translating into a stable, high-market-share position.

The predictable nature of these sustainment contracts, characterized by recurring revenue streams and relatively low growth, solidifies their Cash Cow status. For instance, Textron reported that increased military revenues in Q1 2025 were partly driven by these sustainment efforts, underscoring their consistent contribution to the company's financial performance.

- Stable, high-market-share business.

- Predictable, recurring revenue streams.

- Low growth, consistent profitability.

- Supports existing installed base of aircraft.

Kautex (Automotive Fuel Systems)

Kautex, a key player within Textron's Industrial segment, holds a dominant position in the manufacturing of plastic fuel systems for the automotive industry.

Despite the automotive sector's evolution towards electric vehicles (EVs), Kautex's strong market presence and recent agreements for hybrid electric fuel systems position it as a stable, albeit low-growth, entity.

The business reliably generates substantial cash flow, which is crucial for funding its investments in emerging technologies and supporting other Textron business units.

- Market Position: Kautex is a leading global supplier of plastic fuel systems.

- Financial Performance: Generates consistent and predictable cash flow.

- Industry Trends: Adapting to the automotive industry's shift by supplying hybrid electric systems.

- Strategic Role: Acts as a cash generator for Textron's broader portfolio.

The Beechcraft King Air, Cessna Citation XLS Gen2, Bell's military sustainment programs, and Kautex all exemplify Textron's Cash Cows. These established businesses benefit from significant market share and predictable, recurring revenue streams, ensuring consistent profitability with minimal need for substantial reinvestment. Their steady cash generation plays a vital role in funding other strategic initiatives within Textron.

| Business Unit | Product/Service | Market Position | Revenue Stream | Growth Outlook |

| Textron Aviation | Beechcraft King Air | Dominant Turboprop | Consistent Deliveries | Stable |

| Textron Aviation | Cessna Citation XLS Gen2 | Market Leader (Light-Midsize Jet) | Sustained Demand | Stable |

| Bell | Military Sustainment Programs | High Market Share (Installed Base) | Recurring Contracts | Low |

| Textron Industrial | Kautex Fuel Systems | Leading Global Supplier | Predictable Cash Flow | Low (Adapting to EV) |

Delivered as Shown

Textron BCG Matrix

The Textron BCG Matrix document you are previewing is the identical, fully formatted report you will receive upon purchase. This ensures transparency and allows you to assess the quality and content before committing, guaranteeing no surprises and immediate readiness for your strategic analysis. You'll gain access to a professionally designed tool, complete with all necessary components for effective business planning and decision-making.

Dogs

Textron's Powersports business, notably featuring the Arctic Cat brand, was recently divested in April 2025. This move came after a strategic review prompted by a production pause initiated in late 2024, a direct response to dwindling demand and an oversupply of dealer inventory.

Within the BCG matrix framework, this segment was firmly categorized as a Dog. It exhibited a low market share within a market experiencing minimal growth, meaning it required significant capital investment without generating proportional returns.

The financial performance leading up to the sale underscored this Dog status. For instance, in the fiscal year 2023, Textron's Consumer segment, which included Powersports, reported operating profit of $215 million on revenues of $1.2 billion, showcasing a relatively low margin compared to other Textron divisions and reflecting the challenges in this market.

As Textron Aviation transitions its focus towards the upcoming Gen3 family of light jets, anticipated around 2027, older models like the Cessna Citation M2 Gen2 might be facing a strategic re-evaluation. This shift could see the M2 Gen2 experiencing a declining market share as newer, more technologically advanced aircraft become available. The company's investment strategy will likely prioritize the Gen3, potentially positioning the M2 Gen2 as a product requiring minimal further development or marketing support.

In the context of a BCG Matrix, the Cessna Citation M2 Gen2 could be classified as a Dog. This designation suggests that while it may still generate some revenue, its growth potential is limited, and its market share is likely shrinking. For instance, Textron might consider reducing its marketing spend on the M2 Gen2 or exploring options to sell off remaining inventory at lower margins to free up capital for more promising ventures.

Textron Systems saw a revenue dip in Q1 2025, with lower program volumes contributing. A key factor was the cancellation of the Shadow program in 2024, impacting overall output.

Programs like the Shadow, which are being retired or have lost crucial contracts, fall into the Dogs category of the BCG Matrix. These initiatives often face reduced production runs and dim future growth potential.

Such declining volume programs can struggle to break even, potentially becoming a drain on financial and operational resources. Their limited future prospects mean they tie up capital that could be better invested elsewhere.

Underperforming Industrial Segment Product Lines

Textron's Industrial segment, excluding the Kautex business, experienced a notable revenue decline of $100 million in the first quarter of 2025. This downturn was primarily attributed to reduced sales volumes and less favorable product mix, with Textron Specialized Vehicles being a significant contributor to this underperformance.

Within this segment, certain product lines are exhibiting persistent weakness. These underperforming areas are characterized by sustained low demand, facing fierce competition, or failing to meet anticipated performance benchmarks, with limited prospects for a turnaround.

- Textron Specialized Vehicles: This sub-segment is directly impacted by the broader revenue decrease, signaling potential issues with specific product offerings or market positioning.

- Recreational Vehicles: Historically, this category can be sensitive to economic downturns and discretionary spending, making it vulnerable to underperformance during periods of uncertainty.

- Industrial Equipment: Product lines within this category may be struggling with outdated technology, pricing pressures, or a shift in customer preferences toward alternative solutions.

Products Impacted by 2024 Labor Disruptions with Slow Recovery

Specific Textron Aviation aircraft models faced significant production slowdowns due to the 2024 labor disruptions. This led to a noticeable dip in deliveries, particularly impacting Q1 2025 figures. For instance, the Cessna Citation Latitude, operating in a market segment that saw only a 3% projected growth in 2024, experienced delivery delays that extended into the first quarter of the following year.

If these affected models, like the Latitude, fail to regain their previous production pace and market competitiveness, especially within a slow-growth environment, they could be temporarily categorized as dogs in the BCG matrix. This classification would reflect their current struggle to generate significant returns and their potential for limited future growth. Continued underperformance, even after recovery efforts, would solidify this status.

- Cessna Citation Latitude: Production impacted by 2024 labor strike, affecting Q1 2025 deliveries.

- Market Segment Growth: Projected at only 3% for 2024, indicating a low-growth environment.

- Potential Classification: Temporary dog status if market share and production efficiency do not rebound.

- Underperformance Metric: Continued struggle to meet pre-strike delivery levels would justify the classification.

Products classified as Dogs within Textron's portfolio are those with a low market share in low-growth industries. These often require investment but yield minimal returns, potentially draining resources. Textron's divestiture of its Powersports business, including Arctic Cat, in April 2025 exemplifies this, following a production pause due to declining demand. Similarly, retired or contract-lost programs like the Shadow within Textron Systems are prime examples of Dogs, facing reduced production and limited future prospects.

Textron Specialized Vehicles, a component of the Industrial segment, has contributed to a revenue decline, signaling potential issues with specific product lines. These underperforming areas, characterized by low demand, intense competition, or failure to meet performance benchmarks, are also candidates for the Dog classification. The Cessna Citation Latitude, impacted by 2024 labor disruptions, faced delivery delays in Q1 2025 within a slow-growth market, potentially earning it a temporary Dog status if competitiveness doesn't rebound.

| Business Segment | Product/Brand Example | BCG Matrix Classification | Key Indicators |

| Powersports | Arctic Cat | Dog | Divested April 2025, declining demand, oversupply, low market share in slow growth. |

| Textron Systems | Shadow Program | Dog | Cancellation in 2024, reduced production, dim future growth. |

| Industrial | Textron Specialized Vehicles | Potential Dog | Revenue decline attributed to low volumes and unfavorable mix, persistent weakness. |

| Textron Aviation | Cessna Citation Latitude | Potential Dog (Temporary) | Production slowdowns from labor disruptions, Q1 2025 delivery dip, operating in a 3% projected growth market. |

Question Marks

Textron eAviation, encompassing Pipistrel and emerging electric aircraft projects, is positioned as a Question Mark in Textron's business portfolio. This segment exhibits high growth potential within the burgeoning electric aviation market but currently holds a negligible market share.

In the first quarter of 2025, Textron eAviation generated $7 million in revenue, yet incurred a segment loss of $17 million. This financial snapshot underscores the substantial investment required for research and development in this nascent field, with limited immediate profitability.

To capture significant market share and establish its long-term viability, the eAviation segment necessitates considerable ongoing investment. This strategic need for funding to foster growth aligns perfectly with the characteristics of a Question Mark in a BCG Matrix analysis.

The Cessna Citation Gen3 light jets, including the M2 Gen3, CJ3 Gen3, and CJ4 Gen3, are positioned as Textron Aviation's next generation of offerings, slated for entry into service between 2026 and 2027. This strategic move targets a segment of the aviation market experiencing robust expansion, indicated by a projected compound annual growth rate (CAGR) of approximately 4.5% for the light jet category through 2030, according to industry forecasts.

Currently, these specific Gen3 models hold a nascent market share due to their upcoming introduction, placing them in a classic BCG "Question Mark" category. Their potential is high, but they require significant development and market penetration to establish a strong foothold against established competitors.

Textron Aviation's investment in these platforms, estimated to be in the hundreds of millions of dollars for research, development, and production line establishment, is crucial for their future success. This investment aims to capture a larger share of the growing light jet market, where demand for efficiency and advanced technology remains strong, with over 1,200 light jets delivered globally in 2024.

Bell's involvement in DARPA's SPRINT X-Plane program positions it as a potential disruptor in advanced aerospace technology. The program's focus on novel stop/fold capabilities represents a significant technological leap, targeting future military applications. As of its selection for Phase 2, Bell's market share for this specific X-plane technology is zero, reflecting its pre-commercialization status. This innovative venture demands substantial capital investment for design, construction, and maturation, with the potential for substantial future returns if production contracts are secured.

New Unmanned Systems from Textron Systems

Textron Systems is making significant strides in its unmanned systems portfolio, exemplified by the Cottonmouth® Armored Robotic Vehicle (ARV) and the XM204 terrain shaping obstacles. These innovations are positioned as high-growth potential products within the defense market, reflecting Textron's commitment to advanced capabilities. In 2024, these systems have seen key developmental milestones, indicating a push towards market readiness and adoption.

While these new unmanned systems represent promising future revenue streams, their current market share is relatively low. This is typical for new entrants or products in the early stages of production, placing them in the Question Mark category of the BCG Matrix. Continued investment and successful market penetration are essential for these offerings to transition into Stars.

- Cottonmouth® ARV: Represents a novel approach to robotic ground vehicles, targeting versatile military applications.

- XM204 Terrain Shaping Obstacles: Designed to enhance battlefield control and engineer terrain, offering a unique defensive capability.

- 2024 Milestones: Included successful demonstrations and potential contract awards, signaling progress towards broader deployment.

- Market Position: Currently considered Question Marks due to nascent market share despite high growth potential.

Advanced Air Mobility (AAM) / Urban Air Mobility (UAM) Ventures

Textron's involvement in Advanced Air Mobility (AAM) and Urban Air Mobility (UAM) is primarily situated within its broader eAviation segment, reflecting the nascent nature of these markets. While Textron may not have a distinct AAM/UAM business unit, any ventures in this space would be considered question marks in a BCG Matrix. These markets are characterized by high growth potential but currently minimal, if any, market share for Textron, necessitating significant investment in research and development and strategic alliances to overcome regulatory challenges and foster market adoption.

The AAM/UAM sector is attracting substantial investment, with global market forecasts predicting significant expansion. For instance, by 2030, the AAM market is projected to reach tens of billions of dollars. Textron's Bell segment, with its expertise in vertical lift technology, is strategically positioned to explore opportunities in this evolving landscape. Bell's ongoing development of advanced rotorcraft and eVTOL (electric Vertical Take-Off and Landing) concepts aligns with the foundational requirements for AAM operations. The company's commitment to innovation in electric propulsion and autonomous flight systems is crucial for establishing a foothold in this competitive and rapidly developing sector.

- Market Potential: The global AAM market is anticipated to grow substantially, with projections suggesting it could reach over $200 billion by 2040, according to some industry analyses.

- R&D Investment: Companies like Textron must commit significant capital to research and development, focusing on areas such as battery technology, advanced avionics, and airframe design for eVTOL aircraft.

- Regulatory Landscape: Navigating evolving aviation regulations from bodies like the FAA and EASA is a critical hurdle for AAM/UAM ventures, requiring close collaboration and adherence to safety standards.

- Strategic Partnerships: Success in AAM/UAM often hinges on strategic partnerships with technology providers, infrastructure developers, and potential operators to build a comprehensive ecosystem.

Question Marks represent business areas with low market share but in high-growth industries, demanding significant investment to potentially become market leaders. Textron's eAviation, including Pipistrel and emerging electric aircraft, fits this profile, showing high growth potential in a burgeoning market but currently holding a negligible market share.

The Cessna Citation Gen3 light jets also fall into this category, with upcoming entries into service and nascent market share in a robustly expanding sector, requiring substantial investment for development and market penetration. Bell's participation in DARPA's SPRINT X-Plane program, targeting advanced aerospace technology with zero current market share for the specific technology, is another clear example of a Question Mark.

Textron Systems' new unmanned systems, such as the Cottonmouth® ARV, are also considered Question Marks. These innovative products exhibit high growth potential within the defense market but currently possess low market share, necessitating continued investment and successful penetration to become Stars.

BCG Matrix Data Sources

Our Textron BCG Matrix leverages comprehensive data from Textron's financial statements, industry-specific market research, and competitor performance analyses to provide a clear strategic overview.