Telkom Indonesia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telkom Indonesia Bundle

Telkom Indonesia operates within a dynamic environment shaped by political stability, economic growth, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats. Our PESTLE analysis delves deep into these factors, providing a comprehensive overview of the landscape. Gain a competitive edge by leveraging these insights to refine your market strategy. Download the full version now for actionable intelligence.

Political factors

The Indonesian government is strongly backing digital transformation, evident in programs like 'Making Indonesia 4.0' and the 'Digital Indonesia Roadmap 2021-2024.' These initiatives aim to establish Indonesia as a major digital economy by 2030, a goal supported by significant investment. For instance, the Ministry of Communication and Information Technology targeted a 100% digital literacy rate for the population by 2024.

As a state-owned enterprise, Telkom Indonesia is well-positioned to capitalize on this government support. This strategic alignment translates into advantages for Telkom in expanding its digital infrastructure and services throughout Indonesia, particularly in underserved regions. By 2024, the government aimed to have 100% of its populated areas covered by 4G mobile broadband, a key area for Telkom's growth.

This governmental push includes dedicated efforts to close connectivity gaps in remote and underdeveloped areas, ensuring broader access to digital services. Furthermore, the government actively fosters innovation across various digital sectors, creating a more conducive environment for companies like Telkom to develop and deploy new technologies and solutions, contributing to the nation's digital advancement.

Indonesia's telecommunications regulatory environment is constantly shifting, with recent developments focusing on certification processes and infrastructure sharing. For instance, the Directorate General of Postal and Information Operations (DGPPI) issued Regulation No. 6/2024, which further clarifies guidelines for infrastructure sharing, a move designed to optimize resource utilization across the sector.

The rebranding of the telecommunications authority to the Directorate General of Digital Infrastructure (DJID) underscores a strategic push towards digital transformation. Alongside this, new regulations such as No. 13/2025 are being implemented to streamline the recognition of foreign testing laboratories, aiming to enhance the efficiency and global competitiveness of Indonesian telecommunication standards.

These regulatory adjustments are intended to simplify operational procedures for telecommunications companies, potentially leading to cost reductions. By aligning with international best practices and adapting to technological advancements, these changes are crucial for ensuring ongoing compliance and fostering a more agile and efficient telecom market.

As a state-owned enterprise, Telkom Indonesia's strategic path and leadership selections are significantly shaped by government directives. The recent appointment of Angga Raka Prabowo as President Commissioner, who has connections to the current administration, highlights a move to align with national digital infrastructure goals.

This close governmental link can grant Telkom advantageous access to vital spectrum licenses and federally sponsored initiatives. For instance, in 2024, the Indonesian government continued its push for digital transformation, with state-owned companies like Telkom playing a central role in expanding broadband access to underserved regions.

However, this close relationship also means Telkom is susceptible to political shifts and policy changes. The government's strategic agenda, as demonstrated by its focus on national digital sovereignty, directly impacts Telkom's operational and investment decisions, potentially influencing its competitive landscape against private sector players.

National Cybersecurity Strategy

Indonesia's commitment to bolstering its digital infrastructure is evident in its National Cybersecurity Strategy, as outlined in Presidential Regulation No. 47 of 2023. This strategic directive, further elaborated by BSSN Regulations No. 1 and 2 of 2024, emphasizes the critical need for robust cyber incident response capabilities and comprehensive contingency planning across all sectors.

For Telkom Indonesia, these evolving regulations translate into a heightened imperative for compliance and significant investment in advanced cybersecurity measures. Protecting its extensive network infrastructure and sensitive customer data is paramount, requiring adherence to new mandates for establishing dedicated Cyber Incident Response Teams (CIRTs) and developing detailed response protocols.

- Mandatory CIRT Establishment: BSSN Regulations No. 1 and 2 of 2024 legally require entities like Telkom to create and maintain operational Cyber Incident Response Teams.

- Increased Compliance Burden: Telkom must ensure its security frameworks align with the stricter requirements of the National Cybersecurity Strategy, potentially leading to higher operational costs.

- Investment in Defensive Technologies: The strategy necessitates ongoing investment in cutting-edge cybersecurity solutions to defend against sophisticated cyber threats, safeguarding critical national digital assets.

International Relations and Partnerships

Indonesia's burgeoning digital economy, projected to reach $130 billion by 2025 according to Google, Temasek, and Bain & Company reports, positions it as a key player, attracting significant international collaborations for Telkom Indonesia. These strategic alliances are crucial for advancing national digital infrastructure and services. For instance, Telkom's partnerships with global leaders like Google Cloud and IBM are instrumental in accelerating digital transformation and the integration of artificial intelligence across various sectors in Indonesia.

These collaborations bolster Telkom's expertise and offerings in critical areas such as advanced cloud technologies, sophisticated AI solutions, and robust secure communication services. This directly supports the Indonesian government's ambitious agenda to foster a highly competitive and innovative digital economy, ensuring the nation remains at the forefront of technological advancement. Such international ties are vital for Telkom to leverage global best practices and cutting-edge technologies, thereby enhancing its service portfolio and market competitiveness.

- Digital Economy Growth: Indonesia's digital economy is on track to hit $130 billion by 2025, underscoring its strategic importance.

- Key Partnerships: Collaborations with Google Cloud and IBM are actively driving digital transformation and AI adoption.

- Enhanced Capabilities: These alliances strengthen Telkom's expertise in cloud technology, AI, and secure communications.

- Government Vision Alignment: Partnerships directly support the national goal of building a competitive digital economy.

The Indonesian government's strong backing of digital transformation through initiatives like 'Making Indonesia 4.0' and the 'Digital Indonesia Roadmap 2021-2024' provides a significant tailwind for Telkom Indonesia. The goal of achieving a 100% digital literacy rate by 2024 and covering all populated areas with 4G by the same year directly benefits Telkom's expansion efforts. This government support, coupled with a focus on closing connectivity gaps, creates a favorable operating environment for Telkom to grow its digital infrastructure and services.

Telkom's status as a state-owned enterprise means its strategic direction and leadership are heavily influenced by government directives, such as the recent appointment of Angga Raka Prabowo as President Commissioner, aligning with national digital infrastructure goals. This close relationship can secure preferential access to spectrum licenses and government-backed projects, exemplified by Telkom's central role in the 2024 digital transformation push to expand broadband in underserved areas. However, this also exposes Telkom to political shifts and policy changes that could impact its operations and competitive standing.

Regulatory changes, including the rebranding of the telecommunications authority to the Directorate General of Digital Infrastructure (DJID) and new regulations like No. 13/2025 streamlining foreign testing laboratory recognition, aim to simplify operations and align with international standards. These adjustments are crucial for Telkom's compliance and market agility. Furthermore, the National Cybersecurity Strategy, reinforced by BSSN Regulations No. 1 and 2 of 2024, mandates significant investments in cybersecurity measures, including the establishment of Cyber Incident Response Teams (CIRTs), to protect critical digital assets.

Indonesia's digital economy is projected to reach $130 billion by 2025, making international collaborations vital for Telkom. Partnerships with giants like Google Cloud and IBM are accelerating digital transformation and AI integration, enhancing Telkom's capabilities in cloud, AI, and secure communications, thereby supporting the national objective of a competitive digital economy.

| Government Initiative | Target Year | Impact on Telkom |

|---|---|---|

| Making Indonesia 4.0 | Ongoing | Drives demand for digital infrastructure and services. |

| Digital Indonesia Roadmap | 2024 | Supports expansion of digital services and connectivity. |

| Digital Literacy Target | 2024 | Increases user adoption of digital services. |

| 4G Broadband Coverage | 2024 | Expands market reach for mobile services. |

| National Cybersecurity Strategy | 2023 onwards | Requires investment in security infrastructure and compliance. |

What is included in the product

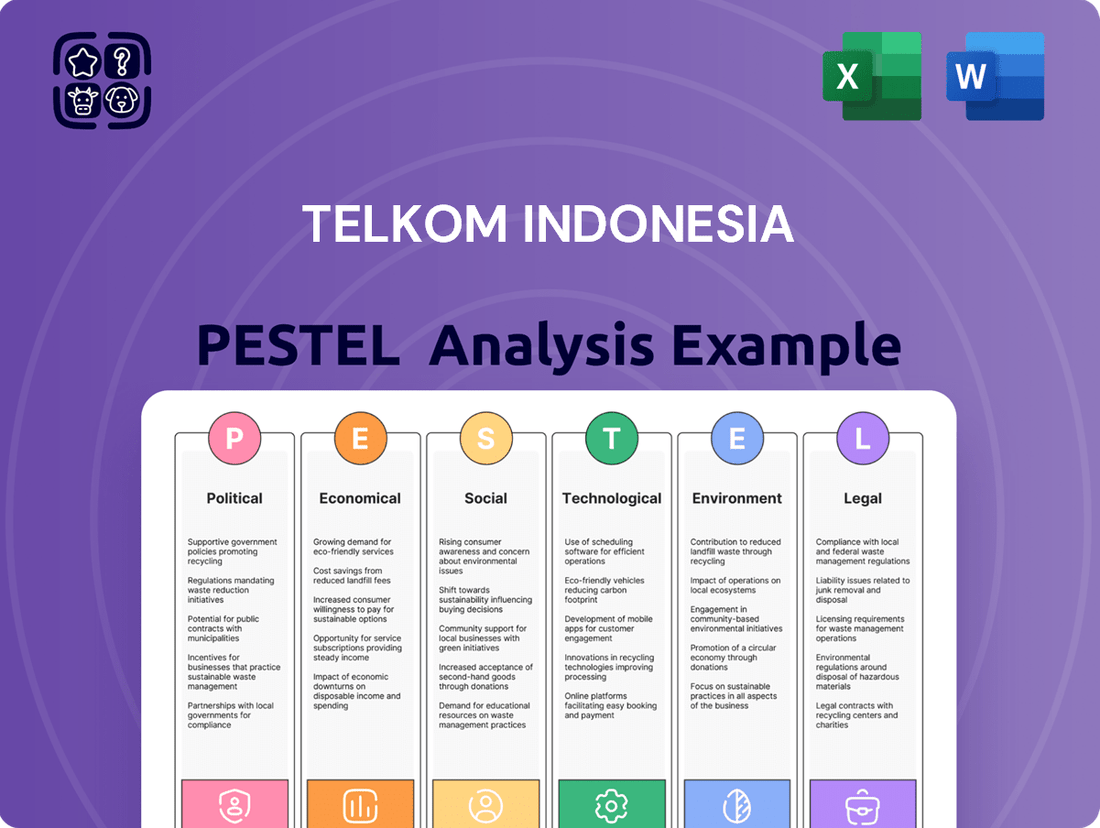

This PESTLE analysis delves into the political, economic, social, technological, environmental, and legal forces impacting Telkom Indonesia, providing a comprehensive understanding of its external operating landscape.

Provides a concise version of Telkom Indonesia's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Helps support discussions on external risk and market positioning by offering a clear, summarized PESTLE analysis of Telkom Indonesia, making strategic planning more informed and less daunting.

Economic factors

Indonesia's digital economy is a powerhouse in Southeast Asia, anticipated to surpass US$130 billion by 2025, showcasing its rapid expansion. This surge is fueled by widespread internet adoption, a youthful demographic adept with technology, and the strong presence of e-commerce. Telkom Indonesia is well-positioned to capitalize on this trend, as the need for digital infrastructure and services escalates.

Consumer spending power remains a critical factor for Telkom Indonesia, even as the digital economy expands. While digital services are growing, how much consumers can and are willing to spend directly impacts Telkom's top and bottom lines.

In 2024, Telkom faced challenges with its revenue growth slowing and net profit decreasing. This was largely driven by fierce market competition and a drop in the average revenue per user, or ARPU, across both its mobile and fixed broadband services. For instance, ARPU in the mobile segment saw pressure throughout the year.

However, there are positive indicators suggesting a potential turnaround. By the end of 2024, initial signs of ARPU recovery began to emerge in key segments. This could signal a stabilization in the market and a potential rebound in spending on telecommunications services.

Indonesia's digital economy growth hinges on substantial investments in digital infrastructure. Telkom Indonesia is at the forefront, aggressively expanding its fiber optic networks, data centers, and 5G capabilities to meet this demand.

Recent initiatives include the expansion of NeuCentrIX data centers and the development of AI-powered NeutraDC facilities. These projects are critical for accommodating the surging need for secure data storage and sophisticated digital services, even as the wider tech startup funding landscape presents broader economic challenges.

Inflation and Foreign Exchange Rates

Macroeconomic headwinds, including ongoing geopolitical tensions and trade disputes, are projected to shape Indonesia's economic landscape through 2025. These global pressures could dampen industry expansion and temper consumer spending, potentially exerting downward pressure on the Indonesian Rupiah. For Telkom Indonesia, this translates to potential fluctuations in operational expenses and the value of its international investments.

The volatility of foreign exchange rates directly impacts Telkom's bottom line. For instance, a weakening Rupiah can increase the cost of imported network equipment and technology, a significant factor for a telecommunications provider. Conversely, it could make Telkom's services more competitive for foreign clients, though this is a smaller part of their revenue.

- Inflationary pressures in Indonesia were observed around 3.5% year-on-year in early 2024, with projections for 2025 suggesting a continued moderate trend influenced by global supply chain dynamics.

- The Indonesian Rupiah (IDR) experienced fluctuations against the US Dollar, trading in the range of IDR 15,500-16,500 per USD throughout 2024, with analysts forecasting continued sensitivity to global economic sentiment in 2025.

- Telkom Indonesia's capital expenditures, heavily reliant on imported technology, could see a cost increase of 5-10% if the Rupiah depreciates significantly against major currencies like the USD or Euro.

- A weaker IDR can also impact the repatriation of profits for foreign investors in Indonesia, potentially affecting foreign direct investment into the telecommunications sector.

Competition Landscape

The Indonesian telecommunications sector is intensely competitive. While Telkomsel, Telkom's mobile division, holds the leading market position, it faces significant challenges from rivals such as Indosat Ooredoo Hutchison and XL Axiata, now integrated as XLSmart. This fierce rivalry has resulted in aggressive pricing strategies, impacting Average Revenue Per User (ARPU) across the industry.

Telkom's strategic response focuses on capitalizing on its vast infrastructure network and advancing Fixed Mobile Convergence (FMC). This approach aims to enhance customer retention and increase revenue generated per household by bundling services.

- Market Share Dynamics: As of late 2024, Telkomsel maintained a dominant share in the mobile market, though Indosat Ooredoo Hutchison and XL Axiata have been actively consolidating and expanding their subscriber bases.

- ARPU Pressure: Intense competition has historically led to price wars, with ARPU figures for Indonesian mobile operators often showing modest growth or even declines in certain segments due to aggressive data package promotions.

- FMC Initiatives: Telkom's strategy to integrate fixed broadband (IndiHome) with mobile services is designed to create a more sticky customer base and offer a comprehensive digital lifestyle experience, potentially increasing household spending on Telkom's services.

- Infrastructure Advantage: Telkom's extensive fiber optic network and widespread mobile tower infrastructure provide a critical competitive advantage, enabling it to deliver reliable and high-speed services across the archipelago.

Indonesia's economic trajectory in 2024 and 2025 is marked by a rapidly expanding digital economy, projected to exceed US$130 billion by 2025, driven by high internet penetration and a tech-savvy youth demographic. However, Telkom Indonesia experienced slower revenue growth and decreased net profit in 2024, largely due to intense market competition and declining Average Revenue Per User (ARPU) in its mobile and fixed broadband segments, although signs of ARPU recovery emerged late in the year. Macroeconomic factors such as geopolitical tensions and trade disputes are expected to influence the Indonesian Rupiah, potentially impacting Telkom's operational costs for imported technology, with the Rupiah trading between IDR 15,500-16,500 per USD in 2024.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on Telkom |

|---|---|---|---|

| Digital Economy Growth | On track to exceed US$130 billion by 2025 | Continued strong expansion | Increased demand for infrastructure and services |

| Consumer Spending Power | Mixed; digital spending growing but ARPU under pressure | Potentially influenced by macroeconomic headwinds | Directly affects revenue generation |

| Inflation | ~3.5% YoY early 2024 | Moderate trend expected | May increase operational costs |

| Rupiah Exchange Rate (vs. USD) | IDR 15,500-16,500 | Continued volatility anticipated | Impacts cost of imported equipment and profit repatriation |

What You See Is What You Get

Telkom Indonesia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Telkom Indonesia PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will gain a thorough understanding of the external forces shaping Telkom Indonesia's strategic landscape. This detailed report will equip you with the insights needed for informed decision-making.

Sociological factors

Internet penetration in Indonesia has seen robust growth, reaching an impressive 79.5% by 2024, with projections indicating 212 million active internet users by January 2025. This surge is largely driven by younger demographics, specifically Millennials and Generation Z, who demonstrate the highest adoption rates and are the most active users. This expanding digital landscape directly translates into a vast and growing customer pool for Telkom Indonesia's diverse range of connectivity and digital services, fueling demand.

Indonesia's digital landscape is rapidly evolving, but a significant digital literacy and skills gap remains a key sociological factor. While internet penetration continues to grow, uneven infrastructure development means access and quality vary across regions. This disparity impacts the ability of many Indonesians to fully participate in the digital economy.

Compounding this challenge is a projected shortfall of 2 million digital workers by 2030. This gap highlights the urgent need for enhanced digital education and training programs to equip the workforce with the necessary skills for future employment. Addressing this will be crucial for Indonesia's continued economic development and competitiveness.

Telkom Indonesia is actively working to bridge this gap through various initiatives. By empowering Micro and Small Enterprises (MSEs) with digital tools and knowledge, Telkom fosters economic growth at the grassroots level. Furthermore, collaborations on Artificial Intelligence (AI) development platforms contribute to building advanced digital capabilities within the nation, promoting a more skilled and digitally inclusive society.

Indonesia's ongoing urbanization presents a dual challenge for Telkom Indonesia: catering to dense urban populations while simultaneously addressing the vast underserved rural areas. As of early 2024, while urban centers see high digital adoption, approximately 70% of Indonesia's landmass, predominantly rural, still grapples with limited internet access. This disparity highlights the critical role Telkom plays in bridging the digital divide.

Telkom is actively working to expand its infrastructure into these remote regions, often in collaboration with government initiatives like the Palapa Ring project, aiming to connect all districts and cities by 2025. This expansion is crucial for fostering inclusive digital transformation, enabling access to education, healthcare, and economic opportunities for rural communities.

E-commerce and Digital Lifestyle Adoption

E-commerce remains the cornerstone of Indonesia's digital economy, consistently generating the largest portion of digital services revenue. The rapid ascent of live commerce, which blends entertainment with shopping, further underscores this dominance. By mid-2024, e-commerce platforms are projected to see sustained growth, driven by increasing consumer trust and more sophisticated online payment systems.

This surge in online shopping is intrinsically linked to a broader societal shift towards a digital lifestyle. Indonesians are increasingly integrating digital technologies into their daily routines, from online education and remote work to the widespread adoption of fintech solutions for banking and payments. Telkom Indonesia plays a crucial role in enabling this digital transformation by providing the essential connectivity and infrastructure that underpins these evolving consumer behaviors and facilitates seamless online transactions.

- E-commerce Dominance: E-commerce continues to capture the largest share of Indonesia's digital economy revenue.

- Live Commerce Growth: Live commerce is rapidly gaining popularity, blending entertainment and shopping experiences.

- Digital Lifestyle Integration: Indonesians are increasingly relying on digital tools for daily activities like learning and financial management.

- Telkom's Enabling Role: Telkom's services are fundamental to supporting these digital behaviors and facilitating online commerce.

Demographic Shifts and Youth Engagement

Indonesia's population is notably young and highly adept with technology. Generation Z, in particular, represents a significant portion of total internet users, showing a strong preference for digital engagement.

This demographic reality directly drives the demand for mobile data services, a wide array of digital content, and novel online offerings. Telkom Indonesia is responding by simplifying its product portfolio and employing artificial intelligence to personalize user experiences, thereby aligning with the dynamic needs of this digitally immersed generation.

- Youthful Demographics: As of early 2024, over half of Indonesia's population is under 30 years old, with Gen Z and Millennials forming the largest consumer blocs.

- Digital Natives: Roughly 90% of Indonesian internet users are under 40, highlighting the importance of digital channels for reaching the consumer base.

- Data Consumption Growth: Mobile data consumption in Indonesia saw an estimated 20% year-over-year increase in 2023, driven by younger users' preference for video streaming and social media.

- AI Personalization: Telkom's investments in AI aim to improve customer retention by offering tailored digital services, a strategy crucial for engaging a generation accustomed to personalized online experiences.

Indonesia's young and tech-savvy population, particularly Gen Z and Millennials, are the primary drivers of digital consumption. This demographic trend fuels demand for mobile data, digital content, and innovative online services, with over half of the population under 30 years old as of early 2024.

Telkom Indonesia is adapting by simplifying its offerings and leveraging AI for personalized customer experiences, crucial for retaining a generation accustomed to tailored digital interactions. The company's focus on this demographic is evident in its strategic alignment with evolving consumer behaviors, particularly the strong preference for digital engagement and mobile-first solutions.

The growing digital literacy gap, with a projected 2 million digital worker shortfall by 2030, presents both a challenge and an opportunity. Telkom's initiatives to empower Micro and Small Enterprises and collaborate on AI development are vital for building a skilled workforce and fostering inclusive digital transformation across the nation.

Urbanization creates a dichotomy, with high digital adoption in cities contrasting with limited access in rural areas, where approximately 70% of Indonesia's landmass lies. Telkom's infrastructure expansion, including the Palapa Ring project, aims to bridge this divide by 2025, ensuring broader access to essential digital services for all Indonesians.

Technological factors

Telkom Indonesia is a major player in the ongoing 5G network rollout across Indonesia, a critical technological advancement. The Indonesian government has made developing a robust 5G infrastructure a cornerstone of its national digital transformation agenda. This push for widespread 5G coverage is designed to unlock the potential of new technologies and deliver significantly faster data speeds to both individuals and businesses nationwide.

Telkom Indonesia's ongoing investment in fiber optic infrastructure development is crucial, forming the backbone for its IndiHome fixed broadband services. This expansion directly supports the increasing consumer and business demand for high-speed internet. For instance, in 2023, Telkom continued its network modernization, aiming to enhance broadband speeds and reliability across Indonesia, a country where internet penetration is rapidly growing.

The company's strategic focus on Fixed Mobile Convergence (FMC) further amplifies the value of this fiber network. By integrating its mobile and fixed-line services, Telkom leverages its extensive fiber optic coverage to offer bundled solutions, enhancing customer experience and driving revenue growth. This integrated approach is key to meeting the diverse connectivity needs of a digitalizing economy, with Indonesia's digital economy projected for significant growth in the coming years.

Technological advancements, particularly in Artificial Intelligence (AI) and the infrastructure supporting it, are reshaping the telecommunications landscape. AI is anticipated to be a significant economic driver for Indonesia, with projections suggesting it could contribute substantially to the nation's GDP by 2030. Telkom Indonesia is strategically positioning itself to capitalize on this trend by integrating AI into its operations and services.

Telkom is actively developing and expanding its data center capabilities, with a specific focus on AI-powered solutions. For instance, its NeutraDC facility in Batam is being designed to support the demanding computational needs of AI applications. This forward-thinking approach not only enhances operational efficiency but also unlocks potential for innovative new services tailored to the evolving digital economy.

Furthermore, Telkom's collaborations with global technology leaders, such as its partnership with IBM, are crucial for delivering sovereign AI solutions. These partnerships enable Telkom to offer advanced AI capabilities to businesses within Indonesia, ensuring data security and compliance with local regulations while fostering domestic AI adoption.

Cloud Computing and Digital Platforms

The surge in cloud computing and digital platforms is reshaping Indonesia's IT landscape, and Telkom Indonesia is actively participating in this transformation. The company is strategically bolstering its digital capabilities and IT services through key subsidiaries like Telkomsigma. These initiatives are designed to expedite digital adoption across diverse sectors by offering advanced infrastructure, modernizing applications, and providing robust data analytics.

Telkom's focus on cloud solutions is evident in its partnerships, such as the collaboration with Google Cloud. This strategic alliance is crucial for accelerating digitalization efforts, enabling businesses to leverage cutting-edge cloud technologies. By enhancing its digital platforms and IT services, Telkom aims to be a primary enabler of digital transformation for Indonesian industries.

- Digitalization Acceleration: Telkom's investments in cloud and digital platforms directly support the Indonesian government's national digital transformation agenda.

- Market Growth: The Indonesian cloud market is experiencing significant growth, with projections indicating continued expansion in the coming years, presenting a substantial opportunity for Telkom.

- Service Expansion: Telkomsigma, as a key player, offers a range of cloud-based solutions including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) to meet evolving business needs.

Cybersecurity Technologies and Threats

As digital adoption accelerates, the landscape of cybersecurity threats continues to evolve rapidly. Telkom Indonesia, a key player in the digital ecosystem, must proactively invest in cutting-edge cybersecurity technologies to safeguard its critical infrastructure, diverse service offerings, and sensitive customer data.

Telkom's strategic framework, specifically its governance pillar 'Elevate Our Business,' explicitly prioritizes cybersecurity and personal data protection. This internal focus aligns with broader national initiatives aimed at bolstering cyber defenses. For instance, Indonesia's commitment to strengthening cyber resilience is reflected in regulations that mandate the establishment of Cyber Incident Response Teams (CIRTs) and the development of robust contingency plans, underscoring the growing importance of these technological capabilities.

The increasing sophistication of cyberattacks poses a significant risk, potentially leading to service disruptions and data breaches. For example, the global cybersecurity market size was projected to reach USD 270 billion in 2024, with a compound annual growth rate (CAGR) of 13.5%, indicating substantial investment and a clear trend towards enhanced security solutions.

- Digital Transformation Risks: Growing reliance on digital services amplifies vulnerability to cyber threats.

- Investment in Advanced Solutions: Telkom needs to deploy next-generation firewalls, intrusion detection systems, and encryption technologies.

- Regulatory Alignment: Adherence to mandates for CIRTs and incident response plans is crucial for compliance and preparedness.

- Data Protection Mandates: Safeguarding customer data is paramount, requiring robust data loss prevention measures.

Telkom Indonesia's technological strategy heavily emphasizes 5G deployment and fiber optic expansion, critical for enhancing broadband services and supporting the nation's digital agenda. The company's commitment to Fixed Mobile Convergence (FMC) leverages this infrastructure to offer integrated solutions, meeting the growing demand for high-speed connectivity as Indonesia's digital economy expands. Furthermore, Telkom is investing in AI capabilities, data centers like NeutraDC, and partnerships to drive innovation and support burgeoning AI adoption across industries.

The company is also bolstering its cloud and digital platform offerings through subsidiaries like Telkomsigma, aiming to accelerate digital adoption across various sectors by providing advanced IT services and infrastructure. This strategic push includes collaborations with global tech giants to enhance cloud capabilities and support Indonesia's digitalization efforts. However, the rapid digital transformation necessitates robust cybersecurity investments to protect infrastructure and data against evolving threats, aligning with national initiatives for cyber resilience.

| Technology Focus | Key Initiatives/Investments | Impact/Opportunity |

|---|---|---|

| 5G Deployment | Nationwide 5G network rollout | Enables new services, faster data speeds, supports digital transformation |

| Fiber Optic Infrastructure | Expansion of IndiHome network | Supports increasing demand for high-speed internet, enhances service reliability |

| Artificial Intelligence (AI) | AI integration in operations, NeutraDC data centers, sovereign AI solutions | Drives operational efficiency, unlocks new service potential, supports national AI growth |

| Cloud Computing & Digital Platforms | Telkomsigma's IT services, partnerships (e.g., Google Cloud) | Accelerates digitalization, offers advanced IT infrastructure and analytics |

| Cybersecurity | Investment in advanced technologies, adherence to data protection mandates | Safeguards infrastructure and customer data, ensures regulatory compliance |

Legal factors

Indonesia's telecommunication sector operates under a dynamic legal landscape, with ongoing regulatory shifts influencing Telkom Indonesia's operations. The Ministry of Communication and Digital Affairs (KOMDIGI) actively updates technical standards, notably with Decree No. 619 of 2024 and Permen KOMINFO No. 3 Tahun 2024, which cover equipment certification and testing for devices. These mandates directly impact Telkom's ability to introduce new products and services, requiring adherence to evolving certification processes.

Indonesia's Personal Data Protection (PDP) Law, officially No. 27/2022, is set for full implementation in October 2024, marking a critical shift in data privacy for its citizens. This legislation introduces stringent rules for how personal data is gathered, used, and stored, even impacting entities outside Indonesia if their data processing affects Indonesian residents.

As a leading telecommunications provider, Telkom Indonesia is significantly affected by these new regulations. The company must implement comprehensive compliance measures, including establishing clear protocols for mandatory data breach notifications and reinforcing its data governance frameworks to meet the law's exacting standards.

Indonesia's competition laws are designed to create a level playing field for all businesses. Telkom, being the dominant player in the telecommunications sector, is closely watched to ensure its market practices adhere to these regulations, particularly concerning potential anti-competitive behavior.

The Indonesian government, through bodies like the Business Competition Supervisory Commission (KPPU), actively monitors market activities to prevent monopolies and unfair trade practices. This regulatory oversight is crucial for fostering innovation and consumer choice in the rapidly evolving digital landscape.

New regulations, such as the Directorate General of Post and Information Resources and Equipment (DGPPI) Decree No. 6 of 2024 on Infrastructure Sharing, are specifically aimed at promoting collaboration. This decree encourages telecommunications operators to share network infrastructure, which could lead to more equitable competition and efficient resource utilization across the industry.

Intellectual Property Rights

Intellectual Property Rights (IPR) are fundamental to Telkom Indonesia's operations in the telecommunications and digital services landscape. The company's ability to innovate and develop proprietary digital platforms and IT services hinges on strong legal protections for its intellectual assets. This includes safeguarding its software, data analytics, and unique service offerings from unauthorized use or replication.

Telkom Indonesia's reliance on robust IPR frameworks is underscored by its significant investments in research and development. For instance, in 2023, the company continued to focus on digital transformation initiatives, which inherently involve the creation of new technologies and services that require IP protection. These protections are vital for maintaining a competitive edge and ensuring that Telkom can monetize its innovations.

Compliance with intellectual property laws is not just about protecting Telkom's own assets; it's also about fostering a healthy ecosystem for digital innovation and collaboration. By respecting existing IPR and ensuring its own practices are compliant, Telkom Indonesia contributes to an environment where partnerships and technological advancements can flourish. This adherence is crucial for building trust with partners and customers in the digital economy.

Key aspects of IPR for Telkom Indonesia include:

- Protection of patents for novel technologies developed in areas like 5G infrastructure and IoT solutions.

- Copyright enforcement for its vast digital content, software, and platform interfaces.

- Trademark registration to safeguard its brand identity across its diverse service offerings.

- Trade secret management for proprietary algorithms and business processes critical to its digital services.

Consumer Protection Regulations

Consumer protection regulations are a cornerstone for telecommunications companies like Telkom Indonesia, ensuring fairness and transparency for its vast customer base. These laws dictate how Telkom must handle service agreements, manage customer complaints, and be upfront about data usage and pricing, especially with the evolving landscape of digital services and bundled offerings. Adherence to these rules fosters customer trust and mitigates the risk of costly legal challenges. For instance, in 2023, Indonesia's Ministry of Communication and Information Technology (Kominfo) continued to emphasize strict enforcement of regulations concerning service quality and consumer rights, particularly impacting how telecommunication providers manage customer data and billing disputes.

Key areas of focus for Telkom Indonesia regarding consumer protection include:

- Service Level Agreements: Ensuring promised service quality and uptime are met.

- Transparent Pricing: Clear communication of all charges, fees, and potential extra costs for services and data.

- Data Privacy and Usage: Adhering to regulations on how customer data is collected, stored, and used, with explicit consent.

- Complaint Resolution: Establishing efficient and fair mechanisms for addressing customer grievances within defined timeframes.

- Contractual Fairness: Ensuring terms and conditions in service contracts are not predatory or misleading to consumers.

The Indonesian government actively regulates the telecommunications sector to ensure fair competition and consumer protection. New decrees, such as DGPPI Decree No. 6 of 2024 on Infrastructure Sharing, encourage operators like Telkom Indonesia to collaborate, fostering more equitable market conditions and efficient resource use. Furthermore, evolving intellectual property laws, including patent and copyright protections, are crucial for Telkom's innovation in digital services and maintaining its competitive edge.

Environmental factors

Telkom Indonesia actively pursues climate change mitigation and energy efficiency through its ESG program, 'GoZero% - Sustainability Action by Telkom Indonesia.' This commitment is tangible through strategic investments in eco-friendly equipment and the widespread deployment of solar panels across its Base Transceiver Stations (BTS). For instance, by the end of 2023, Telkom Indonesia reported a reduction in Scope 1 and Scope 2 greenhouse gas emissions by 7.9% compared to their 2022 baseline, a significant step towards their sustainability targets.

Telkom Indonesia recognizes the critical role of effective waste and resource management, particularly concerning electronic waste (e-waste). This commitment is central to their environmental strategy, aiming to mitigate the impact of their vast network infrastructure.

The company is actively engaged in e-waste management initiatives, including the recycling of fiber optic cables. In 2023 alone, Telkom Indonesia reported recycling a significant volume of old telecommunication equipment, contributing to resource conservation.

Furthermore, Telkom Indonesia promotes a circular economy by distributing recycled electronic devices to various communities. This practice not only reduces landfill waste but also provides valuable resources to those in need, reinforcing their social and environmental responsibility.

Telkom Indonesia is actively engaged in biodiversity preservation, understanding its crucial role in safeguarding the environment. The company's commitment is demonstrated through significant reforestation and marine ecosystem restoration projects across Indonesia.

Notable initiatives include large-scale mangrove planting drives, which are vital for coastal protection and carbon sequestration, and extensive coral reef restoration efforts aimed at reviving marine biodiversity. For instance, by late 2023, Telkom had planted over 100,000 mangrove saplings in critical coastal areas, contributing to habitat regeneration and climate change mitigation.

These programs not only enhance environmental quality by absorbing carbon dioxide and improving water purity but also directly support local ecosystems and the communities that depend on them. The restoration of coral reefs, for example, is crucial for fish populations and the health of marine environments, with Telkom's efforts in 2024 targeting the rehabilitation of 5 hectares of damaged reef systems.

Green Data Center Initiatives

Telkom Indonesia is actively pursuing green data center initiatives to bolster its sustainability efforts. As a significant player in the data center market, the company is focusing on reducing its environmental footprint. This includes the implementation of energy-efficient cooling technologies and architectural designs that leverage natural light to minimize electricity usage.

Further enhancing these green practices, Telkom is integrating renewable energy sources, such as solar panels, into its data center operations. These strategic moves are designed to curb energy consumption and mitigate the environmental impact associated with its expanding digital infrastructure. For instance, by 2023, Telkom had already committed to increasing its renewable energy usage across its facilities, aiming for a substantial reduction in carbon emissions by 2030.

Key aspects of Telkom's green data center strategy include:

- Energy-Efficient Cooling: Adoption of advanced cooling systems that consume less power.

- Natural Lighting Design: Building designs that maximize the use of daylight, reducing reliance on artificial lighting.

- Solar Power Integration: Installation of solar panels to generate clean energy for data center operations.

- Waste Heat Recovery: Exploring technologies to reuse waste heat generated by IT equipment.

These initiatives align with global trends and regulatory pressures pushing for more sustainable digital infrastructure, a critical consideration for Telkom as its data center services continue to grow.

Sustainable Community Engagement

Telkom Indonesia actively blends environmental conservation with community empowerment, demonstrating a commitment to sustainable development. The company's strategy involves conducting environmental awareness campaigns and engaging local communities in various greening programs. This dual focus ensures that environmental efforts also yield positive social and economic outcomes for the regions in which Telkom operates.

Through targeted investments in sustainable practices, Telkom provides crucial support to local communities. This approach not only addresses environmental concerns but also fosters local economic development and enhances societal well-being. For instance, in 2024, Telkom Indonesia reported a 15% increase in community-based environmental projects compared to the previous year, directly involving over 5,000 individuals in reforestation and waste management initiatives.

- Community Greening Programs: Telkom Indonesia's initiatives often include tree planting drives and the development of community gardens, directly involving local residents.

- Environmental Awareness Campaigns: The company conducts educational programs focused on conservation, recycling, and the importance of biodiversity.

- Sustainable Practice Investments: Telkom supports local businesses and initiatives that adopt environmentally friendly methods, contributing to economic resilience.

- Social Impact Measurement: Telkom Indonesia regularly tracks the social return on investment for its community and environmental programs, aiming for measurable positive impacts.

Telkom Indonesia is actively reducing its environmental footprint through initiatives like renewable energy adoption and efficient waste management. By the end of 2023, the company achieved a 7.9% decrease in Scope 1 and 2 greenhouse gas emissions against its 2022 baseline.

The company's commitment extends to biodiversity preservation, with significant reforestation efforts, including planting over 100,000 mangrove saplings by late 2023. Furthermore, Telkom is investing in green data centers, integrating solar power and advanced cooling technologies to minimize energy consumption.

Telkom Indonesia also focuses on community engagement in environmental programs, reporting a 15% rise in such projects in 2024, involving over 5,000 individuals in conservation activities.

| Environmental Initiative | Key Action | 2023/2024 Impact Data |

|---|---|---|

| Climate Change Mitigation | Scope 1 & 2 GHG Emission Reduction | 7.9% reduction (vs. 2022 baseline) |

| Waste Management | E-waste Recycling | Significant volume of old equipment recycled |

| Biodiversity Preservation | Mangrove Planting | Over 100,000 saplings planted |

| Green Data Centers | Renewable Energy Integration | Commitment to increased solar power usage |

| Community Engagement | Community Greening Projects | 15% increase in projects (2024); >5,000 participants |

PESTLE Analysis Data Sources

Our Telkom Indonesia PESTLE Analysis is built upon a robust foundation of data from official government publications, reputable financial institutions like the World Bank and IMF, and leading industry research firms. This ensures comprehensive coverage of political stability, economic trends, and regulatory changes impacting the Indonesian telecommunications sector.