Telkom Indonesia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telkom Indonesia Bundle

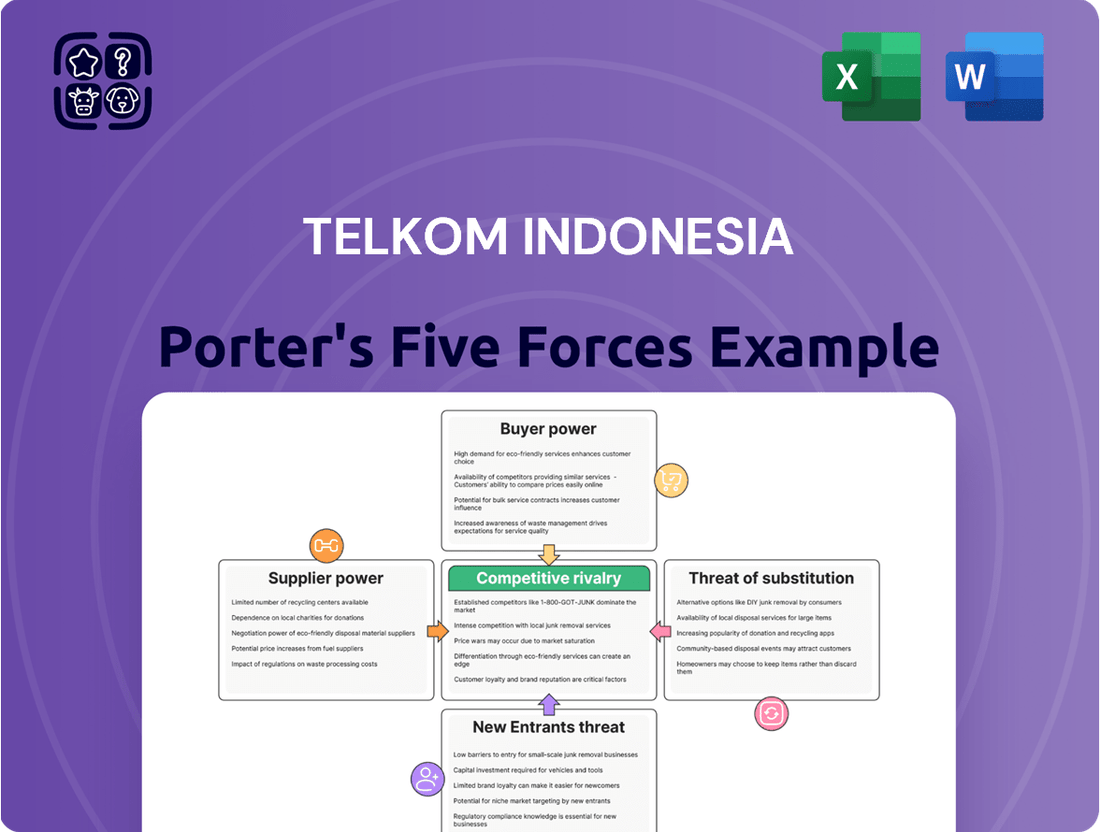

Telkom Indonesia navigates a dynamic telecom landscape where intense rivalry shapes market strategies. Understanding the bargaining power of its buyers and the growing threat of substitutes are crucial for sustained growth. The influence of suppliers, while present, is often managed through scale and strategic partnerships within this sector.

The complete report reveals the real forces shaping Telkom Indonesia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key suppliers significantly impacts Telkom Indonesia's bargaining power. The telecommunications sector depends on a limited number of global providers for essential network components like 5G infrastructure and fiber optic cables. This reliance grants considerable leverage to major players such as Ericsson, Huawei, and Nokia, as Telkom has few viable alternatives for acquiring specialized, high-quality equipment.

These leading suppliers often hold patents and proprietary technology, which further restricts Telkom's ability to switch or negotiate favorable terms. For instance, in 2023, the global market for 5G network infrastructure saw a high degree of supplier concentration, with the top three vendors accounting for a substantial share of global deployments. This underscores the limited bargaining power Telkom Indonesia possesses when procuring such critical technologies.

Telkom Indonesia faces significant bargaining power from its network equipment suppliers due to high switching costs. These costs encompass the substantial expenses associated with retraining staff, integrating new technological systems, and managing potential disruptions to service during a transition. For example, a significant shift in network infrastructure could involve millions in capital expenditure and extended downtime, making it economically unfeasible for Telkom to frequently change providers.

The embedded nature of current technology further solidifies supplier relationships. Telkom's reliance on specialized equipment, often with proprietary software and hardware, means that replacing one vendor’s system requires a complete overhaul, not just a simple swap. This deep integration limits Telkom's ability to negotiate aggressively on price or terms, as the cost and complexity of switching are prohibitive.

Furthermore, long-term contracts are a common feature in the telecommunications industry, locking Telkom into existing supplier agreements. These agreements often include clauses for ongoing support, maintenance, and future upgrades, all of which are difficult and costly to replicate with a new supplier. This dependence inherently strengthens the suppliers’ position in any negotiation.

Suppliers providing advanced technology, like 5G base stations or intricate data center hardware, possess significant leverage. These are not commodities; their specialized nature and the high cost of developing such technology create substantial barriers for new entrants, limiting Telkom's options for sourcing these critical components.

The uniqueness of these inputs directly impacts Telkom's ability to maintain and upgrade its network infrastructure. For instance, the development and rollout of 5G technology rely heavily on a few key global manufacturers of base station equipment, whose proprietary designs and advanced capabilities are essential for achieving desired network performance.

Consequently, Telkom Indonesia, like other major telecommunications providers, faces a situation where these specialized technology suppliers hold considerable bargaining power. This power stems from the difficulty Telkom would encounter in finding comparable alternatives, which could lead to higher component costs or potential delays in network modernization efforts.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Telkom Indonesia, while generally low, represents a potential bargaining chip for key technology providers. Imagine a major network equipment manufacturer deciding to offer their own connectivity services directly to consumers or businesses in Indonesia. This would be a significant undertaking, requiring substantial capital investment and navigating Indonesia's complex regulatory landscape. However, the mere possibility, however distant, of such a move could empower these suppliers during contract negotiations with Telkom, as they could potentially bypass the operator.

This strategic consideration directly impacts how Telkom manages its vendor relationships and procurement strategies. For instance, Telkom's reliance on a few dominant global suppliers for critical infrastructure, such as 5G network components, means that any shift in supplier strategy could have significant implications. In 2024, the Indonesian telecommunications market continued to see substantial investment in network expansion, with companies like Telkom investing heavily. This ongoing investment cycle underscores the importance of maintaining stable and favorable supplier agreements, as the cost of equipment and technology plays a crucial role in overall operational expenditure.

- Low Likelihood: Forward integration by technology suppliers into service provision in Indonesia is capital-intensive and subject to strict regulatory oversight, making it a rare occurrence.

- Potential Leverage: The theoretical ability of a supplier to bypass Telkom and offer services directly grants them a degree of leverage in pricing and contract term negotiations.

- Strategic Impact: This threat influences Telkom's approach to vendor management, encouraging diversification and robust contract structuring to mitigate supplier power.

- Market Context: In 2024, Indonesia's burgeoning digital economy and ongoing 5G rollout mean that reliable, cost-effective supplier partnerships are paramount for Telkom's growth and service delivery.

Importance of Telkom to Suppliers

Telkom Indonesia, as the dominant telecommunications provider in Indonesia, wields considerable influence over its suppliers. Its substantial purchasing volume, particularly for critical infrastructure like 5G network expansion and data center development, makes it an indispensable client for many global equipment and software vendors. For instance, in 2024, Telkom continued its aggressive 5G deployment, requiring significant capital expenditure on network hardware and software, which translates to substantial orders for its suppliers.

This immense market presence offers Telkom a degree of leverage. Suppliers are keen to secure and maintain contracts with such a large-scale operator, potentially leading them to offer more competitive pricing and favorable terms. The strategic importance of the Indonesian market for many international technology firms further bolsters Telkom's negotiating position.

However, the bargaining power of suppliers can be influenced by the uniqueness and proprietary nature of their offerings. If Telkom relies on highly specialized or patented technology that few other suppliers can provide, the suppliers' power increases. Conversely, for more commoditized components, Telkom can more easily switch suppliers, thereby diminishing supplier power.

- Telkom's 2024 Capital Expenditure: Telkom Indonesia's significant investments in network upgrades, including 5G and fiber optic expansion, represented billions of dollars in procurement opportunities for its suppliers.

- Market Dependence: For global technology firms, securing a large contract with Telkom can be a crucial driver of revenue and market share in Southeast Asia.

- Supplier Specialization: The degree to which suppliers offer unique or patented technologies directly impacts their bargaining power with Telkom.

The bargaining power of suppliers for Telkom Indonesia is considerable, primarily due to the specialized nature of telecommunications equipment and the limited number of global manufacturers capable of producing it. This concentration of suppliers, such as those providing advanced 5G infrastructure, means Telkom has few alternatives, granting these vendors significant leverage in negotiations.

High switching costs further empower suppliers. For Telkom, changing network equipment providers involves substantial expenses in retraining, system integration, and potential service disruptions, making such transitions economically unviable. This deep integration of proprietary technology makes it difficult for Telkom to negotiate aggressively, as the cost and complexity of switching are prohibitive.

While Telkom's substantial purchasing power can mitigate supplier influence, the uniqueness of essential inputs like patented 5G technology limits its negotiating edge. In 2024, Telkom's continued investment in network expansion, estimated in the billions of dollars, highlighted the critical need for stable supplier relationships, even with the inherent power imbalance.

| Factor | Impact on Telkom Indonesia | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | High; Limited alternative providers for specialized tech. | Dominance of Ericsson, Huawei, Nokia in 5G infrastructure procurement. |

| Switching Costs | High; Significant financial and operational barriers to changing vendors. | Costs associated with integrating new network hardware and software systems. |

| Uniqueness of Inputs | High; Proprietary technology and patents restrict options. | Reliance on specific manufacturers for advanced 5G base station components. |

| Telkom's Purchasing Power | Moderate; Large order volumes offer some negotiation leverage. | Telkom's 2024 capital expenditure for network upgrades created significant demand for suppliers. |

What is included in the product

Telkom Indonesia's Porter's Five Forces analysis reveals intense industry rivalry and significant buyer bargaining power, while highlighting moderate threats from new entrants and substitutes, and low supplier power.

Effortlessly identify and mitigate competitive threats in the Indonesian telecommunications market by visualizing Telkom's Porter's Five Forces with customizable intensity sliders.

Customers Bargaining Power

Telkom Indonesia benefits from a massive and varied customer base, encompassing individual users, businesses of all sizes, and government organizations throughout Indonesia.

In 2024, Telkomsel alone boasted around 159.4 million mobile subscribers, highlighting the sheer scale of Telkom's reach. This extensive customer pool significantly weakens the bargaining power of any single customer or small group.

The diversity of its clientele, from everyday consumers to large corporations and public sector bodies, further fragments customer influence. This broad distribution means individual customers have limited leverage to negotiate lower prices or demand highly specialized services.

For mobile services in Indonesia, customer switching costs are notably low. The implementation of mobile number portability allows customers to retain their existing numbers even when changing operators, significantly reducing a major barrier to switching. This ease of transition directly empowers customers.

With numerous mobile network operators vying for market share, including giants like Telkomsel (a subsidiary of Telkom Indonesia), Indosat Ooredoo Hutchison, and XL Axiata, the competitive landscape is fierce. Customers can easily compare and move to providers offering better pricing or superior service bundles. For instance, in 2024, Indonesia's mobile market penetration remained high, with millions of potential customers actively seeking value.

This low switching cost translates into substantial bargaining power for customers. They can readily switch to a competitor if they perceive a better deal or a more attractive service offering. This dynamic forces Telkom Indonesia to remain highly competitive on pricing and to continually innovate its service packages to retain its subscriber base.

The Indonesian consumer market exhibits strong price sensitivity, especially for mobile data and voice services. This sensitivity fuels aggressive price wars among telecommunications providers, forcing companies to compete heavily on cost. For instance, Telkomsel's average revenue per user (ARPU) for its mobile segment saw a decline in 2024, a clear signal that customers are responding to lower-priced plans and promotional offers.

Availability of Alternatives

Customers in Indonesia's telecommunications sector possess significant bargaining power due to the availability of numerous strong alternatives. Major competitors like Indosat Ooredoo Hutchison and XL Axiata actively vie for market share, offering diverse plans and services that empower consumers to switch providers if dissatisfied with Telkom Indonesia. This competitive landscape means customers can readily compare pricing, network coverage, and service quality, placing pressure on Telkom Indonesia to remain competitive.

While market consolidation has reduced the number of dominant players, intense competition remains a defining characteristic. For instance, as of early 2024, the Indonesian mobile market sees Indosat Ooredoo Hutchison and XL Axiata as formidable rivals, often engaging in aggressive pricing strategies. Furthermore, the emergence of new entrants, such as Starlink, particularly in providing satellite-based internet services, introduces yet another layer of alternative solutions, especially for customers in previously underserved or remote regions. This broad spectrum of choices directly amplifies the bargaining power of customers.

The competitive dynamics can be summarized by the following:

- Intense Rivalry: Indosat Ooredoo Hutchison and XL Axiata offer competitive pricing and services, giving customers ample choice.

- Market Dynamics: Despite consolidation, the remaining major players maintain strong competitive stances, benefiting consumers.

- Emerging Alternatives: New technologies and service providers, like satellite internet, expand customer options and increase their leverage.

Fixed-Mobile Convergence (FMC) Strategy

Telkom Indonesia's Fixed-Mobile Convergence (FMC) strategy directly addresses the bargaining power of customers by integrating its IndiHome fixed broadband with Telkomsel's mobile services. This bundling creates a more comprehensive and sticky offering, making it less attractive for customers to switch providers. The objective is to lock in customers by increasing the perceived value and convenience of a unified service package, thereby diminishing their leverage to demand lower prices or better terms.

This strategic move aims to foster greater customer loyalty and retention. By offering a seamless experience across both fixed and mobile platforms, Telkom reduces the likelihood of customers seeking services from competing, single-service providers. This increased stickiness is a key mechanism for counteracting customer bargaining power, as it raises the costs and inconvenience associated with switching.

The success of this strategy is evident in its adoption rates. For instance, by the end of 2023, Telkom reported a significant increase in converged users, highlighting the market's positive reception to bundled offerings. This growing base of converged customers signifies a tangible reduction in the overall bargaining power of the customer base as a whole, as more are tied into the ecosystem.

- Increased Customer Loyalty: FMC strengthens customer relationships by providing a single, integrated solution for communication and entertainment needs.

- Higher Switching Costs: Bundled services make it more complex and potentially expensive for customers to migrate to a competitor, thus reducing their leverage.

- Enhanced Stickiness: The convenience and value proposition of converged services encourage customers to stay with Telkom, increasing retention rates.

- Market Penetration Growth: Telkom's FMC strategy has contributed to an increase in penetration for both fixed and mobile services, demonstrating its effectiveness in capturing and retaining subscribers.

Customers in Indonesia's telecommunications market wield considerable bargaining power. This is primarily due to the presence of numerous strong competitors like Indosat Ooredoo Hutchison and XL Axiata, who actively offer competitive pricing and diverse service packages. This intense rivalry, evident in 2024 with significant market penetration and ongoing price competition, allows customers to easily switch providers if they find better value or service elsewhere. Telkom's average revenue per user (ARPU) decline in 2024 further illustrates customer price sensitivity and their ability to influence pricing through provider choice.

| Competitor | 2024 Subscriber Base (Approx.) | Key Offerings |

|---|---|---|

| Telkomsel (Telkom Indonesia) | 159.4 million (mobile) | Extensive network, bundled FMC services |

| Indosat Ooredoo Hutchison | ~100 million+ (combined) | Aggressive pricing, diverse data plans |

| XL Axiata | ~55 million+ | Competitive data packages, digital services |

What You See Is What You Get

Telkom Indonesia Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Telkom Indonesia Porter's Five Forces Analysis detailed here thoroughly examines competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products, offering a strategic overview of the Indonesian telecommunications market.

Rivalry Among Competitors

The Indonesian telecommunications landscape is highly concentrated, with Telkomsel, Indosat Ooredoo Hutchison, and XL Axiata dominating the market. This oligopolistic structure fuels aggressive competition as these three giants vie fiercely for subscribers and market share. Telkomsel, while a leader, faces significant pressure from its well-capitalized rivals.

The telecommunications sector in Indonesia is marked by intense competition, leading to frequent price wars, especially within the mobile and fixed broadband services. This aggressive pricing directly impacts the average revenue per user (ARPU), squeezing profitability for all players.

Telkom Indonesia's mobile ARPU saw a decline in 2024, a clear indicator of the prevailing competitive pricing landscape. This trend highlights the pressure on operators to offer more for less.

Despite these challenges, there were encouraging signs of ARPU recovery towards the end of 2024. This rebound is attributed to strategic pricing adjustments and a degree of market consolidation, though the underlying competitive pressure continues to be a significant factor.

Strategic mergers and consolidation are significantly altering the competitive dynamics within Indonesia's telecommunications sector. The anticipated merger between XL Axiata and Smartfren, for instance, signals a shift towards a more concentrated market, potentially reducing the number of aggressive competitors and fostering a healthier competitive environment. This consolidation is projected to have a positive impact on Average Revenue Per User (ARPU), as fewer players may engage in price wars.

Telkom Indonesia has proactively responded to these shifts by integrating its IndiHome fixed broadband service into Telkomsel, its mobile arm. This strategic move aims to bolster Telkomsel's competitive standing by offering a more comprehensive and integrated service portfolio to consumers. This integration is crucial for Telkom to maintain its market leadership amidst the evolving industry landscape, especially with the potential of a three-major-player market emerging.

Focus on Digital Transformation and Infrastructure Investment

Competitive rivalry within Indonesia's telecommunications sector is intensifying, driven by a strong focus on digital transformation and significant infrastructure investment. Telkom Indonesia and its rivals are locked in a race to upgrade networks, expand digital services, and build robust digital ecosystems.

This strategic shift means competition is no longer solely about basic connectivity or price. Companies are differentiating themselves through advanced offerings like 5G deployment, cloud services, and the development of various digital platforms. For example, Telkomsel, a subsidiary of Telkom Indonesia, has been a key player in 5G rollout, aiming to provide faster speeds and new service possibilities.

- Digital Transformation Focus: Competitors are heavily investing in upgrading their digital capabilities and services beyond traditional mobile and fixed-line offerings.

- 5G Infrastructure Race: Significant capital expenditure is being directed towards the deployment of 5G networks across major Indonesian cities and key economic zones.

- Data Center Expansion: Companies are building and expanding data centers to support cloud services and the growing demand for digital storage and processing.

- Value-Added Services: The competitive edge is increasingly found in innovative digital services, such as IoT solutions, fintech, and digital media platforms.

This strategic alignment towards digital infrastructure and services is a critical factor shaping the competitive landscape. Telkom Indonesia, for instance, has been actively involved in building a comprehensive digital ecosystem, including investments in data centers and digital content. In 2023, Telkom Indonesia reported significant progress in its digital transformation initiatives, with its digital business contributing substantially to its overall revenue.

Geographic and Service Segment Competition

While Telkomsel, a subsidiary of Telkom Indonesia, enjoys a robust footprint in Indonesia's rural and remote regions, the competitive landscape is heating up significantly in urban centers, particularly concerning the rollout of 5G services. This intensified rivalry is also evident in the fixed broadband market, with competition extending beyond the more developed island of Java.

Competitors are actively investing in expanding their network infrastructure and broadening their digital service portfolios. This strategic push creates a multifaceted competitive environment, with battles playing out across various geographic areas and service segments, encompassing mobile, fixed-line, and enterprise-focused solutions.

- Intensifying 5G Race: Urban areas are witnessing fierce competition for 5G deployment, demanding significant capital expenditure and rapid innovation from players like Telkomsel.

- Fixed Broadband Expansion: Beyond Java, competitors are aggressively expanding their fixed broadband networks, challenging Telkomsel's market share in these growing regions. For instance, in 2024, the Indonesian government continued to push for digital infrastructure development, encouraging private sector investment in broadband expansion to previously underserved areas.

- Diversified Service Offerings: The competitive battlegrounds are not limited to just mobile connectivity; they extend to enterprise solutions and digital services, requiring Telkomsel to offer integrated and advanced solutions to retain and attract customers.

Competitive rivalry in Indonesia's telecommunications sector is intense, with Telkom Indonesia, through its subsidiary Telkomsel, facing strong opposition from Indosat Ooredoo Hutchison and XL Axiata. This dynamic is further shaped by potential consolidations, like the proposed XL Axiata-Smartfren merger, which could reshape the market structure.

The competition extends beyond basic connectivity, focusing heavily on digital transformation, 5G deployment, and expanding digital service portfolios. Telkom Indonesia's integration of IndiHome into Telkomsel is a strategic move to enhance its competitive offering in this evolving landscape.

Price wars, particularly in mobile and fixed broadband, continue to pressure Average Revenue Per User (ARPU). While a slight ARPU recovery was observed in late 2024 due to strategic pricing, the underlying competitive intensity remains high, especially in urban areas and for 5G services.

The government's push for digital infrastructure development in 2024 also fuels this rivalry, encouraging private sector investment in broadband expansion to new regions, thereby intensifying competition beyond traditional strongholds.

| Key Competitors | Market Position (Approx.) | Key Competitive Strategies |

|---|---|---|

| Telkomsel (Telkom Indonesia) | Market Leader (Mobile & Fixed) | Digital transformation, 5G rollout, IndiHome integration, rural network strength |

| Indosat Ooredoo Hutchison | Strong Challenger | Network expansion, competitive pricing, digital services |

| XL Axiata | Major Player | Digital service enhancement, potential merger with Smartfren, 5G expansion |

SSubstitutes Threaten

Over-the-top (OTT) services, such as WhatsApp for messaging and Zoom for video conferencing, directly challenge Telkom Indonesia's traditional revenue streams by offering readily available alternatives to voice calls and SMS. These platforms, which rely on the internet infrastructure Telkom provides, siphon off demand from legacy services, impacting Telkom's profitability in these areas.

The growing adoption of OTT services like Netflix also substitutes for bundled television packages, further pressuring Telkom's media and entertainment offerings. This trend is particularly pronounced in Indonesia, where mobile internet penetration continues to climb, enabling wider access to these competing platforms.

In 2023, Indonesia's digital economy was valued at approximately $153 billion, with a significant portion driven by internet-based services, highlighting the substantial shift in consumer behavior towards OTT platforms. This underscores the increasing threat of substitutes as consumers opt for more flexible and often lower-cost digital communication and entertainment solutions.

The growing availability of satellite internet services, notably from providers like Starlink, presents a significant threat to Telkom Indonesia. This is especially true in remote and underserved regions where building traditional fiber optic or mobile infrastructure is costly and challenging.

Starlink's ability to deliver high-speed internet from virtually anywhere directly challenges Telkom's reach in these less-connected areas. This could lead to a gradual erosion of Telkom's market share in rural geographies.

The competitive pressure from satellite providers may force Telkom to reconsider its pricing strategies for existing services, particularly in areas where satellite options become a viable alternative.

As of early 2024, Starlink has expanded its service availability to numerous countries, and its continued global rollout signifies a persistent and increasing threat to incumbent telecom operators worldwide, including Telkom Indonesia.

The increasing prevalence of free public Wi-Fi hotspots in cafes, malls, and transportation hubs presents a viable substitute for Telkom Indonesia's mobile data services. In 2024, a significant portion of urban Indonesians rely on these readily available networks for their daily internet needs, potentially dampening demand for Telkom's cellular data plans. Furthermore, the emerging trend of community-driven mesh networks, though still nascent, offers another layer of substitute connectivity, particularly in densely populated areas.

Direct-to-Device Satellite Connectivity

The emergence of direct-to-device satellite connectivity presents a potential long-term substitute threat to Telkom Indonesia's traditional mobile services. Technologies like 5G Non-Terrestrial Networks (NTNs) and satellite providers such as AST SpaceMobile and Lynk are developing capabilities to connect smartphones directly to orbiting satellites, bypassing terrestrial infrastructure entirely.

While this technology is still in its early stages, its eventual widespread adoption could significantly alter the competitive landscape. For instance, AST SpaceMobile aims to provide seamless connectivity across the globe, directly from standard mobile phones, a capability that could directly challenge mobile network operators. This innovation means users could potentially access mobile services without needing specialized hardware or relying on existing cell towers, especially in remote or underserved areas.

- Technological Advancement: 5G NTN and direct-to-device satellite communication are poised to offer a new paradigm for mobile connectivity.

- Market Disruption Potential: Companies like AST SpaceMobile are actively working to enable direct satellite connections for standard smartphones.

- Geographical Reach: Satellite-based solutions can offer coverage in areas where traditional cellular networks are absent or uneconomical to deploy.

- Competitive Threat: This emerging technology represents a viable alternative for consumers, potentially reducing reliance on established mobile network operators.

Alternative Connectivity Technologies

Emerging connectivity options pose a significant threat. Fixed wireless access (FWA), particularly leveraging 5G, offers a viable substitute for traditional fixed-line broadband in many regions. This technology bypasses the need for extensive physical infrastructure, making it a faster and sometimes more cost-effective deployment for consumers and businesses alike.

Telkom Indonesia must remain agile in its service development to address these evolving alternatives. The increasing availability and performance of wireless solutions mean customers have more choices than ever before. For instance, by the end of 2023, the global FWA market was projected to reach over $60 billion, highlighting its rapid growth and competitive pressure.

- Fixed Wireless Access (FWA) Growth: FWA, especially 5G-based, provides a competitive alternative to fixed-line broadband.

- Infrastructure Bypass Advantage: Wireless solutions often require less physical infrastructure, leading to quicker market penetration.

- Customer Choice Expansion: Telkom faces increased competition as customers gain access to diverse connectivity technologies.

- Adaptation Imperative: Continuous innovation in Telkom's offerings is crucial to counter the threat of substitutes and retain market share.

Over-the-top (OTT) services like WhatsApp and Zoom directly compete with Telkom's voice and SMS offerings, leveraging the internet infrastructure Telkom itself provides. This shift erodes revenue from traditional services. Similarly, streaming platforms like Netflix substitute for Telkom's bundled TV packages, a trend amplified by Indonesia's growing mobile internet penetration, which reached over 77% of the population in 2023.

The threat of substitutes is further amplified by emerging technologies. Satellite internet providers, such as Starlink, are expanding their reach, particularly in remote areas where traditional infrastructure is costly. By early 2024, Starlink's global expansion signifies a persistent challenge to incumbent operators. Additionally, free public Wi-Fi and the nascent development of community mesh networks offer alternatives to cellular data, especially in urban centers. By the end of 2023, the global Fixed Wireless Access (FWA) market was projected to exceed $60 billion, showcasing the rapid growth of wireless alternatives to fixed-line broadband.

Entrants Threaten

The telecommunications sector, particularly in a market like Indonesia, demands substantial upfront capital. Telkom Indonesia, for instance, has consistently invested billions of dollars annually in expanding and upgrading its network. In 2023, the company reported capital expenditure of IDR 36.9 trillion (approximately USD 2.4 billion), primarily focused on network modernization and 5G rollout.

Building out a robust infrastructure, encompassing fiber optic networks, extensive cell tower coverage, and the latest 5G technology, represents a formidable financial hurdle. The sheer scale of investment needed to replicate Telkom's existing nationwide presence makes it incredibly difficult for new entrants to compete effectively from the outset.

This high capital requirement acts as a significant deterrent, effectively limiting the number of potential new competitors. Without the financial muscle to undertake such massive infrastructure projects, any new player would struggle to offer a comparable service level and reach, thereby shielding established players like Telkom from immediate, widespread competitive pressure.

The Indonesian telecommunications sector presents a formidable barrier to new entrants due to its complex regulatory environment and stringent licensing requirements. Obtaining necessary permits for spectrum allocation, network operations, and service provision involves navigating a labyrinth of rules and procedures.

Recent regulatory updates in 2024 and upcoming changes in 2025, specifically concerning the certification of telecommunication equipment, further elevate this complexity. These evolving standards demand significant investment in compliance and technical expertise, making market entry a challenging proposition.

Successfully securing these essential licenses and approvals requires substantial time, financial resources, and specialized legal and technical knowledge, thereby deterring potential new competitors from entering the market and challenging established players like Telkom Indonesia.

Existing players like Telkom Indonesia benefit from significant economies of scale. For instance, in 2023, Telkom Indonesia’s capital expenditure of Rp 29.7 trillion was largely directed towards network expansion and upgrades, allowing them to spread infrastructure costs across a vast customer base. This scale makes it harder for newcomers to match their per-unit cost efficiency in network operation and procurement.

Furthermore, Telkom Indonesia enjoys robust network effects. With millions of active subscribers, the value of their service increases for each user as more people join. This creates a substantial barrier to entry, as a new entrant would need to achieve critical mass quickly to offer comparable value and reach, a challenge compounded by Telkom’s established market presence and subscriber loyalty.

Brand Loyalty and Established Distribution Channels

Telkom Indonesia, through its primary brand and subsidiaries like Telkomsel, has cultivated deep-rooted brand loyalty and trust among Indonesian consumers over many years. This strong brand equity makes it challenging for new players to attract and retain customers. For instance, Telkomsel consistently holds a dominant position in subscriber market share, reporting over 160 million subscribers as of early 2024, a testament to its established customer base.

Furthermore, Telkom Indonesia benefits from an expansive and well-entrenched distribution network that spans the entirety of the Indonesian archipelago, reaching even remote areas. Replicating this extensive reach, which includes thousands of physical outlets and digital touchpoints, presents a significant hurdle for any new entrant. Building a comparable distribution infrastructure would require substantial capital investment and time, creating a formidable barrier to entry.

- Brand Recognition: Telkomsel's consistent market leadership, with subscriber numbers exceeding 160 million in early 2024, highlights its strong brand loyalty.

- Distribution Network: Telkom Indonesia's vast physical and digital distribution channels across Indonesia represent a significant competitive advantage.

- Customer Acquisition Cost: New entrants would face high costs to build brand awareness and acquire customers against Telkom's established presence.

Incumbent Retaliation and Strategic Responses

Existing players, particularly Telkom as the dominant market leader, wield considerable resources and capabilities to discourage new entrants. They are well-positioned to retaliate through aggressive pricing strategies, the introduction of bundled services such as Fixed-Mobile Convergence (FMC), swift network expansion initiatives, and the development of innovative digital services. These actions collectively create significant hurdles for any new company attempting to gain a foothold in the market.

Telkom's strategic initiatives, such as its '5 Bold Moves' program, are specifically designed to solidify its competitive standing and further erect barriers to entry. This proactive approach aims to enhance customer loyalty, optimize operational efficiency, and expand its digital ecosystem, making it considerably more difficult for new competitors to challenge its established position.

- Aggressive Pricing Telkom can leverage its scale to offer lower prices, squeezing the margins of potential new entrants.

- Bundled Services (FMC) Offering integrated fixed and mobile services increases customer stickiness and switching costs.

- Rapid Network Expansion Continuous investment in network infrastructure, including 5G, makes it costly for newcomers to match coverage and quality.

- Digital Service Innovation Launching new digital products and services creates additional value for existing customers and diversifies revenue streams, presenting a moving target for new players.

The threat of new entrants in Indonesia's telecommunications sector is significantly mitigated by immense capital requirements for infrastructure development. Telkom Indonesia's 2023 capital expenditure of IDR 36.9 trillion, primarily for network modernization and 5G, exemplifies this barrier, making it extremely difficult for newcomers to establish comparable nationwide coverage and service quality.

Navigating Indonesia's complex regulatory landscape and stringent licensing procedures further deters new players. Requirements for spectrum allocation and network operations demand substantial time, financial resources, and specialized expertise, creating a formidable entry hurdle as seen with evolving equipment certification standards in 2024 and 2025.

Telkom Indonesia's established economies of scale, evidenced by its vast subscriber base and network effects, create a powerful deterrent. With over 160 million subscribers for Telkomsel in early 2024, the value proposition for existing customers is high, and new entrants would struggle to achieve the critical mass needed to compete effectively.

The company's strong brand loyalty, cultivated over years, and its extensive distribution network across the Indonesian archipelago are significant barriers. Replicating Telkom's deep customer trust and widespread physical and digital touchpoints would demand considerable investment and time, effectively limiting the threat of new market entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Telkom Indonesia leverages data from Telkom's annual reports, financial statements, and investor relations disclosures. We also incorporate insights from industry research firms, market share reports, and telecommunications regulatory filings.