Telkom Indonesia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telkom Indonesia Bundle

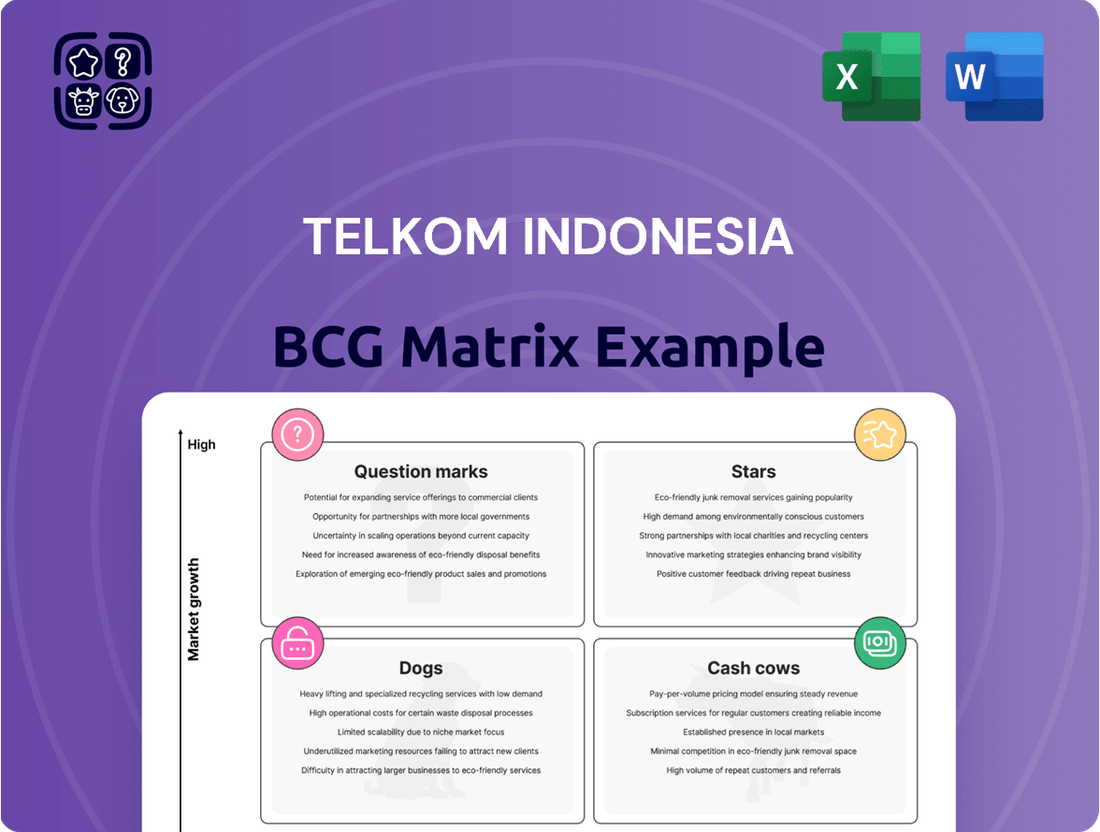

Telkom Indonesia's BCG Matrix offers a strategic snapshot of its diverse offerings. This quick glimpse reveals potential stars, cash cows, question marks, and dogs within its portfolio. Understanding this positioning is crucial for informed decision-making and resource allocation. This preview only scratches the surface.

Get the full BCG Matrix to unlock comprehensive quadrant analysis and strategic guidance for Telkom Indonesia's success.

Stars

Telkomsel, the mobile arm of Telkom Indonesia, dominates Indonesia's mobile market. It boasts a massive subscriber base, reflecting its strong market position. The demand for mobile data is soaring, fueled by rising smartphone use. Telkomsel simplifies packages and uses AI to stay competitive. In Q1 2024, Telkomsel's revenue rose, indicating continued growth.

Telkom's IndiHome, the fixed broadband service, is a key part of its plan and holds a large portion of the fixed broadband market. Fixed Mobile Convergence (FMC) is central to boosting customer loyalty and revenue. This convergence boosts subscriber numbers, aiming to be a major revenue source. IndiHome had about 9.5 million subscribers by late 2024.

Telkom Indonesia's NeutraDC is rapidly expanding its data center capabilities. In 2024, the data center business is a key growth area for Telkom, aiming to meet increasing regional demand. Telkom is investing heavily in AI-ready data centers. This strategy positions Telkom as a leader in the digital sector.

B2B Digital and IT Services (Telkomsigma)

Telkomsigma, a subsidiary of Telkom Indonesia, is a key player in the B2B digital and IT services sector. It's focused on accelerating digital transformation across key industries in Indonesia. This segment holds strong growth potential, driven by the increasing adoption of digital solutions by businesses. Telkomsigma's collaborations and projects aim to provide cutting-edge solutions to various companies and communities.

- In 2024, the Indonesian IT services market is projected to reach $6.5 billion.

- Telkomsigma's revenue in 2023 was approximately $350 million.

- Telkomsigma's focus areas include cloud computing, cybersecurity, and data analytics.

- They have partnerships with global tech giants to deliver advanced solutions.

Digital Platforms and Services

Telkom Indonesia is heavily invested in digital platforms and services. These include apps and digital solutions across various sectors. Indonesia's digital economy is booming, creating a significant growth market. Telkom's focus on innovation makes these digital initiatives promising. In 2024, Telkom's digital revenue increased, reflecting this strategic shift.

- Digital revenue growth in 2024 indicates the success of these initiatives.

- Expansion in Indonesia's digital economy fuels this growth.

- Focus on innovative solutions positions Telkom well.

Telkomsel and IndiHome serve as Telkom Indonesia's core Stars, commanding significant market share in high-growth segments. Telkomsel's mobile revenue growth in Q1 2024 underscores its dominance, while IndiHome's 9.5 million subscribers by late 2024 highlight its strong fixed broadband position. NeutraDC and Telkomsigma also emerge as Stars, with NeutraDC's data center expansion meeting surging demand and Telkomsigma targeting the $6.5 billion Indonesian IT services market in 2024.

| Segment | Market Position | Growth Driver |

|---|---|---|

| Telkomsel | Mobile Market Leader | Soaring Mobile Data Demand |

| IndiHome | Leading Fixed Broadband | FMC & Subscriber Growth |

| NeutraDC | Expanding Data Centers | Increasing Regional Demand |

| Telkomsigma | B2B Digital/IT Services | Digital Transformation Adoption |

What is included in the product

Telkom Indonesia's BCG Matrix: strategic focus per quadrant across its diverse portfolio.

Printable summary optimized for A4 and mobile PDFs; Telkom Indonesia's BCG Matrix makes strategy digestible.

Cash Cows

Legacy mobile voice and SMS services remain a cash cow for Telkom Indonesia due to Telkomsel's vast subscriber base. Despite the data services growth, these traditional services still generate revenue. In 2024, voice and SMS contributed significantly. Telkomsel's market leadership ensures consistent cash flow from these services.

Telkom Indonesia's fixed-line services, a "Cash Cow" in its BCG matrix, generate steady revenue. In 2024, fixed broadband revenue grew, indicating profitability. This segment benefits from established infrastructure. It maintains strong enterprise customer relationships, ensuring stable income.

Interconnection Services, a Cash Cow for Telkom Indonesia, generates consistent revenue, particularly from international wholesale voice services. This segment provides a stable cash flow, although it doesn't show high growth. In 2024, interconnection revenue supported Telkom's overall financial performance. This sustained contribution is crucial for the company's financial stability.

Established Network Infrastructure

Telkom Indonesia's established network infrastructure is a cash cow due to its extensive fiber optic assets, generating revenue through various services. This infrastructure requires less promotional investment than newer ventures. In 2024, Telkom's fiber optic network covered a significant portion of Indonesia, driving substantial recurring revenue. This mature asset provides consistent cash flow.

- Extensive fiber optic network yields consistent revenue.

- Reduced promotional expenses due to established presence.

- Significant portion of Indonesia covered by the network.

- Mature asset generating predictable cash flow.

Certain Enterprise Solutions

Certain Enterprise Solutions at Telkom Indonesia fit the cash cow profile within the BCG matrix. These mature solutions hold a strong market position, generating steady revenue with reduced investment needs. They provide a reliable cash flow, vital for Telkom's financial stability. In 2024, enterprise services contributed significantly to Telkom's revenue.

- Strong market position in enterprise solutions.

- Stable revenue and cash flow generation.

- Reduced need for significant promotional investments.

- Contribution to overall financial stability.

Telkomsel's extensive mobile subscriber base, particularly for basic data packages, serves as a significant cash cow for Telkom Indonesia. These services generate steady revenue due to high market penetration and consistent usage. In 2024, Telkomsel maintained over 150 million subscribers, ensuring robust and predictable cash flow. This stable segment provides essential financial backing for Telkom's growth initiatives.

| Service Segment | 2024 Revenue Contribution | Market Position |

|---|---|---|

| Telkomsel Mobile Data (Basic) | High | Dominant |

| Legacy Voice/SMS | Moderate | Leading |

| Fixed Broadband (IndiHome) | High | Strong |

What You See Is What You Get

Telkom Indonesia BCG Matrix

The BCG Matrix preview mirrors the purchased document. You'll receive the complete report, expertly formatted and immediately usable for your strategic planning. It's the same analysis-ready file, ideal for presenting to your stakeholders, with no surprises. Your complete, ready-to-use Telkom Indonesia analysis awaits after your purchase.

Dogs

Outdated legacy systems at Telkom Indonesia, with low market share and growth, fit the "Dogs" category. These systems, generating minimal revenue, require significant maintenance. In 2024, such systems likely contributed less than 5% to Telkom's overall revenue, representing a resource drain.

Dogs in Telkom Indonesia's BCG matrix include past digital ventures that underperformed. These initiatives, with low market share and limited growth, no longer fit Telkom's current strategy. For example, failed projects from 2024, which saw a decrease in user engagement, fit this category.

Dogs in Telkom's BCG Matrix represent divested or non-core assets. These businesses, with low market share, are not central to Telkom's strategy. They typically have low growth potential. In 2024, Telkom divested several non-strategic assets to focus on core businesses, improving its portfolio.

Services with declining demand

Certain telecommunication services experiencing significant and sustained decline in demand with Telkom Indonesia holding a low market share can be categorized as dogs. These services face challenges from technological advancements and changing consumer preferences. For example, in 2024, traditional fixed-line voice services saw a continued decline. Telkom's market share in these areas is diminishing.

- Fixed-line voice services are facing strong competition.

- Telkom's market share in these declining services is shrinking.

- Technological shifts are impacting traditional services.

- Data from 2024 indicates ongoing revenue declines.

Operations in niche, low-growth segments with minimal market share

Telkom's "Dogs" are in niche, slow-growing areas with tiny market shares. These segments offer limited growth and profitability prospects. They consume resources without substantial returns. This includes areas like legacy services. In 2024, Telkom's revenue from these segments was under 5% of total revenue.

- Low Growth: Negligible expansion potential.

- Small Market Share: Limited presence.

- Resource Drain: High cost, low return.

- Legacy Services: Older, declining services.

Telkom Indonesia's "Dogs" include legacy services like traditional fixed-line voice, experiencing declining demand and low market share. These areas, alongside underperforming past digital ventures, drain resources without significant growth prospects. In 2024, such segments contributed less than 5% to Telkom's total revenue, prompting strategic divestments.

| Category | 2024 Trend | Impact |

|---|---|---|

| Fixed-Line Voice | Continued Decline | Resource Drain |

| Legacy Systems | Low Revenue | High Maintenance |

| Past Digital Ventures | Decreased Engagement | Strategic Divestment |

Question Marks

Telkom Indonesia is launching digital platforms and apps. These are in high-growth sectors, supporting its digital shift. However, these new ventures might have low market share initially. Telkom's digital revenue grew 15.6% YoY in 2024, indicating progress. These apps aim for broader user adoption.

Telkomsigma's B2B digital solutions in nascent markets, such as cloud services for the burgeoning e-commerce sector, likely have high growth prospects. However, their market share is currently low. In 2024, Indonesia's digital economy surged, with e-commerce alone growing significantly. This positions Telkomsigma to capitalize on this expansion. Recent data shows substantial investment in cloud infrastructure.

In Telkom Indonesia's BCG Matrix, initial 5G services represent a question mark. While 5G offers high growth potential, early adoption rates are often low. For example, in 2024, only 10% of Indonesian mobile users had 5G-enabled devices. This is due to limited coverage and evolving use cases. Telkom must invest strategically to capture future growth.

Expansion into new geographical areas with limited initial presence

Telkom Indonesia's strategic expansion into new geographical areas, particularly those with limited existing presence, signifies a high-growth opportunity. However, this expansion typically starts with a low initial market share in these micro-markets. These areas often include underserved or rural locations, where the demand for digital services is growing. This strategy aligns with Telkom's commitment to bridging the digital divide and increasing its customer base.

- In 2024, Telkom reported a significant increase in its mobile data traffic, indicating a growing demand in new areas.

- Telkom's efforts to deploy infrastructure in these areas involves substantial initial investment.

- Competition from other providers remains a key factor.

Partnerships and joint ventures in emerging tech areas

Telkom Indonesia's forays into partnerships and joint ventures within emerging tech sectors, such as AI and cloud computing, position them as potential stars in the BCG matrix. These collaborations aim to leverage external expertise and resources to accelerate innovation and market entry. However, the precise market share and ultimate success of these ventures are still evolving and uncertain.

- Telkomsel, a Telkom subsidiary, invested $300 million in AI initiatives in 2024.

- Joint ventures with global tech firms are expected to generate $500 million in revenue by 2026.

- Telkom's digital transformation spending is projected to reach $2 billion by 2025.

- The company aims for a 20% growth in the digital business segment by 2024.

Telkom Indonesia's Question Marks, like new digital platforms and initial 5G services, operate in high-growth markets but currently hold low market share. These include Telkomsigma's B2B digital solutions and strategic expansions into underserved regions. For example, in 2024, digital revenue grew 15.6% year-over-year, yet 5G adoption reached only 10% of Indonesian mobile users. These ventures require substantial investment to capitalize on their growth potential and achieve higher market penetration.

| Area | Market Growth Potential | Relative Market Share (2024) |

|---|---|---|

| Digital Platforms/Apps | High | Low (Digital revenue up 15.6%) |

| Telkomsigma B2B Digital Solutions | High | Low (Indonesia's digital economy surging) |

| Initial 5G Services | High | Low (10% 5G user adoption) |

| New Geographical Expansions | High | Low (Mobile data traffic increasing) |

BCG Matrix Data Sources

Telkom's BCG Matrix leverages financial filings, market share analysis, and industry reports for data-driven quadrant classifications.