Telefónica Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telefónica Bundle

Telefónica operates in a dynamic telecommunications landscape, constantly navigating intense rivalry among existing players. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and established infrastructure. Buyer power, particularly from large corporate clients, can exert considerable pressure on pricing and service offerings.

The bargaining power of suppliers, especially for network equipment and spectrum licenses, also shapes Telefónica's strategic options. Furthermore, the availability of substitutes, such as over-the-top communication services, continuously challenges traditional revenue streams.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Telefónica’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Telefónica's reliance on a concentrated group of global network equipment vendors, such as Ericsson, Nokia, and Huawei, significantly shapes the bargaining power of suppliers. These vendors provide essential infrastructure for Telefónica's operations, making them indispensable partners.

The highly specialized nature of network equipment, coupled with the substantial costs and technical complexities involved in switching suppliers, grants these vendors considerable leverage. This dependence means Telefónica has limited alternatives when negotiating terms for crucial network components.

In 2024, the ongoing global demand for advanced network technologies, including 5G deployments, further amplifies the bargaining power of these key suppliers. Vendors can command higher prices and dictate terms due to Telefónica's need for cutting-edge equipment to remain competitive.

Consequently, this supplier power directly influences Telefónica's capital expenditure, potentially increasing investment costs and impacting the timelines for rolling out new network services and upgrades.

Telefónica's growing digital transformation amplifies its dependence on key software and technology suppliers for critical areas like BSS/OSS, cloud infrastructure, and cybersecurity. These specialized vendors, particularly those with unique or proprietary solutions, possess significant leverage to influence pricing and contract terms.

The specialized nature of these technologies can lead to substantial switching costs for Telefónica, making it difficult and expensive to change providers. For example, migrating complex BSS/OSS systems can take years and involve millions in investment, thereby strengthening the bargaining power of incumbent suppliers.

In 2024, global IT spending by telecommunications companies was projected to reach over $300 billion, highlighting the significant market for these technology providers. Suppliers who can demonstrate superior integration capabilities or offer unique security features gain an even stronger negotiating position.

Telefónica relies heavily on content and media rights suppliers for its pay-TV and digital entertainment services. These suppliers, such as major Hollywood studios and sports leagues, hold significant sway due to the exclusive broadcasting rights and media licenses they possess. In 2024, the intense competition for premium content, particularly live sports and original series, further amplified the bargaining power of these content providers, directly impacting Telefónica's content acquisition costs.

Infrastructure Sharing and Tower Companies

Telefónica's engagement with independent tower companies and infrastructure sharing partners, while beneficial for reducing capital expenditure, shifts the company's position to that of a tenant. This reliance on third-party infrastructure can elevate the bargaining power of these specialized providers.

These infrastructure entities, often possessing high-value, scarce assets with limited substitute options, can leverage their market position to negotiate strong lease terms. This directly impacts Telefónica's operational expenditures, as rental fees become a significant cost component.

- TowerCo Dominance: In many markets, a few dominant tower companies control a significant portion of critical mobile infrastructure, concentrating bargaining power.

- Lease Renewal Leverage: As contracts approach renewal, tower companies can exploit the high switching costs for mobile operators, demanding higher rental rates.

- Limited Alternatives: The specialized nature of tower infrastructure means operators have few viable alternatives to existing providers, reinforcing supplier strength.

- 2024 Market Trends: The ongoing consolidation within the tower industry in 2024 has further concentrated ownership, potentially intensifying supplier bargaining power for operators like Telefónica.

Limited Number of Key Component Manufacturers

Telefónica's reliance on a few key component manufacturers for critical network elements, like advanced semiconductors or high-capacity optical fibers, can significantly empower these suppliers. This concentration means a small number of companies control essential inputs, giving them leverage over pricing and supply terms. For instance, in 2024, the global semiconductor shortage highlighted how dependency on a limited number of chip foundries can lead to extended lead times and increased component costs for telecommunications firms.

This supplier concentration directly impacts Telefónica's operational costs and strategic flexibility. When suppliers have substantial bargaining power, they can command higher prices for their specialized products, squeezing Telefónica's profit margins. Furthermore, a limited supplier base can create vulnerabilities in the supply chain, as disruptions from even one key manufacturer can have widespread consequences for network deployment and maintenance. Telefónica must carefully manage these relationships to mitigate risks and ensure a steady flow of necessary components.

- Concentrated Supplier Market: In 2024, the market for specialized 5G network equipment components often features a small number of dominant global players, such as Ericsson, Nokia, and Huawei, although geopolitical factors have influenced market access for some.

- Price Sensitivity: The limited competition among these suppliers allows them to set higher prices, directly increasing Telefónica's capital expenditure on network infrastructure.

- Supply Chain Risk: Disruptions at a single key supplier, whether due to production issues or trade restrictions, can significantly delay Telefónica's network upgrades and expansion plans.

- Innovation Dependence: Telefónica's ability to adopt the latest network technologies is often tied to the innovation cycles of these few component manufacturers.

Telefónica faces significant supplier bargaining power from specialized network equipment providers like Ericsson and Nokia, especially concerning 5G infrastructure. Their proprietary technology and high switching costs for Telefónica mean these suppliers can dictate terms, impacting Telefónica's capital expenditure. In 2024, the intense demand for 5G upgrades globally further solidified this supplier leverage, leading to potentially higher investment costs for the telecom giant.

| Supplier Category | Key Players (Examples) | Impact on Telefónica | 2024 Trend/Data Point |

|---|---|---|---|

| Network Equipment | Ericsson, Nokia, Huawei | High leverage due to specialized tech and switching costs; influences CapEx | Strong demand for 5G drives higher pricing from vendors. |

| Software & Technology | BSS/OSS, Cloud Providers | Significant leverage from proprietary solutions; high migration costs | Global telco IT spending projected over $300 billion in 2024. |

| Content & Media Rights | Major Studios, Sports Leagues | Exclusive rights grant considerable power; impacts content acquisition costs | Intense competition for premium content amplifies supplier leverage. |

| Infrastructure (Towers) | TowerCos | Lease terms and limited alternatives empower tower owners | Industry consolidation in 2024 may increase supplier bargaining power. |

What is included in the product

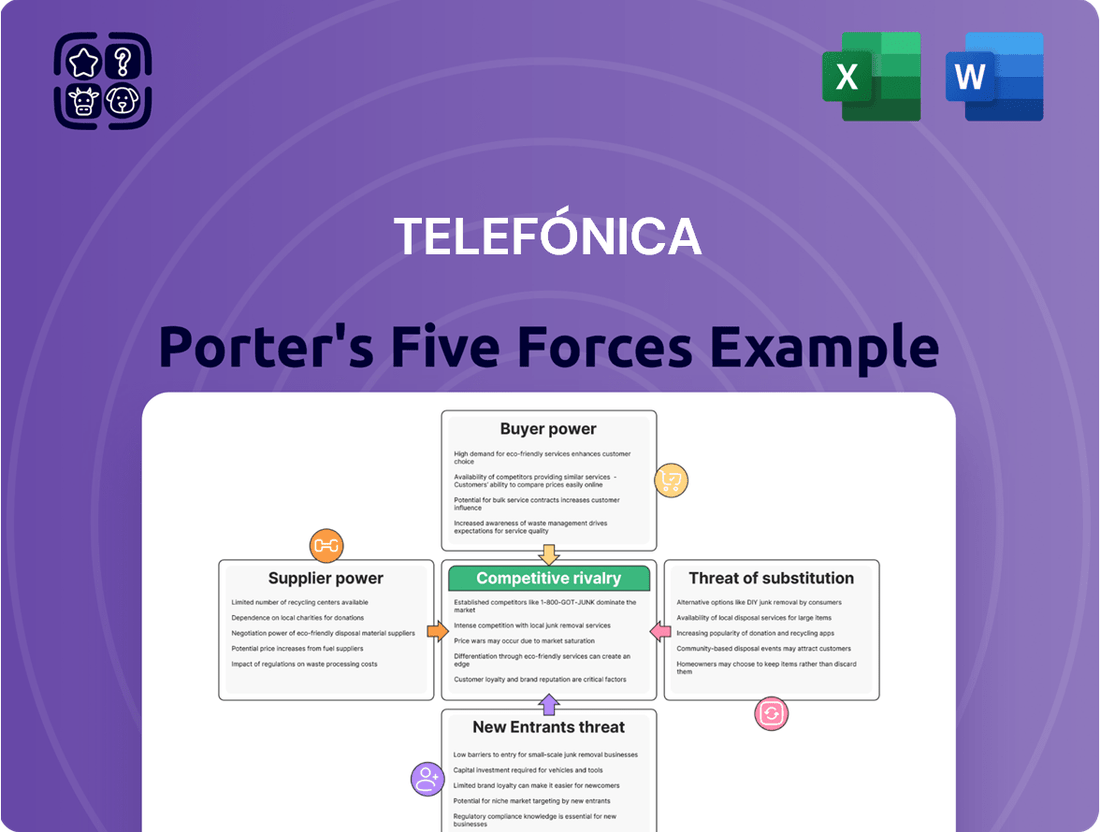

Analyzes the competitive landscape for Telefónica, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the telecommunications industry.

Effortlessly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces for Telefónica.

Customers Bargaining Power

Residential customers in the telecommunications sector are highly attuned to pricing. In 2024, the widespread availability of online comparison tools and a plethora of service providers means consumers can easily shop around for the best deals. This intense scrutiny directly impacts Telefónica's pricing power, compelling them to offer competitive rates and frequent promotions to retain and attract subscribers. The basic nature of many telecom services, like voice and data, contributes to this perception of being a commodity, further heightening price sensitivity among the general public.

The bargaining power of customers for Telefónica is significantly influenced by low switching costs across many of its services. While some contract lock-ins persist, the ease with which customers can port their mobile numbers or switch broadband providers has increased in numerous European markets. This ease of transition allows customers to readily explore and move to competitors offering more attractive pricing or enhanced service quality.

In 2024, this trend continues to exert pressure on telecommunications providers. For instance, in Spain, a key market for Telefónica, the regulatory framework often facilitates number portability within a very short timeframe, sometimes as little as 24 hours. This means Telefónica must remain highly competitive on value, offering compelling bundles and reliable service to prevent customer churn. Failing to do so allows customers to leverage competitive offers from rivals, directly impacting Telefónica's revenue and market share.

Customers can easily access online comparison websites and reviews, enabling them to make informed decisions about telecom providers. This transparency increases customer awareness of market prices and service quality, giving them stronger leverage in negotiations. Telefónica's offerings are constantly scrutinized against those of rivals, for instance, in 2024, comparison sites showed a 15% average price difference for similar mobile data plans across major European providers.

Impact of Over-the-Top (OTT) Services

The rise of Over-the-Top (OTT) services significantly amplifies customer bargaining power against traditional telecom providers like Telefónica. Services such as WhatsApp for messaging and Zoom for video calls offer compelling alternatives to standard voice and SMS plans, often at a fraction of the cost or even for free. This widespread adoption means customers can easily "unbundle" their telecommunications needs, opting for specialized OTT apps rather than comprehensive service packages.

This shift directly erodes Telefónica's ability to dictate terms for its core services. For instance, in 2024, the global monthly active users for WhatsApp surpassed 2 billion, demonstrating a massive customer base that bypasses traditional SMS. Similarly, Zoom reported over 300 million monthly meeting participants in early 2024. These figures underscore the diminished reliance on telcos for basic communication and collaboration, giving customers more leverage to demand lower prices or better value from Telefónica.

- OTT Dominance: Over 2 billion monthly active users for WhatsApp in 2024 highlights the massive customer shift away from traditional SMS.

- Cost-Effective Alternatives: Services like Zoom, with over 300 million monthly meeting participants in early 2024, provide free or low-cost communication channels, reducing dependence on telco voice plans.

- Unbundling of Services: Customers now cherry-pick communication and entertainment solutions from various OTT providers, weakening the bundled offering power of companies like Telefónica.

- Price Sensitivity: The availability of numerous free or inexpensive OTT alternatives makes customers more sensitive to pricing for traditional voice and data services.

Bundling and Multi-Service Offerings

Bundling services, while increasing customer loyalty, also heightens expectations for greater value. Telefónica's customers, accustomed to comprehensive packages, are sensitive to competitor offerings that provide more bang for their buck across multiple services. This dynamic directly impacts pricing power, as customers can leverage competitive bundles to negotiate better terms or switch their entire service portfolio.

The strategy of bundling, therefore, creates a delicate balance for Telefónica. It can foster stickiness, but it simultaneously arms customers with more leverage. If rivals present more compelling multi-service deals, customers have a clear incentive to migrate their entire telecom needs, impacting Telefónica's revenue streams significantly.

To counter this, Telefónica must engage in continuous bundle optimization. This means actively monitoring evolving customer preferences and competitive landscape to ensure its bundled offerings remain attractive and relevant. Proactive adjustments are crucial to prevent customer churn and maintain market share in a segment where switching costs can be perceived as lower when entire service packages are involved.

- Customer Expectations: Bundled services lead customers to expect greater overall value, increasing their price sensitivity.

- Competitive Switching: Attractive competitor bundles can prompt customers to switch their entire service portfolio, not just individual services.

- Bundle Optimization: Telefónica must constantly refine its bundled offerings to meet changing customer demands and deter churn.

- Value Proposition: The perceived value of Telefónica's bundles versus competitors directly influences customer retention and acquisition.

The bargaining power of Telefónica's customers is substantial, driven by the widespread availability of information and competitive alternatives. In 2024, customers can easily compare prices and services online, with an average price difference of 15% for similar mobile data plans observed among major European providers. This transparency empowers consumers, forcing Telefónica to maintain competitive pricing and offer frequent promotions to retain its subscriber base.

| Factor | Impact on Telefónica | Customer Leverage Example (2024) |

|---|---|---|

| Price Sensitivity | Forces competitive pricing and promotions. | 15% average price difference for mobile data plans across providers. |

| Low Switching Costs | Facilitates easy customer migration. | Number portability in Spain often takes as little as 24 hours. |

| OTT Services | Reduces reliance on traditional telco plans. | WhatsApp (2 billion+ users) and Zoom (300 million+ participants) offer free communication. |

| Bundled Services | Increases expectations for value, enabling easier portfolio switching. | Customers can switch entire service portfolios if competitor bundles are more attractive. |

Same Document Delivered

Telefónica Porter's Five Forces Analysis

This preview showcases the comprehensive Telefónica Porter's Five Forces Analysis, detailing the competitive landscape that Telefónica operates within. You're looking at the actual document; once your purchase is complete, you’ll receive instant access to this exact, fully formatted analysis. This includes an in-depth examination of buyer bargaining power, supplier power, the threat of new entrants, the threat of substitute products or services, and the intensity of rivalry among existing competitors. The document you see here is exactly what you’ll be able to download after payment, offering actionable insights into Telefónica's strategic positioning.

Rivalry Among Competitors

Telefónica faces incredibly stiff competition in its core European markets, which are largely saturated. Major players like Vodafone, Orange, and Deutsche Telekom are all vying for customers in countries such as Spain, Germany, and the UK. This crowded landscape naturally fuels aggressive price wars and constant efforts to differentiate through service offerings.

In 2024, the European telecom sector continues to see intense rivalry. For instance, Telefónica's Spanish operations compete directly with Vodafone Spain and Orange Spain, both of whom are actively engaged in promotional activities and network upgrades to capture market share. This dynamic means that any gains for one operator typically come directly from the customer base of another.

The pressure to innovate is relentless. Companies are investing heavily in 5G deployment and fiber optic networks, which in turn drives competition on service quality and speed. Bundling strategies, combining mobile, fixed broadband, and television services, are also a common tactic to lock in customers and increase average revenue per user (ARPU), further intensifying the competitive environment.

Telefónica navigates a fierce competitive landscape in Latin America, a region characterized by its dynamic and fragmented nature. While Telefónica holds significant market share, it contends with powerful rivals such as América Móvil, which boasts extensive operations across several Latin American countries. This intense rivalry isn't limited to major international players; strong local incumbents also pose a considerable threat, often with deep-rooted customer relationships and tailored service offerings.

The competitive intensity is further fueled by a dynamic market environment. Varying regulatory frameworks across different Latin American nations create a complex operating environment, influencing pricing strategies and market entry barriers. This dynamism, coupled with significant growth opportunities, drives aggressive competition for new subscribers and market expansion, as companies vie for increased market penetration.

For instance, in 2023, the Latin American telecommunications market saw continued growth, with mobile penetration rates varying significantly by country but generally on an upward trend. Competition is particularly fierce in areas like 5G deployment and broadband services, where investments are substantial and the race to capture market leadership is ongoing. Local market nuances, including distinct consumer preferences and economic conditions, add another layer of complexity, requiring tailored strategies from all competitors.

Telefónica operates in a sector burdened by substantial fixed costs, primarily stemming from the immense investment required for network infrastructure and the acquisition of valuable spectrum licenses. In 2024, the ongoing rollout of 5G technology continues to demand significant capital expenditure, with operators globally investing billions to expand coverage and enhance capabilities.

This high fixed-cost structure exerts considerable pressure on Telefónica to achieve economies of scale. To maximize network utilization and spread these costs, companies are often compelled to engage in aggressive pricing strategies, aiming to attract and retain a large customer base. This competitive pricing environment is further intensified by the need for continuous, substantial investments to keep pace with technological advancements and evolving customer demands.

Product Differentiation Challenges

Telefónica faces a significant hurdle in differentiating its core telecommunications services. While the company invests heavily in service quality, customer experience, and digital solutions, the fundamental nature of mobile and broadband can often lead to them being viewed as commodities. This perception naturally shifts the competitive battleground towards price and the attractiveness of bundled packages.

This commoditization makes it tough to maintain a lasting edge solely based on product features. Consequently, rivals often engage in price wars or aggressive bundling to attract and retain subscribers. For Telefónica, staying ahead requires a constant focus on innovation, particularly in developing and marketing new digital services that go beyond basic connectivity.

For instance, in 2023, Telefónica reported a substantial portion of its revenue coming from higher-value services and digital transformation projects, indicating a strategic shift. The company's ongoing efforts to expand its fiber optic network and 5G coverage, coupled with offerings like cybersecurity and IoT solutions, are designed to create these differentiating factors.

- Customer perception of core telecom services as commodities limits differentiation.

- Rivalry often centers on price competition and bundled service packages.

- Innovation in new digital services is crucial for Telefónica to gain a competitive advantage.

- Telefónica's strategic investments in fiber, 5G, and digital solutions aim to overcome product differentiation challenges.

Aggressive Bundling and Convergence Strategies

Competitors in Telefónica's key markets, including Spain and Brazil, are aggressively bundling mobile, fixed broadband, TV, and digital services. This convergence strategy creates intense rivalry, as companies vie to offer comprehensive value propositions. For instance, in 2023, many European telecom operators reported that a significant percentage of their new broadband subscriptions were part of triple-play or quadruple-play bundles, indicating customer preference for integrated offerings.

This bundling trend forces Telefónica to continuously innovate its own service packages to remain competitive and retain its subscriber base. Failing to adapt can lead to customer churn as rivals present more attractive, all-in-one solutions. The average revenue per user (ARPU) for bundled services is often higher, making these packages a crucial battleground for market share and profitability.

- Bundling Impact: Competitors are combining mobile, fixed broadband, TV, and digital services to increase customer loyalty and attract new subscribers.

- Convergence Strategy: This approach intensifies competition by shifting the focus from individual services to holistic customer value.

- Market Adaptation: Telefónica must constantly adjust its bundled offerings to match or surpass competitor propositions.

- 2024 Data Insight: Early 2024 reports show continued growth in bundled service adoption across major European markets, with operators highlighting bundle penetration as a key performance indicator.

Competitive rivalry within the telecommunications sector remains exceptionally high for Telefónica, particularly in its established European markets like Spain and Germany, as well as in dynamic Latin American regions. Major players such as Vodafone, Orange, and América Móvil are constantly competing on price, service quality, and network expansion, especially with the ongoing 5G rollout which demands substantial capital investment. This intensifies the pressure for Telefónica to achieve economies of scale and maintain customer loyalty through innovative bundled offerings.

In 2024, the European telecom market continues to witness intense competition, with operators like Telefónica, Vodafone, and Orange locked in aggressive pricing strategies and service differentiation. For example, Telefónica's Spanish operations are in direct competition with Vodafone Spain and Orange Spain, both actively investing in network upgrades and promotional activities to capture market share. This fierce rivalry is further amplified by the trend of bundling services – mobile, broadband, and TV – which enhances customer retention and increases average revenue per user (ARPU). Telefónica's strategic focus on expanding its fiber and 5G networks, alongside digital services, is aimed at creating differentiation in this highly competitive environment.

| Operator | Key European Market | Competitive Tactic | 2024 Focus |

|---|---|---|---|

| Telefónica | Spain | Bundling, 5G Expansion | Digital Services Growth |

| Vodafone | Spain, Germany | Price Promotions, Network Quality | Fiber Rollout |

| Orange | Spain, France | Service Bundles, 5G Leadership | Customer Experience |

| América Móvil | Latin America | Market Penetration, Price Competitiveness | Broadband Expansion |

SSubstitutes Threaten

The rise of Over-the-Top (OTT) communication services presents a significant threat to Telefónica's traditional revenue streams. Apps like WhatsApp, Signal, and Telegram offer free or very low-cost alternatives for voice calls and messaging, directly competing with Telefónica's legacy voice and SMS services.

These OTT platforms utilize internet data, effectively bypassing the traditional circuit-switched networks that Telefónica has historically relied upon. This shift compels Telefónica to adapt by focusing on data-centric plans, increasing data allowances, and investing in its own digital communication solutions to remain competitive.

In 2024, the global messaging app market, dominated by OTT players, continued its expansion, with over 2.7 billion users engaging with WhatsApp alone. This highlights the immense scale of substitution impacting traditional telco services.

The rise of Subscription Video On Demand (SVOD) platforms like Netflix, Disney+, and Amazon Prime Video presents a significant threat of substitutes for Telefónica's traditional pay-TV offerings. These streaming services directly compete by providing on-demand content that appeals to consumers seeking flexibility and personalized viewing experiences, eroding the customer base for linear pay-TV packages.

Customers are actively migrating away from bundled cable subscriptions towards these more adaptable streaming options, which often offer niche content and greater control over viewing schedules. This shift directly impacts Telefónica’s revenue streams from its legacy television products, as subscriber numbers for traditional pay-TV have seen a noticeable decline globally.

For instance, in 2024, the global SVOD market continued its robust growth, with major players reporting substantial increases in subscriber numbers, further underscoring the appeal of these alternatives over traditional television. This trend necessitates Telefónica to strategically integrate or partner with these dominant streaming services to remain relevant and offer competitive content bundles.

VoIP and Wi-Fi calling present significant alternatives to traditional mobile voice services. These technologies enable calls over data networks, bypassing expensive traditional minute charges, particularly beneficial for international roaming. For instance, in 2024, the global VoIP market was valued at over $100 billion, demonstrating its widespread adoption and impact.

Telefónica needs to actively manage its data offerings to remain competitive. Ensuring attractive pricing and robust network performance for data plans is crucial to retain customers who might otherwise opt for these alternative communication methods. The increasing reliance on data for communication, rather than voice minutes, shifts the competitive landscape considerably.

Alternative Internet Access Technologies

While Telefónica's primary business relies on fixed and mobile broadband, the threat of substitutes is notable. Emerging technologies like satellite internet, exemplified by SpaceX's Starlink, offer alternative connectivity, particularly in underserved or rural areas where traditional infrastructure might be lacking. As of early 2024, Starlink has expanded its service to numerous countries, providing a viable broadband option for consumers who may not have access to Telefónica's services or are seeking different performance characteristics.

Furthermore, the proliferation of public Wi-Fi networks in urban centers and transportation hubs acts as a substitute for mobile data plans for many users. This can reduce reliance on cellular data, impacting Telefónica's mobile revenue streams. Additionally, fixed wireless access (FWA) delivered via 5G by non-traditional internet providers presents another competitive threat, offering home broadband without the need for physical fiber or copper lines.

These substitutes can erode Telefónica's market share, especially in segments where cost or convenience are primary drivers for customer choice. The increasing availability and performance of these alternatives necessitate continuous innovation and competitive pricing strategies from Telefónica to retain its customer base.

- Satellite Internet Growth: Starlink's global expansion continues, with service available in over 60 countries by mid-2024, directly competing in regions with limited terrestrial broadband.

- Public Wi-Fi Availability: The number of public Wi-Fi hotspots globally is projected to reach over 500 million by 2025, offering free or low-cost internet alternatives for casual browsing and data-light tasks.

- 5G FWA Adoption: Major telecommunications players are increasingly investing in 5G FWA, with some markets seeing significant uptake as a home internet solution, potentially diverting customers from traditional fixed-line services.

Cloud-Based Enterprise Communication Tools

Cloud-based enterprise communication tools represent a significant threat of substitutes for Telefónica. Platforms like Microsoft Teams and Google Workspace are increasingly replacing traditional Private Branch Exchange (PBX) systems and dedicated business lines. These integrated solutions provide voice, video conferencing, and collaborative features over the internet, directly impacting Telefónica's revenue from legacy enterprise communication services.

The widespread adoption of these cloud platforms offers businesses greater flexibility and often lower costs compared to on-premises solutions. For instance, by mid-2024, a significant portion of small and medium-sized businesses had already migrated their communication infrastructure to cloud-based services, seeking unified and scalable solutions. This trend directly challenges Telefónica's traditional enterprise offerings.

- Market Shift: Businesses are actively moving towards unified communication platforms that consolidate voice, video, and collaboration tools.

- Cost Advantage: Cloud solutions frequently offer a more predictable and potentially lower total cost of ownership for businesses.

- Feature Richness: Competitors like Microsoft and Google continuously innovate their communication suites, adding advanced features that Telefónica must match.

- Telefónica's Response: To counter this threat, Telefónica must bolster its own competitive cloud communication solutions, ensuring they are feature-rich, user-friendly, and competitively priced for its enterprise clientele.

The threat of substitutes for Telefónica is multifaceted, impacting both its consumer and enterprise segments. Over-the-Top (OTT) communication apps like WhatsApp and Signal continue to siphon off traditional voice and messaging revenue, a trend underscored by WhatsApp's over 2.7 billion users in 2024. Similarly, Subscription Video On Demand (SVOD) services are eroding Telefónica's pay-TV business, with global SVOD markets showing robust growth in 2024.

Alternative internet access technologies also pose a threat. Satellite internet providers like Starlink, now operational in over 60 countries by mid-2024, offer connectivity in areas where Telefónica's terrestrial infrastructure is limited. Public Wi-Fi networks and the increasing adoption of 5G Fixed Wireless Access (FWA) further substitute for traditional mobile and fixed broadband services, impacting revenue streams.

In the enterprise sector, cloud-based communication platforms such as Microsoft Teams and Google Workspace are replacing legacy PBX systems. By mid-2024, many small and medium-sized businesses had already migrated to these unified, cost-effective cloud solutions, directly challenging Telefónica's traditional enterprise offerings.

| Substitute Category | Key Players/Examples | Impact on Telefónica | 2024 Data/Trend |

| Communication Apps (OTT) | WhatsApp, Signal, Telegram | Erodes voice and SMS revenue | WhatsApp has over 2.7 billion users globally. |

| Video Streaming (SVOD) | Netflix, Disney+, Amazon Prime | Reduces demand for traditional pay-TV | Global SVOD market shows robust subscriber growth. |

| Alternative Internet Access | Starlink, Public Wi-Fi, 5G FWA | Threatens mobile data and fixed broadband revenue | Starlink available in over 60 countries by mid-2024; 500 million public Wi-Fi hotspots projected by 2025. |

| Enterprise Cloud Communication | Microsoft Teams, Google Workspace | Challenges legacy PBX and business line revenue | Significant SMB migration to cloud communication by mid-2024. |

Entrants Threaten

Building a robust telecommunications network, encompassing fiber optic cables and mobile towers, demands substantial initial capital. For instance, 5G network deployment alone can cost billions, making it a daunting hurdle for newcomers looking to challenge established players like Telefónica.

The high cost of acquiring essential spectrum licenses further solidifies this barrier. In 2024, governments worldwide continued to auction spectrum rights for 5G and beyond, with some auctions generating billions of dollars in revenue for the state, effectively pricing out smaller or less capitalized potential entrants.

This immense capital expenditure acts as a formidable deterrent, significantly limiting the threat of new companies entering the market and directly competing with Telefónica's established infrastructure and market presence.

The telecommunications industry presents significant hurdles for newcomers due to stringent regulatory requirements. Obtaining licenses for spectrum usage, operating national networks, and providing various telecommunication services demands substantial investment and a deep understanding of complex legal frameworks. These extensive licensing processes act as a major deterrent for potential entrants seeking to challenge established companies like Telefónica.

Securing the necessary government approvals is a lengthy and often costly endeavor. Many governments prioritize stability and continuity, sometimes favoring incumbent operators or imposing very strict conditions on new entrants. This can involve high upfront fees, commitments to infrastructure deployment, or specific service obligations, all of which can be prohibitive for businesses without pre-existing resources or established relationships.

For instance, in 2024, spectrum auctions for 5G deployment in many European countries, including those where Telefónica operates, involved billions of euros. New companies must not only secure these expensive licenses but also demonstrate the technical and financial capacity to utilize the spectrum effectively, a task that is exceptionally difficult without prior experience and market presence.

Telefónica enjoys substantial economies of scale in its network operations, from building and maintaining infrastructure to purchasing equipment in bulk. This cost advantage is a significant barrier for new entrants who cannot achieve similar efficiencies without a large, established customer base. For instance, in 2024, Telefónica's extensive fiber optic network across Europe and Latin America represented a massive capital investment that new players would find difficult to replicate quickly or affordably.

Furthermore, strong network effects amplify Telefónica's competitive position. The more customers Telefónica has, the more valuable its network becomes to existing and potential users due to increased connectivity and service options. This creates a self-reinforcing cycle where a larger user base attracts more users, making it exceptionally challenging for a new entrant with a limited customer pool to compete on service quality or reach.

Strong Brand Loyalty and Established Distribution

Telefónica's formidable brand loyalty and deeply entrenched distribution networks present a substantial barrier to new entrants. For decades, the company has invested heavily in building trust and recognition, making it difficult for newcomers to gain traction. This established presence means that any new competitor would need to overcome significant hurdles in customer acquisition and market penetration.

Consider the sheer scale of Telefónica's reach. As of the first quarter of 2024, Telefónica Spain alone served over 20 million mobile customers, a testament to its enduring appeal and widespread accessibility. Similarly, its broadband and TV services boast millions of subscribers across its operating markets. This widespread customer base is not easily swayed, requiring new entrants to offer exceptionally compelling value propositions to even consider challenging Telefónica's market share.

The cost and time required to replicate Telefónica's distribution infrastructure are immense. New companies must not only establish physical retail presence but also build robust online platforms and logistics to effectively serve customers. This capital-intensive undertaking makes it exceedingly challenging to compete on a level playing field, effectively deterring many potential new entrants from entering the market.

The threat of new entrants is therefore significantly mitigated by Telefónica's:

- Strong Brand Recognition: Decades of consistent marketing and service have cultivated a trusted brand image.

- Extensive Distribution Channels: A vast network of retail stores, online platforms, and partner agreements ensures broad customer access.

- High Customer Loyalty: Established customer relationships and bundled service offerings make switching less attractive.

- Significant Capital Requirements: The cost to build comparable infrastructure and marketing presence is prohibitive for many potential new players.

Technological Complexity and Expertise Required

The significant technological complexity inherent in operating and maintaining a modern telecommunications network presents a formidable barrier for new entrants. Telefónica, like its peers, relies on advanced infrastructure requiring deep expertise in areas such as 5G deployment, fiber optic network management, robust cybersecurity protocols, and seamless cloud integration.

New players entering the market would face the substantial challenge of rapidly acquiring or developing this specialized technical knowledge. This includes not only understanding the core technologies but also staying abreast of continuous advancements in the field, which demands significant investment in research and development.

Furthermore, attracting and retaining top-tier talent with expertise in these niche areas is crucial. The global demand for skilled professionals in telecommunications, particularly those with experience in 5G and cybersecurity, is high. For instance, in 2024, the global cybersecurity market was projected to reach over $230 billion, highlighting the competitive landscape for talent.

- High Capital Investment: Building out advanced network infrastructure from scratch requires immense capital expenditure, a hurdle few new entrants can easily overcome.

- Specialized Skillsets: Accessing and retaining personnel with expertise in 5G, fiber optics, and cybersecurity is a major challenge, as these skills are in high demand globally.

- Regulatory Hurdles: Navigating complex telecommunications regulations and obtaining necessary licenses can be time-consuming and costly for new companies.

- Brand Recognition and Trust: Established players like Telefónica benefit from years of building brand recognition and customer trust, which is difficult for newcomers to replicate quickly.

The threat of new entrants in the telecommunications sector, particularly for a company like Telefónica, is significantly dampened by the immense capital required for infrastructure development and spectrum acquisition. For example, the ongoing rollout of 5G networks necessitates billions in investment, a cost that deters many potential competitors. Furthermore, stringent regulatory landscapes, including complex licensing procedures and government approvals, add layers of difficulty for newcomers seeking to establish a foothold.

Telefónica benefits from substantial economies of scale, which translate into lower per-unit costs for network operation and equipment procurement, a distinct advantage over smaller, less established players. The company also leverages strong network effects, where a larger customer base enhances the value of its services, making it challenging for new entrants to attract and retain users. These factors collectively limit the ease with which new companies can enter and effectively compete in the market.

Brand loyalty and established distribution networks further fortify Telefónica's market position. Building comparable brand recognition and an extensive reach across retail and online channels requires significant time and investment, acting as a substantial barrier. For instance, Telefónica Spain's over 20 million mobile customers as of Q1 2024 underscore the deep customer relationships that are difficult for new entrants to disrupt.

The technological complexity of modern telecommunications, including 5G, fiber optics, and cybersecurity, demands specialized expertise and continuous R&D investment. Acquiring and retaining talent in these high-demand fields presents another significant challenge for new market entrants, making it difficult to match the operational capabilities of established providers like Telefónica.

Porter's Five Forces Analysis Data Sources

Our Telefónica Porter's Five Forces analysis is built upon a robust foundation of data, including Telefónica's annual reports and investor presentations, alongside industry-specific market research from firms like Gartner and IDC. We also incorporate data from regulatory filings and telecommunications market statistics from organizations like the ITU to provide a comprehensive view of the competitive landscape.