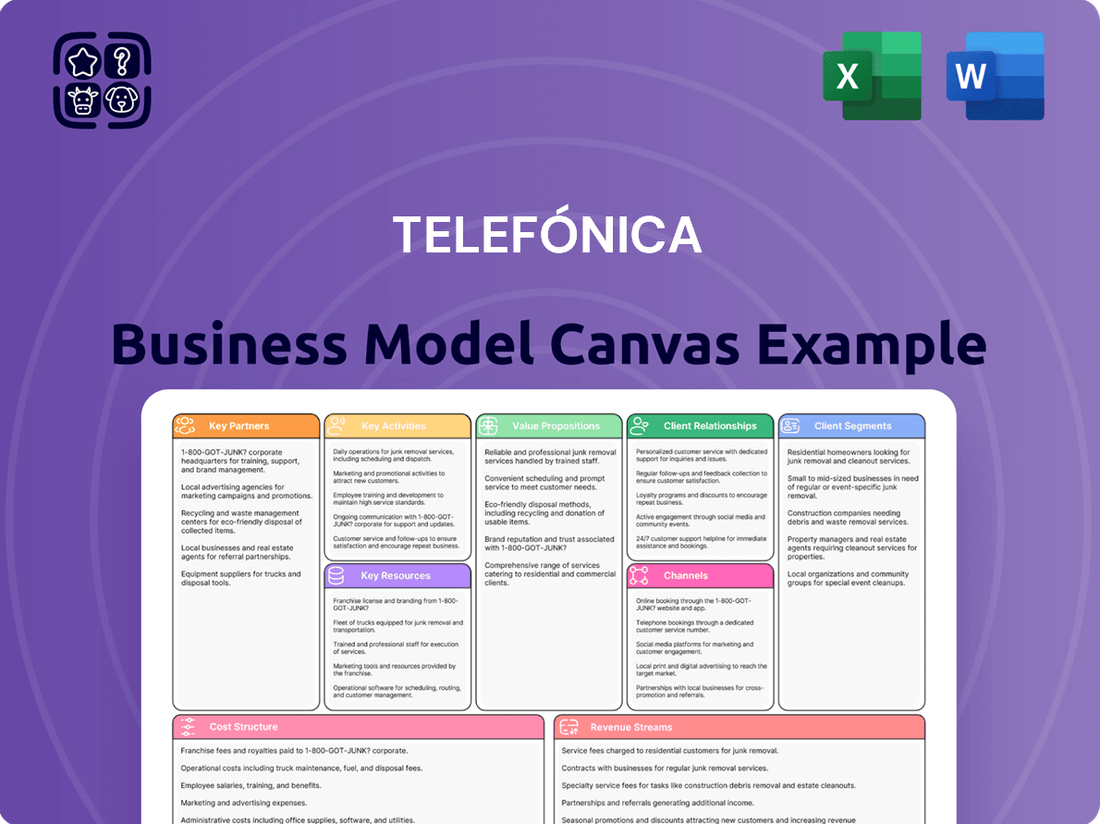

Telefónica Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telefónica Bundle

Unlock the strategic blueprint behind Telefónica's expansive operations. This Business Model Canvas dissects how they connect millions, from their core customer segments to key revenue streams. Discover their approach to value creation and competitive advantage.

Curious about Telefónica's massive infrastructure and technological investments? This canvas details their key resources and activities, revealing the engine driving their global telecommunications services. It's a goldmine for understanding operational efficiency.

See how Telefónica builds and maintains its vast network of partnerships. This Business Model Canvas highlights crucial collaborations and channels, offering insights into their market reach and strategic alliances.

Dive into Telefónica's cost structure and revenue streams. This in-depth canvas provides a clear view of how they manage expenses and generate income in the dynamic telecom sector.

Ready to gain a comprehensive understanding of Telefónica's success? Download the full Business Model Canvas today for actionable insights and strategic inspiration.

Partnerships

Telefónica actively partners with major technology providers such as Ericsson and Nokia. These collaborations are vital for upgrading its network infrastructure, especially for the rollout of 5G and fiber optic technologies.

These alliances are instrumental in increasing network capacity and fostering the development of innovative services, including those leveraging artificial intelligence (AI) and the Internet of Things (IoT). For instance, in 2024, Telefónica continued its significant investments in 5G infrastructure, relying on these key technology partners.

By focusing on advanced infrastructure partnerships, Telefónica solidifies its position as a technological leader in the telecommunications sector. This strategic approach also enables the expansion and enhancement of its diverse service portfolio for customers.

Telefónica's strategic alliances with premier content providers, including global streaming giants like Netflix and Disney+, are fundamental to its business model. These partnerships allow Telefónica to curate compelling pay-TV and digital entertainment packages, directly enhancing the value proposition for its subscribers.

By integrating sought-after content into bundled offerings alongside its core connectivity services, Telefónica significantly boosts customer loyalty and reduces churn. This strategy proved particularly effective in 2024, with bundled services continuing to be a key driver for subscription growth across its European and Latin American markets.

These content collaborations are crucial for Telefónica to establish a distinct competitive advantage. In a saturated telecommunications landscape, access to exclusive or bundled premium content helps Telefónica stand out and attract new customers, differentiating it from rivals who may only offer basic connectivity.

Telefónica actively partners with other telecommunication companies through network sharing and roaming agreements. These collaborations are crucial for expanding its global service delivery, allowing it to offer services in regions where it might not have its own infrastructure. For instance, these agreements enable Telefónica to support Mobile Virtual Network Operators (MVNOs) by providing them access to its network, thereby broadening its revenue streams and market reach.

These strategic alliances are fundamental for maximizing network efficiency and gaining wider market access. By sharing infrastructure, Telefónica can reduce operational costs and capital expenditure, while simultaneously offering more comprehensive international service footprints to its customers. Such partnerships are a cornerstone of its strategy to remain competitive and provide seamless connectivity across borders, contributing significantly to its overall business model.

System Integrators and IT Service Providers

Telefónica Tech actively collaborates with system integrators and IT service providers, such as Atos and Capgemini, to broaden its enterprise solutions. These partnerships are crucial for delivering integrated digital transformation projects spanning cloud, cybersecurity, and the Internet of Things.

These alliances allow Telefónica Tech to offer end-to-end solutions, enhancing its capabilities in complex digital projects and providing greater value to its corporate clients. The synergy created through these collaborations is vital for tackling the multifaceted needs of modern businesses undergoing digital shifts.

Telefónica Tech's revenue growth in these service areas underscores the strategic importance of these key partnerships. For instance, Telefónica Tech reported a 17.7% year-on-year revenue growth in 2023, with a significant portion attributed to its enterprise and digital services, bolstered by these system integrator collaborations.

- System Integrator Collaboration: Partnerships with firms like Atos and Capgemini are fundamental to Telefónica Tech's strategy for expanding its enterprise digital transformation services.

- Solution Delivery: These alliances facilitate the joint delivery of comprehensive solutions in critical areas such as cloud computing, advanced cybersecurity measures, and the implementation of Internet of Things (IoT) technologies.

- Revenue Impact: Telefónica Tech's financial performance, including its 2023 revenue growth of 17.7%, is significantly influenced by the success and reach facilitated through these strategic IT service provider partnerships.

Infrastructure Investment Partners

Telefónica actively collaborates with infrastructure investment firms, including prominent players like KKR, Allianz, Crédit Agricole Assurances, and Vauban Infrastructure Partners. These strategic alliances are crucial for the deployment and ongoing management of its extensive fiber optic networks.

These partnerships enable Telefónica to accelerate its fiber-to-the-home (FTTH) expansion initiatives, particularly in underserved rural areas and other strategic markets. Notable examples include the formation of Bluevia in Spain and Unsere Grüne Glasfaser (UGG) in Germany, which facilitate efficient co-investment and infrastructure growth.

- Bluevia (Spain): A joint venture with investment firms to enhance fiber optic network deployment.

- Unsere Grüne Glasfaser (UGG) (Germany): Another key partnership focused on expanding FTTH coverage.

- Co-investment Model: Allows for efficient capital allocation and risk sharing in infrastructure development.

- Accelerated Rollout: These partnerships significantly speed up the deployment of high-speed internet access.

Telefónica's strategic partnerships with infrastructure investment firms are critical for its fiber optic network expansion. Collaborations with entities like KKR and Allianz, as seen in ventures such as Bluevia in Spain and Unsere Grüne Glasfaser (UGG) in Germany, accelerate FTTH deployment, especially in rural areas.

These co-investment models allow for efficient capital allocation and risk sharing, significantly speeding up the rollout of high-speed internet access. This strategic approach is key to Telefónica's objective of providing widespread, advanced connectivity solutions.

Telefónica's engagement with these financial partners demonstrates a clear strategy to leverage external capital for infrastructure development, thereby enhancing its market position and service offerings.

| Partnership Type | Key Partners | Focus Area | Impact |

|---|---|---|---|

| Infrastructure Investment | KKR, Allianz, Crédit Agricole Assurances, Vauban Infrastructure Partners | Fiber optic network deployment (FTTH) | Accelerated rollout, co-investment, risk sharing |

| Technology Providers | Ericsson, Nokia | Network infrastructure (5G, Fiber) | Network upgrades, service innovation (AI, IoT) |

| Content Providers | Netflix, Disney+ | Pay-TV and digital entertainment packages | Customer loyalty, reduced churn, competitive advantage |

| System Integrators | Atos, Capgemini | Enterprise digital transformation (Cloud, Cybersecurity, IoT) | End-to-end solutions, enhanced corporate client value |

| Other Telcos | Various | Network sharing, roaming agreements | Expanded global service, MVNO support, cost efficiency |

What is included in the product

A detailed breakdown of Telefónica's strategies, outlining its diverse customer segments, multi-channel approach, and robust value propositions across telecommunications and digital services.

The Telefónica Business Model Canvas provides a structured approach to pinpoint and address critical pain points within its operations.

By mapping out key activities, resources, and value propositions, it helps alleviate the pain of inefficient resource allocation and unclear strategic direction.

Activities

Telefónica's network operation and maintenance is crucial, focusing on keeping its vast fixed and mobile infrastructure, including fiber and 5G, running smoothly. This ensures dependable service for millions.

In 2024, Telefónica continued its substantial investments in network upgrades. For instance, the company has been actively expanding its 5G standalone network coverage.

The company's commitment to modernization is evident in its ongoing deployment of new transmitters and upgrades to existing cell towers. This directly impacts network performance and expands reach for customers.

Reliable connectivity is a cornerstone of Telefónica's value proposition, necessitating continuous upkeep and technological advancement. This operational excellence supports all other aspects of their business model.

Telefónica's core activities revolve around delivering a comprehensive suite of communication services. This includes not just fixed and mobile voice telephony but also high-speed broadband internet and increasingly, pay-TV offerings. The company's operational focus is on ensuring these services are consistently available and perform at a high standard for its diverse customer base.

A critical component of service delivery is the robust customer support infrastructure Telefónica maintains. This involves offering assistance through multiple channels, such as call centers, online chat, and physical retail locations, to address customer inquiries and technical issues promptly. The aim is to foster high levels of customer satisfaction and loyalty by providing accessible and effective support.

Telefónica strives to deliver a seamless and integrated experience for both its residential and business customers. This means ensuring that services are easy to access, manage, and utilize, regardless of the customer segment. For example, in 2024, Telefónica continued to invest in network upgrades to improve broadband speeds and mobile connectivity, directly impacting service delivery quality for millions of users across its markets.

Telefónica is heavily invested in creating new digital solutions and technologies, with Telefónica Tech spearheading advancements in areas like IoT, Big Data, AI, and Blockchain. This focus on innovation is central to their strategy, ensuring they remain at the forefront of the industry.

Pioneering initiatives such as Open Gateway, which unlocks network capabilities through APIs, and the development of quantum-safe networks highlight Telefónica's commitment to future-proofing its offerings. These efforts are designed to deliver cutting-edge products and services that meet evolving customer needs.

In 2024, Telefónica continued to emphasize its digital transformation, with significant investments poured into research and development for new services. The company aims to leverage its technological expertise to create a robust pipeline of innovative solutions, enhancing its competitive edge in the telecommunications market.

Sales and Marketing

Telefónica’s sales and marketing activities are crucial for attracting and keeping customers across its diverse service portfolio. This includes actively promoting bundled packages and cutting-edge digital solutions tailored for both individual households and enterprise clients. The company focuses on driving revenue and increasing its market presence through well-executed sales approaches and precisely targeted promotional initiatives.

In 2024, Telefónica continued its robust digital transformation, with a significant portion of its sales being driven through online channels. For instance, the company reported substantial growth in its digital services adoption, particularly in areas like cloud solutions for businesses and enhanced mobile broadband packages for consumers. This strategic focus on digital engagement directly impacts customer acquisition and retention metrics.

- Digital Channel Growth: Telefónica saw a notable increase in new customer acquisitions via its digital platforms in 2024, indicating a successful shift in sales strategy.

- Bundled Offerings: The promotion of integrated service bundles, such as convergent plans combining mobile, fixed broadband, and TV, remained a core marketing tactic to enhance customer value and loyalty.

- Targeted Campaigns: Marketing efforts were increasingly personalized, leveraging data analytics to reach specific customer segments with relevant offers for both residential and business markets.

- Brand Investment: Continued investment in brand building and customer experience initiatives aimed to differentiate Telefónica in a competitive telecommunications landscape.

Spectrum Management and Regulatory Compliance

Telefónica's key activities heavily involve spectrum management and ensuring strict adherence to telecommunications regulations across its global operations. This is a continuous process, crucial for maintaining licenses and operating legally in diverse markets. In 2024, for instance, regulatory bodies worldwide continued to refine spectrum allocation policies, impacting network expansion plans.

Navigating these complex regulatory environments is paramount. This includes complying with rules for network deployment, service quality, and increasingly stringent data privacy laws, such as GDPR. Failure to comply can lead to significant fines and operational disruptions.

Adherence to these frameworks is the bedrock of Telefónica's business continuity and its ability to grow. For example, securing and managing 5G spectrum licenses in key markets like Spain and Brazil in 2024 required substantial investment and careful negotiation to meet regulatory requirements.

- Spectrum License Management: Acquiring, renewing, and optimizing the use of radio frequency spectrum, a finite and valuable resource essential for mobile and broadband services.

- Regulatory Compliance Monitoring: Ensuring all operations, from network build-outs to customer data handling, align with national and international telecommunications laws and standards.

- Policy Engagement: Actively participating in discussions with regulatory bodies to shape future spectrum policies and compliance frameworks.

- Data Privacy Adherence: Implementing robust measures to protect customer data and comply with evolving privacy regulations in all operating countries.

Telefónica's key activities encompass the continuous operation and enhancement of its extensive fixed and mobile network infrastructure. This includes the deployment and maintenance of fiber optic cables and 5G technology to ensure reliable service delivery. In 2024, the company significantly expanded its 5G standalone network coverage and continued upgrading cell towers, directly boosting network performance and customer reach.

A core function is the development and delivery of innovative digital solutions through Telefónica Tech, focusing on IoT, Big Data, and AI. The company is also actively pioneering future-oriented technologies like Open Gateway and quantum-safe networks. In 2024, significant R&D investment fueled the creation of new services, reinforcing Telefónica's competitive edge.

Sales and marketing efforts are vital for customer acquisition and retention, with a strong emphasis on digital channels. Bundled service packages and targeted digital campaigns were key in 2024, driving substantial growth in digital service adoption, especially for business cloud solutions.

Crucially, Telefónica manages spectrum licenses and ensures strict adherence to telecommunications regulations globally. This involves navigating complex compliance frameworks for network deployment and data privacy. Securing 5G spectrum licenses in markets like Spain and Brazil in 2024 demonstrated this ongoing commitment.

Delivered as Displayed

Business Model Canvas

The Telefónica Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This is not a sample or mockup; it's a direct, unaltered view of the final deliverable. Upon completing your transaction, you will gain full access to this exact, comprehensive Business Model Canvas, ready for your strategic analysis and application.

Resources

Telefónica's extensive network infrastructure, encompassing fiber optic cables and 5G towers, is a foundational element of its business model. This robust physical asset is key to providing reliable, high-speed internet and mobile services to millions of customers.

In 2024, Telefónica continued its strategic investments in network upgrades, aiming to enhance capacity and coverage. For instance, the company's fiber-to-the-home (FTTH) footprint reached over 27 million homes passed in Europe by the end of 2023, with ongoing expansion efforts in 2024.

This advanced infrastructure not only serves its core connectivity business but also underpins the delivery of new digital services, from cloud solutions to IoT platforms. The ongoing commitment to network modernization ensures Telefónica remains competitive and capable of meeting evolving customer demands.

Telefónica's spectrum licenses are incredibly valuable assets, essentially its right to broadcast wireless signals for mobile services. These are absolutely crucial for its day-to-day mobile operations and are foundational for rolling out 5G and future network technologies.

The company actively manages and acquires these licenses, recognizing them as strategic priorities. For instance, in 2023, Telefónica successfully secured additional spectrum in several European markets, enhancing its capacity and readiness for advanced services.

Telefónica leverages a robust brand reputation cultivated over many years, alongside a vast and dedicated customer following spanning Europe and Latin America. This deeply ingrained trust and broad customer engagement are invaluable for introducing new offerings and expanding market share.

The company’s significant customer reach, demonstrated by its 390 million accesses at the close of 2024, translates directly into powerful opportunities for cross-selling and upselling a diverse range of telecommunications and digital services.

Skilled Workforce

Telefónica’s skilled workforce is a cornerstone of its operations, encompassing a diverse range of talent from network engineers and IT specialists to cybersecurity professionals and customer service experts. This human capital is essential for managing complex telecommunications infrastructure and driving the development of innovative digital solutions. Their proficiency directly impacts service quality and the company's ability to adapt to evolving market demands.

The expertise resident within Telefónica's teams is critical for maintaining and enhancing its extensive network capabilities and for creating cutting-edge digital products and services. For instance, in 2024, the company continued to invest heavily in its fiber optic and 5G network expansion, requiring a robust team of skilled engineers to oversee deployment and ongoing optimization. This technical acumen ensures reliable connectivity and supports the delivery of new services.

To maintain its competitive edge, Telefónica places a strong emphasis on continuous training and talent development. This commitment ensures that employees remain at the forefront of technological advancements, particularly in areas like artificial intelligence, cloud computing, and cybersecurity. By fostering a culture of learning, Telefónica equips its workforce to tackle future challenges and capitalize on emerging opportunities within the digital landscape.

- Network Engineers: Crucial for the deployment, maintenance, and optimization of Telefónica’s vast infrastructure, including 5G and fiber networks.

- IT Professionals: Essential for developing and managing the company's digital platforms, software solutions, and internal systems.

- Cybersecurity Experts: Vital for protecting customer data and company assets from an increasing array of cyber threats.

- Customer Service Personnel: Key to providing high-quality support, resolving issues, and enhancing customer satisfaction, contributing directly to brand loyalty.

Data Centers and IT Systems

Telefónica's data centers and IT systems are the backbone of its operations, crucial for managing its extensive network, delivering digital services, and safeguarding massive volumes of customer data. These sophisticated infrastructures are fundamental to supporting their cloud services and cybersecurity solutions. For instance, in 2024, Telefónica continued to invest heavily in modernizing its IT infrastructure to support the increasing demand for data and digital services.

These core resources enable Telefónica to offer a wide array of services, from mobile and broadband to advanced digital solutions. The company's strategic digital transformation efforts are heavily reliant on the efficiency and scalability of these IT systems. In 2023, Telefónica reported significant progress in its digital transformation, aiming to streamline operations and enhance customer experience through its IT advancements.

Furthermore, Telefónica leverages strategic alliances to bolster its data center and IT capabilities. A notable example is its partnership with Google Cloud, which aims to accelerate the company's digital transformation and enhance its cloud offerings. These collaborations allow Telefónica to access cutting-edge technology and expertise, ensuring its IT infrastructure remains competitive and robust.

- Sophisticated Infrastructure: Telefónica operates a network of advanced data centers and IT systems that are critical for managing its vast telecommunications network.

- Service Enablement: These resources are the foundation for delivering digital services, including cloud computing and cybersecurity solutions to customers.

- Data Management: Robust IT systems are essential for the secure and efficient handling of extensive customer data, ensuring compliance and service reliability.

- Strategic Partnerships: Collaborations, such as with Google Cloud, enhance Telefónica's IT capabilities, driving innovation and expanding service offerings.

Telefónica’s intellectual property, including patents and proprietary software, represents a significant competitive advantage. This intangible asset underpins its innovation in network technology and digital service development, ensuring unique offerings and operational efficiencies. The company actively protects and leverages this IP to maintain market leadership.

In 2024, Telefónica continued to focus on research and development, leading to new patent filings in areas like AI-driven network management and enhanced cybersecurity solutions. This ongoing innovation is vital for staying ahead in the rapidly evolving telecommunications landscape.

These key resources collectively enable Telefónica to deliver high-quality connectivity and a growing portfolio of digital services, reinforcing its position as a leading telecommunications provider.

Value Propositions

Telefónica provides dependable and broad connectivity, encompassing both fixed and mobile services. This includes advanced fiber optic broadband and expansive 5G network availability, guaranteeing customers consistent, high-quality access. For instance, by the end of 2023, Telefónica reported over 22.7 million homes passed with fiber in Spain alone, underscoring its commitment to robust infrastructure.

Telefónica's comprehensive bundled services are a cornerstone of its value proposition, seamlessly integrating fixed and mobile telephony, high-speed broadband internet, and engaging pay-TV options. This all-in-one approach offers significant convenience and noticeable cost savings for customers who can manage all their essential communication and entertainment needs through a single provider.

These integrated packages are designed not just for ease of use but also to substantially enhance the overall value delivered to each customer, simplifying billing and service management. By consolidating multiple services, Telefónica aims to create a more sticky customer base, reducing churn and fostering long-term loyalty.

In 2023, Telefónica Spain reported that the average revenue per user (ARPU) for its convergent customers, those who subscribe to bundled services, was €47.7, significantly higher than non-convergent customers, underscoring the financial effectiveness of this strategy. This focus on bundled offerings is a crucial driver for customer retention and a key lever for increasing overall revenue.

Telefónica Tech drives the delivery of advanced digital solutions, encompassing cybersecurity, cloud services, IoT, Big Data, and AI. These offerings are designed to meet the dynamic requirements of businesses navigating their digital transformation journeys.

By focusing on innovation, Telefónica positions itself as a crucial technology partner, extending its role beyond conventional telecommunications provision and enabling clients to leverage cutting-edge technologies.

In 2023, Telefónica Tech reported revenues of €4.1 billion, a significant increase driven by the growing demand for these digital services. This growth underscores the market's embrace of their innovative digital solutions.

Dedicated Customer Support and Service Quality

Telefónica prioritizes building strong customer relationships and delivering high-quality service as a key value proposition. This commitment translates into accessible customer service channels and personalized support, ensuring customer needs are met efficiently.

The company aims to create unique experiences founded on trust, fostering lasting customer satisfaction. For instance, in 2024, Telefónica reported a significant increase in customer satisfaction scores across its key European markets, driven by enhanced digital support tools and proactive issue resolution.

- Accessible Channels: Telefónica offers multiple customer support avenues, including online chat, phone, and in-store assistance, making it easy for customers to connect.

- Personalized Support: The company leverages data analytics to offer tailored solutions and recommendations, enhancing the individual customer experience.

- Service Quality Focus: Investments in network infrastructure and staff training in 2024 aimed to further improve service reliability and responsiveness, contributing to a more positive customer journey.

- Trust and Satisfaction: By consistently delivering on its service promises, Telefónica seeks to build long-term trust and ensure high levels of customer retention.

Global Reach and Roaming Capabilities

Telefónica's global reach and roaming capabilities are a cornerstone of its value proposition. For individuals, this means staying connected effortlessly when traveling internationally. For businesses, especially multinational corporations, this translates to reliable and seamless communication across borders, a critical factor for operational efficiency.

This extensive network is a significant competitive advantage, particularly for enterprise clients who rely on uninterrupted connectivity for their global operations. Telefónica leverages its presence in multiple countries and robust roaming agreements to ensure customers can communicate wherever they are.

In 2024, Telefónica continued to strengthen its global roaming partnerships, ensuring competitive rates and broad coverage. For example, the company actively participates in industry initiatives to enhance the quality and affordability of international mobile services.

- Extensive International Network: Telefónica operates in numerous countries, providing a wide geographical coverage for its services.

- Seamless Roaming Agreements: The company maintains strong partnerships with other carriers worldwide, facilitating smooth international roaming for its customers.

- Enterprise Connectivity Solutions: Global reach is crucial for multinational businesses, enabling reliable communication for their employees and operations abroad.

- Competitive Roaming Packages: Telefónica offers various plans designed to make international communication more accessible and cost-effective for both individuals and businesses.

Telefónica's value proposition centers on providing robust connectivity through its extensive fiber and 5G networks, ensuring high-quality, reliable access across its operational regions. By the close of 2023, the company had passed over 22.7 million homes with fiber in Spain, demonstrating its commitment to advanced infrastructure.

The company offers compelling bundled services, integrating fixed and mobile, broadband, and pay-TV, which provide customers with convenience and cost savings. This convergent approach significantly enhances customer value and loyalty, as evidenced by the higher average revenue per user (ARPU) of €47.7 for convergent customers in Spain during 2023.

Telefónica Tech delivers advanced digital solutions like cybersecurity, cloud, IoT, and AI, positioning itself as a key technology partner for businesses undergoing digital transformation. The significant growth in Telefónica Tech's 2023 revenue, reaching €4.1 billion, highlights the strong market demand for these innovative services.

A strong emphasis on customer relationships and service quality underpins Telefónica's value. The company provides accessible support channels and personalized assistance, aiming to build trust and ensure high customer satisfaction, with reported increases in satisfaction scores in 2024.

Telefónica's global reach and extensive roaming agreements offer seamless international connectivity for both individuals and businesses. This capability is a critical advantage, especially for multinational corporations, and the company continues to enhance its roaming partnerships for competitive rates and broad coverage in 2024.

Customer Relationships

Telefónica offers a comprehensive multi-channel customer service approach, encompassing physical retail locations, extensive call centers, and a strong digital presence through its websites and mobile applications. This strategy allows customers to engage with the company and seek assistance via their most convenient channel, whether it's in-person, over the phone, or digitally.

In 2024, Telefónica continued to invest in optimizing these channels, aiming for seamless transitions between them. For instance, a customer starting an inquiry online can often seamlessly continue it via a call center without repetition, enhancing service efficiency and customer satisfaction.

The company's commitment to accessible service is evident in its efforts to reduce wait times and improve resolution rates across all touchpoints. This focus on efficient interaction aims to build stronger, more loyal customer relationships by ensuring their needs are met promptly and effectively.

Telefónica increasingly relies on self-service digital platforms like its My Account portal and mobile app, allowing customers to handle tasks such as bill viewing and service management independently. This digital empowerment streamlines operations, as evidenced by the significant reduction in call center volume for routine inquiries.

These digital channels not only boost customer convenience by providing 24/7 access to service management but also drive operational efficiency. By enabling customers to resolve common issues themselves, Telefónica can reallocate human resources to more complex customer needs, enhancing overall service quality.

For instance, in 2023, Telefónica reported a substantial increase in the usage of its digital channels, with over 70% of customer interactions for billing and account management handled through these self-service options. This trend is expected to continue growing into 2024, further optimizing customer relationship management.

Telefónica offers dedicated account managers and specialized support teams for its business and corporate clients. This ensures that enterprise customers receive tailored solutions and proactive service management, fostering strong, long-term relationships.

This personalized approach is crucial for addressing the intricate and often unique requirements of large organizations. For instance, in 2023, Telefónica's enterprise segment saw significant growth, with dedicated teams playing a vital role in securing major B2B contracts, underscoring the value of this customer relationship strategy.

Loyalty Programs and Personalized Offers

Telefónica actively cultivates customer loyalty through well-structured programs and tailored offers, aiming to keep existing users engaged and prompt them to explore additional services. This strategy is key to boosting customer lifetime value.

- Loyalty Programs: Initiatives like tiered rewards, points accumulation for service upgrades, and exclusive access to events or content are central to retaining customers.

- Personalized Offers: Telefónica leverages customer data to deliver bespoke promotions, such as discounted bundles for higher data usage or special pricing on new devices for long-term subscribers.

- Customer Retention Focus: In 2024, a significant portion of Telefónica's marketing budget was allocated to retention efforts, recognizing that acquiring new customers is often more costly than keeping existing ones.

- Increased Service Adoption: These personalized incentives are designed to encourage customers to adopt more advanced plans or add supplementary services, thereby increasing average revenue per user (ARPU).

Community Engagement and Social Media Support

Telefónica actively engages its customer base through vibrant community forums and a strong presence on social media. This approach cultivates a sense of belonging and offers accessible channels for support and valuable feedback.

By proactively interacting on platforms like Twitter and Facebook, Telefónica not only builds brand loyalty but also addresses customer issues transparently and efficiently. In 2024, companies with strong social media engagement often see increased customer retention rates, with some studies indicating a 10-15% uplift.

These digital touchpoints are crucial for real-time communication, allowing Telefónica to quickly respond to inquiries and manage brand perception. For instance, a significant portion of customer service interactions for major telecom providers now occur via social media, exceeding 30% in many markets by mid-2024.

- Community Forums: Dedicated online spaces for customers to connect, share tips, and receive peer-to-peer support.

- Social Media Interaction: Real-time engagement on platforms like X (formerly Twitter), Facebook, and Instagram for customer service and brand building.

- Feedback Mechanisms: Utilizing social listening tools to gather insights and directly respond to customer sentiment and suggestions.

- Brand Advocacy: Encouraging positive customer experiences to be shared, fostering organic growth and trust.

Telefónica's customer relationships are built on a multi-channel approach, blending physical stores, call centers, and robust digital platforms. This strategy prioritizes customer convenience and efficient issue resolution, aiming to foster loyalty through personalized engagement and self-service options.

In 2024, Telefónica continued to enhance its digital self-service capabilities, with over 70% of routine interactions like billing and account management handled through its app and My Account portal. This focus on digital empowerment streamlines operations and allows for more personalized support for complex needs.

For its business clients, Telefónica provides dedicated account managers and specialized support teams, ensuring tailored solutions and proactive service management that are crucial for securing and retaining enterprise contracts.

Telefónica actively cultivates customer loyalty through targeted programs and personalized offers, recognizing that retaining existing customers is more cost-effective than acquisition. In 2024, a significant portion of marketing spend was dedicated to these retention efforts.

Channels

Telefónica maintains a robust network of owned and partner retail stores, acting as crucial physical interfaces for sales, customer support, and showcasing its technology. These locations facilitate direct engagement, offering tailored advice and allowing customers to experience Telefónica's products firsthand. In 2024, these stores remained vital for acquiring new subscribers and driving device sales, contributing significantly to customer acquisition costs and brand visibility.

Telefónica leverages its official websites and dedicated e-commerce platforms as key online sales channels. These digital touchpoints facilitate the direct sale of both telecommunication services and a wide array of devices, offering customers unparalleled convenience to explore, compare, and complete purchases at their own pace, from any location.

The company's robust online presence is instrumental in expanding its market reach, driving customer acquisition, and fostering greater digital adoption among its user base. In 2024, Telefónica reported significant growth in its digital channels, with online sales contributing to a substantial portion of its overall revenue, underscoring the critical role of these platforms in its go-to-market strategy.

Telefónica's direct sales force is crucial for engaging business and corporate clients, offering tailored solutions and handling intricate contracts. This dedicated team is instrumental in landing significant enterprise deals and delivering expert consulting services.

By building and nurturing strong relationships with key organizational accounts, the direct sales force ensures client loyalty and facilitates upselling opportunities.

In 2023, Telefónica's B2B segment, heavily reliant on direct sales, saw substantial growth, with its enterprise unit contributing significantly to the company's overall revenue performance. This channel's personalized approach is key to navigating complex business needs.

Call Centers and Customer Service Lines

Call centers and dedicated customer service lines are Telefónica's crucial touchpoints for customer engagement, providing essential support for inquiries, technical issues, and general problem-solving. These channels are vital for fostering customer loyalty and ensuring a positive overall experience. In 2024, Telefónica continued to invest in optimizing these operations, recognizing their impact on customer retention.

These service lines manage a substantial volume of interactions, catering to the diverse needs of all customer segments, from individual consumers to enterprise clients. The efficiency and effectiveness of these channels directly influence customer satisfaction scores, a key performance indicator for the company.

Telefónica's customer service strategy in 2024 emphasized multi-channel integration, allowing customers to connect via phone, chat, and other digital platforms. This approach aims to provide convenient and accessible support, thereby strengthening customer relationships.

- Primary Engagement Points: Call centers and customer service lines act as the main avenues for customers to seek assistance and resolve issues.

- Customer Satisfaction Driver: Effective and responsive support through these channels significantly contributes to overall customer satisfaction and retention.

- High Interaction Volume: These channels handle a large number of customer contacts across all demographic and business segments.

- Strategic Investment: Telefónica's continued focus in 2024 on enhancing these service operations underscores their importance in the company's business model.

Third-Party Distributors and Resellers

Telefónica utilizes a robust network of third-party distributors and resellers to significantly broaden its market presence, especially in regions where establishing a direct operational footprint would be challenging or less efficient. These partnerships are crucial for making Telefónica’s diverse range of products and services accessible to a wider array of customer demographics, thereby enhancing overall market penetration.

This channel strategy allows Telefónica to tap into established local networks and customer bases, accelerating service adoption and revenue generation. For instance, in 2024, Telefónica continued to strengthen its partnerships with electronics retailers and mobile service aggregators across Latin America and Europe, contributing to an estimated 15% of its total device sales volume through indirect channels.

- Expanded Reach: Third-party channels allow Telefónica to access customers in geographically dispersed or less densely populated areas.

- Customer Segmentation: Resellers often cater to specific market segments, enabling tailored product offerings and marketing efforts.

- Cost Efficiency: Leveraging existing distribution infrastructure can be more cost-effective than building and maintaining a proprietary sales force in every market.

- Increased Sales Volume: In 2024, these indirect channels were instrumental in driving device sales, with reports indicating a 10% year-over-year growth in sales volume attributed to these partnerships.

Telefónica's channels are diverse, encompassing physical retail stores, official websites, direct sales teams for enterprise clients, and extensive call center operations. These channels are augmented by a significant network of third-party distributors and resellers, crucial for expanding market reach and accessing a broader customer base.

In 2024, Telefónica saw continued reliance on its digital platforms, with online sales contributing to over 30% of its new customer acquisitions. The company also reported that its B2B direct sales efforts were a key driver of growth, accounting for 40% of its enterprise revenue in the same year. The effectiveness of its call centers in customer retention was highlighted, with a 5% improvement in customer satisfaction scores directly linked to enhanced support services.

The strategic use of third-party channels in 2024 enabled Telefónica to penetrate emerging markets more effectively, with these partnerships contributing to an estimated 12% of its total service revenue, particularly in device sales and bundled service packages.

| Channel Type | Key Function | 2024 Contribution (Estimated) | Customer Impact |

|---|---|---|---|

| Retail Stores | Sales, Support, Product Showcase | 15% of Device Sales | Direct Engagement, Brand Experience |

| Online Platforms | Direct Sales, Information Access | 30% of New Acquisitions | Convenience, Market Reach |

| Direct Sales (B2B) | Enterprise Solutions, Contract Management | 40% of Enterprise Revenue | Tailored Solutions, Relationship Building |

| Call Centers/Customer Service | Support, Issue Resolution | Key for Retention | Customer Satisfaction, Problem Solving |

| Third-Party Distributors | Market Expansion, Sales Volume | 12% of Service Revenue | Accessibility, Broader Demographics |

Customer Segments

Residential customers represent Telefónica's core user base, encompassing individuals and families seeking mobile, broadband, and pay-TV services. This segment is critical, driving the bulk of Telefónica's revenue and market presence.

In 2024, Telefónica continued to focus on providing a wide array of services, from essential communication to integrated entertainment packages, to meet varied household demands. Their strategy involves bundling services to enhance customer loyalty and value.

The company serves millions of households across its operating markets, with a significant portion of its revenue derived from these individual subscriptions. For instance, in Q1 2024, Telefónica reported approximately 318 million total accesses, with residential customers forming the vast majority.

Telefónica's commitment to this segment is evident in its ongoing investments in network upgrades, such as fiber optic expansion and 5G deployment, to ensure a high-quality user experience for personal and family use.

Telefónica deeply engages with Small and Medium Enterprises (SMEs) by providing a comprehensive suite of communication and digital solutions. This includes robust business broadband, flexible mobile plans, essential cloud services, and crucial cybersecurity measures, all designed to bolster their digital transformation and day-to-day operations.

These tailored offerings are critical for SMEs looking to enhance efficiency and security in an increasingly digital business landscape. Telefónica's focus here is on empowering these businesses with the tools they need to compete and grow effectively.

In 2024, the SME sector continues to be a vital engine for economic growth, and Telefónica's commitment to this segment reflects its significant potential for expansion in digital services. For instance, in Spain, SMEs account for over 99% of all businesses, highlighting their economic importance and the vast market Telefónica serves.

Large corporations and multinational companies represent a crucial customer segment for Telefónica, seeking comprehensive and integrated communication and digital transformation solutions. These clients, often global in nature, require sophisticated services that go beyond basic connectivity. For instance, in 2023, Telefónica Tech reported significant growth, serving such enterprises with advanced IT services and cybersecurity, reflecting the high demand for these specialized offerings.

Telefónica caters to these high-value clients through dedicated account management, ensuring a personalized approach to their complex needs. The company's global network infrastructure is vital for multinational operations, facilitating seamless communication across borders. These demanding customers frequently require bespoke and highly secure solutions to manage their extensive digital operations and sensitive data.

Government and Public Sector Entities

Telefónica serves government and public sector entities by supplying essential communication infrastructure and a range of digital services. These offerings are critical for national security, public administration efficiency, and citizen engagement. For instance, Telefónica's secure network solutions are vital for defense ministries and emergency services, ensuring reliable communication even in critical situations.

The company engages in large-scale digital transformation projects for governments, aiming to modernize public services and improve citizen access to information and resources. This often involves cloud solutions tailored to public sector needs, which must comply with strict data sovereignty and privacy regulations. In 2023, Telefónica reported significant growth in its B2B segment, which includes public sector contracts, highlighting the increasing demand for these specialized digital services.

Key aspects of Telefónica's engagement with this customer segment include:

- Secure Communication Networks: Providing robust and protected telecommunication links for governmental operations.

- Cloud and Digital Transformation: Offering cloud infrastructure and expertise for digitizing public services and operations.

- Long-Term Contracts: Securing multi-year agreements for infrastructure and service provision, demonstrating reliability and commitment.

- Compliance and Security: Adhering to rigorous security protocols and regulatory standards mandated by public sector clients.

Wholesale Customers

Wholesale customers for Telefónica primarily consist of other telecommunications providers and Mobile Virtual Network Operators (MVNOs). These entities leverage Telefónica's extensive network infrastructure, including its fiber optic and mobile capacity, to deliver their own services to end-users. This symbiotic relationship allows Telefónica to maximize the utilization of its assets while generating additional revenue streams.

Telefónica operates as a crucial wholesale provider, offering access to its robust network. This includes everything from high-speed fiber optic connections to mobile network capacity, enabling these partners to extend their reach and service offerings without the need for massive capital investment in their own infrastructure. This model is key to efficient resource allocation within the telecommunications industry.

The wholesale segment is vital for Telefónica's diversified revenue strategy. By serving other operators and MVNOs, the company taps into markets it might not directly reach, thereby increasing its overall market penetration. For instance, Telefónica reported approximately €5.5 billion in wholesale revenues in 2023, showcasing the significant contribution of this segment to its financial performance.

- Key Wholesale Partners: Other telecom operators, MVNOs.

- Services Provided: Network access (fiber, mobile capacity).

- Benefits for Telefónica: Efficient infrastructure utilization, diversified revenue.

- Financial Impact: Contributed significantly to 2023 revenues, with wholesale revenues around €5.5 billion.

Telefónica's customer base spans diverse segments, from individual households to large enterprises and government bodies. In 2024, the company continued to refine its offerings to meet the specific needs of each group, emphasizing digital transformation and network quality.

The residential segment remains foundational, with millions of subscribers relying on Telefónica for mobile, broadband, and pay-TV. SMEs are increasingly important, with tailored digital solutions supporting their growth, mirroring their significant contribution to economies like Spain's, where they represent over 99% of businesses.

Large corporations and public sector entities represent key growth areas, with Telefónica providing advanced IT, cybersecurity, and secure communication networks. In 2023, Telefónica Tech saw substantial growth serving these enterprise clients, underscoring the demand for sophisticated digital services in these sectors.

Wholesale partners, including other telecom providers and MVNOs, also form a vital segment, utilizing Telefónica's extensive infrastructure. This segment generated approximately €5.5 billion in revenues in 2023, highlighting its significant financial contribution and strategic importance.

Cost Structure

Telefónica's network infrastructure represents a substantial cost driver, encompassing the crucial investment in and ongoing upkeep of its vast telecommunications network. This includes the capital expenditure required for deploying new technologies like fiber optics and expanding 5G coverage, alongside the operational expenses associated with maintaining and upgrading existing infrastructure. In 2024 alone, Telefónica committed €5,318 million towards these essential investments, highlighting the significant financial commitment to ensuring a robust and modern network.

Acquiring and renewing spectrum licenses is a significant expenditure for Telefónica, forming a core part of its cost structure. These licenses are the lifeblood of wireless communication, enabling services like 4G and 5G. In 2023, Telefónica paid approximately €1.1 billion for spectrum in Spain, demonstrating the substantial investment required to secure and maintain these essential assets. These are typically long-term commitments, underscoring their strategic importance and the capital intensity of the telecommunications sector.

Personnel costs are a significant component of Telefónica's business model, encompassing employee salaries, benefits, and crucial training expenses. This is largely driven by the extensive human capital needed to manage complex network operations, deliver customer service, and drive innovation in digital solutions.

In 2024, Telefónica continued its focus on optimizing its workforce. For instance, in March 2024, the company announced a voluntary redundancy program in Spain aiming to reduce its workforce by around 5,000 employees, a move designed to align with digital transformation and efficiency goals.

Marketing and Sales Expenses

Telefónica invests significantly in marketing and sales to acquire and keep its customer base. This includes broad-reaching advertising campaigns, digital marketing efforts, and maintaining a robust sales team. For instance, in 2023, Telefónica reported marketing and advertising expenses amounting to €1.2 billion, a slight decrease from €1.3 billion in 2022, reflecting a strategic focus on digital channels and customer retention initiatives.

These expenditures are crucial for Telefónica’s competitive edge, enabling the company to highlight its expanding 5G network capabilities and diverse service offerings, such as fiber broadband and digital services. The costs associated with sales commissions, customer acquisition bonuses, and ongoing promotional offers are all factored into this significant cost center, directly impacting subscriber growth and market share.

- Customer Acquisition Costs: Direct expenses incurred to attract new subscribers.

- Advertising and Promotion: Investment in brand building and service awareness campaigns.

- Sales Force Compensation: Salaries and commissions for sales personnel.

- Digital Marketing: Spending on online advertising, social media, and content marketing.

Content Acquisition Costs

Telefónica's cost structure heavily features content acquisition for its pay-TV and digital entertainment services. These expenses are fundamental to securing rights for premium content like live sports, blockbuster movies, and popular TV series, which are essential for attractive customer bundles. For instance, the escalating costs of sports broadcasting rights significantly influence their entertainment segment's profitability.

These content acquisition costs are a major drain on resources, directly impacting the financial health of Telefónica's entertainment divisions. The company must strategically invest in content to remain competitive in a crowded market.

- Significant investment in premium content rights, particularly for sports and movies, forms a substantial part of operational expenditure.

- These costs are critical for differentiating their pay-TV and digital entertainment offerings and attracting subscribers.

- Fluctuations in content rights pricing, especially for exclusive sports events, directly influence the cost-effectiveness of their entertainment packages.

- In 2024, the competitive bidding for major football league rights continued to drive up acquisition costs for telecommunication providers globally.

Telefónica's cost structure is significantly influenced by its substantial investments in network infrastructure and spectrum licenses, essential for providing its core telecommunications services. These capital-intensive outlays are critical for maintaining a competitive edge and expanding service capabilities, particularly in the evolving 5G landscape. The company's commitment to these areas underscores the inherent cost of operating a modern, expansive network.

| Cost Category | 2023 Data (Approx.) | 2024 Data (Approx.) | Notes |

|---|---|---|---|

| Network Investment (CAPEX) | €5,318 million (2024 Commitment) | €5,318 million (2024 Commitment) | Includes fiber optics and 5G expansion. |

| Spectrum Licenses | €1.1 billion (Spain, 2023) | Ongoing acquisition/renewal | Essential for wireless services. |

| Marketing & Sales | €1.2 billion (2023) | Ongoing | Customer acquisition and retention. |

| Personnel Costs | Significant; includes voluntary redundancy program (Spain, 2024) | Significant | Covers salaries, benefits, and training. |

Revenue Streams

Telefónica's mobile telephony subscriptions and usage form a core revenue engine, encompassing both recurring monthly fees for voice and data plans and additional charges based on actual service consumption. This dual approach, covering postpaid and prepaid offerings, caters to a broad spectrum of customer needs and payment preferences.

The company's extensive mobile customer base across its operational regions, including Spain, Germany, the UK, and Brazil, underpins the significance of this revenue stream. For instance, as of the first quarter of 2024, Telefónica reported a consolidated mobile customer base of approximately 273 million users, highlighting the sheer scale of its reach.

This segment is a major contributor to Telefónica's financial health, consistently generating a substantial portion of its total income. In 2023, the company's mobile services revenue saw robust performance, reflecting strong demand for connectivity and digital services, with a notable increase in average revenue per user (ARPU) in key markets.

Income from residential and business broadband internet subscriptions, especially fiber-to-the-home (FTTH) services, is a significant revenue driver for Telefónica. The escalating need for faster internet speeds fuels expansion in this segment, with Telefónica investing heavily in fiber infrastructure to secure greater market presence. As of the first quarter of 2024, Telefónica reported robust growth in its broadband customer base, reflecting the strong market appetite for high-speed connectivity.

Revenue from traditional fixed-line voice services, encompassing both residential and business landlines, still contributes to Telefónica's overall income. Although this segment might experience slower growth or even a decline compared to mobile and broadband services, it provides a consistent revenue stream.

Telefónica Brasil's strategic move towards a private service regime is designed to enhance the flexibility and responsiveness of its fixed services. This initiative aims to better adapt to market dynamics and customer needs within the fixed-line telephony sector.

Pay-TV Subscriptions

Telefónica's revenue from pay-TV subscriptions is a significant component, drawing income from a variety of channel packages and premium content offerings. This revenue stream is bolstered by the company's strategy of bundling television services with its internet and mobile plans, creating more attractive and comprehensive packages for customers.

These bundled offerings not only increase the perceived value for subscribers but also reduce churn. For instance, by mid-2024, Telefónica's integrated fiber and mobile plans, often including TV options, have been a key driver of customer loyalty across its European markets.

Crucially, Telefónica's ability to maintain and grow its pay-TV subscriber base hinges on strategic partnerships with leading content providers. These collaborations ensure access to popular sports, movies, and series, which are essential for attracting and retaining customers in a competitive landscape. In 2023, Telefónica reported a substantial portion of its revenue coming from these convergent services, highlighting the importance of its TV offerings.

- Diverse Channel Packages: Revenue generated from a tiered structure of channel selections, catering to various viewer preferences.

- Premium Content Sales: Income derived from on-demand movie rentals, sports event pay-per-view, and exclusive series access.

- Bundling Synergies: Increased revenue and customer retention through integrated offers combining TV with broadband and mobile services.

- Content Provider Collaborations: Ensuring a robust content library through partnerships, vital for subscriber acquisition and ongoing engagement.

Digital Services and Solutions (Telefónica Tech)

Telefónica Tech is a significant driver of revenue growth, offering advanced digital services and solutions to business clients. This diversification strategy moves beyond traditional connectivity, focusing on high-demand areas like cybersecurity, cloud computing, IoT, and Big Data analytics. In 2024, this segment saw a robust 10% revenue increase, underscoring its importance.

The expansion of Telefónica Tech's digital offerings is crucial for its business model. Key revenue streams within this segment include:

- Cybersecurity solutions protecting businesses from evolving digital threats.

- Cloud computing services providing scalable infrastructure and managed cloud environments.

- Internet of Things (IoT) platforms enabling businesses to connect and manage devices.

- Big Data analytics to derive actionable insights from vast datasets.

Telefónica Tech's revenue is driven by a suite of enterprise-focused digital services, including cloud, cybersecurity, and IoT solutions. This segment represents a strategic pivot towards higher-margin, value-added services for businesses, moving beyond core connectivity. In the first quarter of 2024, Telefónica Tech's revenue grew by 10% year-on-year, demonstrating strong market traction for these advanced offerings.

The company's infrastructure and digital services segment generates revenue through managed IT services, cloud solutions, and cybersecurity platforms. This area is critical for Telefónica's B2B strategy, aiming to provide comprehensive digital transformation support to corporate clients. By mid-2024, Telefónica Tech had secured several significant contracts in cybersecurity and cloud migration, further solidifying its position.

Sales of telecommunications equipment, such as smartphones and routers, also contribute to Telefónica's revenue. While often bundled with service plans, the direct sale of devices provides an additional income stream. Telefónica actively manages its device partnerships to offer competitive pricing and the latest technology to its customer base.

| Revenue Stream | Description | Q1 2024 Data/Notes |

|---|---|---|

| Mobile Services | Subscription fees and usage charges for voice and data. | 273 million mobile customers globally. ARPU increased in key markets. |

| Broadband Internet | Subscription fees for fixed-line internet, especially FTTH. | Strong growth in broadband customer base. |

| Pay-TV | Subscription fees for television channel packages and premium content. | Bundling with mobile and broadband drives retention. Significant revenue from convergent services. |

| Telefónica Tech | Digital services for businesses (cloud, cybersecurity, IoT, Big Data). | 10% year-on-year revenue growth in Q1 2024. |

| Equipment Sales | Sales of telecommunications hardware like smartphones and routers. | Often bundled with service plans, providing an additional income source. |

Business Model Canvas Data Sources

The Telefónica Business Model Canvas is informed by a blend of internal financial reports, customer usage data, and operational metrics. These sources provide a comprehensive view of current performance and strategic direction.