Telefónica Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telefónica Bundle

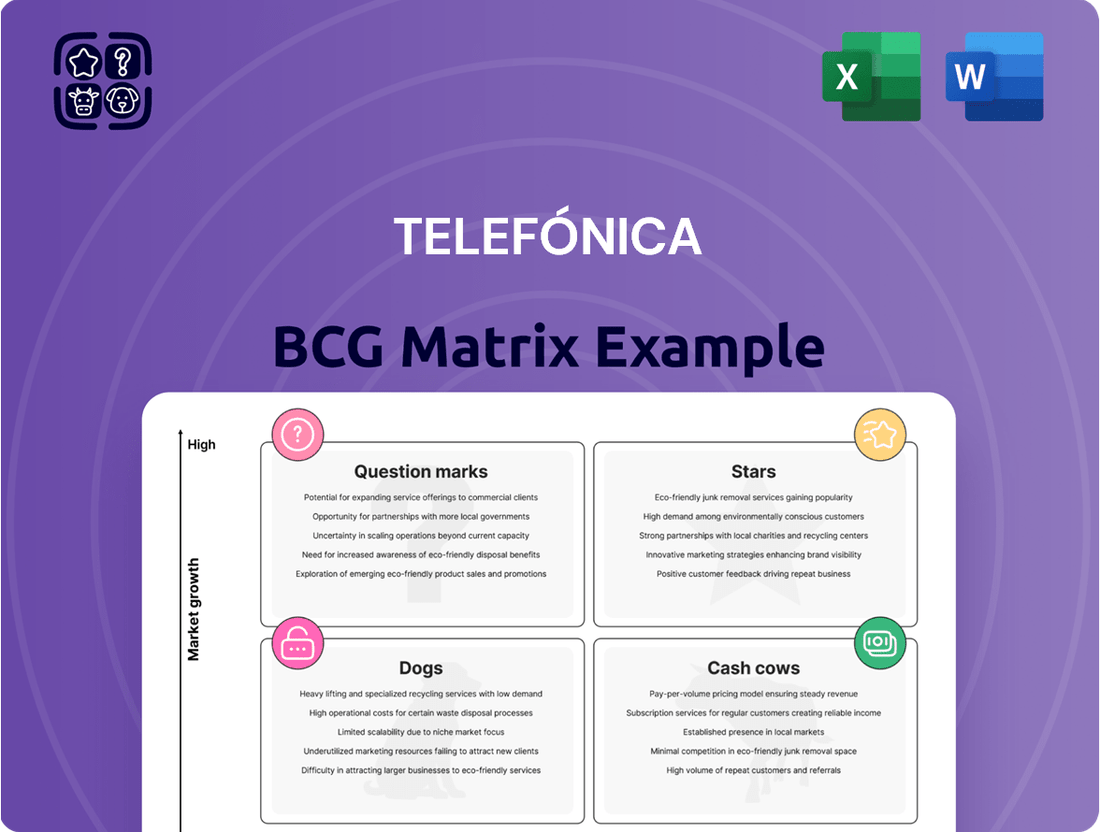

Curious about Telefónica's strategic positioning? Understanding its place within the BCG Matrix—whether as Stars, Cash Cows, Dogs, or Question Marks—is crucial for navigating the competitive telecommunications landscape.

This initial glimpse into Telefónica's product portfolio offers a foundational understanding, but the real power lies in a comprehensive analysis.

Unlock the full strategic potential by purchasing the complete BCG Matrix report.

Gain a granular view of each product's market share and growth rate, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on the detailed insights and actionable recommendations that will empower your strategic planning.

Purchase the full Telefónica BCG Matrix today for a complete roadmap to optimizing your business and securing a competitive edge.

Stars

Telefónica is making significant strides in its core markets, with 5G network coverage expanding rapidly in Spain, Germany, and Brazil. By the end of 2024, these key regions are expected to see substantial population penetration, laying the groundwork for future growth.

This strategic push into 5G is crucial as mobile data consumption continues its upward trajectory, fueled by an increasing demand for faster speeds and more sophisticated applications. Telefónica's investment positions them as a frontrunner in this high-growth sector.

The company's robust 5G infrastructure is designed to cater to both consumer needs, such as enhanced mobile broadband, and burgeoning enterprise demands for private networks and IoT solutions. This dual focus is expected to unlock new revenue streams.

For instance, in Spain, Telefónica aims to have its 5G network cover over 80% of the population by the close of 2024, a testament to their aggressive deployment strategy. Similar ambitious targets are in place for Germany and Brazil, solidifying their leadership in these vital markets.

Telefónica stands as a prominent global player in ultra-broadband, with its Fiber-to-the-Home (FTTH) expansion being a key strategic focus. The company continues to vigorously expand its fiber network, notably in Spain and Brazil, solidifying its position outside of China.

As of early 2024, Telefónica's FTTH network in Spain surpassed 25 million homes passed, a testament to its aggressive deployment strategy. This extensive rollout, coupled with growing customer adoption, translates into a significant market share within the expanding high-speed internet sector.

The increasing penetration of FTTH services directly fuels Telefónica's competitive edge. By capturing a larger share of this high-growth market, the company is effectively securing its long-term revenue streams and positioning itself for sustained financial performance.

Telefónica Tech's cybersecurity services are a significant component of the company's broader digital transformation strategy. This sector is booming, and Telefónica Tech is well-positioned, utilizing its robust network infrastructure to provide a wide array of security solutions. The company is actively pursuing growth in its digital services, with a specific target to substantially increase this revenue stream by 2026.

Focusing on business-to-business (B2B) clients, Telefónica Tech's cybersecurity offerings are experiencing robust revenue expansion. This strong performance suggests a solid market share within a dynamic and increasingly vital industry. The demand for sophisticated cybersecurity measures continues to rise, driven by evolving threats and the global push towards digital operations.

Telefónica Tech's IoT Solutions

Telefónica Tech's IoT solutions are positioned as a Star in the BCG matrix, reflecting its leadership in a high-growth market. Gartner has consistently recognized Telefónica as a global leader in Managed IoT Connectivity Services, underscoring its strong market presence.

The company's strategy involves integrating IoT with cutting-edge technologies such as 5G and artificial intelligence, catering to a wide array of industries. This synergy with emerging technologies further solidifies its growth trajectory.

- Global Leadership: Telefónica is acknowledged by Gartner as a top provider of Managed IoT Connectivity Services, indicating a dominant market share.

- Technological Integration: The business unit actively combines IoT with 5G and AI, creating advanced solutions for various sectors.

- Market Growth: Its strong position in the expanding IoT market suggests significant potential for future revenue and innovation.

- Revenue Potential: In 2024, the global IoT market was projected to reach hundreds of billions of dollars, with connectivity being a crucial component driving this growth.

B2B Digital Transformation Solutions

Telefónica Tech is making significant strides in B2B digital transformation, offering essential services like cloud, Big Data, and AI to businesses. These are rapidly expanding sectors, crucial for enterprise growth and innovation. This focus positions Telefónica as a key player in shaping the digital future of businesses across various industries.

This strategic concentration on high-growth B2B digital solutions is yielding strong results. Telefónica Tech's revenue in this segment experienced a notable increase of 26.6% in the first quarter of 2024, reaching €1.5 billion. This robust performance underscores the demand for their advanced technological offerings and their pivotal role in Telefónica's overall expansion strategy.

- Cloud Services: Telefónica Tech offers comprehensive cloud solutions, including migration, management, and hybrid cloud strategies, enabling businesses to optimize their IT infrastructure and operations.

- Big Data and Analytics: The company provides advanced data analytics platforms and services, helping businesses leverage their data for insights, improved decision-making, and personalized customer experiences.

- Artificial Intelligence (AI): Telefónica Tech is at the forefront of AI implementation, offering solutions for automation, machine learning, and predictive analytics to drive efficiency and innovation.

- Cybersecurity: Integrated security services are a core component, ensuring the protection of digital assets and sensitive data throughout the transformation process.

Telefónica Tech's IoT solutions are positioned as a Star in the BCG matrix, signifying its leadership in a high-growth market. Gartner's consistent recognition of Telefónica as a global leader in Managed IoT Connectivity Services highlights its strong market presence and competitive advantage.

The company's strategic integration of IoT with 5G and AI creates advanced, synergistic solutions for diverse industries, further solidifying its growth trajectory. With the global IoT market projected for substantial expansion, Telefónica's connectivity services are a critical driver of this growth, offering significant future revenue potential.

Telefónica Tech's commitment to B2B digital transformation, encompassing cloud, Big Data, and AI, is a key driver of its Star status. The unit's revenue saw a significant 26.6% increase in Q1 2024, reaching €1.5 billion, demonstrating strong demand for its advanced offerings.

This robust performance in high-growth sectors like cloud, Big Data, and AI, coupled with integrated cybersecurity, positions Telefónica Tech as a pivotal player in enterprise digital evolution, solidifying its Star classification.

| BCG Category | Telefónica Business Unit | Market Growth | Market Share | Key Services |

|---|---|---|---|---|

| Star | Telefónica Tech (IoT) | High | High (Gartner Leader) | Managed IoT Connectivity, 5G/AI Integration |

| Star | Telefónica Tech (Digital Transformation B2B) | High | High (26.6% Q1 2024 Revenue Growth) | Cloud, Big Data, AI, Cybersecurity |

What is included in the product

Highlights which Telefónica business units to invest in, hold, or divest based on market growth and share.

Quickly identify underperforming units, allowing for focused divestment strategies and resource reallocation to high-potential areas.

Cash Cows

Telefónica España's traditional mobile connectivity segment is a classic Cash Cow. It boasts a dominant market share in Spain's mature mobile sector, consistently generating significant revenue from essential voice and data services.

Even with fierce competition, Telefónica's strong brand recognition and loyal customer base translate into predictable and robust cash flows. In 2024, the Spanish mobile market, while saturated, still showed resilience, with Telefónica maintaining a leading position, contributing substantially to the company's overall profitability.

This mature segment demands minimal capital expenditure for expansion, focusing primarily on maintenance. This low investment requirement allows for high profit margins, reinforcing its status as a key cash generator for Telefónica.

Telefónica's fixed broadband services in Spain are a classic Cash Cow within its BCG matrix. This mature market segment, despite lower growth rates, consistently delivers substantial and predictable cash flows, forming a stable financial bedrock for the company.

As of the first quarter of 2024, Telefónica Spain boasted over 4.3 million fixed broadband customers, underscoring the significant penetration and scale of this service. The extensive fiber optic network built out over years provides a strong competitive advantage and high barriers to entry, reinforcing its Cash Cow status.

These broadband services are increasingly viewed as essential utilities, ensuring a steady demand from households and businesses alike. This consistent demand, coupled with efficient operations on established infrastructure, allows Telefónica to extract maximum profit with minimal reinvestment, a hallmark of a Cash Cow.

Telefônica Brasil, known as Vivo, holds a commanding position in Brazil's mobile landscape, particularly with its postpaid customer base. This segment is a bedrock of consistent revenue, boasting strong customer loyalty and a healthy average revenue per user (ARPU).

In 2023, Vivo's Brazilian operations generated approximately €14.1 billion in revenue, with the mobile segment being a substantial contributor. The postpaid subscriber base, which typically exhibits higher ARPU than prepaid, forms a crucial part of this revenue stream, reflecting its cash cow status.

The Brazilian mobile market, though mature, offers a stable environment for Vivo's postpaid services. This stability facilitates operational efficiencies and contributes to robust profit margins, allowing the segment to reliably generate significant cash flow for Telefônica.

Telefónica Deutschland (O2 Germany) Mobile Services

Telefónica Deutschland's O2 Germany mobile services are a classic cash cow within the company's portfolio, operating in the mature but stable German telecommunications market.

With over 45 million mobile lines managed, O2 Germany holds a significant market share, benefiting from its established brand recognition and robust network infrastructure. This strong position in a non-growth market generates consistent and substantial cash flow for Telefónica. In 2024, the German mobile market continued to show resilience, with O2 Germany's revenue from mobile services remaining a dependable contributor to the parent company's financial stability, allowing for reinvestment in other growth areas.

- Market Leader in a Stable Environment: O2 Germany manages over 45 million mobile lines, securing a substantial presence in the German market.

- Consistent Cash Generation: The mature nature of the German mobile segment, coupled with O2's strong brand and network, ensures reliable cash flow.

- Support for Strategic Investments: The steady income from O2 Germany's mobile services provides crucial financial backing for Telefónica's investments in emerging technologies and new markets.

Wholesale Network Services

Telefónica's Wholesale Network Services act as a significant cash cow within its BCG Matrix. The company's vast network infrastructure, developed over many years, is leased to other telecommunications providers through wholesale agreements. This generates a reliable and predictable income, essentially monetizing existing assets in a stable market segment.

This business line requires very little additional capital investment, allowing it to consistently produce strong cash flow. It's characterized by low growth but high profitability, a hallmark of a mature cash cow. For instance, in 2023, Telefónica reported significant revenue from its wholesale operations, underscoring its role as a stable income generator. The company continues to invest strategically to maintain the quality and capacity of this network, ensuring its ongoing value.

- Steady Revenue Stream: Wholesale agreements provide predictable income from leased network capacity.

- Asset Monetization: Leverages existing infrastructure with minimal new investment.

- High Profitability: Despite low growth, the segment is a consistent cash generator.

- 2023 Performance: Wholesale services contributed substantially to Telefónica's overall financial stability.

Telefónica's wholesale network services represent a prime example of a Cash Cow in its BCG Matrix. The company leverages its extensive, pre-existing fiber optic and mobile infrastructure by leasing capacity to other operators. This strategy taps into a stable market where demand for network access remains consistent, generating predictable revenue streams.

In 2023, Telefónica's wholesale business demonstrated strong performance, contributing significantly to the company's overall financial health. The operational model for these services is lean, requiring minimal capital expenditure for growth, which translates directly into high profit margins and robust cash generation. This makes it a vital component for funding other strategic initiatives.

Telefónica's commitment to maintaining and upgrading its wholesale network ensures its continued relevance and profitability. This focus on asset optimization within a mature market segment solidifies its position as a dependable Cash Cow, providing a stable financial base for the organization.

| Segment | BCG Category | Key Characteristics | 2023 Contribution Indicator |

|---|---|---|---|

| Wholesale Network Services | Cash Cow | Leasing network infrastructure to other operators | Significant contributor to overall financial stability |

| Low capital expenditure for expansion | High profit margins | ||

| Stable market demand | Predictable revenue generation |

Preview = Final Product

Telefónica BCG Matrix

The Telefónica BCG Matrix preview you are currently viewing is the identical, fully functional document you will receive upon completing your purchase. This means no alterations, watermarks, or missing sections; you get the entire strategic analysis as is, ready for immediate application. The report is meticulously crafted to offer a clear, actionable overview of Telefónica's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs, providing crucial insights for resource allocation and strategic decision-making. You can confidently rely on this preview to represent the comprehensive and professionally formatted report that will be delivered directly to you, enabling swift integration into your business planning processes.

Dogs

Telefónica is actively phasing out its legacy copper-based fixed-line services, a process well underway in Spain as the company prioritizes its fiber optic network deployment. This strategic shift aims to complete the migration of customers to more advanced infrastructure.

These legacy services are situated in a declining market, characterized by minimal customer growth and escalating operational expenses. The increasing difficulty and cost of maintaining aging copper infrastructure contribute to this challenging market position.

Further investment in these outdated networks offers diminishing returns, making them a significant drain on Telefónica's financial and operational resources. The company's focus is on reallocating these resources towards future-proof technologies.

Telefónica's traditional pay-TV subscriptions, often referred to as linear TV, are positioned in a market facing significant headwinds. The increasing popularity of streaming services and over-the-top (OTT) content has led to a steady decline in subscriber numbers for traditional pay-TV packages globally. In 2024, the trend continued, with many operators reporting net losses in this segment.

This segment is characterized by low growth potential and intense competition, leading to potential customer churn. Telefónica's linear TV offerings, while still a part of its portfolio, are likely to be categorized as a 'Dog' in the BCG Matrix. This suggests that the company might consider optimizing resource allocation away from this mature and declining business line.

Telefónica’s decision to divest its Hispam operations, encompassing countries like Argentina, Peru, and Colombia, places them squarely in the Dogs category of the BCG Matrix. This strategic move, finalized in recent years, reflects a deliberate exit from markets exhibiting subpar growth and profitability. For instance, in 2022, Telefónica reported a significant drop in revenue from its Latin American operations outside of Brazil, underscoring the challenges in these regions.

The rationale behind this divestiture is a clear prioritization of core, high-growth markets where Telefónica can achieve stronger competitive positioning and better returns. These divested businesses likely struggled to gain sufficient market share or generate adequate profit margins, making them less attractive for continued investment. The sale of these assets, completed by late 2021 and early 2022 for many of these markets, represents a commitment to shedding underperforming units.

Legacy 2G/3G Mobile Networks

Legacy 2G/3G mobile networks represent Telefónica's "Dogs" in the BCG Matrix. As the industry pushes towards 4G and 5G, these older infrastructures are experiencing significantly reduced usage and minimal growth prospects. Telefónica's strategic decision to phase out these networks is driven by the need to streamline operations and focus investment on newer, more efficient technologies.

The declining relevance of 2G and 3G is evident in usage statistics. For instance, many operators globally have reported that 3G traffic accounts for less than 5% of total data, while 2G is even lower, primarily used for basic voice calls and legacy IoT devices. Telefónica's approach aligns with this trend, acknowledging the substantial maintenance costs associated with these aging networks that no longer contribute meaningfully to revenue growth.

- Declining Usage: 2G and 3G traffic represents a small fraction of overall mobile data consumption, often below 5% for 3G.

- High Maintenance Costs: Continued operation of legacy networks incurs significant expenses for maintenance and support without commensurate revenue.

- Strategic Phase-Out: Telefónica is actively decommissioning these networks to redirect resources and capital towards 4G and 5G expansion.

- Operational Simplification: Reducing the number of active network technologies simplifies management and enhances overall efficiency.

Underperforming Niche Digital Ventures

Within Telefónica's diverse digital offerings, certain niche ventures may be categorized as underperforming. These are typically smaller-scale projects or applications that haven't captured significant market share in their specific, often slower-growing, digital segments. For instance, a specialized B2B platform for a very specific industry that saw limited adoption might fall into this category.

These ventures represent low market share in low-growth markets, a classic indicator for re-evaluation within the BCG matrix. Telefónica, like many large telecommunications companies, continually assesses its portfolio to ensure resources are allocated efficiently. Ventures in this segment might require a strategic decision, weighing potential future turnaround against the cost of continued investment or the benefits of divestment.

While specific financial data for every minor niche venture isn't publicly disclosed, Telefónica's overall digital services revenue growth is a key indicator. In 2023, Telefónica reported a notable increase in its digital services, highlighting the company's broader success in digital transformation. However, individual ventures within this broader category could still exhibit underperformance.

- Low Market Share: These ventures typically operate with a small percentage of their respective niche markets.

- Low Growth Markets: The specific digital segments they serve are characterized by limited expansion prospects.

- Resource Re-evaluation: Continued investment is questioned, with divestment or restructuring being potential outcomes.

- Portfolio Optimization: They represent a segment of the portfolio requiring careful management to free up capital for more promising areas.

Telefónica's legacy 2G and 3G mobile networks are prime examples of "Dogs" in the BCG Matrix. Usage on these older networks is dwindling, often representing less than 5% of data traffic for 3G, with 2G even lower and primarily for basic calls. Despite high maintenance costs, their contribution to revenue growth is minimal.

The company is actively decommissioning these networks to simplify operations and reallocate capital to 4G and 5G advancements. This strategic phase-out reflects the declining relevance and minimal growth prospects of these older technologies.

Telefónica’s divested Hispam operations are also classified as "Dogs." In 2022, Latin American operations outside Brazil showed a revenue drop, highlighting challenges in these markets. The divestiture, largely completed by late 2021/early 2022, prioritized core, high-growth markets over these underperforming units.

Furthermore, traditional linear TV subscriptions are in a "Dog" category. The rise of streaming services has led to declining subscriber numbers globally, with operators reporting net losses in 2024. This segment faces low growth and intense competition, prompting Telefónica to consider optimizing resource allocation away from it.

Question Marks

Telefónica Global Solutions' satellite IoT offering positions it in a niche, high-potential segment of the broader IoT market. This service connects devices in areas lacking terrestrial network coverage, addressing a critical need for remote operations.

Within Telefónica's portfolio, satellite IoT can be viewed as a Question Mark. While the overall IoT market is a Star, this specific segment for Telefónica is still developing and likely commands a smaller market share currently. Significant investment is needed to scale this offering and capitalize on its future growth potential.

The global IoT market is projected to reach over $1.1 trillion by 2024, with satellite IoT expected to capture a growing portion of this. For instance, the satellite IoT market alone was valued at approximately $3.1 billion in 2023 and is anticipated to expand at a compound annual growth rate of over 20% through 2030, highlighting the investment opportunity.

Edge computing services, a rapidly expanding sector driven by the need for real-time data processing, represent a significant growth opportunity for Telefónica. This segment, characterized by its demand for low-latency solutions, is expected to see substantial market expansion in the coming years. Telefónica Tech is actively building its presence in this nascent market.

Despite its strategic focus, Telefónica's current market share in edge computing is likely modest given the early stage of the technology's adoption. The global edge computing market size was estimated to be around $10 billion in 2023 and is projected to reach over $80 billion by 2028, showcasing the immense potential.

To effectively compete and capture a meaningful share of this high-growth market, Telefónica will need to make substantial investments in its infrastructure, including network capabilities and specialized solutions. Such investments are crucial for delivering the performance and reliability that enterprises require from edge computing services.

Telefónica Tech's venture into new B2B vertical-specific AI solutions positions them in a nascent market characterized by low initial penetration. These specialized AI applications, targeting sectors like smart manufacturing and logistics, are considered question marks due to their high investment requirements and uncertain market share potential. For instance, the global AI market in manufacturing was projected to reach $11.1 billion in 2024, indicating significant growth but also the need for substantial capital to capture a meaningful share.

Expansion of Telefónica Tech Services into New European Markets

Telefónica Tech is strategically deploying its digital expertise, including robust cybersecurity and cloud solutions, into promising new European markets. These regions represent significant opportunities for digital transformation, aligning with Telefónica Tech’s objective to bolster its presence in areas where its market share is not yet established.

The company's expansion targets markets with high growth potential for digital transformation services. This initiative requires substantial investment in establishing a local presence, building out sales capabilities, and tailoring solutions to meet the specific needs of these new European customers. Telefónica aims to capture a larger share of the burgeoning digital services market in these territories.

- Market Expansion Focus: Telefónica Tech is targeting new European markets with its established digital services like cybersecurity and cloud.

- Growth Potential: These markets exhibit strong potential for digital transformation, offering Telefónica Tech avenues for significant revenue growth.

- Investment Requirements: Significant capital outlay is necessary for market entry, sales force development, and creating localized service offerings.

- Strategic Objective: The move is designed to increase Telefónica Tech's market share in geographies where it currently has a limited footprint in digital services.

Private 5G Networks for Enterprises

While 5G for consumers is becoming more common, the real growth opportunity lies in private 5G networks for businesses. These networks offer tailored, high-performance connectivity for industrial applications, promising significant advancements in efficiency and automation.

Telefónica is well-positioned to provide these private 5G solutions, leveraging its existing infrastructure and expertise. However, this market is still in its nascent stages, meaning Telefónica's current market share is modest as the ecosystem matures.

- Emerging Market: The enterprise private 5G market is projected to grow substantially, with some estimates placing its global value in the tens of billions of dollars by the mid-2020s.

- Telefónica's Position: Telefónica is actively developing and piloting private 5G solutions across various industries, demonstrating its commitment to this high-growth area.

- Strategic Imperative: To capitalize on this potential, Telefónica needs to make focused investments in network capabilities and forge strategic partnerships with technology providers and industry leaders.

- Low Current Share: As the market is still developing, Telefónica's market share in enterprise private 5G is currently low, reflecting the early stage of adoption and deployment.

Telefónica's satellite IoT and specialized AI solutions for verticals are prime examples of Question Marks in the BCG matrix. These ventures require substantial investment to build market share in nascent but high-potential areas.

The company's expansion into new European markets with digital services also fits the Question Mark profile. While the growth potential is significant, Telefónica's current market share in these regions is limited, necessitating considerable investment to establish a stronger foothold.

Similarly, the enterprise private 5G market represents a Question Mark for Telefónica. It's an emerging sector with immense promise, but Telefónica's current penetration is low, requiring strategic investment to unlock its full potential.

These Question Mark initiatives, though demanding in terms of capital and strategic focus, are crucial for Telefónica's long-term growth and diversification beyond its traditional markets.

| Business Area | BCG Category | Market Potential | Current Share | Investment Need |

| Satellite IoT | Question Mark | High (Global market ~$3.1B in 2023, >20% CAGR) | Low | High |

| Vertical-Specific AI Solutions | Question Mark | High (AI in Manufacturing ~$11.1B in 2024) | Low | High |

| New European Digital Markets | Question Mark | High (Digital transformation services) | Low | High |

| Enterprise Private 5G | Question Mark | High (Tens of billions $ mid-2020s) | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Telefónica's financial reports, market share analysis, and telecommunications industry growth projections to provide strategic insights.