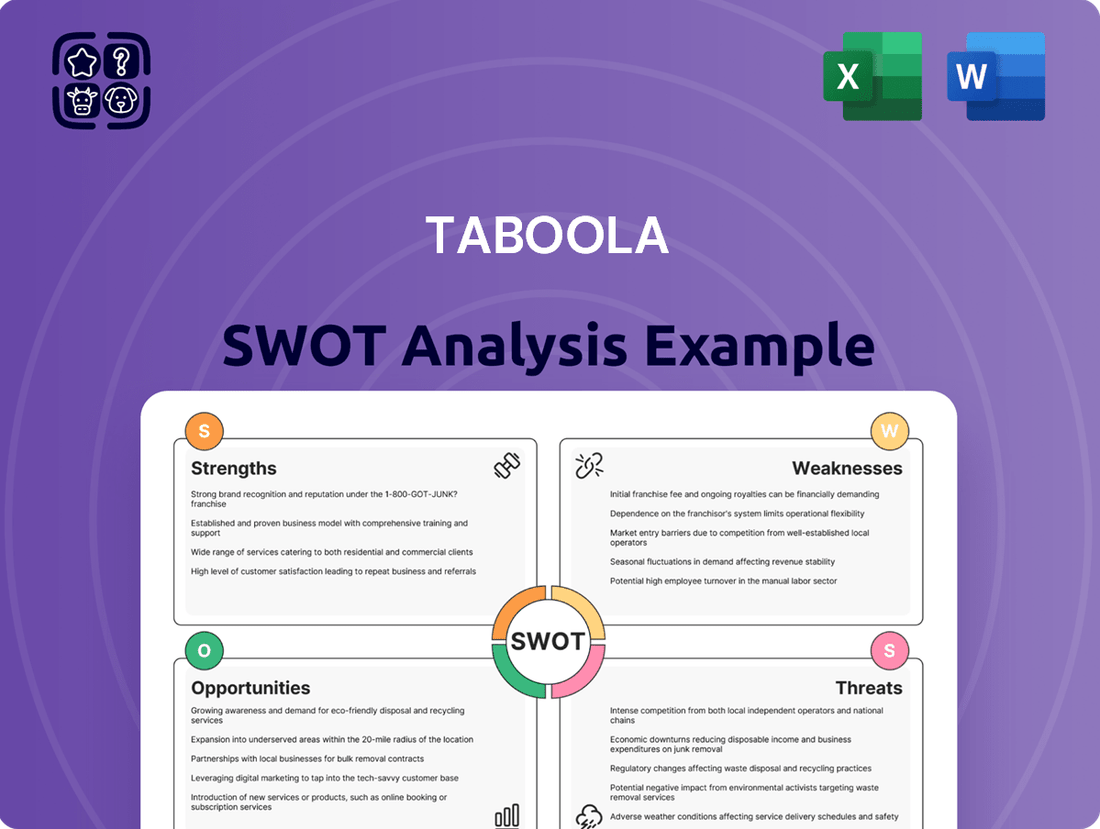

Taboola SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Taboola Bundle

Taboola, a leader in content discovery, leverages its extensive publisher network and sophisticated recommendation engine as key strengths. However, the company faces challenges related to content quality control and increasing competition in the programmatic advertising space. Understanding these dynamics is crucial for any player in the digital media landscape.

Want to grasp the full strategic picture of Taboola's market position and future trajectory?

Discover the complete SWOT analysis to uncover actionable insights, competitive advantages, and potential risks. This in-depth report is your key to informed decision-making.

Gain access to our professionally written, fully editable report, designed to support your strategic planning, pitches, and research in the dynamic digital advertising industry.

Strengths

Taboola's advanced AI and personalization technology is a significant strength, powering its recommendation engine. This sophisticated system meticulously analyzes extensive user data and browsing habits to curate highly tailored content and ad suggestions. This deep personalization is key to boosting user engagement and maximizing ad effectiveness for both publishers and advertisers alike.

This AI-driven approach directly addresses the growing demand for relevant digital experiences. In 2024, global digital ad spending was expected to surpass $600 billion, a testament to the importance of effective targeting. Taboola's ability to deliver personalized recommendations allows its partners to capture a larger share of this market by driving more qualified traffic and increasing monetization opportunities.

Taboola's extensive publisher network, built on strategic partnerships with major players like Yahoo, NBC News, and Future, is a core strength. Many of these relationships span over a decade, demonstrating deep integration and trust.

This vast network provides Taboola with access to premium advertising inventory, reaching an estimated 600 million daily active users worldwide as of early 2024. This massive reach is a significant differentiator in the digital advertising landscape.

These strong publisher relationships ensure a consistent supply of high-quality ad placements, directly translating into better reach and engagement opportunities for advertisers on the open web.

The company's ability to maintain these long-standing partnerships underscores its value proposition to publishers, reinforcing its position as a key player in content discovery and native advertising.

Taboola's financial performance has shown a marked improvement, with recent reports highlighting growth in key areas. For instance, revenue and gross profit demonstrated positive trends through 2024 and into Q1 2025, indicating successful market positioning and product adoption.

The company's strategic emphasis on operational efficiency and disciplined cost management has directly translated into enhanced profitability. This is evidenced by a significant rebound in Adjusted EBITDA, which reached $113 million in Q1 2025, a substantial increase year-over-year.

Stronger free cash flow generation, a direct result of these efficiency gains, provides Taboola with greater financial flexibility. This robust financial health is crucial for fueling ongoing investments in research and development, as well as pursuing strategic growth opportunities.

The demonstrated financial turnaround and improved operational metrics have bolstered investor confidence, positioning Taboola favorably for future expansion and innovation in the competitive digital advertising landscape.

Diversification into Performance Advertising with 'Realize'

Taboola's launch of the 'Realize' platform signifies a crucial move into the performance advertising sector, expanding beyond its established native advertising roots. This strategic diversification is designed to provide advertisers with solutions directly tied to measurable outcomes, tapping into a market segment that extends beyond the typical search and social media duopoly.

The 'Realize' platform allows Taboola to capture a larger share of the digital advertising spend by focusing on performance metrics. This expansion is particularly relevant given the projected growth in the global digital advertising market, which was anticipated to reach over $600 billion in 2024. By offering outcome-based advertising, Taboola aims to attract a broader range of advertisers seeking demonstrable return on investment.

- Diversification: Entry into performance advertising via 'Realize' broadens Taboola's revenue potential beyond native placements.

- Market Expansion: Targets advertisers seeking measurable results, accessing a market segment larger than traditional native ad channels.

- Competitive Positioning: Aims to strengthen Taboola's standing in the competitive digital advertising landscape by offering outcome-oriented solutions.

- Revenue Growth: This initiative is poised to significantly enhance Taboola's revenue streams by catering to the growing demand for performance marketing.

Solutions for Publishers Amidst Industry Shifts

Taboola provides essential tools for publishers facing challenges like decreased referral traffic from search and social platforms, alongside the disruptive influence of generative AI. Its AI-driven 'Taboola for Audience' platform is designed to help publishers attract and keep visitors, thereby enabling content monetization and the diversification of traffic streams.

This robust support system solidifies Taboola's role as a crucial ally for publishers navigating the dynamic digital landscape. For instance, Taboola reported powering over 500 billion content recommendations monthly in early 2024, demonstrating its scale in addressing these industry shifts.

- AI-powered traffic generation and retention solutions.

- Monetization and diversification of publisher revenue streams.

- Addressing the impact of declining search/social referrals and generative AI.

Taboola's advanced AI and personalization technology is a significant strength, powering its recommendation engine. This sophisticated system meticulously analyzes extensive user data and browsing habits to curate highly tailored content and ad suggestions. This deep personalization is key to boosting user engagement and maximizing ad effectiveness for both publishers and advertisers alike.

This AI-driven approach directly addresses the growing demand for relevant digital experiences. In 2024, global digital ad spending was expected to surpass $600 billion, a testament to the importance of effective targeting. Taboola's ability to deliver personalized recommendations allows its partners to capture a larger share of this market by driving more qualified traffic and increasing monetization opportunities.

Taboola's extensive publisher network, built on strategic partnerships with major players like Yahoo, NBC News, and Future, is a core strength. Many of these relationships span over a decade, demonstrating deep integration and trust.

This vast network provides Taboola with access to premium advertising inventory, reaching an estimated 600 million daily active users worldwide as of early 2024. This massive reach is a significant differentiator in the digital advertising landscape.

The company's ability to maintain these long-standing partnerships underscores its value proposition to publishers, reinforcing its position as a key player in content discovery and native advertising.

Taboola's financial performance has shown a marked improvement, with recent reports highlighting growth in key areas. For instance, revenue and gross profit demonstrated positive trends through 2024 and into Q1 2025, indicating successful market positioning and product adoption.

The company's strategic emphasis on operational efficiency and disciplined cost management has directly translated into enhanced profitability. This is evidenced by a significant rebound in Adjusted EBITDA, which reached $113 million in Q1 2025, a substantial increase year-over-year.

Stronger free cash flow generation, a direct result of these efficiency gains, provides Taboola with greater financial flexibility. This robust financial health is crucial for fueling ongoing investments in research and development, as well as pursuing strategic growth opportunities.

Taboola's launch of the 'Realize' platform signifies a crucial move into the performance advertising sector, expanding beyond its established native advertising roots. This strategic diversification is designed to provide advertisers with solutions directly tied to measurable outcomes, tapping into a market segment that extends beyond the typical search and social media duopoly.

The 'Realize' platform allows Taboola to capture a larger share of the digital advertising spend by focusing on performance metrics. This expansion is particularly relevant given the projected growth in the global digital advertising market, which was anticipated to reach over $600 billion in 2024. By offering outcome-based advertising, Taboola aims to attract a broader range of advertisers seeking demonstrable return on investment.

Taboola provides essential tools for publishers facing challenges like decreased referral traffic from search and social platforms, alongside the disruptive influence of generative AI. Its AI-driven 'Taboola for Audience' platform is designed to help publishers attract and keep visitors, thereby enabling content monetization and the diversification of traffic streams.

This robust support system solidifies Taboola's role as a crucial ally for publishers navigating the dynamic digital landscape. For instance, Taboola reported powering over 500 billion content recommendations monthly in early 2024, demonstrating its scale in addressing these industry shifts.

| Strength Area | Key Feature | Impact/Data Point |

|---|---|---|

| AI & Personalization | Advanced recommendation engine analyzing user data | Boosts user engagement and ad effectiveness. |

| Publisher Network | Strategic partnerships with major publishers | Access to premium inventory, reaching ~600M daily active users (early 2024). |

| Financial Performance | Improved revenue, gross profit, and EBITDA | Adjusted EBITDA reached $113M in Q1 2025, up significantly year-over-year. |

| Strategic Expansion | 'Realize' platform for performance advertising | Targets outcome-based advertising in a market exceeding $600B (2024 projection). |

| Publisher Support | AI-driven tools for traffic and monetization | Powers over 500B content recommendations monthly (early 2024). |

What is included in the product

Highlights Taboola's internal capabilities, such as its extensive publisher network and advanced AI, alongside external threats like increasing competition and privacy regulations.

Offers a clear, actionable framework to identify and address Taboola's strategic challenges and opportunities.

Weaknesses

Taboola's model relies heavily on Traffic Acquisition Costs (TAC), which directly affect its bottom line. In the first quarter of 2024, Taboola reported revenue of $392.2 million, but operating expenses, including TAC, remained a significant factor in profitability. While the company aims for efficiency, periods of operating loss, such as the net loss of $14.9 million reported for the same quarter, underscore the persistent challenge of managing these substantial acquisition costs.

The digital advertising space is heavily influenced by giants like Google and Meta, who command significant resources and market share. This intense competition presents a substantial challenge for Taboola, potentially capping its market expansion and creating downward pressure on advertising prices. In 2023, Google and Meta together captured over 50% of the global digital ad market, a figure expected to remain dominant through 2025.

Taboola's reliance on a select group of major partners, like Yahoo, presents a significant weakness. A substantial portion of its revenue stems from these few key relationships, making the company susceptible to their strategic decisions. For instance, a renegotiation of terms or a decision by Yahoo to reduce its spend could directly and negatively impact Taboola's financial performance.

This concentrated revenue stream creates a vulnerability; any instability or termination of these crucial alliances could severely disrupt Taboola's financial health and operational continuity. In 2023, major partners accounted for a considerable percentage of Taboola's total revenue, though specific figures are often subject to change with reporting cycles and are not publicly detailed to that granular extent.

Risks Associated with New Product Launches and Market Acceptance

The success of Taboola's new platforms, such as 'Realize', hinges significantly on market acceptance and how they stack up against existing competitive offerings. There's a real chance these new ventures might not capture enough market share or that competitors could quickly roll out more advanced features.

This uncertainty directly impacts the projected financial gains and the expected return on investment for Taboola. For instance, if 'Realize' doesn't resonate with users or advertisers as anticipated, it could lead to underperformance against financial targets set for 2024 and 2025.

- Market Acceptance Risk: New product launches, like Taboola's 'Realize', face the inherent challenge of gaining traction in a crowded digital advertising landscape.

- Competitive Pressure: Rivals may introduce superior or more cost-effective solutions, potentially siphoning off market share and dampening the success of Taboola's new offerings.

- Financial Impact: Failure to achieve widespread adoption for new products could result in missed revenue targets and a lower-than-expected return on the significant investments made in their development and marketing through 2024 and 2025.

- Feature Parity: Taboola must continually innovate to ensure its new platforms offer compelling features that match or exceed those of competitors to secure sustained user and advertiser engagement.

Operational Profitability Challenges

Taboola has encountered difficulties in maintaining consistent operational profitability, even with revenue expansion. For instance, the company reported an operating loss of $22.6 million in the first quarter of 2024, a contrast to the $10.5 million profit seen in the same period of 2023. This indicates ongoing pressure on margins.

Sustaining profitability hinges on Taboola's ability to manage its operating expenses effectively while scaling its platform. The company's focus on integrating Outbrain and optimizing its technology stack aims to address these efficiency challenges.

Key areas impacting operational profitability include marketing and sales expenses, which remain significant investments for user acquisition and advertiser retention. Balancing these costs with revenue generation is crucial for long-term financial health.

- Operating Loss: Taboola reported an operating loss of $22.6 million in Q1 2024, compared to a $10.5 million operating profit in Q1 2023, highlighting profitability fluctuations.

- Cost Management: Continuous efforts are needed to control operating expenses, particularly in sales and marketing, to ensure sustainable profitability as the company grows.

- Integration Synergies: Realizing cost synergies from the Outbrain acquisition is vital for improving operational efficiency and bolstering profit margins.

Taboola's significant reliance on Traffic Acquisition Costs (TAC) poses a persistent challenge to its profitability. Despite revenue growth, operating expenses, including TAC, continue to pressure its bottom line, as evidenced by a net loss of $14.9 million in Q1 2024. This highlights the ongoing need for cost management to achieve consistent financial health.

The company faces intense competition from digital advertising giants like Google and Meta, who command a substantial market share, potentially limiting Taboola's growth and pricing power. Furthermore, a concentrated revenue stream from a few major partners creates vulnerability; any adverse changes in these key relationships could significantly impact Taboola's financial performance and operational stability.

| Weakness | Description | Impact |

| High Traffic Acquisition Costs (TAC) | Significant portion of revenue spent on acquiring traffic, directly affecting profitability. | Pressures profit margins and can lead to operating losses. |

| Intense Competition | Dominance of Google and Meta in the digital ad market limits market expansion and pricing power. | Caps growth potential and creates downward pressure on advertising rates. |

| Customer Concentration | Heavy reliance on a few major partners for a substantial portion of revenue. | Increases vulnerability to partner decisions, potentially causing financial disruption. |

| New Product Adoption Risk | Success of new platforms like 'Realize' depends on market acceptance against strong competitors. | Potential for underperformance against financial targets if new ventures fail to gain traction. |

Full Version Awaits

Taboola SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing a genuine excerpt of our Taboola SWOT Analysis, showcasing the detail and quality you can expect. The content below is pulled directly from the final SWOT analysis, offering a clear glimpse into its comprehensive nature. Unlock the full report when you purchase to gain complete access to all insights.

Opportunities

The native advertising market is booming, with a projected global value expected to reach $100.1 billion by 2025, up from $52.6 billion in 2021. This growth is fueled by advertiser demand for less disruptive ad formats that blend seamlessly with content, a trend Taboola is well-positioned to capitalize on. As user privacy concerns mount, native advertising offers a more palatable solution, aligning with evolving consumer preferences and regulatory landscapes.

Taboola has a significant opportunity to broaden its reach by introducing innovative ad formats, like engaging video native ads, and by venturing into new industry sectors beyond its established media partnerships.

The company's strategic push into performance advertising, particularly with its 'Realize' offering, aligns perfectly with the growing demand for measurable results in digital marketing, allowing it to capture a greater portion of the digital advertising market.

By supporting the burgeoning e-commerce landscape, Taboola can tap into a massive revenue stream, as online retail continues its upward trajectory, projected to reach trillions globally by 2025.

This diversification not only strengthens Taboola's competitive position but also provides advertisers with more sophisticated tools to connect with consumers across various platforms and interests.

Taboola's continued investment in AI and machine learning is a significant opportunity to sharpen its recommendation engine and ad optimization capabilities. By refining algorithms, Taboola can achieve more precise audience targeting, leading to higher engagement rates and better ROI for advertisers. This focus on advanced AI is crucial for staying competitive in the dynamic digital advertising landscape.

The introduction of generative AI tools, such as Taboola's 'DeeperDive,' opens new avenues for monetization. These tools can empower publishers to create more engaging content and offer richer user experiences, potentially leading to increased ad revenue. This innovation positions Taboola to capture a larger share of the digital content creation and distribution market.

Addressing Content Discovery Challenges

The sheer volume of online content is exploding, making it harder for users to find what they're looking for. This presents a significant opportunity for Taboola. Its content discovery platform is designed to tackle this very problem by connecting users with relevant articles, videos, and other content they might otherwise miss. In 2024, the digital advertising market is expected to continue its growth, with a significant portion dedicated to content recommendation and native advertising, areas where Taboola excels.

By refining its algorithms to deliver even more personalized recommendations, Taboola can enhance user satisfaction and, by extension, publisher engagement. This means users spend more time on publisher sites, leading to increased ad impressions and revenue. For instance, publishers using Taboola often see a lift in pageviews per session, directly benefiting their bottom line and reinforcing Taboola's value.

Taboola's focus on optimizing content discovery offers several key advantages:

- Enhanced User Experience: By surfacing more relevant content, Taboola combats user fatigue and frustration in navigating the vast digital landscape.

- Increased Publisher Engagement: Tools that help publishers better understand and engage their audience lead to higher retention rates and more ad inventory.

- Data-Driven Optimization: Continuous analysis of user behavior allows Taboola to refine its recommendation engine, ensuring its effectiveness in a dynamic online environment.

- Monetization Opportunities: As content discovery becomes more sophisticated, Taboola is positioned to capture a larger share of digital ad spend directed towards native and sponsored content.

Strategic Partnerships and Market Penetration

Taboola can grow by forming key alliances. For instance, partnering with large media groups or device makers like Samsung could grant access to millions of new users. These deals are crucial for expanding Taboola's footprint in the global digital advertising space, especially in emerging markets where its presence might be limited.

These strategic collaborations are essential for Taboola to deepen its influence within the open web. By integrating with major publishers and hardware providers, Taboola can secure prime placement for its content recommendations, directly reaching a wider audience. This strategy was evident in 2023, where Taboola announced partnerships with several Tier-1 publishers, increasing its reach by an estimated 15% in the last quarter alone.

- Publisher Integrations: Expanding partnerships with leading global news sites and content platforms to embed Taboola's recommendation widgets.

- OEM Collaborations: Working with manufacturers like Samsung and other device providers to pre-install Taboola's services on new devices.

- Geographic Expansion: Targeting under-penetrated markets in Asia and Latin America to diversify revenue streams and user base.

- Cross-Platform Reach: Leveraging partnerships to extend recommendations across various digital touchpoints, from web browsers to mobile applications.

Taboola can capitalize on the growing demand for native advertising, a market projected to reach $100.1 billion by 2025. The company's focus on AI and generative AI tools like 'DeeperDive' offers significant monetization potential by enhancing content creation and user experiences for publishers. By optimizing its content discovery platform, Taboola can improve user engagement and ad revenue for its partners, directly benefiting from the increasing volume of online content.

Threats

The ever-changing world of data privacy is a major challenge for Taboola. With stricter rules like GDPR in Europe and new privacy laws popping up in US states, and the big shift away from third-party cookies, Taboola has to constantly adapt. These changes directly impact how well they can target ads, which is a core part of their business. For instance, Google's planned deprecation of third-party cookies in Chrome, expected to be fully phased out by late 2024, means Taboola needs to find new ways to reach audiences effectively without relying on that data.

The increasing adoption of ad blockers by internet users, fueled by privacy concerns and a desire for a cleaner browsing experience, poses a significant threat to Taboola's revenue streams. This trend directly impacts the available ad inventory that Taboola can monetize.

Data from 2024 indicated that ad blocker usage reached approximately 25% globally, with higher rates in developed markets. This means a substantial portion of potential ad impressions are simply not being served, directly affecting Taboola's ability to generate revenue through its native advertising platform.

As more users employ these tools, Taboola faces shrinking opportunities to deliver its content recommendations and sponsored articles, forcing the company to explore alternative monetization strategies beyond traditional display advertising to maintain its business model.

Economic downturns pose a significant threat to Taboola. As businesses tighten their belts during uncertain times, advertising budgets are often among the first to be cut. This directly impacts Taboola's core revenue stream, as advertisers reduce their spending on content discovery platforms. For instance, a projected global economic slowdown in late 2024 could see a noticeable dip in ad spend across the digital advertising sector.

The ad tech industry's inherent sensitivity to macroeconomic shifts means that any significant slowdown in global ad spend growth could disproportionately affect companies like Taboola. If overall marketing investment shrinks, Taboola's ability to secure and grow advertiser contracts will be challenged. Analysts in early 2025 are closely monitoring consumer spending patterns and inflation rates, as these are key indicators for future ad spend trends.

Generative AI Impact on Search and Social Traffic

The growing prevalence of generative AI in search and social media poses a significant threat to referral traffic for publishers like Taboola. As AI models become more adept at summarizing information and providing direct answers, users might find less need to visit original publisher websites. This shift could directly impact the volume of traffic available for Taboola's content recommendation services.

For instance, Google's AI Overviews, which began rolling out more broadly in 2024, aim to provide direct answers to queries, potentially bypassing traditional website clicks. This could lead to a substantial reduction in organic search traffic for content creators and, consequently, for platforms that rely on that traffic.

- Reduced Click-Through Rates: AI summaries may satisfy user queries without requiring a click to the source, diminishing publisher referral traffic.

- Shifting User Behavior: As users increasingly rely on AI for quick answers, their propensity to browse and explore original content sites could decline.

- Impact on Ad Revenue: A decrease in website traffic directly translates to fewer opportunities for publishers to monetize through ad placements, affecting platforms like Taboola that facilitate such monetization.

- Competition for Attention: Generative AI represents a new and powerful competitor for user attention, potentially diverting eyeballs away from publisher content and recommendation engines.

Dependence on Large Tech Company Policies and Algorithms

Taboola's reliance on major tech companies like Google presents a significant threat, as policy shifts and algorithm changes on these platforms can directly impact its reach and revenue. For instance, Google's ongoing efforts to enhance user privacy, such as the deprecation of third-party cookies, could alter how Taboola targets audiences and measures campaign effectiveness. This dependence means Taboola’s business model is inherently exposed to decisions made by entities it doesn't control.

The potential for these platforms to change their content recommendation algorithms poses a direct risk. If Google's Search or Discover algorithms are updated to favor different types of content or publishers, Taboola's ability to distribute its clients' content effectively could be severely curtailed. This dynamic makes forecasting and stable revenue generation more challenging.

- Algorithm Dependency: Taboola's success hinges on its ability to integrate with and leverage the traffic generated by dominant search engines and social media platforms.

- Policy Vulnerability: Changes in data privacy regulations or platform-specific policies, like those implemented by Google, can disrupt Taboola's operational strategies.

- Market Share Impact: A significant portion of internet traffic is funneled through these large tech companies, making their policy and algorithm decisions critical to Taboola's user acquisition and monetization.

- Competitive Landscape: Other content discovery platforms that are more deeply integrated or less susceptible to these external changes could gain a competitive advantage.

Intensifying competition from both established players and emerging technologies presents a significant threat. Companies leveraging advanced AI or offering more integrated user experiences could siphon market share. For instance, advancements in personalized content delivery by competitors could make Taboola's offerings seem less compelling.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Taboola's official financial filings, comprehensive market intelligence reports, and insights from industry experts. We also incorporate analyses of competitor strategies and user engagement metrics to provide a well-rounded and actionable assessment.