Taboola Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Taboola Bundle

Taboola operates in a dynamic digital advertising landscape, facing intense competition and evolving customer demands. Understanding the power of buyers and the threat of substitutes is crucial for navigating this market.

The bargaining power of suppliers, particularly for premium ad inventory and data, significantly influences Taboola's cost structure and operational efficiency. A deep dive into these relationships is essential.

The threat of new entrants, while potentially moderate due to established network effects, requires constant vigilance and innovation to maintain market leadership.

The competitive rivalry within the content discovery and native advertising space is fierce, with numerous players vying for publisher and advertiser attention.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Taboola’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Taboola’s suppliers, primarily digital publishers, are a diverse group, from large media conglomerates to independent bloggers. This wide distribution of suppliers generally dilutes the individual power of any single publisher. For instance, while Taboola partners with thousands of publishers globally, the sheer number means one publisher's departure might not significantly impact Taboola's overall supply chain.

However, this fragmentation isn't absolute. High-traffic, premium publishers, those with substantial and engaged audiences, still possess considerable bargaining power. These publishers offer unique inventory that is attractive to advertisers, giving them leverage in negotiations with platforms like Taboola.

Publishers are increasingly diversifying their revenue streams beyond native advertising, exploring options like direct subscriptions and e-commerce partnerships. This shift, with many publishers actively seeking new monetization models in 2025, reduces their reliance on platforms like Taboola. For instance, by the end of 2024, a significant portion of publishers reported exploring or implementing subscription models to capture direct reader revenue, thereby strengthening their negotiation position.

Publishers, while aiming for monetization, also lean heavily on advanced AI and recommendation technology to boost user engagement and their bottom line. Taboola's AI platform provides sophisticated content matching and monetization tools, making it a valuable asset for publishers who appreciate these technological advantages.

This reliance on cutting-edge technology can actually lessen the bargaining power of these suppliers. In 2024, for instance, publishers are increasingly investing in content discovery solutions that demonstrably improve user session times, a key metric where Taboola's AI excels.

Long-Term Publisher Partnerships

Taboola's strategy of fostering long-term, exclusive publisher partnerships significantly dampens supplier bargaining power. These agreements, some exceeding ten years with prominent entities like Future PLC and the Otago Daily Times, create substantial switching costs for publishers. This lock-in effect reduces their leverage during contract renewals, as finding and integrating a new content discovery platform is both time-consuming and potentially disruptive to their existing operations and revenue streams. The stability offered by these deep relationships allows Taboola to negotiate more favorable terms, effectively limiting the suppliers' ability to demand higher prices or more advantageous conditions.

- Exclusive Deals: Long-term exclusive contracts with major publishers reduce their options and increase switching costs.

- Extended Contracts: Partnerships like those with Future PLC and Otago Daily Times, often spanning over a decade, solidify Taboola's position.

- High Switching Costs: The effort and potential revenue loss involved in changing platforms limit publishers' bargaining power.

- Reduced Leverage: Publishers are less able to dictate terms when facing significant barriers to switching providers.

Data Privacy and Compliance Demands

The increasing complexity of data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), significantly impacts the bargaining power of suppliers in the ad tech industry. Publishers are now obligated to ensure their monetization partners adhere to these stringent rules, placing a premium on ad tech providers capable of delivering privacy-compliant solutions. This regulatory environment empowers publishers to demand more from their ad tech partners, potentially shifting leverage towards those who can demonstrate robust data protection and consent management capabilities.

Publishers are increasingly prioritizing ethical data handling and consent-driven advertising strategies. This focus means that suppliers who can offer transparency and control over user data, in line with evolving consumer expectations and regulatory mandates, gain a competitive advantage. As a result, publishers may be more willing to negotiate favorable terms with ad tech companies that align with these values, thereby increasing the bargaining power of compliant suppliers.

- Regulatory Pressure: Publishers face mounting pressure from GDPR and CCPA to ensure compliant ad monetization.

- Privacy-First Solutions: Ad tech providers offering privacy-centric approaches gain leverage with publishers.

- Publisher Demands: Publishers are increasingly focused on ethical data use and consent-based advertising.

- Supplier Advantage: Suppliers demonstrating strong data privacy and consent management can command better terms.

While Taboola benefits from a vast network of publishers, the bargaining power of these suppliers is influenced by their individual reach and revenue contribution. Premium publishers with large, engaged audiences wield more influence, allowing them to negotiate better terms.

As publishers diversify revenue streams beyond native advertising, their dependence on platforms like Taboola decreases, strengthening their negotiating position. By 2025, many publishers aim to increase direct reader revenue through subscriptions, reducing their reliance on third-party monetization tools.

Taboola's advanced AI and recommendation technology, which publishers depend on for user engagement and monetization, can paradoxically reduce supplier bargaining power. Publishers investing in solutions that demonstrably improve key metrics, where Taboola's AI excels, may find themselves more tied to the platform.

Exclusive, long-term contracts, such as those with Future PLC and Otago Daily Times, create high switching costs for publishers, significantly limiting their leverage. These deep partnerships, often lasting over a decade, reduce publishers' ability to demand more favorable terms due to the complexities and potential revenue disruption involved in changing providers.

| Publisher Segment | Bargaining Power Influence | Taboola's Counter-Strategy |

|---|---|---|

| Large Media Conglomerates | High (due to audience size and revenue) | Long-term exclusive contracts, integrated tech solutions |

| Independent Bloggers | Low (due to smaller reach) | Standardized platform offerings |

| Premium Publishers (High Traffic) | Moderate to High (unique inventory) | Value-added AI tools, performance-based revenue share |

| Publishers Diversifying Revenue | Increasing (reduced reliance on native ads) | Focus on platform integration and data insights |

What is included in the product

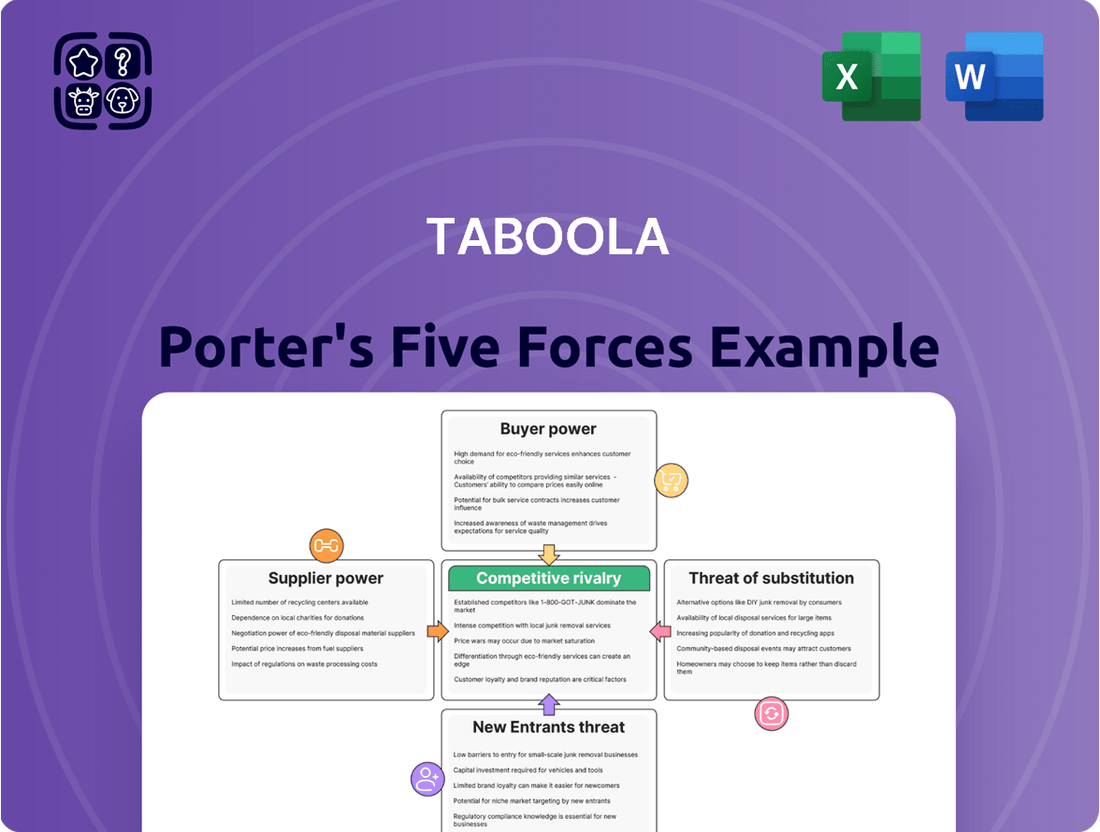

This analysis unpacks the competitive forces impacting Taboola, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the digital advertising landscape.

Instantly visualize competitive intensity with a dynamic five forces dashboard, simplifying complex market pressures for actionable insights.

Customers Bargaining Power

Taboola’s vast and diverse advertiser base significantly dampens customer bargaining power. Serving thousands of advertisers, ranging from small local businesses to major global brands, means no single client holds substantial leverage. This broad reach, with advertisers operating across numerous sectors, prevents any one entity from dictating terms due to their revenue contribution.

Advertisers have a vast array of options for reaching their target audiences, with giants like Google and Meta (Facebook, Instagram) dominating the digital advertising landscape. These platforms, along with a multitude of other native advertising networks, offer advertisers significant flexibility. In 2024, digital ad spending is projected to reach over $600 billion globally, underscoring the sheer volume of choices available to businesses.

Advertisers are increasingly demanding concrete proof of their advertising investment's effectiveness, with a strong focus on measurable performance and return on investment (ROI). This trend significantly influences their interaction with platforms like Taboola.

Taboola has responded to this by highlighting its performance advertising capabilities and introducing its 'Realize' platform, designed specifically to address this advertiser need for demonstrable results. In 2024, the digital advertising market continued its growth, with a significant portion of spend being performance-driven, underscoring the importance of ROI metrics.

If Taboola can consistently prove its ability to deliver superior campaign outcomes and a strong ROI compared to competitors, it effectively mitigates the bargaining power of its customers. Advertisers are more likely to remain loyal and less inclined to negotiate terms when they see tangible success.

Conversely, any perceived or actual failure by Taboola to meet these performance expectations would rapidly shift the balance of power. Advertisers would then feel empowered to explore alternative platforms and solutions that offer a more convincing track record of delivering their desired results, potentially leading to price pressure or reduced ad spend.

AI-Driven Targeting and Optimization Needs

Advertisers increasingly depend on sophisticated AI for precise audience targeting and campaign optimization. This reliance grants significant bargaining power to platforms like Taboola that excel in delivering these advanced capabilities. In 2024, the demand for AI-powered ad solutions continues to surge, with many advertisers willing to pay a premium for platforms that demonstrate superior predictive analytics and personalized ad delivery. Platforms that can demonstrably improve campaign ROI through AI are in a strong position.

Taboola's core strength in AI-driven targeting and optimization is a key factor here. Advertisers seek to maximize their return on ad spend (ROAS) and are attracted to platforms that can effectively connect them with high-intent consumers. The effectiveness of AI in identifying and reaching these audiences directly impacts an advertiser's willingness to allocate budget and can influence their negotiation leverage.

- Advertiser Demand for AI: Marketers are actively seeking platforms that use AI to refine targeting, personalize content, and optimize ad spend for better engagement.

- Taboola's AI Advantage: Taboola's proprietary AI technology is a core differentiator, enabling advanced audience segmentation and real-time campaign adjustments.

- Impact on Bargaining Power: The effectiveness of Taboola's AI in delivering measurable results for advertisers can enhance its negotiating position, as clients are less likely to switch if performance is strong.

- Competitive AI Landscape: While Taboola leverages AI, competitors are also investing heavily in similar technologies, creating a dynamic environment where continuous AI innovation is crucial to maintain leverage.

Brand Safety and Transparency Requirements

Advertisers are increasingly demanding brand safety and transparency, especially in light of concerns about ‘Made for Advertising’ (MFA) sites. This focus is driving a shift in how ad budgets are allocated. For instance, in 2024, many major brands intensified their scrutiny of ad placements to avoid association with inappropriate content.

Taboola’s commitment to brand safety, including its partnerships with premium publishers, directly addresses this advertiser priority. By offering cleaner inventory, Taboola can strengthen its position with advertisers who value a secure and transparent environment for their campaigns. This is a significant factor in maintaining advertiser confidence.

- Advertiser Demand: A 2024 survey indicated that 75% of advertisers consider brand safety a top priority when selecting ad platforms.

- Taboola's Approach: Taboola actively vets publishers and employs advanced technology to prevent ads from appearing on unsafe or low-quality sites.

- Impact on Bargaining Power: Platforms that successfully demonstrate brand safety and transparency gain leverage in negotiations with advertisers, potentially leading to more favorable ad rates and longer-term contracts.

- Transparency Concerns: The rise of MFA sites, which generate revenue through ad impressions rather than user engagement, has heightened advertiser awareness of the need for transparent supply chains.

The bargaining power of customers, or advertisers, is significantly influenced by the availability of alternatives and the cost of switching. With a global digital ad spend projected to exceed $600 billion in 2024, advertisers have numerous platforms to choose from, including major players like Google and Meta, as well as a plethora of other native advertising networks.

Advertisers also prioritize demonstrable return on investment (ROI) and are increasingly reliant on AI for precise targeting and campaign optimization. Platforms like Taboola, which can effectively showcase superior campaign outcomes and leverage AI for enhanced performance, gain considerable leverage, as advertisers are less inclined to negotiate terms when they see tangible success.

Brand safety and transparency are also critical concerns for advertisers in 2024, particularly with the rise of ‘Made for Advertising’ (MFA) sites. Taboola’s commitment to providing a clean and transparent ad environment, by vetting publishers and employing advanced technology, strengthens its negotiating position with clients who value secure campaign placements.

| Factor | Impact on Taboola's Advertiser Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | High; numerous competing digital ad platforms exist. | Global digital ad spend projected over $600 billion. |

| Switching Costs | Moderate to High; depends on advertiser's integration and performance metrics. | Advertisers seek platforms with proven ROI, making switching less appealing if performance is met. |

| Performance & ROI Focus | Lowers power; advertisers demand measurable results. | Significant portion of digital ad spend is performance-driven. |

| AI Capabilities | Lowers power; advertisers value AI for targeting and optimization. | Surge in demand for AI-powered ad solutions; premium paid for superior AI. |

| Brand Safety & Transparency | Lowers power; advertisers prioritize secure ad environments. | 75% of advertisers consider brand safety a top priority. |

Preview Before You Purchase

Taboola Porter's Five Forces Analysis

This preview shows the exact Taboola Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It thoroughly examines the bargaining power of buyers, the threat of new entrants, the threat of substitute products or services, the bargaining power of suppliers, and the intensity of rivalry among existing competitors within Taboola's industry. This comprehensive assessment provides actionable insights into the competitive landscape Taboola operates within.

Rivalry Among Competitors

The native advertising and content discovery space is a battlefield, with companies like Outbrain offering nearly identical services, intensifying competitive rivalry. This similarity means Taboola and its rivals are constantly vying for the same publisher and advertiser partnerships.

This direct competition often spills over into aggressive pricing strategies, as companies try to undercut each other to secure lucrative deals. For instance, in 2023, the digital advertising market saw significant shifts, with native advertising continuing its growth trajectory, making these publisher and advertiser contracts even more valuable.

Consequently, there's a relentless pressure to innovate, with companies like Taboola investing heavily in their technology to offer more sophisticated targeting, better user experiences, and improved performance metrics for advertisers.

This dynamic environment requires constant adaptation and a keen understanding of competitor strategies to maintain market share and profitability.

Beyond rivals directly in the native advertising space, Taboola contends with immense competition from major tech players like Google, Meta, and Amazon. These giants command vast resources, extensive user data, and deeply entrenched advertiser relationships, presenting a formidable challenge to Taboola’s market position and growth.

Google, through its Google Ads and Google Ad Manager platforms, offers a comprehensive suite for advertisers, reaching a massive audience across search, display, and video. Meta leverages its dominance in social media with Facebook and Instagram to provide highly targeted advertising opportunities, while Amazon’s advertising business has seen rapid expansion, capitalizing on its e-commerce platform and shopper data.

The sheer scale of these tech giants allows them to invest heavily in research and development, constantly innovating their ad technologies and data analytics capabilities. This often translates into superior targeting precision and return on ad spend for advertisers, creating a significant barrier to entry and competitive hurdle for companies like Taboola.

In 2023, Google's advertising revenue alone reached approximately $237.8 billion, underscoring its dominance. Meta reported advertising revenue of $134.9 billion for the same year, and Amazon’s advertising services generated $12.06 billion in the fourth quarter of 2023, indicating the immense scale of resources these competitors deploy.

The advertising technology sector is actively consolidating, with a notable uptick in mergers and acquisitions. Companies are actively pursuing these combinations to develop more integrated offerings and achieve greater operational scale. This strategic move is creating a more formidable competitive environment, particularly for niche players like Taboola.

For instance, in 2023, the ad tech industry saw significant M&A deals as businesses aimed to bolster their capabilities and market reach. This ongoing consolidation results in the emergence of larger, more comprehensive competitors capable of offering a wider suite of services, thereby increasing the intensity of rivalry for specialized companies.

Rapid Technological Advancements (AI)

The competitive rivalry in the digital advertising space, particularly concerning content recommendation and optimization, is intensely shaped by the rapid pace of technological advancement, with Artificial Intelligence (AI) at its forefront. Companies like Taboola are compelled to continuously invest in and refine their AI algorithms to enhance content recommendation, improve user targeting precision, and boost overall campaign optimization effectiveness. This relentless pursuit of innovation is crucial for maintaining market share and relevance.

Taboola's competitive standing is intrinsically linked to its ongoing development and expansion within AI capabilities. The company’s strategic focus on leveraging AI to not only improve its core recommendation engine but also to venture into new, high-growth areas such as performance advertising directly addresses the dynamic nature of the industry. Success in these evolving segments requires a steadfast commitment to AI research and development.

- AI Investment: Taboola has consistently invested in R&D, with a significant portion allocated to AI and machine learning to enhance its platform's performance and user experience.

- Algorithm Enhancement: The company actively works on improving its proprietary algorithms for content discovery, audience segmentation, and ad delivery to provide more relevant and engaging experiences.

- Performance Advertising Focus: Taboola's strategic push into performance advertising demonstrates its commitment to expanding its AI applications beyond traditional content recommendation into areas driving measurable business outcomes for advertisers.

- Competitive Landscape: The industry sees heavy competition from other major players also heavily investing in AI to differentiate their offerings and capture market share in the digital advertising ecosystem.

Focus on Publisher Network and Market Share

Competitive rivalry in the ad-tech space, particularly for platforms like Taboola, is intense and heavily influenced by the publisher network. Securing and retaining a vast array of premium publishers is crucial for maximizing audience reach and the available ad inventory. Companies are constantly vying for these partnerships, as a strong publisher base directly translates to greater market share and influence.

This competition often manifests in strategic partnerships and exclusive deals. For instance, in 2024, many content discovery platforms continued to invest heavily in onboarding new publishers and offering favorable terms to retain existing ones. The ability to offer a large, engaged audience is a key differentiator. Companies that can demonstrate a significant and growing network of high-quality publishers gain a distinct advantage.

The market share battle is directly tied to publisher relationships. A larger publisher network means more impressions and clicks, which in turn attracts more advertisers. Consider the dynamic of the industry; securing exclusive rights with major news outlets or popular blogs can significantly shift market share. This ongoing pursuit of premium publishers fuels the intense rivalry among players in the content recommendation and native advertising sector.

- Publisher Network Strength: The ability to attract and retain premium publishers is a primary battleground, directly impacting audience reach and ad inventory.

- Market Share Dynamics: Exclusive deals and strategic partnerships with publishers are key tactics for expanding footprint and gaining market share.

- Audience Reach as a Differentiator: Companies with larger, more engaged publisher networks possess a significant competitive advantage in attracting advertisers.

- Intense Rivalry: The constant pursuit of premium publishers fuels a highly competitive environment among content discovery and native advertising platforms.

The competitive rivalry within Taboola's market is exceptionally fierce, driven by numerous players offering similar services. This intense competition forces companies to constantly innovate and refine their offerings, particularly in areas like AI-driven targeting and user experience. The digital advertising space, including native advertising, saw continued growth in 2023, making publisher and advertiser partnerships highly sought after and fueling aggressive pricing strategies.

Major tech giants like Google, Meta, and Amazon present a significant competitive challenge due to their vast resources, extensive user data, and established advertiser relationships. For instance, Google's advertising revenue reached approximately $237.8 billion in 2023, while Meta's was $134.9 billion, highlighting the scale of these competitors.

The ad-tech industry is also experiencing consolidation, with mergers and acquisitions creating larger, more comprehensive competitors. This trend intensifies rivalry for specialized companies like Taboola, as businesses aim to bolster capabilities and market reach. Securing and retaining premium publishers is a critical battleground, with companies actively pursuing exclusive deals to expand their audience reach and ad inventory.

| Competitor Type | Key Competitive Tactics | Illustrative 2023 Financials (USD Billions) |

| Direct Native Ad Rivals (e.g., Outbrain) | Price competition, feature parity, publisher partnerships | N/A (Privately held or not directly comparable) |

| Large Tech Platforms (Google, Meta, Amazon) | Data advantage, vast user base, integrated ad suites, R&D investment | Google: $237.8 (Ad Revenue) Meta: $134.9 (Ad Revenue) Amazon: $12.06 (Q4 2023 Ad Services Revenue) |

| Consolidated Ad Tech Entities | Integrated offerings, operational scale, expanded market reach | N/A (Reflects industry trend, specific company figures vary) |

SSubstitutes Threaten

Search engine marketing and social media advertising represent significant substitutes for Taboola's native advertising. In 2024, search advertising, dominated by Google, is expected to capture a substantial portion of global digital ad spend, estimated to exceed $200 billion. Similarly, social media advertising platforms, such as Meta (Facebook and Instagram), are projected to generate over $250 billion in ad revenue worldwide during the same year.

These channels offer advertisers alternative avenues to reach target audiences, often with granular targeting options that can rival or surpass those available through content recommendation widgets. For instance, social media platforms allow for demographic, interest-based, and behavioral targeting, enabling advertisers to connect with specific consumer segments directly, bypassing the indirect discovery mechanism of native ads.

The threat is amplified by the sheer scale and established user bases of these substitute platforms. Google's search engine processes billions of queries daily, providing unparalleled reach for advertisers seeking intent-driven consumers. Facebook and Instagram boast billions of active users, offering extensive opportunities for brand building and direct engagement.

Advertisers increasingly bypass traditional ad tech platforms by striking direct deals with publishers. This allows for more tailored ad placements and sponsored content, offering publishers better control over their inventory and pricing. For instance, in 2024, many large brands have been actively exploring direct partnerships to secure premium ad space, reducing reliance on programmatic exchanges.

Publishers are increasingly building their own monetization tools, such as first-party data platforms and subscription services. This directly competes with Taboola's offerings by providing publishers with alternative revenue streams that reduce their dependence on third-party ad tech. For instance, many publishers are investing heavily in their own data infrastructure to better understand and monetize their audiences, a trend that gained significant momentum in 2024 as privacy regulations continued to evolve.

Emerging AI-Driven Content & Ad Models

The increasing sophistication of artificial intelligence presents a significant threat of substitution for Taboola's core business. AI's ability to synthesize information and provide direct answers, as seen in generative AI search engines, could reduce the need for users to browse through multiple articles or content feeds. This shift could divert user attention and, consequently, advertiser budgets away from platforms like Taboola that rely on content discovery.

Consider the following impacts:

- Disintermediation of Content Discovery: AI-powered search and summarization tools could bypass the need for users to navigate publisher websites or content recommendation platforms, directly offering answers or curated content.

- Shift in Advertiser Spend: As user attention moves to AI-driven interfaces, advertisers may reallocate budgets from native advertising on publisher sites to these new AI platforms, seeking more direct engagement.

- New Immersive Experiences: The rise of AI-generated virtual and augmented reality content could offer entirely new ways for users to consume information and be entertained, presenting a substitute for the current web-based content discovery model.

- Efficiency Gains for Content Creators: AI tools can also enable content creators to produce more content faster, potentially saturating the digital landscape and making discoverability even more challenging for traditional recommendation engines.

Content Marketing and SEO

For advertisers seeking to get their content seen, organic content marketing strategies like search engine optimization (SEO) and social media engagement act as significant indirect substitutes to paid content distribution platforms. These methods focus on building an audience and driving traffic through valuable, shareable content rather than direct payment for placement.

While these organic approaches don't involve paying for clicks or impressions in the same way as content recommendation engines, they compete for audience attention and engagement. For instance, in 2024, businesses continued to invest heavily in SEO, with global SEO spending projected to reach over $80 billion, demonstrating its perceived value in attracting organic traffic.

- Content Marketing as a Substitute: Organic strategies aim to attract and engage audiences naturally, reducing reliance on paid promotion.

- SEO's Growing Importance: SEO investments are substantial, reflecting its role in driving unpaid traffic and brand visibility.

- Social Media Engagement: Platforms offer avenues for content distribution and audience building without direct ad spend, competing for user attention.

- Cost-Effectiveness: Organic methods can offer a more sustainable long-term customer acquisition strategy compared to consistently paying for ad placements.

The threat of substitutes for Taboola's native advertising is substantial, encompassing search engines, social media, and emerging AI technologies. In 2024, search advertising is projected to exceed $200 billion in global digital ad spend, with social media advertising revenues surpassing $250 billion. These platforms offer advertisers precise targeting capabilities, directly competing with Taboola's content discovery model.

Furthermore, the rise of AI-powered search and content summarization tools presents a significant substitution risk. These technologies could disintermediate content discovery, potentially shifting advertiser budgets away from traditional recommendation engines towards AI platforms. This trend is amplified by the increasing investment in organic content marketing and SEO, with global SEO spending expected to reach over $80 billion in 2024, as businesses seek cost-effective ways to attract audiences.

| Substitute Channel | 2024 Estimated Global Ad Spend | Key Advantage over Taboola |

|---|---|---|

| Search Advertising | >$200 Billion | Intent-driven targeting, direct user queries |

| Social Media Advertising | >$250 Billion | Granular demographic, interest, and behavioral targeting |

| Organic Content Marketing (SEO) | >$80 Billion (SEO Spend) | Long-term audience building, cost-effectiveness |

| AI-Powered Content Discovery | Emerging | Direct answers, potential disintermediation of content browsing |

Entrants Threaten

The content discovery and native advertising market presents a formidable barrier to new entrants due to the sheer magnitude of capital and technology investment required. Companies looking to establish a foothold must commit significant resources to developing advanced AI algorithms that power recommendation engines, alongside robust data infrastructure and scalable technology platforms. For instance, building a sophisticated recommendation system comparable to Taboola's, which analyzes vast user interaction data, demands substantial upfront and ongoing R&D spending.

The inherent complexity in creating and maintaining a high-performing recommendation engine is a critical deterrent. These systems are not static; they require continuous refinement and adaptation to evolving user behaviors and content trends. This ongoing technological arms race means new players face not only the initial hurdle of development but also the perpetual need for significant investment in innovation to remain competitive, making the threat of new entrants relatively low.

New entrants into Taboola's space face a significant hurdle: building robust network effects. This means they must simultaneously attract a large number of content publishers, who provide the inventory, and a substantial base of advertisers, who drive revenue. Without this dual-sided critical mass, a platform simply cannot function effectively.

Taboola currently boasts an impressive network, connecting over 10,000 publishers with thousands of advertisers. This existing scale presents a formidable barrier to entry for any new competitor looking to replicate its reach and impact.

The challenge for newcomers is to overcome Taboola's established dominance, which is largely built upon its extensive network. Breaking into this ecosystem requires not just technological innovation but also the ability to rapidly scale both sides of the marketplace, a feat that is both capital-intensive and time-consuming.

Established players like Taboola have cultivated significant brand recognition and trust with publishers and advertisers through years of operation. For instance, in 2023, Taboola reported serving over 10 billion recommendations daily, a testament to its extensive reach and established relationships.

New entrants face a substantial hurdle in replicating this incumbency advantage. They would need to commit considerable resources to marketing and forging new partnerships to gain traction against established entities like Taboola, which has a proven track record and a vast existing network.

Regulatory and Data Privacy Hurdles

New entrants in the digital advertising space, like Taboola, face significant regulatory and data privacy hurdles. The increasing stringency of data privacy laws globally, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, creates a complex compliance environment. For instance, by the end of 2023, enforcement actions related to GDPR violations had resulted in substantial fines, underscoring the financial risks associated with non-compliance.

Building robust data collection and targeting systems that adhere to these evolving privacy standards from the ground up is a considerable challenge. This includes establishing secure data storage, obtaining proper user consent, and ensuring data anonymization where required. The operational costs and legal expertise needed to navigate these requirements can be prohibitive for newcomers.

- Compliance Costs: New entrants must invest heavily in legal counsel and technology infrastructure to ensure adherence to regulations like GDPR and CCPA.

- Data Collection Challenges: Obtaining explicit user consent for data collection and usage, as mandated by privacy laws, complicates the process of building user profiles for targeted advertising.

- Reputational Risk: Non-compliance can lead to significant fines and damage to a new company's reputation, making it harder to gain user trust and advertiser partnerships.

- Technological Adaptation: The need to constantly update systems to meet new privacy requirements, such as the phase-out of third-party cookies, demands continuous technological investment.

Access to Premium Publisher Inventory

New players in the digital advertising space face a significant hurdle when trying to access premium publisher inventory. Many of the most sought-after ad placements are already locked into long-term or exclusive agreements with established platforms, making it incredibly difficult for newcomers to secure comparable inventory.

This lack of access directly impacts a new entrant's ability to offer advertisers the reach and quality they demand. Without premium placements, new platforms will struggle to attract advertisers looking for high-impact campaigns, hindering their growth and competitiveness.

For instance, in 2024, major publishers like The New York Times and The Wall Street Journal continue to prioritize relationships with existing, large-scale ad tech partners, often through exclusive deals that limit new entrants' opportunities. This creates a substantial barrier to entry, as securing desirable ad space is fundamental to providing a valuable service to advertisers.

- Limited Access to Premium Inventory: Established platforms often hold exclusive or long-term contracts with top-tier publishers.

- Difficulty in Reaching Target Audiences: New entrants struggle to offer advertisers the same reach and quality of placements.

- Competitive Disadvantage: Without prime inventory, new companies cannot compete effectively for advertiser budgets.

- Publisher Loyalty: Top publishers tend to maintain existing, profitable relationships, leaving little room for new players.

The threat of new entrants into Taboola's market is significantly low due to several formidable barriers. High capital requirements for technology and AI development, coupled with the need for extensive network effects involving publishers and advertisers, make entry extremely challenging. Established brand recognition and the complexities of regulatory compliance further solidify the position of incumbents.

New entrants must overcome the immense challenge of building a two-sided marketplace, attracting both content providers and advertisers simultaneously. Taboola's existing scale, serving billions of recommendations daily in 2023, creates a critical mass that is difficult and costly to replicate.

Furthermore, navigating stringent data privacy regulations like GDPR and CCPA adds substantial compliance costs and technological adaptation needs. Access to premium publisher inventory is also restricted by existing long-term agreements, limiting new players' ability to offer advertisers compelling reach and quality placements.

Porter's Five Forces Analysis Data Sources

Our Taboola Porter's Five Forces analysis leverages data from industry-specific market research reports, financial statements of key players, and analysis from reputable financial news outlets to assess competitive dynamics.