Taboola PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Taboola Bundle

Uncover the hidden forces shaping Taboola's future with our meticulous PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, legal frameworks, and environmental concerns create both challenges and opportunities for the company. Gain a strategic advantage by anticipating market changes and informing your own business decisions. Download the full PESTLE analysis now to equip yourself with actionable intelligence and navigate the complex external landscape with confidence.

Political factors

Governments globally are tightening their grip on digital advertising, focusing on how user data is collected and used for targeting, alongside demands for greater transparency. This increased scrutiny directly affects Taboola's business, as it operates within the native advertising space, a sector heavily reliant on data-driven approaches.

Evolving legislation, such as Europe's Digital Services Act (DSA), poses significant challenges. The DSA, which became fully applicable in February 2024, mandates clearer rules on online ad transparency and imposes restrictions on data usage. Furthermore, the development of voluntary codes of conduct for ad intermediaries, anticipated by summer 2025, suggests a trend toward greater accountability and potential operational shifts for companies like Taboola.

Potential new regulations in the United States could mirror these European developments, impacting Taboola's operational models and increasing compliance costs. These legislative changes are likely to influence how Taboola gathers and utilizes user data, potentially reshaping its targeting capabilities and overall service delivery.

The evolving global data privacy landscape, with regulations like Europe's GDPR and California's CCPA, significantly impacts Taboola's operations. These laws dictate how Taboola can collect, process, and use user data for its recommendation engine, directly affecting its ability to personalize content. Failure to comply can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of a company's annual global turnover.

Geopolitical stability is a significant factor for Taboola, impacting its global advertising operations. For instance, ongoing trade tensions between major economies in 2024 could lead to shifts in advertising budgets as companies reassess their international market presence and associated marketing spend. Taboola's reliance on a diverse publisher and advertiser base means that instability in even a few key regions, such as disruptions to supply chains or financial sanctions affecting advertising payments, can ripple through its revenue streams.

Changes in international trade policies, including tariffs or data localization requirements, directly affect how easily Taboola can operate across borders. If a country implements stricter regulations on cross-border data flows or digital advertising, it could fragment Taboola's network and increase operational costs. For example, the European Union's Digital Services Act (DSA) and Digital Markets Act (DMA) are reshaping the digital advertising landscape, requiring platforms like Taboola to adapt their business models to comply with new rules around transparency and market access in 2024 and beyond.

Censorship and Content Control Policies

Governments worldwide are increasingly scrutinizing online content, leading to tighter censorship and content control policies. This directly impacts platforms like Taboola, which rely on content distribution and advertising. For instance, in 2024, the European Union's Digital Services Act (DSA) began enforcing stricter rules on online platforms regarding illegal content and disinformation, requiring robust content moderation systems. Failure to comply can result in significant fines, potentially impacting Taboola's revenue streams and operational freedom in key markets.

Navigating these varied and evolving regulations presents a significant challenge. Taboola must invest in sophisticated content moderation tools and processes to ensure compliance with local laws, which can differ dramatically from one country to another. This might involve restricting certain types of content or advertising that could be deemed harmful or misleading by specific governments, thereby influencing the platform's ability to monetize content effectively.

- Increased Regulatory Scrutiny: As of early 2024, over 100 countries have implemented or are considering digital content regulations, impacting cross-border operations for platforms like Taboola.

- Content Moderation Costs: Companies are expected to increase spending on AI and human moderation by an average of 15-20% in 2024 to meet new compliance demands.

- Impact on Monetization: Policies restricting certain advertising categories, such as those related to health or finance, can reduce ad revenue potential for publishers and Taboola itself.

Antitrust and Competition Oversight

Antitrust and competition oversight represents a significant political factor for Taboola. Increased scrutiny of major tech companies, particularly those dominant in digital advertising, could reshape the competitive landscape. Governments are actively examining market power, which might influence Taboola's strategic partnerships and potential acquisition targets.

Examples of this trend are evident in ongoing antitrust actions against giants like Google, who are major players in the ad-tech ecosystem where Taboola operates. Such regulatory actions could limit Taboola's ability to compete effectively or pursue growth through mergers and acquisitions. For instance, the European Union's Digital Markets Act (DMA), which came into effect in early 2024, imposes new rules on large online platforms, potentially impacting how companies like Taboola access user data and engage in advertising practices.

- Regulatory Uncertainty: Evolving antitrust legislation creates ongoing uncertainty for Taboola’s business model and strategic planning.

- Market Power Concerns: Governments worldwide are increasingly focused on curbing the market power of dominant tech firms, potentially affecting Taboola's operational freedom.

- Impact on Partnerships: Antitrust actions against major platforms could disrupt crucial partnerships Taboola relies on for content distribution and advertising.

- Acquisition Challenges: Increased regulatory review of mergers and acquisitions may pose hurdles for Taboola's inorganic growth strategies.

Governments globally are increasing their oversight of digital advertising, focusing on data privacy and transparency, which directly impacts Taboola's data-driven model. Legislation like the EU's Digital Services Act (DSA), fully applicable since February 2024, imposes stricter rules on ad transparency and data usage, with voluntary codes anticipated by summer 2025. This trend extends to the US, suggesting potential operational shifts and increased compliance costs for Taboola.

What is included in the product

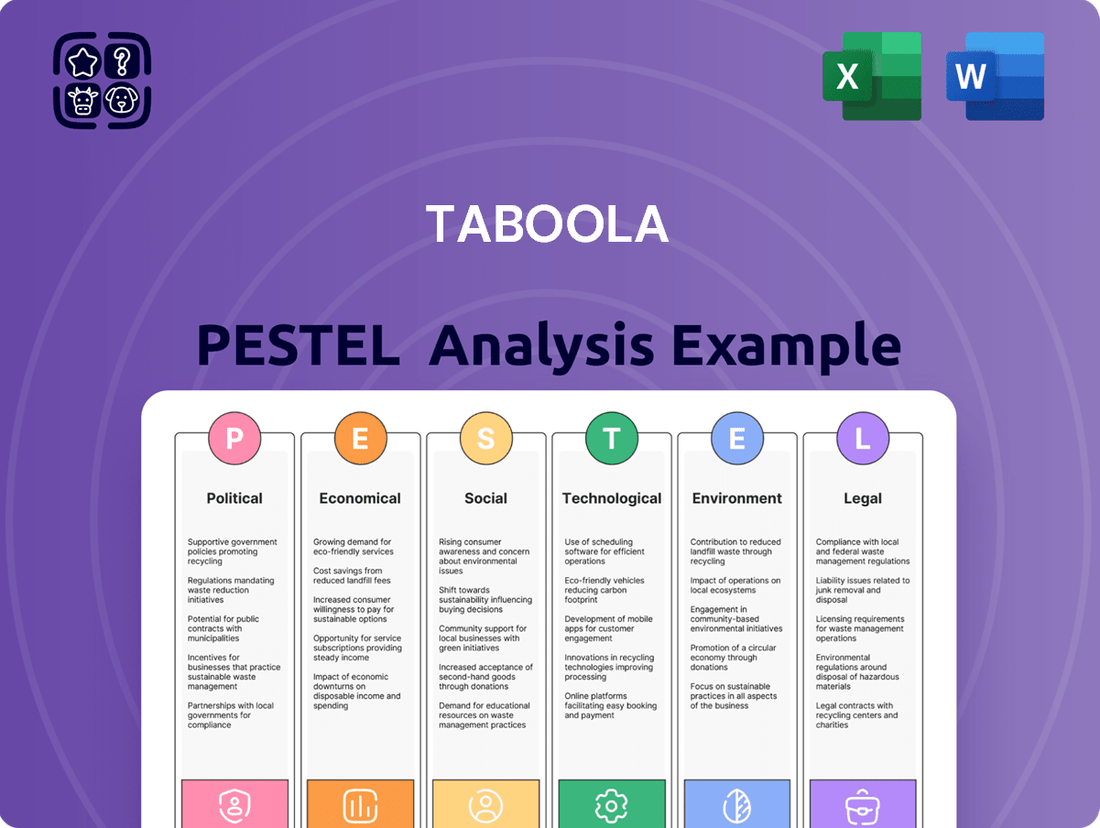

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Taboola, categorized across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable summary of Taboola's PESTLE factors, enabling teams to proactively identify and mitigate external challenges impacting their strategies.

Economic factors

Economic health significantly shapes advertising budgets. When economies falter, ad spending is often an early casualty, impacting companies like Taboola that rely on this revenue stream.

However, the digital advertising sector shows robust growth. Projections estimate the market expanding from $734.24 billion in 2024 to $843.48 billion in 2025. This upward trend suggests a favorable environment for Taboola's digital-native business model.

Looking further ahead, the digital ad market is expected to reach $1.42 trillion by 2029, underscoring the long-term potential for companies operating within this space. This substantial growth indicates continued demand for advertising solutions.

Rising inflation in 2024 and into 2025 presents a significant challenge for Taboola, potentially increasing operational expenses such as employee compensation, technology infrastructure, and marketing outlays. While this environment might push advertisers toward more budget-conscious strategies, sustained inflation could compress Taboola's profit margins if the growth in advertising spend doesn't outpace these escalating costs.

Despite these pressures, Taboola demonstrated some cost management effectiveness. For instance, the company reported an improved adjusted EBITDA in Q1 2025, indicating a degree of success in controlling expenditures. This financial performance suggests that while inflationary headwinds are present, the company is actively working to maintain profitability through operational efficiencies.

Currency exchange rate fluctuations present a significant economic factor for Taboola, a company with a global operational footprint. As Taboola converts earnings from various markets back to its primary reporting currency, shifts in exchange rates can directly influence its reported revenues and profitability, introducing inherent financial volatility.

For instance, Taboola's ex-TAC Gross Profit in the first quarter of 2025 experienced an impact from these currency movements. While the specific magnitude of the impact wasn't detailed, it highlights the sensitivity of its financial results to the economic landscape of the countries in which it operates.

Competition from Other Ad Tech Platforms

The digital advertising landscape is incredibly crowded, with companies like Meta, Google, and TikTok constantly competing for advertiser dollars. This intense rivalry means Taboola needs to keep innovating and proving its value to clients, which can impact its pricing power and the share of the market it holds. For instance, the global digital ad spending was projected to reach approximately $678.8 billion in 2024, a significant portion of which is contested by these major players.

Taboola's strategic move to launch 'Realize' is a clear response to this competitive pressure, aiming to broaden its reach beyond its traditional native advertising niche into the lucrative performance advertising sector. This expansion is critical for growth as the performance advertising market is expected to continue its upward trajectory, driven by a demand for measurable campaign results. In 2023, the global performance marketing market size was valued at around $572.5 billion and is projected to grow further.

- Intense Competition: Taboola faces significant competition from established tech giants and emerging ad tech platforms.

- Pricing Pressure: The need to remain competitive can lead to pressure on Taboola's pricing strategies.

- Market Share Dynamics: Competitors' innovations and marketing efforts directly influence Taboola's ability to capture and retain market share.

- Strategic Expansion: The 'Realize' initiative targets the growing performance advertising market to diversify revenue streams and mitigate competitive risks.

E-commerce Growth and Digital Transformation

The relentless expansion of e-commerce globally, projected to reach $2.7 trillion by the end of 2024 according to Statista, offers significant tailwinds for Taboola. This digital shift means more businesses are allocating marketing budgets to online channels, directly benefiting platforms like Taboola that specialize in content discovery and native advertising. As consumers increasingly shop online, the need for personalized and engaging digital experiences intensifies, creating a fertile ground for Taboola's solutions.

The broader digital transformation across various sectors further amplifies these opportunities. Industries are adopting digital tools and strategies at an unprecedented pace, leading to a greater demand for sophisticated online advertising and marketing technologies. This trend is evident in the global digital advertising market, which is expected to grow by 10.4% in 2024, reaching over $700 billion, according to eMarketer. Taboola's ability to connect publishers with advertisers within this expanding digital ecosystem positions it for substantial revenue growth.

- E-commerce Growth: Global e-commerce sales are projected to reach $2.7 trillion in 2024.

- Digital Ad Market Expansion: The digital advertising market is anticipated to grow by 10.4% in 2024.

- Online Marketing Shift: Businesses are increasingly investing in online advertising to reach consumers.

- Demand for Content Discovery: The digital transformation fuels the need for effective content discovery platforms.

Economic conditions directly influence advertising expenditure, a critical revenue source for Taboola. While economic downturns typically lead to reduced ad budgets, the digital advertising sector itself is experiencing substantial growth, projected to increase from $734.24 billion in 2024 to $843.48 billion in 2025, indicating a favorable market for Taboola's offerings.

Inflationary pressures in 2024 and 2025 pose a challenge, potentially increasing Taboola's operational costs and impacting profit margins if ad spend growth doesn't keep pace. However, the company has shown some success in cost management, as evidenced by an improved adjusted EBITDA in Q1 2025, suggesting proactive efforts to maintain profitability.

Currency exchange rate fluctuations are a notable economic factor for Taboola due to its global operations, directly affecting reported revenues and profitability. For instance, the company's ex-TAC Gross Profit in Q1 2025 was impacted by these currency movements, highlighting the sensitivity to international economic conditions.

| Economic Factor | 2024 Projection/Status | 2025 Projection/Status | Impact on Taboola |

|---|---|---|---|

| Digital Ad Market Growth | $734.24 billion | $843.48 billion | Favorable revenue potential |

| Inflation | Rising | Persisting | Increased operational costs, potential margin compression |

| Currency Exchange Rates | Volatile | Volatile | Impact on reported revenue and profitability |

Same Document Delivered

Taboola PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Taboola PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company. Understand the market landscape and potential challenges Taboola faces. Gain insights into strategic opportunities and risks. This is your complete guide to Taboola's external business environment.

Sociological factors

Consumers are increasingly shifting towards video and audio content, with platforms like TikTok and podcasts seeing massive growth. This means Taboola must refine its recommendation engine to prioritize these formats, as evidenced by the over 2 billion monthly active users on TikTok as of 2024. Adapting ad formats to include more video and interactive elements will be crucial for maintaining user engagement and advertiser effectiveness on the Taboola network.

The growing prevalence of ad blockers presents a significant hurdle for Taboola, as it directly impacts the visibility of the sponsored content that forms the core of its revenue. In 2024, it's estimated that over 40% of internet users globally employ ad blockers, a figure that continues to climb, signaling a strong consumer preference for cleaner web experiences.

This trend is closely linked to widespread ad fatigue, where consumers are increasingly overwhelmed and annoyed by intrusive or irrelevant advertising. This saturation means Taboola must shift its strategy towards creating highly engaging and contextually relevant native content. The goal is to offer value that users actively seek out, rather than passively endure, thereby circumventing ad-blocking software and fostering a more positive user interaction.

Native advertising, which blends seamlessly with editorial content, is emerging as a key solution to this challenge. By prioritizing formats that feel organic and provide genuine interest to the reader, Taboola can improve its effectiveness and user acceptance. For instance, studies from 2024 indicate that native ad formats can achieve up to 3x higher engagement rates compared to traditional display ads, highlighting their potential to navigate the ad-blocking landscape.

Public trust in online information is a significant hurdle for platforms like Taboola. Societal concerns surrounding misinformation, often termed fake news, and the increasing frequency of data privacy breaches are actively eroding confidence in online content and advertising. This directly impacts how users interact with recommendation engines.

For Taboola, maintaining user engagement hinges on proactively addressing these anxieties. By prioritizing content quality, ensuring transparency in how recommendations are generated, and implementing robust data protection measures, Taboola can work to preserve its reputation. Consumers are becoming more discerning about data collection and are demanding greater transparency from the services they use.

For instance, a 2024 report indicated that over 60% of internet users expressed concern about the accuracy of information they encounter online, and a similar percentage are worried about how their personal data is being used by tech companies. This sentiment underscores the critical need for platforms like Taboola to build and maintain trust through verifiable accuracy and clear data handling policies.

Demographic Shifts and Audience Segmentation

Global demographic changes are significantly reshaping consumer behavior. For instance, the world's population aged 65 and over is projected to reach 1.5 billion by 2050, a substantial increase from approximately 700 million in 2020. This aging demographic often has different media consumption habits and product preferences compared to younger generations.

Conversely, Gen Z, born between 1997 and 2012, now represents a significant portion of the global consumer base, with their spending power estimated to reach $360 billion in the US alone by 2024. This generation's digital nativity and preference for authentic, short-form content demand highly personalized and engaging advertising approaches.

Taboola's AI must adeptly navigate these evolving demographics to effectively segment audiences. By understanding the distinct interests and media habits of groups like the aging population and Gen Z, Taboola can tailor content and advertising strategies for maximum impact. This involves not just broad segmentation but granular personalization that speaks directly to individual user profiles.

Personalized content recommendations are central to Taboola's value proposition. In 2023, platforms leveraging advanced AI for personalization saw an average increase in user engagement of 15-20%. For Taboola, this means ensuring its AI can accurately identify and cater to the diverse needs and preferences across various age groups and cultural backgrounds, driving better performance for its partners.

- Aging Population Growth: Global population aged 65+ expected to be 1.5 billion by 2050 (up from ~700 million in 2020).

- Gen Z Consumer Power: Estimated US spending power of Gen Z to reach $360 billion by 2024.

- AI Personalization Impact: AI-driven personalization can boost user engagement by 15-20%.

- Diverse Audience Needs: Tailoring content to distinct demographic groups like seniors and Gen Z is crucial for engagement.

Demand for Ethical Advertising and Brand Safety

Advertisers are becoming much more mindful of their brand's reputation, pushing for greater brand safety. This means they want their ads to show up in environments that align with their values and don't feature problematic content. For Taboola, this translates into a critical need to manage its publisher network meticulously, ensuring that its advertising technology actively filters out inappropriate placements and adheres to ethical advertising standards demanded by a socially conscious market.

Taboola's proactive approach to this trend is evident in its strategic partnerships. For instance, the collaboration with Jounce Media specifically targets the removal of 'Made for Advertising' (MFA) properties from its network. This initiative directly addresses advertiser concerns about ad spend efficiency and brand integrity, as MFA sites are often criticized for prioritizing ad impressions over user experience and content quality.

The demand for ethical advertising is a growing sociological force impacting the digital ad ecosystem. As consumers become more aware and critical of corporate practices, brands are compelled to demonstrate social responsibility. This pressure trickles down to advertising platforms like Taboola, requiring them to develop and implement robust systems that guarantee ads are displayed ethically and safely, reflecting positively on the brands they represent.

- Advertiser Sensitivity: Brands are increasingly scrutinizing ad placements, with a significant majority reporting that brand safety is a top priority in their digital advertising strategies.

- Ethical Content Alignment: A growing percentage of consumers state they will boycott brands that advertise alongside content they deem offensive or harmful, impacting brand perception and sales.

- MFA Site Reduction: Industry reports from 2024 indicate a concerted effort by major ad platforms to reduce their exposure to MFA inventory, with some estimating over 15% of digital ad spend being wasted on such sites.

- Partnership Impact: Collaborations like the one with Jounce Media are crucial for Taboola to maintain advertiser trust, as they demonstrate a commitment to combating ad fraud and ensuring placement quality, which is vital for retaining high-value clients.

Societal concerns regarding misinformation and data privacy are eroding trust in online content, directly impacting user engagement with recommendation engines. Taboola must prioritize content quality, transparency in its recommendation algorithms, and robust data protection to maintain its reputation and user confidence. For instance, a 2024 survey revealed that over 60% of internet users worry about the accuracy of online information and how their data is used.

Technological factors

Taboola's business is fundamentally built on artificial intelligence (AI) and machine learning (ML). These technologies are essential for its core function: personalizing content recommendations and matching advertisements with users. The company's ongoing investment in AI R&D is critical for refining its algorithms, making them more accurate and effective at targeting. This continuous improvement is key to maintaining Taboola's competitive advantage in delivering relevant content experiences.

The evolution of AI promises to significantly enhance personalization across the digital landscape, making it an indispensable component of platforms like Taboola. For instance, by 2024, AI is projected to drive a substantial portion of content discovery, with estimates suggesting that AI-powered recommendations will account for over 80% of user engagement on many platforms. Taboola's commitment to staying at the forefront of these AI advancements ensures its ability to adapt to changing user expectations and market demands.

Ad-blocking technologies are getting smarter, posing a continuous hurdle for companies like Taboola. These advancements mean Taboola’s native advertising needs to evolve to avoid being flagged and blocked. This necessitates creative approaches to how ads are presented and integrated into publisher content, making user experience key to bypass detection while still respecting what users want to see.

The increasing prevalence of ad blockers is pushing the industry towards more subtle, non-intrusive native advertising formats. This evolution means companies must focus on blending ads seamlessly with editorial content to maintain visibility and engagement. For instance, studies in 2024 indicated that over 40% of internet users globally employ some form of ad blocker, a figure that continues to grow, underscoring the urgency for adaptive advertising strategies.

The shift away from third-party cookies, a major trend accelerated by browser updates and privacy regulations, significantly impacts digital advertising. Taboola's strategy is directly shaped by this, necessitating a move towards privacy-centric data solutions. For instance, Google's Chrome is phasing out third-party cookies by 2024, a move that affects the entire advertising ecosystem.

Taboola is positioning itself for this cookieless future by emphasizing its proprietary first-party data and contextual targeting capabilities. This approach allows for user engagement without relying on invasive tracking methods. The company's platform is designed to leverage these privacy-enhancing technologies (PETs) to deliver relevant content recommendations.

By focusing on first-party data, Taboola aims to maintain effective targeting and measurement, crucial for advertisers. This strategy aligns with the growing demand for transparency and user control over personal information. Industry estimates suggest that by 2025, the majority of digital advertising will need to adapt to a privacy-first framework.

Emergence of New Content Formats and Platforms

The digital content ecosystem is in constant flux, with new formats like short-form video and interactive media gaining significant traction. Platforms are also diversifying, extending into areas like connected TV (CTV) and emerging metaverse environments. Taboola must adapt its recommendation engine and monetization strategies to effectively serve these evolving content types and distribution channels. For instance, by 2024, short-form video consumption continued its rapid ascent, with platforms like TikTok and Instagram Reels dominating user attention spans, requiring Taboola to refine its approach to video content placement and engagement metrics.

Taboola's strategic response involves expanding its technological capabilities to seamlessly integrate with and recommend content across these new frontiers. This includes developing sophisticated algorithms that can understand and categorize diverse content formats, from brief video clips to more complex immersive experiences. The company’s partnerships are also crucial, with a stated focus in 2024 and 2025 on onboarding new device manufacturers and emerging platforms to ensure broad reach and relevance.

Key developments include:

- Growth in short-form video: Estimated to account for over 20% of all digital video ad spending by the end of 2024, demanding new ad formats.

- CTV expansion: Connected TV advertising is projected to exceed $30 billion in the US alone by 2025, necessitating robust CTV ad solutions.

- Metaverse integration: Early-stage exploration of virtual environments offers future opportunities for content discovery and monetization.

- Platform partnerships: Taboola's ongoing efforts to integrate with new smart TV operating systems and content aggregators are vital for market penetration.

Cybersecurity Threats and Data Breaches

Cybersecurity threats represent a significant technological challenge for Taboola, a company entrusted with extensive user and publisher data. The sheer volume of information processed makes it a prime target for malicious actors aiming to exploit vulnerabilities. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a 15% increase from 2020, underscoring the financial and reputational risks involved.

Maintaining a robust security infrastructure is not just a best practice but a necessity for Taboola. This involves continuous monitoring of networks and systems for any suspicious activity, alongside swift incident response protocols. The company must invest heavily in advanced security measures to safeguard sensitive information, thereby preserving user trust and ensuring compliance with ever-evolving data protection regulations like GDPR and CCPA.

The increasing global focus on data privacy, exemplified by stricter regulations, elevates the importance of data security for Taboola. Failure to adequately protect user data can lead to severe penalties and irreparable damage to brand reputation. For example, fines under GDPR can reach up to 4% of annual global turnover or €20 million, whichever is greater. This regulatory landscape necessitates a proactive and comprehensive approach to cybersecurity.

- Data Breach Costs: Global average cost of a data breach was $4.45 million in 2023.

- Regulatory Fines: GDPR fines can reach up to 4% of annual global turnover.

- Security Investment: Ongoing investment in advanced cybersecurity measures is crucial.

- Trust and Compliance: Robust security protects sensitive data, maintains trust, and ensures regulatory adherence.

Taboola's core reliance on AI and machine learning dictates continuous innovation in these areas. By 2024, AI-driven personalization is expected to account for over 80% of user engagement on many platforms, making Taboola's algorithm refinement crucial. The company's investment in AI R&D directly impacts its ability to deliver relevant content, a key competitive differentiator.

Legal factors

Taboola must navigate a complex web of global data protection laws, including Europe's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), along with a growing number of similar regulations. These rules significantly influence how Taboola handles user data, from collection and storage to processing and sharing, directly affecting its advertising targeting precision. For instance, the GDPR, implemented in 2018, imposed stringent requirements on consent and data minimization, impacting digital advertising models worldwide.

Compliance with these varied regulations necessitates substantial legal and technical adjustments for Taboola. The evolving landscape means continuous investment in privacy-preserving technologies and robust compliance frameworks. Failure to adhere can result in significant fines; under GDPR, penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

The increasing emphasis on transparency and user consent, driven by these laws, reshapes Taboola's operations. Users are gaining more control over their data, requiring clear communication and explicit opt-ins for data usage in advertising. This shift demands innovative approaches to data management and personalized advertising that respect user privacy.

Taboola's core business relies heavily on distributing publisher content, making intellectual property (IP) rights and content licensing paramount. Navigating these legal areas requires robust agreements to ensure Taboola has the necessary permissions to display and promote content across its network. Failure to secure proper rights or inadvertently infringing on copyright can lead to costly legal battles and damage to publisher relationships.

In 2023, Taboola continued to emphasize its commitment to fair compensation for publishers, a crucial element in maintaining strong licensing partnerships. While specific figures for licensing costs aren't publicly detailed, the company's significant revenue, exceeding $1.3 billion in 2023, underscores the scale of content distribution and the importance of legally sound content acquisition strategies. These agreements are foundational to Taboola's ability to offer a diverse content feed to its users.

Taboola operates within a landscape heavily influenced by advertising standards and consumer protection laws, demanding truthfulness and transparency in its native advertising. Failure to comply with regulations concerning deceptive practices and disclosure requirements can lead to significant penalties. For instance, the Digital Services Act (DSA) in Europe mandates that all online advertisements, including those served by Taboola, must feature clear, concise, and easily understandable disclosures. This focus on clear labeling is crucial for maintaining consumer trust and avoiding regulatory action, which can include substantial fines and damage to brand reputation.

Antitrust and Competition Laws

Antitrust and competition laws are a significant legal consideration for Taboola. Regulators worldwide are increasingly scrutinizing market concentration and anti-competitive practices within the digital advertising sector. This heightened focus could directly impact Taboola's operations and growth strategies.

Potential legal challenges might arise from investigations into market dominance, data access policies, or exclusive partnership agreements. Such scrutiny could necessitate changes in Taboola's business practices or impose restrictions on its expansion plans. For instance, a 2024 ruling against Google concerning its ad tech monopoly could potentially open up new avenues for competitors like Taboola by fostering a more balanced competitive landscape.

- Increased regulatory scrutiny of digital advertising markets.

- Potential for investigations into market dominance and data access.

- Risk of legal challenges leading to changes in business practices.

- Google's ad tech monopoly ruling may create opportunities for competitors.

Content Moderation and Platform Liability

Legal frameworks are rapidly evolving, placing significant scrutiny on platforms like Taboola regarding their liability for hosted or recommended content. This includes issues like misinformation, hate speech, and illegal material. For instance, the Digital Services Act (DSA) in the European Union, which came into full effect in February 2024, mandates that online platforms dedicate substantial resources to identifying and removing illegal content and limiting the spread of disinformation. Failure to comply can result in hefty fines, potentially up to 6% of a company's global annual revenue.

Taboola faces mounting pressure to bolster its content moderation systems and technologies. This is crucial for mitigating legal exposure stemming from harmful content that might appear on its vast network. The DSA, in particular, requires platforms to implement robust measures for content moderation and risk assessment, directly impacting how companies like Taboola operate within the EU. In 2024, many ad-tech companies are investing heavily in AI-powered moderation tools to stay ahead of these regulatory demands.

The DSA's emphasis on combating misinformation and hate speech directly compels platforms to actively invest in and deploy resources for content policing. This means Taboola must continuously refine its algorithms and human oversight processes to ensure compliance. The company's proactive approach to these legal shifts will be a key determinant of its long-term stability and growth, especially as regulatory bodies worldwide begin to adopt similar stringent policies.

Taboola operates under stringent data privacy regulations like GDPR and CCPA, impacting user data handling and advertising precision. Non-compliance can lead to penalties up to 4% of global annual revenue. These laws are reshaping how Taboola manages data, requiring greater transparency and user consent.

Intellectual property rights and content licensing are critical for Taboola's business model, necessitating robust agreements for content distribution. In 2023, Taboola's revenue exceeded $1.3 billion, highlighting the scale of content acquisition and the legal groundwork required.

Advertising standards and consumer protection laws mandate clear disclosures for Taboola's native advertising. The Digital Services Act (DSA) requires clear labeling of all online advertisements, with non-compliance risking substantial fines and reputational damage.

Antitrust and competition laws pose significant legal considerations, with increasing scrutiny on market dominance in digital advertising. A 2024 ruling against Google's ad tech monopoly could potentially benefit competitors like Taboola by fostering a more balanced market.

Environmental factors

Taboola's reliance on extensive digital infrastructure and AI capabilities inherently creates a substantial digital carbon footprint. The energy demands of large data centers powering its platform are a key environmental consideration, with the digital advertising industry as a whole contributing to global IT resource consumption and climate change impacts.

Stakeholders, including investors and consumers, are increasingly scrutinizing companies like Taboola to quantify and actively reduce their energy usage and environmental footprint. For instance, reports in 2024 highlighted that the IT sector's carbon emissions could rival those of the aviation industry if left unchecked, underscoring the urgency for companies to adopt sustainable digital practices.

Societal and investor expectations for corporate social responsibility are significantly shaping how companies, including Taboola, are evaluated. This trend is particularly pronounced in the digital advertising space, where environmental, social, and governance (ESG) issues are receiving heightened attention.

Demonstrating a strong commitment to environmental sustainability, ethical conduct, and robust social governance can be a powerful differentiator. For instance, a 2024 report by the Global Sustainable Investment Alliance indicated that sustainable investments reached $37.4 trillion globally, showcasing a clear market preference for responsible businesses.

This focus on CSR impacts Taboola's ability to attract environmentally conscious partners and top talent, ultimately influencing its long-term business viability and market perception. Companies that proactively address ESG concerns are better positioned to build trust and secure a competitive advantage in an increasingly aware marketplace.

Taboola's reliance on hardware providers and cloud services means its supply chain sustainability is increasingly scrutinized. As of 2024, a significant majority of large enterprises are integrating environmental, social, and governance (ESG) criteria into their procurement processes, with over 70% expecting their suppliers to meet certain sustainability benchmarks.

This trend is likely to influence Taboola's partnership decisions, pushing for vendors who demonstrate ethical sourcing and environmental responsibility. For instance, a growing number of cloud providers are committing to 100% renewable energy by 2030, a factor that may become a key differentiator for companies like Taboola when selecting service partners.

ESG reporting is becoming crucial for Taboola to identify and mitigate risks within its extended network of suppliers. Companies that fail to demonstrate robust supply chain transparency regarding environmental impact, such as carbon emissions or waste management, may face reputational damage and potential regulatory challenges in the coming years.

Climate Change Impact on Infrastructure and Operations

Climate change presents indirect but significant risks to Taboola's operational stability. Extreme weather events, amplified by climate shifts, could disrupt the internet infrastructure that underpins its content delivery network. This raises concerns about the resilience of data centers and network connectivity, emphasizing the need for robust disaster recovery and business continuity strategies. For instance, the increasing frequency of severe storms and rising sea levels in coastal regions, where many data centers are located, poses a tangible threat to uninterrupted service. In 2024, the global cost of natural disasters exceeded $200 billion, highlighting the escalating impact of climate-related events on critical infrastructure.

The company must proactively assess and mitigate these environmental vulnerabilities. This involves evaluating the geographical concentration of its infrastructure and exploring diversification strategies to minimize single points of failure. Investing in resilient infrastructure and redundant systems will be crucial. Furthermore, the burgeoning use of AI in addressing climate challenges offers potential avenues for Taboola to explore, perhaps in optimizing energy consumption for its operations or in developing more resilient network management systems. Businesses are increasingly leveraging AI to monitor environmental risks and adapt their supply chains and operational footprints accordingly.

- Increased Frequency of Extreme Weather: Global average temperatures have risen, leading to more intense heatwaves, floods, and storms, directly impacting physical infrastructure.

- Infrastructure Resilience Costs: Companies may face increased capital expenditure to harden their data centers and network infrastructure against climate-related disruptions.

- AI for Climate Adaptation: AI is being deployed to predict weather patterns, optimize resource usage, and develop early warning systems, offering opportunities for operational resilience.

- Supply Chain Disruptions: Climate-induced events can impact global supply chains, potentially affecting hardware procurement and maintenance for Taboola's technology stack.

Regulatory and Investor Pressure for ESG Reporting

Regulatory bodies and investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors. This trend is compelling companies like Taboola to be more transparent about their environmental impact and sustainability efforts. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) is shaping how financial products are marketed and reported on, impacting companies operating within or selling to the EU market. Taboola's responsiveness to these demands will likely affect its standing with stakeholders and its ability to attract investment capital.

The growing emphasis on ESG reporting means that a company's commitment to sustainability is no longer a secondary consideration but a critical component of its overall valuation and risk assessment. Investors are actively seeking out companies with strong ESG performance, viewing it as an indicator of good management and long-term resilience. In 2024, the global sustainable investment market reached approximately $37.4 trillion according to the Global Sustainable Investment Alliance, highlighting the significant financial influence of ESG considerations.

- Regulatory Scrutiny: Expect stricter regulations globally requiring detailed environmental impact disclosures.

- Investor Demand: A growing number of institutional investors are integrating ESG metrics into their investment decisions, impacting Taboola’s valuation.

- Industry Standards: The digital advertising industry, including companies like Taboola, faces pressure to adopt standardized ESG reporting frameworks.

- Capital Access: Strong ESG performance can enhance Taboola's access to capital and improve its investor relations.

Environmental factors pose significant operational and reputational challenges for Taboola. The energy consumption of its AI-driven digital infrastructure contributes to its carbon footprint, a growing concern for stakeholders. As of 2024, the IT sector's carbon emissions are a significant global issue, making sustainable digital practices crucial for companies like Taboola.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Taboola draws on a diverse range of data, including industry-specific market research reports, economic indicators from reputable financial institutions, and public domain legal and regulatory updates.