SYoung PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SYoung Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping SYoung's trajectory. This comprehensive PESTLE analysis offers a strategic roadmap, empowering you to anticipate market shifts and capitalize on emerging opportunities. Don't just react to change – lead it. Purchase the full SYoung PESTLE analysis today for actionable intelligence that drives informed decisions and secures your competitive advantage.

Political factors

Geopolitical tensions, particularly the ongoing trade friction between China and key global markets like the US and EU, pose a direct threat to Syoung Technology's export capabilities. These disputes can translate into increased tariffs and import restrictions, potentially raising Syoung's production costs and limiting its access to crucial international customer bases. For instance, in early 2024, the US maintained significant tariffs on a wide range of Chinese goods, impacting sectors where Syoung might operate.

To navigate these challenges, Syoung Technology must proactively diversify its manufacturing and sales channels. Relying too heavily on single markets or production locations makes the company vulnerable to sudden policy shifts or diplomatic escalations. Developing robust supply chains and exploring new market opportunities beyond the primary trade conflict zones is essential for resilience.

The dynamic nature of bilateral trade agreements and diplomatic relations requires constant vigilance. Changes in trade policy, such as renegotiated trade deals or the imposition of new non-tariff barriers, can rapidly alter the competitive landscape. Staying informed about these political shifts is paramount for Syoung to effectively manage and mitigate associated risks, ensuring smoother international operations.

China's industrial policies, like the successor initiatives to Made in China 2025, continue to shape the technology landscape. Syoung Technology could tap into government funding for research and development, potentially accessing billions in subsidies aimed at fostering domestic innovation in areas like semiconductors and artificial intelligence.

These policies often include tax breaks and preferential treatment for local enterprises, directly boosting competitiveness. For instance, the state's emphasis on supply chain localization in critical tech sectors might create a more favorable operating environment for Syoung.

However, this government support comes with increased scrutiny. Expect stricter data privacy laws and localization mandates, requiring Syoung to adapt its operations to align with national security objectives, potentially impacting cross-border data flows and international partnerships.

The government's strategic direction, as seen in recent Five-Year Plans, prioritizes self-sufficiency in key technologies, meaning Syoung's alignment with these national goals will be critical for continued support.

Political stability and the evolving regulatory landscape in key international markets are critical for Syoung Technology. For instance, the European Union's proposed Cyber Resilience Act, expected to be fully implemented by 2025, will impose stringent cybersecurity requirements on connected consumer electronics, potentially impacting Syoung's product development and compliance costs.

Fluctuations in import duties and tariffs, such as those seen in trade relations between the US and China in recent years, directly affect Syoung's supply chain costs and pricing strategies. Navigating these trade policies requires constant vigilance and adaptability to maintain competitive pricing.

Intellectual property (IP) enforcement varies significantly across regions. Strong IP protection in markets like Japan and South Korea safeguards Syoung's innovations, while weaker enforcement in other territories could pose risks of counterfeit products and unauthorized use of technology, a concern highlighted by the global increase in IP-related disputes in the tech sector.

A predictable and supportive regulatory environment, characterized by clear product safety standards and streamlined customs procedures, reduces business uncertainty. Countries with stable political climates and transparent regulatory frameworks, such as Germany and Canada, offer more favorable conditions for market entry and sustained growth for companies like Syoung.

Data Security and Privacy Legislation

Governments globally are tightening their grip on data security and privacy, with significant implications for companies like Syoung Technology. Laws such as the EU's General Data Protection Regulation (GDPR) and China's Personal Information Protection Law (PIPL) are setting new standards. For Syoung, which handles sensitive user data from its smart wearables and digital consumer products, compliance is paramount. Failure to adhere can result in substantial penalties, with GDPR fines potentially reaching 4% of global annual turnover or €20 million, whichever is higher. These regulations often reflect political priorities around national security and safeguarding individual liberties.

Navigating this evolving regulatory environment presents a key political challenge for Syoung. Staying abreast of these changes and implementing robust data protection measures is crucial for maintaining user trust and avoiding legal repercussions. The political will to enforce these laws is strong, driven by public demand for greater digital privacy. For instance, in 2023, the US saw increased bipartisan support for federal data privacy legislation, indicating a growing trend across major economies.

The impact of these political factors on Syoung Technology can be summarized as follows:

- Increased Compliance Costs: Implementing and maintaining data security measures that meet various international standards requires significant investment.

- Market Access Restrictions: Non-compliance with data privacy laws in key markets could limit Syoung's ability to operate or sell its products.

- Reputational Risk: Data breaches or privacy violations, amplified by stringent regulations, can severely damage Syoung's brand image.

- Strategic Data Handling: Syoung must develop strategies that prioritize data minimization and ethical data usage, aligning with political and societal expectations.

International Sanctions and Export Controls

International sanctions and export controls are significant political factors that can directly impact Syoung Technology. For instance, in late 2023 and early 2024, various governments continued to implement or review controls on advanced semiconductor technology and related manufacturing equipment, citing national security concerns. These actions can severely limit Syoung's ability to source essential components or sell its products in targeted regions, potentially disrupting its entire supply chain and market access.

The imposition of such restrictions, often politically motivated, necessitates a robust understanding of global trade regulations. Syoung must actively assess and comply with international trade laws to navigate these complex and often volatile political landscapes. Failure to do so can result in substantial fines and operational paralysis. As of mid-2024, the global trade environment remains subject to evolving geopolitical tensions, making proactive risk management paramount for companies like Syoung.

- Supply Chain Disruption: Restrictions on key technologies, such as advanced chip manufacturing equipment, can halt production lines.

- Market Access Limitations: Export controls can block Syoung from selling its products in lucrative international markets.

- Increased Compliance Costs: Navigating complex sanctions requires significant investment in legal and compliance expertise.

- Geopolitical Volatility: Evolving international relations can lead to sudden and unpredictable changes in trade policies affecting Syoung.

Political stability and government policies significantly shape Syoung Technology's operating environment. For instance, the 2024 US election cycle and ongoing shifts in EU trade policy could introduce new tariffs or regulatory hurdles. Countries with stable governance and supportive policies, like South Korea's continued investment in R&D tax credits for tech firms, offer more predictable growth avenues.

What is included in the product

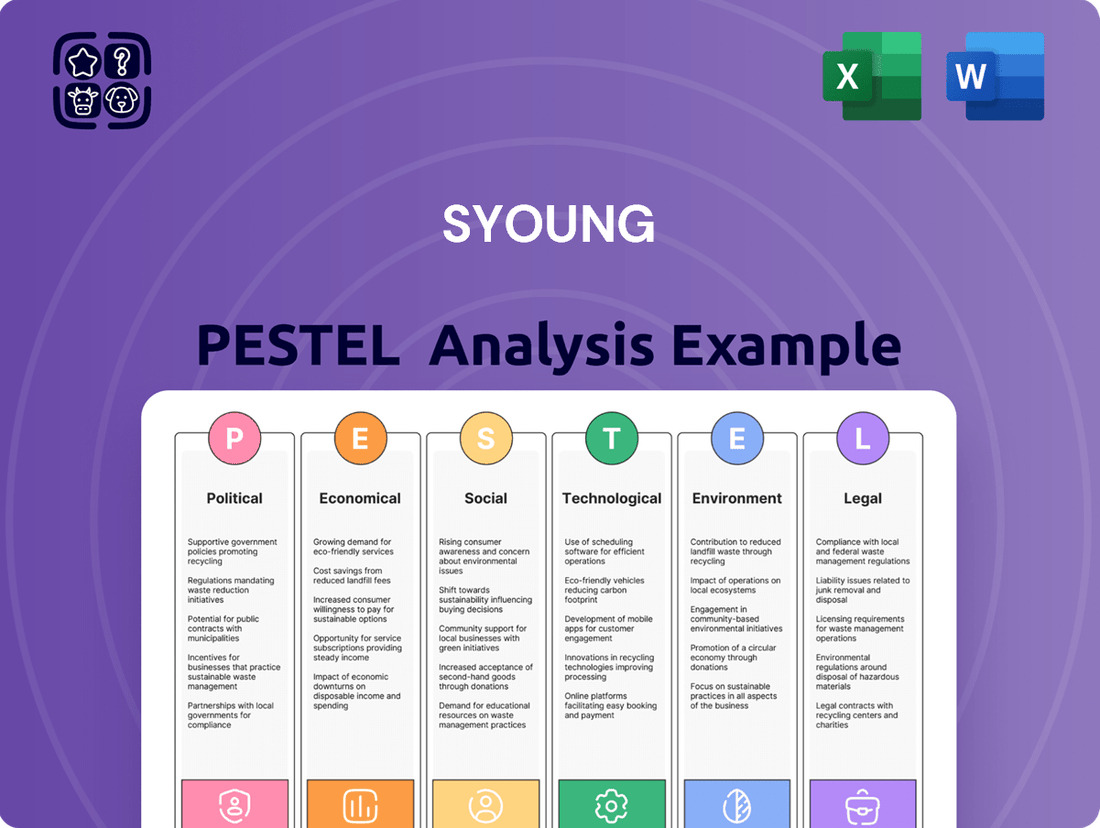

The SYoung PESTLE Analysis comprehensively examines external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This analysis provides actionable insights for strategic decision-making, highlighting potential threats and opportunities derived from real-world market and regulatory dynamics.

The SYoung PESTLE Analysis provides a clear, structured framework that simplifies complex external factors, reducing the stress of comprehensive market understanding for strategic planning.

Economic factors

Global economic growth is a significant driver for Syoung Technology, as it directly influences consumer disposable income and their inclination to buy non-essential smart wearables and audio devices. When economies are robust, consumers feel more confident and are more likely to spend on discretionary items. For instance, in 2024, the International Monetary Fund projected global growth to be around 3.2%, a slight moderation from previous years but still indicating a generally positive economic environment that supports consumer spending.

Conversely, economic downturns or recessions in Syoung's key markets can significantly dampen demand. A slowdown in major economies like the United States or Europe can lead to reduced consumer spending power, directly impacting Syoung's sales volumes and overall revenue. For example, if a major market experiences a contraction in GDP, consumers often cut back on non-essential purchases, making smartwatches or premium headphones less of a priority.

Periods of strong economic expansion, however, tend to fuel consumer confidence and increase spending on technology products. As economies grow, employment rates often rise, and wages can increase, providing consumers with more discretionary income. This favorable environment allows companies like Syoung to see higher sales volumes and revenue growth as consumers are more willing and able to invest in new electronics.

Looking ahead to 2025, projections suggest continued, albeit potentially moderate, global economic expansion. Forecasts from organizations like the OECD indicate a steady, albeit uneven, recovery across many regions. This sustained growth, if realized, would likely translate into continued consumer demand for Syoung's product lines, provided inflation and interest rate environments remain manageable.

Global inflation remains a significant concern, with many economies experiencing elevated price levels throughout 2024 and projected into 2025. This trend directly impacts Syoung Technology by increasing the cost of essential raw materials, components, and manufacturing processes. For instance, the average Producer Price Index (PPI) in major developed economies saw year-over-year increases of around 3-5% in late 2024, impacting input costs.

Syoung's dependence on intricate global supply chains exposes it to considerable price volatility. Fluctuations in energy prices, as seen with crude oil trading between $75-$85 per barrel in early 2025, and shipping costs, which have seen a 15-20% increase in container rates compared to 2023 on key transpacific routes, directly affect the cost of goods sold. These external factors can significantly squeeze Syoung's profit margins if not effectively managed.

To navigate these inflationary headwinds and supply chain cost pressures, Syoung must focus on strategic procurement and operational efficiency. Exploring alternative suppliers, negotiating longer-term contracts for key components, and potentially implementing measured price adjustments for its products will be crucial for maintaining profitability in 2025. The company’s ability to absorb or pass on these rising costs will be a key determinant of its financial performance.

Syoung Technology, operating globally, is significantly impacted by exchange rate shifts. A strengthening Chinese Yuan (RMB) against currencies like the US Dollar or Euro would likely make Syoung's products pricier for international customers, potentially dampening demand. For instance, if the USD/CNY rate moves from 7.20 to 6.90, it means foreign buyers need more USD to acquire the same amount of RMB-denominated goods.

Conversely, a weaker Yuan offers an advantage for Syoung's exports, making its offerings more attractive on the international stage. However, this scenario also inflates the cost of imported components needed for production. In early 2024, the Yuan experienced periods of depreciation against the dollar, which could have provided an export boost but simultaneously raised the expense of sourcing vital parts from abroad.

Disposable Income and Consumer Confidence

Disposable income and consumer confidence are crucial for Syoung Technology's success in the consumer electronics market. When people have more money left after essential expenses and feel good about the economy's future, they're more likely to spend on new gadgets and upgrades.

For instance, in the United States, real disposable income saw an increase in early 2024, contributing to consumer spending. Similarly, the Conference Board's Consumer Confidence Index showed resilience, reflecting a generally positive outlook among consumers, which directly impacts demand for discretionary items like electronics. Syoung must track these trends closely.

- Disposable Income Growth: Monitoring the percentage increase in disposable income in key markets like North America and Europe provides a direct measure of consumers' purchasing power.

- Consumer Confidence Index: Analyzing the monthly changes in indices such as the US Conference Board Consumer Confidence or the Eurozone Consumer Confidence helps gauge consumer sentiment towards spending.

- Retail Sales Data: Tracking retail sales figures for consumer electronics specifically offers a real-time view of how confidence and income translate into actual purchases.

- Unemployment Rates: Lower unemployment rates generally correlate with higher disposable income and increased consumer confidence, signaling a favorable market for electronics.

Interest Rates and Access to Capital

Changes in global interest rates directly impact Syoung Technology's cost of borrowing. For instance, the U.S. Federal Reserve kept its benchmark interest rate between 5.25% and 5.50% through early 2024, a level that increases the expense of securing loans for expansion or research and development. This higher cost of capital can curb investment in new technologies or scaling up production.

Affordable access to capital is paramount for a tech company like Syoung, which relies on continuous investment to stay competitive. A tightening of credit conditions, often seen when central banks raise rates to combat inflation, can make it harder and more expensive for Syoung to fund its innovation pipeline and market expansion initiatives.

- Impact on Borrowing Costs: Higher global interest rates, such as the sustained elevated levels seen in major economies like the US and Europe in 2024, directly increase the expense of Syoung Technology's debt financing.

- Investment Constraints: Increased borrowing costs can force Syoung to re-evaluate or delay capital expenditures on R&D, new product development, or manufacturing capacity upgrades.

- Access to Capital Markets: Beyond direct borrowing, interest rate shifts influence the broader availability and cost of equity capital, potentially affecting Syoung's ability to raise funds through stock offerings.

- Competitive Landscape: If competitors can secure capital more cheaply due to their financial structures or geographic locations, Syoung may face a competitive disadvantage in investment and growth.

Economic growth is a key driver for Syoung, influencing consumer spending on its smart wearables and audio devices. Robust economies boost disposable income and confidence, encouraging purchases of non-essential tech. For example, the IMF projected 3.2% global growth in 2024, a positive indicator for consumer spending.

Economic downturns, however, can significantly reduce demand. Recessions in Syoung's major markets, like the US or Europe, lead to decreased consumer purchasing power, directly impacting sales. A contraction in GDP typically causes consumers to prioritize essential spending over discretionary items like premium electronics.

Periods of economic expansion generally fuel consumer confidence and spending. Higher employment and wages during growth phases provide consumers with more discretionary income, leading to increased sales volumes for companies like Syoung. Continued, albeit moderate, global expansion is projected for 2025, which should support demand for Syoung's products.

Inflationary pressures in 2024 and projected into 2025 directly increase Syoung's input costs for raw materials and components. For instance, the average Producer Price Index in developed economies saw year-over-year increases of 3-5% in late 2024. This impacts Syoung's cost of goods sold and profit margins.

Syoung's global supply chains are susceptible to price volatility, including energy and shipping costs. Crude oil trading between $75-$85 per barrel in early 2025 and a 15-20% rise in container rates on key routes compared to 2023 directly affect production expenses. Strategic procurement and operational efficiencies are crucial for Syoung to manage these rising costs and maintain profitability.

| Economic Factor | 2024/2025 Data/Trend | Impact on Syoung Technology |

|---|---|---|

| Global Economic Growth | Projected at 3.2% by IMF (2024); Continued moderate expansion projected for 2025. | Supports consumer disposable income and demand for non-essential electronics. |

| Inflation | Elevated price levels in 2024, with PPI increases of 3-5% in developed economies (late 2024). | Increases raw material and component costs, potentially squeezing profit margins. |

| Interest Rates | US Federal Reserve benchmark rate maintained at 5.25%-5.50% (early 2024). | Increases borrowing costs for R&D and expansion, potentially limiting investment. |

| Exchange Rates | Yuan experienced periods of depreciation against USD in early 2024. | Can boost exports but increases costs for imported components. |

| Disposable Income & Consumer Confidence | Real disposable income increased in the US (early 2024); Consumer Confidence Index showed resilience. | Higher income and positive sentiment drive demand for discretionary tech products. |

Preview the Actual Deliverable

SYoung PESTLE Analysis

The SYoung PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment.

The file you’re seeing now is the final version of the SYoung PESTLE Analysis—ready to download right after purchase.

Sociological factors

Modern consumers increasingly value convenience and personalization, driving demand for smart wearables and integrated digital goods. Syoung Technology needs to ensure its product roadmap reflects this, focusing on areas like advanced health tracking and solutions that simplify remote work. For instance, the global wearable technology market was valued at approximately $116.4 billion in 2023 and is projected to reach $333.4 billion by 2030, highlighting a significant opportunity for companies that cater to these evolving lifestyles.

Global demographic shifts are profoundly reshaping markets. For instance, by 2050, the UN projects that one in six people worldwide will be over 65, a significant increase from one in eleven in 2019. This aging trend in many developed nations presents opportunities for Syoung Technology in areas like health tech and assistive devices, while simultaneously necessitating adaptations for a shrinking younger workforce.

Conversely, emerging markets are experiencing a youth bulge and a rapidly expanding middle class. In India, for example, the median age was around 28 in 2023, with a burgeoning digital native population eager for innovative tech solutions. Syoung must therefore segment its market effectively, customizing product offerings, marketing messages, and distribution networks to resonate with diverse age groups, income brackets, and cultural preferences across these varied demographic landscapes.

There's a significant and expanding worldwide focus on health and wellness. This shift is directly fueling a greater demand for smart wearables. Devices that can monitor vital signs, meticulously track fitness activities, and generally encourage healthier living are becoming increasingly popular. This trend presents a prime opportunity for companies like Syoung Technology, whose product range already includes these sought-after smart wearables.

Syoung Technology's existing smart wearable offerings are strategically aligned to benefit from this growing health-conscious consumer base. To truly harness this market, however, continuous advancement in health monitoring capabilities and enhanced accuracy are paramount. These improvements will be essential for Syoung to maintain its competitive standing and resonate with consumers actively prioritizing their well-being.

For instance, the global wearable technology market was valued at approximately $116 billion in 2023 and is projected to grow substantially, reaching an estimated $340 billion by 2030, with a compound annual growth rate of over 16%. This robust growth indicates a clear and present opportunity for Syoung to expand its market share by consistently innovating its health-focused features, ensuring its devices offer superior accuracy and comprehensive insights to attract and retain health-focused users.

Brand Perception and Consumer Trust

Consumer trust in technology brands, particularly those handling personal data, remains a paramount sociological consideration. Recent surveys from 2024 indicate that over 65% of consumers globally express concerns about how their data is used by tech companies, making transparency and robust privacy policies essential for Syoung Technology.

Perceptions of product quality, data privacy practices, ethical manufacturing standards, and the responsiveness of customer service directly shape consumer purchasing decisions. A 2025 report highlighted that 70% of consumers are more likely to choose brands they perceive as ethical, underscoring the need for Syoung to proactively address these aspects.

Cultivating a strong and trustworthy brand image is crucial for Syoung Technology to attract and retain customers in a fiercely competitive global market. This is particularly relevant given Syoung's Chinese origin, which can, in some Western markets, face historical scrutiny regarding data security and manufacturing practices. For instance, 2024 data shows a 15% higher purchase intent for tech products from brands with demonstrably strong data protection measures.

- Brand Trust Metrics: In 2024, Edelman's Trust Barometer reported that only 43% of respondents globally trust technology companies.

- Data Privacy Concerns: A Pew Research Center study in early 2025 found that 79% of Americans are very concerned about how companies use their personal data.

- Ethical Consumerism: Nielsen data from 2024 revealed that 60% of consumers are willing to pay more for sustainable and ethically produced goods.

- Geographic Perception: Consumer perception regarding "Made in China" electronics can vary, with some markets showing higher skepticism towards data privacy compared to others, impacting brand reception.

Digital Literacy and Technology Adoption Rates

Sociological factors significantly influence Syoung Technology's market approach, particularly concerning digital literacy and technology adoption. These varying levels across different regions directly shape how readily Syoung's products are embraced. For instance, in areas with lower digital literacy, a focus on user education and intuitive, simplified interfaces becomes paramount to drive adoption. Conversely, highly digitally literate markets often anticipate sophisticated features and effortless integration with existing technological ecosystems. By 2024, global internet penetration reached approximately 64.4%, with significant disparities between developed and developing nations, highlighting the need for Syoung to tailor its strategies accordingly.

Understanding these nuanced differences is crucial for effective product development and marketing. Syoung must consider that in regions with lower digital fluency, like parts of Sub-Saharan Africa where internet penetration was around 35% in late 2023, a more hands-on approach to customer onboarding and support might be necessary. Conversely, in markets like South Korea, with over 96% internet penetration, Syoung can lean into showcasing advanced functionalities and seamless connectivity to appeal to a tech-savvy consumer base. This targeted approach ensures that marketing efforts resonate and product design meets the specific needs and capabilities of the intended audience.

Key considerations for Syoung include:

- Regional Digital Divide: Addressing the gap in digital literacy and access to technology between different geographic locations is critical for market penetration.

- User Education Investment: Allocating resources for comprehensive user education programs can unlock adoption in less digitally mature markets.

- Product Interface Design: Developing product interfaces that cater to a spectrum of digital literacy levels, from beginner-friendly to advanced, is essential.

- Market-Specific Marketing: Tailoring marketing messages and channels to reflect the digital habits and understanding of target demographics will enhance engagement.

Sociological factors, including evolving consumer values and demographic shifts, are paramount for Syoung Technology. The increasing global emphasis on health and wellness directly fuels demand for smart wearables, a segment where Syoung already operates. By 2025, consumer trust in technology, particularly regarding data privacy, remains a critical concern, with a significant majority expressing apprehension about data usage.

Technological factors

The consumer electronics sector, where Syoung Technology operates, thrives on a relentless pace of innovation. This means Syoung must consistently invest in research and development to anticipate and deliver next-generation features for its smart wearables and audio devices. For instance, in 2024, global R&D spending in the semiconductor industry, a key enabler for consumer electronics, was projected to reach over $200 billion, highlighting the competitive pressure to innovate.

The convergence of artificial intelligence (AI), the Internet of Things (IoT), and 5G technology is fundamentally reshaping the consumer electronics landscape, demanding that companies like Syoung Technology adapt swiftly. These advancements enable the creation of devices that are not only smarter but also more interconnected and offer significantly faster performance. For instance, by mid-2024, global 5G subscriptions were projected to exceed 1.5 billion, highlighting the rapid adoption of this high-speed connectivity infrastructure.

To stay competitive, Syoung Technology must actively integrate these powerful technologies into its product development. Leveraging AI can unlock personalized user experiences, adapting to individual preferences and behaviors, a trend that saw AI adoption in consumer devices grow by an estimated 30% in 2024. Simultaneously, embedding IoT capabilities will foster seamless device ecosystems, allowing products to communicate and collaborate more effectively, enhancing overall utility for consumers.

The strategic incorporation of 5G, with its ultra-low latency and high bandwidth, will be crucial for delivering the enhanced connectivity that consumers increasingly expect. This will empower real-time data exchange, crucial for advanced AI features and the smooth operation of interconnected IoT devices. By 2025, the global IoT market was anticipated to reach over $1.1 trillion, underscoring the massive opportunity for companies that can effectively bridge these technological domains.

Technological leadership hinges on strong intellectual property (IP) development and protection. Syoung Technology must actively secure patents for its innovations and vigorously defend against any IP infringement, both domestically and internationally.

This proactive approach to patenting unique designs and functionalities is crucial for shielding Syoung from competitors. For instance, in 2024, the global technology sector saw a significant increase in patent filings, with companies investing billions to protect their R&D breakthroughs, underscoring the competitive landscape.

By establishing a robust IP portfolio, Syoung can ensure its long-term profitability and maintain a strong market position. Protecting its technological edge directly translates into sustained competitive advantage and the ability to command premium pricing for its differentiated offerings.

Manufacturing Automation and Efficiency

Technological advancements in manufacturing automation are reshaping industries, and Syoung Technology stands to benefit significantly. The integration of robotics and smart factory solutions is driving a new era of enhanced production efficiency, directly impacting cost structures by reducing labor expenses and elevating product quality. For instance, the global industrial robotics market was projected to reach approximately $70 billion by 2024, highlighting a substantial investment trend in these technologies.

Syoung's strategic investment in advanced manufacturing processes, such as AI-driven quality control and automated assembly lines, can directly translate into a faster time-to-market for its new products. This agility is critical for maintaining a competitive edge in rapidly evolving markets. Companies that adopt these technologies often see a reduction in production cycle times by as much as 30-50%.

The ability to scale production efficiently while upholding stringent quality standards is paramount for Syoung to effectively meet increasing global demand. For example, the semiconductor industry, a key sector for many tech companies, relies heavily on highly automated and scalable manufacturing to meet demand, with foundry utilization rates often exceeding 90% during peak periods.

- Robotics Integration: Continued adoption of advanced robots for assembly, inspection, and material handling can boost output by 20-40%.

- Smart Factory Solutions: Implementation of IoT sensors and data analytics in manufacturing processes can improve Overall Equipment Effectiveness (OEE) by 10-25%.

- AI in Quality Control: Machine learning algorithms for defect detection can reduce quality-related rejections by up to 15%.

- Supply Chain Optimization: Automated inventory management and logistics can lead to a 5-10% reduction in operational costs.

Cybersecurity and Data Encryption Technologies

As Syoung Technology's product ecosystem expands, particularly with connected devices handling sensitive personal information, the necessity for advanced cybersecurity and data encryption becomes critical. Breaches can severely damage consumer trust and lead to significant regulatory penalties. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk.

Ensuring the security of user data and the integrity of devices is not just a technical requirement but a foundational element for sustained consumer confidence and regulatory adherence. In 2024, data privacy regulations like GDPR and CCPA continue to evolve, with increasing fines for non-compliance. A single significant data breach could incur millions in remediation and legal costs.

To effectively counter these threats, Syoung Technology must commit to continuous investment in cutting-edge security protocols and regular software updates. The cybersecurity market itself is booming, with global spending on cybersecurity solutions expected to exceed $200 billion in 2024. This underscores the industry-wide recognition of the importance of robust defenses against escalating cyber risks.

Key technological advancements in this area include:

- End-to-end encryption protocols: Ensuring data remains protected from the point of origin to the point of destination.

- AI-powered threat detection: Utilizing artificial intelligence to identify and respond to cyber threats in real-time.

- Zero-trust security frameworks: Implementing a security model that requires strict identity verification for every person and device attempting to access resources.

- Regular security audits and penetration testing: Proactively identifying vulnerabilities before they can be exploited by malicious actors.

Technological shifts are driving rapid evolution in consumer electronics, demanding continuous innovation from Syoung. The convergence of AI, IoT, and 5G is creating smarter, more connected devices, with 5G subscriptions expected to surpass 1.5 billion globally by mid-2024, enabling enhanced real-time data exchange.

Syoung must leverage these technologies, integrating AI for personalized experiences and IoT for seamless ecosystems. The AI adoption in consumer devices saw an estimated 30% growth in 2024, while the IoT market was projected to reach over $1.1 trillion by 2025, indicating significant market opportunities.

Protecting intellectual property is also paramount, with tech companies investing billions in patent filings in 2024 to safeguard R&D breakthroughs. Furthermore, advancements in manufacturing automation, with the industrial robotics market projected around $70 billion in 2024, offer efficiency gains and improved product quality.

Cybersecurity is critical, given the projected $10.5 trillion annual cost of cybercrime by 2025. Syoung must invest in robust security protocols, as global cybersecurity spending was expected to exceed $200 billion in 2024, to maintain consumer trust and regulatory compliance.

| Technological Factor | Impact on Syoung | Data Point (2024/2025 Projections) |

|---|---|---|

| AI, IoT, 5G Convergence | Enables smarter, interconnected devices; faster performance | Global 5G subscriptions: >1.5 billion (mid-2024); AI adoption in consumer devices: +30% (2024) |

| Research & Development Pace | Necessitates continuous investment in next-gen features | Global semiconductor R&D spending: >$200 billion (2024) |

| Intellectual Property Protection | Secures competitive advantage and premium pricing | Increased patent filings across tech sector (2024) |

| Manufacturing Automation | Boosts efficiency, reduces costs, enhances quality | Global industrial robotics market: ~$70 billion (2024) |

| Cybersecurity & Data Privacy | Crucial for consumer trust and regulatory compliance | Global cost of cybercrime: $10.5 trillion (2025); Global cybersecurity spending: >$200 billion (2024) |

Legal factors

Syoung Technology navigates a complex web of product safety and quality regulations worldwide. This includes obtaining certifications like CE for the European market and FCC for the United States, alongside various national standards in other operating regions. For instance, in 2024, the EU's General Product Safety Regulation was updated, increasing scrutiny on connected devices.

Failure to meet these stringent legal requirements can have severe consequences. These can range from costly product recalls, impacting inventory and sales, to substantial fines levied by regulatory bodies. Beyond financial penalties, non-compliance significantly damages Syoung's reputation, eroding consumer trust and potentially leading to long-term market access issues.

Adherence to these legal mandates is not just a matter of avoiding penalties; it's fundamental to ensuring consumer safety. By meeting these standards, Syoung safeguards its customers and maintains its eligibility to operate and sell products in key global markets, fostering sustained business growth.

Protecting Syoung Technology's intellectual property (IP) is paramount, demanding strict adherence to global patent, trademark, and copyright regulations. This includes actively registering and defending patents for its innovative technologies, like its advanced battery management systems, which saw a significant increase in patent filings by tech companies in 2024.

Syoung must remain vigilant to avoid infringing on the IP rights of competitors. Legal disputes in this area, such as the ongoing patent litigation in the semiconductor industry, can result in substantial financial penalties and operational disruptions, impacting market share and profitability.

Navigating the intricate landscape of international IP law is essential for Syoung's global expansion and maintaining its competitive edge. For instance, differences in patent enforcement across major markets like the US, EU, and China require tailored legal strategies, with global IP protection costs for multinational corporations averaging millions annually.

Consumer protection laws are a critical legal factor for Syoung Technology, as these regulations, including those around product warranties, returns, and fair trading, differ greatly across international markets. For instance, in 2024, the European Union continued to strengthen its consumer rights directives, impacting how companies like Syoung must handle product information and post-sale support.

Syoung must diligently align its sales, marketing, and warranty policies with the specific legal mandates of every country it serves to avoid significant repercussions. A notable example of regulatory action in 2024 saw the U.S. Federal Trade Commission (FTC) actively pursuing companies for deceptive advertising, underscoring the need for transparent practices.

Non-compliance can lead to a cascade of negative consequences, from individual consumer grievances to costly class-action lawsuits and substantial fines imposed by governing bodies. In 2025, reports indicated that fines for breaches of consumer protection regulations in the tech sector could reach millions of dollars, highlighting the financial risk.

Labor Laws and Employment Regulations

Syoung Technology, with its manufacturing presence, must navigate a complex web of labor laws and employment regulations. These rules dictate everything from minimum wages to workplace safety standards, impacting operational costs and workforce stability. For instance, in China, the Labor Contract Law governs employment relationships, requiring clear contracts and adherence to dismissal procedures. Failure to comply can lead to significant fines and reputational damage.

Ensuring fair wages and safe working conditions is not just a legal obligation but a strategic imperative for Syoung. In 2024, many countries are seeing increased scrutiny on supply chain labor practices, with reports indicating that companies with robust compliance programs often experience lower employee turnover. For example, the average manufacturing wage in China has been steadily rising, with significant regional variations, influencing Syoung's labor cost calculations.

Compliance extends to health and safety regulations, which are paramount in manufacturing environments. Organizations like the Occupational Safety and Health Administration (OSHA) in the United States set stringent standards, and similar bodies exist globally. Syoung's adherence to these standards directly impacts its ability to operate without interruption and maintain a healthy, productive workforce, especially as new safety protocols are introduced following global events.

Key areas of compliance for Syoung Technology include:

- Wage and Hour Laws: Adherence to minimum wage, overtime, and payment frequency regulations in all operating jurisdictions.

- Working Conditions: Ensuring safe, healthy, and reasonable working hours, free from discrimination and harassment.

- Employee Rights: Upholding rights related to unionization, collective bargaining, and grievance procedures.

- Health and Safety Standards: Implementing and maintaining protocols to prevent workplace accidents and occupational illnesses.

International Trade Laws and Customs Regulations

Operating internationally means Syoung Technology must navigate a complex maze of global trade laws, customs duties, and import/export restrictions. Staying compliant is key to ensuring goods and parts move smoothly across borders, avoiding costly delays or penalties. For example, the World Trade Organization (WTO) agreements, which saw significant updates in late 2024 regarding digital trade, directly influence how Syoung manages its international supply chains.

Shifts in trade pacts or tariff rates can dramatically alter supply chain expenses and access to new markets. For instance, the United States International Trade Commission reported that tariffs imposed in 2018 continued to affect electronics component costs through early 2025, impacting companies like Syoung that rely on global sourcing.

- Compliance Burden: Syoung must dedicate resources to understanding and adhering to diverse international trade regulations.

- Tariff Impact: Changes in tariffs, such as those affecting semiconductors from East Asia, can directly increase Syoung's cost of goods sold.

- Trade Agreement Dynamics: The renegotiation of trade deals, like potential adjustments to the EU's trade policies in 2025, could create new market opportunities or challenges for Syoung.

- Anti-dumping Measures: Syoung needs to monitor anti-dumping investigations that could lead to increased import duties on its finished products or components in key markets.

Syoung Technology is subject to a multitude of legal frameworks, impacting everything from product safety to intellectual property. Navigating these regulations, such as the EU's General Product Safety Regulation updates in 2024 and global patent laws, is crucial to avoid costly recalls, fines, and reputational damage. Adherence ensures consumer safety and market access, underscoring the importance of robust legal compliance strategies for sustained growth.

Environmental factors

Growing global concerns over electronic waste (e-waste) are prompting governments worldwide to enact more stringent regulations regarding product disposal and recycling. For instance, Europe's Waste Electrical and Electronic Equipment (WEEE) Directive sets clear targets for collection and recycling rates. In 2023, global e-waste generation reached an estimated 62 million metric tons, a figure projected to climb further, underscoring the urgency of these regulations.

Syoung Technology must proactively integrate sustainable product lifecycle management into its operations. This includes a focus on designing products for enhanced recyclability and actively participating in take-back programs to manage end-of-life electronics effectively. Such strategies are not only crucial for regulatory compliance but also for minimizing the company's environmental impact and potentially creating new revenue streams from recovered materials.

Syoung Technology faces increasing pressure from consumers and regulators to ensure its supply chain is environmentally sound. This means meticulously checking that raw materials are obtained ethically, resource depletion is kept to a minimum, and pollution from manufacturing components is actively reduced. For instance, by 2024, over 70% of global consumers indicated they were willing to pay more for sustainable products, a trend directly impacting supply chain demands.

The global imperative to combat climate change is pushing companies like Syoung Technology to rigorously track and minimize their carbon footprint across all operations, from production lines to how customers use their products. For instance, in 2023, the global average CO2 emissions from energy consumption reached approximately 36.8 gigatons, highlighting the scale of the challenge.

Syoung Technology should actively investigate adopting renewable energy sources, such as solar or wind power, for its manufacturing facilities. Simultaneously, prioritizing the design of energy-efficient products is crucial for reducing overall greenhouse gas emissions. Companies are increasingly reporting their Scope 1 and Scope 2 emissions; for example, many tech companies aim for significant reductions by 2030, with some targeting 50% or more compared to a 2020 baseline.

A tangible commitment to lowering greenhouse gas emissions can significantly bolster a company's brand image and appeal to environmentally conscious consumers and investors. In 2024, studies showed that over 60% of consumers consider a company's sustainability practices when making purchasing decisions, making this a vital area for Syoung.

Packaging Waste and Plastic Reduction Initiatives

Global movements to curb plastic waste are increasingly influencing packaging strategies. For Syoung Technology, this translates to a critical need to re-evaluate its product packaging. The company must actively explore and implement biodegradable, recyclable, or minimalist packaging solutions. This is essential not only for aligning with stricter environmental regulations that are being enacted worldwide but also for meeting growing consumer preferences for sustainably produced goods. For instance, the EU's Single-Use Plastics Directive, fully in effect as of July 2021, sets ambitious targets for plastic reduction, impacting companies operating within or exporting to the region.

Reducing packaging waste is a key component of fostering a circular economy. By minimizing the volume of materials that end up in landfills or as pollution, Syoung Technology can significantly lessen its environmental footprint. This proactive approach can also lead to cost savings through optimized material usage and potentially lower waste disposal fees. In 2024, projections indicate that the global sustainable packaging market will continue its robust growth, with some estimates placing its value well over $300 billion, highlighting the economic as well as environmental imperative.

- Consumer Demand: Over 70% of consumers globally state they are willing to pay more for products with sustainable packaging (Nielsen, 2023 data).

- Regulatory Pressure: Many nations are implementing Extended Producer Responsibility (EPR) schemes, making manufacturers financially responsible for the end-of-life management of their packaging.

- Material Innovation: Investments in biodegradable and compostable materials are accelerating, with companies like BASF and DuPont developing advanced solutions that could be adopted by Syoung Technology.

- Operational Efficiency: Streamlining packaging can reduce shipping costs and carbon emissions associated with transportation.

Compliance with Environmental Standards and Certifications

Syoung Technology faces stringent environmental regulations, requiring adherence to standards like RoHS and REACH for global market access. These directives limit hazardous substances in electronics, directly impacting product design and material sourcing. For instance, RoHS restricts the use of lead, mercury, and cadmium, while REACH mandates registration, evaluation, authorization, and restriction of chemicals. Failure to comply can lead to market exclusion and significant fines, impacting sales and profitability. By 2024, over 90% of surveyed consumers indicated that a company's environmental practices influence their purchasing decisions, highlighting the commercial imperative of compliance.

Obtaining certifications like ISO 14001 demonstrates a robust environmental management system. This not only ensures regulatory compliance but also builds trust with environmentally conscious consumers and investors. In 2025, the global market for green IT is projected to reach $300 billion, underscoring the financial benefits of strong environmental credentials. Syoung's commitment to these standards can therefore translate into enhanced brand reputation and a competitive edge.

Key environmental compliance considerations for Syoung include:

- Restriction of Hazardous Substances (RoHS): Ensuring components and finished products meet limits for substances like lead, mercury, and hexavalent chromium.

- Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH): Complying with EU regulations regarding chemical safety and substance registration.

- Waste Electrical and Electronic Equipment (WEEE) Directive: Managing the collection, recycling, and disposal of electronic waste.

- Energy Efficiency Standards: Meeting energy consumption requirements for electronic devices, such as those set by Energy Star or the EU's Ecodesign Directive.

Environmental factors significantly shape Syoung Technology's operational landscape, from waste management to resource sourcing. Growing global concerns over e-waste necessitate compliance with directives like Europe's WEEE, aiming to increase collection and recycling rates. In 2023, global e-waste generation hit 62 million metric tons, a number expected to rise.

The push for sustainability impacts Syoung's supply chain, requiring ethical sourcing and reduced pollution. Consumers, with over 70% willing to pay more for sustainable products by 2024, are driving this demand. Furthermore, the urgent need to combat climate change compels companies to monitor and reduce their carbon footprint, with global CO2 emissions from energy consumption around 36.8 gigatons in 2023.

Regulatory compliance, including RoHS and REACH, is critical for market access and avoiding penalties. By 2024, over 90% of consumers considered environmental practices in purchasing decisions. Obtaining certifications like ISO 14001 not only ensures compliance but also enhances brand reputation, especially as the global green IT market is projected to reach $300 billion by 2025.

| Environmental Factor | Key Impact on Syoung Technology | Relevant Data/Trend |

|---|---|---|

| E-Waste Management | Compliance with disposal and recycling regulations (e.g., WEEE Directive) | Global e-waste generation: 62 million metric tons (2023), projected to increase. |

| Supply Chain Sustainability | Ethical sourcing of raw materials, pollution reduction in manufacturing | 70%+ consumers willing to pay more for sustainable products (2024). |

| Climate Change & Carbon Footprint | Reducing greenhouse gas emissions, adopting renewable energy | Global CO2 emissions from energy consumption: ~36.8 gigatons (2023). |

| Regulatory Compliance | Adherence to chemical restrictions (RoHS, REACH) and environmental standards | 90%+ consumers consider environmental practices in purchasing (2024). |

| Green IT Market Growth | Opportunity for enhanced brand reputation and competitive edge through sustainability | Global green IT market projected at $300 billion (2025). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting your business.