SYoung Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SYoung Bundle

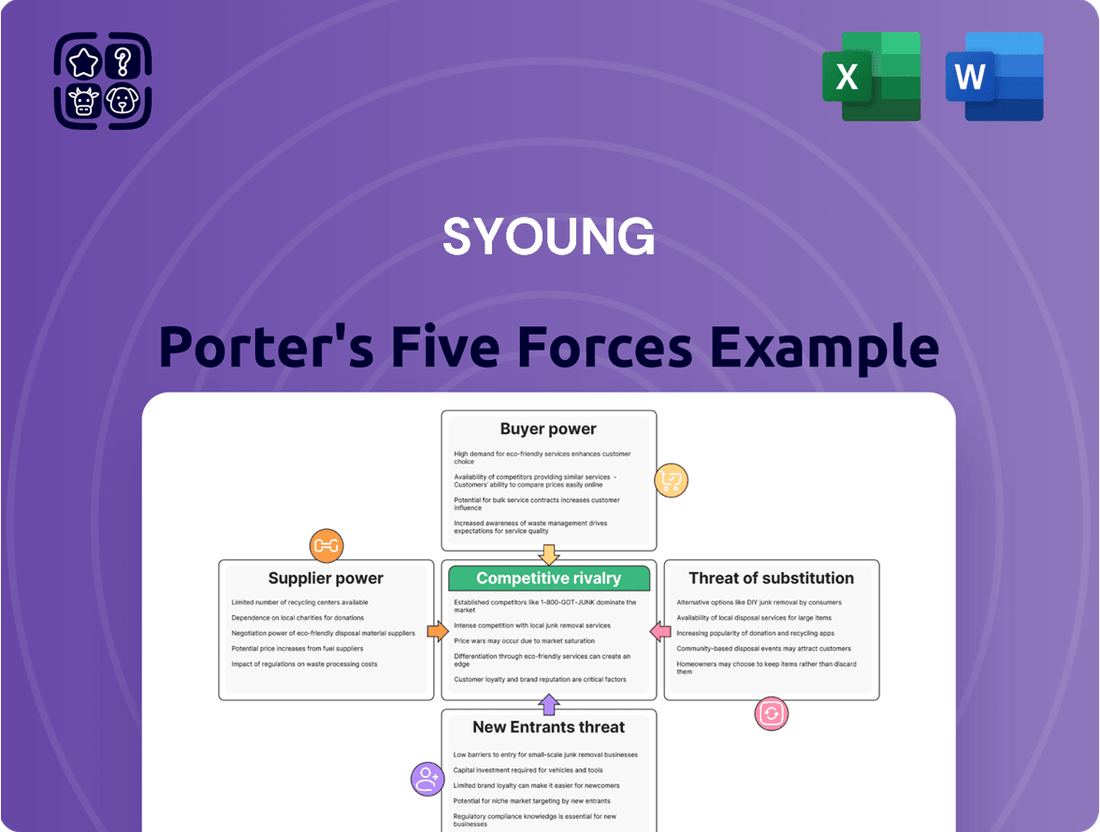

Understanding SYoung's competitive landscape is crucial for strategic success. Our Porter's Five Forces analysis reveals the intensity of rivalry, the power of buyers and suppliers, and the threats from new entrants and substitutes. This framework offers a clear view of the external forces shaping SYoung's industry.

The complete report delves deeper, providing a comprehensive, data-driven understanding of SYoung's market dynamics. Unlock actionable insights to navigate these forces and identify your competitive advantages.

Ready to move beyond the basics? Get a full strategic breakdown of SYoung’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The consumer electronics sector, encompassing smart wearables and audio gadgets, finds itself dependent on a limited number of major suppliers for essential components such as semiconductors, unique displays, and sophisticated sensors. This consolidation of the component market grants these primary suppliers considerable influence over companies like Syoung Technology Co., Ltd.

This concentrated market power means suppliers can heavily influence pricing and delivery schedules. For instance, in 2024, the average price of advanced mobile processors, crucial for smart wearables, saw a notable increase due to high demand and limited production capacity from a few key chip manufacturers, directly impacting the cost structure for device makers.

Consequently, Syoung Technology Co., Ltd. faces the risk of dictated terms, which can significantly inflate its production expenses and extend lead times. This reliance on a few dominant players for critical inputs can hinder Syoung's ability to control its supply chain and maintain competitive pricing for its products.

Suppliers possessing proprietary technology or patents for crucial components, like advanced audio codecs or energy-efficient chipsets, wield significant bargaining power. Syoung Technology might encounter elevated costs or restricted choices if its innovative product designs rely on such exclusive technologies.

For instance, if a supplier holds patents on next-generation display technology vital for Syoung's premium smartphones, they can dictate terms, potentially impacting Syoung's profit margins. In 2024, the semiconductor industry saw continued consolidation and innovation, with key players securing patents for advanced manufacturing processes, further strengthening their supplier position.

Switching suppliers for Syoung Technology presents significant challenges, often involving substantial costs and operational disruptions. These costs can include the expense of redesigning components, retooling manufacturing equipment, and the time-consuming process of requalifying new materials or parts. For instance, in the semiconductor industry, a sector Syoung operates within, the requalification of a new component can take upwards of six months and cost hundreds of thousands of dollars, impacting production timelines and budgets.

These elevated switching costs inherently grant considerable power to Syoung's suppliers. When the effort and expense to change providers are high, Syoung's flexibility is diminished, making it more difficult to negotiate favorable terms or switch to a more competitive supplier. This situation leaves Syoung more susceptible to potential price hikes or less advantageous contract conditions from their current partners, as the barriers to seeking alternatives are quite high.

Supplier's Forward Integration Threat

The threat of suppliers forward integrating into Syoung Technology's consumer electronics manufacturing presents a significant challenge. If a key component supplier, for instance, a major semiconductor manufacturer, were to begin producing finished consumer electronics, they would directly compete with Syoung. This scenario would drastically shift the power dynamic, as Syoung would then be reliant on a competitor for essential parts, potentially leading to unfavorable pricing and supply terms.

While forward integration by suppliers is not as prevalent as other competitive forces, its potential impact on Syoung cannot be ignored in the fast-evolving tech landscape. Such a move by a supplier could severely restrict Syoung's strategic flexibility and bargaining leverage, especially if the supplier's components are critical and difficult to substitute. For example, in 2024, the automotive industry saw increased instances of Tier 1 suppliers exploring direct-to-consumer models, illustrating this trend's growing relevance across sectors.

- Supplier Capability: Assess if key suppliers possess the financial resources, manufacturing expertise, and market access to enter Syoung's core business.

- Market Dynamics: Analyze industry trends where suppliers have historically or are currently considering forward integration to gauge Syoung's vulnerability.

- Component Dependency: Evaluate Syoung's reliance on specific suppliers for critical components that would be difficult or costly to replace, amplifying the supplier's threat.

- Strategic Options: Consider Syoung's contingency plans, such as diversifying its supplier base or developing in-house component capabilities, to mitigate this risk.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences supplier bargaining power. When a company like Syoung Technology can readily source alternative raw materials or components, suppliers have less leverage. However, in specialized sectors like consumer electronics, finding suitable substitutes can be challenging, thereby strengthening the suppliers' position.

For Syoung Technology, particularly with its smart wearables and audio devices, the limited availability of direct substitutes for key components means suppliers can exert considerable control. This control extends to dictating prices and managing supply volumes, impacting Syoung's production costs and schedules.

- Limited Substitutes for Key Components: In the rapidly evolving smart wearable and audio device markets, specialized components like advanced microprocessors or unique sensor modules may have few, if any, readily available alternatives.

- Supplier Pricing Power: When substitutes are scarce, suppliers can command higher prices, as seen in the semiconductor industry where lead times and demand often outstrip supply, forcing manufacturers to accept higher costs. In Q1 2024, average semiconductor prices saw a notable increase year-over-year due to persistent demand and supply chain constraints.

- Impact on Syoung's Margins: Syoung Technology's ability to negotiate favorable terms is directly tied to the interchangeability of its inputs. If crucial components are proprietary or uniquely manufactured, Syoung faces higher input costs, potentially squeezing profit margins.

- Supply Chain Vulnerability: A reliance on suppliers offering unique or difficult-to-substitute inputs makes Syoung's supply chain more vulnerable to disruptions, whether from geopolitical events, natural disasters, or the supplier's own production issues.

Suppliers hold significant power when they are few in number, essential to a company's operations, or possess unique technologies. For Syoung Technology, this means a handful of semiconductor or display manufacturers can dictate terms, impacting pricing and delivery. In 2024, the persistent demand for advanced chips, coupled with limited production expansion by major players, led to increased component costs for electronics manufacturers like Syoung.

The bargaining power of suppliers is amplified when switching costs are high. If Syoung Technology faces substantial expenses or disruptions in changing component providers, their current suppliers gain leverage. For example, requalifying a new semiconductor supplier can take over six months and cost hundreds of thousands of dollars, a significant barrier for Syoung in 2024.

The threat of suppliers moving into Syoung's market by producing finished goods themselves also increases their leverage. If a key component provider starts manufacturing consumer electronics, Syoung would be dependent on a direct competitor, potentially facing unfavorable terms. This trend, observed in sectors like automotive in 2024, highlights a growing risk for companies like Syoung.

Limited availability of substitute components directly strengthens supplier bargaining power. When Syoung Technology cannot easily find alternative parts for its smart wearables and audio gadgets, suppliers can command higher prices and control supply. For instance, Q1 2024 saw average semiconductor prices rise due to limited substitutes and ongoing demand, impacting Syoung's profit margins.

What is included in the product

Analyzes the competitive intensity and profitability potential within SYoung's industry by examining the five key forces shaping its market landscape.

Effortlessly identify and address competitive threats by visualizing the intensity of each of Porter's five forces.

Customers Bargaining Power

In the fiercely competitive global consumer electronics arena, particularly within digital goods, Syoung Technology faces customers who are acutely sensitive to price. This means Syoung must keep its prices competitive, which restricts its flexibility in absorbing or transferring rising operational costs to consumers.

The sheer volume of available alternatives for consumers in this sector significantly amplifies their bargaining power. For instance, in 2024, the global consumer electronics market was valued at approximately $1.1 trillion, with numerous brands vying for market share, giving consumers considerable leverage in price negotiations.

For many consumer electronics, including audio devices and smart wearables, the cost for customers to switch brands is surprisingly low. This makes it easy for consumers to jump ship if they aren't happy with Syoung Technology's offerings. In 2024, the global consumer electronics market saw intense competition, with many brands vying for market share, further empowering customers.

This low barrier to switching means customers hold significant power. They can easily explore alternatives if Syoung Technology's products don't meet their expectations regarding price, features, or overall quality. For instance, a consumer looking for wireless earbuds can find numerous comparable options from different manufacturers for under $100, making brand loyalty less of a constraint.

Customers now possess an unprecedented amount of information, readily available through online reviews, comparison platforms, and social media channels. This easy access to data empowers them to thoroughly research products and services, making more informed purchasing decisions than ever before.

This heightened transparency allows consumers to effortlessly compare Syoung Technology's products and pricing with those of its competitors. Consequently, this capability exerts downward pressure on Syoung's prices and fuels customer demands for greater value, directly impacting the bargaining power of customers.

For instance, in the highly competitive electronics market, a significant majority of consumers, estimated at over 70% as of 2024 data, consult online reviews before making a purchase. This widespread reliance on readily available information significantly amplifies their bargaining power.

Customer Segmentation and Volume

Customer segmentation significantly influences bargaining power. While individual consumers generally have low switching costs and thus higher individual power, large B2B clients like major retailers or online distributors purchasing in bulk from Syoung Technology wield substantial influence. For instance, in 2024, the top 10 retail partners of many electronics manufacturers accounted for over 60% of their total revenue, giving them considerable leverage. These large volume buyers can dictate terms, pushing for preferential pricing, extended payment schedules, and significant marketing co-op funds, all of which directly impact Syoung's profitability and operational flexibility.

The sheer volume purchased by these key accounts allows them to negotiate more aggressively. They can threaten to shift their substantial orders to competitors if their demands are not met. This dynamic is particularly potent in the tech sector where product lifecycles can be short and market share is fiercely contested. For Syoung, managing these relationships and understanding the cost implications of concessions is crucial for maintaining healthy margins.

- High Volume Customers: Large retailers and distributors can command better pricing and terms due to their significant purchase volumes.

- Switching Costs: While low for individual consumers, switching costs can be high for large B2B clients if they have integrated Syoung's products into their established supply chains and sales platforms.

- Negotiating Leverage: Bulk orders empower these customers to demand concessions on pricing, payment terms, and promotional support.

- Impact on Margins: Aggressive negotiation by large customers can squeeze Syoung's profit margins, particularly in competitive markets.

Product Standardization

If Syoung Technology's smart wearables and audio devices become too standardized, customers will view them as commodities. This lack of perceived differentiation makes it easy for buyers to switch to rival products, significantly boosting their bargaining power. For instance, in the competitive smartwatch market, where features often overlap, a consumer might choose a competitor based solely on a slightly lower price point if Syoung's unique selling propositions aren't strong enough.

This scenario highlights the critical need for Syoung to maintain a robust innovation pipeline. Continuous development of unique features and superior performance in its smart wearables and audio devices is essential to counter commoditization. By offering something truly distinct, Syoung can reduce the likelihood of customers treating its products as interchangeable with those of its competitors, thereby mitigating the increased bargaining power that standardization brings.

Consider the smartphone market as an analogy; while many devices offer similar core functionalities, brands that consistently innovate with camera technology, battery life, or unique software features can command higher prices and retain customer loyalty, even when cheaper alternatives exist. In 2024, the wearable technology sector saw rapid advancements, with companies like Apple and Samsung introducing new health monitoring features and improved battery efficiency, pushing the benchmark for differentiation.

- Increased Switching Costs: Standardization lowers switching costs for customers, making it easier and less expensive to move to a competitor.

- Price Sensitivity: When products are perceived as similar, customers become more sensitive to price, giving them leverage to negotiate lower costs.

- Innovation Imperative: Syoung must prioritize ongoing research and development to create unique features that justify premium pricing and discourage customer defection.

- Brand Loyalty: Strong brand building and differentiated product offerings are key to fostering loyalty and reducing the impact of customer bargaining power driven by standardization.

Customers wield significant power when they can easily switch between suppliers, especially in markets with numerous alternatives. In 2024, the global consumer electronics market, valued at roughly $1.1 trillion, offered consumers a vast array of choices, empowering them to readily shift to competitors if Syoung Technology’s products didn't meet their expectations. This ease of switching, often with minimal cost, amplifies customer leverage, particularly when products become commoditized and differentiation is low.

| Factor | Impact on Syoung Technology | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | High customer power due to many comparable products. | Global consumer electronics market valued at $1.1 trillion, with intense competition. |

| Switching Costs | Low switching costs for consumers increase their ability to change brands easily. | Consumers often find comparable smart wearables and audio devices under $100. |

| Information Availability | Informed customers can easily compare prices and features, driving down prices. | Over 70% of consumers consult online reviews before electronics purchases. |

| Customer Concentration (B2B) | Large B2B clients have substantial power to negotiate favorable terms. | Top 10 retail partners can account for over 60% of a manufacturer's revenue. |

What You See Is What You Get

SYoung Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You are looking at the complete Porter's Five Forces analysis, meticulously crafted to provide a comprehensive understanding of competitive forces within the SYoung industry. This document is ready for immediate download and application, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The global consumer electronics market, especially for smart wearables and audio devices, is brimming with many different competitors. Syoung Technology finds itself in a highly competitive landscape, facing off against massive global brands, other Chinese companies, and even new, innovative startups. This intense competition means everyone is constantly fighting for a bigger piece of the market. For instance, in 2024, the global wearables market alone was projected to reach over $150 billion, showcasing the significant revenue up for grabs and the sheer number of companies aiming to capture it.

The consumer electronics sector, where Syoung Technology operates, is characterized by substantial fixed costs. These include heavy investments in research and development, advanced manufacturing plants, and extensive marketing campaigns. For instance, the global semiconductor industry alone saw R&D spending exceed $200 billion in 2023, a figure that highlights the upfront capital required.

Such high fixed costs compel companies to operate at or near full capacity to achieve economies of scale and reduce per-unit production expenses. This drive for volume often fuels intense competition. Syoung Technology and its competitors may resort to aggressive pricing strategies and promotional offers to secure market share and cover their significant overheads.

In 2024, the pressure to maintain high capacity utilization can be particularly acute. Companies might offer discounts or bundle products, impacting profit margins across the industry. This competitive dynamic is a direct consequence of the industry's capital-intensive nature.

While Syoung Technology operates in dynamic digital consumer goods, certain segments, like the traditional smartwatch market, show signs of maturation. This slowing growth in established areas intensifies rivalry, as companies must actively gain share rather than benefiting from a rapidly expanding market. For example, the global wearable device market, while still growing, saw its growth rate moderate in early 2024 compared to previous years, putting pressure on established players.

High Stakes and Strategic Importance

The consumer electronics sector is a battleground where brand perception, cutting-edge technology, and integrated product ecosystems are paramount. Companies view this market as crucial for building strong brand loyalty and driving future growth.

This intense strategic focus means competitors, including Syoung Technology, are likely to engage in aggressive tactics. Expect price wars, lightning-fast product updates, and substantial marketing spend as businesses fight for market share.

For instance, in 2024, the global consumer electronics market was projected to reach over $1 trillion, highlighting the immense value and fierce competition within the industry. Companies are willing to invest heavily to capture even a small portion of this lucrative market.

- Aggressive Pricing: Companies often use promotional pricing and discounts to attract new customers and retain existing ones, impacting profit margins.

- Rapid Innovation: The pace of technological change is relentless, forcing companies to constantly develop and release new products to stay relevant.

- Extensive Marketing: Significant investment in advertising and promotional activities is necessary to build brand awareness and differentiate products in a crowded marketplace.

- Ecosystem Lock-in: Companies aim to create integrated product ecosystems, encouraging customer loyalty and increasing switching costs.

Product Differentiation and Innovation Pace

Competitive rivalry in the consumer electronics sector is fierce, largely driven by the imperative for continuous product differentiation and innovation. Syoung Technology must aggressively invest in research and development to introduce novel features, attractive designs, and cutting-edge technologies. This sustained R&D focus is crucial for carving out a distinct market position and preventing its offerings from being perceived as mere commodities.

The rapid pace of technological advancement means that even successful products can quickly become obsolete. For instance, in 2024, the smartphone market saw manufacturers like Apple and Samsung rapidly iterating on camera technology, display refresh rates, and AI integration, forcing competitors to keep pace or risk losing market share. Syoung Technology's ability to out-innovate rivals directly impacts its pricing power and ability to capture premium segments.

- High R&D Investment: Companies in this space often spend upwards of 10% of revenue on R&D to maintain competitiveness.

- Feature Proliferation: The introduction of new features, such as advanced AI capabilities in smartphones and foldable displays in laptops, defines competitive differentiation.

- Rapid Product Cycles: The average product lifecycle in consumer electronics can be as short as 12-18 months, demanding constant new product introductions.

- Brand Loyalty vs. Feature Adoption: While brand loyalty exists, consumers are often swayed by significant technological leaps, creating intense pressure on all players.

The competitive rivalry within the consumer electronics sector, where Syoung Technology operates, is exceptionally intense. This is largely due to the high number of players, from global giants to niche startups, all vying for market share in a sector projected to exceed $1 trillion globally in 2024. Companies must constantly innovate and differentiate to stand out.

The drive for market share often leads to aggressive pricing strategies and rapid product cycles, with lifecycles sometimes as short as 12-18 months. For example, in 2024, major smartphone manufacturers heavily promoted new AI features and camera upgrades, forcing competitors to match these advancements or risk obsolescence.

Syoung Technology faces pressure from both established brands known for ecosystem lock-in and agile newcomers introducing disruptive technologies. This dynamic necessitates significant investment in R&D, often exceeding 10% of revenue, to maintain relevance and avoid being perceived as a commodity product.

| Key Competitive Factors | Impact on Syoung Technology | Industry Data (2024 Estimates) |

| Number of Competitors | High, requiring constant differentiation | Thousands globally, with hundreds in key segments like wearables |

| Pace of Innovation | Necessitates continuous R&D investment | Average smartphone upgrade cycle: ~2-3 years; Wearable tech: <1 year for significant feature updates |

| Pricing Pressure | Impacts profit margins, leading to promotional activity | Average selling price (ASP) for smartwatches: ~$250-$350; Audio devices: Wide range from $50-$500+ |

| Marketing Spend | Crucial for brand visibility and product launch success | Global consumer electronics advertising spend: Billions of dollars annually |

SSubstitutes Threaten

Multi-functional smartphones represent a growing threat of substitution for Syoung Technology's specialized offerings. Modern smartphones now frequently incorporate features like advanced fitness tracking, sophisticated audio playback, and high-fidelity recording, capabilities once exclusive to dedicated devices. For instance, by the end of 2024, the global smartphone market is projected to reach over 1.3 billion units shipped, with many models boasting integrated health sensors and premium audio components, directly challenging the need for separate smart wearables and audio equipment.

Tablets, laptops, and smart TVs increasingly offer capabilities that overlap with some of Syoung Technology's offerings, particularly in media consumption and basic interactive tasks. For instance, the global tablet market saw shipments reaching approximately 35.7 million units in the first quarter of 2024, indicating their widespread adoption and utility.

As these general-purpose computing devices become more powerful and versatile, they can diminish the unique selling proposition of specialized Syoung products. Many consumers now find that a single device can fulfill multiple needs, potentially reducing the demand for dedicated solutions.

The increasing integration of streaming services and app ecosystems across laptops and smart TVs further blurs the lines. For example, smart TV sales continue to grow, with an estimated 247 million units sold globally in 2023, showcasing their dominance in home entertainment, directly competing with any specialized media devices.

This trend suggests that Syoung Technology faces a growing threat from substitutes, as consumers may opt for more multi-functional devices that offer a broader range of capabilities at a comparable or lower perceived cost.

For some consumers, traditional, non-smart alternatives can function perfectly well. Think about basic headphones instead of advanced wireless earbuds, or an analog watch versus a smartwatch. Even simpler fitness trackers can fulfill the core need for activity monitoring without the bells and whistles. These options often come with a significantly lower price tag, making them appealing to budget-conscious individuals or those who don't require the advanced features.

While Syoung Technology aims for cutting-edge innovation, the persistence of these low-tech substitutes presents a genuine threat. For example, the global market for traditional watches, though overshadowed by smartwatches, still represents billions in sales annually, indicating a dedicated consumer base. Similarly, basic wired headphones continue to hold a substantial market share, especially in emerging economies where affordability is a primary driver for many purchasers. This segment of the market, prioritizing simplicity and cost over advanced functionality, can indeed divert potential customers away from Syoung's more sophisticated offerings.

Software-Based Solutions

The threat of substitutes for Syoung Technology's hardware is growing, particularly from software-based solutions. Many functions traditionally requiring dedicated hardware, like health tracking or audio improvement, can now be accomplished or enhanced through apps on smartphones and other existing devices. This trend can significantly reduce the demand for specialized hardware, impacting Syoung's market position.

For instance, wearable health trackers, a core area for some hardware companies, face competition from smartphone apps that leverage built-in sensors. By 2024, the global market for health and fitness apps was projected to reach over $20 billion, demonstrating substantial consumer adoption of software alternatives. This widespread availability of powerful, often cheaper, software substitutes directly challenges the value proposition of standalone hardware devices.

- Software can replicate many hardware functions: Health monitoring, audio processing, and even some imaging capabilities are increasingly handled by apps.

- Lower cost of entry for consumers: Utilizing existing devices for these functions eliminates the need to purchase new hardware.

- Rapid innovation in software: App development cycles are faster, allowing for quicker feature updates and improvements compared to hardware refresh rates.

- Increased accessibility: A vast number of users already own smartphones, providing an immediate platform for software-based solutions.

Changes in Consumer Lifestyle and Preferences

Shifts in consumer lifestyles can significantly impact demand for Syoung Technology's products. For example, a growing preference for minimalism or digital detox might reduce the need for multiple specialized electronic devices. This trend could encourage consumers to consolidate their technology, opting for fewer, more versatile gadgets, thereby posing a threat of substitution.

Syoung Technology must stay attuned to these evolving consumer preferences. A move towards sustainability and reduced consumption, for instance, could see consumers holding onto devices longer or seeking out refurbished options. In 2024, the global market for refurbished electronics saw substantial growth, indicating a consumer willingness to explore alternatives that reduce reliance on new purchases.

- Consumer Shift: Growing interest in minimalism and digital detox potentially reduces demand for multiple specialized electronics.

- Substitution Risk: Consumers may opt for fewer, more versatile devices, substituting specialized products.

- Market Trend: The refurbished electronics market experienced notable growth in 2024, highlighting a move towards alternative consumption patterns.

The threat of substitutes for Syoung Technology's specialized hardware is significant, primarily driven by the increasing capabilities of multi-functional consumer electronics. Smartphones, in particular, are now equipped with advanced sensors and features that can replicate the functionality of dedicated devices, a trend bolstered by over 1.3 billion smartphone units projected for shipment in 2024.

Furthermore, software-based solutions are rapidly emerging as potent substitutes. Health and fitness apps, for example, leverage existing smartphone hardware to offer tracking and monitoring, with the health and fitness app market projected to exceed $20 billion by 2024, directly challenging the necessity of standalone wearable devices.

Even simpler, lower-cost alternatives like basic headphones or analog watches retain considerable market share, appealing to price-sensitive consumers. The global market for traditional watches, despite the rise of smartwatches, still generates billions in annual sales, illustrating the persistent appeal of less technologically advanced yet functional substitutes.

Consumer lifestyle shifts, such as a growing preference for minimalism and digital detox, also contribute to this threat. This can lead consumers to consolidate their devices, favoring fewer, more versatile gadgets over specialized ones, a trend supported by the notable growth in the refurbished electronics market observed in 2024.

Entrants Threaten

Entering the smart wearable and audio device sector, where Syoung Technology operates, demands significant upfront capital for research and development, sophisticated design, and setting up robust manufacturing lines. For instance, the global wearables market was valued at an estimated $116 billion in 2023 and is projected to grow, indicating the scale of investment needed to capture even a small share. This high initial investment acts as a formidable barrier, discouraging many potential competitors from entering the fray.

Established players like Syoung Technology command significant brand loyalty, built over years of consistent product delivery and customer engagement. This loyalty acts as a substantial barrier, making it difficult for new entrants to attract and retain customers who are already satisfied with existing brands. For instance, in the competitive consumer electronics market, brands with a strong legacy often see repeat purchases exceeding 60%.

Furthermore, existing companies possess well-developed distribution channels, encompassing both physical retail presence and robust online sales platforms. Newcomers must invest heavily to replicate these networks, a costly endeavor that can significantly delay market entry and increase initial operational expenses. In 2023, the cost of establishing a comparable global distribution network for a new electronics brand could easily run into hundreds of millions of dollars.

Developing advanced consumer electronics, like those Syoung Technology specializes in, demands deep technical skill in areas such as intricate hardware engineering, sophisticated software coding, and efficient global supply chain orchestration. This creates a significant barrier for newcomers.

New companies often struggle to match the decades of accumulated know-how and practical experience that established players like Syoung have cultivated, making it difficult to replicate their product quality and operational efficiency. For example, in 2024, the average time for a new hardware startup to bring a complex product to market often exceeds 18-24 months, a significant hurdle against established players with streamlined processes.

The sheer depth of knowledge required, from circuit board design to firmware optimization, means that new entrants face a steep learning curve. This expertise isn't easily acquired and represents a substantial investment in talent and research and development, which can deter potential competitors.

Regulatory and Certification Hurdles

The consumer electronics sector faces significant regulatory and certification hurdles, especially for companies aiming for global market reach. New entrants must diligently comply with a patchwork of safety standards, environmental regulations, and product-specific certifications, such as CE marking in Europe or FCC certification in the United States.

Navigating these complex requirements can be a time-consuming and costly affair. For instance, obtaining necessary certifications can take months and incur substantial fees, effectively increasing the capital investment needed to bring a product to market. This process acts as a considerable barrier, deterring potential new competitors who may lack the resources or expertise to manage these complexities efficiently.

- Regulatory Compliance Costs: Companies often spend millions on testing and documentation to meet global standards.

- Certification Lead Times: Obtaining key certifications can delay product launches by 6-12 months.

- Global Variations: Different regions have unique, sometimes conflicting, regulatory landscapes, complicating market entry.

- Intellectual Property Protection: Ensuring compliance also involves navigating existing patents and standards, adding another layer of complexity.

Intellectual Property and Patents

The extensive intellectual property and patent portfolios of established players present a significant barrier to entry. New companies often find it challenging to develop novel products or services without the risk of infringing on existing patents, which can lead to costly legal battles. For instance, in the semiconductor industry, where Syoung Technology operates, patent litigation is a common occurrence, with major firms holding thousands of patents that protect their core technologies.

Syoung Technology can strategically bolster its competitive position by proactively building its own robust patent portfolio. This approach serves a dual purpose: it protects Syoung's innovative solutions from being copied by rivals and acts as a deterrent against potential new entrants who might otherwise be tempted to leverage similar technologies. By investing in research and development and securing patents for its unique innovations, Syoung can create a defensible market space.

- Barrier Creation: Syoung's patents can prevent competitors from using its proprietary technologies, thereby raising the cost and complexity for new market entrants.

- Innovation Protection: Securing patents safeguards Syoung's investments in R&D, ensuring it reaps the rewards of its technological advancements.

- Deterrent Effect: A strong patent portfolio signals Syoung's commitment to innovation and its willingness to defend its intellectual property, discouraging potential competitors.

- Licensing Opportunities: Patents can also open avenues for revenue generation through licensing agreements with other companies.

The threat of new entrants for Syoung Technology is moderately high, primarily due to the industry's attractiveness but tempered by substantial barriers. While the smart wearable and audio device market, valued at approximately $116 billion in 2023, offers significant growth potential, the high capital requirements for R&D, manufacturing, and distribution, estimated in the hundreds of millions for a global network, present a formidable hurdle. Furthermore, established brand loyalty and the need for deep technical expertise in hardware and software development also serve as significant deterrents, making it difficult for newcomers to gain traction in this competitive landscape.

| Barrier Type | Description | Estimated Cost/Impact (USD) | Relevance to Syoung |

|---|---|---|---|

| Capital Requirements | Investment in R&D, manufacturing, marketing | $100M+ for global network | High |

| Brand Loyalty | Customer preference for established brands | Repeat purchase rates >60% for legacy brands | High |

| Technical Expertise | Hardware engineering, software development, supply chain | Steep learning curve, 18-24 months for new hardware | High |

| Distribution Channels | Physical and online sales networks | Costly to replicate existing networks | High |

| Intellectual Property | Patents and proprietary technology | Potential for costly infringement lawsuits | High |

| Regulatory Compliance | Safety standards, certifications (CE, FCC) | Months of lead time, significant fees | Moderate to High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including company annual reports, industry-specific trade publications, and comprehensive market research reports.