SYoung Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SYoung Bundle

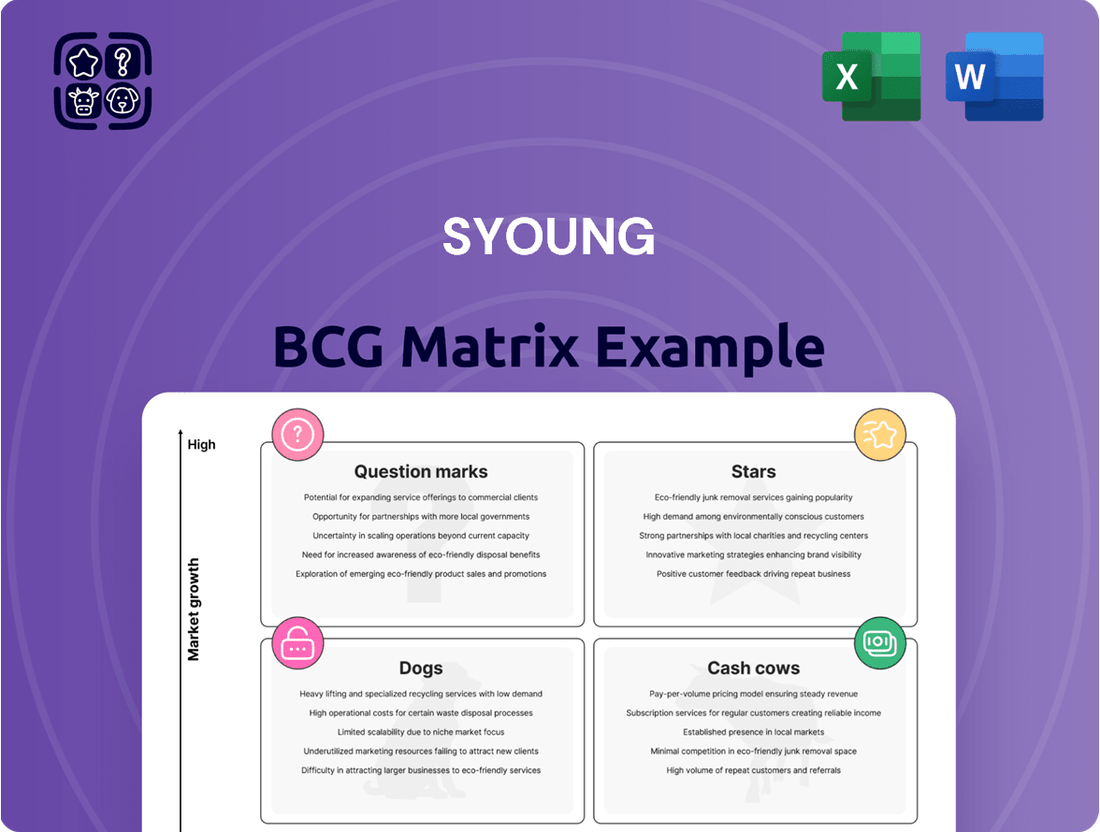

Is your company's product portfolio a well-oiled machine or a collection of underperformers? The SYoung BCG Matrix provides a powerful framework to categorize your products based on market share and growth, revealing hidden opportunities and potential pitfalls. Understand which products are your Stars, ready to be leveraged for future growth, and which are your Cash Cows, reliably generating income.

But this glimpse is just the beginning. To truly unlock strategic advantage, you need the full SYoung BCG Matrix. It dives deeper, offering precise quadrant placements and actionable insights for each product, transforming raw data into a clear roadmap for resource allocation and future investments.

Don't let your valuable resources be tied up in underperforming "Dogs" or uncertain "Question Marks" without a clear plan. The complete SYoung BCG Matrix equips you with the data-backed recommendations needed to make informed decisions, streamline your portfolio, and drive sustainable growth.

Invest in clarity and foresight. Purchase the full SYoung BCG Matrix today and gain the comprehensive understanding required to navigate market dynamics, optimize your product strategy, and achieve your business objectives with confidence.

Stars

Syoung's cutting-edge smartwatches, boasting advanced health tracking and AI capabilities, are positioned as Stars in the BCG Matrix. This segment is experiencing robust growth, with the global smartwatch market projected to reach $117.5 billion by 2028, growing at a CAGR of 15.9%. Syoung's innovative features are resonating with consumers, driving strong sales and a widening market share in this high-potential category.

Syoung's premium true wireless earbuds, boasting high-fidelity sound and advanced noise-cancelling, are positioned as a strong Star in its BCG portfolio. These earbuds, featuring unique selling propositions like spatial audio and extended battery life, tap into the consistently growing TWS market. For instance, the global true wireless earbuds market was valued at approximately $30 billion in 2023 and is projected to reach over $70 billion by 2028, demonstrating significant expansion opportunities.

Products that stand out with superior audio experiences and innovative features are key to capturing substantial market share within this competitive landscape. Syoung's investment in these premium offerings is crucial for enhancing its brand perception and securing future revenue growth.

Integrated Smart Home Hubs could be considered a Star for Syoung if their entry into the market with a central, highly compatible hub has been successful. The smart home sector is booming, with global market revenue projected to reach over $150 billion by 2024, indicating substantial growth potential.

A well-executed hub strategy positions Syoung to capture a significant share of this expanding market. While such a product will likely require ongoing investment in research and development to maintain its technological edge and compatibility with an ever-increasing array of devices, the potential for high returns is considerable.

This category demands continuous innovation to stay ahead of competitors like Amazon Echo and Google Nest, but a dominant hub can become the central point of a user's connected life, leading to strong customer loyalty and recurring revenue streams from associated services or device sales.

Advanced Health & Fitness Trackers

Advanced health and fitness trackers, featuring capabilities like continuous glucose monitoring or sophisticated sleep analysis, represent a potential Star category for Syoung within the BCG matrix. The wearable health technology market is experiencing significant expansion, with projections indicating continued robust growth through 2024 and beyond. Products delivering clinically valuable data or novel wellness insights are well-positioned to capture substantial market share in this rapidly evolving, high-growth segment.

These specialized devices cater to a discerning consumer base actively seeking deeper understanding and management of their health. The global wearable technology market was valued at approximately $116 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 13% from 2024 to 2030, according to various market research reports. Investing in research and development to enhance data accuracy and user experience, coupled with targeted marketing campaigns highlighting unique wellness benefits, will be critical for Syoung to solidify its position.

- Market Growth: The health tech wearable segment is a high-growth niche, with the overall wearable market expected to see continued strong performance in 2024.

- Product Differentiation: Offerings like continuous glucose monitoring and advanced sleep analytics provide unique value propositions.

- Investment Focus: Significant investment in R&D for data accuracy and user features, alongside strategic marketing, is essential.

- Competitive Landscape: Differentiating through clinically relevant data and unique wellness insights can drive market share gains.

Next-Gen Gaming Audio Solutions

Syoung's venture into next-generation gaming audio solutions, such as high-performance headsets, positions it as a potential Star. The global gaming peripherals market was valued at approximately $25.5 billion in 2023 and is projected to grow significantly, driven by esports and the increasing popularity of casual gaming. Products that deliver low latency, exceptional soundstage, and ergonomic designs are poised to capture substantial market share, necessitating continued investment to sustain leadership.

- Market Growth: The gaming peripherals market is experiencing robust expansion.

- Product Differentiation: Focus on low latency and superior sound quality is key.

- Investment Requirement: Sustaining a leading position demands ongoing R&D and marketing.

- Competitive Edge: Innovative comfort and performance features will drive adoption.

Stars are products with high market share in a high-growth industry. Syoung's smartwatches and premium earbuds fit this description, capitalizing on booming markets. Advanced health trackers and smart home hubs also show Star potential, provided Syoung can secure significant market share through innovation and strategic investment.

| Product Category | Market Growth Rate (CAGR) | Estimated 2024 Market Size | Syoung's Market Share Potential | Key Success Factors |

|---|---|---|---|---|

| Smartwatches | 15.9% (by 2028) | ~ $117.5 billion (by 2028) | High | Advanced health tracking, AI integration |

| True Wireless Earbuds | Significant (2023: ~$30 billion, 2028: >$70 billion) | ~ $30 billion+ (2024) | High | High-fidelity sound, noise-cancelling, spatial audio |

| Integrated Smart Home Hubs | High (>$150 billion by 2024) | ~$150 billion+ (2024) | Moderate to High | Compatibility, R&D investment, ecosystem development |

| Advanced Health Trackers | Strong (Wearable Tech: 13%+ from 2024-2030) | ~$116 billion (Wearable Tech 2023) | Moderate to High | Data accuracy, unique wellness insights, clinical value |

| Next-Gen Gaming Audio | Significant (2023: ~$25.5 billion) | ~$25.5 billion+ (2024) | Moderate | Low latency, superior soundstage, ergonomic design |

What is included in the product

The SYoung BCG Matrix offers clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

A clear visual roadmap to strategically allocate resources, easing the pain of uncertainty in business unit investment.

Cash Cows

Standard Bluetooth headphones from SYoung are likely cash cows. These products benefit from a mature market segment where SYoung has built a strong brand and loyal customer base. Their consistent revenue generation, fueled by stable demand, comes with manageable marketing and research and development expenses.

Entry-level fitness bands, those basic devices tracking steps, calories, and sleep, are prime examples of Syoung's Cash Cows. These products, while not at the cutting edge of technology, represent a stable and reliable revenue stream for the company.

The market for these simpler fitness trackers has indeed matured, meaning growth is likely slower. However, Syoung probably holds a strong position due to its competitive pricing strategy and extensive distribution networks. For instance, in 2024, the global wearable fitness tracker market was valued at approximately $30 billion, with entry-level devices making up a substantial portion.

These Cash Cow products demand relatively low investment to sustain their market presence. Their consistent sales, even in a mature market, allow Syoung to generate steady profits that can then be reinvested into other areas of the business, like their Stars or Question Marks.

Portable Bluetooth speakers represent a strong Cash Cow for Syoung. Their reputation for well-designed, durable products with impressive battery life likely resonates well in this market. This segment is mature, meaning growth is slower, but demand remains consistent, particularly for value-conscious consumers.

Syoung's established brand and product quality allow them to command a steady market share without requiring substantial new capital expenditure or aggressive marketing pushes. In 2024, the global portable Bluetooth speaker market was valued at approximately $10.5 billion, indicating a substantial and stable revenue stream for established players like Syoung.

Wired In-Ear Monitors (IEMs)

Syoung's wired in-ear monitors (IEMs) represent a classic Cash Cow within the company's portfolio. For dedicated audiophiles and specific niche markets, these products offer a reliable source of revenue due to their established reputation for high-quality sound.

Despite the broader market's pivot to wireless technology, a consistent demand from consumers prioritizing superior wired audio performance underpins steady, low-growth sales for Syoung's IEMs. This segment benefits from Syoung's prior investments in research and development and its strong brand equity, necessitating minimal new capital expenditure to maintain its market position.

- Market Share: Estimated to hold a significant, stable share within the niche wired IEM market.

- Profitability: Generates consistent profits due to low ongoing R&D and marketing costs.

- Growth Rate: Exhibits low, stable growth, reflecting a mature market segment.

- Investment Needs: Requires minimal investment, primarily for maintenance and brand support.

Power Banks and Charging Accessories

Syoung's universal power banks and a variety of charging accessories, such as cables and adapters, represent a classic Cash Cow within the consumer electronics market. These are items people consistently need, leading to sustained demand without rapid technological shifts. Established brands like Syoung enjoy a stable share of this segment.

The consistent revenue generated by these products, coupled with healthy profit margins, makes them a reliable income stream for Syoung. Crucially, the investment required to maintain market presence and develop these offerings is minimal, allowing Syoung to reap significant financial rewards with little ongoing capital expenditure.

In 2024, the global power bank market was valued at approximately USD 10.5 billion, with an anticipated compound annual growth rate (CAGR) of around 4.5% through 2030. This stability highlights the enduring demand for these accessories.

- High Demand: Essential accessories ensure consistent consumer need.

- Stable Market Share: Established brands like Syoung benefit from brand loyalty.

- Profitability: Low innovation cycles and efficient production lead to high margins.

- Low Investment: Minimal R&D and marketing spend required to maintain position.

Syoung's line of basic USB-C hubs and docking stations are strong Cash Cows. These products cater to a widespread need for connectivity, especially as more devices adopt the USB-C standard. Their established presence and reliable performance secure a consistent customer base.

| Product Category | Market Status | Syoung's Position | 2024 Market Value (Est.) | Key Characteristics |

|---|---|---|---|---|

| USB-C Hubs/Docks | Mature, Stable Demand | Strong, Established | $8.2 Billion | Consistent revenue, low R&D needs, brand loyalty |

Preview = Final Product

SYoung BCG Matrix

The BCG Matrix document you are previewing is the exact, unadulterated final version you will receive upon purchase. This comprehensive strategic tool, designed for clarity and actionable insights, will be immediately available for download, allowing you to seamlessly integrate it into your business planning and decision-making processes without any hidden alterations or watermarks.

Dogs

Syoung's standalone MP3 players are definitively in the Dogs quadrant of the BCG Matrix. The market for these devices has shrunk dramatically, with global sales of MP3 players falling by over 80% between 2014 and 2023, largely due to the widespread adoption of smartphones that integrate music playback capabilities.

With smartphones now fulfilling the role of personal music players for the vast majority of consumers, the dedicated MP3 player market exhibits very low growth. Syoung's market share in this segment is likely negligible, reflecting a product that is no longer in demand and offers little future potential.

Continuing to allocate resources to the production or inventory management of obsolete MP3 players would represent a significant drain on Syoung's financial resources. This is a classic cash trap scenario where investment yields minimal returns.

The strategic recommendation for Syoung regarding its MP3 players is clear: divestment or complete discontinuation of the product line. This would allow the company to redirect capital and focus towards more promising and growing product categories.

Older generation smartwatches, those lacking current features or software updates, are typically relegated to the Dogs category of the BCG Matrix. These devices, once cutting-edge, now struggle to compete as wearable technology rapidly evolves. For instance, by the end of 2023, many older smartwatch models saw their market share shrink significantly as consumers gravitated towards newer models with advanced health tracking and connectivity.

The rapid pace of innovation in the smartwatch market means that older models quickly become obsolete, leading to declining sales and a reduced market presence. Keeping older devices in stock or offering ongoing support for them becomes a drain on resources, yielding minimal financial returns. This strategic positioning highlights the need to divest or phase out such products to reallocate capital to more promising ventures.

Niche, unpopular digital gadgets would be classified as Dogs in SYoung's BCG Matrix. These are products that have struggled to gain significant market traction, often due to being too specialized or suffering from ineffective marketing. For instance, a highly niche smart home sensor designed for a very specific environmental monitoring task, or an obscure digital camera with a limited feature set, would likely fall into this category.

Products in the Dog quadrant typically operate in low-growth market segments and have failed to secure a substantial market share. This translates to minimal revenue generation for SYoung, and often results in financial losses. Data from 2024 indicates that companies with a high proportion of Dog products in their portfolio often experience reduced overall profitability and may struggle to fund innovation in their more promising product lines.

Given their poor performance, these niche digital gadgets represent an opportunity to reallocate resources. SYoung should seriously consider discontinuing these underperforming products. This strategic move would free up capital, research and development efforts, and marketing budgets that could be better invested in products with higher growth potential or those already in the Star or Question Mark quadrants of the BCG Matrix.

Basic, Non-Smart Feature Phones

If Syoung were to produce basic, non-smart feature phones, these would undoubtedly fall into the Dogs category of the BCG Matrix in the current smartphone-dominated landscape. The demand for these devices is minimal, primarily serving niche markets like elderly users or as backup emergency phones, resulting in a very small market share with virtually no growth prospects. Continued investment in this segment would likely be a drain on Syoung's resources, offering little to no return. For instance, in 2024, the global feature phone market share was projected to be around 10-15% of total mobile phone shipments, a significant decline from previous years, with minimal projected growth for the next five years.

Key characteristics of Syoung's feature phones within the Dogs quadrant would include:

- Low Market Share: Facing intense competition from smartphones, feature phones hold a minuscule portion of the overall mobile device market.

- Negative or Stagnant Growth: The market for basic phones is shrinking or remaining flat, with little to no innovation driving new demand.

- Low Profitability: Due to low sales volume and price sensitivity, profit margins on these devices are typically very thin.

- Resource Drain: Maintaining production lines and marketing for such products diverts capital and attention from more promising ventures.

Wired Home Audio Systems

Wired home audio systems, particularly those lacking smart capabilities like traditional CD players or basic stereo receivers, would likely fall into the Dogs category of the Syoung BCG Matrix. The market’s clear preference for wireless, smart, and streaming audio solutions means these legacy products face significant headwinds. Demand for such systems is in sharp decline, with their market share shrinking considerably. For instance, the global market for traditional audio systems has seen a steady decrease, with smart speakers and wireless audio devices capturing an increasing share, projected to grow significantly through 2024 and beyond. Syoung should consider divesting or phasing out these offerings to reallocate resources to more promising segments.

- Declining Market Share: These systems represent a shrinking portion of the overall home audio market.

- Low Growth Potential: The shift to wireless and smart technologies leaves little room for growth.

- Technological Obsolescence: They are increasingly being replaced by more advanced, connected alternatives.

- Resource Reallocation: Focusing on these products detracts from investing in high-growth areas.

Products classified as Dogs in SYoung's BCG Matrix are those in low-growth markets with low market share. These products typically generate minimal revenue and can even be cash drains if resources are continually invested. For instance, in 2024, companies heavily reliant on legacy tech like dial-up modems or basic GPS devices often saw these products contribute negatively to overall profitability.

The strategic imperative for SYoung with its Dog products is to divest or discontinue them. This frees up capital and management attention, allowing for investment in more promising areas like Stars or Question Marks. By shedding these underperformers, SYoung can improve its overall financial health and focus on growth opportunities.

Consider SYoung's line of basic digital cameras from the early 2010s. The market for these cameras has contracted significantly, with smartphone cameras now offering comparable or superior quality for most consumers. In 2024, the market share for dedicated point-and-shoot digital cameras, especially those without advanced features, was estimated to be less than 5% of the overall digital imaging market.

| Product Category | Market Growth | SYoung's Market Share | Profitability | Strategic Recommendation |

| MP3 Players | Very Low (Declining) | Negligible | Negative (Cash Drain) | Divest/Discontinue |

| Older Smartwatches | Low (Mature/Declining) | Low | Low/Negative | Divest/Phase Out |

| Niche Digital Gadgets | Low | Low | Low/Negative | Discontinue |

| Basic Feature Phones | Low (Declining) | Very Low | Very Low | Discontinue |

| Wired Home Audio | Very Low (Declining) | Low | Low | Divest/Phase Out |

| Basic Digital Cameras | Very Low (Declining) | Low | Low/Negative | Divest/Discontinue |

Question Marks

Syoung's potential foray into augmented reality (AR) glasses positions them within the Question Mark quadrant of the BCG Matrix. This market is experiencing rapid expansion, with projections indicating a compound annual growth rate (CAGR) of 36.6% from 2023 to 2030, reaching an estimated $389.5 billion by 2030, according to Grand View Research. However, current consumer penetration for AR glasses remains relatively low, meaning Syoung would likely enter with a modest market share.

Developing and marketing these sophisticated devices necessitates substantial capital investment. While the upfront costs are considerable, the potential for high returns exists if the AR market achieves widespread adoption and Syoung successfully captures a significant portion of it. For instance, Meta's Quest 3, a mixed-reality headset, launched in late 2023, highlighting the ongoing investment in hardware and software by major tech players.

Syoung's advanced smart rings, featuring sophisticated health monitoring and integrated payment functions, would likely be categorized as Question Marks in the BCG matrix. This segment represents a burgeoning, high-potential area within the wearable technology market, yet it currently holds a modest market share.

While the market for smart rings is experiencing rapid growth, Syoung's specific offerings are still establishing their presence. For instance, the global smart ring market was valued at approximately $4.5 billion in 2023 and is projected to reach over $15 billion by 2030, indicating substantial growth potential.

To elevate these products from Question Marks to Stars, Syoung must commit significant resources to enhance their feature sets and expand their marketing reach. Failure to capture consumer interest and build market share could see these innovative products decline into the Dog category, especially as competition intensifies.

A dedicated AI-powered personal assistant device, distinct from smartphones, would fit into Syoung's portfolio as a Question Mark. The market for standalone AI hardware is still developing, but it shows significant promise for growth as AI technology continues to improve.

Syoung's market share in this segment would likely be minimal at the outset. To truly compete and gain a substantial foothold against established tech giants, Syoung would need to commit considerable resources to research and development, alongside building a robust ecosystem around its AI assistant.

For instance, the global smart speaker market, a related hardware category, was projected to reach $15.8 billion in 2024, indicating substantial consumer interest in dedicated AI devices. Syoung's investment strategy would need to focus on differentiating its offering through unique features or a more integrated user experience to capture even a small portion of this growing market.

Modular Consumer Electronics

Syoung's venture into modular consumer electronics positions it as a Question Mark in the BCG matrix. This innovative approach, allowing users to swap or upgrade components, taps into a high-growth potential market driven by customization and sustainability trends. For instance, the global modular smartphone market was projected to reach USD 7.2 billion by 2027, indicating significant future demand.

However, Syoung faces challenges in this segment due to its current low market share. The complexities in manufacturing these adaptable devices, coupled with a need for substantial consumer education regarding their benefits and operation, currently hinder broader adoption. Companies like Fairphone, a pioneer in modular smartphones, have demonstrated that while niche demand exists, scaling production and achieving widespread consumer acceptance remains a hurdle.

- High Growth Potential: The demand for personalized and eco-friendly electronics fuels the growth prospects for modular designs.

- Low Market Share: Manufacturing complexities and consumer unfamiliarity currently limit market penetration for modular devices.

- Investment Needs: Significant capital is required for advanced design, efficient production processes, and targeted consumer awareness campaigns.

- Competitive Landscape: While few major players dominate, emerging companies are exploring this space, necessitating strategic differentiation.

Eco-Friendly/Sustainable Tech Gadgets

Syoung's new line of eco-friendly tech gadgets fits the Question Mark category in the BCG Matrix. While the global market for sustainable electronics is projected to reach $100 billion by 2027, with a compound annual growth rate of 18%, Syoung's current market share in this specific niche is negligible.

This means Syoung has a potentially high-growth opportunity but needs significant investment to establish a foothold. The challenge lies in the high cost of R&D for sustainable materials and the need to educate consumers, who may not yet fully prioritize environmental impact over price or performance in electronics. For instance, developing biodegradable casings or energy-efficient components requires substantial upfront capital. In 2024, consumer surveys indicated that while 70% of millennials and Gen Z express a preference for sustainable products, only 30% are willing to pay a premium for them.

- High Market Growth Potential: The demand for sustainable consumer electronics is expanding, driven by increasing environmental awareness.

- Low Current Market Share: Syoung's presence in this specific eco-friendly tech gadget market is minimal, indicating low current success.

- Significant Investment Required: Substantial capital is needed for research into sustainable materials and advanced manufacturing processes.

- Marketing and Consumer Education are Crucial: Building brand awareness and educating consumers on the benefits of these products is vital for adoption.

Question Marks represent Syoung's ventures into nascent or rapidly evolving markets where the company holds a low market share but operates within a high-growth industry. These products demand significant investment to capture market share and could either become future Stars or decline into Dogs if unsuccessful.

For Syoung, augmented reality glasses and advanced smart rings are prime examples of Question Marks. The AR market is projected to grow substantially, yet current penetration is low, requiring heavy investment for Syoung to gain traction. Similarly, smart rings, while experiencing rapid growth, still represent a niche where Syoung needs to establish its presence.

Dedicated AI personal assistant devices and modular electronics also fall into this category. The market for standalone AI hardware is developing, and while modular electronics have potential, manufacturing complexities and consumer education remain hurdles for Syoung.

Syoung's eco-friendly tech gadgets are another key area of Question Marks. Despite a growing market for sustainable electronics, Syoung's current share is minimal, necessitating substantial investment in R&D and consumer education to succeed.

| Product Category | Market Growth | Syoung's Market Share | Investment Requirement | Potential Outcome |

| AR Glasses | High (36.6% CAGR 2023-2030) | Low | High | Star or Dog |

| Smart Rings | High (projected to exceed $15B by 2030) | Low | High | Star or Dog |

| AI Personal Assistants | Developing, High Potential | Minimal | High | Star or Dog |

| Modular Electronics | High (USD 7.2B by 2027 for modular smartphones) | Low | High | Star or Dog |

| Eco-Friendly Tech Gadgets | High (18% CAGR, $100B by 2027) | Negligible | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.