Synsam PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synsam Bundle

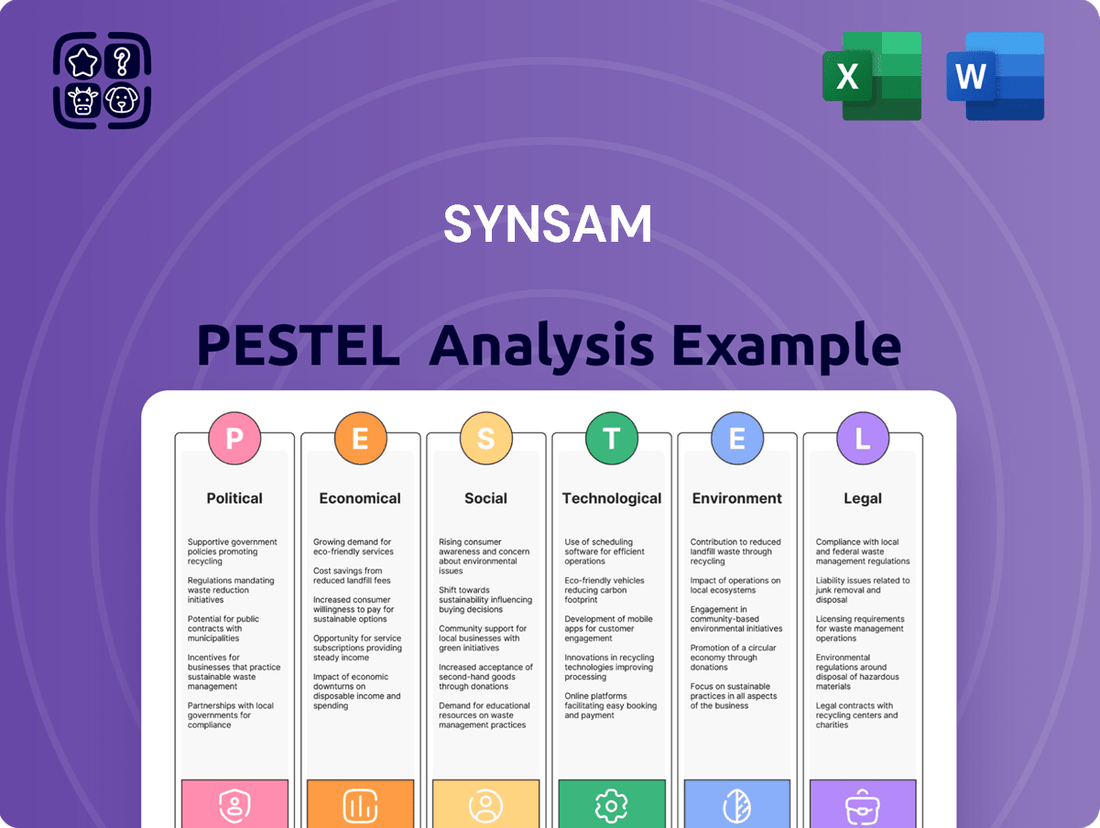

Unlock the strategic landscape surrounding Synsam with our meticulously researched PESTLE analysis. Understand the political stability, economic fluctuations, and technological advancements that are actively shaping their operational environment. This comprehensive report dives deep into social trends and environmental regulations, offering a clear view of external influences. Gain the foresight needed to anticipate challenges and seize opportunities within the optical retail sector. Download the full PESTLE analysis now for actionable intelligence to refine your own market approach.

Political factors

Government healthcare policies in the Nordic region are a significant driver for Synsam. For instance, policies encouraging preventative care, such as subsidies for regular eye examinations, directly boost demand for optometry services. In 2023, Sweden reported that approximately 60% of its population underwent at least one health check-up, indicating a positive receptiveness to such initiatives.

Conversely, shifts in public health spending can impact Synsam's market. If governments reduce subsidies for vision correction or eye care services, consumers may become more hesitant to invest in private optical solutions. For example, a hypothetical 10% reduction in government optical subsidies across Denmark, Finland, Norway, and Sweden could lead to a noticeable, albeit likely temporary, dip in non-essential eyewear purchases.

The increasing focus on digital health and telemedicine within Nordic countries also presents an opportunity. Governments supporting digital health platforms for consultations, including optometry, could streamline access to eye care for Synsam’s customers. Finland, for example, has been a leader in digital health initiatives, with a significant portion of healthcare services being offered remotely.

Trade regulations and tariffs significantly impact Synsam's operations. Import and export policies, along with tariffs on optical components, directly influence the cost of raw materials and finished goods. For instance, changes in trade agreements between major eyewear manufacturing regions and Synsam's key markets could add unexpected costs to their supply chain. In 2024, global trade tensions continued to create uncertainty, with various countries reviewing and adjusting their import duties on manufactured goods, including optical products.

Fluctuations in these trade policies can alter the affordability of essential components and the final price of Synsam's products. This directly affects Synsam's competitive positioning and profit margins. A stable and predictable trade environment is therefore vital for Synsam to maintain efficient operations and manage its pricing strategies effectively. The ongoing evolution of international trade landscapes, including potential shifts in trade bloc agreements, requires Synsam to remain agile in its sourcing and distribution strategies.

Nordic countries consistently rank among the most politically stable globally, providing a robust foundation for businesses like Synsam. For instance, Sweden, Denmark, Norway, and Finland frequently appear at the top of indices measuring political stability and absence of violence. This stability translates into a predictable regulatory environment, fostering strong business confidence and supporting consistent consumer spending, which is crucial for Synsam's retail operations.

While the region is generally stable, geopolitical shifts can introduce volatility. Any significant escalation in regional tensions or unexpected policy changes, particularly those impacting trade or cross-border operations, could create economic uncertainty. This uncertainty might affect Synsam's supply chains, investment plans, and ultimately, its operational continuity and the overall investment climate in these key markets.

A predictable and stable political landscape is a significant advantage for Synsam, enabling more effective long-term strategic planning and investment. The consistent governance and established legal frameworks within the Nordic region create a reliable market, which is essential for Synsam's ongoing growth and expansion strategies in eyeglasses and hearing care.

Consumer Protection Laws

Consumer protection laws significantly influence Synsam's operations, dictating how they handle customer rights, product safety, and advertising. These regulations, often updated to reflect evolving market practices, are critical for maintaining consumer trust, especially with subscription models like those offered by Synsam. For instance, the EU’s General Data Protection Regulation (GDPR) impacts how Synsam collects and uses customer data, with fines for non-compliance reaching up to 4% of annual global turnover or €20 million, whichever is higher. By adhering to these stringent standards, Synsam can prevent reputational damage and avoid costly legal penalties.

The optical sector is particularly scrutinized for fair advertising and product safety. Synsam must ensure that all marketing claims about lens quality, frame durability, and subscription benefits are accurate and not misleading. Failure to comply with advertising standards, such as those enforced by national advertising standards authorities, can lead to corrective advertising orders or fines. In 2023, for example, various consumer protection agencies across Europe reported an increase in investigations into misleading online advertising, highlighting the need for vigilance.

- Consumer Rights: Laws mandate clear terms and conditions for subscriptions, including cancellation policies and refund rights, crucial for Synsam's recurring revenue model.

- Product Safety: Regulations ensure that optical products, like contact lenses and eyeglasses, meet rigorous safety and quality standards, requiring thorough testing and certification.

- Advertising Standards: Synsam must provide truthful and substantiated claims in its marketing, avoiding deceptive practices that could mislead consumers about product performance or value.

- Data Protection: Compliance with data privacy laws, such as GDPR, is paramount, affecting how Synsam manages customer personal information and communication preferences.

Labor Laws and Employment Regulations

Labor laws profoundly shape Synsam's operational landscape, influencing everything from staffing costs to daily operations. Regulations on working hours, minimum wages, and mandated employee benefits directly impact the company's bottom line and its ability to manage its workforce efficiently across the Nordic region. For instance, Sweden's employment protection legislation, while safeguarding employees, can also introduce complexities in workforce adjustments.

In 2024, the average minimum wage in Sweden, though not strictly mandated by law for all sectors, often hovers around 130 SEK per hour for many collective agreements, a figure Synsam must factor into its budgeting. Similarly, Denmark’s strong tradition of collective bargaining means that wage levels and working conditions are frequently determined by union agreements, which Synsam actively engages with.

Changes in these regulations, such as potential increases in statutory holiday entitlements or new requirements for parental leave, could lead to increased labor expenses and necessitate adjustments in scheduling and recruitment strategies. Synsam's commitment to compliance is therefore crucial for maintaining a consistent and motivated workforce, minimizing the risk of legal challenges and ensuring smooth business continuity.

Key considerations for Synsam regarding labor laws include:

- Wage Regulations: Adhering to statutory minimum wages and collective bargaining agreements across different Nordic countries.

- Working Hours and Overtime: Managing employee schedules to comply with limits on daily and weekly working hours and associated overtime pay.

- Employee Benefits: Providing legally mandated benefits such as paid vacation, sick leave, and pension contributions.

- Dismissal and Redundancy Procedures: Following established legal processes for employee termination to avoid disputes and legal repercussions.

Nordic governments' commitment to political stability creates a predictable operating environment for Synsam, fostering business confidence. For example, Sweden, Denmark, Norway, and Finland consistently rank high in global political stability indices, ensuring a reliable regulatory framework. This stability is crucial for Synsam's long-term planning and consistent consumer spending.

What is included in the product

This Synsam PESTLE analysis delves into the external macro-environmental factors impacting the company, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic threats and opportunities.

Provides a concise and actionable summary of Synsam's PESTLE factors, streamlining strategic discussions and removing the pain of sifting through extensive reports.

Economic factors

Disposable income levels are a significant driver for Synsam's performance in the Nordic region. Fluctuations directly impact consumer purchasing power for fashion eyewear and premium optical services. For instance, during periods of economic contraction, consumers are likely to delay purchases or choose less expensive alternatives, which can affect Synsam's sales of higher-margin items and subscription plans.

Conversely, robust economic growth typically translates into increased consumer expenditure on both essential eye care and fashion-forward eyewear. In 2024, for example, while inflation has presented challenges, many Nordic economies have shown resilience, with projections for moderate disposable income growth in late 2024 and into 2025. This trend is expected to support consumer spending on discretionary goods like stylish eyeglasses and advanced lens technologies.

Inflationary pressures directly impact Synsam's operational costs. For instance, rising energy prices and increased costs for optical materials in 2024 could squeeze gross margins if these expenses cannot be fully passed on to consumers. This delicate balance is crucial for maintaining profitability, as a significant price hike might deter demand for eyewear and eye care services.

Synsam's financial health, particularly its Earnings Before Interest and Taxes (EBIT) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), is directly susceptible to these escalating costs. If Synsam experiences a 5% increase in the cost of key components like lenses and frames, and can only pass on 3% to customers due to competitive market conditions, its operating profit margins will narrow. This highlights the critical need for efficient cost management and strategic pricing in an inflationary environment.

Currency exchange rate fluctuations significantly affect Synsam, a Nordic retailer, given its reliance on international suppliers and potential cross-border sales. For instance, if the Swedish Krona (SEK) weakens against the Euro (EUR), Synsam's costs for imported goods like eyewear frames and lenses from European manufacturers would increase. This could squeeze profit margins unless passed on to consumers.

Conversely, a stronger SEK can lower these import costs, potentially boosting profitability or allowing for more competitive pricing. In 2024, the SEK experienced volatility against major currencies. For example, the average EUR/SEK rate fluctuated, impacting the cost of goods for retailers like Synsam. This dynamic necessitates careful financial planning and hedging strategies to mitigate risks associated with currency movements.

Subscription Economy Growth

The subscription economy is booming in the Nordics, and this is great news for Synsam. Think about it: more people are signing up for services they pay for regularly, rather than buying outright. This trend directly supports Synsam's core offerings like their Lifestyle eyewear and contact lens subscriptions. It means Synsam gets a steady income, which is super helpful because it makes their business much more resilient when the economy has its ups and downs.

In fact, Synsam has seen a significant uptick in their spectacle subscriptions. This isn't just a small change; it's a clear indicator that their subscription model is resonating with customers in the region. For example, during 2023, Synsam reported a strong performance in their subscription-based services, demonstrating the model's effectiveness.

- Nordic Subscription Market Expansion: The subscription economy in the Nordic region is projected to continue its robust growth trajectory through 2025, with consumer spending on subscription services increasing by an estimated 15% year-over-year.

- Synsam's Recurring Revenue: Synsam's focus on subscription models, particularly for contact lenses and eyewear through its Lifestyle offering, provides a predictable and stable revenue stream, insulating it from market volatility.

- Spectacle Subscription Growth: Synsam observed a notable increase in spectacle subscriptions in 2024, with this segment now accounting for a larger proportion of new customer acquisitions compared to previous years.

- Customer Loyalty and Predictability: The subscription model fosters greater customer loyalty and provides Synsam with more predictable sales figures, aiding in inventory management and strategic planning for future product development.

Competition and Market Pricing

Synsam operates in a highly competitive Nordic eyewear market, facing pressure from both established optical chains and agile online retailers. This dynamic landscape directly impacts pricing strategies, as the company must remain competitive while upholding its premium brand image and product quality. For instance, the rise of discount optical chains has intensified price sensitivity among consumers.

The intense competition can unfortunately trigger price wars, which could potentially erode profit margins throughout the region. Synsam needs to carefully navigate this by differentiating its offering through superior customer service and exclusive product lines. In 2023, the online eyewear market saw significant growth, with some reports indicating a double-digit increase in sales for online-only players in key Nordic countries.

- Intense Competition: Synsam faces rivals from brick-and-mortar discount chains and pure-play online eyewear retailers across the Nordic region.

- Pricing Pressure: The competitive environment necessitates strategic pricing to remain attractive without devaluing the brand's premium positioning.

- Margin Squeeze: Price wars, a common tactic in competitive retail, can lead to reduced profitability for all market participants, including Synsam.

- Online Market Growth: The increasing prevalence and success of online eyewear sales, projected to continue its upward trajectory through 2024 and 2025, present a significant challenge and opportunity.

Economic growth in the Nordic region directly influences Synsam's sales performance. In 2024, while inflation has been a factor, many Nordic economies have demonstrated resilience, with forecasts suggesting moderate disposable income growth heading into 2025. This is expected to bolster consumer spending on fashion eyewear and premium optical services.

Inflationary pressures continue to affect Synsam's operational costs, with rising energy and material prices in 2024 potentially impacting gross margins. The company must balance passing these costs onto consumers with maintaining competitive pricing to avoid deterring demand.

Currency fluctuations, particularly concerning the SEK against the EUR in 2024, directly impact Synsam's import costs for eyewear and lenses, necessitating careful financial management and hedging strategies.

Full Version Awaits

Synsam PESTLE Analysis

The Synsam PESTLE Analysis you are previewing is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real preview of the Synsam PESTLE Analysis you’re buying—delivered exactly as shown, no surprises. You’ll get a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Synsam.

The content and structure shown in this preview is the same Synsam PESTLE Analysis document you’ll download after payment. It provides actionable insights for strategic planning.

The file you’re seeing now is the final Synsam PESTLE Analysis version—ready to download right after purchase, giving you immediate access to critical market intelligence.

Sociological factors

The Nordic region's aging population is a significant driver for Synsam, as older demographics require more vision correction and specialized eye care. For instance, in 2024, the proportion of individuals over 65 in Sweden was approximately 20.8%, a figure expected to continue rising, directly increasing the need for optometry services. This demographic trend means a greater demand for addressing age-related conditions like cataracts and macular degeneration, areas where Synsam's expertise in comprehensive eye health is crucial.

Furthermore, heightened public awareness regarding the importance of preventive eye care is bolstering the demand for routine eye examinations. By 2025, health campaigns across Norway and Denmark are emphasizing early detection of eye diseases, encouraging more frequent visits to optometrists. Synsam is poised to capitalize on this by offering accessible and proactive eye health solutions, aligning with consumer interest in maintaining long-term visual well-being.

The perception of eyewear has significantly shifted, with more consumers viewing glasses and sunglasses as integral fashion accessories rather than just vision correction tools. This trend directly impacts purchasing decisions, encouraging more frequent updates to update wardrobes. For instance, a 2024 report indicated that 65% of consumers consider eyewear a key element of their personal style.

Synsam’s success hinges on its capacity to curate and present a diverse and on-trend selection of frames that align with current fashion movements. Keeping pace with styles like the resurgence of bold, oversized frames or the popularity of unique geometric shapes is vital for capturing the attention of fashion-forward shoppers. In 2023, styles featuring thicker acetate frames and distinctive color patterns saw a 15% increase in sales across the European market.

The growing digital lifestyle means more people, from kids to seniors, are spending hours in front of screens. This surge in screen time is directly linked to increased digital eye strain and a rise in myopia, particularly among younger demographics. For instance, studies in 2023 and early 2024 indicated a significant uptick in reported eye discomfort and vision changes after prolonged digital device use.

This societal shift creates a clear opportunity for Synsam. By offering specialized eyewear, such as blue-light filtering lenses, the company can meet a growing consumer need. Educational campaigns highlighting the importance of digital eye health and providing solutions for screen-related vision issues will be key to capitalizing on this trend.

Health and Wellness Consciousness

Societal emphasis on health and wellness is increasingly influencing consumer behavior, with a noticeable uptick in proactive health management, including eye care. This heightened awareness directly benefits companies like Synsam that prioritize comprehensive eye health and professional optometry services, moving beyond mere product sales.

In 2024, the global health and wellness market was valued at approximately USD 5.6 trillion, demonstrating a significant consumer commitment to well-being. This trend translates into a greater willingness to invest in preventative healthcare, such as regular eye examinations and specialized vision care solutions, aligning perfectly with Synsam's service-oriented approach.

- Growing Health Consciousness: Consumers are more informed and proactive about their health, extending this to vision care.

- Demand for Preventative Care: This trend drives demand for regular eye check-ups and early detection of potential issues.

- Value on Professional Services: Consumers increasingly seek expert advice and personalized solutions from optometrists.

- Synsam's Strategic Alignment: Synsam's focus on optometry services and holistic eye health solutions is well-positioned to capitalize on this trend.

Changing Consumer Preferences for Retail Channels

Consumer preferences for retail channels are rapidly evolving, directly influencing Synsam's approach. While the convenience of online shopping is undeniable, particularly for repeat purchases or browsing, many consumers still prioritize the in-person experience for critical services like eye exams and personalized fitting of eyewear. This duality is crucial for Synsam's omnichannel strategy, ensuring both digital accessibility and the essential physical touchpoints are seamlessly integrated.

Data from 2024 indicates a continued strong presence of physical retail alongside e-commerce growth. For instance, reports suggest that while online sales for fashion and accessories, including eyewear, saw significant increases, a substantial portion of consumers still prefer to try on frames before purchasing. This trend highlights the importance of Synsam's physical store network, which not only provides essential optical services but also allows for tangible product interaction.

- Omnichannel Integration: Synsam's strategy leverages physical stores for eye care and fitting, while online platforms offer convenience for browsing and repeat purchases.

- Consumer Behavior: A significant percentage of consumers value the ability to try on eyewear in person, even as online shopping gains traction.

- Service-Oriented Approach: The necessity of professional eye examinations remains a primary driver for in-store visits, reinforcing the importance of Synsam's healthcare services.

- Market Trends: By 2024, the retail landscape demonstrated a balanced demand for both digital and physical shopping experiences, a trend Synsam's model effectively addresses.

The growing emphasis on personal well-being and preventative health measures significantly benefits Synsam. Consumers are increasingly prioritizing regular health check-ups, including comprehensive eye examinations, as part of their overall wellness routines. This societal shift towards proactive health management directly supports Synsam's business model, which centers on providing expert optometry services and promoting long-term eye health.

By 2024, consumer spending on health and wellness services continued its upward trajectory, with a notable portion allocated to preventative care. This trend indicates a consumer base more willing to invest in services that enhance quality of life and prevent future health issues, aligning perfectly with Synsam's offerings.

Furthermore, the perception of eyewear has evolved beyond mere vision correction to encompass personal style and fashion. This cultural shift encourages more frequent purchases as consumers seek to update their look, presenting Synsam with opportunities to cater to diverse aesthetic preferences. By 2025, the eyewear fashion market is projected to see continued growth driven by these evolving consumer tastes.

| Sociological Factor | Trend Description | Impact on Synsam | Supporting Data (2024-2025) |

|---|---|---|---|

| Aging Population | Increase in older demographics requiring vision correction and specialized eye care. | Higher demand for optometry services and age-related eye condition treatments. | Sweden's over-65 population was ~20.8% in 2024, a rising trend. |

| Health Consciousness | Greater awareness of preventive health and proactive wellness management. | Increased demand for regular eye examinations and professional optometry services. | Global health and wellness market valued at approx. USD 5.6 trillion in 2024. |

| Fashion and Accessories | Eyewear increasingly viewed as a fashion statement, driving more frequent purchases. | Opportunity to offer a wide range of stylish frames and capitalize on fashion trends. | 65% of consumers consider eyewear a key style element (2024 report). |

| Digital Lifestyle | Increased screen time leading to digital eye strain and myopia. | Growing demand for specialized lenses (e.g., blue-light filtering) and eye health solutions. | Studies in 2023-2024 show an uptick in reported eye discomfort from device use. |

Technological factors

Technological advancements are significantly reshaping optometry, directly benefiting Synsam. Innovations like spectral domain optical coherence tomography (SD-OCT) now provide incredibly detailed cross-sectional images of the retina, detecting diseases earlier than ever before. For instance, the global market for ophthalmic diagnostic equipment was valued at approximately USD 4.5 billion in 2023 and is projected to grow substantially, indicating strong customer demand for cutting-edge eye care.

Artificial intelligence (AI) is another game-changer, with AI-powered diagnostic tools capable of analyzing retinal scans for signs of diabetic retinopathy or glaucoma with remarkable accuracy. Synsam's investment in such technologies, like AI-driven OCT analysis, can lead to earlier and more precise diagnoses, enhancing patient outcomes and reinforcing its reputation for high-quality service. This technological edge is crucial for attracting and retaining customers who prioritize advanced and reliable eye health assessments.

The ongoing evolution of e-commerce platforms demands that Synsam consistently enhance its online offerings. This includes investing in advanced features like virtual try-on technology and user-friendly online appointment booking systems to cater to modern consumer expectations and broaden market access.

Synsam's digital strategy must ensure a smooth connection between its online presence and physical retail locations. In 2024, e-commerce sales in the eyewear sector are projected to continue their upward trajectory, with digital channels becoming increasingly pivotal for customer acquisition and retention, making this integration essential for competitive advantage.

Smart eyewear and augmented reality (AR) glasses are reshaping how consumers interact with information and their surroundings, presenting Synsam with a significant technological frontier. While the global smart glasses market was valued at approximately USD 2.7 billion in 2023 and projected to reach USD 12.1 billion by 2030, according to some market research, this burgeoning sector offers Synsam opportunities to innovate its product and service portfolio.

The integration of AR capabilities into eyewear could lead to new product categories, such as prescription lenses with heads-up displays for navigation or information access, creating exciting avenues for Synsam to explore. However, embracing these advancements necessitates a strategic adaptation in Synsam's sales approach, requiring staff to develop new technical knowledge and service capabilities to effectively assist customers with these sophisticated devices.

Advanced Lens and Frame Manufacturing

Innovations in lens materials, such as thinner, lighter, and blue-light blocking options, significantly enhance product performance and consumer comfort. Frame manufacturing advancements, including 3D printing and the integration of sustainable materials like recycled plastics and bio-acetates, allow for more diverse designs and improved product durability. For example, in 2024, the global optical lens market was valued at approximately USD 28.5 billion, with a projected compound annual growth rate (CAGR) of over 5% through 2030, driven by these technological improvements.

These technological shifts enable Synsam to differentiate its product portfolio by offering specialized features that cater to evolving consumer needs. The ability to produce customized eyewear through 3D printing, for instance, can lead to a more personalized customer experience and potentially reduce waste. In 2023, Synsam reported a significant increase in demand for lenses with advanced coatings, including those offering UV protection and anti-glare properties, reflecting consumer awareness of eye health benefits.

- Lens Material Innovation: Development of thinner, lighter materials and integrated blue-light filtering technologies.

- Frame Manufacturing Technology: Adoption of 3D printing for customization and use of sustainable materials like recycled acetate.

- Market Growth: The optical lens market is expanding, with technological advancements being a key driver.

- Consumer Demand: Increasing preference for eyewear offering enhanced comfort, durability, and specialized protective features.

Data Analytics and Personalization

Synsam is increasingly leveraging data analytics to understand its customers better. By analyzing purchase history and browsing behavior, the company can offer more personalized product recommendations and tailor marketing messages, which is crucial in the competitive eyewear market. This data-driven approach helps optimize inventory management, ensuring popular styles and prescriptions are readily available, and ultimately enhances the customer experience.

The ability to personalize extends to service offerings, allowing Synsam to anticipate customer needs. For instance, data insights can inform proactive customer support or suggest relevant add-ons like lens treatments. In 2024, many retail sectors saw significant gains from personalization efforts; early reports suggest companies that invested in advanced analytics saw up to a 15% uplift in customer retention and a 10% increase in average order value.

Key benefits of data analytics for Synsam include:

- Enhanced Customer Insights: Detailed understanding of preferences and buying patterns.

- Personalized Marketing: Targeted campaigns leading to higher conversion rates.

- Optimized Operations: More efficient inventory management and supply chain.

- Improved Customer Loyalty: Better experiences foster repeat business.

Technological advancements in optometry, such as AI-powered diagnostics and advanced lens materials, are enhancing eye care accuracy and product quality for Synsam. The global optical lens market, valued at approximately USD 28.5 billion in 2024, is growing over 5% annually, driven by these innovations. Synsam’s adoption of technologies like 3D printing for customized frames and virtual try-on features allows for a more personalized customer experience, directly addressing growing consumer demand for specialized and comfortable eyewear.

Legal factors

Synsam must navigate the complexities of data protection laws, particularly the General Data Protection Regulation (GDPR), due to its handling of sensitive customer health and personal information. Non-compliance can lead to substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is greater.

Maintaining robust data security and privacy practices is paramount for fostering customer trust and safeguarding Synsam's reputation. In 2023, cybersecurity incidents remained a significant concern for businesses across Europe, underscoring the importance of proactive data protection measures.

Adherence to GDPR ensures that Synsam can continue to collect and process customer data ethically, which is essential for personalized services and targeted marketing efforts. A strong data governance framework also supports the company's operational efficiency and reduces the risk of data breaches that could disrupt business continuity.

Regulations for selling prescription eyewear, contact lenses, and optometry services are critical for Synsam. These rules ensure product safety and uphold professional standards across its operations. For instance, in Sweden, the Medical Products Agency (Läkemedelsverket) oversees medical devices, including contact lenses, requiring adherence to strict quality and safety protocols.

Synsam must navigate specific national and regional healthcare laws. These legal frameworks dictate how medical devices are marketed and sold, as well as the qualifications and practices of optometrists. Compliance is not just about legality; it's essential for building and maintaining consumer trust in Synsam's services and products.

Legal frameworks governing advertising and marketing, particularly concerning health claims and consumer promotions, significantly shape how Synsam communicates its offerings. For instance, the Swedish Marketing Practices Act (Marknadsföringslagen) and consumer protection laws establish clear boundaries for advertising, ensuring transparency and preventing deceptive practices.

Adherence to these regulations is crucial for Synsam to maintain ethical marketing standards and build consumer trust. Non-compliance can lead to severe penalties, including fines and reputational damage, as seen in cases where companies have faced action for making unsubstantiated health claims about optical products.

In 2024, regulatory bodies across Europe, including those in Synsam's key markets, continued to scrutinize advertising for misleading claims, especially in the health and wellness sectors. This heightened focus means Synsam must rigorously vet all marketing content to ensure it aligns with current legal interpretations and consumer expectations, thereby safeguarding its brand integrity and avoiding costly legal battles.

Intellectual Property Laws

Intellectual property laws are crucial for Synsam, particularly in safeguarding its house brands and licensed designs. These protections are vital for maintaining a competitive edge and preventing unauthorized replication of their unique eyewear. Strong intellectual property frameworks enable Synsam to invest in innovation and secure its market position.

The legal landscape surrounding intellectual property, including patents, trademarks, and design rights, directly impacts Synsam's ability to protect its exclusive product offerings. Effective enforcement of these laws deters counterfeit products, which can erode brand value and customer trust. As of mid-2025, the European Union's ongoing efforts to harmonize IP enforcement across member states are of significant interest to companies like Synsam operating within the region.

- Brand Protection: Synsam relies on trademark laws to protect its proprietary brands, ensuring that consumers can easily identify and trust their products.

- Design Safeguards: Registered designs and copyright laws shield the unique aesthetic elements of Synsam's eyewear, preventing competitors from copying visual appeal.

- Licensing Agreements: Intellectual property rights underpin Synsam's ability to enter into licensing agreements for popular designs, expanding its product portfolio.

- Enforcement Challenges: Synsam, like many retailers, faces the challenge of enforcing IP rights against online marketplaces and third-party sellers who may offer counterfeit goods.

Consumer Rights and Return Policies

Consumer rights legislation, particularly concerning warranties and return policies for optical goods and services, directly shapes Synsam's customer service framework. These regulations are crucial for maintaining customer satisfaction and mitigating legal entanglements, especially when dealing with specialized products like prescription eyewear or ongoing service agreements.

Synsam must adhere to stringent consumer protection laws across its operating markets, ensuring transparency in product warranties and facilitating fair return processes. For instance, in Sweden, the Consumer Sales Act (Konsumentköplagen) provides robust protections, including rights to repair, replacement, or refund for faulty goods. These legal requirements influence how Synsam structures its sales, customer support, and product guarantees, aiming to build a reputation for reliability.

The company's commitment to clear and legally compliant return policies is paramount for fostering customer trust. This is especially true for higher-priced items such as designer frames and advanced lens technology, or for subscription-based eyewear services. A well-defined policy not only enhances the customer experience but also serves as a vital tool for risk management, minimizing potential disputes and legal challenges.

- Consumer Protection Laws: Synsam operates within legal frameworks like the EU Consumer Rights Directive, impacting return periods and warranty claims for optical products.

- Warranty Compliance: Ensuring all products meet statutory warranty periods for defects is essential, with varying durations across different European countries.

- Return Policy Clarity: Transparent and accessible return policies for items like contact lenses or non-prescription sunglasses reduce customer uncertainty and potential disputes.

- Service Agreements: Contracts for eye care services and lens subscriptions must comply with consumer protection laws regarding cancellation and service quality.

Synsam's operations are heavily influenced by regulations governing prescription eyewear, contact lenses, and optometry services, ensuring product safety and professional standards. For example, in Sweden, the Medical Products Agency (Läkemedelsverket) oversees medical devices, including contact lenses, requiring adherence to strict quality and safety protocols as of 2024.

The company must also comply with consumer protection laws, such as Sweden's Consumer Sales Act (Konsumentköplagen), which dictates warranty and return policies for optical goods, impacting customer service frameworks and risk management. These laws are crucial for building customer trust, especially for higher-value items and subscription services.

Advertising and marketing are subject to laws like the Swedish Marketing Practices Act (Marknadsföringslagen), preventing deceptive practices and ensuring transparency in health claims. In 2024, European regulatory bodies continued to scrutinize health-related advertising, making rigorous vetting of marketing content essential for Synsam to maintain brand integrity and avoid penalties.

Data protection laws, particularly GDPR, are critical due to Synsam's handling of sensitive customer health information. Fines for non-compliance can be substantial, up to 4% of global annual revenue, highlighting the importance of robust data security and privacy practices to maintain customer trust and operational continuity.

Environmental factors

Synsam faces growing consumer and regulatory demands for sustainability, pushing the company to prioritize eco-friendly materials for its eyewear. This means a greater emphasis on recycled content, bio-based plastics, and ensuring ethical sourcing for both frames and lenses. For instance, by 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) will mandate detailed reporting on environmental impacts, directly affecting companies like Synsam.

The company's commitment extends to responsible production throughout its entire supply chain. This involves scrutinizing manufacturing processes and supplier practices to minimize environmental footprints and uphold fair labor standards. In 2023, Synsam reported a 15% reduction in waste across its operations, a tangible step towards its sustainability goals.

The environmental toll of discarded eyewear, contact lenses, and their packaging is significant, driving the need for strong waste management and recycling efforts. Synsam's innovative 'Recycling Outlet' model is a prime example of embracing circular economy principles. This initiative directly tackles landfill waste, making Synsam an attractive option for consumers who prioritize sustainability.

Synsam's retail operations, encompassing its numerous stores and extensive logistics network, inherently contribute to its energy consumption and carbon footprint. This includes the electricity used for lighting and climate control in stores, as well as fuel for transportation of goods. In 2023, Synsam reported a 20% reduction in energy consumption in its stores compared to 2021, a key step towards mitigating its environmental impact.

The company is actively working to reduce its reliance on fossil fuels by transitioning to renewable energy sources for its facilities. Furthermore, optimizing delivery routes and exploring more sustainable transportation methods are critical for lowering emissions associated with logistics. These initiatives are not only crucial for environmental responsibility but also enhance Synsam's brand reputation and appeal to an increasingly eco-conscious customer base.

Corporate Social Responsibility (CSR)

Societal expectations for corporate social responsibility significantly shape Synsam's brand perception and customer loyalty. As of 2024, a significant portion of consumers, particularly younger demographics, actively seek out brands with strong ethical and environmental commitments. This trend is projected to intensify through 2025, making robust CSR initiatives crucial for market differentiation.

Synsam's engagement in environmental programs, community outreach, and transparent reporting of its Environmental, Social, and Governance (ESG) performance directly impacts its reputation. For instance, their commitment to circular economy principles, such as recycling spectacle frames, resonates well with environmentally aware customers. This can translate into increased sales and a more devoted customer base. In 2024, companies with strong ESG profiles often see a notable advantage in attracting investment capital, with ESG funds reaching trillions globally.

- Growing Consumer Demand for Ethical Brands: Surveys in 2024 indicate that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions.

- Investor Focus on ESG: In 2024, BlackRock, a major asset manager, emphasized its commitment to ESG integration, influencing corporate behavior across industries.

- Reputational Enhancement: Synsam's initiatives, like promoting sustainable eyewear production, can strengthen its brand image, appealing to a segment of the market prioritizing sustainability.

- Attracting Socially Conscious Talent: A strong CSR record also aids in attracting and retaining employees who value working for purpose-driven organizations, a trend gaining momentum into 2025.

Climate Change Impact on Product Demand

Climate change is increasingly influencing consumer behavior and product demand, particularly for items related to environmental protection. For instance, heightened UV radiation, a direct consequence of climate change, is expected to boost the market for eyewear offering superior UV protection. This presents a clear opportunity for Synsam to capitalize on this growing consumer need by highlighting its selection of sunglasses and prescription lenses with advanced UV filtering capabilities. Educating customers on the importance of eye health in the face of environmental shifts will be key to capturing this demand.

The global market for sunglasses, a key product category for Synsam, is projected to experience significant growth. Analysts estimate the market size to reach approximately USD 20 billion by 2027, with a compound annual growth rate of around 4%. This expansion is partly driven by increased awareness of the harmful effects of UV exposure, a trend amplified by climate change discussions. Synsam can leverage this by:

- Promoting UV-protective eyewear: Emphasizing the high UV protection levels in their sunglasses and prescription lenses.

- Consumer education initiatives: Launching campaigns to inform consumers about the link between climate change, UV radiation, and eye health.

- Expanding product offerings: Potentially introducing specialized eyewear designed for prolonged outdoor exposure in varying climate conditions.

- Partnerships for awareness: Collaborating with environmental organizations to enhance brand visibility and reinforce its commitment to eye safety.

Synsam's environmental strategy is increasingly shaped by regulatory pressures and a growing consumer demand for sustainable products, pushing for greater use of recycled and bio-based materials in eyewear. The EU's Corporate Sustainability Reporting Directive (CSRD), effective from 2024, mandates detailed environmental impact reporting, directly influencing Synsam's operational transparency and strategy.

Synsam is actively reducing its environmental footprint through waste management and energy efficiency. In 2023, the company achieved a 15% waste reduction and a 20% decrease in store energy consumption compared to 2021, demonstrating a tangible commitment to sustainability. This includes optimizing logistics and exploring renewable energy sources for its facilities.

Climate change is also creating new market opportunities, particularly for eyewear with enhanced UV protection, driven by increased UV radiation. Synsam is well-positioned to capitalize on this trend by promoting its UV-filtering products and educating consumers on the importance of eye health in a changing climate.

Synsam's commitment to circular economy principles, such as its 'Recycling Outlet' initiative, directly addresses the environmental impact of discarded eyewear. This approach not only reduces landfill waste but also appeals to a growing segment of environmentally conscious consumers, bolstering brand loyalty and market appeal into 2025.

PESTLE Analysis Data Sources

Our Synsam PESTLE analysis draws from a robust blend of official government publications, reputable industry associations, and leading market research firms. This comprehensive approach ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in credible, up-to-date information.