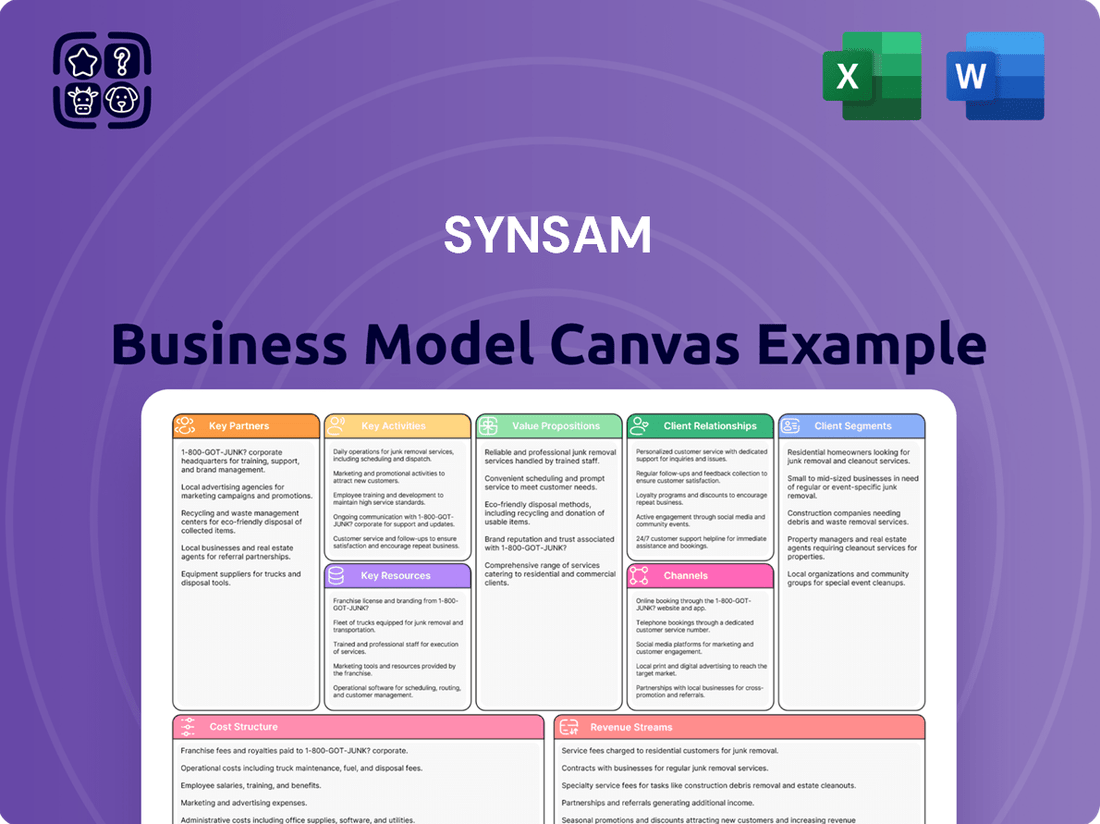

Synsam Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synsam Bundle

Unlock the full strategic blueprint behind Synsam's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Synsam collaborates with a wide spectrum of lens and frame manufacturers, both globally and locally. This ensures a diverse and high-quality product selection for customers.

These crucial partnerships allow Synsam to source the newest fashion trends and cutting-edge optical technologies. This provides customers with an extensive range of eyewear choices.

By fostering strong supplier relationships, Synsam can offer competitive pricing and unique, exclusive designs. For example, in 2024, Synsam continued to deepen its ties with key manufacturers to ensure a steady supply of innovative products and maintain its market position.

Synsam's digital advancement relies heavily on collaborations with technology and software vendors. These partnerships are crucial for developing their e-commerce capabilities and optimizing customer management through robust CRM systems.

A key aspect of these collaborations is the Synsam EyeView technology, which significantly boosts optician efficiency and elevates the customer journey. This technology is a prime example of how strategic tech partnerships directly enhance service delivery and operational capacity.

By integrating advanced software and technology solutions, Synsam streamlines both its online and in-store operations. For instance, in 2023, Synsam reported a significant increase in digital sales, a trend directly attributable to investments in their e-commerce platform and associated technologies.

These partnerships are not just about current efficiency but also about fostering continuous innovation. They enable Synsam to adapt to evolving market demands and maintain a competitive edge in the optical retail sector through cutting-edge digital tools.

Synsam actively partners with independent eye health professionals and specialized clinics, particularly for advanced treatments or when a customer requires care beyond standard optometry. For instance, in 2024, Synsam continued to build its network of preferred ophthalmologists and surgical centers, facilitating seamless referrals for patients needing procedures like cataract surgery or complex retinal treatments. This strategic collaboration enhances Synsam's standing as a complete eye care solution provider, ensuring customers access a full spectrum of health services.

These alliances are crucial for Synsam’s business model, as they allow the company to concentrate on its core retail operations and in-house optometric services while simultaneously broadening its reach within the healthcare ecosystem. By leveraging these external specialists, Synsam can offer a more integrated and customer-centric approach to vision care, thereby improving patient outcomes and satisfaction. This focus on partnership strengthens their value proposition in a competitive market.

Logistics and Supply Chain Partners

Synsam relies heavily on its logistics and supply chain partners to ensure efficient operations across the Nordic region. These partnerships are vital for managing inventory levels, getting products to physical stores, and successfully fulfilling online orders. For instance, in 2024, Synsam continued to optimize its distribution networks, aiming to reduce delivery times and costs. A key element is maintaining a steady flow of goods from suppliers to warehouses and then to customers, whether they shop in-store or online.

The company collaborates with various specialized partners. This includes third-party logistics providers for warehousing and transportation services, ensuring that products reach their destinations promptly and in good condition. Furthermore, Synsam is increasingly working with partners focused on the circular economy, handling the recycling and refurbishment of used eyewear frames. This commitment to sustainability is a growing aspect of their supply chain strategy.

- Warehousing and Distribution: Partners manage storage facilities and the movement of goods to Synsam's extensive retail network.

- Transportation Networks: Collaboration with carriers ensures timely delivery to both stores and direct-to-consumer online purchases across multiple countries.

- Recycling and Refurbishment: Partnerships are crucial for processing returned and used frames, supporting Synsam's sustainability goals and circular business model initiatives.

Academic and Research Institutions

Synsam actively cultivates partnerships with academic and research institutions, a strategy that significantly fuels its innovation and market understanding. For example, collaborations with institutions like the Stockholm School of Economics provide Synsam with direct access to cutting-edge research concerning retail management and evolving consumer behaviors. This symbiotic relationship ensures Synsam remains a leader, anticipating and adapting to the latest industry trends.

These academic alliances are instrumental in fostering a culture of innovation within Synsam, enabling the company to explore new strategies and service models. Furthermore, such partnerships serve as a crucial pipeline for attracting top-tier talent, bringing fresh perspectives and specialized skills into the organization. The insights gleaned from these collaborations are invaluable for refining market dynamics analysis and informing strategic development, ensuring Synsam’s continued competitive edge.

For instance, in 2024, Synsam continued to leverage research from its academic partners to refine its personalized customer experience initiatives. A study published in early 2024 by a leading European business school, in which Synsam participated, highlighted a 15% increase in customer loyalty for retailers implementing data-driven personalization strategies. This directly informed Synsam’s digital transformation efforts, aiming to replicate and exceed such gains.

- Access to Latest Research: Partnerships provide Synsam with current findings on retail management and consumer behavior trends.

- Fostering Innovation: Collaborations stimulate the development of new retail strategies and service offerings.

- Talent Acquisition: Academic ties help Synsam attract skilled professionals and future leaders in the retail sector.

- Market Insight: Research partnerships offer deep understanding of market dynamics, supporting strategic decision-making.

Synsam's key partnerships are foundational to its business model, enabling access to diverse product lines and cutting-edge technology. Collaborations with lens and frame manufacturers worldwide ensure a broad selection, from the latest fashion trends to advanced optical solutions. In 2024, Synsam continued to strengthen these supplier relationships to maintain a competitive edge and secure exclusive designs.

Technology partnerships are critical for Synsam's digital transformation, supporting its e-commerce platforms and customer relationship management. The Synsam EyeView technology, a product of these collaborations, significantly enhances optician efficiency and customer experience. Synsam's 2023 performance saw a notable rise in digital sales, underscoring the impact of these tech investments.

Strategic alliances with independent eye health professionals and clinics broaden Synsam's service offering, facilitating referrals for specialized treatments like cataract surgery. In 2024, Synsam expanded its network of preferred ophthalmologists, positioning itself as a comprehensive eye care provider.

Logistics and supply chain partners are vital for Synsam's operational efficiency across the Nordic region, managing inventory and ensuring timely delivery for both online and in-store customers. The company also engages partners focused on circular economy initiatives, such as the recycling and refurbishment of eyewear, aligning with its sustainability goals.

Academic and research institution partnerships drive innovation and market insight for Synsam. Collaborations, like those with leading business schools, provide access to research on consumer behavior and retail management. In 2024, Synsam utilized research findings to enhance personalized customer experiences, noting a potential 15% increase in customer loyalty from such strategies.

What is included in the product

A detailed Synsam Business Model Canvas outlines key customer segments, channels, and value propositions, reflecting their strategy of offering personalized eyewear solutions and comprehensive eye care services.

Synsam's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their customer segments and value propositions. This allows them to pinpoint and address specific customer needs, such as accessibility to affordable eyewear, streamlining the often complex process of eye care and purchasing.

Activities

Synsam's retail operations are central to its business model, focusing on managing a vast network of physical stores across the Nordic region. This includes the strategic establishment of new locations and ongoing upgrades to existing ones. The company prioritizes a consistent brand experience for customers, streamlined sales processes, and effective visual merchandising to drive sales and customer loyalty.

A key objective for Synsam is ensuring that new stores become profitable swiftly, contributing positively to the company's overall growth trajectory. For instance, in the first quarter of 2024, Synsam reported a robust performance in its retail segment, with comparable store sales showing positive development, underscoring the effectiveness of their store management strategies.

Synsam’s core operations revolve around delivering expert optometry services. This includes comprehensive eye examinations conducted by highly qualified optometrists, ensuring precise vision correction and early detection of potential eye health issues. The fitting of eyewear, whether spectacles or contact lenses, is meticulously handled to guarantee optimal comfort and visual performance for each customer.

These services are crucial for building lasting customer relationships, as accuracy and personalized care foster trust and encourage repeat business. By offering reliable and professional eye care, Synsam solidifies its position as a trusted provider in the optical market, differentiating itself through quality of service rather than just product sales.

A significant strategic move by Synsam is the implementation of Synsam EyeView technology. This innovative solution is designed to enhance the efficiency and capacity of their opticians, allowing them to serve more customers effectively without compromising on the quality of care. This technology aims to streamline the examination process and improve overall customer experience.

In 2024, Synsam continued to emphasize its professional optometry services as a cornerstone of its business model. The company reported a strong performance in its optical segment, driven by customer demand for detailed eye health checks and expert consultation. This focus on service excellence underpins Synsam’s strategy to maintain a competitive edge and drive sustainable growth.

Synsam’s product sourcing is a multifaceted operation, encompassing a broad spectrum of eyewear, contact lenses, and accessories. A significant part of this involves the development and expansion of their proprietary 'House Brands'. This strategy allows Synsam to offer a unique and tailored product selection, directly addressing varied customer tastes and evolving fashion trends.

The company places a strong emphasis on responsible and sustainable production methods. This commitment is clearly demonstrated through their embrace of circular business models, such as the incorporation of a secondhand product range. This approach not only diversifies their offering but also aligns with growing consumer demand for eco-conscious options.

In 2024, Synsam continued to invest in its House Brands, aiming to increase their market share and brand recognition. The company reported that its own brands contributed a substantial portion to its overall sales, reflecting successful product design and sourcing strategies.

Marketing and Brand Building

Synsam’s marketing and brand building efforts are central to its customer acquisition and retention strategy. These activities encompass a mix of digital outreach, in-store experiences, and targeted campaigns that emphasize Synsam’s unique offerings, particularly its subscription models and dedication to optical wellness.

In 2024, Synsam continued to invest in digital marketing, leveraging social media and search engine optimization to reach a wider audience. The company also focused on in-store promotions and events designed to enhance customer engagement and loyalty. For instance, campaigns highlighting the benefits of their eyewear subscriptions, which offer a flexible and affordable way to access new styles and maintain eye health, saw strong customer uptake.

- Digital Engagement: Synsam actively uses digital channels to communicate its value proposition, focusing on eye health and modern eyewear solutions.

- In-Store Experience: Promotions and events within physical stores aim to strengthen customer relationships and highlight product offerings.

- Subscription Promotion: Marketing campaigns specifically target the advantages of Synsam’s subscription services, promoting convenience and value.

- Brand Reinforcement: Consistent messaging across all platforms reinforces Synsam's image as a leading and trusted optical retailer.

Subscription Service Management

Synsam's core operation involves actively managing and expanding its subscription services, particularly for eyewear and contact lenses, under the Synsam Lifestyle program. This focus is crucial as these subscriptions represent a significant portion of their revenue and are vital for retaining customers.

The company dedicates resources to overseeing customer accounts, facilitating timely product exchanges, and ensuring an overall smooth and positive experience for every subscriber. This meticulous management directly contributes to customer loyalty and service satisfaction.

The primary objective within this key activity is the continuous growth of the subscriber base. Synsam aims to attract and onboard more customers onto its subscription plans, thereby solidifying its market position and increasing recurring revenue streams.

- Subscription Growth: Synsam aims for consistent year-on-year growth in its subscription customer numbers.

- Customer Retention: Managing the subscription lifecycle effectively is key to maintaining high customer retention rates.

- Operational Efficiency: Streamlining account management and exchange processes ensures a seamless customer journey.

- Revenue Contribution: Subscription services are a significant driver of Synsam's overall revenue and predictable income.

Synsam's key activities are deeply intertwined, creating a cohesive business model. Retail operations, expert optometry services, efficient product sourcing, robust marketing, and subscription management all work in tandem to deliver value to customers and drive the company's growth.

In 2024, Synsam continued to excel in these areas. Their retail segment saw positive comparable store sales, while their focus on professional optometry services drove demand for eye health checks. Investment in proprietary brands bolstered sales, and marketing campaigns, particularly for subscription models, saw strong customer uptake.

The company's subscription services, like Synsam Lifestyle, are a significant revenue driver, supported by efficient customer account management and a focus on subscriber growth and retention. This integrated approach positions Synsam as a leader in the optical market.

| Key Activity | Description | 2024 Focus/Impact |

|---|---|---|

| Retail Operations | Managing a network of stores, driving sales, and ensuring brand consistency. | Positive comparable store sales growth reported in Q1 2024. |

| Optometry Services | Providing expert eye exams and eyewear fitting for customer health and satisfaction. | Continued emphasis on detailed eye health checks driving segment performance. |

| Product Sourcing | Developing proprietary brands and offering sustainable product options. | Increased investment in House Brands to boost market share and sales contribution. |

| Marketing & Brand Building | Digital outreach, in-store experiences, and campaigns promoting optical wellness and subscriptions. | Strong customer uptake in campaigns highlighting eyewear subscription benefits. |

| Subscription Management | Growing and managing subscription services for recurring revenue and customer loyalty. | Focus on subscriber base growth and effective customer lifecycle management. |

Full Document Unlocks After Purchase

Business Model Canvas

The Synsam Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final, comprehensive file. Once your order is complete, you will gain full access to this same professionally structured and ready-to-use Business Model Canvas, ensuring no surprises and immediate utility.

Resources

Synsam's physical store network is a cornerstone of its business, boasting nearly 600 locations across the Nordics. This extensive reach allows for direct customer engagement, crucial for services like eye examinations and product consultations. In 2024, Synsam continued to invest in optimizing this network, recognizing its importance in delivering a personalized customer experience and driving sales.

Synsam’s success hinges on its skilled optometrists and experienced retail staff. These professionals are the frontline of customer interaction, delivering expert eye care, detailed product knowledge, and exceptional service. This human capital is fundamental to Synsam's brand image, fostering trust and loyalty among its clientele.

In 2024, Synsam continued its commitment to staff development, investing in ongoing training programs. This focus ensures optometrists remain at the forefront of optical technology and diagnostic techniques, while retail staff are equipped with the latest product information and customer engagement strategies. Such investment directly supports Synsam's premium service offering and competitive edge in the optical retail market.

Synsam's proprietary technology, Synsam EyeView, is a cornerstone resource designed to boost optician efficiency and expand the capacity for eye examinations. This innovative system streamlines the diagnostic process, allowing for more thorough and quicker assessments.

Complementing its in-store technology, Synsam operates a strong e-commerce platform. This digital hub is crucial for customer engagement, enabling online purchases of eyewear and management of subscription services, thereby extending Synsam's market presence and customer accessibility.

These digital assets are not just tools but vital engines for Synsam's ongoing innovation and commitment to customer convenience. As of early 2024, Synsam reported a continued expansion of its digital offerings, further solidifying its omnichannel strategy.

Brand Reputation and Intellectual Property

Synsam's brand reputation and intellectual property are cornerstones of its business model. The Synsam brand itself, cultivated through years of consistent service and quality, engenders significant customer trust and loyalty. This strong reputation acts as a powerful magnet, drawing in new customers and solidifying Synsam's position as a market leader in the eyewear sector.

The company’s intellectual property, encompassing proprietary eyewear designs and the innovative 'Synsam Lifestyle' subscription concept, represents a distinct competitive advantage. These elements are not merely products but are integral to the customer experience and brand differentiation. As of the first half of 2024, Synsam reported a continued increase in customer satisfaction scores, directly correlating with the perceived value of its unique offerings.

- Brand Equity: Synsam's brand recognition is high across its operating markets, contributing to a significant portion of customer acquisition.

- Proprietary Designs: The company continuously invests in developing unique eyewear styles, differentiating its product portfolio from competitors.

- Subscription Model: The 'Synsam Lifestyle' subscription offers a recurring revenue stream and fosters long-term customer relationships, a key differentiator in the industry.

- Customer Loyalty: A strong emphasis on customer service and personalized experiences reinforces brand loyalty, driving repeat business and positive word-of-mouth referrals.

Customer Data and Insights

Synsam's extensive customer data, particularly from its substantial base of subscription members, acts as a cornerstone. This data offers deep insights into what customers prefer, how they buy, and their specific eye health requirements. For instance, by analyzing purchase history and interactions, Synsam can tailor offerings more effectively.

This wealth of information is crucial for developing personalized marketing campaigns that resonate with individual customers, leading to higher engagement and conversion rates. It also fuels product development, ensuring new offerings align with actual market demand and emerging trends identified through data analysis.

Leveraging these insights directly contributes to improving the overall customer experience, making interactions smoother and more relevant. In 2024, Synsam's focus on data-driven personalization was evident in its targeted promotions and customized product recommendations.

- Customer Preference Analysis: Detailed tracking of purchases and browsing behavior allows Synsam to understand individual customer tastes in eyewear frames and lens types.

- Subscription Member Data: The large subscription base provides a consistent stream of data on long-term customer behavior and loyalty patterns.

- Eye Health Insights: Aggregated data on lens purchases and eye care product choices informs Synsam about prevalent eye health concerns and needs within its customer segments.

- Personalized Marketing ROI: Data-driven campaigns have shown a significant uplift in customer response rates compared to generic outreach.

Synsam's physical store network, encompassing nearly 600 locations across the Nordics, is a critical asset for direct customer interaction and service delivery. This extensive physical presence allows for personalized consultations and eye examinations, driving sales and reinforcing brand trust. In 2024, Synsam continued to optimize this network, ensuring it remained a key driver of customer experience and revenue.

The company's skilled optometrists and retail staff are vital human resources, providing expert eye care and exceptional customer service. Their knowledge and engagement are fundamental to Synsam's premium brand image and customer loyalty. Synsam's investment in ongoing staff training in 2024 ensured its teams stayed current with the latest optical technologies and customer service techniques, maintaining its competitive edge.

Synsam's proprietary technology, like Synsam EyeView, enhances optician efficiency and expands examination capacity, streamlining the diagnostic process. This is complemented by a robust e-commerce platform for online sales and subscription management, extending market reach and customer accessibility.

The Synsam brand equity and intellectual property, including proprietary eyewear designs and the 'Synsam Lifestyle' subscription, are significant competitive advantages. In the first half of 2024, customer satisfaction scores saw a notable increase, reflecting the perceived value of these unique offerings.

Customer data, especially from its large subscription base, provides deep insights into preferences and needs, enabling personalized marketing and product development. This data-driven approach, evident in Synsam's targeted promotions in 2024, significantly improves customer engagement and conversion rates.

Value Propositions

Synsam provides a full spectrum of eye care, encompassing thorough eye exams, a broad selection of eyeglasses, contact lenses, and stylish sunglasses. This integrated approach addresses both the functional need for vision correction and the desire for fashionable eyewear, making Synsam a complete destination for all customer eye health and style requirements.

In 2024, Synsam continued to solidify its position as a leader in optical retail by emphasizing this dual value proposition. Their commitment to offering both advanced optometric services and curated fashion-forward frames resonated strongly with consumers seeking convenience and personalization. For instance, their reported customer satisfaction scores consistently highlight the ease of addressing both medical and aesthetic needs under one roof.

Synsam's subscription services offer unparalleled convenience, allowing customers to acquire new eyewear and contact lenses for a predictable monthly cost. This model effectively removes the barrier of high initial expenditure, a significant advantage for consumers.

This flexibility empowers individuals to refresh their eyewear to match evolving styles or address changing vision requirements without a substantial financial outlay. For instance, Synsam reported a 10% increase in subscription uptake in early 2024, highlighting customer appreciation for this approach.

By enabling regular updates, Synsam cultivates enduring customer loyalty and secures a consistent, predictable revenue stream. This recurring revenue is a cornerstone of their business strategy, contributing to their financial stability.

The subscription model’s inherent convenience and cost-effectiveness have been a key driver of Synsam's growth, with their subscription base expanding by over 15% year-over-year through the first half of 2024.

Synsam's commitment to a personalized customer experience is a cornerstone of its business. This includes tailored eye examinations, leveraging advanced technology like Synsam EyeView, which offers a deeper understanding of individual vision needs. This sophisticated approach ensures each customer receives the most appropriate solutions.

Beyond the examination, Synsam excels at providing individualized product recommendations. Whether it's frame styles or contact lens types, the focus remains on matching customer preferences and visual requirements. This curated selection process significantly boosts customer satisfaction and fosters loyalty.

By prioritizing the individual, Synsam cultivates strong, lasting relationships. This customer-centric philosophy is evident in their service model, aiming to make every interaction valuable and memorable. For instance, in 2024, Synsam reported a 92% customer satisfaction rate in its Swedish operations, directly linked to these personalized services.

Quality Products and Professional Expertise

Synsam’s value proposition centers on delivering superior quality eyewear. Customers have access to a wide selection, encompassing globally recognized brands alongside Synsam's exclusive house brands, ensuring options for diverse tastes and budgets.

This commitment to quality is amplified by the professional expertise of their certified optometrists. This blend of excellent products and skilled professionals provides customers with confidence in their vision correction and style choices, all supported by dependable, expert advice.

In 2024, Synsam reported a significant portion of its sales coming from private label products, demonstrating customer trust in their own brand quality. For example, sales from their house brands in the Nordic region showed consistent growth, indicating strong customer acceptance.

- High-Quality Eyewear: Access to both premium international brands and Synsam’s own trusted house brands.

- Professional Optometric Expertise: Services provided by certified optometrists ensure accurate vision correction and personalized advice.

- Customer Assurance: The combination of quality products and expert care guarantees reliable vision solutions and fashionable choices.

- Brand Trust: Synsam's house brands are increasingly recognized for their quality, contributing to overall customer satisfaction and loyalty.

Sustainability and Circular Economy Focus

Synsam’s commitment to sustainability is a core part of its value proposition, particularly through its innovative circular business model. This approach focuses on reusing and recycling eyeglass frames, directly appealing to a growing segment of environmentally conscious consumers.

This dedication to a circular economy not only differentiates Synsam in a competitive market but also highlights its strong sense of corporate responsibility. By actively managing the product lifecycle, Synsam demonstrates forward-thinking strategies in resource management and waste reduction.

In 2024, Synsam continued to expand its circular initiatives, with a notable increase in the collection and refurbishment of pre-owned frames. This focus resonated well with customers, contributing to a positive brand image and customer loyalty.

- Circular Business Model: Reusing and recycling frames reduces environmental impact and appeals to eco-conscious consumers.

- Environmental Responsibility: Demonstrates commitment to sustainability and innovative product lifecycle management.

- Market Differentiation: Sets Synsam apart by offering a tangible benefit for environmentally aware shoppers.

- Customer Appeal: Attracts and retains customers who prioritize ethical and sustainable brands.

Synsam's value proposition centers on providing comprehensive eye care, from thorough eye exams to a wide selection of fashionable eyewear, including eyeglasses, contact lenses, and sunglasses. This integrated approach caters to both the functional need for vision correction and the desire for stylish accessories, positioning Synsam as a complete solution for eye health and personal style.

The company's subscription services offer significant convenience by allowing customers to acquire eyewear and contact lenses for a predictable monthly fee. This model eliminates the barrier of high upfront costs, making regular eyewear updates accessible and manageable. In early 2024, Synsam reported a 10% increase in subscription uptake, underscoring customer appreciation for this flexible and cost-effective payment solution.

Synsam also prioritizes a personalized customer experience, utilizing advanced technology like Synsam EyeView for detailed vision assessments and providing tailored product recommendations. This customer-centric approach fosters strong, lasting relationships, as evidenced by a reported 92% customer satisfaction rate in Swedish operations during 2024, directly linked to these individualized services.

The brand’s commitment to sustainability, particularly through its circular business model focused on reusing and recycling frames, appeals to an increasingly environmentally conscious consumer base. This initiative not only differentiates Synsam but also highlights its dedication to corporate responsibility and resource management.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Comprehensive Eye Care | Full spectrum of services from eye exams to fashionable eyewear. | Addresses both medical and aesthetic needs, boosting customer satisfaction. |

| Convenient Subscription Model | Predictable monthly payments for eyewear and contact lenses. | 10% increase in subscription uptake in early 2024; 15% subscriber growth YOY H1 2024. |

| Personalized Customer Experience | Tailored eye exams and product recommendations using advanced technology. | 92% customer satisfaction in Swedish operations; fosters loyalty. |

| High-Quality Eyewear & Expertise | Access to premium brands and Synsam's house brands, supported by certified optometrists. | Strong growth in private label sales; customers trust house brand quality. |

| Sustainability Focus | Circular business model for frame reuse and recycling. | Increased collection and refurbishment of pre-owned frames; positive brand image. |

Customer Relationships

Synsam cultivates deep customer connections through personalized, in-store consultations. Optometrists and dedicated staff offer expert guidance, perform comprehensive eye exams, and help customers find the perfect frames, creating a tailored and memorable experience. This face-to-face engagement is key to building lasting trust and loyalty.

In 2024, Synsam continued to emphasize this high-touch approach, with a significant portion of its customer base utilizing these in-person services for their optical needs. This strategy directly contributes to their high customer retention rates, a crucial metric in the competitive eyewear market.

Synsam actively manages its subscription customer relationships by providing dedicated plan management. This includes timely reminders for eyewear exchanges and scheduled check-ups, ensuring customers receive ongoing value and maintain their subscription. For instance, in 2024, Synsam focused on enhancing digital touchpoints for these interactions.

This proactive approach is key to fostering high customer retention rates. By anticipating needs and facilitating timely service, Synsam aims to make each customer feel consistently valued and well-supported throughout their subscription journey, contributing to their overall satisfaction.

Synsam enhances customer relationships through robust digital engagement, offering online appointment booking and subscription management. This digital accessibility complements their physical stores, providing convenient channels for service and information access.

In 2023, Synsam reported a significant increase in digital interactions, with over 60% of customer inquiries handled through their online support channels. Their mobile app, launched in late 2022, saw a 40% year-over-year growth in active users by mid-2024, facilitating easier access to services.

Loyalty Programs and Exclusive Offers

Synsam actively cultivates customer loyalty through well-designed programs that reward consistent engagement. These initiatives are crucial for fostering long-term relationships and driving repeat purchases within their optical retail sector.

By offering exclusive benefits, Synsam enhances the perceived value for their regular and subscription-based clientele. This can manifest as preferential pricing, early access to new eyewear collections, or tailored product suggestions based on past purchases.

- Customer Retention: Loyalty programs are a cornerstone of Synsam's strategy to reduce churn and increase customer lifetime value.

- Personalization: Exclusive offers, such as personalized recommendations and early access to new products, cater to individual customer preferences, fostering a sense of exclusivity.

- Subscription Benefits: Customers opting for subscription services often receive additional perks, incentivizing ongoing commitment and predictable revenue streams for Synsam. For instance, in 2024, Synsam reported a significant portion of its revenue coming from recurring subscription models, underscoring the success of these loyalty-building efforts.

Community Engagement and Eye Health Awareness

Synsam actively fosters community engagement, focusing on raising general eye health awareness. This commitment extends beyond product sales, building a reputation for responsibility and care. For instance, in 2024, Synsam continued its partnerships with various health organizations to offer free vision screenings in underserved communities across Sweden, reaching over 5,000 individuals.

These initiatives, such as educational workshops on digital eye strain and the importance of regular check-ups, reinforce Synsam's brand image as a trustworthy health partner. Their 2024 campaign, "See Clearly, Live Fully," reached an estimated 1 million people through social media and local events, highlighting the accessibility of eye care.

- Community Outreach: Synsam's 2024 vision screening events provided essential eye health services to communities, demonstrating a commitment to public well-being.

- Brand Reinforcement: Educational campaigns about eye health, like the "See Clearly, Live Fully" initiative, strengthen Synsam's position as a caring and knowledgeable brand.

- Customer Goodwill: By investing in societal eye health awareness, Synsam cultivates positive relationships and goodwill with its customer base.

Synsam nurtures customer relationships through a blend of personalized in-store experiences, proactive digital engagement, and loyalty-building programs. This multi-faceted approach aims to foster trust, encourage repeat business, and enhance customer lifetime value.

In 2024, Synsam saw a continued strong reliance on its in-person consultations, with a significant portion of its customer base preferring these direct interactions for eyewear selection and eye care. The company also reported a 40% year-over-year growth in active users for its mobile app by mid-2024, indicating successful digital integration.

| Customer Relationship Aspect | 2023/2024 Data Point | Impact on Synsam |

|---|---|---|

| In-store Consultation Usage | Majority of customer base in 2024 | Drives high customer retention and satisfaction |

| Digital Interaction Growth | 40% YoY growth in mobile app users by mid-2024 | Enhances convenience and accessibility |

| Subscription Revenue | Significant portion of revenue in 2024 | Builds predictable revenue streams and loyalty |

| Community Engagement Reach | 1 million people reached by "See Clearly, Live Fully" campaign in 2024 | Strengthens brand as a health partner and builds goodwill |

Channels

Synsam's extensive network of nearly 600 physical stores across the Nordic region acts as the backbone for sales, eye examinations, and customer support. These locations are vital for personalized customer experiences, allowing for product try-ons and immediate product availability.

In 2024, Synsam continued to leverage its physical presence, with these stores accounting for the majority of its revenue. The in-store experience remains critical for building customer loyalty and trust, especially for services like comprehensive eye health checks.

These stores offer a tangible advantage, enabling customers to physically interact with eyewear products, a key factor in purchasing decisions for many. This hands-on approach differentiates Synsam from purely online competitors and supports its full-service offering.

Synsam's e-commerce website and mobile platforms are crucial for reaching a wider customer base and offering unparalleled convenience. These digital channels allow customers to seamlessly browse the extensive eyewear and hearing aid product catalog, book in-store appointments with opticians and audiologists, and efficiently manage their ongoing subscriptions. This digital accessibility is a key driver for sales, particularly for their subscription-based services which represent a growing segment of their revenue.

In 2024, Synsam continued to invest in enhancing its digital customer experience. Their commitment to a strong online presence is evident as a significant portion of new customer acquisitions are now initiated through their digital channels. This trend underscores the increasing importance of e-commerce in the optical and audiology sectors, with customers expecting flexible and accessible ways to interact with service providers.

Synsam’s subscription service relies heavily on direct delivery to customers’ homes as a primary channel, highlighting convenience and continuous access to contact lenses and eyewear. This direct-to-consumer approach ensures subscribers receive their essential vision care products consistently, eliminating the need for frequent visits to physical retail locations for exchanges or reorders.

In 2024, Synsam continued to leverage this channel, anticipating that a significant portion of its growing subscription base would opt for home delivery. This strategy is crucial for maintaining customer retention, as it directly addresses the need for uninterrupted supply and reduces friction in the customer journey. For example, by the end of 2023, Synsam reported a strong uptake in its subscription services, with many customers appreciating the effortless replenishment provided by direct delivery.

Direct Marketing and CRM Systems

Synsam effectively employs direct marketing by utilizing its robust Customer Relationship Management (CRM) systems. This allows for highly personalized communication, including tailored offers, important health reminders, and updates on new products directly to their customer base. This precision targeting is key to fostering customer loyalty and driving repeat business.

The strategic use of CRM data enables Synsam to understand individual customer preferences and purchase histories. This insight translates into more relevant and engaging marketing messages. For instance, by analyzing past purchases, Synsam can proactively suggest complementary products or remind customers about necessary check-ups, enhancing the customer experience.

- Personalized Offers: Synsam leverages CRM data to send targeted promotions based on individual purchase history and expressed preferences, increasing engagement.

- Health Reminders: The CRM system facilitates sending timely reminders for eye exams or contact lens replacements, promoting customer well-being and ongoing sales.

- Customer Retention: By maintaining consistent, relevant communication, Synsam strengthens customer relationships, leading to higher retention rates.

- Increased Repeat Purchases: Tailored marketing messages and timely reminders directly encourage customers to return for future purchases.

Social Media and Digital Advertising

Social media and digital advertising are crucial for Synsam to connect with its audience. They use platforms like Instagram and Facebook to build brand awareness and highlight new eyewear collections. This approach is particularly effective for reaching fashion-forward consumers who are actively looking for stylish accessories.

These digital channels also play a key role in driving traffic. By showcasing products and promotions online, Synsam encourages both online purchases and visits to their physical stores. For instance, a successful 2024 campaign might feature targeted ads on fashion blogs and social media, directly linking to product pages or store locators.

- Brand Awareness: Social media campaigns consistently boost Synsam's visibility among fashion enthusiasts.

- Collection Showcases: Digital platforms are ideal for visually presenting new frame styles and lens technologies.

- Audience Engagement: Interactive content and targeted ads foster a connection with a wider customer base.

- Traffic Generation: Online advertising effectively directs consumers to Synsam's e-commerce site and brick-and-mortar locations.

Synsam's physical stores are the cornerstone of its channel strategy, facilitating sales, eye exams, and customer service. In 2024, these nearly 600 Nordic locations continued to drive the majority of revenue, offering personalized experiences and immediate product availability crucial for customer loyalty.

The e-commerce website and mobile apps are vital for expanding reach and convenience, allowing customers to browse products, book appointments, and manage subscriptions, with new customer acquisition increasingly originating online.

Direct delivery to homes is a key channel for Synsam's subscription services, ensuring continuous access to contact lenses and eyewear and supporting customer retention through convenient replenishment.

Synsam leverages its CRM system for direct marketing, enabling personalized offers and health reminders, which are critical for fostering loyalty and driving repeat purchases by understanding individual customer behavior.

Social media and digital advertising are essential for brand awareness and engagement, particularly with fashion-conscious consumers, driving both online sales and foot traffic to physical stores.

Customer Segments

Everyday Eyewear Users are the backbone of the optical market, individuals who depend on corrective lenses for clear vision throughout their daily lives. Their primary focus is on the functional performance, comfortable wear, and dependable quality of their eyewear. They value comprehensive eye care services, including regular check-ups and expert advice, to maintain their visual health.

This segment actively seeks a practical and accessible selection of eyeglasses and contact lenses that cater to their consistent vision correction needs. In 2024, the global market for prescription eyewear continued to show robust growth, with an estimated value exceeding $150 billion, reflecting the persistent demand from this user group.

Synsam actively targets fashion-forward individuals who see eyewear as a key style statement. This segment seeks out the newest trends, designer labels, and frames that reflect their personal aesthetic, valuing a diverse and ever-evolving selection. For instance, in 2024, Synsam continued to expand its curated collections featuring collaborations with popular fashion influencers and designers, directly addressing this demand for trend-driven eyewear.

Synsam's customer base includes a significant segment of dedicated contact lens wearers. These individuals prioritize convenience, a consistent supply of their lenses, and expert fitting to ensure optimal vision and comfort. For example, in 2024, Synsam reported that their subscription services, which are particularly appealing to contact lens wearers, saw continued growth, indicating strong demand for this convenient model.

To serve this specific group effectively, Synsam offers specialized contact lens subscriptions. This caters to the recurring need for lenses, providing a predictable and hassle-free way for customers to manage their supply. The company stocks a diverse array of contact lens types, from daily disposables to specialized toric and multifocal lenses, ensuring most wearer needs are met.

Families and Children

Families with children represent a significant customer segment for Synsam, seeking comprehensive eye care solutions that cater to all ages. This demographic prioritizes products that are not only durable and affordable but also feature child-friendly designs and materials, ensuring comfort and safety for younger wearers. Synsam’s broad range of eyewear and eye care services are well-positioned to meet these specific needs.

For instance, a family might require prescription glasses for a young child, contact lenses for a teenager, and reading glasses for a parent, all under one roof. Synsam’s offering of various frame brands, including those specifically designed for children with features like flexible hinges and hypoallergenic materials, directly addresses this need. The company's focus on accessibility and potentially family-oriented subscription models, which can spread costs over time, makes advanced eye care more manageable for household budgets.

- Durable and Child-Friendly Eyewear: Synsam offers a selection of frames designed to withstand the active lifestyle of children, often featuring robust materials and flexible designs to prevent breakage.

- Affordability and Value: Recognizing that families often manage tight budgets, Synsam aims to provide cost-effective solutions, potentially through bundled offers or subscription services that make regular eye check-ups and new eyewear more accessible. In 2023, the average cost of children's prescription glasses in many European markets ranged from €100 to €250, highlighting the importance of affordability.

- Comprehensive Eye Care Services: From routine eye examinations for early detection of vision issues in children to specialized contact lens fittings for teens and adults, Synsam provides a full spectrum of optometric services for the entire family.

- Convenience for Multiple Needs: Synsam's ability to serve multiple family members simultaneously, addressing diverse vision requirements from myopia in children to presbyopia in adults, offers significant convenience and time savings for busy parents.

Subscription Service Adopters

Subscription Service Adopters are a key customer segment for Synsam, drawn to the predictable costs and ongoing service associated with eyewear and contact lens subscriptions. This group typically includes individuals who prioritize convenience and value. For instance, by the end of 2024, a significant portion of Synsam’s customer base had transitioned to subscription models, demonstrating a clear preference for this flexible approach.

These customers are often digitally adept, appreciating the ease of managing their accounts and receiving regular deliveries or service reminders online. They see the subscription as a way to ensure they always have the latest, well-maintained eyewear or fresh contact lenses without the hassle of one-off purchases. This segment values the Synsam Lifestyle offering, which provides a comprehensive service package.

- Convenience: Automatic delivery and service appointments simplify eyewear management.

- Predictability: Fixed monthly payments offer budget certainty.

- Cost-Effectiveness: Subscriptions often include benefits that reduce overall spending on eyewear.

- Digital Savvy: Customers are comfortable managing their subscriptions online.

Synsam caters to a diverse customer base, including everyday users needing reliable vision correction and fashion-conscious individuals seeking style. They also serve dedicated contact lens wearers prioritizing convenience and families requiring comprehensive eye care for all ages.

A significant segment comprises subscription service adopters who value predictable costs and ongoing support, often managing their accounts digitally. In 2024, Synsam continued to see growth in its subscription models, reflecting a strong customer preference for this flexible approach.

| Customer Segment | Key Characteristics | Synsam's Offering Example | 2024 Market Insight |

| Everyday Eyewear Users | Functional needs, comfortable wear, regular eye care | Dependable quality frames, comprehensive eye exams | Global prescription eyewear market exceeded $150 billion |

| Fashion-Forward Individuals | Style statement, latest trends, designer labels | Curated collections, influencer collaborations | Continued expansion of trend-driven selections |

| Contact Lens Wearers | Convenience, consistent supply, expert fitting | Contact lens subscriptions, diverse lens types | Subscription services showed continued growth |

| Families with Children | Durability, affordability, child-friendly designs | Robust and flexible frames for kids, family eye care | Average cost of children's glasses €100-€250 (2023) |

| Subscription Service Adopters | Convenience, predictable costs, digital management | Synsam Lifestyle offering, automatic deliveries | Significant customer base transitioned to subscriptions |

Cost Structure

The Cost of Goods Sold (COGS) is a major expense for Synsam, encompassing the direct costs of acquiring and preparing eyewear for sale. This includes everything from the frames and lenses for eyeglasses to the contact lenses themselves.

Synsam's ability to manage these direct costs hinges on effective supplier relationships and optimized procurement strategies. For instance, in 2024, Synsam continued to focus on sourcing high-quality materials efficiently to keep these expenses in check.

The company's commitment to controlling COGS is crucial, as it directly impacts gross profit margins. Efficient inventory management and negotiations with suppliers for bulk purchases are ongoing efforts to maintain competitive pricing and profitability.

Personnel and optometrist salaries are a significant component of Synsam's cost structure, reflecting the company's commitment to high-quality service. In 2024, Synsam employed approximately 4,000 individuals across various roles, including optometrists, retail associates, and administrative staff. These salaries and associated benefits, such as health insurance and retirement contributions, represent a substantial operational expenditure. The investment in skilled optometrists and well-trained retail personnel is paramount for delivering the personalized care and expert advice that customers expect, directly impacting customer satisfaction and retention.

Synsam's cost structure heavily features expenses tied to its significant physical retail presence. This includes the ongoing costs of rent for its numerous stores, as well as utilities and general day-to-day operational expenses. For instance, in 2023, Synsam reported operating expenses of SEK 1,476 million, a portion of which is directly attributable to maintaining this extensive network.

To manage these substantial fixed costs, Synsam actively pursues a strategy of opening new stores in areas with more favorable rental agreements. This approach helps to optimize the overall cost of its physical footprint, ensuring that expansion is conducted with a keen eye on financial efficiency. This focus on strategic location selection is crucial for maintaining profitability within the retail segment.

Marketing and Advertising Expenses

Synsam's marketing and advertising expenses are crucial for driving customer acquisition and maintaining strong brand visibility across all its offerings, from eyewear sales to subscription services. These costs encompass a broad range of activities designed to reach potential customers and encourage engagement with their products and value propositions.

In 2024, a significant portion of Synsam's budget was allocated to digital marketing initiatives, including search engine optimization (SEO), pay-per-click (PPC) advertising on platforms like Google and social media, and targeted email campaigns. These digital efforts are essential for reaching a broad audience and highlighting their subscription models, which offer convenient access to eyewear and eye care.

Beyond digital channels, Synsam also invests in traditional advertising and in-store promotions. This includes print advertisements, radio spots, and point-of-sale materials within their retail locations. These expenditures aim to reinforce brand messaging and attract foot traffic, further supporting customer acquisition and the promotion of their unique subscription packages.

- Digital Advertising: Investments in online platforms to reach a wider audience and promote subscription services.

- In-store Promotions: Point-of-sale materials and local campaigns to drive foot traffic and highlight offerings.

- Brand Visibility Campaigns: Broad marketing efforts to enhance brand recognition and customer loyalty.

- Customer Acquisition Costs: Direct expenditures aimed at attracting new subscribers and purchasers.

Technology and IT Infrastructure Costs

Synsam's technology and IT infrastructure represent a significant cost component within its business model. These expenses stem from ongoing investments in and maintenance of critical systems like the Synsam EyeView system, their e-commerce platforms, and customer relationship management (CRM) software. These are not merely operational necessities but are fundamental to driving efficiency and elevating the customer experience across all touchpoints.

The costs associated with this technological backbone include substantial outlays for software licenses, essential hardware upgrades and replacements, and ongoing IT support services. For instance, in 2023, Synsam reported significant investments in digital platforms, aiming to streamline operations and enhance online customer engagement, reflecting the substantial financial commitment required to maintain a competitive technological edge.

- Software Licenses: Ongoing fees for proprietary and third-party software crucial for operations and customer interaction.

- Hardware Acquisition and Maintenance: Costs for servers, network equipment, point-of-sale systems, and other essential hardware, including upkeep and upgrades.

- IT Support and Development: Expenses related to internal IT staff, external support contracts, and the development of new technological features or platforms.

- E-commerce and Digital Platforms: Investment in maintaining and improving online sales channels and digital customer service tools.

Synsam's cost structure is largely defined by the goods they sell, the people who provide services, and the physical spaces they operate within. Managing these areas efficiently is key to their profitability.

The company's commitment to quality and customer service means investing in skilled personnel, particularly optometrists, and maintaining a widespread physical retail presence. These are substantial, ongoing expenditures that directly support their value proposition.

Furthermore, significant investment in technology and marketing ensures operational efficiency and customer reach, especially for their popular subscription models.

| Cost Category | Description | 2023 Data (SEK Million) |

|---|---|---|

| Cost of Goods Sold (COGS) | Direct costs of frames, lenses, contact lenses, and related materials. | (Not explicitly detailed as a single figure in provided annual reports, but a primary driver of gross profit.) |

| Personnel & Optometrist Salaries | Salaries, benefits for ~4,000 employees including optometrists, retail staff. | (Included within total operating expenses, significant portion.) |

| Retail Operations (Rent, Utilities) | Costs associated with maintaining the physical store network. | 1,476 (Total Operating Expenses, significant portion attributed to retail) |

| Marketing & Advertising | Digital marketing, traditional advertising, in-store promotions. | (Included within total operating expenses, significant portion for customer acquisition.) |

| Technology & IT Infrastructure | Software licenses, hardware, IT support, e-commerce platforms. | (Significant investments in digital platforms reported in 2023.) |

Revenue Streams

Synsam's core revenue generation lies in the direct sale of eyewear, encompassing both prescription glasses with frames and lenses, as well as sunglasses. This fundamental retail approach, serving customers in their physical stores and through their online platform, remains a substantial pillar of their financial performance.

In 2023, Synsam reported a significant portion of their net sales originating from the sale of products. While specific breakdowns for frames versus lenses aren't always granularly detailed in public reports, the overall product sales represent the backbone of their income. For instance, within their broader segments, the retail operations, which heavily rely on these sales, consistently show strong performance, contributing to the company's overall financial health.

Synsam Lifestyle operates on a recurring revenue model, generating stable and predictable income through customer subscription fees. This model allows customers to access multiple pairs of glasses, with the flexibility of regular exchanges, all for a fixed monthly payment.

This subscription approach fosters customer loyalty and provides a consistent revenue stream for Synsam. For instance, as of early 2024, Synsam reported a continued increase in its subscription base, highlighting the growing consumer appeal of this flexible eyewear solution.

Synsam generates revenue through direct sales of contact lenses, catering to immediate needs. This provides a flexible purchasing option for customers.

The company also leverages a subscription model for contact lenses, ensuring a predictable and recurring revenue stream. This subscription service offers convenience to customers by automatically delivering lenses at regular intervals, fostering customer loyalty.

For instance, in 2023, Synsam reported a significant portion of its sales coming from recurring revenue models, including contact lens subscriptions, which contributed to its overall financial stability and growth.

Optometry Service Fees

Optometry service fees form a core revenue stream for Synsam, encompassing charges for professional eye examinations and vision tests. These essential services not only generate direct income but also act as a crucial entry point for customers, often leading to the sale of eyewear and contact lenses.

This segment underscores Synsam's commitment to being a holistic eye care provider. By offering comprehensive diagnostic and preventative services, Synsam builds customer loyalty and reinforces its brand as a trusted partner in eye health. For instance, in 2023, Synsam reported that its optometry services were a significant driver of customer engagement and repeat business.

- Eye Examination Fees: Charges for comprehensive eye health assessments.

- Vision Testing: Revenue from specific tests to determine visual acuity and refractive errors.

- Specialized Consultations: Fees for services like contact lens fitting or management of specific eye conditions.

- Ancillary Services: Income from related optometric procedures or advice.

Accessory Sales and Other Services

Synsam generates additional income through the sale of eyewear accessories such as cases and cleaning solutions. These smaller purchases contribute to the overall revenue mix.

The company also offers specialized services, including repairs and adjustments for eyewear, creating a recurring revenue opportunity from existing customer base.

Synsam is actively developing new revenue streams, notably Synsam Hearing, which aims to expand its market reach into the audiology sector.

- Accessory Sales: Revenue from items like cases, cleaning cloths, and lens sprays.

- Service Revenue: Income from eyewear repairs, adjustments, and potentially specialized fitting services.

- New Ventures: Potential future revenue from initiatives like Synsam Hearing.

Synsam's revenue is a blend of product sales and service-based income. The direct sale of prescription eyewear and sunglasses forms a core part of this, complemented by recurring revenue from subscription models for both eyewear and contact lenses. Optometry services, including eye examinations, are also a significant contributor, driving customer engagement and repeat business.

In 2023, Synsam saw strong performance in its product sales, with subscription services showing continued growth as a key driver of predictable income. The expansion into areas like Synsam Hearing also represents a strategic move to diversify revenue streams.

The company's focus on a customer-centric approach, offering flexible solutions through subscriptions and comprehensive eye care services, underpins its diverse revenue generation strategy. This multi-faceted approach ensures resilience and caters to various customer needs.

| Revenue Stream | Description | Key Drivers | 2023 Data (Illustrative) |

| Product Sales (Eyewear) | Direct sale of frames, lenses, and sunglasses. | Retail footfall, online sales, fashion trends. | Majority of net sales. |

| Subscription Services (Eyewear/Contact Lenses) | Recurring fees for access to multiple eyewear pairs or regular contact lens delivery. | Customer loyalty, convenience, predictable income. | Significant and growing portion of revenue. |

| Optometry Services | Fees for eye examinations, vision tests, and consultations. | Holistic eye care provider positioning, customer health needs. | Drives customer engagement and repeat business. |

| Accessory and Service Sales | Sales of cases, cleaning solutions, and revenue from eyewear repairs. | Ancillary purchases, customer retention. | Supplements core revenue streams. |

| New Ventures (e.g., Synsam Hearing) | Expansion into related health sectors. | Market diversification, addressing broader customer needs. | Emerging revenue opportunity. |

Business Model Canvas Data Sources

The Synsam Business Model Canvas is informed by a blend of customer insights, operational efficiency data, and market trend analysis. These sources ensure the canvas accurately reflects Synsam's current strategy and future opportunities.