Synsam Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synsam Bundle

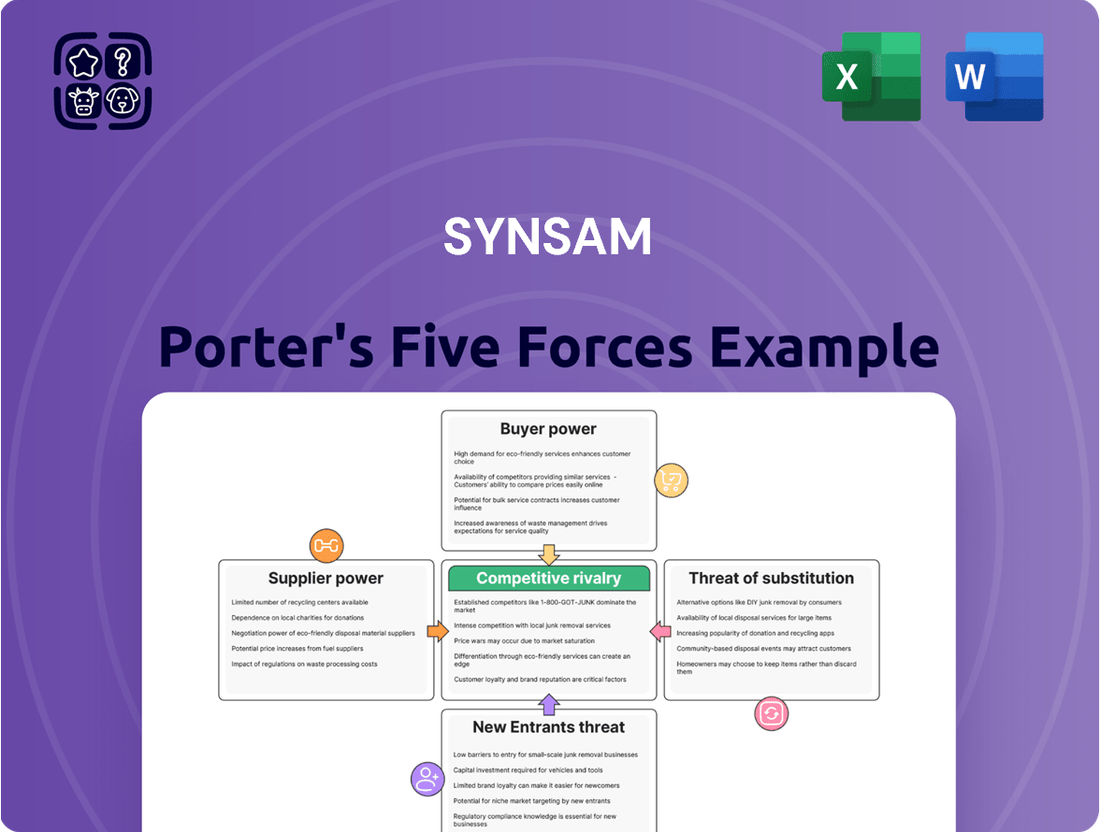

Synsam navigates a complex retail landscape, where the threat of new entrants is moderate due to brand loyalty and capital requirements. Buyer power is significant, as customers can easily switch between opticians and online retailers, driving price competition. The bargaining power of suppliers, particularly for lenses and frames, also exerts influence on Synsam's costs.

The threat of substitutes is a key concern, with advancements in contact lenses and potential future vision correction technologies posing long-term challenges. Rivalry among existing competitors is intense, with numerous brick-and-mortar stores and a growing online presence vying for market share. Understanding these forces is crucial for Synsam's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Synsam’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Synsam's bargaining power of suppliers hinges significantly on supplier concentration and specialization. If Synsam relies heavily on a few key suppliers for essential items like high-quality lenses or specific branded frames, these suppliers gain considerable leverage. This concentration can translate into suppliers dictating terms, increasing prices, or controlling delivery schedules, directly impacting Synsam's operational efficiency and cost structure.

For instance, a specialized supplier of advanced optical coatings or unique frame designs might hold a strong position, as finding alternative sources could be difficult and time-consuming. This is particularly true for proprietary technologies or materials that are not widely available. The more specialized the supplier's offering, the greater their power, as Synsam's ability to switch is limited.

However, Synsam's significant market presence in the Nordic region likely provides some counter-leverage. By consolidating its purchasing power across its numerous stores, Synsam can negotiate better terms through bulk orders. This scale can make Synsam an attractive customer, potentially mitigating some of the supplier's inherent power, especially if suppliers are eager to secure large, consistent orders.

Synsam faces significant switching costs when dealing with its major eyewear suppliers. These costs can include the expense and time involved in retooling manufacturing processes to accommodate new lens specifications or frame materials. Furthermore, the need to re-certify products with regulatory bodies after a supplier change adds another layer of complexity and financial burden.

Retraining staff on new product lines or handling procedures is also a considerable expense for Synsam. Beyond operational adjustments, losing access to established, popular eyewear brands that are synonymous with a particular supplier can directly impact Synsam's market appeal and sales volume. These embedded costs and potential revenue disruptions strengthen the bargaining power of Synsam's current suppliers.

Synsam's suppliers offer a range of products, from lenses to frames. The uniqueness of these offerings directly impacts supplier bargaining power. If Synsam relies on suppliers with patented lens technologies or exclusive designer brands that are integral to its premium product lines, those suppliers gain considerable leverage.

For instance, if a key supplier provides proprietary lens coatings or unique frame designs that Synsam cannot easily replicate or source elsewhere, this creates a dependency. This dependency allows suppliers to potentially dictate terms, including pricing and delivery schedules, thereby strengthening their bargaining position. The lack of readily available substitutes for these specialized components amplifies this power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail operations, directly competing with Synsam, is a significant consideration. If suppliers, such as eyewear manufacturers or lens producers, possess the capital and strategic intent to establish their own retail chains or e-commerce platforms, they gain considerable leverage in price and term negotiations. This capability allows them to bypass Synsam and capture a larger share of the value chain, potentially impacting Synsam's margins and market access.

For instance, a large eyewear manufacturer could leverage its existing brand recognition and production capacity to launch its own direct-to-consumer (DTC) brand, cutting out intermediaries like Synsam. Such a move would directly challenge Synsam's business model and could lead to increased price competition.

- Potential for Supplier-Owned Retail: Suppliers could establish their own physical stores or robust online sales channels.

- Leverage in Negotiations: The ability to bypass Synsam gives suppliers greater power to dictate terms or prices.

- Impact on Synsam's Margins: Direct competition from suppliers could compress Synsam's profit margins.

- Market Share Erosion: Suppliers entering the retail space might attract customers directly, reducing Synsam's customer base.

Importance of Synsam to Suppliers

Synsam's significance to its suppliers plays a crucial role in its bargaining power. If Synsam constitutes a substantial portion of a supplier's overall sales, that supplier would likely be more accommodating to Synsam's demands to protect a vital revenue stream. This interdependence can diminish the supplier's leverage.

Conversely, if Synsam is a minor client for a large supplier, the supplier's bargaining power increases. In such scenarios, Synsam's business is less critical, allowing the supplier to dictate terms more assertively without fearing a significant loss of income. This dynamic directly impacts Synsam's ability to negotiate favorable pricing and conditions.

- Customer Dependency: Synsam's substantial purchasing volume for optical products, particularly lenses and frames, makes it a key customer for many eyewear component manufacturers.

- Supplier Concentration: The market for specialized optical components can have a limited number of high-quality suppliers, potentially increasing their bargaining power if Synsam relies heavily on a few key partners.

- Impact on Negotiations: A supplier heavily reliant on Synsam for a significant percentage of its revenue (e.g., over 10-15%) would likely have reduced bargaining power, prioritizing Synsam's business and potentially accepting lower margins or more favorable terms.

- Strategic Sourcing: Synsam's strategy of diversifying its supplier base and fostering long-term relationships with key partners aims to mitigate supplier power by creating competition and ensuring supply chain resilience.

The bargaining power of Synsam's suppliers is moderately high, primarily due to the specialized nature of optical components and branded frames. While Synsam's scale offers some leverage, suppliers of unique lens technologies or exclusive frame designs can command higher prices and dictate terms. This is exacerbated by the significant switching costs Synsam incurs, including retraining and potential brand appeal loss.

Synsam's reliance on a few key suppliers for its premium offerings, such as advanced lens coatings or specific designer collections, grants these suppliers considerable power. For example, if a supplier holds patents for a unique progressive lens technology that is crucial to Synsam's high-margin products, their ability to influence pricing and supply is substantial. This dependency limits Synsam's options and strengthens the supplier's negotiating position.

| Factor | Synsam's Position | Supplier Bargaining Power |

|---|---|---|

| Supplier Concentration/Specialization | Moderate reliance on specialized suppliers for lenses and frames. | Moderate to High |

| Switching Costs | High due to retraining, product recertification, and brand loss. | High |

| Synsam's Importance to Supplier | Varies; Synsam is a significant customer for many, but not all. | Moderate |

| Threat of Forward Integration | Low to Moderate; some manufacturers have DTC capabilities. | Low to Moderate |

What is included in the product

Synsam's Porter's Five Forces analysis reveals the competitive intensity within the eyewear market, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly identify and quantify competitive pressures, enabling proactive strategies to mitigate threats and capitalize on opportunities within the optical retail market.

Customers Bargaining Power

Synsam's customers exhibit varying degrees of price sensitivity, influenced heavily by the availability of information. With the proliferation of online optical retailers and price comparison websites, customers can effortlessly benchmark prices for frames, lenses, and contact lenses. For instance, a 2024 report indicated that over 60% of consumers research product prices online before making a purchase, a trend that directly empowers them by highlighting cheaper alternatives. This ease of comparison significantly amplifies customer bargaining power.

The Nordic optical market presents consumers with a robust selection of retailers, ranging from dominant chains like Specsavers and Synsam itself, to numerous independent opticians and a growing segment of online-only providers. This abundance of choice directly amplifies customer bargaining power. For instance, as of late 2024, the Nordic optical market is estimated to have over 5,000 optical outlets, with online retailers capturing an increasing share of the market, reportedly around 15% and growing.

This wide availability means customers can readily compare prices, product offerings, and service quality across different providers. If Synsam’s pricing is perceived as too high, their product selection is lacking, or their customer service falls short, consumers have a readily accessible avenue to switch to a competitor. This competitive landscape forces Synsam to remain vigilant about its value proposition to retain its customer base.

Customer switching costs for Synsam are a key factor in their bargaining power. While eyeglasses themselves are commodities, Synsam's subscription models, like their eyewear and contact lens plans, introduce a layer of inconvenience for customers looking to switch. These ongoing services provide benefits such as regular updates and specialized care, making a simple product purchase elsewhere less appealing.

For instance, if a customer is mid-way through a year-long contact lens subscription with Synsam, switching providers before the subscription ends would mean forfeiting any remaining value or paying early termination fees, effectively increasing the cost of switching. This subscription-based approach is designed to foster loyalty and reduce the ease with which customers can move to a competitor, thereby mitigating the bargaining power of individual customers.

Customers' Ability to Substitute Products/Services

The bargaining power of customers in the eyewear industry is significantly influenced by the availability of substitute products and services for vision correction. For Synsam, this means customers can opt for alternatives to traditional glasses and contact lenses. For instance, the growing acceptance and accessibility of refractive surgery, such as LASIK, present a direct substitute that can reduce reliance on eyewear, thereby increasing customer leverage.

The growing market for laser eye surgery directly impacts Synsam's customer bargaining power. As of early 2024, procedures like LASIK continue to gain traction, offering a permanent vision correction solution for many. This trend empowers consumers who may see these surgical options as a long-term investment that negates the ongoing costs associated with purchasing eyewear or contact lenses from retailers like Synsam.

- LASIK Procedure Growth: The global refractive surgery market, including LASIK, has seen consistent growth, indicating increasing consumer adoption of non-eyewear vision correction.

- Cost-Benefit Analysis: Customers increasingly perform cost-benefit analyses, weighing the one-time cost of surgery against the recurring expenses of glasses and contact lenses.

- Technological Advancements: Ongoing advancements in surgical techniques and post-operative care further enhance the appeal and effectiveness of vision correction surgery as a substitute.

Customer Grouping and Influence

Synsam's customers, particularly large corporate clients or group purchasing organizations, can exert significant bargaining power by demanding better pricing or tailored service packages. While individual consumers typically have minimal leverage, the collective voice amplified through social media and online reviews can influence Synsam's service offerings and product quality, indirectly boosting customer influence.

The bargaining power of Synsam's customers is a key factor in its market dynamics. Large corporate clients, such as businesses requiring eyewear for their employees, possess the ability to negotiate bulk discounts and customized service agreements, thereby increasing their influence.

- Customer Concentration: Synsam serves a diverse customer base, but the presence of large corporate accounts grants them greater negotiation leverage for bulk purchases and specialized services.

- Switching Costs: For individual consumers, switching to another optician is relatively easy, which limits their individual bargaining power. However, for corporate clients, the administrative effort and potential disruption of switching suppliers can be significant, giving them some leverage.

- Information Availability: The widespread availability of pricing information and customer reviews online empowers consumers to make informed choices and collectively pressure Synsam for better value. For instance, online platforms often feature customer feedback regarding pricing and service quality.

- Price Sensitivity: While eyewear can be a necessity, price sensitivity varies. Customers seeking basic corrective lenses may be more price-sensitive than those opting for premium brands or specialized lens technology, influencing the negotiation dynamics.

Customers possess substantial bargaining power due to the readily available information and numerous alternatives in the optical market. The ease of online price comparisons, with over 60% of consumers researching prices online in 2024, empowers them to find cheaper options. Furthermore, the Nordic market's density of over 5,000 optical outlets, including a growing 15% online share by late 2024, ensures abundant choice, forcing Synsam to maintain competitive pricing and service.

Preview Before You Purchase

Synsam Porter's Five Forces Analysis

This preview reveals the complete Synsam Porter's Five Forces Analysis, detailing the competitive landscape of the optical retail industry. You're looking at the actual document, which meticulously examines the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within Synsam's market. The document you see here is exactly what you’ll be able to download after payment, ensuring you receive a comprehensive and professionally formatted analysis for your strategic planning.

Rivalry Among Competitors

The Nordic optical retail market is a crowded space. Major players like Specsavers and GrandVision operate alongside a significant number of independent opticians, creating a multi-faceted competitive environment. This diversity means consumers have a wide array of choices, from budget-friendly options to high-end, specialized services.

Adding to the complexity, online-only optical retailers are increasingly capturing market share. These digital disruptors often compete on price and convenience, forcing traditional brick-and-mortar stores to adapt their strategies. For instance, in 2023, online sales of eyewear in the Nordics saw continued growth, putting pressure on established chains to enhance their digital offerings.

The presence of competitors employing distinct strategies, such as a focus on low-cost models versus premium offerings, further intensifies the rivalry. This varied approach means Synsam must constantly differentiate itself and innovate to maintain its position. For example, Specsavers' strong brand recognition and value proposition in Sweden, a key market, presents a direct challenge.

The steady growth projected for the Nordic eyewear market in 2024 influences competitive rivalry. A market expanding at a moderate pace means companies are less likely to engage in cutthroat competition to gain share. Instead, there's more room for multiple players to coexist and grow without intense direct confrontation, although competition for customer loyalty remains a key factor.

Synsam actively differentiates itself through its subscription model, offering customers access to new frames and lenses at regular intervals. This approach moves beyond simple product sales, fostering customer loyalty and reducing direct price comparisons with competitors offering traditional purchase options. For example, Synsam's subscription services often include benefits like free eye exams and discounts on accessories, adding value that goes beyond the basic eyewear itself.

Exit Barriers for Competitors

Synsam operates within the Nordic optical market, where competitors face significant hurdles when considering an exit. These exit barriers can keep even underperforming companies engaged, intensifying competitive rivalry.

High upfront investments in specialized retail infrastructure, including optical stores and advanced diagnostic equipment, represent a substantial sunk cost for many players. For instance, the cost of fitting out a modern optical store can range from €50,000 to €150,000, making it difficult to recoup these expenditures if a business is sold or closed prematurely.

- Specialized Assets: Optical retailers invest heavily in store locations and specialized equipment, which have limited resale value outside the industry.

- Long-Term Leases: Many competitors are bound by long-term commercial leases for prime retail spaces, incurring ongoing financial obligations even if operations are scaled back.

- Employee Commitments: Commitments to employee benefits, training, and established workforces can create severance costs and operational complexities associated with exiting.

- Brand and Reputation: The cost of maintaining brand reputation and customer loyalty means that a disorderly exit could damage a company’s broader standing.

Strategic Commitments and Market Share Objectives

Competitors in the optical retail sector, including Synsam's rivals, often pursue aggressive strategies focused on market share. For instance, Specsavers, a major European player, has historically emphasized rapid expansion and a value-driven customer proposition to capture a larger slice of the market.

Synsam's own strategic commitments, such as its ongoing program of opening new physical stores and growing its subscription service, directly contribute to intensified competitive rivalry. By actively pursuing market share, Synsam signals its intent to compete vigorously, prompting other players to respond in kind.

- Synsam's ambition to grow its subscription base suggests a long-term strategy to secure recurring revenue and customer loyalty, directly challenging competitors' traditional sales models.

- Key competitors in the Nordics, such as Specsavers and GrandVision (owner of Pearle Optic and Specsavers in some markets), also have significant expansion plans, aiming to increase their store count and online presence.

- In 2024, the optical market continues to see consolidation and strategic partnerships as companies seek to gain scale and efficiency, thereby increasing the intensity of competition.

- Synsam's reported strategy for 2024 includes further digital investments and a focus on customer experience, which necessitates outperforming competitors on multiple fronts to achieve its market share objectives.

Competitive rivalry is intense in the Nordic optical market, characterized by a mix of large chains, independent opticians, and growing online players. Competitors like Specsavers and GrandVision employ aggressive market share strategies, as seen in their expansion plans. Synsam's own growth initiatives, including new store openings and subscription service expansion, further fuel this rivalry, forcing all players to innovate and differentiate to capture customer loyalty. The market's steady growth in 2024 suggests competition may focus more on customer retention than aggressive price wars, though strategic moves for scale, like consolidation, are also increasing competitive pressure.

| Competitor | Key Strategy | Nordic Market Presence | 2024 Focus |

|---|---|---|---|

| Specsavers | Value proposition, rapid expansion | Significant in Sweden, Denmark, Norway | Enhancing digital offerings, customer loyalty |

| GrandVision (Pearle Optic) | Brand recognition, diverse portfolio | Strong presence across Nordics | Market consolidation, operational efficiency |

| Synsam | Subscription model, customer experience | Leading player in Sweden, expanding | Digital investment, store growth, subscription expansion |

SSubstitutes Threaten

The price-performance trade-off of substitutes, particularly LASIK eye surgery, presents a notable threat to traditional eyewear and contact lenses. While LASIK surgery typically carries a higher upfront cost, often ranging from $2,000 to $4,000 per eye in 2024, its potential for long-term vision correction can appeal to consumers seeking a permanent solution. This perceived long-term value proposition, even with the initial investment, challenges the ongoing expenses associated with purchasing eyeglasses or contact lenses and their associated solutions.

Customers are increasingly open to alternatives to traditional eyewear, especially with growing awareness of procedures like LASIK. Factors such as perceived risk, cultural acceptance, and the efficacy of these alternatives significantly influence this shift. As technology improves and success rates climb, the comfort level with substitute options rises.

For Synsam, this means that while eyeglasses and contact lenses remain core products, the appeal of vision correction surgery as a substitute is growing. This trend is supported by a general increase in public acceptance of medical advancements. For instance, the market for refractive surgery has seen steady growth, indicating a willingness among consumers to explore non-traditional vision correction methods.

Ongoing innovations in alternative vision correction, like advanced laser eye surgery techniques, are making these options more appealing and less limiting. For example, the adoption of SMILE (Small Incision Lenticule Extraction) laser surgery has continued to grow, offering a less invasive alternative to LASIK for many patients.

The development of smart eyewear also presents a significant threat. Companies are investing heavily in creating glasses that can overlay digital information, potentially reducing the need for traditional eyeglasses or contact lenses for some consumers.

Continuous improvement in these substitutes can quickly escalate competitive pressure on traditional optical retail. As these technologies become more sophisticated and accessible, they may draw a larger segment of the market away from established optical providers.

Switching Costs for Customers to Substitutes

Switching from Synsam's eyewear offerings to alternatives like contact lenses or vision correction surgery involves varying degrees of customer cost. For contact lenses, the ongoing expense of purchasing lenses and solutions represents a recurring financial commitment, while LASIK surgery, despite its significant upfront cost, offers a long-term solution that can eliminate future eyewear expenditures, effectively lowering the perceived switching cost over time.

The convenience factor also plays a role; customers accustomed to the ease of glasses or regular contact lens use might find the transition to or from surgical correction inconvenient, involving recovery periods and potential follow-up appointments. For instance, the average cost of LASIK surgery in 2024 can range from $2,000 to $4,000 per eye, a substantial initial outlay compared to the monthly cost of contact lenses, which might be around $30-$50.

While Synsam focuses on the fashionable and functional aspects of eyeglasses, the underlying need for vision correction can be met by these substitutes. The emotional investment in a particular style of eyewear or the comfort of established routines also contributes to switching costs, making a complete shift to a different vision correction method a more considered decision.

The threat of substitutes is therefore moderated by the specific financial, emotional, and convenience barriers customers face when considering alternatives to Synsam's core product categories.

Regulatory and Medical Acceptance of Substitutes

The threat of substitutes for Synsam's products, primarily eyewear and hearing aids, is significantly influenced by regulatory approval and medical community acceptance. If governing bodies ease regulations on alternative vision and hearing solutions, or if medical professionals actively recommend and integrate these substitutes into treatment plans, their market penetration would likely accelerate.

For instance, the increasing acceptance of advanced contact lenses, including multifocal and extended-wear options, presents a growing substitute threat to traditional eyeglasses. In 2023, the global contact lens market was valued at approximately $11.6 billion, with projections indicating continued growth. This trend is bolstered by endorsements from optometrists who recognize the convenience and evolving capabilities of these products.

Similarly, the hearing aid market is seeing innovation with over-the-counter (OTC) hearing aids. The FDA's final rule in 2022 allowing these devices without a prescription could expand accessibility and adoption, potentially drawing consumers away from traditional, professionally fitted hearing aids. This regulatory shift, coupled with growing consumer awareness, elevates the threat of these accessible alternatives.

- Regulatory Hurdles: Stringent approval processes for new medical devices and vision correction technologies can slow the introduction and acceptance of substitutes.

- Medical Endorsement: The extent to which doctors, audiologists, and optometrists recommend or prescribe substitutes directly impacts their perceived credibility and adoption rates.

- Insurance Coverage: Reimbursement policies for substitutes play a crucial role; if insurers cover alternative solutions more readily than Synsam's core offerings, the threat increases.

- Technological Advancements: Innovations in areas like augmented reality glasses or advanced digital hearing solutions could offer compelling alternatives that gain rapid medical and consumer traction.

The threat of substitutes for Synsam is substantial, driven by advancements in vision correction surgery like LASIK and the growing accessibility of over-the-counter (OTC) hearing aids. These alternatives offer different value propositions, from long-term vision freedom to increased convenience, potentially diverting customers from traditional eyewear and professionally fitted hearing solutions.

The increasing acceptance and technological improvements in alternatives like advanced contact lenses and refractive surgery are key drivers. For instance, the global contact lens market reached approximately $11.6 billion in 2023, indicating a strong and growing consumer base for these substitutes.

Furthermore, regulatory changes, such as the FDA's 2022 rule allowing OTC hearing aids, significantly lower barriers to entry for competing solutions. This regulatory shift, combined with evolving consumer perceptions and technological innovation, amplifies the competitive pressure from substitutes.

The perceived switching costs, encompassing financial outlay, emotional attachment to current solutions, and convenience factors, play a crucial role in moderating this threat for Synsam.

| Substitute Category | Example | 2024 Estimated Cost (Typical) | Key Advantage | Potential Impact on Synsam |

|---|---|---|---|---|

| Vision Correction Surgery | LASIK | $2,000 - $4,000 per eye | Long-term vision correction, eliminates ongoing eyewear costs | Reduces demand for eyeglasses and contact lenses |

| Contact Lenses | Multifocal/Extended Wear | $30 - $50 per month (plus solutions) | Convenience, aesthetic preference | Direct competitor to eyeglasses |

| Hearing Solutions | OTC Hearing Aids | $100 - $1,000+ per device | Accessibility, lower upfront cost than custom aids | Challenges traditional hearing aid sales |

Entrants Threaten

Establishing a presence in the Nordic optical retail market demands substantial financial backing. Consider the costs associated with securing prime retail locations, stocking a diverse range of eyewear and contact lenses, and investing in advanced diagnostic equipment like autorefractors and slit lamps. In 2024, rental costs for desirable retail spaces across major Nordic cities can easily run into tens of thousands of euros per month, with initial store fit-outs often exceeding €100,000. Furthermore, significant marketing budgets are necessary to build brand awareness and attract customers, potentially adding another €50,000 to €100,000 in the first year.

Synsam benefits significantly from economies of scale and its established experience curve. As a large, established player in the eyewear market, Synsam can leverage bulk purchasing power to secure lower prices on frames, lenses, and accessories. This allows them to offer competitive pricing to consumers, a feat difficult for new entrants to replicate without substantial initial investment.

Furthermore, Synsam's long operational history has honed its supply chain management and customer acquisition processes. Their efficient logistics reduce operational costs, and their existing brand recognition and customer loyalty make acquiring new customers more cost-effective than for a startup. For example, in 2024, Synsam reported a revenue of SEK 4,495 million, indicating a scale that new entrants would find challenging to immediately match, thus presenting a significant barrier.

Synsam enjoys considerable brand recognition and customer loyalty across the Nordic region, a significant barrier to new entrants. This loyalty is further bolstered by their innovative subscription services, which lock customers into ongoing relationships and recurring revenue streams. For instance, Synsam's subscription models, offering regular eyewear upgrades and maintenance, create tangible value that new competitors must convincingly replicate to attract customers.

Access to Distribution Channels and Supply Chains

New optical retailers face considerable hurdles in accessing established distribution channels and supply chains, making market entry difficult. Securing prime physical retail locations and developing sophisticated, user-friendly online platforms require substantial investment and existing relationships, which newcomers often lack.

Synsam's advantage lies in its expansive network, boasting close to 600 stores across the Nordics. This vast physical presence, coupled with well-developed logistics and strong ties with key optical suppliers and manufacturers, creates a formidable barrier for potential new entrants. Their integrated supply chain ensures efficiency and cost advantages that are hard for new players to replicate.

- Distribution Channel Access: Synsam's nearly 600 physical stores and established e-commerce platforms offer significant reach, making it difficult for new entrants to compete on accessibility.

- Supply Chain Relationships: Long-standing partnerships with key optical manufacturers and suppliers provide Synsam with preferential terms and reliable inventory, a challenge for new businesses to match.

- Brand Recognition and Trust: Synsam's established brand presence in its markets fosters customer loyalty, further complicating market entry for new, unproven competitors.

Regulatory Requirements and Optometry Expertise

The threat of new entrants in the optical retail sector, particularly for businesses offering comprehensive optometry services like Synsam, is significantly mitigated by stringent regulatory requirements and the necessity of specialized optometric expertise. Operating an optical business demands adherence to a complex web of regulations, including licensing for optometrists, which ensures a baseline of professional competence and patient safety. For instance, in many European countries, optometrists must complete rigorous academic programs and pass professional examinations to obtain their licenses. This professional barrier is crucial, as it ensures that services involving eye health are delivered by qualified individuals, making it difficult for purely online or less clinically-focused newcomers to compete effectively.

These regulatory hurdles extend to health standards and data privacy, particularly concerning patient records. Businesses must comply with national and international health regulations, such as GDPR in Europe, when handling sensitive customer information. The capital investment and operational complexity associated with meeting these standards, alongside the need for physical locations or partnerships to provide in-person eye examinations, create substantial barriers. For example, establishing a brick-and-mortar clinic often involves significant upfront costs for equipment and leasehold improvements, in addition to the ongoing expenses of maintaining a qualified clinical staff.

- Licensing Requirements: Optometrists require specific professional licenses, varying by jurisdiction, which involves extensive education and examination.

- Health and Safety Standards: Adherence to strict health and safety protocols in clinical settings is mandatory, impacting operational setup.

- Data Protection: Compliance with data privacy laws like GDPR is essential for handling patient health information.

- Clinical Expertise: The need for qualified optometrists and opticians is a fundamental requirement that demands specialized human capital.

The threat of new entrants for Synsam is considerably low due to high capital requirements and established brand loyalty. Newcomers face substantial costs for prime retail locations, inventory, and advanced equipment, with rental costs in Nordic cities often reaching tens of thousands of euros monthly in 2024. Synsam's established economies of scale, efficient supply chain, and nearly 600-store network create significant barriers.

| Barrier Type | Description | Impact on New Entrants | Synsam's Advantage |

|---|---|---|---|

| Capital Requirements | High costs for retail space, inventory, and equipment. | Significant financial hurdle. | Leverages existing infrastructure and scale. |

| Brand Loyalty & Recognition | Established customer base and trusted brand. | Difficult to attract customers from incumbents. | Strong customer relationships and subscription models. |

| Distribution & Supply Chain | Extensive store network and supplier relationships. | Challenging to match accessibility and sourcing terms. | Nearly 600 stores and preferential supplier agreements. |

| Regulatory & Expertise | Licensing, health standards, and specialized staff. | Complex compliance and need for qualified personnel. | Established compliance framework and professional staff. |

Porter's Five Forces Analysis Data Sources

Our Synsam Porter's Five Forces analysis leverages a comprehensive mix of data sources, including Synsam's annual reports, industry-specific market research from firms like Euromonitor, and competitor financial disclosures to provide a robust understanding of the competitive landscape.