Synaxon AG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synaxon AG Bundle

Synaxon AG's strengths lie in its established IT distribution network and partnerships, providing a solid foundation for growth. However, the company faces challenges related to market competition and the rapid pace of technological change, which could impact its opportunities.

While Synaxon AG possesses significant market reach, its reliance on specific product categories presents a potential vulnerability. Understanding these nuances is key to unlocking its full potential.

Want the full story behind Synaxon AG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Synaxon AG's extensive European partner network, numbering over 3,200 and exceeding 4,500 partners across the continent, is a significant strength. This broad reach cultivates strong customer loyalty and firmly establishes its position in the IT channel.

This vast network enables Synaxon AG to generate substantial synergies and operational efficiencies within the IT ecosystem. It provides a solid bedrock for the company's ongoing business activities and market engagement.

The sheer volume of partners amplifies Synaxon AG's collective purchasing power, a crucial advantage in negotiations and cost management. This also bolsters its market penetration capabilities, particularly in vital economic zones such as Germany, Austria, Switzerland (DACH), and the United Kingdom.

Synaxon AG's significant purchasing volume, which reached €3.2 billion in 2024, is a major strength. This aggregated buying power allows them to negotiate highly favorable terms with IT vendors and distributors. This directly benefits their partners by ensuring competitive pricing and better product availability, ultimately boosting partner profitability and market standing.

Synaxon AG's strength lies in its diverse service portfolio, extending well beyond basic distribution. They offer managed services, marketing assistance, IT project support, and even franchise licenses, creating multiple avenues for revenue and partner engagement.

The company has strategically expanded into high-growth sectors. A new cybersecurity platform, launched in February 2025, and a Device-as-a-Service (DaaS) solution, introduced in August 2024, are prime examples. These initiatives significantly diversify revenue streams, reducing dependence on traditional hardware sales.

This multi-faceted service approach allows Synaxon AG to effectively cater to the ever-changing demands of the market. By offering a broad spectrum of solutions, they also significantly strengthen the capabilities of their partners, fostering a more robust ecosystem.

Strong Market Position in DACH Region

Synaxon AG commands a leading market position and boasts significant brand recognition within the DACH region. This core market, encompassing Germany, Austria, and Switzerland, represented a substantial 65% of the company's total sales in 2024, underscoring its deep market penetration and established customer trust.

This strong foothold in the DACH region translates into a stable and considerable revenue stream for Synaxon AG. The company's success is built on effective, localized strategies tailored to the specific needs of its business-to-business clientele in these key European markets, solidifying its competitive advantage.

- Leading Market Share: Dominant presence in Germany, Austria, and Switzerland.

- Brand Recognition: High level of trust and awareness among B2B customers.

- Revenue Stability: DACH region contributed 65% of 2024 sales.

- Localized Strategy: Effective approach tailored to regional B2B market needs.

Proven Adaptability and Financial Resilience

Synaxon AG has consistently shown its ability to thrive even when the economic climate is tough. This financial resilience means they can handle unexpected challenges, which is a major strength. For instance, despite the global economic headwinds and supply chain disruptions experienced throughout 2024, Synaxon AG managed to achieve growth.

Looking ahead, projections for 2025 indicate this positive trajectory is set to continue, further solidifying their adaptability. This consistent performance, even during difficult periods, points to a strong underlying business model and smart decision-making by the company's leadership.

- Proven Adaptability: Synaxon AG has navigated economic downturns and supply chain issues effectively.

- Financial Resilience: The company demonstrated positive financial performance in challenging market conditions.

- Continued Growth: Synaxon AG maintained growth in 2024 and is forecasted to continue this trend in 2025.

- Robust Business Model: This consistent performance highlights a solid business strategy and foresight.

Synaxon AG's expansive European partner network, exceeding 4,500 entities, is a cornerstone of its strength. This extensive reach, particularly in key markets like the DACH region, which accounted for 65% of its 2024 sales, fosters deep customer loyalty and market penetration.

The company's substantial purchasing volume, reaching €3.2 billion in 2024, grants significant negotiation power with vendors, translating into competitive pricing and improved product availability for its partners.

Synaxon AG's diverse service portfolio, including managed services and IT project support, coupled with strategic expansion into areas like cybersecurity and Device-as-a-Service (DaaS) as of August 2024, diversifies revenue and strengthens partner capabilities.

The company's proven financial resilience, demonstrated by its ability to achieve growth throughout 2024 despite economic headwinds and supply chain disruptions, points to a robust business model and effective leadership.

| Strength | Description | Supporting Data (2024/2025) |

| Extensive Partner Network | Broad European reach cultivating customer loyalty and market presence. | Over 4,500 partners; DACH region 65% of sales. |

| Significant Purchasing Power | Ability to negotiate favorable terms due to aggregated buying volume. | €3.2 billion purchasing volume. |

| Diversified Service Portfolio | Offering of managed services, marketing support, and new tech solutions. | Launched DaaS (Aug 2024), Cybersecurity platform (Feb 2025). |

| Financial Resilience & Adaptability | Consistent growth achieved during challenging economic periods. | Achieved growth in 2024 despite headwinds; positive 2025 projections. |

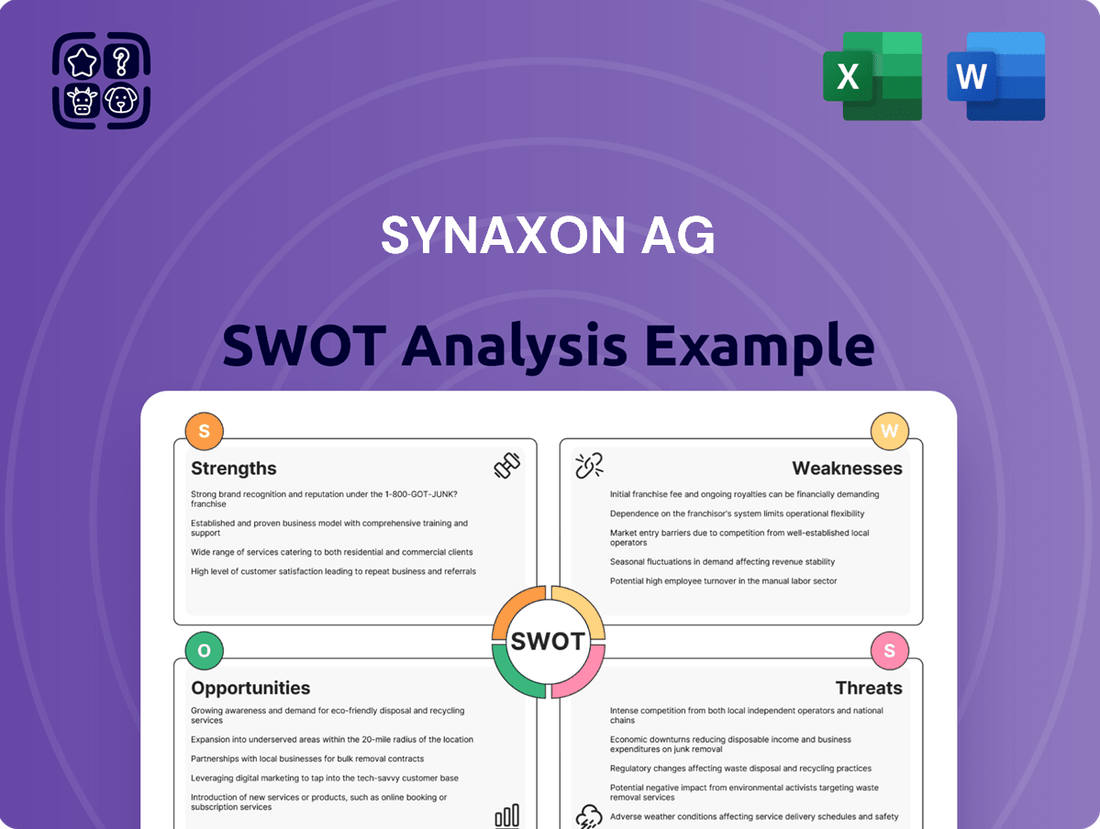

What is included in the product

Delivers a strategic overview of Synaxon AG’s internal and external business factors, identifying key strengths and opportunities alongside potential weaknesses and threats.

Offers a clear, organized overview of Synaxon AG's strategic landscape, simplifying complex market dynamics for actionable insights.

Weaknesses

Synaxon AG's significant reliance on hardware sales presents a notable weakness. This revenue stream is increasingly vulnerable as the IT industry rapidly shifts towards cloud-based solutions. For instance, the global cloud computing market was valued at an estimated $610.4 billion in 2023 and is projected to grow significantly, indicating a declining share for traditional hardware in many IT budgets.

This increasing "cloudification" directly erodes the demand for on-premise hardware, a core component of Synaxon AG's historical business model. As businesses opt for scalable, subscription-based cloud services, the need for physical servers and related equipment diminishes, posing a direct threat to a substantial portion of their income.

Consequently, Synaxon AG faces pressure to accelerate its transition to service-oriented offerings. Failure to successfully pivot and develop robust service portfolios could leave the company exposed to declining hardware revenues without adequate compensatory growth in new areas, impacting its long-term financial stability.

Synaxon AG faces a significant hurdle as its primary customer base, independent IT service providers, is shrinking. Reports indicate that between 500 and 1,500 of these businesses leave the market each year, out of an estimated total of 18,000. This contraction isn't driven by a lack of work, as many of these firms are reportedly well-booked, but rather by factors like owner retirement or an inability to keep pace with industry changes.

Synaxon AG faces hurdles when trying to expand beyond its core DACH (Germany, Austria, Switzerland) market. Replicating the strong foothold it has in this region proves difficult in new European territories.

While the United Kingdom market demonstrated a promising 15% year-over-year growth in 2024, achieving the same level of partner engagement as in Germany, where it boasts over 3,000 partners, demands significant and ongoing investment. This requires developing highly specific strategies for each new market.

The diverse market dynamics across different European countries can hinder consistent and uniform growth, making a one-size-fits-all approach ineffective for international scaling.

Intense Competitive Landscape

Synaxon AG operates within a fiercely competitive IT distribution and services sector, facing a multitude of rivals, including substantial global entities. The market is populated by over 1085 active competitors, compelling Synaxon to prioritize continuous innovation and unique value propositions to secure its market position and engage new partners. This intense rivalry can strain operational budgets and demand constant strategic recalibration.

The sheer volume of competitors, exceeding 1085 active players, presents a significant challenge. This necessitates substantial investment in marketing and product development to stand out. For instance, in 2024, the IT distribution market saw significant consolidation, with larger players acquiring smaller ones, further intensifying the pressure on companies like Synaxon to maintain competitive pricing and service levels.

- Market Saturation: Over 1085 active competitors create a crowded marketplace.

- Global Players: Large international companies possess greater resources for R&D and market penetration.

- Innovation Demands: Constant need to develop new services and adapt to technological shifts to avoid obsolescence.

- Price Sensitivity: High competition often leads to price wars, impacting profit margins.

Vulnerability to External Economic Factors

Synaxon AG faces significant risks from broader economic downturns and disruptions within global supply chains, both of which can directly impact its operating expenses and overall profitability. For example, the cost of essential components saw a notable increase of 15% in 2024, underscoring the company's susceptibility to external market forces and their volatility.

These market fluctuations have the potential to significantly reduce profit margins. Consequently, Synaxon AG may be compelled to either increase its prices, which could affect sales volume, or absorb these higher costs, thereby diminishing its financial performance. This exposure highlights a key vulnerability in its business model.

- Economic Downturns: Synaxon AG's revenue and profitability are sensitive to reductions in consumer and business spending during economic slowdowns.

- Supply Chain Disruptions: Interruptions in the availability or transportation of critical components, as seen with a 15% price hike in 2024, directly inflate costs.

- Inflationary Pressures: Rising inflation can increase operational costs, from raw materials to logistics, squeezing margins if not passed on to customers.

- Geopolitical Instability: International conflicts or trade disputes can disrupt supply routes and affect component sourcing, leading to unpredictable cost increases and potential stockouts.

Synaxon AG's heavy reliance on hardware sales is a significant vulnerability, especially as the IT sector increasingly embraces cloud solutions. For example, the global cloud market's projected growth highlights a shrinking role for traditional hardware in IT investments.

The diminishing demand for on-premise hardware, due to the rise of scalable cloud services, directly impacts Synaxon AG's core business. This necessitates a swift pivot to service-based offerings to offset declining hardware revenues and ensure long-term financial stability.

Synaxon AG faces challenges in expanding beyond its established DACH region, with the UK market showing 15% growth in 2024 but still lagging behind Germany's partner engagement. This requires tailored strategies for each new market to achieve comparable success.

The company contends with intense competition, with over 1085 active competitors. This environment demands continuous innovation and unique value propositions to maintain market position, particularly as larger players consolidate, as seen in 2024.

Preview Before You Purchase

Synaxon AG SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual Synaxon AG SWOT analysis file. The complete version of this in-depth analysis becomes available after checkout, offering a comprehensive understanding of the company's strategic position.

Opportunities

The increasing need for managed IT services and strong cybersecurity is a major chance for Synaxon AG. The cybersecurity market is projected to reach $300 billion by 2025, showing substantial room for growth.

Synaxon's introduction of a new cybersecurity platform in February 2025, alongside partnerships for Device-as-a-Service (DaaS), demonstrates a clear strategic push into these lucrative sectors. These moves are well-timed to capture market share.

By growing its offerings in managed services and cybersecurity, Synaxon can build a more predictable, recurring revenue stream. This also enhances the value and capabilities offered to its partners, meeting a critical demand in the business landscape.

Synaxon AG is actively pursuing strategic partnerships and acquisitions to broaden its offerings and market presence. Recent collaborations, such as the integration of Lywand Software GmbH's cybersecurity solutions and Topi's Device-as-a-Service (DaaS), highlight this strategy. Furthermore, strengthening distribution through partners like Nestec and Infinigate allows Synaxon to reach a wider customer base with advanced technologies.

Building on its strong performance, including 15% growth in the UK market during 2024, Synaxon AG is well-positioned to expand its reach across other European nations. This presents a significant opportunity for further international market penetration.

By adapting its successful strategies from the DACH region and tailoring them to local market nuances, Synaxon AG can tap into new revenue streams and bolster its European market share. This localization effort is key to unlocking untapped potential.

Consistent and strategic investment in these target European markets will be vital for achieving sustainable, long-term expansion and cementing Synaxon AG's presence across the continent.

Leveraging Emerging Technologies like AI

The rapid evolution of artificial intelligence and other cutting-edge technologies presents a significant opportunity for Synaxon to streamline its internal operations, create novel service offerings, and bolster its platform capabilities. Discussions at the 2025 SYNAXON Partner-Geschäftsführertagung underscored a strategic imperative to prepare for technological shifts, including AI integration, indicating a proactive approach to leveraging these advancements. This strategic focus can translate into enhanced operational efficiency and the development of compelling new value propositions for Synaxon's partners.

By embracing AI, Synaxon can unlock new avenues for growth and competitive advantage. For instance, AI-powered analytics can provide deeper insights into market trends and partner needs, enabling more targeted service development. Furthermore, AI can automate routine tasks, freeing up resources for innovation and strategic initiatives. This proactive stance on technology adoption is crucial for maintaining relevance and driving future success in the dynamic IT services market.

- AI-driven process optimization: Automating tasks like data analysis and customer support can boost efficiency.

- Development of innovative services: Creating AI-powered solutions for partners can open new revenue streams.

- Enhanced platform offerings: Integrating AI features into existing platforms can improve user experience and functionality.

- Competitive differentiation: Early adoption of AI can position Synaxon as a technology leader in the IT services sector.

Addressing the IT Skills Shortage

The persistent shortage of IT talent presents a significant opportunity for Synaxon AG. By offering automated solutions and comprehensive training, Synaxon can become an indispensable partner for IT service providers struggling with staffing. For instance, the Lywand platform's automated security audits directly address the limited personnel available to conduct such crucial tasks, allowing partners to expand their services.

This strategic positioning not only helps Synaxon's partners overcome their operational hurdles but also deepens their reliance on Synaxon's ecosystem. By equipping its partners with the necessary tools and skills, Synaxon reinforces its value proposition and fosters a more robust network. The IT skills gap is a well-documented issue, with reports in late 2024 and early 2025 indicating millions of unfilled cybersecurity roles globally, making Synaxon's support even more critical.

- Key Opportunity: Leverage the IT skills deficit to become a primary solutions provider.

- Synaxon's Role: Offer automation, training, and support to bridge the talent gap for partners.

- Example Solution: Lywand platform automates security audits, alleviating partner staff constraints.

- Strategic Benefit: Strengthen the Synaxon ecosystem by empowering partners and expanding their service capabilities.

Synaxon AG can capitalize on the expanding cybersecurity market, which is expected to reach $300 billion by 2025, by leveraging its new cybersecurity platform and strategic partnerships. The company's proactive integration of solutions like Lywand Software GmbH's cybersecurity offerings and Topi's Device-as-a-Service (DaaS) positions it to capture significant market share in these high-demand areas.

Further expansion into new European markets, building on a 15% growth in the UK during 2024, presents a substantial opportunity. By adapting its successful DACH region strategies, Synaxon can unlock new revenue streams and increase its continental market presence.

The integration of AI technologies offers Synaxon a chance to optimize internal processes and develop innovative services. This strategic embrace of advancements, highlighted at the 2025 SYNAXON Partner-Geschäftsführertagung, can lead to enhanced efficiency and competitive differentiation.

Addressing the IT talent shortage is another key opportunity. Synaxon can become a crucial partner by providing automated solutions and training, as demonstrated by the Lywand platform’s automated security audits, thereby empowering its partners and deepening their reliance on Synaxon's ecosystem.

Threats

The ongoing shift towards cloud computing, often referred to as accelerated cloudification, presents a considerable challenge for Synaxon AG. This trend directly impacts the demand for traditional IT hardware, a segment that has historically been a substantial revenue generator for the company. As businesses increasingly migrate their operations and data to cloud-based solutions, the need for on-premises hardware diminishes.

This migration is not a minor adjustment; it represents a fundamental change in IT expenditure. Reports indicate that the cloud's share of total IT spending is seeing robust growth, projected to increase by approximately 20% year-over-year. This rapid expansion of cloud services means that companies like Synaxon must proactively adapt their strategies to remain competitive and financially viable in this evolving landscape.

The core threat lies in the potential for a significant decline in revenue if Synaxon's business model does not evolve swiftly to align with this cloud-centric IT environment. A failure to pivot effectively could result in a loss of market share and a decrease in overall profitability, making strategic adaptation a critical imperative for the company's continued success.

The IT distribution and services landscape is a battleground with 1085 active competitors, a number that underscores the fierce rivalry Synaxon AG faces. This crowded market isn't just about sheer numbers; it's also about significant consolidation, meaning larger, financially robust players are consistently emerging or strengthening their positions. This trend directly pressures Synaxon's ability to maintain and grow its market share and, consequently, its profitability.

As these larger entities consolidate power, they often wield greater influence with suppliers and can offer more aggressive pricing or bundled solutions to customers. This dynamic forces Synaxon to constantly evaluate its own value proposition and operational efficiency. The ongoing consolidation means that even established competitors are evolving, making it imperative for Synaxon to stay ahead of the curve in terms of innovation and service delivery to remain competitive.

The constant need to innovate is not a suggestion but a necessity for survival. Synaxon must continuously develop new services, optimize its distribution channels, and enhance its partner ecosystem to counter the aggressive market entries and expansions from rivals. Failing to do so risks being outmaneuvered by competitors who can leverage scale and capital for rapid growth and market penetration.

Economic instability and persistent inflation represent significant threats to Synaxon AG. For instance, component prices saw a substantial 15% surge in 2024, directly impacting operational costs and potentially squeezing profit margins.

These macroeconomic conditions can lead to reduced IT spending by businesses, affecting Synaxon's sales volumes and overall revenue generation. A potential economic downturn could further exacerbate these challenges, making it harder to maintain growth.

To counter these threats, Synaxon AG must focus on robust risk management strategies and develop flexible pricing models. This agility will be key to navigating the volatile economic landscape and protecting its financial stability.

Supply Chain Disruptions

Global supply chain vulnerabilities remain a significant threat, impacting the availability and timely delivery of IT products for Synaxon AG. The ongoing geopolitical tensions and the lingering effects of the pandemic have exposed fragilities in international logistics networks. For instance, in late 2024, the semiconductor industry, crucial for IT hardware, continued to face allocation challenges, with lead times for certain components extending by an average of 10-15% compared to early 2024, impacting production schedules across the sector.

Dependencies on a stable supply chain expose Synaxon AG to the risk of product shortages and increased logistics costs. A disruption, such as port congestion or unexpected freight rate hikes, could directly affect inventory levels and the ability to fulfill partner orders promptly. Freight costs for ocean shipping, while easing from 2023 peaks, remained volatile in early 2025, with some key routes experiencing 5-10% price increases due to capacity constraints.

The inability to meet partner demands due to supply chain issues can severely damage relationships and Synaxon AG's market reputation. Consistent delays or stockouts can lead partners to seek more reliable suppliers, impacting future sales and market share. In 2024, customer satisfaction surveys for IT distributors indicated that supply chain reliability was a key differentiator, with an average of 60% of partners stating they would switch providers if delivery promises were consistently broken.

- Continued Geopolitical Instability: Ongoing international conflicts and trade disputes can disrupt shipping routes and increase the cost of goods.

- Component Shortages: Persistent issues in semiconductor manufacturing and raw material sourcing can lead to extended lead times for essential IT components.

- Logistics Bottlenecks: Port congestion, labor shortages in the transportation sector, and rising fuel prices can all contribute to delivery delays and increased costs.

- Impact on Partner Relations: Failure to deliver products on time can erode trust and lead to a loss of business from key partners.

Rapid Technological Obsolescence and Disruption

The IT sector is a prime example of rapid innovation, where yesterday's cutting-edge technology can quickly become obsolete. For Synaxon AG, this means a constant need to upgrade its product portfolio and ensure its partners are equipped with the latest knowledge. Failing to keep pace with disruptive forces, such as the increasing adoption of cloud-native architectures and the rise of AI-driven solutions, could significantly impact Synaxon AG's market position and its ability to deliver value.

Consider the pace of change: in 2024, the global IT spending was projected to reach over $5 trillion, with a significant portion dedicated to new technologies like artificial intelligence and cybersecurity. Synaxon AG's success hinges on its agility in integrating these advancements into its service offerings and training programs. For instance, a failure to adapt to the growing demand for edge computing solutions could leave its partners at a disadvantage.

- Rapid obsolescence: Existing IT products and services can quickly lose their relevance due to swift technological progress.

- Investment imperative: Synaxon AG must continuously invest in R&D and partner education to remain competitive.

- Disruptive innovation: Emerging technologies pose a threat if Synaxon AG doesn't adapt its offerings and value proposition.

- Market relevance: Failure to adapt risks diminishing Synaxon AG's competitiveness and partner value.

The increasing dominance of cloud computing poses a threat to Synaxon AG's traditional hardware business. As businesses shift to cloud solutions, demand for on-premises hardware is declining, impacting a key revenue stream. This trend is accelerating, with cloud spending projected to grow significantly year-over-year, necessitating a swift strategic adaptation by Synaxon to maintain relevance and profitability.

Intense market competition, characterized by ongoing consolidation, presents another significant challenge for Synaxon AG. Larger, well-capitalized competitors can leverage economies of scale to offer more aggressive pricing and bundled solutions. This forces Synaxon to continuously innovate its services and distribution channels to avoid being outmaneuvered by rivals who benefit from greater financial resources and market influence.

Macroeconomic factors like economic instability and inflation directly impact Synaxon AG's operational costs and sales potential. Rising component prices, such as the 15% surge observed in 2024, squeeze profit margins. Furthermore, potential reductions in business IT spending during economic downturns can lead to decreased sales volumes, making robust risk management and flexible pricing models crucial for financial stability.

Global supply chain vulnerabilities continue to threaten Synaxon AG's ability to deliver products reliably and cost-effectively. Geopolitical tensions and pandemic after-effects have led to component shortages, as seen with extended semiconductor lead times, and volatile freight costs. In 2024, supply chain reliability was a critical factor for IT distributors, with a significant percentage of partners indicating a willingness to switch suppliers due to consistent delivery failures.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Synaxon AG's official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-informed strategic overview.