Synaxon AG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synaxon AG Bundle

Navigate the dynamic landscape surrounding Synaxon AG with our comprehensive PESTLE analysis. Understand the crucial political, economic, social, technological, legal, and environmental factors that are actively shaping its operations and future trajectory. This detailed report offers actionable intelligence, empowering you to anticipate challenges and capitalize on emerging opportunities. Unlock a deeper understanding of Synaxon AG's strategic positioning and gain a significant competitive advantage. Download the full PESTLE analysis now to make informed decisions and drive your business forward.

Political factors

Government IT policies in the DACH region and across Europe are a significant driver for Synaxon AG. A key focus for many governments, including Germany and Switzerland, is the acceleration of digital transformation. For instance, Germany's Digital Strategy 2025 aimed to bolster digitalization across various sectors, and subsequent initiatives continue this trend. These policies often include funding and support programs designed to encourage businesses, especially small and medium-sized enterprises (SMEs), to adopt new IT solutions. Such government backing directly translates into increased market opportunities for Synaxon's partners, who provide these essential IT services and products.

The push for digitalization of public services, often referred to as e-government, is another crucial element. Countries like Austria have been actively working to digitize administrative processes and citizen services. This creates a substantial demand for IT infrastructure, software, and consulting services, areas where Synaxon's network of IT system houses and service providers are well-positioned to contribute. The success of these public sector digitalization projects can also spill over into the private sector, encouraging further IT investment.

However, the IT market's growth is not without its political sensitivities. Shifts in government priorities or changes in budget allocations for IT infrastructure and digital initiatives can create uncertainty. For example, a change in political administration might lead to a re-evaluation of existing digital strategies or a redirection of public funds. Such shifts could potentially slow down the pace of IT adoption or alter the specific areas of technology that receive government support, thereby impacting Synaxon AG's market dynamics.

Synaxon AG's European focus makes it particularly sensitive to shifts in global trade policies and regional political climates. For instance, a resurgence of protectionist measures or trade disputes between major economic blocs could lead to increased tariffs on imported IT components, directly impacting Synaxon's cost of goods sold and potentially its pricing strategies. The World Trade Organization (WTO) reported a slowdown in global trade growth in 2023, a trend that could continue if geopolitical tensions escalate.

Geopolitical instability within Europe, such as conflicts or significant political realignments, poses a direct threat to Synaxon's operational continuity. Disruptions in key logistics hubs or unforeseen changes in regulatory environments within countries where Synaxon operates or sources its products can create significant supply chain vulnerabilities. For example, the ongoing geopolitical situation in Eastern Europe has already demonstrated the potential for widespread supply chain disruptions across various industries, including technology.

The digital economy's regulatory environment is a significant political factor for Synaxon AG. Governments worldwide are increasingly focusing on data localization requirements, digital services taxes, and updated competition laws, all of which directly impact how companies like Synaxon operate. For instance, the European Union's Digital Services Act (DSA) and Digital Markets Act (DMA), fully in effect since February 2024, impose stringent rules on online platforms regarding content moderation, advertising transparency, and fair competition among digital gatekeepers, potentially affecting Synaxon's partner ecosystem.

Stricter compliance with these evolving regulations can lead to increased operational costs for Synaxon and its partners, particularly concerning data handling and market practices. Conversely, a more predictable and supportive regulatory framework could encourage innovation and facilitate Synaxon's expansion into new markets. In 2024, many nations are still refining their digital tax policies, with ongoing discussions and potential implementations that could alter the financial landscape for technology service providers.

Government Support for IT Channel and SMEs

Government initiatives designed to bolster the IT channel and small and medium-sized enterprises (SMEs) directly benefit Synaxon AG by strengthening its partner network. For instance, in 2024, the German federal government continued its focus on digitalizing SMEs through various funding programs, potentially increasing demand for IT solutions facilitated by Synaxon's platform. These programs often include subsidies for cloud adoption and cybersecurity enhancements, which are key areas for Synaxon's partners.

Financial incentives, such as tax credits for IT investments or grants for employee training in digital skills, can significantly boost the business volume processed through Synaxon's ecosystem. For example, the EU's Digital Europe Programme, with a budget of €7.5 billion for 2021-2027, supports digital transformation initiatives across member states, indirectly benefiting Synaxon by fostering a more robust digital market for its partners. This kind of support is vital for ensuring a vibrant and competitive landscape for IT retailers and service providers.

- Increased IT Spending: Government support often translates to higher IT expenditure by SMEs, driving more transactions through Synaxon's partners.

- Cybersecurity Focus: Programs promoting cybersecurity upgrades directly benefit Synaxon's partners offering security solutions.

- Skills Development: Funding for training IT professionals enhances the capabilities of Synaxon's partner network.

- Digital Transformation: Broader government digital agendas create a more favorable market for IT services and products distributed via Synaxon.

Political Stability and Investment Climate in DACH Region

Political stability in the DACH region significantly bolsters Synaxon AG's operating environment by fostering business confidence and encouraging sustained investment in IT infrastructure. For instance, Germany, Austria, and Switzerland consistently rank high in global political stability indices, creating a predictable landscape for business operations. This stability directly translates into a more receptive market for Synaxon's platform, as businesses feel secure in committing to IT upgrades and service subscriptions.

Conversely, any perceived political uncertainty could dampen investment appetite. Businesses might adopt a more cautious stance, leading to reduced IT spending and slower adoption of new technologies. This cautious behavior among Synaxon AG's partners and end-customers directly impacts the company's growth trajectory and revenue potential. For example, a sudden shift in government policy or geopolitical tensions could trigger a wait-and-see approach from key clients.

- Germany's Federal Government coalition stability: The current coalition's ability to navigate legislative challenges and economic policy decisions directly influences business sentiment.

- Switzerland's neutral foreign policy: This long-standing neutrality provides a bedrock of stability, attracting international business and investment, which benefits Synaxon's cross-border operations.

- Austria's economic policies: Government initiatives supporting digitalization and innovation can create favorable conditions for IT service providers like Synaxon.

- European Union regulatory alignment: Changes in EU-wide regulations that affect data privacy or digital markets can have a ripple effect on the DACH region's investment climate.

Government IT policies are a significant driver for Synaxon AG, with a strong focus on digital transformation across Europe, particularly in Germany and Switzerland. Initiatives like Germany's Digital Strategy 2025 and the push for e-government in countries like Austria create substantial demand for IT solutions, benefiting Synaxon's partner network. However, shifts in government priorities or budget allocations can introduce market uncertainty.

Synaxon AG is sensitive to global trade policies and regional political climates, as protectionist measures or trade disputes can increase tariffs on IT components, impacting costs. Geopolitical instability, such as conflicts in Eastern Europe, poses direct threats to supply chains and regulatory environments. The EU's Digital Services Act and Digital Markets Act, fully in effect since February 2024, impose stringent rules on digital platforms, influencing how Synaxon and its partners operate and potentially increasing compliance costs.

Government initiatives supporting the IT channel and SMEs, like Germany's continued focus on SME digitalization in 2024, directly benefit Synaxon by strengthening its partner network. Financial incentives, such as the EU's Digital Europe Programme (€7.5 billion for 2021-2027), foster a more robust digital market. Political stability in the DACH region, with Germany, Austria, and Switzerland consistently ranking high in stability indices, fosters business confidence and sustained IT investment, creating a predictable market for Synaxon.

What is included in the product

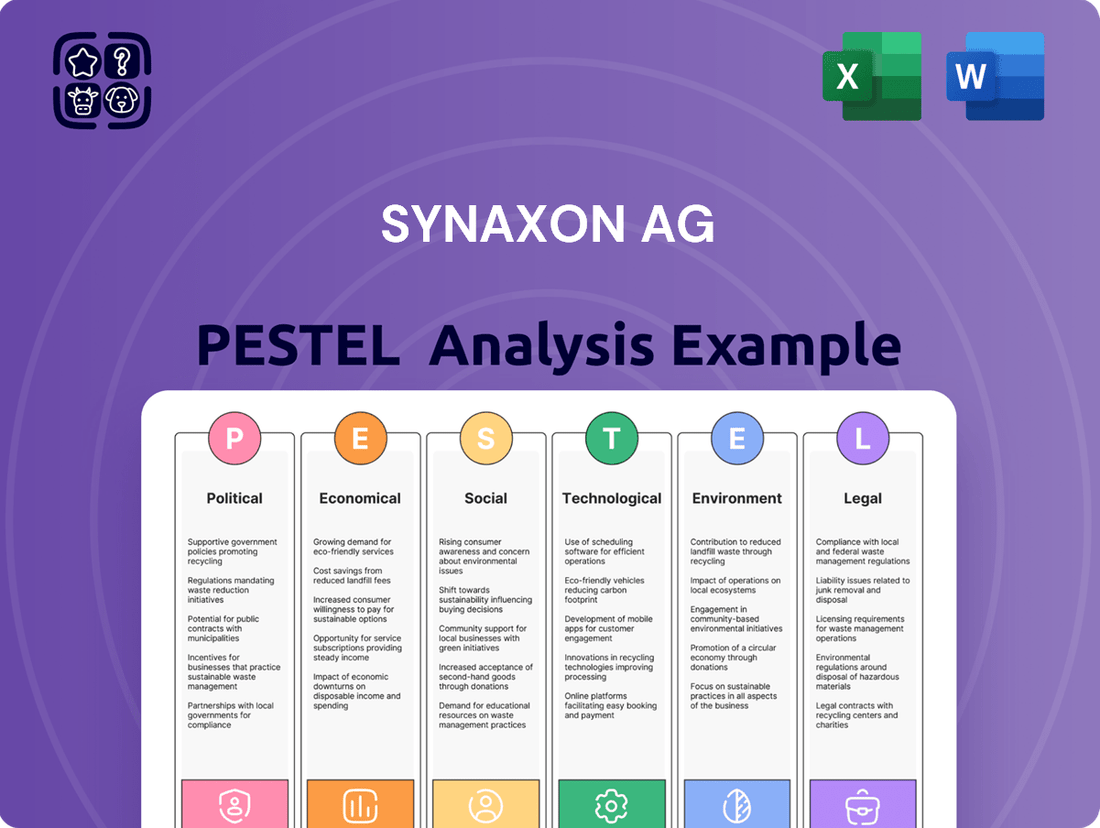

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Synaxon AG, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats shaped by current market trends and regulatory landscapes.

Provides a concise version of Synaxon AG's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, thereby simplifying strategic discussions.

Economic factors

The economic climate in Europe, especially within the DACH region, is a significant driver for IT expenditures by both businesses and individuals. A positive outlook for 2025 forecasts a 3.6% increase in collective sales for the European IT distribution market, signaling favorable conditions for Synaxon AG.

Conversely, economic slowdowns or recessions typically result in decreased IT investment and reduced order volumes for Synaxon's business partners. For instance, if economic growth falters, companies might postpone upgrades or new technology purchases, directly impacting Synaxon's sales channels.

Rising inflation in 2024 and projected into 2025 is a significant concern for Synaxon AG. This trend directly impacts operational costs, with increased expenses anticipated for raw materials, supply chain services, and employee compensation. For instance, if inflation reaches the 3-4% range, as some forecasts suggest for key European markets, Synaxon's procurement and logistics budgets could see substantial upward pressure, potentially squeezing profit margins.

Interest rate fluctuations present another complex economic factor. Central banks, like the European Central Bank, have been adjusting rates to combat inflation. Higher interest rates in 2024-2025 make borrowing more expensive for Synaxon AG, impacting its ability to finance new ventures or capital expenditures. Furthermore, it increases the cost of financing for Synaxon's business partners who rely on credit to fund IT projects, potentially slowing down demand for Synaxon's services and products.

Global supply chain disruptions continue to be a significant factor affecting the IT component market, directly influencing Synaxon AG's capacity to deliver purchasing advantages. The German component distribution market experienced a notable downturn, with a 35% contraction in the fourth quarter of 2024. This challenging environment is expected to persist with a subdued outlook extending into mid-2025, creating headwinds for businesses reliant on timely and cost-effective component sourcing.

Despite these broader market challenges, Synaxon AG's robust partner network and substantial purchasing volume, which reached €3.2 billion in 2024, serve as crucial mitigating factors. These strengths allow Synaxon to navigate the complexities of component availability and pricing more effectively, thereby protecting the value proposition it offers to its partners in a volatile economic landscape.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Synaxon AG, a European group with operations spanning multiple countries. Fluctuations in exchange rates, particularly between the Euro and currencies like the British Pound, can directly impact Synaxon's profitability, especially as they target doubling revenue in the UK market. For instance, if the Pound weakens against the Euro, the cost of goods purchased from international vendors denominated in Euros would effectively increase for Synaxon's UK operations, squeezing profit margins. Conversely, a stronger Pound would boost the Euro-denominated revenue reported by its UK subsidiaries.

This exposure is amplified by Synaxon's strategic goals, such as expanding into non-Eurozone markets. The company's aim to double revenue in the UK by 2025 necessitates careful management of the Euro-Pound exchange rate. Recent data from early 2024 indicates that the Pound Sterling has shown some resilience against the Euro, trading around 1.17 EUR/GBP. However, historical volatility, with rates fluctuating between 1.10 and 1.25 in the past two years, highlights the potential for substantial financial impacts. These currency swings can affect the cost of imported IT hardware and software, a core part of Synaxon's business, and the translated value of sales generated abroad.

- Impact on Cost of Goods: A weaker Pound Sterling increases the Euro cost of imported IT products for Synaxon's UK operations.

- Revenue Translation: Fluctuations directly alter the Euro value of revenue generated in the UK.

- Profitability Concerns: Significant currency movements can erode profit margins on international transactions.

- Strategic Market Expansion: Synaxon's UK growth targets are directly influenced by the Euro-Pound exchange rate performance.

IT Market Competition and Pricing Pressures

The IT distribution sector, particularly in Germany, is intensely competitive, which often translates into significant pricing pressures for all players. The software distribution market alone is projected for robust growth, intensifying this dynamic further.

Synaxon AG's strategic approach, centered on consolidating the purchasing power of its partners and delivering supplementary services, is designed to equip them to navigate these market-wide pricing challenges effectively. This model aims to bolster their ability to remain competitive.

- Market Growth: The German IT market, especially software distribution, is expected to see substantial growth through 2025, creating opportunities but also heightening competition.

- Pricing Pressure Impact: Intense competition directly leads to downward pressure on prices, affecting profit margins for distributors and resellers.

- Synaxon's Mitigation Strategy: By aggregating demand, Synaxon AG can negotiate better terms, and its value-added services differentiate partners beyond just price.

- 2024 Outlook: Analysts anticipate continued high competition in 2024, making Synaxon's model of collective bargaining and service provision increasingly valuable for its partners.

The economic outlook for Europe in 2025 suggests growth, with the IT distribution market collectively expected to see a 3.6% sales increase, creating a favorable environment for Synaxon AG.

However, inflation remains a key concern, with projections of 3-4% in key European markets for 2024-2025, potentially increasing Synaxon's operational costs for materials and logistics.

Interest rate hikes implemented to combat inflation in 2024-2025 will make borrowing more expensive for Synaxon and its partners, possibly dampening demand for IT projects.

Currency fluctuations, particularly the Euro-Pound exchange rate, pose a risk to Synaxon's profitability, especially with its goal to double UK revenue by 2025, as the Pound's volatility between 1.10 and 1.25 EUR/GBP in recent years demonstrates.

Preview Before You Purchase

Synaxon AG PESTLE Analysis

The preview shown here is the exact Synaxon AG PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Synaxon AG.

The content and structure shown in the preview is the same document you’ll download after payment, offering deep insights into Synaxon AG's strategic landscape.

The file you’re seeing now is the final version of the Synaxon AG PESTLE Analysis—ready to download right after purchase for your strategic planning needs.

Sociological factors

Growing digital literacy in Europe, with a significant portion of the population now comfortable with online transactions and digital tools, directly boosts demand for Synaxon AG's IT services. For instance, a 2024 Eurostat report indicated that over 75% of EU individuals regularly used the internet for various activities, including purchasing goods and services, signaling a strong foundation for digital B2B interactions.

Businesses, especially small and medium-sized enterprises (SMEs), are increasingly recognizing the benefits of technology. In 2024, IT spending by European SMEs was projected to grow by 8%, with a particular focus on cloud services and cybersecurity, areas where Synaxon AG's platform can offer significant value through its partner network.

This widespread readiness to adopt new technologies means a greater uptake of managed IT services and integrated solutions. As more companies seek to streamline operations and enhance efficiency through digitalization, the demand for the comprehensive IT procurement and management solutions provided by Synaxon AG's ecosystem is set to rise substantially.

The societal embrace of remote and hybrid work is significantly reshaping demand within the IT sector. This shift fuels a robust need for cloud infrastructure, advanced collaboration platforms, and robust cybersecurity measures, directly impacting the market for services Synaxon AG provides.

Synaxon AG is well-positioned to capitalize on this trend. Their expertise in managed IT services and offerings like Device-as-a-Service (DaaS) directly address the challenges businesses face in equipping and safeguarding a dispersed workforce.

In 2024, a significant portion of the global workforce continues to operate under hybrid or fully remote arrangements. For instance, a mid-2024 survey indicated that over 60% of companies still offer hybrid work options, driving sustained investment in the IT solutions that enable this flexibility.

This societal preference for flexible work arrangements translates into a consistent demand for scalable and secure IT solutions. Companies are prioritizing investments in cloud services to support remote access and collaboration tools to maintain productivity, areas where Synaxon AG excels.

The IT skills gap remains a significant challenge in the DACH region, impacting Synaxon AG and its partners. In 2024, Germany alone faced a shortage of approximately 1.3 million skilled IT professionals, a number projected to grow. This scarcity drives up labor costs, making it harder for Synaxon's partners to recruit and retain talent, potentially hindering their ability to deliver cloud, cybersecurity, and managed services effectively.

Consumer and Business Data Privacy Concerns

Societal awareness around data privacy is escalating, impacting how both consumers and businesses approach digital interactions and demanding stronger cybersecurity measures. This heightened concern directly fuels the market for sophisticated data protection solutions. For Synaxon AG, this trend is a significant driver for its strategic focus on managed security services.

Synaxon AG's proactive response to these evolving societal expectations is evident in its strategic expansion into managed security services. The launch of its new cybersecurity platform in February 2025 is a prime example of aligning business strategy with societal needs for enhanced data protection. This move positions Synaxon AG to capitalize on the growing demand for reliable security solutions.

- Growing Public Awareness: A significant majority of consumers express concern over how their personal data is collected and used online, leading to increased scrutiny of company data handling practices.

- Business Imperative: For businesses, data breaches can result in substantial financial penalties, reputational damage, and loss of customer trust, making robust data privacy a critical operational requirement.

- Regulatory Pressure: Evolving data protection regulations globally, such as GDPR and its equivalents, further underscore the societal demand for privacy and compel companies to invest in compliant security measures.

- Synaxon AG's Response: The February 2025 platform launch aims to address these concerns by offering advanced security features, directly responding to the market’s need for trustworthy data management.

Demographic Shifts and Workforce Dynamics

Demographic shifts are significantly reshaping the IT landscape. For instance, the aging workforce in many developed nations means a potential decline in experienced IT professionals, while a younger, digitally native generation is entering the market. This dynamic influences the demand for IT solutions, leaning towards user-friendly interfaces and cloud-based services that align with the preferences of newer entrants. Synaxon AG must therefore adapt its partner support and solution offerings to meet these evolving needs, focusing on accessible training and efficient knowledge transfer to maintain a robust network.

The changing age demographics directly impact workforce dynamics within the IT sector. In 2024, projections indicated a continued trend of experienced IT professionals nearing retirement age in key markets, creating a skills gap. Simultaneously, Gen Z and younger millennials are increasingly entering the IT workforce, bringing new perspectives and expectations regarding technology adoption and work culture. Synaxon AG's strategy needs to incorporate this reality by developing programs that facilitate seamless knowledge transfer from seasoned professionals to emerging talent, ensuring continuity and innovation.

- Aging Workforce Impact: In Germany, the proportion of the population aged 65 and over reached approximately 22.6% in 2023, a figure expected to grow, potentially impacting the availability of experienced IT personnel.

- Emerging Talent Pool: The influx of younger generations into the IT sector, often with innate digital skills, necessitates tailored solutions and support that leverage their familiarity with modern technologies.

- Demand for Modern Solutions: Consumerization of IT means demand is shifting towards intuitive, cloud-native solutions and services that simplify management and enhance user experience, reflecting generational preferences.

- Knowledge Transfer Imperative: Synaxon AG's ability to foster effective knowledge sharing between different age groups within its partner network is crucial for upskilling and retaining expertise.

The increasing digital literacy across Europe, with over 75% of EU individuals regularly using the internet in 2024 for transactions, directly supports Synaxon AG's IT service offerings. Businesses, particularly SMEs, are boosting IT spending, with an 8% projected growth in 2024 for cloud and cybersecurity solutions, areas Synaxon AG actively serves through its partner network.

The sustained societal embrace of remote and hybrid work, with over 60% of companies offering such options in mid-2024, continues to drive demand for cloud infrastructure and collaboration tools. Societal concern over data privacy is escalating, pushing businesses to invest in robust cybersecurity, a trend Synaxon AG addresses with its February 2025 cybersecurity platform launch.

Demographic shifts, including an aging workforce and the rise of digitally native younger generations, are reshaping IT skill demands. In Germany, the proportion of the population aged 65+ reached 22.6% in 2023, highlighting a potential skills gap that necessitates effective knowledge transfer within Synaxon AG's partner ecosystem.

| Sociological Factor | Impact on Synaxon AG | Supporting Data (2024/2025 Focus) |

|---|---|---|

| Digital Literacy & Adoption | Increased demand for IT services and digital solutions. | Over 75% of EU individuals regularly used the internet for transactions (2024). |

| Workforce Trends (Remote/Hybrid) | Sustained need for cloud, collaboration, and security solutions. | Over 60% of companies offered hybrid work options (mid-2024). |

| Data Privacy Concerns | Growth in managed security services market. | Synaxon AG launched new cybersecurity platform (Feb 2025). |

| Demographic Shifts | Need for adaptable IT solutions and knowledge transfer. | 22.6% of German population aged 65+ (2023), impacting IT talent pool. |

Technological factors

The ongoing evolution of cloud computing and Software-as-a-Service (SaaS) presents a crucial technological force for Synaxon AG. This shift allows Synaxon's partners to deliver adaptable and scalable IT services, directly supporting their end-clients. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the vast opportunities within this sector.

Synaxon AG's strategic emphasis on managed services and cloud-native offerings positions it favorably to capitalize on this trend. The German software distribution market is experiencing a surge, with cloud-based solutions being a primary catalyst. Industry reports indicate a compound annual growth rate (CAGR) of over 15% for cloud services in Germany leading up to 2025, underscoring the market's robust expansion.

The accelerating pace of AI and automation is fundamentally reshaping the IT sector, presenting both challenges and significant opportunities for companies like Synaxon AG and its partners. By 2028, AI is projected to be a colossal growth driver for the channel ecosystem, and Synaxon AG is proactively positioning itself and its partners to harness this potential.

Synaxon AG's strategic focus is clearly on leveraging AI for critical business functions, including optimizing internal processes, bolstering cybersecurity defenses, and developing innovative new services for its clients. This commitment is evident in the company's 2025 partner conferences, which are already prioritizing AI as a key discussion point.

The digital landscape is constantly shifting, and with it, the threats to our data and systems. Cybersecurity is no longer a static defense; it's a dynamic arms race. As threats become more sophisticated, the need for equally advanced solutions grows. This is a critical technological factor influencing businesses today.

Synaxon AG recognized this evolving threat landscape and proactively responded. In February 2025, they enhanced their managed services by integrating a new cybersecurity platform. This platform leverages the technology developed by Lywand Software GmbH, equipping Synaxon's partners with the necessary tools to effectively evaluate and bolster their customers' security postures. This strategic move aligns with the increasing global investment in cybersecurity, which is projected to reach over $260 billion by the end of 2025, highlighting the market's demand for such solutions.

Platform Economy and Digital Ecosystems

Synaxon AG thrives within the platform economy, acting as a crucial nexus for IT vendors, distributors, and retailers. This model positions them directly within the dynamic landscape of digital ecosystems. The increasing dominance of hyperscaler marketplaces, like Amazon Web Services or Microsoft Azure, presents both significant avenues for Synaxon to integrate and expand its offerings, and concurrently, intensifies the competitive pressures as these giants control vast customer bases and data.

The company's substantial network, boasting over 3,200 partners, is a key technological advantage, enabling reach and transaction volume. This extensive partnership base is critical for navigating the evolving digital ecosystem, allowing Synaxon to leverage collective strengths and data insights. For instance, in 2024, the global platform economy was projected to reach trillions of dollars in value, underscoring the massive potential for businesses like Synaxon that facilitate these digital marketplaces.

- Platform Operations: Synaxon facilitates transactions and relationships between over 3,200 IT partners, a core function of the platform economy.

- Digital Ecosystem Integration: The company's strategy must account for the growing influence of hyperscaler marketplaces and their potential impact on partner networks.

- Competitive Landscape: Increased competition from large digital ecosystems necessitates continuous innovation in Synaxon's service offerings and partner value proposition.

- Network Effects: Synaxon's extensive partner network is a significant asset, amplifying its market presence and the value it delivers to participants.

Development of Managed Services and XaaS Models

The growing demand for Managed Services and 'Anything-as-a-Service' (XaaS) models represents a significant technological tailwind for Synaxon AG. This shift allows businesses to outsource IT functions, creating predictable revenue streams. Synaxon AG has been a player in the Managed Service Provider space since 2018, and this segment continues to be a strategic focus.

Synaxon AG is actively expanding its managed services offerings. This includes the development of Device-as-a-Service (DaaS) solutions, catering to the increasing need for flexible hardware procurement and management. Furthermore, the company is organizing a dedicated Managed Services Summit in 2025, specifically designed to equip its partners with the tools and knowledge to successfully deliver recurring IT services.

- Growing MSP Market: The global managed services market was valued at over $200 billion in 2023 and is projected to grow significantly, with CAGR estimates often exceeding 10% through 2028.

- XaaS Adoption: Businesses are increasingly adopting XaaS models, with cloud-based services and subscription models becoming the norm for software, infrastructure, and even hardware.

- Synaxon's Commitment: Synaxon AG's continued investment in DaaS and its 2025 Managed Services Summit underscore its strategic alignment with this dominant technological trend.

The technological landscape continues to evolve rapidly, with AI and automation driving significant shifts across industries. Synaxon AG is strategically positioning itself to leverage these advancements, focusing on AI integration for process optimization and enhanced cybersecurity. This proactive approach is crucial as AI adoption is expected to be a major growth driver for the IT channel ecosystem by 2028.

Cybersecurity remains a paramount concern, necessitating advanced solutions to combat increasingly sophisticated threats. Synaxon AG's integration of a new cybersecurity platform, developed by Lywand Software GmbH, in early 2025 demonstrates its commitment to equipping partners with robust security tools. The global cybersecurity market's projected growth to over $260 billion by the end of 2025 reflects the urgent demand for such capabilities.

The platform economy, where Synaxon AG operates as a central connector, presents both opportunities and challenges. Its extensive network of over 3,200 partners is a key asset, facilitating transactions and data insights within a digital ecosystem valued in the trillions of dollars globally. However, the dominance of hyperscaler marketplaces intensifies competition, requiring Synaxon to continuously innovate its service offerings to maintain its competitive edge.

The increasing adoption of Managed Services and 'Anything-as-a-Service' (XaaS) models represents a significant technological advantage for Synaxon AG. The company's ongoing expansion into Device-as-a-Service (DaaS) and its dedicated Managed Services Summit in 2025 highlight its strategic focus on recurring revenue models. The managed services market, already exceeding $200 billion in 2023, is expected to see robust growth through 2028, underscoring the market's appetite for these flexible IT solutions.

| Technological Factor | Impact on Synaxon AG | Key Data/Projections |

| AI & Automation | Process optimization, enhanced cybersecurity, new service development | AI to be a major growth driver for IT channel by 2028 |

| Cybersecurity Evolution | Need for advanced security solutions, integration of new platforms | Global cybersecurity market to exceed $260 billion by end of 2025 |

| Platform Economy & Ecosystems | Leveraging partner network, competition from hyperscalers | Global platform economy valued in trillions; Synaxon has over 3,200 partners |

| Managed Services & XaaS | Expansion of recurring revenue models, DaaS offerings | Managed services market >$200 billion (2023), strong CAGR expected through 2028 |

Legal factors

Synaxon AG must navigate stringent data protection laws, such as the GDPR, which dictates how personal data is managed. This means careful attention to data collection, processing, and storage for Synaxon AG and its business associates.

Failure to comply with these regulations can result in substantial financial penalties; for instance, GDPR fines can reach up to €20 million or 4% of annual global turnover, whichever is higher. Maintaining robust data security protocols is therefore paramount for Synaxon AG to safeguard its operations and reputation.

As a major IT distribution and service player across Europe, Synaxon AG operates within a framework of stringent antitrust and competition laws. These regulations are designed to prevent market dominance and foster a level playing field for all participants in the IT channel.

Any proposed mergers, acquisitions, or strategic alliances undertaken by Synaxon AG must undergo rigorous review by regulatory bodies such as the European Commission. For instance, in 2024, the EU continued to scrutinize tech sector deals, with several significant technology mergers facing in-depth investigations to assess their potential impact on competition.

Compliance with these laws is crucial to avoid hefty fines and potential operational disruptions. Synaxon AG's business model, which involves consolidating purchasing power and offering aggregated services, must demonstrate that it does not stifle innovation or limit consumer choice within the dynamic IT market.

E-commerce and consumer protection laws significantly shape Synaxon AG's operational landscape, impacting its retail partners and direct-to-consumer channels. Staying abreast of regulations concerning online transactions, digital agreements, and buyer safeguards is paramount for legal adherence and fostering trust within its extensive network. For instance, the EU's Digital Services Act, fully in effect by February 2024, imposes stricter rules on online platforms regarding content moderation and transparency, directly influencing how Synaxon's partners manage their digital storefronts.

Intellectual Property Rights and Licensing

Synaxon AG's operations heavily rely on safeguarding intellectual property (IP) and strictly adhering to software licensing agreements, given its extensive dealings with a multitude of IT vendors and software distributors. This is crucial for a company that facilitates software procurement and management for its clients.

Failure to ensure partner compliance with IP laws and licensing terms could expose Synaxon AG to significant legal challenges, including infringement claims and contractual breaches. For instance, in 2024, global software piracy rates remained a concern, with the Software Alliance reporting substantial economic losses due to unlicensed software usage, underscoring the importance of vigilance.

- Intellectual Property Protection: Synaxon AG must ensure its platform and services do not infringe on existing patents or copyrights held by technology partners.

- Software Licensing Compliance: Strict adherence to end-user license agreements (EULAs) and volume licensing terms is paramount to avoid penalties and maintain vendor relationships.

- Partner Due Diligence: Verifying that Synaxon AG's partners and the software they distribute are legally sound and properly licensed is a continuous requirement.

- Risk Mitigation: Proactive management of IP and licensing issues helps prevent costly litigation and protects Synaxon AG's reputation in the IT ecosystem.

Labor Laws and Employment Regulations

Synaxon AG, employing over 300 individuals and collaborating with independent partners, navigates a complex web of labor laws across the DACH region and other European markets. Compliance with these regulations, covering working conditions and employee rights, directly impacts operational expenses and the company's approach to attracting and retaining talent. For instance, Germany's Works Constitution Act grants significant rights to employee works councils, influencing decisions on working hours and operational changes.

Recent trends in European labor markets highlight increasing scrutiny on fair employment practices and the gig economy. In 2024, several EU countries are reviewing legislation to better protect freelance and contract workers, which could affect Synaxon's partner network. The average labor cost in Germany, a key market for Synaxon, was approximately €43,437 per year per employee in 2023, a figure influenced by statutory contributions and benefits mandated by law.

- Compliance with German Works Constitution Act: Mandates employee co-determination in certain operational decisions.

- EU Freelancer Protection: Evolving regulations in 2024 and 2025 may impact Synaxon's partner agreements.

- Rising Labor Costs: Germany's average labor cost per employee was around €43,437 in 2023.

- Data Protection in HR: Strict adherence to GDPR is essential for managing employee data across all operating regions.

Synaxon AG operates under a strict legal framework, including comprehensive data protection laws like the GDPR, which mandates careful handling of personal data. Non-compliance risks severe penalties, potentially up to €20 million or 4% of global annual turnover, emphasizing the need for robust data security.

The company must also adhere to antitrust and competition laws across Europe, preventing market monopolization and ensuring fair competition in the IT sector. Regulatory bodies closely examine mergers and acquisitions, as seen in 2024 EU scrutiny of tech deals, to assess their impact on market dynamics.

Furthermore, Synaxon AG is governed by e-commerce and consumer protection laws, such as the EU's Digital Services Act fully effective by February 2024, which imposes rules on online platforms regarding content and transparency. Intellectual property protection and software licensing compliance are also critical, with global software piracy remaining a concern in 2024, impacting companies like Synaxon that facilitate software distribution.

Labor laws across its operating regions, including Germany's Works Constitution Act, affect Synaxon AG's employment practices and costs. The average labor cost in Germany was approximately €43,437 per employee in 2023, and evolving regulations in 2024-2025 concerning freelance workers could influence partner agreements.

| Legal Area | Key Regulations/Considerations | Potential Impact/Penalties | Relevant Data/Examples (2023-2025) |

|---|---|---|---|

| Data Protection | GDPR | Fines up to €20M or 4% global turnover | Continued focus on data privacy in 2024/2025 |

| Competition Law | EU Antitrust Regulations | Merger review, potential fines for anti-competitive practices | EU scrutiny of tech sector deals in 2024 |

| E-commerce & Consumer Protection | Digital Services Act (EU) | Stricter platform rules, transparency requirements | Fully effective Feb 2024 |

| Intellectual Property & Licensing | Software Licensing Agreements, IP Laws | Infringement claims, contractual breaches | Global software piracy losses significant in 2024 |

| Labor Law | Works Constitution Act (Germany), EU Freelancer Protections | Impact on employment practices, operational costs | German avg. labor cost ~€43,437/employee (2023); EU freelancer law reviews in 2024/2025 |

Environmental factors

European Union directives are intensifying scrutiny on electronic waste (e-waste), a trend directly affecting Synaxon AG's operations and its partners within the IT supply chain. The EU's commitment to circular economy principles means stricter rules around how IT equipment is disposed of and recycled. For instance, the Waste Electrical and Electronic Equipment (WEEE) directive mandates collection and recycling targets for member states, with a significant portion of e-waste needing to be processed responsibly.

These evolving regulations, including extended producer responsibility schemes, compel businesses like Synaxon to re-evaluate their product lifecycle management strategies. This could translate into developing new service offerings focused on repair, refurbishment, and responsible end-of-life processing for IT hardware. By 2027, the EU aims to increase the collection rate of WEEE to 85% of total waste generated, underscoring the urgency for adaptation.

The energy demands of IT infrastructure, particularly data centers, are a significant environmental concern. In 2024, global data center energy consumption was estimated to be around 1.5% of total electricity usage, a figure projected to rise as digital transformation accelerates.

Synaxon AG, operating within the IT channel, faces increasing pressure from customers and regulators to promote energy-efficient hardware and cloud services. This trend pushes Synaxon to encourage its partners to adopt sustainable IT practices, thereby reducing the collective carbon footprint of their operations.

The push for greener IT solutions means Synaxon AG must adapt its product and service offerings. By prioritizing partners who demonstrate commitment to energy efficiency, Synaxon can align with market demands and contribute to a more sustainable technology ecosystem.

Customers and investors are increasingly prioritizing companies with strong environmental, social, and governance (ESG) commitments, directly impacting Synaxon AG. This trend suggests a growing expectation for transparency in sustainability practices, even if specific 2024-2025 Synaxon AG reports are not yet public. For example, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, reflecting this significant investor shift.

Regulatory bodies are also tightening requirements for environmental reporting and corporate accountability. Synaxon AG, operating within the European Union, will likely face evolving directives related to carbon emissions and supply chain responsibility. Companies that proactively integrate sustainability into their core strategies, such as implementing energy-efficient operations or adopting circular economy principles, are better positioned to meet these future compliance demands and gain a competitive edge.

Supply Chain Environmental Standards

Synaxon AG, as a facilitator in the IT supply chain, faces increasing scrutiny regarding the environmental footprint of the products it connects. This means the company is indirectly impacted by evolving environmental standards that govern IT hardware and software production. For instance, regulations like the EU's Ecodesign Directive, which sets energy efficiency and recyclability requirements, directly influence the types of products available for distribution through Synaxon's platform.

The push for greater supply chain transparency and sustainability means Synaxon may need to consider the environmental credentials of its vendor partners more rigorously. This could translate into preferences for distributors and manufacturers who demonstrate adherence to ethical sourcing, such as the responsible sourcing of conflict minerals or the reduction of hazardous substances in electronics, aligning with global initiatives like the UN Guiding Principles on Business and Human Rights.

By 2024, the global IT hardware market alone was valued in the hundreds of billions of dollars, and a significant portion of this value chain is subject to environmental compliance. For example, a growing number of enterprise clients are mandating that their IT procurements meet specific environmental, social, and governance (ESG) criteria, which in turn pressures intermediaries like Synaxon to ensure their partner network can satisfy these demands.

- Vendor Selection: Synaxon may need to implement stricter environmental due diligence for new vendors.

- Product Compliance: Pressure to ensure distributed products meet standards like RoHS (Restriction of Hazardous Substances) is likely to increase.

- Market Demand: Growing customer preference for sustainably sourced and energy-efficient IT products will shape Synaxon's offerings.

- Regulatory Landscape: Evolving environmental legislation, such as extended producer responsibility schemes, will necessitate adaptation.

Climate Change Impact on Operations and Logistics

Climate change presents indirect operational challenges for Synaxon AG, primarily through its impact on logistics and supply chain stability. Extreme weather events, which are becoming more frequent and severe, can disrupt transportation routes across Europe. This is a critical consideration for a distributor like Synaxon AG, whose business relies on the efficient movement of IT products.

The company's extensive distribution network, serving numerous European markets, is vulnerable to climate-related disruptions. For example, severe flooding in key transit corridors or unseasonable heatwaves impacting road infrastructure could lead to significant delays and increased costs. Synaxon AG must therefore prioritize robust contingency planning to mitigate these risks and ensure the resilience of its European operations.

Recent data underscores the growing threat. The European Environment Agency reported in 2024 that the economic damage from weather and climate-related disasters in Europe reached approximately €50 billion in 2023 alone, a stark illustration of the potential impact on businesses reliant on physical distribution. This highlights the need for Synaxon AG to:

- Diversify transportation routes and modes to reduce reliance on single points of failure.

- Enhance inventory management strategies to buffer against potential supply chain interruptions.

- Develop strong relationships with logistics partners who demonstrate resilience and adaptability to climate-related challenges.

- Invest in predictive analytics to anticipate potential disruptions and proactively adjust operational plans.

Synaxon AG operates within an evolving environmental regulatory landscape, particularly concerning e-waste and energy consumption. The EU's push for a circular economy, exemplified by WEEE directive targets aiming for an 85% collection rate by 2027, necessitates responsible end-of-life processing for IT hardware. Furthermore, the significant energy demands of IT infrastructure, estimated at 1.5% of global electricity usage in 2024, drive demand for energy-efficient solutions, pushing Synaxon to promote sustainable IT practices among its partners.

Growing investor and customer focus on ESG commitments is a key environmental driver, with the global sustainable investment market reaching an estimated $35.3 trillion in early 2024. This trend compels companies like Synaxon to ensure transparency in their sustainability practices and that their vendor network adheres to environmental standards, such as RoHS, and ethical sourcing principles.

Climate change poses indirect operational risks to Synaxon AG through potential disruptions in its logistics and supply chain. Increased frequency and severity of extreme weather events in Europe, which caused approximately €50 billion in economic damage in 2023, highlight the vulnerability of distribution networks and the need for robust contingency planning and diversified logistics strategies.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Synaxon AG is informed by a comprehensive review of official government publications, reputable economic forecasts from institutions like the IMF and World Bank, and leading industry research reports. This ensures a data-driven understanding of political, economic, social, technological, legal, and environmental influences.