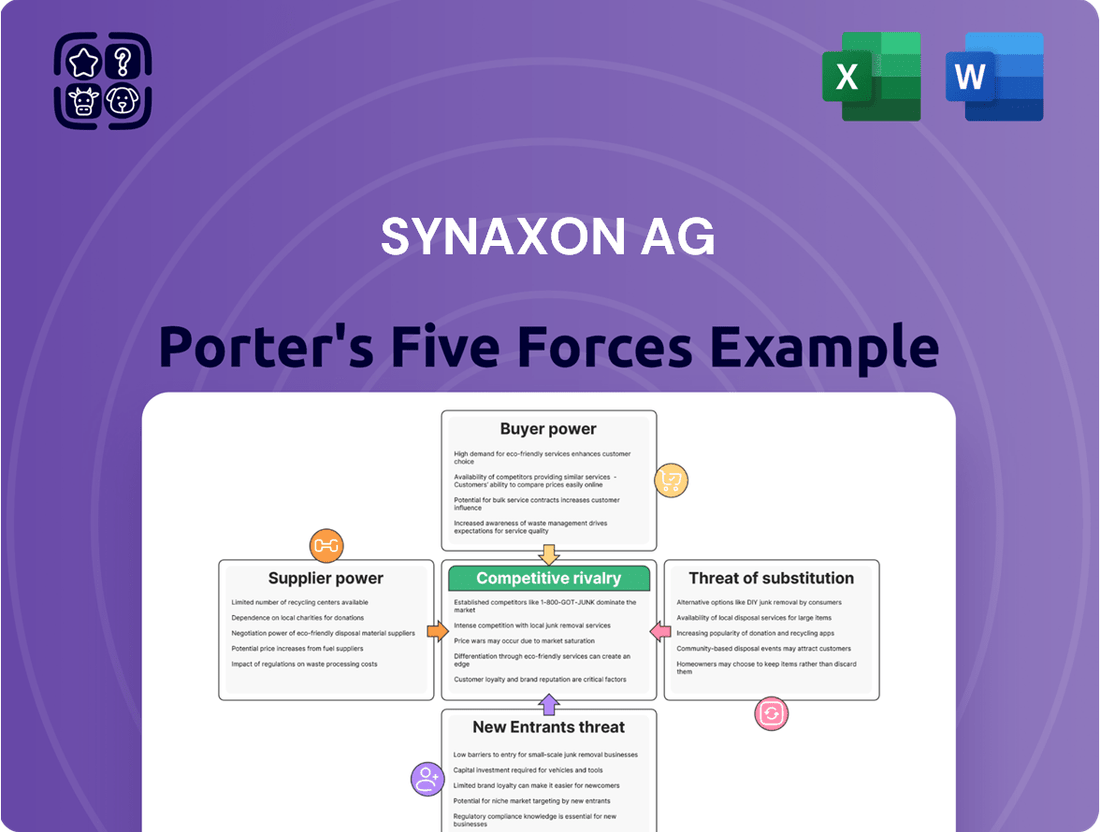

Synaxon AG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synaxon AG Bundle

Synaxon AG navigates a competitive landscape shaped by moderate buyer and supplier power, indicating a balanced market. The threat of substitutes is present but manageable, while the threat of new entrants is somewhat constrained by industry specificities. Rivalry among existing competitors, however, demands constant strategic adaptation.

The complete report reveals the real forces shaping Synaxon AG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The IT hardware and software market is characterized by significant vendor concentration in many key areas, which directly influences Synaxon AG's bargaining power. When only a handful of dominant companies supply essential components or specialized software, these suppliers can often set higher prices and more stringent terms. For instance, in 2023, the global server market saw a concentration with Dell Technologies, HPE, and Supermicro holding substantial market shares, giving them considerable leverage.

This concentration amplifies supplier power because Synaxon, and by extension its member companies, may have limited alternatives for crucial IT infrastructure. Proprietary technologies further solidify this advantage, making it difficult for Synaxon to switch suppliers without incurring significant costs or disruptions. In contrast, a more fragmented market for commoditized IT products, like standard networking cables or basic office software, allows Synaxon to leverage its collective purchasing volume to negotiate better deals, thereby reducing individual supplier influence.

High switching costs for Synaxon, particularly when integrating new vendor systems or adapting its platform, significantly bolster supplier power. For example, if a key software provider requires extensive re-certification processes or substantial IT infrastructure overhauls to switch, Synaxon faces considerable expense and disruption. This makes it challenging for Synaxon to easily change its sourcing, thereby granting incumbent vendors greater leverage in pricing and contract negotiations.

The uniqueness of IT products and services vendors offer significantly impacts their bargaining power with Synaxon AG's IT retailers. When suppliers provide highly specialized, proprietary, or strongly branded technologies that are in high demand among Synaxon's network, these vendors gain considerable leverage to negotiate more favorable terms.

For instance, if a vendor offers a critical software component or a unique hardware solution that is difficult for Synaxon's retailers to source elsewhere, that supplier can dictate pricing and contract conditions. Conversely, when products are standardized and readily available from multiple sources, a vendor's ability to exert influence is greatly reduced, as Synaxon can easily switch to alternative suppliers, thereby diminishing the supplier's bargaining strength.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers presents a significant challenge to Synaxon AG. If key IT vendors, such as major hardware manufacturers or software developers, decide to bypass Synaxon and sell directly to IT retailers or even end-users, their bargaining power increases substantially. This direct access diminishes Synaxon's value as an intermediary.

Should these suppliers successfully establish efficient direct sales channels or robust online platforms, Synaxon's role in the supply chain becomes less indispensable. This shift could lead to a reduction in Synaxon's market share and erode its profitability. For instance, as of early 2024, many large technology companies have been actively expanding their direct-to-consumer and direct-to-business online sales capabilities, indicating a growing trend toward disintermediation.

- Increased Supplier Leverage: Suppliers gain more control over pricing and terms when they can reach customers directly.

- Reduced Intermediary Role: Synaxon's function as a distributor becomes less critical if suppliers manage their own sales.

- Market Share Erosion: Direct sales by suppliers can siphon off business that would have otherwise gone through Synaxon.

- Trend Towards Disintermediation: Major tech players are increasingly investing in direct sales models, as evidenced by their growing e-commerce revenues in 2023 and projected for 2024.

Importance of Synaxon to Suppliers

Synaxon AG's role as a significant revenue generator and market access provider directly impacts its suppliers' bargaining power. For smaller or niche technology providers, Synaxon's established platform, connecting them with its network of over 3,200 partner companies, can be a vital gateway to broader market penetration.

This reliance on Synaxon for customer reach can diminish these smaller suppliers' ability to negotiate favorable terms. Their dependence on Synaxon for a substantial portion of their sales volume grants Synaxon considerable leverage in pricing and other contract conditions.

Conversely, for large, globally recognized technology vendors, Synaxon might represent just one of many distribution channels. In such cases, these established suppliers often possess greater bargaining power due to their brand recognition and existing customer relationships, allowing them to negotiate more robust terms with Synaxon.

- Market Access: Synaxon provides critical market access to its partner network, especially for smaller suppliers.

- Revenue Volume: The revenue volume Synaxon generates for its suppliers is a key determinant of their dependence and thus their bargaining power.

- Supplier Dependence: Smaller suppliers relying heavily on Synaxon for sales volume have less bargaining power than larger, diversified vendors.

- Network Size: Synaxon's network of over 3,200 partner companies amplifies its importance as a channel for many suppliers.

The bargaining power of suppliers to Synaxon AG is significantly influenced by market concentration and the uniqueness of their offerings. When few suppliers dominate essential IT components, like the server market where Dell Technologies, HPE, and Supermicro held substantial shares in 2023, they command higher prices and stricter terms, limiting Synaxon's alternatives.

High switching costs for Synaxon, such as the expense and disruption of re-certifying systems with a new software vendor, further empower suppliers by making it difficult to change sourcing. Additionally, proprietary or strongly branded technologies that are difficult to source elsewhere give vendors considerable leverage, as seen with specialized software or hardware solutions in demand by Synaxon's network.

The threat of forward integration by suppliers, where vendors bypass intermediaries like Synaxon to sell directly to retailers or end-users, also increases their bargaining power. This trend is evident in early 2024 as large tech companies expand their direct online sales capabilities, potentially eroding Synaxon's role and profitability.

Synaxon's position as a significant revenue generator for smaller, niche technology providers, who rely on its network of over 3,200 partner companies for market access, grants Synaxon leverage. Conversely, large, globally recognized vendors with established customer bases often hold greater bargaining power, viewing Synaxon as just one of many distribution channels.

| Factor | Impact on Supplier Bargaining Power with Synaxon AG | Example/Data Point (as of 2023/early 2024) |

|---|---|---|

| Market Concentration | High | Global server market dominated by Dell, HPE, Supermicro. |

| Uniqueness of Offerings | High for proprietary/branded tech | Difficult-to-source specialized software/hardware. |

| Switching Costs | High | Extensive re-certification or infrastructure overhaul needed. |

| Forward Integration Threat | Increases power | Expansion of direct-to-consumer/business online sales by tech giants. |

| Supplier Reliance on Synaxon | Low for large vendors, High for small | Small vendors depend on Synaxon's 3,200+ partner network for sales volume. |

What is included in the product

Synaxon AG's Porter's Five Forces Analysis reveals the intense competition within the IT services sector, highlighting the bargaining power of customers and the threat of new market entrants impacting profitability.

Instantly identify and address competitive threats with a dynamic, interactive five forces model.

Customers Bargaining Power

The bargaining power of Synaxon's customers hinges significantly on customer concentration and the volume of their purchases. A small number of large IT retailers or resellers within Synaxon's network, by virtue of their substantial individual order sizes, can exert considerable pressure for more favorable pricing, extended payment terms, and enhanced service levels. This concentrated buying power allows these key clients to negotiate from a position of strength, directly impacting Synaxon's margins.

However, Synaxon strategically leverages its extensive network to mitigate this individual customer power. By aggregating the purchasing volume across its vast array of partners, Synaxon creates a collective buying force. This aggregated demand allows Synaxon to negotiate better terms with its own suppliers, thereby offering competitive advantages to its network members. For instance, in 2023, Synaxon's partner network facilitated procurement volumes exceeding €1.5 billion, demonstrating the scale of its collective bargaining influence.

The bargaining power of Synaxon AG's customers, primarily IT retailers, is significantly influenced by the ease with which they can switch to alternative distributors or establish direct relationships with vendors. Low switching costs mean customers hold more sway in negotiations or can easily depart, impacting Synaxon's pricing power and customer retention.

In 2024, the IT distribution landscape continues to offer numerous alternatives. For instance, large online marketplaces and direct-to-business channels from major hardware manufacturers present readily available options for IT retailers. If Synaxon's platform requires substantial effort or investment to transition away from, this naturally locks customers in, reducing their bargaining power.

Synaxon AG actively works to mitigate this by bundling integrated services, offering robust marketing support, and facilitating knowledge exchange among its members. These value-added components are designed to increase the perceived cost or effort involved in switching, thereby strengthening Synaxon's position by making it more attractive for retailers to remain within its ecosystem.

The proliferation of alternative distribution channels significantly bolsters the bargaining power of Synaxon AG's customers. When IT retailers have readily available options to source products directly from manufacturers or through other established distribution networks, their reliance on Synaxon diminishes. For instance, a significant portion of IT hardware is now directly accessible from major manufacturers, bypassing traditional distribution intermediaries.

This ease of access means that if Synaxon AG cannot offer compelling advantages, such as exclusive product lines, superior logistics, or better pricing, customers can simply shift their purchasing to these alternative channels. The ability for retailers to form buying cooperatives further amplifies this power, allowing them to collectively negotiate better terms, directly challenging Synaxon's market position and increasing their leverage in price and service discussions.

Price Sensitivity of Customers

The price sensitivity of Synaxon AG's customers, primarily IT retailers and resellers, significantly impacts their bargaining power. These businesses often operate in intensely competitive end-user markets, forcing them to closely manage their own costs and margins.

When the end-user market is characterized by aggressive price competition, these retailers and resellers will naturally exert greater pressure on distributors like Synaxon. They will scrutinize every aspect of the supply chain, demanding lower product prices and improved service margins to remain competitive.

- Customer Price Sensitivity: In 2024, the average gross margin for IT resellers in Europe hovered around 15-20%, making them highly attuned to supplier pricing.

- Competitive Market Impact: Retailers facing a 5% year-over-year price decline in their primary product categories are more likely to push for similar cost reductions from their distributors.

- Margin Squeeze: A 10% increase in a reseller's operating expenses, without a corresponding revenue boost, directly translates to increased pressure on Synaxon for better purchasing terms.

- Demand Elasticity: For IT products with readily available substitutes, customer price sensitivity increases, granting customers more leverage to negotiate lower prices from Synaxon.

Information Asymmetry

Information asymmetry significantly influences customer bargaining power in the IT distribution sector. When customers possess less knowledge about pricing, product features, and available alternatives compared to suppliers, their ability to negotiate favorable terms is diminished. Conversely, a more informed customer base can leverage this knowledge to challenge supplier pricing and demand better value.

The IT distribution market, particularly in 2024, has seen a substantial increase in transparency. Online comparison tools and detailed product specifications readily available to consumers and businesses alike reduce the information gap. For instance, platforms that aggregate pricing data and user reviews empower buyers, increasing their leverage.

Synaxon AG, through initiatives like its IT-Service-Preisspiegel, actively contributes to leveling the playing field. This benchmark pricing tool provides critical data points, enabling partners and customers to understand fair market value. Such transparency directly enhances customer bargaining power by equipping them with the data needed for effective negotiation.

- Reduced Information Gap: Online platforms and industry benchmarks in 2024 make IT product pricing and availability more transparent, increasing customer knowledge.

- Informed Decision-Making: Greater access to information allows customers to compare offerings more effectively, leading to better negotiation outcomes.

- Synaxon's Role: Initiatives like the IT-Service-Preisspiegel empower Synaxon's partners by providing crucial pricing intelligence, thereby strengthening their bargaining position.

- Supplier Pressure: Increased customer information puts pressure on IT distributors to offer competitive pricing and superior service to retain business.

The bargaining power of Synaxon AG's customers, primarily IT retailers, is significantly impacted by market concentration and the availability of substitutes. With numerous IT distributors and direct vendor channels available in 2024, customers can easily switch if Synaxon's offerings are not competitive. This easy substitutability grants them considerable leverage in price and service negotiations.

Synaxon mitigates this by fostering strong relationships and offering value-added services that increase switching costs. For example, its extensive partner network, which facilitated over €1.5 billion in procurement in 2023, provides economies of scale that individual retailers might not achieve. Furthermore, Synaxon’s efforts to enhance transparency, like its IT-Service-Preisspiegel, equip customers with better information, ironically strengthening their ability to negotiate effectively.

| Factor | Impact on Synaxon's Customers' Bargaining Power | 2024 Context/Data |

|---|---|---|

| Customer Concentration | High concentration among large buyers increases their power. | Key IT retailers often represent significant volume, enabling stronger negotiation. |

| Availability of Substitutes | Numerous alternative distributors and direct vendor channels empower customers. | Online marketplaces and direct-to-business channels are prevalent. |

| Switching Costs | Low switching costs mean customers can easily move to competitors. | Synaxon counters with bundled services and marketing support to retain clients. |

| Price Sensitivity | High price sensitivity in competitive end-user markets forces customers to seek lower distributor prices. | Average IT reseller gross margins of 15-20% in 2024 necessitate cost efficiency. |

| Information Asymmetry | Reduced information asymmetry (due to online tools) empowers customers. | Platforms providing pricing data and reviews enhance customer knowledge and leverage. |

Full Version Awaits

Synaxon AG Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Synaxon AG delves into the competitive landscape, examining the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Each force is thoroughly analyzed with specific insights relevant to Synaxon AG's market position and strategic considerations.

Rivalry Among Competitors

The competitive landscape for Synaxon AG is shaped by a substantial number of diverse players in the European IT distribution and service group market. This sheer volume and variety of competitors significantly influence market dynamics, often leading to heightened rivalry.

In 2024, the European IT distribution sector features a mix of large, established global distributors alongside numerous smaller, specialized regional companies. This creates a complex competitive environment where Synaxon must navigate strategies against entities of varying scales and service focuses, impacting pricing and service innovation.

The presence of many equally matched competitors, each offering comparable IT solutions and services, naturally escalates competition. This often translates into aggressive price wars and a strong emphasis on differentiating through unique service offerings or specialized expertise to capture market share.

Synaxon's operational arena is marked by this dynamic, where rivalry is intensified by the coexistence of global giants with extensive reach and resources, and nimble regional players who often possess deep local market knowledge and customer relationships.

A slow or stagnant growth rate in the IT distribution market significantly heats up competitive rivalry. When the market isn't expanding, companies are forced to battle fiercely for the same slice of the pie, often leading to price wars and aggressive marketing. This contrasts sharply with booming markets where expansion is easier, and firms can grow without directly impacting competitors' existing customer bases.

Despite a shrinking German IT market, Synaxon AG has demonstrated impressive resilience and growth. For instance, in 2023, the German IT and office equipment market saw a slight decline, yet Synaxon managed to achieve robust revenue figures, indicating an ability to gain market share even in challenging conditions. This performance highlights their strategic advantage in a market where overall expansion is limited.

The ability of competitors to make their IT distribution services stand out is a key factor influencing rivalry. When these services become seen as interchangeable, the battle often shifts to who can offer the lowest price.

Synaxon AG actively works to avoid this commoditization by offering more than just product delivery. Their approach focuses on providing significant purchasing benefits, robust marketing assistance, and a suite of business services designed to support their partners holistically.

This 360-degree support model is intended to create value beyond the core distribution function, aiming to build stronger relationships and reduce the likelihood of customers switching solely based on price. For instance, in 2024, many IT distributors reported increased pressure on margins, highlighting the importance of such differentiation strategies.

Exit Barriers

Synaxon AG, like many in the IT distribution sector, faces the challenge of high exit barriers. These barriers can trap companies in the market even when they are not performing well, leading to sustained competitive pressure. For instance, specialized IT infrastructure and established logistics networks represent significant sunk costs that are difficult to recover if a company decides to exit. This makes it less appealing to simply shut down operations.

The persistence of unprofitable competitors due to these exit barriers directly fuels intense rivalry. Companies that might otherwise leave the market are forced to remain and continue competing, often aggressively, to try and recoup some of their investment. This dynamic keeps overall market pressure high, impacting profitability for all players, including Synaxon AG. In 2023, the global IT distribution market saw a slight slowdown, with some smaller distributors struggling to adapt to changing market conditions, a clear indicator of how exit barriers can prolong the life of less efficient players.

- Specialized Assets: High investment in IT infrastructure and warehousing makes divesting difficult.

- Long-Term Contracts: Commitments with suppliers and customers can lock distributors into operations.

- Employee Severance Costs: Significant liabilities related to workforce reduction can deter exiting.

- Market Saturation: In some regions, the IT distribution market is mature, making it hard for exiting firms to find buyers for assets.

Cost Structure of Competitors

The cost structure of competitors, especially the balance between fixed and variable costs, significantly shapes competitive dynamics in the IT channel. Companies with high fixed costs, such as those invested in extensive infrastructure or research and development, may feel compelled to operate at full capacity. This often leads to more aggressive pricing strategies to ensure overheads are covered, potentially igniting price wars and intensifying rivalry.

For instance, in the IT distribution sector, businesses with substantial warehousing and logistics networks carry considerable fixed expenses. If Synaxon AG's competitors operate with a high proportion of fixed costs, they might engage in price reductions to maintain sales volume and avoid underutilization, even if it marginally impacts profit margins in the short term. This behavior directly influences the intensity of competition Synaxon faces.

Understanding the operational models and efficiency levels of these competitors is crucial for assessing the long-term sustainability of competitive pressures. A competitor's ability to manage its cost base effectively, perhaps through economies of scale or optimized supply chains, directly impacts its capacity to engage in price competition and its overall resilience. For example, in 2024, many IT distributors focused on streamlining logistics to reduce their fixed overheads, a move that could either dampen price wars or shift the competitive battleground to service levels.

- High fixed costs in the IT channel can drive price competition as firms aim to cover overheads.

- Competitors with substantial infrastructure investments may operate at full capacity, leading to aggressive pricing.

- Assessing competitors' operational efficiency and cost management is key to understanding rivalry intensity.

- In 2024, many IT distributors focused on logistics optimization to manage fixed costs.

The European IT distribution market is characterized by intense rivalry, fueled by a large number of competitors, including global players and specialized regional firms. This environment often leads to price wars and a strong focus on service differentiation to capture market share.

Synaxon AG navigates this landscape by offering value-added services beyond basic distribution, aiming to build customer loyalty and avoid commoditization. Despite market challenges, like a slight contraction in the German IT market in 2023, Synaxon has shown resilience, suggesting effective strategies for gaining ground.

High exit barriers in the IT distribution sector, such as significant investments in infrastructure and long-term contracts, can keep less profitable competitors in the market, thus sustaining intense rivalry. Competitors with high fixed costs may engage in aggressive pricing to cover overheads, directly impacting Synaxon.

| Factor | Impact on Rivalry | Synaxon AG's Position/Response |

|---|---|---|

| Number of Competitors | High rivalry due to many players | Navigates against global and regional entities |

| Market Growth | Intensified rivalry in slow-growth markets | Demonstrated resilience and market share gains in 2023 |

| Service Differentiation | Commoditization leads to price wars | Offers value-added services and business support |

| Exit Barriers | Unprofitable firms persist, increasing pressure | Operates in a market with high sunk costs |

SSubstitutes Threaten

The rise of IT vendors selling directly to retailers, bypassing traditional distributors like Synaxon AG, poses a significant threat. Many major tech companies, including giants like Dell and HP, have robust direct-to-business and direct-to-consumer e-commerce platforms. For instance, in 2023, direct sales channels continued to be a crucial revenue stream for many hardware manufacturers, allowing them to capture a larger margin and control the customer experience more effectively. This trend means retailers might find it more appealing or cost-effective to source directly, diminishing Synaxon's role as an intermediary.

Large IT retailers and reseller chains are increasingly developing their own sophisticated in-house procurement and logistics capabilities. This trend allows them to bypass external distributors like Synaxon AG. For instance, in 2024, several major European electronics retailers announced significant investments in their supply chain infrastructure, aiming for greater control and cost efficiency. This direct negotiation with vendors directly substitutes the core value proposition offered by distributors, potentially impacting Synaxon's market share.

Alternative aggregation platforms pose a threat by offering similar purchasing power benefits to IT retailers. While these platforms may not replicate Synaxon's comprehensive service model, they can serve as substitutes for its core aggregation function. For instance, a retailer might opt for a simpler buying consortium to achieve cost savings on IT hardware, bypassing Synaxon's additional services.

This means retailers have choices for consolidating their procurement needs. If another group offers comparable discounts through bulk purchasing, the incentive to use Synaxon's full offering diminishes. Consider that in 2024, the IT distribution market saw continued consolidation, with smaller, specialized buying groups emerging to cater to specific retailer segments, intensifying this substitution pressure.

Cloud-based Software and Services

The widespread adoption of cloud-based software and Software-as-a-Service (SaaS) presents a significant threat of substitution for Synaxon AG's traditional IT distribution model. This shift means customers can increasingly access and utilize software and services without needing to purchase and install physical products, directly impacting the demand for Synaxon's core business. The market for cloud computing services is experiencing substantial growth; for instance, worldwide cloud computing revenue was projected to reach over $679 billion in 2024, a significant increase from previous years, highlighting the scale of this substitution.

This trend fundamentally alters revenue streams from one-time hardware or software sales to recurring subscription fees, a model that offers a compelling alternative to traditional purchasing. For example, the global SaaS market alone was estimated to be worth approximately $300 billion in 2023 and is expected to continue its upward trajectory. This recurring revenue model can be more attractive to end-users due to its flexibility and lower upfront costs.

- Reduced reliance on physical IT products: Cloud services diminish the need for on-premise servers and traditional software licenses.

- Shift in customer spending: Budgets are increasingly allocated to subscription services rather than capital expenditures on hardware.

- Emergence of new service providers: Cloud platforms foster a diverse ecosystem of service providers, offering alternatives to traditional IT distribution channels.

- Scalability and flexibility benefits: Cloud solutions offer users the ability to scale resources up or down as needed, a key advantage over fixed hardware investments.

DIY and Open-Source Solutions

The rise of DIY and open-source solutions presents a notable threat of substitutes for Synaxon AG's traditional IT product distribution. For smaller businesses and individuals with technical expertise, free or low-cost alternatives can fulfill many IT requirements, bypassing the need for commercially packaged hardware and software. This trend, while not a direct replacement for Synaxon's core distribution model, influences the broader market demand for distributed IT products.

For instance, the global open-source software market was valued at approximately $35.2 billion in 2023 and is projected to grow significantly. Companies like Synaxon must consider how this impacts the overall volume of traditional IT product sales. The increasing accessibility and capability of open-source operating systems, office suites, and even server solutions mean that some customer segments may opt out of purchasing proprietary alternatives altogether.

- Open-Source Software Market Growth: The open-source software market continues its robust expansion, indicating a growing preference for cost-effective and customizable solutions.

- DIY Hardware Adoption: The increasing availability of individual IT components and online guides facilitates DIY hardware assembly, potentially reducing demand for pre-built systems.

- Impact on IT Distribution: These alternatives can siphon off demand from traditional IT product distribution channels, particularly for less complex or specialized IT needs.

- Strategic Consideration for Synaxon: Synaxon AG needs to monitor the evolving capabilities of open-source and DIY solutions to understand potential shifts in customer purchasing behavior.

The threat of substitutes for Synaxon AG is significant, primarily driven by the growing direct sales channels of IT manufacturers and the increasing self-sufficiency of large IT retailers. Many tech giants now have robust online platforms, allowing them to bypass intermediaries like Synaxon and control customer relationships, a trend that continued to be crucial for revenue capture in 2023. Furthermore, major retailers are investing heavily in their own logistics and procurement, aiming for greater cost efficiency and direct vendor negotiation in 2024, which directly challenges Synaxon's value proposition.

The rise of cloud computing and Software-as-a-Service (SaaS) also represents a major substitution threat, fundamentally altering IT spending from capital expenditures to recurring subscriptions. Worldwide cloud computing revenue was projected to exceed $679 billion in 2024, a testament to this shift. The SaaS market alone was estimated at around $300 billion in 2023, offering flexibility and lower upfront costs that are increasingly attractive to end-users, thereby reducing the demand for traditional IT product distribution.

Finally, the proliferation of DIY solutions and the expanding open-source software market offer cost-effective alternatives, particularly for technically adept customers. The global open-source market was valued at approximately $35.2 billion in 2023, with continued growth expected. These alternatives can divert demand from traditional IT products, forcing Synaxon to adapt to evolving customer purchasing behaviors.

Entrants Threaten

The IT distribution sector demands a considerable financial commitment to even enter the market. Building a comprehensive IT distribution network requires substantial investment in warehousing facilities, sophisticated logistics, and cutting-edge IT infrastructure. For instance, companies like Synaxon AG have already invested heavily in these areas, creating a significant hurdle for newcomers. New entrants would need to secure substantial credit lines to manage inventory and offer competitive payment terms, a challenge for those without an established financial track record.

Synaxon AG, with its impressive aggregated volume exceeding 1 billion Euros, enjoys substantial economies of scale. This scale advantage translates directly into lower per-unit costs for purchasing, logistics, and the development and maintenance of its IT platforms. For instance, bulk purchasing of hardware and software allows Synaxon to negotiate significantly better prices than a smaller, emerging competitor could hope for.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the established volume, they would likely incur higher per-unit costs, making it challenging to compete on price. This necessitates a substantial initial investment to build the necessary infrastructure and achieve the scale required to achieve comparable cost savings.

New companies entering the IT distribution market face significant hurdles in securing access to established distribution channels and networks. Synaxon AG's strength lies in its deeply entrenched relationships with over 3,200 IT vendor partners and a vast network of IT retailers and resellers. These long-standing connections, cultivated over decades, represent a formidable barrier to entry, making it exceptionally difficult for new entrants to quickly establish a comparable reach and market presence.

Brand Loyalty and Reputation

Synaxon AG benefits significantly from its established brand recognition and a strong reputation built on reliability, comprehensive service, and dedicated partner support within the IT retail sector. This creates substantial customer loyalty, presenting a formidable barrier for any new entrants attempting to gain market traction.

The company's long-standing presence and its distinctive 360-degree support model have cultivated a trusted platform for its partners. Consequently, new competitors must undertake considerable investment in marketing initiatives and extensive relationship-building efforts to even begin to challenge Synaxon's entrenched position.

- High Customer Retention: Synaxon's focus on partner satisfaction and consistent service delivery fosters strong loyalty, making it difficult for new entrants to poach existing customers.

- Reputational Capital: A solid reputation for dependability and a comprehensive offering requires new players to invest heavily in building trust and credibility from scratch.

- Economies of Scale in Marketing: Synaxon's established brand may achieve marketing efficiencies that are out of reach for nascent competitors, further increasing the cost of entry.

Regulatory and Legal Barriers

While not as stringent as in heavily regulated sectors, Synaxon AG faces potential new entrants needing to navigate a complex web of IT product distribution rules, data privacy laws like GDPR, and cross-border trade regulations, particularly within its core DACH market. Successfully managing these requirements demands substantial legal and operational expertise, which can be a significant initial investment for newcomers. For instance, understanding and implementing data protection measures for customer information, as mandated by regulations that saw increased enforcement and fines in 2024, adds a layer of compliance cost and complexity.

New entrants must also contend with varying national certifications and import/export requirements for IT hardware and software. This can translate into increased lead times and upfront costs for product sourcing and market entry. The ongoing evolution of data sovereignty laws in various European countries further complicates cross-border distribution, requiring adaptable compliance strategies.

- Regulatory Compliance Costs: New entrants face upfront investment in legal counsel and compliance officers to understand and adhere to regional IT distribution and data privacy laws.

- Data Privacy Hurdles: Navigating regulations like GDPR, which saw significant updates and enforcement actions in 2024, requires robust data handling protocols and potential technology investments for new distributors.

- Cross-Border Trade Complexity: Varied national import/export rules and certifications for IT products necessitate specialized knowledge and can delay market entry for unprepared companies.

- Resource Intensiveness: Effectively managing these multifaceted regulatory landscapes demands significant financial and human resources, acting as a barrier to entry for smaller or less experienced competitors.

The IT distribution sector presents a high barrier to entry due to significant capital requirements for infrastructure, logistics, and IT systems. Synaxon AG's established economies of scale, exceeding 1 billion Euros in aggregated volume as of 2024, provide substantial cost advantages. New entrants would need to invest heavily to achieve comparable cost efficiencies, making it difficult to compete on price.

Furthermore, Synaxon's deeply entrenched relationships with over 3,200 IT vendor partners and a vast reseller network create a formidable barrier. Building such extensive networks and brand recognition requires considerable time and investment, which new companies often lack. Regulatory compliance, including evolving data privacy laws like GDPR, also adds complexity and cost for any new player in the market.

| Barrier to Entry | Synaxon AG's Position | Impact on New Entrants |

| Capital Requirements | Significant investment in warehousing, logistics, IT infrastructure. | High upfront costs for infrastructure and operational setup. |

| Economies of Scale | Aggregated volume > 1 billion Euros (2024 data), leading to lower per-unit costs. | Difficulty competing on price due to higher initial per-unit costs. |

| Network Effects | 3,200+ vendor partners, extensive reseller network. | Challenges in establishing market reach and supplier relationships quickly. |

| Brand Reputation & Loyalty | Strong, trusted brand built on reliability and support. | Need for substantial investment in marketing and relationship building to gain trust. |

| Regulatory Compliance | Navigates complex IT distribution and data privacy laws (e.g., GDPR). | Requires expertise and investment in legal and operational compliance. |

Porter's Five Forces Analysis Data Sources

Our Synaxon AG Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from Synaxon AG's annual reports and investor presentations, as well as industry-specific market research reports from reputable firms. We also leverage data from publicly available competitor financial statements and relevant trade publications to gain a comprehensive understanding of the competitive landscape.