Symbotic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Symbotic Bundle

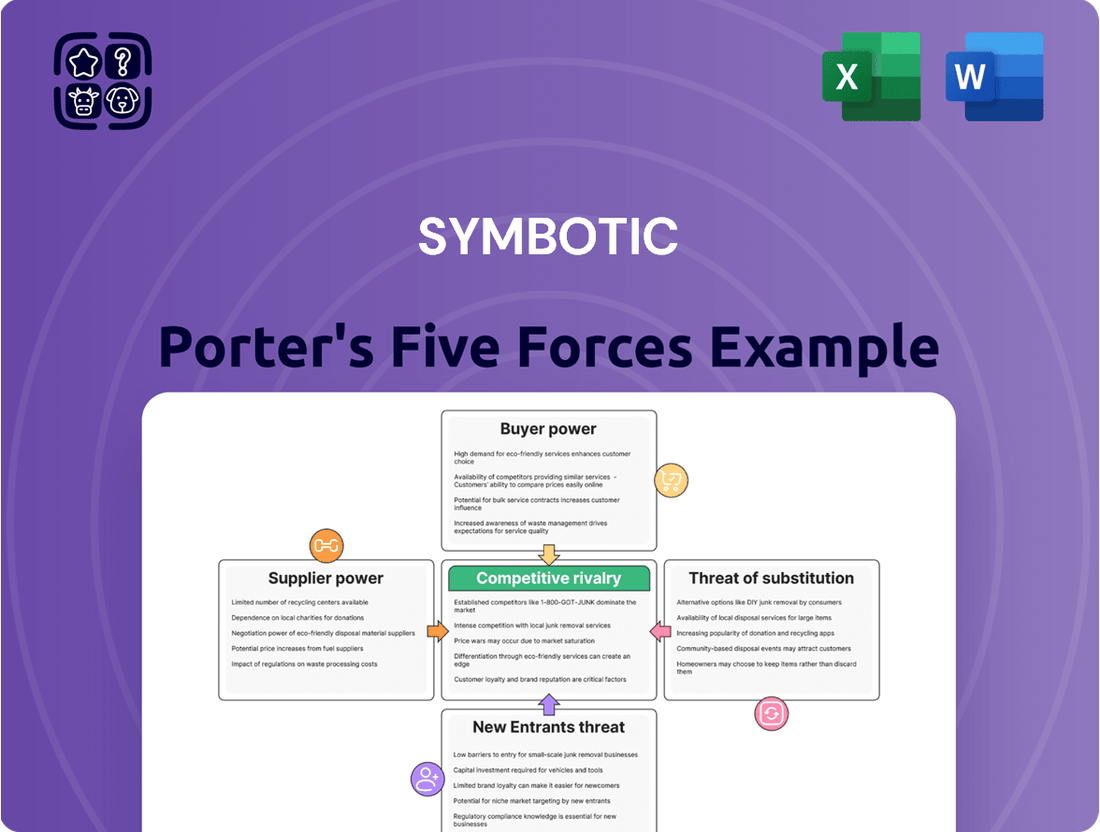

Symbotic operates within a dynamic landscape shaped by five key competitive forces. Understanding the intensity of buyer power, the threat of new entrants, the bargaining power of suppliers, the threat of substitutes, and the intensity of rivalry is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Symbotic’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Symbotic's reliance on highly specialized components, such as advanced AI algorithms and custom robotics, often means sourcing from a limited pool of suppliers. This concentration of specialized knowledge and manufacturing capability can grant these suppliers considerable leverage. For example, a single vendor providing a unique optical sensor critical for Symbotic's automated warehouse systems might possess significant pricing power.

When few suppliers can offer the necessary proprietary technology or unique manufacturing processes, their bargaining power increases. This situation can lead to higher input costs for Symbotic if these suppliers are able to dictate terms or charge premiums for their specialized offerings. The scarcity of alternative sources for these critical components amplifies the supplier's ability to influence pricing and supply conditions.

The bargaining power of suppliers for Symbotic is significantly influenced by the high switching costs associated with their highly integrated robotic and automation systems. Companies integrating Symbotic’s solutions face substantial expenses and operational disruptions, including redesigning processes, extensive retesting, and complex integration challenges, if they were to switch to a different provider.

This elevated switching cost effectively locks in customers and strengthens the leverage of Symbotic's existing specialized suppliers. For instance, the lead times for acquiring highly specialized robotic components can extend considerably, further complicating and increasing the cost of any potential supplier change.

Suppliers who possess unique and proprietary technologies, like cutting-edge AI algorithms or specialized robotic components, wield significant bargaining power over Symbotic. These distinct offerings are fundamental to Symbotic's ability to provide differentiated solutions, thus creating a reliance on these specific suppliers.

This dependency allows such suppliers to negotiate for premium pricing or impose more stringent contractual conditions, directly impacting Symbotic's cost structure and operational flexibility. For example, a supplier of advanced AI software critical for Symbotic's warehouse automation could command higher fees if Symbotic has no readily available alternative.

In 2024, the increasing demand for sophisticated automation solutions, driven by supply chain resilience efforts, further amplifies the leverage of technology providers with unique intellectual property. Companies like Symbotic, aiming to deliver state-of-the-art systems, find themselves in a position where they must secure these specialized inputs, even at a premium.

Importance of Supplier's Input to Symbotic's Product

Symbotic's reliance on specialized components and software from its suppliers is substantial, directly impacting the effectiveness of its automated warehouse solutions. These inputs are not merely parts; they are the building blocks that enable Symbotic's systems to achieve high efficiency and throughput, making the quality and availability of these supplies critical. For instance, advanced robotics, AI-driven software, and high-speed sorting mechanisms, all sourced from external partners, are core to Symbotic's value proposition. This deep integration means that any disruption or increase in cost from these suppliers can significantly affect Symbotic's operational capabilities and pricing power. In 2024, Symbotic's cost of goods sold was approximately $1.1 billion, a figure heavily influenced by the pricing and availability of these key supplier inputs.

The bargaining power of Symbotic's suppliers is heightened due to the specialized nature of the components and software they provide. Symbotic requires highly specific, often proprietary, technology that few suppliers can offer. This creates a situation where Symbotic has limited alternatives for these critical inputs, thereby strengthening the suppliers' negotiating position. The company's ability to deliver its advanced automation solutions hinges directly on the consistent delivery of these specialized items, underscoring the suppliers' influence over Symbotic's product performance and cost structure.

- Criticality of Inputs: The components and software from suppliers are essential for Symbotic's automated systems to function efficiently and accurately.

- Limited Alternatives: The specialized nature of these inputs means Symbotic has few, if any, substitute suppliers, increasing supplier leverage.

- Impact on Performance: The quality and timely delivery of supplier inputs directly affect Symbotic's ability to meet customer demands for high-throughput solutions.

- Supplier Influence: Symbotic's dependence on these specialized inputs grants suppliers significant power in price negotiations and terms.

Potential for Forward Integration by Suppliers

While less common, major suppliers of specialized components or software for warehouse automation could theoretically integrate forward, offering complete solutions themselves. This would demand substantial capital investment and technical know-how, making it a significant undertaking. However, the mere possibility of this occurring can bolster a supplier's negotiating position with companies like Symbotic.

The bargaining power of suppliers in the intelligent robotics and automation sector is generally considered moderate. This is due to a market structure where a few large, established players often dominate the supply of critical components or advanced software.

- Market Concentration: A limited number of large, specialized suppliers often dictate terms in the robotics and automation component market.

- Supplier Expertise: Suppliers possessing unique, proprietary technology or deep expertise in niche areas can command higher prices or more favorable terms.

- Forward Integration Threat: The potential, though often challenging, for suppliers to move into providing full-service automation solutions can act as a leverage point in negotiations.

Symbotic's suppliers, particularly those providing highly specialized AI algorithms and custom robotics, often hold significant bargaining power. This leverage stems from the critical nature of their proprietary technology and the limited availability of alternative sources, as seen in the 2024 demand surge for advanced automation. These suppliers can dictate terms, leading to higher input costs for Symbotic, as evidenced by Symbotic's $1.1 billion cost of goods sold in 2024, which is heavily influenced by these specialized inputs.

| Supplier Characteristic | Impact on Symbotic | 2024 Relevance |

|---|---|---|

| Specialized AI & Robotics | High dependence, limited alternatives | Increased demand amplified supplier leverage |

| Proprietary Technology | Premium pricing potential, stringent terms | Core to Symbotic's differentiated solutions |

| High Switching Costs for Symbotic's Customers | Strengthens existing supplier relationships | Discourages customer migration, reinforcing supplier position |

| Criticality of Inputs | Direct impact on system performance & cost | $1.1B COGS reflects input cost influence |

What is included in the product

This analysis dissects Symbotic's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly visualize competitive intensity across all five forces with a dynamic, interactive dashboard.

Effortlessly identify and quantify the impact of each force on profitability, simplifying complex competitive analysis.

Customers Bargaining Power

Symbiotic's customer base is highly concentrated, with major clients including large retailers, wholesalers, and food and beverage distributors. This concentration means that a few key customers wield significant influence.

Walmart stands out as a particularly significant client for Symbiotic. The sheer size and purchasing power of Walmart grant it substantial negotiation leverage over Symbiotic, impacting pricing and contract terms.

The capital expenditure plans of these large customers, especially Walmart's investments in supply chain automation, directly influence Symbiotic's revenue trajectory. A substantial portion of Symbiotic's business relies on these major clients continuing to invest in their automated systems.

For instance, Walmart's ongoing investments in modernizing its distribution centers, which heavily feature automation, are a critical driver for Symbiotic's order pipeline. This dependence makes Symbiotic vulnerable to shifts in Walmart's strategic spending priorities.

Once a Symbotic system is installed, customers face substantial hurdles in switching to another provider. This is because the hardware, unique software, and ongoing services become deeply embedded within their warehouse operations. The sheer cost and complexity of replacing such an integrated system significantly limit a customer's ability to easily change vendors.

This deep integration translates directly into high switching costs for Symbotic's clients. Consider the extensive training, potential operational downtime during a transition, and the capital expenditure required to rip and replace an entire automated infrastructure. These factors make switching a major undertaking, effectively reducing the bargaining power customers wield over Symbotic in the long run.

Large customers, particularly those with substantial resources like Walmart, can develop their own automation or acquire smaller robotics firms. This capability for backward integration significantly enhances their bargaining power.

For example, Walmart previously acquired its own Advanced Systems and Robotics business, a move that Symbotic later reversed by acquiring that very business. This illustrates how a customer's potential to bring critical functions in-house creates leverage.

In 2024, major retailers continue to invest heavily in supply chain technology, with companies like Amazon and Walmart dedicating billions to automation and robotics, underscoring their capacity to insource development if needed.

Importance of Symbotic's Solution to Customer Operations

Symbotic's advanced automation solutions are indispensable for modern warehousing, directly impacting a customer's ability to operate efficiently and meet escalating demands. These systems are crucial for enhancing throughput and accuracy, particularly in the face of persistent labor shortages and the rapid growth of e-commerce, which saw online retail sales reach an estimated $1.14 trillion in the US in 2024. Customers are increasingly dependent on Symbotic's technology to maintain a competitive edge in their logistics operations.

This deep integration into core supply chain functions significantly diminishes the bargaining power of Symbotic's customers. When a company's operational success and competitive advantage hinge on the reliability and performance of Symbotic's systems, their ability to negotiate terms or switch providers becomes limited. For instance, customers often invest substantial capital, with Symbotic's average system cost potentially running into tens of millions of dollars, making switching a costly and disruptive undertaking.

- Criticality of Symbotic's Automation: Essential for boosting efficiency, accuracy, and throughput in large-scale warehouses.

- Addressing Market Pressures: Helps overcome labor shortages and meet the growing demands of the e-commerce sector, which continues its upward trajectory.

- Customer Reliance: Customers depend on Symbotic for a competitive advantage in their logistics and supply chain management.

- Reduced Bargaining Power: This reliance weakens the customers' ability to negotiate favorable terms or switch to alternative solutions.

Price Sensitivity of Customers

Customers in the warehouse automation sector, including those considering Symbotic's offerings, often exhibit significant price sensitivity. This is largely due to the substantial upfront capital investment required for such advanced systems. For instance, a fully integrated robotic warehouse solution can easily run into tens of millions of dollars, making the initial cost a critical factor in purchasing decisions.

This sensitivity means clients will rigorously evaluate the total cost of ownership and demand a clear, compelling return on investment (ROI). They will scrutinize pricing structures, maintenance contracts, and potential upgrade costs. In 2024, with ongoing economic uncertainties and a focus on efficient capital deployment, this pressure on pricing is likely to intensify.

- High Upfront Costs: Warehouse automation systems represent a major capital expenditure, often running into millions of dollars, increasing customer price sensitivity.

- ROI Scrutiny: Clients demand demonstrable and rapid returns on investment, influencing their willingness to pay premium prices.

- Negotiation Leverage: The significant investment provides customers with leverage to negotiate favorable terms, potentially impacting Symbotic's profit margins.

- Competitive Landscape: The presence of alternative solutions, even if less advanced, can further empower customers to seek competitive pricing.

Symbiotic's customers, especially large entities like Walmart, possess considerable bargaining power due to their concentrated purchasing volume and strategic importance. Their ability to influence pricing and contract terms is significant, amplified by their substantial investments in supply chain automation. This power is further bolstered by the critical nature of Symbiotic's technology for customer operational efficiency.

The high switching costs associated with Symbiotic's deeply integrated systems, including hardware, software, and services, somewhat mitigate customer bargaining power. However, customers' capacity for backward integration, such as acquiring automation firms, presents a direct challenge to Symbiotic's leverage. For example, in 2024, major retailers continue substantial investments in robotics, underscoring their potential to insource capabilities.

Customers also exhibit high price sensitivity given the millions in upfront capital for automation solutions, demanding clear ROI. This financial scrutiny provides leverage for negotiation, especially amidst economic uncertainties in 2024. While Symbiotic's solutions are vital for efficiency and competitive advantage, customers' financial considerations and potential for in-house development temper their overall bargaining power.

| Factor | Impact on Customer Bargaining Power | Symbiotic's Mitigation Strategy |

|---|---|---|

| Customer Concentration (e.g., Walmart) | High leverage due to large order volumes and strategic importance. | Deep integration, long-term contracts, demonstrated ROI. |

| Switching Costs | Low ability to switch due to embedded systems and operational disruption. | Focus on customer retention through superior service and continuous innovation. |

| Potential for Backward Integration | Customers can develop or acquire competing automation capabilities. | Acquisition of key technologies (e.g., Advanced Systems and Robotics) and ongoing R&D. |

| Price Sensitivity & ROI Demands | Customers scrutinize costs and demand clear returns, pressuring pricing. | Highlighting efficiency gains, throughput improvements, and long-term cost savings. |

Full Version Awaits

Symbotic Porter's Five Forces Analysis

This preview shows the exact Symbiotic Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, which comprehensively breaks down the competitive landscape for Symbiotic. Once you complete your purchase, you’ll get instant access to this exact, detailed file, ready for your strategic planning.

Rivalry Among Competitors

The warehouse automation market is characterized by a substantial number of players, contributing to a moderately consolidated but fiercely competitive environment. Symbotic, for instance, faces a landscape with 745 active competitors, a figure that underscores the breadth of the industry.

This diverse field includes not only established giants like AutoStore, Dematic, and TGW Logistics Group, known for their extensive offerings and global reach, but also a significant influx of emerging firms. These newer entrants often bring innovative technologies and specialized solutions, further intensifying the rivalry as they seek to capture market share and disrupt existing dynamics.

The warehouse automation market is on a significant growth trajectory, with projections indicating it will reach $39.93 billion by 2030, growing at a compound annual growth rate of 14.83% from 2025. This robust expansion offers ample opportunity, potentially dampening direct rivalry as demand outstrips supply for many. However, the pursuit of market share in this expanding landscape can still fuel aggressive competition among established players and emerging entrants alike.

Symbotic's competitive rivalry is significantly shaped by its proprietary AI-enabled robotics technology. This advanced system is designed for high-density, automated storage and retrieval, setting it apart from competitors. The company's commitment to continuous innovation in AI, robotics, and software is a key driver of its competitive edge.

This focus on innovation forces rivals to substantially increase their research and development spending. They must strive to develop and offer unique solutions and features to keep pace with Symbotic's technological advancements. For instance, in 2024, the warehouse automation market saw continued investment, with companies like Honeywell and ABB also pushing their R&D efforts in robotics and AI integration to capture market share.

Switching Costs for Customers

While high switching costs can indeed shield Symbotic's existing contracts, this also means rivals face considerable challenges in attracting Symbotic's current clientele. This dynamic intensifies the competition for new business and for customers whose current systems are nearing their operational limits or necessitate substantial upgrades.

For Symbotic, this creates a stable revenue base from entrenched customers. However, it also highlights the critical importance of winning over new clients or those undergoing significant technology refreshes, as the cost of transitioning away from an established Symbotic system can be prohibitive.

- High upfront investment in automation hardware and software makes switching costly.

- Integration of Symbotic's systems with a client's existing supply chain infrastructure creates deep dependencies.

- The learning curve and retraining required for employees to operate new systems further increase switching barriers.

- Symbotic's focus on tailored solutions means each implementation is unique, complicating a direct replacement by a competitor.

High Exit Barriers

The significant capital required for developing and implementing advanced robotics and automation solutions presents substantial exit barriers for companies in this sector. These high upfront investments, often running into tens or hundreds of millions of dollars for a single facility deployment, make it economically challenging for firms to simply walk away from their operations. For instance, Symbotic’s own investments in advanced manufacturing and deployment of its warehouse automation systems represent a considerable financial commitment. This means that even when market conditions soften, competitors are often compelled to stay in the game, leading to intensified rivalry as they strive to maintain operations and market presence.

These high exit barriers directly fuel competitive rivalry. Companies are less likely to divest or cease operations, even in periods of reduced demand, due to the difficulty of recouping their substantial investments in specialized equipment and intellectual property. This persistence can lead to price wars or aggressive market share grabs as companies fight for survival, prolonging competitive battles. For example, in the competitive landscape of warehouse automation, a company might continue to offer services at lower margins rather than abandon its installed base and the possibility of future recovery, thereby increasing pressure on all players.

- High Capital Investment: Developing and deploying complex robotics and automation systems can cost Symbotic and its competitors hundreds of millions of dollars for large-scale projects.

- Difficulty in Divesting Assets: Specialized robotics and automation equipment have limited resale value outside of their intended industry, increasing the cost of exiting.

- Persistence in Downturns: Companies often remain operational despite market downturns due to the inability to recover invested capital, intensifying competition.

- Increased Rivalry: Competitors fight harder for market share and survival, potentially leading to price pressures and innovation races.

The warehouse automation sector is intensely competitive, with Symbotic facing around 745 active rivals. This rivalry is fueled by a market projected to reach $39.93 billion by 2030, growing at a 14.83% CAGR. While market growth offers opportunities, it also spurs aggressive competition for market share, as firms like Honeywell and ABB boost R&D in AI and robotics in 2024.

Symbotic's technological edge, particularly its AI-enabled robotics, forces competitors to invest heavily in R&D to keep pace. The high upfront costs for automation systems create significant switching barriers for customers, making it challenging for rivals to gain Symbotic's existing clientele. This dynamic intensifies the battle for new contracts and technology upgrades.

High exit barriers, stemming from substantial capital investments in specialized equipment, compel companies to persist even in challenging market conditions. This persistence can lead to price competition and a prolonged fight for market share, as firms aim to recoup their investments rather than exit. For example, a company might continue operations at lower margins to retain its customer base and avoid abandoning its installed assets.

| Metric | Value | Year |

|---|---|---|

| Number of Competitors | 745 | 2024 |

| Projected Market Size | $39.93 billion | 2030 |

| CAGR | 14.83% | 2025-2030 |

| R&D Investment Focus | AI, Robotics Integration | 2024 |

SSubstitutes Threaten

Manual labor and traditional warehousing are viable substitutes for highly automated systems, especially for smaller businesses or those with lower volume needs. However, the economic landscape is shifting; for instance, the average hourly wage for warehousing and storage workers in the US reached approximately $21.50 in early 2024, a figure that continues to climb.

This upward pressure on labor costs, coupled with persistent labor shortages in the logistics sector, makes purely manual operations increasingly uneconomical for large-scale enterprises. The cost-effectiveness of automation becomes more pronounced as labor expenses rise, pushing businesses to explore alternatives to traditional methods.

Customers may choose less complex automation options like basic conveyors or forklifts instead of Symbotic's fully integrated AI-driven systems. These simpler alternatives often come with a lower initial price tag, making them attractive to businesses with tighter budgets. For instance, the market for standalone automated guided vehicles (AGVs) saw significant growth, with reports indicating a global market size of approximately $2.5 billion in 2023, projected to reach over $6 billion by 2030, highlighting a strong demand for less sophisticated solutions.

The threat of substitutes for in-house automation in warehousing and fulfillment is significant, primarily from Third-Party Logistics (3PL) providers. Companies can choose to outsource these operations rather than investing heavily in their own automated systems. This allows them to tap into existing infrastructure and expertise, potentially achieving cost savings and faster deployment.

By leveraging 3PLs, businesses effectively substitute direct capital expenditure on automation with service fees. The global 3PL market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating strong adoption. This growth suggests that many companies find outsourcing a viable alternative to building their own automated warehouses.

Many 3PL providers are themselves investing in advanced automation, offering their clients access to these technologies without direct investment. This dual benefit – outsourcing operational burdens and gaining access to automation – strengthens the substitute threat. For instance, companies like DHL and Kuehne+Nagel are heavily investing in robotics and AI for their warehousing operations, making them attractive alternatives for businesses considering in-house automation.

Software-Only Optimization Solutions

Software-only optimization solutions present a significant threat of substitution for companies like Symbotic, which focus on comprehensive automation hardware. Advanced Warehouse Management Systems (WMS) and Warehouse Execution Systems (WES) offer pathways to improve operational efficiency by better managing data and streamlining workflows within existing infrastructure. These software-centric approaches can reduce the need for substantial capital expenditure on robotics and automated hardware.

The market for WMS and WES is growing, indicating a strong adoption of these alternative solutions. For instance, the global warehouse management system market was valued at approximately $3.9 billion in 2023 and is projected to reach around $7.8 billion by 2030, demonstrating a compound annual growth rate of over 10%. This growth signifies a clear demand for efficiency gains achievable through software alone.

- Software-driven efficiency: WMS/WES can optimize labor allocation, inventory tracking, and order fulfillment processes without requiring new physical automation equipment.

- Lower upfront cost: Implementing software solutions typically involves lower initial investment compared to deploying complex robotics and automated hardware.

- Faster implementation: Software upgrades and configurations can often be rolled out more quickly than integrating large-scale physical automation systems.

- Scalability: Software solutions can often be scaled more easily to meet changing business demands compared to the physical expansion of automated infrastructure.

Hybrid Automation Models

The threat of substitutes for Symbotic's high-density automation systems emerges from businesses opting for hybrid automation models. These models blend limited automation with existing human labor, representing a less capital-intensive alternative to a full Symbotic deployment. This approach offers flexibility and allows for phased investment, but it typically falls short of the efficiency gains and cost reductions achievable with Symbotic's integrated, fully automated solutions.

While hybrid models might appeal to companies with tighter budgets or those hesitant about a complete overhaul, they introduce a different set of limitations. For instance, businesses relying on these partial solutions may continue to face higher operational costs due to manual intervention and may not realize the full benefits of optimized throughput and reduced error rates that Symbotic's technology provides.

Consider the logistics sector, where some companies are implementing robotic picking for specific tasks rather than automating the entire warehouse. This allows them to address immediate labor shortages or bottlenecks. However, a fully automated system like Symbotic's can process significantly more units per hour. For example, Symbotic's systems are designed to achieve throughputs that can far exceed those of manually assisted operations, impacting the overall competitiveness of businesses that choose less comprehensive automation.

- Hybrid automation offers incremental investment, allowing businesses to adopt automation in stages rather than committing to a large-scale Symbotic system.

- These models may provide flexibility in adapting to changing operational needs but often do not achieve the same level of efficiency or cost savings as Symbotic's integrated solutions.

- Companies opting for hybrid automation might still face higher labor costs and potentially lower throughput compared to fully automated warehouses powered by Symbotic technology.

- The ultimate effectiveness of hybrid models as a substitute depends on the specific business needs and the degree to which they can offset the performance advantages of Symbotic's advanced automation.

The threat of substitutes for Symbotic's integrated automation solutions is multifaceted, ranging from less sophisticated automation to outsourcing. Businesses can opt for simpler, standalone automated systems like automated guided vehicles (AGVs) or automated mobile robots (AMRs) which offer a lower entry cost than Symbotic's comprehensive offerings. For example, the AMR market alone was projected to reach over $10 billion by 2027, illustrating a significant segment of the market seeking less complex automation.

Furthermore, the rise of Third-Party Logistics (3PL) providers presents a substantial substitute threat. Companies can outsource warehousing and fulfillment operations to 3PLs that may already possess or be investing in their own automation capabilities. This allows businesses to avoid significant capital expenditure on in-house systems. The global 3PL market demonstrated strong growth, reaching approximately $1.1 trillion in 2023, indicating a preference for outsourcing among many firms.

Software-only solutions, such as advanced Warehouse Management Systems (WMS) and Warehouse Execution Systems (WES), also serve as substitutes by enhancing efficiency through data optimization and workflow management within existing infrastructure. The WMS market was valued at roughly $3.9 billion in 2023 and is expected to grow substantially, highlighting the appeal of software-driven improvements. These alternatives allow companies to achieve operational gains without the large-scale hardware investment required for systems like Symbotic's.

| Substitute Category | Key Characteristics | Example/Data Point | Implication for Symbotic |

|---|---|---|---|

| Less Sophisticated Automation | Lower upfront cost, easier implementation, targeted functionality | AGV/AMR market projected to exceed $10 billion by 2027 | Appeals to smaller businesses or those with specific, limited automation needs. |

| Third-Party Logistics (3PL) | Outsourced operations, access to existing infrastructure/expertise, variable cost model | Global 3PL market valued at approx. $1.1 trillion in 2023 | Reduces the need for direct capital investment in automation by clients. |

| Software-Only Optimization | Improved data management, workflow streamlining, enhanced efficiency via WMS/WES | WMS market valued at approx. $3.9 billion in 2023 | Offers efficiency gains without the need for new physical automation hardware. |

Entrants Threaten

The warehouse automation sector, particularly for advanced AI-driven robotics and comprehensive system implementations, demands considerable financial outlay. New players must invest heavily in research and development, establish robust manufacturing capabilities, and fund the intricate project execution required for large-scale deployments. For instance, companies like Symbotic have demonstrated the need for significant upfront capital, with their investments in proprietary technology and infrastructure. This high barrier effectively deters many potential competitors from entering the market.

Symbotic's advanced proprietary software, hardware, and AI capabilities are safeguarded by robust intellectual property, creating a significant hurdle for potential new entrants. Replicating Symbotic's integrated and sophisticated technology demands substantial investment in research and development, along with considerable time, effectively acting as a powerful barrier to entry.

Established players like Symbotic already leverage significant economies of scale in their manufacturing, procurement of components, and the deployment of their advanced automation systems. This allows them to achieve cost efficiencies that are incredibly difficult for new entrants to replicate. For instance, Symbotic’s substantial investment in its own manufacturing facilities, as evidenced by its ongoing capacity expansions, directly contributes to lower per-unit costs.

The experience curve plays a crucial role in the complex field of robotic automation and system integration. Incumbents, having navigated numerous projects and refined their processes over time, possess invaluable know-how in design, installation, and ongoing support. This accumulated expertise translates into smoother project execution, fewer errors, and ultimately, a more predictable and cost-effective solution for customers, posing a substantial barrier to entry for those without a proven track record.

Strong Customer Relationships and Brand Loyalty

Symbotic's established relationships with major retailers represent a significant barrier to new entrants. The company has secured substantial, long-term contracts with industry giants, showcasing a proven ability to deliver and a deep understanding of client needs. For instance, Symbotic's agreement with Walmart, a multi-year deal valued in the billions, highlights the scale of commitment required.

These strong customer ties make it challenging for newcomers to gain a foothold. Large enterprise clients prioritize reliability, performance, and a history of successful implementation, factors that new entrants would struggle to demonstrate immediately. Building this level of trust and proving capability in the highly specialized warehouse automation sector takes considerable time and investment.

- Long-term contracts with key players like Walmart and Albertsons

- Demonstrated track record of successful deployments

- High switching costs for clients due to integration and training

- Need for significant capital investment and proven technology for new entrants

Regulatory Hurdles and Safety Standards

The robotics industry, particularly for warehouse automation like Symbotic’s, faces significant regulatory hurdles. New entrants must navigate a complex web of safety standards and certifications, which can be a substantial barrier. For instance, compliance with Occupational Safety and Health Administration (OSHA) regulations in the United States, and similar bodies globally, demands rigorous testing and adherence to specific operational guidelines for automated systems.

These regulatory requirements often necessitate substantial investment in research, development, and validation processes before a new product can be deployed. The time and capital required to achieve compliance can deter smaller or less-established companies. In 2024, companies investing in advanced robotics often allocate 10-15% of their R&D budget specifically to regulatory affairs and safety certifications, reflecting the high cost of entry.

- Safety Certifications: New entrants must obtain certifications from recognized bodies like UL (Underwriters Laboratories) or CE marking in Europe, ensuring their robotic systems meet stringent safety protocols.

- Operational Compliance: Adherence to site-specific safety regulations and integration protocols within existing warehouse infrastructure is crucial for deployment.

- Data Security and Privacy: Regulations concerning the handling and storage of data generated by automated systems are increasingly important, adding another layer of complexity for new market participants.

- Intellectual Property Protection: While not a direct regulatory hurdle, protecting proprietary technology is vital, and navigating patent laws adds to the cost and complexity of market entry.

The threat of new entrants in Symbotic's warehouse automation market is mitigated by several substantial barriers. High capital requirements for R&D, manufacturing, and deployment, coupled with the need for proprietary technology and intellectual property protection, make entry exceedingly costly. For instance, developing AI-driven automation systems comparable to Symbotic's often requires hundreds of millions in upfront investment.

Economies of scale achieved by incumbents like Symbotic, through integrated manufacturing and component procurement, further depress costs and deter new players. Symbotic’s investment in its own manufacturing facilities, for example, grants it a significant cost advantage. Furthermore, the steep learning curve and accumulated expertise in complex system integration and project execution favor established companies with proven track records.

Strong customer loyalty and high switching costs, stemming from deep integration and client-specific training for systems like Symbotic's, create sticky relationships that are hard for newcomers to break. Securing large-scale, multi-year contracts, such as Symbotic's with Walmart, demonstrates the difficulty for new entrants to gain initial traction with major clients.

Regulatory compliance, including stringent safety certifications and operational guidelines for automated systems, adds another layer of complexity and cost for potential market entrants. In 2024, navigating these requirements can add 10-15% to a company's R&D budget, making it a significant hurdle.

| Barrier Type | Description | Impact on New Entrants | Example for Symbotic |

| Capital Requirements | High investment needed for R&D, manufacturing, and deployment. | Deters firms without substantial funding. | Development of proprietary AI and robotics. |

| Proprietary Technology & IP | Patented software, hardware, and AI create a unique advantage. | Replication is time-consuming and expensive. | Symbotic's integrated system architecture. |

| Economies of Scale | Lower per-unit costs due to high-volume production and procurement. | New entrants struggle to match cost efficiencies. | Symbotic's in-house manufacturing capacity. |

| Customer Loyalty & Switching Costs | Established relationships and integration complexity lock in clients. | Difficult for new players to acquire initial customers. | Long-term contracts with major retailers. |

| Regulatory Hurdles | Compliance with safety standards and certifications. | Adds significant cost and time to market entry. | Meeting OSHA and UL safety requirements. |

Porter's Five Forces Analysis Data Sources

Our Symbotic Porter's Five Forces analysis is built on a foundation of comprehensive data, including Symbotic's SEC filings, investor reports, and industry-specific market research from firms like Gartner and IDC.